11 minute read

The MG saga

It was back in February 2021, more than a year ago, that Javed Afridi’s Morrison Garages (MG) Motors found themselves in the headlines in an under-invoicing scam. Now, the Public Accounts Committee (PAC) has ordered a reopening of the tax evasion case against the company. Under question are Rs 8 billion worth of custom duty which MG has allegedly evaded through the practice of under-invoicing. While it is a common occurrence in Pakistan’s imports sector, it is rare in major industries that have regulations like automobiles. The accusation against MG is that they failed to reveal a joint venture agreement between them and a company in China that provides them with their vehicles - even though under the law they are supposed to. Sources have told Profit that MG had used government contacts, corrupt officials in the customs department as well as members of former Prime Minister Imran Khan’s staff to get the matter hushed up. However now, after the arrival of the Sharif administration, the inquiry is being opened up again. Profit spoke with MG’s chief in Pakistan, Javed Afridi, over the allegations. Afridi told Profit that the company was being misrepresented and that no under invoicing had taken place. As of now, under the instruction of PAC, the FBR has formed a four member investigation committee to conduct a probe. The committee will take a detailed look at the comparable prices of Completely Built Units and Completely Knocked Down units of MG cars and determine the fair value that should have been established by the custom authorities. Further, the committee is also directed to investigate the role of FBR’s field operations in the matter. Using interviews with Javed Afridi, confidential sources, and an internal document of the investigative agency made available to us, Profit looks at what happened with MG, and where the investigation is headed.

Advertisement

Under invoicing and MG

Most developed countries set high tariffs on imports. Pakistan is no exception. While this provides valuable tax revenue for the government and protects local industries, because of weak enforcement of controls, it also gives rise to two practices - smuggling and under invoicing. Under invoicing is the practice of declaring a lower value of the product being imported so that the custom duty on it is charged as such. For example, a product worth Rs 100 might have a custom duty of 200% - meaning the final cost to procure that product will be Rs 300. Meanwhile, a product worth Rs 80 might have a custom duty of 150%.

The phenomenon of under invoicing is not new in Pakistani imports. Traders regularly indulge in concealing the actual value of the imported goods and declaring it at a much lower level to the customs authorities. Thereafter, the custom duty is assigned to these goods on the declared or custom assessed value. Thus, under invoicing leads to the importer evading massive amounts of duties rendering the products more competitive in the market. This doesn’t only lead to the menace of tax evasion but also defeats the purpose of high import duty on certain items to discourage consumption and subsequently reduce the import bill.

The MG motors under invoicing case first came to light last year around February. As per reports, the vehicles imported were declared at a value which was considerably below the original purchase price of the vehicles.

Cars are imported in two forms - Completely Built Units (CBUs) or Completely Knocked Down Units (CKD). As the names suggest, the CBUs are entirely assembled cars while CKD units are IKEA versions that are then assembled locally. CBUs are naturally

more expensive, except in MG’s case, they weren’t. And that was where the story began. 0

As per sources, around 1000 vehicles were cleared on verbal directives of the Member operations at a declared value of $ 11,000 per CBU. However, the CKD kits for the same vehicle were declared at a price of $16,000 at the Lahore dry port which technically meant that unassembled parts of a car were being said to be more expensive than the assembled unit of the car itself. Now, immediately alarm bells started to ring and people thought the $11,000 price tag on the CBUs was too low - which could mean under invoicing.

However, MG had a response to this. “Comparison of CKD kits with CBU vehicles is based on misplaced assumptions, without knowing facts. There are only 24 kits in total which are being relied upon for such an irrelevant comparison whereas the total numbers of CBU vehicles are more than 10000,” Javed Afridi tells Profit. According to him, the CKDs ordered at a rate of $16,000 were because only a few units were being imported back then as samples. The CBUs were imported at $11,000 because there were 1000 of them.

“These CKD kits were imported only as Pre-Production Vehicles (PPV) kits to assemble high quality sample vehicles which is proved from their import documents. Freight of these kits as mentioned on import documents is 1400 US$ greater than the freight of CBU vehicles. CKD kits have been imported with high quality packaging, costing up to US$ 900, to preserve them for longer periods for subsequent use. Steep rise in prices of micro chips, used in these kits, in the international market added up to US$ 800 in costs of these kits. Hence, these facts amply demonstrate the price difference between CKD kits and CBU vehicles.”

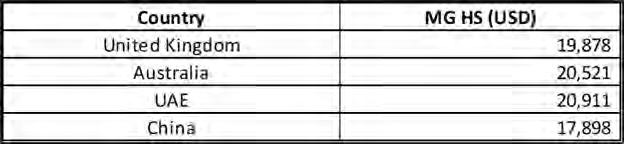

This is a reasonable enough explanation. However, comparable makes of MG in other jurisdictions were being declared at a base price of around $20,000 as per custom department’s internal investigation conducted last year. Further, the declared value of MG HS, the model in question, was substantially lower than comparable SUVs in the country. Hyundai Tucson’s declared value was between $18,000 to $16,000. While the declared value of the KIA Sportage vehicle was also around similar lines.

During our investigation, we came across a twitter thread that explained how MG prices were significantly lower than its competitors and a possible reason for it was concealment of original prices at the customs to avoid duty.

The thread compares the pricing Honda Vezel 2021 and MG HS 2021. As per the comparison, “Vezel, being hybrid, gets 50% rebate on taxes so Vezel duty is 2.2 million and MG Hs is non hybrid so it’s duty is 4.4 million. After adding the price of the car + custom duty + freight charges Honda Vezel costs 6.5 million and sells around 7.5 million and for MG HS no idea about cost because MG Pakistan doesn’t share anything nor does FBR but it sells for 5.7 million.”

As per the calculation above, Vezel declared value for duties and taxes is 4.3 million and MG declared value for duties and taxes is only 1.3 million.

Source: Report of Directorate of Post Clearance Audit

The investigation

The Directorate of Post Clearance Audit (PCA) also investigated the matter once news broke about malpractice in the clearance process. The report of the Director Post Clearance Audit clearly pointed out the heavy under -invoicing in this case. Yet the findings of that report were ignored by the customs officials.

“The Directorate of Post Clearance Audit employed methods of valuation which are prohibited,” Afridi said in his response given to Profit. “That is why the Adjudication Collector vacated the contravention report as the same was based on the prohibited methods.”

The Committee of Collectors applied their own mind and determined values as per law which resulted in recovery of additional duties and taxes up to 1.1 billion whereas no additional duties and taxes have been recovered in import of similar SUVs” he added.

The Committee of Collectors consisted of 3 Collectors of Customs appraisement Karachi who submitted a report to the Board determining the value of vehicles at US$12,400. However, as per officials in the Customs department, who spoke to Profit on the condition of anonymity, the officers responsible for the appraisal were themselves involved in the under assessment matter. Further, an internal document of customs obtained by Profit also pointed to under invoicing by MG motors. The document reads, “Mis-declaration and under-valuation by M/S JW SEZ (Pvt) Ltd. Involving duty and taxes Rs. 823.7 million against import of 687 SUV MG HS/MG ZS and MG ZS EV vehicles in CBU condition under HS code 8703.2260. Reportedly, more than four thousand vehicles have been imported by way of mis-declaration of value.”

However, Javed Afridi denied such allegations stating, “the clearance collectorates made due diligence and determined values as per law at their level and recovered Rs. 1.1 billion additional duties and taxes. Initially, 774 vehicles were cleared at Karachi which were allowed clearance by the respective collectorate themselves. There is no evidence at all of any influence by any quarters.”

Profit got hold of the investigation report by the PCA. As per the report, JW SEZ (Pvt.) ltd, the company that imports MG cars in Pakistan was in a Joint Venture Agreement with SAIC international Co., the Chinese company that sold the MG vehicles. The report states, “The declared customs transaction value by M/s JW SEZ (Pvt.) limited cannot be accepted as actual transaction value in terms of Section 25 (1) (d) and 25 (3) of the customs act 1969, as being the buyer M/s JW SEZ (Pvt.) limited, Lahore and seller, M/s SAIC International Co. are related parties. Hence the declared custom values are found to be influenced.”

As per the official Business Plan of the JW SEZ (importer of MG vehicles), submitted with the Engineering Development Board, the joint venture agreement gave 49% holding to JW SEZ, the importing company and 51% to the seller SAIC Motor International Co. Ltd.

The Customs document further pointed out that the Chinese supplier (Related Party) sold the vehicles to the Pakistani importer at a price that was well below the amount mentioned on the official website of the Chinese manufacturer. Further, JW SEZ (importer) did not disclose the underlying JV that governed the transactions between the company and the supplier rendering the normal methods of valuation of goods under section 25(1) and 25(3) of the custom act 1969 inapplicable. Further, as per the report, import data for MG cars was not available other than that procured by JW SEZ which is the sole importer of the said vehicles in the country.

Therefore, the PCA used the MSRPs available on official MG China website to ascertain the value of the vehicles. The price determination was carried out under the Fall Back Method mentioned in the Customs act 1969.

As per the World Trade Organisation, “When the customs value cannot be determined under any of the other official methods, it may be determined using reasonable means consistent with the principles and general provisions of the Agreement and of Article VII of GATT, and on the basis of data available in the country of importation. To the greatest extent possible, this method should be based

on previously determined values and methods with a reasonable degree of flexibility in their application.”

Therefore, in absence of reliable data to ascertain the value of the vehicles, the PCA employed the Fall Back Method permitted under the Section 25 of Customs Act 1969. Further, the estimation of charges, freight and taxes on the vehicle were made in accordance with long established practices of the clearance collectorate, the report says. The following table shows the value determined by the authorities of the MG HS vehicle.

After establishing the price for the MG vehicles, PCA assessed that total loss to the national exchequer was 823,700,261 on the import of 747 vehicles under nine goods declarations that were investigated (It is to be noted that the PCA only investigated declarations upto february 2021 and as of now more than 10,000 MG vehicles have been imported). Subsequently, the PCA issued a show cause order to the importers of MG vehicles in Pakistan.

However, the order of the Directorate of Post Clearance Audit was vacated by the Collector of Customs (Adjudication) on the basis of defective valuation as the prices obtained from the official site of the Chinese manufacturer required further authentication from the aforementioned. The PCA challenged this decision and went into appeal before the Customs Appellate Tribunal.

Further, as per Profit’s sources in the customs department, those officials of the customs department that refused to engage in the activity of under invoicing, were penalized through transfers. Speaking to Profit, former chairman FBR, Dr. Muhammad Ashfaq Ahmed, stated, “They all are upright and conscientious officers and don’t compromise if there’s anything illegal.”

The recent committee formed at the direction of the Public Accounts Committee is also instructed to probe the adjudication process assessing the legality of the orders passed by the collector of customs (Adjudication).

However, Javed Afridi maintains that the hype created around the MG under invoicing case is nothing except an effort to malign his company and efforts to bring in investments to the country. While talking to Profit, he claimed, “News about alleged MG Import Scam is total disinformation with ulterior motives to tarnish the image of officers who have unblemished careers and to negatively target Chinese investments in Pakistan. Fact is that there is no under-invoicing in import of MG vehicles. Actually, all the SUVs like Toyota Rush, Prince Glory, Proton, Changan have been imported and cleared at declared values whereas only the value of MG vehicles is enhanced and extra duties and taxes up to 1.1 billion have been recovered from importers of MG vehicles.” n