PRESIDENT

Gerald F. Hemphill, CIC, LUTCF (VA/DC) ghemphill@gfhinsurance.com

PRESIDENT-ELECT

Richard A. Savino, CIC, CPIA richs@broadfieldinsurance.com

VICE PRESIDENT/TREASURER

Ariel Rivera, CIC (PR) ariel@deerinsurance.com

SECRETARY/ASSISTANT TREASURER

Mark A. Suhr, CIC, CPIA (NE) msuhr@suhrlichty.com

IMMEDIATE PAST PRESIDENT

Anthony Curti, CIC, LIC (MI) tcurti@acrisure.com

EXECUTIVE VICE PRESIDENT/CEO Mike Becker (PIA National) mbecker@pianational.org

PUBLISHER/EDITOR-IN-CHIEF

Ted Besesparis | tbesesparis@pianational.org

MANAGING EDITOR Sade Hale | shale@pianational.org

ADVERTISING DIRECTOR

Robert Holt, CLU, ChFC, CASL | rholt@pianational.org

GOVERNMENT AFFAIRS EDITOR

Jon Gentile | jgentile@pianational.org

REGULATORY AFFAIRS EDITOR

Lauren Pachman, Esq. | lpachman@pianational.org

MARKETING EDITOR Madeleine Stern | mstern@pianational.org

CONTRIBUTING EDITOR

Patricia A. Borowski, CPIW

October 2022

PIA Connection is published ten times yearly by the National Association of Professional Insurance Agents. 419 North Lee Street Alexandria, Virginia 22314

©2022 All rights reserved.

The information in this publication is general in nature and is not intended to serve as legal, accounting, financial, insurance, investment advisory or other professional advice as to any reader’s particular situation. Users are encouraged to consult with compe tent legal, financial, insurance, investment advisory and or other professional advisors concerning specific matters before making any decisions and we disclaim any responsibility for any decisions or actions by readers.

All PIA members receive PIA Connection at the member subscription rate of $12.00 per year.

Non-member subscriptions available at $24.00 per year ppd.

For additional information on any of the subjects addressed in this publica tion, please access the PIA National website at www.pianational.org.

| www.pianational.org

GERALD F. HEMPHILL INSTALLED AS PRESIDENT OF PIA NATIONAL

page 14

NEWS BRIEF 6-7

Hurricane Landfall Less Likely…Louisiana Citizens Approves 63% Rate Hike…Vehicle Thefts Continue to Rise…A.M. Best: Prospects for Commercial Auto May Dim…NAIC: Cyber Market Grew 61% in 2021… Cyber Insurance Pricing Comes Off Spikes

PCF INSURANCE SERVICES JOINS PIA 8

“We would like to welcome PCF and its Agency Partners into PIA,” said PIA CEO Mike Becker.

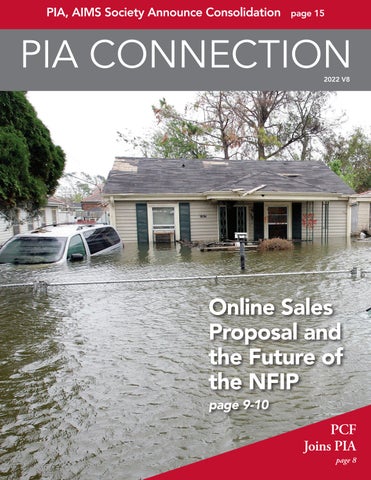

SALES PROPOSAL AND THE FUTURE OF THE NFIP 9-10 PIA counsel and director of regulatory affairs Lauren G. Pachman, Esq. reports that a request for information (RFI) by FEMA was not published in the Federal Register, not posted publicly and not shared with flood insurance agents, who were initially not invited to comment.

PIA IS EXCITED TO ANNOUNCE THE BREEZE PROGRAM 11-13 With instant quotes, an online application process, and case management done for you, Breeze makes it easy to earn competitive commissions and grow revenue by offering top-rated disability insurance to your clients.

GERALD F. HEMPHILL INSTALLED AS PRESIDENT OF PIA NATIONAL 14

NEW 2022-2023 PIA NATIONAL OFFICERS SWORN IN 14

PIA, AIMS SOCIETY ANNOUNCE CONSOLIDATION 15 PIA and the AIMS Society announced they will combine entities to redefine the future of insurance education. It is “a big win for PIA, the AIMS Society and the insurance industry,” said PIA CEO Mike Becker.

From the President 5

From the CEO 5

PIA Member Benefits 16

PIA Member Benefit Spotlight 17

PIA Connection Marketplace 17

PIA Affiliate Listings 18

Cover photo: Ethan Miller/Getty Images

IT IS TRULY MY HONOR TO SERVE AS THE President of the National Association of Professional Insurance Agents . I am writing this after having returned from our Fall meeting in San Diego. I would have loved to have brought back the weather, however what I did bring back was a renewed sense of energy and appreciation for the many individuals that make this association what it is and what it will be!

I’d like to start by thanking our current Immediate Past President, Anthony “Tony” Curti for his steady leadership this past year, as well as Wayne White, Past President, who rolls off of the Executive Committee. Both gave of their time, talents and vision as we position to be a forward “action” oriented association, and we are eternally grateful.

PIA is constantly expanding its ability to be the preferred resource for independent agents. The four pillars; Inform, Educate, Advocate and Protect, serve as the foundation, while vision and action allow us to take the Association to new heights.

During my remarks in San Diego, I mentioned a quote that has made a significant impact on me and one that I keep at my desk, “Change is inevitable, Growth is optional”.

Our Association heads into Fall and 2023 in a position of strength, purpose and vision. I look forward to visiting many of our affili ates over the coming months and encourage you to visit our refreshed website www.pianational.org. With many initiatives, programs, products and services, there are a lot of exciting things happening within your Association, and I look forward to serving alongside our Board, Members, Staff, Affiliates and carrier partners, and I am grateful for this opportunity.

Gerald F. Hemphill PresidentOVER THE PAST SEVERAL YEARS, PIA HAS accelerated its innovation and delivery of programs and ser vices. Our new member benefits are designed to help agents better adapt and respond to fast-changing challenges in the marketplace. The landscape continues to evolve, and fast.

Throughout its history, PIA has been known as “the education association,” offering a wide array of education and professional development through our nationwide network of state and regional affiliate associations.

Our recent announcement that PIA is joining forces with the American Insurance Marketing and Sales Society (AIMS Society) illustrates our ongoing commitment to agent edu cation and professional development. The AIMS Society is dedicated exclusively to marketing and sales education for the insurance industry through the Certified Professional Insurance Agent (CPIA) designation. Now, PIA will build upon the CPIA designation framework and utilize PIA resources to

further empower the insurance professional of the future.

Change is occurring at an incredible rate in our industry, as it is in the world at large. The many programs and services that PIA delivers support a strong value proposition for you, our members, and provides powerful reasons for you to renew your membership, which I hope you do.

PIA is not just a forward-thinking organization but a forward-acting organization. As an association, it’s our respon sibility to advocate with passion and enable the success of our members. Thank you for the opportunity to serve you.

Mike Becker CEO

In the aftermath of Hur ricane Ian, Colorado State University forecasters updated their Atlantic hurricane season forecast, stating, “The 2022 Atlantic hurricane season has been slightly below normal,” and the forecasters say the probability of a hurricane making landfall in the United States is waning.

The report suggests that “anomalously strong verti cal wind shear [is] forecast across the entire tropical Atlantic and Caribbean,” which hampers the devel opment of tropical storms that could make landfall on the Americas.

The group had expected 4 major hurricanes out of 8 hurricanes that developed from 18 named tropical storms this year, but only 2 major hurricanes, including Ian, have formed to date.

Louisiana Insurance Com missioner Jim Donelon has signed off on a 63% homeowners rate increase for Louisiana Citizens Property Insurance Corp. Citizens, the state’s insurer of last resort. The increase is required by law to ensure its rates are at least 10% above voluntary market rates, according to Donelon. The increase affects Citizens’ personal lines, including homeown ers, dwelling, renters/ condo, mobile home and wind-only.

“There’s no sugarcoat ing it — this increase is extremely painful but required by law to make sure Citizens can handle a potential future disaster for its many policyholders,” said Donelon.

Vehicle thefts continued to rise across the U.S. last year, according to the recently released annual Hot Spots report from the National Insurance Crime Bureau (NICB).

In 2021, 932,329 vehicles were reported stolen to law enforcement, a 6% increase over 2020 and a 17% increase since 2019, NICB reported. The top 5 states with the most thefts by volume, which include Illinois, Florida, Colorado, California, and Texas, accounted for 44% of all vehicle thefts nationwide last year, totaling 412,008 vehicles.

Since the release of the 2020 Hot Spots report last September, 22 states have seen decreases in vehicle thefts. Florida did see a slight decrease in vehicle thefts with 42,808, down from 44,940 in 2020.

Commercial auto insur ance providers may return to less favorable under writing results in 2022 after a good year with an aggregate combined ratio below 100 in 2021, accord

ing to an AM Best market analysis.

The sophistication of vehicles and increased cost of repair, higher raw mate rial costs, distracted driv ing, social inflation, fatal accident increases, and recreational marijuana use all led to both increased

claim frequency and sever ity, AM Best’s report stated.

Speaking at the recent Insurance Leadership Forum, insurance company representatives and brokers said cyber liability insur ance buyers should expect to keep seeing large rate increases during upcoming renewals, though likely not at the level of recent spikes, reports Business Insurance

While insurers are still interested in selling cyber

policies, they have begun to restrict their capacity after suffering major losses during the coronavirus pandemic. Experts say the market has been impacted by rising rates and declin ing capacity after a series of cyber incidents and ransomware attacks.

However, insurance companies were able to maintain stability through investments in technology and underwriting tools. For their part, policyholders are paying more atten tion to cyber “hygiene” and cybersecurity. Marsh LLC reports that average

cyber liability rates went up 54% in July, versus a 133% increase in Decem ber 2021.

The National Association of Insurance Commis sioners (NAIC) released its Cyber Insurance report, utilizing data found within the Cyber Supplement, as well as alien surplus lines data collected through the NAIC’s International Insurance Department. The 2021 data shows a cyber security insurance market of roughly $6.5 billion,

reflecting an increase of 61% from the prior year.

Insurers writing standalone cybersecurity insurance products reported approxi mately $4.5 billion in direct written premiums, and those writing cybersecu rity insurance as part of a package policy reported roughly $2 billion in direct written premiums.

U.S. domiciled insurers wrote $4.8 billion in direct written premiums, while alien surplus lines insurers wrote $1.7 billion in direct written premiums.

PCF INSURANCE SERVICES (PCF) announced that it has joined the National Association of Professional Insurance Agents (PIA). Headquartered in Lehi, Utah, PCF is a top 20 U.S. insurance brokerage firm that currently serves more than 465,000 clients through its network of nearly 165 Agency Partners* across 37 states.

PIA provides a range of products and services to its member agencies nationwide, along with passionate advocacy on legislative and regula tory matters impacting professional independent insurance agents. Some of these benefits include access to the latest industry research, brand ing materials, more than 50 personal and commercial lines carriers and online raters, errors and omissions (E&O) and cyber insurance coverage, a resource crisis hub for agents, agency succession planning materials, and more. As part of the partnership, all PIA membership benefits will be avail able to PCF’s Agency Partners effective immediately.

These benefits will complement the broad array of business solu tions and resources PCF Insurance offers its Agency Partners to enable growth and promote entrepreneurial success, including access to industryleading expertise, technology, health and retirement benefits, professional opportunities, world-class training, equity upside and incentives, and more. Together, these collective ben efits further expand PCF Insurance’s shared services function, providing Agency Partners with additional operational and sales resources to supercharge their success.

“We would like to welcome PCF and its Agency Partners into the National Association of Professional Insurance Agents. Membership with PIA will provide PCF’s Agency Partners with solutions to take their businesses to the next level, includ ing access to business-building tools; marketing resources; and focused, indepth engagement in industry affairs,” said PIA CEO Mike Becker. “Just as PIA broadens an agency’s horizons

through new opportunities to grow and engage in our industry, PCF’s inclusion into our organization will make us a richer and stronger asso ciation through their vast collective industry experience.”

“At PCF, we are propelled by our people. In turn, we continually seek avenues to provide benefits and value-add opportunities to enrich our Agency Partners and their employ ees,” said Peter C. Foy, Chairman, Founder and CEO of PCF Insurance. “Partnering with PIA allows us to further build on our agency-centric operating model and support Agency Partners with additional resources while amplifying collaboration and growth opportunities among our network.”

*As of June 30, 2022, and agencies under letter of intent

About PCF Insurance Services

A top 20 U.S. broker headquartered in Lehi, Utah, PCF Insurance Services is a leading full-service consultant and insurance brokerage firm offer ing a broad array of commercial, life and health, employee benefits, and workers’ compensation solu tions. Propelled by its people, PCF Insurance’s agency-centric operating model and entrepreneurial environ ment support its tremendous growth profile, offering partners alignment through equity ownership, significant leadership incentives, and resources to over 3,100 employees throughout the U.S. Recognized as a top acquirer by The Hales Report, ranked #20 on Business Insurance’s 2022 Top 100 Brokers and #13 on Insurance Journal’s 2022 Top Property/Casualty Agencies, PCF Insurance is a notable leader in the insurance space. Learn more at pcfins.com

A request for information (RFI) by FEMA was not published in the Federal Register, not posted publicly and not shared with flood insurance agents, who were initially not invited to comment.

RECENTLY, THE PROCUREment office of the Federal Emergency Management Agency (FEMA) quietly issued a request for information (RFI) regarding a proposal to offer consum ers the option of purchasing a National Flood Insurance Program (NFIP) policy online. The RFI provides some background on the history of the NFIP, which is housed within FEMA, and the implementation of the NFIP’s Risk Rating (RR) 2.0 methodology, which is now being used to price all NFIP poli cies, whether new or renewing.

The RFI also describes the structure of the Write-Your-Own (WYO) pro gram and the NFIP Direct program, which is serviced by FEMA without carrier involvement. In the WYO program, which makes up nearly 90 percent of all NFIP policies, carri ers write policies and contract with independent agents to sell and service those policies. The Direct program ser vices the remaining 10-plus percent of all NFIP policies.

In the RFI, FEMA posits that the program could easily adapt to a format in which consumers use an online platform to purchase NFIP policies, potentially without the participation of carriers, independent insurance agents, or both. In reality, without indepen dent agents, the WYO program would cease to exist, because independent agents are the salesforce of the NFIP. Particularly in the post-RR 2.0 era,

agents with comprehensive NFIP expertise are rare and valuable, and their counsel is vital to consumers.

PIA agents have been concerned about the Direct to Consumer (D2C) initiative since David Maurstad, FEMA’s NFIP administrator, first mentioned it during a presentation he and his deputies made at PIA’s May governance meetings. PIA members sell flood insurance through both the NFIP and the private market, and they were eager to alert FEMA to their wor ries in PIA’s response to the RFI. PIA’s objections to the issuance of the RFI began with its dissemination. Unlike most regulatory publications, the RFI was not published in the Federal Register, nor was it posted publicly on regulations.gov, which is typically done to encourage engagement with the public and ensure proposals reach the widest possible audience. As a result, predictably, members of the public, including but not limited to NFIP policyholders, agents, and carrier rep resentatives, were less likely to review and comment on it. Fortunately, members of the flood insurance indus try distributed it among themselves, which is how agent groups, includ ing the Flood Insurance Producers National Committee (FIPNC), gained access to it.

FIPNC was assembled in 1982 by FEMA’s Federal Insurance Administrator to facilitate improved

communications between independent agents and the NFIP. Representatives of FIPNC’s member associations meet with representatives of FEMA regularly several times each year. PIA takes this duty very seriously and seeks to represent the full spectrum of our flood agent members’ experi ences in both our PIA and FIPNC interactions with FEMA. Despite that seemingly strong, lengthy relationship with FIPNC as a whole and the three independent agent trade association members individually, as indicated above, FEMA did not distribute the RFI to any agent representatives; rather, PIA obtained it from non-agent industry partners.

FIPNC was designed to provide independent agents with a forum in which to provide FEMA with con structive feedback about new ideas before those ideas were distributed to the masses and to enable FEMA to consider its proposals in the context of the independent agent experience before its proposals were finalized.

Despite FIPNC’s purpose, FEMA did not consult with independent agents— via FIPNC or otherwise—during the development of D2C.

FIPNC typically does not respond as a collective to NFIP policy pro posals; however, after considering the unorthodox method in which this RFI was conceived of and circu lated, FIPNC took the unusual step of objecting with one voice to the secretive way the D2C proposal was developed and disseminated.

PIA members also expressed an array of concerns regarding the sub stance of the proposal. First, a D2C process would likely convey far less comprehensive information than an independent agent could, and depriv ing consumers of access to agents could prompt consumers to make choices that an agent would have dis couraged. Second, the NFIP currently faces several pressing challenges, each of which could present obstacles that would prevent the successful imple mentation of digital services. Those challenges include but are not limited to record-setting inflation and crush ing Treasury debt.

Specifically, the NFIP already has an affordability problem; many property owners at risk of loss due to flooding remain uninsured because they can not afford flood insurance premiums. Those uninsured property owners may be those least able to pay for the broadband or smartphone that would give them access to a D2C system. Plus, implementing a D2C initiative would cost everyone involved in the program. A project of this magnitude would be financially risky anytime, but, at present, the nation appears to be lingering in a post-pandemic economic downturn, making the cir cumstances especially precarious. The

current economy has resulted in an environment in which even experts are loathe to predict America’s financial future. Moreover, even experienced independent agents may find challeng ing the conversation necessary to con vince property owners that they need flood insurance. A D2C system would require property owners to conclude that they need flood insurance without any conversation at all.

Furthermore, over the past two years, industry stakeholders invested in burdensome modifications to their business practices to implement RR 2.0. Some independent insurance agencies struggled to integrate RR 2.0 into their businesses. Now, imme diately on the heels of those expen ditures, and despite the industry’s relatively nimble adaptation to RR 2.0’s rocky rollout, the D2C initiative would impose additional costs on, poten tially, every sector of the economy that interacts with flood insurance. Now is not the time to burden FEMA’s NFIP partners with another expensive experiment.

Of course, the biggest risk to selling online is the chance that consumers will make poor choices because they lack the knowledge to understand their risks and how best to protect themselves. Without the expert advice of independent agents, consumers are liable to misunderstand their level of risk and make uninformed decisions that leave their properties under- or unprotected. The NFIP is complex; even before RR 2.0 was implemented, independent agent expertise was essential to consumer understanding. Now, the guidance of independent agents is indispensable.

The concept of risk is itself com plicated, and agents often invest a great deal of time in conversation with

potential customers about their risk tolerance and then enabling those potential customers to apply their newfound understanding to their flood insurance decision making. D2C will exacerbate the apparent opac ity of RR 2.0 and will not be able to replicate the agent-consumer dialogue. Today, potential NFIP policyhold ers with questions seek answers from independent agents. In a D2C world, a prospective customer may purchase a policy without understanding how much (or little) it covers, or, worse, abandon the buying process altogether because they are asked questions to which they do not have answers, find the process too frustrating, or feel like it is prohibitively difficult to understand.

Moreover, the NFIP does not boast a vast universe of experts. Even now, without D2C, independent insurance agents with comprehensive NFIP expertise are rare and valuable, and their counsel is vital to consumers. The knowledge and expertise of indepen dent agents cannot be supplanted or replaced by an online system. Indeed, the cost of reducing agents’ investment of time and expertise to a few clicks in a browser window could be cata strophic. Even the suggestion that any aspect of their work is replaceable with an automated system may discourage agents from remaining in the NFIP or expanding their businesses to include NFIP products. For the foreseeable future, FEMA should be encouraging more, not fewer, agents to become and remain sellers of flood insurance.

Lauren G. Pachman, Esq. is counsel and director of regulatory affairs of PIA National. She is PIA’s representative to the Flood Insurance Producers National Committee (FIPNC).

AUTO INSURANCE AND LIFE INSURANCE ARE PRETTY STRAIGHT forward. One protects your car and the other pays benefits if the insured dies. Disability insurance (DI), on the other hand, can be more confusing to some. It’s a product many people know very little about.

You and Breeze can help. We know disability insurance and can help you present it effectively to your clients. DI fits in perfectly with the other insurance products and financial planning services you’re already providing. The basic sales principals are still in play but a successful DI salesperson also helps clients understand how income protection boosts their overall financial plan.

According to the Federal Reserve, only 48% of American adults have enough savings to cover three months of living expenses in the event they’re not earning an income. In other words, 48% of Americans would benefit from a disability insurance policy. That’s where you can make a difference with the help of these three pro tips.

PRO TIP #1: KNOW WHAT IDEAL DI BUYERS LOOK LIKE

Start with your current clients. They know you, trust you, and value your advice. Let them know it’s important to have a complete income replacement plan in place before they need it. Most consumers have never been approached about the need for disability insurance. That means you have many opportunities to simply start the conversation and help clients think about protecting their most valuable asset — their ability to earn an income.

White collar workers typically understand the value of disability insurance — especially doctors and other medical professionals. White collar workers also can normally afford DI easily, which makes them a no brainer. White Collar = No Brainer Breeze offers the only way to buy and sell Principal’s top-rated long-term disability insur ance plan through a fully online process. This is the ideal income protection product for white collar workers.

Middle market workers are neither the richest nor the poorest consumers. This segment is

PIA IS EXCITED TO ANNOUNCE THE PIA

PROGRAM.

With instant quotes, an online application process, and case management done for you, Breeze makes it easy to earn competitive commissions and grow revenue by offering toprated disability insurance to your clients.

U n l o c k a n e w r e v e n u e c h a n n e l a n d s t a r t g r o w i n g y o u r b u s i n e s s t o d a y w i t h o u r s u i t e o f t o p - r a t e d d i g i t a l i n c o m e p r o t e c t i o n p r o d u c t s — i n c l u d i n g l o n g - t e r m d i s a b i l i t y, s h o r t - t e r m d i s a b i l i t y, a n d c r i t i c a l i l l n e s s i n s u r a n c e.

G e t c o n t r a c t e d a t p i a n a t i o n a l . o r g / b r e e z e

frequently overlooked when it comes to income protection. Middle market folks can afford DI but they typically don’t understand the value as read ily as white collar workers. For many advisors, your middle market clients are an untapped resource.

Middle Market Client Profiles: Individuals & couples ages 30 – 50

Incomes between $40,000 – $150,000 Family oriented

· Recently married

· New parents Homeowners

· Risk adverse – having something to protect

· and not wanting to risk financial loss

· Chiropractors

IT Professionals & Project Managers

· Mid-Level Managers Nurse Practitioners

· Physician Assistants Physical, Respiratory & Occupational Therapists Software Engineers & Web Developers

· Teachers, Professors & Graduate Assistants

Current clients: You already have a pool of prospective DI clients. Search your book of business for clients who fit the middle market profile mentioned above. Also, clients who have recently experienced a life event, such as getting married, becoming new parents, or

buying a home, may feel they’re ready to make financial plan changes.

Civic organizations: Join a local civic organization—think Lion’s Club, Rotary Club, local Chamber of Commerce—and make yourself known to the members of your com munity. But not just to make a sales pitch. Find an organization you’re interested in that’s doing something in the community you believe in.

Professional Associations: State and county bar associations and local chapters of national organizations like the American Institute of CPA’s and the American Medical Association are great places to get leads and start the conversation with a new audience. Try running ads in newsletters and offer to speak to members during meetings.

This is the most important but often overlooked part of the pitch. Be sure to talk about the need for disability insurance before jumping to the solu tion. Most clients don’t even realize lack of income protection is a prob lem. They’ll need to understand the problem before they’ll be receptive to a solution. Talk about what’s at stake for them personally if their income sud denly stopped.

Start by finding out what’s important to your client. The things they value most—their family, home, financial plans, kids’ college funds—these are the priorities they’ll want to protect. Based on your conversations and knowing your client, you can help clients identify the things that are at risk if they were unable to earn an income.

· What’s the most important asset you have?

· You insure your car and your home—why not your paycheck?

· How much income would you need to support your family if you couldn’t work due to illness or injury?

How long could you go without a paycheck before it became dif ficult to pay your bills?

· How would you afford to pay your mortgage or rent if your paycheck stopped?

At this point, your client has deter mined what is most important to them. They’ve considered the risks and the impact of losing their income. Now is the time to discuss how disabil ity insurance can help provide the solution. However, clients don’t want to be “sold.” They want someone who can explain how disability insurance works, help them consider the various levels of protection, and feel confident that they’re making the right decision.

Help your clients consider how soon they would need benefits to begin and how long they’d like to be covered. Elimination and benefit periods for disability insurance policies affect the premium. It’s important for clients to feel they have coverage that meets their need and fits their budget.

Then introduce your clients to the solution—Breeze, the incredibly simple way to buy disability insurance online and protect your income. Show them how they can get an instant, personalized quote in seconds and complete a simple, secure application process in minutes—entirely online.

Start selling disability insurance like a pro with PIA and Breeze today.

GERALD F. HEMPHILL, CIC, LUTCF, of Richmond, Virginia was installed as president of the National Association of Professional Insurance Agents during the organization’s September 22, 2022 board of directors meeting held in San Diego, California.

Hemphill was sworn in together with his four fellow national officers: Richard A. Savino, CIC, CPIA, of Warwick, New York, President-elect; Ariel Rivera, MBA, CIC, CPIA, of San Juan, Puerto Rico, Vice President/ Treasurer; Mark A. Suhr of Seward, Nebraska, CIC, CPIA, Secretary/ Assistant Treasurer; and Anthony “Tony” Curti, CIC, LIC, of Bloomfield Hills, Michigan, Immediate Past President. All the officers will serve one-year terms that begin on October 1, 2022 and run through September 30, 2023.

“PIA is constantly expanding its ability to be the preferred resource for independent agents,” said Hemphill. “During my installation remarks in San Diego, I mentioned a quote that has made a significant impact on me and one that I keep at my desk, ‘Change is

inevitable, Growth is optional.’”

Hemphill pointed out that PIA is currently in the ascendency, the result of making significant advances in key areas in recent years. He said PIA adapted quickly to changes in the business environment prompted by the coronavirus crisis, having already invested in technology upgrades. He lauded PIA’s aggressive advocacy on behalf of independent agents that has produced legislative and regulatory victories that have added to agencies’ bottom lines.

“Our Association heads into 2023 in a position of strength, purpose and vision,” he said. With many initiatives, programs, products and services, there are a lot of exciting things happening within our Association, and I look for ward to serving alongside our Board, Members, Staff, Affiliates and Carrier partners. I am humbled and grateful for this opportunity.”

An independent insurance agent in the metro-Richmond, Virginia area since 1993, Gerald represents all lines of insurance, specializing in commer cial and life insurance risks. He was an

agent for a large domestic carrier for five years and has been principal of his own agency ever since.

In 1996, Gerald earned his LUTCF (Life Underwriter Training Council Fellow) designation, and in 2002, com pleted his CIC (Certified Insurance Counselor) designation. He is a gradu ate of Campbell University and Fork Union Military Academy. In addition to his designations, he holds property and casualty, and life, health and annu ity licenses.

Hemphill was President of the Professional Insurance Agents Association of Virginia/DC in 2010 and has served on the National Board of PIA since 2013. He was named the PIA of Virginia/DC Agent of the Year in 2012.

Gerald and his wife have two daughters, Ashley and Taylor, and three grandchildren.

of the National Association of Professional Insurance Agents (PIA) were installed during the group’s annual Board of Directors meeting held September 22, 2022 in San Diego, CA.

Gerald F. Hemphill, CIC, LUTCF, of Richmond, Virginia was installed as president. Hemphill was sworn in together with his four fellow national officers: Richard A. Savino, CIC, CPIA, of Warwick, New York, President-elect; Ariel Rivera, MBA, CIC, CPIA, of San Juan, Puerto Rico, Vice President/Treasurer; Mark A. Suhr of Seward, Nebraska, CIC, CPIA, Secretary/Assistant Treasurer; and Anthony “Tony” Curti, CIC, LIC, of Bloomfield Hills, Michigan, Immediate Past President.

All the officers will serve one-year terms that began on October 1, 2022 and run through September 30, 2023.

Leading insurance organizations join forces to redefine the future of insurance education.

PIA AND THE AMERICAN Insurance Marketing and Sales Society (AIMS Society) have announced they will combine entities to redefine the future of insurance education.

The coming together of the two powerhouse organizations, each with a deep history of providing top-flight education programming for independent insurance agents, will benefit both independent agents and the insurance industry as a whole. A formal agreement was signed by both organizations and has been approved by their members.

For decades PIA has been known as ‘the education asso ciation,’ offering a wide array of education and professional development through its nation wide network of state and regional affiliate associations. The AIMS Society is dedicated exclusively to marketing and sales education for the insurance industry through the Certified Professional Insurance Agent (CPIA) designation.

“This is a big win for PIA, the AIMS Society, and the insurance industry,” said PIA CEO Mike Becker. “Our organizations will build upon the CPIA designa tion framework and utilize PIA resources to further empower the insurance professional of the future.”

“The strategic partnership between our organizations is especially appropriate, as the CPIA

designation was originally offered exclusively by PIA until 1996, when PIA transferred it to the AIMS Society,” Becker said. “So the partnership we are announc ing today is not only a coming together, but also a coming home.”

“The AIMS Society is excited to partner under the PIA umbrella to expand program offerings for the benefit of independent insurance agents and the entire insurance industry,” said Dulce SuarezResnick, President of the AIMS Society. “This alliance positions both organizations as forward-thinking, with a focus on the future.”

Founded in 1968 as The Firemark Society (FMS), the American Insurance Marketing and Sales (AIMS) Society provides training, information and networking services designed to increase the personal and agency sales production of property and casualty insurance agents.

✦ DISABILITY INSURANCE. With instant quotes, an online application process, and case management done for you, Breeze makes it easy to earn competitive commissions and grow revenue by offering top-rated disability insurance to clients. pianational.org/breeze

✦

HARTFORD FLOOD INSURANCE. PIA’s endorsed flood provider since 2004. Dedicated local sales directors and book transfer/rollover team plus great commissions for PIA members. Call (860) 547-5006. pianational.org/hartford

✦ PIA AGENTS UMBRELLA PROGRAM. Excess insurance protection includes E&O and business liability coverage, with available endorsements for EPL and personal coverage. pianational.org/umbrella

✦ CYBER LIABILITY INSURANCE. Coverage and pricing tailored to small and mid-sized businesses. pianational.org/cyberinsurance

✦

PIA BLUEPRINT FOR AGENCY SUCCESS. A 3-part resource guide for business planning, growth strategies, and agency continuity. pianational.org/blueprint

✦

PIA MEMBER REIMBURSEMENT PROGRAM: Receive reimbursements on PIA marketing and PIA Partnership programs (up to $250 per program, for a total of up to $500). pianational.org/moneyformembers

✦

PIA DMV: PIA’S DIRECT MARKETING VAULT. Targeted direct mail and digital advertising campaigns. Turn-key yet highly customizable. pianational.org/dmv

✦ MARKETING SUPPORT FOR PIA MEMBERS. Print ads, radio commercials, consumer-oriented flyers and social media support for PIA members. pianational.org/marketingsupport

✦ PIA MARKET ACCESS. Access to over 50 national and specialty carriers, real-time online rating, ownership of your book and no exit fees for a low monthly rate. pianational.org/marketaccess

✦ AVYST EFORMS WIZARD. Quickly and easily prepare ACORD, agency-specific, and carrier-unique applications and forms, entering data only once in an organized interview format. Get to market faster! pianational.org/avyst

✦

PIA AGENCY MARKETING GUIDE Hands-on marketing tips from industry experts. Published annually. pianational.org/memberbenefits

✦ ROUGH NOTES - ADVANTAGE PLUS. Identifies risk exposures. Provides detailed coverage analysis. PIA member price $600 annually (reg. $700). Call 800-428-4384. Use your PIA member ID# above name on mailing label. pianational.org/roughnotes

✦ E&O INSURANCE. With access to admitted and non-admitted markets with differing appetites chances are we can find the coverage and price that’s right for you. pianational.org/eando

AND GROUP INSURANCE PRODUCTS. Basic, voluntary and dependent term life; long/short term disability; and AD&D. piatrust.com

✦ WINNING@CYBERSECURITY DEFENSE. A four-part educational resource created to teach you and your clients about the most common cyber dangers faced by small and mid-sized businesses as well as the best business practices and insurance coverages that can reduce these risks. pianational.org/cybersecurity

✦ WINNING@VIRTUAL. Your guide to evolving your sales and service in a digital world. pianational.org/winningatvirtual

✦ READY FOR EVERYTHING. The online crisis resource hub for insurance agents. pianational.org/readyforeverything

✦ WINNING@TALENT. Your guide to hiring, motivating and retaining the best agency employees. pianational.org/winningattalent

AGENCY JOURNEY MAPPING. Value your agency, maximize your retire ment income, and plan for unex pected death/disability while creating a perpetuation plan for your agency. pianational.org/agencyjourneymapping

✦ SMALL COMMERCIAL and the DIGITAL OPPORTUNITY. A variety of resources that help agents increase their digital capabilities and improve the digital experience for their customers. pianational.org/digitalopportunity

✦ CLASSIC PIA PARTNERSHIP PROGRAMS: Less recent (but still relevant) programs including Reaching Gen Y, Closing the Gap, Agency Touchpoints and Practical Guide to Succession Planning. pianational.org/classicprograms

✦ PIA 401(K). The PIA 401(k) plan has you covered by performing over 90% of administrative tasks and becoming your retirement department support team. pianational.org/401k

✦ ACORD FORMS END USER LICENSES. Available for free to qualifying PIA members who access ACORD forms through agency management systems and other authorized distributors. Plus PIA member discounts on the ACORD Advantage Plus Program. pianational.org/acord

✦ AGENCY AGREEMENT REVIEW SERVICE. Free to members and carriers, PIA recommends changes to carriers and highlights concerns for members. pianational.org/agreementreview

✦ EMPLOYEE PROFILING. Hire the right people with skills and personality testing from OMNIA. pianational.org/omnia

✦ HIRE WITH IDEALTRAITS. The comprehensive, go-to hiring tool for agencies looking to hire top performers. pianational.org/idealtraits

✦ CYBER RISK ASSESSMENT. A low cost cyber risk assessment designed specifically for you. This delivers a one-two-three punch that identifies your unique risks, how to mitigate them, AND guidance/tools to turn the recommendations into action. pianational.org/cyberassessment

✦ THE AGENT EXPERIENCE. Practical information and resources to help you develop and grow customer relationships online. pianational.org/agentexperience

✦ PIA member discounts on licensing and more.

✦

PIA ADVOCACY BLOG. Timely updates about what’s happening on Capitol Hill and on state and federal regulatory issues. PIAAdvocacy.com.

✦ GRASSROOTS ALERTS. Send pre-written, fully-editable letters directly to your elected officials. pianational.org/grassroots

✦

PIA ADVOCACY DAY. Every spring, PIA members visit Capitol Hill to talk with their elected representatives about issues that are important to independent insurance agents. pianational.org/advocacyday

✦

PIA POLITICAL ACTION COMMITTEE (PIAPAC). PIAPAC contributes to the campaigns of candidates to federal office who share our pro-insurance, pro-business perspective and who support our issues. pianational.org/piapac

Learn more about these PIA member benefits at www.pianational.org.

to reintroduce Agency Journey Mapping, a perpetuation/succes sion planning program for agency owners at every stage

Whether you are planning for the eventual sale of your agency, planning for the unexpected, or simply want to value your agency, PIA’s Agency Journey Mapping program will put you on the right path. We’ll help you understand the challenges and best practices of agency ownership transfer, so you can create a perpetuation/succession plan for your agency. You will receive access to dozens of tools to help you do it.

You make decisions every day that set the stage for your options long-term. Agency Journey Mapping helps you see the impact of your actions today on your agency’s value, ability to respond

to new opportunities, and preparation for the unexpected. The program addresses succession and perpetuation planning. But it’s not only for agents headed for the exit. It’s so much more. It is designed to give agency owners — at every stage — control of their future by investing in a little planning today.

· Step 1: Attend live or on-demand seminar. Step 2: Access a library of resources.

· Step 3: Develop a customized plan for YOUR agency.

TO ACCESS PIA’S AGENCY JOURNEY MAPPING, VISIT: AGENCYJOURNEYMAPPING.COM

PIA Members: PIA has funds reserved to reimburse your purchase of the Agency Journey Mapping program. Learn more at: pianational.org/moneyformembers

Thank you to the PIA Partnership for making all of this possible! Learn more at: pianational.org/pia-partnership

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096

PHONE: (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com | Web Site: piasouth.com

PIA of Arkansas Inc.

102 Country Club Parkway, Suite 201, Maumelle, AR 72113

PHONE: (501) 225-1645 e-mail: staci@piaar.com Web Site: www.piaar.com

PIA Western Alliance, 3205 Northeast 78th St #104, Vancouver, WA 98665 PHONE: (888) 246-4466 | FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Connecticut, P.O. Box 997, Glenmont, NY 12077-0997

PHONE: (800) 424-4244 | FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Florida, Inc., 419 N. Lee Street, Alexandria, VA 22314-2353

PHONE: (850) 893-8245 | FAX: (703) 549-5190 e-mail: piafl@piafl.org | Web Site: www.piafl.org

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096

PHONE: (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com | Web Site: piasouth.com

PIA of Hawaii, 1247 Kelewina St. Kailua, HI 96734

PHONE: (808) 261-9460 | FAX: (808) 262-5355 e-mail: piahi@hawaiiantel.net | Web Site: www.piahawaii.com

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Indiana, 50 E. 91 Street Ste. 207 Indianapolis, IN 46240

PHONE: (317) 899-9200 | FAX: (317) 493-0408 e-mail: info@piaindiana.com Web Site: www.piaindiana.com

Kansas Association of Professional Insurance Agents 216 SW 7th Ave, Topeka, KS 66603

PHONE: (785) 232-4143 | FAX: (785) 232-0272 e-mail: trina@kansaspia.org | Web Site: www.kansaspia.org

KENTUCKY

PIA of Kentucky, 107 Consumer Lane, Frankfort, KY 40601

PHONE: (502) 875-3888 | FAX: (502) 227-0839 e-mail: clemay@piaky.org | Web Site: www.piaky.org

PIA of Louisiana Inc. 4021 W. E. Heck Ct., Building K, Baton Rouge, LA 70816

PHONE: (225) 766-7770 | (800) 349-3434 LA only FAX: (225) 766-1601 e-mail: jody@piaoflouisiana.com Web Site: www.piaoflouisiana.com

Maine Insurance Agents Association

17 Carriage Lane, Hallowell, ME 04347

PHONE: (207) 623-1875 | FAX: (207) 626-0275 e-mail: lisa@maineagents.net Web Site: www.maineagents.net

Insurance Agents & Brokers of Maryland

650 Wilson Lane, Suite 200, Mechanicsburg, PA 17055-4440

PHONE: (717) 795-9100 FAX: (717) 795-8347 e-mail: iab@iabforme.com | Web Site: www.iabforme.com

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

Michigan PIA, P.O. Box 99579 Troy, Michigan, 48099 PHONE: (616) 454-4461 FAX: (616) 454-4491 e-mail: inquiry@mipia.com | Web Site: www.mipia.com

PIA of Minnesota, 8646 Eagle Creek Circle, Suite 202, Savage, MN 55378 PHONE: (866) 694-7070 FAX: (866) 749-8678 e-mail: info@piamn.com Web Site: www.piamn.com

PIA Southern Alliance, 3805 Crestwood Pkwy. NW, Ste. 140, Duluth, GA 30096 PHONE (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com Web Site: piasouth.com

Missouri Association of Insurance Agents

3315 Emerald Lane, Jefferson City, MO 65109-6878

PHONE: 573-893-4301 | FAX: 573-893-3708 e-mail: mbarton@moagent.org | Web Site: www.missouriagent.org

PIA Western Alliance, 3205 NE 78th St Ste 104, Vancouver, WA 98665-0697 PHONE: (888) 246-4466 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PIA of Nebraska/Iowa, 11932 Arbor Street, Ste. 100, Omaha NE 68144 PHONE: (402) 392-1611 FAX: (402) 392-2228 e-mail: cathy@pianeia.com | Web Site: www.pianeia.com

PIA of New Hampshire, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIA New Jersey, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

NEW YORK

PIA New York, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIANC, 1059 Technology Park Dr, Glen Allen, VA 23059 PHONE: (804) 264-2582 e-mail: kevin@pianc.net | Web Site: www.pianc.net

PIA of North Dakota

827 28th Street South, Suite C-2, Fargo, ND 58103

PHONE: (701) 223-5025 (800) 733-1050 ND&MN only FAX: (701) 223-9456 | e-mail: info@piand.com Web Site: www.piand.com

PHONE: (703) 836-9340 FAX: (703) 836-1279 email: membership@pianational.org Web Site: www.pianational.org

OKLAHOMA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

OREGON/IDAHO

PIA Western Alliance

3205 Northeast 78th Street, #104, Vancouver, WA 98665

PHONE: (888) 246-4466 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PENNSYLVANIA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PUERTO RICO & CARIBBEAN

PIA of Puerto Rico and the Caribbean Inc 419 N. Lee Street, Alexandria, VA 22314

PHONE: 800-742-6900 FAX: 703-836-1279 e-mail: membership@pianational.org | Web Site: www.piapuertorico.org

RHODE ISLAND

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

SOUTH CAROLINA

PIA of South Carolina, PO Box 6167, Columbia, SC 29260

PHONE: (803) 772-0557 (888) 742-6372 | FAX: (803) 772-0846 e-mail: PIASC@piasc.net | Web Site: www.piasc.net

SOUTH DAKOTA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

TENNESSEE

PIA of Tennessee Inc 504 Autumn Springs Court Suite A-3, Franklin, TN 37067 PHONE: (615) 771-1177 FAX: (615) 771-3456 e-mail: piatn@piatn.com | Web Site: www.piatn.com

TEXAS

PIA of Texas

5605 N. MacArthur Blvd. Suite 1000, Irving, TX 75038

PHONE: (972) 862-3333 FAX: (972) 307-7888 e-mail: vicki@piatx.org Web Site: www.piatx.org

UTAH

Utah Association of Independent Insurance Agents 4885 S. 900 E., Suite 302, Salt Lake City, UT 84117

PHONE: (801) 269-1200 FAX: (801) 269-1265 e-mail: mattchild@uaiia.org | Web Site: www.uaiia.org

VERMONT

PIA of Vermont P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIA Assn of Virginia & DC 1059 Technology Park Dr, Glen Allen, VA 23059

PHONE: (804) 264-2582 FAX: (804) 266-1075 e-mail: kevin@piavadc.com | Web Site: www.piavadc.com

WASHINGTON/ALASKA

PIA Western Alliance 3205 Northeast 78th Street, #104, Vancouver, WA 98665

PHONE: (360) 571-7100 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

WEST VIRGINIA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

WISCONSIN

PIA of Wisconsin, Inc., 725 Heartland Trl Ste 108, Madison, WI 53717-1976

PHONE: (608) 274-8188 (800) 261-7429 | FAX: (608) 274-8195 e-mail: phanson@piaw.org | Web Site: www.piaw.org

Assoc. of Wyoming Ins. Agents, PO Box 1321, Cheyenne, WY 82003

PHONE: (307) 201-4801 FAX: (775) 796-3122 e-mail: awia@vcn.com Web Site: www.awia.com

www.pianational.org |

www.pianational.org |

Since 1969, independent insurance agents have been enjoying the advantage of products offered by the PIA Services Group Insurance Fund (also known as the PIA Trust). PIA members and their employees can choose from high-quality, competitively-priced insurance plans to help protect themselves and their families. All of the insurance products can be customized to match the insured’s individual needs. Your employees may apply for all of the plans without your participation (except for Basic Life). These plans are administered by Lockton Affinity.

Term Life Insurance

Expenses continue for your family if something happens to you. You can help protect their financial future with life insurance.

Basic Life Insurance

$50,000 of Basic Life Insurance is available to Agency Owners/Managers. This Basic Life coverage is also available for employees (up to $30,000 with 100% participation of eligible employees and employer pays 100% of the premium.) There is no medical underwriting.

If you have Basic Life coverage, you can add your Dependent Spouse for the same coverage level as you have purchased. You also can purchase Basic Life coverage for your children. Both of these coverages are not medically underwritten.

Member agencies are not responsible for the cost of Spouse and/or Dependent Basic Life Plans.

Supplemental Life Insurance

Additional term life insurance up to $500,000 is available through the Supplemental Life Insurance Program (medically underwritten). If you have Basic or Supplemental Life, Dependent Term Life Insurance is also available up to $100,000 for spouses (medically underwritten) and $10,000 for children (not medically underwritten).

*PIA National membership, when requred, must be current at all times. Policies or provisions may vary or be unavail able in some states. Policies have exclusions or limitations which may affect any benefits payable.

If you suffer an injury which results in a loss of life or limb, the coverage will pay the sum as outlined in the policy for the Loss provided the accident that caused the Loss occurred while covered under this benefit; and except for loss of life, the Loss occurs within the 365 day period immediately after the date of the accident.

Your acceptance is guaranteed! There is no medical exam and no medical questions.

“If you are unable to perform the material and substantial duties of your occupation, this coverage can help fill the income gap before your long term disability benefits begin. You may choose up to $1500 per month for a period of 9 or 22 weeks to create a seamless transition from Short Term Disability to Long Term Disability benefits. This plan is medically underwritten.

Long Term Disability

Consider how you would manage if a long-term disability reduced your earning power. If you become disabled this plan can help replace up to 60% of your lost income on the base plan and up to 100% in the event of a catastrophic disability. The base plan offers monthly benefit amounts to $8,000. There is no medical underwriting up to $4,000, however disability income benefits are subject to a preexisting condition limitation.

As an agent, the more you have to offer, the more opportunities you have to customize coverage for your customers. That’s why we equip you with a full suite of products—including auto, home, motorcycle, boat, RV, and more—so you can give your customers peace of mind knowing that whatever they need, you’ve got it covered.

Plus, as a Progressive agent, you have access to our industry-leading commercial coverage to round out your offerings and meet all your customers’ needs.

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

All the products you need to protect your customers