UBL

presents better than expected half year results

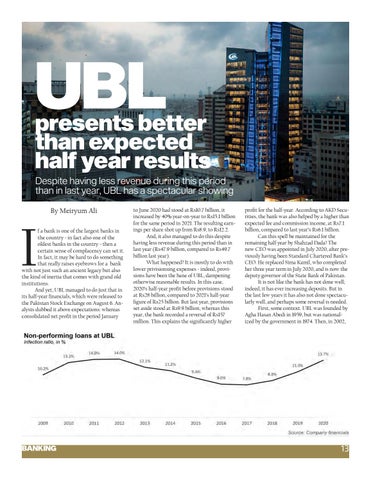

Despite having less revenue during this period than in last year, UBL has a spectacular showing By Meiryum Ali

I

f a bank is one of the largest banks in the country - in fact also one of the oldest banks in the country - then a certain sense of complacency can set it. In fact, it may be hard to do something that really raises eyebrows for a bank with not just such an ancient legacy but also the kind of inertia that comes with grand old institutions. And yet, UBL managed to do just that in its half-year financials, which were released to the Pakistan Stock Exchange on August 6. Analysts dubbed it above expectations: whereas consolidated net profit in the period January

BANKING

to June 2020 had stood at Rs10.7 billion, it increased by 40% year-on-year to Rs15.1 billion for the same period in 2021. The resulting earnings per share shot up from Rs8.9, to Rs12.2. And, it also managed to do this despite having less revenue during this period than in last year (Rs47.9 billion, compared to Rs49.7 billion last year). What happened? It is mostly to do with lower privisionsing expenses - indeed, provisions have been the bane of UBL, dampening otherwise reasonable results. In this case, 2020’s half-year profit before provisions stood at Rs28 billion, compared to 2021’s half-year figure of Rs25 billion. But last year, provisions set aside stood at Rs9.9 billion, whereas this year, the bank recorded a reversal of Rs157 million. This explains the significantly higher

profit for the half-year. According to AKD Securities, the bank was also helped by a higher than expected fee and commission income, at Rs7.1 billion, compared to last year’s Rs6.1 billion. Can this spell be maintained for the remaining half year by Shahzad Dada? The new CEO was appointed in July 2020, after previously having been Standard Chartered Bank’s CEO. He replaced Sima Kamil, who completed her three year term in July 2020, and is now the deputy governor of the State Bank of Pakistan. It is not like the bank has not done well; indeed, it has ever increasing deposits. But in the last few years it has also not done spectacularly well, and perhaps some reversal is needed. First, some context. UBL was founded by Agha Hasan Abedi in 1959, but was nationalized by the government in 1974. Then, in 2002,

13