PIA National to Congress: Reject the Big Beautiful Bill’s AI Moratorium » 7

GEICO’s Struggles: Terminates 30,000 Employees » 17

Tort Reform Part 1: The High Cost to the Economy » 24

PIA National to Congress: Reject the Big Beautiful Bill’s AI Moratorium » 7

GEICO’s Struggles: Terminates 30,000 Employees » 17

Tort Reform Part 1: The High Cost to the Economy » 24

Did you know that PIA’s company council, The PIA Partnership, has conducted nationwide research about the insurance buying preferences of small business owners?

The research is encouraging because it found that small business owners strongly prefer independent insurance agents as they make choices in today’s online world.

However, the results also serve as a wake-up call that agents must take steps to continue to demonstrate their value and also be more engaged online.

PIA and the companies belonging to The PIA Partnership have created a public website that helps agents understand PIA’s findings.

PIA members also have access to a private website containing a series of strategies and tools to help them stay ahead of online competition in commercial lines.

To access the newest PIA Partnership project, Small Business Insurance & The Internet — The Voice of the Commercial Lines Customer.

If you are not a PIA member and want to access all of the tools available through this program, contact us for a membership application or visit us online at www.pianational.org/header-utility-items/join/Join-PIA

N. Washington St., Alexandria, VA 22314-2353 www.pianet.com | membership@pianet.org | (703) 836-9340

PIA National to Congress: Reject the Big Beautiful Bill’s AI Moratorium | 7

PIA National has sent a letter to the leadership of the U.S. Senate urging that body to remove language in the One Big Beautiful Bill that will place a 10-year moratorium on any state-level legislative or regulatory action relating to AI.

NEXT Insurance Survey of Small Business: The Biggest Concerns — Inflation & Labor | 9

To get an idea of what’s bothering small business, NEXT Insurance did a survey.

The Sign Post Ahead: Drivers in a Twilight Zone of Insurance Frustration | 10

In the old Twilight Zone TV series, creator and host, Rod Serling used to warn viewers that the sign post ahead said you are now entering, “The Twilight Zone.”

PIA National’s Summer School: The Summer Agency Leadership Series PIA National’s Summer School — The Summer Agency Leadership Series | 11

PIA National has announced its Summer Agency Leadership Series. It is a dynamic three-part program designed to inspire and empower insurance professionals.

GEICO’s Struggles: Terminates 30,000 Employees | 13

Though Berkshire Hathaway Vice Chairman of Insurance Operations Ajit Jain won’t give a time frame for the layoffs, GEICO has cut over 30,000 jobs in the recent past to turn the company’s financial picture around.

FEMA: Big Changes Coming? | 14

President Donald Trump has made no secret that he’s not a big fan of the Federal Emergency Management System (FEMA).

Tort Reform Part 1:

The High Cost to the Economy | 24

The financial analysts of the Perryman Group say tort costs in the U.S. are not just excessive, they’re horribly excessive. And those tort costs are putting a huge strain on the U.S. economy and the insurance industry.

Tort Reform Part 2: Nuclear Verdicts | 26

The research company, Marathon Strategies did a report on nuclear verdicts called, Corporate Verdicts Go Thermonuclear 2025 Edition. And they did — indeed — go thermonuclear.

Tort Reform Part 3:

The Triple I Takes Action | 27

PIA Summer Leadership Series | 17

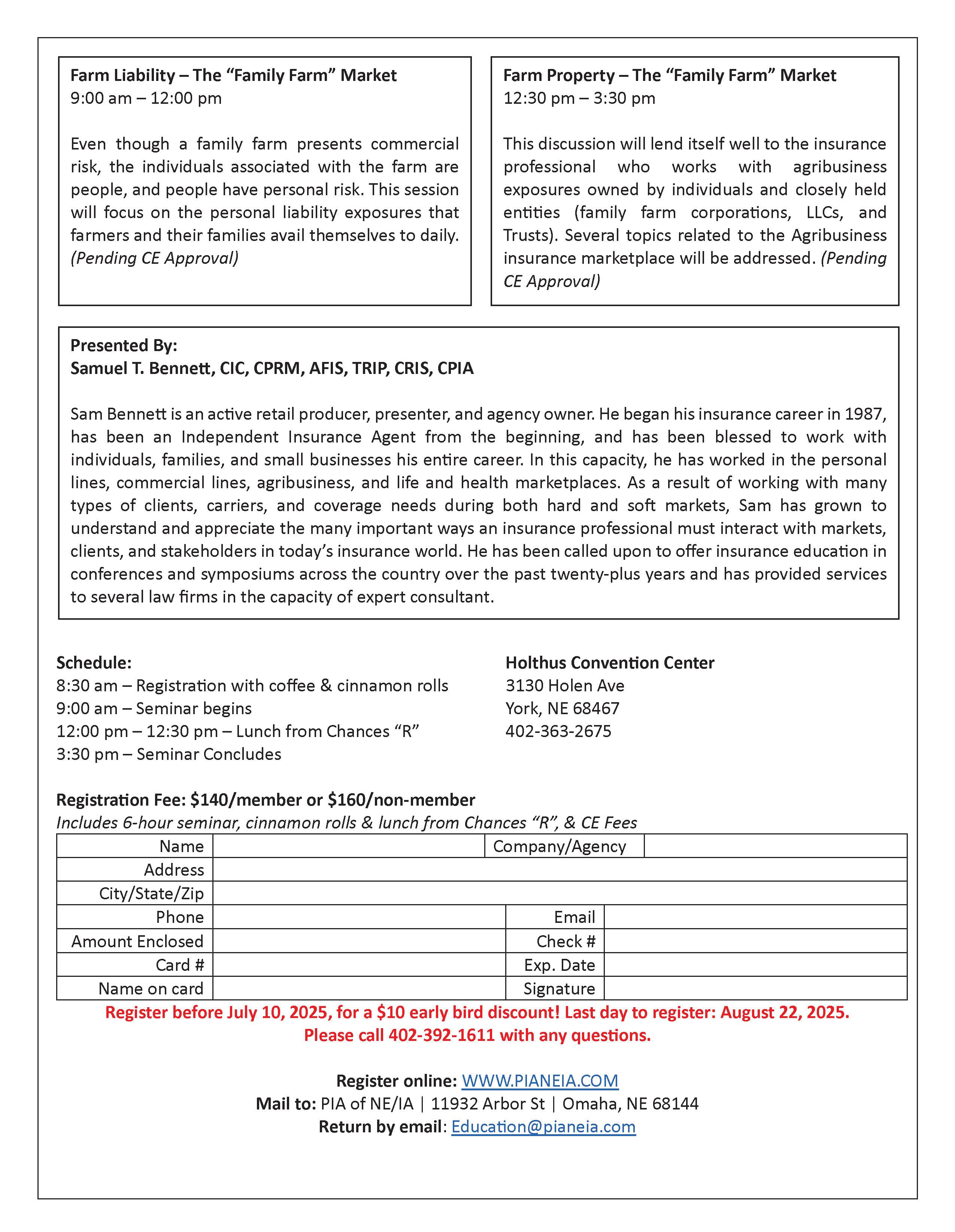

Upcoming Events Calendar 2025 | 18 2025 Rural Town & Agents Seminar | 22

While much complaining goes on about tort reform and nuclear verdicts, the Insurance Information Institute (Triple-I) has decided to take action. Contact Lindsey to place an ad at 402-392-1611.

PIA Association for Nebraska and Iowa is committed to focusing its resources in ways that cast the most favorable light on its constituents. We are dedicated to providing the type of programs, the level of advocacy, and the dissemination of information that best supports the perpetuation and prosperity of our members. We pledge to always conduct ourselves in a manner that enhances the public image of PIA and adds real value to our members.

Professional Insurance Agents NE IA

Attention: Editorial Main Street Industry News 11932 Arbor Street, Ste. 100 Omaha, NE 68144

Email: office@pianeia.com Ph: 402-392-1611 www.pianeia.com

The PIA NE IA, Main Street Industry News reserves the right to edit your comments to fit space available. We respectfully ask that you keep the comments to 200-300 words. Cathy Klasi, Executive Director (402) 392-1611

Ad

(402) 392-1611

PIA National has sent a letter to the leadership of the U.S. Senate urging that body to remove language in the One Big Beautiful Bill that will place a 10-year moratorium on any state-level legislative or regulatory action relating to AI.

In the June 16th letter PIA National CEO Mike Skiados told senators the language of the One Big Beautiful Bill not only applies to the systems doing advanced learning but it also applies to a large group of processes that use analytical tools and software.

These are tools insurers and agents are already using for underwriting and claims.

“This overly broad definition could prevent state legislators and regulators from conducting appropriate oversight of insurers, whether the risk is related to AI or not,” Skiados said in an interview with Insurance Business America.

“It would also increase costs and regulatory uncertainty for the targeted entities and states and potentially delay the implementation of needed consumer protections.”

On another front, Skiados said the federal government is not allowed to regulate anything in insurance.

“The business of insurance has been successfully regulated at the state level for over a century, and the McCarran-Ferguson Act of 1945 codified the longstanding exemption of the insurance industry from most federal regulation,” Skiados said. “The local expertise of state insurance regulators has proven

beneficial for consumers, insurers, and the industry at large, thanks to their ability to quickly respond to emerging insurance risks associated with changing technologies, including artificial intelligence.”

The language in the bill comes from a push by Amazon, Google, Microsoft, and Meta (Facebook, Instagram, WhatsApp and others.). They want the federal government to come up with a unified approach to regulate AI. The tech heavyweights worry rules unique to the individual states could stifle innovation and slow down, or stop, competition with China.

Cory Weeks is PIA National’s manager of government relations and acts as the association’s press secretary. He said definite, and enforceable rules, need to be in place or insurers might stop investing in AI technology. That would leave consumers and businesses without safeguards when AI is applied to insurance rates, underwriting and claims.

“The risks can be significant for both the consumer and insurer,” Weeks told Insurance Business America. “There is no comprehensive federal legislation regulating its use, and it’s unclear whether future federal actions would even apply to insurance.”

On the insurance side of things, Weeks said AI is incredibly helpful to consumers and business. It has made huge improvements in underwriting, claims analysis and processing, and for customer service. With that said, Weeks noted that this technology presents a big

challenge for the independent insurance agents of the PIA and for insurance agents everywhere.

“Agents are consumers’ most valuable resource for navigating a complex insurance market, and while AI has enabled agents to better serve customers, it has also given rise to direct-toconsumer platforms which don’t always provide enough guidance,” Weeks said.

Whatever regulations are settled upon, Weeks said they need to make sure AI tools promote transparency that provides safe, accountable and fair insurance practices.

In the letter, Skiados told the leadership in the Senate the National Association of Insurance

Commissioners (NAIC) adopted a Model Bulletin in 2023 that requires insurers to implement AI governance programs in accordance with all existing state and federal laws.

It also offers a template by which insurance commissioners can communicate their expectations to their domiciliary carriers. As of May 2025, nearly 30 states had already adopted the NAIC’s model bulletin on the use of artificial intelligence systems by insurers.

Sources: PIA National and Insurance Business America

To get an idea of what’s bothering small business, NEXT Insurance did a survey. The biggest stressor to 62% of those surveyed is inflation. It’s followed by 30% saying the biggest concern is labor shortages.

Chris Rhodes is the president and chief insurance officer at NEXT Insurance. He said 61% of start up business worry about the cost of goods and services.

“Small business owners are demonstrating remarkable resilience amid economic headwinds,” Rhodes said. “This data underscores the importance of providing accessible, tailored insurance solutions to help these businesses navigate their specific needs and protect their operations during times of market volatility and overall uncertainty.”

He noted 92% of small business owners have insurance but just 13% say they’re ready for risk. Here’s why. Just 14% have insurance that is tailored for their specific business needs and 69% say they’re confused about coverage, how its defined, coverage limits policies, and other insurance issues.

More from the survey:

• 43% worry about consumer spending dropping off

• 47% are concerned about the rising cost of goods and services

• 37% lose sleep over changes in tax policies

• 34% worry about shortages of workers

Source: PropertyCasualty360.com

In the old Twilight Zone TV series, creator and host, Rod Serling used to warn viewers that the sign post ahead said you are now entering, “The Twilight Zone.” That’s where U.S. drivers are today when it comes to auto insurance premiums.

This not from the late Rod Serling but instead from a survey done by Guardian Service.

So far this year, 66% of auto insurance policyholders had their premiums go up and it’s happening while they try to find ways to cope with the increases. The average rate hike was $70 but 27% of those surveyed say their premiums jumped $100 to $200.

The increases have led to 85% of drivers thinking the auto insurance pricing models used by insurers are unfair. And 71% of them think insurance companies are using inflation as an excuse to raise their rates more than they need to be raised.

This has led 23% to think about canceling their current policy and go seeking cheaper pastures. That, too, is frustrating as 20% say they shopped around and couldn’t find anything cheaper with their current coverage.

To continue to afford insurance:

• 39% have completely skipped or delayed auto maintenance

• 15% have reduced driving to save on expenses

• 15% actually made the switch to a different insurer

• 10% have reduced their liability coverage

• 10% increased their deductible

• 8% even thought about selling their auto

• 7% have dropped comprehensive or collision coverage or both

Drivers turn to tech to ease premium crisis:

• 33% say they’d think about switching to usage-based insurance

• 42% would install AI-generated safety features to get discounts

• 33% would stop late-night driving and other driving habits

Source: PropertyCasualty360.com

PIA National has announced its Summer Agency Leadership Series. It is a dynamic three-part program designed to inspire and empower insurance professionals. The series is open to both members and non-members. Members are free and there is a fee for nonmembers to take the classes.

They will be held virtually in July, August and September and you can attend just one, two or all three. Each session is recorded and you will be given a recording after each session.

The three sessions brings agency owners, industry leaders, young professionals, and technology experts together to tackle the more pressing issues facing today’s independent agencies.

PIA National COO Dana Anaman said the sessions will focus on innovation, growth and leadership.

"Whether you're just starting out or a seasoned pro, these sessions offer actionable strategies and fresh perspectives to help you thrive in today’s market,” Anaman said. “Our goal is to ensure every attendee walks away with practical tools and relevant insights to drive results.”

SYNOPSIS OF THE THREE SESSIONS:

Inspiring the Next Generation of Agency Leaders — July 16, 2:00–3:00 PM ET

A panel of rising insurance agents will explore what drives them — from workplace culture and flexibility to the importance of mentorship and technology. Participants will share personal stories, challenges, and strategies for making a meaningful impact in their careers and within the industry.

Winning@Work: Creating Agencies Where Employees Want to Work — August 7, 2:00–3:00 PM ET

Agency owners will share how they’re building environments that support the development of next-generation talent. This panel will dive into best practices in fostering agency culture, employee growth, and the role of technology and mentorship. Attendees will also receive a complimentary copy of PIA’s Winning@Work Report, featuring insights from young agents nationwide.

Using AI for Effective Agency Communications Workshop — September 10, 2:00–3:30 PM ET

This hands-on session will explore how AI tools like ChatGPT and Copilot are transforming

communications in the insurance industry. From sales and social media to client interactions and data security, attendees will learn how to use AI effectively and responsibly, with practical exercises and best practices from leading agencies.

"Whether you're just starting out or a seasoned pro, these sessions offer actionable strategies and fresh perspectives to help you thrive in today’s market,” said Dana Anaman, PIA COO. “Our goal is to ensure every attendee walks away with practical tools and relevant insights to drive results.”

To register or learn more, visit https://www. pianational.org/events-webinars/pia-summerleadership-series

Though Berkshire Hathaway Vice Chairman of Insurance Operations Ajit Jain won’t give a time frame for the layoffs, GEICO has cut over 30,000 jobs in the recent past to turn the company’s financial picture around.

He said GEICO wasn’t keeping up with its insurer competition.

As a result, Jain said GEICO posted a $2.2 billion pretax underwriting result in 2025’s first quarter. That’s up 13% from the first quarter of last year. Part of the reason for the increase is the addition of a lot of new business.

Jain credited Chief Executive Officer Todd Combs with the turnaround based on a workforce reduction and an improvement in the use of technology.

“I do not want to be so arrogant to say ‘mission accomplished,’” Jain said and pointed out that GEICO is continuing to develop AI to accomplish its goals.

Source: PropertyCasualty360.com

President Donald Trump has made no secret that he’s not a big fan of the Federal Emergency Management System (FEMA). Several times Trump has stated he wants changes to the agency, a restructuring, or even doing away with it entirely and just sending the money used to operate FEMA directly to the states.

To get recommendations on what to do with the agency Trump has formed the FEMA Review Council. Chubb CEO Evan Greenberg has been asked to serve on the bipartisan group tasked with reforming and streamlining the agency.

Co-Chair: Secretary of Homeland Security

Kristi Noem

Co-Chair: Secretary of Defense Pete Hegseth

Greg Abbott, governor, State of Texas

Phil Bryant, former governor, State of Mississippi

Jane Castor, mayor, City of Tampa, Florida

Mark Cooper, former chief of staff, Governor John Bel Edwards

Rosie Cordero-Stutz, sheriff, Miami-Dade County

Kevin Guthrie, executive director, Florida Division of Emergency Management

W. Nim Kidd, chief, Texas Division of Emergency Management

Michael Whatley, chairman, Republican National Committee

Glenn Youngkin, governor, Commonwealth of Virginia

Robert J. Fenton, Jr., region 9 administrator and two-time acting administrator, FEMA

In the meantime, the president fired acting administrator Cam Hamilton. No reason was given for Hamilton’s release. David Richardson, a now former Homeland Security assistant secretary for countering weapons of mass destruction, has replaced Hamilton.

In his first contact with the FEMA staff, Richardson made it clear that it was not to get in the way of the president’s push for reforms. He says in most agencies about 20% of a staff will not support the vision of those tasked with running the organization.

“Don’t get in my way if you’re those 20% of the people, I know all the tricks,” Richardson said. “Obfuscation. Delay. Undermining. If you’re one of those 20% of the people and you think those tactics and techniques are going to help you, they will not because I will run right over you. I will achieve the president’s intent. I am as bent

on achieving the president’s intent as I was on making sure that I did my duty when I took my Marines to Iraq.”

Richardson said one thing that will likely change is more cost sharing by the states when disaster hits. “We’re going to find out how to do things better, and we’re going find out how to push things down to the states that should be done at the state level,” he said. “Also going to find out how we can do more cost sharing with the states.”

How much is still up in the air.

This issue — how much states, as opposed to the federal government, should pay for disaster recovery — has been a growing concern, especially at a time of an increasing number of natural disasters that often require Congress to repeatedly replenish the federal fund that pays for recovery.

But states often argue that they are already paying for most disaster recoveries on their own and are only going to the federal government for those events truly outside of their ability to respond.

Richardson did not take questions from the staff members, saying he wanted them to first read memos he was going to be sending out later Friday. He planned a town hall next week, when he will take questions from the staff. A ‘mission analysis’ is planned for FEMA

In the memos obtained by The Associated Press, Richardson told the agency it would be conducting a “Mission Analysis” of the organization to identify “redundancies and inefficiencies” while also clarifying the organization’s “core” mission and “deterring mission creep.”

He also listed tasks to be accomplished in the coming weeks — including providing internal assessments of the agency’s preparedness for 2025; a list of all known gaps “in preparedness or core capabilities"; a list of lessons learned from past disasters; and an overview of “disaster aid before FEMA’s existence and the role of states and the federal government coordinating disaster management.”

He said he was honored to be in the role, leading an organization he described as an “unwieldy beast.”

Richardson arrives at FEMA at a time of immense turmoil and as it prepares for hurricane season, an extremely busy time for the agency.

Sources: PropertyCasualty360.com and Associated Press

PIA National is proud to present the PIA Summer Leadership Series — a three-part virtual program designed to inspire, educate, and empower insurance professionals at every stage of their career. Spanning July through September, this series brings together agency owners, leaders, and tech experts to share strategies for growth, innovation, and leadership.

July 16: Inspiring the Next Generation of Agency Leaders

August 7: Winning@Work: Creating Agencies Where Employees Want to Work

September 10: Using AI for Effective Agency Communications

REGISTRATION LINK: CLICK HERE

July 8, 2025 Bad Machines, Evil People: The Latest in Cyber

July 8, 2025 Ethics in Insurance - Protecting the Client and the Agency

July 8, 2025 CISR: Commercial Casualty 2

July 9, 2025 The Fine Print: Understanding the Contractual Obligations of Your Insured

July 10, 2025 Homeowners Endorsements Insureds Don't Want (But Do Need)

July 10, 2025 An Hour with Nicole: Making Sense of Homeowners Deductibles (Once and For All!)

July 15, 2025 Certificates, Contractors, and You: Fights, Coverage Issues, Best Practices

July 15, 2025 Reasons Personal Lines are Broken (and What to Do About It)

July 16, 2025 CISR: Insuring Commercial Property

July 17, 2025

Hour with Patrick: Reinsurance: How It Works & Why It Matters

July 22, 2025 An Hour with Sam: Commercial General (CGL) vs. Farm Liability: Key Differences for Farm Accounts

July 22, 2025 Liar!: An Agent's Role in Identifying & Handling Fraud

July 22-23, 2025 CIC: Personal Lines Institute

July 29, 2025 Just Use Mine: Home, Vehicle and Other Sharing Exposures Insurance Doesn’t Like

July 29, 2025 Dawn of New Age or End of the World? Emerging Risks That Make You Wonder

July 30, 2025 An Hour with Dave: E&O: Talking Exposures with an Attorney

July 31, 2025 Forward and Backward: Insuring Emerging Risks, Surviving Deteriorating Markets

5, 2025 Imminent Danger: Spotting Site Risks & Saving Construction Insureds

5,

August 6, 2025 An Hour with Dave: Understanding Ordinance or Law (Because Insureds Still Don’t)

7,

August 12, 2025

August 21, 2025 Why Inadequate EPLI

August 25,

September 10, 2025 Homeowners Endorsements Insureds Don't Want (But Do Need)

September 10, 2025 An Hour with Nicole: Making Sense of Homeowners Deductibles (Once and For All!)

September 11, 2025 An Hour with Cathy: Understanding (Finally!) How Claims Made Policies Work

September 11-12, 2025 CIC: Commercial Property Institute

September 11-12, 2025 CIC: Commercial Property Institute

September 13-16, 2025 PIA National Fall Leadership Meetings - Starts Sunday

Webinar: 8 - 11 AM

September 16, 2025 PIA National Installation of New PresidentTuesday, 5:30-7:00 PM 5:30-7:00 PM

September 17, 2025 PIA National Advocacy Day on The Hill - WednesdayDepart Thursday

September 16, 2025 Reasons Personal Lines are Broken (and What to Do About It)

September 17, 2025 An Hour with Dave: What Everyone Must Know About Flood

September 18, 2025 Name That Endorsement: Business Auto and

September 25, 2025 Bad Machines, Evil People: The Latest in Cyber

September 30, 2025 Liar!: An Agent's Role in Identifying & Handling Fraud

September 30, 2025 Scholarship Golf Outing Quarry Oaks

September 30, 2025 An Hour with Sam: Physical Damage Coverage Concerns in the Personal Auto Policy

7, 2025 CISR: Life & Health Essentials

October 9, 2025 Ethics, Diligence, Success: What Agencies Need to Know NE/IA

October 9, 2025 CPIA 2: Implement for Success

and

October 14, 2025

October 14, 2025 Commercial Property: Claims, Coverages, Consequences

October 16, 2025 Eroding: The Personal Lines Implosion and What Happens Next

October 16, 2025 An Hour with Nicole: Personal Lines: Read the %^&* Form!

October 21-22, 2025 CIC: Commercial Multiline Institute

October 21-22, 2025 CIC: Commercial Multiline Institute

October 21, 2025 An Hour with Cathy: I Pay What? How Commercial Policy Deductibles Work

October 23, 2025 Dawn of New Age or End of the World? Emerging Risks That Make You Wonder

October 28, 2025 Stinkin Rich, Insurance Poor: P&C Coverage Challenges for High-Net-Worth Individuals

The financial analysts of the Perryman Group say tort costs in the U.S. are not just excessive, they’re horribly excessive. And those tort costs are putting a huge strain on the U.S. economy and the insurance industry.

Perryman says tort reform is not just a good idea, it’s now nearing critical that reforms happen, and soon.

Here are some mind-boggling statistics and how tort costs impact the economy:

• $367.8 billion in annual direct costs

• $557.8 billion in annual output, the gross product

• Over 4.8 million jobs are lost when the dynamic effects of excessive court decisions are measured

• They cost $103.2 billion in lost annual federal revenues

• $28.8 billion in lost annual state revenues

• $24.1 billion in lost annual local government revenues

Overall, excessive tort results can be considered something like a tax. And bundling the statistics above together, this tort tax costs now $1,666 per year per person and $5,215 per family.

1. District of Columbia Annual tort tax: $7,813.46

2. Massachusetts Annual tort tax: $2,560.07

3. Washington Annual tort tax: $2,558.19

4. New York Annual tort tax: $2,534.85

5. California Annual tort tax: $2,458.33 Where does Nebraska & Iowa fall?

10. Nebraska Annual Tort Tax: $1,847.77

23. Iowa Annual Tort Tax: $1,432.15

In conclusion, the Perryman Group analysts said this unbalanced judicial system is wreaking

chaos to the economy. Here are some of the negative effects:

• Increased costs — and risks — of doing business

• Disincentives to create innovations that help consumers

• The lose tort system encourages lawsuits of questionable merit

• Insurance premiums that are much higher than they should be

• High health care costs and fewer places offering medical services

• Economic development is deterred Perryman notes the overly aggressive judicial system environment is a big drain on the economy of states and the country.

Manufacturers hit hardest by lawsuits include pharma, chemicals, tools, tires, and welding.

In conclusion, tort reform has a number of benefits. Here are some of them:

• Product innovation

• Increased productivity

• The reduction of accidental deaths because of safety product innovation

• Lower costs of healthcare

Source: Citizens Against Lawsuit Abuse

The research company, Marathon Strategies did a report on nuclear verdicts called, Corporate Verdicts Go Thermonuclear 2025 Edition. And they did — indeed — go thermonuclear.

In 2024, $10M+ nuclear verdicts hit 135—a 52% jump from 2023.

Even more difficult to imagine is the total cost the 135 verdicts. Marathon said they cost those being sued $31.3 billion, 116% rise over 2023.

Then there are thermonuclear verdicts. The report said, “Thermonuclear verdicts” of $100 million or more increased to 49 last year, with five of those cases resulting in verdicts greater than $1 billion.”

Marathon says the causes of the increases is a growing mistrust of corporations, a society that is increasingly pessimistic, a desensitized public and a tort system that is slowly crashing.

Texas had the most nuclear verdicts at 23. The state of California wasn’t far behind at 17, Pennsylvania had 12.

As a testament to what can happen if tort reform is enacted, Florida — which ranked number two on the list from 2009 to 2022 — dropped to number 10 after the Legislature began reforming its laws.

The state with the highest sum of verdicts is the state of Nevada. The silver state saw verdicts hitting $8.4 billion. A series of multi-billion awards against a former Las Vegas bottled water company, Real Water, pushed Nevada to the top.

Without that series of verdicts the top spot would belong to the state of California. It ranked second in 2024 with $6.9 billion in nuclear verdicts. The Golden State is followed by Pennsylvania at $3.4 billion, Texas had settlements of $3 billion, New York sits at $2.1 billion, Missouri is a billion less at $1.2 billion, Delaware is the last in the billions of dollars at $1 billion.

Rounding out the top 10 is Louisiana’s $733 million, Illinois’ $654 million and Florida’s $538 million.

The report found that nuclear verdicts occur more often in state court than federal courts. State courts accounted for 85 nuclear verdicts in 2024 totaling $20.1 billion. Federal verdicts were half that at $11.2 billion.

Product liability led the list of the highest verdicts against corporations. That’s been a trend for decades. Product liability suit verdicts totaled $13.9 billion in 2024.

The industry hit hardest is pharmaceuticals. There were 10 verdicts. Technology hardware,

storage and peripherals, trucking, hotels, restaurants and leisure followed.

Pharmaceuticals had the most verdicts of any industry with 10, followed by technology hardware, storage & peripherals (9), trucking (8) and hotels, restaurants and leisure (8).

Source: Insurance Journal

While much complaining goes on about tort reform and nuclear verdicts, the Insurance Information Institute (Triple-I) has decided to take action. Triple-I CEO Sean Kevelighan says the first salvo is being fired in Louisiana because the state is among those with the least affordable home and auto insurance.

Kevelighan said frivolous lawsuits and nuclear verdicts are costing insurers millions and that impacts consumers who face much higher rates. Thus, the campaign.

“As we continue to see the influence of billboard attorneys preying on vulnerable individuals and increasing insurance costs, now is the time for Louisiana’s legislators to take action to address legal system abuse,” the Triple-I said in its campaign statement.

Digital billboards at bus stop shelters and panels on urban billboards in downtown Baton

Rouge are telling people about the danger of nuclear verdicts, the need for serious tort reform and encouraging people to join the fight and courage their legislators to act.

There are also billboards along highways heading into the capital.

“Louisiana, with the leadership of its insurance commissioner, Tim Temple, is on a potential path to stabilizing its insurance market,” Kevelighan said. “We’ve seen in other states, like Florida, that legal reform can lead to market stabilization, increased competition, and more favorable pricing for consumers.”

He also noted the danger to consumers of what he terms, “billboard attorneys” whose practices contribute to frivolous lawsuits.

Source: Insurance Business America