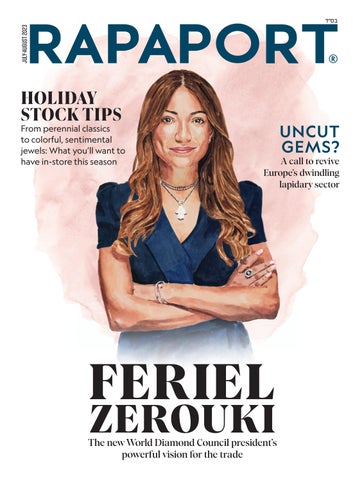

HOLIDAY STOCK TIPS

From perennial classics to colorful, sentimental jewels: What you’ll want to have in-store this season

call to revive Europe’s dwindling lapidary sector

From perennial classics to colorful, sentimental jewels: What you’ll want to have in-store this season

call to revive Europe’s dwindling lapidary sector

The new World Diamond Council president’s powerful vision for the trade

EDITOR IN CHIEF: SONIA ESTHER SOLTANI

NEWS EDITOR: JOSHUA FREEDMAN

SENIOR NEWS REPORTER: LEAH MEIROVICH

SENIOR COPY EDITOR: RACHEL BEITSCH-FELDMAN

COPY EDITOR: NECHAMA VEEDER

ART DIRECTOR: TARDEO AJODHA

SENIOR DESIGNER: DAVID POLAK

DESIGNER: NICOLE BEDNARZ

DATA ANALYST: OREN YANNAI

VICE PRESIDENT OF OPERATIONS: DAVID EHRLICH

PROJECT MANAGER: ANNA SIMAKOVA

SALES OPERATIONS MANAGER: ZOIA KOLTON

SALES AND OPERATIONS

COORDINATOR: YANA SHLYAKMAN

PODCAST AND VIDEO PRODUCER: VANINA PIKHOLC

SOCIAL MEDIA MANAGER: TALY COHN

PUBLISHER: MARTIN RAPAPORT

ASSOCIATE PUBLISHER: LEA SCHIFF

ADVERTISING SALES MANAGER : CHAMUTAL LEVIN

INDIA ADVERTISING SALES MANAGER : NEERAV PATEL

TEL: 91.22.6628.6592

NEERAV.PATEL@RAPAPORT.COM

TO CONTACT EDITORIAL: SONIA ESTHER SOLTANI SONIA.SOLTANI@RAPAPORT.COM

RAPAPORT MAGAZINE AND ONLINE

CONTENT IS PUBLISHED BY RAPAPORT USA INC.

1212 AVENUE OF AMERICAS, SUITE 801 NEW YORK, NY 10036, USA

TEL: 212.354.9100

NY@RAPAPORT.COM

133 EAST WARM SPRINGS ROAD, SUITE 100 LAS VEGAS, NEVADA 89119, USA

TEL: 702.893.9400

INFO@RAPAPORT.COM

RAPAPORT INTERNATIONAL

RAPAPORT BELGIUM

HOVENIERSTRAAT 53, BOX 13

B-2018 ANTWERP, BELGIUM

TEL: 32.3.232.3300

BELGIUM@RAPAPORT.COM

RAPAPORT ISRAEL

TUVAL ST. 21, SUITE 1362

RAMAT GAN 52521, ISRAEL

TEL: 972.3.613.3330

ISRAEL@RAPAPORT.COM

RAPAPORT INDIA

101, THE CAPITAL, PLOT NO C-70, BKC, BANDRA EAST

MUMBAI 400 051, INDIA TEL: 91.22.6628.6500 INDIA@RAPAPORT.COM

RAPAPORT INDIA – SURAT 501-504 C WING, DIAMOND WORLD BUILDING, MINI BAZAAR, MANGADH CHOWK, VARACHHA ROAD

SURAT 395 006, INDIA

TEL: 91.261.672.3300

INDIA@RAPAPORT.COM

RAPAPORT HONG KONG

UNIT 404-405, PROSPEROUS BUILDING 48-52 DES VOEUX ROAD

CENTRAL, HONG KONG, CHINA

TEL: 852.2805.2620

HK@RAPAPORT.COM

RAPAPORT DUBAI

DUBAI DIAMOND EXCHANGE

LEVEL 2, OFFICE D06

ALMAS TOWER, JUMEIRAH LAKE TOWERS

PO BOX 340600, DUBAI, UAE

DUBAI@RAPAPORT.COM

Of all the watch trends to emerge from this year’s Watches and Wonders fair in Geneva, one in particular continues to dominate the conversation: the shrinking size of timepieces. With collectors embracing the return to a more modest case size, I speak to Mark Toulson of Watches of Switzerland Group and vintage expert Eric Wind about the growing appeal of smaller watches and the reasons behind the shift.

With party season just around the corner, I discuss trends, buying plans and jewelry details with six retailers. My article highlights striking pieces to wear through a season of get-togethers, weddings and other events. Rebooted classics and hints of decadence are on everyone’s radar for gifting, while whimsical shapes, big earrings, textured links, and pops of color are quickly gaining ground as fun styling vibes, especially for people with a carefree approach to jewelry.

As with many young women, my first jewels were pearls — such symbols of bourgeois restraint in those days — so it’s been fascinating to watch and record the extraordinary shift in perception and aesthetic. Has any jewel undergone such a radical change in profile as the pearl? My story, “The Pearl Revolution,” shows how designers are having fun with pearls, letting their imaginations run riot and generating avantgarde appeal.

When 28 JAR pieces from a private collection went up for auction at Christie’s Geneva in May, 100% of them found buyers. The same month saw the controversial Christie’s sale of Austrian billionaire Heidi Horten’s jewelry, which exceeded estimates despite publicity about how her first husband, Helmut Horten, had made his fortune in Nazi Germany. In my articles on the subject, I look at how both of these sales underscored the robust health of the top-tier jewelry auction market.

Also in this issue: Anthony DeMarco, Richa Goyal Sikri, Sarah Jordan, Joyce Kauf, Avi Krawitz, Kate Matthams, Adrianne Sanogo, Phyllis Schiller, Rachael Taylor and Isabella Yan

The first half of 2023 has been packed with emotions and new projects for the Rapaport information team. We said goodbye to Senior Analyst Avi Krawitz in June but are delighted that Avi will still be a freelance contributor to Rapaport while he works on new and exciting personal endeavors.

We have also been busy developing our digital home, Rapaport.com, to make sure our community has access to the most relevant news and analyses in a user-friendly environment. Articles from the print magazine — present and past — are readily available online, too.

One of a journalist’s greatest privileges is to give a voice to people and share their stories with an engaged audience. We are doing this on our Rapaport Diamond Podcast, a fortnightly discussion with leading figures in the industry. And we have been steadily expanding to other platforms: We host Instagram Lives spotlighting careers in the industry and exclusive tours of key companies, and we interview emerging designers on our Rapaport Jewelry Pro YouTube channel. Other audiovisual products include a weekly Market Comment video and a quarterly webinar.

In short, we hope we are meeting you where you are — whether it’s in print or

LEFT: I am getting strong dolce vita vibes from these Medium Goccia earrings by Giorgio B, which feature coral enamel and 18-karat rose gold cabochons. Both geometric and sensual, they make a bold statement.

ABOVE: For her Goddess ring capsule collection, Alice Cicolini worked with Parisian illustrator Charlotte Gastaut and Colombian goldsmith Juan Sebastian Galan Bello. The results are mesmerizing jewels in repoussé 18-karat yellow gold, drawing on the energy of Greek and Roman deities. Featured here is the Luna ring, which exquisitely depicts natural elements associated with the moon.

Katherine Jetter

Katherine Jetter

People shine like diamonds. Like a diamond, they have facets and angles. Perspectives and economic interests they seek to promote and reflect. The best diamonds show brilliance, scintillation and fire as they intensify and integrate light through the reflections of facets. So too with leadership. The role of the leader is to integrate different perspectives and align competing economic interests for the benefit of the common good.

Feriel Zerouki, our esteemed cover personality, is providing leadership across many platforms. Her creation and management of the De Beers GemFair program in Sierra Leone is transformative and highly commendable. Ms. Zerouki plays an important role in our industry as the De Beers senior vice president for corporate affairs and has extended her influence as president of the World Diamond Council (WDC), honorary treasurer and member of the Responsible Jewellery Council (RJC) executive committee, and most recently as a director of the Jewelers Vigilance Committee (JVC).

It is important to recognize Ms. Zerouki for the leader she is and to learn about her views. Ms. Zerouki and I strongly disagree about a number of critical industry issues, such as the relationship

of the diamond trade within the Kimberley Process (KP) and the WDC System of Warranties. Whatever our differences, the role of Rapaport Magazine and Rapaport information services must be to honestly communicate the diversity of views within our industry, even and especially those views that we may strongly disagree with.

Ms. Zerouki, De Beers, the WDC, the RJC and the JVC will face serious unprecedented challenges over the next few months and years. Synthetics, sanctions, and the bifurcation of the diamond trade as we enter a global economic world war will demand attention. It will be interesting to see how the current industry leadership confronts these challenges.

Leadership will require the merging of different perspectives and economic interests for the common good. It will also require the exclusion of unethical members of the industry from trade organizations. Ms. Zerouki seeks to be all-inclusive, but she cannot be everything to everyone everywhere. Tough decisions lie ahead.

As the Rapaport Group enters its 46th year of publishing diamond prices, we devote ourselves to promoting better communication and the exchange of ideas that can help the diamond industry grow and prosper.

Lab-grown stones and the industry’s most important sales contract dominated the last two months of news in the diamond world.

Results at Richemont pointed to a possible high-end slowdown in the US. Sales at jewelers Cartier, Van Cleef & Arpels, and Buccellati were “broadly flat” in the Americas during the third fiscal quarter, which ended June 30, the company said. Their global revenues rose 19% year on year to EUR 3.6 billion ($4.04 billion) due to a rebound in Asia.

De Beers and Botswana have finally agreed on a deal for the extraction and sale of the country’s rough diamonds. State-owned Okavango Diamond Company will initially gain access to 30% of production from Debswana, the joint mining venture between De Beers and the Botswana government. That share will grow to 50% over the course of the 10-year contract.

Russia’s diamond trade declined but managed to avoid a heavy collapse last year after Western sanctions had only a limited impact on the sector. The country’s rough exports slid 24% to 36.7 million carats in 2022 and fell 4% by value to $3.87 billion, according to data the Kimberley Process (KP) released in June.

This 7.5-carat lab-grown diamond entered the spotlight in June when Indian Prime Minister Narendra Modi gifted it to US First Lady Jill Biden on a state visit. Indian Commerce and Industry Minister Piyush Goyal touted the F-color, VVS2-clarity stone’s “eco-friendly” origins, as producer Greenlab uses only renewable energy at its Surat factory.

De Beers’ lab-grown brand, Lightbox, launched sales of engagement rings featuring stones of up to 2 carats. This led some in the industry to suspect the miner was rolling back its previous claim that synthetic diamonds were solely for fun fashion jewelry.

Accurately screen out simulants, synthetics and treated stones.

Ignite’s leading-edge instruments used in combination, significantly reduces the number of diamonds that require time-consuming laboratory testing.

VISIT DE BEERS GROUP IGNITE AT IIJS 2023, MUMBAI, 3-8 AUGUST 2023

Ignite is a leading innovation, science and technology division of De Beers Group. Through continuous research, development and innovation, our advanced suite of detection and verification instruments provide consistent and accurate screening results.

Industry professionals have long maintained that the only way to transform diamond traceability and transparency is to have everyone march to the beat of the same drum.

De Beers Group recognized this in June when it opened up its Tracr digital diamond-tracking platform to industrywide participation. Before that, it had been a De Beers flagship, drawing on blockchain technology to log diamonds at the company’s global mining sites and follow them through the value chain. Now, high-profile participants include the Gemological Institute of America (GIA), Gemological Science International (GSI) and diamond jewelry retailer Brilliant Earth.

“We believe the diamond industry is desperate for a way to tell the rich story of natural diamonds at the point of sale,” says Tracr CEO Wes Tucker. “This requires a trusted, scalable digital solution where every actor in the value chain can share their part of this journey, from discovery to sale.”

Different companies throughout the diamond pipeline will use the Tracr platform differently. When rough sells to a manufacturer, the manufacturer takes ownership of the diamond’s tamper-proof “digital fingerprint,” according to Tracr, and can then add information and images about the cutting and polishing process

to the blockchain. Retailers, meanwhile, can look up any diamond in their inventory by its Tracr ID and use the interactive Tracr Diamond Experience tool to show customers the full history of the stone they’re buying.

All aboard

That said, the size, scale and influence of the newly publicized Tracr participants have led some to wonder how suitable the platform is for smaller businesses with fewer resources. De Beers is quick to address this issue.

“[Tracr’s] ultimate ambition is to support the entirety of the diamond industry, from the smallest miners all the way through to the largest,” a company spokesperson tells Rapaport Magazine.

While large luxury brands may use the platform to build ethical assurances into their supply chains, online retailers may employ it to enhance their digital storytelling or as a third-party tool in the sales consultation process.

As for the GIA, it sees its participation in Tracr as a service it can offer its business-to-business (B2B) clients to help boost consumer confidence.

“When a diamond that has been traced from the source is submitted to the GIA for grading, it will have a Tracr ID, which will allow the GIA to match the polished stone to [its] Tracr record,” explains Pritesh Patel, the institute’s senior vice president and chief operating

officer. “At a time when this information is more important than ever, Tracr has come forward with an industry solution that we are hopeful will attract more participants.”

At the time of this writing, De Beers has registered more than half of its production by value on Tracr, representing more than 1.3 million rough diamonds at the mining level and 110,000 at the manufacturer level. The group recognizes, however, that Tracr will only become an industry-wide tool if it can move beyond De Beers’ own supply. Onboarding competitor producers is the logical next step, and the miner has purposefully designed and tested the platform to achieve this.

If tempting other mining companies into the fold is the long game, Tracr’s short-term focus is on the other end of the supply chain: consumer-facing brands that can market the authentic provenance story behind their Tracrregistered stock. Tracr is also reportedly developing ways for consumers to add info to the blockchain themselves.

If shoppers begin opting for Tracr diamonds over their blockchain-free counterparts, more diamond businesses will have an incentive to participate in the program. This purchasing power will determine the Tracr landscape in the decades to come.

Now

platform is open to the entire industry, the next step is to get more brands and miners to sign on. By Sarah Jordan

The recent State of the Art Jewelry Summit at Harvard brought key sustainability issues to the fore.

By Adrianne Sanogo

By Adrianne Sanogo

Ethics and sustainability were among the main topics of conversation at the inaugural State of the Art Jewelry Summit, which took place in June at Harvard University’s Mineralogical and Geological Museum (MGMH). The event brought together academics, industry experts, visionaries, and an audience that spanned multiple disciplines to discuss the latest research, technology, business and art developments in the jewelry world.

The African view

To kick off the conference, keynote speaker Dan Schrag shared a startling fact about CO2 emissions. While the US, Europe and China are the biggest emitters, one might assume that Africa, with its abundance of mining operations, is near the top as well. However, the continent is actually responsible for less than 4%, according to Schrag, an environmental science and engineering professor at Harvard. Panelist Monica Stephenson offered a similar stat, but also a warning. “Sub-Saharan Africa is responsible for less than 3% of total emissions, but I have seen firsthand that the artisanal miners and communities there will bear the brunt of the damage from climate change,” said the founder of gem supplier Anza Gems, which works to benefit those communities.

One African success story that came up was Botswana. The country “utilized diamonds mined there to transform its economy,” jewelry designer Thelma West noted on a separate panel. She commended Botswana for this accomplishment and suggested that the nation should receive more recognition for it.

Working together

Cohosting the summit were Responsible Jewellery Council (RJC) executive director Melanie Grant, Gemological Institute of America (GIA) CEO Susan Jacques, and MGMH curatrix Raquel Alonso-Perez.

The RJC in particular addressed environmental, social and governance (ESG) issues, using the event to launch its “ESG Toolkit.” The document, which aims to help jewelry businesses improve their sustainability practices, outlines practical steps for putting together an ESG report that will comply with global standards.

One thing that became clear during the gathering was the importance of working together and pooling resources. “The exchange of ideas, knowledge and culture is fundamental for the advancement of the worldwide industry,” declared panelist Laura Inghirami, founder of branding consultancy Donna Jewel. Others highlighted the power of a single person to inspire change. In his closing remarks, MGMH director and Harvard professor Charles Langmuir recounted how he’d once followed someone’s lead and ordered a coffee without a plastic lid. One individual’s small decision could influence 100 people, he stressed, and those people could then influence 1,000, creating a ripple effect that could have a far-reaching positive impact.

AVAILABLE NOW TO SELECT JEWELERS

this one by research firm Return on Disability — describes people with disabilities as “an emerging market the size of China [and] the European Union [combined],” with 1.85 billion people globally who account for $1.9 trillion in annual disposable income. Add in family and friends who might buy products for them, and the numbers get even higher.

At the JCK Las Vegas show in June, Tiffany Yu made a striking statement. “We, as disabled people, actually control about $21 billion of discretionary income, which is more than the Black [$3 billion] and Latinx [$16 billion] markets combined,” said the founder of Diversability, a social enterprise that advocates for young people with disabilities.

These figures come from a 2018 study by the American Institutes of Research that points to the “significant and growing economic power of the disability market.” Another recent study —

Yu, who has paralysis in one arm due to a car accident when she was a child, was speaking at the Women’s Jewelry Association (WJA) Generating Community Impact Breakfast. Her statement was enough to pique interest in the room, which contained many C-suite jewelry executives. She also gave a live demonstration of how difficult it was for her to put on traditionally designed jewelry; for someone with the use of only one arm, she noted, clasps are particularly challenging.

People with disabilities have had little representation in the jewelry world, but activists in the industry hope to change that — and open up new business opportunities in the process.

By Rachael Taylor

The other speaker at the breakfast was Molly Kettle, chief operating officer at talent agency Gamut, which represents people with disabilities who are in the public eye — including Yu — and works to connect brands with the disabled community. Kettle posed some challenging questions to the audience. What were they doing to sell to people with disabilities, she asked, and how were they making workplaces more inclusive for employees with disabilities?

These conversations need to happen more in the jewelry industry, believes WJA executive director Jennifer Markas, who organized the JCK talk. People with disabilities are not well represented, she says. “How many people do you see on a retail floor in wheelchairs?”

She points to diamond dealer André Messika, who has a child with disabilities, as doing great work to highlight inclusionary job environments. Messika actively employs people with disabilities at his cutting and polishing factory in Windhoek, Namibia. Generally, though, disability inclusion “has never been spoken about at scale” in the jewelry industry, Markas states.

By connecting the audience at JCK not just with the human experience of feeling excluded in the jewelry world, but also with a potential business opportunity, Markas hopes to open some minds.

“That’s really why we had the two speakers,” she says. “We knew that if Tiffany spoke, it would be like, ‘Oh, that’s nice, interesting.’ But the minute Molly was talking about the business case and how you could be a leader in this and set the stage for what adaptive jewelry is, I think [many people] were like, ‘Oh wow, this isn’t just something that we’re talking about, this is something I should actually explore.’”

And as Kettle pointed out at JCK, adaptable collections don’t just benefit those born with disabilities: “If we’re all lucky enough to age, we will probably join the disability community at some stage in our life.”

Seeing the potential, some jewelry companies are already paying attention to this potentially lucrative market. A number of major luxury brands have accessible collections in development that will likely launch in the next couple of years, bringing the industry that much closer to welcoming and accommodating all jewelry lovers.

Mariana Russo Chambers was scrolling through Instagram one day in 2021 when she stumbled across the account of Stephanie Thomas — a stylist for people with disabilities, and a congenital amputee born with missing digits. Russo Chambers, founder of New York jewelry brand Cut + Clarity, connected instantly with Thomas’s story and reached out to her. A friendship developed, and a year later, the pair collaborated on a line of adaptive jewelry called Disabled + Stylish.

Using the patented Accessible, Smart, Fashionable system that Thomas’s Cur8able styling consultancy had developed, “we thought about ways to make jewelry with the disabled community front and center,” relates Russo Chambers. “The disabled community is not a monolith; it would be impossible to design for all types of disabilities. So we took Stephanie’s difficulty in dressing herself and her clients — because she is missing a thumb — as our primary focus.”

They didn’t want anything too dainty for people with motorfunction issues to manage, so they replaced lobster clasps with sliding-ball clasps, and sized their chains to slip over the head. Thomas “challenged me to design a hand chain that she could put on easily,” recalls Russo Chambers, “and after many iterations, our Accessible Handchain was born and became our best seller.”

Disabled + Stylish is a permanent collection at Cut + Clarity, with new designs added periodically. Russo Chambers believes more jewelers should be looking into adaptive design. “Working with Stephanie has changed how I look at fashion, jewelry design, and the industry as a whole,” she says. “According to [the Centers for Disease Control and Prevention (CDC)], one in four adults in the US is living with a disability, but very few brands are addressing their needs. I am proud not to be part of that herd.”

When estate dealers

Thomas Faerberand Ronny Totah launched GemGenève in May 2018, they aimed to create the perfect antidote to the declining Baselworld watch fair: an intimate show, organized by the trade for the trade, that would offer every sector of the industry the attention it deserved. This applied equally to diamonds and gemstones, vintage jewelry, labs, and emerging designers.

The sixth edition of the fair, which took place in Geneva from May 11 to 14, cemented its status as an unmissable stop on the European trade-show circuit. The organizers recorded 4,320 visitors, 1,400 of whom attended more than once, bringing the total number of visits to 6,487 — an increase of more than 1,000 from the November 2022 event.

“We’re proud that with this most recent edition, GemGenève has now become an established part of the cultural fabric of Geneva and the international scene,” said Totah.

Exhibitors reported steady traffic and positive sentiment during the four-day event, with Thursday and Friday being particularly strong. Some conducted successful business transactions during the VIP preview the Wednesday afternoon before the show. Buyers included international retailers, leading jewelry houses, collectors and private buyers. The big brands’ colored-stone and diamond-buying teams could be seen systematically walking the aisles.

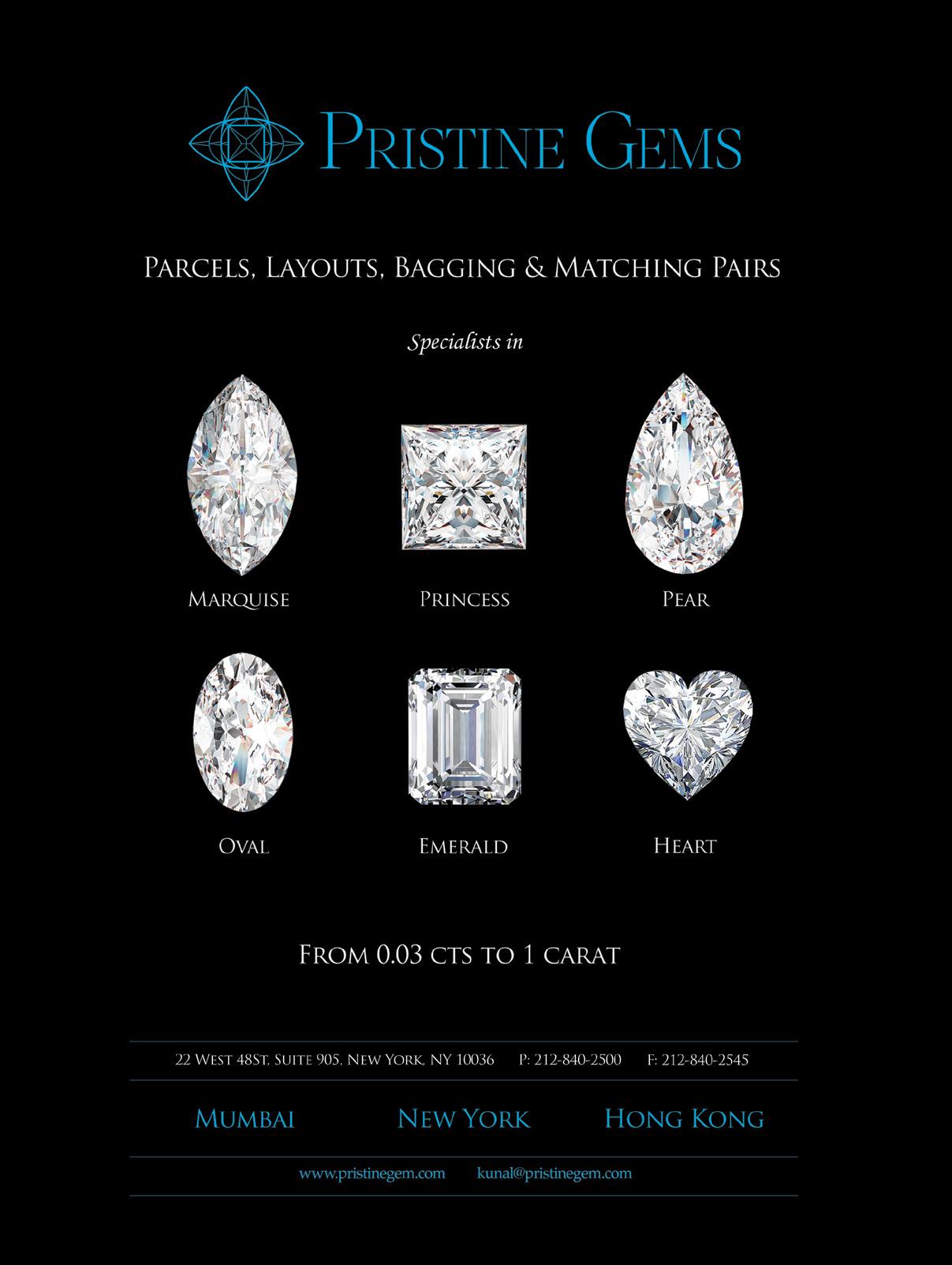

Kunal Shah, president of New Yorkbased diamond company Pristine Gems, didn’t exhibit at the show but visited

because he saw it as a good place to get a feel for the current demand and pricing.

“The show is more focused toward the brands, so the product offering is top-shelf,” said Shah, whose company specializes in the high-end market. “Prices tend to be in line with that specific clientele.”

Another company that didn’t have a booth but attended the Geneva event was Indian diamond manufacturer Dimexon. After a lukewarm beginning to the year, the “real sense of positivity at GemGenève” offered hope for a more robust second half, said company director Vishal Mehta.

His trip to Geneva was a successful one, he related. “There was strong interest demonstrated at the show for exceptional diamonds, and we were part of some encouraging discussions regarding potential business for the

remainder of the year for certified and melee diamonds. For exceptional colored gemstones, we understand that there was strong demand, with successful transactions executed at the show.”

Returning exhibitor Harsh Maheshwari, executive director of Kunming Diamonds, concurred that the overall sentiment at the show was positive. However, this year’s edition didn’t live up to last year’s results. “We

had a very busy first two days of the show, and overall had a few good sales,” he reported. “But both the GemGenèves last year were better for us.”

This was a reflection of the general market, rather than a criticism of the show, added Maheshwari, who specializes in fancy-colored diamonds. His conversations and transactions with clients and peers signaled that the middle to ultra-high-end segments would only see a drop in demand, not in prices.

“Fancy colors have always been a rare specimen, and with even more shortage of supply, we will maintain a decent year

ahead, just not as exceptional as the last two years,” he said.

With GemGenève becoming a biannual event — the next show is planned for November 2 to 5 — exhibitors will have another opportunity this year to gauge the health of the market. The organizers added the second edition in 2022 at the exhibitors’ request because trade fairs were not going ahead in Asia at the time.

The reintroduction of the Hong Kong shows might affect the Geneva event, remarked co-organizer Nadège Totah, Totah’s daughter, in an interview for

the event’s in-house publication. “If all the exhibitors have a very good show in Hong Kong, we will discuss with them whether it makes sense to come back a month later with the same goods and the same buyers. We have the flexibility to be able to cancel or postpone even at very short notice.”

She also said the show might consider having editions in Dubai or Singapore, though she ruled out the US because regulations made it more challenging.

Back in 2018, GemGenève hosted 147 exhibitors, including 120 dealers. In May, 192 professional dealers out of 230 total exhibitors showcased at Geneva’s Palexpo — the highest number the organizers have ever agreed to host. While they aim to keep the fair a friendly size, the growth speaks for itself.

“The show is more focused toward the brands, so the product offering is top-shelf. Prices tend to be in line with that clientele”

Every two weeks, the Rapaport team releases a new episode of the Diamond Podcast. Check out the four most recent episodes as of press time.

US restrictions on Russian goods will likely tighten to reflect the actual behavior of jewelers and the public, according to Tiffany Stevens, CEO, president and general counsel of the Jewelers Vigilance Committee (JVC).

Many consumers and industry members have refused to buy Russian diamonds since the start of the war with Ukraine in February 2022 — even when the stones were technically legal because they had undergone manufacturing in another country.

In other topics, the industry has expressed its opposition to the word “recycled” as a descriptor of metals or jewelry, Stevens revealed in the June episode. These views emerged during the process of submitting recommendations to the Federal Trade Commission (FTC) for its new Green Guides, which deal with environmental claims.

“I am impressed with how seriously people [from the trade sector] are coping with the sanctions. Everyone seems to be doing everything that they can. Most of them are hungry for more direction and clarity from the government.”

Tiffany StevensThe big news on this podcast was from the Rapaport Group itself: Senior Analyst Avi Krawitz’s departure from the company after 16 years of service. Wiping away the tears, the editorial team fired questions at Krawitz: What were his plans for day one post-Rapaport? Had the industry ever disappointed him? And what was the job like when he started in 2007?

Krawitz has become known for his thought-leading analyses in the monthly Rapaport Research Report, his insightful webinars, and his gripping interviews on this very podcast — along with being an all-around nice guy. His interrogators were Rapaport Editor in Chief Sonia Esther Soltani, Senior News Reporter Leah Meirovich, and News Editor Joshua Freedman.

“I do remember very clearly my interview at Rapaport… I remember being taken aback, [thinking] wow, this is a company that is kind of eccentric and interesting. And [this is] an industry that is eccentric and interesting, so I might be a good fit for it. And that gut feeling was correct.”

Avi KrawitzThe market is seeing a spate of green diamonds coming back from grading labs as treated, according to Thomas Hainschwang, cofounder of GGTL Laboratories.

In his conversation with News Editor Joshua Freedman, he also discussed the latest issues in grading, his views on synthetic diamonds, and whether one could use technology to identify a stone’s origin.

“Synthetic diamonds being in competition with natural reminds me of the stories of when synthetic rubies were grown. People were freaking out, and look at the ruby market today.

Synthetic ruby is in cheap jewelry, and natural rubies are more expensive than ever.”

Thomas Hainschwang

In this episode, Amish Shah, founder of Altr Created Diamonds, came on to discuss the inaugural Lab-Grown Diamond Symposium, which took place in Dubai on July 10. Industry members met to debate the economics and marketing of synthetic diamonds, as well as issues like sustainability.

On the podcast, Shah — a panelist at the event — described the gathering’s relaxed atmosphere and gave his views on the latest lab-grown news, from De Beers’ engagement-ring launch to reports of a price slump.

“One aspect of sustainability is climate action, but sustainability is built on a variety of pillars, from doing good for your employees, to HR people, to water conservation. So let’s focus as an industry on all the various things we can do instead of going after one piece of the puzzle.”

Amish ShahThe Rapaport Diamond Podcast is available on Google Podcasts, Apple Podcasts, Spotify and YouTube. Find out more about older episodes at rapaport.com/type/podcasts

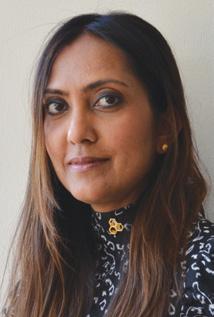

Feriel Zerouki has a clear vision for her term as World Diamond Council president: to make the trade body more accessible, and to heighten awareness of responsible-sourcing issues. By

Avi Krawitzoaming the halls of diamond conferences and industry meetings, Feriel Zerouki stands out from the crowd. Aside from being one of only a few women in the room, the new president of the World Diamond Council (WDC) has made a habit of pushing the industry’s boundaries.

“When I first met the different trade associations, I may have ruffled a few feathers,” she remarks in an interview with Rapaport Magazine. “I walked in without any expectations, full of questions and with a very strong opinion.”

At the time, she explains, they were discussing the same old topics, predictably relating to De Beers supply and the banking sector. “I’d point out to say, surely we’ve moved on,” recalls Zerouki. Drawing on her work at De Beers — where she is now senior vice president of corporate affairs — she saw other major issues the trade needed to address, namely responsible sourcing, sustainability and human rights.

Today, she acknowledges, the industry has moved on, even if it faces many new challenges.

As the first woman to head an international diamond trade body, Zerouki “feels welcome, accepted and respected” in her role. Having begun her two-year term in May, she expects her experience will help evolve the diversity dynamic within trade associations.

“Others won’t face the same challenges I did, because we’ve tackled them already,” she asserts. “I’m looking forward to getting more diversity into these trade organizations — more women and other cultures — and I’m thinking about how to do that.”

Historically, industry members needed a seat on a WDC board in order to make themselves heard, but the council is considering other ways that newcomers can offer their opinions. Under previous president Edward Asscher, the body changed its bylaws to allow more people to participate in its committees. By making itself accessible to a broader audience, Zerouki believes, the council can better educate people about challenges facing the industry, the role of the Kimberley Process (KP), and that of the WDC itself.

The WDC serves two main functions, she explains: It represents the industry at the KP, and it manages the System

of Warranties (SoW), through which businesses can provide assurances about their diamond sources.

It recently updated the SoW to include business practices relating to human and labor rights, anti-money laundering, and anti-corruption. The WDC also introduced a self-assessment mechanism to ensure that participants were meeting the stated standards.

However, it is within the corridors of the KP that the WDC exerts its biggest influence. That’s no simple feat, given that unlike governments, it has no voting power there — only observer status.

Zerouki dismisses assertions that the KP has lost its relevance, stressing that no one else can fulfill its important task of controlling rough diamonds’ movement across borders. However, she acknowledges that it falls short when it comes to broader social concerns in the supply chain.

“Is [the KP] sufficient to address all issues? It never was,” she says. The WDC has been working to incorporate those issues into the definition of “conflict diamond,” which is currently limited to diamonds that fund civil wars. The council’s updates to the SoW have provided an example of what a responsible-sourcing declaration can look like for rough diamonds, she adds.

Meanwhile, the WDC has gradually gained trust at the KP, which has given the council greater influence in discussions, she reports. The KP, which Zimbabwe currently chairs, has asked the WDC to take the lead in meetings pertaining to the definition change.

But while the conflict-diamond definition and other “big issues” create headlines, there are many smaller wins at the KP, according to Zerouki. The organization has multiple working groups making technical decisions that affect the industry daily — and then “there is the really important work being done at the KP on artisanal mining, that no one wants to write about.”

“When I first met the different trade associations, I may have ruffled a few feathers. I walked in without any expectations, full of questions and with a very strong opinion”

On top of all that, the war in Ukraine has prompted greater scrutiny of the industry’s sourcing practices. The Group of Seven (G7) nations — Canada, France, Germany, Italy, Japan, the UK and the US — have been working on requiring diamond companies to declare their goods’ origins at customs to ensure they are not contributing to Russia’s war effort. Here, Zerouki strikes a cautious tone.

“I’m really worried about the informal sector,” she says, referring to both artisanal miners and the independent artisans and traders — primarily in India — that the trade calls “the cottage industry.”

The G7 requirements won’t discriminate between the formal and informal sectors, as all diamonds will need to comply, she explains. This poses a challenge, because much of the industry does business by aggregating or mixing goods from various sources. This is especially true of the cottage industry, which has never sorted its diamonds by provenance, she argues. “They can do it, but it will require training and developing systems that bring them along.”

Zerouki is aware that the scope of these industry issues is daunting and that the work the KP and WDC are doing is often misunderstood. In her role as WDC president, she aims to change that, and to ensure no one is left behind.

“The industry isn’t aware of all these things, which is partly because we never communicated it strongly,” she admits. “I want to use my presidency to bring that outside world in and make them understand how critically important these issues are for the future of our industry.”

Feriel Zerouki’s emergence as a leader in diamond-industry policy was unplanned, but it was also unsurprising.

Born in the United Arab Emirates and of Algerian heritage, Zerouki is a trained mathematician. She joined De Beers as a supply chain analyst, developing models to measure whether the company could deliver on its supply commitments.

She moved from forecasting to pricing, but soon got “an itch” to understand the rest of the diamond pipeline and interact with the broader industry, she recalls. “I had my education, but I also have my personality.”

A position opened up within De Beers to work on the company’s Best Practice Principles (BPPs), which were in their early development stages. Compliance issues were new to the diamond trade at the time, pushing Zerouki to learn the supply chain and develop standards “based on common sense” and what other industries were doing.

The BPPs continued to evolve. Meanwhile, there was a need for guidelines that the broader industry could adopt. De Beers cofounded the Responsible Jewellery Council (RJC), with Zerouki participating in the standards committee.

Today, at 41, she has built a reputation as an expert on industry compliance. In addition to her role at the WDC, she sits on the boards of both the RJC and the Jewelers Vigilance Committee (JVC), which provides legal and compliance guidance to the jewelry trade.

All of this is a far cry from her days as a supply chain analyst — and Zerouki revels in the direction her career has taken.

“I love mathematics because it’s black or white, but the issues we deal with are very complex,” she reflects. “I’m good at the technical stuff, and that gives me an advantage.”

Her expertise makes it easier to convey these issues to others in the trade who might otherwise be resistant, “because people block things they don’t understand or that they fear.”

Fostering that understanding “gets you a long way,” she says, and “I do love the engagement with people.”

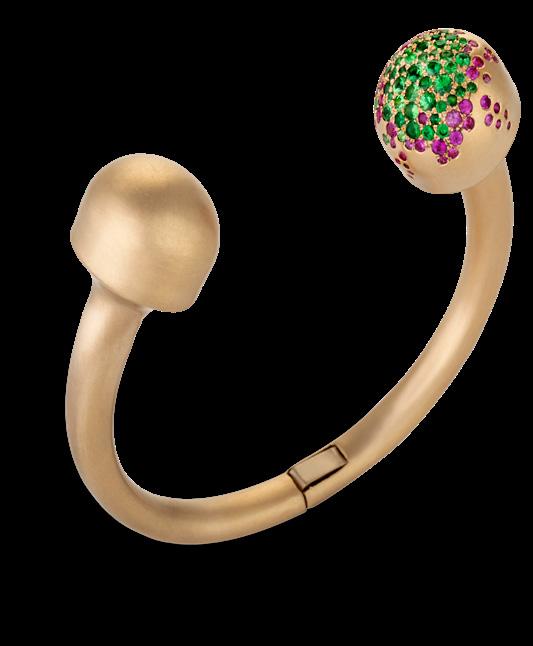

What are the must-have jewelry styles for your store shelves this holiday season? Six retailers share their buying plans.

Twist: Everything gold, wearable modern looks, and lots of charms Paul Schneider, cofounder of Twist, is planning his store’s holiday buys right now, and those will primarily be gold. The retailer’s top designers haven’t changed much over the past several years; pieces by Cathy Waterman and Foundrae are on everyone’s radar, and some fun styling choices include modern, wearable pieces in gold and diamonds by Anita Ko and Viltier.

“We have worked with Anita Ko since she started, and it’s an important part of our business,” relates Schneider, whose company has boutiques in Seattle, Washington, and Portland, Oregon. “Viltier from Paris is a new line, and we have been selling their earrings really well.”

Customers can stay tuned for shiny new offerings from Boochier and Sophie d’Agon, large gemmy rings from Retrouvai, and bright, colorful designs from Jamie Joseph, Anaconda, and Brooke Gregson. Colored-stone and gold pieces by Mallary Marks, Ten Thousand Things, Kothari, and Judy Geib have a devout following, as emeralds, sapphires and turquoise continue to cast their spell.

Charms are difficult to resist, and the more, the merrier. Clients love them strung in groups along necklaces, as well as on bracelets and earrings.

Twist always sells a wide range of styles from multiple designers, with prices starting at $500 and the sweet spot balanced between $3,000 and $6,000, according to Schneider.

By Smitha SadanandanSelf-purchasing has been “continually growing,” he adds, and the price range “has been inching higher every year.”

Be On Park: Rivière necklaces, cocktail rings and vibrant drops

Emily Dowling Williams, owner of Be On Park in Winter Park, Florida, is focusing on strategic buying ahead of the busy holiday season, when clients have a perfect excuse to splurge on precious gifts. Self-purchasers hover around $2,500 to $5,000, while holiday gift-buyers usually spend between $10,000 and $20,000.

That said, “the sky’s the limit, depending on the customer,” according to Williams. Shopping

during this time of year can be pretty dramatic: “We could have someone walk into our store and spend $150,000 on Christmas eve.”

Williams’s must-haves include classics — rivière necklaces, line bracelets and diamond studs — and bright drop earrings in pretty designs and a range of prices. Vibrant drops by Lauren K are a holiday staple here.

Some men happily shop for contemporary jewelry, taking cues from their wives. Others, however, mosey into the familiar territory of rivière necklaces and tennis bracelets. When buying for themselves, women often turn to uplifting pieces and new designers. “They think outside the box; they are a little bit

more independent and a little bit trendier,” says Williams.

Be On Park is bringing in new looks from Paul Morelli and Jenna Blake in time for the holiday madness. The store will also be hosting trunk shows during the season, with Lauren K, Sethi Couture, and Penny Preville among the featured brands.

New York diamond jeweler Kwiat, unarguably the store’s “banner holiday designer,” has a great fashion line and a breadth of easy-to-wear pieces, with prices running from $1,500 to $200,000. Its signature Ashoka-cut diamonds, Starry Night series, and classics with a Kwiat twist get replenished at the store throughout the year.

Williams, who sports a ring on every finger, has amped up her store’s ring game for selfpurchasers. “Perhaps it gives people permission to stack it up,” she muses — which is why Emily P. Wheeler’s bright cocktail rings fit nicely into this wheelhouse.

Few jewels have the impact of a great stack of bangles, especially the easy-to-wear hinged

“We continue to see a strong interest in yellow gold, although for the first time in years, there is an uptick in interest for white gold”

versions. Sparkly diamond, single-color or fancier ombre bangles are perfect for a great wrist party. Layering up bezel-set rivière necklaces, meanwhile, makes for a contemporary take on laid-back luxe. “A bezel-set necklace plays well with a fun [bead-strand] necklace,” Williams says.

Hamilton Jewelers: Elevated classics, stackables, and stretchable bangles

This holiday season, Hamilton Jewelers — with its flagship boutique in Princeton, New Jersey, and outposts in Florida — is seeking out best-selling silhouettes that are highly giftable. These include diamond tennis bracelets, studs and rivière necklaces, alongside such elevated gold classics as hoops, chunky chains, and bangles — all of which executive vice president Anne Russell saw in abundance at the latest Las Vegas jewelry shows.

“We also get to play around a bit more with colored gemstones, which is always fun for our clients when they are on the party circuit,” says Russell.

Another category that does well is diamond stretch bracelets. These come in myriad sizes and materials and are ideal for layering, she says. “We see this item flying out the door for both giftgiving and self-purchasers.”

The core focus is on everyday elegance across all categories, be they modern or traditional. On the high end, Russell usually sees an uptick in the company’s Private Reserve collection at this time of year, from rare Colombian emerald cocktail rings to megawatt diamond earrings. Layering is the most nonchalant way to amplify such sparklers as the party season approaches. With the unwaning interest in multiple neckpieces and stackable rings, creations by David Yurman, Pomellato, Temple St. Clair, and Dinh Van never fail to find takers.

At CD Peacock in Chicago, Illinois, the moment calls for individual style. There isn’t a dominant trend of layering or statement pieces like in seasons

past, reports Chelsea Holtzman Lawrence, the jeweler’s vice president of marketing and communications; it’s all about “what makes our clients feel their best.”

The stacked wrist is back in a bold way with three, five or even seven bracelets. Customers are creating their own looks by combining different designs — such as a link chain with a bold gold cuff and a diamond tennis bracelet — or mixing metals and colorways in their stacks, Holtzman Lawrence says. Roberto Coin has some incredible link-style options to play with.

Traditional gems like sapphires and emeralds remain prevalent, but unexpected pops of color in the form of stones such as pink and yellow sapphires, opals, and tourmalines are also showing up everywhere. CD Peacock finds clients choosing rainbow styles; a single piece that offers a range of color is money well spent. Length and movement are also important, and what better way to make a holiday statement than with a gorgeous diamond lariat or a pair of linear drops? “Anita Ko leads the way in this trend and once again incorporates gemstone touches with diamonds,” says Holtzman Lawrence.

Sentimental jewels are all the rage for gifting this year. The store prices classic pieces — birthstones, medallions, evocative motifs, and initial and engraved pendants — from about

And it’s not just women who get shiny gifts. For men, chains and layered-wrist styles are still in vogue. Links in varied textures and forms — such as Cuban, Franco and wheat — continue to dominate the gift category and are available for under $3,000. These include handmade chains from Fope that come in 18-karat white, yellow or rose gold. Beyond that, observes Holtzman Lawrence, “men are expressing their personal style by incorporating strands of pearls and diamonds into their everyday look.”

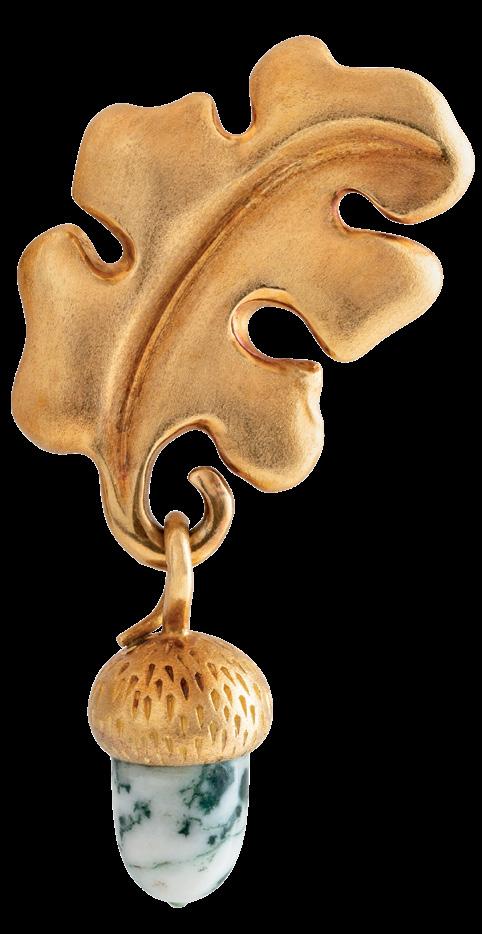

Reinhold: Whimsical, nature-inspired designs and large earrings

When in doubt, Yael Reinhold recommends seeking out colorful designs. You can never go wrong with

collection and classic gemstone earrings by Jane Taylor will be part of the line-up as well, and no party is complete without a Yeprem ear cuff, Reinhold maintains.

Her team has handpicked one-of-a-kind jewelry for well-traveled clients, including the distinctive creations of Sevan Bıçakçı, which take inspiration from myth and the ancient world. Diamonds will also shine and wink from delightful new works by Lizzie Mandler, Hoorsenbuhs, and Mason and Books.

Zachary’s Jewelers: Textured links, bezel settings and bold gold For Constance Polamalu, chief operating officer at Zachary’s Jewelers, holiday trends veer toward strikingly individual designs and appealing collections. The new favorite at the Maryland-based store is the Jaipur series from Marco Bicego; the Jaipur Link line, with its gold and diamond chain styles, has been resonating strongly with customers who seek a carefree approach to jewelry.

The unmistakable shift toward “bolder gold looks over the last few years” is bound to make its presence felt this holiday season, says Polamalu, even though her store’s market “is typically more cautious in trend chasing.” Heavier necklaces and bracelets are turning into trend definers. If you’re

looking to dial up the splendor, fancy-colored diamonds and pastel gems might just do the trick.

“Two-stone rings in all varieties are and will continue to be immensely popular,” she says. For clients who want something made to order, the store can turn to jewelry manufacturer Stuller or custom designer David Rovinsky for creative assistance. Zachary’s also does its own custom combinations for those keen on a particular color, cut or type of gem.

For holiday-ready styles, rings featuring double trillion-cut fancy-yellow diamonds, pink sapphires, and tourmalines would be fabulous choices. Station necklaces, bracelets and pendants echo the spirit of elegant festive accessory, and personalizing the jewels with engraved messages makes the gift all the more endearing.

Observing a renewed interest in bezel settings, Polamalu has expanded the store’s offering with variations like the signature “cuddle” settings from Phillips House, in which a seamless row of stones has a partial bezel around the edges, rather than a full frame around each. Phillips House likes to mix cuts in its designs, employing pear, emerald, oval and round diamonds. If customers prefer an understated vibe in their bezel jewelry, they can play with shapes and widths.

he Rapaport Price List is commonly used by dealers as a guideline for evaluating natural diamond prices. Readers should understand the List’s standards for describing diamonds, as well as its limitations and how it can be used to aid buyers and sellers. The Round and Pear Shape Price Lists are published online every month.

The Price List quotes Rapaport opinion of high cash asking prices for Rapaport Diamond Specification A3 and better natural diamonds. These prices may be substantially higher than actual transaction prices. It is most common for the diamond trade to transact at discounts to the List. However, select quantities that are in short supply or subject to speculative demand may trade at significant premiums to the List.

Detailed information about discounts is provided online in real time via our RapNet® and RapX® diamond trading networks. They are also included in the Trade Sheets published in this magazine.

The level of discount or premium is influenced by many factors, including diamond quality and cut, credit/memo terms, the location and type of market, the liquidity level of particular size-quality combinations, and the associated risk of ownership. The easier it is to sell a diamond, the lower its discount to the List. Hard-to-sell diamonds often trade at large discounts. Very in-demand, scarce diamonds may trade at premiums.

The Price List relates to Rapaport Diamond Specification A3 or better natural diamonds that are graded based on Gemological Institute of America (GIA) standards (except for SI-3, an additional intermediate non-GIA grade).

CAUTION: Grading laboratories use subjective methods of analysis. The same diamond may be evaluated differently by different labs or even each time it is submitted to the same lab.

Grading reports and our Price List do not replace the human factor in evaluating diamond quality or price determination. The Rapaport Price List does not provide transaction prices, but price indications that serve only as guidelines — a starting point for negotiations and a basis for estimating value. Buyers and sellers are advised to consult with experts before trading diamonds.

The Rapaport Price List is based on the following specifications:

Grading report GIA

Shape Round brilliant

Cut Excellent

Polish Excellent

Symmetry Excellent

Culet None

Depth % 58.5%-63.5%

Table % 55%-62%

Girdle No extremely thin, extremely thick or very thick

Fluorescence None

Weight No .00 sizes for 1.00 and larger

GIA comments No GIA color comment

GIA comments No knot or cavity

GIA comments For SI1 or lower, no “Clarity based on cloud”

Seller requirement No green tint

Seller requirement No Marange diamonds

© Copyright 2023 by Rapaport USA

CUT SPECIFICATION

The Price List relates to fine-cut Rapaport Specification A3 or better diamonds. Additional Rapaport specifications are available at rapaport.com/rapspec These specifications are subject to change without prior notice.

RAPAPORT DIAMOND SPECIFICATION A3Approximate percentage increases from 5-carat prices for larger sizes*

These indications should only be used as guidelines. Large stones are very thinly traded, and prices may vary significantly from dealer to dealer and stone to stone. Availability of large, better-quality stones may be limited, and buyers may find that asking prices and/or transaction prices may be significantly higher or lower than these price indications. This price information should only be used as a general indication of the current market.

* Asking price indications are based on Rapaport Cut Specification A3 or better.

The impact of fluorescence on price depends on its noticeability. In some cases, fluorescence gives the stone a milky-white appearance, which greatly lowers value. In some instances, the fluorescence is hardly noticeable and has minimal impact on the stone’s brilliance. Blue fluorescence gives lower-color stones a whiter, brighter face-up appearance. Yellow or white fluorescence is problematic and may require an additional 5% to 10% discount. Generally, the higher the quality and price per carat, the more fluorescence lowers value. In the table below, we present our estimation of the price gap between nonfluorescent polished round diamonds, and polished round diamonds that show varying degrees of fluorescence. The percentages represent the average price difference for each of the size, color and clarity categories indicated.

LIST IS ALSO AVAILABLE ONLINE. YOU CAN SUBSCRIBE AT RAPAPORT.COM/JOIN OR CONTACT US AT SERVICE@RAPAPORT.COM

8%, $59 MILLION VOLUME:

▲ 54%, 2.4 MILLION CARATS

By Joyce Kauf

By Joyce Kauf

Just steps from its original SoHo location, the newly reopened Broken English boutique reflects what is “sexy, cool and amazing about New York City,” says owner Laura Freedman.

In true New York style, it wows with sleek design and a curated collection of contemporary and vintage jewelry and home decor. Tall glass windows create an entrance that stands out from the surrounding old brick buildings. Inside, light from an Art Deco Palmette chandelier in pink Murano glass dances on the antique cases, which hold diamond and gemstone jewelry as well as colorful Lucite hoop earrings.

Both elegant and inviting, the shop offers “jewelry for everyone,” says Freedman, who believes “jewelry should commemorate memories, milestones and moments.” To that end, she sells items at all price points. “It’s part of our DNA, of who we are as a brand and what we represent: We carry jewelry that is aspirational and pieces that are attainable.”

It’s the same approach she follows at her other — and first — store in Los Angeles, which opened in 2006, taking its name from Marianne Faithfull’s iconic song. The New York branch started as a pop-up in 2014 and later closed before relocating to its current spot.

Along with celebrity clients on both coasts, her customers include people who started with less expensive pieces and have “grown into” higher price points and different styles over time, she says.

Freedman follows her intuition when selecting jewelry, choosing “innovative” pieces as well as those that make her feel good. Working with designers who are “incredible businesspeople” helps, she says. However, she also keeps a finger on the market’s pulse so she can carry jewelry that “clients gravitate to and [that] is very much part of the zeitgeist.”

She credits her mother, a former Las Vegas showgirl, with influencing her aesthetic. While she remembers the “whole regalia of feather headdresses,” she also recalls looking for geodes after the family moved to a tiny town outside of Zion National Park in Utah.

Today, she collects display cases from around the world, keeping them in a storage facility. “I buy them whenever I see them,” she says. For a future boutique, perhaps? “Maybe.”

Unfazed by a possible recession, independent jewelers are renovating, expanding or moving into larger stores — whether because the pandemic boosted business, or simply to keep up with customer needs.

By Anthony DeMarco

By Anthony DeMarco

The surge in consumer spending during the pandemic left some retailers flush with money. Summerwind Jewelers & Goldsmiths in Portsmouth, New Hampshire, was one of them; it saw record sales in 2021 after reopening from lockdown. The extra cash allowed the store to do a full first-floor renovation that took about a year and cost well into six figures.

“We ended up in 2021 with our sales up 80% [over the previous year],” reports co-owner Melvin Reisz. “We were putting money aside every month for the renovation, and we were very fortunate in 2022 that we maintained this level of income. So far this year, we are 2% ahead of last year. Our business has not slowed down from the increase during the pandemic.”

Summerwind is a quintessential main-street business in a historic small city about an hour’s drive north of Boston. The

updates to the store included exposing more of the original brick walls, installing a vinyl floor, adding finishes to structural beams on the ceiling, and putting in new lighting and display cases. The cases are designed to let customers and staff interact side-by-side instead of over a counter, a shift that’s becoming more common in retail environments. One long display case serves as the bridal bar, where clients can sit on stools and peer down at the display of bridal jewels while speaking to the salesperson. This provides a more intimate environment, explains Reisz.

“The end result is that [the store is] still a long, narrow space, but the traffic flow is so much better, and it feels more open,” he says.

“One thing I always heard is that if you do a remodel of your store, your business generally goes up,” he adds. “It was 18 years since the last remodel, and the income from the pandemic gave us that opportunity.”

For Louis Anthony Jewelers in Pittsburgh, Pennsylvania, expanding had little to do with economic conditions; rather, the catalyst was the “overwhelming demand for additional showroom and office space, as well as hospitality services,” says vice president Veronica Guarino.

“This was a decision we made several years ago,” she explains. “In fact, we have a history of thriving in difficult economic times — opening our business during a recession in 1990, moving to a new location in 2000 during another recession, expanding our store in 2008 during yet another recession, and executing our current expansion under the threat of a recession.”

On this project, “we decided to trust our instincts. We began expanding during a time when the economy was strong, and [the store] continues to thrive today.”

The jeweler recently completed the first phase of its 3,000-square-foot addition, which included setting up shop-inshops for watch brands TAG Heuer, Tudor and Carl F. Bucherer. Phase two is set to be finished in the summer and will include a David Yurman boutique, new jewelry spaces and a Louis Anthony home collection. A dedicated corner space for Rolex is scheduled for completion in the first quarter of 2024. By the end of 2023, the store will total more than 9,000 square feet.

In May, Gunderson’s Jewelers announced plans to move its store in Omaha, Nebraska, to a new location that, once complete, will have 25,000 square feet of retail and operations space. The move is a result of customer demands in Omaha, as well as the company’s strategy to offer a greater range of luxury products and services, says Breanne Demers, president and chief operating officer of the family business, which has five stores in five Midwestern states.

“Our current location just can’t accommodate the demand we’re seeing. Our Omaha clients want access to more exclusive brands that will require boutiques and buildouts,” she says. “We hope to transition from being an engagement-ring and timepiece store to something that attracts luxury shoppers from surrounding states.”

Gunderson is also expanding into other areas. In April 2021, the company acquired JB Hudson, a jeweler in Minneapolis, Minnesota. It is now working on relaunching that store in October.

“With dedicated boutiques for several brands, we’re demonstrating our strong partnerships with our vendors and adding an urban flair to the overall atmosphere,” Guarino elaborates.

There will also be a “hospitality bar” where customers can enjoy coffee and alcoholic drinks. “There is a strong demand for personal experiences in retail,” she says. “Our business does and will continue to feel like home to our clientele.”

As for future plans, Guarino says the store is developing its own line of custom jewelry and watches.

Even with increasing sales, store owners remain wary of buying lab-created diamonds for stock.

By Joyce KaufIt’s almost quaint to think back to some retailers’ initial reactions to synthetic diamonds. Fast forward to today, and many report an almost even split between mined and lab-grown when it comes to selling loose stones for bridal.

But the conversation has also shifted to the very real concerns of lab-grown’s plummeting prices and its oversaturation of the market. As a result, retailers walk a fine line between meeting customer demand and buying merchandise that’s losing value.

Successful retailers are always attuned to the pulse of the market. Purchasing a larger synthetic stone at a substantially lower retail price than a natural diamond is an attractive option for customers with limited budgets, as well as those who have more discretionary income.

“It’s a no-brainer. Customers really are excited that they can get a bigger stone,” says Joy Thollot, who cofounded Thollot & Co. Jewelers in Thornton, Colorado, with her husband Troy. “Fewer and fewer people think in terms of resale, especially the younger engaged couple.”

In her recent loose-stone unit sales, lab-grown has outnumbered mined two to one. The average lab-created center diamond is 2 to 2.50 carats, a size she says has been “growing by percentage” since the beginning of the year.

“Lab-grown took off like wildfire about a year and a half ago,” affirms Michael Littman, co-owner of Gary Michaels Fine Jewelers in Manalapan, New Jersey. “Even customers who might not be considered lab-grown buyers are asking for them.” These stones account for half his store’s loose-diamond bridal sales by unit, and that’s without his promoting them. He’s even sold a 15-carat lab-grown.

At Erik Runyan Jewelers in Vancouver, Washington, “almost 80% of our unit sales in the accessory area — including earrings, studs and pendants — are labgrown,” reports owner Erik Runyan. In loose stones for bridal, the ratio of mined to lab-grown unit sales is approximately 50-50. He attributes these figures to both the savings and the “size difference” that lab-grown offers.

Even as lab-grown sales increase, retailers are not stocking them for inventory the way they generally do with mined diamonds; they are largely purchasing on memo. Describing herself as an “early joiner” of the lab-grown segment, Thollot realized that “if we

be sure of its value. It creates a lot of angst to own something that will retail for less than what I paid for it.” As he notes, this is “not a good or sustainable business plan.”

Littman buys on memo for “almost 99%-plus” of his lab-grown, a practice he has followed since the beginning. “We haven’t invested in them as stock, because we still can get lab-grown that meets our exacting standards [via memo].”

To some extent, memo can shelter retailers from synthetic stones’ falling prices. But with consumers expecting to pay less, it can be hard to compete with other jewelers.

invested in it and the prices dropped, we would be upside down very quickly.” When synthetics first came on the market, her suppliers readily agreed to memo terms, she recalls. While she’s since changed vendors, she still buys her lab-grown on memo only.

Her one exception to this rule is De Beers’ Lightbox brand. “Their prices are so low. But more importantly, it is a brand that is promoted on the market,” she explains.

“I did buy some lab-grown for stock early on to have them,” relates Runyan. “But my thinking has evolved; I’m wary of purchasing a product [when] I can’t

“The visibility of loose lab-diamond pricing on well-known websites is setting prices for our clients, and I need to make sure I can stay competitive,” says Thollot. The only way to do this and still make a profit, she explains, is to work with suppliers that are willing to accept the latest market price as payment, since it may well be lower than the original memo price by the time the goods sell.

Store owners also voice concern for their clients. “I’m bluntly honest with my customer that I can only offer a trade-in for what the lab-grown is worth at the time of purchase, unlike a mined diamond they buy now and sell in the future,” says Runyan.

Even with the supply of lab-grown expanding rapidly, the robust demand should be keeping prices steadier than they are in practice, Littman argues. “Prices don’t have to drop so precipitously. Customers are buying at high levels. It almost feels like a race to the bottom.”

“It creates a lot of angst to own something that will retail for less than what I paid for it”IMAGES: SHUTTERSTOCK

French designer Alix Dumas describes the process of fashioning the spectacular floral brooch that earned her a coveted award at Couture in Las Vegas.

By Sonia Esther Soltani

By Sonia Esther Soltani

From the picturesque French town in Brittany where she lovingly handcrafted her Magnolia brooch, to the glitzy Couture show in Las Vegas where she won first place in the Haute Couture category, Alix Dumas has been on a breathtaking journey.

Dumas’s miniature sculpture featuring diamonds, spinels and sapphires in gold, recycled silver, and titanium is a tour de force in 12 by 10 centimeters. The French designer wanted to interpret the flower — a delicate symbol of rebirth — by using innovative technology and the techniques she’s honed over the years.

“This piece really shows the specialties of my craftsmanship, all the technique of lace that I

make in metal using patterns, but in very thick layers to enhance the inherent volume of the piece,” she explains.

Playing on light and textures, the jewel displays an artistic selection of colors — among them the gradient-shaded spinels from Vietnam and the larger diamond she sourced from Antwerp-based Fima Diamonds to match the rose gold. The use of anodized titanium for its coloring and weight was equally intentional. As for silver, “I love working with [the metal] because I can work with it in very thick layers,” says Dumas. “It weighs much less than gold, so I can have bigger volumes for less weight, and it blackens with diamonds.”

While her husband lent a hand to the coloring work on the titanium, the jeweler worked on all other aspects of her creation, including positioning every single gem though she left the task of pushing the metal in to the setter.

“I want the stones to be so close that there is no metal left except for only two or sometimes three beads,” she states. “It’s a very selective setting, very high-end. But this way, you really have the color come out, and the metal is almost nowhere to be seen except in the places where I want it to be seen.”

The Magnolia brooch will soon be getting a “little sister,” using gems from the same batch of stones but in a different palette. The awardwinning piece contains spinels that run from pink to the first shades of purple, while the smaller jewel will range from very light pink to a deeper violet.

“They will go together, but not be the same vibrancy,” Dumas says.

Emeralds, tsavorites and other gems in this verdant shade are sprouting up in both designer and museum collections.

By Rachael Taylor

Stroll into the American Museum of Natural History in New York right now and you will find a welcome addition to the gallery: 44 pieces of Van Cleef & Arpels jewelry, each with verdant gemstones. The treasures have been grouped together in an exhibition titled “Garden of Green,” which runs until January 2024. It offers up a forest of malachite, peridot, chrysoprase, jade and — of course — emeralds.

While the exhibition is a reminder that green gems have been steadily in favor over the past century, it is also a prompt to make us realize how fresh they feel today. Case in point: The Las Vegas shows were brimming with green gemstones.

Green’s connection with nature is obvious, but some jewelers believe the shade’s allure goes deeper. Sergio Antonini speaks of a “serene” gem that works with all skin tones, while Kimberly McDonald points out that it is the color of the heart chakra and “resonates with your energy beyond what your eye can see.” Others point to fashion trends — those that favor green, but also shades that work well with green; the list is long. On top of that, green is considered a symbol of luck, vitality and rebirth. This is a color brimming with positivity.

Jewelers report that fine emeralds are selling well in the US market, but for those seeking alternatives, there are plenty of choices. Tsavorite, demantoid garnet, tourmaline, jasper, Oregon sunstone, peacock pearls, and even green diamonds if you can find them.

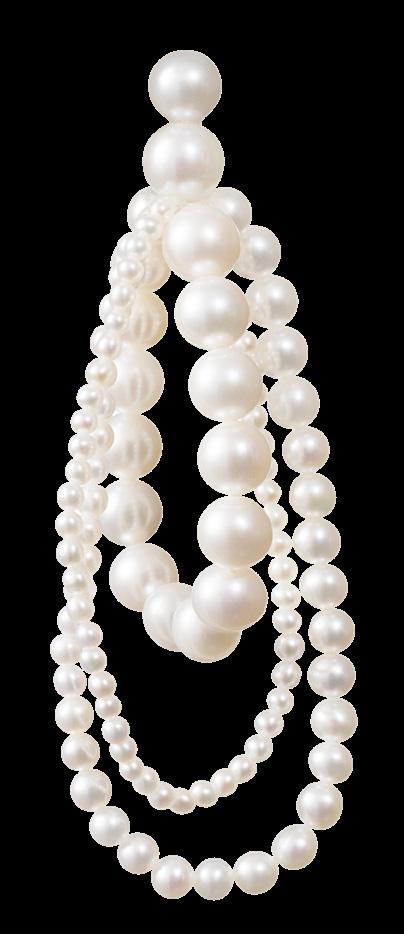

Pearls are not so much having a “wow moment” as entering a completely new era of imaginative design and styling. Whether it’s the sliced and spiked creations of Melanie Georgacopoulos and Bibi van der Velden, the edgy, unorthodox collections that Thakoon and Prabal Gurung have made for Tasaki, or the gentler but no less radical looks from Sophie Bille Brahe and Mizuki, artists and consumers alike are learning to have fun with their pearls.

Matthew Harris of jewelry brand Mateo New York is a fan of both round and baroque cultured freshwater pearls. “I absolutely adore them. You can play around with them without breaking the bank, yet make something so special.”

Pearls are firmly on fashion’s radar as well. These lustrous jewels embellished full Balmain and Givenchy outfits on the fall-winter 2023 runways and appeared in the butterfly-themed necklaces

By Francesca Fearonat Dior’s recent cruise show in Mexico. Baroque pearl earrings accessorize nearly every collection from fashion brands Erdem and Simone Rocha. Also fueling interest is Tiffany & Co.’s cute new Bird on a Pearl capsule collection, inspired by the works of designer Jean Schlumberger. Meanwhile, pearls ruled the red carpet at this year’s Met Gala and were the go-to jewelry — courtesy of Australian specialist Autore — for Queen Charlotte in Netflix’s new Bridgerton prequel.

There is a lot of buzz surrounding these little beauties. As Georgacopoulos points out, “younger people are seeing more pearls in fashion shows, which trickles through to the high street with fashion [jewelry] pieces. As they get older, they convert that look to gold and come to us.”

The quirky contours of freshwater cultured baroques and keshi pearls tend to be popular for the same reason Harris offers: They let you play.

“Because of its one-of-a-kind nature, [a baroque pearl] is just sublime when paired with gold and colored semiprecious gemstones,” he says.

Georgacopoulos agrees. “Baroques have

“I absolutely adore [cultured freshwater baroques]. You can play around with them without breaking the bank, yet make something so special”

explosion

a bit more personality than round pearls,” she says, admitting that she would have preferred if the South Sea pearls she pierced with gold for her M/G Tasaki Baroque Drops collection had been more unusually shaped.

As a sculptor, Mizuki founder Mizuki Goltz often approaches her works from a visual perspective. For those designs, she says, “I choose more specific pearls like South Sea and akoya, along with unique shapes and color.” Other times, when she wants to create a mood, she opts for freshwater and akoya pearls; “their scale, size and effortlessness become essential.”

Getting an earful Round and baroque freshwater cultured pearls have become popular with the fashion crowd because they are not a heavy investment. This makes them ideal for styling trends like stacking and layering.

Maria Tash’s Pearls Go Punk collection features a curated ear stack with pearl hoops, ear cuffs, spiked pendulum charms, and doublepearl connector-chain charms. Sophie Bille Brahe’s Wrapped line has loops of pearls that sell as individual earrings for asymmetrical wear with a stud or other designs. Mizuki has cascading pearl ear cuffs and baroque pearl hoops, and Eéra adds akoya drops to its own multicolored square hoops. Mateo New York’s Pearl Blizzard Mobile earrings

“Ear cuffs have done great with retailers overall. They do especially well with floating pearl chain necklaces and long pearl lariats. All have touches of diamonds, which add to a playful look”Marie Lichtenberg Mauli pearl necklace with gold locket. Opposite, from top: Erdem springsummer 2023 collection; Mizuki diamond and baroque pearl ring in 14-karat gold.

take inspiration from artist Alexander Calder, while the brand’s Dots collection explores the geometry of a cube-shaped ring with a perfect pearl sphere on top — quite a statement.

“Pearl ear cuffs have done great with retailers overall,” says Goltz. “They do especially well with floating pearl chain necklaces and long pearl lariats” for layered styling. “All have touches of diamonds, which add to a playful look.”

Besides being ideal for ear curation, pearls also highlight the animal- and insect-themed cuffs and necklaces of Gaelle Khouri and Bibi van der Velden. Mateo, Sophie Bille Brahe and Mizuki

are swapping simple necklaces for more playful designs with graduating pearl sizes, while knotted threads in different colors punctuate the pearls in Marie Lichtenberg’s pieces.

For retail showcases, Goltz advocates unfussy diamond or gold-chain necklaces with a statement pearl, or statement rings like her open ring with a baroque pearl and cascading diamonds — a signature Mizuki look. Pairing asymmetrical and minimalist designs with baroques makes for “a dynamic piece,” she says.

And pearls have gained serious street cred, Harris notes. “The pearl has been revolutionized with sleek and modern designs that are visually a work of art.”

By Sonia Esther Soltani

By Sonia Esther Soltani

As a designer who’s made a name for herself with her evocative, symbolic hand-enameled jewels, Cece Fein-Hughes faces an interesting challenge. Her bespoke-jewelry clients want to pack all the elements of their lives, meaningful signs and all, onto the small surface of a signet ring or pendant. The founder of Cece Jewellery has to remind them that she’s playing with a space the size of a grain of rice for each drawing.

“People have the craziest ideas, and it’s a bit like I become a therapist, going through emails and phone calls about their life and their story,” she muses.

Her dedication to interpreting her clients’ wildest dreams has translated into loyal customers and legions of online fans. The British jeweler’s creations stem from two distinct sources of inspiration that come together harmoniously: tattoos and fairy tales.

“I’m obsessed with old-school sailor tattoos,” she shares. “I just love the swallows and horns with the arrows through them. It’s quite kitsch and tacky in a really fun way. And then I merged that with fairy tales that are very English and very spooky, which remind me of where I grew up in Dartmoor, in Devon, which is very Wuthering Heights.”

These talismanic jewels have worked magic for her business, which is a family affair: Fein-Hughes’s father is the company’s manager after a career in construction, her mother helps with the creative side, and her sister has just joined.

GBP 40,000 ($51,000) seed investment and has since grown over 6,000% in terms of sales — from GBP 14,000 ($18,000) to GBP 960,000 ($1.2 million), with revenue projected to reach GBP 2 million ($2.5 million) this year. The creations, all handcrafted by goldsmiths in London’s Hatton Garden district, are available at luxury vendors Net-a-Porter, Liberty London, and Goop. The brand

has also entered the US market and is selling at stores known for their edgier curation: Catbird in New York, and Twist on the west coast.

Fein-Hughes now faces the issue that most successful companies must confront: how to retain her brand identity while growing and scaling her business. Another obstacle has to do with her signature enamel style; she only has one enameling artisan she trusts to produce work of the highest standards. As a result, she is shifting her collections toward new models that aren’t enamelreliant, such as chunky bombé-style gold rings with diamond- or sapphire-set stars, and versatile charm earrings that let the wearer write their own story — which is, after all, at the core of Cece Jewellery’s DNA.

“People have the craziest ideas, and it’s a bit like I become a therapist, going through emails and phone calls about their life”

A product of ancient ammonite fossils deep underground in Canada, this iridescent stone is a mesmerizing alternative to opal.