10 minute read

The changing dynamics of the telecommunication market

By Ahtasam Ahmad

Two decades after the 2002 Telecom Policy ushered in the mobile communications revolution, the telcos find themselves in search of an unknown path into the future. Their business model for two decades was centered around providing voice and short messaging services for a growing consumer base.

Advertisement

With the rise of social media platforms, and the increasing speeds at which their system is able to operate, data has emerged as the new frontier and none of them is sure how to turn it into a profitable proposition.

This is a dilemma unlike what most other businesses face. Their own investments are rendering their own business model obsolete. Over the past decade, they have invested more than $2 billion in purchase of high speed spectrum and installed the required equipment to provide 4G services to their customers, but in the course of doing so, their own revenue base has been eaten away as the higher speeds have made it possible for their customers to make voice calls and send short messages without using the telcos own service.

Today the telecoms are searching for the business model that helps carry them into the new world that has been ushered in by the proliferation of high speed telecommunications. Two decades ago nobody thought that one day telecoms would be looking at ways to process payments or manage bank accounts, provide streaming content or operate Super Apps to provide myriad services to their customers like hailing a cab, making a restaurant reservation or purchasing cinema tickets.

Today all this and much more is being looked at because, as telecom executives put it, they cannot remain a “pipe” connecting two individuals for much longer. They must branch out into other services.

Once known to be the core of telcos, the voice and texting services have seen a decline in importance as more and more OTT players like Whatsapp and Facebook enter the market. As per PTA annual report 2020, “10% decline in total ARPU occurred because consumers shifted away from traditional voice services.”

The willingness to change

CEO of Jazz, Aamir Ibrahim while he was on a panel discussion arranged by Tabadlab last year stated, “Jazz was a telecom company. Today we are a tech company and in the future we’ll be a data company.” However, he is not the only one to foster this ambition, Irfan Wahab, the CEO of Telenor, in an interview with Profit stated, “The digital economy, it’s a proven thing, will generate most of the wealth in the coming decades. ICT sector exports, young freelancers, startups all have to rely on this and we acknowledge the added responsibility and are committed to that.” These statements and a strategic emphasis on shifting the telecom business model is not new. The search for new business avenues by Mobile Network Operators (MNO) has picked up ever since the digital revolution hit the Pakistani market. A testament to this change was back in 2016 when Jazz launched Veon, an all-purpose app where users could do almost everything using mobile phones like news feeds and self-serving mobile top-ups and cellular bill payments. Though the app proved to be a failure, it underpinned the importance telcos were placing on digital services to replace their core business “Cellular”. The Cellular services have two components; Data and Voice. The demand for data services continues to grow with ample space remaining in the market for MNO’s to acquire. As per PTA, the Mobile Broadband Penetration is around 50% in Pakistan which is comparatively low compared to economies

like China that have a mobile broadband penetration rate of more than 70%.

While the fact that Teledensity is already around 86% in the country coupled with falling voice and messaging revenue leaves the conventional services market a very saturated one with limited opportunities to grow.

PKR 30,181 PKR 30,572 PKR 47,407

What avenues Telcos are exploring?

Mobile Data and Adjacent Digital Services will be the primary revenue streams for Telcos in the future. The importance of Mobile broadband as a revenue stream for Telcos has been widely discussed and the impact of 3G, 4G and now 5G rollout has been assessed in detail over the past few years. However, the data services available in the country are one of the cheapest around the world, but the investment for provision of these services is considerably high. This means that the standalone return on investment from mobile data services would be quite low. However, as the data penetration grows, so will the demand for adjacent services and telecom can be seen as the “Sector of Sectors”. As the economy digitizes, it finds itself an enabler of multiple services. Therefore, venturing into these services segments provides opportunity for synergies and healthy profitability. As per GSMA report, Pakistan: progressing towards a fully fledged digital economy, “Digital economies are multi-faceted constructs: high-speed internet access, digital identity frameworks and multi-sided platforms provide the foundations for effective digital citizenship, rich digital lifestyles and global digital commerce. Mobile is at the center of Pakistan’s national development plan and its progression along the digital society path, helping to close connectivity gaps, increase financial inclusion and sustainably transform verticals as part of the Fourth Industrial Revolution.”

The MNOs are quite aware of the opportunity that lies in the digital sector and they are actively trying to make a shift towards providing these services.

Telenor Pakistan’s parent, in its strategy mentioned, “Beyond our core operations, Telenor will continue to offer selected products and services to offer customers with new solutions. The combination of 5G and other network assets, AI and IoT will bring opportunities to create value further from the core.Telenor will explore such opportunities, in cooperation with customers and targeted partnerships.”

The statement further added, “Monetising these opportunities and delivering on customers’ needs will to a large degree require capabilities outside of what Telenor has today. Thus, developing partnerships is a key priority. This includes partnerships with Big Tech players, traditional players as well as smaller players with more niche capabilities and offerings. Based on these partnerships Telenor seeks to understand the position where it can create the most value, which capabilities it will have to develop and what type of business models to deploy.”

Jazz, in an internal strategy document, also laid down its direction to be; Best self care ecosystem (Jazz World), Win adjacent digital markets & be the market leader: in FinTech, Affordable Device segment, Digital Content, Instant Messaging, Cloud, Data Monetization & Adtech.

However, the search for diversification is not just limited to pieces of paper. There are many onground examples. One such is the Digital Financial Service Market. The telcos specially, Telenor and Jazz are amongst the pioneers of this business model in Pakistan.

Back in 2008 when Telenor partnered with Tameer to develop Easypaisa App, not many people actually understood the business case. However, soon the industry realized the potential of the market. Jazz launched Jazz Cash in 2012 while Ufone followed with Upaisa in 2013.

The market proved a successful endeavor for the Telcos. PTCL, the parent company of Ufone, experienced a declining revenue from its conventional streams between 2018-2021, However, its Mobile banking business saw significant growth.

Jazz on the other side is gearing up to be the market leader. Last year it registered a company for its Digital Financial Service operation with SECP. A move to shift its Mobile Financial Service business to a dedicated entity that will focus on; a separately branded fintech platform

Opening API for merchants, Developing Agent & Merchant network and introducing

PKR 25,645

2018 2019

Source: PTA

2020 2021

Source: UBank Financial Statements

Loan/savings products. The company projects to generate around 15% of its service revenue from DFS by 2023.

Another avenue that the Telcos are actively exploring is the Cloud Computing and IoT services. At present, Pakistan has a very underserved market for cloud solutions. However, in the past few years demand has increased due to the massive growth shown by the country’s IT sector and this has resulted in MNOs providing their own Cloud Solutions.

Earlier this month, Jazz launched its dedicated cloud service platform “Garaj” as per Ali Naseer, Chief Business Officer, Jazz, “Garaj will enable a secure and affordable cloud experience as more businesses and government seek digitalization to capture efficiencies and reinvent their customer experience. Cloud solutions will allow for much needed cost and operational efficiencies, while delivering security and improving the ease of doing work.”

While talking to Profit about their Cloud and IoT ventures, CEO of Telenor said, “In Pakistan, we have deployed tens of thousands IoT solutions primarily in energy management, vehicle tracking and similar solutions. We work with a lot of banks, have been working with energy companies and FMCG merchants like Nestle, Unilever etc.”

He further added, “In the IoT space, our B2B solutions are cloud based and we are selling those cloud solutions to our customers as well. So as the market evolves, you will see more and more shouting around it as well.”While Zong is also offering IoT and Cloud solutions to enterprises through China Mobile’s (Parent Company of Zong) dedicated platform OneNet.

A Step towards diversification

Achange in Business Model will not only have an effect on the revenue model, but also lead to changes in the resource mix. Initially when the Pakistani Telecom market opened up to foreign players in the early 2000s, the focus of all these companies was to build infrastructure and compete on coverage. Therefore, a lot of initial investment went into building tower sites and purchasing equipment.

However, as the market evolved this focus has shifted towards service other offerings which require the MNOs to free up capital to route it into segments that have better ROI.

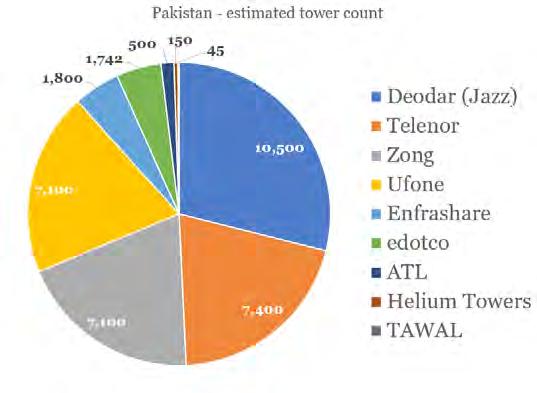

As per TowerXchange’s research, Pakistan has an estimated 36,187 towers serving four MNOs with 189mn subscribers, while estimated 30-40,000 additional towers will be required over the next five years

The research further stated that of the 36,1687 towers, 10,000 operate as co-location that means they serve multiple MNOs.

The model going forward would be that the MNOs outsourcing their infrastructure to third party service providers while they themselves focus on service offerings.

There is a genuine shift towards this approach evident from the developments in the Telecom market over the past few years. An example is Jazz creating a special purpose vehicle, Deodar, and transferring ownership of all its towersites to the company. The aim behind this move is to sell off all the towersites as an incorporated company when a suitable bid arrives.

Official representative of Jazz commented on the matter, “Jazz supports passive and active sharing as it reduces CAPEX and OPEX costs incurred by the business, allowing us to provide quality services specifically to unserved areas. The current regulatory framework entails passive sharing, and we hope to have an update on active and spectrum sharing in the near future to optimize network spend, open secondary markets, and create innovative network expansion opportunities.”

Not just Jazz, but also other operators are moving towards the infrastructure sharing approach.

While talking to Profit, the CEO of Telenor stated, “When we were building most of our sites back in the 2004-2008 period, there were no tower sharing companies. Therefore, we had to build our own infrastructure but now we are sharing and we are sharing quite substantial numbers”.

He further added, “However, I suggest we should move on from passive sharing to more active sharing like in other countries where regulators and the policymakers are moved to the point that they allow for electronics and frequencies to be shared. Because that’s where the biggest synergy lies.”

Last year, as per TowerXchange, Telenor and Zong undertook Pakistan’s first RAN sharing trials across around 30 sites. A step towards active infrastructure sharing.

Ufone also has been searching for a suitable sale and leaseback transaction for its tower sites across Pakistan.

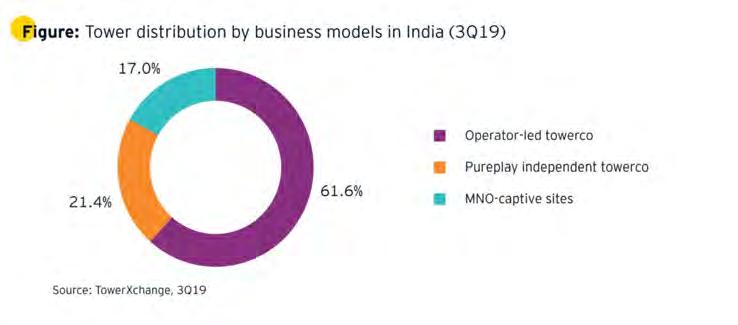

A very pertinent example of Asset light strategy is the Indian telecom market. As per EY report, From evolution to revolution, India has 83% sites with shared infrastructure, only second to China’s 100%.

In the report, “How telecom companies can win in the digital revolution”, published by McKinsey & Company, it is mentioned that for telcos to lift their business, there is a need for two major changes. First one would be the reinvention of core services while second would be to pursue adjacencies.

This is the path that most telcos have adopted and the Pakistani companies are no different. In the next few years the pace of change will speed up and one thing is certain that going forward, connectivity will be just one of the many services that Telcos provide. n

Source: TowerXchange