7 minute read

Can Silver Hit The Ball Out Of The Park?

Kunal Sawhney, Kalkine Group, Australia,

considers the present state of silver and whether it has enough steam to continue performing well in the future.

An onslaught by the coronavirus pandemic had a momentous effect on virtually all markets across the globe. In the past 12 months alone, the commodity market has been extremely volatile, thanks to the changing dynamics. Looking ahead, with widespread vaccination programmes and many economies inching towards pre-pandemic levels, the damage caused by the pandemic is anticipated to taper off in the upcoming years.

The actions taken by world's government authorities to curtail the spread of COVID-19 virus led to a crash in the commodity markets in the initial phases; however, with almost all major governments across the world announcing stimulus packages, the excess liquidity lifted many commodities to higher than pre-pandemic levels.

Since the onset of the pandemic, silver prices have been volatile. After surging to multi-year highs of US$30.03/oz, silver prices consolidated in 2021 and corrected to US$21.39/oz. Rising inflationary pressure and the accommodative monetary policy followed by central banks have boosted prospects for precious metals. While some economists argue that inflationary forces may be transient, the inflation figures from the US and other major economies suggest otherwise.

Silver demand

As per the Silver Institute, the demand for silver in 2021 was anticipated to reach six-year highs of 1.029 billion oz in 2021, with the demand for industrial and physical silver firming up.

A significant surge in demand for silver is attributed to the recovery in investment demand, silverware fabrication, jewellery, and the industrial demand.

The global demand for jewellery was forecasted to bounce back to 173 million oz in 2021, but it remained below the pre-COVID level. The uptick in the jewellery demand was associated with an exceptional recovery in India. Likewise, a similar outcome in silverware was dominated by the Indian market. The global demand is expected to remain considerably lower than the 2019 level, even though total silverware fabrication was expected to see a two-digit percentage gain in 2021.

The industrial demand for silver witnessed an impressive growth in 2021 – the demand from the electrical and consumer electronics sector, in particular, is expected to record magnificent gains. Apart from this, the implementation of 5G technology in the consumer electronics sector is anticipated to push the industrial demand further.

Robust growth in the photovoltaic (PV) technology added to the silver demand. As compared to other metals, silver has the highest electrical conductivity, thus making it an ideal metal for solar power generation. Many large global economies have committed to switching to solar and green energy in hopes of a sustainable and greener future.

The economies of scale and support by local governments have contributed significantly towards making solar energy a practical alternative to conventional sources. In fact, in the International Energy Agency’s (IEA) World Energy Outlook 2020, the organisation claimed that solar is now the cheapest electricity in many jurisdictions. The current strong oil and gas price environment further extends the support for solar energy as the energy of the future.

The momentum is anticipated to continue in 2022, as well as subsequent years. Additionally, the growing popularity of electric vehicles (EV) has also aided in boosting the demand for the silver. It is a known fact that EVs use more silver than internal combustion engines.

Silver prices make a rebound

Just like any asset class, the price of a commodity is primarily determined by the demand and supply forces. Silver is an extremely versatile metal which finds its place as a valued investment, and also as one of the precursors of trending technologies such as PV cells and 5G telecommunication technology. In fact, these new demand avenues have begun to contribute as a significant factor in the silver prices.

The recovery in prices of silver was first witnessed in 2019, and continued in 2020 due to the popularity of the precious metal as a safe-haven investment. The average annual price of silver jumped from US$16.19 in 2019 to US$20.52 in 2020, recording a dramatic 27% gain during the period.

To fight the damage caused by lockdown restrictions, many countries followed an expansionary monetary policy, bringing down real interest rates and boosting prices of silver along with other precious metals.

Silver price was in a bull rally at the start of 2021, which was further boosted by retail investor frenzy on social media platforms. This pushed silver prices to eight-year highs and the gold silver price ratio hit a seven-year lows of 62. The gold to silver price ratio indicates how many ounces of silver can be bought with one ounce of gold.

Market trends in the silver industry

Reopening of economies boosts silver supply

The silver mine supply was severely hit due to widespread lockdown restrictions. Moreover, the silver mine supply has been significantly decreasing every year for the last five years.

Fortunately, most of the miners across the globe that were affected by COVID-19 restrictions have resumed their operations. The improvement in the supply of silver was driven by higher output from primary silver mines and the commencement of new projects in Australia and Mexico. The supply from silver scrap is expected to make a significant contribution for the fifth consecutive year.

The latest commodity super cycle has motivated miners across the world to ramp up their mining activities, aiding the supply of silver. Apart from this, the recycled silver supply was also anticipated to grow in 2021. Furthermore, the silver market was also projected to face a supply deficit in 2021.

Silver plays an important role in the world’s craving for a better and stronger connectivity. Almost every connectivity application needs a huge number of monitoring devices, sensors, tracking, and communication systems. Many of these devices use silver in their manufacturing, including electrical contacts, semiconductors, and several other components.

The connectivity transition is being supported by booming technologies like the internet of things and 5G network.

Booming demand for silver in the electronics market

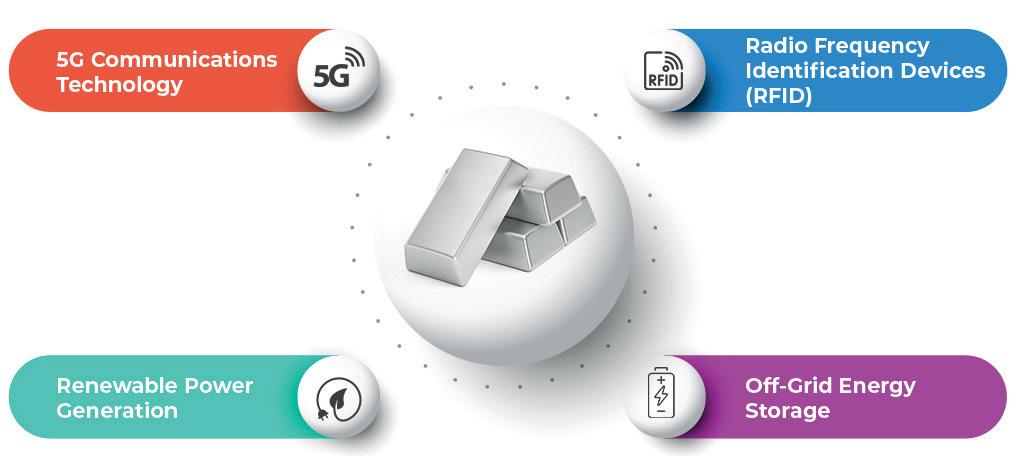

More than 33% of the world’s total silver industrial fabrication demand comes from the electrical and electronics market because of its unique electrical properties. Thanks to its superior conductivity, silver is extensively used in almost all electronic devices regularly used by humanity. Apart from its application in traditional electrical and electronics industries, silver is now critical for the next wave of technological advancements, right from disruptive telecommunication technology to the sustainable and Figure 1. Trending applications of Silver Source (Image courtesy of Kalkine Media 2021). environmentally friendly

energy sector. In fact, the Silver Institute forecasts the demand from the electrical and electronics market to grow to 246 million oz in 2025, registering over a 10% increase against the 2020 levels. n Radio frequency identification devices (RFID) can connect different objects wirelessly and can be used for real-time, efficient tracking, data gathering, and monitoring. The usage of such devices is slated to increase by over 400% by 2030, as per the

Silver Institute. n The expansion of 5G communication technology and a broader ecosystem of connected devices via the

‘Internet of Things’ (IoT) will lead to faster-than-before communications and data flow. With IoT, historically non-communicative physical objects establish instantaneous connections between people and the suite of devices and objects. Demand for silver is rising due to the use of silver in the manufacturing of circuit boards that make these devices connected and smart. n A major uptick in the silver demand has been witnessed from renewable power and off-grid energy storage as leading economies gear up to achieve a carbon-neutral economy in coming decades. As per the IEA’s Sustainable Development Scenario, the share of electricity generated via renewables is anticipated to increase from 29% in 2020 to 49% in 2030.

Auto market to boost silver demand

Nearly two-fifths of the cost of a vehicle is incurred by electronics assembly. The demand for silver has skyrocketed due to the high utilisation of precious metals in electronic systems and automotive glasses.

Booming demand in the aviation sector

Silver is an important component for the manufacturing of electrical structures of aeroplanes. In addition, the deployment of high-end entertainment systems, cameras, sensors, and communication devices in aeroplanes is increasing the demand for silver significantly.

Conclusion

On the back of high inflationary forces and the changing monetary policy stance, the investor’s appetite for precious metals, especially silver, may strengthen. In 2020, silver saw almost three times inflows into exchange-traded products (ETPs) against the corresponding period in 2019.

The rise of disruptive technologies, such as IoT and 5G, is expected to contribute to silver demand dynamics, and the improving penetration of PV and renewable power is further expected to keep demand firm. For a balanced market, supply needs to meet the burgeoning demand. In silver’s case, the significant progress made since the peak of the ongoing pandemic may strengthen mineral players’ capacity to bring new operations on-stream, as well as expand existing ones.

Overall, the consumption and investment demand are expected to remain strong in the short to medium term.

Visit us! SME, Salt Lake City Utah, USA February 27– March 02, 2022