THE PATHFINDER

REPORT September 2020

IN THIS ISSUE 2

CHARTING THE COURSE MEGATRENDS: Pandemic Accelerating Some, Reversing Others

5

FINDING YOUR PATH The Death of Retail?

8

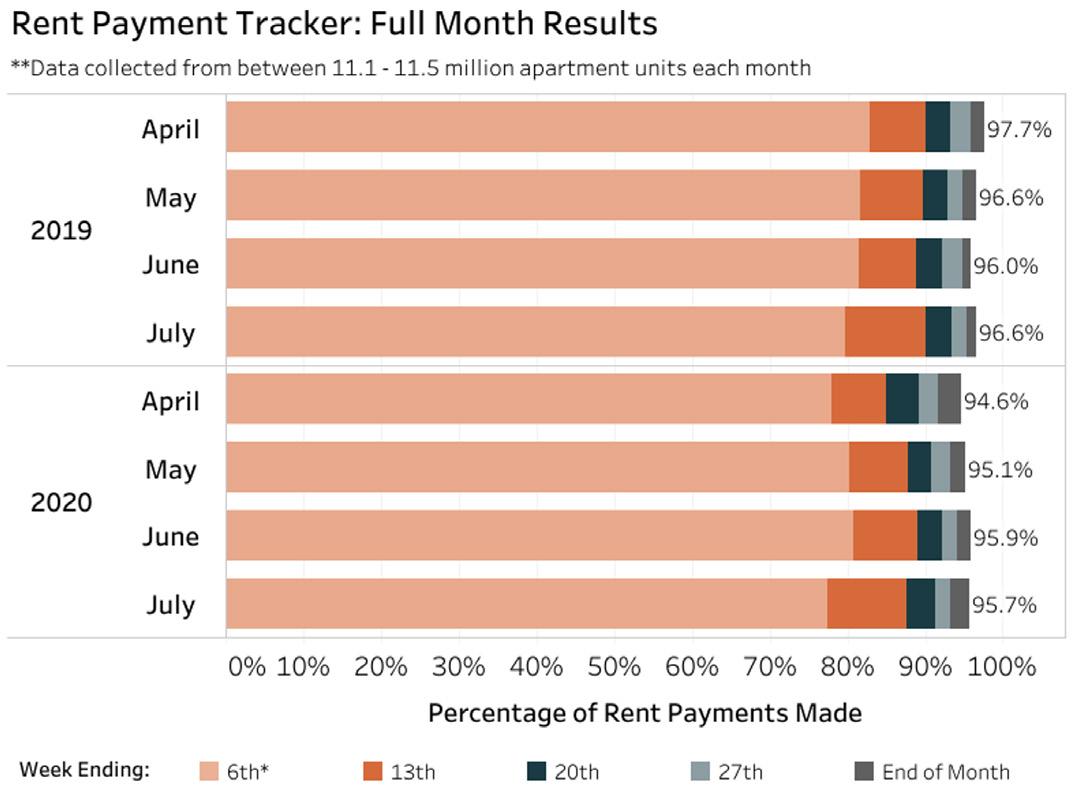

GUEST FEATURE: The Elephant in the Multifamily Boardroom – What Will Happen to Values

11

ZEITGEIST: NEWS HIGHLIGHTS

13

TRAILBLAZING The Fleetwood, Tempe, AZ

15

NOTABLES AND QUOTABLES Wisdom

T HE PAT HF I N DE R R E PO R T: SE PTE MB E R 2020

1