5 minute read

Retirement Planning vs Post Retirement Investing

from SBI Second Innings Sept 2019 issue carries Life and Career of Prof Dr Chowdari Prasad in 11-12 pages

Very often a question is asked “Does retirement mean only an attempt to meet expenses and manage cash outflow?” Traditionally, most senior citizens only aspire to have retirement plans that process to manage expenses and contingencies which is nothing but capital protection as the centrepiece of an investment plan. However, they should also aim to grow their money in the safest manner. Let’s look at how we can enable this opportunity. Over the years age-based investing has become an efficient way for financial services companies to place investments options. We have a large base of Retirees & Pensioners as our Clients with a long standing banking relationships. The foundation of our Wealth Proposition is our Asset Allocation Model which is pillared on matching Client Risk Rating (CRR) with Product Risk Rating (PRR). With the evolution of Wealth Management Business Unit we have realised a key distinction between Post Retirement Planning & Post- Retirement Investment. The average age profile of our clientele is 50-55+; but our Risk profiling tells us another story. Approximately 47% of our Clients fall in the Risk Profile of Aggressive to Very Aggressive. We will first showcase Risk Profiling and the role it plays in Asset Allocation and then address the myths surrounding age-based investing. Client Risk Profiling Risk profiling is at the core of Wealth Management business. Risk profiling helps to understand how much risk an individual investor can take in order to achieve certain financial goals. It also enables the Wealth Managers to better understand and further advice the Investor based on his/her financial requirements. Investor’s goals, time horizon, liquidity needs, and risk aversion, are the key elements assessed by a Wealth Manager while suggesting suitable investment options and/or building efficient long-term investment strategies for investors. Risk Profiling is based on two pillars of Wealth Management i.e. “Risk & Return”. It is a method to determine the optimum level of risk an investor is willing to take after considering his/ her Risk Willingness (based on his/her Goal), Risk Appetite and Risk Tolerance.

Client Risk Profiling

Advertisement

Risk Willingness : A study of the Investors Financial Goals and the Time Horizon to achieve the desired returns in future

Risk Appetite: The degree of financial risk one can afford to take to achieve your goals. It is determined by the Investors current financial situation such as his/her earning stability, number of dependents, net-worth & cashflow situation.

Risk Tolerance: The degree of risk an investor is actually comfortable with. This is a subjective & behavioural aspect of an investor and can be judged by historical track records and investment patterns.

Asset Allocation Model of SBI Wealth is pillared on Client Risk Rating and Product Risk Rating Processes. At the time of On-Boarding a Wealth Client we conduct a Client Risk Rating (CRR) process, through our Risk Profiling Questionnaire. The questionnaire addresses 3 key areas namely, Financial Profiling, Investment Knowledge Profiling and Risk Profiling. On the basis of responses received, a risk profile score is generated. Client is then assigned a Risk Rating in-line with the Score generated.

Standard Process for Risk profiling

Define Goal

Fill Out Risk Profile Questionnaire

Score Questionnaire Determine Asset Allocation Implementation

Similarly, we have assigned Product Risk Rating (PRR) for all Products we offer to our Clients. This rating is based on Risk Return Profile of the Product.

Asset Class/Category PRR Liquid Funds 1 Gold 2 Large Cap Fund 3 Midcap Fund 4

Asset Class/Category PRR Banking & PSU Fund 2 Corporate Bond Fund 2 Dynamic Bond Fund 3 Money Market Fund 1 Multicap Fund 3 Credit Risk Fund 5 Portfolio Management Services 5 Ultra Short Term Debt Fund 1

Alternative Investment Funds 6

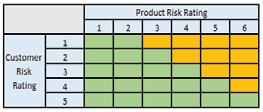

Curriculum Once we have assessed the Client Risk Rating, we present Clients with suitable Investment options that match his/her Risk Profile. For Example, a Client with a 3 Risk Rating i.e. Moderate, can be referred products which falls in the PRR category up to 4 only. The thumb-rule for approval is, Products with Ratings 1+CRR will be auto-approved for Clients to initiate investment. Our CRR-PRR model has checks in place and any mismatch in the same will be highlighted by our Risk Team.

PERMIT TRANSACTION

BLOCK TRANSACTION

Myths : Age-based Investing Traditional investment prudence suggests that age and risk appetite are inversely related. But the experience we have gathered has broken the myths of age based investing.

Myth #1: Your age is a good indicator of your risk tolerance.

Age-based investing takes your age as a good proxy for your risk tolerance, and hence your portfolio can shift over time between equities, fixed-income and cash based on your age. But we believe that beyond capital protection, there should be an opportunity to be relatively aggressive to grow one’s money.

Myth #2: All individuals of the same age act in a similar way.

Like age think alike? Not necessarily. How you perceive risk outside of a market context may tell you a lot about how you will perceive risk in the markets

Myth #3: Stick to risk free investment Products.

This is not true. Portfolio structure should be based on an investor’s risk tolerance and factor in three main considerations: risk willingness (based on his/her Goal), risk appetite and risk tolerance. Individuals have an innate risk tolerance, and their risk perception may change over time.

To conclude, we would like to draw a distinction between Retirement Planning as means to an end and Post – Retirement Investing. While the former is an accumulation plan, the latter is a capital growth plan. The asset allocation of each life-stage differs. The Retirement Corpus of a Retiree should be bifurcated into 1) Investment in conservative cash and money market options a proxy to providing income flow for lifestyle maintenance and 2) the surplus – which should be invested as growth capital. Retirees can look for a conservative asset allocation for the former while looking for moderate to aggressive asset allocation for the excess capital to plan for inheritance, luxury, etc.

SBI WEALTH ASSET ALLOCATION MODEL

We advise Retirees/Pensioners to remain cognizant of their Risk Profile Rating and ensure adherence to the same by all financial intermediaries while investing. Clients should review their Risk Rating at least once a year and proactively keep their Wealth Managers updated of any change in their Risk Rating on account of shift in goals or appetite.

SBI Wealth wishes you all a happy investing and happy times ahead!!!

Shri Giridhara Kini CGM Wealth Wealth Management Business Unit State Bank of India