3 minute read

Sri Lanka's economic reform plan to end bankruptcy by 2026

from Epaper_23-02-9 KHI

islamabad news desk

On Tuesday, Sri Lanka's President Ranil Wickremesinghe announced that the country will remain in a state of bankruptcy for at least three more years as he aims to repair the government's finances that have been devastated by an unprecedented economic crisis.

Advertisement

The President took office during a time of national unrest due to shortages of food, fuel, and medicine. Since then, he has pushed through tax hikes and negotiated with international creditors after a default on Sri Lanka's foreign debt in order to secure an IMF bailout.

Wickremesinghe stated that the economy may have contracted by up to 11% in the last calendar year, causing foreign exchange reserves to dry up and leaving traders unable to import vital goods.

However, he expects the economy to return to growth by the end of 2023 as new revenue measures boost government coffers. The President's policies, including tax increases and the removal of fuel and electricity subsidies, have been unpopular among Sri Lanka's public, who have already been hit hard by the crisis and rampant inflation. At the same time as

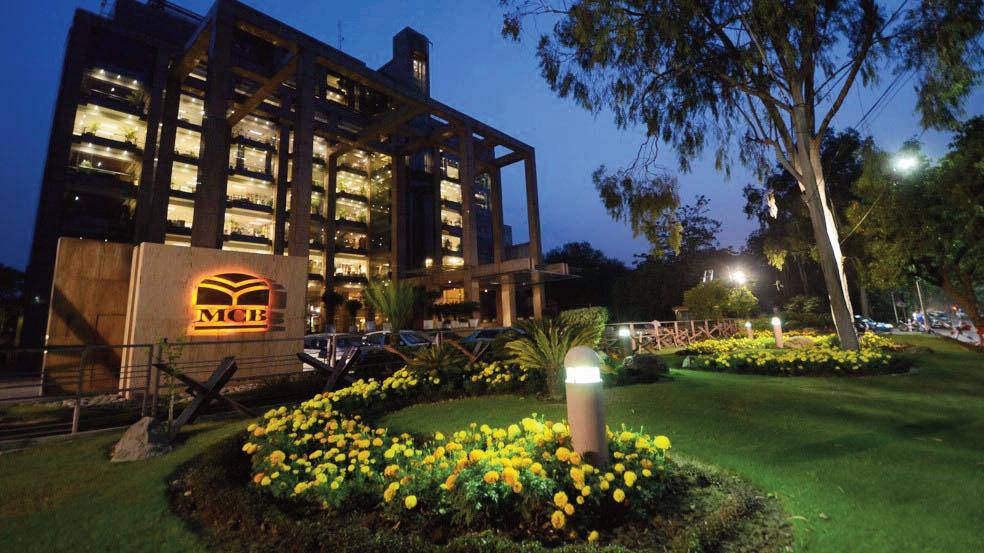

MCB Bank posts highest ever profit before tax of Rs71.4b

lahore staff report

The Board of Directors of MCB Bank Limited (MCB) in its meeting under the Chairmanship of Mian Mohammad Mansha, on February 08, 2023, reviewed the performance of the Bank and approved the financial statements for the year ended December 31, 2022. The Board of Directors has declared final cash dividend of Rs. 6.0 per share i.e. 60%, in addition to 140% already paid, bringing the total cash dividend for the year 2022 to 200%.

With strong build up in core earnings, MCB’s Profit Before Tax (PBT) for the year ended December 31, 2022, posted an impressive growth of 37.3% to reach a historic high of Rs. 71.4 billion. Retrospective application of tax amendments along with higher tax rates for the current year enacted through Finance Act, 2022 resulted into a 54% average tax rate for the year compared to an average tax rate of

41% for last year. Profit After Tax (PAT) registered a growth of 6.3% and increased from Rs. 30.8 billion to Rs.

32.7 billion; translating into Earning Per Share (EPS) of Rs. 27.63 as compared to EPS of Rs. 26.00 reported in the last year.

On the back of strong volumetric growth in current account and favourable yield curve movements, net interest income for the year ended December 31, 2022 increased by 36% over last year. Average current deposits of the Bank registered a highest ever growth of Rs. 96.8 billion (+18%) in 2022, on the back of strategically focused drive.

Non-markup income registered a growth of 23% and reported a base of

Rs. 24.6 billion against Rs. 20.1 billion in the last year. Improved transactional volumes, diversification of revenue streams through continuous enrichment of Bank’s product suite, investments towards digital transformation and an unrelenting focus on upholding the high service standards supplemented a growth of 14% in fee income. The contribution from foreign exchange line, debit cards, trade business and home remittances remained strong during the year.

The Bank continues to manage an efficient operating expense base and manage costs prudently. Despite exceptionally high inflation, impact of currency devaluation and continued investments in human resources, branch network and technological upgradation, operating expenses of the Bank were recorded at Rs. 41.8 billion, growing by 17% over the last year, while the cost to income ratio significantly improved to 37.4% from 42.4% reported in the last year.

Wickremesinghe's policy address, a huge trade union strike took place, with air traffic controllers, doctors, and other industries staging work stoppages.

The President stated that Sri Lanka is in the final stage of IMF discussions to secure a preliminary $2.9 billion bailout, which has been delayed by debt restructuring negotiations with China and other major creditors. Wickremesinghe said that Sri Lanka is in direct discussions with China about its outstanding debt and is working towards a final agreement. He concluded by saying that if the country follows the plan, it can rise out of bankruptcy by 2026.

To read the full article visit www.brecorder.com

Pak-Italy collaboration to promote Olive Culture through training

The OliveCulture initiative is a joint effort between the Pakistani government and Italian Cooperation aimed at promoting olive farming and cultivation in Pakistan. As part of the Project , experts from Italy are invited to Pakistan to share their knowledge with local farmers. These experts conducted training sessions in three provinces (KP, Punjab, and Balochistan) for over 800 stakeholders. A recent training session took place at the Salahuddin Farm in Manki Sharif, Nowshera district, as part of a three-week program on Olive Good Agronomic Practices. The well-kept olive orchard serves as a model for the rest of Pakistan. pr