PRESIDENT

Anthony Curti, CIC, LIC (MI) tcurti@acrisure.com

PRESIDENT-ELECT

Gerald F. Hemphill, CIC, LUTCF (VA/DC) ghemphill@gfhinsurance.com

VICE PRESIDENT/TREASURER

Richard A. Savino, CIC, CPIA richs@broadfieldinsurance.com

SECRETARY/ASSISTANT TREASURER

Ariel Rivera, CIC (PR) ariel@deerinsurance.com

IMMEDIATE PAST PRESIDENT

Wayne F. White, CPA, CPIA, PFMM (AR) wwhite1948@aol.com

EXECUTIVE VICE PRESIDENT/CEO

Mike Becker (PIA National) mbecker@pianational.org

PUBLISHER/EDITOR-IN-CHIEF

Ted Besesparis | tbesesparis@pianational.org

MANAGING EDITOR

Sade Hale | shale@pianational.org

ADVERTISING DIRECTOR

Robert Holt, CLU, ChFC, CASL | rholt@pianational.org

GOVERNMENT AFFAIRS EDITOR

Jon Gentile | jgentile@pianational.org

REGULATORY AFFAIRS EDITOR

Lauren Pachman, Esq. | lpachman@pianational.org

MARKETING EDITOR

Madeleine Stern | mstern@pianational.org

CONTRIBUTING EDITOR

Patricia A. Borowski, CPIW

PRODUCTION EDITOR

Laurel Prucha Moran | laurelpm@blueroomstudio.com

September 2022

PIA Connection is published ten times yearly by the National Association of Professional Insurance Agents. 419 North Lee Street Alexandria, Virginia 22314 ©2022 All rights reserved.

The information in this publication is general in nature and is not intended to serve as legal, accounting, financial, insurance, investment advisory or other professional advice as to any reader’s particular situation. Users are encouraged to consult with compe tent legal, financial, insurance, investment advisory and or other professional advisors concerning specific matters before making any decisions and we disclaim any responsibility for any decisions or actions by readers.

All PIA members receive PIA Connection at the member subscription rate of $12.00 per year.

Non-member subscriptions available at $24.00 per year ppd.

For additional information on any of the subjects addressed in this publica tion, please access the PIA National website at www.pianational.org.

NEWS BRIEF 6-7

30 Year Anniversary of Hurricane Andrew…Younger Homeowners

Expect Extreme Weather Damage…Annual Cost of Insurance Fraud: $308.6 Billion…All California Local GEICO Offices Closed…GA Commissioner King “Angry” at Allstate…Nebraska Holds Insurance Trade Talks in U.K.

PIA NATIONAL GUIDE TO MEMBER BENEFITS 9-12

A detailed look at many of the benefits and advantages of PIA membership such as business building tools, insurance products, cutting-edge communications, agency management tools, legislative & regulatory advocacy – and a whole lot more!

IS THE ACTIVE ASSAILANT INSURANCE MARKET EVOLVING? 13-15

PIA Counsel and Director of Regulatory Affairs Lauren G. Pachman, Esq. takes an in-depth look at the costs of active assailants and how – and whether – insurance products are up to the task of protecting us, today and in the future.

PIA DMV: PIA’S DIRECT MARKETING VAULT 17

PIA’s turnkey, direct mail, marketing campaign creator puts you in the driver’s seat. Your next client is waiting for you!

IT IS WITH A SENSE OF GRATITUDE AND SATISfaction that I come to the end of my one-year stint as President of PIA. This year has been one of great aspirations and many accomplishments, thanks to the talent, dedication and hard work of a lot of people.

Our future is bright, as PIA has the right balance of leader ship, experience, and chemistry in place. Importantly, PIA and our stakeholders are in accord on our strategy. We are moving in the same direction.

Our staff continues to perform at a high level. I’m impressed with the focus, promptness, and commitment they demon strate. Our CEO Mike Becker is a trusted ally. He is a visionary in tune with the industry and is so very committed to making PIA the best it can be. Thanks, Mike!

The groundwork laid out by Presidents Savino, Kuhnke and White allowed me to build off of a solid foundation. The advice and counsel from Kevin Svingen and Andy Harris have been essential to me. Their leadership, experience and mentorship made my job easier. I want to thank each of them.

In the past year, PIA has made significant advances, espe cially in the areas of education and membership. Over the past decade, PIA has continued to improve across the board. Today, our association is accomplishing more and is better positioned

PIA’S ADVOCACY IS NOT EXCLUSIVELY FOCUSED on legislatures. Regulatory bodies also have influence that, depending on how it is exerted, can also have an effect on inde pendent insurance agencies.

In recent years, it seems that no issue has been more central to our regulatory advocacy than flood insurance.

PIA agents recently served as resources for the Federal Emergency Management Agency (FEMA)’s examination of the Write-Your-Own (WYO) reimbursement rate in connection with a RAND study on this issue.

PIA also responded to FEMA’s request for information on a proposal to develop a direct-to-consumer method of selling National Flood Insurance Policies (NFIP) policies online. PIA filed highly critical comments.

Flood insurance is just one issue involved in the regulatory arena in which we are engaged.

Over the last few months, PIA has participated in a vari ety of conferences and events, including meetings held by the National Council of Insurance Legislators (NCOIL), the Industry Education Council (IEC), the National Association of Insurance Commissioners (NAIC), the Flood Insurance

for long-term success than we have been in many years.

For more than 20 years, PIA has worked together with premier carrier members that support the Agency Distribution System to create The PIA Partnership, which provides agents with a steady stream of tools they can use to build their agencies and books of business. One of our national leaders recently called The PIA Partnership the “Crown Jewel” of PIA. That’s certainly true!

As I make way for our next President, my friend Gerald Hemphill, I do so with confidence that he and the national officers of PIA will continue to work together to move PIA to even greater success. We have made meaningful progress, but we still have a lot of work to do.

PIA has thrived for almost 92 years because members and stakeholders who came before us had an abiding commitment to PIA. If we work hard and stay the course, we will celebrate our 100 year anniversary not long from now.

Tony Curti PresidentProducers National Committee (FIPNC), the National Insurance Producer Registry (NIPR), FEMA, and the National Flood Association (NFA), among others.

As part of PIA’s advocacy work, PIA routinely files pub lic comments on behalf of PIA members to a variety of governmental or industry organiza tions. Thank you to the many members who contribute to the thought behind those comments through PIA Advisory Councils. These comments are included in the PIA Advocacy Blog, www.piaadvocacy.com, so please be sure to check the blog on a regular basis.

Key advocacy issues are important, and we take great honor in representing PIA members every day.

Mike Becker CEO

It was 30 years ago that Hurricane Andrew cut a path of destruction across southern Dade and northern Monroe counties in Florida. Andrew made landfall south of Miami on August 24, 1992, with 165 mph winds, and a 16.9-foot storm surge that caused the loss of 65 lives, 60,000 homes destroyed and more than $25 billion in damage. At the time, Hurricane Andrew was only the third Category 5 hurricane to land on U.S. soil.

A new Policygenius survey found that 72 percent of insured homeowners aged 18 to 34 said their homes are very or somewhat likely to be damaged by extreme weather during the next three decades, versus 45 percent of all adult homeowners. The survey also found that 31 percent of home policyhold ers have already experienced damage from a hurricane, tor nado, wildfire, flood or other extreme weather events.

The survey found that onethird of homeowners don’t think or aren’t sure they’ll have enough insurance to fully rebuild their dwelling should it be damaged by extreme weather, Policygen ius reported. For example, just 21 percent of homeown ers have flood insurance, even though flood damage isn’t covered by most home insurance policies.

Insured homeowners who said their homes are very or somewhat likely to be damaged by extreme weather during the next three decades

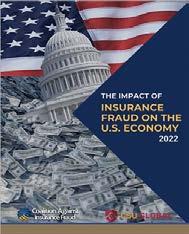

According to a report from the Coalition Against Insur ance Fraud, the annual cost of insurance fraud to U.S. consumers and businesses is $308.6 billion. This is the first time the figure has been updated in 27 years, and the first time it has gone beyond property and casualty to include other lines such as life and health, workers’ compensation, and auto theft. The report found that fraud totaled $45 billion for property and casualty, $34 billion for workers’ comp, $36.3 billion for health, and $74.7 billion for life insurance. Fraud related to auto theft totaled $7.4 billion.

Aged 18 to 34 All

Home policyholders who have already experienced damage from extreme weather events

“Our goal is that when this study is updated next time, for that figure (cost of fraud total) to go down. There’s no reason it shouldn’t,” said Matthew J. Smith, Esq, executive director of the Coalition Against Insurance Fraud. “We have technology, we have the resources, we have great insurers in this country, and we have leg islators and regulators who are interested. Let’s work cooperatively to get that number down.”

Homeowners who have flood insurance

All 38 GEICO offices in California have been closed and phone sales in the state have halted. According to a statement from the company, the GEICO local offices that closed are sales offices owned by independent contractors. Media reports say “hundreds” of employees have been laid off. People will need to access their offer ings through a computer or a mobile device, as California customers cannot purchase policies via phone. This comes after GEICO made the decision in April 2022, to suspend quoting in their call centers across several states — includ ing California.

“The company’s actions will make it harder for

consumers to buy GEICO policies, particularly those who are computer challenged or prefer to meet an agent in person,” said former California Insurance Com missioner Dave Jones. The Sacramento Bee reported that on Thursday August 11, several GEICO customers who attempted to meet with local agents at the GEICO office at 5211 Madison Ave. in Sacramento were turned away. They were told to call an 800 number.

Georgia Insurance and Safety Fire Commissioner John F. King is alerting consumers that Allstate Property & Casualty Company has filed an overall statewide automobile rate increase of 25 percent on their Georgia policy holders.

Under Georgia’s dual rate filing system governing automobile insurance rates established in Georgia state law, the Insurance Commissioner only has the authority to approve or disapprove minimum limits policy filings, while all other filings can go into effect immediately under what is known as “file and use.” The latest rate increase filed by Allstate falls into the latter category.

“I am angry and disappointed that Allstate has chosen to exploit a loophole in state law to implement such a substantial increase in costs on hardworking Geor gians when families are already struggling with historic inflation everywhere from the gas pump to the grocery store,” said Commissioner King.

A Nebraska trade delegation, including state agency direc tors, agricultural producers, insurance industry leaders, and economic development leaders, recently completed a week-long trade mission visit to the United Kingdom.

Nebraska Department of Insurance Director Eric Dunning and other key leaders from the state’s insurance industry are developing relationships with regulators and insurers in the United Kingdom during the trade mission to position Nebraska as a key partner with the insurance market.

Since the United Kingdom exited the European Union in 2020 (Brexit), U.K. insurers have been looking to develop stronger relationships in the United States. With bilat eral trade talks stalled between the British and American federal gov ernments, the U.K. has begun reaching out to individual US states.

Nebraska Gov. Pete Ricketts (front and center in blue tie) and members of the Nebraska trade delegation at a meeting with The BritishAmerican Business Association in London.

> PIA Member Reimbursement Program. PIA is here to help your agency get back to business. Receive reimbursements on PIA marketing and PIA Partnership programs (up to $250 per program, for a total of up to $500). pianational.org/moneyformembers

> PIA DMV: PIA’s Direct Marketing Vault. A one-stop shop for direct mail and digital advertising services. Customizable postcard templates are available to use with the USPS Every Door Direct Mail Program and Targeted Direct Mail. Double your impact with add-on digital advertising services. piadmv.com

> Marketing Support for PIA Members. Market your agency using PIA’s print advertisements, social media support, and consumer-facing marketing content for your clients and prospects. pianational.org/marketingsupport

> Hartford Flood Insurance. Easy enrollment, your dedicated local sales directors and book transfer/rollover team, training/CE, free certified zone determinations, 24/7 claims reporting and special PIA member commissions regardless of volume. pianational.org/hartfordfloodinsurance

> PIA Market Access. Access to over 50 national and specialty carriers, real-time online rating, ownership of your book and no exit fees for a low monthly rate. piamarketaccess.com

> AVYST eForms Wizard. Quickly and easily prepare ACORD, agency-specific, and carrierunique applications and forms, entering data only once in an organized interview for mat. Get to market faster! pianational.org/avyst

> Rough Notes Advantage-Plus. Helps identify risk expo sures and provides detailed coverage analysis for C/L and P/L. Save $100/year with PIA member discount. pianational.org/roughnotes

> E&O Insurance. Professional liability, errors and omissions insurance. With access to multiple markets with differing appetites, including admitted and non-admitted markets, chances are we can find the coverage and price that’s right for you, even if you have a more unusual risk. pianational.org/eando

> PIA Agents Umbrella Program. Excess insurance protection includes E&O and business liability coverage, with available endorsements for EPL and personal coverage. Coverage not available in all states. pianational.org/umbrella

> Cyber Insurance. PIA is proud to offer robust coverage tailored to small and mid-sized busi nesses. Coverage is available for you to purchase and also to sell. pianational.org/cyberinsurance

> Individual and Group Insurance Products. Basic, voluntary, and dependent term life; long/short term disability; and AD&D for you, your employ ees, and families. piatrust.com

Through our ongoing activities with The PIA Partnership, PIA’s company council, we develop hands-on tools specifically designed for you to strengthen your agency.

The PIA Partnership — a joint effort of leading insurance carriers and PIA — develops hands-on tools for you and your agency such as:

> Winning@Cybersecurity Defense. A four-part educational resource created to teach you and your clients about the most common cyber dangers faced by small and midsized businesses as well as the best business practices and insurance coverages that can reduce these risks. pianational.org/cybersecurity

> Winning@Virtual Sales and Service. Modern agents must be prepared to sell and service virtually. This program addresses how your agency should transform themselves to take advantage of modern technology and changing consumer expectations caused by changes in technology. pianational.org/winningatvirtual

> Ready For Everything. This hub brings together resources for crisis planning and preparation, so that you can survive any crisis. pianational.org/readyforeverything

> Winning@Talent. Your guide to hiring, motivating, and retaining the best agency employees. pianational.org/winningattalent

> Agency Journey Mapping. Value your agency, maximize your retirement income, and plan for unexpected death/disability while cre ating a perpetuation plan for your agency. pianational.org/agencyjourneymapping

> Small Commercial — the Digital Opportunity. A variety of resources that help you increase your digital capabilities and improve the digital experience for your customers. pianational.org/digital

> Closing the Gap — Growth & Profit. Project and plan for new business growth and profitability using PIA’s calculators. Use PIA’s turnkey approaches for improving retention, sales and account-rounding in your agency. pianational.org/growth

> Agency Touch Points — The Voice of the Customer. Learn how to capitalize on Partnership research to give personal lines customers what they really want. pianational.org/touchpoints

> Reaching Gen Y. This online tool helps you understand and reach Gen Y age group insurance consumers and convert them into loyal agency customers. pianational.org/geny

> Practical Guide to Successful Planning. This valuable resource helps you plan for success within your agency and coordinate your plans with the carriers you represent. pianational.org/successfulplanning

> PIA 401(k). The PIA 401(k) plan is easy to administer, offers minimal fiduciary responsibility, is low-fee and low-cost. It has you covered by performing over 90% of administrative tasks and becoming your retirement department support team. pianational.org/401k

> PIA Blueprint for Agency Success. Your 3-part resource guide for business planning, growth strategies, and agency continuity. pianational.org/blueprint

> ACORD Forms End User Licenses. Available for free if you qualify and access ACORD forms through agency management systems and other authorized distributors. Plus PIA member discounts on the ACORD Advantage Plus Program. pianational.org/acord

> Agency Agreement Review Service. Free to you and carriers, PIA recommends changes to carriers and highlights concerns for members so you can make informed decisions about the agreements sign. pianational.org/agreementreview

> Employee Profiling. Hire the right people with skills and personality testing from OMNIA. pianational.org/omnia

> Hire with IdealTraits. The comprehensive, go-to hiring tool to help you hire top performers. pianational.org/idealtraits

> Cyber Risk Assessment. A low cost cyber risk assessment designed specifically for you. This delivers a one-two-three punch that identifies your unique risks, how to mitigate them, AND guidance/tools to turn the recommendations into action. pianational.org/cyberassessment

> The Agent Experience. Practical information and resources to help you develop and grow customer relationships online. pianational.org/agentexperience

> Discounted producer licensing services from Central Licensing Bureau.

> Free subscriptions to industry publications.

PIA National represents members’ interests in state capitals and in Washington, D.C. to ensure that lawmakers and regulators understand and support the independent agency system. That’s why PIA actively works with Congress and the Executive branch to ensure that your voice is heard when policymakers make decisions that impact you.

PIA has one common strategy: always put the interests of agents first! Whether it’s fighting encroachment by the Federal Insurance Office, standing up for agent commissions, protecting the vital role that independent agents play in delivering federallybacked crop and flood insurance, and safeguarding the employer-sponsored healthcare system, PIA is your advocate in the halls of Congress, with regulators and throughout our industry.

In addition, PIA works with Congress on other vital issues like cybersecurity, data security legislation and the Terrorism Risk Insurance Act (TRIA).

PIA National’s advocacy also extends to important organizations like the National Association of Insurance Commissioners (NAIC), state lawmakers through the National Council of Insurance Legislators (NCOIL) and InsureTech standards groups like the Association for Cooperative Operations Research and Development (ACORD), and others — to ensure that the concerns of independent agents are addressed.

Here are some ways you can get involved:

> PIA Advocacy Blog. The PIA Advocacy blog is your one-stop shop for timely updates on what’s happening on Capitol Hill and on state and federal regulatory issues. Follow the blog by visiting: PIAAdvocacy.com

> PIA Advocacy Day (formerly the Federal Legislative Summit).

Every spring PIA members gather in the nation’s capital to meet with their elected representatives to discuss issues that are important to independent insurance agents. PIA Advocacy Day gives policymakers and their staffs a chance to hear directly from you, their constituents. This year the event will be held virtually on a rolling basis throughout the year. Learn more by visiting: PIAAdvocacyDay.com

> Grassroots alerts. To ensure legislators feel the heat from their constituents, PIA occasionally organizes grassroots campaigns in which PIA members can easily send pre- written, fully-editable letters directly to their elected offi cials. Send one now by visiting: piagrassroots.com

Contact us

Have a question? Not sure how to access a particular program?

> PIA Political Action Committee (PIAPAC). PIAPAC is the Professional Insurance Agents Political Action Committee. The PAC contributes to the campaigns of candidates to federal office who share our pro-insurance, pro-business perspective and who support our issues. PIAPAC is funded by the contributions of individual PIA members. To learn more visit: piapac.com

The Professional Insurance Agents Insurance Foundation (501(c) (3)) strives to further the insurance knowledge and education of those engaged in the independent insurance agency system. It is also home to the PIA Disaster Relief Fund which solicits charitable contributions and, in turn, provides relief grants to businesses following catastrophic events.

Want to vent about something? That’s what your staff at PIA is for. Please contact us using the information to the right.

Connect with PIA National facebook.com/PIANational

@PIANational

linkedin.com/company/pianational instagram.com/pia_national

Connect with other PIA members

Join the PIA Peers group on Facebook

National Association of

Professional Insurance Agents 419 N. Lee Street Alexandria, Virginia 22314 (703) 836-9340 membership@pianational.org pianational.org/contactus

The COVID-19 pandemic collectively distracted us from the horrific phenomenon of active shooters or active assailants over the past three years. As we take another look now, has anything changed? Beyond the toll in human lives, we examine the other costs of active assailants and how—and whether—insurance products are up to the task of protecting us, today and in the future.

SINCE THE LAST TIME ACTIVE shooter insurance was addressed in these pages, countless communities have been added to the growing list of those devastated by mass shootings: Highland Park (July 2022; eight killed, 29 injured). Uvalde (May 2022; 22 killed, 17 injured). Buffalo (May 2022; 10 killed, three injured). Sacramento (April 2022; six killed, 12 injured).1 The venues of the attacks—a Fourth of July parade, an elementary school, a grocery store, outside a bar/club—have been as varied as the geographic areas of the country in which they occurred. All welcome members of the public, as employees, patrons, or both, and thus they subject people to a risk that might have been unheard of a few decades ago: the risk of being fatally attacked or wounded by an assailant with a gun, bomb, homemade explosive device, or even a car.

The Federal Bureau of Investigation (FBI) defines an active shooter as one or more individuals actively engaged in killing or trying to kill people in a

populated area.2 The active shooter or assailant is the person (or, less com monly, group of people) who plans and executes the often-fatal attack on acquaintances or strangers in a relatively public place, usually without warning, using guns, knives, explo sives, or other means.

In the United States, such assail ants typically use guns, although the April 2013 Boston Marathon bombing, which killed three and injured hun dreds, demonstrated that homemade explosive devices could be deadly as well. And in August 2017, a white nationalist rally in Charlottesville, VA drew both racists and anti-racist pro testers. There, a white nationalist drove his vehicle into a crowd, striking and killing a protester.

The need for businesses to purchase active assailant insurance coverage has become more pronounced as “lone wolf” active shooter and other domes tic terrorist attacks have proliferated against what had commonly been thought of as “soft targets,” relatively low-profile locations targeted by indi viduals working alone or in very small groups.

Historically, traditional insurance did not offer coverage that could protect assets at risk of loss from an attack by an active assailant. Most of the time, the owner of a venue that became the site of such an attack could turn only to its commercial general liability (CGL) policy for financial recourse after an attack, even though such events have the capacity to catastrophi cally damage the physical property on which they occur.3 More recently, though, active assailant insurance has become available to fill the gap cre ated by the limitations on most CGL policies on losses resulting from active assailant attacks. Over the past several years, carriers have developed policies or endorsements specifically designed to cover losses sustained during an

1 Gun Violence Archive: 2022 Mass Shootings. https://www.gunviolencearchive.org/reports/massshooting (last visited September 6, 2022).

2 “Active Shooter Incidents in the United States in 2021,” https://www.fbi.gov/file-repository/activeshooter-incidents-in-the-us-2021-052422.pdf/view (last visited September 6, 2022).

3 See Allstate Ins. Co. v. Neal, 304 Ga. App. 267, 696 S.E.2d 103 (2010), in which the plaintiff police officer was injured by the intentional gunfire of the homeowner, whose arrest warrant the officer had sought to serve. The court found that the homeowners’ insurance policy did not cover the officer’s injuries because said injuries were intentionally inflicted and thus was not “unforeseeable” to the policyholder. https:// casetext.com/case/allstate-ins-co-v-neal (last visited September 6, 2022).

active assailant event. Such coverage is usually triggered by a physical attack by an armed person or group of people executing a pre-planned assault while on the premises during the event.4

Active assailant coverage typically covers some of the same losses that a CGL policy would cover, like physical damage, business interruption, and legal liability. However, active assailant coverage could also address expenses associated with medical care or funeral expenses for victims, trauma counsel ling for victims, and risk assessment, public relations consulting, additional security staffing, and crisis manage ment for employers or property own ers, among other costs.5, 6 It may also provide ongoing business interrup tion coverage for closures prompted by local and/or federal law enforce ment investigation(s) and, later, losses associated with an affected business’s closure for rehabilitation, relocation, or rebuilding. While relocation or rebuilding can be necessitated by the attack itself, it may also be precipitated by local leaders’ conclusion that such a change is in the best interests of the affected community.

Carriers offering such policies encourage their policyholders to prospectively engage in prevention

4 Norris, Melanie Morgan. “Active Shooter Insurance Policies,” National Law Review, September 30, 2021. https://www.natlawreview. com/article/active-shooter-insurance-policies (last visited September 6, 2022).

5 “Dedicated Coverage for Active Assailant Events,” Marsh. https://www.marsh.com/us/services/ terrorism-risk/products/active-assailant-coverage. html (last visited September 6, 2022). 6 Moorcraft, Bethan. “What is active shooter insurance coverage?” Insurance Business Magazine, Dec. 14, 2018. https://www. insurancebusinessmag.com/us/guides/what-isactive-shooter-insurance-coverage-118961.aspx (last visited September 7, 2022).

strategies and take steps toward response preparedness to help reduce the potential for fatalities, injuries, and property damage. For instance, some carriers offer employee trainings in how to respond to active assailant scenarios, provide consumer evacua tion plans, etc.7 Underwriters are likely to consider whether a prospective policyholder has taken steps like these in determining whether to provide a prospect with active assailant coverage. Additionally, state governments may view some settings as more inherently dangerous than others. In

7 “Dedicated Coverage for Active Assailant Events,” Marsh. https://www.marsh.com/us/services/ terrorism-risk/products/active-assailant-coverage. html (last visited September 6, 2022).

California, for example, California’s Occupational and Safety Health Administration (CAL OSHA) has begun to require hospitals and health care sites to develop evacuation and sheltering plans in response to active shooters.8

Active assailant coverage may exclude employee liability protections, offer ing coverage only to guests or visitors.

8 “Companies Taking Notice of Safe Workplace OSHA Requirements,” February 11, 2021. https:// www.mcgowanprograms.com/blog/taking-noticesafe-workplace-osha-requirements/ (last visited September 6, 2022).

Certain weapons could be excluded, like vehicles or homemade bombs. Active assailant coverage could also include casualty thresholds, where coverage would apply only after a certain number of injuries or fatalities; some such policies only cover losses once an attack results in more than three or four victims, leaving carriers and agents in the unenviable position of potentially having to deny coverage for an attack resulting in an insufficient number of casualties.9

Exclusions may also be based on the motive for the attack; some active

9 Norris, Melanie Morgan. “Active Shooter Insurance Policies,” National Law Review, September 30, 2021. https://www.natlawreview. com/article/active-shooter-insurance-policies (last visited September 6, 2022).

assailant policies contain terrorism exclusions. Even within that category, the definition of “terrorism” may vary across carriers and policies. Acts perpetrated by employees against their place of current or former employment may also be excluded.10

One of the lessons we can extract from the array of locales where active assailant attacks have taken place is that no geographic area, venue, or

10 Moorcraft, Bethan. “What is active shooter insurance coverage?” Insurance Business Magazine, Dec. 14, 2018. https://www. insurancebusinessmag.com/us/guides/what-isactive-shooter-insurance-coverage-118961.aspx (last visited September 7, 2022).

sector of the economy is immune, unfortunately. Since the Marjory Stoneman Douglas High School shooting in February 2018, commer cial property owners’ interest in active assailant policies has been intensify ing. Each time an active assailant attack in the United States targets a different type of venue, agents see a burst of inquiries about protecting similarly situated venues. As that trend continues, commercial insur ance consumers will increasingly rely on independent agents to be familiar with the available products, even as the range of options continues to broaden.

Lauren G. Pachman, Esq. is counsel and director of regulatory affairs of PIA National.

✦ PIA MEMBER REIMBURSEMENT

PROGRAM: Receive reimbursements on PIA marketing and PIA Partnership programs (up to $250 per program, for a total of up to $500). www.pianational.org/agentsupport

PIA DMV: PIA’S DIRECT MARKETING VAULT. Targeted direct mail and digital advertising campaigns. Turn-key yet highly customizable. www.piadmv.com

✦ MARKETING SUPPORT FOR PIA MEMBERS. Print ads, radio commercials, consumer-oriented flyers and social media support for PIA members. www.piabrandingprogram.com

✦

PIA MARKET ACCESS. Access to over 50 national and specialty carriers, real-time online rating, ownership of your book and no exit fees for a low monthly rate. www.piamarketaccess.com

✦ HARTFORD FLOOD INSURANCE. PIA’s endorsed flood provider since 2004. Dedicated local sales directors and book transfer/rollover team plus great commissions for PIA members. Call (860) 547-5006.

✦ PIA CYBER INSURANCE: Robust coverage tailored to small and mid-sized businesses. Coverage with special PIAonly enhancements is available for PIA members to sell.

✦ AVYST EFORMS WIZARD. Quickly and easily prepare ACORD, agency-specific, and carrier-unique applications and forms, entering data only once in an organized interview format. Get to market faster!

✦ PIA AGENCY MARKETING GUIDE. Handson marketing tips from industry experts. Published annually.

✦ ROUGH NOTES - ADVANTAGE PLUS. Identifies risk exposures. Provides detailed coverage analysis. PIA member price $600 annually (reg. $700). Call 800-428-4384. Use your PIA member ID# above name on mailing label.

✦ AGENCY REVENUE TOOLS. Boost personal lines sales by engaging in employee worksite marketing using your appointed markets at regular commission rates.

✦ PIA LOGO. Put the PIA logo on your business card, website, stationery and signage. Order items with the PIA logo in our online store.

✦ E&O INSURANCE. With access to admitted and non-admitted markets with differing appetites chances are we can find the coverage and price that’s right for you. www.pianational.org/eando

✦ PIA AGENTS UMBRELLA PROGRAM. Excess insurance protection includes E&O and business liability coverage, with available endorsements for EPL and personal coverage.

CYBER LIABILITY INSURANCE. Coverage and pricing tailored to small and mid-sized businesses.

✦ INDIVIDUAL AND GROUP INSURANCE PRODUCTS. Basic, voluntary and dependent term life; long/short term disability; and AD&D. www.piatrust.com

TOOLS FROM THE PIA PARTNERSHIP, PIA’S COMPANY COUNCIL

✦ WINNING@CYBERSECURITY DEFENSE is a four-part educational resource created to teach agents and their clients about the most common cyber dangers faced by small and mid-sized businesses as well as the best business practices and insurance coverages that can reduce these risks.

✦ WINNING@VIRTUAL. Your guide to evolving your sales and service in a digital world.

✦ READY FOR EVERYTHING. The online crisis resource hub for insurance agents.

✦ WINNING@TALENT. Your guide to hiring, motivating and retaining the best agency employees.

✦ AGENCY JOURNEY MAPPING. Value your agency, maximize your retirement income, and plan for unexpected death/disability while creating a perpetuation plan for your agency.

✦ SMALL COMMERCIAL and the DIGITAL OPPORTUNITY. A variety of resources that help agents increase their digital capabilities and improve the digital experience for their customers.

✦ CLOSING THE GAP—GROWTH & PROFIT. Plan for growth and profitability. Includes tools for improving retention, sales and account-rounding.

✦ AGENCY TOUCH POINTS—THE VOICE OF THE CUSTOMER. Give personal lines customers what they really want.

✦ REACHING GEN Y. Convert Gen Y age group insurance consumers into loyal agency customers.

✦ PRACTICAL GUIDE TO SUCCESSFUL PLANNING. Plan for success within your own agency.

Learn more about these

✦ THE PIA 401(K) PLAN is easy to administer, offers minimal fiduciary responsibility, is low-fee and low-cost. It has PIA members covered by performing over 90% of administrative tasks and becoming your retirement department support team.

✦ THE AGENT EXPERIENCE. Practical information and resources about how to develop and grow customer relationships online.

✦ PIA BLUEPRINT FOR AGENCY SUCCESS. A 3-part resource guide for business planning, growth strategies, and agency continuity.

✦

ACORD FORMS END USER LICENSES. Available for free to qualifying PIA members who access ACORD forms through agency management systems and other authorized distributors. Plus PIA member discounts on the ACORD Advantage Plus Program.

✦ AGENCY AGREEMENT REVIEW SERVICE. Free to members and carriers, PIA recommends changes to carriers and highlights concerns for members.

✦ AGENCY PREPAREDNESS AND RECOVERY PLAN. The PIA guide to creating an agency-specific business contingency plan.

✦ EMPLOYEE PROFILING. Hire the right people with skills and personality testing from OMNIA.

✦ HIRE WITH IDEALTRAITS. The comprehensive, go-to hiring tool for agencies looking to hire top performers. www.idealtraits.com/pia

✦ PIA member discounts on licensing and more.

✦ PIA ADVOCACY BLOG. Timely updates about what’s happening on Capitol Hill and on state and federal regulatory issues. www.PIAAdvocacy.com

✦ GRASSROOTS ALERTS. Send pre-written, fully-editable letters directly to your elected officials. www.pianational.org/grassroots

✦ PIA ADVOCACY DAY. Every spring, PIA members visit Capitol Hill to talk with their elected representatives about issues that are important to independent insurance agents. www.pianational.org/advocacyday

✦

PIA POLITICAL ACTION COMMITTEE (PIAPAC). PIAPAC contributes to the campaigns of candidates to federal office who share our pro-insurance, pro-business perspective and who support our issues. www.pianational.org/piapac

member benefits at www.pianational.org.

ONE OF THE EASIEST WAYS TO REACH MORE customers is with the PIA DMV: PIA’s Direct Marketing Vault

PIA’s turnkey, direct mail, marketing campaign creator puts you in the drivers seat. With the PIA DMV, you can:

· Target personal or commercial lines prospects, anywhere in the U.S.

· Select demographics such as location, income, age, type of household, etc. for your personal lines campaigns or target an industry for commercial lines campaigns.

Use PIA’s creative templates or have our partner, One Brand Marketing, create a design just for your agency.

· Use geofencing technology to reach prospects with digi tal ads on their devices.

In the PIA DMV you can access direct mail and digital adver tising services to help reach your next client. With Every Door Direct Mail, no mailing list is required. Simply, select a postal route you want to reach or specify the demographics you want to target and send a customized postcard to every home on that postal route. If you already know who you would like to reach but want to round out your list a bit more, purchase a list from One Brand of your targeted demographics.

You’ll deliver the one-two punch to your campaign by adding targeted digital ads to your order. With the help of geofencing technology, recipients of your postcard will see a digital version of your ad on their electronic devices.

Your next client is waiting for you! pianational.org/piadmv

Learn about PIA’s Direct Marketing Vault (DMV) with guest speaker Eric Rice of One Brand Marketing:

· B enefits of membership with PIA and One Brand Marketing partnership, including specially designed tem plates, pricing, low-cost bulk mailing program and new and improved features.

Direct Mail programs available, including direct and tar geted mail, new movers and discounted saturation mail. How to gain access to the PIA: Direct Marketing Vault.

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096

PHONE: (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com | Web Site: piasouth.com

PIA of Arkansas Inc.

102 Country Club Parkway, Suite 201, Maumelle, AR 72113

PHONE: (501) 225-1645 e-mail: staci@piaar.com Web Site: www.piaar.com

PIA Western Alliance, 3205 Northeast 78th St #104, Vancouver, WA 98665

PHONE: (888) 246-4466 | FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

COLORADO

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Connecticut, P.O. Box 997, Glenmont, NY 12077-0997

PHONE: (800) 424-4244 | FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

DELAWARE

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Florida, Inc., 419 N. Lee Street, Alexandria, VA 22314-2353 PHONE: (850) 893-8245 | FAX: (703) 549-5190 e-mail: piafl@piafl.org | Web Site: www.piafl.org

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096 PHONE: (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com | Web Site: piasouth.com

PIA of Hawaii, 1247 Kelewina St. Kailua, HI 96734 PHONE: (808) 261-9460 | FAX: (808) 262-5355 e-mail: piahi@hawaiiantel.net | Web Site: www.piahawaii.com

PHONE: (703) 836-9340 | FAX: (703) 836-1279 e-mail: membership@pianational.org Web Site: www.pianational.org

PIA of Indiana, 50 E. 91 Street Ste. 207 Indianapolis, IN 46240 PHONE: (317) 899-9200 | FAX: (317) 493-0408 e-mail: info@piaindiana.com Web Site: www.piaindiana.com

Kansas Association of Professional Insurance Agents

216 SW 7th Ave, Topeka, KS 66603

PHONE: (785) 232-4143 | FAX: (785) 232-0272 e-mail: trina@kansaspia.org | Web Site: www.kansaspia.org

PIA of Kentucky, 107 Consumer Lane, Frankfort, KY 40601

PHONE: (502) 875-3888 | FAX: (502) 227-0839 e-mail: clemay@piaky.org | Web Site: www.piaky.org

PIA of Louisiana Inc.

4021 W. E. Heck Ct., Building K, Baton Rouge, LA 70816

PHONE: (225) 766-7770 | (800) 349-3434 LA only FAX: (225) 766-1601 e-mail: jody@piaoflouisiana.com Web Site: www.piaoflouisiana.com

Maine Insurance Agents Association

17 Carriage Lane, Hallowell, ME 04347

PHONE: (207) 623-1875 | FAX: (207) 626-0275 e-mail: lisa@maineagents.net Web Site: www.maineagents.net

Insurance Agents & Brokers of Maryland

650 Wilson Lane, Suite 200, Mechanicsburg, PA 17055-4440

PHONE: (717) 795-9100 FAX: (717) 795-8347 e-mail: iab@iabforme.com | Web Site: www.iabforme.com

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

Michigan PIA, P.O. Box 99579 Troy, Michigan, 48099

PHONE: (616) 454-4461 FAX: (616) 454-4491 e-mail: inquiry@mipia.com | Web Site: www.mipia.com

PIA of Minnesota, 8646 Eagle Creek Circle, Suite 202, Savage, MN 55378

PHONE: (866) 694-7070 FAX: (866) 749-8678 e-mail: info@piamn.com Web Site: www.piamn.com

PIA Southern Alliance, 3805 Crestwood Pkwy. NW, Ste. 140, Duluth, GA 30096 PHONE (770) 921-7585 | FAX: (770) 921-7590 e-mail: info@piasouth.com Web Site: piasouth.com

Missouri Association of Insurance Agents 3315 Emerald Lane, Jefferson City, MO 65109-6878 PHONE: 573-893-4301 | FAX: 573-893-3708 e-mail: mbarton@moagent.org | Web Site: www.missouriagent.org

PIA Western Alliance, 3205 NE 78th St Ste 104, Vancouver, WA 98665-0697 PHONE: (888) 246-4466 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PIA of Nebraska/Iowa, 11932 Arbor Street, Ste. 100, Omaha NE 68144 PHONE: (402) 392-1611 FAX: (402) 392-2228 e-mail: cathy@pianeia.com | Web Site: www.pianeia.com

PIA of New Hampshire, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIA New Jersey, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIA New York, P.O. Box 997, Glenmont NY 12077-0997 PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIANC, 1059 Technology Park Dr, Glen Allen, VA 23059 PHONE: (804) 264-2582 e-mail: kevin@pianc.net | Web Site: www.pianc.net

PIA of North Dakota 827 28th Street South, Suite C-2, Fargo, ND 58103 PHONE: (701) 223-5025 (800) 733-1050 ND&MN only FAX: (701) 223-9456 | e-mail: info@piand.com Web Site: www.piand.com

OHIO

PHONE: (703) 836-9340 FAX: (703) 836-1279 email: membership@pianational.org Web Site: www.pianational.org

OKLAHOMA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PIA Western Alliance 3205 Northeast 78th Street, #104, Vancouver, WA 98665

PHONE: (888) 246-4466 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PENNSYLVANIA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PUERTO RICO & CARIBBEAN

PIA of Puerto Rico and the Caribbean Inc 419 N. Lee Street, Alexandria, VA 22314

PHONE: 800-742-6900 FAX: 703-836-1279 e-mail: membership@pianational.org | Web Site: www.piapuertorico.org

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PIA of South Carolina, PO Box 6167, Columbia, SC 29260

PHONE: (803) 772-0557 (888) 742-6372 | FAX: (803) 772-0846 e-mail: PIASC@piasc.net | Web Site: www.piasc.net

SOUTH DAKOTA

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PIA of Tennessee Inc 504 Autumn Springs Court Suite A-3, Franklin, TN 37067 PHONE: (615) 771-1177 FAX: (615) 771-3456 e-mail: piatn@piatn.com | Web Site: www.piatn.com

PIA of Texas 5605 N. MacArthur Blvd. Suite 1000, Irving, TX 75038 PHONE: (972) 862-3333 FAX: (972) 307-7888 e-mail: vicki@piatx.org Web Site: www.piatx.org

Utah Association of Independent Insurance Agents 4885 S. 900 E., Suite 302, Salt Lake City, UT 84117

PHONE: (801) 269-1200 FAX: (801) 269-1265 e-mail: mattchild@uaiia.org | Web Site: www.uaiia.org

PIA of Vermont P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342 e-mail: pia@pia.org | Web Site: www.pia.org

PIA Assn of Virginia & DC 1059 Technology Park Dr, Glen Allen, VA 23059 PHONE: (804) 264-2582 FAX: (804) 266-1075 e-mail: kevin@piavadc.com | Web Site: www.piavadc.com

PIA Western Alliance 3205 Northeast 78th Street, #104, Vancouver, WA 98665 PHONE: (360) 571-7100 FAX: (360) 571-7600 e-mail: piawest@piawest.com | Web Site: www.piawest.com

PHONE: (703) 836-9340 FAX: (703) 836-1279 e-mail: membership@pianational.org | Web Site: www.pianational.org

PIA of Wisconsin, Inc., 725 Heartland Trl Ste 108, Madison, WI 53717-1976 PHONE: (608) 274-8188 (800) 261-7429 | FAX: (608) 274-8195 e-mail: phanson@piaw.org | Web Site: www.piaw.org

Assoc. of Wyoming Ins. Agents, PO Box 1321, Cheyenne, WY 82003 PHONE: (307) 201-4801 FAX: (775) 796-3122 e-mail: awia@vcn.com Web Site: www.awia.com

Since 1969, independent insurance agents have been enjoying the advantage of products offered by the PIA Services Group Insurance Fund (also known as the PIA Trust). PIA members and their employees can choose from high-quality, competitively-priced insurance plans to help protect themselves and their families. All of the insurance products can be customized to match the insured’s individual needs. Your employees may apply for all of the plans without your participation (except for Basic Life). These plans are administered by Lockton Affinity.

PIA Trust insurance plans,

Expenses continue for your family if something happens to you. You can help protect their financial future with life insurance.

Basic Life Insurance

$50,000 of Basic Life Insurance is available to Agency Owners/Managers. This Basic Life coverage is also available for employees (up to $30,000 with 100% participation of eligible employees and employer pays 100% of the premium.) There is no medical underwriting.

If you have Basic Life coverage, you can add your Dependent Spouse for the same coverage level as you have purchased. You also can purchase Basic Life coverage for your children. Both of these coverages are not medically underwritten.

Member agencies are not responsible for the cost of Spouse and/or Dependent Basic Life Plans.

Additional term life insurance up to $500,000 is available through the Supplemental Life Insurance Program (medically underwritten). If you have Basic or Supplemental Life, Dependent Term Life Insurance is also available up to $100,000 for spouses (medically underwritten) and $10,000 for children (not medically underwritten).

*PIA National membership, when requred, must be current at all times. Policies or provisions may vary or be unavailable in some states. Policies have exclusions or limitations which may affect any benefits payable.

Affinity, for PIA members and their employees.

If you suffer an injury which results in a loss of life or limb, the coverage will pay the sum as outlined in the policy for the Loss provided the accident that caused the Loss occurred while covered under this benefit; and except for loss of life, the Loss occurs within the 365 day period immediately after the date of the accident.

Your acceptance is guaranteed! There is no medical exam and no medical questions.

“If you are unable to perform the material and substantial duties of your occupation, this coverage can help fill the income gap before your long term disability benefits begin. You may choose up to $1500 per month for a period of 9 or 22 weeks to create a seamless transition from Short Term Disability to Long Term Disability benefits. This plan is medically underwritten.

Consider how you would manage if a long-term disability reduced your earning power. If you become disabled this plan can help replace up to 60% of your lost income on the base plan and up to 100% in the event of a catastrophic disability. The base plan offers monthly benefit amounts to $8,000. There is no medical underwriting up to $4,000, however disability income benefits are subject to a preexisting condition limitation.

contact

1-800-336 4759.

1-800-336-4759

As an agent, the more you have to offer, the more opportunities you have to customize coverage for your customers. That’s why we equip you with a full suite of products—including auto, home, motorcycle, boat, RV, and more—so you can give your customers peace of mind knowing that whatever they need, you’ve got it covered.

Plus, as a Progressive agent, you have access to our industry-leading commercial coverage to round out your offerings and meet all your customers’ needs.

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.