RESULTS REVEALED: SEVENTH ANNUAL NU/PIA INDEPENDENT INSURANCE AGENT SURVEY

HOW DOES YOUR

Over the last 12 months, there was an increase in agency production and gross income, continuing a trend noted in the 2022 Independent Insurance Agent Survey. For 2023, the largest increase occurred in agencies experiencing a greater than 10% increase over 2022 in both production and gross income. However, agents also lament that clients don’t fully understand their insurance coverage nor are many of them sufficiently shielded from major risks. As in previous years, we noted the continuation of a near-even split between the percentages of personal and commercial lines insurance written by agencies. However, we found that this year, there was a slight increase in personal lines and a slight decrease in commercial lines. It may be too soon to determine if this is a trend or an anomaly.

WHAT ADJUSTMENTS HAS YOUR AGENCY MADE IN RESPONSE TO THE CURRENT FINANCIAL CLIMATE?

HOW MUCH HAVE COSTS INCREASES AND INFLATIONARY PRESSURE IMPACTED YOUR BUSINESS?

HOW CONCERNED ARE YOU ABOUT THE POTENTIAL EFFECTS OF AN ECONOMIC DOWNTURN/RECESSION ON YOUR AGENCY’S BUSINESS DURING 2023?

There was no denying the impact of a tough economic climate on agents and their clients. More than one in three survey respondents said their clients have decreased coverage while around 25% of respondents said that their clients have increased insurance coverage to match the market in terms of replacement rates and costs. Such circumstances can be dicey to navigate.

Asked how they have adjusted in response to the current financial climate, more than half of the respondents report relying on crossselling. Building strong relationships, furthering exemplary service and expanded carrier partnerships were also cited as strategies.

WHERE ARE THE BIGGEST GAPS IN YOUR CLIENT’S COVERAGE SHOULD THEY BECOME THE VICTIM OF A NATURAL DISASTER?

HOW HAVE YOUR CLIENTS CHANGED THEIR INSURANCE COVERAGE DUE TO THE ECONOMIC CLIMATE?

Westfield was founded in 1848 by a small group of hardworking farmers who believed in the promise of the future and the power of the individual. Today, 175 years later, as a leading U.S.-based property and casualty insurance company with $8.5 billion in GAAP assets, Westfield underwrites commercial, personal, surety, and specialty lines of coverage through a network of over 1,000 leading independent agents and brokers. Westfield recently acquired Lloyd’s of London Syndicate 1200, establishing the Company as a global franchise. Learn more at westfieldinsurance.com.

Forever forward.

WHAT CHALLENGES DOES YOUR AGENCY FACE WHEN IT COMES TO ADOPTING NEW TECHNOLOGIES?

Not surprisingly, digital security is top of mind with agents. Overall 62.4% say that data security/privacy compliance is their biggest concern in serving clients online.

Meanwhile, digital security is top of mind for today’s insurance businesses. More than 62% of respondents reported that data security and compliance are chief concerns for their clients.

HOW ESSENTIAL TO BUSINESS IS AN AGENCY MOBILE APP?

WHAT DO YOU THINK HAVE BECOME THE ESSENTIAL FEATURES OF A MODERN INSURANCE AGENCY WEBSITE?

This research revealed that technology challenges persist: Many of them will not be surprising to industry insiders. More than 46% of respondents said that keeping adequate records across multiple communication channels, and 45.2% cited lack of integration between website and agency management systems, as challenges.

More than half of respondents to the NU/PIA 2023 Independent Insurance Agent Survey said their ability to deliver insurance products digitally is extremely or very important to their success. This is up from 48.5% in the 2022 Agent Survey.

It also appears that agencies are torn about the importance of having an app for customers. Overall, 45.6% say an app is moderately important, 34.3% say it’s not important at all, and 20% swear by their apps, saying they’re very important.

HAS YOUR AGENCY IMPLEMENTED MULTI-FACTOR AUTHENTICATION FOR THE AGENCY MANAGEMENT/POLICY ADMINISTRATION SYSTEM?

WHICH OF THE FOLLOWING TECHNOLOGIES AND ONLINE CAPABILITIES ARE CURRENTLY AVAILABLE AT YOUR AGENCY?

WHAT PERCENTAGE OF YOUR INSURANCE CARRIERS CURRENTLY REQUIRE MULTI-FACTOR AUTHENTICATION WHEN USING THE INSURANCE CARRIER SYSTEM?

41.8%

Insurance agencies continue to struggle to find and retain great people. One reason: compensation, with 38.5% of survey respondents reporting that this is the biggest challenge when it comes to fostering long-term employees. More than half of agents describe their ability to attract the next generation to their agencies as somewhat or very difficult. And 50% say that attracting and retaining talent is the number one challenge their agencies are currently facing.

Asked to describe their ability to attract professionals, more than 53% said such efforts were either “somewhat difficult” or “very difficult,” as opposed to being “very easy” or “somewhat easy.”

Networking is by far the biggest focus for boosting recruiting efforts—58.8% of agents say they’re networking. A much smaller number—27.7 percent are offering internships. Only 17% attend career fairs.

One issue that plays a role in recruiting is flexibility. The pandemic has changed workplace practices and the expectations of some potential employees. Overall, 40% say they offer remote to some staff and 27% offer it to all staff. Respondents were very supportive of continuing education (CE). Over 75% said CE was either indispensable or very important to the success of their agency.

WHAT STEPS ARE YOU TAKING TO BOOST RECRUITMENT EFFORTS?

WHICH OF THE FOLLOWING INITIATIVES HAVE YOU UNDERTAKEN TO FURTHER DIVERSITY WORK AT YOUR AGENCY?

DESCRIBE YOUR ABILITY TO ATTRACT RISING PROFESSIONALS (GEN ZS AND MILLENIALS) TO YOUR AGENCY

HOW IMPORTANT DO YOU BELIEVE A DIVERSE WORKFORCE IS TO THE HEALTH OF YOUR BUSINESS?

WHAT IS YOUR BIGGEST ISSUE WHEN IT COMES TO RETAINING GREAT EMPLOYEES?

This year’s survey indicated significantly fewer agents expressed concern about competition from direct writers. Overall, 57.7% of agents said they are only slightly concerned, or not at all concerned, about competition from direct and online markets. This number is growing. Last year, the number of agents saying they were only slightly or not concerned was just 40%. In this area, agents are expressing more confidence.

WHAT, IF ANY, EMPLOYEE INCENTIVES DO YOU OFFER FOR HIGH PERFORMANCE?

HOW CONCERNED ARE YOU ABOUT COMPETITION FROM ONLINE AND/OR DIRECT-TOCONSUMER INSURANE PROVIDERS?

HOW IMPORTANT IS IT THAT YOUR CARRIER-PARTNERS OFFER EACH OF THE FOLLOWING?

WHEN THE FIRST INDEPENdent Insurance Agent Survey arrived in 2017, it highlighted producers’ greatest fears and challenges. This year’s installment looks to uncover the keys to success for agents in 2023. (Diki/Adobe Stock)

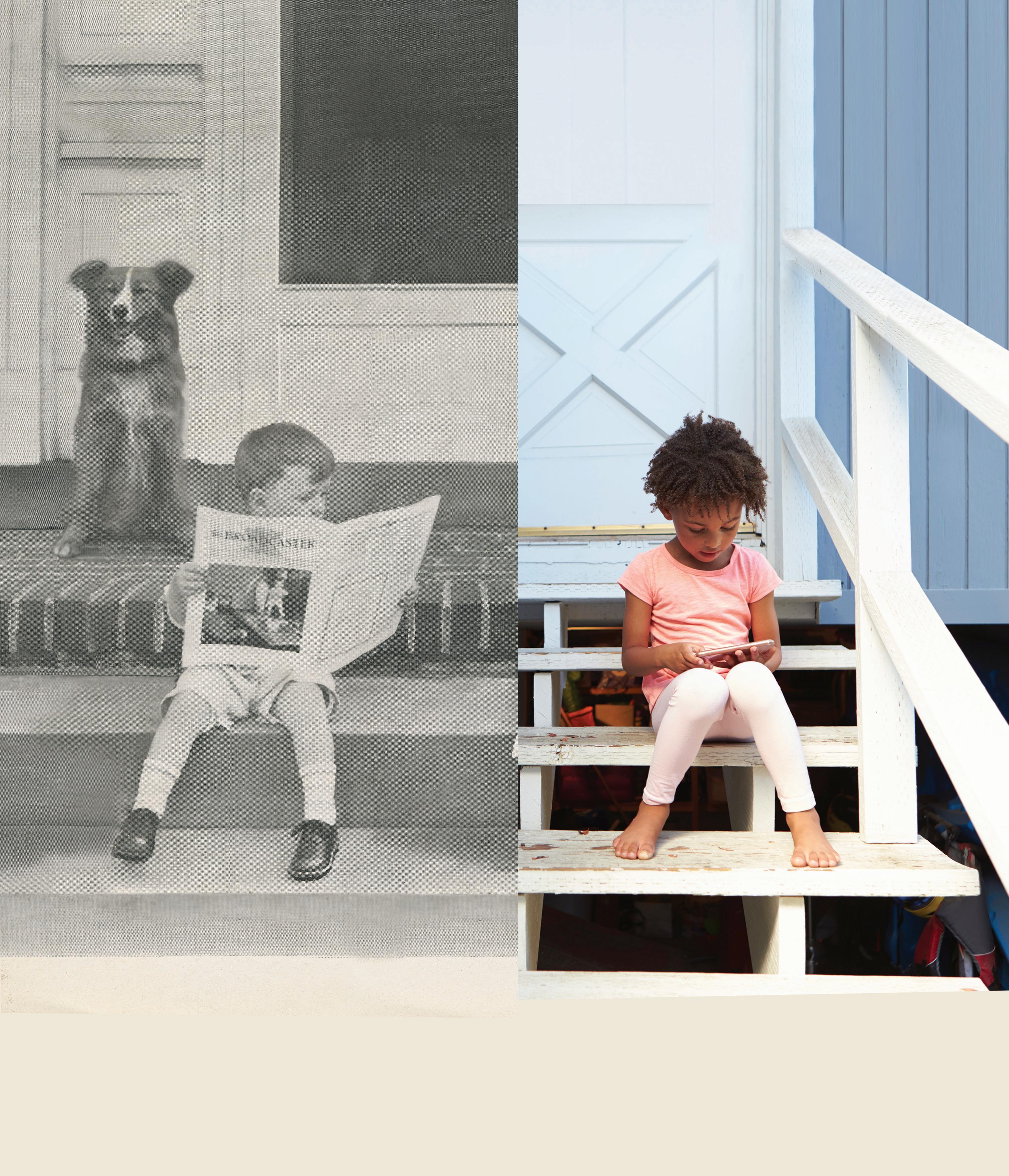

We talk a lot at PropertyCasualty360.com about how the P&C insurance sector mirrors what’s happening in society and the world.

Few places is that more evident than in responses to our annual Independent Insurance Agent Survey, produced by ALM Intelligence in partnership with the National Association of Professional Insurance Agents (PIA).

The Independent Insurance Agent Survey is conducted by NU Property & Casualty magazine, PropertyCasualty360.com and ALM Intelligence in partnership with the National Association of Professional Insurance Agents.

When the first Independent Insurance Agent Survey arrived in 2017, it aimed to uncover producers’ greatest fears and challenges.

“One recurring theme resounded throughout the comments made by agents: Better and increased communication with their carrier partners is greatly desired,” wrote Shawn Moynihan, then editor in chief of NU Property & Casualty magazine and PropertyCasualty360.com.

“Others expressed concern — and frustration — over reduced commissions and profit-sharing.”

The 2018 survey explored what would make independent insurance agents more satisfied with their work. Close to half of respondents that year (46.7%) said they’d like to see carriers develop a higher risk appetite while about 40% said they wanted carriers to make it easier to do business. About 32% said they needed to be able to offer policyholders more competitive rates, and about 30% said they needed faster response times from carriers.

Survey respondents in 2019 noted that carrier relationships were improving, although many of the same challenges persisted. This also was the first year that agents began to express concern over insurers developing direct-to-consumer sales models. “Carriers that do not focus on [the] independent agency channel pose a direct threat,” one 2019 respondent replied.

Of course, the world shifted in 2020, thanks to the coronavirus pandemic, and independent insurance agents were not immune. This was the year that producers began to characterize the availability of insurtech tools as the single biggest factor supporting (or thwarting) their success.

“Agents pointed out the increasing cost of incompatible systems,” wrote Rosalie Donlon, editor in chief of

Insurance & Tax Publications for ALM Media. One respondent “told us that ‘management system expense is too high.’ Another respondent said, “Too many varied platforms equal IT headaches and take time away from sales.’”

Survey responses in 2021 highlighted agents’ creative resilience. While agents were “rising to new challenges,” wrote PIA National CEO Mike Becker, “fallout from the pandemic is far from over.”

And finally, answers a year ago to the 2022 Independent Insurance Agent Survey showcased agents’ can-do attitude: “Independent insurance agents donned their business armor and enlisted an increasingly robust arsenal of digital tools to manage mounting business challenges that included negative fallout from pandemic coverage disputes; shifting to a largely remote workforce; helping clients prepare for and recover from increasingly severe catastrophes; finding and retaining skilled, diverse talent; facing increased government scrutiny; and readying their agencies for the future.”

The data-rich insurance industry has no shortage of researchers and analysts, but the Independent Insurance Agent Survey produced by NU Property & Casualty magazine, ALM Intelligence and PIA National is unique in its focus squarely on today’s producers.

produced every year by NU Property & Casualty magazine, ALM Intelligence and PIA is an annual checkup for agents and agencies. It takes the temperature of the sector, assessing the success of independent agents as it identifies concerns, challenges and potential issues.

You have to know where you’ve been and where you are now, in order to get a clear view of where you should be headed and the best way to get there.

Results of our 2023 survey show that 2022 was for the most part a good one for many independent agents during a very difficult economic time for many people. Once again, agents have demonstrated they have what it takes to succeed: strength, stability and resilience.

Agents’ businesses grew last year. Over the last 12 months there was a continuing increase in agency production and gross income, continuing a trend noted in last year’s survey.

At the same time, the survey notes that clients have relied on their agents to help them navigate uncertainty in the economy. Some agents said many of their clients cut back on coverage, while others increased coverage for more protection.

of agents saying they were only slightly or not concerned was just 39.7%. In this area, agents are expressing more confidence.

While there was plenty of good news for many agents, there were also concerns. For almost a decade there has been an awareness that recruiting talent is one of the greatest challenges currently faced by the industry at large, as well as by independent agencies.

Fully half of the respondents to this year’s survey reported that attracting and retaining talent is their #1 challenge. Asked to describe their ability to attract professionals, more than 53% said such efforts were either “somewhat difficult” [34.81%] or “very difficult” [19.11%], as opposed to being “very easy” [2.73%] or “somewhat easy” [9.39%].

This year’s survey indicated significantly fewer agents expressed concern about competition from direct writers. Overall, 57.7% of agents say they are only slightly concerned, or not at all concerned, about competition from direct and online markets. This number is growing. Last year, the number

Asked how their agencies differentiate themselves from their direct writer competition, responses and rankings were consistent year-to-year in 2023 and the prior year. The top points of differentiation were: relationships [86.6%] service [79.3%] expertise [63.7%] and advice [54.5%].

The continuing success of independent agents and the growth of the agency distribution system, even in more challenging times, should not come as a surprise. Professional independent insurance agents are in a business built on relationships, providing service to their clients that draws upon their unique expertise.

PIA has partnered with the National Underwriter to survey independent agents for seven years. The results, while sometimes varied, have remained remarkably consistent since this survey’s inception in 2017. It shows that agents are skilled at relationship building and adapting to change and, as a result, the agency distribution system remains strong.

We live in a time of ongoing adaptation. The pandemic — which is still with us — along with economic uncertainty over the past several years, put agents in the position of having to rapidly adapt to these and other changes, such as increased digital delivery of insurance products. Agency staff in many cases started working remotely early in the pandemic, bringing more change. Extreme weather events have increased the demands placed on agencies even further.

Agents have faced these rapid changes while maintaining a can-do attitude, and their positivity contributes to their competitive advantage. It also serves to demonstrate who they are: neighbors and friends, members of the local community who help their neighbors use insurance to protect their property, their health, their way of life, and their lives.

Agents are truly in a helping profession. And they are good people.

Becker CEOYou have to know where you’ve been to get a clear view of where you should be headed and the best way to get there.

“There was a continuing increase in agency production and gross income.”

“Over half of the respondents say attracting and retaining talent is their #1 challenge”

As an agent, the more you have to offer, the more opportunities you have to customize coverage for your customers. That’s why we equip you with a full suite of products—including auto, home, motorcycle, boat, RV, and more—so you can give your customers peace of mind knowing that whatever they need, you’ve got it covered.

Plus, as a Progressive agent, you have access to our industry-leading commercial coverage to round out your offerings and meet all your customers’ needs.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.