Pass the gavel

Contemporary collections find favor at auction

Pass the gavel

Contemporary collections find favor at auction

The market for vintage and antique jewelry is booming. Here’s how to cash in on the rush

Don’t flatter me

The designers taking a stand against copycats

8 Pre-owned jewelry is booming in the US

14 How three dealers keep current with the past

17 The new Rocksbox pop-up in San Francisco

18 Old jewels find new fans online

20 Top appraisers share their wisdom

24 Five tips for estate collectors

26 Secondhand-watch prices are going down

30 A century of Art Deco

34 How to care for a country’s crown jewels

36 Guide to price lists

39 Price list

44 Parcel price list

45 RapNet price list

46 A peek at CD Peacock’s supersized flagship

50 The brands killing it in live-stream sales

54 Taking new jewels straight to auction

80 Under 30s: Rising retail star Grace Isley

58 How designers are combating copycats

62 Can wood be as precious as gems?

64 Slim baguette diamonds are in vogue

68 A deep dive into the Paraiba market

72 Emmanuel Tarpin heads to Brazil’s mines

76 The AGTA Spectrum Awards

EDITOR IN CHIEF: RACHAEL TAYLOR

SENIOR ANALYST: JOSHUA FREEDMAN

MANAGING EDITOR: LEAH MEIROVICH

NEWS WRITER: MARNI DAVIMES WEINBAUM

SENIOR COPY EDITOR: RACHEL BEITSCH-FELDMAN

COPY EDITOR: NECHAMA VEEDER

ART DIRECTOR: TARDEO AJODHA

SENIOR DESIGNER: DAVID POLAK

DESIGNER: NICOLE BEDNARZ

DATA ANALYST: OREN YANNAI

VICE PRESIDENT OF OPERATIONS: DAVID EHRLICH

PROJECT MANAGER: ANNA SIMAKOVA

SALES AND OPERATIONS COORDINATOR: YANA SHLYAKMAN

PODCAST AND VIDEO PRODUCER: VANINA PIKHOLC

RAPAPORT DIAMOND REPORT Issue No. 6 Vol. 47 December 2024 (ISSN 0746-9829). The Rapaport Diamond Report is published bimonthly for $250 US, $350 International per year by Rapaport USA Inc., 133 East Warm Springs Rd., Suite 100, Las Vegas, NV 89119. Periodical postage paid at Las Vegas, NV, and additional mailing offices. POSTMASTER: Send address changes to Rapaport USA Inc., 133 East Warm Springs Rd., Suite 100, Las Vegas, NV 89119.

PUBLISHER: MARTIN RAPAPORT

ASSOCIATE PUBLISHER: LEA SCHIFF

SALES EXECUTIVE : DIANA STERN

DIANA.STERN@RAPAPORT.COM

BUSINESS DEVELOPMENT MANAGER, INDIA: TANYA JHA

TEL: 91.22.6628.6592 TANYA.JHA@RAPAPORT.COM

TO CONTACT EDITORIAL: EDITOR@RAPAPORT.COM

Model wears a selection of vintage jewelry from the Geneva Jewels Auction: Two sale, which took place in May at Phillips.

Cover shoot by GEM Kreatives, with photography by Julia Flit, and styling and art direction by Liza Urla.

RAPAPORT MAGAZINE AND ONLINE CONTENT ARE PUBLISHED BY RAPAPORT USA INC.

1212 AVENUE OF AMERICAS, SUITE 801 NEW YORK, NY 10036, USA TEL: 212.354.9100 NY@RAPAPORT.COM

133 EAST WARM SPRINGS ROAD, SUITE 100 LAS VEGAS, NEVADA 89119, USA TEL: 702.893.9400 INFO@RAPAPORT.COM

RAPAPORT INTERNATIONAL

RAPAPORT BELGIUM HOVENIERSSTRAAT 53, BOX 13 B-2018 ANTWERP, BELGIUM TEL: 32.3.232.3300 BELGIUM@RAPAPORT.COM

RAPAPORT ISRAEL

TUVAL ST. 21, SUITE 1362 RAMAT GAN 52521, ISRAEL TEL: 972.3.613.3330 ISRAEL@RAPAPORT.COM

RAPAPORT INDIA

101, THE CAPITAL, PLOT NO C-70, BKC, BANDRA EAST MUMBAI 400 051, INDIA TEL: 91.22.6628.6500 INDIA@RAPAPORT.COM

RAPAPORT INDIA – SURAT 501-504 C WING, DIAMOND WORLD BUILDING, MINI BAZAAR, MANGADH CHOWK, VARACHHA ROAD

SURAT 395 006, INDIA TEL: 91.261.672.3300 INDIA@RAPAPORT.COM

RAPAPORT HONG KONG UNIT 404-405, PROSPEROUS BUILDING 48-52 DES VOEUX ROAD CENTRAL, HONG KONG, CHINA TEL: 852.2805.2620 HK@RAPAPORT.COM

RAPAPORT DUBAI DUBAI DIAMOND EXCHANGE LEVEL 2, OFFICE D06 ALMAS TOWER, JUMEIRAH LAKE TOWERS PO BOX 340600, DUBAI, UAE DUBAI@RAPAPORT.COM

There is a perfect storm brewing around estate jewelry right now. Consumers are actively seeking out sustainable, distinctive designs that offer elevated craftsmanship — three touchpoints this category can serve well. Meanwhile, the popularity of yellow gold is rising about as fast as the price, and vintage and antique pieces can offer better value for your money.

Worldwide, the estate category is worth $4.4 billion, as our in-depth report will tell you. In the US, as we anticipate the Great Wealth Transfer — in which older generations will pass an estimated $84 trillion of assets on to their heirs in the next two decades — we expect to see not only an influx of disposable income among young people, but also a fresh wave of estate jewels hitting the market as heirlooms are sold.

This is a boon for dealers who can get the right stock, and we are seeing fresh players join the market. Some are operating through traditional retail channels, while others are building followings and sales funnels through social media. We are also seeing innovative selling models pop up on high streets and in department stores. No matter what your retail style or customer profile is, it seems there are possibilities for pre-owned jewels, which is why we have put together this special issue of Rapaport Magazine to help you gain a deeper understanding of the growing estate market.

Rachael Taylor EDITOR IN CHIEF

I joined the Responsible Jewellery Council (RJC) at a dinner to celebrate Californian artist Djeneba Aduayom, winner of the inaugural JewelryArts 24 prize. The prize — which the RJC set up with the Gemological Institute of America (GIA) and the Mineralogical & Geological Museum at Harvard University — encourages using creative storytelling to highlight the importance of responsible practices.

Creativity, man-made gems, and sustainable business practices were the main topics of the evening when I interviewed jewelry designer Anabela Chan in front of a live audience as part of the Leaders in Conversation event series from jewelry-box maker Wolf.

When it comes to contemporary diamond designs, it seems consumers just can’t get enough of fancy cuts, as I was reminded during a meeting with Eva Fehren founder Eva Zuckerman to view her new EXO titanium high-jewelry collection.

ANTHONY DEMARCO

“I didn’t know what to expect when I was invited to the ‘Treasures, Royal Gems & Jewellery’ colloquium in Lisbon. What I received was a broad understanding of what it takes to acquire and preserve jewels of immense historical significance, which I share with readers though just as meaningful was my firsthand immersion in Portugal’s culture.”

SARAH JORDAN

“Diamond jewelers have a front-row seat to the changes in consumer dynamics, from caution amid political changes to spirited holiday shopping. I have interviewed some exceptional retailers investing time, energy and funds in pushing boundaries. In this issue, I profile one Chicago store that claims to be the largest of its kind in the US.”

SMITHA SADANANDAN

“Tracking the world of antique and vintage jewelry through trade fairs such as the Las Vegas Antique Jewelry & Watch Show, I’ve asked retailers and appraisers for the tips they’d give new collectors. My feature in this issue also covers how market trends influence a piece’s desirability, and which trade shows should be on your radar.”

Also in this issue: Beth Bernstein, Carol Bessler, Jessica Busiashvili, Francesca Fearon, Jennifer Heebner, Joshua Hendren, Kate Matthams, Ruth Peltason, Sonia Esther Soltani, Kristin Taylor Young

Martin Rapaport PUBLISHER MARTIN@RAPAPORT.COM

The Kimberley Process (KP) is a highly politicized multinational government process that misrepresents itself as a certifier of ethical diamond sourcing while in fact supporting the certification of blood diamonds as legitimate.

The EU is trying to use the KP and Group of Seven (G7) sanctions to illegitimately control the international trade of diamonds through its Belgium trading center by using ineffective exclusionary sanctions processes. This is an attempt to grab power in support of Belgium’s national interests at the expense of diamond producers, manufacturers and consumers.

It should be clear that governments operate in their own self-interests. In this case, they are using the KP and G7 sanctions to promote their national, political, economic and security interests.

Governments cannot and should not be trusted or relied upon to ensure the legitimacy of diamonds. The diamond trade must recognize that governments do what they must to protect their national interests, and these interests are more important to governments then ensuring a responsible and ethical diamond trade.

Witness the KP certification of blood diamonds sourced from the Wagner Group. Witness the US dropping sanctions against Zimbabwe due to concerns about China’s exclusive sourcing of critical Zimbabwe minerals, including uranium.

The diamond industry has its own interests and a responsibility to ensure the legitimacy of the diamonds we buy and sell. We cannot, will not and should not survive if the diamonds we trade support severe human-rights abuses or terrorist funding.

The interests of the diamond trade and governments are not the same, and they are not aligned. The KP is a false flag misrepresenting the legitimacy of the diamonds we trade.

The diamond trade must establish its own independent standards for ethical diamond sourcing. Such standards must be based on honest source certification using diamond tracing and blockchain technology to ensure transparent legitimacy.

The way forward is for the trade to address consumers’ desire to buy diamonds that make the world a better place. We must focus on marketing good diamonds while excluding bad diamonds that support human-rights abuses, terrorism and money laundering.

The diamond trade must add value to diamonds by honestly marketing the level of social responsibility its diamonds provide. Not all diamonds are the same, and social responsibility competition will drive demand and prices. Consumers will get the level of social responsibility they are willing to pay for — no more and no less.

There is a reason G-D gave diamonds to the poorest people in the world and made the richest desire them. Bridging that gap is tikun olam — fixing the world. That is the reason the diamond trade exists.

The fast-growing estate-jewelry category is capturing the hearts of eco-conscious shoppers who want to stand out from the masses. By Kristin Taylor Young

As Gen Z and Millennial consumers increasingly eschew machine-made, mass-produced pieces in favor of rare and distinctive finds, the vintage and estate category is emerging as a bright spot in the glittering world of fine jewelry. Experts in the field predict the category will experience significant growth in the coming years.

The numbers tell part of the story. In 2023, market research company Kentley Insights pegged estate and antique jewelry retail sales at $4.4 billion worldwide. The global vintagering market — the largest segment within the category — stands at $3.29 billion for 2024, according to consulting firm Global Research Intellect, which projects that rising disposable income and a growing demand for luxury items will propel that total to $5.23 billion by 2031. North America currently leads vintage and estate sales, though analysts forecast a high growth rate in the Asia-Pacific region thanks to a greater acceptance of antique and preowned jewelry.

Overall, there has been a palpable shift in the perception of estate jewelry on a mainstream level as consumers gain greater access to education on

rarity, craftsmanship and inventory. The industry is responding in kind — dedicating more real estate to vintage and estate jewelry on trade show floors, hosting pop-up shops, and forming marketplaces for collectors and enthusiasts.

“I’ve been in the business 35 years, and a lot of people once regarded antique and vintage jewelry as grandma’s jewelry,” says Marianne Fisher, owner of New York-based dealer Paul Fisher. She’s also a founding member of the Jewelers Circle, a business-to-business (B2B) community that began when six well-known vintage and estate jewelers came together to navigate the market during the pandemic. Offering some of the world’s rarest jewelry finds, the alliance has since grown to include dozens

“People are recognizing that you can get a lot more bang for your buck with quality materials and handmade craftsmanship”

of companies and hundreds of experts, and it opened its wares and educational resources to the public 18 months ago. That business-to-consumer model now counts more than 500 subscribers.

“Vintage and estate jewelry is slowly being recognized and has so much further to go,” says Fisher. “Young thirtysomethings are tired of the big brands. They’re recognizing [that machine-made] jewelry is not artistry anymore, it’s branding.”

Konstantinos Leoussis, founder of the NYC Jewelry and Vintage Show (NYCJAVS), has been seeing “this really big shift economically. More and more men are wearing vintage jewelry, and more and more women are buying it for themselves.” He held his first pop-up

“Young thirtysomethings are tired of the big brands”

Marianne Fischer Paul Fischer

event in New York in October, with plans for monthly editions through January 2025.

“The market is hot and has been for a few years now,” agrees Amie Park, owner of Rogue Vintage Jewels and a recent exhibitor at NYCJAVS. “People are recognizing that you can get a lot more bang for your buck with quality materials and handmade craftsmanship versus automated, mass-produced pieces. It’s remarkable to find pieces made before electricity was invented.”

Demand-wise, the overriding trend in the estate world is yellow gold. Even in the face of record gold prices — $2,669 per ounce as of press time — consumers are clamoring for chunky statement jewelry in the yellow metal: chains, collars, charms, cuffs, bangles, gemset cocktail rings, and hoop, drop or oversize-button earrings.

“Everyone wants gold jewelry right now,” Fisher confirms. “I find it shocking because it’s so expensive. It’s contradictory. But it’s fashion-driven. It speaks to the casual nature of what people are wearing.”

There are material reasons for the shift as well, according to Andrea Friedenson, owner of La Plus Charmante in Wellesley, Massachusetts. “This is a very fancy, heavy gold chain,” she says, pointing to an ornate Victorian piece. “It was made at a time when labor was cheap but materials were expensive, so you want to get every scrap of decorative value that you can out of it. Later, in the 1960s through ’80s, you see gold becoming less expensive relative to labor, so you start to see heavy gold pieces with lessdecorative qualities. Now we’re seeing expensive materials and expensive labor, so new pieces are lightweight, machinemade, and they don’t exude quality. So people come to vintage for quality, and the prices are often a lot better.”

Entering the ring

Estate fine jewelers are also making inroads in the engagement-ring market, which may be the segment benefiting most from consumers’ aversion to massproduced, cookie-cutter products.

“As the diamond market has changed and fluctuated, we’re seeing estate jewelry do really well” in this category, reports Hana Goble, cofounder of Wyndstone Antique & Vintage Jewelry in Los Angeles. “We’re seeing a lot of my young customers moving to vintage engagement rings because these diamonds were mined years ago. They like that it’s eco-conscious, but they’re also drawn to unique, one-of-a-kind pieces that express their individuality.”

Vintage and antique engagement rings are also one of the best-selling categories for Paul Lubetsky, founder and CEO of Windsor Jewelers in New York. He specifically cites ones with old mine and old European-cut diamonds.

“Customers are seeking out these cuts with much less faceting,” he says. “They’re special and captivating.”

Rethinking the classics

Across the board, signed brand-name pieces remain sought-after because of their prestige and resale value, say retailers. Buccellati, Cartier, Bulgari, Van Cleef & Arpels, Harry Winston and

“Customers really want to come see things in person. They want to connect”

Lauren DeYoung Lauren DeYoung Jewelry

Tiffany & Co. continue to top collectors’ lists, followed by lesser-known but no less coveted marks like JAR, Mellerio, René Boivin, and Verdura.

However, not everyone is casting their lot with big players. “People want to shop differently and with less intimidation, and that’s why I’ve chosen to focus on unsigned vintage jewelry,” says Randi Molofsky, founder of For Future Reference (FFR). The New York-

and Los Angeles-based consultancy, which specializes in jewelry from the 1940s to ’80s, debuted its vintage collection at New York’s Bergdorf Goodman in August and is now an available partner to other retailers eager to launch an estate business.

“There’s a lot of inventory out there, and it doesn’t have to be produced at today’s sky-high gold prices, offering a tremendous value and more room for margin,” Molofsky adds.

Victorian, Edwardian, Art Nouveau and Art Deco are all popular eras among consumers. However, the less-fussy Retro period and any decade from the ’40s to the ’80s appear to be dominant these days. At Bardy’s Estate Jewelry in Boca Raton, Florida, president Joel Bigelman has seen interest in pieces from the ’40s to the ’90s.

“A lot of customers think that vintage jewelry means Art Deco or Victorian or Edwardian — pieces that are highly detailed, delicate or too expensive to be realistic,” comments Molofsky. “We’re slowly educating clients that ‘vintage’ doesn’t always mean ‘antique’ and that it can feel just as modern as today’s contemporary brands.”

Additionally, the market is red-hot for natural, untreated emeralds and sapphires, and to a lesser extent, rubies. Windsor Jewelers has enjoyed sales

of rare Kashmir and Montana blue sapphires.

“Natural, untreated stones of over a carat are a smart thing to collect,” says Fisher. “There’s only a finite amount of them, because the production is just not there right now, and the price is rising.”

However, it’s not just about the stones’ intrinsic value. Semiprecious gems like garnets, aquamarines and opals are gaining traction alongside emeralds, sapphires and rubies. Customers see them as “more affordable than traditional colored stones, but also, they’re drawn to the colors subjectively,” explains Goble.

While serious collectors may be purchasing for resale potential or for the prestige of owning a signed piece or

“Part of our role is to educate collectors...to help them find the piece of their dreams”

Julie Thompson-Leriche The Jewelers Circle

rare gem, the casual estate consumer’s motives are far less complicated. Sustainability, for instance, is one of vintage and antique jewelry’s biggest selling points.

“There’s nothing more sustainable than estate jewelry,” says Lubetsky. “It lasts forever and recycles back into the market.”

This factor is less important to Bigelman’s clients. “We don’t run into customers looking for the green aspect,” he says. “My customer is more about taste, what they like and what they can wear in today’s world.”

Meanwhile, vintage and estate purveyors are finding new ways to sell in today’s shifting retail landscape. Jewelers Circle is moving to a hybrid model that lets customers browse its inventory online and then purchase through a

salon-like concierge service. The group’s team engages with clients via Instagram, Facebook and Pinterest, but also by phone, Zoom meetings and private appointments.

“Part of our role is to educate both collectors and new entrants to help them find the piece of their dreams,” says chief operating officer Julie ThompsonLeriche. “We’ve seen a shift back to interaction and experience.”

Jewelers Circle has also partnered with the International Antique Jewelers Association (IAJA) to ensure that every piece it sells is carefully vetted by a team of experts. “We’re excelling in showing people what’s special, unique and rare, and teaching them why, and guaranteeing [the quality and provenance of the pieces],” says Fisher.

FFR’s vintage business tailors estate offerings to specific retailers. “For many years, coveted ‘vintage jewelry’ was really

“There’s a lot of inventory out there, and it doesn’t have to be produced at today’s sky-high gold prices”

Randi Molofsky For Future Reference

anything by Cartier, Bulgari, Tiffany or Van Cleef,” explains Molofsky. “But now independents see an opportunity to drill down and reflect their store’s clientele specifically, and that’s what we’re doing with FFR Vintage. When we work with a new [client], we talk about what the needs are: the price points, the silhouettes, the gemstones. This gives us a leg up, because we are able to come into a retailer with inventory that makes sense, but we still do it all from our own point of view, which is statement jewels — gold- and gemstone-heavy — that speak to the brand we created.”

A good story

Of course, one cannot separate estate jewelry from the need for storytelling. Conveying a piece’s history, provenance, craftsmanship and design, as well as its gemstone cuts and the materials its creators used during the given period, can make for a powerful motivator to purchase.

At the recent New York City Jewelry & Watch Show, Lauren Levy, owner and founder of Lauren DeYoung Jewelry, showed this reporter an Edwardian pendant necklace with moonstone and diamonds, remarkable for its warm patina of sterling silver-plated 14-karat gold. It was a common treatment emblematic of the period, she explained.

“Customers really want to come see things in person,” she said. “They want to connect. They’re excited, and they want to learn.”

As categories like the engagement ring undergo a period of upheaval, businesses looking to stand out should consider adding vintage and antique jewelry to their assortments. With new retail models offering customers more ways to access these pieces both online and in person, and consulting firms helping jewelers curate their estate selections, the category’s surging popularity at stores and trade shows is making it a more natural and profitable move than ever.

Three retailers share how they’re evolving with their customers’ antique- and vintage-jewelry tastes. By Beth Bernstein

“Recent pre-owned pieces...attract collectors who appreciate both contemporary designs and hardto-find treasures”

Yamron Jewelers, Naples, Florida

Yamron Jewelers originally sold designer jewelry, high-end watches, and estate pieces under one roof, but it expanded its estate offering in 2020 by opening sister store La Maison Yamron.

“It was primarily driven by space considerations,” relates president and CEO Benji Kendall. “Our collection of estate jewelry is extensive, and we wanted to showcase it properly. By creating a separate store, we could dedicate a venue exclusively to vintage, signed jewelry and secondhand luxury jewels, allowing us to expand the collection and offer a more tailored experience for clients seeking these one-of-a-kind pieces.”

Benji

Giovane Piranesi pearl, emerald and diamond drop necklace in platinum, circa 1980s.

La Maison Yamron’s wares are a mix of Art Deco jewels, signed 1960s pieces from names like Bulgari, Van Cleef & Arpels, and Cartier, and high-end pre-owned items from the ’80s onward by renowned brands like Graff, Harry Winston, and the three aforementioned houses.

“These more recent pre-owned pieces can be part of current collections or [may have been] recently discontinued, making them highly sought-after,” he says. “They attract collectors who appreciate both contemporary designs and hard-to-find treasures from recent years.”

One of the standout pieces he has sold is a custommade Bulgari sapphire suite from the 1960s. “We’ve also been fortunate to handle remarkable pieces from Harry Winston, showcasing the timeless elegance and craftsmanship of this iconic brand,” he adds.

Kendall acquires many of the signed pieces and specific brands directly from the public. “Naples is home to a discerning clientele of collectors and connoisseurs of fine jewelry, providing us with the opportunity to curate exceptional items. Through our exclusive program, customers can sell, trade, or purchase exquisite pieces.”

He also has connections with high-end dealers, whom he trusts to find the right estate goods for his customers’ tastes and his store’s aesthetic.

Krombholz Jewelers Cincinnati, Ohio

Lee Krombholz previously specialized in designer and custom jewelry alongside a selection of antique and vintage pieces. But this past September, the fourthgeneration owner of Krombholz Jewelers transitioned to carrying only estate jewelry.

“Gold prices continue to soar, and labgrown seems to be where a large portion of the diamond market is going,” he says, adding that he’s “not a fan” of the latter trend. “I have found that I can get better-quality fine jewelry at more reasonable prices when purchasing antique and vintage. Over the past 15 years, our

Tiny Jewel Box, Washington, DC

Jestate department has accounted for a third of our business and has continued to be our best-performing category.”

Additionally, Krombholz’s daughter Izzi, a big fan of jewelry from eras past, is now taking over a portion of the business.

The eras that do best at Krombholz are the sturdier Victorian pieces from the Grand Period, which includes archeologicalrevival and Grand Tour items. The store has also begun buying more bold gold jewelry from the 1970s and ’80s, which the elder Krombholz explains is “easy-maintenance for everyday wear.”

Charms make up a substantial part of his business as well, especially from the ’40s and ’50s. Meanwhile, “Edwardian and Art Deco rings are a draw for engagement rings and always have been,” he says.

Another area of interest is conversion pieces. “My daughter is a bench jeweler and is taking pieces such as stick pins and small brooches, as well as beautiful old stones that aren’t being worn in the original condition, and reworking them into pieces for the contemporary woman.”

Krombholz obtains his merchandise from customer trade-ins, as well as fairs and dealers he has known for years.

im Rosenheim inherited Tiny Jewel Box from his parents, who opened it in 1944 as an antique-jewelry store. Working there as a young boy, Rosenheim learned all about treasures from the past. He took over the shop in 1972, and by 1996, he and his son Matthew were selling international designers as well as high-end watches and every category of modern jewelry.

The Rosenheims’ uncanny ability to foresee their clients’ desires and spot up-and-coming creators helped launch many contemporary designers’ careers while still keeping the shop’s original specialty: antique and vintage jewelry.

The Rosenheims have changed with the times for over 85 years. When the two noticed a shift after the pandemic toward easy-to-wear looks that suited a more relaxed lifestyle, they switched gears, culling their estate offering to emphasize antique and vintage engagement rings. They also played up their own custom line of bridal jewelry, inspired by details and settings from late-Victorian through Art Deco-era rings. In the estate-jewelry department, “[vintage] bridal is

selling better than any other category,” reports the elder Rosenheim.

Design-wise, “we still pepper the store with less-dressy antique pieces that are more in keeping with today’s lifestyle,” he says. “But our main antique and vintage sales are in Edwardian and Art Deco rings — when we can find them in pristine condition — and simplified designs such as three-stone rings, lower-profile solitaires with interesting galleries or shanks, and five-stone rings, all with the character and personality that old-cut diamonds lend.”

Rosenheim acquires these pieces through long-term relationships with dealers and trade fairs. “But there is a challenge finding these antique and vintage styles that check all the boxes of what our clients are looking for when they are getting engaged. This is why we launched our own collection to create exclusive rings with elements of antique and vintage, which we can make to our customer’s specifications as far as diamond cuts, color, clarity and settings.”

The pre-owned jewelry e-tailer recently debuted a brick-and-mortar store in upscale San Francisco. By Rachael Taylor

If you need any more proof that estate jewelry is a hot topic right now, take a trip to San Francisco’s Pacific Heights neighborhood. This affluent part of the northern California city is famous for its iconic early-20th-century architecture (which has appeared in films such as Mrs. Doubtfire), picturesque views of the bay, and great restaurants. It is also a hub for chic boutiques, including jewelers Catbird, Gorjana, Fiat Lux, and Alexis Bittar.

The latest addition to this fashionable enclave is Rocksbox. Entrepreneur Meaghan Rose launched the company as a jewelry rental service in 2012, and Signet Jewelers acquired it in 2021. This summer, the retail group announced it would be phasing out rental at Rocksbox in favor of selling pre-owned and sustainably sourced new jewelry, a strategy shift it attributed to rising consumer demand.

“The younger generation is extremely interested in purchasing pre-owned jewelry,” says Rocksbox president Allison Vigil. “Our data shows Zillennials and Gen Z consumers are motivated to shop by factors such as responsible sourcing and unique pieces that represent who they are. We’ve seen these values come to life in the rise in popularity of vintage and thrifted styles among Gen Z customers. Pre-owned jewelry is a great way to find a unique piece that tells a story, [and it] gives these beautiful styles a second life and contributes to the circular economy.”

The San Francisco Rocksbox store its first brick-andmortar shop opened on Fillmore Street on November 19. Its interior is an ice-cream-sundae palette of soft pinks and creams, curvaceous boucle furniture, and potted plants. The atmosphere the team had in mind was “inviting, accessible and warm…like you’re in a friend’s house trying on jewelry.”

The price points are similarly accessible. These are not the signed diamond jewels of high-end estate dealers, but pre-

“[ The estate segment] gives these beautiful styles a second life”

owned pieces from Signet’s Kay, Jared and Zales chains, ranging from under $100 to $800. The store will also carry new collections from 13 brands, including Kate Spade, Luv Aj, Kendra Scott, Ana Luisa, and Lele Sadoughi, each chosen for utilizing sustainable manufacturing or materials, having strong philanthropic credentials, or being a female-founded or -operated business.

At present, the San Francisco boutique is very much a test. Signet has taken out a lease for six months and will no doubt be measuring how shoppers interact with its pre-owned jewelry offering during that time. Should the Rocksbox experiment prove successful, Vigil says, “more stores are a possibility,” opening a gateway for younger generations to the wider estate-jewelry market.

If your Instagram algorithm resembles mine in any way, you will be hard pressed to scroll very far without encountering estate-jewelry content. Just as antiquing and thrifting and crafting have found millions of eager digital devotees, so, too, has pre-owned jewelry. Why does this content perform so well online? Here are a few factors that make the difference.

Generally, educational content performs well on social media platforms, and this is a strategy that brands and retailers often adopt as a way to soft sell — to provide value through content rather than just giving a straight-up sales pitch. Watch a video featuring a brandnew jewel, and it will likely leave you feeling appreciative of the design or in awe of the gemstones. Watch one with an estate jewel, and

By Rachael Taylor

you might well finish it feeling that you’ve learned something, be it about the jewel’s era of origin or the history of the craft.

Danielle Miele runs the popular Instagram account @GemGossip and sells her estate jewelry finds through the dedicated @ShopGemGossip account. One of her top posts this year was a selection of old-cut antique diamonds that she had sourced for a collaboration with Yearly Company, a jewelry store in Nashville, Tennessee. Shoppers could select one of the loose diamonds Miele had curated and have it set in a bangle.

“Pieces with old-cut diamonds are very popular,” says Miele when asked which types of posts get her followers excited. “Whether it’s an old mine cut or old European cut, I think people are realizing the rarity of these stones, how they were cut by hand — not an easy feat — and how, as time goes on, original old cuts are getting harder to come by.”

Another reason social media is proving to be such fertile ground for digital-first estate dealers is storytelling around distinctive pieces. The unusual and the curious stop us in our scrolling, and estate jewelry does this better than almost any other category.

It was a vintage oval-link bracelet in 18-karat gold that ended up being the hottest piece of the year on Olivia Harris’s @BigOhBijoux Instagram account, which she runs out of New York. The quirky design — which had the phrases “Don’t panic” and “This too shall pass” engraved on the chunky links — generated 8,000 likes, 3,900 saves, and over 700 shares.

“I believe it was such a hit because it serves as a lovely, wearable talisman to remember to breathe and take things one day at a time, whatever battle may lie ahead,” says Harris, who later replicated the design because it was so popular.

“Another draw is the mystery and sentimentality of antique pieces,” posits Shari Cohen, founder of Seal & Scribe, a San Diego jewelry brand that incorporates antique seals and intaglios into modern designs. “Our clients don’t gravitate toward newly created intaglios. They prefer antique and vintage because they appreciate that these little objects are imbued with sentiments that transcend time and space. Something that was used to convey one

message 300 years ago can still mean the same thing today, or it can be reinterpreted into a new meaning for today’s wearer.”

Online estate-jewelry shopping appeals to a certain type of customer — one who’s looking for a bargain and willing to put in the time to find just what they want. In June, eBay users searched for “vintage jewelry” about 30 times per minute, according to statistics the auction site shared with Rapaport — further proof of the strong demand for pre-owned jewels. In a recent effort to shore up its luxuryjewelry offering, eBay started providing a consignment service for a set number of jewelry and watch brands, including Gucci, David Yurman, Chanel, Hearts on Fire, TAG Heuer, and Hublot. In 2022, it partnered with the Gemological Institute of America (GIA) to launch a fine-jewelry authentication program for pieces on the site that were selling for over $500.

While social media users seem to engage most often with the quirky and unusual, the eBay search history shows a more predictable thirst for brand staples. From January to October this year, the site’s top five mostsearched jewelry-style terms were “Cartier Love Bracelet,” “Cartier Juste Un Clou Bracelet,” “Van Cleef Alhambra Necklace,” “Van Cleef Alhambra Bracelet” and “Tiffany & Co. Engagement Ring.”

Whether it’s the lure of finding that coveted icon at a lower price, a way to discover standout designs, or simply the chance to learn about a piece’s history, shoppers are increasingly going digital to bolster their collections.

What does it take to be an appraiser, and why are they so important to the trade? Experts in the field share their thoughts. By Ruth Peltason

Appraisers are the behind-the-scenes enforcers of responsible jewelry stewardship, from the intangible aspects like discretion and reputation, to the quantifiable ones like fair market value and retail replacement value assessments. These cool-headed sleuths of the jewelry world — and there are some 6,400 registered appraisers throughout the US — are respected for both their knowledge and their integrity. They work with efficiency, supporting their assessments with an arsenal of documentation, equipment, and often decades of experience. Accuracy is the coin of their realm.

Retailers, dealers, insurance companies, banks and private clients all rely on appraisers to sort out and offer advice on some of the thorniest and most personal issues surrounding fine jewelry. A new baby in the family, a second marriage, a large consignment for auction, a family disagreement over an important estate — all of these are good reasons to have appraisers on your speed dial. For their clients’ protection and privacy, they fly under the radar, but make no mistake: An appraiser is the best professional friend you could have.

Not only do appraisers have to follow the evidence without bias and be understanding — especially when delivering less-than-desirable news about a valuation — they must have impeccable credentials and references. The latter criteria are increasingly critical; those certifications from the Gemological Institute of America (GIA) and the Uniform Standards of Professional Appraisal Practice (USPAP) signal that an appraiser has attained a trifecta of knowledge, reliability and trustworthiness. That’s metaphorical gold in the competitive, often insular jewelry sector.

While training, experience and contacts are essential qualities in the best appraisers, a number of questions swirl about the industry. How do you know whom to trust? Should you use the in-house appraiser at your local jewelry store? Apart from the GIA’s activities, what is being done on the national level to regulate the trade and provide acrossthe-board standards? And of course, there’s the issue of lab-grown diamonds, a trendy bête noire that has become a significant concern for appraisers.

Here, appraisers from across the country weigh in on the strengths and challenges of their field and speculate on what the future may hold.

“It’s the

there”

YOSEF CALDARON

Fine Jewelry Acquisition Initiative for the Winston Art Group, New York

Credentials: GG, AJP, GP, Gem-A, FGA, CMA

“ Your gut is

JENNIFER LEITMAN BAILEY

Jennifer Leitman Bailey Ltd., New York

Credentials: GG, AJP, AAA, USPAP-compliant

One of the many issues Yosef Caldaron can discuss with familiarity is the lack of regulation in the field. Given his numerous degrees, vast experience and solid reputation, his opinion carries weight. Aside from being director of the Fine Jewelry Acquisition Initiative for the Winston Art Group, he is also the only certified master appraiser (CMA) in New York.

It’s no surprise, then, that he thinks regulatory measures have fallen short in the US. “The appraisal world is not regulated nationally, but state by state,” he explains. “This means many people can say they’re an appraiser without having a certification, versus being USPAP-compliant. It’s kind of the wild, wild west — there’s very little regulation.”

That being the case, “it’s on the person seeking the appraisal to look at the qualifications of the appraiser,” he says. “I would only hire an appraiser with membership in an established appraisal society, which also means that person is doing continual education.”

Among his other bona fides is a deep knowledge of diamonds and the global gemstone market; he has worked for the GIA out of Israel as well. Caldaron has seen the diamond market change substantially because of synthetics. He is an advocate of using the Yehuda detector and believes that at minimum, it’s the appraiser’s job to screen for lab-grown. These stones, he says, have brought about “a major shift in the way we do appraisals.”

Value for money, planning for the future, buying the best signed jewelry — these are just some of the core views that make Jennifer Leitman Bailey an appraiser’s appraiser.

“You have to follow the market, to really home in on the market when you’re appraising things,” she says. “Fair market value will always differ from retail replacement value, and the fair market is based on the market today.”

This no-nonsense approach means she sometimes has to deliver disappointing news. “It’s hard, and sometimes you also become a therapist for your client.”

In the Leitman Bailey universe, there’s also room for gut instinct. “I remember everything to a T,” she declares, “which is very important when you’re appraising. Your gut is number one.” However, she adds, “your gut intuition comes from the experience you’ve had. It’s not just made.”

Signed jewelry, often the benchmark for some of the finest collections, is another of her specialties because she is “trained to think resale.”

She advises clients to collect signed pieces, as her market research demonstrates that they hold their value. “I always tell people that jewelry is a place to hold your money. Enjoy it, wear it, but [if] God forbid you need to sell it, natural diamonds, signed pieces, gem-set [pieces containing] colored stones with certifications [are where] you can’t go wrong.”

She also does a fair amount of self-purchasing, all of it signed. “I love my jewelry, but I’m always estate planning, so it’s for my children.” That’s the mark of an appraiser who takes her own advice.

DAPHNE LINGON

Daphne Lingon LLC, Charleston, South Carolina

Credentials: GG, AAA, USPAP-compliant

Being an appraiser isn’t solely a path for the newly minted graduate gemologist or junior cataloguer anxious to fill in their résumé. Sometimes it’s for corporate leaders who have decided they’re ready for a change that can put their experience and contacts to use.

As Daphne Lingon has discovered, it is possible to pivot from the auction world to that of appraisals and advisories. Formerly head of jewelry for the Americas at Christie’s New York, she held

one of the most visible positions in jewelry. After 30 years with the auction house, however, she decided to step away, move to the south, and become an independent quiet force behind the curtain as principal of Daphne Lingon LLC. The changes were neither as drastic nor as different as she had imagined. She still works with clients and looks at a lot of jewelry, though her client relationships have changed. So has the jewelry.

“You never know what you’re going to encounter with a client, and that’s what makes it exciting,” she says. She recalls a time she questioned why a large cubic zirconia ring was in among a client’s fine jewelry. She asked the client to look in her elderly mother’s travel jewelry, where it turned out her mother had inadvertently switched out the rings. “You’re talking about a $400,000 emerald-cut diamond ring versus one that has no value.”

Nowadays, the former camaraderie of being in an office comes from a network of like-minded appraisers across the country. In the wake of the heady years with Christie’s and overseeing major estates — among them Doris Duke’s, Elizabeth Taylor’s, and Anne Eisenhower’s — the intimacy of being an appraiser suits her.

“On the whole, appraisers are a community [of people who] support one another. Being on your own is very different than being part of a large department, and there are times when you need another opinion,” she says. “Or maybe someone reaches out because there’s a need for an appraiser in some other city. It’s collaborative.”

There is, however, one similarity to being with a large auction house: reputation. At the GIA, where Lingon trained in 1993, she was told that “your reputation is everything.” More than three decades later, the message continues to resonate: “It has been at the core of everything I do — at Christie’s and as an appraiser.”

A quick guide to appraiser credentials

GG: Graduate gemologist

ASA: American Society of Appraisers

AAA: Appraisers Association of America

AJP: Applied Jewelry Professional (GIA)

GP: Graduate Pearls

Gem-A: The Gemmological Association of Great Britain

FGA: Fellow of the Gemmological Association (Gem-A)

CMA: Certified master appraiser

USPAP: Uniform Standards of Professional Appraisal Practice

LEA KOONCE OGUNDIRAN

Lea Koonce Ogundiran LLC

Chicago, Illinois

Credentials: GG, USPAP-compliant

“Product KNOWLEDGE is key”

EDWARD

LEWAND, Consultant Appraisal Services, New York

Credentials: GG, ASA, AAA

What does the future hold for appraisers? Location is less binding in our post-pandemic world; great collectors aren’t only in major cities, and neither, for that matter, are appraisers.

“People are moving all over the country, so jewelry is moving, and you’re seeing jewelry you’d never expect in certain markets,” says Lea Koonce Ogundiran. “When I was living in Charlotte, North Carolina, for example, I was seeing goods from the Middle East because it’s near a military center. I saw a lot of glass-filled gemstones because soldiers were buying them in Afghanistan, thinking they were getting really nice stones.”

Koonce Ogundiran believes climate change will be another important factor, especially given the recent storms in the US. “You never know what’s going to happen — a forest fire, flooding. My prediction is that retail replacement value will become more important, and I think we’ll be doing more insurance appraisals.”

To meet this demand, the industry needs more appraisers, and for that, it needs to step up its career advancement. Recently the National Association of Jewelry Appraisers (NAJA) and software provider Instappraise began jointly offering scholarships for those going into the field. The GIA continues to bring in young, accredited jewelry professionals, though Koonce Ogundiran thinks it should be “more aggressive” in promoting appraisal as a career path. For instance, she says, “they don’t teach you how to price something” — an important skill for would-be appraisers.

Street smarts, on-the-job training, and looking at a lot of jewelry over many decades has formed the foundation of Edward Lewand’s career. His parents were antique-jewelry dealers, and Lewand went to the GIA straight out of high school. From there, it was a job in New York’s diamond district on 47th Street, with college studies at night. Along the way, he met influential people in the field, including Antiques Roadshow alum Joyce Jonas, gemologist and appraisals authority Anna Miller, and leading certification pioneer Elly Rosen.

The result is that Lewand brings a highly practiced eye to the field, knows just about everyone, and is unequivocal about understanding fine jewelry.

“Product knowledge is key,” he says. To him, this means not just examining the front of a piece, but turning it over, checking it for wear, seeing how the stones were mounted, and distinguishing between, for instance, an Italian-made piece and a French one. “What is the actual value of an object? You have to answer it on evidence and comparables. You have to understand the history.”

For a man who was once a consultant to the Internal Revenue Service (IRS), liability issues are paramount. Being careful and doing evaluations the right way are critical to avoiding any potential liability. At the end of the day, Lewand says, his role is “helping people find the truth about something.”

Store owners and appraisers share their top tips for new collectors of pre-owned jewelry.

By Smitha Sadanandan

attention

“When it comes to estate jewelry, there’s more to consider than meets the eye — provenance, condition and authenticity are all crucial. Each piece requires detailed attention, much like handling an important work of art, with full cataloging and documentation. Estate jewelry is never simple, and the last thing a retailer wants is to lose a valued client by offering something incorrect. That’s why experience — having bought, sold, and encountered many similar works — is so important. Expertise in this field comes from understanding the nuances that aren’t always visible at first glance.”

Lee Siegelson — Owner, Siegelson, New York

jewelry appraised

“You should certainly have the estate jewelry checked out by a qualified appraiser, one who is at minimum a graduate gemologist (GG) or equivalent and someone who has gone through a proper appraisal course and who follows the Uniform Standards of Professional Appraisal Practice (USPAP) guidelines. When appraising, I look at styling, era of production, method of production, quality of the stones and the metalwork, content of the metal, and the aesthetic appeal of the piece, and then search for comparables in the secondary market or auction markets for valuation.”

Sherlene Y. Bradbury Owner, Yantz Bradbury Associates Rockville, Maryland

“Estate items are being evaluated for purchase at a comparable market rate in the wholesale trade, whereas appraisals are official documents for the current retail replacement value, typically used for insurance purposes. Condition of the piece matters, so inspect for signs of alteration, repair or damage, such as chipped stones, bent prongs, and oxidized metal. Check hallmarks on the material or perform tests to identify metal makeup; verify gemstones with in-house gemologists, lab reports, or by sending to labs for confirmation. Look for brand or provenance hallmarks, particularly for signed designer pieces or items made in France, Italy and England. Familiarize yourself with variations of these hallmarks. For antique pieces, having provenance or historical records can significantly affect both value and desirability. Keep track of demand for certain eras, as trends affect market value.”

Paul Lubetsky — Founder/CEO, Windsor Jewelers, New York

“Staying active in the auction world is essential, as auctions often feature unique period pieces. Attending a variety of shows is invaluable for sourcing estate, antique, and vintage pieces. In New York, TEFAF at the Park Avenue Armory is an essential visit, while the New York Jewelry & Watch Show at the Metropolitan Pavilion is also good to visit. Depending on your specialized interests, there are wonderful shows to attend. The Palm Springs Modernism Show [in California] is one such event. It is a treasure trove of mid-century modern art, design, and architecture. If you collect Indigenous Native American jewelry, you must attend the Heard Museum Market [in Phoenix, Arizona,] and the queen of them all, the Santa Fe Indian Market [in New Mexico]. One of the largest fairs is the Original Miami Beach Antique Show, and it is not to be missed.”

Mahnaz Ispahani Bartos Founder/CEO, Mahnaz Collection New York

“The situation gets trickier with the proliferation of counterfeit jewelry and watches in the market, and one way you can avoid a perilous purchase is to work with an established and reputed retailer or seller. Check how long the dealer-retailer you are keen to buy from has been in the business. Look up their websites, and check their referrals. I also urge new collectors to educate themselves really well: Look at what’s available at fairs, check out the wares at several dealers, and do a price comparison. Allow yourselves a few months to get acquainted with the dealer or store before buying from them. It is also crucial for any buyer to ensure the invoice contains all relevant information, including the condition of the piece, the time period it pertains to, details of the metal and its weight, type of stones (natural or synthetic), caratage of the natural stones, and as much information as the jeweler can provide. You need all of this documented in the invoice for the purposes of insurance, especially if they are significant in price and have provenance.”

Janet Z. Dunayevich Cofounder, L & Z Jewelry and Gifts Morrisville, Pennsylvania

Secondhand watch prices are steadily dropping, but for many sellers, this is part of a natural cycle. By Carol Besler

Over the past four years, the market for luxury pre-owned watches has been on a down cycle, to put it mildly. Sales exploded during the Covid-19 pandemic, but now they’re tanking — though most stakeholders say it’s less a crisis than it is a return to normal.

The pre-owned market began to heat up in 2020, when shuttered retail stores and locked-down watch factories meant fewer new goods, and consumers reallocated their travel budgets to other, more tangible luxuries. Sales zoomed, speculators moved in, and suddenly prices on blue-chip models from brands like Patek Philippe, Audemars Piguet and Richard Mille were selling for as much as five times their retail value.

Prices on the secondary market peaked in May 2022 and have been dropping ever since, with 2023’s fourth quarter marking the seventh consecutive quarter of decline, according to a mid-January report from Morgan Stanley and analytics company WatchCharts. Prices have continued to drop in the first half

“Our business is booming.... Basically the market has settled into where it should be”

of 2024, as a report from the two companies revealed in July.

“Given reduced market speculation, worsening value retention, depressed absorption rates (inventory turnover), and the historically high age of inventory, it seems unlikely that secondary prices will stabilize in the near future,” said the July document.

Even auction houses, which sell the generally recession-proof top category of luxury watches, saw those sales dip 13% in 2023, according to industry consultancy The Mercury Project’s Hammertrack report.

‘We’re not panicking’ But is this a crisis? Secondhand dealers seem more relieved than stressed about the drop.

“Prices have definitely come down the last few years, but they went up so fast and so high that there’s no way that the market was going to sustain that kind of pricing,” says Joe DeMesy, president of DeMesy Fine Watches & Jewelry in Dallas, Texas, which sells both new and pre-owned watches. “As soon as supply and demand caught up with pricing, the prices definitely dropped back. But the pre-owned market is huge. I mean, for every hundred pre-owned watches we sell, maybe we sell 10 new ones. Our business is booming. We’re not panicking at all. Basically the market has settled into where it should be.”

Some dealers say they’ve escaped the downturn altogether.

“It’s important not to apply a broad-stroke analysis across the entire pre-owned watch market,” says John Shmerler, CEO of The 1916 Company — a merger of online dealer WatchBox and three other US jewelers. “While demand has shifted in certain categories, we are still seeing strong sales across The 1916 Company. In the

specific segments we focus on — highvalue collectibles, independent watchmakers, and the Rolex Certified Pre-Owned (RCPO) program — we’re seeing trends that diverge from what WatchCharts is reporting on a global scale.”

seen a corresponding rise in demand for high-end watches. For example, when Bitcoin surged from $42,000 to $62,000, it fueled strength in the upper tiers of the watch market.”

During the nine-quarter slump to date, the pre-owned sector has become a buyer’s market instead of a seller’s market in some ways. However, certain brands and models have remained almost immune to the price declines.

There are several other macro factors influencing “the cyclical nature of the market,” he observes. “During the early days of the pandemic, for instance, the watch industry benefited as consumers shifted their spending to luxury goods in a substitution economy, given fewer opportunities to spend elsewhere. That effect is now tapering off as consumer options have broadened.”

The advent of cryptocurrency also fed the upsurge. “When discussing the impact of the crypto market, it’s similar to other moments in recent history when new forms of wealth were created,” continues Shmerler. “During times of rapid growth in cryptocurrencies, for instance, we’ve

“We’re seeing growing interest in elite independent brands and models in the $50,000-plus category, which remains a bright spot in the market,” says Shmerler. “We continue to observe strong consumer demand for independent brands such as F.P. Journe, De Bethune, H. Moser & Cie., and Greubel Forsey.”

Overall, in fact, he says sales have not gone down at 1916: “We’ve seen year-over-year growth in the high single digits to low double digits so far this year, demonstrating resilience in the segments we specialize in.”

Contributing to that resilience is the pre-owned market’s considerable size. Sales of secondhand timepieces hit $24 billion in 2023, around a third of the retail value for all luxury watch sales, according to EveryWatch, which tracks secondary-market transactions worldwide. And despite dropping in 2023, auction sales were still high at CHF 610 million ($696 million); for comparison, 2021’s auction sales for the category came to CHF 634 million ($646 million). It seems the 1% are, as they say, impervious to the vagaries of the market.

How well have pre-owned timepieces from the major brands held their resale value? Here’s a look at their recent performance

down 9% in the past year

down 1.9% in the past year

Selling for an average of 29% below new-model retail prices Prices down 3.3% in the past year Prices up 1.2% in the past year Prices down 8.1% in the past year

Selling for an average of 20% above new-model retail prices

Selling for an average of 25% above newmodel retail prices

Selling for an average of 11% above new-model retail prices

Selling for an average of 22% below new-model retail prices

Best-performing model: Datejust — down 0.6% year on year Best-performing model: Panthère — up 8% year on year Best-performing model: Royal Oak — down 9% year on year Best-performing model: Gondolo — down 0.6% year on year

Best-performing model: Dynamic — up 13% year on year

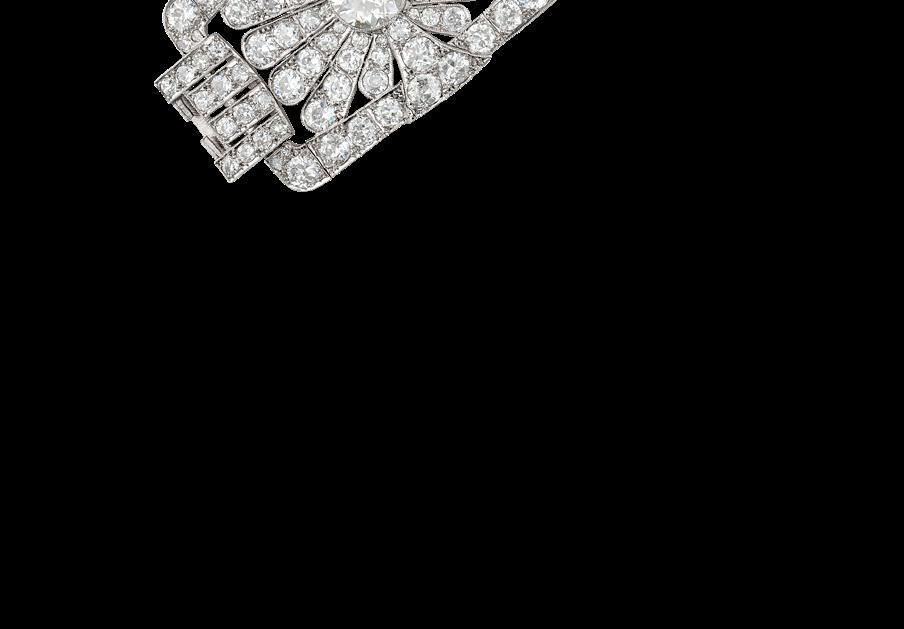

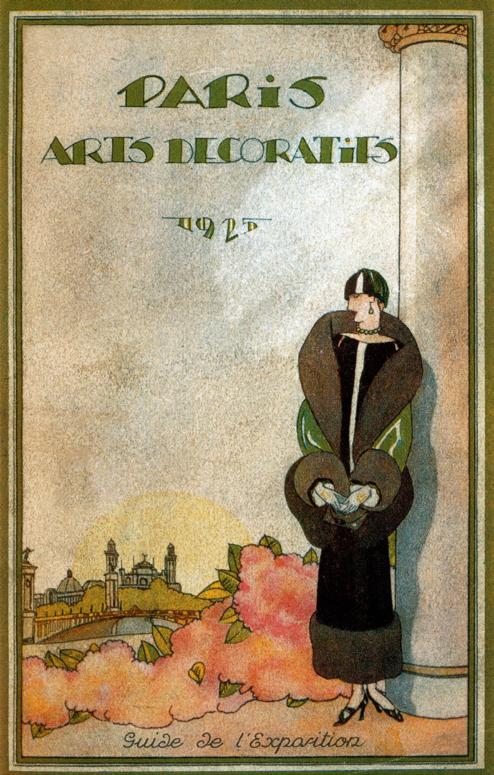

With its avant-garde vibe and geometric elegance, this period never gets old for jewelry lovers.

By Sonia Esther Soltani

In the constant ebb and flow of fashion, Art Deco is the only design style that has remained popular for 100 years and shows no sign of abating. The International Exhibition of Modern Decorative and Industrial Arts, which took place in Paris between April and October 1925, launched a revolutionary aesthetic. Organized by the French government and “open to all manufacturers whose products are artistic in character and show clearly modern tendencies,” the event hosted some 15,000 exhibitors, including Cartier, Van Cleef & Arpels, Boucheron, and Jean Fouquet.

The legacy of this feast of modernity, which showcased groundbreaking architecture, artworks and decorative objects, is unparalleled. The design movement’s timeless nature makes it enduringly appealing, says jewelry historian Vanessa Cron. “Much of this timelessness stems from Art Deco’s mix of abstraction and stylization. Its motifs, shapes, geometry, pure design, and avant-garde spirit feel strikingly relevant in today’s world, embodying an elegance that transcends time.”

A bold beginning

The exhibition, which had been scheduled for 1915 but had to wait another 10 years due to World War I, signaled a completely new design mind-set. “It marked the end of the 19th century and turned its back on nostalgia,” says author and jewelry historian Vivienne Becker. “Throughout the 19th century, jewelry and the decorative arts had looked to the past, with many revivals. At the 1925 expo, jewelry and the decorative arts showed that they could and should capture and reflect the moment in time.”

a resolutely modernist style influenced by the technology of the age — fast cars, planes, and assembly lines. The Egyptian-inspired jewels that followed the 1922 discovery of Tutankhamun’s tomb were iconic as well.

However, Cron says there’s no single piece that fully captures the spirit of the period; “it’s more of a ‘vibe,’ as we might say now. It’s the long sautoirs paired with straight-line ‘I’ silhouette dresses, the stacking of diamond bracelets, the use of clear and frosted rock crystal, the onyx and black-enamel outlines, the bold two-tone color schemes, the popularity of the double-clip brooch, the carved gemstones in the tutti frutti style, the machine-age-inspired creations by Union of Modern Artists (UAM) jewelers.”

“Much of this timelessness stems from [a]mix of abstraction and stylization”

The “modern style,” as the public called it before the term “Art Deco” was coined in the 1960s, was characterized by an “explosion of color,” in clear contrast with the subdued pastels of the Belle Epoque, Becker notes. The use of coral, lapis lazuli, turquoise, jade and onyx in bold combinations reflected the enthusiasm for Orientalism and the vibrant colors of the Ballets Russes, a disruptive dance company touring Europe since 1909.

The movement had different periods, Becker continues. It started with a slightly figurative stage that evolved into

Under the hammer

All these items are usually the highest-selling lots at auction and a popular request among estate dealers’ clients. Professionals concur that Art Deco is the top era for collectors, with two maisons — Cartier and Van Cleef — at the pinnacle of desirability. In recent years, head-turning results at Sotheby’s have included a Cartier tutti frutti bracelet from the 1930s that sold for over $1.3 million in 2020, and a 1929 diamond-tie necklace that bore a VCA signature and tripled its estimate at $3.6 million last year.

Art Deco pieces buck the trend that diamond-heavy jewelry performs best at auction. A Cartier necklace with over 169 carats of aquamarines from circa 1940 sold for $604,000 at Bonhams in 2019, three times its presale estimate. Discerning buyers also favor pieces by Fouquet, whose 1925 necklace featuring an 85-carat aquamarine sold for $1.2 million at Christie’s Paris in 2021. But for all the headline-making pieces, Art Deco jewelry is available at a wide range of prices — from as little as $3,000 for unsigned pieces to $100,000 for those with exceptional stones. What draws collectors to the style is its craftsmanship and emphasis on design.

“It’s the most consistently sought-after period because a lot of people respond to the Art Deco period as the golden age of

jewelry making,” explains Guy Burton, managing director at jeweler Hancocks in London, commenting on the innovative techniques that creators developed in the 1920s and ’30s, such as Van Cleef’s mystery setting.

Style chameleons

The modern allure of Art Deco jewels means they blend harmoniously with other styles. “The sleek, streamlined geometry still feels fresh and modern a century later, and the styles tend to play well with other jewelry eras,” remarks Nicole Corsini, marketing manager at Lang Antique and Estate Jewelry in San Francisco.

Requests for Deco line bracelets are high, she reports, as they stand out on their own and stack nicely with other pieces, while couples often opt for an Art Deco diamond engagement ring because of its “amazing hand-fabrication and engraving.”

There’s another jewelry trend making the era a hit among collectors: “Lately we’re seeing a lot of men interested in Art Deco brooches for evening or special events, because they bring such sparkle and personality to the lapel of a suit or tuxedo,” Corsini says.

“Lately we’re seeing a lot of men interested in Art Deco brooches for evening or special events”

Variety is also part of the period’s appeal. “The Art Deco design has infiltrated all tiers of the jewelry world, from charms and engagement rings to parures and encrusted handbags,” observes specialist Kerri Orlando of Philadelphia-based dealer Wilson’s Estate Jewelry.

Far-reaching impact

Art Deco pieces are plentiful on the market due to the rise in jewelry production from the 1920s to World War II. However, this doesn’t always equal high-quality finds.

“We see more Art Deco jewelry than many other eras of design, but finding truly distinguishable, well-designed pieces can be challenging — even more so for signed pieces,” comments Orlando.

As the 100th anniversary of the historic exhibition approaches, retailers should remind buyers that Art Deco designs have stood the test of time, advises Corsini. A key message is that “many of today’s jewelry trends — long, layered necklaces, stacks of bracelets — were originally popularized in the Art Deco era.”

Cron, for her part, “would love to see the industry celebrate this era without merely reviving it. The Art Deco style is established. It deserves to be celebrated in ways that inspire fresh, groundbreaking designs rather than copying past forms.”

She does wish she could have experienced the original exhibition itself, though. If augmented reality could produce “an immersive experience that allows us to ‘visit’ it…I’d absolutely say yes!” she declares. The 1925 pioneers, with their appreciation for the latest technology, would undoubtedly have approved.

If there is one style that’s omnipresent, from the mainstream to the highest echelons of jewelry, it’s Art Deco. Kay Jewelers recently released the Neil Lane Artistry Heritage collection, comprising platinum engagement rings and wedding bands with lab-grown diamonds in Art Deco-inspired cuts. Another designer embracing the aesthetic is Istanbulbased Melis Goral, whose collections offer a contemporary take on the Art Deco movement. The geometric jewels star the Big Three gems — emeralds, sapphires and rubies — as well as malachite, lapis lazuli, black onyx and other stones reminiscent of the 1920s. Also taking inspiration from the era is Parisian Amélie Huynh, the founder of Statement. The brand’s signature My Way ring combines Art Deco’s codes and celebration of craftsmanship, the jeweler says. “I admire the style’s refined geometry and luminous sophistication, and I hope it shows in my pieces. Each line and each detail evoke the perfect harmony of shapes, where the brilliance of gold and precious stones celebrates the elegance of a bygone era, the Roaring ’20s.”

Meanwhile, in New York, Art Deco has influenced nearly all of Lindley Gray’s work with its “restraint and sense of geometric proportion,” says the designer. Her latest SoHo capsule collection of studs and charms interprets her favorite Art Deco illustrations, textiles, buildings and objets d’art Fellow New Yorker Kia Schwaninger launched her Kia Schwan high-jewelry brand after working at Harry Winston and Van Cleef & Arpels. Its inaugural Colorhythms collection joyfully blends geometric lines and semi-spherical carved stones such as coral, malachite and turquoise. In the Art Deco spirit, her creations are customizable and transformable. “Collectors are buying the design and the craftsmanship more than the stone,” she says.

What do you do with a country’s crown jewels? Museum curators share the ins and outs of managing this niche category. By

Crown jewels are the ultimate estate jewels. Since they belong to governments or monarchs and hold an important place in a country’s history, they will likely never appear in a public sale. Because of their distinctive status, they receive different treatment and care than pieces that end up on the market.

“They are not products. They are objects with stories that have history,” says gem education consultant Rui Galopim de Carvalho. “They are different than jewelry that appears at auction. Those are products for sale. They are not museum items. Although museums have the same kinds of objects as those we see on the market, they are not jewelry products.”

Galopim de Carvalho was a co-organizer of a two-day colloquium called “Treasures, Royal Gems & Jewellery,” which took place in November at the Royal Treasure Museum in Lisbon, Portugal. Those in attendance included gemologists, historians, museum curators, valuators, mineralogists, auction professionals, and others with an interest in historic jewels and gems.

Crown jewels present particular challenges, such as restoring, organizing and maintaining them, as well as figuring out how best to present them to the public. Three of the speakers at the event were in charge of museums with royal collections, and they discussed some of these issues.

Denmark: Fit for the queen

Anthony DeMarco

Peter Kristiansen is curator of the Royal Danish Collection, which includes the Danish crown jewels. Dowager Queen Sophie Magdalene established the collection in her will in 1746, and it became effective upon her death in 1770, he explained via video feed at the gathering.

“The collection belongs in principle to the monarch, still today,” he told participants. “And the monarch can in principle do what he wants with the collection, but there are some limitations. He can’t sell it. He can’t give it away, and he is obliged to preserve it.”

The jewels have been in Rosenborg Castle with the Royal Danish Collection since 1915 and on public display there since 1922. Four sets of items have the designation of crown jewels: the Emerald Set, the Pearl-Ruby Set, the Brilliant Set and the Rose-Cut Diamond Set. The jewels also cannot leave the country, Kristiansen explained. Their use is limited to a few state celebrations and royal funerals. In the past, they have been part of coronations, but these ceremonies no longer exist. Since they are still in use, the jewels get adjusted to keep up with current fashions and to fit the reigning queen comfortably. In January, Queen Margrethe II abdicated her throne after 52 years, citing health reasons. Her eldest son, Frederik X, became king of Denmark, and the jewels were tweaked for his wife Mary.

France: Out of the vault Eloïse Gaillou is responsible for the approximately 100,000 samples of minerals at the Mines Paris – PSL school’s Mineralogy Museum, where she is director and curator. Among them are some 150 gems from the French crown jewels.

About a century after the French Revolution, the French government decided to sell the collection to rid itself of all symbols of the monarchy, Gaillou related in her presentation. The jewels went up for auction in 1887. “Everything was put on display, and in 10 days, everything had to be sold. It was not sold for [the pieces’] heritage. It was not even sold for the price of the stones, because everything was put into suites of gems and sold to the highest bidder. Only a few sets of jewels were left for the last empresses.”

Some of the experts of the time convinced the government to keep some gems for mineralogical study and historical purposes, she continued. These got divided among The Louvre Museum, the National Museum of Natural History in Paris, and Mines Paris – PSL, which received Colombian emeralds, Siberian amethysts and Brazilian pink topaz.

Apparently, however, no one at Mines Paris knew about the gems until 2016.

“Everything was kept in a vault but not written as the French crown jewels,” Gaillou explained. Once she learned of their historical significance, she immediately decided to display them, dividing them by category — amethyst, pink topaz and emerald — and showcasing them in a tall cabinet.

The institute is now researching which jewels contained the gems, and who owned them.

The next challenge for the three French museums is buying back at least some of the original crown jewels based on what they can afford, according to Gaillou. “The decision was made to try to find and purchase back those pieces that were still set in jewelry. Not loose gemstones, but a few things that have the savoir faire, the craftsmanship, of the jewelers.”

Bavaria: Sharing with the public

Jonas Jückstock is conservator at the Treasury of Munich Residence, a palace that served as the seat of government and home of Bavarian dukes, electors and kings from 1508 to 1918. The Treasury is a collection of about 1,250 jewels, goldsmiths’ works, and objects of enamel, crystal and ivory. In his 1565 will, Duke Albrecht V stipulated that the items in this collection should never go up for sale.

Jückstock is an expert in restoration. He spends much of his time at his workbench restoring jewels and other artifacts that date back to the 14th century. He is passionate about finding out as much as possible regarding each item in the museum.

“We work for museums. That means we work for the public,” he told the event attendees. “That comes with the responsibility to give the public not only views of objects, but also the information about it. And I think we like to do that, as well as opening these items to scientific methods to gain additional insights.”

Another challenge he addressed was how museums should plan for the future — whether these institutions that preserve the past should also be anticipating and collecting the types of art and objects that will have historical significance further down the line. “Most of the time, we look back at what has happened, but simultaneously we should think about what we will present in the future, what principles you want to present as a museum [to educate] the public,” he stated.

The Rapaport Price List is commonly used by dealers as a guideline for evaluating natural diamond prices. Readers should understand the List’s standards for describing diamonds, as well as its limitations and how it can be used to aid buyers and sellers. The Round and Pear Shape Price Lists are published online every month.

The Price List quotes Rapaport opinion of high cash asking prices for Rapaport Diamond Specification A3 and better natural diamonds. These prices may be substantially higher than actual transaction prices. It is most common for the diamond trade to transact at discounts to the List. However, select quantities that are in short supply or subject to speculative demand may trade at significant premiums to the List.

Detailed information about discounts is provided online in real time via our RapNet® and RapX® diamond trading networks. They are also included in the Trade Sheets published in this magazine.

The level of discount or premium is influenced by many factors, including diamond quality and cut, credit/memo terms, the location and type of market, the liquidity level of particular size-quality combinations, and the associated risk of ownership. The easier it is to sell a diamond, the lower its discount to the List. Hard-to-sell diamonds often trade at large discounts. Very in-demand, scarce diamonds may trade at premiums.

The Price List relates to Rapaport Diamond Specification A3 or better natural diamonds that are graded based on Gemological Institute of America (GIA) standards (except for SI-3, an additional intermediate non-GIA grade).

CAUTION: Grading laboratories use subjective methods of analysis. The same diamond may be evaluated differently by different labs or even each time it is submitted to the same lab.

Grading reports and our Price List do not replace the human factor in evaluating diamond quality or price determination. The Rapaport Price List does not provide transaction prices, but price indications that serve only as guidelines — a starting point for negotiations and a basis for estimating value. Buyers and sellers are advised to consult with experts before trading diamonds.

The Rapaport Price List is based on the following specifications:

Grading report GIA

Shape Round brilliant

Cut Excellent

Polish Excellent

Symmetry Excellent

Culet None

Depth % 58.5%-63.5%

Table % 55%-62%

Girdle No extremely thin, extremely thick or very thick

Fluorescence None

Weight No .00 sizes for 1.00 and larger

GIA comments No GIA color comment

GIA comments No knot or cavity

GIA comments For SI1 or lower, no “Clarity based on cloud”

Seller requirement No green tint

Seller requirement No Marange diamonds

© Copyright 2024 by Rapaport USA

The Price List relates to fine-cut Rapaport Specification A3 or better diamonds. Additional Rapaport specifications are available at rapaport.com/rapspec

These specifications are subject to change without prior notice.

Approximate percentage increases from 5-carat prices for larger sizes*

These indications should only be used as guidelines. Large stones are very thinly traded, and prices may vary significantly from dealer to dealer and stone to stone. Availability of large, better-quality stones may be limited, and buyers may find that asking prices and/or transaction prices may be significantly higher or lower than these price indications. This price information should only be used as a general indication of the current market.

*Asking price indications are based on Rapaport Cut Specification A3 or better.

APPROXIMATE % INCREASE OVER 5-CARAT PRICES

The impact of fluorescence on price depends on its noticeability. In some cases, fluorescence gives the stone a milky-white appearance, which greatly lowers value. In some instances, the fluorescence is hardly noticeable and has minimal impact on the stone’s brilliance. Blue fluorescence gives lower-color stones a whiter, brighter face-up appearance. Yellow or white fluorescence is problematic and may require an additional 5% to 10% discount. Generally, the higher the quality and price per carat, the more fluorescence lowers value. In the table below, we present our estimation of the price gap between nonfluorescent polished round diamonds, and polished round diamonds that show varying degrees of fluorescence. The percentages represent the average price difference for each of the size, color and clarity categories indicated.

Longtime Chicago jeweler CD

Peacock’s expansive new flagship pays tribute to its history and its hometown.

As Chicago’s first jeweler and Illinois’s first business with more than 185 years of history, CD Peacock has a certain reputation to uphold. After all, its archives include handwritten letters by former President Abraham Lincoln, whose wife was a client. However, rather than settling in the past, CD Peacock has made bold steps to reinvent the retail experience with a new store: the CD Peacock Mansion, which covers 20,000 square feet at Oakbrook Center, around 30 minutes from downtown Chicago.