with their blessing, made significant progress to offering even more aviators the ability to utilise the RAAus system to their advantage by opening our doors to aircraft up to 760kgs. Our efforts here included the removal of the arbitrary 45kt stall speed initially detailed in the regulations. In addition to this we continue to advocate for access to controlled airspace for our members to ensure that we are not repeatedly forced into tiger country which presents substantial risks to the lives of our pilots and their passengers.

The 2021/22 year has been yet another challenging one. Over the past few years we have looked ahead and said “surely it has to get better” and yet we continue to face significant challenges from a range of areas. Having said this, RAAus remains one of the healthiest (if not THE healthiest) general aviation advocacy body in Australia. We also remain strong in terms of membership numbers with our organisation representing in excess of 9000 aviators across the country. Moreover, our register contains more than 3300 aircraft and we have some 190 flight schools in the system providing employment opportunities for pilots and training services to members.

This most recent 12 months has seen RAAus participate in a number of regulatory reform spaces including medical reform, airworthiness standards and pilot training. Some of these activities are ongoing while others have come to a conclusion, however, in all cases RAAus continues to work closely with the regulator, the Minister, the Department and other government and industry stakeholders to advance causes for the industry.

This has seen us realise several key milestones in the history of RAAus including the awarding of Australia’s first unrestricted part 149 certificate. We have also worked closely with industry, and

The sector as a whole continues to face pressures from economic factors as well as other environmental influences. This includes the obvious COVID related difficulties that have plagued the broader economy through to industry specific concerns. On the recovery from pandemic related shutdowns and restrictions we now encounter issues such as limitations by government owned entities that impose constraints on training operations that are, in some instances, worsening the financial troubles faced by our flight training schools.

Of course the weather and the continued presence of La Niña cycles presents its own set of challenges with an unprecedented third consecutive year of the conditions making it difficult to go flying.

These challenges aside, we have come through the year in a position that allows us to continue serving our members and meeting the needs of the broader industry where appropriate. With a total comprehensive surplus of $564k (noting that this has been bolstered by a positive asset revaluation), we continue to remain financially healthy.

The organisation has taken the time to reflect on the previous year’s operations and proactively look towards the future and will set out a new strategic plan to ensure the strong performance of the past is continued into the future. This will include looking inwards and providing our staff and volunteers with the training and support they require as well as looking outward and considering our members needs as well as those of the industry at large.

It is worth taking a moment to consider the objects of RAAus and how we are performing against this simple measure. Our constitution states clearly that we will pursue the advancement of aviation and encourage training in a number of related areas. To this end, I believe we continue to serve our members interests as well as those of the aviation sector more holistically.

Considering that we cater to a number of different forms of aviation directly including powered parachutes, weightshift microlight aircraft and 3-axis aircraft, we represent a broad cross section of aviators. Our efforts to include even more aviators continue with our ongoing support of a number of industry initiatives that benefit aviators of all kinds. Our engagement and support of other sport aviation organisations and our ongoing presence in bodies such as the General Aviation Advisory Network and The Australian Aviation Associations Forum are just two examples of our collaborative efforts to further the interests of aviation in Australia.

In a more forward looking capacity we will continue to face challenges in the near future. I expect that the world economy and perhaps even political unrest will provide us with considerable trials in the next few years. Inflationary pressures are already present and the potential for a sizeable economic downturn on a global scale should not be underestimated.

Of course we already have the actions of Russia in Ukraine that have affected a number of aircraft suppliers having flow on effects into the

organisation while the China and Taiwan tension in the APAC region also looms large.

Broadening our focus to include new forms of aviation as they emerge and evolve in coming years will also offer new opportunities and help spread rising costs over a larger user base. The wider uptake of electric technologies and the introduction of new powered lift vehicles creates some exciting hurdles to overcome but also brings with it equally exciting prospects for the industry as these new ideas are adopted.

All of these things will remain on our risk radar together with those items more directly related to the day to day operations of our organisation. With some forethought, preparation and positive execution of our business plans, we will remain in a solid position for many years to come.

RAAus is about to enter its fifth decade of existence and is one of the oldest aviation organisations of its type in Australia. With a stable platform, a steady hand at the helm and some forward thinking I expect that Australia’s largest member based aviation advocacy body will continue to thrive into the future. The chance to shape and guide advances in aviation across our country is one that we are ready to take advantage of. We are a wide open land with a diverse landscape ideally suited to aviation and RAAus is equally diverse in its thinking and approach to delivering on its objectives.

Whilst we may continue to face further challenges in the coming years as we have done in those years most recently gone by, we are well placed to thrive and remain in a position to deliver on the industry’s needs.

Michael Monck Chair

We are a wide open land with a diverse landscape ideally suited to aviation and RAAus is equally diverse in its thinking and approach to delivering on its objectives.

From an operational perspective this year was busy! We worked to embed the processes associated with our CASR Part 149 certificate, implemented the changes associated with the new CASA Flight Operation Regulations and assisted in the development of Part 103 – which will eventually replace the 95-series CAOs, developed our application for administering Group G (lightweight aeroplanes <760kg), assisted with the establishment of the ADS-B rebate program, hosted the inaugural Fly’n For Fun at Parkes, participated in a range of technical working groups and consultation activities, just to name a few. Not bad for a team of 16 full time and two part time staff!

I’m proud to present this annual report for the 2021–2022 financial year. Challenging conditions during the year including COVID-19 lockdowns, floods and La Niña saw RAAus fare well and land ahead of our financial budget.

As members will see in the audited Financial Statement, our comprehensive surplus was $564,875, which was very much assisted by a positive revaluation of our office unit in Fyshwick, ACT. Excluding this revaluation, the underlying result for the year was a deficit of ($75,011), which was still ahead of our budgeted position.

Like most membership-based organisations, during the years affected by COVID-19 RAAus experienced a fluctuation in membership numbers, both positive and negative. At the end of the FY22 financial year RAAus had 9,090 ordinary members, which was down on FY21 where we saw a strong rebound after the initial lockdowns. In FY22 the rebound in membership numbers after the July 2021 lockdowns on the East Coast was not as pronounced, however there were other factors that came in to play none more so than the weather! Be it the case, our membership numbers continue to trend in the right direction with our temporary members exceeding expectations and this means more and more Australians are participating in aviation activities – which is great news.

Throughout the reporting period it’s pleasing to say we had some ‘wins’ with the regulator. These were brought about through assertive yet respectful advocacy. It’s important that we advocate in such as way that our message is heard loud and clear, but that we’re also ‘playing the game not the person’. That is, I take the view that the majority of people get up in the morning and go to work to do a good job. It isn’t their intention to be obstructionist or difficult, but pressures that are often not seen by us are the main driver for why we don’t always get what we want. On this basis we are respectful but we’re also tenacious in that if we fail to succeed, we regroup and try and different but still respectful approach.

Three such examples of our wins in the last year include:

• CASA permitting ASAOs to apply for administering aircraft up to and including 760kgs.

• The removal of a 45 knot stall limitation on the aircraft operating within the 760kg category.

• CASA publishing a GA Roadmap that specifically calls out that they will shortly consult on a proposal to increase access to Class C and D airspace for sport and recreational aviation.

It’s true that these ‘wins’ have taken many years to come to fruition, but these matters are not always as simple as they may seem. There are often many stakeholders involved, there are also

those people for and against, and of course there is the need for us to demonstrate that there is a sound safety argument to proceed.

An area where RAAus has played a large role is in the world of airspace. As many of our members know, over the past year Airservices Australia published another consultation to seek industry views on the lowering of Class E airspace on the East Coast, this time from 8,500ft to 6,500ft. As a result of RAAus putting forward a strong rebuttal to their earlier proposals and by working with them, Airservices conducted considerable safety and economic modelling in support of their latest proposal. Although there is some financial impact to airspace users, the merit of the proposal was such that RAAus did not object to the proposal. Furthermore, with the ADS-B rebate program now in effect to financially assist our members to fit transponders and ADS-B this made the proposal more palatable.

I’d like to thank our partners at Pace that produce our fantastic SportPilot magazine. I regularly hear our members saying what a great publication this is. The care and effort the Pace team put in to producing our magazine is a real credit to them. Interestingly, SportPilot is one of only a few remaining Australian aviation-centric magazines still on sale in newsagents around the country and the sales are good, indicating continued appetite for aviation in this country.

It can’t be left unsaid about the value our staff at RAAus continue to deliver for our members. Our team of professionals have worked solidly throughout the pandemic and beyond. Be it storing of online store stock at home and sending items to members at their local post office, spending their own time at events, burning the midnight oil to ensure a registration is completed or a membership is updated, or setting their workstation up on their dining room table to deliver seamless service to our members. This commitment is what makes RAAus great. It’s our aim to deliver exceptional customer service to our members and to make life easy for those wishing to participate in recreational aviation. It’s a privilege to lead this team and I thank them very much for all that they achieve.

In summing up the year that was FY22, I am proud of the result RAAus achieved for our members. We are a small organisation that exists for the advancement of aviation in this country and to encourage training in all areas of aviation. I believe we do this and more, whilst being supportive of other forms of aviation, be it our sport aviation cousins, new and emerging industries such as Advanced Aerial Mobility (AAM) or those operating in the CASA regime. We’re a relatively small industry and it’s important that we work together for the betterment of the industry and I’m proud to say that RAAus is playing our part.

Matt Bouttell Chief Executive Officer

I am proud of the result RAAus achieved for our members. We are a small organisation that exists for the advancement of aviation in this country and to encourage training in all areas of aviation.

RAAus is pleased to announce the results of our 2021 Director Elections. Each elected Director will serve a three-year term from the end of our 2021 AGM.

RAAus received three nominations for the two positions available. During the voting period (1 September 2021 to 28 September 2021) a total of 1226 members participated in the voting process, which was more than double the participation rate from 2020.

From the 1226 voting participants, a total of 2,138 votes were cast. Remembering that each member could vote for a director in each of the two vacant positions, so a total of up to two choices per member was permitted.

Votes were cast as follows:

Candidate Total Votes Elected Simon Ozanne 741 YES Luke Bayly 706 YES Rodney Birrell 691 NO

19 April 2022

THURSDAY 12 MAY 2022 AT 5.00 PM AEST

Pursuant to Section 249L of the Corporations Act 2001 (Cth) and Clause 21.3 of the RAAus Constitution, notice is hereby given that the Directors have called a General Meeting for members to consider approval of several amendments to the RAAus Constitution.

Place: RAAus Office Unit 3/1 Pirie St, Fyshwick ACT 2609 and via electronic means utilising Vero Voting meeting platform.

RSVP: For those wishing to attend the meeting in person at the RAAus office, they are requested to RSVP by 5pm Tuesday 10 May by emailing admin@ raaus.com.au

General nature of business: To seek member approval of a Special Resolution.

Special Resolution: Refer below and on the Member Portal.

Situation regarding

appointing proxies: Members can appoint a proxy. Appointment of proxy is required to be completed by no later than 5pm Tuesday 10 May 2022 and is to be performed using the Vero Voting meeting platform.

RAAus has engaged Vero Voting to provide a means for members to participate in the General Meeting via secure, electronic means that utilises a web-based proprietary application and the Zoom video conferencing application. This application is also to be used for the appointment of proxy.

Each eligible member will be provided with unique login details and instructions shortly after announcement of this General Meeting.

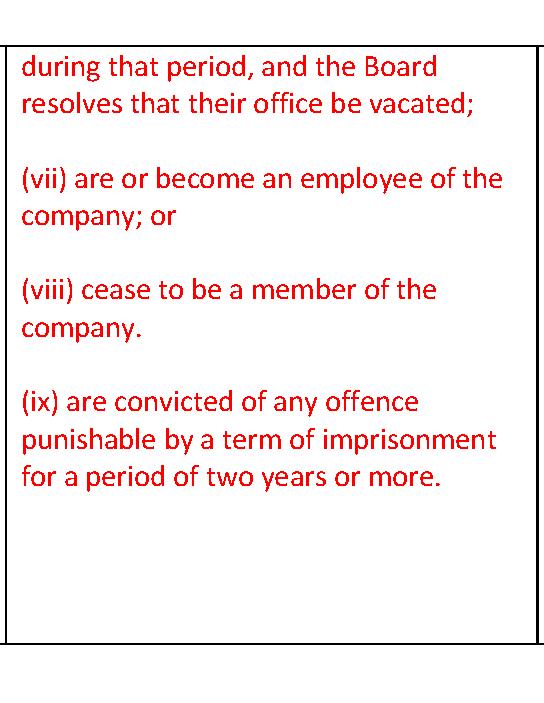

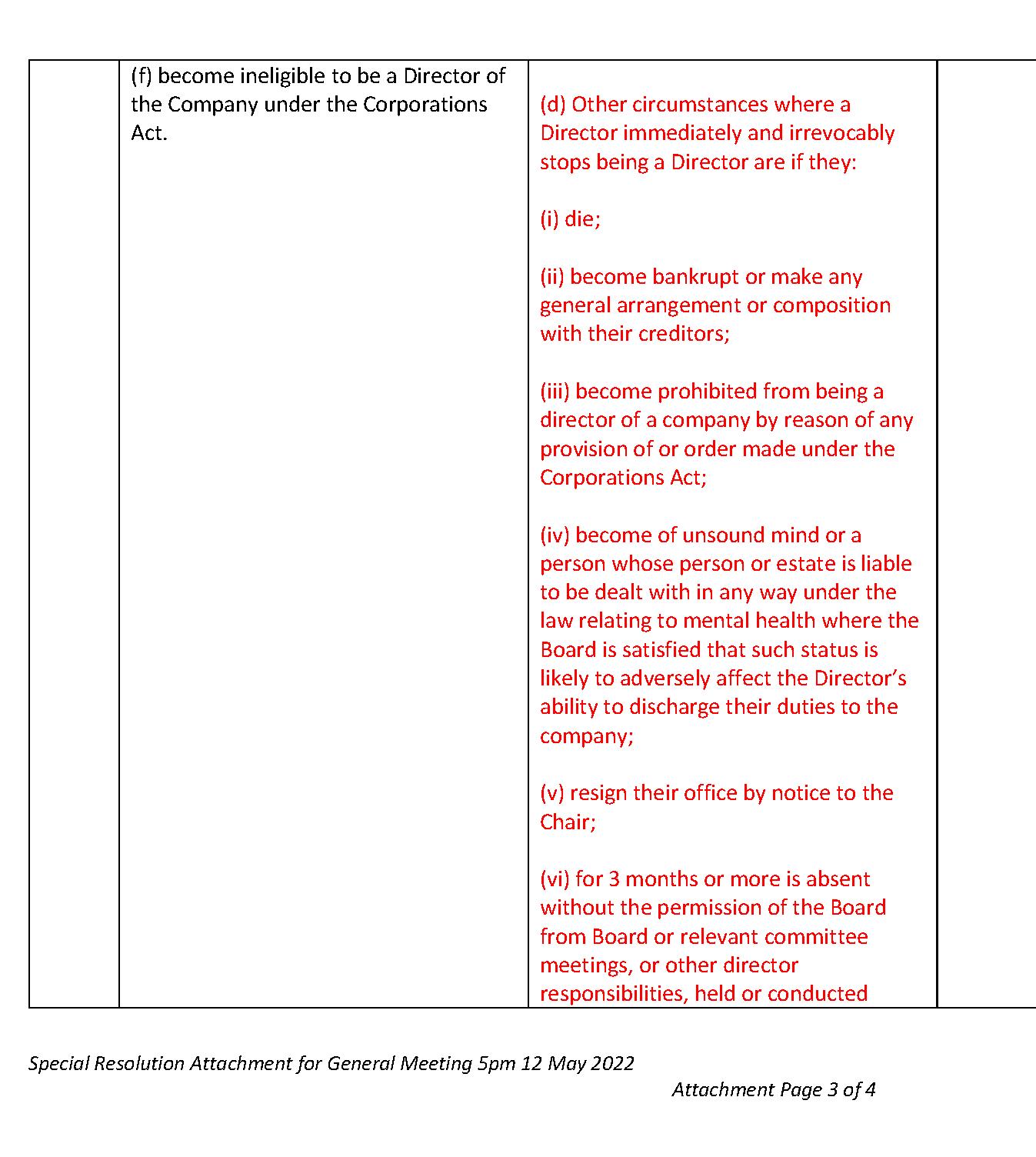

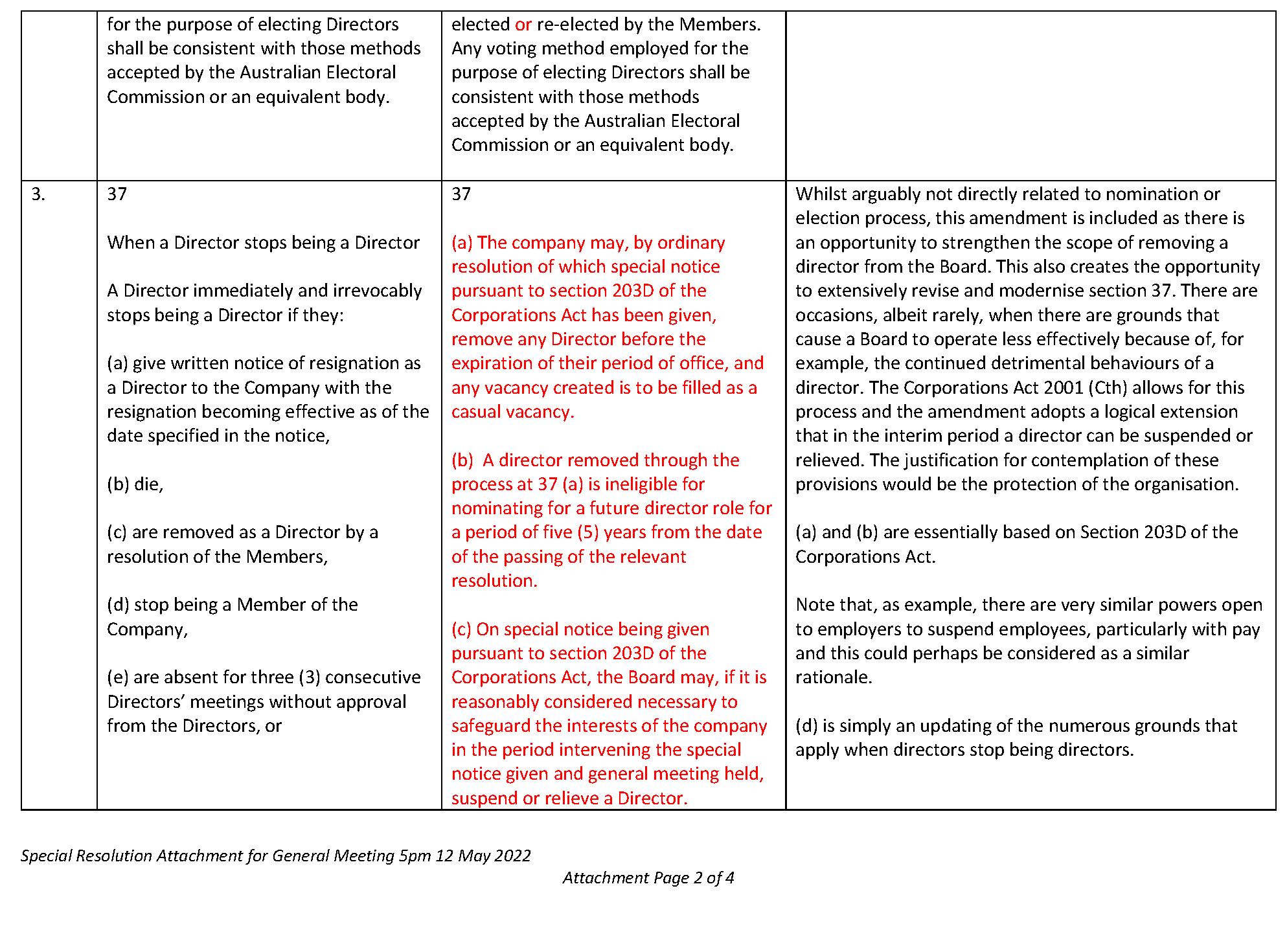

The resolution relates to the Director nomination and election process. Given the contemporary focus on effective governance, it is consistent with the RAAus approach to continuous improvement to seek member approval for several proposed amendments to the Constitution. This special resolution has a particular focus on improving, and creating certainty regarding, the Director nomination and election process, the process for removing a director by member resolution, and an update of the circumstances where a Director ceases to be a Director.

Section 34.3

The intent of the proposed amendment is to enable the Board to approve the scope of the mandatory criteria for nomination as approved by the Board. Each year during the conduct of the nomination and election process any process issues are

recorded and appropriate proposed amendments developed for Board consideration and approval. The proposed amendments are now presented to members seeking approval.

Section 34.4

The intent of the proposed amendment is to compel the Board to review the process annually to ensure contemporary issues and needs are addressed.

Section 37

The intent of the proposed amendment is to:

Codify and utilise the available Corporations Act (Section 203D) powers regarding the ability to remove director.

Further, that a director so removed be disqualified for a period of five (5) years from nominating again.

Introduce a step that enables a director to be suspended or relieved pending the outcome of a Section 203D process. This ensures the protection of the company on an interim basis.

That members approve the proposed amendments to the Constitution as presented in Attachment 1 below (numbered 1,2 & 3 in that attachment). The following attachment can also be viewed in the Member Portal.

Dear member,

By now, you would have probably seen the notice regarding a general meeting to discuss some changes to the rules that govern RAAus – our constitution. This constitution, according to the law, has the effect of being a contract between RAAus and its members making it our single most important governing document. During the last board election cycle some areas that could use a little improvement were identified. These primarily related to the requirements to be met in order to be eligible to be a director, the process used during elections and when someone stops being a director.

For the past ten years or so, and perhaps even longer, RAAus has published a nominations pack outlining the requirements to be met in order to nominate for a role on the board. This includes dates to submit, the requirement to submit an election statement, declarations of items that relate to material interests in the activities of RAAus and so forth. In the 2021 election, one candidate did not comply with these requirements and challenged the validity of them despite it being the status quo for a number of years prior. The fallout of this was that RAAus expended considerable amounts of time and member funds exploring the legal issues around this which diverted attention away from our core activities. The changes to clause 34.3 in our constitution are designed to remove any ambiguity about the validity of these requirements and alleviate the risks associated with spending more member funds on frivolous claims.

An example of our nomination pack and the criteria which have been in place for around a decade can be seen in the member portal at: https://members.raa.asn.au/storage/raaus-boardnomination-pack-2021.pdf

The second area identified for change relates to the process used to conduct the elections. Previously it was acceptable that the status quo remain and that no review is required. Given the events of the past year the board now feels that it is appropriate to compel current and future directors to be active in their review of the process each and every year. The amendment to 34.4 now stipulates that the board MUST do this meaning it is no longer optional. This additional requirement gives members more assurance that the board

will, now and in years to come, be proactive in their review of policies in this space and can no longer rely on it being good enough based on past performance.

The final area of change is to simply highlight that members have a right to remove directors. This, in some ways, is no change to existing members rights as the ability to remove a director is already embodied in the Corporations Act. Having said this, many of our members are not across those rights that are conferred on them via the Act and do not wish to peruse the hundreds of pages of law to learn what they can and cannot do. With this in mind, your board felt it is appropriate to replicate these rights in our constitution to make it easier for members to understand.

It is important to note that the Act prevents directors from removing directors and a company constitution cannot override this. That is, this clause in no way whatsoever allows your board to remove a director, that is a privilege reserved for members only. The only power this clause gives the board is to suspend a director should the members feel it is appropriate to exercise their powers to remove that particular director. This power to suspend can only be exercised if members move a motion to remove a director and only lasts until a vote on that motion has been taken. The power is triggered by members and is terminated when members make their ultimate decision. The board cannot exercise this power without the members first taking action to allow the board to do so.

As our organisation continues to mature, and the landscape in which we operate changes or when gaps are identified in the way we govern, your board will continue to review and update our internal policies, procedures and processes accordingly. These constitutional amendments are just one thing in this space that have arisen out of the things that we have learned over the past year or so. Just like pilots like to improve the way they fly, we like to improve the way the organisation is run so that our ability to fly is protected. We hope that you will support these changes and strengthen the organisation for years to come.

Michael Monck ChairOutcome 19 May 2022

On behalf of the Board, I’m pleased to share with you that a Special Resolution to amend the RAAus Constitution was passed last Thursday at a General Meeting. These amendments are currently being incorporated and registered with ASIC, with the new version to be published on the RAAus website in the coming week.

For the first time we held a General Meeting using the Vero Voting meeting platform that enabled electronic management of proxies and voting as

well as participation in the meeting using Zoom. From our perspective this system worked well and we look forward to expanding our capability with this in the future. Should you have any feedback on the system I’d certainly welcome you sharing it with me so we can continue to improve. Please email me at ceo@raaus.com.au

The following table sets our the number of Board Meetings attended by each director

*Committee meetings attended Total Michael Monck (Chair) 6 6

Directors eligible to attend Board meetings attended

Barry Windle 5 4 9 Eugene Reid 5 5

Trevor Bange 6 6

Andrew Scheiffers 6 6

Luke Bayly 6 4 10

Simon Ozanne (Commenced 6/11/2021) 4 4 Rodney Birrell (Ceased 6/11/2021) 1 1

*TheOnlyCommitteeformedbytheBoardinFY22wastheRisk,AuditandFinanceCommittee

20 December 2021

RAAus welcomes today’s announcement of an Aviation Recovery Framework, by the Deputy Prime Minister Hon Barnaby Joyce MP. In his media release today, the Deputy Prime Minister said “This policy framework is being put in place to help Australia’s aviation industry emerge bigger, better and stronger on the other side of the pandemic.”

One of the key support measures being introduced in the Framework is funding of $30 million in rebates to recreational and general aviation operators for up to $5,000 or 50 percent of the cost of installing ADS-B technology.

RAAus CEO Matt Bouttell said today that “We’re very grateful that the Deputy Prime Minister has invested in our industry. These measures will yield financial and safety benefits for many years to come. Furthermore, we’re encouraged to see that the RAAus submissions made to the Airservices Australia Class E Proposals earlier this year (see here and here) did not fall on deaf ears, and that our contribution whilst working across Government and it’s agencies has assisted in making the ADS-B funding become a reality.

“We see this this initiative as not only improving air traffic management surveillance and safety, but it will stimulate aircraft maintenance by supporting jobs and enabling the safe integration of new technology such as Advanced Air Mobility (AAM) and Remote Piloted Aircraft Systems (RPAS). From a financial perspective, this scheme will enable the retirement of costly enroute radar infrastructure and see other efficiencies be derived, resulting in savings being passed onto industry in the longer term.”

After the announcement, Michael Monck, RAAus Chair, said “RAAus continues to participate in many Government and industry Working Group’s and we’re seen as a trusted advisor across many areas. Over the past few

years we’ve represented our members, and the industry more broadly, on the Deputy Prime Minister’s General Aviation Advisory Network (GAAN), the National Emerging Aviation Technologies Consultation Committee (NEAT CC), CASA’s Aviation Safety Advisory Panel (ASAP) and countless Technical Working Groups (TWGs), to name a few. We’d therefore welcome involvement in the Strategic Advisory Committee being established to oversee the rollout of the Aviation Recovery Framework.

“Our strategic involvement helps to influence the landscape and we’re grateful that the Deputy Prime Minister recognises the role RAAus plays across industry.”

RAAus will support our members as the scheme is rolled out, particularly those who choose not to take up this generous rebate, to minimise any operational effect. We will also continue to advocate that any airspace design changes resulting from this scheme are justified on safety grounds. The funding also increases the value for those who have already invested in ADS-B technology by making the technology available to more people and improving situational awareness for all users.

Finally, we congratulate Qantas for being brave and putting this forward as an initiative in their Future of Aviation Submission to support general and recreational aviation. This demonstrates the ability for all industry stakeholders to appreciate each others’ challenges and to work collaboratively across industry, even in areas they’re not specifically involved in, to achieve outcomes for the greater good.

The Aviation Recovery Framework is available at: www.infrastructure.gov.au/ infrastructuretransport-vehicles/aviation

Recreational Aviation Australia (RAAus) has today announced a range of measures totalling $100,000, aimed at supporting members as they manage the aftermath of devastating floods in South-East Queensland and NSW.

Over the past several years the aviation community has been faced with many challenges including bushfires and COVID-19. We’re now observing the tragic events unfold in Ukraine and experiencing unprecedented flooding in parts of south-eastern Queensland and NSW. RAAus recognises that the compounding effect of these events is really starting to bite, and is fortunate to be in a financial position to play a larger role in supporting our members.

Chair of the RAAus Board, Michael Monck said that “our member-based organisation is a community that looks out for one another. And with a strong balance sheet we are very much able to play a part in supporting our members, aircraft owners, maintainers and flight training schools as they deal with these devastating floods.

Today the RAAus Board resolved to implement a range of measures, that includes:

• Access to dedicated funds of up to $25,000 for RAAus aircraft owners, RAAus Flight Training Schools and RAAus aircraft maintainers, where RAAus will co-fund up to 50% of insurance excess for aircraft, tooling, or flight training school premises to a maximum value of $250 per affected member

• Setting aside up to $15,000 in registration fees for owners of severely damaged or written-off aircraft, to assist members when registering another aircraft or re-registering their repaired aircraft in the future

• Making available $45,000 of financial assistance to our flight training schools should they temporarily re-locate or need to re-establish themselves.

• Supporting affected RAAus maintainers,

• Putting $10,000 towards facilitating the availability of L2/L4 maintainers so they can travel to affected locations and support aircraft owners as they repair their aircraft

• Continuing the existing program that funds working bee lunches at a range of airfields that will keep the energy up for those working in often torrid conditions during the clean-up

• Establishing a community of RAAus helpers, where members wishing to assist those in need, can advertise their services for the rebuilding efforts.

• Making available counselling services through a dedicated specialist service provider

The RAAus Board also recognises that we need to plan and support our members now and into the future. We have committed to working toward dedicating a fund where our members can call upon RAAus in the future to assist in similar ways, should the need arise. We are still working through the details of this however we maintain the principle that as members of RAAus, the benefits extend well beyond the registering of aircraft and issuance of pilot authorisations.”

RAAus CEO Matt Bouttell said today that “whilst RAAus provided a range of fee-waiving options throughout the COVID-19 pandemic in support of members doing it tough, this latest package, as approved by the RAAus Board, goes much further in terms of the quantum, whom it supports and how it will be delivered. Over the coming week my team and I will be finalising the terms and conditions of each measure so we there are clear expectations for members around eligibility and how to access this support. This will all be communicated to members via a dedicated E-News along with updates to our website.”

also known as Non-flying members, who may also seek extension to their membership for twelve monthsG’day folks,

I’m very pleased to share with you that CASA has released its Summary of Consultation for the removal of a 45 kt stall speed limitation for aircraft designed to operate within the lightweight aeroplane category per CAO 95.55. The conclusion that CASA reached is that they will remove this limitation, and include, as appropriate, requirements in relation to competency standards and units of competency for the operation of lightweight aeroplanes, including for the flying training mentioned in section 11 of the CAO (95.55).

This is an outstanding outcome for our members and the industry more broadly, including aircraft manufacturers, to provide more choice in the types of aircraft that may safely operate under our simple and accessible ruleset.

Lightweight aeroplanes will be known by RAAus as ‘Group G’ and in simple terms, these aircraft are to be either an amateur built aircraft or a type certified aircraft designed to relevant standards and that are permitted within the pilot operating handbook (POH) to operate with a maximum takeoff weight (MTOW) between 601 kgs and 760 kgs. These aircraft will also need to be registered with RAAus in the Group G category and display different registration markings to aircraft in other Groups. Group G aircraft may not be a light sport aircraft (LSA) at this stage.

For Group G operations, there will be some additional flight training requirements for Recreational Pilot Certificate (RPC) holders and instructors and the need to hold a specific Group G endorsement. Whilst we don’t believe these

requirements will be onerous, it’s important that all RPC holders are aware that this is the case. Also, the maintenance requirements for Group G aircraft will be different to other Groups including L4/LAME maintenance requirements. We are aiming to host a Live Stream event in June to share more detail on Group G so please keep an eye out when we publish information on how to participate in that.

When will Group G commence? Well, our team is working hard to develop a submission to CASA that will allow us to commence registering (applicable) Group G aircraft and to enable the granting of endorsements for those pilots wanting to fly them. We remain on track to make this submission to CASA by 30 June and then expect a bit of ‘backand-forth’ with them over a period of a couple of months, before we obtain the approval. That means that until we obtain this approval from CASA, we cannot take advantage of the increased MTOW. It’s a process that we always knew about and that as a Part 149 organisation, we must follow.

I’m immensely proud of our whole team, who have worked tirelessly to advance these privileges for our members and to help grow the industry. So thanks team!

Stay safe out there folks, and lets all hope that the wet weather affecting so many of us disappears soon to allow us to clock some hours up!

Cheers

Matt

On the first weekend in April RAAus held our inaugural Fly’n For Fun at Parkes. Our main objectives were to see what appetite there was for such an event, to bring our community together after a couple of years away due to COVID-19, and to provide a vehicle for industry exhibitors to show their wares. I’m pleased to report back that we ticked all of these boxes and more. Our community triumphantly came together and the overwhelming response from all that I spoke to was that ‘it was great to be back’. And it really was.

Throughout the weekend in Parkes we saw more than 70 aircraft, both RAAus and VH- registered, fly in. We also had many other attendees drive in and

event site or opt for motel accommodation in the town of Parkes. Whilst the

provided some challenges and kept numbers lower than registered, these numbers still surpassed our expectations and, with two years to prepare for the next Fly’n For Fun along with the continued support from the AMDA Foundation, there is no doubt that we will do this again and make it bigger and better. To those that attended, I hope you enjoyed yourself because we certainly did!

PK Valeri 2/07/2021

CP Hird 3/07/2021

HJ Freudenstein 3/07/2021

S Whale 3/07/2021

D Milton 3/07/2021

WC Van De Lindt 4/07/2021

MA Soulsby 4/07/2021

C Zhang 5/07/2021

MJ Patterson 6/07/2021

JWN Hunter 6/07/2021

BG Walsh 6/07/2021

D Rowling 7/07/2021

C Matheson 7/07/2021

M Howard 7/07/2021

J Barker 7/07/2021

AJ Surplice 7/07/2021

R Staier 8/07/2021

JL Mattiacci 8/07/2021

DR Evezard 8/07/2021

R Maxwell 10/07/2021

C Duirs 10/07/2021

PB Sigmund-Michelini 11/07/2021

F Theron 11/07/2021

NG Bennett 11/07/2021

K Bennett 11/07/2021

KG Muir 12/07/2021

LH Mcdonald 12/07/2021

S Hayes 13/07/2021

VB Cronin 13/07/2021

R Bunch 13/07/2021

A Wood 14/07/2021

P Thistleton 14/07/2021

CC Totenhofer 14/07/2021

HB Templeton 15/07/2021

K Rowe 15/07/2021

E Partush 16/07/2021

B Smith 18/07/2021

A Drake 18/07/2021

M Trifu 19/07/2021

J Ryan 19/07/2021

LJ Mcvey 19/07/2021

MJ Vayro 20/07/2021

GJ Russell 21/07/2021

J Brewster 21/07/2021

B Craw 21/07/2021

P Crabtree 21/07/2021

TR Gilbo 22/07/2021

R Barron 22/07/2021

C Parker 23/07/2021

EJ Lowndes 23/07/2021

MR Stewart 26/07/2021

D Moore 26/07/2021

M Zuchetto Schemes 26/07/2021

NMS Houston 27/07/2021

D Conway 27/07/2021

R Crothers 28/07/2021

MJ Schoen 29/07/2021

EH Bullock 29/07/2021

JC Matthes 30/07/2021

K Diao 30/07/2021

N Knight 30/07/2021

S Kennedy 30/07/2021

A Canaris 30/07/2021

S Harris 30/07/2021

S Rees 31/07/2021

D Osses-Santander 1/08/2021

MGA Herps 1/08/2021

MA Jambor 2/08/2021

JA Ford 3/08/2021

TMA Kingsley 3/08/2021

K Cornall 4/08/2021

G Little 5/08/2021

C Mock 5/08/2021

J Richert 6/08/2021

B Harvey 8/08/2021

A Szymfeld 8/08/2021

J Pulbrook 8/08/2021

J Thatcher 9/08/2021

M Trotter 9/08/2021

J Boyd 10/08/2021

PR Suri 11/08/2021

JD Ottaway 11/08/2021

M Swaby 11/08/2021

S Williams 12/08/2021

MS Mangat 14/08/2021

A Seymour 14/08/2021

T Macdonald 14/08/2021

SJ Ahrens 14/08/2021

E Alley 14/08/2021

WC Nicholas 16/08/2021

JA O'Brien 17/08/2021

E Simmons 18/08/2021

M Hemming 18/08/2021

PT Merritt 19/08/2021

N Spackman 19/08/2021

S Anderson 20/08/2021

OJ Lane 20/08/2021

D Eichhorn 20/08/2021

A Hammarfalk 20/08/2021

M Dows 21/08/2021

WJB Greer 24/08/2021

S Allen 24/08/2021

AD Prior 25/08/2021

P Kooistra 26/08/2021

PR Fetchik 27/08/2021

E Henry 27/08/2021

F Jaques 28/08/2021

I Van Heerden 28/08/2021

JD Lis 28/08/2021

A Fountain 29/08/2021

JD Moreno Medina 29/08/2021

T Redgrave 31/08/2021

V Travers 1/09/2021

M Brown 1/09/2021

G England 1/09/2021

D Seymour 1/09/2021

ME Waddell 1/09/2021

A Rivero 2/09/2021

TJ Oag 2/09/2021

A Fleming 2/09/2021

ED Murray 3/09/2021

JA Stewart 3/09/2021

H Liu 3/09/2021

J Darcy 4/09/2021

J Brandon 4/09/2021

SR Rotherham 4/09/2021

AG Theron 5/09/2021

J Mackin 6/09/2021

B Lewis 7/09/2021

A Locke 7/09/2021

PR Haxell 7/09/2021

S Pylilo 8/09/2021

C Anderson 8/09/2021

NR Mason 8/09/2021

T Cronan 8/09/2021

D Ranger 9/09/2021

R Aggarwal 9/09/2021

RI Unwin 9/09/2021

Z Stewart 9/09/2021

NJ Afrakoff 9/09/2021

N Brennan 10/09/2021

K Warren 10/09/2021

BG Harkup 10/09/2021

TJ Mccluskey 11/09/2021

J Fraser 11/09/2021

B Perrett 12/09/2021

CK Russell 13/09/2021

S Wing 13/09/2021

CJ Hackett 13/09/2021

M Gabell 15/09/2021

D Walker 15/09/2021

RW Owen 15/09/2021

HA Cunningham 15/09/2021

MG Burns 15/09/2021

AP Harris 15/09/2021

S Thomas 16/09/2021

M Withoos 16/09/2021

S Coote 16/09/2021

LM Sycz 17/09/2021

DJ Salvemini 17/09/2021

ID Hislop 17/09/2021

S Olver 17/09/2021

S Scoffell 19/09/2021

A Wise 19/09/2021

T Eather 19/09/2021

W Rooklyn 19/09/2021

NI Forbes 19/09/2021

C Galante Biscuola 20/09/2021

RT Onley 22/09/2021

AJ Hipwell 22/09/2021

P Anderson 22/09/2021

C Kunde 23/09/2021

JD Thompson 23/09/2021

KN Gliddon 23/09/2021

J Payne 24/09/2021

TJ Walton 24/09/2021

DP Bolton 24/09/2021

B Smith 24/09/2021

GL Freeman 24/09/2021

K Francis 24/09/2021

M Greig 25/09/2021

HL Dahl 26/09/2021

TW Denham 26/09/2021

P Smith 27/09/2021

D Snow 27/09/2021

J Drzewucki 27/09/2021

DJ Appleton 28/09/2021

RJ Koprowicz 28/09/2021

J Simons 28/09/2021

MI Scells 29/09/2021

D Britchford 30/09/2021

J Sweeney 2/10/2021

J Cotterill 2/10/2021

S Campbell 2/10/2021

H Marouff 3/10/2021

JA Hillard 3/10/2021

M Aarons 3/10/2021

D Townsend 4/10/2021

J Currie 5/10/2021

A Zbeidi 5/10/2021

MMA Afridi 5/10/2021

DS McAlpine 5/10/2021

DA Imhoff 5/10/2021

M Wallace 6/10/2021

NS Larwood 6/10/2021

B Singh 7/10/2021

B Irvine 8/10/2021

F Ashman 9/10/2021

M Inall 9/10/2021

JDGS Perera 9/10/2021

A Kemp 9/10/2021

MW Kelsey 9/10/2021

RH Brooke 9/10/2021

JM Ellis 10/10/2021

S Brady 10/10/2021

T Yaguchi 10/10/2021

DG Thornhill 11/10/2021

C Macaulay 12/10/2021

JM Stanich 14/10/2021

KM Bailey 15/10/2021

TR Morgan 16/10/2021

J Livermore 16/10/2021

FL Ben 16/10/2021

E Dickeson 17/10/2021

S Metcalf 19/10/2021

J Delia 19/10/2021

LR Kopecny 19/10/2021

S Savage 20/10/2021

BJ Obrien 20/10/2021

D Bowles 21/10/2021

K Draper 21/10/2021

A Margetts 21/10/2021

A Pirzadeh 22/10/2021

S Panazzolo 22/10/2021

AJ Boswell 22/10/2021

E Delves 22/10/2021

ND Haydon 22/10/2021

TPC Morton 23/10/2021

CC Quartermaine 24/10/2021

D Scurr 25/10/2021

R Dunshea 26/10/2021

D Mccluskey 27/10/2021

JR Dubey 27/10/2021

CC Lowe 28/10/2021

P Musgrave 28/10/2021

A Eastwood 29/10/2021

J Harris 30/10/2021

TP Baltjes 31/10/2021

H Abu-obeid 31/10/2021

AP Bell 1/11/2021

AS Webber 2/11/2021

E Holland 2/11/2021

S Nikolic 2/11/2021

GT Warner 3/11/2021

TJ Travis 3/11/2021

CK Yong 4/11/2021

W Ingmire 4/11/2021

A Mckenzie 5/11/2021

J Bacon 5/11/2021

ADW Taylor 5/11/2021

B Higgins 6/11/2021

SR Brookes 6/11/2021

J Goggin 6/11/2021

PA Cash 6/11/2021

J Dowd 7/11/2021

BS Hinchcliffe 7/11/2021

AW Jackson-Rogers 7/11/2021

B Allan 8/11/2021

C Tagliapietra 8/11/2021

K Moore 9/11/2021

AJ Chalmers 9/11/2021

MJ Dow 9/11/2021

DBS Strydom 9/11/2021

G Belford 9/11/2021

C Brandis 9/11/2021

DJ Gibbs 10/11/2021

C Hodges 10/11/2021

PT Sullivan 11/11/2021

C Lacey 11/11/2021

M Duffy 11/11/2021

BA Hunt 12/11/2021

JA Bollen 12/11/2021

JA Kirkwood 12/11/2021

D Henderson 14/11/2021

K Ellis 15/11/2021

PJ Fogarty 16/11/2021

L Sakac 16/11/2021

NJ Ebzery 16/11/2021

JR Newgrain 17/11/2021

JD Dunnet 17/11/2021

JER Welch 17/11/2021

BJ Chauvier 17/11/2021

L Horsford 17/11/2021

LM Wallace 17/11/2021

M Butcher 18/11/2021

DW Heiberg 20/11/2021

GK Bennett 20/11/2021

TO Young 20/11/2021

S Westerman 21/11/2021

J Walmsley 21/11/2021

C Li 21/11/2021

N Niu 23/11/2021

F Rayson-hill 24/11/2021

JL Mitchell 24/11/2021

C Black 27/11/2021

S Park 28/11/2021

HJ Kerr 29/11/2021

L Shannon 29/11/2021

DJC Brown 30/11/2021

G O'neill 30/11/2021

K Hernfield 30/11/2021

J Turkington 1/12/2021

WJ Waideman 2/12/2021

J Budinsky 2/12/2021

S Barnes 2/12/2021

T Lincoln 2/12/2021

BD Rawson 2/12/2021

A Siemek 3/12/2021

PT Davidson 3/12/2021

MGB Brown 4/12/2021

PG De Ryck 4/12/2021

ZS Walton 5/12/2021

K Abdelmajeed 5/12/2021

HD Smith 5/12/2021

RW Peapell 6/12/2021

JDT Constable 6/12/2021

MJ Doyle 6/12/2021

M King 7/12/2021

C Young 7/12/2021

GC Garthwaite 7/12/2021

K Sales 8/12/2021

B Hackett 8/12/2021

MW Caddy 9/12/2021

B Gordon 9/12/2021

AJ Cannon 9/12/2021

NJ Wright 9/12/2021

C Beck 10/12/2021

K Todorashko 10/12/2021

D Duncan 10/12/2021

THM Longbottom 10/12/2021

G Brodrick 11/12/2021

JW Francis 11/12/2021

DJ Schmidt 11/12/2021

A Holland 11/12/2021

G Murphy 11/12/2021

NL Rich 11/12/2021

J Skinner 11/12/2021

M Roods 12/12/2021

A Heffernan 12/12/2021

TD Woolley 12/12/2021

MJ Mclaren 13/12/2021

L Fishpool 13/12/2021

A Jalandoni 13/12/2021

C Parker 13/12/2021

RJ Hearle 13/12/2021

D Jaeggi 14/12/2021

BR Hignett 14/12/2021

P Barry 14/12/2021

N Wong 14/12/2021

K Diamond 14/12/2021

DJ Fry 14/12/2021

GB Holloway 15/12/2021

LLG Alderton 15/12/2021

T Nguyen 15/12/2021

FJ Howard 15/12/2021

NA Lingaiah 16/12/2021

A Matthies 16/12/2021

KM Javor 16/12/2021

N Fowler 17/12/2021

ZA Sakac 17/12/2021

MD Langrehr 18/12/2021

BJ O'Sullivan 18/12/2021

A Dastani 18/12/2021

D Maruskanic 18/12/2021

N Garraway 20/12/2021

MK Wise 20/12/2021

MS Wood 21/12/2021

M McCann 21/12/2021

BC Eddy 21/12/2021

M Sturgeon 21/12/2021

BJ Davies 21/12/2021

R Rickards 22/12/2021

SJ Smith 23/12/2021

N Bennett 23/12/2021

MC Goulden 23/12/2021

CJ Mann 23/12/2021

BM Starfield 24/12/2021

CW Dawson 24/12/2021

J Ives 24/12/2021

GD Jordaan 24/12/2021

S Perceval 24/12/2021

JP Starkie 27/12/2021

J Wharington 27/12/2021

B Bonselaar 29/12/2021

J Cherry 31/12/2021

C Martin 31/12/2021

C Hayden 1/01/2022

D Coates 2/01/2022

D King 2/01/2022

A Limmer 3/01/2022

S Figredo 3/01/2022

IA Mayfield 4/01/2022

T Sullivan 5/01/2022

AJ Concannon 6/01/2022

JP Sharp 6/01/2022

J Douglas 7/01/2022

DC Connell 7/01/2022

V Bhaskar 8/01/2022

J Appleby 9/01/2022

RP Rieger 9/01/2022

AM Richards 10/01/2022

E La Grange 10/01/2022

C Hamilton 11/01/2022

R Burbury 11/01/2022

B Sabin 12/01/2022

DA Anderson 13/01/2022

D Spong 13/01/2022

HR Owen 15/01/2022

JC Lea 16/01/2022

RT Deegan 16/01/2022

A Cross 16/01/2022

H Borchard 17/01/2022

H Tarrant 17/01/2022

F Peterson 17/01/2022

AM Barton 17/01/2022

D Craig 17/01/2022

DB Armstrong 17/01/2022

PN Game 17/01/2022

R Bertuna 17/01/2022

KA Mclaughlin 17/01/2022

M Freestone 18/01/2022

EJ Barr 18/01/2022

C Rieger 18/01/2022

BC Rodrigues 19/01/2022

TJ Greer 19/01/2022

CA Browne 19/01/2022

R Quinn 19/01/2022

LGB Bolton 19/01/2022

GI Warren 20/01/2022

A Skinner 20/01/2022

B Rosiak 20/01/2022

N Funga 20/01/2022

S Peacey 21/01/2022

DJ Sonneveld 24/01/2022

A Yared 24/01/2022

FJ Apel 24/01/2022

I San Andres 25/01/2022

A Tsounis 25/01/2022

G Godwin 25/01/2022

S Beckwith 27/01/2022

AJ Hayes 27/01/2022

SML Drew 27/01/2022

PC Weerasinghe Basnayake 28/01/2022

P Hagan 28/01/2022

JM Goodhew 28/01/2022

L Overton 29/01/2022

CF Robinson 29/01/2022

S Kuiper 30/01/2022

P Rejto 30/01/2022

K Hollosi 30/01/2022

M Janse Van Rensburg 31/01/2022

LF Williams 1/02/2022

J Lykke 1/02/2022

L Curr 1/02/2022

J Melia 2/02/2022

Z Liu 2/02/2022

B Morris 3/02/2022

DK Phillis 4/02/2022

D Schuback 4/02/2022

PW Shannon 5/02/2022

ND Dee 9/02/2022

G Turton 9/02/2022

JD Rayner 10/02/2022

MT Yarde 10/02/2022

MJ Brownlie 10/02/2022

R Piyabandu 12/02/2022

WC Beasley 13/02/2022

A Abiri 13/02/2022

R O'Connell 13/02/2022

J Frost 14/02/2022

T Barrett 14/02/2022

AJ Travers 15/02/2022

DJ McEvoy 16/02/2022

R McQueen 16/02/2022

L Seears 16/02/2022

A De Moor 17/02/2022

M Golding 17/02/2022

S Lau 17/02/2022

D Tye 17/02/2022

LM Thomas 18/02/2022

D Lee 18/02/2022

OJ Taylor 19/02/2022

J Kendall 20/02/2022

M Kendall 20/02/2022

S Rogers 20/02/2022

SC Murcott 21/02/2022

TC Stewart 21/02/2022

J Roberts 21/02/2022

KG Balas 22/02/2022

A Callaghan 22/02/2022

M Clark 22/02/2022

J Healey 22/02/2022

PC Hogan 22/02/2022

PJ Hatch 23/02/2022

LA Eadie 25/02/2022

J Rose 27/02/2022

R Nel 28/02/2022

MC Rodda 2/03/2022

LG Talty 3/03/2022

VF Bongiorno 3/03/2022

N Bonselaar 3/03/2022

T Jameson 5/03/2022

W Hunn 6/03/2022

SL Watkins 7/03/2022

MJ Lapthorne 9/03/2022

BJ Ring 10/03/2022

SJ Butler 10/03/2022

AP Weidemier 11/03/2022

JP Mcilvenny 11/03/2022

B Penfold 12/03/2022

E Owen 12/03/2022

DP Pearson 12/03/2022

S Rawson 12/03/2022

SJ Hall 13/03/2022

J Jaggs 13/03/2022

WA Ogle 14/03/2022

J Vermeulen 14/03/2022

B Mahnken 15/03/2022

M Moran 15/03/2022

M Brown 16/03/2022

B Chauvet 16/03/2022

J Taubenschlag 18/03/2022

G Taubenschlag 18/03/2022

S Webb 18/03/2022

M Coleman 19/03/2022

NP Morrison 19/03/2022

V Palaniswamy 19/03/2022

B Randall 20/03/2022

JD Tocknell 20/03/2022

TL Duncan 20/03/2022

HR Clifford 22/03/2022

L Bestajovsky 23/03/2022

AP Kirwan 27/03/2022

HK Noles 27/03/2022

Z Ward 27/03/2022

C Summersell 28/03/2022

BB Carr 29/03/2022

ML French 29/03/2022

JL Finlay 30/03/2022

TOF Tadhg 30/03/2022

CJ Paterson 30/03/2022

IO Polderman 31/03/2022

R Holstegge 31/03/2022

P Sansom 31/03/2022

MC Woodgate 2/04/2022

CA Nankervis 2/04/2022

C Letham 3/04/2022

WR Skinner 5/04/2022

HF Tavner 5/04/2022

J Neal 6/04/2022

A Charlton 6/04/2022

N Hepworth 6/04/2022

JB Herbert 6/04/2022

SA Fiorentino 6/04/2022

MM Giraldo Uribe 6/04/2022

C Hunt 7/04/2022

C Wilson 7/04/2022

KM Mudri 8/04/2022

F Angeles 8/04/2022

AP Swallow 8/04/2022

RG Day 9/04/2022

S Barker 9/04/2022

T Gertig 9/04/2022

AB Mcarthur 10/04/2022

F Wierzynski De Oliveira 10/04/2022

W Maunder 10/04/2022

R Hassan Zaki 10/04/2022

T Guse 11/04/2022

J Falconer 12/04/2022

AF Hines 12/04/2022

PR McDonald 13/04/2022

LLG Neagle 13/04/2022

H Bartlett 14/04/2022

PM Pless 14/04/2022

CA Drew 15/04/2022

S McGlory 15/04/2022

S Whitby 16/04/2022

DR Mcgrath 16/04/2022

PJ Baylis 16/04/2022

CS Humphreys 18/04/2022

S Collins 20/04/2022

M Derby 21/04/2022

SA Michie 22/04/2022

AJ Bindon 22/04/2022

HM Jones 22/04/2022

DD Mott 22/04/2022

LR Dean 22/04/2022

A Drage 23/04/2022

PR Loone 24/04/2022

B Fenwick 24/04/2022

A 26/04/2022

JD Amey 26/04/2022

DP Shannon 26/04/2022

OE De Jong 27/04/2022

K Nawa 27/04/2022

KLL Vandersee 29/04/2022

JK Chum 29/04/2022

MJ Hentschke 30/04/2022

S Elfar 30/04/2022

L Rigg 30/04/2022

TP Morgan 1/05/2022

C Noye 2/05/2022

J Lea 2/05/2022

AJ Marquez 2/05/2022

CA Custodio 3/05/2022

KP Riley 3/05/2022

A Hannaford 3/05/2022

J Walker 5/05/2022

GA Stoddart 5/05/2022

S Aneja 6/05/2022

KE Weldon 6/05/2022

SR Stead 6/05/2022

B Keep 7/05/2022

M George-Lightbown 7/05/2022

A Thomson 7/05/2022

E McCoullough 7/05/2022

J Madsen 8/05/2022

C Randive 9/05/2022

A Adam 9/05/2022

JA Skelly 10/05/2022

J Frend 12/05/2022

R Quinn 13/05/2022

P Johnson 14/05/2022

J Johnson 14/05/2022

J Watts 15/05/2022

C Gibson 15/05/2022

L Parker 15/05/2022

S Jafari 17/05/2022

G Cologni 17/05/2022

TA Burgess 18/05/2022

RM Onley 19/05/2022

R Chamberlain 19/05/2022

AJ Schiemer 19/05/2022

DA Walker 20/05/2022

N Evans 20/05/2022

T Houtman 21/05/2022

M Cairns 21/05/2022

FI Samat 22/05/2022

U Gupta 23/05/2022

KJ Thole 23/05/2022

AJJ Buchan 25/05/2022

M Small 26/05/2022

LG Charker-Pulle 26/05/2022

VR Pisani 26/05/2022

K Bolton 26/05/2022

CJ Ferrari 26/05/2022

PL Hofmann 28/05/2022

M Spencer 28/05/2022

MJ Ferraretto 30/05/2022

E Franklin 31/05/2022

SC Miranda 1/06/2022

AE Crevola 2/06/2022

LM Hanby 2/06/2022

M Laurent 3/06/2022

F Johnstone 3/06/2022

MH Napthali 3/06/2022

V Hoad 4/06/2022

H Cai 4/06/2022

A Rich 6/06/2022

M Graham 7/06/2022

S Tighe 7/06/2022

R Mccarthy 8/06/2022

A Entwisle 8/06/2022

S Best 10/06/2022

RL Robertson 11/06/2022

JT Mauger 11/06/2022

P Frame 12/06/2022

DI Harris 12/06/2022

M Cox 13/06/2022

J Muller 13/06/2022

AD Young 14/06/2022

A Smith 14/06/2022

H Bosley 15/06/2022

PL Roome 15/06/2022

MP Hope 15/06/2022

A Fowler 16/06/2022

MA Peterson 16/06/2022

G Sharma 16/06/2022

J Trewin 17/06/2022

D Kirby 17/06/2022

CR Spencer-Scarr 17/06/2022

C Edwards 18/06/2022

D Pedlar 18/06/2022

S Zou 18/06/2022

K Gagguturu 19/06/2022

MJ Hawke 19/06/2022

J O'Donohue 19/06/2022

MR Berry 19/06/2022

JW Ludwig 20/06/2022

M Bellert 20/06/2022

B Griggs 21/06/2022

DR King 21/06/2022

CM Moran 22/06/2022

S Edmunds 22/06/2022

K Clifton 22/06/2022

SJ Johnson 23/06/2022

M Monyok 23/06/2022

AM Swart 23/06/2022

M Maddocks 23/06/2022

KT Or 23/06/2022

J Hassall 24/06/2022

KC Leggett 24/06/2022

JJ Hodges 25/06/2022

J Henson Gallardo 25/06/2022

DT Carter 26/06/2022

N Schuster 26/06/2022

LC Doyle 27/06/2022

NM Trimmer 28/06/2022

RI Squire 29/06/2022

PA Weymouth 29/06/2022

JA Allport 29/06/2022

AG D'amico 30/06/2022

JW Hamilton 30/06/2022

J Roberts 30/06/2022

3

2021–2022 2970 2945 2951 2960

2020–2021 2911 2902 2930 2947

2019–2020 2926 2895 2913 2896

2018–2019 2932 2943 2950 2922

2017–2018 2852 2886 2897 2920

Weight

2021–2022 161 156 154 152 2020–2021 170 169 166 164 2019–2020 200 185 182 177 2018–2019 208 204 203 195 2017–2018 208 206 211 214

2021–2022

2021–2022 3299 3268 3268 3274 2020–2021 3252 3243 3266 3288 2019–2020 3306 3255 3270 3247 2018–2019 3328 3330 3335 3297 2017–2018 3264 3289 3304 3329

Recreational Aviation Australia Limited

ABN 40 070 931 645

For the Year Ended 30 June 2022

Contents

30 June 2022

Financial Statements 24

Director’s Report 25

Statement of Comprehensive income 27 Statement of Financial Position 28

Statement of Changes in Equity 29 Statement of Cash Flows 30

Notes to the Financial Statements 31

Directors’ Declaration 40

Auditor’s Independence Declaration 41 Independent Auditor’s Report 42

The Directors present their report on Recreational Aviation Australia Limited for the financial year ended 30 June 2022.

The following persons held office as directors of Recreational Aviation Australia Limited during the financial year:

Michael Monck (Chair)

Trevor Bange

Luke Bayly

Rodney Birrell (ceased 6 November 2021)

Eugene Reid

Barry Windle

Andrew Scheiffers

Simon Ozanne (elected 6 November 2021)

The principal activity of the Company during the year was to administer light aircraft in Australia. The Company has delegated functions from the Civil Aviation Safety Authority for the control and management of light aircraft registrations and pilot training and certification. The Company is responsible for setting standards for light aircraft maintenance and the training of pilots.

There were no significant changes to the operations of the Company during the year ended 30 June 202 2. The company put in place several COVID safe measures to protect staff and allow the business to meet all of its day to day requirements.

No significant changes in the nature of these activities occurred during the year.

No matter or circumstance has arisen since 30 June 202 2 that has significantly affected, or may significantly affect: (a) the Company's operations in future financial years, or (b) the results of those operations in future financial years, or (c) the Company's state of affairs in future financial years.

The Company will continue the same operations as described in the principal activity section in future years. The Company will commence the administration of larger aircraft within the next year under CASR Part149. This will add to the existing administrat ion functions performed.

A respected organisation that continues to advance safe aviation and encourage training across our industry. We do this by creating opportunities for a wide range of aviation activities, through industry leadership, fostering a diverse community, and innovating across light aviation.

YEAR ENDED 30 JUNE 2022

The following table sets out the number of meetings of the directors attended by each director.

Board, eligible to attend Board attended Committee Meetings Total

Michael Monck 6 6

Barry Windle 5 4 9

Eugene Reid 5 5

Trevor Bange 6 6

Andrew Scheiffers 6 6

Simon Ozanne (Commenced 6/11/2021) 4 4

Luke Bayly 6 4 10

Rodney Birrell (Ceased 6/11/2021) 1 1

In the event of the Company being wound up, ordinary members are required to contribute a maximum of $1 each. Honorary members are not required to contribute.

The total amount that members of the company are liable to contribute if the company is wound up is $9, 090, based on 9,090 current ordinary members.

The total comprehensive surplus for the year amounted to $564,875 (2021: $123,512).

Total comprehensive surplus was achieved through a revaluation of property which otherwise would have resulted in a deficit of ($75,011). This revaluation also increased Asset revaluation reserve substantially from the previous financial year

Signed in accordance with a resolution of the Board.

Michael Monck Director

Dated: Andrew Scheiffers Director

Dated:

STATEMENT OF COMPREHENSIVE

FOR THE YEAR ENDED 30 JUNE 2022 2022 2021 Note $ $

Revenue 2 3,018,831 2,990,709

Employee benefits expense 1,638,031 1,486,665 Depreciation and amortisation expense 156,648 89,584 Printing, publications and merchandise 233,251 218,326 Insurance 610,689 543,915 Other expenses 3 455,223 528,707

Total expenses 3,093,842 2,867,197

Surplus/(deficit) before income tax expense (75,011) 123,512 Income tax expense -Surplus/(deficit) for the year (75,011) 123,512

Other comprehensive income Gain on revaluation of buildings 639,886Total comprehensive surplus for the year 564,875 123,512

The accompanying notes form part of the financial statements

2022 2021

ASSETS Note $ $

CURRENT ASSETS

Cash and cash equivalents 4 1,772,495 1,609,481 Trade and other receivables 1,595 28,358 Inventories 5 43,042 43,953 Other current assets 6 23,277 21,615

TOTAL CURRENT ASSETS 1,840,409 1,703,407

Property, plant and equipment 7 1,416,013 811,718 Intangible assets 8 191,320 255,349

TOTAL NON-CURRENT ASSETS 1,607,333 1,067,067

TOTAL ASSETS 3,447,742 2,770,474

CURRENT LIABILITIES

Trade and other payables 9 145,323 126,308 Short-term provisions 10 260,094 244,701 Income in advance 11 1,573,693 1,505,011

TOTAL CURRENT LIABILITIES 1,979,110 1,876,020

NON-CURRENT LIABILITIES

Long-term provisions 10 18,456 9,153 TOTAL NON-CURRENT LIABILITIES 18,456 9,153

TOTAL LIABILITIES 1,997,566 1,885,173

NET ASSETS 1,450,176 885,301

EQUITY

Reserves 987,134 347,248 Retained Earnings 463,042 538,053

TOTAL EQUITY 1,450,176 885,301

The accompanying notes form part of the financial statements

Retained earnings Asset revaluation reserve Total

$ $ $

Balance at 30 June 2020 414,541 347,248 761,789

Surplus attributable to members 123,512 - 123,512

Balance at 30 June 2021 538,053 347,248 885,301

Deficit attributable to members (75,011) 639,886 564,875 Balance at 30 June 2022 463,042 987,134 1,450,176

The accompanying notes form part of the financial statements

2022 2021 Note $ $

Receipts from members and others 3,112,249 3,043,451

Interest received 2,027 3,492 Payments to suppliers and employees (2,894,234) (2,777,293)

Net cash provided by (used in) operating activities 220,042 269,650

Purchase of property, plant and equipment (13,003) (40,212)

Purchase of intangibles (44,025) (29,450) Net cash provided used in investing activities (57,028) (69,662)

Net increase in cash and cash equivalents held 163,014 199,988

Cash and cash equivalents at beginning of year 1,609,481 1,409,493 Cash and cash equivalents at end of year 4 1,772,495 1,609,481

The accompanying notes form part of the financial statements

The financial statements cover Recreational Aviation Australia Limited as an individual entity. Recreational Aviation Australia Limited is a not-for-profit company limited by guarantee under the Corporations Act 2001.

The principal accounting policies adopted in the preparation of the financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

The entity has adopted all of the new or amended Accounting Standards and Interpretations issued by the Australian Accounting Standards Board ('AASB') that are mandatory for the current reporting period.

Any new or amended Accounting Standards or Interpretations that are not yet mandatory have not been early adopted.

The adoption of these Accounting Standards and Interpretations did not have any significant impact on the financial performance or position of the company

The following Accounting Standards and Interpretations are most relevant to the company:

The company has adopted the revised Conceptual Framework from 1 July 2021. The Conceptual Framework contains new definition and recognition criteria as well as new guidance on measurement that affects several Accounting Standards, but it has not had a material impact on the company’s financial statements.

AASB 1060 General Purpose Financial Statements - Simplified Disclosures for For-Profit and Not-for- Profit Tier 2 Entities

The company has adopted AASB 1060 from 1 July 2021. The standard provides a new Tier 2 reporting framework with simplified disclosures that are based on the requirements of IFRS for SMEs. As a result, there is increased disclosure in these financial statements for related parties.

These general purpose financial statements have been prepared in accordance with the Australian Accounting Standards - Simplified Disclosures issued by the Australian Accounting Standards Board ('AASB'), and the Corporations Act 2001, as appropriate for not-for-profit oriented entities.

The financial statements have been prepared under the historical cost convention.

As the company is a charitable institution in terms of subsection 50 -5 of the Income Tax Assessment Act 1997, as amended, it is exempt from paying income tax.

Assets and liabilities are presented in the statement of financial position based on current and non -current classification.

An asset is classified as current when: it is either expected to be realised or intended to be sold or consumed in the company's normal operating cycle; it is held primarily for the purp ose of trading; it is expected to be realised within 12 months after the reporting period; or the asset is cash or cash equivalent unless restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period. All o ther assets are classified as non-current.

A liability is classified as current when: it is either expected to be settled in the company's normal operating cycle; it is held primarily for the purpose o f trading; it is due to be settled within 12 months after the reporting period; or there is no unconditional right to defer the settlement of the liability for at least 12 months after the reporting period. All other liabilities are classified as non -current.

Non-financial assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable amount.

Recoverable amount is the higher of an asset's fair value less costs of disposal and value -in-use. The value-inuse is the present value of the estimated future cash flows relating to the asset usin g a pre-tax discount rate specific to the asset or cash-generating unit to which the asset belongs. Assets that do not have independent cash flows are grouped together to form a cash-generating unit.

When an asset or liability, financial or non-financial, is measured at fair value for recognition or disclosure purposes, the fair value is based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date; and assumes that the transaction will take place either: in the principal market; or in the absence of a principal market, in the most advantageous market.

Fair value is measured using the assumptions that market participants would use when pricing the asset or liability, assuming they act in their economic best interests. For non -financial assets, the fair value measurement is based on its highest and best use. Valuation techniques that are appropriate in the circumstances and for which sufficient data are available to measure fair value, are used, maximising the use of relevant observable inputs and minimising the use of unobservable inputs.

Revenues, expenses and assets are recognised net of the amount of associated GST, unless the GST incurred is not recoverable from the tax authority. In this case it is recognised as part of the cost of the acquisition of the asset or as part of the expense.

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST recoverable from, or payable to, the tax authority is included in other receivables or other payables in the statement of financial position.

Cash flows are presented on a gross basis. The GST components of cash flows arising from investing or financing activities which are recoverable from, or payable to the tax authority, are presented as operating cash flows.

Commitments and contingencies are disclosed net of the amount of GST recoverable from, or payable to, the tax authority.

The preparation of the financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts in the financial statements. Management continually evaluates its judgements and estimates in relation to assets, liabilities, contingent liabilities, revenue and expenses. Management bases its judgements, estimates and assumptions on historical exper ience and on other various factors, including expectations of future events, management believes to be reasonable under the circumstances. The resulting accounting judgements and estimates will seldom equal the related actual results. The judgements, estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities (refer to the respective notes) within the next financial year are discussed below.

Coronavirus (COVID-19) pandemic

(continued)

Judgement has been exercised in considering the impacts that the Coronavirus (COVID -19) pandemic has had, or may have, on the company based on known information. This consideration extends to the nature of t he products and services offered, customers, supply chain, staffing and geographic regions in which the company operates. Other than as addressed in specific notes, there does not currently appear to be either any significant impact upon the financial statements or any significant uncertainties with respect to events or conditions which may impact the company unfavourably as at the reporting date or subsequently as a result of the Coronavirus (COVID-19) pandemic.

The company determines the estimated useful lives and related depreciation and amortisation charges for its property, plant and equipment and finite life intangible assets. The useful lives could change significantly as a result of technical innovations or some other event. The depreciation and amortisation charge will increase where the useful lives are less than previously estimated lives, or technically obsolete or non -strategic assets that have been abandoned or sold will be written off or written down.

The Company assesses impairment at each reporting date by evaluating conditions specific to the company that may lead to impairment of assets. Should an impairment indicator exist, the determination of the recoverable amount of the asset may require incorporation of a number of key estimates. No impairment indicators were present as at year end.

The liability for employee benefits expected to be settled more than 12 months from the reporting date are recognised and measured at the present value of the estimated future cash flows to be made in respect of all employees at the reporting date. In determining the present value of the liability, estimates of attrition rates and pay increases through promotion and inflation h ave been taken into account.

2022 2021 $ $

Member receipts 2,170,620 2,190,521

Advertising 29,717 19,051

Aircraft registration 566,863 530,477 ASIC fees 800 1,080

Operating grant 191,497 173,088

Other 16,071 32,000

Sale of merchandises 41,236 41,000

Interest income 2,027 3,492 3,018,831 2,990,709

Revenue from contracts with customers

Revenue is recognised at an amount that reflects the consideration to which the company is expected to be entitled in exchange for transferring goods or services to a customer. For each contract with a customer, the company: identifies the contract with a customer; identifies the performance obligations in the contract; determines the transaction price which takes into account estimates of variable consideration and the time value of money; allocates the transaction price to the separate performance obligat ions on the basis of the relative stand-alone selling price of each distinct good or service to be delivered; and recognises revenue when or as each performance obligation is satisfied in a manner that depicts the transfer to the customer of the goods or services promised.

Variable consideration within the transaction price, if any, reflects concessions provided to the customer such as discounts, rebates and refunds, any potential bonuses receivable from the customer and any other contingent events. Such estimates are determined using either the 'expected value' or 'most likely amount' method. The measurement of variable consideration is subject to a constraining principle whereby revenue will only be recognised to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur. The measurement constraint continues until the uncertainty associated with the variable consideration is subsequently resolved. Amounts received that are subject to the constraining principle are recognised as a refund liability.

Revenue from sale of goods is recognised when received or receivable.

Grant revenue is recognised in profit or loss when the company satisfies the performance obligations s tated within the funding agreements.

Interest revenue is recognised as interest accrues using the effective interest method. This is a method of calculating the amortised cost of a financial asset and allocating the interest income over the relev ant period using the effective interest rate, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to the net carrying amount of the financial asset.

The Company’s membership subscription runs for periods of either 12 months, 24 months, 36 months or 60 months. The subscription is recognised over the period the membership relates to.

Other revenue is recognised when it is received or when the right t o receive payment is established.

2022 2021 $ $

Accommodation, meetings and travel 83,545 65,326

Advertising and promotions 18,265 53,715 Bank charges 31,151 29,515 Computer system 34,658 38,289

Legal expenses - 17,149 Office expenses 138,533 129,749 Other professional fees 82,611 53,017

Postage and PO Box 10,570 22,111

Scholarships and donations 55,890 114,157

Loss on disposal of assets - 5,679 455,223 528,707

2022 2021 $ $

Cash on hand 500 500

Cash at bank 1,771,995 1,608,981 1,772,495 1,609,481

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2022

Cash and cash equivalents includes cash on hand, deposits held at call with financial institutions, other shortterm, highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

2022 2021 $ $

Note 5: Inventories

Merchandise 43,042 43,953

Inventories are measured at the lower of cost and net realisable value. Cost of inventory is determined using the weighted average costs basis and is net of any rebates and discounts received.

2022 2021 $ $

Note 6: Other current assets

Prepayments 23,277 21,615

2022 2021 $ $

Note 7: Property, plant and equipment

Building - at fair value 1,370,000 820,000 Accumulated depreciation - (69,386) 1,370,000 750,614

Furniture and fittings - at cost 97,560 97,560 Accumulated depreciation (74,892) (71,356) 22,668 26,204

Office equipment - at cost 103,730 100,377 Accumulated depreciation (99,509) (87,866) 4,221 12,511

Computer equipment - at cost 82,339 76,120 Accumulated depreciation (63,215) (53,731) 19,124 22,389

Total Property, plant and equipment 1,416,013 811,718

Note 7: Property, plant and equipment (continued)

Movements in Carrying Amounts

Movement in the carrying amounts for each class of property, plant and equipment between the beginning and the end of the current financial year:

Buildings Furniture and Fittings Office Equipment Computer Equipment Total $ $ $ $ $

Balance at 30 June 2020 771,114 9,825 21,168 18,409 820,516 Additions - 24,438 1,816 13,958 40,212 Disposals - (4,821) (163) (697) (5,681) Depreciation expense (20,500) (3,238) (10,310) (9,281) (43,329)

Balance at 30 June 2021 750,614 26,204 12,511 22,389 811,718

Additions - - 3,352 9,651 13,003 Revaluation 639,886-Depreciation expense (20,500) (3,536) (11,642) (12,916) (48,594)

Balance at 30 June 2022 1,370,000 22,668 4,221 19,124 1,416,013

The building was revalued based on a valuation by Egan National Valuers as at 5 August 2022. The valuation has been determined on the basis current market value assuming vacant possession. Market value was determined by reference to comparable sales.

Accounting policy Plant and equipment is stated at historical cost less accumulated depreciation and impairment. Historical cost includes expenditure that is directly attributable to the acquisition of the items. Buildings are recorded at fair value and subject to periodical inde pendent valuations.

Depreciation is calculated on a straight-line basis to write off the net cost of each item of property, plant and equipment (excluding land) over their expected useful lives as follows:

Class of fixed asset Useful life Depreciation rate Buildings 40 years 2.5%

Furniture and fittings 5 to 10 years 10% - 20% Office equipment 3 to 10 years 10% - 33% Computer equipment 3 years 33%

The residual values, useful lives and depreciation methods are reviewed, and adjusted if appropriate, at each reporting date.

An item of property, plant and equipment is derecognised upon disposal or when there is no future economic benefit to the company. Gains and losses between the carrying amount and the disposal proceeds are taken to profit or loss.

Note 8: Intangible assets

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 JUNE 2022

2022 2021 $ $

Modernisation project - software 555,993 511,968 Accumulated amortisation (364,673) (256,619) 191,320 255,349

Intangible assets relate to developed software used in the provision of services to members. The costs capitalised relate to development costs only and exclude the costs of research. Developed software is amortised on a straight line basis over 10 years. Amortisation methods, assets’ useful lives and residual values are reviewed at each reporting date and adjusted if appropriate.

2022 2021 $ $

Note 9:

Trade payables 52,003 59,511 Accrued expenses 28,518 15,326

GST and PAYG liabilities 50,830 38,304 Other payables 13,972 13,167 145,323 126,308

These amounts represent liabilities for goods and services provided to the company prior to the end of the financial year and which are unpaid. Due to their short -term nature they are measured at amortised cost and are not discounted. The amounts are unsecured a nd are usually paid within 30 days of recognition.

2022 2021 $ $

Note 10:

CURRENT

Provision for annual leave 133,129 139,346

Provision for long service leave 126,965 105,355 260,094 244,701

NON-CURRENT

Provision for long service leave 18,456 9,153 18,456 9,153 278,550 253,854

Short-term employee benefits

Liabilities for wages and salaries, including non -monetary benefits, annual leave and long service leave expected to be settled wholly within 12 months of the reporting date are measured at the amounts expected to be paid when the liabilities are settled.

Other long-term employee benefits

The liability for annual leave and long service leave not expected to be settled within 12 months of the reporting date are measured at the present value of expected future payments to be made in respect of services provided by employees up to the reporting date using the projected unit credit method. Consideration is given to expected future wage and salary levels, experience of employee departures and periods of service. Expected future payments are discounted using market yiel ds at the reporting date on national government bonds with terms to maturity and currency that match, as closely as possible, the estimated future cash outflows.

Defined contribution superannuation expense

Contributions to defined contribution superannuat ion plans are expensed in the period in which they are incurred.

2022 2021 $ $

Note

Unearned income 1,573,693 1,505,011

The Company maintains a nil refund policy on subscriptions except in exceptional circumstances or as required by law. Although this is the case, the AASB requires subscriptions for services yet to be delivered to be shown in the Statement of Financial Position as a Current Liability when in fact, this income will be realised as revenue over the subscription period/s.

During the financial year the following fees were paid or payable for services provided by RSM Australia, the auditor of the company

Audit services 16,000 14,500