22 20 24 26 28 /// CONTENTS Volume 31 | Issue 2 06 EDITOR’S NOTE Rejuvenating Your Parcel Operation By Amanda Armendariz 08 INDUSTRY INSIGHT How Long Will It Last? UPS and FedEx Fight for Share By Joe Wilkinson 10 SUPPLY CHAIN SUCCESS “How Can We Get My Manager on Board?” Managing Leadership Expectations During an RFP By Chelsea Snedden 12 GUEST COLUMN The Future of Last-Mile Delivery: Innovations and Expectations for Seamless Shipping By Charles Haverfield 16 REVERSE LOGISTICS Going Circular By Tony Sciarrotta 18 PARCEL COUNSEL Anatomy of a Lawsuit, Part Four: Alternative Dispute Resolution By Brent Wm. Primus and Andrew M. Danas 20 THE TOP HABITS OF SUCCESSFUL SHIPPERS Parcel shippers are under more pressure than ever to contain costs. To succeed in this new era requires shippers to embrace active shipping management. By Josh Dunham 22 AI AND THE IMPACT ON SUPPLY CHAINS By Anthony Michael and Patrick Bangert 24 A BALANCING ACT: E-COMMERCE CUSTOMER EXPECTATIONS AND THE COST TO MEET THEM By Matthew Kulp 26 THE FIGHT FOR FREE SHIPPING Cost pressures are changing the face of free shipping and threatening its ubiquitous status. By Mingshu Bates 28 STAYING COMPETITIVE IN A GREEN ECONOMY: TOOLS FOR ACCURATELY MEASURING CARBON EMISSIONS By Steve Beda 30 KATE MUTH AWARDED THIRD ANNUAL MEGAN J. BRENNAN AWARD FOR EXCELLENCE By Amanda Armendariz SPONSORED CONTENT 14 NEED SHIPPING SOFTWARE? LOOK HERE! 17 IS IT TIME FOR A CONSULTANT? GET OUR NEWSLETTER? SUBSCRIBE FOR FREE 4 PARCELindustry.com MARCH-APRIL 2024

PRESIDENT

CHAD GRIEPENTROG

PUBLISHER

KEN WADDELL

EDITOR

AMANDA ARMENDARIZ [ amanda.c@rbpub.com ]

AUDIENCE DEVELOPMENT MANAGER

RACHEL CHAPMAN [ rachel@rbpub.com ]

CREATIVE DIRECTOR

KELLI COOKE

ADVERTISING

KEN WADDELL (m) 608.235.2212 [ ken.w@rbpub.com ]

JOSH VOGT [ josh@rbpub.com ]

PARCEL (ISSN 1081-4035) is published 7 times a year by MadMen3. All material in this magazine is copyrighted 2024 © by MadMen3. All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to PARCEL, MadMen3 or its staff becomes the property of MadMen3. The articles in this magazine represent the views of the authors and not those of MadMen3 or PARCEL. MadMen3 and/or PARCEL expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: Free to qualified recipients: $12 per year to all others in the United States. Subscription rate for Canada or Mexico is $35 for one year and for elsewhere outside of the United States is $55. Back-issue rate is $5.

Send subscriptions or change of address to: PARCEL, P.O. Box 259098 Madison WI 53725-9098

Allow six weeks for new subscriptions or address changes.

REPRINTS: For high quality reprints, please contact Chad Griepentrog, 608-241-8777, chad.g@rbpub.com

P.O. Box 259098 Madison WI 53725-9098 p: 608.241.8777 f: 608.241.8666

PARCELindustry.com

MARCH-APRIL 2024 PARCELindustry.com 5 SUBSCRIBE FOR FREE!

REJUVENATING YOUR PARCEL OPERATION

By Amanda Armendariz

Spring is the perfect time to take stock of your parcel operation and identify what is currently going right and what you could be doing better, before too much of the year gets underway. There are many places in your small-package operation that deserve examination. Perhaps you’ve let your parcel spend management fall by the wayside in the wake of your other responsibilities; that is maybe understandable, given your workload, but not advisable. Josh Dunham’s article on page 20 will highlight the habits of the best shippers with respect to spend management, so you can make sure you’re incorporating these items into your regular to-do list. Or perhaps you’re wondering how

to juggle the ever-growing customer expectations consumers have for their e-commerce orders, without breaking the bank. Matthew Kulp’s article on page 24 walks you through how to best approach this balancing act. Or maybe it’s that you are unsure how to approach senior management about the results of the RFP process. Don’t worry; Chelsea Snedden has got you covered on page 10.

No matter what obstacle you may be facing in your operation, or what goals you hope to accomplish, this issue of PARCEL is packed with the information you need to run your organization efficiently and effectively. We hope that you find it helpful, since it’s our goal to be your industry partner every step of the way. And if you haven’t already, check out PARCELForum. com to stay updated on and register for this year’s show (held September 16-18 at the Gaylord Texan). This conference is consistently praised by our attendees as being the best out there, and we’ve got a variety of tracks and sessions to appeal to and educate shippers, no matter what part of the supply chain you may be responsible for. I’d love to see you there.

As always, thanks for reading PARCEL.

6 PARCELindustry.com MARCH-APRIL 2024 EDITOR’S NOTE

INDUSTRY INSIGHT

HOW LONG WILL IT LAST? FEDEX AND UPS FIGHT FOR SHARE

By Joe Wilkinson

In the middle of 2022, the US parcel market began shifting in shippers’ favor. While it took a while to make up the ground lost in 2020/2021, savings started to become a possibility, even a likelihood, in mid- to late 2023. But in July of last year, when UPS and the Teamsters reached a tentative agreement (later ratified), and the prospect of a major capacity disruption faded, the brakes came off. We are now experiencing what appears to be the most shipper-friendly parcel market since DHL Express exited the US market in 2009. The argument could be made that this market tops even that, as DHL was then seen as a low-cost option, and those stranded volumes needed to find a home, even at a higher cost, leaving UPS and FedEx to divvy up the spoils at higher rates. Now, UPS is attempting to claw back volumes that shippers diverted to other carriers to mitigate the risk of a work stoppage, while FedEx and other carriers try to defend and expand on those gains. All of which combines to make this a very soft, shipper-friendly market.

It is important to note that when we talk about parcel prices and the market, there is a sharp distinction between what is happening to published prices and what is happening in negotiated prices. Both UPS and FedEx have been aggressive in their General Rate Increases (GRIs). Increases on published rates have been surprisingly high, and even more so on surcharges and effective minimum package charges. But what we are addressing here is what is going on in pricing negotiations.

This situation was over three years in the making, and it came with significant suffering on the part of shippers. In 2020/2021, all carriers were caught off guard by the

spike in market-wide parcel volumes, especially e-commerce volumes. Shippers scrambled to find safety valves for volumes subject to aggressive carrier rate increases, or in some cases, volumes being declined by carriers altogether. At that time there were no safe havens. Most carriers were struggling, and in many cases failing, to service current customers, with little appetite for new business. Ignoring the lessons of history, many in the industry proclaimed that the e-commerce surge was not a surge at all but was instead the new normal. These people said that the e-commerce growth rates seen in 2020, over 24%, could be expected to extend into the future indefinitely. And, in my opinion, UPS and FedEx bought in. They both began to quickly build out capacity, both fixed and flex capacity. Predictably, parcel volumes did not continue their meteoric rise. 2022 volumes slipped by two to six percent, depending on which source you believe. The slide continued and intensified through 2023, and this took place in the face of the national parcel carriers’ now overbuilt networks.

But falling volumes was not the only driver. There were others that played a role. Amazon continued to pull more volumes in-house. While this did not reduce

total parcel volumes, it did reduce national carriers’ total addressable market volume.

OnTrac’s acquisition by LaserShip, and the company’s (now simply OnTrac) subsequent national strategy is having an impact as well. While the strategy is not yet fully realized, many shippers are adding OnTrac to explore the service, build the relationship, and to be in a position to quickly implement on a broader scale when and if OnTrac becomes a de facto national carrier (and often to save some money in the meantime). Additionally, new entrants like Veho and Better Trucks, along with established regional carriers, have captured significant volumes during and after the pandemic. Carriers like upstarts Veho and Better Trucks, and seasoned regionals GLS, Spee-Dee, and LSO also garnered a lot of volume during and immediately following the pandemic. Although shippers are focusing less on diversification than they were in 2021/2022, so that situation seems to have mostly stabilized.

Finally, we have USPS’s Ground Advantage, which is proving to be a serious disruptor. The service is very well suited to SMBs with low package weight and high residential deliveries. So, apparel, footwear, health and beauty, and other categories that are still showing positive

8 PARCELindustry.com MARCH-APRIL 2024

growth are being further encroached by the USPS, again reducing the addressable market, or at least making it expensive to compete, for UPS and FedEx.

During a recent panel discussion at Stifel’s Logistics and Transportation conference, I was asked, how long will this shipper-friendly market last? It is a complex question. In my view, the competitiveness will last until capacity and volume reach equilibrium. Or, put more accurately, when the carriers’ networks are deemed right-sized for the addressable market. UPS has taken a first step in this, by announcing cuts of up to 12,000 positions this year and ending remote work for most of its corporate employees (which looks a lot like a transparent bid to drive attrition). This will help, but it will take time, and more than this, if market-wide package volumes continue to fall. Look for similar measures from FedEx in the near future. Which brings us back to the question; how long will it last? Well, 2020 and 2021 put a serious crack in my crystal ball.

But I do not see this situation turning around before the end of the year. Failing some sort of black swan event, nothing visible on the horizon is going to materially change the competitiveness in this market.

Which is not to say wait it out. Shippers took the brunt of exorbitant rate increase when capacity was tight. Now that the pendulum has swung in the other direction, it is time to recoup some of those losses. Savings are like a river. Once they are past, they never come back.

Far better in my opinion to take some of the winnings off the table through active negotiations. While there are no signals that the market will become less competitive this year, the last four years should have taught us that the unexpected can, and usually does, happen.

Joe Wilkinson is VP, Professional Services (Transportation Consulting) at Intelligent Audit. He can be reached at joeywilkinson@ intelligentaudit.com

MARCH-APRIL 2024 PARCELindustry.com 9

SUBSCRIBE FOR FREE!

“HOW

CAN WE GET

MY

MANAGER ON BOARD?”

MANAGING LEADERSHIP EXPECTATIONS DURING A RFP

By Chelsea Snedden

Explaining the importance of a Request for Proposal (RFP) can be tricky to those who don’t have familiarization with parcel shipping and logistics terminology — more so when it’s your own team members.

Shippers regularly seek out my team’s consulting services to get lower rates on shipment services. But a weak point among them is communicating the necessity of an RFP to their own management team. Often, a shipping client will be well-versed in what the RFP is meant to accomplish, but their leadership (vice presidents, CEOs, department directors) are not on the same page, which can be detrimental to the RFP negotiation process.

How Does This Happen?

The knowledge and skills gap between our clients and their upper managers is common due to differences in daily duties. An average CEO might not understand the nuance between FedEx or UPS for their international program, but they may understand that shipping costs are increasing year over year. Additionally, there are distinctions even the client may not know until they get access to an annual summary of shipping characteristics, which helps both clients and upper management understand what their options are for savings on the RFP launch.

What Are the Stages of an RFP?

Parcel shipping contracts tend to be active for three years, so shippers typically go to bid just before the end of the contract. The RFP begins with an information collecting stage, where the shipper’s consultant will gather a year’s

worth of relevant shipping data to build a profile of the shipper’s program. A year is recommended so they can see the times of peak shipping and flow of program demand over the year.

After information collection, shippers and the consultants will create a file containing pricing requirements and a file containing the shipment characteristics. Common requirements could be a rate cap on future pricing hikes, fuel discounts, cost-per-package targets, or the need for the carrier to include Canadian pricing. The characteristic files can contain number of shipments, number of international shipments, and a weight break summary for carrier’s information.

After requirements are communicated, the shipper will send the RFP document to their outlined carriers to request them to submit a proposal. The shipper’s consultant guides them through this stage and looks at any responses submitted and how it compares to current rates for the same package. An example of this would be if a client had asked for a $7 cost per package on ground shipments, but the first round RFP pricing came back at $8.17 per package for a certain carrier. Our team would then advise the shipper that this carrier’s proposal is more expensive for that service, and they should ask for round 2 pricing.

How Can I Explain the Necessity of the RFP?

1. Speak to them in the

universal language – money. It is crucial to communicate the expected savings of the RFP project. It is best to utilize your consultant to get a clear image of your yearly program and speak to the story of the proposals submitted to your management, i.e., “We will save $1.5M on our $10M program if we move this volume to UPS” or “We are expected to have 6.5% annual savings if we switch our program to FedEx.”

2. Ensure transparency of process and knowledge of shipping terminology.

Clearly outline shipping terms in a cheat sheet for your management. This will enable them to understand the depth of certain discounts before decision-making. An uninformed CEO might push for only basic discounts, which saves only $20K per year on a $10M program, when targeting a fuel discount or additional handling discounts could save them up to $1M.

3. Outline contract expiration dates and the risk of going to list rates.

If a shipping contract expires with an incumbent carrier and the business goes to list rates, it will increase shipping costs by more than 150% in certain cases as the business will have no relevant discounting on shipping services. This will quickly eat into the client’s profit margins. The client also loses the stability and predictability of their pricing, making budgeting and financial planning more challenging. Additionally,

10 PARCELindustry.com MARCH-APRIL 2024

SUPPLY CHAIN SUCCESS

relying on list rates means relinquishing any negotiated service levels or guarantees, potentially resulting in poorer service quality, delivery delays, and diminished customer satisfaction. It’s best to communicate to your leadership, “Our contract expires in November 2024, so we need to send out an RFP by May 2024, or else we risk going to list rates, which will increase our shipping costs by 130%.”

4. Make sure you’re on the same side and can leverage your program size.

Understand what your upper management needs to feel comfortable with the RFP process. Emphasize the importance of leveraging the company’s program size and shipping volume as a bargaining tool during negotiations with carriers. Far too often, my team sees larger shippers unaware of the power they can wield in negotiations. If you’re promising to give $100M in new shipping business to FedEx, your incumbent carrier UPS may not be able to offer such steep discounting. Upper management may feel more comfortable staying with UPS even though FedEx offers millions in more savings for their program, which can delay or diminish the success of the RFP process. It’s

best to communicate, “I know we’ve been with UPS since 2002, but FedEx is offering $20M in steep discounts in 2024; perhaps we can keep a small amount of volume with our incumbent and realize those savings.”

Overall, the shipper should prioritize always keeping management in the loop, noting savings and potential risks to their program. By demonstrating a large potential business opportunity within the RFP process, upper management can understand the significant leverage their company holds in negotiating favorable rates and terms. By framing the RFP as a strategic

initiative aimed at driving cost efficiencies and enhancing operational performance, upper management is more likely to support and champion the process.

Chelsea Snedden is a Transportation Consultant at Körber Supply Chain. She works with clients to model transportation scenarios, often interpreting complex agreements as the primary data analyst. With a background in sustainability and logistics, she brings a future-oriented perspective to managing transportation programs. Some of the customers she has worked with include Canva, GNC, Covetrus, Baxter, and many others.

SUBSCRIBE FOR FREE!

THE FUTURE OF LAST-MILE DELIVERY: INNOVATIONS AND EXPECTATIONS FOR SEAMLESS SHIPPING

By Charles Haverfield

Last-mile delivery, the final stretch from warehouse to consumer, presents businesses with a myriad of challenges. High shipping costs, time-consuming processes, and the escalating demand for seamless service underscore the need for a shift in how businesses approach this crucial stage.

Let’s explore the key shipping trends businesses should expect this year and the innovations that will help streamline the last-mile delivery process.

Drones and Autonomous Vehicles

The once speculative concept of drone delivery has rapidly evolved into a tangible and impactful reality within the logistics sector. Forward-thinking businesses are actively incorporating this technology into their operations, acknowledging the limitations of conventional delivery methods.

Walmart is one of the enterprises that has expanded its network to offer drone deliveries in seven states, having successfully completed over 10,000 deliveries since the launch of its program in 2021. Similarly, Amazon has recently announced plans to use drones for UK parcel delivery, with a commitment to delivering packages in under an hour.

Drone delivery emerges as a solution to challenges posed by congested roadways, geographical barriers, and the increasing demand for swift delivery services. However, while it opens exciting prospects for commercial operations, it also introduces hurdles that require careful consideration.

Critical to the success of drone delivery is airspace management, as drones must navigate shared skies without

disrupting existing aviation traffic. This necessitates precise navigation systems and adherence to clear regulatory compliance to prevent aerial congestion and accidents.

Privacy emerges as another significant concern, given that drones often carry cameras and sensors, posing a risk of unintentional surveillance or data collection from private properties.

Ongoing efforts are being made to establish clear guidelines and safety protocols, ensuring that drone delivery is not only effective but also secure and respectful of privacy.

Advanced Technology Integration

AI is a transformative force, offering solutions to navigate the complexities and challenges of last-mile logistics. Its versatile capabilities extend to optimizing delivery routes, resource allocation, demand pattern prediction, and mitigating environmental impact. The integration of cognitive robotics is introducing intriguing possibilities for addressing intricate last-mile delivery scenarios. Equipped with advanced AI and natural language processing, cognitive robots can navigate complex environments like apartment buildings and office spaces, facilitating precise deliveries to specific individuals or locations.

Predictive analytics play a pivotal role in enhancing last-mile delivery efficiency by optimizing delivery routes. Through comprehensive analysis of traffic patterns, businesses can identify the

most efficient routes for their drivers, resulting in reduced delivery times and overall operational enhancement.

Sustainability in Last-Mile Delivery

Last-mile delivery is frequently linked to elevated emissions and environmental harm, attributable to fossil fuel-powered vehicles like trucks, vans, and cars. These vehicles release carbon dioxide and other detrimental pollutants, contributing to air pollution.

Beyond emissions, lastmile delivery exacerbates traffic congestion, particularly in urban areas where a higher concentration of delivery destinations intersects with limited space for vehicles to manoeuvre.

To address these environmental concerns, both companies and policymakers are exploring alternative delivery methods. This includes the adoption of electric and hybrid vehicles and the use of bike and foot couriers. These alternatives hold the potential to significantly reduce emissions, alleviate traffic congestion, and enhance both delivery efficiency and customer satisfaction.

Moreover, concerted efforts are underway to promote the consolidation of deliveries. This involves grouping multiple deliveries to a single location, diminishing the number of trips and vehicles required for delivery.

Same-Day Deliveries

Recent studies indicate that nearly half of Gen Z (49%) and Millennial (48%) con-

12 PARCELindustry.com MARCH-APRIL 2024

GUEST COLUMN

sumers have high expectations for quick deliveries, with a preference for same-day or next-day options. Additionally, features such as enhanced tracking and varied courier choices are gaining significance in the eyes of these tech-savvy generations.

Failing to meet delivery deadlines can result in a substantial loss of customers — up to 84%. To ensure that your delivery service aligns with customer expectations, it is crucial to establish genuine and achievable promises.

Firstly, businesses should expedite the shipping process by employing reliable route planners, which provides accurate and instant ETA information for customers. Meeting customer delivery expectations hinges on the proactive sharing of real-time tracking information, fostering trust and satisfaction in the delivery process for those expecting same-day deliveries.

Innovative Packaging Solutions

The global smart packaging market, valued at $35.92 billion in 2023, plays a crucial role in enhancing the efficiency and transparency of the delivery process. Smart packaging employs advanced sensors and technologies to monitor package contents, including temperature, pressure, weight, and humidity. This enables precise tracking of the package’s location and estimated time of arrival.

For instance, active smart packaging goes beyond the traditional role of merely containing and protecting products. It actively interacts with the product, preserving its quality, freshness, and shelf life. Another innovative approach is connected packaging, a form of intelligent packaging that links parcels with external consumer devices like smartphones, tablets, and computers.

This connection empowers businesses and customers to access real-time information about the parcel through these devices, fostering transparency and enhancing the overall customer experience.

The innovative concept of micro-fulfilment centers has also emerged as a groundbreaking solution to tackle the challenges inherent in last-mile delivery.

Walmart has already embraced this approach by establishing these centers within existing stores, strategically minimizing the distances that delivery drivers need to cover. This not only reduces fuel consumption but also contributes to a notable decrease in CO2 emissions.

These compact and technology-driven hubs are positioned in densely populated areas, revolutionizing the processing, preparation, and swift dispatch of goods to eager customers.

SUBSCRIBE FOR FREE!

Charles Haverfield is CEO of US Packaging & Wrapping. Visit https://uspackagingandwrapping.com/ for more information.

NEED SHIPPING SOFTWARE? LOOK

Since 1980, ConnectShip has developed, maintained, and supported comprehensive multi-carrier shipping technology. We establish relationships with major, national, international, and regional carriers to ensure consistent compliance for our customers. Our solutions can be used independently or integrated into ERP, transportation, and warehouse management systems, scaling to fit customer growth and global expansion goals. As a wholly owned subsidiary of UPS with decades of experience, ConnectShip enables customers across industries and shipping volumes to meet their transportation and logistics needs. We are technology moving commerce. connectship.com

CT Logistics is a global logistics supply chain and IT solutions provider with a century-long legacy. At the heart of CT’s operations lies a commitment to delivering significant cost reduction initiatives, thereby offering a compelling value proposition to clientele. Solutions can be tailored to suit specific needs and are available through various models such as outsourced, hosted, or licensed. Among the array of offerings are audit and TMS platforms for parcel and non-parcel shipment planning, execution, and label creation along with a BI tool for understanding trends and key metrics, enabling organizations to enhance efficiency, mitigate risks, and seize opportunities. www.ctlogistics.com

After four decades of providing comprehensive system integration solutions, DCS recognized the need for a new breed of warehouse execution system (WES). One built from the ground up and independent from the software offered by OEMs. One with the ability to deliver on the promise of scalability, availability, flexibility, and reliability. DATUM does just that. The DCS WES blends warehouse control with tasks traditionally handled by a WMS. It handles order planning, intelligently releases tasks, synchronizes all current work, and continuously reprioritizes it for the optimal process flow. It can be deployed in semi-automated or completely automated distribution centers to fill high-velocity orders with specific delivery deadlines. www.DesignedConveyor.com

Intelligent Audit, established in 1996, stands out in the complex supply chain market by offering a powerful combination of freight audit, recovery, and advanced analytics. Leveraging machine learning and business intelligence, they provide clear, actionable insights, enabling businesses to navigate volatility with data-driven decisions. Their services ensure cost savings and operational efficiencies by normalizing data across carriers and regions. With a focus on reducing anxiety and guesswork, Intelligent Audit empowers businesses with strategic decision-making tools, distinguishing itself as a critical partner for achieving logistics and shipping success in uncertain times. www.intelligentaudit.com

Address correction fees have once again increased; FedEx now charges $21 per correction. Avoid unnecessary costs associated with incomplete or inaccurate address information such as missing apartment numbers, misspelled street names, and wrong ZIP Codes with affordable, easy-to-use Address Verification solutions from Melissa. Our USPS® CASS Certified™ Address Autocompletion and point-of-entry Address Verification tools ensure information enters your system correctly, shipments are delivered accurately, and customers are satisfied. Visit our website for free trials and a 120-Day ROI guarantee. Melissa.com

Retailers, 3PLs, manufacturers, and consumer brands shipping direct to consumers face rising costs, increasing complexity, and higher expectations. Pierbridge’s Transtream multi-carrier parcel management allows them to ship from anywhere, to anywhere, anytime. It provides them with the enterprise, omnichannel, global, and developer tools to improve shipping performance. Helping them to optimize the customer delivery experience, improve fulfillment efficiency, and reduce shipping costs. Retailers and consumer brands can turn shipping into a competitive advantage. Manufacturers can better serve downstream customers and consumers. 3PLs can expand their service offer. Pierbridge.com

High-volume shippers: stop struggling with complex processes and unreliable shipping solutions! ProShip, the industry-leading multicarrier shipping software, allows enterprise shippers to automate rate shopping, optimize carrier service selection, and easily build and manage complex business rules all within one carrier-agnostic system. ProShip seamlessly integrates with your existing WMS, OMS, ERP systems, and other automation processes, scaling effortlessly as your business grows. With both on-platform and cloud deployment options, ProShip empowers high-volume shippers to streamline complex workflows, maintain carrier compliance, decrease IT dependency, and find a quick ROI. Trusted by leading brands, ProShip is the last shipping software you’ll ever need. www.proshipinc.com

ShipNetwork unlocks effortless growth and efficiency for your business. Our nationwide fulfillment network strategically positions inventory closer to your customers, significantly cutting shipping transit and costs. This approach enhances customer satisfaction by delivering the speed of expedited shipping without the costly premiums. As your business evolves, our flexible model facilitates easy scaling. Begin with strategic locations and expand at your pace, avoiding the common logistical challenges and high investments associated with growth. This strategy streamlines your fulfillment and boosts operational efficiency. Discover how a current client cut their shipping costs by nearly 15% by expanding into our nationwide fulfillment network. Shipnetwork.com

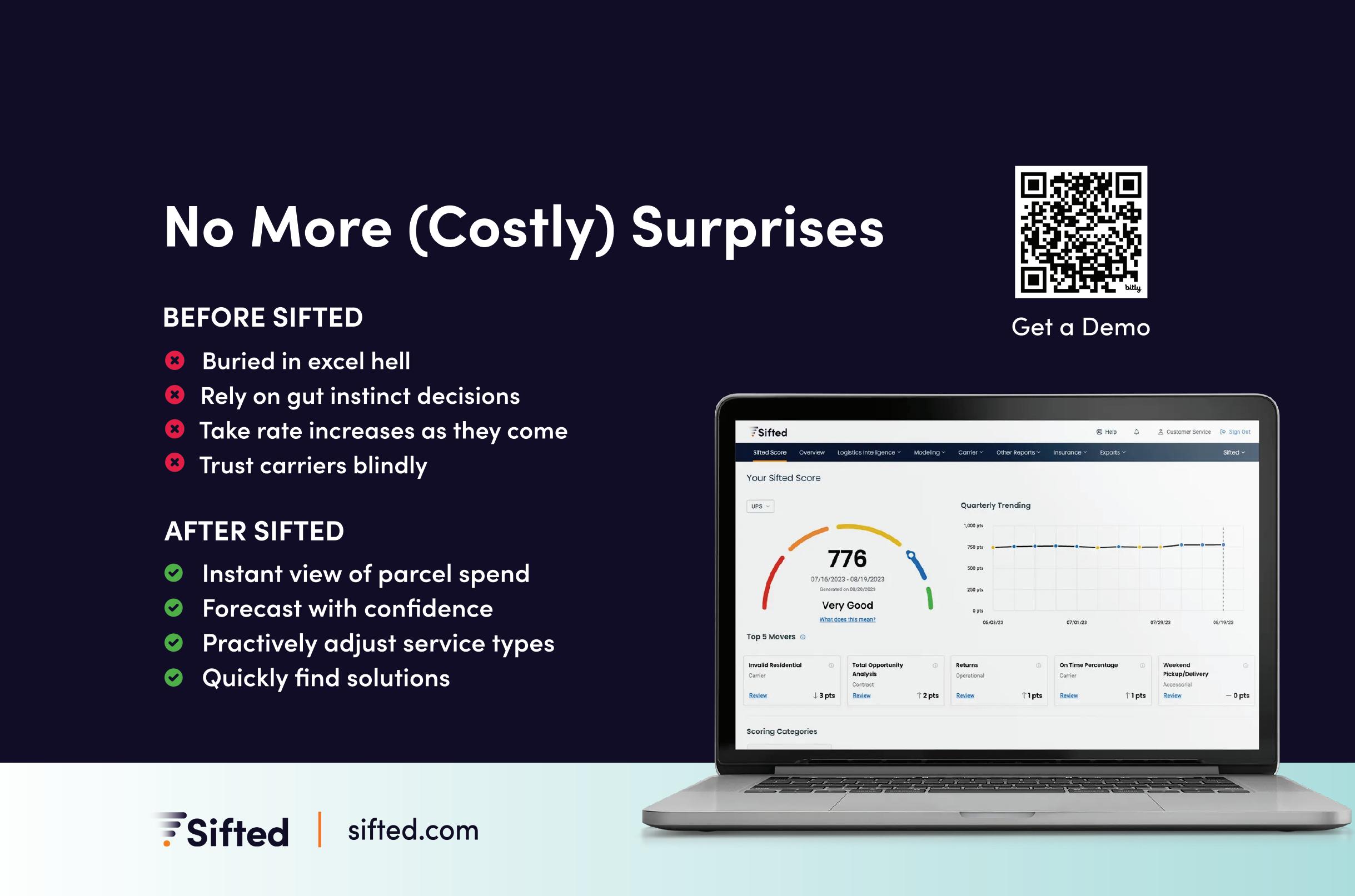

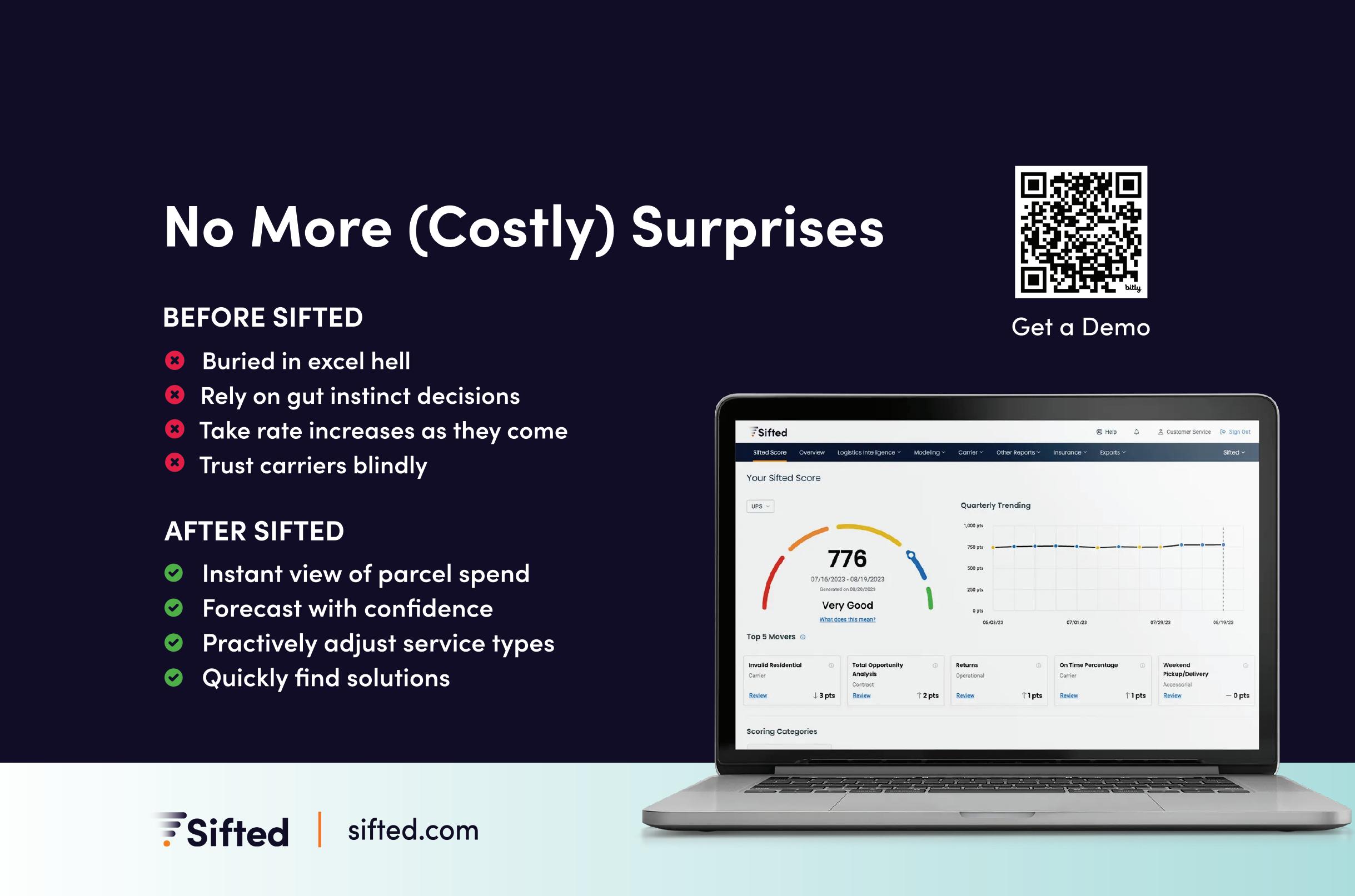

ease. Sifted’s machine learning capabilities transform data from billions of shipments into personalized, benchmarked analytics. No more sorting through multiple data sets. Sifted syncs and normalizes your carrier data, making management and automation a breeze. Equipped with hard-dollar ROI and unparalleled transparency into carrier performance, shippers gain clarity, autonomy, and control — a tectonic shift from traditional consultancies sifted.com

14 PARCELindustry.com JANUARY-FEBRUARY 2022

SPONSORED CONTENT

HERE!

Risk. Rising

constraints.

familiar?

Complexity. Pressure.

costs. Time

Sound

Put Sifted’s Logistics Intelligence Platform to work and start managing your parcel spend with

REVERSE LOGISTICS

GOING CIRCULAR

By Tony Sciarrotta

The record-breaking 20th annual Reverse Logistics Association (RLA) annual conference featured many great events and sessions, including the Women in Reverse Logistics Luncheon with Colleen Robinson, Director of Reverse Logistics at Amazon Lab126, as the keynote speaker, the Interactive Champagne Roundtables, the startup pitch contest and more. But the highlight of the conference was the official launch of the book Going Circular: The Evolution of Reverse Logistics into a Competitive Weapon by former RLA Advisory Board Member and industry leader Richard Bulger.

In a special session, Bulger shared his journey of reinventing reverse logistics at Verizon and Cisco to generate a new revenue stream and returning to school to receive a Master’s in Reverse Logistics from American Public University, the first and only university to offer a graduate degree in reverse logistics. Each RLA Conference attendee received a complimentary hard copy.

Bulger also noted that in 2023 when he spoke at a leadership conference, he encountered about 20 logistics graduates who had yet to be exposed to reverse logistics in their academic curriculum.

Indeed, when I was asked to figure out the returns problems with consumer electronics firm Philips, I relied on the book Going Backwards: Reverse Logistics Trends and Practices, written by Dr. Dale Rogers and Dr. Ron Lemke, to understand the basics of reverse logistics. The book was written in 1998 and has been referenced by many reverse logistics practitioners since then.

Since 1998, however, supply chains have embraced the circular economy. Per Bulger’s book, the circular economy is defined as an economic model that aims to eliminate waste and encourage the reuse of resources by moving products backward to their original source, usually involv-

ing the recycling, repairing, and refurbishing products to extend their lifespan and reduce environmental impact. According to Bulger, with growing environmental awareness and shifting customer preferences toward sustainability, businesses face increasing pressure to manage products from creation to end of life in an environmentally responsible manner. As a result, the balance between environmental responsibility and intelligent business practices is becoming more critical.

Trends

A number of trends are highlighted in the book, including:

Material shortages: Over $100 billion flows into the global market annually, stressing the scale of consumption that includes a growing population. Companies will likely feel the pinch in not only shortages but also in higher costs in securing materials. “The future may well belong to businesses that preemptively adopt circular manufacturing principles that reintroduce materials into the manufacturing process,” writes Bulger.

Government pressure and regulations: The increase in consumer electronics purchases has given rise to Right to Repair laws. Currently 27 US states are considering legislation that would make it easier to repair or refurbish items containing electronic

components. In addition, platforms such as the World Economic Forum emphasize the importance of embedding sustainable practices into global business operations.

The informed consumer: Speaking of repairability, 96% of American consumers consider repairability necessary when selecting a car, and 77% of Americans value repairability when choosing a smartphone. According to a ThredUP report, 46% of Gen Z and Millennials actively contemplate the future resale value of apparel before finalizing a purchase.

Going Circular is a big deal for those in the reverse logistics space and across the entire supply chain. According to the Ellen MacArthur Foundation, “geopolitical shocks and economic uncertainties have highlighted the vulnerability of traditional linear supply chains. Circular supply chains enable businesses to become more resilient by decoupling operations from the extraction of natural resources, thereby increasing material security and reducing exposure to price volatility.”

tices in managing reverse logistics.

16 PARCELindustry.com MARCH-APRIL 2024

Tony Sciarrotta is Executive Director of the Reverse Logistics Association. The RLA offers various tools, white-papers, and monthly webinars that provide best prac-

For over 30 years, AFMS has helped more than 3,000 companies reduce their shipping costs by 15-25%. Specializing in transportation benchmarking, carrier contract negotiations, full RFP and RFQ support for carrier optimization & invoice auditing of your parcel and LTL carriers. Our expert team of former carrier pricing executives and analysts from UPS, FedEx, DHL, USPS and the major LTL carriers have over 500 years of combined industry experience. AFMS will provide a FREE full shipping analysis and shipping profile of where you stand in the market today. www.afms.com

CT Logistics, a recognized global logistics supply chain provider, specializes in implementing impactful cost reduction strategies. Identified by Gartner Group as a leading provider of global freight audit and payment solutions and certified by FedEx, CT offers comprehensive services including BI analytics, contract management, benchmarking, impact studies, and bid management tailored for small package and other modes. Additionally, CT offers an array of value-added services including TMS, managed freight, and shipping co-op services. Our operations adhere to rigorous standards including SOC and ISO 9001:2015 certification. With over a century of expertise, CT consistently delivers proven cost savings and reductions. www.ctlogistics.com

The DCS Supply Chain Consulting team offers a range of services to help your operations address the challenges it faces. Working in partnership with you, DCS consultants analyze your business data — existing workforce, workflow processes, inventory, order data, operations, and more — to determine a strategy that addresses your unique needs. Whether you need an operations assessment, process improvement recommendations, or distribution design services, DCS consultants will help guide you to the material handling system or operational solution that best meets your current and future needs as well as your budget. www.DesignedConveyor.com

Choose DMW&H’s supply chain consulting for unparalleled expertise and tailored solutions. Our consultants offer detailed data analysis and advanced modeling to optimize your factory or warehouse’s future state. Whether upgrading existing equipment, expanding, or implementing new automation, we define solution scopes and provide robust business cases. With over 60 years of experience and a commitment to collaboration, we partner with you to drive efficiency, boost productivity, and maximize your operations’ potential. Trust DMW&H for innovative strategies, deep industry knowledge, and enduring partnerships. Opt for consulting services that deliver results beyond expectations. www.dmwandh.com

At Green Mountain, we’re proud to serve as a trusted partner to some of the world’s top shippers. What makes us different from the rest? We guide shippers to the top of the summit through our unique blend of deep industry expertise, strong carrier relationships, best-in-class data, incomparable technology, and advisory services. If you’re ready to unlock the power of optimized shipping to maximize profitability and deliver on your promise to customers in 2024 and beyond, let’s talk. After all, isn’t it time to make shipping your competitive advantage? “Green Mountain brings a lot of expertise without preconceptions — there’s one path, but no one right way. They bring a great understanding of a very complex industry and they’re able to balance that for the different industries.”-Director, Logistics greenmt.com

Korber Transportation Solutions Consulting (TSC) specializes in sourcing strategy, modeling, and analytics with data. Contract optimization is the primary service offered by TSC, involving sourcing projects for various transportation modes, such as parcel freight. TSC works with clients to develop strategic roadmaps, offer post-implementation support, and provide proactive consulting and monthly reporting for ongoing contract management. https://koerber-supplychain.com

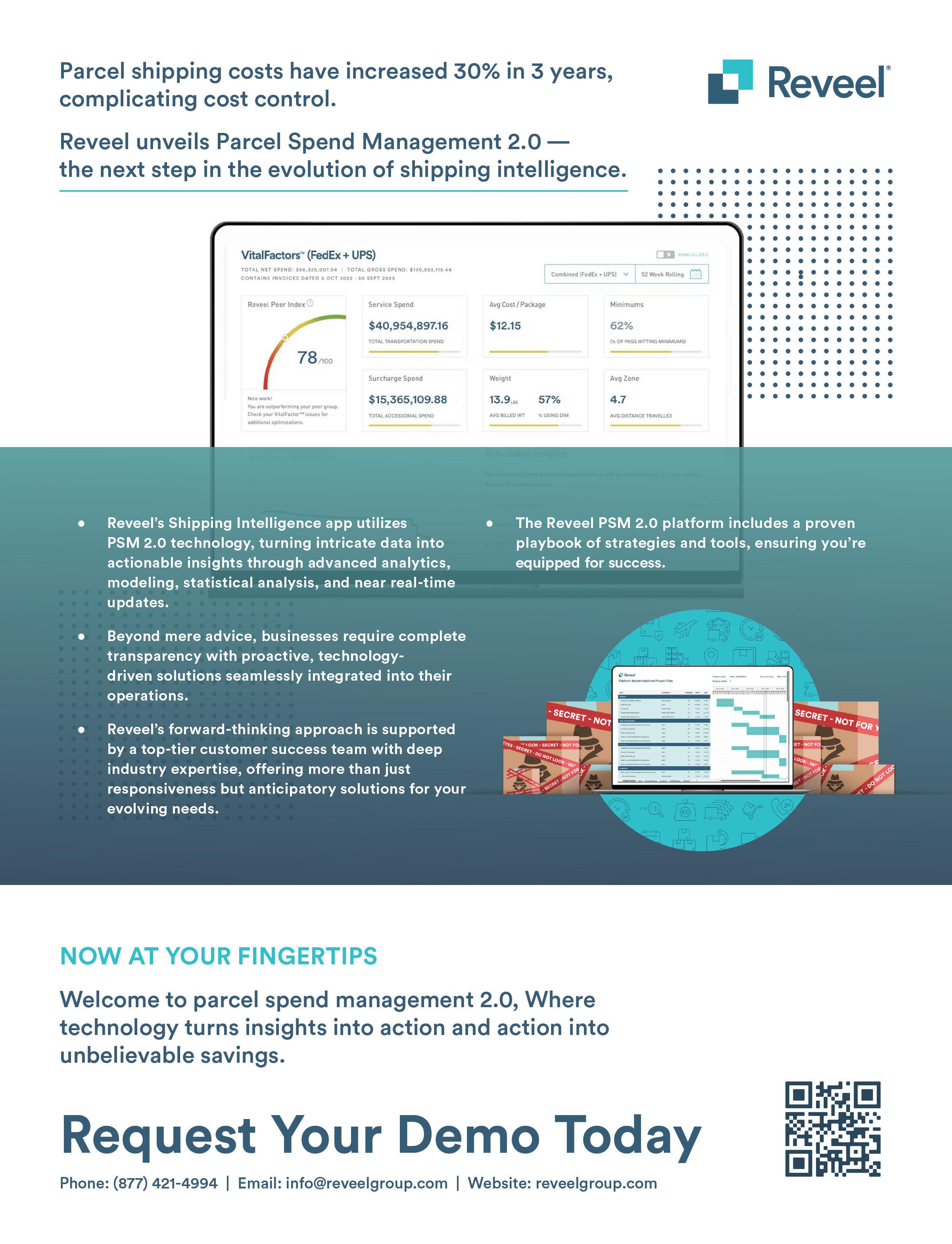

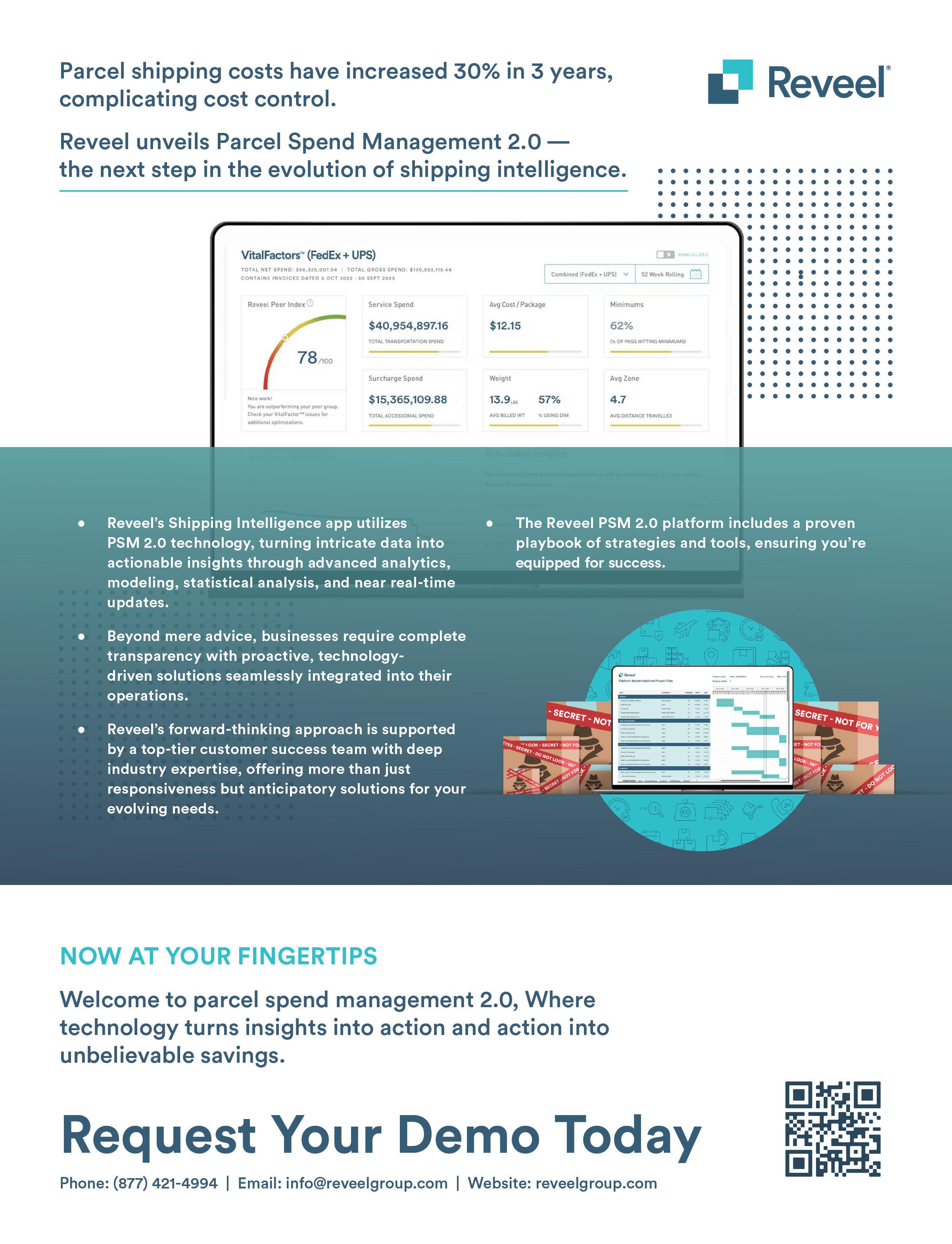

Reveel unveils Parcel Spend Management 2.0 — the next step in the evolution of shipping intelligence. Parcel shipping costs have surged 30% in 3 years, making it harder than ever to control costs. Parcel Spend Management 2.0 marks a shift towards a more strategic, real time, data-driven approach. You’re empowered to optimize parcel spend with advanced technologies like AI and Machine Learning, Modeling and Simulation, and Statistical Analysis. It’s easy-to-use customer facing technology, backed by world class customer support teams that anticipate the needs of shippers like you. Welcome to PSM 2.0 — where technology transforms insights into savings. www.reveelgroup.com

SPONSORED CONTENT

IS IT TIME FOR A CONSULTANT?

Complexity. Pressure. Risk. Rising costs. Time constraints. Sound familiar? Put Sifted’s Logistics Intelligence Platform to work and start managing your parcel spend with ease. Sifted’s machine learning capabilities transform data from billions of shipments into personalized, benchmarked analytics. No more sorting through multiple data sets. Sifted syncs and normalizes your carrier data, making management and automation a breeze. Equipped with hard-dollar ROI and unparalleled transparency into carrier performance, shippers gain clarity, autonomy, and control — a tectonic shift from traditional consultancies. sifted.com Supply Chain Secret Sauce: repairs, strengthens, and bulletproofs supply chains. What we have done: Packaging Optimization, shipping and distribution operations analysis, averaging $1.7M in savings. We help install machines, solve vendor problems, fix logistics issues, find the right robotic 3PL services, and provide data analytics in a simple way. We solve problems. Our Secret Sauce: over 30yrs of experience in production, warehouse operations, logistics and procurement. We value data driven strategy & solutions. Monthly subscription based, no contracts, easy to work with. Call us today, for your free review of your business called our Quick Business Review Program. https://supplychainsecretsauce.com

ANATOMY OF A LAWSUIT, PART FOUR: ALTERNATIVE DISPUTE RESOLUTION

By Brent Wm. Primus and Andrew M. Danas

The last three installments of PARCEL Counsel explored various aspects of a lawsuit: the terminology that lawyers use; the procedures that a litigant will experience in court; and how to effectively utilize a lawyer. In this issue of PARCEL, we will look at Alternative Dispute Resolution methods, abbreviated as ADR.

There are several kinds of ADR. However, the most common ones are mediation and arbitration. Each is a structured method of privately resolving a dispute by using neutral third parties without going to court.

Mediation is a process where the mediator listens to both sides of the dispute and works with the parties to agree to a voluntary settlement. If the parties do not reach a settlement, their dispute will have to go to court or to arbitration for a final resolution.

Contracts may require mediation before a party commences litigation. Many courts will also require a mediation session to see if a lawsuit can be settled before going to trial.

When effective, mediation can be the best method of ADR as it can often result in an earlier resolution of a dispute at a lower cost. In some instances, mediation may repair the relationship as well as resolve the dispute.

Arbitration is a contract-based non-judicial adjudication by a neutral third party that results in a binding decision regarding the merits of the dispute.

While an agreement to mediate or arbitrate a dispute may be entered into after the dispute has arisen, parties frequently agree to use ADR to resolve future disputes at the time of the transaction or initial contract. With a few exceptions, including one for employment agreements with transportation workers, the United States Supreme Court has

repeatedly held that under the Federal Arbitration Act courts must enforce properly structured arbitration agreements, even if they are set forth in standardized form contracts or a transportation provider’s terms and conditions.

What are the pros and cons of arbitration? On the plus side, it can often be a faster, less expensive and more efficient resolution of disputes. The parties can specify the rules and even the number of arbitrators to resolve their dispute, including selecting arbitrators with a specialized knowledge of their industry. For example, in transportation and logistics matters the Transportation Arbitration Board (TAB) uses transportation professionals as arbitrators. (https:// tlcouncil.org/transportation-arbitration-board-inc/). Some corporations may also favor arbitration because the Supreme Court has ruled that contractual clauses that mandate arbitration can waive class action arbitration of certain claims. Critics of arbitration say that it can frequently be as expensive as litigating a case in court, that streamlined arbitration procedures may not afford either evidentiary discovery or the procedural safeguards available in a court proceeding, and that an arbitration decision may not contain a reasoned explanation explaining the decision of the arbitrator. Further, an arbitration decision is usually subject to very limited judicial review

in the absence of misconduct on the part of the arbitrator.

To conclude, if one is involved in a business dispute, ADR should be given serious consideration before proceeding with litigation. However, many breach of contract lawsuits can quickly evolve into lawsuits over whether the parties agreed to arbitrate their dispute. Any party entering into a commercial relationship should thus carefully review the language of any ADR clauses in their contracts as well as in any document that may be incorporated by reference such as a transportation provider’s terms and conditions.

All for now!

Brent Wm. Primus, J.D., is the CEO of Primus Law Office, P.A., the Senior Editor of transportlawtexts, inc., and Director of Virtual Education for the Transportation and Logistics Council, Inc.

Andrew M. Danas is Partner, Grove, Jaskiewicz and Cobert, LLP. For more information, visit www. gjcobert.com or email adanas@ danaslaw.com. The information contained in this article is intended to be general background information. It does not constitute and should not be relied upon as legal advice. Readers should contact a qualified attorney should they have a specific legal question.

18 PARCELindustry.com MARCH-APRIL 2024

Previous

William J. Augello, may be

the “Content Library” on PARCELindustry.com. Your questions are welcome

brent@ primuslawoffice.com.

columns, including those of

found in

at

COUNSEL

PARCEL

BY JOSH DUNHAM

BY JOSH DUNHAM

THE TOP HABITS OF SUCCESSFUL SHIPPERS

Parcel shippers are under more pressure than ever to contain costs. To succeed in this new era requires shippers to embrace active shipping management.

Parcel spend management of course is not a new concept. Shippers have always looked for ways to lower their costs, toiling over ledgers and spreadsheets in an effort to find opportunities for savings, and engaging consultants for carrier contract analysis and contract negotiation expertise.

In recent years, though, the parcel shipping role has changed. Shippers are under greater pressure to deliver savings than ever before. They are also increasingly seen as stewards of top-line growth by C-suite leaders who appreciate the impact they have on omnichannel businesses, including the ability to absorb the costs required to offer “free” or discounted shipping.

E-commerce itself is also more prevalent. In 2001, it represented just over one percent of retail sales. In Q3 of 2023, the United States Census Bureau estimated that 15.6% of total retail sales, or $284.1 billion, were online purchases.

Then there is the march of technology itself. Over the past two decades, supply chains and fulfillment operations, like many business functions, have evolved to include technology-enabled sophistication previously unimaginable.

Business intelligence is now ubiquitous across industries, e-procurement software has enabled industry leaders to all but

tame maverick spending for supplies, and fulfillment operations increasingly rely on automation and robotics that enable throughput levels and order accuracy inconceivable until recently.

Now parcel shipping, so long isolated from such transformative trends, is front-and-center in what I call parcel spend management 2.0 — a time when data-driven decision-making and insights are used not only to better manage and lower shipping costs, but also to elevate and empower shippers in the businesses they serve.

Parcel Spend Management 2.0 Is Now Mainstream

Powerful data analytics, machine learning, and artificial intelligence now make it possible for shippers to take proactive cost-saving steps in real time that were not possible before, but the strategies on-demand software enables are not new. In fact, the shipping intelligence platforms available today democratize practices long embraced by leading shippers.

The best shippers all share a similar approach: All employed what I call active shipping management. They planned, measured, monitored, and optimized their parcel spend on a continual basis.

This approach, active shipping management, is the backbone of parcel

spend management 2.0. It marks a significant departure from the reactive approaches of the past and is broadly applicable to any organization.

The best shippers plan. The days of poring over spreadsheets and carrier invoices are over. With the active shipping management inherent in parcel spend management 2.0, shippers proactively align their shipping strategies and financial plans — something data-driven decision-making makes easier than ever.

Perhaps no other business imperative reveals this more than the creation of parcel shipping budgets. Historically, many shippers applied the carriers’ annual general rate increases (GRIs) to their existing budgets, added margin, and hoped for the best, but the most effective shippers have long looked not only at carriers’ rates, but also how the numerous new rules and fees carriers introduce impact their business.

Technology has taken this to a new level — making it possible to run models that let shippers compare how new carrier contracts and rates will impact their spend if they make the same shipments. Our own analysis shows just how impactful this can be. Although FedEx and UPS introduced a 5.9% GRI this year, we found that the average FedEx customer will pay 8.17% more in 2024

20 PARCELindustry.com MARCH-APRIL 2024

than they did last year, and the average UPS customer will pay 7.72% more.

Such granular analysis empowers new levels of sophistication in other planning initiatives, too, from pricing strategies to the SKU-level analysis of the profitability of specific product lines once shipping costs are factored in.

The best shippers measure.

You can’t manage what you don’t measure. The most effective shippers measure the vital factors of their shipping operation continually. These include total shipping spend, the average cost-pershipment, surcharge spend, the average weight per shipment, average zone, and where they fall on minimums.

They also assess how changes like fuel surcharges impact spend and know that even a subtle change like a new box with dimensions that subject it to oversize fees can dramatically impact costs. Just as importantly, they actively compare their operational performance to that of peers with a similar shipping profile, something technology now makes possible.

The best shippers monitor. Parcel spend management is dramatically impacted by many constantly changing variables. The best shippers constantly monitor their shipping activity and the factors that influence it.

One common example is negotiated surcharge discounts that expire before the contract. It’s a common occurrence that radically influences spend.

Another is parcel auditing. A comprehensive audit typically uncovers savings of one to two percent of total spend, often because a package arrived late; however, it is estimated that 75% of rebates are never requested. In contrast, the best shippers always monitor service-level guarantees and other factors.

The best shippers optimize.

The best shippers constantly look at how to take their parcel spend management efforts to the next level. This includes everything from designing ergonomic facilities to being constantly

vigilant of how close they are to the next volume discount tier.

They understand which discounts to pursue and how to ask for them. And just as importantly, they constantly analyze their options — whether it’s considering a new carrier or using a different service; for example, opting for ground delivery rather than air when timing allows.

For years, the best shippers have actively managed their shipping — planning, measuring, monitoring, and optimizing continually. In the new, technology-enabled era of parcel spend management 2.0 they can do so faster, easier, and more effectively than ever. Now the strategies of the very best shippers are applicable and available to all.

Josh Dunham is the co-founder and CEO of Reveel. The company’s Shipping Intelligence Platform provides shippers with the actionable insights they need to optimize their operations and save money.

Josh Dunham is the co-founder and CEO of Reveel. The company’s Shipping Intelligence Platform provides shippers with the actionable insights they need to optimize their operations and save money.

SUBSCRIBE FOR FREE!

AI and the Impact on Supply Chains

By Anthony Michael and Patrick Bangert

Generative AI is the topic of conversation these days and could be applied in many places and industries. While models of language are very interesting and useful in the office environment, it is the larger field of AI that is more relevant out of the office with respect to the physical processes of supply chain management. We will cover both angles in this article.

Large language models (LLMs) or Generative AI broadly offer increased productivity to desk workers by approximately 30-40%, according to a McKinsey study. These models will provide a simple language interface to other software and make workflow automation even more seamless. They will draft emails and reports. They summarize large documents, audio files, and videos. Most usefully, they represent an efficient way of searching through all the company’s records and not just getting a list of possible sources, but generating an actual answer to the posed question (this is called enterprise search).

As supply chain challenges are largely dominated by physical processes and imponderables, numerical accuracy and strict adherence to boundary conditions

of schedule, weight, and price are required. LLMs are not designed to incorporate logical or causal reasoning or to do mathematical calculations. Such challenges require other AI methods, not LLMs, for their effective execution.

Enhanced Visibility and Transparency

Having blind spots in a supply chain is risky in modern competitive markets. Combining AI models with GPS, IoT sensors, and data from mapping services can provide granular, real-time visibility into the location, condition, and potential delays of shipments. Thus, AI combined with location intelligence ensures accurate routing and on-time deliveries, reducing inaccuracies and proactive mitigation of issues.

Accurately predicting demand prevents inventory shortages or overflows and takes into account historical data and market trends. AI enables optimized inventory levels across warehouse locations, which can be easily visualized to help with efficient resource allocation and cost savings.

Optimized Routes and Transportation

Google’s AI-powered solutions can create routing algorithms based on essential business parameters. The dynamic nature

of mapping services analyzes real-time factors such as traffic congestion, weather conditions, and road closures to optimize delivery routes, slashing transportation time and fuel costs. This dynamic approach ensures the most efficient journey for each shipment, regardless of external circumstances. There is no limit to the mode of transportation as well. AI models can explore various options — road, rail, air — based on cost, speed, and environmental impact, enabling businesses to select the most efficient and sustainable combination for each shipment.

Combining many sources of information, AI can provide a systematic overview of all the business’s carbon emissions of all scope levels. In addition to tracking this, AI can provide a digital twin that allows proactive decision-making toward a controlled reduction of emissions driving neutrality and other ESG goals.

Predictive Maintenance and Risk Management

AI acts as a fortune teller for your equipment. Analyzing sensor data from vehicles and warehouses predicts potential failures before they occur,

22 PARCELindustry.com MARCH-APRIL 2024

allowing for preventative maintenance and minimizing costly downtime. Processing external data like weather forecasts, news feeds, and social media to anticipate potential disruptions — natural disasters, political unrest, etc. — allows businesses to proactively adapt their operations and minimize the impact of unforeseen events.

Having forecasted adverse events with numerical AI methods, generative AI can now help to organize the relief effort by analyzing manuals and spare part lists to decide who will do what; when and where to use which spare parts; and how to procure these in time. During the repair, assistance can be provided by AI using virtual reality, minimizing equipment downtime and maximizing chances of success.

Improved Customer Experience

No more wondering where your package is. Mapping systems provide customers with real-time order tracking, accurate ETAs, and proactive updates on any delays. This transparency builds trust,

improves customer satisfaction, and fosters loyalty.

Navigating international services such as customs declarations can be a major obstacle for logistics companies in dealing with foreign languages, forms, and regulations. Generative AI can ingest large amounts of data — such as regulatory documents — in many languages and make sense of them. It is capable of translating text into other languages with uncommon accuracy and thus streamlining such bureaucratic processes.

Significant efforts are spent in resolving various problems arising in the supply chain, often requiring a customer hotline. More than half of hotline requests can be dealt with completely automatically by a well-integrated large language model. Not only does this obviate the typical frustrating menu options by allowing the customer to simply say what the problem is, but it can also answer or resolve these queries. It is a common observation that this automation shortens hotline calls by

about 30% and improves net promoter scores by two points. Interestingly, it also improves job satisfaction for your employees staffing the hotline as they receive fewer annoyed customers venting their anger.

In conclusion, we see that there are many use cases that standard and generative AI can provide in the logistics and supply chain industry. The impact lies in the automation of repeatable tasks, thus saving either time, material, or cost. By saving time for the customer, you elevate the experience and thus raise revenue. Even though generative AI is mostly useful for knowledge workers, there are plenty of applications in and around the physical workflows of logistics supported by standard AI tools to provide forecasts and better data analysis.

Anthony Michael is Global Director, Location Intelligence Practice, Searce. Patrick Bangert is SVP of Data, Analytics and AI, Searce. Visit www.searce.com for more information.

MARCH-APRIL 2024 PARCELindustry.com 23

SUBSCRIBE FOR FREE!

By Matthew Kulp

By Matthew Kulp

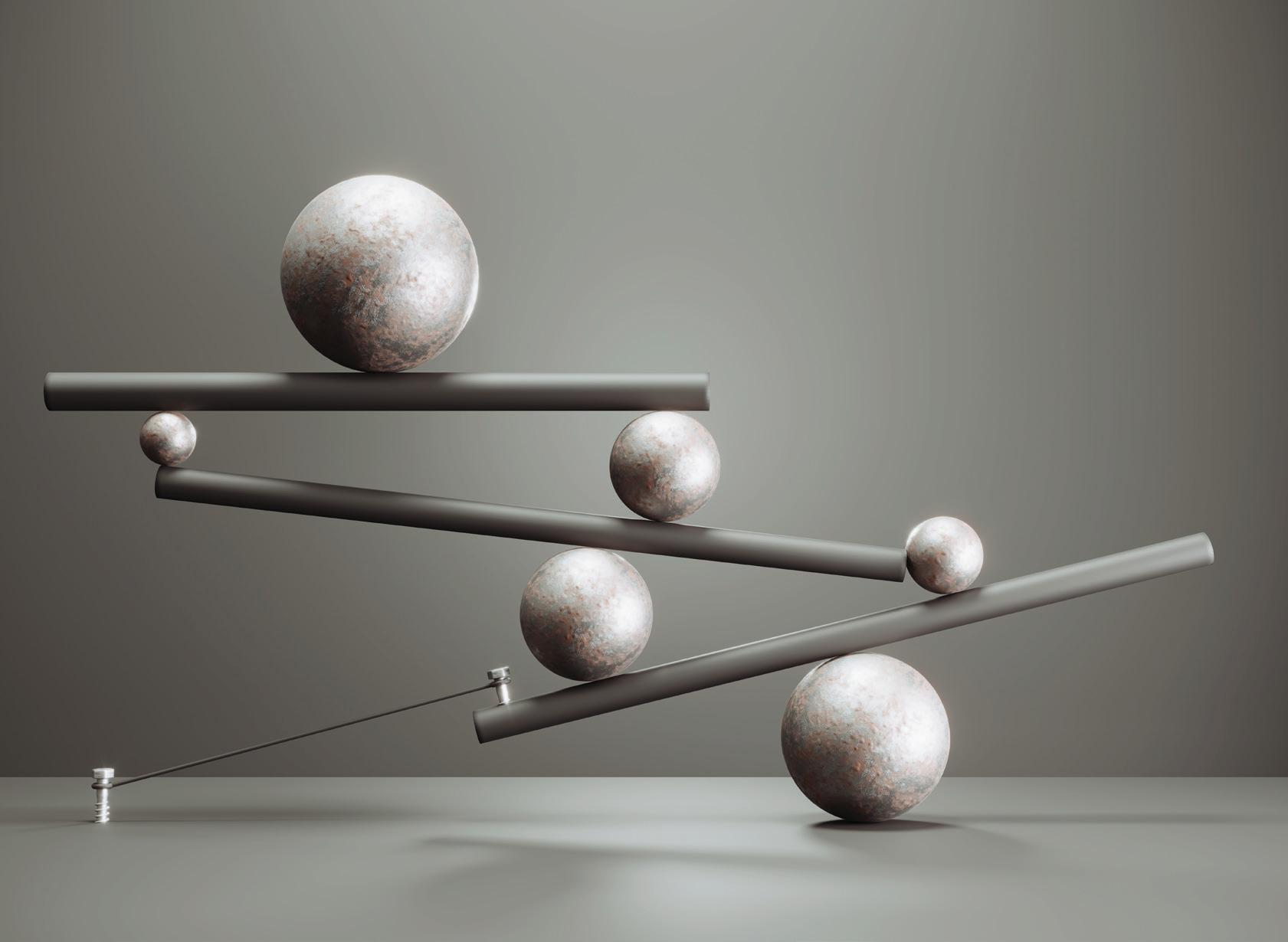

A BALANCING ACT: E-COMMERCE CUSTOMER EXPECTATIONS AND THE COST TO MEET THEM

Agoraphobia or efficiency? Mysophobia or effectiveness? Blame or celebrate COVID for remote work? Whatever the driver, real or otherwise, more and more people today want to live as much of life as possible from home. Ok, maybe mysophobia is a little extreme — call it an engineer’s attempt at a literary hook. But even if you haven’t locked yourself up in your home, at the very least many of us are looking to squeeze a little more into each day. It logically follows that e-commerce will continue to see more and more growth.

If you are a shipper that has figured out how to service the world through e-commerce, then you are balancing a range of increasing customer expectations coupled with growing competition fighting for a piece of that pie. You may even lose sleep pondering many things, including how to provide an overall value to your customers greater than your competition

by balancing your customer expectations with the costs to meet those expectations.

So, how do you beat your competition and gain more customers? Well, first let me admit that there is no one answer, and if there is, I certainly don’t have it. What I do have are some thoughts collected over decades of working with scores of e-commerce clients; I hope some of those thoughts can be helpful to you.

1. Define

If your objective is to balance your operational costs to meet (and exceed) as many of your customer expectations as possible, then the first step is to define both sides of that equation. Pull together the most creative and most informed members of your team into a brainstorming session.

To quote Simon Sinek, “Start with why.” Why are you doing what you are doing? Why do you have customers and why do they choose you? Identify what your customers expect. Do your

customers require next-day, or even same-day, delivery? Many e-commerce shippers make this assumption and further assume that if the customer doesn’t get it, they will shop somewhere else. But have you fact-checked this assumption lately? In many cases (and admittedly more and more) that is true. But ask yourself, for how many of your customers is this true? Of course they would like immediate delivery, but will they choose one of your competitors if it takes two or three days? Or is it more important for the customer to know when to expect delivery, and not so much how fast to expect delivery? Is what the customer really wants the ability to plan their lives?

Do your customers expect you to offer the lowest price for your products? Which is more important — assuming they have to choose and can’t say “all” — speed of delivery, expected delivery day and time, or lowest price? Speed and cost seem to dominate the conversation, but some other expectations may be product selection, follow-up customer services, perfect order status, or white glove delivery. Understanding what the majority of your customers expect and how they prioritize those expectations is the first step. Make sure to synthesize those expectations into a measurable key performance indicator (KPI). If it’s speed, then track a metric fully within your control like time from order receipt to order ship, as well as customer perceived metrics that are not fully within your control, such as time from order receipt to customer receipt. If the expectation is low cost, well, I’m sure no one needs to be told to track their costs! Make sure there is a measurable KPI assigned to each expectation. Then the final preparation step is to measure your current performance for each KPI so that you have a baseline.

2. Discover

The next step is to look internally at your business and understand how you meet as many of your customers’ expectations as possible. It’s important to note that I said, “as many of.” It is possible that you will not need to meet all customer demands. Gather the same team that

24 PARCELindustry.com MARCH-APRIL 2024

helped define your customer expectations and turn the conversation inward. A tried and true method for starting the process is to consider your company’s strengths, weaknesses, opportunities, and threats — or as most of you know it, conduct a S.W.O.T. analysis.

3. Differentiate

Again, you may not be able to meet all of your customer demands, so focus on matching your strengths with their demands and try to differentiate yourself from your competition.

Psychological studies suggest that most people can only remember a maximum of three to four things in their working memory. Pick one or two strengths that you want to focus on and have your clients remember. Why one or two? Well, my thinking — and perhaps it is just me here — is that when your clients are thinking about the particular product or service you offer, you’d like one or two things about your company to stand out, driving them to choose

you. The product or service is the first item, your standout characteristics are the second and third, and we will allow the customer to fill in another one if they have capacity for four. You now have a differentiation strategy.

4. Deliver

Now it’s time to get to work. Time to translate ideas into action. One of my favorite proverbial phrases is that “Ideas without action is just daydreaming.” Another favorite is “Think big, but start small.” If I may be permitted one more, “The journey of a thousand miles begins with the first step.” It’s time to make an action plan with milestones. Create a vision of what your company offering looks like and then create a plan and schedule to get from where you are to that vision. One thing I’ve learned is to think it all the way through, but don’t get too detailed. It’s more important to get started. Any plans past six months will almost certainly change. You will learn a lot along the way, and you need

to remain flexible to adapt and change to the evolving conditions around you. But if you keep the vision in mind, you will stay on course. Make sure that you continue to measure results going forward to ensure that you’re getting the results that you expected. If you’re not, make adjustments.

The four steps to balancing costs to meet customer expectations are: define, discover, differentiate, deliver. Is there anything to the psychological science mentioned earlier? Play along and set a calendar reminder for one month and see if you can remember all four steps. Or better yet, get started on the journey, and your transformation plan will already be there in your working memory.

Most of all, I wish you success in whatever goals or dreams you are chasing.

MARCH-APRIL 2024 PARCELindustry.com 25

Matthew Kulp is EVP, Managing Partner, St. Onge Co. Visit www.stonge.com for more information or connect with Matt on LinkedIn.

SUBSCRIBE FOR FREE!

By Mingshu Bates

THE FIGHT FOR FREE SHIPPING

Cost pressures are changing the face of free shipping and threatening its ubiquitous status

Peanut butter and jelly. Batman and Robin. Mario and Luigi. In contemporary retail, the dynamic duo consumers have come to expect is e-commerce and free shipping.

Amazon popularized free shipping in the early 2000s, and in doing so, shaped the expectations of online shoppers. The allure continues two decades later, with a 2021 study revealing that 59% of consumers consider free shipping a deciding factor in purchasing decisions. With online competition just a click away, retailers have played the game to offer free and increasingly faster shipping options.

But the pandemic threw a major wrench into the e-commerce retail and shipping landscape, with massive spikes in demand as consumer spending shifted from experiences to goods, and from in-person to online formats. The sharp growth in parcel volume shifted parcel markets in favor of carriers, with the TD Cowen / AFS ground parcel index reaching a new high of 27.4% in Q2 2022 and then setting another record high in Q1 2023 at 31%.

With parcel costs rising to such a great extent, retailers set their sights on major cost-cutting goals to take back control of shipping costs as the bullwhip effect of the pandemic era waned. With corner offices setting savings targets of as high as 25%, the longstanding but costly e-commerce staple of free shipping fell squarely in the crosshairs.

Free Shipping – with an Asterisk

Free shipping is becoming a nuanced conversation. Such offers now come with important strings attached, such as minimum purchase amounts or some sort of annual fee. To get access to the fastest free shipping benefits, online shoppers may have to pay for a membership and even so, those offers still may require a minimum purchase. Or, if customers are willing to wait longer for merchandise to arrive, shipping may be free without a required minimum purchase amount. No matter the exact policy, the general trend is that free shipping that prioritizes all-out delivery speed is taking a backseat as retailers seek to take control of shipping costs that have spiraled in recent years.

Of course, while shippers changing what they offer customers can make a meaningful difference on the balance sheet, that’s only half the equation. Carriers have complex, sophisticated pricing schemes designed to prioritize volumes that are most efficient for them to carry, while making shippers pay up for parcels that are not.

The Ground Shifting Beneath Shippers’ Feet

Aside from demand-side pressure driving up rates during the pandemic-era parcel boom, pricing movement comes from more subtle actions by carriers, often targeted at certain kinds of freight delivered to certain types of destinations. Bulky packages are a common example. Large, bulky items are

26 PARCELindustry.com MARCH-APRIL 2024

harder and more costly for carriers to move through distribution centers, as they often don’t fit through the automated conveyor and sorting infrastructure, and can be difficult to efficiently load into vehicles for delivery. Carriers also recognize more revenue delivering packages to commercial destinations compared to residential addresses.

A particularly undesirable package for parcel carriers would be a large, awkwardly sized parcel like a picture frame or TV destined for residential delivery. Such a parcel would be subject to oversize surcharges and a litany of additional handling surcharges based on dimensions, weight, and packaging — not to mention demand-based surcharges that originated during holiday peak season, but are now active year-round. Over time, carriers have adjusted the criteria for which these charges apply, so that a wider range of parcels are subject to them. Take the additional handling surcharge as an example. In 2014, it applied to packages with dimensions of 60 inches or greater for the longest side. But in 2017, carriers announced changes that lowered the minimum length to 48 inches, added an extra additional handling surcharge for peak and lowered the dimensional weight divisor to drive a higher billed rate. In 2022, carriers made another change, making the additional handling surcharge based on zone.

The combined impact of these changes can make the same parcel more than four times as expensive to ship in 2023 compared to 2014. For a ground shipment with dimensions of 50 x 5 x 7 inches, the combined impact from general rate increases (GRIs), adjustments to the dimensional weight divisor, and surcharge changes pushes the total cost to ship from $11.21 in 2014 to $48.98 in 2023.

But bulky, oversized items are not the only parcels on the receiving end of significant increases. Consider the compounding effect of annual GRIs. Every year, carriers decide that parcel rates will rise 4.9%, 5.9%, or 6.9%, and each increase is applied to a higher “principal,” meaning the existing rates that were increased last year, and the year before, and so on. This quickly adds up to a dramatic effect. With the latest 5.9% increase taking effect in January 2024, the cost of shipping common one-pound packages like clothes or a paperback book is over 22% higher compared to just 25 months earlier.

In a Softer Parcel Market, Are Generous Free Shipping Policies on the Horizon?

Carriers have reported softer volumes in recent quarters, and in the competition to keep trucks and planes full in the face of limited demand, they have exhibited a willingness to discount. According to the TD Cowen / AFS ground parcel

index, rates are down year-over-year for the third straight quarter in Q1 2024. But while the parcel pendulum is swinging back to a shippers’ market, does that mean looser free shipping policies from retailers are back on the horizon?

Freight is a notoriously cyclical industry, and making major decisions like free shipping policies requires a longer-term, more comprehensive approach than the fleeting tailwind of a favorable market cycle. To limit the cost pressures that ultimately dictate decisions on free shipping, shippers can take steps like shifting from premium to lower-cost services, employing a rigorous audit function to stave off excess charges, or even re-configuring logistics networks.

Regardless of how shippers approach limiting parcel costs, the decisions they make are part of a high-stakes game, with key rules that evolve quickly. Not only do the consequences of these decisions affect the bottom line, they influence the viability of offering a critical perk that influences purchasing decisions — according to 2023 research, extra fees like shipping costs are the most common cause of online shopping cart abandonment.

MARCH-APRIL 2024 PARCELindustry.com 27

SUBSCRIBE FOR FREE!

Mingshu Bates is Chief Analytics Officer, AFS Logistics.

STAYING COMPETITIVE IN A GREEN ECONOMY: TOOLS FOR ACCURATELY MEASURING CARBON EMISSIONS

By Steve Beda

In the rapidly evolving green-economy landscape, the significance of accurately measuring carbon emissions cannot be overstated. The transparency and accountability provided by precise emissions data have become a cornerstone for businesses striving to stay competitive in an increasingly eco-conscious marketplace. Moving forward, tracking and measuring carbon emissions won’t be an added bonus of companies, but a required mandate from the Securities and Exchange Commission (SEC) that all publicly traded companies report on their greenhouse gas (GHG) emissions starting in January of 2025. This new reporting standard underscores the growing importance of environmental responsibility in business operations.

Scope 1 and Scope 2 carbon emissions reporting is more straightforward. Scope 1 emissions result directly from your own operations. Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling. Both of these rely on data that every company can compile because they have to do with the company’s own activity.

Scope 3 is not direct nor simple. Per the Environmental Protection Agency (EPA), Scope 3 emissions are the “result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly affects in its value chain.” Meaning if you are a shipper, you have to start compiling activity on your partners’ carbon emissions footprint, such as your logistics service providers (LSPs) and carriers. That is much easier said than done, as you would have to go to every partner and compile emissions data for each company, each product, and each shipment — one by one. Furthermore, the methods for calculation will most likely vary between individual LSPs making reporting consistency nearly impossible.

To keep pace with these requirements, you have a second, more streamlined option. You can take advantage of innovative solutions that do the work for you and compile data pertaining to emissions of greenhouse gases in a quick and efficient manner. Companies that focus on the billing side of transportation already have the capabilities and visibility into the metadata needed to establish benchmarks, track, and measure the carbon emissions of all your vendors. Transportation spend invoices have data such as shipment mode, cost, weight, origin, delivery locations, distance traveled, and carrier details. Adding a carbon emissions calculation based on these factors makes it easy to operationalize and normalize the data for customers across all inbound and outbound shipments in order to establish and measure their carbon emissions consistently. Shippers can leverage a comprehensive and holistic view of their cost, service, and carbon emissions activity, allowing them to make informed business decisions towards the company’s operations and sustainability objectives.

Did you know that the correlation between actions to reduce cost and actions to reduce carbon emissions overlap in roughly 80% of cases? That means if you take the specific steps to reduce operational costs, you will end up reducing your company’s carbon footprint as well. For example, with load consolidation, when you consolidate two shipments into one by utilizing certain modes of transportation, instead of individual shipments, you typically reduce cost per unit weight but also reduce your carbon footprint, or overall CO2 per distance. Carbon emissions are based on weight, distance, and mode, and by consolidating shipments, you’re reducing the cost per unit weight and lowering carbon emissions at the same time.

On the other hand, network optimization tackles carbon emissions reduction from another angle. This strategy focuses on the organization’s network of suppliers, distribution centers, and customers, with the aim of minimizing travel dis-

28 PARCELindustry.com MARCH-APRIL 2024

tances. By strategically placing facilities closer to customers, consolidating shipments, and choosing more efficient modes of transportation, the overall distance traveled and number of shipments can be significantly reduced. The direct outcome of this strategy is a substantial reduction in carbon emissions, contributing to a greener supply chain.

Carbon emissions are based on weight, distance, and mode, and by consolidating shipments, you’re reducing the cost per unit weight and lowering carbon emissions at the same time.

The correlation between load consolidation, network optimization, and reduced carbon emissions cannot be downplayed. Both strategies, when implemented effectively, can lead to significant carbon emissions reduction while also lowering operational costs. This dual benefit makes them integral components of any sustainability-focused logistics strategy. This is an example of “operationalizing” the information — to optimize execution and reduce carbon emissions.