3 minute read

Rubber Executives See Dip in 2022 Fourth-Quarter Indicators but Remain Cautiously Optimistic

By Andrew Carlsgaard, analytics lead, ARPM

How do industry executives view the US rubber industry – a diverse sector that produces a wide range of rubber products, generates billions of dollars in revenue and supports thousands of jobs – going into 2023? ARPM’s 2023 State of the Rubber Industry Report aimed to answer this query by surveying leaders across 86 rubber processors for their thoughts on various topics, addressing 2022 fourthquarter results and optimism for 2023. One of the critical factors influencing the outlook of the US rubber industry in 2023 is the state of the global economy at the end of 2022. As the world continues to recover from the pandemic, there is hope that the demand for rubber products should increase as specific industries return to pre-2020 levels of production, especially in segments such as automotive and construction.

Advertisement

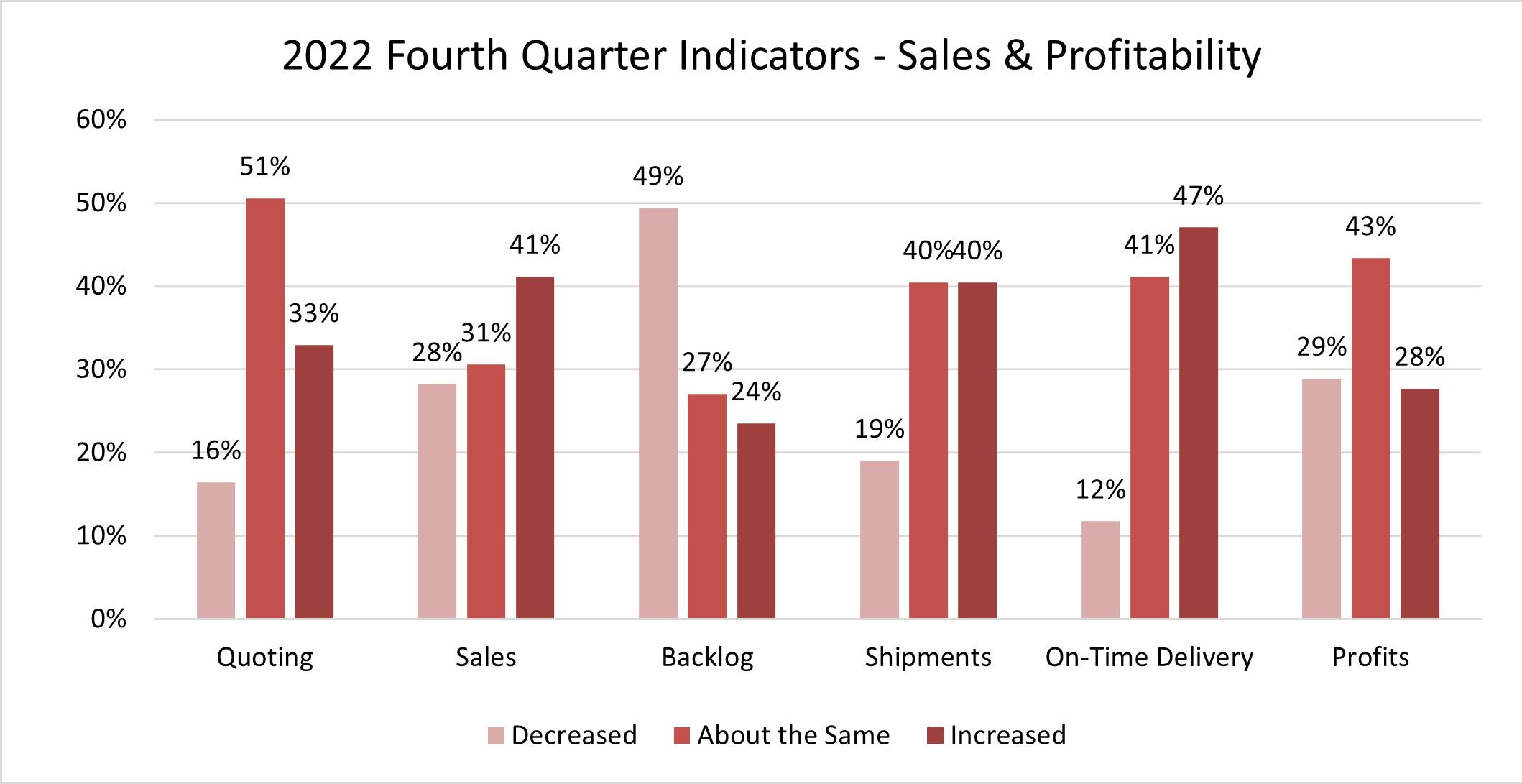

At this time last year, rubber processing executives viewed 2022 with optimism, accompanied by solid momentum in several major business performance indicators at the end of 2021. Fortunately, the rampant supply chain issues from 2021 began to subside in the second half of 2022, allowing the industry to see continued growth and forward progress throughout the year. However, although most Q4 performance metrics vaulted the sector across the finish line a year ago, several Q4 2022 indicators related to sales and operations may cause processors to temper expectations for 2023.

Growth potential for the next year likely is to be strongly influenced by 2022 sales performance, with momentum coming from how it ended the year before. Compared to the end of the previous year (2021), where 54% of respondents reported increased sales going from the third to the fourth quarter, 2022’s final quarter only saw 41% experience a sales increase from the prior quarter. The sales increase in 2021 primarily was due to new programs or increased volume in current programs from existing customers. In 2022, most increases came from new customers – potentially signaling an expansion of the industry’s client base over the past year. Despite the decline in sales momentum at the end of 2022 compared to how 2021 ended, executives still forecast optimism, as 89% of respondents indicated sales increased overall in 2022, and 78% anticipate growing sales in 2023. Also, 85% reported 5% or higher profit margins in the past year, an improvement compared to 77% in 2021 (Chart 1).

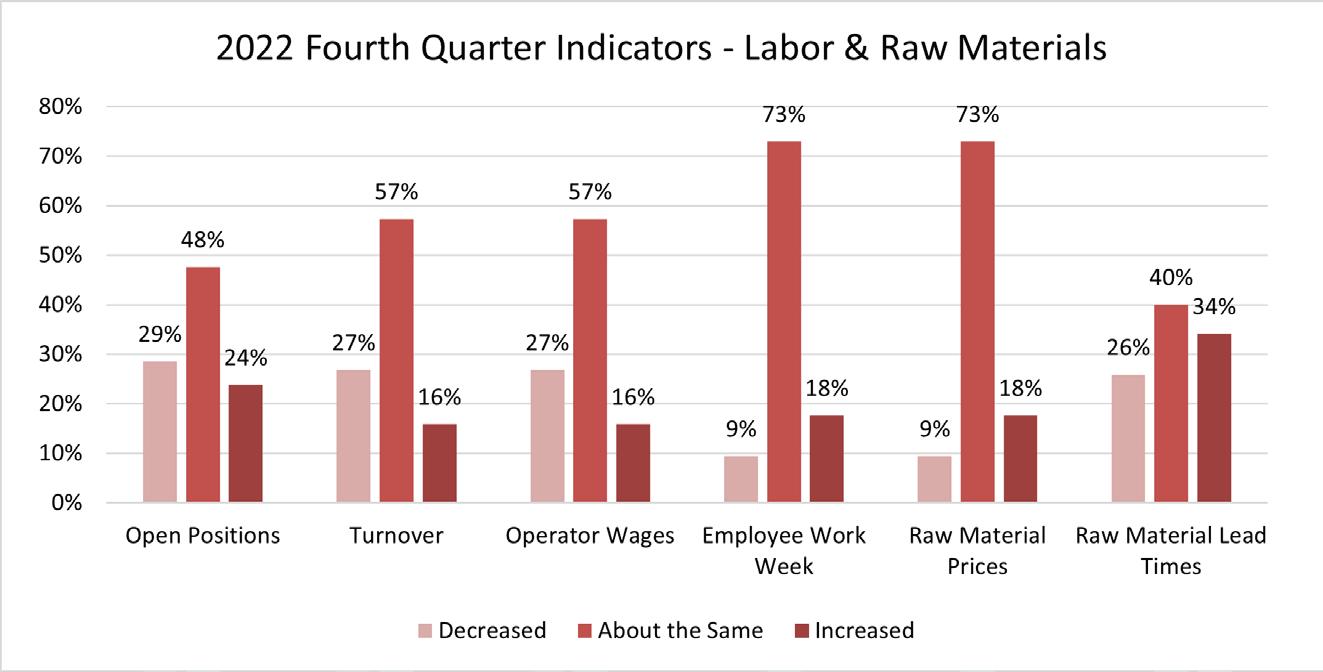

On a less optimistic note, rubber processing business leaders also face continued labor issues – a consistent struggle even before the pandemic, and one that may impact the industry’s performance in 2023. Participants reported some red flags in the fourth quarter regarding labor, particularly around rising cost pressures on entry-level wages (partly due to scarcity and doubledigit inflation). However, the number of open positions and turnover rates stabilized slightly compared to the fourth quarter of 2021. Though processing leaders have realized some stabilization with logistics and raw material challenges, the costs of having enough employees to perform the work likely will cut their bottom line (Chart 2).

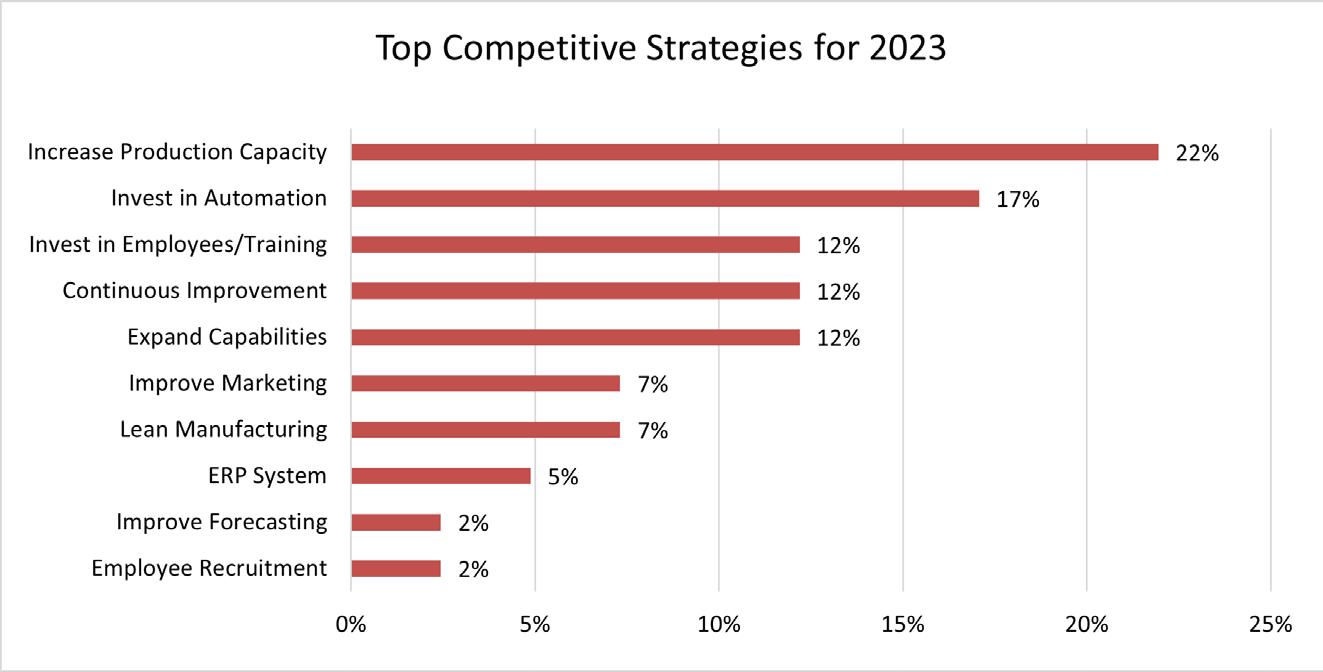

Other factors influencing the outlook of the US rubber industry in 2023 are technological innovation and strategic investments. Developing new materials, manufacturing processes and automation could improve the rubber segment’s efficiency and quality, making the sector more competitive globally. According to the survey respondents, these remain topics at the top of the list of potential investments over the next 12 months, along with expanding their production capacity and capabilities. Environmental regulation also may play a role in shaping the future of the US rubber industry as concerns about climate change and pollution continue to grow. As a result, rubber manufacturers may be pressured to adopt more sustainable practices and reduce their environmental footprint –another area where processors expect to see innovation (Chart 3).

Overall, the outlook for the US rubber industry in 2023 will depend on various factors, though the state of the global economy is the most important. From a sales perspective, an underwhelming end to 2022 signals there may be headwinds going into the new year. However, improvements in the supply chain and the labor market could help boost profitability for producers if economic conditions improve and inflation slows down compared to the previous year’s highs. Regardless of the economy’s direction, the industry must remain resilient as it navigates this “new normal” full of uncertainty and speculation to take full advantage of more prosperous times that hopefully are around the corner. n

To discover the latest outlook of the US rubber industry, obtain ARPM’s 2023 State of the Rubber Industry Report at www.arpminc.com/publications.