22 minute read

How many MG cars is Chelsea Football club worth?

The football club is worth billions of dollars and will give instant fame to anyone that buys it

By Abdullah Niazi

Advertisement

On the 2nd of March, the Khaleej Times reported that Pakistani businessman and owner of Pakistan Super League (PSL) franchise Peshawar Zalmi, Javed Afridi, was in the running to buy Chelsea, one of the biggest football clubs in the world. The club, which is up for sale by Russian oligarch Roman Abramovich who is selling the club because of pressure on him in the face of the Ukraine crisis, has in the past been valued at $3.2 billion and is expected to sell at a price upwards of $4 billion. To put that into perspective, in 2015 Javed Afridi bought Peshawar Zalmi for $1.2 million. That would mean that Afridi would be able to buy 3333 more PSL teams in the price that it would take for him to buy all of Chelsea Football Club. And if Afridi was to invest the $1.2 million that he spent on Peshawar Zalmi to put money in a consortium buying the Chelsea Football Club, it would give him exactly a 0.03% stake in the team. To further put this into perspective, the current owner of Chelsea, Roman Abramovich, has a personal net worth of around $13 billion. In comparison, Pakistani origins busi- nessman Shahid Khan (reportedly the richest ‘Pakistani origins’ has a net worth of $8.6 billion, and when he bought the NFL team Jaguars in 2011, he spent $770 million on it - the team is now worth $2.33 billion and the 23rd most expensive team in the NFL. That means to buy Chelsea, Shahid Khan would have to sell the Jacksonville Jaguars and would still only have just over half the amount needed to buy the team.

This makes the news that Afridi is in the running to buy the club a little suspect. According to the 2020 audited financials for Haier Pakistan, which is owned by Afridi, the assets of the company are worth over Rs 56 billion, which is equivalent to around $313 million. Meanwhile in 2015, Afridi bought the Peshawar Zalmi team for $12 million, which is to be paid in 10 equal instalments over 10 years. Even if Afridi were able to sell both of these and funnel the money into the club, he would not be able to acquire even 10% of the Chelsea Football franchise.

According to the report of the Khaleej Times, “Afridi’s team held a meeting on Wednesday with a sports and legal agency in the UK. According to a source quoted by KT, a number of investors are interested in the project and there has been some conversation that someone from Asia should come in and put money in the team.” Even here Afridi’s team has simply held meetings and made inquiries at most, and he himself has mentioned nothing in the public sphere in terms of his desire to buy the team.

On top of that, even if he were to sell everything and become part of a consortium wanting to buy the club, the problem is that sports franchises are not profit making enterprises and are not meant to be. These teams are normally vanity assets for the uber-rich who pour money into these sides without making profits to connect with the sports that they love. Being the owner of such teams is also a way to gain an international profile because of the reach and interest that sports teams have. Any such investment from a Pakistani businessman would not only be a huge purchase, it would also result in a massive rise in international status. According to another report, Abramovich has already declined an offer upwards of $3.4 billion for the club.

The likelihood of Afridi buying the club is a near impossibility. What is worth looking at, however, is how the business of sports franchises work, and why people are willing to spend such big money on projects that are not meant to be profitable, as well as what would happen if some Pakistani billionaire ever did have to buy a club like Chelsea.

What is Chelsea worth and how much will it go for?

Alongstanding part of the English Premier League, Chelsea has been around since 1905 and has won 5 Premier League and 2 UEFA Champions League titles in its more than 100 year long history. According to Forbes, the football club is worth a whopping $3.2 billion, with a gross annual revenue of $520 million - which mostly comes from sponsorships and tournament revenue pools. In the past two years, with the club Chelsea winning the UEFA Champions Trophy in 2021, the club’s value has risen by a massive 24%.

According to initial reports, the club will likely go for a price tag above $4 billion. The club was listed on the London Stock Exchange back in 1996, and the current owner bought just over 85% of the club in 2003 and took control.

Buying the club, however, will not necessarily be a matter of making money as sports teams are rarely a profitable business and are usually a passion project for the ultra-rich that enjoy both the opportunity to be involved in the game of their choice and the fame (or in some cases infamy) that comes with the territory. “Most teams operate at a net loss. Most of the revenue generated by the team is paid out to the players in the form of salary, and the rest is used to cover the operating expenses of the business,” says Jeff Farmer, a sports executive based in the

United States. “Like any other company, they also employ lawyers, finance people, marketers, sales people, HR, etc. Obviously every league/ team/country is different and some teams may turn a small profit on occasion.”

Even when Abramovich bought the club in 2003, it had debts of around £100 million, which included a ten-year £75 million Eurobond. Over the past two decades, he has poured billions of dollars into the club and provided it with soft loans as well to buy high-ranked players and turn the club into a championship contender. At the time of his exit, the club owed in excess of $1.5 billion to Abramovich.

It is extremely unlikely that Afridi will be able to pull in the kind of money that is needed to buy the club. Even if he were to sell all of his assets and spend everything he has from Haier, MG, and Peshawar Zalmi on the club, he would not be able to muster the funds to buy the football club. However, allowing the rumours to run amuck is in his interest. Even just the news that he is in contention has given him a boost in terms of his profile.

According to a report in The Independent, Swiss billionaire and football enthusiast Hansjorg Wyss has already confirmed that he has been offered the chance to buy Chelsea and a number of other international oligarchs have their eye on the club. Simply by having the rumour run around that he is in talks to buy the team, Afridi gets a boost in profile by being in the same company of some of the wealthiest people in the world.

And that also goes to the heart of the psyche that is involved in buying sports franchises. They are more about the prestige than they are about the money - and since winning is important, those that can afford it are happy to pour in the big bucks because they can afford to and make their teams the best in the world.

Why would anyone want to buy the club?

The business of football, however, is not an easy one and rarely a profitable one. There are many reasons to own a sports franchise that are not fiscal, with prestige being the most obvious, diversification of wealth, passion for the sport, etc. As Malcolm Gladwell has written about the motivation behind owning teams in the US’s National Basketball Association (NBA): “The issue isn’t how much money the business of basketball makes. The issue is that basketball isn’t a business in the first place — and for things that aren’t businesses how much money is, or isn’t, made is largely irrelevant….”

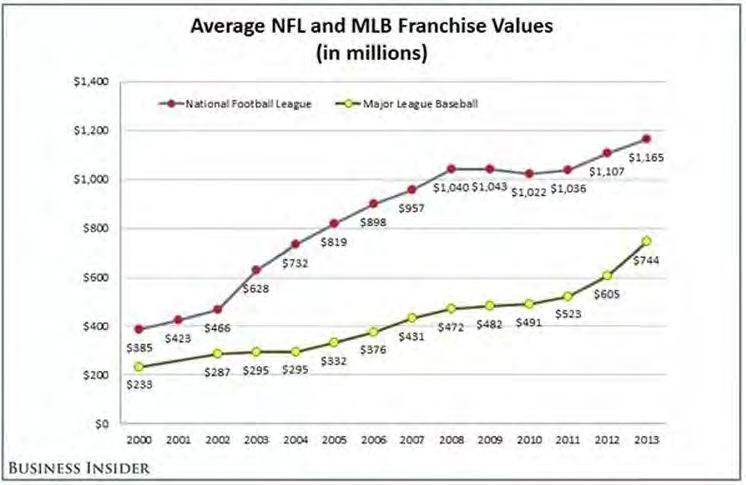

However, there is also economic value in owning a sports franchise - most obviously the fact that the value appreciates over time. Think of buying a sports franchise like buying an asset rather than buying a business - much like owning art, rare coins or other collectibles (in an example more familiar to Pakistan - think of it as buying a plot in DHA Phase 5). In fact, when Chelsea was bought by Abramovich in 2003, it was sold to him for £140 million - and is now being sold for close to £4 billion. This rise in value can also be seen in other franchises, and has been charted by Business Insider in the case of the American NFL and MLB franchises.

Of course, this increase in value has come after decades of money being poured into franchises. According to ESPN, Abramovich is the sole shareholder of Fordstam Limited, which is Chelsea FC plc’s parent company. Over the years, Abramovich has pumped £1.514 billion ($2 billion) of his own money into Fordstam to acquire Chelsea FC plc and support it financially; in turn, Chelsea FC plc owns Chelsea Limited (the actual club). But that financial support for Chelsea FC plc has come largely in the form of loans. Since Abramovich owns both Fordstam and Chelsea FC plc, he has effectively been lending money to himself, which is not an uncommon way for club owners to finance their teams.

What could a purchase mean for Pakistan?

We have only recently discussed in Profit how the franchise owners of the PSL are not necessarily in it to make money but in it for the prestige, for the fame, and to be close to the game. All of these reasons could also be the same for Afridi being interested in being a part of buying out Chelsea.

Think of it this way. There is one possibility in which Afridi is leading or part of a consortium that is pooling money to take Chelsea off Abramovich’s hands. In that case, Afridi might invest a smart amount of money, get some publicity through it, and be able to make a killing whenever the club is sold again eventually. It would be him hedging his money and protecting his income by putting it in an asset that also helps him gain international fame.

However, this money would be a small amount and it would mean Afridi would be a one-time investor and never regularly involved with the club - which would make it one time publicity. However, if a Pakistani billionaire like, say Mian Mansha, decided to buy a football club (not Chelsea but a smaller club because even Mian Mansha could likely not afford a $4 billion vanity project) then it might mean certain things for Pakistan.

After all, teams like Chelsea have an international following and reputation, and the game of football is the biggest sport in the world. Being involved in that might cause some losses initially, but it also opens up a number of doors. The other possibility is that Afridi is in it for the prestige and knows it. Just the news that he is in the running to buy the club has excited many, actually buying the club would obviously be a much bigger deal.

Meanwhile, football fans in Pakistan will be hoping that there is truth to the reports. If a Pakistani buys the club or is in any way involved, it will mean a lot more interest in football in Pakistan and the game’s profile rising in the country. It might also mean that the person buying would be able to get the team involved in Pakistan, which would bring massive marketing opportunities. The thought of Chelsea holding training sessions at a football stadium in Peshawar already has football fanatics in Pakistan giddy with excitement. While the likelihood of this happening is low, the possibilities would be gargantuan. n

MPC: To status quo or not, that is the question

Will the SBP make a bold move or will it wait and watch - that’s the rub

By Ariba Shahid

All eyes are on the State Bank of Pakistan (SBP) right now, as the central bank’s Monetary Policy Committee is set to meet, deliberate, and announce what will happen to Pakistan’s monetary policy on the 7th of March this Saturday. Only a week after Prime Minister Imran Khan’s address to the nation in which he announced an economic relief package, the interest in the decision is high. As per a survey by Profit, most research departments at financial institutions expect the policy rate to remain status quo at 9.75%. This is in contrast to the way the market was responding during the last quarter of the calendar year 2021. To recap, in November, the SBP increased the Cash Reserve Requirement from 5% to 6% and increased the policy rate by 150 bps within the same week. To add to the situation, the SBP also brought forward the MPC meeting and increased the frequency of meetings. This made the market go into a frenzy whereby the expectation was for rates to go high and fast.

In December, the policy rate was further hiked by 100bps. That again created multiple distortions in the debt market as the market started to anticipate more. It turned into a chicken and egg problem whereby the SBP was hiking policy rates to get ahead of the market, but the market was increasing the spread in expectation of higher policy rates.

What’s different this time?

Well for starters, we’re in an IMF program that requires fiscal and monetary discipline. However, despite that, on Tuesday, Prime Minister Imran Khan came out with a “mega relief package” which is far from fiscal prudence. In a televised address to the nation (after a long ramble), the Prime Minister made some major announcements which are deviations from the IMF’s bailout package.

The package had it all, tax exemptions, subsidies, amnesty for the industrial sector, internships, stipends, scholarships, and the commitment to keep fuel and power charges at a low. Needless to say, tax collection doesn’t seem to be on the right foot, whereas there is now more the government will spend instead of collect.

For instance, Prime Minister Imran announced incentives for the information technology (IT) sector by giving 100% tax exemption to both companies and freelancers; 100% foreign exchange exemption and 100% exemption from capital gains tax for investments in start-ups. Moreover, Rs 407 billion to be distributed as subsidized loans under the Kamyab Pakistan Program to the youth, farmers and for low cost housing.

The stipend for the Ehsaas program was increased from Rs 12,000 to Rs14,000 per month, announced a graduate internship stipend of Rs30,000 per month and allocated Rs2.6 million scholarships with Rs38 billion. While these steps may help on the political front by garnering more support from the public, the implications on the budget, the deficit, and the rupee will be drastic. Keeping this in mind, one would expect the SBP to make tough decisions, especially in light of the SBP amendment act.

Expectations for the policy rate

Profit surveyed 17 research departments at financial institutions. 11 expected the policy rate to remain unchanged. Only Adam Securities expected the policy rate to go up by 25 bps, while 5 respondents expected the policy rate to rise by 50 bps. They include Al Habib Capital Markets, BMA Capital, JS Global Capital, KASB Securities, and SCS Trade. AHL expects the policy rate to remain unchanged. Tahir Abbas, head of Research at AHL Research explains, “The rationale behind our stance is based on the downward trend in the CPI due to the relief package announced by the PM. Moreover, a reduction in the current account deficit in the upcoming months is expected, considering the trade deficit for Feb22 is at 10 month low. Lastly, the SBP has already indicated in the last MPS that the current level of money policy settings is appropriate.”

Abbas adds, “Despite the fact that things have changed drastically since the last MPC Meeting, we believe that SBP wil use the ‘wait and watch’ approach for this monetary policy.”

On the note of forward guidance, Fahad Rauf, Head of Research at Ismail Iqbal Securities notes, “ given the rise in commodity prices (SBP expecting a fall), and the start of loose fiscal policy (PM package) could change SBP’s stance on forward guidance.”

Saad Hashmi, Director Research at BMA Capital, however expects a 50 bps hike “due to the 2022 Russian Energy Shock”.

Hashmi explains, “Parallels of this are being made with the 1973 Arab oil embargo, 1979 Iranian Revolution and the 1990 Gulf War. Brent is currently trading at $115+/bbl which means that it is up by $40 since last monetary policy in Jan. This in turn means an external account burdened by an additional $8bn on an annualized basis!”

Can the SBP keep the policy rate status quo?

Unprecedented circumstances is a word we’ve grown quite used to. The IMF was easier with its conditions during the initial stages of COVID. However, as we know more about the virus and the world is going back to normal, the fund has been getting tougher. Despite that, there is now a war between Russia and Ukraine - an important war with all eyes on it. This might give the SBP more room considering the impact the war has had on commodity prices and in the short run on inflation. With these developments, one can expect that the SBP will keep the policy rate unchanged and wait for things to settle down before making any sudden moves that send the market into a frenzy, especially considering the impact of the last rate hike. Moreover, with the PM’s package out and the likelihood of inflation settling down,

the SBP could justify a status quo policy rate. However, the debt market has already started betting on the tightening cycle to continue.

The SBP can hike the policy rate in order to push the government to show more prudence when it comes to fiscal expenditure, especially popularist moves. You may be wondering how? But it’s simple. When the policy rate goes up, the government will have to borrow from banks at higher yields. This may help push them towards spending less as the government will have to pay back debt, interest and also pay for operational expenses. However, this move may not always push the government to save, instead the SBP may have to resort to massive OMO injections as a means for cheaper indirect credit to the government.

The latest T-bill auction conducted on February 23rd, shows that the 3 month cut off yields are up 19 bps to 10.49%, 6 month are up by 23 bps to 10.89%, and 12 month are up by 12 bps to 11%. That isn’t as scary as the fact that the government did not manage to raise much of what it set out to. The target of the auction was Rs 800bn. It received bids of Rs 732 billion but only managed to raise Rs 367 billion.

This shows that not only was the raised amount significantly lower than what the government set out to raise, but also shows that participants’ bids didn’t even equal to that amount.

This is not a case of low liquidity, it is a case of wanting higher yields. In order to raise more, the yields would have to go up higher. In March the government is faced with a big auction target of Rs 1.8tr cumulative in two March auctions.

This distortion in the market will eventually be sorted out through either an OMO to calm markets and flush them with cheap liquidity, or by eventually increasing the policy rate by the end of this fiscal year.

In the past, during an exclusive interview with Profit Magazine, Governor State Bank Reza Baqir however explained how the SBP likes to stay one step ahead of banks and market expectations.

To lead or to follow?

Before the November MPS decision, the market had anticipated at least a 100bps policy rate hike based on the debt market auctions. In order to beat the market, or in other words, lead the market instead of following the lead, the SBP hiked interest rates by 150 bps which is 50 bps over the expectations.

Baqir said, “If the rate increases too much, well above the hundred basis points that the markets were expecting, then that may be counterproductive, because it may signal something that we don’t want to signal. It may signal that the concerns about developments are actually very pronounced, which is not really the case. So the discussion in the MPC was to strike the right balance. And in the view of the MPC, 50 basis points more than what the market anticipated was considered to be striking the right balance in these considerations.”

What all this suggests is that on Tuesday the SBP is still very capable of increasing the policy rate to get ahead of the markets. However with tensions regarding cost push inflation rising the SBP may not be too keen, especially after a mass media campaign signaling a pause in the tightening cycle. The decision to hike drastically will only bring chaos to the markets and push everyone to completely ignore forward guidance.

In short, can the SBP keep the policy rate status quo? Yes. Will they, it’s up to them. Should they, er, well… n

A brief history of Ukraine-Pakistan trade ties

A brief account of Pakistan’s relationship with Ukraine after the dissolution of the Soviet Union

By Saad Tanvir

As the crisis in Ukraine deepens, its effects on the world are far-reaching. Crude and Brent have reached 7-year highs, equity markets around the globe are facing steep decline, and the Pakistani premier has held bilateral meetings with Russian President Vladimir Putin. While the impact on the globe and Pakistan has been direct, there are also larger implications for Pakistan because the country being invaded is Ukraine.

Historically, Ukraine and Pakistan have had a steady relationship based on bilateral trade since the former became an independent nation at the time of the dissolution of the Soviet Union. In August 2021, the Foreign Minister - Shah Mahmood Qureshi said that Pakistan highly values its relations with Ukraine, and desires to enhance bilateral cooperation in all areas of mutual interest.

At present, there are numerous dimensions to the relation between the two states including economic, trade, military, technology, and infrastructure projects. The two vital aspects to this relationship are military and economic trade essentially revolving around weaponry and agricultural output.

The total trade between the two stood at US$ 801.2 million during 2021 including Pakistani exports to Ukraine of US$61.7 million and imports of US$ 739.51 million. Since the inception of Pak-Ukraine relations in 1996 (four years into Ukraine’s independence), Pakistan has been a loyal customer for Ukraine’s armored battle tanks with multiple acquisition and upgradation contracts in place. Apart from military vehicles, 39% of Pakistan’s total imported wheat comes from Ukraine courtesy of a massive supply and demand mismatch in Pakistan. In 2021, the principal import from Ukraine to Pakistan was Cereal (mainly wheat) amounting to US$ 477.8 million, followed up by seeds and fruits, and iron and steel.

On the flip side, Pakistan’s exports to Ukraine have been rather conventional with the primarily focus on staple fibers (cotton yarn, jute yarn, wool yarn, silk yarn etc.) - essentially half of the total exports to Ukraine, followed up by Edible fruits, nuts, rice, raw cotton etc.

Although recently Pakistan has shifted its focus towards Chinese made battle vehicles, Islamabad has been one of the most enthusiastic clients of Ukraine’s arms industry. According to UkrSpetsEksport, a Ukrainian state-owned foreign arms trading agency, Kyiv is currently working on 12 contracts valued at over $150 million.

According to Stockholm International Peace Research Institute (SIPRI), Ukraine has completed arms contracts with Pakistan worth US$ 1.6 billion since its independence. The relation started when Pakistan offered to buy 320 Ukrainian T-80UD tanks in august 1996, which essentially had been introduced during the Soviet Union period before the independence of Ukraine (pre-1991). At a contract cost of US$ 650 million, Pakistan did get the tanks at a 40% discount compared to alternate suppliers primarily due to the dying Kharkiv Malyshev Tank Factory in Ukraine from bankruptcy subject to lack of business activity after the dissolution of USSR. The contract was completed between 1997-2002.

Alongside the acquisition of Tanks, Pakistan has signed a major deal with the same Ukrainian factory valuing at ~ US$ 85.6 million for repair and upgradation of the same 20–25-year-old fleet of Ukrainian T-80UD. This contract once again enabled the Pakistani defense industry to give the Malyshev factory a boost, which was at that time struggling with its burgeoning debt of US$ 67 million.

According to UkrOboronProm, a Ukrainian state-owned agency for managing & promoting the country’s public-sector defense industry, a Memorandum of Understanding (MOU) worth US$ 600 million was signed between High Industries Taxila (HIT) and Ukrspecexport in november 2016, for ‘technical service, maintenance and modernization’ for the Pakistani tanks including an order of 200 - 1,200 hp 6TD-2 diesel engines for the Chinese-Pakistani MBT 2000 tanks, commonly known as Al-Khalid I.

Pakistan also ventured into the Aircraft refueling industry of Ukraine back in December, 2008 and manage to sign an agreement with Ukraine to purchase four IL-78 refueling aircraft outfitted with Russian-designed UPAZ refueling pods, with all aircraft arriving in 2012

Only recently, Pakistan has gone shopping for Ukraine’s aircraft repair services by signing two new contracts to repair its Ilyushin Il 78 refueling tankers. From this, the deal for modernization of one Pakistan Air Force Il-78 aerial refueling tanker aircraft was completed on February 02, 2022, and the aircraft was delivered to the Pakistan Air Force. The deal was worth US$ 30 million signed back in 2020.

“The successful implementation of this contract is another confirmation of the high level of cooperation between Ukraine and Pakistan in the field of military-technical cooperation. We are not putting an end to this, because we have many more joint projects ahead.”

Artur Maksimov, Deputy Director General of Ukrspetsexport.

The second IL-78 refueling tanker deal was signed in June, 2021 at the Arms and Security exhibition in Kyiv, Ukraine, the delivery of which is expected in mid-2023.

Ukraine has also been one of the leading cereal exporters in the world with a penetration of ~9% and total production of 24 million metric tons worth ~ US$ 9.4 billion. Pakistan gets approximately half of its wheat imports from Ukraine amounting to US$ 477.78 million in 2021 out of a total wheat imports bill of ~US$ 930 million, because of the development of a steep demand-supply gap in the Pakistani Wheat industry. Alongside wheat, Pakistan also imports barley, buckwheat, oats, grain & corn. n