Art ificial Intelligence

Enabling carbon capture with oxyfuel

Carbon capture is a critical technological pathway for cement decarbonization. That’s a challenge. But there are ways to make it easier. Like converting to oxyfuel combustion. Oxyfuel raises the CO2 concentration in cement plant exhaust gases and makes capturing that CO2 much more cost-efficient.

Here at KHD we’ve been involved in oxyfuel development since 2010. We also come with a long history of excellence in innovation, plant design, and process engineering. So, when it comes to implementing oxyfuel at your cement plant, we are your expert partner.

Discover more on our website or connect with our experts to discuss your specific oxyfuel application needs and let’s deliver Cement beyond Carbon together.

CONTENTS

03 Comment

05 News

REGIONAL REPORT

10 Year Of The Dragon?

SILOS & STORAGE

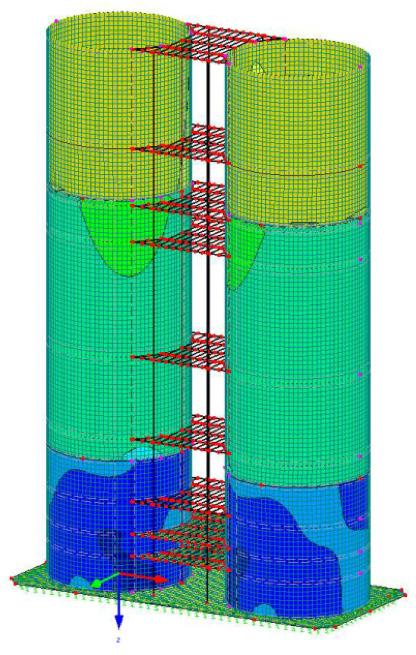

39 Supporting Silos

Martin Wuerth, Wuerth Consulting Engineers, discusses a cost-effective silo repair method that can extend silo lifetime by more than 30 years.

David Bizley, Senior Editor of World Cement, provides a brief overview of some of the factors facing the Chinese economy and the consequences for the construction and cement sectors.

REFRACTORIES

16 Sustaining Cyclone Efficiency

Preecha Chokjarearnsuk, HASLE Refractories, discusses the role of dip tubes in preheater cyclones and reveals how a new generation of ceramic vortex finder has performed for the ADBRI Birkenhead cement plant in Australia.

SOFTWARE, AUTOMATION & PROCESS CONTROL

22 Artificial Intelligence Turns Cement Production Green

Mark Israelsen, Quantum IR Technologies, explains how the use of AI analytics can help to reduce energy consumption and emissions in cement kilns.

26 Autopiloting The Cement Process

Fayez Boughosn and Ighnatios Maatouk, ES Processing, explore the benefits of autopiloting the cement manufacturing process.

30 All Eyes On AI

Chris Kiddle, AVEVA, explores the growing role of AI in the cement industry and considers both the benefits and the risks.

35 MPC, It’s Easy As ABC Juliano de Goes Arantes, Rockwell Automation, explains how cement producers can conquer their most complex processes with MPC.

ON THE COVER

CARBON CAPTURE

44 Capturing Tomorrow

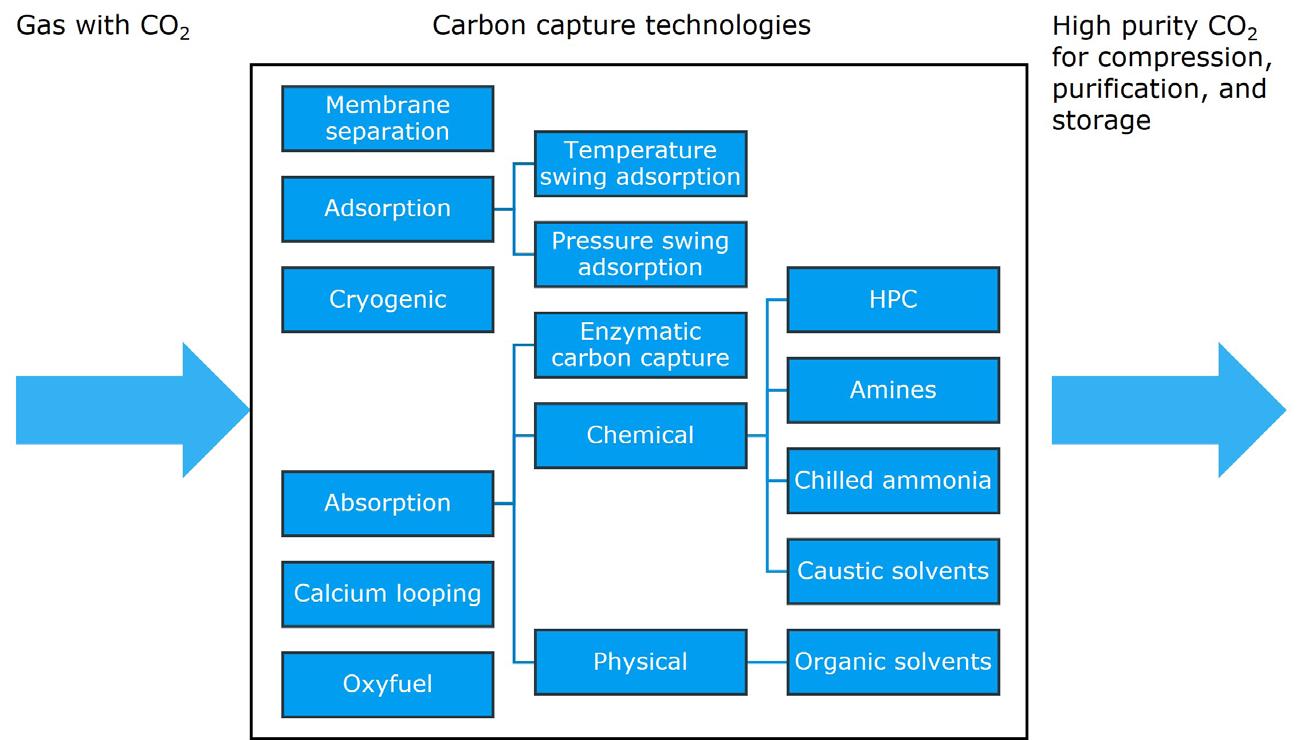

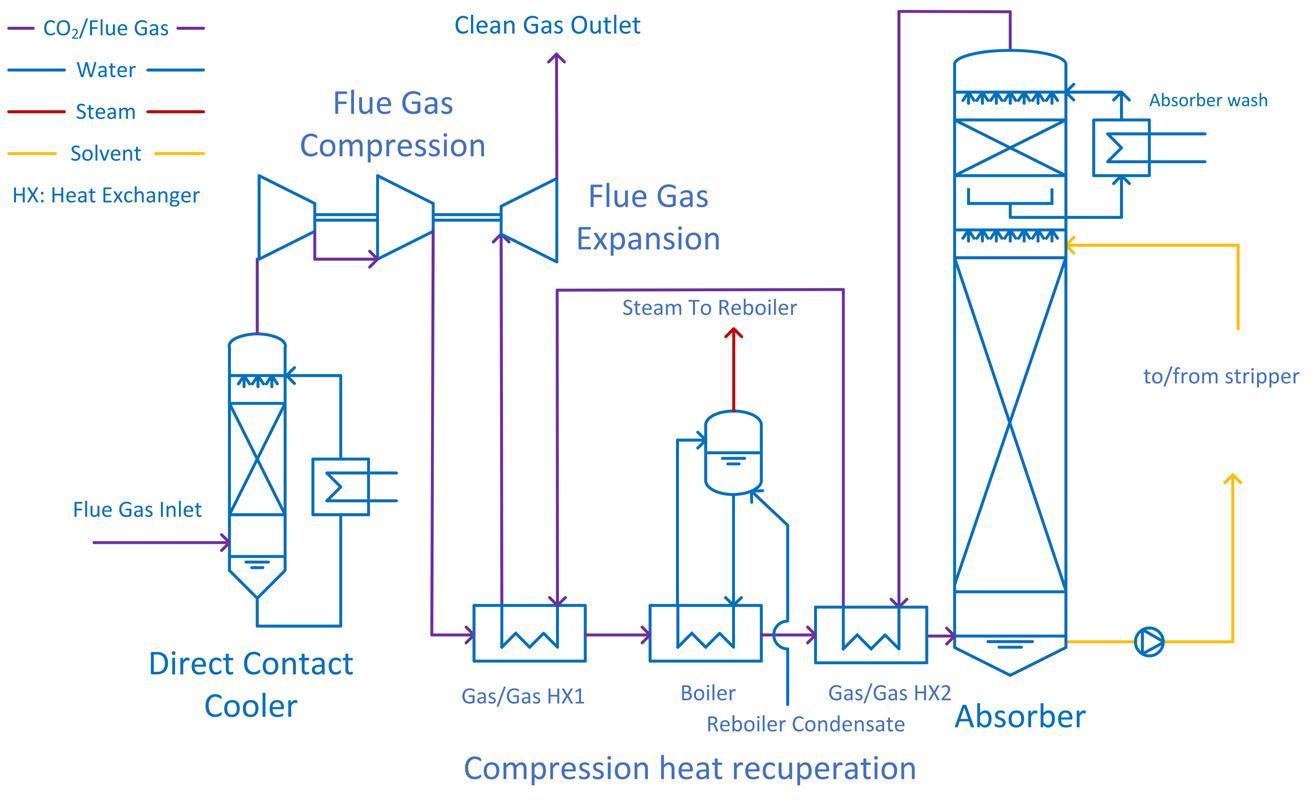

Prateek Bumb, Carbon Clean, emphasises the importance of carbon capture for the cement industry to achieve net-zero goals.

48 Beyond Emissions

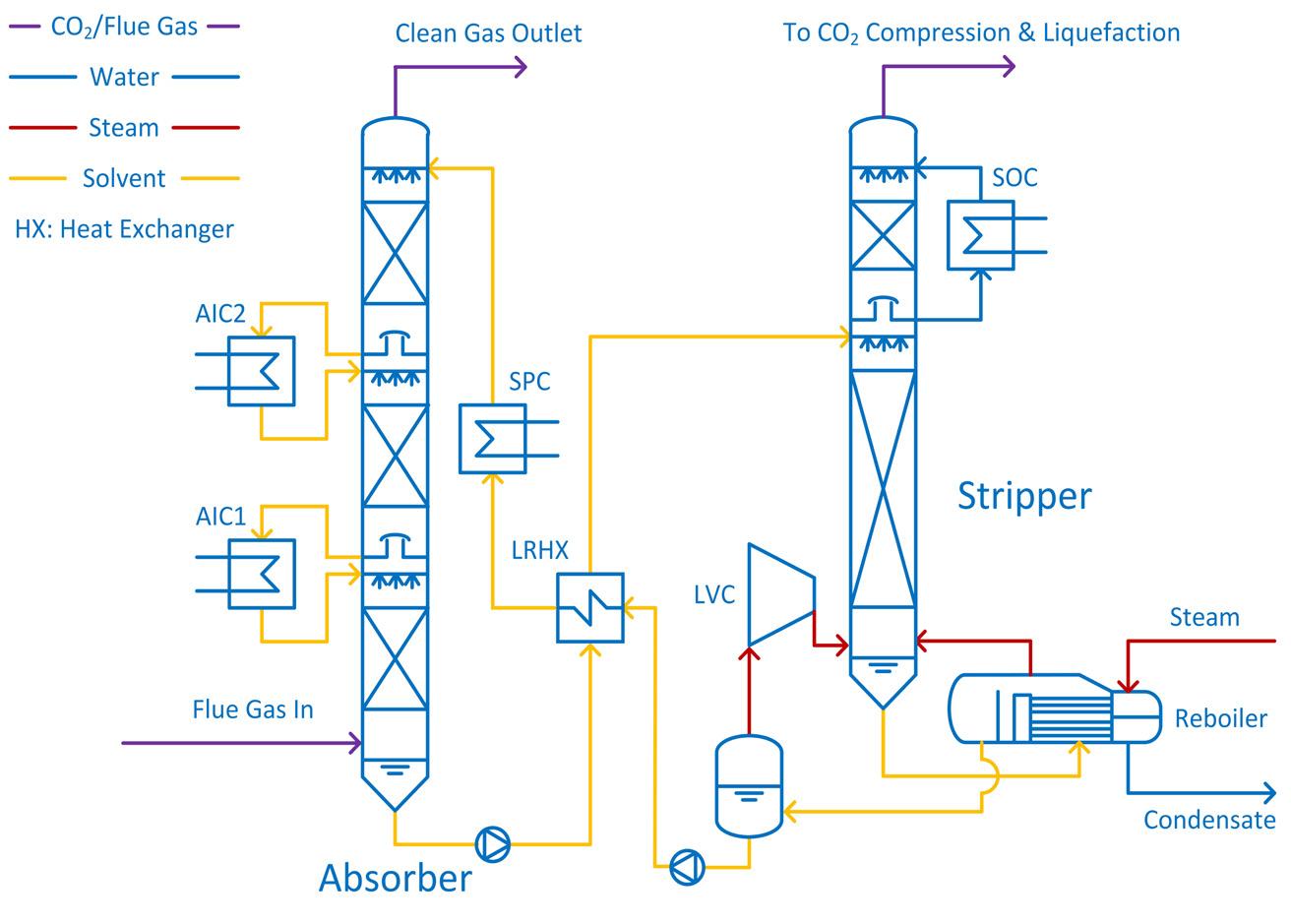

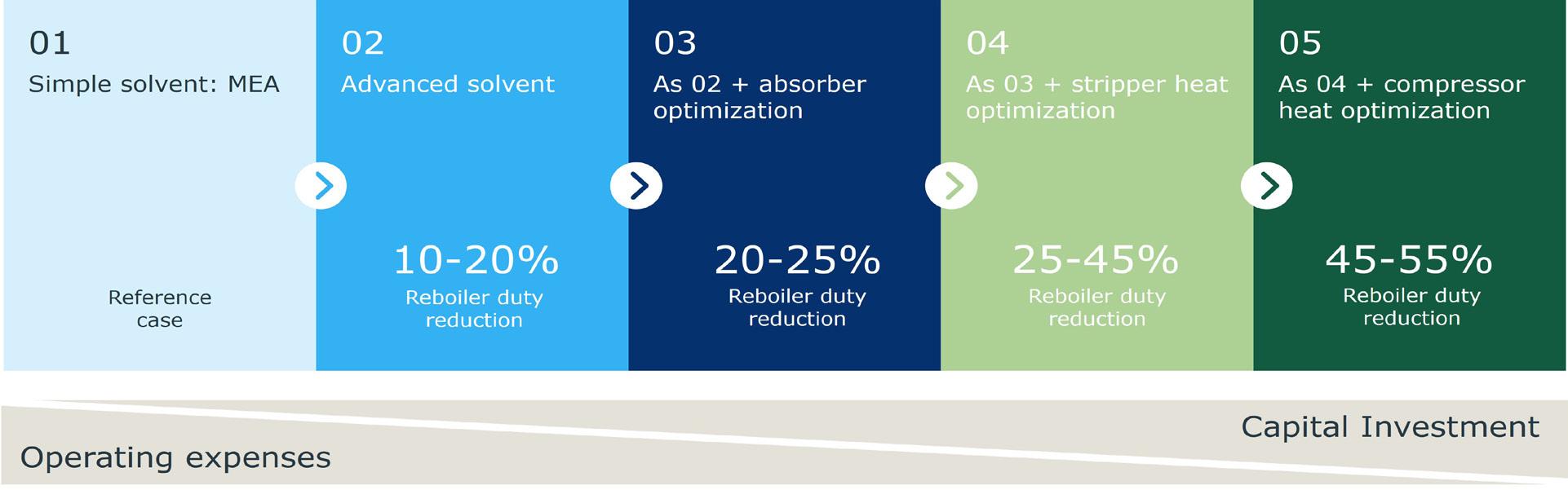

Jens Kristian Jørsboe, Jimmy Andersen, Christian Riber, and Burcin Temel McKenna, Ramboll, discuss the various carbon capture technologies and their advantages and disadvantages.

DECARBONISING CEMENT & CONCRETE

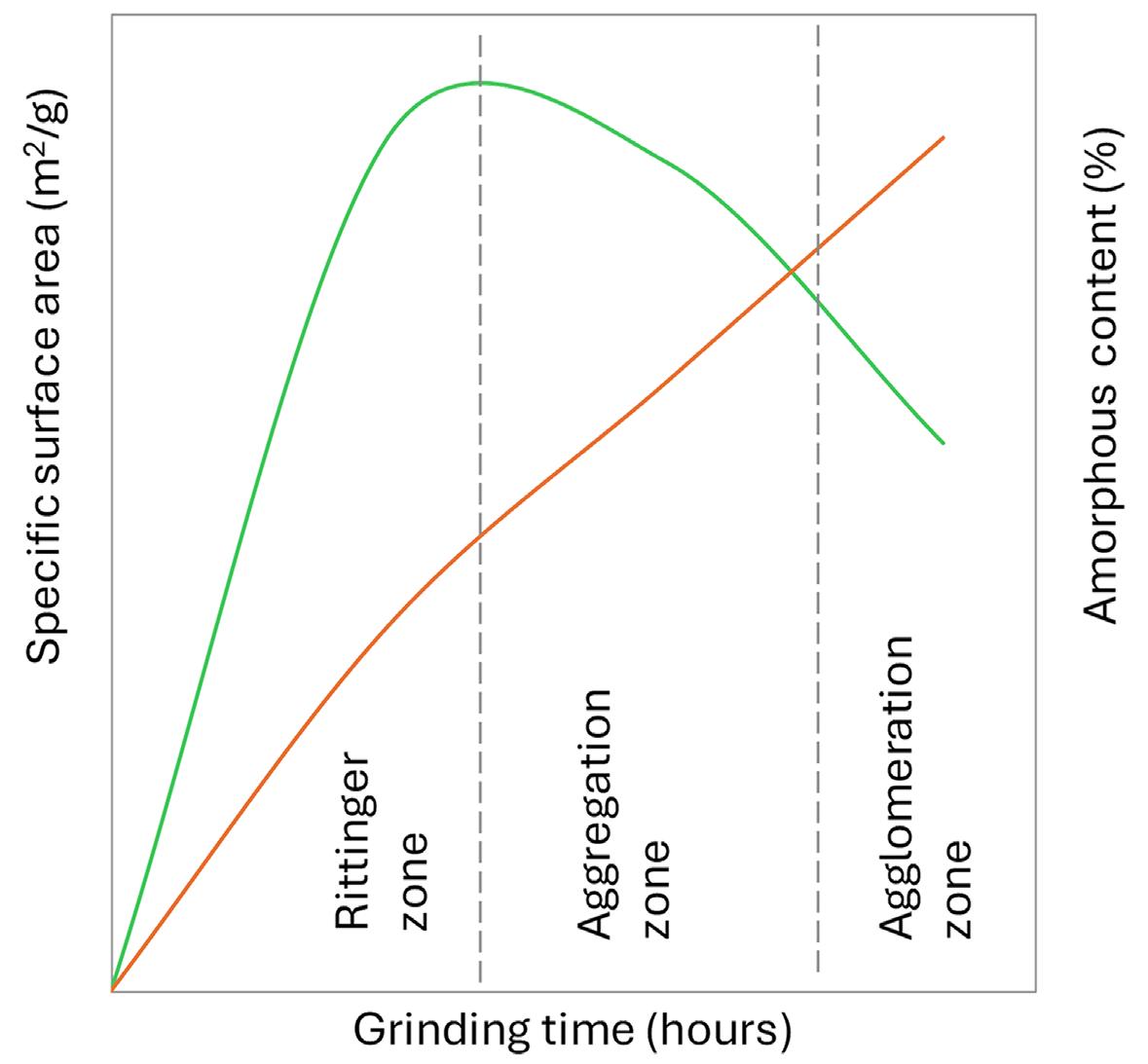

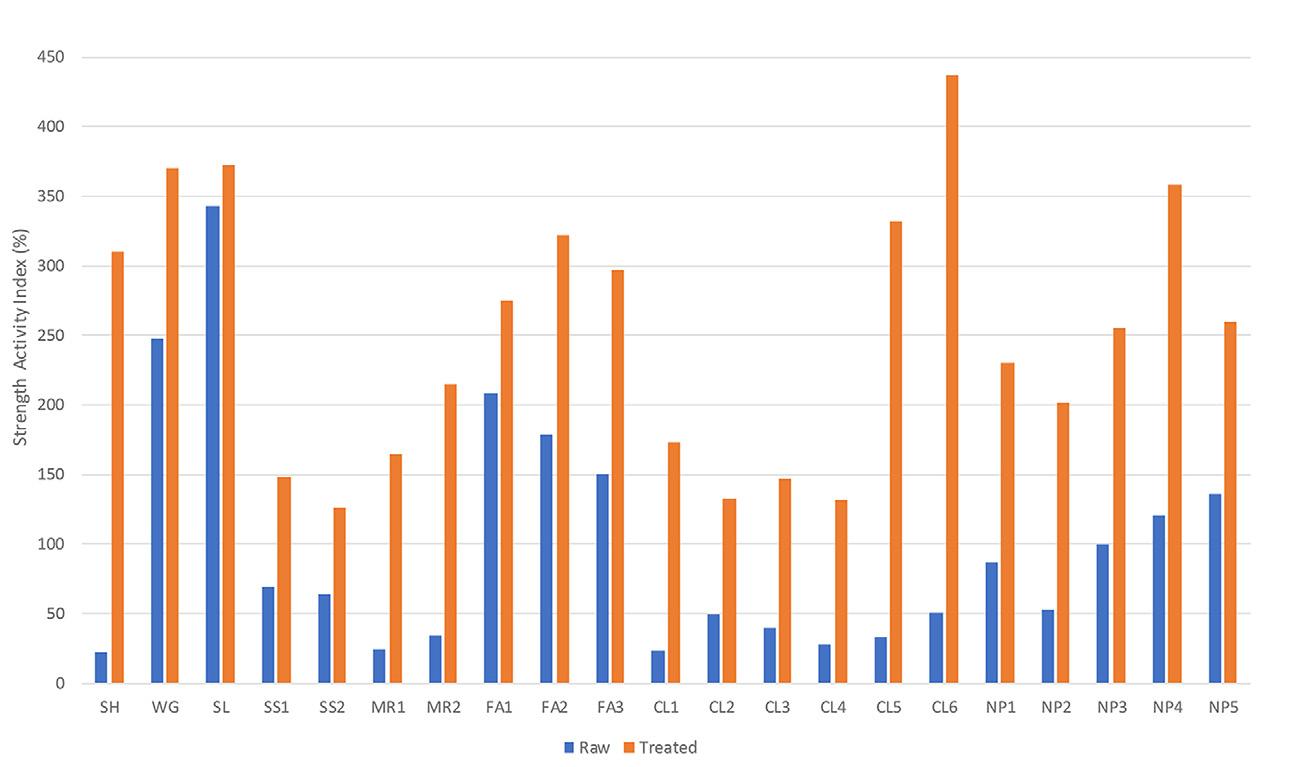

55 Advancing Mechanochemical Activation

A. Thomas, S.C. Liew, M. Pagels, & P. Suraneni, Carbon Upcycling Technologies, explore the use of enhanced mechanochemical activation to transform materials into SCMs.

61 CO2 Capturing Concrete Additives

Tim Sperry, Carbon Limit, explains how merging direct air capture (DAC) technology with carbon mineralisation can help diminish the carbon footprint associated with cement and concrete production.

The use of AI in the cement industry is increasing at a rapid pace with a focus on moving to more efficient management.

Mark Israelsen of Quantum IR Technologies outlines the capabilities of AI solutions when it comes to reducing energy consumption and emissions in cement kilns on pg. 22.

WE MOVE INDUSTRIES

HEKO offers the whole range of chains, rollers, sprockets and scrapers for reclaimers. HEKO products are proven in thousands of bucket elevators and conveyors, worldwide.

Our components for the cement industry: central chains, link chains, reclaimer chains, sprockets, bucket elevators and clinker conveyors.

MORE THAN

COMMENT

rod.hardy@palladianpublications.com

Sales Manager: Ian Lewis ian.lewis@palladianpublications.com

Sales Executive: Louise Graham louise.graham@palladianpublications.com

Events Manager: Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator: Merili Jurivete merili.jurivete@palladianpublications.com

Digital Administrator: Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager: Laura White laura.white@palladianpublications.com Reprints reprints@worldcement.com

TCBP019982

SUBSCRIPTIONS

Annual subscription (published monthly): £160 UK including postage/£175 (€245) overseas (postage airmail)/US$280 USA/Canada (postage airmail). Two year subscription (published monthly): £256 UK including postage/£280 (€392) overseas (postage airmail)/US$448 USA/Canada (postage airmail). Claims for non receipt of issues must be made within 4 months of publication of the issue or they will not be honoured without charge.

Applicable only to USA and Canada: WORLD CEMENT (ISSN No: 0263-6050, USPS No: 020-996) is published monthly by Palladian Publications, GBR and is distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831.

Periodicals postage paid at Philadelphia, PA and additional mailing offices. POSTMASTER: send address changes to World Cement, 701C Ashland Ave, Folcroft PA 19032

Copyright © Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Uncaptioned images courtesy of Adobe Stock. Printed in the UK.

Palladian Publications Ltd 15 South Street, Farnham, Surrey GU9 7QU, UK Tel +44 (0)1252 718999

Email: mail@worldcement.com Website: www.worldcement.com

May 2024 World Cement

DAVID BIZLEY, SENIOR EDITOR

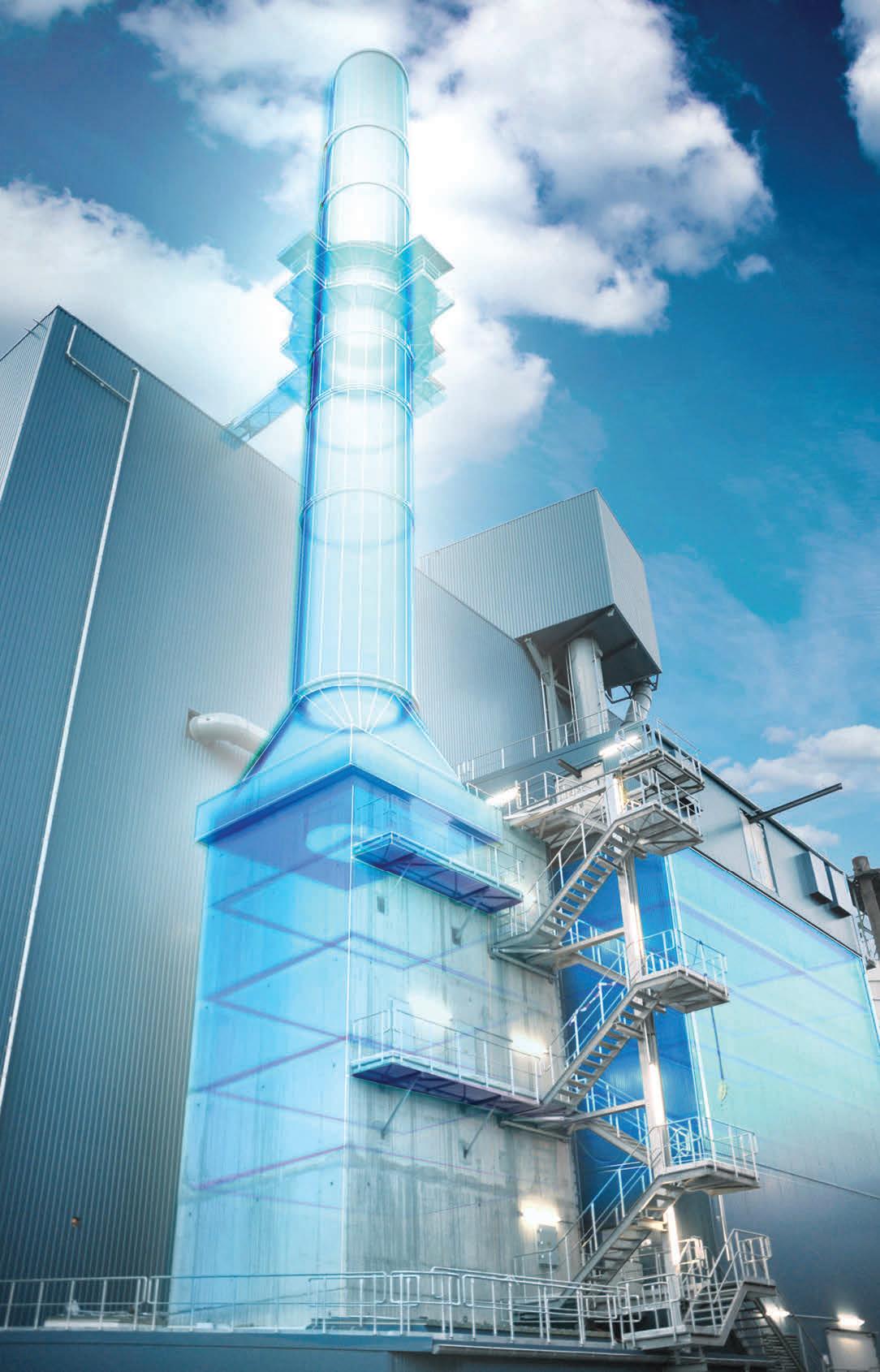

he march towards net-zero cement production continues apace. One of the latest headline-grabbing stories comes from Holcim and the news that it has begun construction of one of the world’s first carbon-neutral cement plants in Lägerdorf, Schleswig-Holstein, Germany.

The plant, which is expected to be commissioned in 2028, will rely on technology from thyssenkrupp Polysius and Linde Engineering to enable carbon capture on an industrial scale, almost completely eliminating CO2 emissions from the site. The process gas is to be processed into high-purity CO2 and can subsequently be used as a starting material in the chemical industry or as a raw material in other industries, or even stored if needed. This process will be able to cut CO2 emissions from the Lägerdorf plant by around 1.2 million tpy.

Elsewhere in green cement news, TITAN’s Roanoke cement plant in Virginia, USA, has received an award from the US Department of Energy (DOE) worth US$61.7 million to support the first-of-a-kind development of a calcined clay production line. The award comes as part of the US$6.3 billion ‘Industrial Demonstrations Program’, which is managed by DOE’s Office of Clean Energy Demonstrations (OCED) and is primarily focused on CO2 reduction. Bill Zarkalis, President & CEO of Titan America, stated: “We are honoured to be selected for this first-in-the-nation initiative in spearheading the production of reduced emissions cement, helping lead our industry toward a net-zero future through deep decarbonisation technologies.”

Leonidas Canellopoulos, TITAN’s Chief Sustainability and Innovation Officer, added: “This initiative aligns with our Green Growth strategy’s focus on advancing cementitious materials, harnessing innovation and novel technologies. Building upon the successful pilot test conducted at our Patras plant in Greece, we are now scaling up the development of low-carbon calcined clays. Our dedication to sustainable solutions propels us as we stand among the frontrunners in leading the charge towards decarbonising the industry.”

If you want to hear more about these kinds of projects in person, but missed the chance to join the World Cement team in Lisbon for EnviroTech 2024, then be sure to register your interest for next year’s show at: www.worldcement.com/envirotech2025 today.

Following the same formula of high-quality presentations, expert-led panel discussions, and multiple networking opportunities, all located within a luxury venue, EnviroTech is an unmissable experience for those wishing to be at the forefront of the decarbonisation discussion.

And if you can’t wait until then, World Cement will be hosting the fifth edition of our flagship virtual ‘Optimisation’ conference on 22 October. Featuring a keynote presentation from Cementos Molins’ new Chief Technology Officer, Javier Sueiras, and technical presentations from industry leaders on topics such as digitalisation, AI, machine learning, and process optimisation. Stay tuned for more details, including a registration link, coming soon.

Ship unloaders

Road mobile ship unloaders

The answer to your bulk handling questions

Storage & reclaim

Convey units

Truck loading

Ship loaders

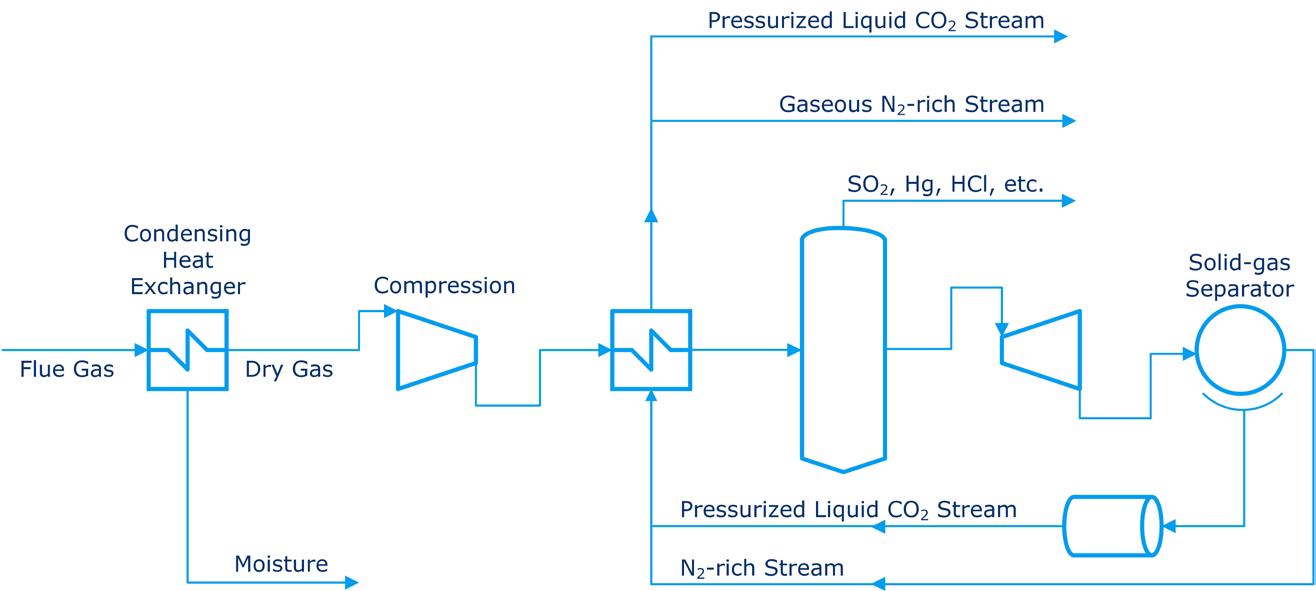

Groundbreaking ceremony for new CO2-neutral cement plant

One of the world’s first climate-neutral cement plants is taking shape: Vice-Chancellor and Federal Minister of Economics Dr. Robert Habeck and the Minister President of Schleswig-Holstein, Daniel Günther, together with Holcim Germany CEO Thorsten Hahn, have initiated the ‘Carbon2Business’ innovation project in Lägerdorf.

By 2028, the site will be home to a cement plant that uses a new technology to capture CO2 on an industrial scale, enabling the greenhouse gas to be almost completely captured from the exhaust air. The CO2 will then be processed for use as a raw material in industry.

To this end, Holcim Germany is building a new kiln line using pure oxygen to burn cement clinker and a CO2 processing unit at the Lägerdorf plant. With this technology, Holcim and its project partners thyssenkrupp Polysius and Linde Engineering are advancing CO2 capture on an industrial scale and contributing to the development of a CO2 economy in Germany.

Federal Minister Robert Habeck: “The cement industry is facing a particularly big challenge when it comes to decarbonisation. Here in Lägerdorf, it is shown how it can be done: decarbonising production and boldly implementing climate-neutral production of cement and concrete. The fact that carbon dioxide can not only be captured, but also used as a raw material, is a prime example of green transformation.”

“Today we are giving the go-ahead for another innovative German industrial project. The prototype for the decarbonisation of the cement industry will be built on an industrial scale in Lägerdorf. This shows once again that the future is climate-neutral. And this future begins here in Schleswig-Holstein, the number one state for energy transition”, said Daniel Günther, Minister President of Schleswig-Holstein.

“We’re laying the groundwork for a sustainable world through cement”, asserts Thorsten Hahn, CEO of Holcim Germany. “Cement is essential for our cities, factories, homes, bridges, and beyond. As we transition towards renewable energy, we must also construct the foundations and structures for wind turbines and railway tracks. With our climate-neutral cement plant, we ensure that this vital building material remains accessible without further harm to

the atmosphere.” CO2 emissions are an inherent part of cement production. The burning process releases the majority of CO2, approximately two-thirds, from the minerals themselves. Even with the utilisation of renewable energy in operating the cement kiln, these emissions persist. Hahn emphasises, “Through this groundbreaking project, we’re fostering sustainable prosperity. By capturing and repurposing CO2 as a valuable raw material, we’re mitigating climate impact and facilitating the development of new value chains.”

In Lägerdorf, Holcim, alongside project partners thyssenkrupp Polysius and Linde Engineering, is erecting a second-generation oxyfuel kiln and a CO2 Processing Unit (CPU). Unlike conventional methods, this kiln will utilise pure oxygen instead of ambient air, yielding a process gas enriched with CO2. Subsequently, this gas undergoes purification and processing within the CPU. Holcim Germany’s investment in this climate-neutral cement plant totals in the mid three-digit million euro range. Additionally, the EU is providing funding support to the tune of approximately €110 million for the project.

Carbon is an important raw material for sectors such as the chemical industry, where it is used to make plastics, tyres, speciality chemicals and medicines. Due to climate protection measures and the phase-out of fossil fuels, the industry will need new sources in the future. Captured and processed CO2 (carbon capture and utilisation/CCU) can fill this gap.

The successful development of this market necessitates adequate infrastructure, encompassing pipelines, intermediate storage facilities, and transshipment hubs for shipping, alongside legal regulations for transportation. Hahn remarked, “The German government and the EU are addressing these issues in their carbon management strategies. As a partner, we stand ready to collaborate with policymakers to propel Germany’s CO2 economy forward.”

Holcim Germany has set ambitious decarbonisation goals. Alongside the climate-neutral cement plant in Lägerdorf, scheduled to commence operations in 2028, test projects are presently underway at other cement plants in Höver (Lower Saxony) and Beckum (North Rhine-Westphalia). These facilities are also slated for conversion, integrating technologies for capturing and processing CO2

Frankfurt, Germany www.achema.de

HILLHEAD 2024

25 – 27 June, 2024 Buxton, UK www.hillhead.com

FICEM TECHNICAL CONGRESS

02 – 04 September, 2024 Guatamala www.ficem.org

SOLIDS Dortmund 2024

09 – 10 October, 2024 Dortmund, Germany www.solids-dortmund.de

VDZ CONGRESS

06 – 08 November, 2024 Düsseldorf, Germany www.vdz-online.de

AUCBM AICCE27

26 – 28 November, 2024 Tunis, Tunisia www.aucbm.net

Network of 450 scientists and industry leaders from around world meet in Switzerland

Academics and industry players from around the world are gathering in Lausanne, in Switzerland, to drive forward critical research into making concrete, the world’s most used human-made material, carbon neutral.

They are taking part in the Innovandi Global Cement and Concrete Research Network (GCCRN) annual gathering. The network brings 450 researchers and scientists from more than 40 world leading universities and academic institutions, together with business-leaders from some of the industry’s top manufacturers and suppliers. They are collaborating on critical research and initiatives focused on achieving net-zero concrete, in line with the GCCA’s 2050 Roadmap.

Universities attending include the renowned EPFL in Lausanne, which is hosting the event, researchers from South East University and Wuhan University in China, University of Toronto, Indian Institute of Technology in Delhi, University of Cape Town, Imperial College London and University of São Paulo.

Claude Loréa, Cement, Innovation and ESG Director at the Global Cement and Concrete Association (GCCA), said: “Innovation, collaboration and research are all vital to helping our industry decarbonise, in line with the GCCA’s Net Zero Roadmap. And our Spring Week gathering – our biggest yet – provides the key opportunity for our industrial and academic partners to meet face-to-face with PhD students, Postdocs and researchers from all over the world. This amazing global community is coming together with one focus in mind – to decarbonise the world’s essential building material, concrete.”

Concrete is vital for modern infrastructure, including homes, hospitals, bridges, tunnels, roads and so much more, but it currently accounts for 7% of the world’s CO2 emissions. That is why its leading manufacturers recently came together to commit to decarbonising this essential material.

Dr. Davide Zampini is Vice President of Global Research and Development at CEMEX, and the GCCRN’s Industrial Chair. He said: “If we are to reach our goal of net-zero concrete by 2050, then we cannot do so alone. We need to explore as well as harness solutions and collaboration well beyond our industry. That’s why Spring Week is so important.”

During Spring Week, attendees will exchange ideas, conduct workshops, review progress and discuss next steps for ongoing and future research.

Karen Scrivener is the GCCRN’s Scientific Chair, and Professor and Director of the Laboratory of Construction Materials at the EPFL in Lausanne, which is hosting the week. She said: “Everyone here at EPFL is proud to be hosting this year’s Spring Week, anticipated as our largest gathering yet, marking a significant milestone in our journey toward net-zero research.”

Research topics which will be discussed during the week, include: the use of AI in decarbonisation; new materials and processes for manufacturing cement, including sourcing and improving the use of alternatives to clinker (the most carbon intensive element of the manufacturing process), as well as further development on the use of calcined clays; concrete recycling; the use of renewable energy and kiln

electrification; and further development of carbon capture, use and storage (CCUS).

TITAN America has been selected by the US Department of Energy

TITAN’s Roanoke cement plant, in Virginia, USA, has been selected for negotiations by the US Department of Energy (DOE) for an up to US$61.7 million award to support the first-of-a-kind deployment of a calcined clay production line.

The implementation of this cement technology will substantially reduce CO2 emissions and become a model for building more sustainable infrastructure in the USA and across the group. Upon successful completion of negotiations, TITAN will support the project with additional investments.

The selection of TITAN’s project underscores the company’s dedication to reducing CO2 emissions throughout the organisation, aligning closely with its ambitious goal of achieving net-zero concrete by 2050. This move is also in line with the group’s Green Growth Strategy 2026, aimed at expanding the range of low-carbon cementitious products offered to customers. The technology from this project is poised to set a new standard for building bridges, hospitals, schools, and other critical infrastructure projects.

Bill Zarkalis, President & CEO of Titan America, stated: “We are honoured to be selected for this first-in-the-nation initiative in spearheading the production of reduced emissions cement, helping lead our industry toward a net-zero future through deep decarbonisation technologies.”

The project is part of the US$6.3 billion Industrial Demonstrations Program, which is managed by DOE’s Office of Clean Energy Demonstrations (OCED) and is primarily focused on CO2 reduction.

Leonidas Canellopoulos, TITAN’s Chief Sustainability and Innovation Officer, added: “This initiative aligns with our Green Growth strategy’s focus on advancing cementitious materials, harnessing innovation and novel technologies. Building upon the successful pilot test conducted at our Patras plant in Greece, we are now scaling up the development of low-carbon calcined clays. Our dedication to sustainable solutions propels us as we stand among the frontrunners in leading the change towards decarbonising the industry.”

Christian Myland to be the new CEO of thyssenkrupp Polysius

thyssenkrupp has announced the appointment of Christian Myland as the new Chief Executive Officer of thyssenkrupp Polysius, effective 1 June 2024. He succeeds Pablo Hofelich, who has decided to take on a new professional challenge outside thyssenkrupp.

Christian Myland brings more than 16 years of corporate experience to his new position. In addition to various roles and management functions in Germany and abroad – including at thyssenkrupp Steel Europe AG and thyssenkrupp Steel Americas as well as in thyssenkrupp’s automotive business – he has spent seven years as CFO and five years as CEO at Uhde High Pressure Technologies (UHPT).

Miguel López, CEO of thyssenkrupp AG: “Christian Myland has stabilised and modernised our Uhde High Pressure Technologies business unit with its global project activities, sophisticated technologies and in-house production in Hagen and significantly improved its performance – both in new business and in the service business. He is therefore ideally qualified for his new role at thyssenkrupp Polysius. At the same time, we would like to thank Pablo Hofelich for his valuable work and wish him all the best for the future.”

Breedon Group provides AGM trading update

Breedon Group plc, provided the following trading update ahead of the group’s Annual General Meeting.

Trading during the first quarter was impacted by the ongoing macroeconomic uncertainty and reduced construction activity due to wet weather conditions. This led to softer volumes which were partially offset by resilient pricing. As a result, revenue reduced by 5%, or 9% on a like-for-like basis, when compared to the first quarter of 2023.

Highlights:

f In Great Britain trading conditions were particularly affected by the wet weather. The company completed two bolton acquisitions; Eco-Asphalt, a well-connected asphalt plant in the North West, and Phoenix Surfacing which enhanced the company’s surfacing capability in the Midlands.

f Ireland had a strong tendering season and is well positioned for the rest of the year, supported by

healthy housing and infrastructure markets and the return of the governing Assembly to Stormont.

f Cement delivered two scheduled kiln maintenance shutdowns, on time and within budget, and continued to expand the use of alternative fuels and the provision of lower clinker content products.

f The company launched its third platform in the USA with the acquisition of BMC, which completed on 7 March 2024. The first weeks of trading under its ownership have been encouraging, the integration is progressing well and the outlook is positive.

Rob Wood, Chief Executive Officer, commented: “I am encouraged by our strategic progress in the first quarter. Whilst there were fewer trading days due to the timing of Easter, and it was impacted by exceptionally wet weather, seasonally it is the least significant trading period for Breedon and our industry.

“We have laid good foundations for the remainder of the year; progressing pricing, pursuing efficiencies, completing two bolt-on acquisitions and launching our third platform by entering the US market. Although the economic landscape remains uncertain, I am confident our discipline and focus, coupled with our strong customer relationships, will see us deliver against our unchanged expectations for 2024.”

Cementir Group launches newer lower carbon white cement

Cementir has launched a new Aalborg White® Cement with a lower carbon footprint, D-Carb®, which presents a 15% reduction in CO2 emissions when compared with CEM I 52.5R.

D-Carb is the first white cement in the market to match a lower-carbon footprint with high performances at early ages. It is available in European markets before being launched globally.

“We are thrilled to introduce D-Carb, our new umbrella brand for lower carbon cements, as part of Cementir Group’s ongoing commitment to address environmental challenges and climate change”, says Michele Di Marino, Chief Sales, Marketing, & Commercial Development Officer of Cementir. “As a leading white cement producer, the successful rollout of D-Carb is pivotal in advancing our ‘net-zero emissions’ ambition. Embracing a customer-centric approach, the unveiling of this

product is eagerly anticipated. D-Carb, integrating lower-carbon, high performance and unique aesthetic value underscores our resilience in facing challenges in our decarbonisation efforts. We believe that D-Carb will further support stakeholders in the value chain with lower-carbon finished products aligned with sustainable building standards.”

The synergy between well-known Aalborg White clinker and pure limestone has been optimised by choosing a fit-for-purpose grinding aid to achieve comparable performances to the CEM I 52.5R at early ages, meeting the strict requirements of construction timelines.

D-Carb also inherits the extra properties given by the Aalborg White clinker used, extremely low alkali and low chloride content, ensuring reliable quality and durability of the finished products.

“Performances and white colour are key features of D-Carb, and exploring suitable raw materials and their combinations have been crucial in the product assessment. This has resulted in the accurate selection of pure, very light limestone from a stable source, improving and stabilising whiteness. Additionally, leveraging limestone fineness and particle size distribution, D-Carb ensures enhanced and consistent rheology, ideal for wet-cast applications, such as self-compacting concrete. These distinctive rheological properties allow for concrete finishes resembling marble surfaces. Moreover, the enhanced synergy and compatibility between cement and admixture cater to a wide range of white cement applications”, explains Stefano Zampaletta, Group Product Development Manager.

Leveraging on its peculiar performances achieved by D-Carb and after a specific testing programme on site, customers are able to replace CEM I 52.5R in their manufacturing processes, especially when early age performances are the main targets. Cementir will support this sustainable transition with its technical experts to guide users in adopting D-Carb product and integrating it into their production processes.

The introduction of D-Carb marks a profound impact on the building and construction sectors, offering a vital solution for decarbonising practices within the industry, while enhancing Cementir’s portfolio of lower-carbon products. Cementir Group continues its broader decarbonisation efforts for low-carbon products, ongoing assessments are in progress to strengthen the D-Carb range with additional sustainable solutions.

Year of the dragon?

David Bizley, Senior Editor of World Cement, provides a brief overview of some of the challenges facing the Chinese economy and the consequences for the construction and cement sectors.

Since the late 1970s, the Chinese economy has undergone a remarkable transformation. The market-oriented reforms first brought in under the leadership of Deng Xiaoping allowed China to rapidly evolve from an almost entirely agrarian society into a global economic powerhouse.

Today, China stands as the world’s second-largest economy by nominal GDP, wielding considerable influence in global trade and finance. However, challenges such as income inequality, environmental degradation, and demographic shifts loom large, posing complex hurdles to sustaining its economic momentum in the future.

This article aims to provide a brief outline of the current economic situation in China, with a focus on the construction and cement sectors.

Economic miracle

Since China’s economic reforms began back in 1978, the country has achieved an average GDP growth of over 9% per year, lifting almost 800 million people out of poverty over that time. The country has also made major improvements to healthcare, education and other public services over that time period. The World Bank reports that China is now an ‘upper-middle-income’ country. However, despite the rapid growth and the elimination of extreme poverty in 2020, a little over 17% of the population still live on less than US$6.85 a day, placing them under the poverty line for upper-middle-income countries.

As of today, the Chinese economy is second only to the United States in nominal terms, and actually the largest when adjusting for purchasing-power-parity. Much of this

extraordinary economic rise is due to economic policies that focused largely on two key pillars: internal investment and export-oriented manufacturing. Internal investment, particularly in vast infrastructure projects, has been a cornerstone of Chinese economic growth, with the country investing heavily in high-speed rail, highways, ports, bridges, dams, and more. Meanwhile, the focus on export-oriented manufacturing has converted the country into a modern-day ‘workshop of the world’ and has made it the leading global supplier of a whole range of goods, including textiles, electronics and heavy machinery. China is also expanding into emerging technologies, including solar panels and electric vehicles.

Headwinds

Challenges, however, are looming. Though successful for decades, China’s key economic policies appear to be reaching their limits. And as the country approaches what the World Bank refers to as ‘structural constraints’, such as unfavourable demographics (including a declining labour force), a shift in approach from manufacturing and investment to high value services and consumption will be necessary.

Adding weight to this argument, The Financial Times reported in January of this year that Chinese manufacturing had undergone its fourth consecutive month of contraction, despite the efforts of policymakers to boost prospects. The non-manufacturing index recorded minor growth, but it too was sluggish, recording a rise of just 0.3 points, which analysts attributed to a long-running property downturn, weakened export demand and low investor confidence. The Financial Times also quoted Zhiwei Zhang, president and chief economist of Pinpoint Asset Management as saying: “Economic momentum remained muted as the deflationary pressure persists.”

In terms of demographics, China faces another major, seemingly intractable challenge. The country’s National Bureau of Statistics recently announced a second consecutive year of population decline with a decrease of 2.08 million recorded for 2023, marking a significant acceleration following the decline of 850 000 recorded for 2022. This trend, if it continues, poses a considerable challenge for the future of the Chinese economy – fewer people means fewer workers, fewer customers, and a lower tax base. And, as the population continues to age, the costs of elder care and retirement benefits will burden already strained local governments. The UN has forecast a population decline of over 100 million by 2050, with a possible reduction to below 1 billion by the end of the century.

Another area of concern for the Chinese economy is ongoing tension with the West. Specifically, concerns relating to Chinese support of Russia and worries over access to advanced technologies, have resulted in various US sanctions. These have added a further dampening factor to China’s post-COVID recovery and risk hindering technological development. At the time of writing, it has just been announced that the US is drafting additional sanctions targeting certain Chinese banks in response to their commercial support of Russian military production.

Despite these headwinds, the Chinese economy still recorded GDP growth of 5.2% in 2023, slightly above the target of 5%. The IMF predicts that ongoing stimulus efforts will see the Chinese economy achieve GDP growth of 4.6% this year, reflecting the impact of stronger than expected growth in 2023 and increased government spending.

Shaky ground

China’s construction sector, particularly with regard to residential construction, has been embroiled in an ongoing crisis for the last three years. The origins of the crisis are largely attributed to a legislative crackdown in 2021 which regulated the amount of leverage that could be taken on by developers, thus limiting their borrowing. This ultimately triggered the default of the heavily leveraged residential construction giant, Evergrande, in late 2021 and sent shockwaves throughout the rest of the sector. According to IA Cement, there have been US$29 billion worth of company defaults since 2021.

Though an outright collapse of the sector was avoided as a result of government intervention, the decline was significant and is still ongoing with UBS estimating that the sector now represents just 22% of Chinese GDP, down from 25% a few years prior. IA Cement notes that national real estate development declined 9.3% in the second half of 2023, with the area of newly constructed housing falling by 23%. The figures for the first quarter of 2024 are not looking much brighter either, with the National Bureau of Statistics reporting a further decline of 27.8% in the total area under construction, with the area of commercial real estate declining by 19.4% y/y. Putting it simply, Sheng Laiyun, deputy commissioner of the National Bureau of Statistics, said: “The investment and sales of real estate in the first quarter are indeed not very optimistic. The real estate market is still in a process of adjustment.”

The picture is somewhat brighter for public works, with IA Cement reporting a growth rate of 5.9% in the first 10 months of 2023, with further (albeit) slower growth forecast for this year. Specifics include a 25% increase in expenditure on rail projects, a 6% increase in water conservation

projects, and stable expenditure levels on highways.

Cement

The mixed fortunes of the Chinese construction sector have, naturally, had an impact on the outlook for the country’s titanic cement sector, which is responsible for roughly half of the entire world’s cement production. Indeed, Fitch Ratings notes that, in addition to the volatile construction sector, Chinese cement production faces greater challenges than other heavy industries, such as steel and aluminium, including reduced interaction with the profitable manufacturing and renewable energy sectors, and an ongoing shift away from concrete and towards steel structures.

Facing these challenges then, it is perhaps little surprise that the cement sector has reported consistent negative growth since May 2021. Although the pace of decline slowed in 2023 compared to 2022, IA Cement notes that a recovery in March – April of 2023 was short-lived, with output in the first 10 months of the year declining by 1.1% to its lowest level since 2011.

The sector’s malaise is being borne out in company results. CNBM’s Basic Building Materials Group reported a 63.6% decline in profit in its 2023 Annual Report, blaming “insufficient demand, weakening expectations and weakening off-peak season characteristics” across the entire cement sector. This result helped drag down CNBM’s overall revenue for the year by 10.1%, with after tax profits falling by 32.5%. The company has recently issued a profit warning stating that first quarter 2024 losses are likely to have more than doubled y/y, with an expected decline of approximately US$180 million, driven by lower selling prices for its key products, worsening performance of associate companies, and higher currency losses.

Another national cement enterprise, Tianrui Group Cement Co., also posted negative results for 2023, announcing a more than 30% decline in sales from US$1.6 billion to less than US$1.1 billion, with a full-year loss of US$87.7 million. The news marks a concerning reversal of the company’s profit of US$62 million from a year prior. Indeed, the company appears to be in some form of financial difficulty after being recently suspended from trading on the Hong Kong Stock Exchange after it fell in value by 99%, cutting market capitalisation to just US$18 million.

Summary

China, its economy, and by extension, the cement sector, face a range of significant structural challenges in the years ahead, including demographic and environmental issues. Exactly how China will deal with these challenges remains to be seen, but the impact is likely to be felt across the globe.

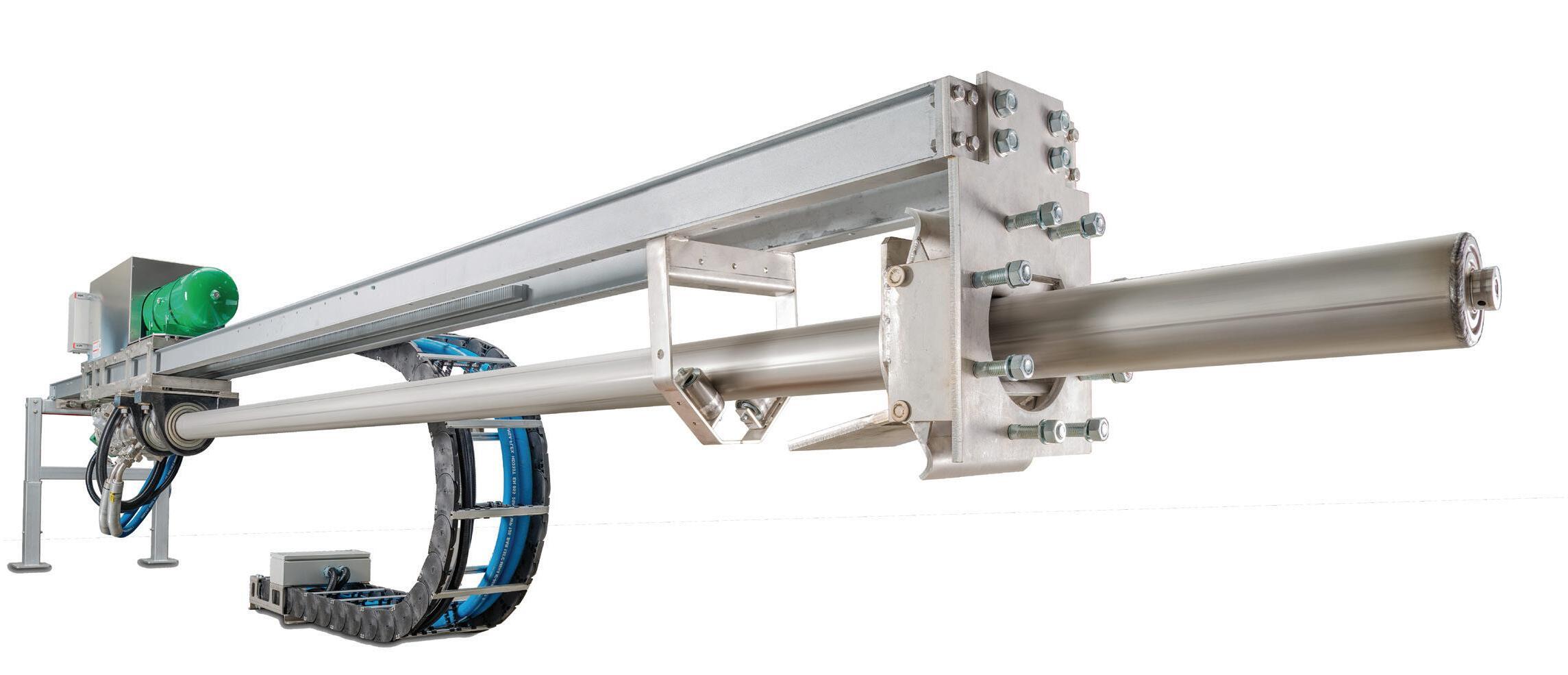

The Modern Way

CEMTEC®

DESIGNED FOR PERMANENT MEASUREMENT

CEMTEC advantages

• Probe gas entrance inside the rotary kiln

• Plunger prevents blockages at sample gas entrance

• Large filter surface for dust-free gas sample

• Gas sample above water dew point temperature

• Suitable for hot/wet or cold/dry flue gas analysis

Probe gas entrance inside rotary kiln

Reliable and maintenance-free gas sampling system for the rotary kiln inlet.

Features

• Cyclic plunger movement with 7000 N

• Probe insertion/retraction force 20000 N

• Cyclic anti-stick probe rotation with 700 Nm

Sustaining cyclone efficiency Sustaining cyclone efficiency

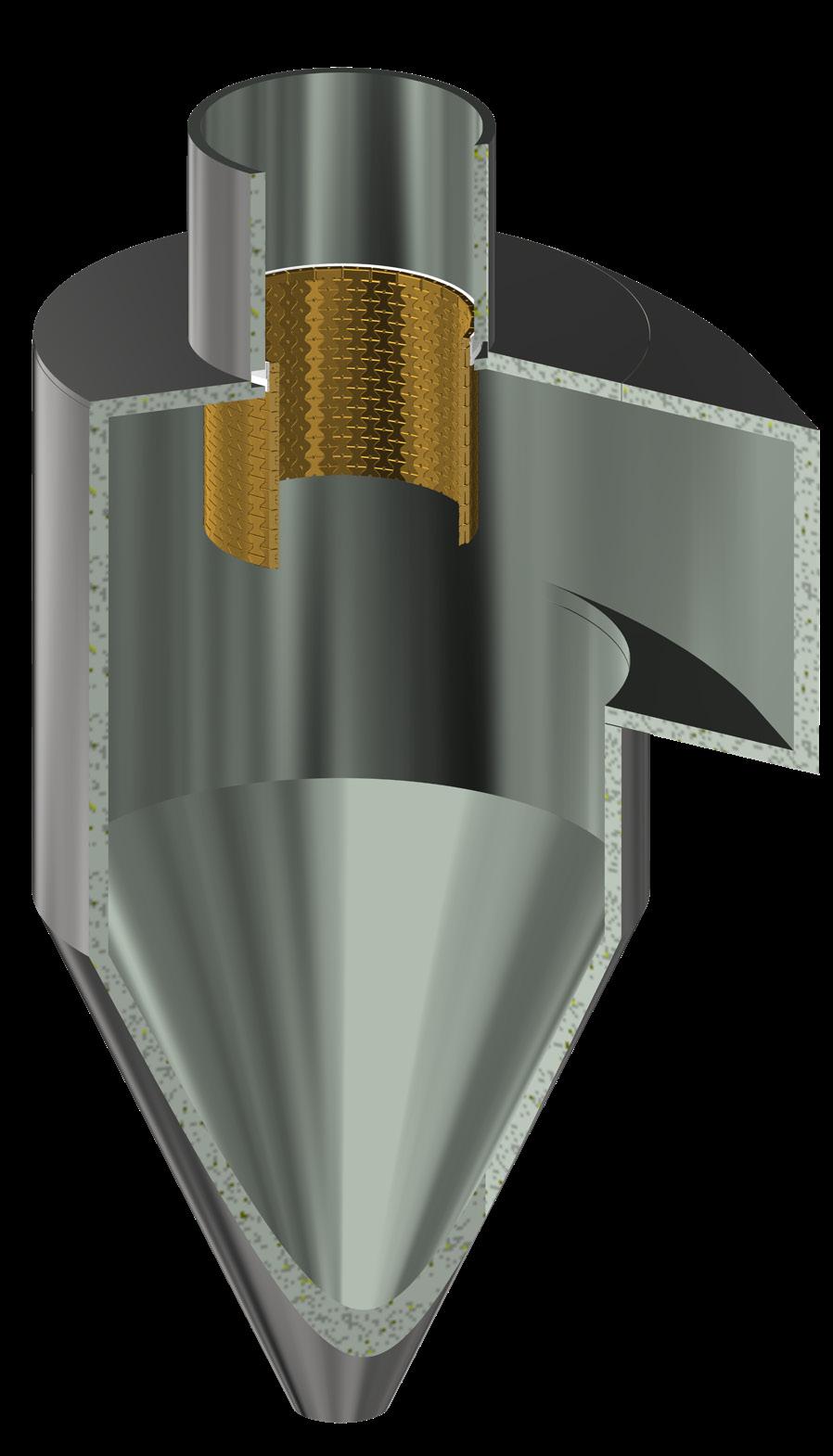

Preecha Chokjarearnsuk, HASLE Refractories, discusses the role of dip tubes in preheater cyclones and reveals how a new generation of ceramic vortex finder has performed for the ADBRI Birkenhead cement plant in Australia.

Cement clinker manufacturing is a highly energy-intensive process, with energy costs typically accounting for 15 – 40% of total production costs. This proportion is expected to rise due to anticipated carbon taxes and increased competition for alternative fuels (AF), making energy consumption reductions imperative for economically viable cement production amid the global transition to greener practices.

Over 85% of the energy utilised in cement production is typically consumed as heat input in the rotary kiln and calciner. While coal and other fossil fuels remain prevalent globally, there is a growing

Vortex finders are installed in preheater cyclones to improve the separation between the raw meal and the hot gas, thereby increasing the heat efficiency of the preheater process. But many plants run without it due to issues with short lifetimes.

trend towards using AF such as waste materials, biomass, and other low-carbon fuels. However, increased usage of these fuels presents challenges in maintaining process stability, including temperature and pressure fluctuations due to unsteady combustion, as well as ensuring the longevity of refractory linings, imposing higher maintenance costs.

Efficiency gain with dip tube

One component especially impacted by the intensified usage of AF is the dip tube, also referred to as a thimble or vortex finder, in the lowest stage cyclone of the preheater tower. Its function is to define the flow field in the cyclone and prevent the entering particles from shortcutting the cyclone. A missing or damaged dip tube results in a significantly lower separation efficiency, which in turn lowers the heat recovery efficiency of the entire preheater tower, as a large portion of the preheated raw material particles is not entering the kiln but sent back to the upper cyclone stages. Consequently, the operating temperature in all cyclone stages increases, entailing a higher overall fuel demand. The additional fuel requirement may be in the range between 1 – 1.5% of the total fuel consumption when the dip tube is entirely absent in the lowest stage.

Troubled steel dip tubes at elevated temperatures

Today, most dip tubes are made of heat-resistant Cr-Ni-alloyed cast steel. In light of increased AF usage, steel however has some considerable disadvantages, which may limit the performance and lifetime of the dip tube. Firstly, steel is a ductile material and, hence, prone to deformation, especially at elevated temperatures. Higher mechanical and thermal loads from AF combustion can accelerate the deformation and creep of the commonly used steel dip tubes. Secondly, burning AF increases the concentration of various corrosive species in the gas phase, such as halides, acids, and alkali salts. In order to avoid intensified corrosion damage, higher alloyed steels have to be used, which results in both significantly higher investment costs and higher emissions of carcinogenic chromate (Cr(VI)), which are hazardous gasses posing health risks to maintenance personnel. In turn, many cement plants choose to run without any dip tube in the lowest stage cyclone.

A new vortex finder

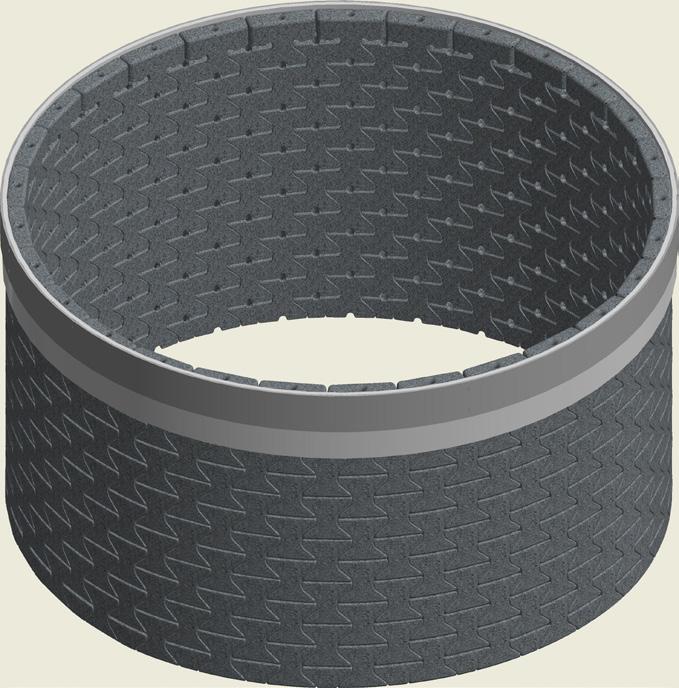

The HASLE Ceramic Vortex Finder provides an alternative to steel dip tubes. It is assembled on-site by individual ceramic elements, which interlock to form a stable tube suspended from a steel support ring welded to the roof casing of the cyclone.

To overcome the drawbacks of traditional steel dip tubes at elevated temperatures, a Ceramic Vortex Finder (CVF) was developed by HASLE Refractories during the 1980s. The CVF

consists of pre-cast and pre-fired refractory elements, which interlock to form a stable tube suspended from a steel ring welded to the roof casing of the cyclone.

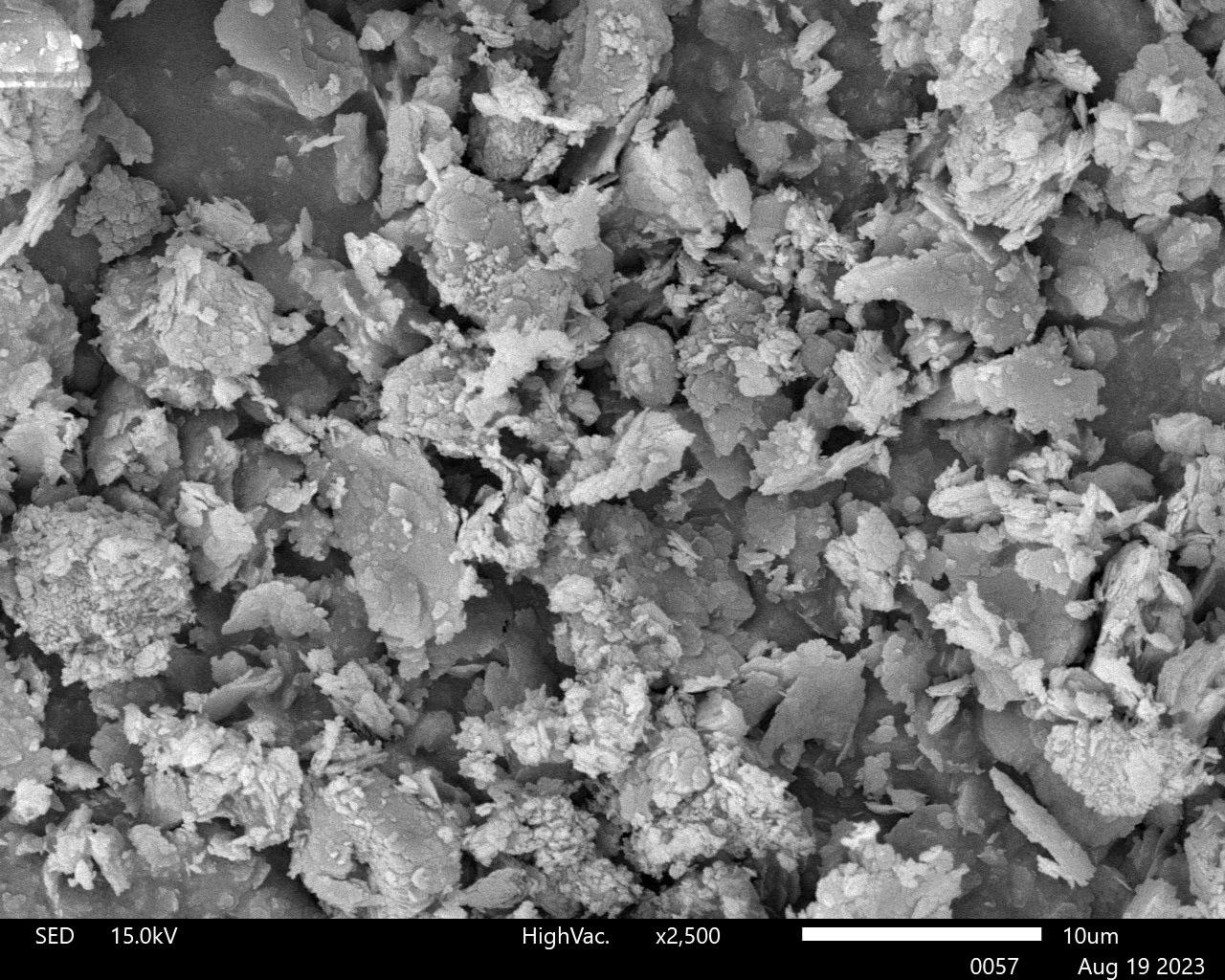

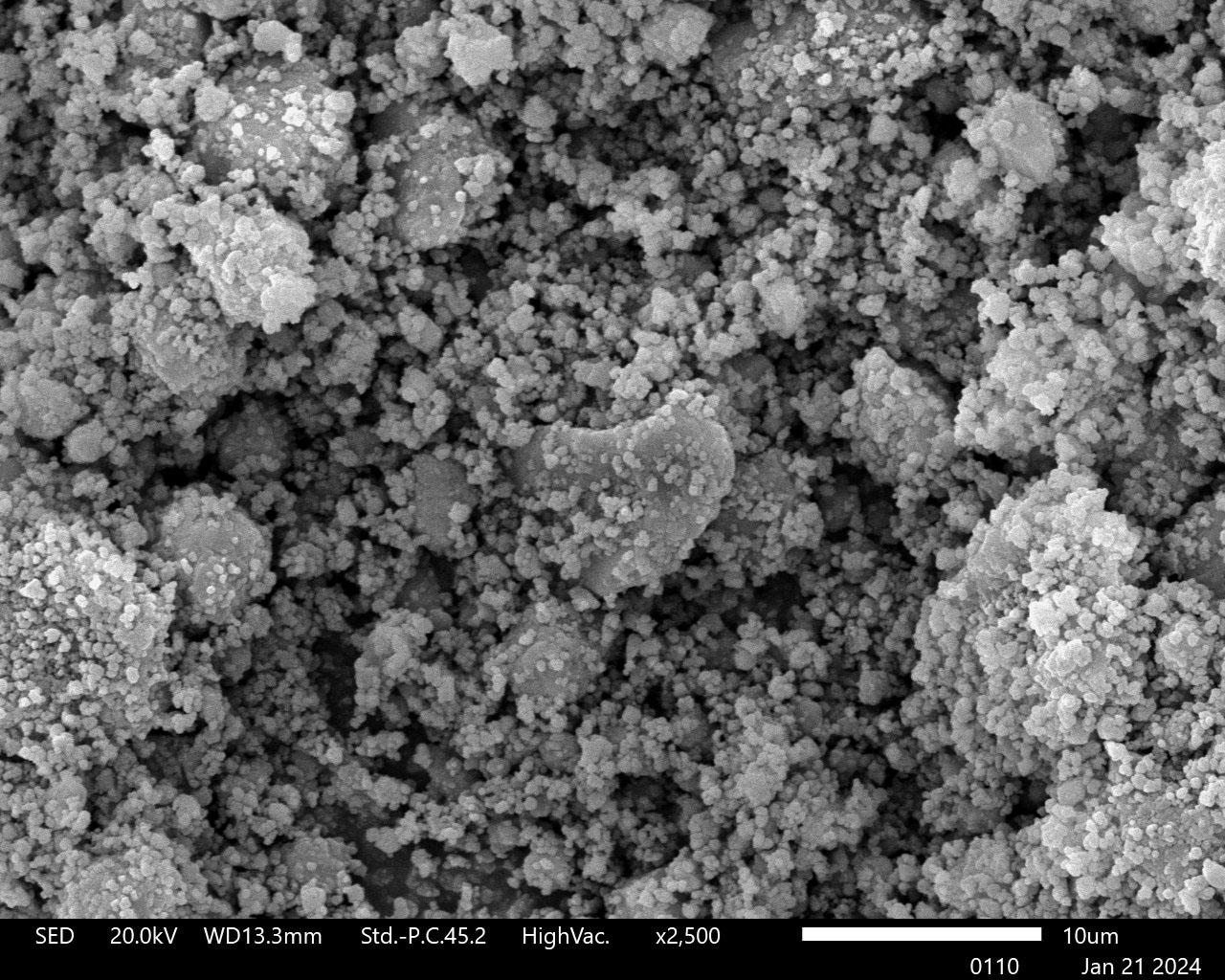

Recently, a new generation of the CVF (GEN3-CVF) has been developed, which has been specially designed to cope with the harsh operating conditions in cement plants using AF. Following a thorough development phase involving laboratory as well as field tests, the GEN3-CVF is a general overhaul of the existing CVF product line with both new-shaped elements and a unique high-performance refractory material.

Australian plant looking for dip tube alternatives

Nestled on the LeFevre Peninsula in southern Australia, the ADBRI Birkenhead cement plant enjoys a picturesque setting, surrounded by the captivating panorama of the St. Vincent Gulf and the Adelaide cityscape. With a rich history spanning more than a century, this 4000 tpd plant operates predominantly on natural gas. But the plant also incorporates a substantial amount of refuse-derived fuel (RDF) – on average 40% – which is charged into the calciner.

The cement plant operates a dual-string preheater design merging into one calciner unit and subsequently the kiln. This design includes a single lowest-stage cyclone at the exit of the calciner where the operating temperature is maintained at 850 – 900˚C. In the late 2000s, the plant initially trialled generation 1 of the HASLE CVF in the lowest stage cyclone. This, however, yielded mixed results with the GEN1-CVF experiencing operational lifespans down to six months. Notably, a contributing factor to the short lifetimes was the usage of AF in the calciner which was also increased during that period.

Faced with these challenges, the plant decided to run without any dip tubes in the lowest stage cyclone to minimise the risk of unscheduled shutdowns, as no dip tube solution could reliably operate for a full campaign at that point in time.

A new generation with high-performance castable

The ceramic elements for Generation 3 of the HASLE Ceramic Vortex Finder are made from a newly developed

in the 1980s by HASLE Refractories,

Due to the individual elements’ low weight of 6 – 19 kg, no heavy lifting equipment is required for handling, and it is possible to use the existing manholes for the installation.

The ADBRI Birkenhead plant, nestled by the St. Vincent Gulf and Adelaide’s skyline, boasts a rich history spanning more than a century. Developed the first generation of the Ceramic Vortex Finder was also installed at the ADBRI Birkenhead plant. Here an installation in 2009 is shown.high-grade castable with pure synthetic and high-performance raw materials to ensure against impurities. Nanoparticles are included for high fracture toughness and optimal strength. In addition, the materials used provide high

The alignment and level of the steel supporting are verified, prior to the installation of Ceramic Vortex Finder in the lowest stage cyclone at the ADBRI Birkenhead plant in Southern Australia.

Assembling the GEN3-CVF; the top row of ceramic elements is placed on the brackets of the steel support ring; the remaining elements are suspended from the elements in the top row.

resistance to chemical attacks, making the CVF suitable for plants burning high levels of AF.

The GEN3-CVF elements are manufactured under strictly controlled conditions at HASLE’s factory in Denmark. Firstly, the shapes are carefully cast and cured in specialised moulds to obtain a smooth surface and their unique profile. Subsequently, they are pre-fired to elevated temperatures to achieve maximum strength.

The result is a dip tube capable of withstanding temperatures up to 1200˚C without deformation or creep and that exhibits high dimensional stability. This ensures that the CVF does not buckle, maintaining a high separation efficiency throughout its service life. Furthermore, the small-sized ceramic elements minimise the risk of cyclone blockage in case of falling elements as they can pass through the feed pipe, allowing operations to continue.

The CVF has a high level of corrosion resistance against all common corrosive substances in the gas phase as well as a high abrasion resistance. Additionally, only the precast refractory elements are in contact with the hot gas phase reducing the chromate emissions significantly.

A new trial

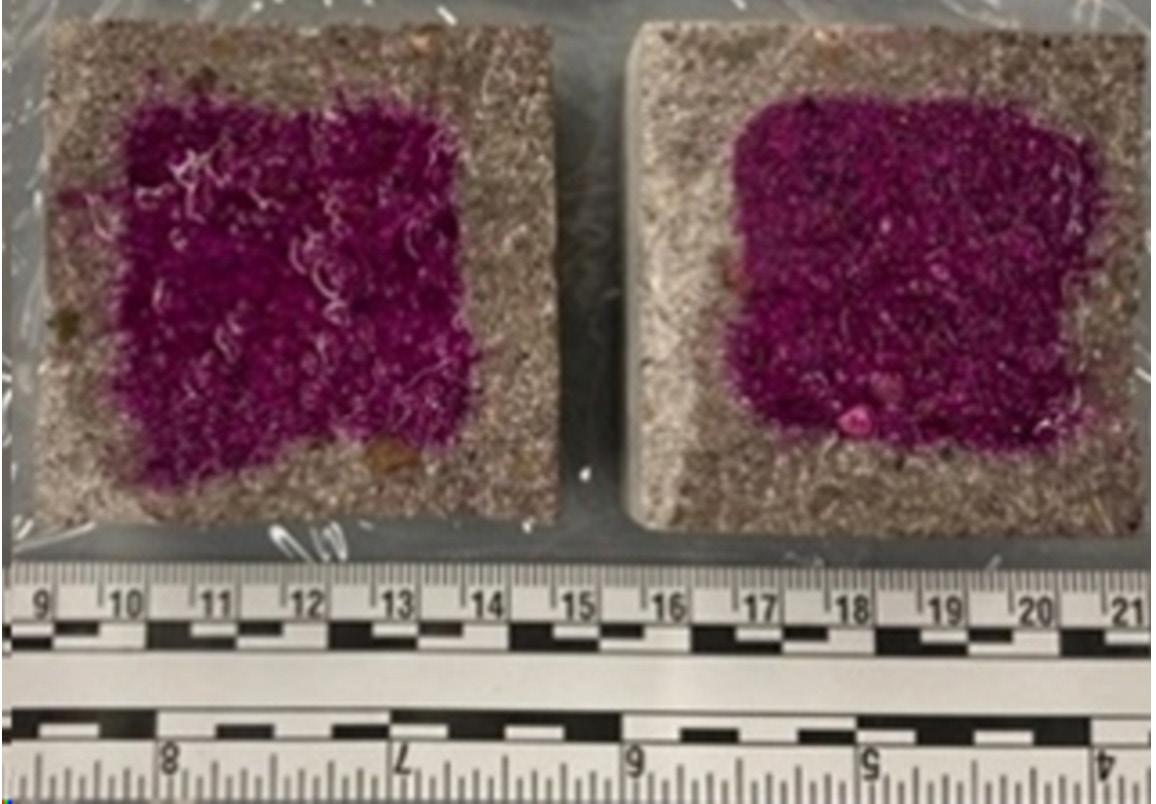

In light of the introduction of the GEN3-CVF in 2022, HASLE engaged in discussions with the management at the Birkenhead plant. Seeing potential for operational process benefits and equipped with a more robust dip tube solution, a trial in the lowest stage cyclone was initiated. Beyond the projected fuel savings, the primary goal is that the CVF will contribute to an enhanced RDF combustion. This, in turn, aims to reduce the amount of unburnt fuel carried down to the kiln inlet area, consequently minimising undesirable build up in that area.

Flexible installation

The HASLE Ceramic Vortex Finder was installed in the lowest stage cyclone, at the ADBRI Birkenhead plant in January 2023, featuring a diameter of approximately 3.7 m and a length of 2 m. The installation was assisted by an experienced supervisor from HASLE, supporting the work effort of the local installation team.

The installation sequence began with welding the steel support ring to the roof casing. Subsequently, ceramic fibre blankets were placed against the steel ring to allow adequate space for thermal expansion. Following this, the assembly itself took only a few hours. The assembly process was initiated by placing the top row of ceramic elements onto the brackets on the steel support ring. The remaining CVF elements were suspended

The CVF (Gen3) fully assembled in the lowest stage cyclone at ADBRI’s Birkenhead plant.from the elements in the top row. Thanks to the low weight of each individual element (ranging from 6 – 19 kg), no heavy lifting equipment is required for handling, and it is possible to use the existing manholes for the installation. Lastly, the final row of CVF elements was securely locked in place with a heat-resistant sealant.

The CVF is structured as a modular system of precast, ceramic elements, providing adaptability to individual operating conditions and cyclone dimensions. Its standardised shapes with different angles interlock through advanced tongue-and-groove joints and offer variable diameter options up to 7.5 m and lengths up to 5 m.

Surpassing one year lifetime in lowest-stage cyclone

After a complete year of continuous operation, the CVF at the Birkenhead plant underwent a comprehensive inspection during the annual shutdown in January 2024. Initially, the plan was to replace the existing CVF with a new one. However, the inspection revealed that the current CVF was in excellent condition. The thorough examination indicated no signs of damage, leading to the decision to extend its operational life for another 12 months, bringing the lifespan up to two full campaigns.

Experiences from Europe

The GEN3-CVF has also been applied in cement plants with even higher proportions of AF usage. A 5000 tpd cement plant in Germany, operating on 82 – 95% RDF, was facing short lifetimes of its steel dip tubes in the lower stages of the preheater. In the lowest stage cyclone operating at around 950˚C, the dip tube typically only had a 2 – 3 month lifespan, before it was necessary to switch it due to heavy corrosion from the burning of AF. Consequently, the plant decided to explore the GEN3-CVF, with the latest installation reaching a one year lifetime. It achieved a significantly longer lifespan compared to the steel dip tube previously used, and is now able to run a full campaign. Further up in the preheater, the plant also successfully deployed a CVF in the second-lowest stage cyclone operating at temperatures up to 850˚C, which has now achieved a three year lifetime and continues to be in operation.

About the author

Preecha Chokjarearnsuk is the Head of Sales and Technical Support for Southeast Asia and Australia at HASLE Refractories, Thailand. Preecha holds a bachelor’s degree in industrial engineering from Mahidol University and has 15 years of experience working with refractories in high temperature industries.

After a year of operation, the CVF in the lowest stage cyclone at the ADBRI Birkenhead plant underwent a comprehensive inspection. It was found to be in excellent condition with no visible damage, leading to the decision to continue its operation.

Scaffolding is often required to access the installation area in the cyclone roof. The CVF at the ADBRI Birkenhead plant after four months of operation.

Artificial intelligence turns cement production green

Mark Israelsen, Quantum IR Technologies, explains how the use of AI analytics can help to reduce energy consumption and emissions in cement kilns.

Artificial intelligence (AI) is revolutionising cement production by driving advancements towards more sustainable and efficient practices. As the world grapples with the pressing need to mitigate environmental impacts, the cement sector, known for its substantial carbon footprint, is turning to AI to lead the charge in reducing emissions and energy consumption. By harnessing the power of advanced analytics, AI is capable of processing and correlating millions of data points in real-time. This wealth of information provides cement operators with prescriptive insights that enable them to fine-tune kiln operations for peak performance and to implement predictive maintenance strategies. Such optimisation not only reduces energy usage but also extends the life of equipment, thereby contributing to a more environmentally friendly and cost-effective production process.

Energy in global cement production

The cement industry, known for its substantial energy requirements, occupies a significant position as one of the most energy-intensive sectors worldwide. It accounts for a notable portion of total industrial energy use, with its energy consumption primarily rooted in the production processes required for cement manufacturing. These processes encompass a range of operations from quarrying and crushing to grinding, blending, and the operation of rotary kilns. The industry’s energy use is characterised by both direct and indirect

consumption; the former pertains to energy directly utilised in production processes, while the latter refers to energy needed for powering auxiliary equipment and facilities.

Energy consumption relies heavily on fossil fuels, including coal, oil, and natural gas, being the predominant sources of energy for the cement sector, essential for generating the thermal energy required in cement kilns for clinker production. Additionally, electricity plays a critical role in operating the diverse array of machinery, equipment, and lighting found within cement plants. Factors such as kiln technology, equipment, facility age, and efficiency, as well as the nature of the processed raw materials, influence the industry’s energy consumption levels.

Production methods like the wet and dry processes – with the latter being more energy-efficient due to reduced heat requirements – further delineate the industry’s energy usage patterns. The industry’s energy consumption intensity, often measured per ton of clinker or unit of cement produced, sheds light on plant energy efficiency and highlights potential areas for enhancement.

As a result, the industry faces the challenge of reducing its environmental impact while meeting the growing demand for cement. Adopting energy-efficient technologies, including alternative fuel (AF) usage, waste heat recovery systems, and advanced kiln designs, offer significant potential to curb energy consumption and associated carbon emissions. The exploration and implementation of

AF (e.g., biomass, municipal solid waste, and tyres) and raw materials (such as industrial by-products or natural pozzolans) are strategies aimed at reducing the energy footprint and promoting sustainability within the industry.

While the cement industry’s high energy intensity presents considerable environmental challenges, opportunities abound for reducing energy consumption through technological innovation and sustainable practices. These efforts are pivotal not only for minimising the sector’s environmental impact but also for advancing towards a more sustainable and energy-efficient future.

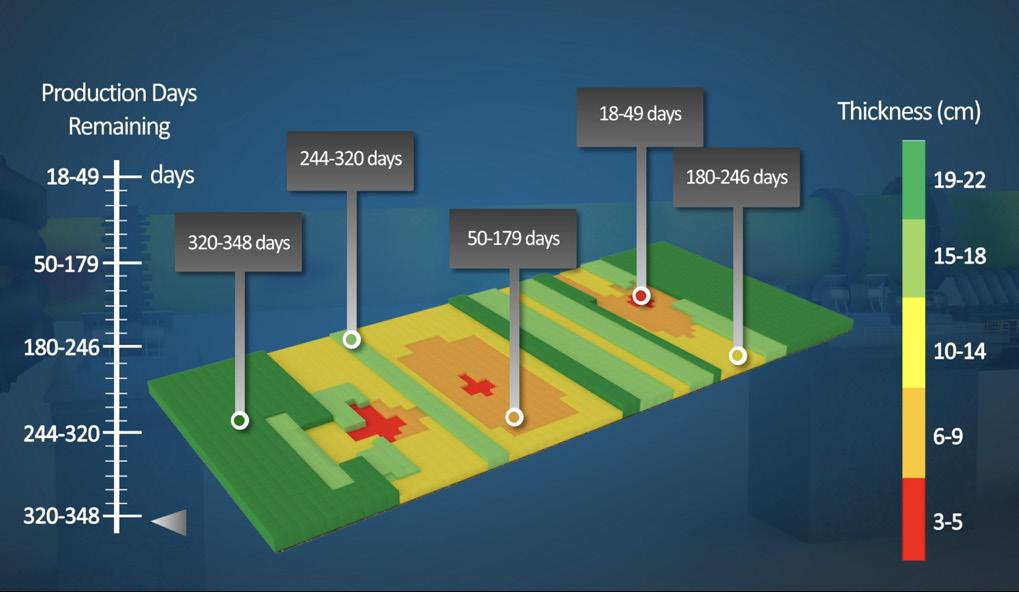

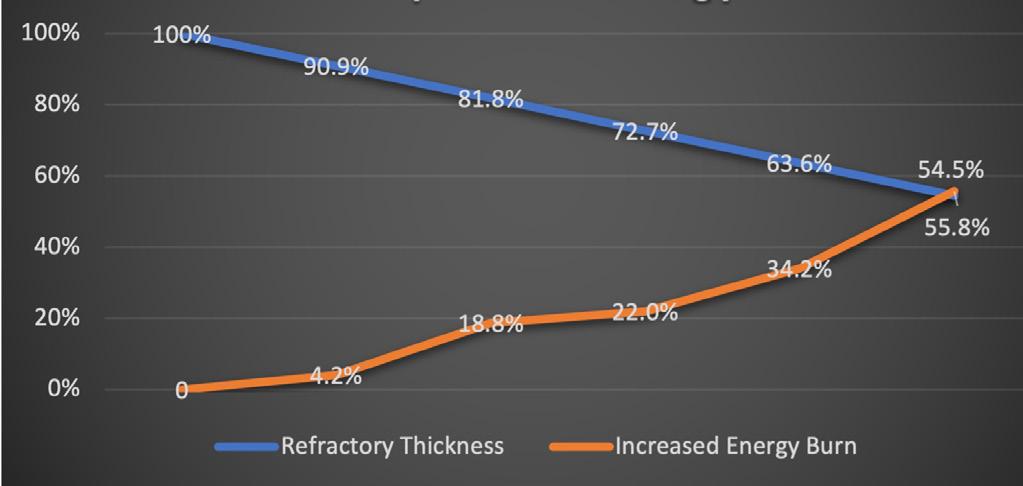

AI optimises kiln refractory life

AI optimisation of the kiln refractory is a critical advancement in the cement production industry, offering a strategic approach to emissions reduction and energy efficiency. With a precise focus on the management of kiln refractories, AI systems are equipped with advanced sensors that continuously monitor refractory thickness, delivering real-time data that drills down to the level of individual bricks. This granular level of monitoring is instrumental in assessing the refractory’s rate of deterioration, which directly influences the thermal efficiency of the kiln.

AI’s predictive capabilities play a vital role in forecasting the lifespan of the refractory lining, giving operators a clear estimate of the number of production days remaining before maintenance is required. By predicting the optimal time for refractory replacement, AI significantly mitigates the risk of unforeseen kiln shutdowns, which are costly in terms of both production loss and energy waste. The proactive management of the refractory life not only extends the operational period between maintenances but also maximises the revenue potential of the kiln by ensuring it remains in service for the longest possible time.

Furthermore, maintaining the integrity of the refractory lining through AI optimisation translates to better insulation of the kiln. This, in turn, decreases the amount of energy needed to reach the high temperatures required for clinker production, leading to a direct reduction in emissions. The energy savings are twofold: they lower the overall environmental impact of cement production and simultaneously result in significant cost savings for the producers.

AI integrates refractory, energy and emissions optimisation

The integration of AI-based analytics into the monitoring and optimisation of cement kiln operations represents a significant leap forward in the pursuit of sustainability and efficiency in the cement production process.

AI provides precise refractory information.

AI provides precise refractory information.

These advanced analytics systems are adept at continuously monitoring the energy emitted through the kiln shell, thereby providing a comprehensive view of the kiln’s thermal performance. By assessing the heat loss and correlating it with the energy required to maintain optimal internal temperatures, AI analytics offer a nuanced understanding of the kiln’s energy dynamics.

This capability extends to calculating the additional energy consumption necessitated by any inefficiencies in the kiln’s thermal management, including suboptimal refractory thickness or uneven wear. Importantly, these systems can also estimate the consequent increase in CO2 emissions resulting from the excess energy usage. Such insights are critical, as they highlight the direct link between operational efficiency, energy consumption, and GHG emissions within the cement manufacturing process.

AI analytics play a pivotal role in synthesising this data into actionable intelligence. By leveraging advanced algorithms and machine learning techniques, these systems can generate an analytical curve that maps the interplay between energy consumption, refractory thickness, and emissions. This curve serves as a powerful tool for identifying the point of optimal energy usage, where the kiln operates at peak efficiency with the lowest possible emissions profile.

The implications of this technology are profound. By providing a clear visual of the relationship between these key operational parameters, Quantum IR AI analytics enable plant managers and engineers to make informed decisions aimed at optimising production. This includes determining the ideal timing for refractory maintenance or replacement, adjusting operational parameters to minimise heat loss, and selecting the most efficient fuel mix to reduce energy consumption and emissions.

Moreover, the predictive capabilities of AI-based analytics facilitate a proactive approach to maintenance and operations. By forecasting potential inefficiencies and recommending pre-emptive actions, these systems can help avoid unplanned downtime and ensure the kiln operates within its optimal energy and emissions envelope.

In essence, AI-based analytics offer a comprehensive solution for enhancing the sustainability of cement production. By optimising energy consumption, extending the life of critical kiln components, and minimising emissions, this technology supports the cement industry’s transition towards more sustainable and environmentally friendly practices.

About the author

Mark Israelsen is the founder and CEO of Quantum IR and holds over 10 AI-based patents in the cement and petrochemical industries.

• BULK MATER IALS STORAGE & HANDL ING SO LU TIONS

• MAR INE TERMINALS

• ECO-HOPPERS

• TURNKEY INSTALLAT IONS

SCAN THE QR-CODE AND VISI T OUR WEBSI TE TO FIND OU T MORE

Autopiloting the cement process

Fayez Boughosn and Ighnatios Maatouk, ES Processing, explore the benefits of autopiloting the cement manufacturing process.

The cement industry is being reshaped through various challenges such as climate engagement initiatives, digitalisation, energy costs, and market volatility.

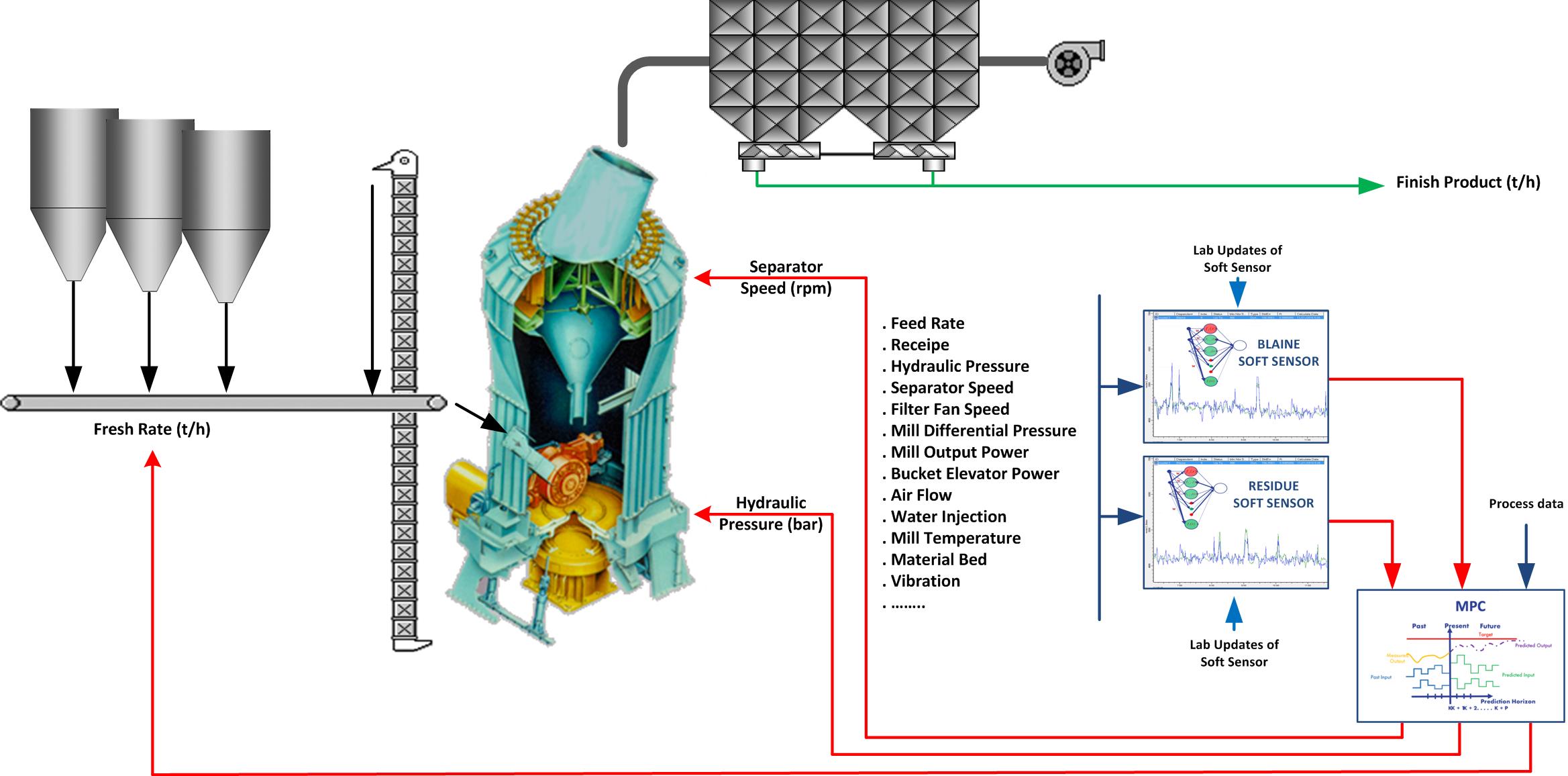

ES Processing developed its first APC-AI CMO as a ball mill autopilot, introducing artificial intelligence (AI) and advanced process control as new levers for cement manufacturing, continuously optimising the mill grinding process.

The company’s CMO (cement mill optimiser for ball mills), VMO (vertical mill optimiser) and KPO (kiln process optimiser) solutions are field proven and have consistently evolved with the latest technology.

Autopilot solutions

The CMO, VMO and KPO solutions represent a complex combination of AI, machine learning and advanced process control, able to predict product quality every 30 seconds instead of performing routine sampling every hour or more. They then perform the proper actions on the kiln and mills’ manipulated variables every 30 seconds. Predictions are continuously adapted to the new process conditions such as quality of throughput material, feed rates, rejects, pressure, etc.

These solutions help transform the cement manufacturing process into proactive, autopiloted operations, embedding continuous accurate predicted product quality into

a continuous decisions matrix of process optimisation.

Process optimisers

The processes in cement manufacturing, especially clinkerisation and grinding, are highly nonlinear and unstable, with directly impact product quality, plant performance, and operational costs. Therefore, the main target behind ES Processing’s advanced optimisers (CMO/VMO/KPO) is to enhance the production of uniform clinker/cement at the targeted quality. These solutions optimise the product quality, significantly reducing variations, whilst boosting the output and stabilising the overall process.

The CMO, VMO, and KPO solutions act as autopilot systems for the cement kilns and mills, enhancing the clinker reactivity and the cement fineness whilst ultimately increasing overall production and reducing the specific energy consumption.

They also continuously determine the optimum setpoints for the mill/kiln manipulated variables in order to establish a seamless operation while ensuring product quality and optimum performance.

Each solution’s main strategy is to provide inferred quality measurements, at a high frequency (every 30 seconds), to be used as a decision support system, helping to implement proper adjustments to selected manipulated variables. This speeds up operations with increased stability by reducing the traditional dead time caused by the lack of continuous quality analysis.

These solutions are composed of a complex combination of: f Soft sensors: These are very sophisticated but stable models formed by combining multiple data-based algorithms adopted from machine

learning and based on linear and non-linear identification techniques, PLS and genetic algorithms. They determine the best correlation between different process parameters and product quality results and thus are able to predict very accurately the main product quality indicators (blaine, residue, C3S, free lime) every 30 seconds.

f MPC: This is a highly complex multivariable model based on transfer functions built according to impulse tests results performed on each equipment. It is able to handle complex plant dynamics including long-dead times and non-minimum phase behaviour, constraint handling, hierarchical and weighted optimisation and predictive control. Thus, it can adjust the process manipulated variables every 30 seconds.

With this combination, the plant is consistently pushed to achieve its operational targets, driven by the continuous prediction of quality product and process reactions, along with the optimal adjustments of operating conditions. It is like having a dozen of the best highly-skilled operators continuously monitoring all process parameters, including online product analysis, and working simultaneously together to adjust the process parameters every 30 seconds to optimise the entire process.

Product quality prediction

The product quality has always been the weakest part of the chain in cement manufacturing due to many factors including: process time delay, sampling challenges, analysis accuracy as well as operation techniques.

Through understanding that the continuous monitoring of product quality helps to optimise the

CMO & VMO solutions, for horizontal and vertical mills, are maximising the performance of the cement process.

processes, ES Processing introduced its soft sensors to predict, every 30 seconds, the clinker/cement quality. Numerical data-based algorithms, adopted from machine learning and AI, build the core of the soft sensors. Adapting engineering correlations between the plant historical process and quality data, the soft sensors are used to infer cement fineness (blaine and/or residue) and clinker quality (C3S and/or free lime) from a defined set of inputs that show a strong correlation with the outputs.

Eventually, these soft sensors act as real-time product quality measurement devices, providing continuous feedback to the control systems even in the absence of laboratory data. Once laboratory measurements become available, the soft sensors use the results to dynamically improve and tune their predictions.

A chess strategy for advanced process control

Under normal operation, the CCR operator checks the product quality analysis and, based on other process indicators, selects a combination of actions on the kiln/mill. Technically, a skilled operator would have to decide and make calculated adjustments by using their experience to understand the possible process reactions. For improved performance and stable operation, a computational tool is required to exploit the current process indicators and past conditions of the plant in order to predict precisely the future plant behaviour and calculate a combination of control moves.

The MPC module of the CMO/VMO/KPO solutions, built based on advanced numerical algorithms derived from the plant data, applies

the famous chess-game strategy, consisting of taking continuous and simultaneous actions (every 30 seconds) on the different manipulated variables of the mill/kiln while always predicting the process reaction for the next 120 moves (one hour of operation).

Eventually, the MPC actively controls and stabilises the mill/kiln in real time, aiming to produce a uniform product at the best targeted quality along with an optimised performance resulting in increased volumes at lower costs.

About the authors

Fayez Boughosn is the founder and CEO of ES Processing. Fayez started his career as an Automation & Process Control Engineer for Holcim, where he worked with Siemens to develop one of the most advanced cement production lines of the time. Moving on as a Siemens Solution Partner, he led numerous challenging process control projects worldwide. Coupling his passion to innovate with his cement industry experience, Fayez founded ES Processing in 2007.

Ighnatios Maatouk is the Process expert & APC Projects Manager at ES Processing, managing the most challenging projects of advanced process control and AI solutions for cement plants’ optimisation. Ighnatios started his career as a site engineer for power plants and afterwards served in engineering managerial roles in the cement industry for Holcim as Process Performance Manager. Ighnatios’ ambitions for bringing innovation and AI solutions to the cement Industry led him naturally to join ES Processing in 2018. KPO

All eyes on AI

Chris Kiddle, AVEVA, explores the growing role of AI in the cement industry and considers both the benefits and the risks.

Few industries are exempt from the wave of artificial intelligence (AI) sweeping across the digital landscape. The cement industry is not exception when it comes to recognising the power of AI and the opportunity it presents to the sector. Early use cases promise prolonged efficacy. Positive impacts are being seen through the cement manufacturing portion of the supply chain from energy efficiency, improved carbon capture, increased uptime, automated performance enhancements of plant control, matured usage of applications in the supply chain optimisation via integrated planning and AI suggestions to performance variables to name a few examples of use.

With the promise of optimising production processes, reducing energy consumption,

enhancing quality and improving supply chain management via AI, are cement companies actually achieving higher operational efficiency, cost savings, and environmental sustainability?

This article plans to explore the opportunities AI presents in cement manufacturing; consider it a snapshot in time, with AI posing several promising opportunities for future applications.

Why AI?

But firstly, why is AI critical to cement production? McKinsey noted that companies have several options to decarbonise cement: “Optimistically, our analyses show that CO2 emissions could be reduced by 75% by 2050. However, only a small portion (around 20%) will come from operational advances, while the remainder will need to come from technological innovation and new growth horizons.”1

While this is not the only reason, it is widely agreed there is no direct path to net zero for the cement industry at this time, so while technological investment races to solve this dilemma, it is critical to meet social expectations and increasing pressures such as lowering embodied carbon in the construction sector. To continue to be the construction material of choice, improving production capacity while reducing energy

consumption via means such as increasingly efficient production is critical.

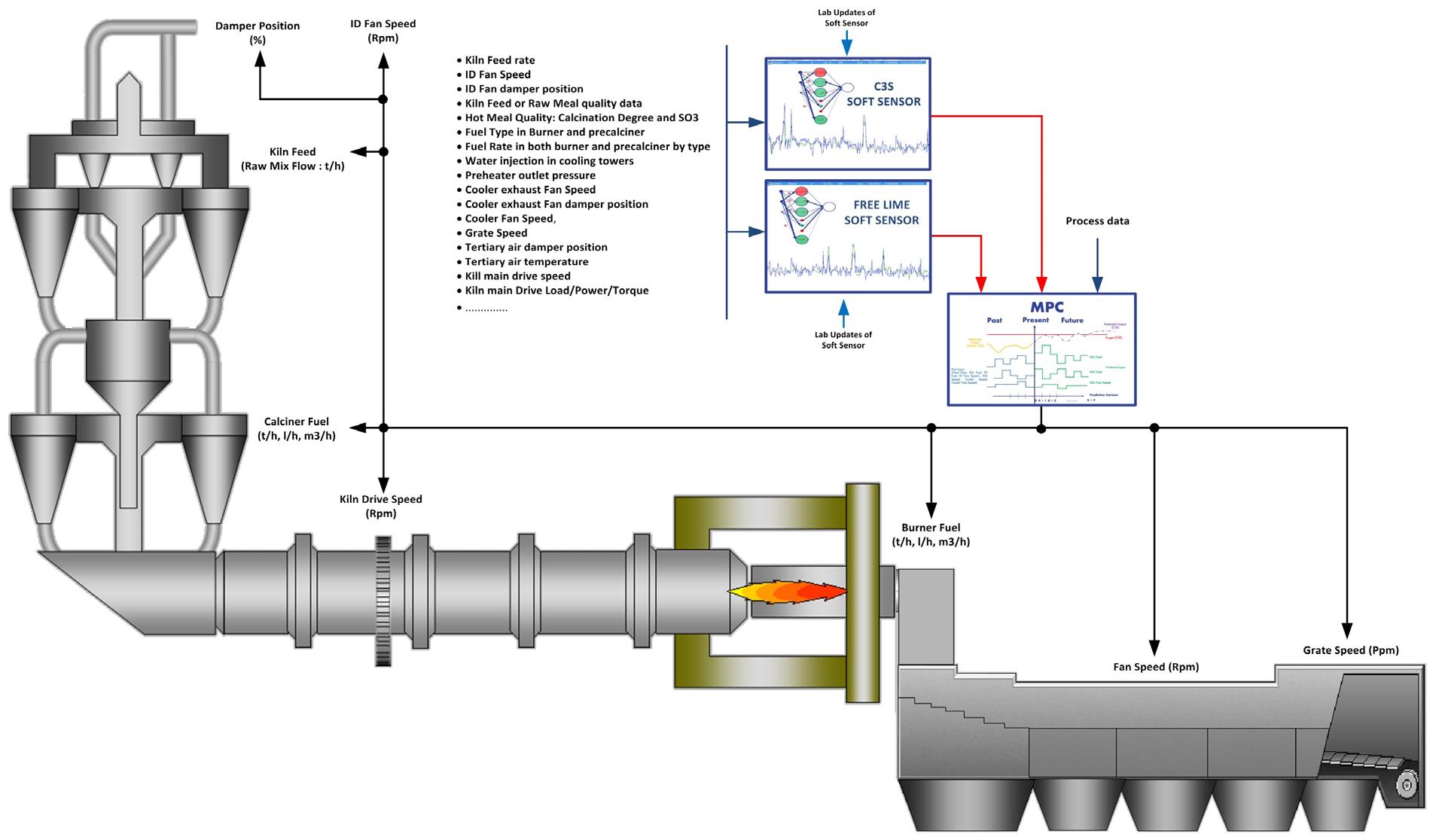

From an operational architecture perspective, the cement industry is being propositioned by the application of AI to the process control layer.

This could be due to the improved computation power and increased training speed of deep neural networks, and the explosion of IIOT in the sector, which is driving a proliferation of available data and vast data storage facilities, using a combination of on-site, hybrid, and cloud architecture options.

Fit-for-purpose algorithms, combined with prescriptive actions, have proposed to make AI-infused analytics a regular part of operations oversight. Optimisation occurs when there is more access to data.

The application of security best-practices and requirements for IT environments are already being applied to AI systems. However, the opportunity to leverage open AI models (still considered to be in their infancy) and connecting this technology with production systems and sensitive corporate data that could be exposed to malicious cyber-attacks is not a supported practice that AVEVA has seen.

The use of open AI appeals far more to the scientists amongst us all, yet the quality of the source data and concerns regarding intellectual property are just a few known issues from amongst a litany of problems that face this rapidly maturing use case.

There is a risk that “the rapid adoption, deployment, and use of AI capabilities can make them highly valuable targets for malicious cyber actors. Actors, who have historically used data theft of sensitive information and intellectual property to advance their interests, may seek to co-opt deployed AI systems and apply them to malicious ends.”2

So, as industry embraces the opportunities presented by AI, it is critical to remember the fundamental building blocks of enablement; even beyond security the area of primary importance is establishing a solid data infrastructure. This is key to unlocking the power of AI. The challenge that AI presents in respect to integration into a

Integrating AI into a company’s data infrastructure is key to unlocking the technology’s potential.

company’s data infrastructure is becoming more unique than the work of a control systems engineer or even what a business user would undergo when defining compliance to industry standards such as ISA95. It is expected to be a vastly different world in the future, and concepts such as Industry 4.0/Smart manufacturing networked architectures should be considered.

AI use-cases in the cement industry AI uses include examples like Nuvoco Vistas Corp, which has found that by “analysing data from sensors and cameras, AI algorithms can identify deviations from standard parameters such as particle size, chemical composition, and colour. This real-time analysis enables cement suppliers to adjust their production process, ensuring consistent product quality.”3

In keeping with the material movements, advances are also being seen in vendor hardware and software offerings with the likes of plant controllers: “Plant controllers can now simultaneously manage multiple control variables to optimise the plant’s performance. EcoStruxure Plant Advisor – Process Intelligence goes beyond a standard business intelligence (BI) dashboard by incorporating self-learning to recommend appropriate actions to help optimise a process. As a result, mining and cement plants can improve their overall equipment effectiveness (OEE) and water and energy consumption, while also increasing throughput.”4

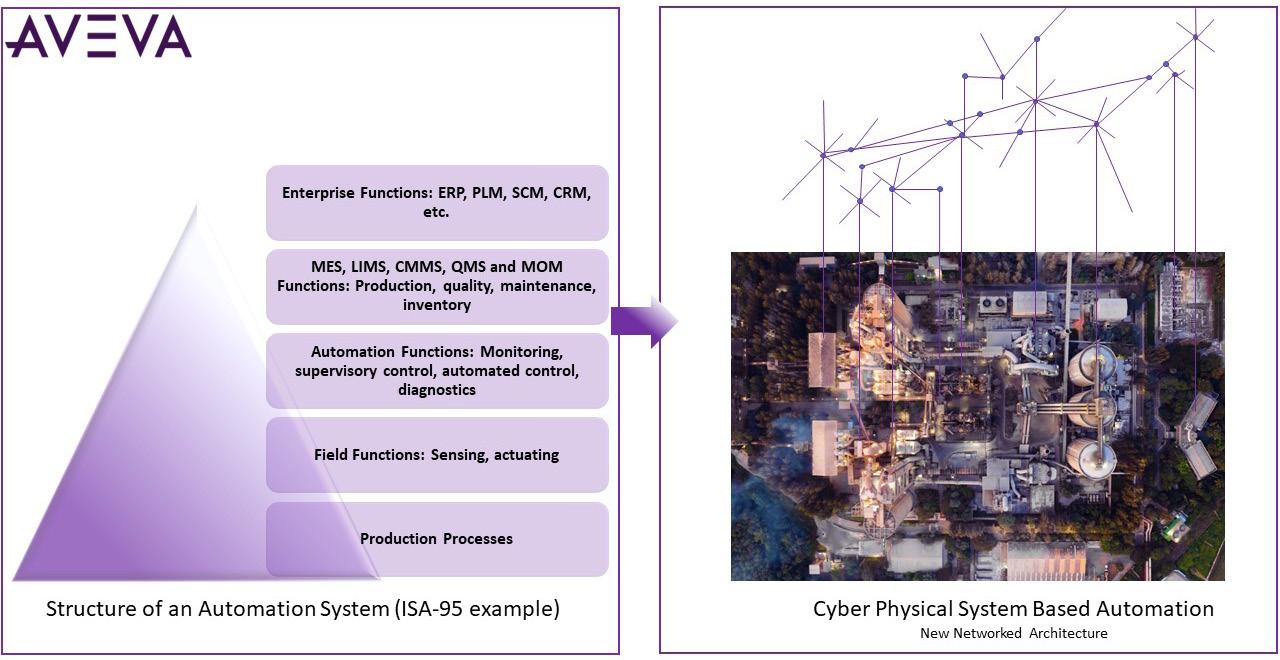

In terms of looking at asset predictive behavioural analysis and prescriptive optimisation results, Votorantim Cimentos wanted to better understand their asset performance and implement a condition-based maintenance programme by using machine learning to predict asset behaviour.

“Using AVEVA Predictive Analytics we wanted to realise a vision of our next-generation plant operations, using data to shape our decision-making. Because AVEVA’s software is agnostic we were able to click in the systems within days, and see benefits within weeks, driving unparalleled optimisations that spanned our entire operations and our network of plants.”5

Boston Consulting notes that a competitive advantage exists for first movers in the adoption of Industry 4.0 and two of the five identified steps include:

f Analytics-driven predictive maintenance.

f Predictive quality analytics.

With respect to predictive quality models that make use of machine-learning algorithms to correlate the quality of each production batch with the relevant production parameters, these can result in a “predictive model that transforms the necessary quality of the final product from an output of the process into an input that guides decision making at every step of the way.”6

Based on the power of this competitive advantage, S&P Global anticipates that leaders in carbon emissions reductions will be better off than their less-efficient competitors because their marginal cost of cement production will be lower, thus increasing their competitive edge in the sector.

Summary

The points discussed in this article are only a subset of AI applications seen in the cement manufacturing process. The broader supply chain is experiencing a similar adaptation of evolving AI solutions.

To quote Milan Kundera, “A worker may be the hammer’s master, but the hammer still prevails. A tool knows exactly how it is meant to be handled, while the user of the tool can only have an approximate idea.”

The adaptation of AI should be performed with those that developed it and in the ways that it was intended, in order to provide maximum value. Developing the knowledge of the tool’s capabilities is a key factor for AI success. AI is revolutionising the cement industry by improving efficiency, reducing costs, and supporting the development of a sustainable path forward. This article has explored various AI applications in cement manufacturing, such as optimising energy usage, enhancing quality control, and predicting maintenance needs. Additionally, it has emphasised the importance of robust cybersecurity measures and data infrastructure to support successful AI implementation.

Overall, the transformative potential of AI in cement production and its role in addressing industry challenges are perfectly aligned. The adoption of AI in a controlled manner should expedite value realisation for the industry at financial, social, and environmental levels.

References

1. ‘Laying the foundation for zero-carbon cement’ – https:// www.mckinsey.com/industries/chemicals/our-insights/layingthe-foundation-for-zero-carbon-cement

2. ‘Deploying AI Systems Securely’ – https://www.cyber.gov. au/resources-business-and-government/governance-anduser-education/artificial-intelligence/deploying-ai-systemssecurely

3. ‘The Role of Artificial Intelligence in Cement Industry Transformation’ – https://nuvoco.com/blog/blog-the-role-ofartificial-intelligence-in-cement-industry-transformation

4. ‘Schneider Electric launches new scalable IIoT and AI solution for mining and cement industries’ – https:// www.se.com/ww/en/about-us/newsroom/news/pressreleases/schneider-electric-launches-new-scalableiiot-and-ai-solution-for-mining-and-cement-industries6279c9a3cd0c7b34f370a374

5. ‘Votorantim Cimentos – Cement Producer Transforms Operations Within One Year’ – https://www.aveva.com/en/ perspectives/success-stories/votorantim/

6. ‘Why Cement Producers Need to Embrace Industry 4.0’ – https://www.bcg.com/publications/2018/why-cementproducers-need-embrace-industry-4?linkId=61303862

MPC, it’s easy as ABC

Juliano de Goes Arantes, Rockwell Automation, explains how cement producers can conquer their most complex processes with MPC.

The familiar challenges of cement production – such as high energy costs, raw material variability and process inefficiencies – are only intensifying as producers lose skilled workers to retirement, and adjust their operations to be more sustainable. But some cement producers are finding a way to optimise production even as they navigate disruptive change by using model predictive control (MPC).

Variability and uncertainty in the production process become less of a concern when a cement producer shifts from basic regulatory control to MPC. This is because MPC technology models the production process and accounts for the many different variations that can occur within it. The technology then proactively adjusts setpoint targets on its own. This creates an automated, closed-loop control system that can optimise production in real-time while lightening the load of human operators.

Cement producers have used MPC technology in recent years to boost productivity, improve

quality, reduce energy usage and emissions, and more. And these results are often achieved without needing major capital investments or infrastructure overhauls, because the technology can be deployed on top of the DCS or PLC layer that they already have in place.

From reactive to proactive control

Like other complex continuous-control applications, cement production involves a lot of variables that go unseen by operators. And when operators cannot see what is happening in production in real-time, it is all but impossible for them to optimise processes.

Instead, they just try to keep processes stable by reacting to the limited insights that are available to them.

MPC technology makes a more proactive control approach possible. The technology can access and monitor the many variables that a human operator cannot see, while also monitoring PID controller activity. This data is then fed into models that also leverage process equations, operator knowledge, plant test data and historical production data.

Equipped with all this information, MPC technology can assess current and predicted operational data, compare that data to desired results, and update the setpoint targets for a process. By doing this continuously, the technology can push a process to its constraints while maintaining safety margins.

In this role, MPC technology essentially becomes a cement plant’s best operator. It can access and analyse a volume of data that would overwhelm a human operator if they could access it in the first place. And it can operate non-stop, without concern about fatigue setting in or needing a minute off.

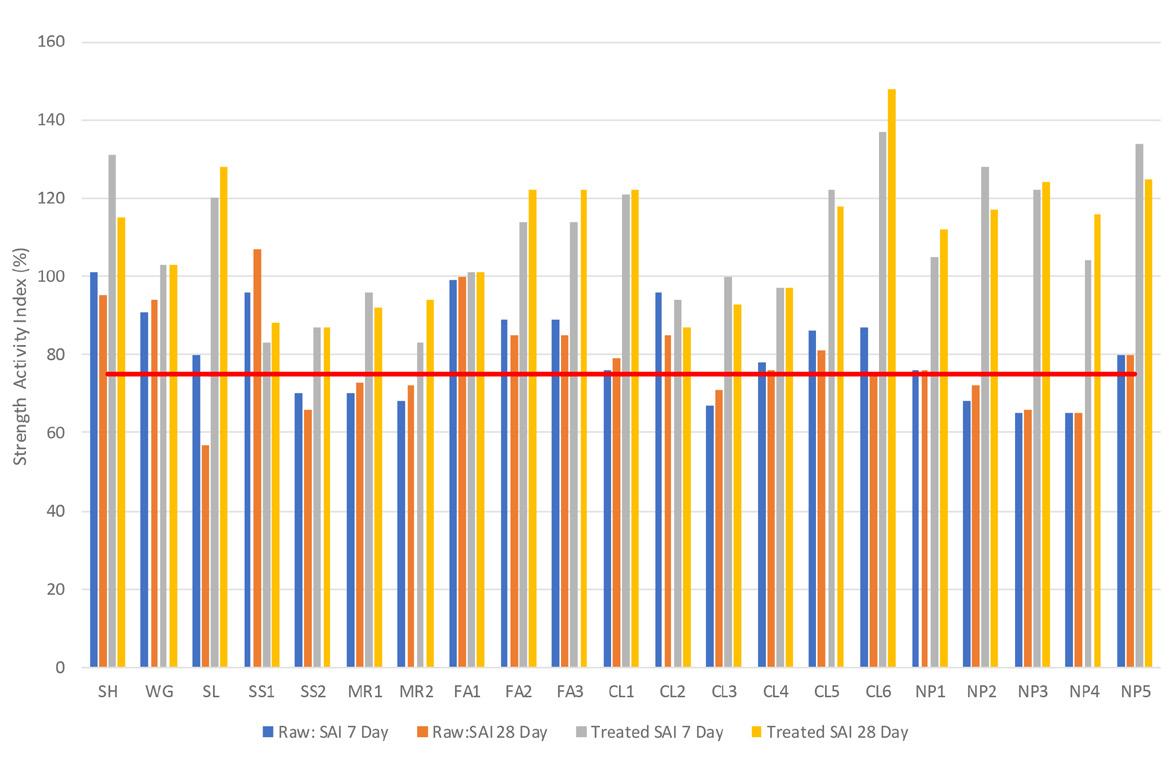

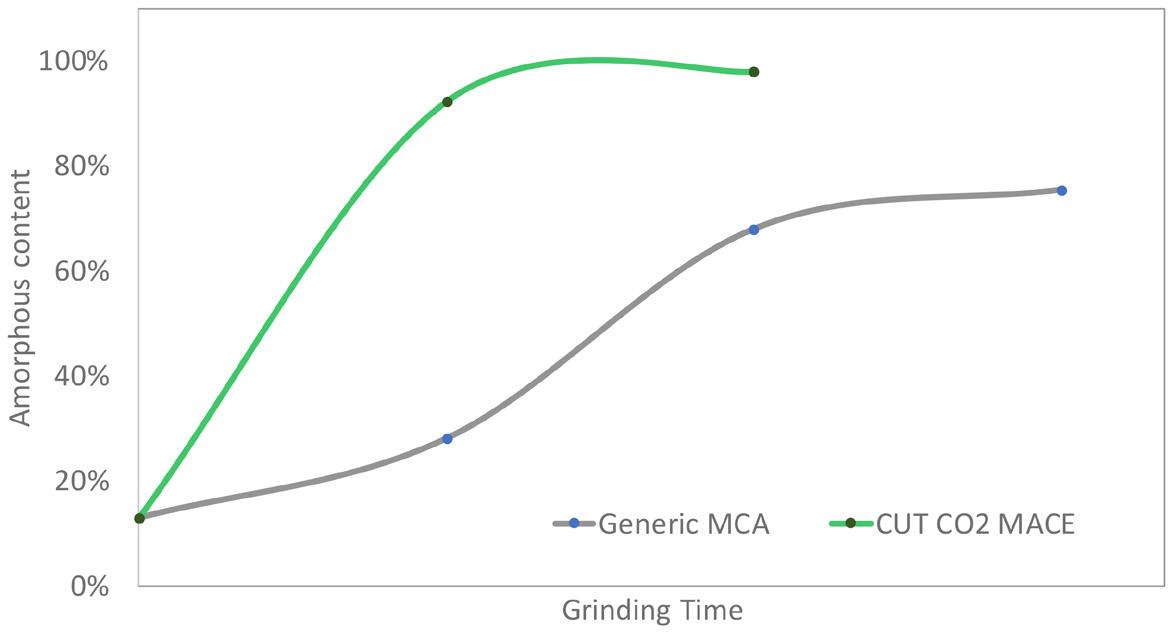

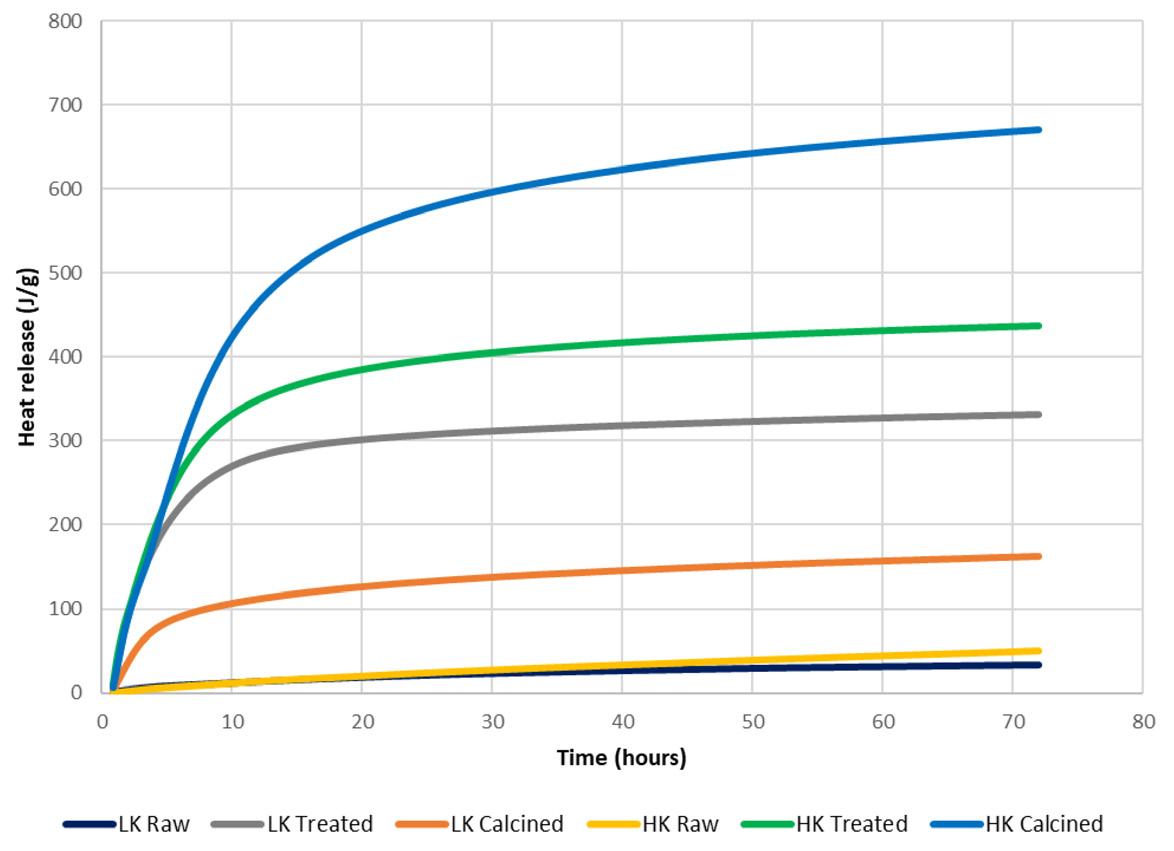

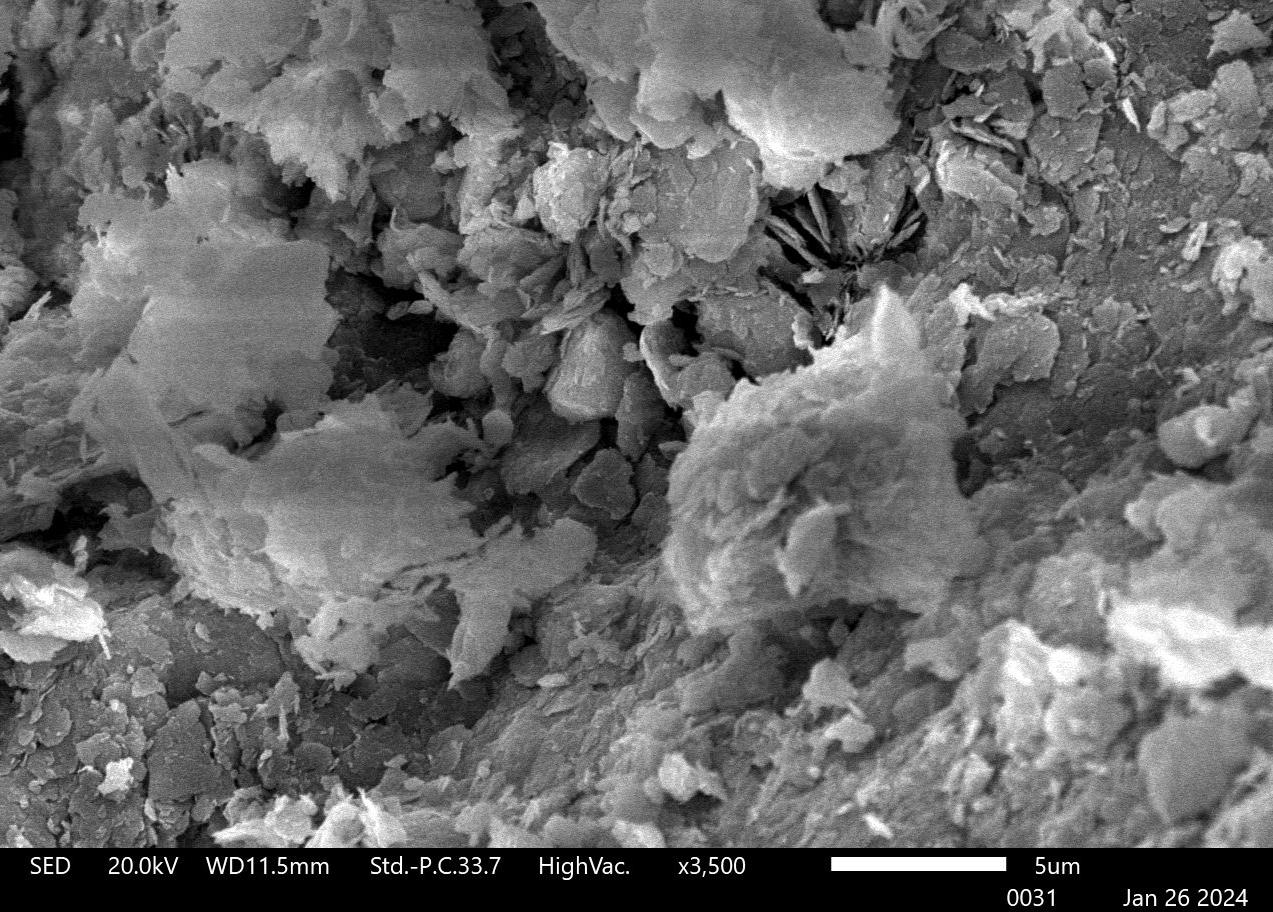

This can free up human operators from both tedious and intensive aspects of process control, allowing them to focus on supervising and optimising operations at a higher level. This transition to more value-added work has the potential to boost employee morale and make it easier to attract and retain new employees at cement plants.