10 minute read

CON TENTS

8

08 What plagues the solar industry and what can be done about it?

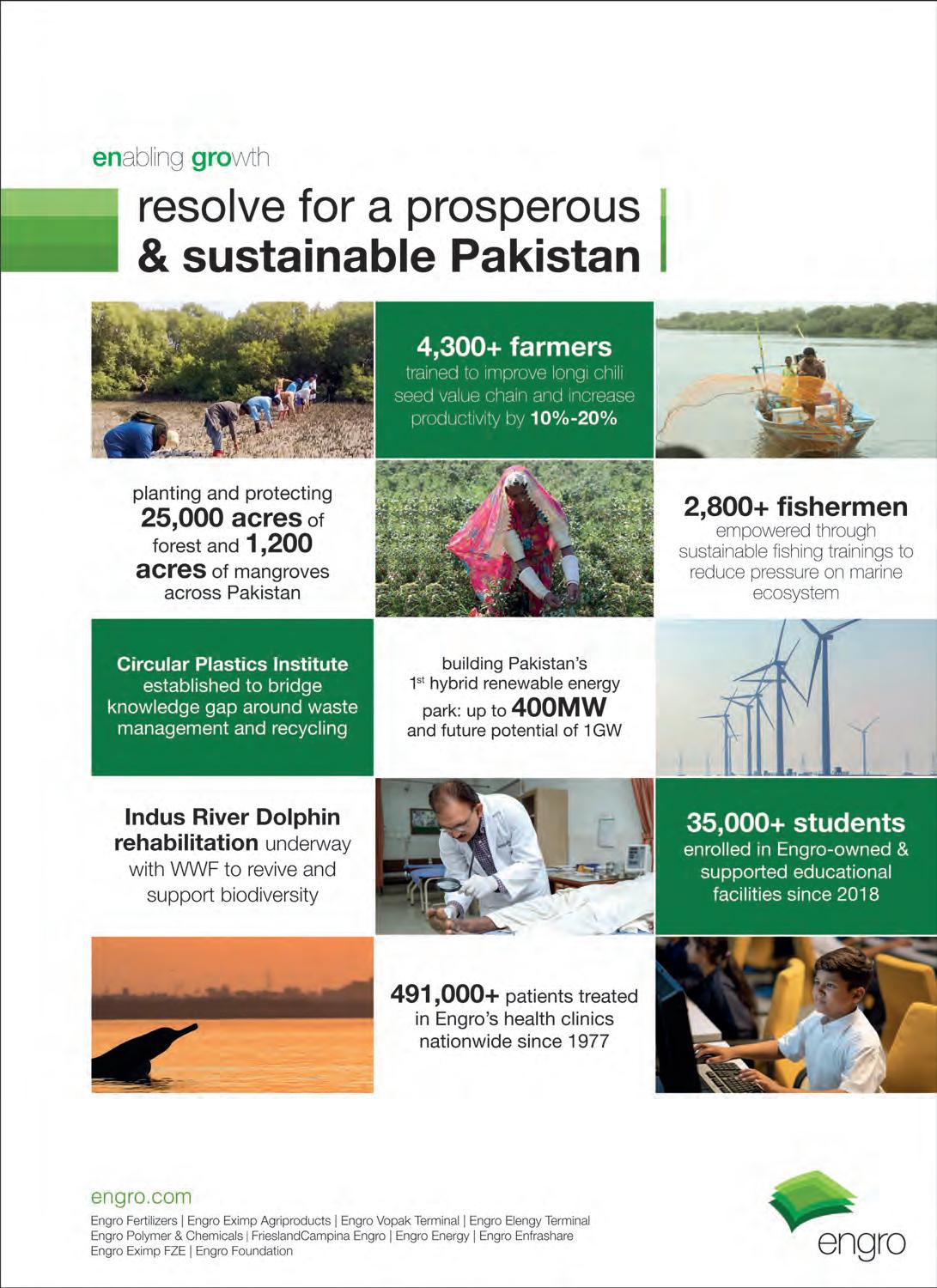

Advertisement

14

12 Golden opportunity for cement manufacturers as Afghanistan slashes duties

16 A tale of two defaults

24

24 Bykea managed to dodge a bullet, but will everyone else be as lucky?

20

20 Anatomy of a stock market crash: How the SECP sat back and let mayhem unfold in 2000

Publishing Editor: Babar Nizami - Joint Editor: Yousaf Nizami

Senior Editor: Abdullah Niazi

Executive Producer Video Content: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel

Reporters: Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani

Shehzad Paracha l Aziz Buneri | Daniyal Ahmad |Shahnawaz Ali l Noor Bakht l Nisma Riaz

Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb) Business, Economic & Financial news by 'Pakistan Today'

Contact: profit@pakistantoday.com.pk

By Urooj Imran

One thing the citizens of Pakistan may have been particularly frustrated with last week was the sun, which shone intensely wherever one went. The government, perhaps, would have taken it as another reason why solarization would be a highly successful prospect for the country.

It is well-known that Pakistan has a recurring balance of payments crisis and its foreign exchange reserves are critically low — $ 4.01 billion as of June 9, 2023, which is not enough to cover even a month’s imports.

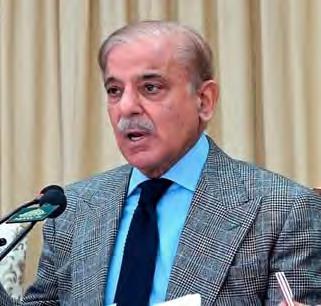

As the country’s foreign exchange reserves depleted sharply last year, the government identified that energy generation-related expenses, for which Pakistan has to import fuel, were quite high. It, therefore, decided to launch the National Solar Energy Initiative, with Prime Minister Shehbaz Sharif announcing the government would launch solar projects to generate 10,000 megawatts of electricity.

While announcing the budget for fiscal year 2024 on June 9, 2023, Minister for Finance and Revenue Ishaq Dar revealed the decision to remove customs duties on the import of raw material of solar panels, inverters and batteries.

The government also allocated Rs 300 crore to convert 50,000 tube wells to solar energy. Following the announcement, the solar industry must have collectively breathed a sigh of relief, for it has been plagued by numerous problems in the current fiscal year that will end on June 30.

The problems began back when the Pakistan Tehreek-e-Insaf (PTI) government decided to impose a 17 percent general sales tax (GST) on the import of all solar equipment at the start of 2022.

While the incumbent Pakistan Democratic Movement government eventually removed the tax in May 2022, demand for solar systems remained subdued in the first half of the year due to the increased costs.

Then, in April, the State Bank of Pa- kistan (SBP) issued a requirement for solar imports to post a 100 percent cash margin on all letters of credit (LCs), which placed another burden on the cash flows of businesses operating in the sector.

And then came an even bigger blow — given the country’s deteriorating economic and foreign exchange reserves situation, the government banned the import of “non-essential” items on May 19, 2022.

Subsequently, in a circular issued on July 5, 2022, the SBP updated the list of items for which importers would need prior approval from its Foreign Exchange Operations Department for opening LCs. The list included items covering solar panels, inverters, and batteries. This led to an industry-wide equipment shortage with companies facing challenges in completing their orders.

Despite this, Prime Minister Shehbaz Sharif approved a 10,000 megawatts solar energy project in December. In the project’s first phase, power generated through the solar project would be supplied to government buildings, tubewells running on electricity or diesel, and households with low consumption.

“Govt buildings & tube wells running on diesel will be shifted to solar. Power plants operating on diesel, coal & furnace oil will be partially replaced,” the prime minister tweeted.

“A major chunk of electricity is produced from imported fuel whose prices have gone up in recent months. Our National Solar Energy Initiative is aimed at substituting costly energy with cheap solar power, which will provide massive relief to people & save precious foreign exchange.”, he added.

The website of the Alternate Energy Development Board (AEDB), which was tasked with overseeing the project, shows that bids have been received for designing and installing solar systems on government buildings.

While the SBP removed the requirement to obtain prior approval on December 27, 2022, it still directed banks to prioritize the imports of essential items such as food, raw pharmaceutical material, medicines, surgical equipment; oil, gas and coal; raw material and spare parts for the export-oriented industry; seeds, fertilizers and pesticides; items imported on self-funded or deferred payment; and plant and machinery for export-oriented projects near completion. There was no relief for the solar industry yet again.

Meanwhile, the rupee was on a steep decline. According to SBP data, on June 30, 2022, the PKR closed at Rs 204.85 per USD in the interbank market. On June 16, 2023, the rate had fallen to Rs 287.19 per USD; 40% depreciation year-on-year. Naturally, this not only increased the cost of importing solar equipment, but the exchange rate volatility also made it harder for companies to maintain stable rates.

What do local sellers say?

Pantera Energy CEO Furqan Ali Akhtar said the biggest problem the solar industry faced this fiscal year was supply chain disruption after solar equipment was deemed “non-essential” following the government’s move to curb imports. Consequently, companies faced challenges in opening LCs. Since solar equipment needs to be imported, companies “had limited equipment to sell and the demand-supply gap caused prices to increase, he said. Reon Energy CEO Mujtaba Haider Khan said 70 percent of solar equipment is imported so there was a very big impact on demand due to the curbs.

Feroze Power Sales Manager Ammad Asif also agreed. In addition to the import ban leading to an industry-wide equipment crunch, the rupee’s depreciation affected the solar industry’s financial health, he pointed out. “Even though prices of solar systems were reduced in the international market, the dollar rate in Pakistan was so high. If you were getting some solar equipment for Rs 30,000 previously, you would now get it for Rs 55,000-60,000, so the system costs rose.” Resultantly, customers that had locked price agreements with the company were able to get the systems installed with “minor rate adjustments” but those who hadn’t were informed that the price had now risen significantly and they decided to not go ahead with the installation, Asif added.

There was yet another factor that affected the solar industry which was related to subsidized financing, the sales manager said. The SBP had introduced its Revised Financing Scheme for Renewable Energy on June 20, 2016, under which financing was available to install solar systems under three categories at a markup rate of up to 6 percent, which made it opportune to switch to solar. Last year, the central bank extended the scheme till June 30, 2024. However, the reality was different, according to Asif.

“A large part of the industry [that shifted to solar] used this scheme. But this option was also taken off the table, which had a huge impact on the solar industry.”

Separately, Khan also said that the non-availability of green financing at fixed rates was a problem. While the policy framework existed, no new limits were set by the SBP. “So, the policy was there, but there was no money.

Will the budget change things for the better?

Akhtar said the government had done some “damage control” in the last 2-3 months and the situation had stabilized.

When asked whether he expected the next fiscal year to be better, the Pantera Energy CEO responded with “absolutely”. He said the recently introduced budget was very supportive of the solar industry.

The solar financing option was back as well. “Good things are coming up,” he said.

Asif said that while there were no customs duties on the import of solar panels in the past, the duties on batteries and inverters had also been removed in the budget. While there would be an impact on the price of inverters, this would be offset by the rupee’s depreciation, he noted. On the other hand, the reduction in prices of batteries would mainly affect household consumers as industries did not opt for hybrid solar systems in which batteries are used.

“The overall impact on price will not be a lot. The prices of solar panels, which had gone up a lot, have reduced by 50 percent anyway. People are now again considering installing solar systems, so the expectation is that the industry will grow. A reduction in international prices will not affect local prices significantly unless the rupee regains the value it lost. There hasn’t been a big difference — if something cost $ 1,000 previously, it now costs $ 930, it isn’t like it has decreased to $ 500. Any decrease in international prices is offset by the rupee’s devaluation.”, said Asif.

The prices of solar equipment in the international market, which had risen significantly last year, were lowered earlier this year as new polysilicon factories — polysilicon being a key component of solar panels — became operational at the end of 2022. Besides this, the price of wafers, which are pieced together to make the panels, also reduced.

While international prices had gone down, Akhtar explained that domestic rates would likely be maintained because of the rupee-dollar parity. “Of course, if there is foreign exchange loss and the rupee falls to Rs 400 per dollar, there will be pressure.”

Local production

Almost all parts of a solar system have to be imported. There are some companies which assemble the batteries in Pakistan, according to Asif, but the bulk of the cost is due to a weak rupee. The question then arises whether Pakistan will ever become self-sufficient in the production of solar equipment.

The Pantera Energy CEO said “eventually”. He explained that the current demand is increasing every year and eventually it would reach to a point that setting up an entire solar manufacturing plant would be feasible. “When the consumption increases, it will become feasible for companies to set up plants in Pakistan. I hope that happens in another few years.”

Asif said that Feroze Power plans to manufacture solar equipment in the long run but it may or may not materialize because of the many challenges the industry faces in Pakistan. “If resources are utilized correctly, Pakistan can become a manufacturing country and obviously local production would reduce prices by a lot.”

It is pertinent to mention here that the prime minister had directed that a policy for locally manufacturing solar panels and allied equipment be submitted to the federal cabinet for approval earlier this year. Profit reached out to both Minister for Power Khurram Dastgir Khan and Convener of the Task Force on Renewable Energy Shahid Khaqan Abbasi but they did not respond.

What the government can do

“What we have right now in terms of solarisation is just the tip of the iceberg,” Akhtar said. There is a lot more to do in terms of execution, especially when it comes to solarizing Pakistan’s rural areas.

“The government should announce more subsidies and take initiative for solarization.”

Khan had a number of valuable suggestions for the government to help the solar industry flourish. “Around 10-12 years ago, when this industry began in Pakistan, 100 percent solar equipment was being imported — the design, the engineering, the material. Over time, 30 percent of the industry has been indigenized and some equipment is being manufactured locally such as cables and fabricated metallic structures.

“What the industry needs now is a sustainable run rate — sustainable policies for the next 10 years that are carried through when a government completes its tenure.”

Besides this, the industry also needed a steady demand forecast, the Reon Energy CEO said.

Elaborating on how important solar is globally, Khan pointed out that solar accounted for half of all capacity additions last year, while the total installed solar capacity rose to 1 terawatt (TW).

“A very high percentage of new power generation will be through solar. It is already the cheapest way to generate electricity on any scale,” he said.

A time would come soon when solar would become the preferred mode of electricity generation. Khan said that according to Reon Energy’s calculations, every dollar the government spent on solar would be returned in gains the same year as it would cut fuel use.

Referring to the government’s decision to categorize solar equipment as non-essential and ban its imports, he said it would be mindless to impose import curbs on solar and aggravate the already expensive power generation in the country as Pakistan not only had to import the fuel but also the technology needed when relying on fuel for electricity.

“Solar imports should not be categorized as ‘non-essential’. Of course, we are not saying that they should be placed alongside medicines but there should be something between essential and non-essential.”

Besides this, the solar industry needed to be categorized separately instead of being lumped with the automotive and mobile phone sectors since they were poles apart, he said.

“The government also needed to encourage good imports and check illicit trade. While custom duty on batteries and inverters would be removed in the upcoming fiscal year, solar panels were already exempted and unregistered companies and individuals had been importing substandard panels and even broken glass in the guise of solar equipment”, Khan said.

He suggested the government only allow companies registered with the AEDB to import solar equipment from suppliers included on Bloomberg New Energy Finance list, and ensure that the equipment imported pass quality checks.

Reon Energy CEO added that the government could also allocate land to solar equipment manufacturers in special economic zones as it is a critical sector, not just for Pakistan but globally as well in view of the transition to zero-carbon energy production to meet climate change prevention goals, and offer concessional borrowing rates to local manufacturers.

He also emphasized on countering the lack of research and development in Pakistan, saying the government should set up a lab under a public ownership model that can conduct sophisticated tests on solar equipment and build a research-oriented advanced facility or university that could collaborate with top universities worldwide on renewable energy. “We need investment in research and development, because without it, we will just remain copycats.”

“If we look at India and Turkey, they have started local manufacturing. What India did was offer higher tariff rates for those companies that were producing electricity through locally manufactured solar equipment. It also now has a 40 percent customs duty on imported solar panels.”

Khan noted that Pakistan’s industry could not compete with China’s, which is why the government should offer subsidies to incentivize local manufacturing. “The government needs to focus on batteries as well since they are useful not only for the solar industry but also the electric vehicle industry,” he added.

With the world recognizing the value of and switching to solar, whether the government will take meaningful steps to facilitate the industry or risk its growth in the upcoming year amid the precarious economic situation can only be assessed later. n