53 minute read

Atlantic Financial Group: Housing market special report

from Pan Finance Magazine Q3 2022

by PFMA

Housing Market

SPECIAL REPORT

The global housing market has been steadily growing since 2012. This trend accelerated during the Covid-19 pandemic, pushing house prices to new heights. Under the current economic and financial conditions, a deflation of the real estate bubble seems unavoidable. Despite this, there are niche markets that will do well in the coming years.

A. EVOLUTION OF PROPERTY PRICES OVER THE LAST 15 YEARS

After the subprime crisis in 2008-09, the housing market began a healthy stabilisation in 2010- 11, followed by a slow and steady price appreciation between 2012 and 2019. Global economic growth allowed housing construction to proceed at a moderate pace, while demand was underpinned by rising household wealth but also by their well-established expectations of long-term capital gains.

In 2020 and 2021, under the influence of the health crisis, prices tended to rise more rapidly (see Fig. 2). Several factors explain this phenomenon.

On the demand side:

• Lockdowns have increased the desire to live in spacious places

• Heavy fiscal packages have led to a surge in household savings

• The low interest rate environment has reduced mortgage funding costs

• The banks have applied particularly advantageous conditions for access to credit

On the supply side:

• The initial stock of goods for sale was relatively small

• Lockdowns have hampered the production of raw and construction materials

• Logistical problems have hampered the transport of these materials

ALL OVER THE WORLD, IN AN ENVIRONMENT OF STRONG DEMAND AND LIMITED SUPPLY, PROPERTY PRICES HAVE SOARED TO NEW HEIGHTS (SEE MAIN CHART).

B. REAL ESTATE BUBBLE

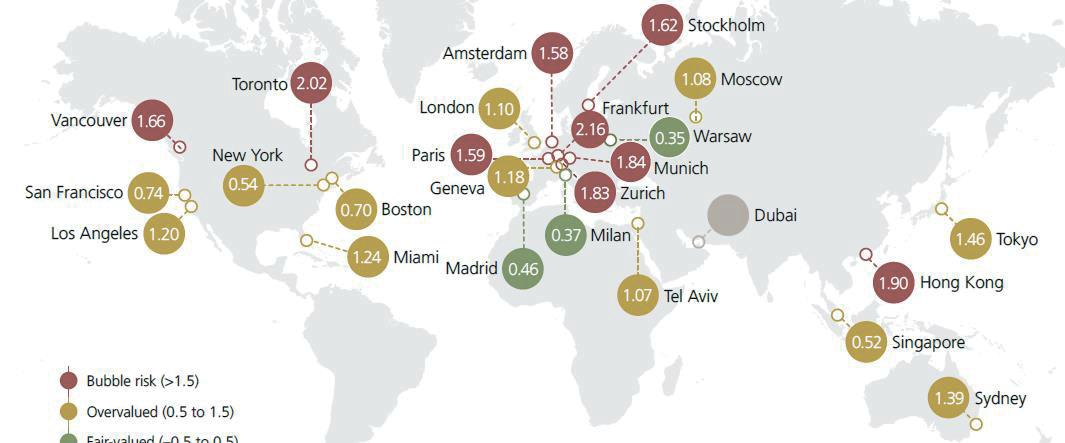

The overheating of the real estate market has led to major imbalances. The analysis of a few key indicators makes it possible to visualise this phenomenon. This is what UBS does, for example, when constructing its property bubble indices for the world’s major cities. The key ratios are as follows:

1. House prices in relation to household disposable income is undoubtedly the most important ratio. Households buy property mainly because they can afford it. The correlation between house price growth and disposable income growth is very strong (see Fig. 3).

There is sometimes a lag of a few years between the two series, due to behavioural biases of households or public policies, but the link is strong. It has prevailed since 1840 in France. The ratio between house prices and household disposable income is therefore very effective in determining the over- or undervaluation of the housing market (see Fig. 4). It is now reaching record levels, all over the world.

2. The housing affordability index (see Fig. 5) is widely used in the US. It measures whether the average family has a sufficiently high income to qualify for a mortgage to buy a standard home. While it is similar to the previous ratio, it introduces the concept of mortgage rate. The higher the rate, the lower the borrowing capacity of households. In concrete terms, a housing affordability index of 200 means that the average household income is twice as high as the income needed to obtain a mortgage. Today, at 124, it is only 24% above the minimum income required.

3. The price of housing in relation to rents gives investors a quick overview of rental profitability, but above all it reflects the trade-off that households make between buying and renting their residence (cf. Fig. 6). If the ratio is too high, as it is at present, then there are fewer buyers. As supply is relatively inelastic, demand will weaken until prices adjust downwards.

4. House prices in relation to inflation. Like all real assets, property prices adjust to changes in consumer prices, especially when its return is made up of rents indexed to the inflation rate. In the long term, investing in property is one of the best ways to protect against rising prices. In the short term, however, there is often a time lag between inflation in consumer goods and inflation in real estate. When the consumer price index peaks, the economic crisis and the resulting rise in real interest rates tend to cause property prices to fall significantly, only to rebound later (see Fig. 7). This was particularly the case during the double oil shock of 1973 and 1979, but also in the early 1990s and in 2009. The real value (inflation-adjusted) of real estate fell before rising again.

5. Mortgage demand relative to household income. This ratio is forward-looking. The higher it is, the more vulnerable households will be to financial stress. The likelihood that they will fall into arrears or default will increase during adverse income shocks or during periods of rising mortgage interest rates.

6. The household debt ratio, or debt service ratio, whether in relation to wealth, income or simply GDP, is a measure of borrowers’ ability to repay. In contrast to the 1950s to 1990s, household debt is now very high, equivalent to 77% of GDP in the United States (see Fig. 8). This is a serious handicap for taking out new loans when the horizon is clear and, even more so, for repaying existing ones in the event of a crisis.

7. The evolution of mortgage rates (see Fig. 9). The notion of debt burden depends on the volume of debt but also on the evolution of mortgage rates. Monitoring mortgage rates is therefore crucial, both for new property buyers and for those with adjustable or variable rate mortgages. Recently, in the US, 30-year mortgage rates have risen from 3% to 6%, reducing affordability for new homebuyers and increasing the debt burden for existing homeowners.

8. The weight of the construction sector in the Gross Domestic Product (GDP) is not the most relevant of ratios, but it does add some depth to the analysis of the property market. If the construction sector occupies an abnormally high place in a country’s value creation, it is likely that the real estate supply will eventually become excessive, and prices will suffer.

ALL ANALYSTS REFER TO THESE RATIOS TO ASSESS THE STATE OF THE REAL ESTATE MARKET IN THE WORLD.

According to UBS, the riskiest markets are Germany, Hong Kong, Canada, Switzerland, but also Sweden, the Netherlands and France (see Fig. 10). For the OECD, the most overvalued markets are New Zealand, Australia, and Canada.

C. RISK OF A PROPERTY MARKET CORRECTION

Just because a market is in a bubble does not mean that prices must necessarily and instantly fall to clear the situation. They can remain high for several years before normalising. Other variables can also adjust to make prices relatively fair. Unfortunately, in the current case, two factors have recently come to darken the picture. They imply a high risk of contraction in 2022 and beyond:

• Inflation is running at 8% per year, a situation not seen for 40 years. As prices are rising much faster than wages, it is eroding the purchasing power of households. Households have to choose between spending on basic goods (food, health, running costs) and discretionary goods (leisure, luxury goods, cars, but also housing).

• Commercial banks are increasing mortgage financing costs, forced to pass on the rise in central bank interest rates, but also the expected increase in their bad loans. In addition, they are tightening lending conditions, for example by requiring additional equity capital. More and more households are giving up on buying a house because they cannot get mortgage financing from a commercial bank. Banks believe that borrowers are not creditworthy enough, but they are also forced to drastically reduce their home loan lending in order to improve their own balance sheets. In countries subject to Basel III rules (where the strengthening of the level and quality of capital allows for increased liquidity risk management) the phenomenon is more visible. As an explicit example, in France, Société Générale and Crédit du Nord have suspended lending to brokers, who carry nearly 40% of the business, because the conditions have become too restrictive and the margins too low.

With supply constrained and prices high, a contraction in prices seems unavoidable in 2022 and beyond to reflect the slowdown in housing demand discussed above. The fall in prices has already begun in several major markets, notably in the main US and European cities. This correction could even be accentuated if the economic growth outlook were to deteriorate, for example with a recession, or if inflationary pressures were to persist, due to a deterioration in the geopolitical environment among other things. Finally, the tightening of monetary policy is likely to be much more damaging than expected. The Australian central bank has estimated that a 2% increase in its key interest rate could lead to a 15% fall in house prices over a two-year period.

On the other hand, there are many elements that can prevent a collapse in property prices and, on the contrary, restore the confidence of households and investors.

• Learning from past crises, the banking sector has sufficient safety rules to limit household over-indebtedness, the risks associated with it and, ultimately, to ensure its resilience to unforeseen changes in the housing markets. A banking crisis is therefore unlikely to come on top of a housing crisis, as in 2008-09.

• Households’ balance sheets are now stronger than before. As a corollary to the previous point, tighter regulation has limited their risk-taking over the past decade. In addition, their savings grew strongly during the pandemic, supported by lower temporary spending and, above all, by large-scale public support. Household debt service remains low (see Fig. 11) and well below the ratios considered risky. It is mainly low-income borrowers who are seeing their ability to repay deteriorate. SPECIAL REPORT

• Households have made more use of fixed-rate loans than in the past. Over the last ten years, low interest rates have encouraged them to move away from adjustable or variable rate loans. Households have thus generally been able to secure their interest costs (debt service) and reduce the likelihood of default in the event of a future increase in mortgage rates. Among the major advanced economies, Japan, and some European countries (Bulgaria, Spain, Finland, Greece, Norway, Poland, Portugal, Romania, Sweden, and the Baltic States) still have a significant share of adjustable-rate mortgages (see Fig. 12). They are therefore naturally the most at risk.

• Demography is a structural support variable. An influx of population, whether caused by an increase in the birth rate or a positive migratory balance, is a support factor for the property market. Conversely, an increase in deaths or negative net migration will lead to a fall in prices.

Moreover, the number of households is tending to rise even faster than the population. This is due to the ageing of the population, which increases the proportion of households without children, to the increase in divorces and to the change in the behaviour of young people, who often settle alone rather than as a couple when they leave their parents. Thus, the increase in population and the even faster surge in the number of households create ever-increasing housing needs. In France, for example, the Commissariat Général au Plan forecasts that the number of households will increase by 30% between 2015 and 2050. In addition, changes in the age structure of the population will lead to significant changes in the housing market. In France, 5% of people under 25 years of age are homeowners, compared to 70% of people over 40. As a consequence of these different phenomena, the typology of useful housing has changed: large family properties are less in demand, while there is a strong demand for two- and three-room apartments.

• Supportive public policies can be implemented by governments when households are struggling to finance their homes or when the construction sector is in crisis. Whether on the demand or supply side, these government-subsidised interventions can facilitate the acquisition of property and increase house prices.

• The performance of other asset classes can provide support for the real estate market. According to various analyses of the dynamism of investment types, real estate remains one of the best performing sectors. Over the last 40 years, listed equities have been the best performer. Unlisted real estate comes in second place. In terms of portfolio diversification, real estate has a longer cycle and provides decorrelation. Between January and

June 2022, for example, when stocks and bonds were performing in double digits, property prices remained broadly stable.

• Property is a real asset. In an environment where central banks are printing money at a frantic pace, investors are not immune to a devaluation of major international currencies. In this case, a “Louvre” or “Plaza” type agreement between central banks is likely to stabilise currencies against each other. They would then depreciate against real assets, such as gold, silver, but also oil, grain, farmland, and real estate.

• Finally, from a more granular point of view, even in a down market, there are differentiating factors that allow one to benefit. The location of a property, its exposure, its condition, its surface area, or its facilities, are all parameters that can allow the price of a property to rise.

United States: In Uncle Sam’s country, after soaring in 2020 and 2021 (cf. Fig. 13), home sales and prices are falling in some large cities, mainly because of rising mortgage rates (cf. Fig. 14). 6% of sellers have already conceded a fall in their selling price and this trend is expected to increase.

China: Rules to curb excessive property price rises (the “three red lines” introduced in August 2020) have led to tighter liquidity conditions for property companies and to defaults, such as Evergrande, or downgrades, such as Greenland. Over the next few years, the continuation of this restrictive strategy will continue to put downward pressure on prices. In May 2022, for the first time since 2015, new house prices fell.

France: Residential property prices have continued to rise by more than 7% over the last twelve months. Houses in the provinces and single-family homes are still supporting the rise, while prices in Paris have been losing momentum since 2020. The next publications will be much less encouraging, as the rise in mortgage rates takes its toll.

Switzerland: Due to the strong real estate market, the Federal Council has decided to reactivate the anti-cyclical capital buffer from September 2022 and increase it to 2.5% of risk- weighted positions secured by real estate pledges on residential properties in Switzerland.

F. NICHE SEGMENTS THAT WILL FARE BETTER

Among the sectors of the residential property market that should continue to benefit from their strong fundamentals are:

• Luxury real estate, historic districts or “golden triangles”: In every market crisis, whether it is a bond, stock market or real estate crisis, the assets with the strongest fundamentals hold up better than those that have grown by mimicry but whose investment rationale is not robust. This tautology will direct real estate investors to properties in structurally attractive areas, where the size of the property matches the most sought-after demand and where the interior facilities and services offered on the outside are the most in demand. These properties are often owned by the most affluent investors, those with the experience and ability to weather crises without having to sell at any price to meet their day-to-day consumption and health needs. Prices are therefore less volatile in the most sought-after neighbourhoods and at the very top end of the market than the market as a whole. Buying during a crisis is a long-term bargain.

• Life annuity: A so-called “random” variant of real estate sales, it consists of selling a property to a third party in exchange for a “bouquet”, i.e. a sum of money paid in cash when the deed of sale is signed, followed by the payment of a periodic life annuity, often monthly, until the unforeseeable death of the buyer. It therefore allows people who own their own home, often elderly, to transform part of their capital into cash, without passing on their property to their heirs. The life annuity sale is based on the principle of uncertainty since, at the time of signing the deed of sale, neither the seller nor the buyer knows for what amount the property will be acquired. This amount will depend on the date of the seller’s death.

Investors are understandably reluctant to speculate on the death of an elderly person. Fortunately, this is not the case. The life expectancy of the seller is in no way affected by the establishment of the life annuity. The life annuity is an exchange of good practices between an owner who wishes to sell his property and a provider of cash who wishes to invest. This transaction makes it possible to restore purchasing power to those who wish to do so, mainly retired people wishing to receive additional income and an annuity for the rest of their lives. In this way, life annuities can improve the living conditions of elderly people and, if they so wish, help them to remain at home. The purchasing power of the elderly is becoming a key issue as the world’s population ages. With the increase in the number of pensioners, longer life expectancy, but also the decrease in the number of working people, the balance of the pension system will become more and more uncertain.

Moreover, the purchasing power of the elderly is not guaranteed. On the contrary, senior citizens are currently experiencing a punishing scissors effect: inflation of their expenses and low growth of their pensions. At a time in their lives when the need for assistance is increasing, this creates major financial imbalances. Life annuities are one of the few options for making a substantial part of their assets liquid and guaranteeing their living conditions. In an environment of crisis in purchasing power, the life annuity market has a promising future, particularly in countries such as France and Belgium where it is already established.

• Warehouse real estate: In recent years, online retailers such as Amazon have been particularly keen to build warehouses to address their logistics and “last mile delivery” issues. In the US, over eight million square metres of new warehouse space was delivered in the first quarter of 2022. Despite this, the rate of available space continues to fall and is now 3.4%. Demand is such that prices have tripled in six years. Private equity giants such as Blackstone, KKR, Carlyle, Apollo, and Sweden’s EQT have all bought up sites to ride the warehousing wave. The tyranny of instant delivery is not over. The big brands are bound to multiply storage locations to get closer to their customers, especially in suburban areas. However, the hype has been such that a pause is likely.

Demand is expected to remain much more robust for data storage centres. Driven by e- commerce, 5G, streaming, but also the metaverse in the future, the segment is expected to continue to grow strongly. Between 2016 and 2021, the main European markets - London, Paris, Frankfurt, Amsterdam - doubled or tripled their digital storage capacity. The only question that remains concerns the quantity of buildings to be constructed, because for data centres, surface area is not sold in square metres but in terms of electrical capacity in megawatts.

• Agricultural land. Often overlooked, this real asset has a strong potential for price growth. Investing in agricultural land means owning arable land in order to rent it to a farmer who will farm it in return for a lease, i.e. a regular rent.

Like forests or vineyards, agricultural land benefits from the current economic and geopolitical context where agricultural commodity prices have risen sharply and even more so in a scenario where these prices are expected to remain structurally high. Moreover, in an environment of rapid population growth, the need for food will increase. This phenomenon will be more noticeable as climate change, with its increasing number of natural disasters, will certainly prevent food supply from keeping pace with demand. The price of farmland is therefore likely to rise sharply.

• Projects that base their strategy on sustainable, socially responsible agriculture, but also aim to relocate the production of plant species in Europe, will benefit from the current enthusiasm of consumers, industry, investors, and governments.

CONCLUSION:

• The global housing market started the year significantly overvalued. Several factors are clouding the horizon: declining purchasing power and rising borrowing rates are reducing the ability of households to become homeowners, banks are curbing the growth of their bad debts by tightening their lending conditions, while investors are becoming less numerous as rental profitability falls.

• While it seems certain that the property market is heading for a major crisis, there are cushioning factors: population growth is a structural support, households and banks are in good financial health, investors are disappointed with the performance of other financial investments, governments will support the sector if necessary and, in a major currency crisis scenario, property will have the huge advantage of being a real asset that can be used as a refuge.

• As we enter a complex situation not seen for 15 years, investors will be looking for more professional guidance in property investment. In any crisis, there are opportunities. It is still necessary to be able to detect them, finance them, promote them, manage them... to grab them.

• Among the different segments of the real estate market, residential property in sought-after areas or at the top end of the market will hold up better. Beyond this niche segment, life annuities, storage properties and agricultural land offer the best prospects.

DISCLAIMER

This document is issued by Atlantic Financial Group (hereinafter “Atlantic”). It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document.

This document is provided for information purposes only. It does not constitute an offer or a recommendation to subscribe to, purchase, sell or hold any security or financial instrument. It contains the opinions of Atlantic, as at the date of issue. These opinions and the information herein contained do not take into account an individual’s specific circumstances, objectives, or needs. No representation is made that any investment or strategy is suitable or appropriate to individual circumstances or that any investment or strategy constitutes a personal recommendation to any investor. Each investor must make his/her own independent decisions regarding any securities or financial instruments mentioned herein. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Atlantic does not provide tax advice. Therefore, you must verify the above and all other information provided in the document or otherwise review it with your external tax advisors.

Investment are subject to a variety of risks. Before entering into any transaction, an investor should consult his/her investment advisor and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. The information and analysis contained herein are based on sources considered to be reliable. However, Atlantic does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices, market valuations and calculations indicated herein may change without notice. Past performance is no guarantee of current or future returns, and the investor may receive back less than he invested. The investments mentioned in this document may carry risks that are difficult to quantify and integrate into an investment assessment. In general, products such as equities, bonds, securities lending, forex, or money market instruments bear risks, which are higher in the case of derivative, structured, and private equity products; these are aimed solely at investors who are able to understand their nature and characteristics and to and bear their associated risks. On request, Atlantic will be pleased to provide investors with more detailed information concerning risks associated with given instruments.

The value of any investment in a currency other than the base currency of a portfolio is subject to the foreign exchange rates. These rates may fluctuate and adversely affect the value of the investment when it is realized and converted back into the investor’s base currency. The liquidity of an investment is subject to supply and demand. Some products may not have a well-established secondary market or in extreme market conditions may be difficult to value, resulting in price volatility and making it difficult to obtain a price to dispose of the asset. If opinions from financial analysts are contained herein, such analysts attest that all of the opinions expressed accurately reflect their personal views about any given instruments. In order to ensure their independence, financial analysts are expressly prohibited from owning any securities that belong to the research universe they cover. Atlantic may hold positions in securities as referred to in this document for and on behalf of its clients and/ or such securities may be included in the portfolios of investment funds as managed by Atlantic.

The Statement

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS

www.panfinance.net

INNOVATIVE FINANCE CAN HELP REBUILD UKRAINE

PRIVATE EQUITY’S ESG GENERATION

THE POST-INFLATION ECONOMY THAT COULD BE GLOBAL BUSINESS DIGEST & MARKET ANALYSIS

INVESTORS BET AGAINST UK GOVERNMENT BONDS

Fears of a long recession and increased public spending to deal with the cost of living crisis have pushed the interest rate on Britain’s debts to their highest monthly rise in nearly 40 years.

The yield on 10-year bonds is set to fall by the most in a month since 1986, while yields on five-year and 20-year bonds are set to rise by the most in decades.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

AMÉRICA MÓVIL LAUNCHES SITIOS LATINOAMÉRICA

América Móvil, S.A.B. de C.V. announced that all prerequisites and implementation procedures for the spin-off of its telecommunications towers and other related infrastructure in specific Latin American nations have been met.

A new company called Sitios Latinoamérica, S.A.B. de C.V. has now received some of the assets, liabilities, and money that were transferred as a result of AMX’s spin-off, which its shareholders approved in 2021.

Mexican business Sitios Latam is apart from the leadership and capitalization of AMX. Construction, usage, and sale of towers and other structures for the installation of telecommunications equipment are the company’s primary commercial activities.

All wireless telecommunication service providers in the following Latin American nations will have access to and use of its towers: Argentina, Brazil, Chile, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Panamá, Paraguay, Puerto Rico, and Uruguay.

According to applicable Mexican securities regulations issued by the CNBV1, AMX and Sitios Latam will publish a press statement containing pertinent information about Sitios Latam (including certain financial information) and the process of distributing its shares to AMX’s shareholders after receiving the CNBV’s and BMV’s required approvals for the registration and listing of Sitios Latam shares (which are in process). IFC GIVES $150M IN FUNDS TO DIALOG AXIATA PLC

Dialog Axiata PLC (Dialog), the leading connectivity provider in Sri Lanka, plans to increase broadband access nationwide with assistance from the International Finance Corporation (IFC). With a loan from IFC of up to $150 million, Dialog will be able to upgrade current locations and build new 4G locations, increasing the capacity of its network. In order to improve the capabilities and efficiencies of its core network operations, Dialog also aims to expand the area covered by its fibre optic network and undertake modifications.

Dialog is well-positioned to effectively increase the availability of high-quality connectivity options in underserved areas of Sri Lanka because it is the country’s largest provider of telecommunications services, accounting for over 50% of both the mobile and fixed broadband markets in the island nation.

With over 32 million mobile customers, Sri Lanka has significantly increased the penetration of mobile services, with a mobile penetration rate of 149% compared to an average of 85% among its South Asian counterparts.

Sri Lanka is in the top 20 countries for broadband affordability, but its internet quality and speed are subpar, with the country’s download speed ranked 125th out of 141 countries worldwide. The market’s pronounced reliance on mobile services for data usage and the use of outmoded technologies like 3G are the key causes of this huge quality difference.

www.panfinance.net

Appointments

ÉTIENNE DUBUC

Executive Vice-President & Co-Head National Bank

National Bank announces the appointment of Étienne Dubuc as Executive Vice-President and Co-Head, Financial Markets. Mr. Dubuc will share the responsibilities of this role with Denis Girouard, the current position holder as of November 1, 2022. He will also join the Senior Leadership Team and report to Laurent Ferreira, President and Chief Executive Officer. Appointing a Co-Head of Financial Markets is part of the strategy to ensure a smooth transition and develop succession.

“I am pleased to welcome Étienne Dubuc to the Senior Leadership Team. Étienne has extensive knowledge of financial markets and has frequently shown his ability to rally teams to achieve ambitious goals and make the Bank a leader in key activities. His leadership and ability to generate growth will be major assets for the organization,” stated Laurent Ferreira, President and CEO of National Bank. PATRICK IYAMABO

Executive Director First Bank

First Bank of Nigeria Limited has announced the appointment of Patrick Iyamabo as an Executive Director. According to a statement, the appointment is subject to the approval of the Central Bank of Nigeria (CBN).

Prior to Iyamabo’s appointment as Executive Director of FirstBank, he served as the Chief Financial Officer of FirstBank and its subsidiaries, having joined the Bank in August 2016 from First City Monument Bank Limited, where he served as its Senior Vice President of Strategy and M&A and then the Group Chief Financial Officer of FCMB Holdings.

Speaking on the appointment, Dr. Adesola Adeduntan, CEO, FirstBank said, “We are delighted with the appointment of Patrick Iyamabo, as his elevation to the board is hinged on his excellent track record and the level of commitment he has demonstrated to the FirstBank Group. DIXIT JOSHI

Chief Financial Officer Credit Suisse

Dixit Joshi rejoined Credit Suisse, taking up the role of CFO. He replaced David Mathers who decided to step down after more than 11 years in his role as previously communicated. For the past five years, Dixit Joshi served as Group Treasurer at Deutsche Bank, where he played a key part in the bank’s restructuring while overhauling the firm’s balance sheet. During his career spanning three decades, he held various senior investment banking roles across different geographies, helping oversee a series of businesses as well as complex transformation projects.

Previously, Dixit Joshi served as Deutsche Bank’s Head of the Fixed-Income Institutional Client Group, Listed Derivatives and Markets Clearing as well as Head of Global Prime Finance and as Head of APAC Equities in Hong Kong.

NASDAQ HOPES LATAM MAKES UP FOR LOST IPOS

According to a top Nasdaq executive, Latin American firms could replace at least part of the Chinese companies’ initial public offerings (IPOs) that have vanished from western markets this year.

Chinese companies listed in the United States are being closely inspected by regulators in Beijing and Washington, and a conflict over access to audit files may result in Chinese companies being delisted from U.S. exchanges.

Chinese listings have not yet appeared in the United States this year, compared to 29 last year. Four Latin American firms were listed, down from 20 the previous year, and 11 Southeast Asian companies, down from 19 the previous year. Bob McCooey, the global head of capital markets for Nasdaq, visited Sao Paulo this week to speak with Brazilian businesses about future listings and to attend an investment gathering organised by online broker XP Inc.

The most recent Latam IPO was Semantix, a tech company that was combined with SPAC Alpha Capital and floated on Nasdaq last week. Inter & Co, a digital bank, switched from a Brazilian listing to Nasdaq in June.

Latin America is starting to witness serial entrepreneurs who reinvest the profits from selling their first businesses, in addition to seasoned venture capital organisations.

In the past five years, Nasdaq has listed 159 Chinese companies and 37 Latin American companies.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

HSBC expands global securities services in ADGM

For its important sovereign, institutional, and investment manager clients, HSBC has expanded its Markets and Securities Services business in the Abu Dhabi Global Market (ADGM) by gaining an arranging custody licence. Cross-border financial flows are made possible through custody services, which include the storage and maintenance of securities and other financial assets on behalf of clients. They also assist the risk management needs of asset owners and investment managers.

The extension links customers to a custodian network in 96 markets worldwide and offers a premier digital platform for securities services activities, providing institutional clients with global custody services.

From sovereign and institutional clients to family offices and extremely wealthy people to investment managers and retail customers, HSBC is expanding its wealth management capabilities across all customer groups.

www.panfinance.net

Deutsche Bank expands team in South Africa

As part of a strategy to expand across the continent, Deutsche Bank AG is expanding its investment banking staff and offerings in South Africa. According to the country head for South Africa, Saloshni Pillay, the German lender has added a senior corporate originator to the team who sources clients and business possibilities. The goal, according to her, is to create a deals hub for all of Africa.

“We will continue to build on what we have with a select number of clients and deliver to them,” said Pillay. “Then we have identified a broader client base that we will be targeting, really to build a pipeline of deals and work for 2023-2024.”

In order to rebuild after personnel numbers dropped as a result of two rounds of worldwide reorganisations the lender took out in 2018 and 2019, Pillay was hired by Deutsche earlier this year from Absa. Early successes included assisting with the $2 billion acquisition of Empire Logistics by DP World.

68 individuals work in the South African office, according to Pillay. Since 1979, Deutsche has operated in the nation.

According to the co-chief executive officer for the Middle East and Africa, Kees Hoving, Deutsche has identified Africa as a growth opportunity and will assist clients intending to invest there or incumbents looking to access different banking services. According to him, the technique used in Asia over the previous 20 years will serve as the foundation for the plan.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

Saudi Arabia invested $500m+ in Russia’s energy firms amid invasion

According to the company’s papers, Kingdom Holding Co. of Saudi Arabia invested more than $500 million in three significant Russian energy firms at the same time that Russia began its invasion of Ukraine. Kingdom Holding Co reportedly made significant investments in the three major Russian energy firms Gazprom, Rosneft, and Lukoil between the months of February and March, according to recently published regulatory documents.

The company invested 1.37 billion riyals ($365 million) and 196 million riyals ($52 million) in the worldwide depository receipts of Gazprom and Roseneft, respectively, and 410 million riyals ($109 million) in the US depository receipts of Lukoil during February and March.

According to reports, this is the first time Kingdom Holding Co., which is owned by the national wealth fund of Saudi Arabia and its chairman, Crown Prince Mohammed Bin Salman, has disclosed the specifics of its assets.

As a result of their substantial investments in Russian energy companies, it is assumed that the Kingdom was looking for undervalued assets with the potential for growth. That approach had proven successful with its investments in other businesses that were once unknown before achieving fame in foreign markets, like Citigroup and Apple.

When Moscow began its ongoing war of Ukraine, these investments into Russian industries were made. As a result, numerous Western countries imposed harsh sanctions on the Kremlin, its affiliates, as well as Russian energy corporations and their officials.

Western countries, who have encouraged them to impose comparable measures on Russia, have expressed their confusion over Saudi Arabia’s and the Gulf States’ stance on the conflict in Ukraine. However, Riyadh and other states in the area have maintained an overt neutral position and offered to mediate the crisis.

www.panfinance.net

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

Members sought by FCA for new ESG committee

Stakeholders are being sought by the UK’s Financial Conduct Authority (FCA) to join a new committee that focuses on environmental, social, and governance (ESG) issues. The FCA board will get advice from the new ESG Advisory Committee on developing ESG subjects and issues, how to carry out its oversight of ESG concerns, and how to create its ESG strategy. The committee will be made up of “a small number of external experts who have an in-depth knowledge of ESG issues in the financial sector,” the FCA said. However, membership will not be open to any individuals who are currently employed by an FCA-regulated firm.

The initial meeting of the committee is scheduled for the fourth quarter of this year, and subsequent meetings will be held every three months. The FCA has invited potential committee members to submit a copy of their resume by September 16, 2022.

The US plans $26m clean energy demo projects

The U.S. Department of Energy (DOE), on behalf of the Biden-Harris Administration, today announced $26 million in funding for projects that will show a combination of solar, wind, energy storage, and other clean distributed energy resources that can dependably power the nation’s electricity grid.

The Solar and Wind Grid Services and Reliability Demonstration Program, funded by President Biden’s Bipartisan Infrastructure Law, will demonstrate how clean energy resources can address significant grid reliability challenges by developing and testing tools and plant functions that allow the grid to remain online amid disturbances and restart if it goes down.

The data from the demonstration projects will show how President Biden’s target of 100% renewable electricity by 2030 can be met while promoting system resilience.

Initially designed to supply homes and businesses in the United States with electricity from a select few major fossil fuel power plants, the grid now incorporates both conventional and renewable energy sources.

The creation of new technologies that help grid operators control this increasingly complicated network is made possible by DOE investments. As grid operators deal with an increasing number of interruptions, such as cyberattacks, extreme weather conditions, and wildfires, such solutions now need to be shown at a larger scale in order to enhance their adoption and foster trust.

In order to create a clean power industry, sustainable energy sources like solar and wind generation and energy storage must demonstrate their ability to support the grid in both normal and emergency circumstances.

Dispatch tweak to US$448m Peru hydro project

In the Puno region, Hydro Global Peru (HGP) intends to alter the power dispatch portion of its US$448 million, 205.8MW San Gabán III hydropower project. The company, owned by China Three Gorges and Energaes de Portugal, has submitted a request to the Environmental Certification Service for Sustainable Investments (Senace) to modify the transmission line’s path.

“The energy generated from the project, in principle, would be distributed through the Paquillusi substation to the Onocora substation… however, due to contractual differences between the owner of the construction of the SET [substation] Onocora and the Peruvian State, there is no certainty of the construction and operation of the aforementioned SET,” according to HGP.

The project’s developer is currently working to link the line to the active Pumiri (Azgaro Nueva) substation. The original route would change after kilometre 17.76 and continue for an additional 159.97 kilometres. The infrastructure will cost US$78.8 million and take 12 months to construct.

According to data from energy and mining investment regulator Osinergmin, HGP has proposed delaying the hydro’s commercial launch until 2027 and requested force majeure due to “extraordinary, unforeseeable…events.” 34% of physical development has already occurred.

The concession contract, which was signed in 2016, originally called for a startup date of this February. The power grid coordinator COES’s prediction of an efficient generation coming online in the medium term includes San Gabán III. www.panfinance.net

SMEs seek funding to reach environmental goals

Small and medium-sized businesses are placing more and more emphasis on obtaining funding to advance their environmental goals. A recent study by Allica Bank found that 76% of asset financing brokers and 65% of commercial mortgage brokers reported seeing an increase in loans for sustainable development. According to the bank, this trend is being driven by SMEs making improvements to outdated equipment a first priority.

SMEs seeking financing to purchase electric vehicles has increased, according to 26% of commercial mortgage brokers and 70% of asset finance brokers. Meanwhile, 28% of asset finance brokers and 35% of commercial mortgage brokers report seeing an increase in the number of corporate borrowers looking to boost the green credentials of their current properties.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

The biggest Spanish cryptocurrency exchange, Bit2Me, has said that it has acquired the majority of Fluyez, a Peruvian competitor. According to Bit2Me COO Andrei Manuel, the cost of the purchase of the 85% stake was more than 1 million euros ($1.022 million), but he did not provide a specific amount. As of March 2021, Luis Eduardo Berrospi will continue to serve as the co-founder and CEO of Fluyez.

According to Manuel, the Peruvian company intends to increase its user base from 10,000 to 100,000 over the course of a year and will retain its current identity after being bought.

According to Manuel, Bit2Me is also in talks to purchase an exchange in Chile and is also interested in acquiring exchanges in Uruguay and Colombia throughout Latin America. He went on to say that the targets should be between $1 million and $20 million.

“We are looking for companies that are fully compliant, have users, a wallet where you can exchange cryptocurrencies and fiat, and a solid team,” Manuel said.

Bit2Me acquires Peruvian crypto exchange

www.panfinance.net

BTG Pactual launches crypto trading platform

The biggest investment bank in Latin America, BTG Pactual, has introduced Mynt, a platform for trading cryptocurrencies. On the same day, investment broker XP also unveiled its platform. The Mynt platform is a distinct application that does not currently support cryptocurrency deposits or withdrawals. Additionally, XP does not permit deposits or withdrawals.

André Portilho, Head of Digital Assets, said of the feature: “We are working on this feature. In weeks or months, we plan to release. We think clients will want to bring the assets to BTG, given the cases we had of withdrawal restrictions.”

With more than 3.6 million clients, XP is one of the largest investment brokers in the nation. Customers can currently purchase BTC and ETH on its platform.

The past year has witnessed a number of cryptocurrency-related debuts in Brazil, or at least announcements to that effect. A cryptocurrency trading service has been launched by Santander Brazil for institutional and individual clients.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

TABBY SECURES $150M DEBT FINANCING

Atalaya Capital Management and current investor Partners for Growth have provided $150 million in debt funding to the Dubai-based paytech company Tabby. The latest debt financing comes after Tabby closed a $54 million Series B extension in March.

According to Tabby, the investment strengthens the company’s balance sheet and helps it maintain steady growth in transaction volumes and product diversification. It continues to offer MENA consumers access to finance that is “otherwise unavailable to them” without levying interest or other costs, the company said.

Tabby’s income increased by 10 times, its active customers increased by 8 times, and its retail partners increased by 3 times in the first half of 2022 compared to the same period in 2017.

The loan commitment, according to Tabby’s CEO and co-founder Hosam Arab, “is validation of our strong track record and business model” as the company approaches profitability and “we’re in the fortunate position of not having to raise equity under the current market conditions.”

Founded in 2019, Tabby offers clients buynow, pay-later (BNPL) services “without the interest, fees, or debt traps.” It has revealed that Saudi Arabia, the United Arab Emirates, Egypt, and Kuwait hold more than two million of its active users. NEON SECURES $80M TO DRIVE PORTFOLIO EXPANSION DANA SCORES $250M FROM SINAR MAS

In order to provide millions of Brazilians with a “conscious path to credit,” Brazilian fintech Neon has funded $80 million in its first Credit Rights Investment Fund (FIDC), which is primarily focused on credit cards.

Neon has raised money twice this year in the private credit market. At the start of 2022, it raised more than $40 million for its private payroll deductible FIDC.

Emprica, which has a portfolio of more than 50 funds and more than $1.5 billion in assets under management, will be in charge of managing the new fund. The overall fund now stands at $170 million, and Neon says it anticipates that figure to double.

According to the fintech, the FIDC will enable the digital bank and fintech to increase their array of loan products “in a sustainable and balanced way.” The financing will also enable the business to use its technological resources and credit analysis models more effectively.

Neon CEO Jamil Marques says: “Today our credit engine is mature and the FIDC resources will give us the strength to continue expanding our portfolio.” Neon had a $270 billion loan portfolio at the end of 2021, and the FIDC will provide its growth plan with more flexibility. Dana, a player in the Indonesian digital wallet market, declared that the local conglomerate Sinar Mas Group has invested $250 million in the company. Lazada, an online retailer backed by Alibaba, also paid US$304.5 million to acquire 4.8 million shares of Dana from its current backer Emtek.

The Sinar Mas Group announced earlier this year that it will be making a US$225 million investment in Dana through its subsidiaries DSST Dana Gemilang and Bank Sinarmas.

Dana was established in 2018, and among its backers are the local media conglomerate Emtek Group and Ant Financial, another payments company sponsored by Alibaba. Vincent Henry Iswaratioso, the company’s founder and CEO, previously served as Alipay’s Indonesian national manager.

Dana claimed in a statement that it now has more than 115 million users and processes more than 10 million transactions daily. There are presently about 900 people working there, many of them are part of the product team.

According to Dana, its overall payment volume and gross transaction value will have doubled from the same period in 2021 by the end of this year.

www.panfinance.net

CITIGROUP LOOKS TO WIND DOWN RUSSIAN CONSUMER OPERATIONS

After efforts to sell the business were thwarted by Russia’s invasion of Ukraine and the ensuing financial system sanctions, Citigroup Inc. will wind down its consumer bank in Russia.

The bank estimated that over the following 18 months, the move would cost roughly $170 million.

Beginning this quarter, the wind-down will also involve closing its commercial banking activities for regional Russian businesses. Citi had made the decision to leave that commercial banking operation as well following the invasion. The New York bank initially announced in April 2021 that it will stop offering consumer banking in Russia as part of a general withdrawal from global consumer operations. DIGITAL BANKING PLATFORM UNDER PRESSURE

Revolut, a digital banking platform based in Europe, is reportedly under pressure from its auditors to strengthen internal controls after UK regulators discovered issues in the bank’s auditing accounts.

According to the Financial Reporting Council (FRC), the weaknesses might lead to undiscovered material misstatement and carry a high risk of material misstatement. The payments business has continued to grow quickly in Europe over the past few months, but it has also experienced a number of high-level departures from its risk and compliance teams, which has caused regulators to worry about the future of its more than 7 million customers in the UK and Europe. 12% RETURNS FROM EUROPEAN P2P LENDING

Peer-to-peer lending investments in Europe have an average annual return of 12%, ranking them as the fourth most profitable investment category for 2022. P2P lending is one of the best portfolio additions during times of financial turbulence, according to a recent analysis by the Croatian platform Robo.cash.

A number of indexes and equities were examined and it was discovered that natural gas, which has increased by 107.8% in the first half of this year, has had the highest growth. Brent oil is in second position, up 39.3%, and is followed by palladium, which has climbed by 15.6% since the year’s beginning. With an average return of 12% in the first half of the year, P2P investments are in fourth place.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

China’s central bank is shoring up the Yuan

The People’s Bank of China declared it will lower the minimum amount of foreign currency that banks must keep for the second time this year. Moves like this theoretically reduce the weakening pressure on the yuan, which has fallen to two-year lows against the U.S. dollar in recent weeks. According to analysts, the PBOC’s most recent action to limit the rate of yuan depreciation was motivated by impending political events in China and worries about capital outflows. Chinese authorities typically highlight the yuan’s position in relation to a basket of currencies, against which it has risen by approximately 1% in recent months.

A new group of leaders will be chosen by China’s ruling Communist Party in October, whilst strengthening President Xi Jinping’s position of power.

www.panfinance.net

Turkey’s soaring inflation bad news for Gulf banks

Since Turkey’s currency started rapidly depreciating in 2018, banks with exposure to the country have experienced losses; now, lenders in several oil-rich Gulf states in particular are expected to experience losses in the upcoming year as a result of their connections to the nation, according to a recent report by ratings agency Fitch.

According to Fitch, GCC banks with Turkish subsidiaries reported net losses in the first half of 2022 of over $950 million, “Turkish exposures constitute a risk for the capital situations of GCC banks due to currency translation losses from the lira depreciation.”

Even though inflation was close to 80%, Turkey stunned the markets by cutting its main interest rate in the middle of August. The Turkish Lira has lost 26% of its value versus the dollar so far this year, making it much harder for Turkey’s 84 million citizens to import commodities and buy necessities.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

India to look carefully at Russian oil price cap

G-7 finance ministers have come to an agreement on a strategy to put in place a mechanism to control the price of Russian oil exports. When asked if India would support the G-7 proposal to cap the price of Russian oil, Indian Petroleum Minister Shri Hardeep Singh Puri responded that India would carefully consider its decision and that the world economy was still adjusting to the effects of the coronavirus pandemic and Russia’s invasion of Ukraine.

Puri further stated that it was yet unknown which nations will participate in the proposed price cap on Russian oil and what effects it may have on the energy markets.

Following the Russian invasion of Ukraine, China and India have expanded their purchases of Russian oil, taking advantage of lower prices.

Assets of top 8 Middle East SWFs cross $3tn

According to a survey, the eight major Middle Eastern sovereign wealth funds (SWFs) have a combined total asset value of more than $3 trillion as a result of strong oil prices, which are supplying the funds with new resources to raise their allocations to alternative investments.

According to research, because the funds receive the majority of their funding from state-owned oil and gas industry earnings, the present high oil prices are giving them new money to raise their allocations to alternatives. This creates new potential for managers to assist SWFs in diversifying their portfolios and reducing their reliance on commodities.

The Abu Dhabi Investment Authority (Adia) recently raised the goal allocation bands for infrastructure from 1–5% to 2–7% and private equity from 2–8% to 5–10%.

Family offices in the Middle East have far greater faith in China than the general investor base does when it comes to which emerging economies will offer the best chances over the next 12 months, with 63% selecting this market as offering among the best opportunities.

Adia boosted private equity allocations from 2-8% to 5-10%. High oil prices are bringing in new money to increase investments in alternatives. China is listed as one of the markets offering among the best chances in the next 12 months by 63% of Middle Eastern family offices.

Dubai to house BuildingSMART’s first MEA office

The Middle East and Africa’s first BuildingSMART International office will be located in Dubai. The action highlights Dubai’s leadership in digital transformation and innovation in the construction and infrastructure sectors on a regional and global scale.

By embracing and creating open standards, Dubai Municipality, the organization’s host in the UAE, hopes to promote and support the digital transformation of the building and construction industry in the UAE.

A non-profit organisation called BuildingSMART International was founded with the goal of advancing the digital transformation of the built asset environment by developing and implementing open, global standards for infrastructure and buildings.

These standards promote greater efficiency and cooperation among all parties involved in the asset lifetime, including owners, architects, engineers, contractors, and operators.

The UAE’s position as one of the world’s leaders in infrastructure is further cemented with the inauguration of BuildingSMART International’s first MEA branch in Dubai. Several global competitiveness reports, particularly those for the infrastructure and building industries, place the UAE among the top nations. www.panfinance.net

Qatar inks electricity deal with Southern Iraq Network

The Gulf Cooperation Council Interconnection Authority (GCCIA) and the Qatar Fund for Development (QFFD) have inked a contract to establish and link the regional electrical system to the southern Iraq network. It is envisaged that this will help the network operate more effectively and reliably while also helping to meet some of the demand for electricity in southern Iraq.

Doha News reports that this action will result in the construction of a new 400KV transformer substation in Kuwait’s Wafra neighbourhood. Through the Al-Faw electricity transformer station in southern Iraq, this will be connected to both the Iraqi electricity network and the Gulf power interconnection system.

“This initiative will have a pivotal role in the economic contribution and infrastructure development,” said the Director General of the QFFD, Khalifa bin Jassim Al-Kuwari.

The signing of the agreement is reportedly one of the GCC’s key strategic projects. The project will get underway this month, and it should be up and running by the summer of 2024.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022

MALAYSIA’S SWF EXPLAINS WHY IT DIDN’T BACK GRAB

The sovereign wealth fund of Malaysia, Khazanah Nasional, has defended its choice not to participate in Southeast Asia’s super app for food delivery and ride-hailing, Grab, right away.

The fund’s investment approach, according to chief investment officer Azmil Zahruddin, is to concentrate on substantial investments rather than direct startup deals. Khazanah was unable to finalise a deal quickly to finance Grab, which was created in Malaysia.

Grab later attracted additional investors, including Singapore’s state-owned investor Temasek, and the ride-hailing behemoth moved its headquarters there. Grab became the largest listing by a Southeast Asian firm in the United States after raising $4.5 billion and launching on Nasdaq in late 2021 through a SPAC merger with Altimeter Growth Corp.

Khazanah received no small criticism for what some termed a “missed opportunity” for Malaysia. “You have to look at what Khazanah is and what its DNA is,” Zahruddin said in an exclusive interview with CNBC.

“Our DNA is that we manage large investments. [Venture capital] investing is not really what we do, and it’s not really our expertise and skill set.”

According to him, Khazanah would continue to support Malaysian startups by indirectly investing in funders that own shares in them and then possibly investing directly in them after they have grown to a level that satisfies the fund’s investment requirements. $2.7BN+ PROJECTS ON NEW SINGAPORE ONLINE PORTAL

Infrastructure Asia, a platform created by Enterprise Singapore and Singapore’s Central Bank, the Monetary Authority of Singapore, unveiled an online portal for infrastructure projects that links the government, developers, and financiers (MAS).

Indranee Rajah, Singapore’s second minister for finance, made the official announcement of the portal on August 2 at the Asian Infrastructure Forum. She stated that it aims to support greater regional collaboration among complementary experts and raise awareness of the project opportunities in the exciting growth sector of sustainable infrastructure.

In addition to surfacing the pipeline of infrastructure projects in the region, the new online project site acts as a marketplace for diverse parties interested in constructing infrastructure projects in Asia.

There are 11 infrastructure projects posted on the platform which has a total valuation of over USD2.7 billion, according to a look at the projects that are now listed there. Seven projects are concerned with water and sanitation, two with logistics, and two with rail transportation.

With five projects listed, Indonesia has the most, followed by two projects each from Cambodia and the Philippines, five from Vietnam, and one from India. The second stage of the New Delhi Railway Redevelopment Project is the Indian project that is listed on the portal. AL RAJHI BANK TAPS FEEDZAI FOR DIGITAL BANK

Al Rajhi Bank Malaysia (ARBM) is implementing the risk-ops platform Feedzai’s cybersecurity in an effort to protect the clients of its new digital bank.

The risk-ops platform integration will assist the digital bank in meeting various security requirements throughout its operations.

The cloud-based system includes a full range of integrated fraud and anti-money laundering (AML) solutions, from customer due diligence to watchlist screening and transaction monitoring, as well as device authentication, malware defence, behavioural biometrics, and malware detection.

Additionally, Feedzai performs a number of fraud detection scenarios that will assist the bank to find security flaws before the criminals can. These scenarios encompass classic con games and account takeovers.

The 2021-founded digital bank stands out for “its high levels of innovation, customer-centricity, and reliability,” according to an official release.

www.panfinance.net

MUFG KICKS-OFF DIRECT LENDING GROUP BANKIFI SECURES $4.8M INVESTMENT FOR EXPANSION

In order to support the portfolio firm LBO and recapitalization transactions of the bank’s private equity sponsor clients, Mitsubishi UFJ Financial Business (MUFG) has formed a Direct Lending group.

Matt Maley, who joined MUFG in 2018 to manage sponsor coverage, will serve as the team’s leader. Maley will answer to Jon Lindenberg, Head of Global Corporate and Investment Banking (GCIB) in the Americas, in his new position as Head of Direct Lending.

“We started a direct lending initiative in 2019 when our sponsor clients approached us to finance their middle market LBOs outside of the broadly syndicated institutional market,” said Maley. “Having completed more than 50 direct loan transactions to date, this offering has become an important tool in our toolbox, helping us grow our U.S. sponsor business to $300 million in revenue.”

“Setting up a dedicated group to target the direct lending market with an end-to-end solution will enable us to meet the needs of our clients and take advantage of MUFG’s $3 trillion balance sheet, one of the largest in the world,” Lindenberg said.

By utilising the extensive MUFG platform and set of capabilities, MUFG tackles the direct lending market as a solutions provider to private equity sponsor clients and their portfolio firms. For its international growth into North America, BankiFi, a top supplier of embedded banking solutions for small and medium-sized businesses (SMB), has raised $4.8 million. By 2024, BankiFi will have the resources to offer its market-leading embedded banking platform to more than two million SMBs on four continents thanks to this strategic growth investment.

To solve the unique difficulties of their SMB portfolio, BankiFi offers an open cash management platform and architecture that financial institutions may integrate into their present digital banking infrastructure. The investment is distinctive because every investor is already a shareholder, demonstrating their belief in BankiFi’s capacity to enable North American financial institutions to take advantage of its technology.

“Technology investments have been slowing down this year, and to see our investors show such a strong commitment is a huge vote of confidence in BankiFi’s direction and growth,” said Keith Riddle, CEO of BankiFi Americas. “Our mission is to make all aspects of cash management and payments easier for SMBs everywhere, and this investment is another huge step to making that a reality.”

Praetura Ventures, whose goal is to provide businesses with both financial and operational support so they may realise their potential, is the investment round’s lead investor. UKRAINIANS CAN OPEN BANK ACCOUNTS IN EU

The Temporary Protection Directive, a particular policy that applies to immigrants from Ukraine, also permits persons in this category to create a bank account in the 27-nation bloc, which will ease their current predicament.

Ukrainian nationals who are lawful residents are permitted to open a bank account with all essential features, free of charge or for a fair cost, according to the European Commission website.

Having a bank account gives Ukrainian individuals access to basic services like paying bills, making deposits, and sending money to others. This service is especially useful for Ukrainians trapped in conflict zones who are running low on food and other supplies.

People who want to open a bank account must provide an identity document or other proof of identification. While millions of Ukrainians are fleeing their native country and arriving in Europe, these measures can make life easier for those who already reside there.

GLOBAL BUSINESS DIGEST & MARKET ANALYSIS PAN Finance Magazine Q3 2022