By Amanda Armendariz

By Amanda Armendariz

It’s hard to believe we’re entering the home stretch of 2022. The holiday season is fast approaching (and will, in fact, be almost over by the time this issue hits your mailbox). Consumers (including yours truly) are deep in the throes of holiday gift shopping, with a large percentage of those purchases arriving directly on our doorsteps, rather than being selected in stores. On the one hand, gift shopping online feels so seamless (at least to anyone not in our industry). We fill our carts, enter the payment information, hit enter, and within a few days the (hopefully plain, so as to not give away any holiday surprise) brown boxes show up at our front door. Who needs to brave the crowds and the lines when online shopping is just so darn easy?

Of course, for anyone who works in our industry, in any capacity, we know that delivering a flawless customer experience (especially during the holiday rush) is far from simple. Companies need to be sure they have accurate information on their websites (no one wants to place an order only to be told later that their product is actually out of stock) and provide true shipment costs right up front. Shopping cart abandonment is no joke, and seeing higher than expected shipping costs is one way to get people to quickly exit out of your site. Once orders are in, shippers need to make sure

they have the carrier capacity to handle this increase in orders, which often means diversifying their carrier portfolios prior to peak season. No customer is going to be happy if the gift they were promised would arrive December 21 shows up on December 26. Finally, the returns process needs to be streamlined so that if Great-Aunt Maud didn’t quite hit the right notes with her gift selections this year, the recipients can easily and quickly return or exchange them. Phew! It’s no wonder that every successful peak season should be treated like you just ran a marathon, because your company basically did!

But after a couple days of downtime to recharge, it’s full steam ahead for the new year. 2023 is going to be an expensive one, with UPS and FedEx increasing their rates, on average, 6.9%; much higher than the standard 4.9% that had been common in recent years. Make sure you take proactive steps early in the year to mitigate these costs, whether that means reaching out to your carrier rep or researching other carriers (like the USPS and regionals) that might provide a better option. Also, make sure you note what went right with this year’s peak and what did not, so that you can make the necessary changes now to avoid any negative issues from happening again.

Wishing you all the best this holiday season and beyond, and as always, thanks for reading PARCEL.

MadMen3 PO Box 259098 Madison WI 53725-9098 Tel: 608.241.8777 Fax: 608.241.8666 Email: customerservice@rbpub.com

PARCEL (ISSN 1081-4035) is published 7 times a year by MadMen3. All material in this magazine is copyrighted 2022 © by MadMen3. All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to PARCEL, MadMen3 or its staff becomes the property of MadMen3. The articles in this magazine represent the views of the authors and not those of MadMen3 or PARCEL. MadMen3 and/or PARCEL expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: Free to qualified recipients: $12 per year to all others in the United States. Subscription rate for Canada or Mexico is $35 for one year and for elsewhere outside of the United States is $55. Back-issue rate is $5.

Send subscriptions or change of address to: PARCEL, P.O. Box 259098 Madison WI 53725-9098

Allow six weeks for new subscriptions or address changes.

REPRINTS: For high-quality reprints, please contact our exclusive reprint provider, ReprintPros, 949.702.5390, www.ReprintPros.com. MadMen3, PO Box 259098 Madison WI 537259098, 608-241-8777. Periodical postage paid at Madison WI and additional offices.

POSTMASTER

Send address changes to: Mailing Systems Technology PO Box 259098 Madison WI 53725-9098

The case of Hadley v. Baxendale was decided in 1854 by a court in England.

Although decided nearly 170 years ago in a foreign jurisdiction, the principle announced in that case, based upon even earlier decisions, is very much alive and well today.

The plaintiffs in the case were “Hadley and another” who “were proprietors and occupiers of the City Steam-Mills.” They used a steam-engine to run the mills. The defendants were “common carriers of goods and chattels for hire.”

When the iron shaft of the steam engine broke, the plaintiffs arranged with the defendants to transport the broken shaft to a business in Greenwich that would make a new shaft. Both the plaintiff shippers and the defendant carriers contemplated that the broken shaft would be delivered on the second day, but, for reasons not specifically described in the decision, it was not delivered for seven days, resulting in a delay of five days. Litigation ensued.

The plaintiffs’ position was that “the completing of the said new shaft was delayed for five days, and the plaintiffs were prevented from working their said steam-mills… and from carrying on their said business… for the space of five days beyond the time that they otherwise would have been prevented from so doing, and they thereby were unable to supply many of their customers… during that period, and were obliged to buy flour to supply some of their

other customers, and lost the means and opportunity of selling flour… and were deprived of gains and profits… which otherwise would have accrued to them, and were unable to employ their workmen, to whom they were compelled to pay wages during that period, and were otherwise injured…” (Italics added.)

Defense counsel argued that it is not fair to hold the carrier liable for the damages resulting from the closure of the mill simply because the carrier knew that the defendant wanted this shipment to be transported as fast as possible. As the court pointed out, “But how could the defendants here know that any such result would follow?”, i.e., that the mill was closed and could not reopen until the replacement shaft was received.

In reaching its decision, the court acknowledged that there will almost always be damages arising out of a breach of contract beyond what are sometimes called the actual or general damages, such as the replacement costs for cargo that was totally lost or the cost of repair to damaged cargo.

The court stated: “Where two parties have made a contract, which one of them has broken, the damages which the other party ought to receive in respect of such breach of contract should be such as may fairly and reasonably be considered either arising naturally, i.e. according to the usual course of things,

from such breach of contract itself, or such as may reasonably be supposed to have been in the contemplation of both parties at the time they made the contract, as the probable result of the breach of it.”

Put another way, one could only recover consequential damages if there was sufficient reason for the breaching party to have foreseen them. These are also referred to as incidental damages or special damages.

In 2022, this is still the rule used by courts: consequential damages can be awarded when foreseeable. However, since it would be very hard to determine exactly what the carrier foresaw or should have foreseen with respect to any given shipment, carriers or intermediaries almost always have tariff provisions or business terms stating: “IN NO EVENT WHATSOEVER SHALL ANY CONSEQUENTIAL DAMAGES BE ALLOWED, EVEN IF REASONABLY FORESEEABLE.”

All for now!

Brent Wm.

of transportlawtexts, inc. Previous columns, including those of William J. Augello, may be found in the “Content Library” on the PARCEL website (PARCELindustry.com). Your questions are welcome at brent@primuslawoffice.com.

2023 is shaping up to be another strong year for e-commerce, and many companies continue to look for next-generation solutions. Companies are asking themselves: How can we ship orders faster and more efficiently with less labor? How can we lower operating costs without affecting the customer experience? Are we prioritizing sustainability?

As consumer expectations evolve and new solutions emerge, supply chain leaders are investing in advanced technologies, including automation, to keep up. In fact, a survey by MHI and Deloitte found that 64% of business and supply chain leaders plan to increase their investment in technology. Of that, 66% say they will spend over $1 million over the next two years.

Here are four packaging trends to watch in 2023:

Adopting flexible, fit-to-size packaging automation

Historically, many e-commerce companies have been hesitant to implement automation for a variety of reasons. However, these organizations are realizing more and more just how efficient they must be to stay competitive. The cost of transportation continues to rise, making large parcels more expensive to ship. At the same time, labor continues to become scarce and more expensive, making it difficult to meet customer demand for fast shipping. Because of this shift, e-retailers are moving to an automated packaging solution. These systems create fit-to-size boxes on demand every three or seven seconds for single- and multi-item orders while reducing or eliminating the need for void-fill. Automated packaging is creating a streamlined fulfillment process that can effectively overcome challenges with higher speed, efficiency, and reliability.

Next to inventory, labor costs are usually the largest expense in a warehouse facility’s operating budget. It’s also

one of the most unpredictable resources for an organization. It’s difficult to maintain steady throughput when you struggle to source labor and have high labor costs. Right-sized automated packaging is providing a key means for many e-commerce companies to overcome this challenge, by only requiring one or two operators and eliminating up to 20 packing stations. By automating the packaging process, e-retailers are reducing and reallocating labor, boosting overall efficiency and profitability.

When it comes to e-commerce orders, first impressions matter. With the growth of e-commerce, more orders are being placed online. This means, for many customers, their only interaction with a company happens during the unboxing experience, making this moment more critical than ever before. Many e-commerce companies are bridging the gap with branded, right-sized boxes that are void-fill free, arrive on time, and deliver orders undamaged. Additionally, with print-on-box technology, custom messages, logos, and branding can be individually tailored for each and every package at lightning speed. By right-sizing and branding the packaging, e-retailers are showing customers that they can provide the expected customer conveniences without sacrificing productivity.

When it comes to e-commerce, packaging is the most outward testament to a brand and its commitment to sustainability. Implementing eco-friendly processes are good for building an organization’s positive brand awareness and showcasing its commitment to the environment. A number of strategies are available to companies to support this priority, with automated packaging leading the pack. By creating the smallest parcel necessary, businesses can lessen their environmental impact and lower shipping material costs by an average of 38%, for a more environmentally friendly parcel. As e-retailers reduce each package’s carbon footprint, they are saving valuable money and resources in the long run.

As we continue to look ahead, it’s important that business leaders recognize the emerging packaging trends in e-commerce and adapt. Contact Sparck Technologies for more information about fit-to-size automated packaging solutions.

https://sparcktechnologies.com sales.packaging@sparcktechnologies.com

returns as retailers look to mitigate costs.

In a Forbes interview, Steve Rop, chief operating officer at goTRG, an RLA member, said, “It’s not sustainable for retailers and DTC brands to continue to absorb the costs for returns. It all comes down to economics.”

Amuted holiday season is expected as the National Retail Federation (NRF) forecasts retail sales to grow between six and eight percent over 2021 to between $942.6 billion and $960.4 billion.

“While consumers are feeling the pressure of inflation and higher prices, and while there is continued stratification with consumer spending and behavior among households at different income levels, consumers remain resilient and continue to engage in commerce,” NRF President and CEO Matthew Shay said in a statement.

The expected growth in retail sales will also result in higher returns.

According to the Reverse Logistics Association’s (RLA) quarterly returns index, survey respondents expect fourth-quarter returns costs and volumes to increase.

The availability of holiday returns data is sparse, but UPS’s annual holiday returns statement typically serves as a proxy.

In 2021, UPS forecasted that it would handle a record of more than 60 million returned packages from November 14, 2021 to January 22, 2022, a 10% increase from 2020.

UPS also expected one in four consumers to make a return. Of those returning items, 41% say they plan to return three or more items. More than one in five consumers made a return before Christmas.

This year’s holiday season will likely focus more on

A market research report from Apriss Retail and Incisiv found more than two-thirds of retailers surveyed (69%) said they treat returns as a cost center, while the same number said they lacked a good understanding of the root cause of returns.

“Returns can feel like a second-class citizen,” Nathan Smith, SVP of products at Apriss Retail, told the online news outlet, Multichannel Merchant. “There is no chief returns officer responsible for the end-toend flow because it’s split between different silos in the company, and no one person owning it.”

Indeed, RLA has several research projects to understand total returns in companies. We’re now seeing some retailers charge a small fee for returns and others telling customers to keep certain returns because the returns cost is too high for retailers.

Third-party reverse logistics service providers are investing in automation to reduce returns costs while retailers utilize their omnichannel strategies to encourage customers to return items to stores, thereby helping

reduce transportation costs to pick up and transport to a store or warehouse.

Overstock.com and UPS are testing a returns service during the holiday season in which Overstock.com customers can have product returns picked up at home without reboxing the product.

The Overstock.com and UPS pilot is similar to a collaboration between FedEx Office and Happy Returns, now owned by PayPal. However, with the FedEx Office and Happy Returns partnership, consumers bring unboxed returns to a FedEx Office location, including a QR code generated from initiating the return process online. Using Happy Returns’ technology, FedEx aggregates box-free items from multiple merchants into a single shipment, reducing the cost of the process for participating retailers.

As companies emerge from the pandemic in which supply chains were costly due to high transportation and warehousing rates and worker shortages, companies are now looking at their reverse supply chain as a means to mitigate costs and improve processes.

white-papers, and monthly webinars that provide best practices in managing reverse logistics.

WE help our clients become smarter consumers of freight services resulting in average client savings of over 17%. We care about YOUR shipping costs as much as you do. We are passionate and data driven. Using our proprietary CarrierCop© software and our team’s years of experience, we will find the savings you desire. You are the boss, you make all final decisions, let us work for you, and focus our energies on bringing you the savings you need.

www.Go-ACT.com | SendMeInfo@Go-ACT.com | 248.630.1326

Green Mountain Technology (GMT), founded in 1999, brings innovation and technology together to create a truly powerful and unmatched parcel and LTL spend management platform. We’ve applied nearly 25 years of experience and lessons learned to create highly accurate and proven processes for the audit and pay, cost allocation, and overall strategic management of your transportation network. With a real industry expert and true strategic partner like GMT by your side, curbing increasing transportation costs and gaining visibility into critical optimization opportunities have never been easier.

www.GreenMountainTechnology.com | contact@GreenMountainTechnology.com | 877.397.2834

Get the best deal — guaranteed. To get the best deal in a carrier agreement negotiation, it’s essential you know two things: what you can ask for and how to ask for it. Our expert team of former FedEx, UPS, and DHL pricing analysts have seen thousands of carrier agreements — plus, they’re backed by millions of benchmarking data points from our analytics platform. They’ll tell you which discounts you can negotiate, and how you can get the absolute best deal on your agreement — guaranteed.

Reveelgroup.com | support@reveelgroup.com | 877.421.4994

www.shipnetwork.com | getstarted@shipnetwork.com | 866.983.7447

accurate picture of true cost and service fulfillment. High volumes, multiple surcharges, contracted delivery guarantees, limited access to information — it all adds up to a complicated invoice process prone to inaccuracies and unnecessary costs. Our small parcel experts work with you to proactively identify areas to reduce expenses with customized solutions that integrate small parcel and freight data for an accurate view of your true transportation spend.

Usbank.com/transportation-solutions/small-parcel | cpstransportation@usbank.com

And all through the distribution center, elves were frantically picking, packing, and shipping. Yes, frantically! The peak season is a trial-by-fire of the procedures and processes you have implemented to handle the onslaught of this season. If you were to give yourself a grade for this year, what would it be? On a scale of one to five, would you get a top score? Unfortunately, many would likely be closer to one, especially if you were to close the loop and take into consideration the consumers’ experiences. Oftentimes, the distribution center stops accountability as soon as that package leaves the door. Whether the package was picked/ packed or shipped correctly requires a holistic review of the entire process.

For a person who has been in the supply chain for a number of years, the holiday shipping season makes me cringe. Too often, I find myself thinking, “How did they get this wrong?” This is especially true when orders come from name brands that I have worked with in the past; my mind immediately jumps to, “What happened?”

Already this quarter, I have plenty of real-life examples of supply chain gone wrong.

1. I ordered a video game for one of the people on my list, the order was confirmed, so, so far so good, right? Within a week, I receive it in a padded envelope. Excellent! Except… two weeks later, I get another one from the UK. Most consumers don’t think about the cost to the company. On the other hand, I not only think about the cost to the company, but also wonder what broke in their system to get a duplicate sent internationally. Plus, if it happened to me, how many more times is this happening throughout this company’s well-known supply chain?

2. I ordered some toys (seven total) from another popular company. I received free shipping because my total purchase was over $75. Not only did all seven toys come in separate boxes, but the dimensioning of the container was a joke. One very small item (Minnie Mouse earrings) was sent alone in a box that was 12 x 8 x 8 with no dunnage. This popular retailer is matching others’ prices, so the

margin on the items is not huge. As a consultant doing the numbers, it appears that surely the profitability of this order was in the red. Then the mind goes to… how many times does this happen?

3. I ordered an expensive item, only one. I received three. In an effort to return the two sent by mistake, I was told by customer service that their system does not allow them to return more than the one and to just keep the other one. Did I mention it was expensive? After asking the customer service associate how often this happens, she explained, “Often, and I’m not sure why they don’t fix it.” Are you picturing my head spinning? You’d be correct.

4. I ordered a picture book. It was delivered by USPS and didn’t fit in the mailbox so the carrier left it at the door, that was not covered by a porch, on a rainy day. Needless to say, it was destroyed.

5. A popular toy ordered for one of the littles in the house arrived with a label slapped on the toy and in no unmarked box. Not only did it spoil the Christmas surprise, but I then had to explain the difficult fact that they must still wait for Christmas to use it. These are just a few of the blunders we have made in the supply chain. There are more, but my point is obvious. We can do better! It begs the question, who is keeping an eye on the customer experience, or are we in such a hurry to just get it out the door (even though it’s incorrect)? We know better, your team knows

better, so what failed? Doing a post-season audit of the supply chain holistically is a lot of work, but you only know that you have made these mistakes if you do such an audit. The old saying “you don’t know what you don’t know” is so accurate when you talk about the “true” customer service in the supply chain. There were delivery mistakes made by FedEx, UPS, and USPS. There were retailer mistakes from very well-known companies, enough to make one ask, “Who’s watching the store (aka supply chain)?”

Some may say that it’s just Christmas and not a huge deal (except, of course, if you are in the pharma business and you are shipping out life-critical products!). Yes, mistakes happen, but if we are just fixing the issue instead of going back and finding out what caused the problem, it will continue to happen. And what will those mistakes do to customer satisfaction and your company’s bottom line? The best supply chains will review and audit and go all the way back to the root cause and fix those issues so the inherent problem does not re-occur. On the bright side, there were some shippers that did an excellent job, which was refreshing! Happy shipping, and I wish you all the best discovering the many ways that next season can be even better!

Susan Rider, President of Rider & Associates, Supply Chain Consultant, and Executive Life Coach can be reached at susanrider@msn.com.

Delivering a seamless shopping experience to your customers is more important than ever in the face of growing competition. One negative delivery experience can be enough to turn a customer away from your company for good. So, obviously, many businesses invest time and effort in perfecting their packaging and shipping processes, but what about the insurance end of things? Your parcel goes through so many steps to get from your distribution center dock to your customer’s doorstep, and what if things aren’t exactly picture-perfect along the way? A lost or damaged package could quickly lead to a damaged company reputation in your customer’s eyes. So it’s wise to make sure you have the best insurance necessary to cover any snafus that pop up along the way. The experts listed below will be happy to help you customize your parcel insurance plan to fit your company’s needs. Call them, and when you reach out, be sure to mention you saw them in PARCEL.

Parcel Insurance Plan has specialized in insuring packages since 1966. All policies are underwritten by Allianz Global Corporate & Specialty rated A+ Excellent by A.M. Best. Instead of using the carrier’s insurance or declared value, we invite you to choose PIP for your parcel insurance needs. We offer low rates, exceptional customer service, and claims are paid in 7-10 business days. To qualify, your company must ship insured packages over $100 in value on a daily basis or spend at least $1000 annually on declared value charges. Request a quote at www.pipinsure.com/parcelmedia/ today to see how much your company can save.

www.pipinsure.com/parcelmedia | office@pipinsure.com | 800.325.7390

U-PIC Shipping Insurance specializes in package insurance solutions for shippers from small to large. Coverage is available for shipments originating in the United States and Canada through all major shipping carriers to destinations around the globe.

U-PIC customers enjoy shipping insurance rates that are typically 50% - 90% less than shipping carrier insurance programs. Additionally, we employ a simple online claims process that ensures prompt processing and payment.

| www.u-pic.com | sales@u-pic.com | 800.955.4623

UPS Capital Insurance Agency, Inc. (UPSCIA) is helping SMBs to large shippers insure exceptional shipping experiences despite everyday disruptions like lost, stolen, or damaged merchandise. With InsureShield® shipping insurance, powered by UPSCIA, businesses can easily protect their packages, profits, and reputation across any carrier. Join the more than 450,000 shippers protected by InsureShield coverage. Wow customers with amazing post-purchase experiences in the digital marketplace and throughout the supply chain. Plus, file claims easily online directly with UPS Capital, rather than going through the carrier. Most claims are paid within days not weeks, helping make the claims process efficient for both you and your customers.

| https://upscapital.com | upscmarketing@ups.com | 877.263.8772

Buckle up, folks. 2023 is shaping up to be an especially eventful year in the parcel industry. Economic conditions continue to drive industry change, and both FedEx and UPS are facing unique challenges in the upcoming year. How these events play out will have wide-ranging implications for shippers, carriers, and consumers alike. Here are the industry events shippers should watch for and the steps to take to best prepare for a potentially volatile year.

FedEx Performance Concerns FedEx Corporation aces a number of significant changes entering 2023. Most notable is the integration of its Express and Ground networks. Siloed by design in the original FedEx business model, FedEx announced the integration of these two distinct organizations, called Network 2.0, in June 2022. On the surface, this move represents a strategic decision to overcome operational inefficiencies and improve profitability over the next five years. The basic idea follows the notion that FedEx can leverage all of its capacity and optimize lower cost solutions (e.g., Ground) to execute on its commitments.

Long-term, the course charted by new FedEx CEO, Raj Subramaniam, seems to make sense. Many in the supply chain make similar decisions on a daily basis. However, as with many transformations of this scale, shippers should be wary and expect some operational pain in the short term, especially in 2023.

FedEx service providers, the independent contractors who man the FedEx Ground network, represent a particular vulnerability to FedEx operations. As FedEx engages these providers on a per-stop, or per-mile, basis,

rises in cost — labor, fuel, equipment, etc. — could result in a number of providers folding shop. At this point in 2022, there is no indication that reliance on these operators will change in the new network schema, leaving this as a risk for 2023 performance.

On-time delivery is also a concern. Over the past two years, FedEx has particularly struggled with on-time delivery performance, hitting 84.8% in mid-December 2021, falling 10% YoY from 2020. UPS, by comparison, achieved 95.8% during the same period, and consistently outperformed FedEx throughout the year. As FedEx works towards network integration, it is unclear how the network changes will impact its on-time performance, but it is unlikely that it will dramatically improve.

The 2022 peak season will provide a bell-weather as to what shippers can expect in 2023. Tactically, shippers should monitor performance metrics on a weekly basis, especially in the early months of 2023 to protect against potential service disruptions to customers. Understanding the importance of on-time delivery, and what service or carrier options are available, will be necessary for a successful year.

United Parcel Service (UPS) enters 2023 in a similarly precarious position as the 2018 Teamsters Union Agreement is set to expire on July 31, 2023. Early indications show

that this could be a particularly contentious renegotiation as the Union presses on eliminating driver tiers and increasing wages. As the largest parcel carrier in the United States, the consequences of this negotiation, for better or worse, will have wide-ranging implications. Industry observers should expect to see the word, “strike,” frequently in the coming months. Do not take it lightly.

The Teamsters Union last held a general UPS strike in 1997. The strike lasted 16 days and cost UPS hundreds of millions of dollars. For shippers locked in UPS agreements, the cost was significantly higher and ravaged shipper-carrier relationships.

In sum, when making plans for 2023, UPS shippers ought to consider what their contingency plans are in the event of a UPS service disruption. Begin compiling a plan that lays out the resources necessary to pivot to an alternative carrier should the need arise. In other words, if a secondary carrier is needed, do you already have the contracts in place? Do you have the shipping bays to facilitate a new carrier? Is your operation flexible enough to handle a new sort process? Is IT aligned or will changes need to be made? All these questions and more should form the basis of contingency planning. It is unlikely that UPS will allow negotiations to reach the threshold of a strike, but not out of the realm of possibility. Be ready.

Economic conditions remain uncertain for 2023, however, early indications paint a lackluster picture. The Consumer Price Index (CPI), a measure of price change over time (i.e., inflation) currently shows a 6.6% YoY increase (less Food and Energy) with little sign of abatement. Energy, including fuel costs, is significantly higher YoY, at 19.8%. Both metrics play an important role in the transportation industry as carriers scramble to contain cost.

While many in the industry are painfully aware of fuel surcharge metrics — and the frequency at which these tables can change — one of the newer tactics taken by carriers involves the CPI. FedEx, and to a lesser extent DHL, have both begun including language surrounding general rate increase (GRI) caps, making them contingent upon three-month average CPI increases. Specifically, if the CPI exceeds a certain average percentage over a three-month period, contractual caps are waived. This means that shippers will receive the full published increase year-over-year. Be on the lookout for this type of language if you plan on negotiating contracts in 2023 or beyond.

As 2023 unfolds, inflation — along with the other hurdles carriers will be grappling with — will determine much of what we can expect going into the 2023 peak season and 2024. The GRI is now officially 6.9% for both FedEx and UPS and 7.9% for DHL. These percentages may become a more normalized (even low) expectation for the next few years. Carriers have been creative with these increases in the past, so it is also possible that exceptions for areas such as fuel may make a reappearance in their calculations. For peak season, shippers should also brace for some “creativity.” UPS will be licking its wounds after a labor negotiation, and given its focus on revenue quality, the 2023 peak season may be an early opportunity to relieve the pain. For its part, FedEx has been struggling with its revenue, period. If Network 2.0 underperforms, the 2023 peak season also represents a potentially lucrative opportunity. In short, cost increases will be a recurring theme in 2023. Remaining updated on the industry and in frequent communication with your parcel service provider will be must for all shippers.

1. Review Existing Carrier Agreements: Devoting time to look over existing carrier agreements is an essential step in developing a sound 2023 strategy.

Look to answer the following questions: When does my

agreement expire? Are my revenue-based discounts secure with an expected increase or decline in shipping volume? Do I have agreements with multiple carriers? If yes, am I optimizing them?

These questions, and more, will help narrow down any necessary actions or analysis that needs to take place and create a rough timeline for execution. It is also important to note that while contract negotiation is usually the best option for savings, if your program is looking at a change in volume, amending your existing agreement or securing an extension can be a sound short-term decision.

2. Secure a Secondary Carrier (if You Can): Securing a backup agreement with a secondary carrier is a prudent step to mitigate the risk of a service disruption. Having the ability to continue shipping, even at an increase in cost, often outweighs the cost of sitting on idle shipments.

Right now, it is an especially good time to approach an alternative carrier as capacity begins to open back up following the COVID-19 peaks. Bear in mind minimum volume commitments and what it will take to maintain the relationship in the interim.

3.

Allocation: Over the last two-year period, one of the more common industry trends involves carrier diversification. Josh Dinneen, Chief Commercial Officer at LaserShip/ OnTrac recently authored a great article in PARCEL discussing these advantages.

What I would add here, is that if you utilize multiple carriers and expect a change in volume, be mindful of how your shipments are allocated. Most FedEx and UPS contracts today include revenue-based discounts sensitive to changes in volume. Moving too much volume to a second carrier can result in an overall cost increase if you are unaware of these thresholds. Look at recent carrier invoices to determine current tier calculations or contact a freight audit provider if you are concerned about volume changes.

4. Implement Rate-Shopping Software: Rate shopping software is an excellent tool to manage costs, manage carriers, and maintain customer commitments. As cost-reduction efforts continue to increase in importance entering 2023, consider reaching out to a service provider today to understand if this software would be a good fit.

There is much to be on the lookout for in 2023. All signs point to an eventful year. Remaining proactive with your program, maintaining an open line of communication with your carrier, and planning through each scenario will be the best course of action to navigate a turbulent year.

Congratulations! After years of searching, sitting through countless demos where you smile politely and promise to call (but you know you won’t), you’ve finally done it. You found The One. They’re perfect, checking off every box on your list of required attributes of a third-party logistics provider: They’re attentive, their website is eye-catching, and most important of all, they promise to help you save lots and lots of money. You can’t wait to spend the rest of your professional life with them, and you want that life to start today.

But, before you put pen to paper, take a breath. Pull yourself out of that warm glow of PowerPoint animations and hearty handshakes, and try to think about what that partnership will look like three months from now. But don’t stop there. What will it look like a year from now? How about five years from now? This 3PL that has you head-overheels for their synergies may promise to save you money, but the fact is that most 3PLs out there can provide some level of savings, at least in the short

term. The more important question for you and your business is: How do they plan to save you that money? Those dollar signs they keep flashing don’t just appear out of thin air, so what does a partnership with their company actually look like, on the day to day? And are they worth it in the long run?

It’s easy to get excited about saving percentages and promises of automation, but integrating with a 3PL can be tricky, and it can have a massive impact on your operations . . . as well as your bottom line. Here are three things to consider about your potential partner to help you see how compatible the two of you really are:

Communication: The most basic part of integrating with a 3PL, or any strategic partner, is oftentimes the most overlooked. How does that partner plan to communicate with your carriers, not to mention you and your team? Are they set up for API connections, and can they work with regional carriers who might not be? For those rare instances when PDF/paper invoices are the only option, what’s their plan? How do they

handle carrier exceptions or disputes? There are many different ways for partners to interact with carriers, but what’s most important is that whatever their methods and capabilities are, they have to work for you and your operations.

The second part of the question is equally important: How do they plan to communicate with you and your team? Do they have a web portal that is easily accessed, and suitable for your needs? Can they send monthly reports, or ad hoc? Will there be weekly meetings with a dedicated account manager, or quarterly summaries sent by email?

Changing existing systems for a new 3PL is always expensive and time-consuming, so making sure their technology can seamlessly link to your current stack is vitally important. Again, there’s no one right way, but the important part is making sure they are capable of communicating in the method and cadence that works best for you.

Values: The next piece to consider when integrating with a 3PL is the

value you derive from the relationship, and vice versa. Obviously, the primary draw of working with a 3PL is that they promise to save you money, and most of them deliver on that promise (to varying degrees). But audit savings are just the tip of the iceberg when it comes to trimming down transportation expenses. Does the 3PL provide business intelligence that can help improve efficiency, saving time and resources? What about visibility that can help optimize your supply chain? Audit savings are a great conversation starter, but efficiency and visibility are the cornerstones of a successful and, in the end, more profitable partnership. Remember, it’s not a bad thing to ask what you’re getting out of the relationship.

And don’t forget to understand the value the 3PL derives from your business, as well. How a company bills you can and does influence the nature of the relationship, for better or worse. Are they a transaction-based company, or do they operate on a gain-share model? Where

are they incentivized to help you succeed, for their own success? Ideally, business relationships are win-win, but understanding how your partner “wins” can help you choose the partner that’s right for you.

3Growth: Where do you see yourself in five years? Down the line, will this 3PL still be a trusted strategic partner, or will you have you outgrown them? There’s nothing wrong with using casual solutions that work in the moment, but for any business looking for long-term success, growth and scalability need to be part of the discussion. If your volume increases, can the 3PL’s processes and technology keep up? What if your carrier profile expands? Are they set up to handle acquisitions or separate business groups? As much as we would like it to be, integration is not a destination, it’s a journey. Understanding the limitations of your partner will help you forecast your own, and making tough decisions now can ultimately lead to success and profits down the road.

Relationships, including professional ones, are tough. It’s much easier and exciting to leap in, head first, and just hope that things will work out for the best. But when it comes to selecting and integrating with a 3PL, asking the tough questions earlier, doing the hard work and understanding the technical fit, can ultimately lead to a much more rewarding partnership.

So, the question is: Are you compatible?

Brad McBride has been in the transportation industry for over 30 years. He founded Zero Down Supply Chain Solutions in 2003 after many years in high-level sales and operations roles in the logistics industry. In 2016, determined to make an impact on traditional industry practices and provide considerable savings for businesses, Brad also launched FreightOptics, the cutting-edge technology that provides one-login access to view and optimize all modes of transportation. Brad can be reached at brad@zdscs.com.

How do you want customers to feel about your products and store? Are you achieving those goals, or do constant complaints, refund requests, and other concerns make it feel like you’re missing the mark?

Customer satisfaction is among the most important factors for your business to focus on when thinking about long-term growth. E-commerce satisfaction rates have a significant

impact on revenue right away — realizing the value on goods sold while minimizing expenses like returns and support agents. Then, happy customers tend to come back for more, especially when you’re introducing new products or running

On the other hand, bad experiences drive down immediate revenue and mean you’ll spend more trying to acquire new customers. There’s also a risk of poor reviews and reputational harm that can drive down sales among existing targets

If you want to build loyalty, there are a few things to start

The first part of improving e-commerce customer satisfaction is to set expectations. The easy work is reviewing product descriptions and info to ensure things are accurate, pictures are recent, and reviews are honest. The more difficult part is tweaking and adjusting the things that make a difference when a customer is choosing between you and

Start with elements like your shipping and returns policies. Is everything clear? Are you direct and easy to understand? Can your operations live up to every promise you offer?

With peak season starting, it’s easy to focus on big sales events. The underpinning is making everything else run smoothly so customers can trust you, get what they want, and not have a bad surprise arrive on their doorstep.

When something happens, work to have a process that clearly explains it. For instance, FedEx and UPS are massively ramping up their general rates next year. You may want to put a simple explanation on your website, letting customers know shipping costs are increasing due to this change.

Another big point of frustration are those long forms with way too much detail that you don’t actually need to get an order to a customer. Mandatory profiles and signing in, phone numbers, birthdates, and tracking details that you don’t use to personalize offers all make the sales process longer for no good reason.

Streamline and simplify. Single-page checkout processes often have a better conversion rate, according to studies. Adding discounts and shipping information sooner in the process, emphasizing how someone can get free shipping, and having carts follow people all make it easier to shop and buy. The more satisfied someone is with the store experience, the more likely they are to make a purchase and keep your doors open.

When in doubt, help them out.

Improving the order management process not only helps your company control costs in the warehouse, but it also increases e-commerce customer satisfaction rates. If your

3PL partner improves order accuracy, then they’re saving you from shrinkage and loss as well as helping you generate more recurring revenue.

When the correct item arrives to the customer at the time they expect, you’ll experience fewer returns. That means you capture more revenue and avoid paying reverse logistics costs on top of refunds or replacement costs.

Internally, improving order accuracy helps you forecast total shipping costs, minimize packaging usage, and manage operational expenses by having predictable shift and staffing needs. You can even reduce customer support demands, saving staff time and helping sales focus on higher-value opportunities.

E-commerce can feel simple from the customer’s point of view. They click a few buttons, add in payment details, and then get their newest purchase in a few days. To them, it doesn’t feel like there’s much that can go wrong.

Of course, every e-commerce shop owner knows the truth. Things can break from the point of manufacturing to inbound freight, through receiving and storage, then in picking and packing, and finally in shipping to the customer. Many things

small and large can happen at every point, but you never want that feeling to reach the customer.

So, protect yourself and your reputation by introducing multiple easy ways to get help. Give your support team the tools that track orders and inventory, look for transaction issues, and help people get carrier details. Then, let customers reach out through multiple methods, such as email and on-site chat, or add in social handles and phone support. Thankfully, many tools make it easy for support agents to help from a single screen, no matter how your customers ask.

The goal here and in other areas above is to simplify processes so customers get what they want faster and more reliably. Every improvement you make to accuracy and speed is one that will pay dividends for e-commerce customer satisfaction and return shopping rates.

Jake Rheude is the Vice President of Marketing for Red Stag Fulfillment, an e-commerce fulfillment warehouse that was born out of e-commerce. He has years of experience in e-commerce and business development. In his free time, Jake enjoys reading about business and sharing his own experience with others.

The concept of evaluating a Return on Investment (ROI) seems straightforward: ROI = Annual Net Benefit (Revenue + Savings – Expenses) / Initial Investment Expense. On the surface, this seems like a simple approach to prove the viability of a material handling automation project. The truth is, while the calculation may be simple, the output of the calculation is only as good as the data that is put into it. To build an accurate ROI case, proper steps must be taken to gather accurate data.

The process of gathering data begins at the initial idea phase. Implementing material handling automation can be overwhelming. As technology advances, the material handling tasks within a facility that can be automated are virtually endless. Many people know that they have deficiencies within their facility but are uncertain of where to focus their automation efforts to get a positive ROI.

The area of focus for automation to provide the best ROI is different for every project. Some common pain points

where automation can make sense are areas where labor is a concern (both labor reduction and retention), tasks that require precision, safety issues, and repetitive actions. Regardless of where the focus of the automation is, there are two factors to focus on when calculating the savings of an ROI:

1. Quantitative Factors: These factors include reducing and retaining labor, increasing throughput, and saving space in the facility. Quantitative factors provide numerical data points to help drive the decision-making process. These factors are easier to place a monetary value on for ROI calculation.

2. Qualitative Factors: These factors include service benefits and accuracy improvements. They are more subjective and unique to the application. Qualitative factors can be harder to monetize but can have a significant impact on proving a positive ROI.

Once you determine where to focus your project, there are some other key steps that can be taken to help provide a better ROI and for overall project success:

Determine the Planning Horizon –Projects shouldn’t be planned for the present. Future business growth projections need to be considered for project planning. An automation project that gets outgrown before the ROI can be achieved is a catastrophe. A typical planning horizon is at least five years.

Plan for Expansion – Planning for additional growth or potential future business changes may not have a direct impact on the project ROI, but not planning for future expansion may have a huge impact on the potential ROI of future projects. Without an expansion plan, the cost of future projects and the impact that those projects have on the operation can be negative.

Build in Flexibility – Business is constantly changing. Anticipating potential changes and designing a system that is functional when things change is important. Do not get locked in with hard automation that can’t grow and change with the needs of the business.

Properly Size the System – Properly sizing the system is key to creating an accurate ROI case. A system that is too small may cost less but will not fit the needs of the business. A system that is too large will make the ROI goals unachievable. Getting accurate data and business growth projections to properly size a system is imperative.

With data being the driving force to build an accurate ROI case, it’s crucial that the data being used is correct. This starts with making sure the system is being planned for the correct timeframe. A rule of thumb is to plan for at least five years of business growth when considering automation while simultaneously planning for future expansions. The initial planning horizon takes into account the immediate needs of the business. The expansion plan builds in flexibility and allows the business to react quickly as a business grows and changes.

Along with identifying the correct planning horizon, determining the correct capacity is needed for building an accurate ROI case. Planning a system to the overall average capacity will undersize the system for peak season. Using the peak capacity can drive the cost of the system up considerably. Often, a system that can support a reduced peak for the system’s design year is the best fit. Building in flexibility to the system design can be a good way to handle peak surges. This flexibility can include additional operating hours, bringing in additional equipment for peak season (a system design that supports short-term equipment leasing like many Roboticsas-a-Service providers is a good example of this), or designing a system that will function with additional, temporary labor, when required.

Once it’s determined where to focus automation and the data is gathered to build an automation plan, it’s important to determine if the ROI case fits the needs of the business. With labor challenges in

many markets, the traditional target of an automation project providing a return in two years or less is being extended. Defining what a successful ROI is for a project needs to be done on a case-bycase basis and needs to consider the unique challenges each business faces.

If the success of a potential automation project is being determined based on an ROI case, the ROI being prepared needs to be accurate. Knowing where to focus automation, providing accurate data to build a plan, and defining what is a successful ROI for the business are all crucial elements to creating a successful project.

Josh Duane is the Director of Sales for Hy-Tek’s Southern Operations. He uses his 15+ years in material handling automation design experience to help his customers come up with creative, cost-effective, and efficient solutions to get their products out of their distribution centers and into their customers’ hands.

As shippers approach the end of a year unlike any other, here are five resolutions they can make to help ensure that they begin 2023 on the right foot.

New Year’s resolutions often begin with reflection. Last fall, our data scientists created a model that combined the 5.9% general rate increase (GRI) for 2022 announced by FedEx and UPS with the new surcharges, rules, and fees each carrier also introduced, but did not include in the 5.9% average increase. We then ran a macro-level analysis by modeling the new rates against actual shipments our customers made the previous year to see the real impact on costs.

In that analysis, announced in December of 2021, we found that fewer than three percent of shippers would see their costs increase by 5.9% or less. We also said that in 2022 the average company using UPS would see

its costs increase by 10.25% and that the average company using FedEx would see an increase of 12.86%. At the time those were eye-opening, even controversial findings — radical increases that quickly contributed to the pursuit of record revenues for both carriers.

Although accurate, we now know they were just the beginning. When Russia’s attack on Ukraine sent energy costs skyrocketing, multiple fuel surcharges followed. But unlike years past, even those included hidden costs. FedEx, for example, changed the table used to calculate fuel surcharges, a move that generated another 1.7% increase in profits over the actual surcharges. And in earnings calls, fuel surcharges were discussed not as the unwelcome cost increases customers grapple with, but as mechanisms that

helped to drive sustained increases in revenue-per-package.

Then, of course, there was the 2022 peak season: new dates — for many FedEx customers, it began on September 5 — and, of course, more new surcharges. Combined, these factors left no question: 2022 was the most expensive year on record for shippers.

Keeping that in mind as we begin 2023 is important. The carriers have shown their willingness to take aggressive measures to increase revenues. And that is unlikely to change anytime soon.

There are, however, things all shippers can do to level the playing field and gain the intelligence needed to make the best shipping decisions with confidence. These new year’s resolutions can help ensure that you start 2023 on the right foot.

1Know My Shipping Profile Better Than the Carrier: Despite historic increases — the 2022 GRI of 5.9 % was the highest ever introduced until the 2023 rate of 6.9% was unveiled, again with both FedEx and UPS announcing the same increase — there are still many ways to manage your shipping operation and lower spend.

It has always been imperative that you know your shipping profile better than the carrier does — former carrier sales representatives, myself included, will tell you that customers who understand their shipping profile, and have the data to back it up, enjoy a significant advantage over their peers when asking for discounts. This is particularly true today when carrier reps have more information to draw on. UPS’s CEO Carol Tomé, for example, noted in the company’s Q1 FY2022 earnings call that reps would be using Deal Manager, a new tool that “is providing pricing analytics to our sales team as they go about negotiating

deals.” Data is crucial and you don’t want to be outgunned.

actual increase was twice that for their shipping profile.

If you know your shipping profile and follow the money, it’s possible to do an impact analysis on the new rates and the new rules to determine exactly how much it will impact your costs. Then forecast accurately and budget accordingly.

Know My Shipping Vital Factors: Within your shipping profile, pay particular attention to your shipping vital factors. These are the key performance indicators that hundreds of shippers we surveyed pay attention to so they can manage their operations, monitor and measure their performance, and inform good decision making.

Shipping vital factors include service spend, surcharge spend, average cost per shipment, weight (average billed weight and the percentage of packages billed at their dimensional weight), minimums — the percentage of parcels that meet the minimum threshold for charges — and the average zone or zones you ship to most.

Use My Shipping Profile to Follow the Money: Armed with a keen understanding of your shipping profile and the vital factors that define it, look deeply into the areas where your operation is spending the most. Remember that GRIs are an average. They impact each and every organization differently and do not include the surcharges and rules that typically accompany them. It’s crucial to know exactly how they will impact your organization because of where you are spending.

Remember, too, that even small things can radically increase costs. For example, a small change in what defines an oversized package can exponentially increase the costs associated with some parcels. Don’t wait until you receive your first-quarter bill to discover them.

Make Better Strategic Decisions: Use modeling capabilities to analyze your shipping costs all the way down to the SKU level. With many thousands of shipments occurring each day, it can be easy to overlook problem areas.

For example, each year, many shipping leaders are surprised to find that specific products, often those that new rates and surcharges now categorize as oversize or subject to special-handling charges, are being sold and shipped at rates that actually lose the organization money. Analytics should also be used to determine if items truly need to be delivered via expensive services that expedite delivery times. For example, ground services can often get shipments to customers on the same day as air services in many metro markets. Whether the item is delivered at 8 AM or 10 AM may be immaterial to the customer.

Every year, I see shippers take the announced GRI at face value and use it for budgeting; for example, taking last year’s 5.9% increase and increasing their budget by 6.5% just to pad it a bit, only to find out that the

Despite macro-economic trends, the shipping landscape will likely remain challenging into 2023. By considering these resolutions and reaching out to peers for assistance and guidance along the way, shippers can gain the insights and shipping intelligence needed to make informed decisions. We can’t dictate shipping costs, but we can determine how we address them and manage our operations to not only optimize costs, but also the many ways that shipping performance can impact top-line and bottom-line results.

Josh Dunham is CEO and co-founder, Reveel. Visit www.reveelgroup.com for more information.

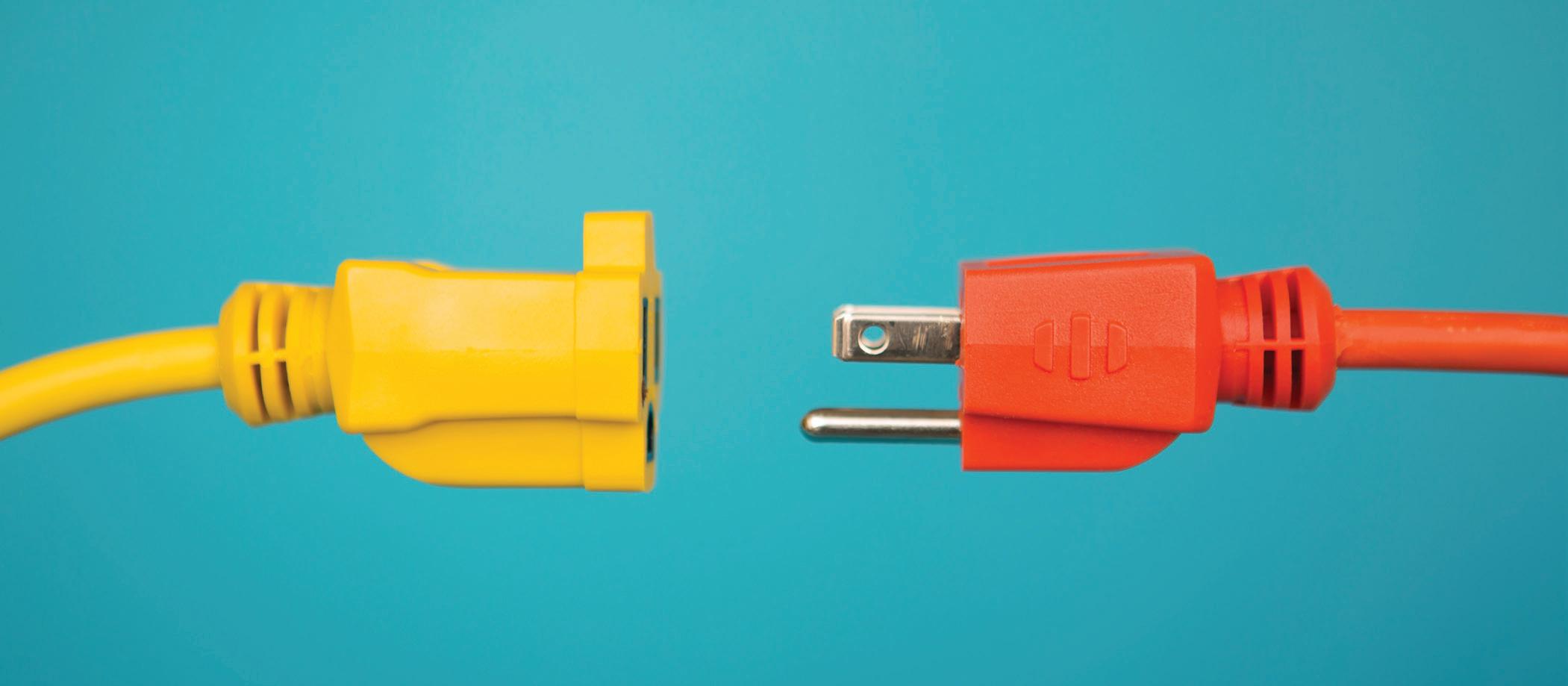

It was such a privilege to be celebrating the PARCEL Forum 20th anniversary in Chicago with so many of you this October. The staff of both PARCEL Forum and PARCEL Media want to take a moment to say “thank you” to all who made it possible for us to still be thriving after two decades, even in the face of the recent COVID-19 pandemic and its associated closures. Now, more than ever, small-package shippers need a place where they can come network, learn, and grow, and it’s our hope that the Forum will continue to be that place for our attendees. The explosive growth of the package industry, fueled in large part by the enormous increase in e-commerce, means that we’ll continue to be here for many years to come, helping you meet those challenges head-on.

This year’s show was a pleasant blend of old and new faces alike. As someone who has been attending the conference for more than 15 years, running into some of our regulars feels like meeting up with old friends. (And, from a busi-

ness perspective, it’s encouraging that they keep coming back, since, clearly, they are learning new information that they and their company find valuable, year after year). Of course, it’s always nice to chat with the newcomers too. I enjoy hearing what drew them to the show and what they hope to take away.

As is usually the case, the major force driving most people to attend is the desire to mitigate costs and improve order-to-ship efficiencies. Especially in the wake of FedEx’s 2023 general rate increase announcement in late September, in which the company announced a record-high increase of 6.9%, with the most common surcharges increasing by even more than that, shippers at this year’s conference were concerned about what the new year was going to do to their budgets. (And if you’ve been following PARCEL for any length of time, you’ll know that the announced increase is usually far lower than what most shippers actually experience. After all, 6.9% is just the average; most shippers will see their costs increase by much

more than that). As a result, the “Carrier 411” and “2023 Rate Impact” learning pods were, not surprisingly, some of the best-attended.

But, while understanding your carrier profile and acing the negotiation sessions with your carrier rep are, of course, some of the best ways to save your company money, they’re certainly not the only ways. Everything from packaging optimization to last-mile delivery hacks was discussed at this year’s show, giving our attendees insight from some of the best and brightest in the industry. As Anna Ameduri, Vice President, Global Logistics, Glidewell

noted, “This event is informative for anyone new to the industry or us veterans. Networking is always amazing and learning what's new and what to expect in the near months is key.” After all, in this ever-changing industry, being armed with all the information conveyed at the conference certainly puts a shipper at an advantage.

Speaking of networking, I was especially excited about the Women in Logistics Mimosa Meet-Up (sponsored by the Women in Logistics and Delivery Services [WILDS]), held on the exhibit hall floor the last day of the conference. It was so humbling to be surrounded by

so many brilliant women in the logistics industry, especially when our conference content director remarked that during the first year of the show, there were only about 10 women attending. How far we’ve come!

Thanks to everyone who attended and exhibited at the 2022 show, and we look forward to seeing you at PARCEL Forum '23 Nashville, September 11-13 at the Gaylord Opryland.

If you are interested in speaking, sponsoring, exhibiting, or attending, please email info@EventEvolution.com. Visit www.PARCELForum.com for more information.

“It’s really refreshing to be around likeminded people that are passionate about parcel and the shared learning not only from vendors, but others who do what I do. The content is very much geared towards us to help make actual business decisions when leaving the Forum.”

- Cassandra Baas, Director of Parcel Division, C.H. RobinsonA BIG “THANK YOU” TO OUR CORPORATE PARTNERS Women in Logistics Mimosa Event sponsored by WILDS Grand Reception sponsored by USPS Crowded Exhibit Hall Featuring 115 Companies Packed Interactive Educational Sessions By Ashley Holden

It’s been nearly 35 years since FedEx transitioned to EDI billing, and not a single shipper today would accept what was a standard FedEx or UPS parcel invoice prior to 1990. Imagine a paper invoice summarizing hundreds of shipments with little to no information beyond dollar amounts owed. Do you trust these numbers? How do you verify their amounts? Does each amount correspond to an individual shipment — and, more importantly, do these amounts account for delivery errors or shipping credits? Even today, shippers often lack confidence in their carrier invoices practically brimming with shipment information by comparison. This was the impossible reality that ultimately gave rise to the Freight Bill Audit and Pay (FBAP) provider industry (wherein third-party experts help shippers audit and pay carrier invoices with accuracy) in the late 1990s. But did you know that FBAP providers are having more than a moment in today’s competitive parcel landscape — and their shining star isn’t necessarily their audit or pay services? In fact, in the 20+ years since, standout FBAP providers are joining shippers at the network strategy table and helping solve complicated and persistent problems. Why and how is this happening?

First, shippers expect more useful (decisive) data to guide their networks. Cleansed, labeled, and normalized carrier data happens to be a great data mine, and it has gained importance through the pandemic as shippers have had to rely more on carrier diversification and less on contract negotiation to achieve goals like cost mitigation and increased delivery speed. Though this was happening before the pandemic, 2020 really underscored the need for shippers to look inward as much as possible to overcome unforeseeable (sometimes global) supply chain bottlenecks. FBAP providers’ view of carrier data offers a number of areas to begin: which carriers are or aren’t performing, which zones are most problematic, which surcharges or accessorials are impacting your bottom line most?

This brings us to another important evolution for FBAP providers — shippers are looking for more cost justification and decision-making support from them than ever before. Instead of asking which carrier is right for them, shippers increasingly want to know which carrier is the most cost-effective or perhaps the best delivery experience provider for a particular package type, zone, or customer. On top of all these considerations, carriers have introduced

new or adjusted existing fees, and those changes have come both swiftly and frequently. The incorporation of these fees requires constant updates to your rating logic and analysis of the larger network impact. This has heavily increased the importance of partnering with a FBAP provider that will verify and monitor such changes with you, as close to real time as feasibly possible.

Second, shippers are seeking to actually do something with their customer data, too — and when you combine carrier and customer data feeds skillfully together, you unlock newfound potential to analyze your network and identify winning future opportunities. Your understanding grows from assessing a shipment based purely on size/weight, cost, or time, to what’s inside the box, and — in some cases — the purchase intent that created the box. Many shippers use this combined approach to gain more accurate order statistics, ultimately helping guide and fortify their budget and inventory plans for the year(s) ahead. Some rely on this kind of approach for more timely compliance reporting, and others are using it to better understand larger components of their business, like order cycle times. Separate, these two data feeds already tell you a great deal about your network, your business, and your brand, but together you may find the missing ingredient to solving peskier problems that have seemed out of reach. Take package theft concerns, for example; many are starting to look to FBAP providers to gain some sense of the likelihood or risk of theft within a designated location. With such information in hand, shippers can choose to change the delivery options for a consumer in a high-risk area, opting for commercial pickup instead of residential delivery for example.

Third, shippers are creatively applying a blend of carrier, customer, and overall network data obtained from FBAP providers to gain better supply chain footing. Shippers are looking to FBAP providers to help provide a more holistic view of their supply chain networks and make smart decisions. Shippers are asking questions like — does that data indicate an order fulfillment risk or bottleneck, can that data support (or demand) a distribution center change, or should I change my e-commerce shipping offerings (i.e. Express, Economy, or Deferred Delivery)? Take carrier diversification, for example, which became a significant area of focus for shippers throughout the pandemic. Shippers no longer simply want guidance on how to diversify their carrier mix, but now want guidance on how to also optimize that diverse carrier mix — just like they would a primary carrier.

Others are using FBAP provider data to optimize modes, too, by enabling their WMS/TMS to push particular shipments to LTL in the effort to reduce overmax charges. Some partner strategically with FBAP providers for box carton analysis at ship-from-store locations, reducing both errors and time. But shippers aren’t always looking to FBAP providers for guidance regarding their specific network. They’re also starting to seek guidance about the global supply chain, and how their network fits into it (or at least

We’ll get you back on track.

Parcel optimization and savings experts

Auditing of all freight modes

Reporting and analytics tools

Payment processing solutions

General ledger coding solutions

White label solutions for consultants www.Go-ACT.com 248-630-1326 | Connect@Go-ACT.com

Our goal is to reduce your shipping costs, it’s all we do.

could be impacted by it). In addition to helping guide budget and inventory decisions, FBAP providers are beginning to help clarify the global supply chain to shippers and their executive leadership teams.

Shippers are ultimately looking for a wider range of tools to identify opportunities that could be leveraged to mitigate shipping costs or reduce delivery times, as well as increased data to help them understand their shipping network, their customer, and their overall business strategy better. In the past, shippers’ reliance on FBAP providers was largely limited to the scope of the audit — anything extra, such as opportunity identification or decision-making support, was simply a delight. Today, shippers have an all-hands-on-deck approach to utilizing every resource available to them, and the examples above indicate how their relationship with FBAP providers has evolved into something much greater.

Ashley Holden is a Solutions Manager at Green Mountain Technology (GMT). Ashley partners with GMT’s clients representing nearly $1B in parcel spend to provide GMT’s strategic Parcel Spend Management solutions – Network Optimization, Spend Analytics, and Contract Management.

Your shipping costs are too high.

Smart shippers need every ounce of help in today’s rising rate environment. Choosing the right warehouse network keeps you in the game and beats the competition.

Warehouse networks are collections of physical buildings that hold inventory while distributing products to and from customers. In the past, these buildings had a large “storage” role, with substantial piles of inventory. Today’s distribution warehouses are much leaner, focusing on item velocity, throughput, and customer service.

All warehouses need a mission or guiding purpose. Some common purposes can be delivering customer orders, supplying other warehouses, supporting specific sales channels, performing emergency roles, handling returns, or combinations of the above. Involving key stakeholders (sales, marketing, finance, operations) early in the process determines what’s in and out of scope.

Warehouses networks range physically in size from million-plus square foot facilities down to smaller retail stores. Warehouses can be operated by a third party (3PL), leased, or owned. At a minimum, you need at least one. Having more than one location allows for diversification, customization, decreased transit time, and reduced cost.

Your warehouse network is the most important decision you have control over. It establishes a value proposition to customers based on the service you provide and the associated cost structure.

Service to customers is defined by the time from when the customer orders to when the order is delivered. It can range from minutes to months.

Lack of internal understanding of the role service plays in your business is dangerous when designing warehouse networks. If your service time is too long, customers will shop elsewhere. Conversely, over- servicing your customers may make you uneconomical in a competitively priced environment.

Cost is another important dimension to consider. While everyone wants to drive costs to zero, it is important to understand the competitive landscape you operate in. Talk internally with stakeholders to understand the level of customer service needed to capture new customers and retain existing ones.

Warehouse networks control four primary costs. The magnitude of these costs from largest (1) to smallest (4) are:

1. Transportation Costs – Inbound and Outbound

2. Warehouse Labor and Supervision

3. Inventory Costs

4. Warehouse Facility Costs

Large (20%-40%) total cost opportunities exist between companies that have optimized their warehouse networks and those who have let their networks grow haphazardly.

When to Design a Warehouse Network Warehouse networks are dynamic creatures that flex with the environment they serve. Letting your warehouse network stagnate deteriorates performance to key customers and fails to provide cost containment in the marketplace.

At a minimum, you should evaluate your warehouse network annually. This planning process often coincides or follows shortly after budget planning, key sales meetings, and notifications of carrier price increases.

There are also other urgent events (Figure 1) that may force you to evaluate your network on a more ad-hoc basis.

Lease Terminations

Annual Sales Meeting New Large Customer(s) Capacity Issues Align Channels

Merger/Acquisition

Competitive Pressure

• Decrease Cost

• Improve Service

Designing a warehouse network starts with the big picture and the long term. There are key questions that need answering to arrive at an optimal solution. These include: How many warehouses to have Where they should be located How big they should be What should be stored in them What is their mission (central, regional, returns, slow-moving, and so on)? What cost and service is expected

There is no one-size fits all network. Warehouse networks need personalization in two dimensions: The baseline (shipment profile and costs) pattern you incorporate to model your business and the ensuing management discussion (what should we do) around the analysis.

All warehouse network designs start with a shipment pattern. This pattern can be where your historical shipments were delivered to, your expected forecasted shipments, demographic patterns (US population, high income zips, etc.) or combinations of the above. Using this shipment pattern in the model allows optimization around the time it takes to deliver a package to customers.

Adding in the costs of the current network allows savings benchmarking of a proposed network versus the current. Costs typically include inbound and outbound transportation, costs to process the order, and warehouse overhead costs.

Costs depend greatly on the network design and should be accounted for carefully. Adding in cost elements often changes the locations of warehouses and the resulting territories.

It is impossible to separate a warehouse network from its transportation partners. Having tens of warehouses in strategic locations means nothing if product can’t be quickly transported to end customers. Likewise, it is expensive to ship parcels via air from a single warehouse to satisfy time-definite customers. Knowing your carrier capabilities and costs is a crucial first step.

Transportation costs typically decrease as the network adds more warehouses. This is because there is more efficient inbound freight (via Container, LTL, or TL) and decreased distance travelled for expensive parcel freight.

Labor costs (workers actually handling the orders) tends to be a constant function of a company’s total throughput. Fewer warehouses mean more employees at each facility, while increased warehouses mean fewer employees. One caveat is that larger facilities may be able to justify increased automation that reduces headcount, but this is offset by the associated spend on technology.

Inventory and facility costs, on the other hand, increase as the network grows. Typically, supervision and management costs are incurred at each warehouse regardless of its size or throughput.

To complicate the network designer’s task, these costs are interdependent. Low inventory availability, causing out-ofstocks, can be compensated for with additional emergency

shipments from more remote warehouses.

Adding together transportation, inventory, labor, and facility costs allows us to understand the total cost of a proposed network. This allows an apples-to-apples comparison of possible choices. The network designer needs to understand and optimize this total cost, not just one component.

Network modeling requires analytics to evaluate alternatives and arrive at the optimal solution. There are two fundamental differences in systems that design warehouse networks. Some are “cost calculators” and some are “optimizers.” Cost calculators merely report the results of an alternative that you input. Optimizers find the best alternative among many.

For instance, if you wanted to test placing five warehouses in 100 possible cities, you’d have to make 75,287,520 evaluations. This is difficult in a cost calculator but can performed by a good optimizer in seconds.

The final and most valuable part of a warehouse network analysis is the discussion around what to do. Once you have established a cost and service baseline, it is time to let the optimization begin. This is a participatory step where many different options should be evaluated quickly, prioritized, and

presented for discussion. Done properly, this step should spur additional “what if” runs and scenarios.

Each network option should summarize important metrics. Some common ones include: total cost (inbound, outbound, inventory, etc.) detail and summary, weighted average zone, percentage of packages delivered (same-day, 1-day, 2-Day, etc.), facility throughput, and logical geographic territories.

Finalist networks should be portrayed graphically with key customer locations identified. Changes in routing should have the impact (savings or cost, service times) identified. This allows sales the opportunity to identify any critical messaging that needs to be done.