34 minute read

Syz Group: How green bonds accelerate the shift to sustainability

from Pan Finance Magazine Q3 2022

by PFMA

SUSTAINABILITY PAN Finance Magazine Q3 2022 FOCUS

Surprisingly for many, Poland became the first country to issue a green bond in December 2016, winning the race ahead of France, which had already announced in April 2016 that it would launch a green-linked instrument in the capital markets. ` In the capital markets, states, local authorities and companies raise billions every year to finance projects, mainly through institutional investors. Poland is not your normal green crusader. The EU member state is known for coal mining and poor air quality. It also regularly reaches Earth Overshoot Day 1 in May. As Mathis Wackernagel, inventor of the concept of the carbon footprint, says - post-May Poland is living on credit. Translated to finances, from May it runs a budget deficit.

RESEARCH | ANALYSIS | INSIGHT

How green bonds accelerate the shift to sustainability

12 July 2022

Sacha Bernasconi Portfolio Manager For many green bond issuers, the only future lies in the sustainable economy. They are setting their sights on achieving the global net zero FOR MANY GREEN BOND ISSUERS, THE ONLY FUTURE LIES IN THE SUSTAINABLE ECONOMY. THEY ARE SETTING THEIR SIGHTS ON ACHIEVING THE GLOBAL NET ZERO TARGET FOR 2050 Syz Asset Managementtarget for 2050 by 2040 or even earlier. BY 2040 OR EVEN EARLIER.

Sacha Bernasconi n Portfolio Manager

Likewise, Switzerland and many other countries have already used up their entire annual ecological budget by May.

Switzerland is still in the preparatory phase and plans to issue its first green bonds only at the end of 20222. France has issued over 54 billion in green bonds since 2017, financing green projects. Meanwhile, Germany issued an innovative green bond in 2020 that has exactly the same maturity as its non-green counterpart.

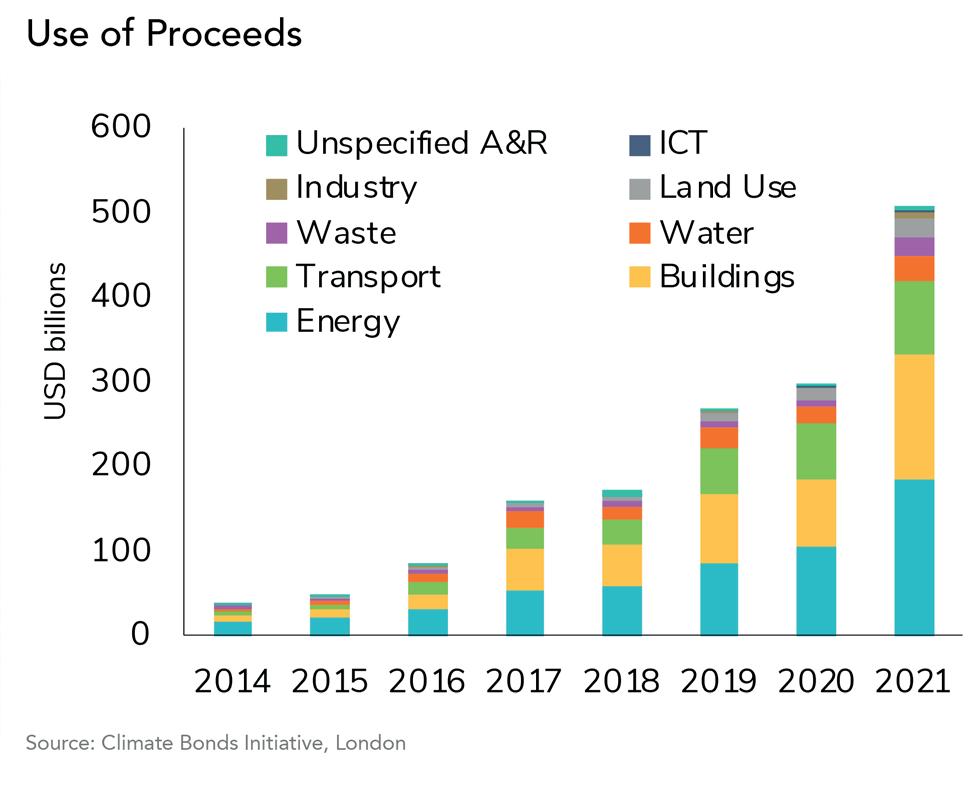

This shows how big an interest rate difference the two different bonds have. In fact, the difference in terms of yield is only 0.05 percent, which is very small. Other countries have already advanced their transition to sustainability by issuing green bonds: Fiji (first Green Bond as of 2017), Nigeria (2017), Indonesia (2017), Belgium (2018), Lithuania, (2018), Ireland, (2018), Chile (2019), the Netherlands (2019), Hong Kong (2019), Hungary (2020), Sweden (2020), Egypt (2020), Italy (2021), Spain (2021), Serbia (2021), Colombia (2021), South Korea (2021) United Kingdom (2021), Canada (2021) and Austria (2021). WHAT IS FINANCED WITH THE MONEY?

Around two thirds of the funds raised are used for the energy and construction sectors. The energy sector mainly includes measures for electricity and heat. Companies from the private sector seem to be taking very specific measures to reduce the energy they consume. Apple, for example, has invested around USD 1.1 billion from a total of USD 2.5 billion in green bonds in the development park in Cupertino and other sustainable buildings. This alone enables the company to save 1.2 million tonnes of CO2 emissions annually. At the same time, renewable energy production facilities with a capacity of 571 megawatts were installed, 91,000 tonnes of waste were avoided, 360 million litres of water were saved, and several other measures were achieved thanks to the issuance of the green bond.

www.panfinance.net

WHY ARE SO MANY ISSUERS ARE RACING TO ISSUE GREEN BONDS?

• Since mid-2014, the International Capital Market Association (ICMA) has acted as secretary of the Green Bond Principles (GBP).

• GBP are voluntary guidelines for the issuance of green bonds that were jointly drawn up by market participants with the aim of promoting transparency and integrity in the green bond market.

• Novelty: Green bonds are purpose-built investments, but essentially, they built on the tried and tested format of bonds.

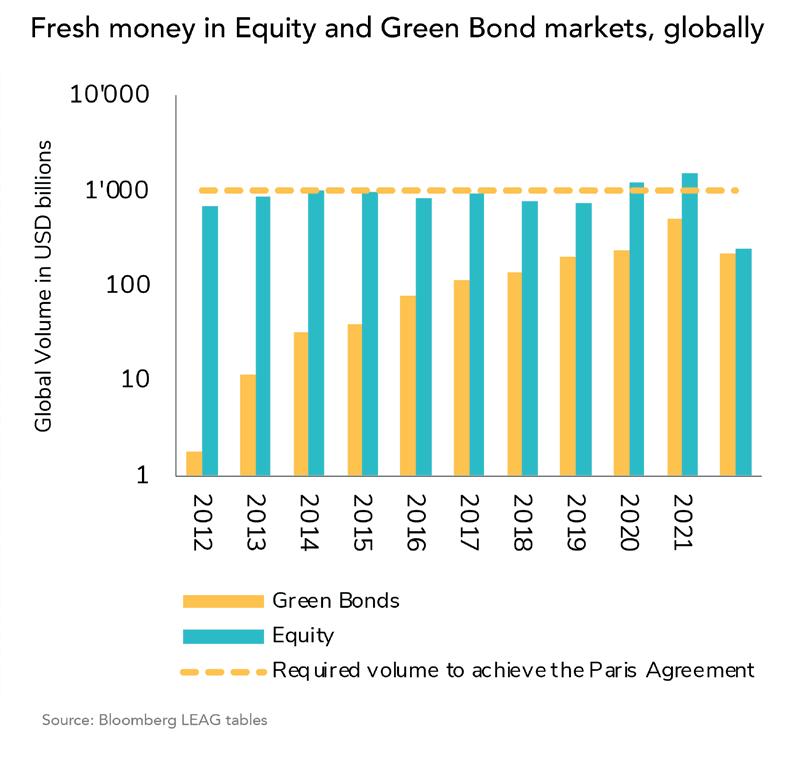

What sounds unspectacular, with formal language such as “secretary” and “voluntary guidelines” , has led to a quiet and silent revolution. For who would have thought 10 years ago that one day the fresh money for green projects would be the same or even more than that for all the freshly subscribed shares worldwide? This turning point seems to have come as early as 2022. The chart below shows how rapidly the green bond market has developed since 2012.

ARE THE VOLUMES SUFFICIENT?

The International Energy Agency estimates that an investment volume of USD 1 000 billion per year is necessary to achieve the energy transition. The Climate Bonds Initiative from London has also set itself the goal of achieving an annual volume of over USD 1 000 billion for green bonds as quickly as possible. The non-profit organisation acts as an intermediary and advises countries and companies on how to issue green bonds.

While the UN Climate Council and the Climate Youth are justifiably making massive demands to combat climate change quickly and consistently, the international political will is geared towards achieving net zero by 2050 at the earliest. Fortunately, many issuers of green bonds see a future only in a sustainable economy and are aiming for net zero by 2040 or earlier. With this voluntary and, in terms of volume, massive but silent transformation, the hope remains that a transition to more a more sustainable economy with the help of the financial markets will be easier than many thought.

1. According to the Global Footprint Network, Earth Overshoot Day is the day in the current year when human demand for renewable resources exceeds the Earth’s supply and capacity to reproduce those resources in that year.

2. On behalf of the Federal Council, the Federal Finance Administration (FFA), in collaboration with the Department of the Environment, Transport, Energy and Communications (DETEC), will develop a framework for the emission of “Green Confederates” and submit it to the Federal Council for decision by the end of 2022

FOR FURTHER INFORMATION

Syz Asset Management Dreikönigstrasse 12 8002 Zurich Tel +41 58 799 77 37 Fax +41 58 799 22 03 syzgroup.com Sacha Bernasconi, Portfolio Manager Sacha.Bernasconi@syzgroup.com

SUSTAINABILITY PAN Finance Magazine Q3 2022

Madeline Taylor

Senior Lecturer, Macquarie University

Historic new deal puts emissions reduction at the heart of Australia’s energy sector

Australia’s energy ministers on Friday voted to make emissions reduction a key national energy goal, in a major step forward in the clean energy transition.

Federal, state and territory energy ministers agreed to include emissions in what’s known as the “national energy objectives”. The objectives guide rule-making and other decisions concerning electricity, retail energy and gas.

Announcing the deal on Friday, Climate Change and Energy Minister Chris Bowen said it was the first change to the objectives in 15 years. He added:

This is important, it sends a very clear direction to our energy market operators, that they must include emissions reductions in the work that they do… Australia is determined to reduce emissions, and we welcome investment to achieve it and we will provide a stable and certain policy framework.

The agreement comes not a moment too soon. To meet Australia’s net-zero goals, variable renewable energy capacity must increase nine-fold by 2050. That means doubling Australia’s renewables capacity every decade. So let’s take a closer look at what the deal means.

PRIORITISING EMISSIONS REDUCTION

A body called the Australian Energy Market Commission (AEMC) makes the rules for the electricity and gas market. It must refer to the national energy objectives to guide the formation of these rules.

The exclusion of emissions from the objectives meant the commission did not have to consider the long-term climate implications of the rules it set. Instead, the objectives mostly meant the commission considered the price, quality, safety, reliability and security of energy.

This limited scope meant some investment decisions by the commission were based on short-term economic grounds. For example, these old regulations required a transmission company to maintain diesel generators rather than build a world-first clean energy mini-grid near Broken Hill, New South Wales.

Other jurisdictions worldwide already include sustainability objectives in electricity laws.

For example, a principal objective of the United Kingdom’s Electricity Act 1989 requires officials to protect the interests of existing and future consumers. The first listed priority is the need to reduce greenhouse gas emissions

www.panfinance.net

from electricity supply.

WHAT HAS ITS EXCLUSION MEANT FOR PROJECTS?

The environment used to be included in the objectives, but the Howard government removed it more than two decades ago. The move was a major setback for climate action and the transition to renewable energy.

The energy market operator may consider the environmental or energy policies of participating jurisdictions to identify effects on the power system. But Friday’s deal means consideration of emissions would no longer be optional for the commission.

The traditional principles of efficiency and reliability are, of course, still crucial to energy systems. Yet, the ongoing energy crisis shows we must invest in a suite of technologies to reach net-zero goals while assuring future energy security.

ENSURING THE TRANSITION IS FAIR

Including emissions in investment decisions is crucial for planning the future of the National Electricity Market. Some states are making excellent progress.

For example, New South Wales has mapped five “renewable energy zones” to replace ageing coal-fired generators. The roadmap’s objectives explicitly include improving “the affordability, reliability, security and sustainability of electricity supply”.

A successful energy transition must also consider society’s values. This includes consulting with landholders and communities about developing renewable energy projects on their land.

Making sure Australia’s transition is fair for everyone means prioritising people and their involvement. It also means getting a social licence for energy industry decisions.

The requirement to consider emissions in energy investment decisions may create further incentives for energy bodies to consider societal impacts. This is also reflected in Friday’s ministerial commitment to work on a co-designed First Nations clean energy strategy. Considering climate impacts in energy financing and planning decisions is also crucial to the resilience of our energy systems. It will help ensure we don’t see a repeat of the Black Summer bushfires in 2019-2020, when entire sections of the national grid were destroyed.

ALIGNING WITH OUR LONG-TERM INTERESTS

This is a momentous period for Australia’s energy policy. The new federal government recently established Australia’s first offshore wind zone and is close to enshrining an emissions target in legislation. All this signals a long-needed embrace of the energy transition towards net zero.

This latest change increases this momentum. Importantly, it sends a direct signal for more investment net-zero technologies.

The international COP27 climate conference is due in November and Australia wants to cohost COP29 in 2024 with our Pacific Island neighbours. With that in mind, our regulation must reflect our commitment to the energy transition – and this new deal is a crucially important step.

SUSTAINABILITY PAN Finance Magazine Q3 2022

Renee Adams

Professor of Finance, University of Oxford

Jing Xu

Lecturer in Finance, University of Technology Sydney

Female finance leaders outperform their male peers, so why so few of them in academia and beyond?

The gender diversity of thought leadership in finance is lower than in most other academic fields, our research shows. Finance ranks 132nd out of 175 fields with a representation of only 10.3% women among its thought leaders. Yet these women outperform their male peers.

How did we measure this? The impact of an academic’s ideas can be quantified using academic citations – how often their work is referenced in research published by other academics. We consider thought leaders to be academics who have been ranked among the top 2% in their respective fields by citations in the Scopus database.

We found the percentage of female thought leaders in finance is lower than in economics and in the fields of science, technology, engineering and mathematics (STEM). It’s surprising since finance is a younger field than economics and so might be expected to be less traditionally male-dominated. The field of academic finance was carved out of economics in the early 1940s.

Our evidence on thought leadership is consistent with other evidence that women are less represented in finance academia than in economics. This is true at every level, from incoming PhD students through to full professors.

We see the under-representation of women in finance both among academics and more broadly. A 2020 Deloitte report noted:

“All but six of 111 CEOs at the 107 largest US public financial institutions (including four with co-CEOs) are men.” WHY ARE SO FEW WOMEN IN FINANCE?

The fact that finance is less gender-diverse than other maths-intensive fields suggests standard arguments about women’s preferences with respect to STEM subjects cannot explain their low representation in finance.

Country-level culture is also unlikely to explain women’s representation in finance. As our research shows, finance thought leadership is geographically concentrated. Only 20% of finance thought leaders are located outside the USA or UK.

Instead, we argue the culture of academic finance is less welcoming to women than it is to men. We provide two pieces of evidence for this argument.

First, we show that individual female thought leaders in finance have more impact than

www.panfinance.net

their male peers, as measured by citations per paper, their academic rank and a composite score of six citation metrics (total citations, H-index, Hm-index, citations of single, first and last-authored papers). This finding is especially striking given evidence that women’s research is less likely to be cited. Female thought leaders in finance also have relatively more impact than they do in economics or other STEM fields.

These results suggest the obstacles women face in finance are greater than in other fields. The individuals who overcome these barriers outperform their peers.

Second, we show that women’s beliefs about the level of innate talent needed to succeed in finance, instead of motivation and effort, are not correlated with women’s representation in finance thought leadership, but men’s beliefs are. These results are consistent with the idea that men’s beliefs represent a greater barrier to equality in thought leadership, role modelling and education in the “masculine” field of finance than in other fields.

LACK OF DIVERSITY IS A HANDICAP

economy. It’s the third-largest industry in Australia, accounting for 8% of economic output. The lack of diversity in thought leadership for such an important sector is problematic for several reasons.

Diversity of thought and innovation are linked. Lack of diversity means the finance industry may be less innovative than it could be.

The finance sector may also be less welcoming to women than it should be. The general public does not always embrace finance despite its importance. Stockmarket participation is low in some countries and demographic groups, as is financial literacy.

Trust in finance might be higher when finance professionals are more similar to members of the general population.

WHAT CAN UNIVERSITIES DO ABOUT IT?

Women are also less likely to enter the field of finance after graduating. They make up only 35% of MBA enrolments in Australia (41% in the USA). The absence of female thought leadership, role models and educators in finance may help explain women’s under-representation in MBA enrolment and in the finance sector. To overcome the inequality of finance, the culture of finance academia must change. But culture cannot change on demand.

The leadership of academic finance associations and our universities should provide opportunities for introspection, reflection and discussion of these issues. We should start by discussing why academia seems to be focused primarily on producing more science, rather than better science.

We should also acknowledge the role of gatekeepers and take steps to diminish their influence. Universities, academic associations and journals should increase the transparency of their operations. The process through which positions of power are filled, like those of university deans and journal editors, should be transparent. Opportunities for individuals to exercise their voice without repercussion should be provided.

All these organisations must demonstrate a commitment to unbiased decision-making as a core element of good governance. Only when the rules of the game are clear can there be a hope of changing the rules to level the playing field.

SUSTAINABILITY PAN Finance Magazine Q3 2022

David Bailey

Professor of Business Economics, University of Birmingham

Phil Tomlinson

Professor of Industrial Strategy, Deputy Director Centre for Governance, Regulation and Industrial Strategy (CGR&IS), University of Bath

The road ahead for electric cars relies on affordability, not scrapping grants

Since 2011, the UK government has been providing a tax-payer funded discount on the sale of battery electric vehicles. Known as the “plug-in car grant”, it was designed to help persuade motorists make the switch from diesel or petrol and commit to electric driving.

But last month the grant was scrapped with immediate effect. It wasn’t exactly a surprise, given that the amount buyers were able to claim back had gradually been whittled down from £5,000 to £1,500; or that it was recently available only for new vehicles costing less than £32,000 (the average cost of electric cars is around £43,000).

In fact, the government had been trying to scrap the grant completely for a while. Only a major backlash a couple of years ago forced the government to do a speedy handbrake turn and keep it going for a while longer. Now though, the high level of demand for electric vehicles appears to have given the Treasury the green light to pull the plug once and for all. Instead it is apparently opting for a “shift in focus” towards charging infrastructure, although no new money has been announced for this.

The government’s argument for scrapping the subsidy is that it has already done its job of getting the wheels of the electric car market moving. There are also significant financial benefits to owning an electric car such as reduced running costs, and no road tax bill.

And it is true that the market for electric vehicles is strengthening. Prices have come down, the range of models has improved, and it is estimated that one in four cars sold in the UK and EU this year could be battery powered. which have withdrawn financial support for car buyers have seen a dip in demand for electric cars.

For now, the government is essentially saying it will switch towards supporting the charging infrastructure and company car buyers.

At first glance, targeting the purchase of company cars makes sense. Lots of firms buy new cars, and their drivers tend to clock up more miles than private owners. So if they can be encouraged to buy electric cars, this will help reduce CO₂ emissions on the roads.

After two or three years, those company cars are fed into the used car market, potentially increasing the number of electric vehicles available.

But it raises a big question over fairness. Subsidising company cars provides savings to business owners, and employees who may

www.panfinance.net

benefit from company car tax breaks. Opting for an electric vehicle is becoming an increasingly obvious choice for managers and business owners, with a tax system designed to assist them.

So far, so good – for the relatively well off. In affluent areas of the UK, shiny new Teslas, Polestars, e-Trons plugged into the domestic electricity supply have become a common sight on driveways.

DRIVING AWAY BUSINESS

In poorer areas, they are much less common, and so are the driveways. But those with their own private home charging point enjoy much cheaper rates, because plugging into an onstreet charging point means paying 20% VAT on the electricity rather than the 5% of a domestic tariff. So while targeting company cars and fleet drivers makes some sense in promoting wider electric vehicle uptake, the policy seems pretty regressive. The government seems to have forgotten about helping the less well off into electric vehicles.

In contrast, New Zealand recently announced a “clean car upgrade programme” which aims to help low and middle income families into low-emission cars through what is effectively a scrap-and-replace scheme. In Scotland, a new plan offers interest-free loans to anyone looking to buy a new or used electric cars. It will be interesting to see whether these ideas have the desired effect.

Meanwhile, the global car industry is being severely constrained by the chip shortage. In the UK, it also finds itself under pressure from the shift in approach which now favours the “stick” of economic mandates over the “carrot” of widely available grants.

Under the zero emission vehicle mandate, manufacturers will be required to sell a certain proportion of electric vehicles before 2030. If they don’t hit the targets they will be fined.

Unsurprisingly, the government’s latest moves have not gone down well with a car industry struggling in a difficult economic climate. And nor should the government forget the economic challenges for drivers of soaring petrol prices and the rising cost of living. If it wants more of them to make the switch to electric vehicles, it should be much more focused on making them an affordable option for as many motorists as possible.

INFRASTRUCTURE PAN Finance Magazine Q3 2022

www.panfinance.net

PAN FINANCE AWARD WINNERS

Established to be a true indicator of excellence, the Pan Finance Awards identifies organisations and individuals who have excelled in their fields. Our awards directory serves to shine a spotlight on and also applaud these leading examples of best practice.

BEST DIGITAL BANKING PLATFORM - MEA 2022 -

Aion is a leading fintech headquartered in Bahrain, with a presence in Saudi Arabia, Kuwait, and the UAE. Through its digital engagement platform, the company’s key focus is the digital and data transformation of banks. The Aion platform embeds regulatory and banking innovations for the quick and cost-effective launch of digital banking services. Financial institutions have strengthened their competitive position using the platform, processing millions of transactions every day.

Aion works across four main pillars:

Cloud-Agnostic Digital Banking Platform - Rubix Our platform and solutions make the experience of opening a deposit account, obtaining financing and making payments simpler, faster, and more secure. Customized for GCC regulatory and banking environment Ai Powered We help clients apply the data they have, via embedded artificial intelligence capabilities, to build deep personalized relationships with their customers

Deep Ecosystem Play We enable clients to securely and quickly provide their customers with access to third-party apps and fintechs, via our platform

Flexible, Modular Architecture We enable the rapid creation of new products through our modular architecture and low-code design tools

Aion strives to Bringing Purpose Back to Banking building digital-first solutions, but without the significant costs (capex) or time taken to launch.

MOST TRUSTED WEALTH MANAGEMENT ADVISORY SERVICES - EUROPE 2022 -

The Blacktower Group was established in 1986 to bring wealth management advice and financial planning solutions to a global client base.

With 28 offices internationally, our financial advisers continually keep pace with the changing needs of our customers. We believe passionately that the best wealth management service is offered through personal, face-to-face advice and we ensure that the same high level of professionalism and attention is provided to every client, no matter what services they require or where they are located.

The world of investment and financial services is complex, and finding the right products is time consuming. With our knowledge and expertise we help our clients save time and money whilst providing them with peace of mind. Offering a range of services from international pensions, to tax planning, we are there for our clients at all the key moments in their lives.

With 36 years of experience, an extensive regulatory footprint, and a team of experienced advisers, we are equipped to help our clients achieve their goals and protect their financial horizon, whether that’s at home, or abroad.

Blacktower entities are licenced in every jurisdiction in which our financial advisers operate.

For specific permissions and licences, please visit: www.blacktowerfm.com

ASSET MANAGER OF THE YEAR - CHINA 2022 MOST SUSTAINABLE ASSET MANAGER - CHINA 2022 -

Founded in April 1998, China Asset Management Co., Ltd. (ChinaAMC) is a leading asset management company in China. It brings local edge with on the ground research capability and obtains first-hand and indepth knowledge via active corporate engagement and dialogues with regulators and policymakers. With $268 billion in AUM, ChinaAMC is committed to finding the best investment opportunities for its clients.

ChinaAMC serves over 95,000 institutional clients, among which are overseas central banks, sovereign wealth funds, insurance companies, and banks in Europe, North and Latin America, and Asia Pacific as we continue to expand our global footprint. ChinaAMC also leverages its global partnerships to issue offshore mutual funds to offer global clients access to the Chinese market. Wielding great influence in China’s asset management space, ChinaAMC is committed to promoting responsible investment. ESG sits at the center of its investment philosophy and is integrated into its investment process. It became the first full-service Chinese asset manager to join the UN PRI in 2017 and launched the first China Equity ESG UCITS fund in 2020. It is also the first China-based asset manager to clearly state the specific goal of “carbon neutrality” and its corresponding implementation blueprint at an operational level. *Source: ChinaAMC, data as of June 30, 2022.

Contact us Website: https://en.chinaamc.com

Founded in 2020, Cloud Capital was born from the firm idea of creating an offer that could benefit the customer by showing a better return on their capital compared to what other financial instruments in the market currently offer.

Cloud Capital specializes in the foreign exchange market and the company’s offer combines the safety and solidity with the easiness and flexibility anyone should have, with minimum attainable investment amounts and no forced deadlines. The company has the first business model of this type that is solidly structured and backed up by prestigious partners.

Cloud Capital currently has around $60,000,000 MXN ($3,000,000 USD) assets under management and intends to keep reaching out to many more customers while supporting the financial culture in Mexico and the world.

BEST PAYMENT SOLUTIONS PROVIDER - JAPAN 2022 -

Crowd Cast, Ltd. is a Tokyo-based Fintech x B2B SaaS startup. Our vision is to enable corporate cashless which opens up a huge opportunity in Japan. Our modern, technology service “Staple” is a spend management solution to simplify the payment process between the company and employees. It includes award-winning apps and GPR (general purpose reloadable), VISA branded corporate prepaid cards that did not exist in Japan when we build.

Dunas Capital is an independent financial group of Spanish origin that strives to become the leading institution on the Iberian marketplace, in the asset management industry and for both financial and real-estate investments, by offering a concentrated and specialized range of complementary and high-quality products with great added value. We are fully dedicated to managing portfolios of financial institutions and third parties, through traditional products and alternative investments. This involves managing global assets and portfolios with return targets that are established with a special concern for capital preservation, while continuously assessing the risk/return relationship, and applying the strictest standards for controlling and managing financial risks. Thanks to all this, together with a very experienced and recognized management team and our extensive regulatory knowledge, we are well equipped to advise our clients, being supervised by both the Spanish National Securities Market Commission (CNMV) and the General Directorate of Insurance and Pension Funds (DGSFP).

With total assets under management of around €2Bn as of September 2022, our business model is designed for the long term, through sustainable and controlled growth, with innovative and sophisticated strategies, a solid and diversified customer base and rooted upon our 6 founding principles which are: Independence, Transparency, Flexibility, Innovation, Experience and Sustainability.

MOST INNOVATIVE PETs COMPANY - USA 2022 -

Enveil is a pioneering Privacy Enhancing Technology company protecting Data in Use. Enveil’s business-enabling and privacy-preserving capabilities change the paradigm of how and where organizations can leverage data to unlock value. Defining the transformative category of Privacy Enhancing Technologies (PETs), Enveil’s ZeroReveal® solutions allow analysts to securely derive insights, cross-match, and search third-party data assets without ever revealing the sensitive/regulated content contained in the search itself or compromising the security or ownership of the underlying data.

Enveil’s decentralized approach allows data to be securely and privately leveraged between entities and across organizational, jurisdictional, and security boundaries, expanding data usability without the need to move or pool sensitive assets. Further, Enveil’s Machine Learning capabilities extend the boundary of trusted compute by enabling encrypted federated learning and the secure usage of disparate, decentralized datasets for machine learning applications. A World Economic Forum Technology Pioneer founded by U.S. Intelligence Community alumni, Enveil is deployed and operational today, revolutionizing data usage in the global marketplace.

Learn more at www.enveil.com.

Lemania - Pension Hub, which was founded in 2018 on the initiative of Gonet & Cie SA Bank with the support from the Mirabaud Group at a time when the pension sector is experiencing a boom. It was initiated by bringing together three foundations: the FRPI (Fondation romande en faveur de la prévoyance individuelle), the FLLP, (Fondation Lemania de libre passage) and the FCDE (Fondation pour cadres et dirigeants d’entreprises).

The platform is fully digitalised for its partners active in pension planning and asset management. It has already met its goal of becoming the first open platform in Switzerland to bring together top providers from the pension and financial sectors. It has assets under management at CHF 450 million after a little more than three years of operation, with a goal of CHF 1 billion by 2028–2030.

The lemania pension hub has already been awarded multiple awards for its ingenuity and platform. It uses a unique approach integrating a one-stop shop for pension brokers and authorised asset managers. The online interface is used to compare the many mutual funds that are available for investment while the Client Lifecycle Data Management (CLM) Dashboard is used by the partners to onboard end clients with a digital signature.

HSBC in Poland is a part of the global banking and financial organisation – the HSBC Group. We offer comprehensive financial services, which include corporate banking, foreign trade services, receivable finance, funds and asset management, capital market services, finance, pension and investment fund management and stock transactions.

HSBC in Poland is focused on the following groups of services: Corporate Banking, Treasury Services & Global Banking.

MOST INNOVATIVE SOLUTIONS FOR FINANCIAL FIRMS - USA 2022 -

IgnitionSystems.io (ISio) helps Accounting, Advisory & Financials Service Firms scale rapidly to over $1 million in recurring yearly revenue without paid ads or agency fees. Since early 2018, we’ve become trusted partners to hundreds of firms in the accounting & financial services industry across 3 different continents. Companies working with us reach their revenue targets faster, and their owners experience more freedom. And it’s all thanks to our exclusive focus, know-how, network, and systems that ensure we deliver consistently better results year after year.

We’ve added a case study section to our site & homepage to showcase some of these transformations. You’ll discover clients saying how our automated marketing systems helped them systematize their business and reclaim 10+ years of their life to spend with loved ones. Other clients will tell you how they’ve acquired multiple new high net worth clients, each with fees worth $250k+ per annum at a low cost using our tailor-made systems. All of these testimonials come from customers who have gone through our intense process of perfecting their market strategy, offers, pricing model, and practice processes.

In a matter of weeks, we bring you to market stronger and faster than before, ready to acquire high net-worth prospects. Our system works so well that you can say that we’re simply “the path of least resistance” when it comes to growing Accounting, Advisory & Financial Service Firms.

Typical results? You can expect 20 to 50+ qualified opportunities per month within your target market after going through our whole process and applying our systems to your business.

IQ-EQ is a leading investor services group employing over 4,000+ people across 24 jurisdictions worldwide. We have the know how and the know you to support fund managers, global companies, family offices and private clients. Assets under administration ~US$500b

Moody’s is a global integrated risk assessment firm that empowers organizations to make better decisions. Its data, analytical solutions and insights help decision-makers identify opportunities and manage the risks of doing business with others. We believe that greater transparency, more informed decisions, and fair access to information open the door to shared progress. With approximately 14,000 employees in more than 40 countries, Moody’s combines international presence with local expertise and over a century of experience in financial markets.

The Rizal Commercial Banking Corporation (RCBC) is majority-owned by the Yuchengco Group of Companies (YGC), one of the oldest and largest conglomerates in Southeast Asia covering over 60 businesses. It is among the largest private domestic banks in the country in terms of assets and has a network of over 444 branches and 2,492 ATMs and ATM Go units as of end-March 2022. Since its establishment in 1960, RCBC has been a pillar of the banking industry, providing a wide range of financial services to its customers through its retail and investment bank, microfinance unit, foreign exchange brokerage house, leasing company and overseas remittance tie-ups. In 2019, RCBC merged with its thrift unit, RCBC Savings Bank which resulted in a larger asset base and stronger financial standing.

The Bank, in synergy with its YGC affiliates SunLife GREPA Financials (SLGFI) and Malayan Insurance Company, Inc. (MICO) also offers investment-linked life insurance products, auto, fire, personal accident, and other non-life insurance products.

SUSTAINABLE BANK OF THE YEAR - CAMEROON 2022 EXCELLENCE IN CUSTOMER SERVICE - CAMEROON 2022 -

Present in Cameroon for 59 years, Société Générale Cameroun’s expertise is based on a team of attentive advisors dedicated to customer satisfaction and offers a complete and diverse range of products and services as well as an innovative multichannel platform. Société Générale Cameroun is a bank that is fully integrated into the Cameroonian economy to serve Cameroon and Cameroonians.

With 662 employees, 148 ATMs and 43 branches spread across Cameroon, Société Générale Cameroun places accessibility and proximity at the heart of its commitment and daily actions. Société Générale Cameroun teams standby their 246 800 customers to support them over the long term, with customized solutions.

Our bank is therefore committed to offering its customers of large and medium-sized companies, professionals, institutions, associations and individuals with quality, flexible and innovative products tailored to their needs. The bank has, in more than five decades of its presence in Cameroon, established itself as a leading player in the Cameroonian banking sector. With many awards collected, those distinctions reflect the continued solid performance of our Bank and demonstrate the efforts made since our creation, as part of a policy of consolidating achievements and constant transformation.

Through a relationship embodied by its interactions with all of its various customer segments, we are today a key player in the Cameroonian economic landscape. We have always stood by the State of Cameroon since its creation, as well as individuals, Cameroonian companies and those operating in the country. Thus, we would like to support everyone in their development projects and contribute to the development of the Cameroonian economy.

Wealth Partners

BOUTIQUE WEALTH ADVISORY OF THE YEAR - NORTH AMERICA 2022 -

At Stenner Wealth Partners+ of CG Wealth Management, we are driven by your success and dedicated to helping clients reach their financial goals. Our in-person or virtual team is composed of exclusive, award-winning Wealth Advisors for investors with at least $10+ Million of investment capital, or $25+ Million net worth. We specialise in this wealth segment across Canada and the USA. The firm has received several different awards and recognitions for its excellent and innovative service delivery in its industry.

The Stenner Wealth Partners+ team is led by V. Thane Stenner, CIM®, FCSI® who has spent over three decades understanding and managing the unique financial complexities facing wealthy investors, family offices, and institutional fiduciaries in North America.

Thane is cross border licensed with FINRA in the USA, and with IIROC in Canada, with clients based in San Francisco and the Bay Area as well as across Canada. He is also a Fellow of the Canadian Securities Institute (FCSI®), the highest Canadian Securities Institute designation and Chartered Investment Manager (CIM®), the recognized standard for portfolio management.

MOST INNOVATIVE PRIVATE BANK - SWITZERLAND 2022 -

The Syz Group is a family owned and managed Swiss financial group focused on excellent long-term investment performance, robust risk management, and personal service for clients. Descending from a family that have been entrepreneurs for centuries, the group was co-founded in 1996 by Eric Syz who still leads the firm alongside his two sons and a team of industry experts. Stable and secure – the Syz Group holds substantial equity, at around double Switzerland’s regulatory requirements.

The group serves clients across four main areas:

• Bank Syz offers private clients a genuine alternative to the traditions of Swiss private banking • Syz Independent Managers offers independent asset managers custody and investment services tailored to meet their clients’ needs.

• Syz Capital offers investors the opportunity to invest alongside the

Syz family in hard to access alternative investments such as private markets

• Syz Asset Management primarily invests the assets of Swiss institutional investors in bonds and money market instruments.

Syz clients share the group’s long-term view and focus on building sustainable wealth for the future. Syzgroup.com

BEST CFTC AND NFA COMPLIANCE CONSULTANCY - 2022 -

Turnkey Trading Partners (“Turnkey”) provides high touch, high service, consulting, accounting, and compliance solutions to brokerage and trading firms operating within the alternative investments industry. Turnkey’s customers include International Banks, Clearing Organizations, Swap Dealers, Hedge Funds, Commodity Trading Advisors, Brokers and Traders, as well as Crypto and Digital Asset firms. After more than fifteen years of successful operations, Turnkey supports hundreds of clients from around the globe, making it one of the largest derivatives consulting firms in the United States. As a frequent winner of industry “Best” awards, Turnkey has staked its reputation on successfully providing efficient, cost-effective business support that is custom tailored to meet each of its customer’s unique needs. Turnkey’s team of leading industry professionals is well prepared to address nearly every situation which may be encountered while operating a regulated trading and brokerage business. Turnkey was founded in Chicago, IL during 2007 by a former industry regulator. In 2017 the firm expanded its operations to the greater Miami area where it now maintains an office in Ft. Lauderdale, FL.

To learn more about Turnkey and its service offerings please visit www.turnkeytradingpartners.com.

MOST INNOVATIVE SME FINANCIAL SOLUTIONS - THAILAND 2022 EXCELLENCE IN DIGITAL TRANSFORMATION - THAILAND 2022 -

United Overseas Bank (Thai) Public Company Limited (UOB Thailand) is a fully-licensed commercial bank with a network of 149 branches and 352 ATMs (as of 31 December 2021). UOB Thailand is 99.66 per cent owned by United Overseas Bank Limited (UOB), one of Singapore’s oldest and Southeast Asia’s biggest banks.

A regional bank rooted in Thailand since 1999, UOB Thailand has established a reputation for delivering an integrated and omni-channel banking experience anchored in our robust regional infrastructure and digital transformation strategy. We provide comprehensive financial solutions to individuals and businesses, including personal financial services, commercial and corporate banking, and treasury services.

UOB Thailand is among the top-ranking banks in Thailand: A3 by Moody’s Investors Service and AAA(tha) by Fitch Ratings.

Awards