NATIONAL ASSOCIATION OF PROFESSIONAL INSURANCE AGENTS

PRESIDENT

Gerald F. Hemphill, CIC, LUTCF (VA/DC) ghemphill@gfhinsurance.com

PRESIDENT-ELECT

Rich A. Savino, CIC, CPIA (NY) richs@broadfieldinsurance.com

VICE PRESIDENT/TREASURER

Ariel Rivera, CIC (PR) ariel@deerinsurance.com

SECRETARY/ASSISTANT TREASURER

Mark A. Suhr, CIC, CPIA (NE) msuhr@suhrlichty.com

IMMEDIATE PAST PRESIDENT

Anthony Curti, CIC, LIC (MI) tcurti@acrisure.com

EXECUTIVE VICE PRESIDENT/CEO

Mike Becker (PIA National) mbecker@pianational.org

PUBLISHER/EDITOR-IN-CHIEF

Ted Besesparis | tbesesparis@pianational.org

MANAGING EDITOR

Sade Hale | shale@pianational.org

ADVERTISING DIRECTOR

Robert Holt, CLU, ChFC, CASL | rholt@pianational.org

GOVERNMENT AFFAIRS EDITOR

Jon Gentile | jgentile@pianational.org

REGULATORY AFFAIRS EDITOR

Lauren Pachman, Esq. | lpachman@pianational.org

MARKETING EDITOR

Madeleine Stern | mstern@pianational.org

CONTRIBUTING EDITOR

Patricia A. Borowski, CPIW

Shawn Moynihan

February 2023

PIA Connection is published ten times yearly by the National Association of Professional Insurance Agents. 419 North Lee Street

Alexandria, Virginia 22314

©2023 All rights reserved.

The information in this publication is general in nature and is not intended to serve as legal, accounting, financial, insurance, investment advisory or other professional advice as to any reader’s particular situation. Users are encouraged to consult with competent legal, financial, insurance, investment advisory and or other professional advisors concerning specific matters before making any decisions and we disclaim any responsibility for any decisions or actions by readers.

All PIA members receive PIA Connection at the member subscription rate of $12.00 per year.

Non-member subscriptions available at $24.00 per year ppd.

NEWS BRIEF

Gen Z Shuns Cars, Drivers Licenses…Insured Losses for Turkey-Syria Quakes Could Top $5 Billion…Insurance Industry Employment Mixed… An Insurance Gap in Missouri’s New Madrid Zone…Extreme Weather Events Cost $156 Billion in 2022.

6-7

For additional information on any of the subjects addressed in this publication, please access the PIA National website at www.pianational.org

PIA ANNOUNCES PRIORITIES FOR 2023 ADVOCACY

8 PIA Policy Priorities for 2023 have been developed in consultation with PIA members throughout the country. “While these items are our top priorities for 2023, PIA is always working to promote the interests of our independent agent members, wherever those interests take us’” said Jon Gentile, vice president of government relations for PIA.

VP of Government Relations Jon Gentile looks at two bills before the 118th Congress, a data privacy bill that would preempt state law and a flood insurance continuous coverage bill.

counsel and director of regulatory affairs recently participated in a panel discussion hosted by the National Flood Association (NFA), on whose board she serves.

The Federal Trade Commission (FTC) is considering a proposed rule that would ban employers from entering into non-compete clauses or agreements with their workers. The proposal has prompted concern and outrage. PIA Counsel and Director of Regulatory Affairs Lauren G. Pachman, Esq. takes

low-cost solution for agency owners and their employees.

• outsources functions to third parties for less fiduciary strain on the company

• lower cost

• payroll integrations and year-end data

• less error

IN JANUARY THIS YEAR, THE FEDERAL TRADE Commission (FTC) issued a notice of proposed rulemaking that would ban the use of non-compete provisions and agreements between employers and workers. If it is finalized as initially written, the ban would apply to both employees and independent contractors and would require employers to stop using non-compete provisions and agreements.

The proposal would also require employers to withdraw existing non-compete provisions and agreements and inform workers subject to any such provisions or agreements that they are no longer in force.

PIA knows how important this issue is to agency owners and the extent to which many agencies rely on the use of noncompete provisions and agreements to protect our businesses.

PIA is submitting comments to the FTC to request that the

ACCORDING TO A NEW STUDY BY THE CONference Board, corporate America needs a plan for recruiting Gen Z workers — or they’ll lose the talent war. While talent recruitment has been a major concern in the insurance industry, our situation is not unique.

The report explores the most important motivations of Gen Z, a cohort that is expected to represent nearly a third of the workforce by 2025. Based on interviews with more than 100 Gen Zers, they place the biggest premium on five critical values: adequate compensation, control, safety and wellness, growth, and purpose. The Conference Board reports that while these objectives are important to all generations of employees, for Gen Zers, they are imperatives.

Our industry’s ongoing efforts to address the need to recruit talent of all ages can be aided by developing innovative new approaches or, in some cases, re-thinking older ones. Recently, the state of Nebraska initiated the Apprentice Insurance

agency withdraw its proposal to ban non-compete provisions and agreements.

Non-compete agreements and provisions exist because the labor market permits them; if workers were unwilling to exchange the promise not to compete for an offer of employment or some other thing of value, noncompete agreements and provisions would cease to exist. This is an example of the free market working, and the prospect of unwise regulations causing damage.

Gerald F. Hemphill PresidentProducer License, which is a temporary license that allows residents to test the waters of becoming an agent while working with a sponsoring agent.

“I looked at the impending gap in insurance staffing and Nebraska’s continued needs, and it hit me—a new type of agent license,” said Eric Dunning, the state’s director of insurance.

This is the kind of outside the box thinking that powers the success of independent insurance agents and will lead our industry to creative ways to entice talented people to join our ranks.

Mike Becker CEO

Generation Z consumers seem to be getting their driver’s licenses at lower rates than their predecessors, relying on ridesharing apps and seeing cars less as a ticket to freedom.

In 1997, 43% of 16-year-olds and 62% of 17-year-olds had driver’s licenses. In 2020, those numbers had fallen to 25% and 45%, respectively, according to a Washington Post report. Older members of Gen Z (up to age 25) are following similar trends. In 1997, almost 90% of 20-to-25-year-olds had a driver’s license; in 2020, it was 80%.

Whether this trend will continue depends on whether Gen Z is acting out of inherent preferences, notes Triple-I in an analysis, or postponing key life milestones that often spur car purchases, such as living on their own, getting married, having children, and moving out of urban areas.

According to CoreLogic, Turkey could see more than $4 billion in insurable losses from the earthquakes that occurred near the TurkeySyria border on Feb. 5-6, with another $1 billion in insured losses possible from the quake that hit the region two weeks later.

Damages to buildings and contents for residential,

commercial, industrial,

and agricultural structures in Turkey are included in the estimates. However, the estimates exclude losses from damage to infrastructure such as road and rail networks; water and electric power systems; and oil and gas pipelines. They also exclude additional living expenses; business interruption and contingent business interruption; and demand surge. Uneven insurance penetration rates

have made calculating insurable losses in the impacted areas difficult.

Insurance industry employment rose 1.83% last year, but is still not back to pre-pandemic employment levels. Insurance industry vacancies continued to rise in 2022 despite increased industry efforts to hire and retain employees. That’s according to an

industry study done by Ward Benchmarking and the Jacobson Group, firms that provide analysis on employment and compensation trends and do recruiting and placement.

There were about 386,000 open insurance industry jobs at the end of 2022, according to the study. Overall insurance sector salary increases averaged about 6%, according to the federal Bureau of Labor Statistics (BLS). Average

monthly job openings for finance and insurance hit a record of 386,000 in 2022, compared to 296,000 in 2021.

Unemployment

insurance carriers and related activities sector decreased to 2.3% in January, however the BLS reported that insurance hiring was down 5,100 jobs in January, bucking the national trend. Still, over the past 12-month period, insurance jobs were up 44,400, the BLS reported. Data by industry segment, broken out by various carrier and noncarrier categories, are available only on an unadjusted basis for prior months. Categories that showed declines for December included agencies and brokerages, down 800 jobs to 939,600.

There are hundreds of minor earthquakes each year in Missouri’s New Madrid Seismic Zone (NMSZ), but most of them are too small for people living in the area to feel. While several major earthquakes—magnitude 7.0 or greater—occurred between 1811-1812 in the NMSZ, none have happened since then, creating a knowledge gap in earthquake preparedness.

There’s an insurance gap among residents in the New Madrid region which, in addition to Missouri, includes parts of Arkansas, Tennessee, Kentucky and Illinois, according to the National Association of Insurance Commissioners

(NAIC) and the Missouri Department of Commerce and Insurance. “We also found a lot of people didn’t know what actions they could take, such as having earthquake insurance,” Houston said.

The National Oceanic and Atmospheric Administration’s (NOAA) annual national climate assessment indicates that Hurricane Ian, wildfires in Alaska, and drought in the western United States were some of 2022’s record-setting events. Damage costs from extreme weather events last year totaled over $165 billion, the third-most costly year since 1980 and up from about $155.3 bil-

lion last year.

NOAA reported that 18 disasters last year generated over $1 billion in damages, including flooding in Missouri and Kentucky, tornadoes in the South, and a derecho in the Midwest. The report also found that temperatures last year rose above their annual average in multiple states, with Florida and Rhode Island having the fifth-warmest years on record. Overall, the continental U.S. saw its 18th warmest year on record for average annual temperature, compared to the fourth warmest in 2021.

“In consultation with PIA members across the country, we have developed these Policy Priorities for this year,” said Jon Gentile, vice president of government relations for PIA. “While these items are our top priorities for 2023, PIA is always working to promote the interests of our independent agent members, wherever those interests take us.”

Crop Insurance: PIA supports the federal crop insurance program, which is a highly technical program that relies on the expertise of independent insurance agents. The program requires private-sector insurance carriers to offer crop insurance to eligible growers who are interested in purchasing it. With the Farm Bill, which includes the federal crop insurance program, up for renewal in September 2023, PIA will work to ensure the program is not subjected to budget cuts.

Flood Insurance: PIA supports the long-term reauthorization of the National Flood Insurance Program (NFIP) with needed reforms. The NFIP, which has been extended over 20 times on a short-term basis since 2017, will expire again on September 30, 2023 absent action from Congress. PIA will continue to seek long-term Congressional reauthorization of the NFIP to provide consistency to consumers and to avoid a lapse in the program.

Repeal of the Federal Insurance Office (FIO): PIA supports legislation to repeal the Federal Insurance Office (FIO). The FIO was created by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and is an ongoing threat to the successful state insurance regulatory system. To prevent the continued expansion of the FIO’s authority, and to prevent its further intrusion on states’ power to regulate the business of insurance, the FIO must be fully repealed. We will continue to encourage members of Congress to introduce and support FIO repeal legislation in both chambers.

Consumer Data Privacy: Rep. Patrick McHenry (R-NC), the new Chairman of the House Financial Services Committee, has indicated that passing a data privacy bill will be among his top priorities early in the new Congress.

PIA will work to prevent Congress from passing intrusive federal law in this area; the development of a prescriptive

federal legislative regime that would preempt and disrupt existing state law would be disastrous for the state-based insurance regulatory structure.

Cannabis Safe Harbor: PIA strongly supports the Secure And Fair Enforcement (SAFE) Banking Act, (not yet introduced in the 118th Congress), which would protect insurance agents and carriers from federal criminal liability for engaging in the business of insurance with cannabis-related entities in states where cannabis is legal. This issue is broadly bipartisan; the SAFE Banking Act has passed the House 7 times total; 4 of those times were during the last Congress. Unfortunately, the legislation stalled in the Senate each time. PIA will continue to advocate for its passage during this Congress.

Tax Issues: PIA supports the Main Street Tax Certainty Act, which would make permanent the 20 percent tax deduction presently available to some S corporations, also known as passthrough corporations.

Healthcare Issues: PIA supports policies that improve independent agents’ ability to sell health insurance and demonstrates the value of employer-sponsored health coverage to the health insurance industry.

The Centers for Medicare and Medicaid Services (CMS) recently finalized a rule that made significant changes to existing marketing requirements for both Medicare Advantage and Medicare Part D plans. PIA, along with other agent groups, strongly opposed the final rule, which imposes an additional demand on licensed agents and brokers attempting to assist Medicare beneficiaries in choosing suitable health care and prescription drug plans. PIA will support legislation to exempt agents from this burdensome requirement.

AFTER HOLDING A HEARING ON THE SUBJECT in early February, House Financial Services Committee Chairman Patrick McHenry (R-NC) passed a bill out of committee, the Data Privacy Act of 2023, on February 28.

The bill seeks to revise existing federal standards created by the 1999 Gramm-Leach-Bliley Act (GLBA) that protect consumer data by expanding the requirements imposed on “financial institutions,” including independent insurance agencies, that collect and retain consumer data as part of their normal business operation. Chairman McHenry has indicated that his goal is to create a uniform national standard that would govern all financial institutions’ use of consumers’ nonpublic personal information (NPI).

Of course, PIA supports the scrupulous protection of insurance consumers’ data and applauds all 50 states for their prompt regulatory response to GLBA after it was passed. Because all 50 states currently have a GLBA-responsive regulatory regime in place, we oppose the development of a prescriptive federal legislative regime that attempts to impose redundancy on the insurance industry’s existing, robust protection of consumer data.

PIA appreciates the Committee’s attention to the evolving issues around protecting consumer data; however, we have had concerns about this legislation for months, and the current draft has not alleviated those concerns. Over the last several months, PIA engaged with the committee on the bill and highlighted the redundancy that it would create, the challenges that it would pose for independent insurance agencies, and the existential threat it represents to the state insurance regulatory system.

Some of PIA’s concerns were addressed before the committee considered the legislation. Specifically, we are pleased that the strict liability and private right of action provisions have been eliminated, and we appreciate that the existing enforcement section was largely retained.

However, PIA continues to have concerns about this legislation and cannot support it in its current form for

three primary reasons: 1) the bill would impose potentially unworkable requirements on insurance agencies, 2) this bill would effectively fully preempt state insurance regulation in the context of GLBA, and 3) it would require state insurance regulatory systems to enforce inappropriate federal regulations against state insurance licensees.

The bill would effectively preempt state law governing insurance in all meaningful ways but would require state insurance regulators to enforce federal regulations that are illsuited to their licensees and that are not meant to operate against state insurance licensees.

PIA will continue to work with policymakers to ensure that consumer data is protected while also applying any federal requirements in a workable and realistic way for insurance agencies, and keeping with the successful state insurance regulatory system we’ve had for over 150 years.

On February 9, Reps. Kathy Castor (D-FL), and Blaine Luetkemeyer (R-MO) reintroduced H.R. 900, the Continuous Coverage for Flood Insurance Act. The bill would provide continuous coverage protection to policyholders who leave the National Flood Insurance Program (NFIP) to purchase a private flood policy and then need to return to the NFIP.

H.R. 900 would allow consumers whose private-market flood policies are cancelled in the middle of a policy year, through no fault of their own, to return to the NFIP and purchase a policy at their previous rate. Without continuous coverage, consumers with subsidized NFIP policies are effectively penalized with higher rates for attempting to return to the NFIP after leaving it for the private market.

PIA strongly supports H.R. 900 and views the inclusion of a continuous coverage provision as a top priority in the NFIP reauthorization process.

LAUREN PACHMAN, PIA’S counsel and irector of regulatory affairs, recently participated in a panel discussion hosted by the National Flood Association (NFA), on whose board she serves. She was joined on the panel by Chris Brown of Mindset, Brett Hewitt of the American Property Casualty Insurance Association (APCIA), Travis Johnson of 1607 Strategies, and Alden Knowlton of the Mortgage Bankers Association (MBA), and the webinar was moderated by Tom Glassic of the District of Columbia Insurance Federation (DCIF).

Among other issues, the panelists discussed the likelihood of the 118th Congress passing a package to reform and reauthorize the National Flood Insurance Program (NFIP) this year. Panelists agreed that reforms will need to be narrowly tailored enough to garner bipartisan support generally, of course, but also robust enough to draw the support of specific members in both chambers who have expressed a vested interest in changing the program.

One of the reforms that should be achievable even within those constraints is the passage of a continuous coverage provision, which has historically had bipartisan support. The identification of continuous coverage as a readily available bipartisan issue was supported by the introduction, weeks later, of one of the first bills of the 118th Congress, H.R. 900, by Reps. Kathy Castor (D-FL) and Blaine Luetkemeyer (R-MO). The Continuous Coverage for Flood Insurance Act would provide continuous coverage protection to policyholders who leave the NFIP to purchase a private-market flood policy and then seek to return to the NFIP.

Of course, passage of any NFIP

reform bill will hinge on details around its structure and funding, but the 118th Congress will need creatively assembled coalitions to legislate on the NFIP—or anything else.

The struggle every Congress seems to face is the need to reauthorize the flood program for enough time to allow members to examine it and consider needed reforms, and somehow force members to prioritize that examination before an imminent lapse. For the past decade, Congress has been content to reauthorize the program as-is and only pay attention to it when it is about to expire. Flood insurance advocates need a reauthorization long enough for Congress to examine the program and a mechanism that somehow incentivizes members of Congress to improve it during that time. The clock is already ticking for the NFIP in the 118th Congress; the program will need to be reauthorized again before its next scheduled expiration date on Sept. 30, 2023.

Finally, no webinar on the NFIP

would have been complete without a discussion of Risk Rating 2.0 (RR2). While most policies are now subject to RR2 rating, the final tranche of policies will not finish transitioning to RR2 until March 31, 2023. Even then, though, RR2 struggles may persist for policyholders whose households are considered “cost-burdened” (in which a household spends more than 30 percent of its income on housingrelated expenses). Policyholders in cost-burdened households who are still on the “glide path” to actuarially based rates may eventually find those rates cost-prohibitive, particularly when combined with an ever-tightening homeowners’ market.

PIA hopes to see the NFIP’s affordability challenges addressed by the 118 th Congress before they result in worsening economic struggles, mortgage defaults, or foreclosures for policyholders. Going forward, we will continue this important dialogue with the Federal Emergency Management Agency (FEMA), industry colleagues, and members of the 118 th Congress.

THIS SPRING, THE DEPARTMENT OF LABOR (DOL) Wage and Hour Division is expected to issue a Notice of Proposed Rulemaking (NPRM) offering an update to the Fair Labor Standards Act (FLSA) requirement known as the Overtime Rule, which addresses worker eligibility for overtime.

Eligibility exemptions exist for “executive, administrative, and professional” employees. Such exemptions are commonly referred to as “white-collar” exemptions, and their applicability is based on each employee’s annual salary and duties. The current Overtime Rule establishes a minimum salary threshold of $35,568; employees earning more than that are ineligible for overtime pay.

The DOL has proposed Overtime Rule updates several times over the past decade or so, but they have not done so since the pandemic-induced labor market disruption began in 2020. Symptoms of that disruption have changed over the past three years, but the labor market has not returned to a prepandemic version of “normal.” Despite our current economic circumstances, the DOL is expected to increase the minimum salary threshold for exempt employees, increasing the pool of employees eligible for overtime pay. This proposal will cost most employers more money to hire and retain employees; it could also prompt employers to cut labor costs by laying people off or to offset the additional costs by increasing prices.

The current Overtime Rule provides employers with crucial flexibility in the current economic environment. Expanding the exemption while our national economic future remains uncertain is unnecessarily risky and threatens the livelihoods of employees and employers alike. Finally, with the job market so competitive, employers with the financial means to increase worker compensation are strongly incentivized to do so.

In state regulatory news, the National Association of Insurance Commissioners (NAIC) is currently in the process of updating its consumer data privacy-related model law framework by combining two of its four existing models. Specifically, the NAIC framework is composed of its Insurance Information and Privacy Protection Model Act (MDL-670), Privacy of Consumer Financial and Health Information Regulation (MDL-672, which was passed in response to the 1999 passage of the Gramm-LeachBliley Act), Insurance Data Security Model Law (MDL-668), and the Standards for Safeguarding Customer Information Model Regulation (MDL-673).

Since its formation in 2019, the NAIC’s Privacy Protections (H) Working Group has been examining the NAIC’s existing privacy

framework. It began by attempting to update the Insurance Information and Privacy Protection Model Act. However, as regulators worked through the early part of that process, they concluded that more extensive changes were needed.

As a result, last year, the Working Group announced its intent to replace its 1992 Insurance Information and Privacy Protection model and its 2017 Privacy of Consumer Financial and Health Information Regulation model with one new model to be known as the Insurance Consumer Privacy Protection Model Law (MDL-674). The initial draft of the new model was published earlier this month and is currently being exposed for comment until early April.

In other state insurance oversight activity, the National Council of Insurance Legislators (NCOIL) has been developing the Insurance Underwriting Transparency Model Act, which would expand a consumer’s ability to request and be provided with greater transparency around adverse insurance underwriting decisions. Under the stewardship of NCOIL’s immediate past president, state Representative Matt Lehman (IN), various iterations of the Model Act have been under consideration for about a year.

At NCOIL’s most recent meeting in November, industry members were divided as to its value. Some viewed it as an opportunity to enhance consumer transparency and increase their credibility, while others saw it as overly burdensome and restrictive, particularly as applied to smaller carriers. Members of the NCOIL Property and Casualty (P&C) Insurance Committee were similarly split. In response to the stalemate, Rep. Lehman announced that he would introduce a version of the model at the beginning of Indiana’s state legislative session and place that version before the Committee at its next meeting.

Since that time, Rep. Lehman introduced Indiana H.B. 1329, which includes a somewhat modified version of his Insurance Underwriting Transparency Model Act. He successfully shepherded it through the Indiana state committee process, and it appears poised for approval by NCOIL’s P&C Insurance Committee at its Spring Meeting next month.

PIA will continue to offer updates on these and other regulatory developments as they become available. For the most updated information, please check out our advocacy blog at www.piaadvocacy.com

Lauren G. Pachman, Esq. is Counsel and Director of Regulatory Affairs of PIA National.

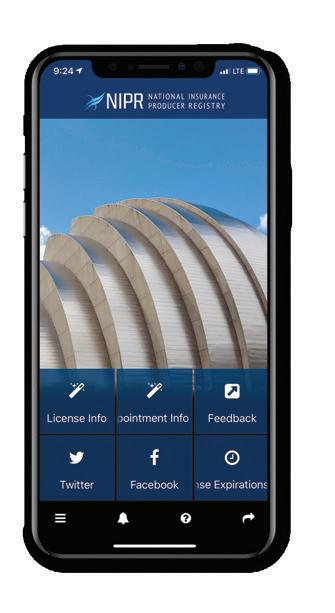

MANY SMALL BUSINESS OWNERS MAY NOT think they need cyber liability coverage, but small businesses are extremely vulnerable to security threats. And that’s why PIA members can sell PIA cyber insurance to their clients!

PIA and ABA Insurance Services have worked with Great American E&S Insurance Company (rated A+ by A.M. Best) to create a cyber insurance program that responds to the most common threats facing small and mid-sized businesses.

The PIA enhanced cyber insurance policy covers both firstand third-party loss for the most common cyber risks such as social engineering, funds transfer fraud, ransomware, network

interruption, data breach, network security, and media liability. In addition to the seven coverage parts, PIA members’ clients are provided with special PIA enhancements and reduced rates compared to Great American’s standard program for social engineering coverage.

PIA members who sell the PIA cyber insurance receive 12.5% in sales commission.

Agents are able to purchase the same PIA cyber insurance for their agency for a significantly reduced rate through their local PIA affiliate producers.

THE FEDERAL TRADE COMMISSION (FTC) recently issued a Notice of Proposed Rulemaking (NPRM)1 that would ban employers from entering into non-compete clauses or agreements with their workers on the basis that their use constitute “unfair methods of competition.” However, independent insurance agency owners use non-compete clauses and agreements to protect themselves from workers who would otherwise steal their ideas, business practices, and/or intellectual property for use in their own businesses or to share with a competitor of their employer, likely to improve their own opportunities for professional advancement.

The FTC’s proposed ban on non-competes has prompted an outcry from businessowners, including agency owners, many of whom routinely use them or similar agreements to protect their primary asset: their book of business, composed of the clients and relationships the agency has cultivated over the course of years. As the FTC’s comment period concludes, we explore the question of what problem the FTC proposal is trying to solve and whether a non-compete ban will do more to

1 https://www.regulations.gov/document/FTC-2023-0007-3959

solve the problem or create new ones.

Agency owners know it can be nearly impossible to enforce non-compete clauses and agreements, and many have adapted their businesses to use alternatives like non-solicitation or nondisclosure agreements instead. So distinguishing among these types of agreements is an essential prerequisite to reaching a conclusion about whether the proposed ban will substantially hamper agency owners’ ability to protect their businesses.

Let us begin by examining the FTC’s definition of a noncompete clause.

The proposed rule defines “non-compete clause” as a “contractual term between an employer and a worker that prevents the worker from seeking or accepting employment with a competing person, or operating a competing business, after the conclusion of the worker’s employment with the employer.” Standard non-compete clauses are limited in geographic scope and typically last for a predetermined period once the worker’s employment ends.

The proposed ban would apply to employer-worker relationships, although the term “worker” is expansively defined and includes employees, externs, volunteers, apprentices, interns, or independent contractors, without regard to whether one is paid

or unpaid. The ban is applicable to non-compete provisions that restrict what a worker—as defined in the proposal—may do after the conclusion of their relationship with the employer.

Under the proposed ban, whether the FTC would view a provision legally as a non-compete clause would depend not on what the clause is called but on how it functions. The FTC’s definition of a non-compete clause generally does not include other similar provisions, like non-disclosure agreements (NDAs) or non-solicitation agreements (NSAs), because those generally do not prevent a worker from seeking or accepting employment with a competitor or operating a competing business after the worker is no longer associated with the employer.

However, the FTC cautions that “some employers may seek to evade [the ban]” by imposing restrictions on workers using contracts that “restrain such an unusually large scope of activity that they are de facto non-compete clauses.” The FTC refers to such contracts as “functional equivalents,” and the ban would be enforced against agreements that are deemed functional equivalents of non-competes, regardless of whether they were drafted purposefully to evade it.

Should the ban be finalized as proposed, agency owners will want to tread lightly in their uses of other protective employment provisions, like NDAs or NSAs, because, if the provision in question is broad enough to be perceived as a functional non-compete, then it will be invalidated. One example of a functional non-compete set forth by the FTC is a clause that requires a worker to pay damages as a penalty if the worker opts to compete against the employer; the FTC says that it will view such provisions as state courts do—as functional non-competes.

Non-compete clauses generally prevent workers who are parties to them from seeking or accepting employment with someone who is in competition with their former employer. They also prevent workers from operating a competing business, typically within certain geographic parameters and for a certain period of time.

Non-solicitation clauses restrict workers who are parties to them from soliciting former clients of the employer. For agency owners, this type of provision is a crucial tool in their asset-protection arsenal; agency owners must be able to protect themselves against former workers who would attempt to wrest away the business of clients they have worked hard to attract and retain.

Non-disclosure clauses prevent workers from disclosing or using certain information and protect the intellectual property of a business owner; NDAs are the easiest of the three to enforce, largely because, of the three, they are the most likely to be redundant with existing applicable state law governing trade secrets and proprietary information.

Now that we have established what the FTC has said a noncompete is and identified some other protections available to agency owners, let us take a step back and examine the context of this proposed ban on non-competes.

The FTC’s proposal purports to address the perceived problem of employers that “overuse” non-compete clauses.

Agency owners justifiably view the proposed ban with great trepidation largely because of its references to “de facto noncompete clauses” and “functional violations.” Agency owners may find it difficult to enter into new employment relationships without the protection of a non-disclosure or non-solicitation agreement, on the one hand, and without certainty as to what distinguishes a legal NDA or NSA from a de facto noncompete clause, on the other. The vagueness of this distinction would make it challenging for agency owners to know whether their business practices comply with the rule.

The FTC’s proposal is a blunt regulatory instrument. The proposed ban is not tailored to target the discrete problem it claims exists; rather, it bans all non-compete clauses for all employers, regardless of the time frame or geographic limitation involved. Plus, the proposed rule would not simply prohibit the future use of non-competes between employers and workers. It would also require employers to rescind any existing non-competes currently in use, and employers would be required to inform current and former workers that previously executed non-competes are no longer effective.

The ban will pose challenges to agency owners even if they do not intentionally use non-competes; the prudent owner may wish to re-examine and revise existing employment agreements, whether the agreements violate the ban. Plus, because those employment agreements may include many essential provisions worthy of preservation, alongside a now-banned non-compete provision, businesses will likely be forced to uniformly amend existing employment agreements to replace or remove the banned provision.

Perhaps the most burdensome part of the proposed ban is the requirement that employers notify former workers of the rescission of existing non-competes. For agency owners, this poses a particular challenge. Ideally, a worker asked to execute a non-compete will be asked to execute a non-solicitation agreement as well. However, if the proposed ban is finalized as written, and a former worker has signed only a non-compete agreement, the rescission of said agreement will leave the agency’s assets wholly unprotected from poaching by a former worker, for whom such an act would be legal. This requirement alone could cost an employer dearly, depending on the employer’s size and the volume of its former workers.

Returning to the question we began with, is the FTC’s proposed non-compete ban going to solve an existing problem?

Not quite. If a problem exists, that problem is not being caused by independent agency owners using non-competes. If the FTC finalizes this proposal as written, though, then, unfortunately, independent agency owners may find protecting their businesses harder than it was before.

Lauren G. Pachman, Esq. is Counsel & Director of Regulatory Affairs of PIA.✦ DISABILITY INSURANCE. With instant quotes, an online application process, and case management done for you, Breeze makes it easy to earn competitive commissions and grow revenue by offering top-rated disability insurance to clients. pianational.org/breeze

✦ HARTFORD FLOOD INSURANCE. PIA’s endorsed flood provider since 2004. Dedicated local sales directors and book transfer/rollover team plus great commissions for PIA members. Call (860) 547-5006. pianational.org/hartford

✦ PIA MEMBER REIMBURSEMENT PROGRAM: Receive reimbursements on PIA marketing and PIA Partnership programs (up to $250 per program, for a total of up to $500). pianational.org/moneyformembers

✦ PIA DMV: PIA’S DIRECT MARKETING VAULT. Targeted direct mail and digital advertising campaigns. Turn-key yet highly customizable. pianational.org/dmv

✦ MARKETING SUPPORT FOR PIA MEMBERS. Print ads, radio commercials, consumer-oriented flyers and social media support for PIA members. pianational.org/marketingsupport

✦ PIA MARKET ACCESS. Access to over 50 national and specialty carriers, real-time online rating, ownership of your book and no exit fees for a low monthly rate. pianational.org/marketaccess

✦ AVYST EFORMS WIZARD. Quickly and easily prepare ACORD, agency-specific, and carrier-unique applications and forms, entering data only once in an organized interview format. Get to market faster! pianational.org/avyst

✦ PIA AGENCY MARKETING GUIDE Hands-on marketing tips from industry experts. Published annually. pianational.org/memberbenefits

✦ ROUGH NOTES - ADVANTAGE PLUS. Identifies risk exposures. Provides detailed coverage analysis. PIA member price $600 annually (reg. $700). Call 800-428-4384. Use your PIA member ID# above name on mailing label. pianational.org/roughnotes

✦ E&O INSURANCE. With access to admitted and non-admitted markets with differing appetites chances are we can find the coverage and price that’s right for you. pianational.org/eando

✦ PIA AGENTS UMBRELLA PROGRAM. Excess insurance protection includes E&O and business liability coverage, with available endorsements for EPL and personal coverage. pianational.org/umbrella

CYBER LIABILITY INSURANCE. Coverage and pricing tailored to small and mid-sized businesses. pianational.org/cyberinsurance

✦ INDIVIDUAL AND GROUP INSURANCE PRODUCTS. Basic, voluntary and dependent term life; long/short term disability; and AD&D. piatrust.com

✦ WINNING@CYBERSECURITY DEFENSE. A four-part educational resource created to teach you and your clients about the most common cyber dangers faced by small and mid-sized businesses as well as the best business practices and insurance coverages that can reduce these risks. pianational.org/cybersecurity

✦ WINNING@VIRTUAL. Your guide to evolving your sales and service in a digital world. pianational.org/winningatvirtual

✦ READY FOR EVERYTHING. The online crisis resource hub for insurance agents. pianational.org/readyforeverything

✦ WINNING@TALENT. Your guide to hiring, motivating and retaining the best agency employees. pianational.org/winningattalent

✦ AGENCY JOURNEY MAPPING. Value your agency, maximize your retirement income, and plan for unexpected death/disability while creating a perpetuation plan for your agency. pianational.org/agencyjourneymapping

✦ SMALL COMMERCIAL and the DIGITAL OPPORTUNITY. A variety of resources that help agents increase their digital capabilities and improve the digital experience for their customers. pianational.org/voiceofthecustomer

✦ CLASSIC PIA PARTNERSHIP PROGRAMS: Less recent (but still relevant) programs including Reaching Gen Y, Closing the Gap, Agency Touchpoints and Practical Guide to Succession Planning. pianational.org/classicprograms

✦ PIA 401(K). The PIA 401(k) plan has you covered by performing over 90% of administrative tasks and becoming your retirement department support team. pianational.org/401k

✦ PIA BLUEPRINT FOR AGENCY SUCCESS. A 3-part resource guide for business planning, growth strategies, and agency continuity. pianational.org/blueprint

✦ ACORD FORMS END USER LICENSES. Available for free to qualifying PIA members who access ACORD forms through agency management systems and other authorized distributors. Plus PIA member discounts on the ACORD Advantage Plus Program. pianational.org/acord

✦ AGENCY AGREEMENT REVIEW SERVICE. Free to members and carriers, PIA recommends changes to carriers and highlights concerns for members. pianational.org/agreementreview

✦ EMPLOYEE PROFILING. Hire the right people with skills and personality testing from OMNIA. pianational.org/omnia

HIRE WITH IDEALTRAITS. The comprehensive, go-to hiring tool for agencies looking to hire top performers. pianational.org/idealtraits

✦ CYBER RISK ASSESSMENT. A low cost cyber risk assessment designed specifically for you. This delivers a one-two-three punch that identifies your unique risks, how to mitigate them, AND guidance/tools to turn the recommendations into action. pianational.org/cyberassessment

✦ THE AGENT EXPERIENCE. Practical information and resources to help you develop and grow customer relationships online. pianational.org/agentexperience

✦ PIA member discounts on licensing and more.

✦ PIA ADVOCACY BLOG. Timely updates about what’s happening on Capitol Hill and on state and federal regulatory issues. PIAAdvocacy.com

✦ GRASSROOTS ALERTS. Send pre-written, fully-editable letters directly to your elected officials. pianational.org/grassroots

✦ PIA ADVOCACY DAY. Every spring, PIA members visit Capitol Hill to talk with their elected representatives about issues that are important to independent insurance agents. pianational.org/advocacyday

✦ PIA POLITICAL ACTION COMMITTEE (PIAPAC). PIAPAC contributes to the campaigns of candidates to federal office who share our pro-insurance, pro-business perspective and who support our issues. pianational.org/piapac

PIA members and agents appointed by carriers belonging to The PIA Partnership can access IdealTraits’ hiring platform to hire top performing sales and service staff for their agencies.

Using the IdealTraits online platform, agencies ready to hire can post jobs on numerous websites, such as ZipRecruiter, Google for Jobs, Indeed, Glassdoor and 100 others; track applicants in one place; pre-screen candidates to predict job performance and ultimately identify the right candidate and make an offer. Compared to a traditional hiring process, agency management will find IdealTraits to be more efficient and effective.

“Hiring good people is always a challenge,” said PIA National Past President Dennis Kuhnke, CIC, CPIA, of Milwaukee, Wisconsin. “But hiring good people into an insurance agency can be even more difficult. Thankfully, tools like those offered by IdealTraits as well as PIA’s Winning@Talent program help to level the playing field.”

Winning@Talent is a comprehensive hiring program created by PIA’s carrier council, The PIA Partnership. IdealTraits is available to PIA members at pianational.org/idealtraits

Learn how you can get $250 back from PIA on your IdealTraits purchase through the PIA Member Reimbursement Program at pianational.org/moneyformembers!

Step 1 - Post Jobs: Build the best job postings with versatile templates for ZipRecruiter, Google for Jobs, Indeed, Glassdoor, and 100+ job boards.

Step 2 - Applicant Tracking: View resumes, comment, rate, organize, and move your candidates through hiring stages.

Step 3 - Send Pre-Hire Assessments: Pre-screen candidates to predict job performance.

Step 4 - Identify and Hire: Use assessment results to identify strengths and weaknesses and hire the best candidate.

PIA/IdealTraits: pianational.org/idealtraits

Winning@Talent: pianational.org/winningattalent

ALABAMA

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096

PHONE: (770) 921-7585 | FAX: (770) 921-7590

e-mail: info@piasouth.com | Web Site: piasouth.com

ARKANSAS

PIA of Arkansas Inc.

102 Country Club Parkway, Suite 201, Maumelle, AR 72113

PHONE: (501) 225-1645

e-mail: staci@piaar.com Web Site: www.piaar.com

CA/NV/AZ/NM

PIA Western Alliance, 3205 Northeast 78th St #104, Vancouver, WA 98665

PHONE: (888) 246-4466 | FAX: (360) 571-7600

e-mail: piawest@piawest.com | Web Site: www.piawest.com

COLORADO

PHONE: (703) 836-9340 | FAX: (703) 836-1279

e-mail: membership@pianational.org Web Site: www.pianational.org

CONNECTICUT

PIA of Connecticut, P.O. Box 997, Glenmont, NY 12077-0997

PHONE: (800) 424-4244 | FAX: (518) 434-2342

e-mail: pia@pia.org | Web Site: www.pia.org

DELAWARE

PHONE: (703) 836-9340 | FAX: (703) 836-1279

e-mail: membership@pianational.org Web Site: www.pianational.org

FLORIDA

PIA of Florida, Inc., 419 N. Lee Street, Alexandria, VA 22314-2353

PHONE: (850) 893-8245 | FAX: (703) 549-5190

e-mail: piafl@piafl.org | Web Site: www.piafl.org

GEORGIA

PIA Southern Alliance, 3805 Crestwood Pkwy NW #140, Duluth, GA 30096

PHONE: (770) 921-7585 | FAX: (770) 921-7590

e-mail: info@piasouth.com | Web Site: piasouth.com

HAWAII

PIA of Hawaii, 1247 Kelewina St. Kailua, HI 96734

PHONE: (808) 261-9460 | FAX: (808) 262-5355

e-mail: piahi@hawaiiantel.net | Web Site: www.piahawaii.com

ILLINOIS

PHONE: (703) 836-9340 | FAX: (703) 836-1279

e-mail: membership@pianational.org Web Site: www.pianational.org

INDIANA

PIA of Indiana, 50 E. 91 Street Ste. 207 Indianapolis, IN 46240

PHONE: (317) 899-9200 | FAX: (317) 493-0408

e-mail: info@piaindiana.com Web Site: www.piaindiana.com

KANSAS

Kansas Association of Professional Insurance Agents

216 SW 7th Ave, Topeka, KS 66603

PHONE: (785) 232-4143 | FAX: (785) 232-0272

e-mail: trina@kansaspia.org | Web Site: www.kansaspia.org

KENTUCKY

PIA of Kentucky, 107 Consumer Lane, Frankfort, KY 40601

PHONE: (502) 875-3888 | FAX: (502) 227-0839

e-mail: clemay@piaky.org | Web Site: www.piaky.org

LOUISIANA

PIA of Louisiana Inc.

4021 W. E. Heck Ct., Building K, Baton Rouge, LA 70816

PHONE: (225) 766-7770 | (800) 349-3434 LA only FAX: (225) 766-1601

e-mail: jody@piaoflouisiana.com Web Site: www.piaoflouisiana.com

MAINE

Maine Insurance Agents Association

17 Carriage Lane, Hallowell, ME 04347

PHONE: (207) 623-1875 | FAX: (207) 626-0275

e-mail: lisa@maineagents.net Web Site: www.maineagents.net

MARYLAND

Insurance Agents & Brokers of Maryland

650 Wilson Lane, Suite 200, Mechanicsburg, PA 17055-4440

PHONE: (717) 795-9100 FAX: (717) 795-8347

e-mail: iab@iabforme.com | Web Site: www.iabforme.com

MASSACHUSETTS

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

MICHIGAN

Michigan PIA, P.O. Box 99579 Troy, Michigan, 48099

PHONE: (616) 454-4461 FAX: (616) 454-4491

e-mail: inquiry@mipia.com | Web Site: www.mipia.com

MINNESOTA

PIA of Minnesota, 8646 Eagle Creek Circle, Suite 202, Savage, MN 55378

PHONE: (866) 694-7070 FAX: (866) 749-8678

e-mail: info@piamn.com Web Site: www.piamn.com

MISSISSIPPI

PIA Southern Alliance, 3805 Crestwood Pkwy. NW, Ste. 140, Duluth, GA 30096

PHONE (770) 921-7585 | FAX: (770) 921-7590

e-mail: info@piasouth.com Web Site: piasouth.com

MISSOURI

Missouri Association of Insurance Agents

3315 Emerald Lane, Jefferson City, MO 65109-6878

PHONE: 573-893-4301 | FAX: 573-893-3708

e-mail: mbarton@moagent.org | Web Site: www.missouriagent.org

MONTANA

PIA Western Alliance, 3205 NE 78th St Ste 104, Vancouver, WA 98665-0697

PHONE: (888) 246-4466 FAX: (360) 571-7600

e-mail: piawest@piawest.com | Web Site: www.piawest.com

NEBRASKA/IOWA

PIA of Nebraska/Iowa, 11932 Arbor Street, Ste. 100, Omaha NE 68144

PHONE: (402) 392-1611 FAX: (402) 392-2228

e-mail: cathy@pianeia.com | Web Site: www.pianeia.com

NEW HAMPSHIRE

PIA of New Hampshire, P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342

e-mail: pia@pia.org | Web Site: www.pia.org

NEW JERSEY

PIA New Jersey, P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342

e-mail: pia@pia.org | Web Site: www.pia.org

NEW YORK

PIA New York, P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342

e-mail: pia@pia.org | Web Site: www.pia.org

NORTH CAROLINA

PIANC, 1059 Technology Park Dr, Glen Allen, VA 23059

PHONE: (804) 264-2582

e-mail: kevin@pianc.net | Web Site: www.pianc.net

NORTH DAKOTA

PIA of North Dakota

827 28th Street South, Suite C-2, Fargo, ND 58103

PHONE: (701) 223-5025 (800) 733-1050 ND&MN only

FAX: (701) 223-9456 | e-mail: info@piand.com

Web Site: www.piand.com

OHIO

PHONE: (703) 836-9340 FAX: (703) 836-1279

email: membership@pianational.org Web Site: www.pianational.org

OKLAHOMA

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

PIA Western Alliance

3205 Northeast 78th Street, #104, Vancouver, WA 98665

PHONE: (888) 246-4466 FAX: (360) 571-7600

e-mail: piawest@piawest.com | Web Site: www.piawest.com

PENNSYLVANIA

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

PUERTO RICO & CARIBBEAN

PIA of Puerto Rico and the Caribbean Inc

419 N. Lee Street, Alexandria, VA 22314

PHONE: 800-742-6900 FAX: 703-836-1279

e-mail: membership@pianational.org | Web Site: www.piapuertorico.org

RHODE ISLAND

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

SOUTH CAROLINA

PIA of South Carolina, PO Box 6167, Columbia, SC 29260

PHONE: (803) 772-0557 (888) 742-6372 | FAX: (803) 772-0846

e-mail: PIASC@piasc.net | Web Site: www.piasc.net

SOUTH DAKOTA

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

TENNESSEE

PIA of Tennessee Inc

504 Autumn Springs Court Suite A-3, Franklin, TN 37067

PHONE: (615) 771-1177 FAX: (615) 771-3456

e-mail: piatn@piatn.com | Web Site: www.piatn.com

TEXAS

PIA of Texas

5605 N. MacArthur Blvd. Suite 1000, Irving, TX 75038

PHONE: (972) 862-3333 FAX: (972) 307-7888

e-mail: vicki@piatx.org Web Site: www.piatx.org

UTAH

Utah Association of Independent Insurance Agents 4885 S. 900 E., Suite 302, Salt Lake City, UT 84117

PHONE: (801) 269-1200 FAX: (801) 269-1265

e-mail: mattchild@uaiia.org | Web Site: www.uaiia.org

VERMONT

PIA of Vermont

P.O. Box 997, Glenmont NY 12077-0997

PHONE: (800) 424-4244 FAX: (518) 434-2342

e-mail: pia@pia.org | Web Site: www.pia.org

VIRGINIA/DC

PIA Assn of Virginia & DC 1059 Technology Park Dr, Glen Allen, VA 23059

PHONE: (804) 264-2582 FAX: (804) 266-1075

e-mail: kevin@piavadc.com | Web Site: www.piavadc.com

WASHINGTON/ALASKA

PIA Western Alliance 3205 Northeast 78th Street, #104, Vancouver, WA 98665

PHONE: (360) 571-7100 FAX: (360) 571-7600

e-mail: piawest@piawest.com | Web Site: www.piawest.com

WEST VIRGINIA

PHONE: (703) 836-9340 FAX: (703) 836-1279

e-mail: membership@pianational.org | Web Site: www.pianational.org

WISCONSIN

PIA of Wisconsin, Inc., 725 Heartland Trl Ste 108, Madison, WI 53717-1976

PHONE: (608) 274-8188 (800) 261-7429 | FAX: (608) 274-8195

e-mail: phanson@piaw.org | Web Site: www.piaw.org

WYOMING

Assoc. of Wyoming Ins. Agents, PO Box 1321, Cheyenne, WY 82003

PHONE: (307) 201-4801 FAX: (775) 796-3122

e-mail: awia@vcn.com Web Site: www.awia.com

As an agent, the more you have to offer, the more opportunities you have to customize coverage for your customers. That’s why we equip you with a full suite of products—including auto, home, motorcycle, boat, RV, and more—so you can give your customers peace of mind knowing that whatever they need, you’ve got it covered.

Plus, as a Progressive agent, you have access to our industry-leading commercial coverage to round out your offerings and meet all your customers’ needs.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.