Venue: GMP Sports & Social Club, The Hough End Centre, Manchester

Chairman’s Welcome

Welcome to our third NWFF conference.

I am very excited about the event today and am looking forward to hearing from all the speakers including City of London Police, PSFA and Dr Felia Allum. I want to thank each and every speaker for agreeing to speak at the conference - without you we wouldn’t be able to put on the event.

Over the last year NWFF have held four masterclasses on topics such as whistleblowing, cyberfraud, Company House reforms, ECTA and ESG Fraud and have hosted a Christmas networking session The fraud forums nationally are a key asset in the fight against fraud - creating relationships between fraud investigators, upskilling through masterclasses and allowing best practice to be shared. Whilst I am encouraged that there has been a reporting of a 10% drop in the levels of fraud in the UK, there is no room for complacency due to the looming threat of artificial intelligence and the rise in organised fraud against sectors such as the telecommunications and online retail sector. I am however heartened by the government’s commitment to developing a new expanded Fraud Strategy and I look forward to the Data Use and Access Bill coming into law which will allow a new framework for the sharing of information for the prevention of crime - something I have been mentioning for years now.

On a more localised level the NWFF are keen to continue to grow and I would ask that you spread the word and encourage others to join. In the next year we have several masterclasses being planned. The next one will be a hybrid event on 1 April led by the ICO covering the topic ‘The price of a line and the unlawful trading of data’.

We are also on the look out for new topics so please do email me if you would like to present or have any ideas of what you would like covered.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Chairman’s Welcome

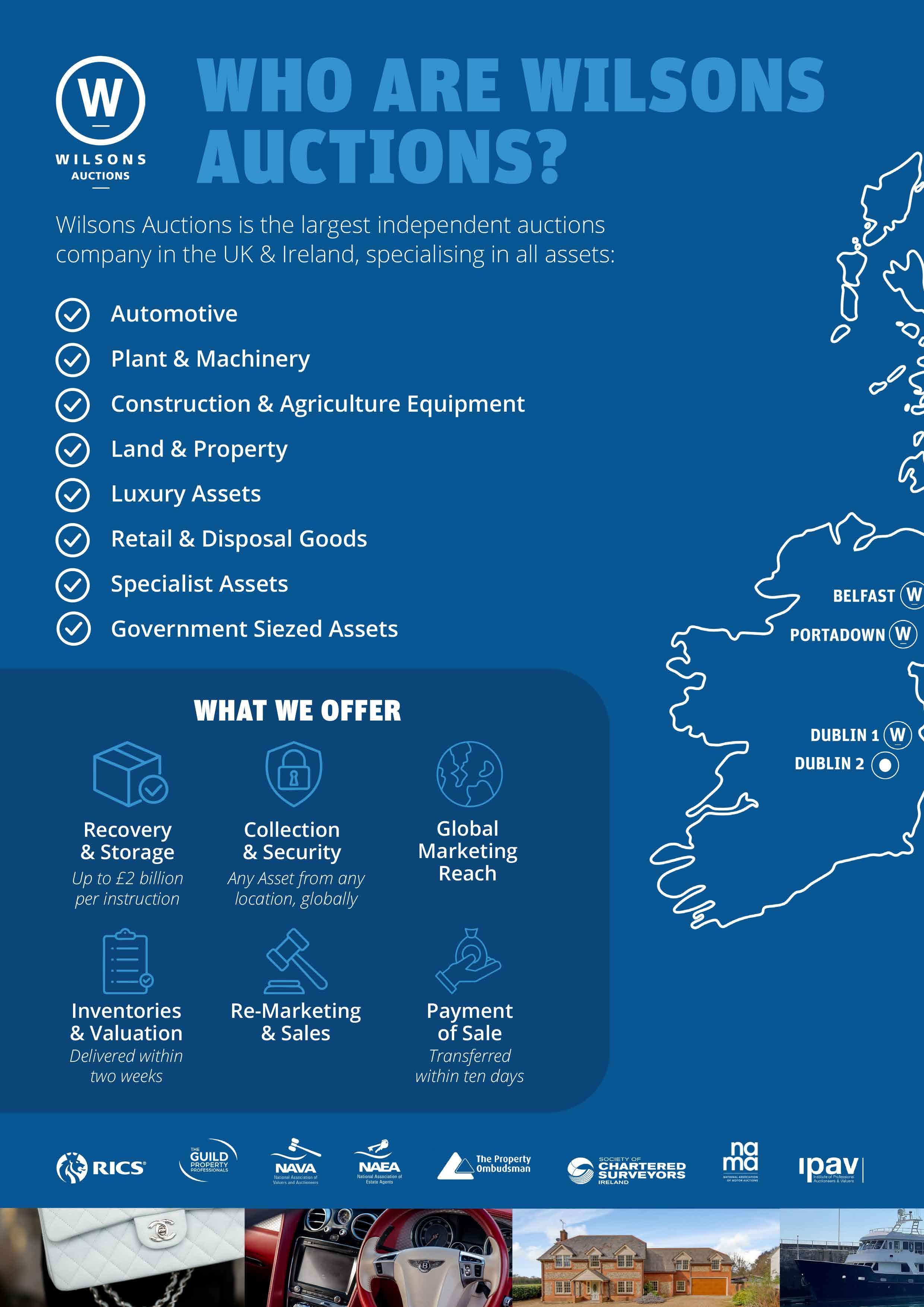

Finally, I would like to take this opportunity to thank our sponsors: NWROCU, The Insolvency Service, RGI Solutions, Wilsons Auctions, Altia, Asset Reality and WPC Software. Without such support events such this conference would simply not be possible.

Claire Graham Chair and Director of

the NWFF Claire.Graham@tlt.com

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

AGENDA

08.30: REGISTRATION, COFFEE MEET OUR EXHIBITORS

09.10: CHAIRMAN’S WELCOME

Claire Graham, Chair of NWFF

09.15: OPENING OF CONFERENCE

Kate Green, Deputy Mayor of Greater Manchester, Safer and Stronger Communities

09.30: UPDATE ON NATIONAL FRAUD STRATEGY AND INTENSIFICATIONS

T/Detective Superintendent Oliver Little, City of London Police

10.05: FRAUD STRATEGY - THE NORTH WEST FOCUS

ACC Rowan Moore, NWROCU

10.25: THE GOVERNMENT'S STRATEGY & VISION TO PREVENT AND DETECT PUBLIC SECTOR FRAUD

Rob Malcomson, Public Sector Fraud Authority

11.00: COFFEE, NETWORKING MEET OUR EXHIBITORS

11.30: NHS FRAUD - CRADLE TO GRAVE CASE STUDY

John Marsden - Ex Blackpool Teaching Hospitals NHS Trust (recently retired)

12 05: FRAUD RISK AND THE IMPORTANCE OF GOOD CULTURE WITHIN YOUR BUSINESS

Megan Quilter, BDO

12.25: MEET THE PLATINUM SPONSORS

12.35: LUNCH, NETWORKING MEET OUR EXHIBITORS

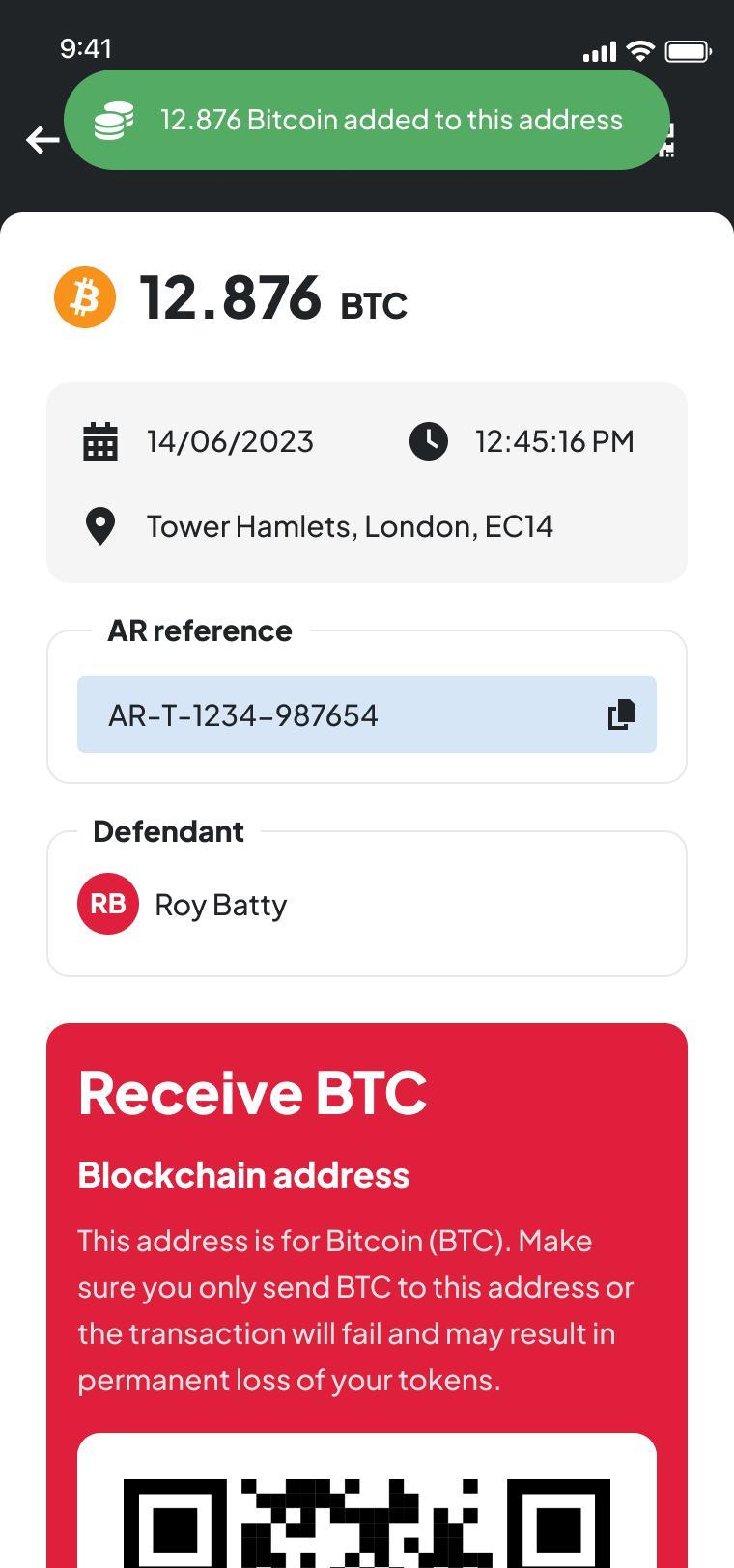

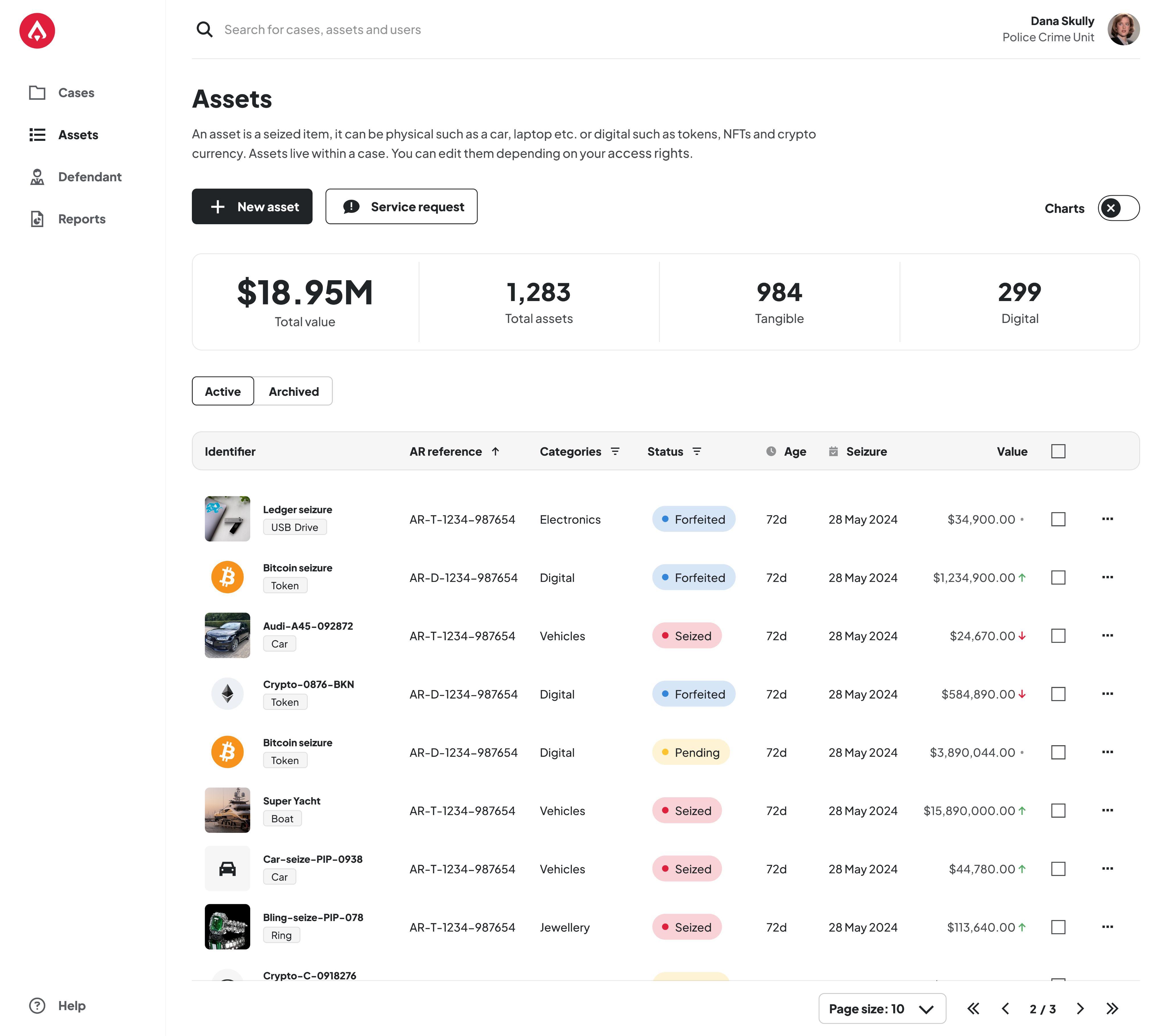

13.35: MIND THE GAP: INVESTIGATION TO CUSTODY AND WHAT LIES BETWEEN (A FOCUS ON THE OVERLOOKED BUT CRITICAL ROLE OF ASSET SEIZURE IN COMBATING FINANCIAL CRIMES)

Dani Haston, Asset Reality

14.10: FAILURE TO PREVENT FRAUD CORPORATE OFFENCE

Polly Sprenger, Addleshaws

14.45: COFFEE, NETWORKING MEET OUR EXHIBITORS

15.15: SHINING A LIGHT ON ORGANIZED CRIME AND GENDER: UNPACKING THE GENDERBLIND SPOT IN FRAUD AND WHITE COLLAR CRIME INVESTIGATIONS

Felia Allum, University of Bath

15 50: PROSECUTION STRATEGY AND PUBLIC INTEREST

Joseph O’Connor, CPS

16.25: CONFERENCE SUMMARY CLOSE

16 30: NETWORKING POST CONFERENCE DRINKS

Email: admin1@northwestfraudforum.co.uk

SPONSORS

North West Fraud Forum would like to thank our sponsors and exhibitors, whose support is invaluable in helping us to put on events.

Sponsors and Exhibitors

Email: admin1@northwestfraudforum.co.uk

Speaker Biographies

Claire Graham, Partner, TLT LLP

Claire is the Chair of the NWFF and a solicitor and partner at TLT LLP.

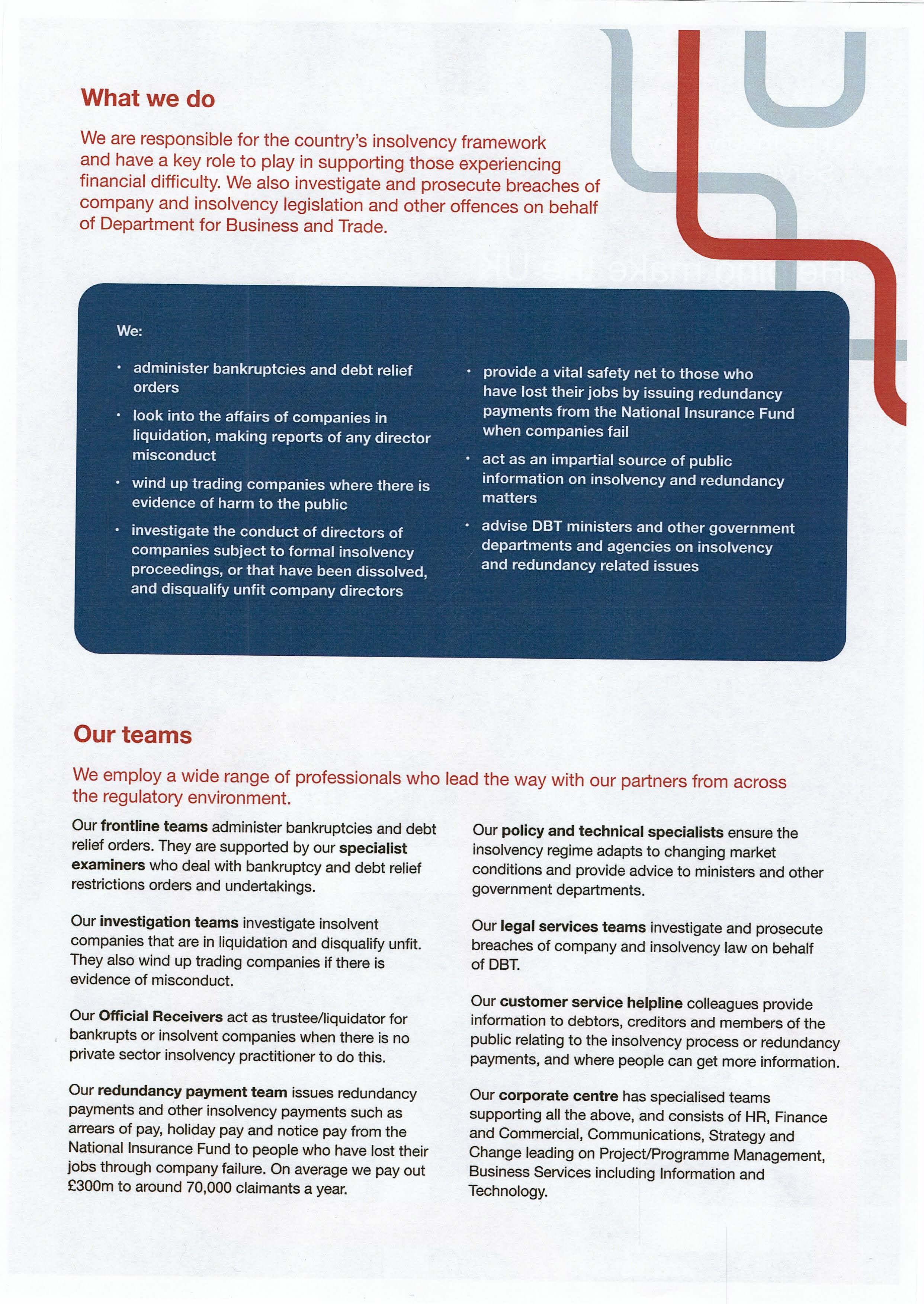

Claire has extensive expertise in commercial litigation and in claims relating to fraud. Her practice includes advising Insolvency Practitioners on contentious insolvency matters (including fraud, breaches of fiduciary duties and civil recovery actions). Claire heads up a team which carried out investigations for entities such as the Department of Business, and Trade. The team also acts on behalf of Official Receivers in respect of contentious insolvency matters. Such actions arise out of fraud but also include the recovery of extensive director loan accounts, carrying out tracing claims, advising on trusts and preference claims.

Claire has acted for the Insolvency Service for over 25 years advising it in respect of company law and insolvency issues, including director disqualification investigation and applications, and bankruptcy restriction applications. Claire is often instructed to advise the Insolvency Service in respect of public interest winding up matters where she uses her extensive experience in pursuing provisional liquidator appointments and injunctions.

Claire has experience of seeing life from the client’s perspective having been trained as an investigator during an 18-month secondment with the Insolvency Service. Claire has extensive investigation experience and is currently carrying out investigations into targeted limited companies under S447 of the Companies Act 1985 on behalf of the Secretary of State for Business and Trade.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Kate Green, Deputy Mayor of Greater Manchester with responsibility for Safer and Stronger Communities

Kate Green was appointed as Deputy Mayor of Greater Manchester with responsibility for Safer and Stronger Communities in January 2023. From 2010 to 2022, she served as the Member of Parliament for Stretford and Urmston. While in parliament, Kate held a number of shadow ministerial posts, including Shadow Secretary of State for Education, and Shadow Minister for Women and Equalities, and served on the Justice, Home Affairs and Work and Pensions select committees, and the Public Accounts Committee.

Prior to her election to parliament, Kate was Chief Executive of the Child Poverty Action Group and before that Director of the National Council for One Parent Families (now Gingerbread). She worked in the Home Office between 1997 and 2010 on community safety, criminal justice and police reform, with a focus on performance measurement. Kate served as a magistrate for 16 years. She is a member of the board of governors at Manchester Metropolitan University, sits on the Museum of Science and Industry Advisory Board, and is a trustee of Manchester Camerata.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Detective Superintendent Oliver Little, City of London Police

Detective Superintendent Oliver Little has been working in key policing leadership roles in economic crime for 15 years with experience across Cyber and Fraud operations, including industry funded units. Prior to his current post he was on secondment to the National Economic Crime Centre where he lead a series of national multi-agency intensifications targeting fraud and money laundering. In his current role he leads the coordination of the policing response across forces and regions and is a board member of the London and South East Fraud Forum.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Assistant Chief Constable Rowan Moore, North West Regional Organised Crime Unit

Rowan Moore joined the North West Regional Organised Crime Unit (NWROCU) in 2024, following his promotion from the Police Service of Northern Ireland (PSNI). With 29 years of service, Rowan has held diverse roles in neighbourhood policing, anti-corruption, surveillance, undercover policing, CID, and strategic firearms command.

Rowan began his policing career with Kent Police before transferring to the Royal Ulster Constabulary in 1998. He served in response and neighbourhood teams in Omagh and Belfast, later specialising in covert policing and firearms command. Rowan has extensive experience in the operational, tactical, and strategic delivery of proactive counter-terrorist and counter-serious organised crime (SOC) operations in Northern Ireland.

As the head of PSNI's Specialist Operations Branch, Rowan was responsible for Air Support, CTSFO Teams, Surveillance, Undercover Policing, and Firearms Command. Most recently, he served as the local policing commander for Belfast.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Rob Malcomson MBE, Deputy Director for Data, Analytics & AI at the Public Sector Fraud Authority

Rob Malcomson leads the data, analytics, and artificial intelligence work of the Public Sector Fraud Authority (PSFA). This includes oversight of key initiatives such as the National Fraud Initiative (NFI), the Single Network Analytics Platform (SNAP), the Counter Fraud AI Programme, and the Digital Economy Act Team.

With 14 years of experience in counter fraud and economic crime, Rob specialises in leveraging data and analytics to prevent and detect fraud and improper payments. He has designed and delivered data-driven counter fraud solutions across a wide range of areas, including taxation, welfare, education, criminal justice, grants, housing, company incorporation, and digital identity fraud.

Rob’s earlier career includes leading public sector fraud policy, legislation, and strategy development for the UK Government and the Counter Fraud Function. He also served as Chair of the International Public Sector Fraud Forum, collaborating with global partners to tackle fraud in the public sector. Rob was awarded an MBE for his public service and for his charity work with Manchester Pride and akt, a dedicated LGBTQ+ youth homelessness charity, reflecting his dedication to both professional excellence and community impact.

His expertise is supported by a post-graduate qualification in counter fraud and corruption, for which he was awarded a distinction. Additionally, he qualified as a Chartered Public Finance Accountant during his time at the Audit Commission, where he worked with local authorities, police, and NHS organisations to conduct statutory and system-based audits.

In his current role, Rob remains committed to innovating and improving the use of data and technology to combat fraud, delivering impact across the public sector and beyond.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

John Marsden, Ex Blackpool Teaching Hospitals NHS Trust (recently retired)

Prior to his recent retirement, John Marsden was directly employed as an accredited Local Counter Fraud Specialist (LCFS) by Blackpool Teaching Hospitals and was responsible for the delivery of a fully inclusive Counter Fraud provision for the Trust and a small Independent Health Provider.

Having 20 years’ experience as a senior benefit fraud Investigator for a Local Government authority, in 2009 John moved into the NHS for a new challenge. Initially John provided a counter fraud provision to a number of NHS clients as a consortium based LCFS, however, in 2013 John made the move to Blackpool Teaching Hospitals as their “full time” LCFS.

As a substantive LCFS John could instil, develop and enhance a counter-fraud culture that ensured a zero-tolerance attitude towards fraud, bribery and corruption was embedded across the Trust.

John has led on a numerous investigations that have resulted in custodial sentences, community service orders, cautions, fines and compensation orders (POCA). John has also provided evidence to numerous internal disciplinary hearings and been the principal witness for a number of GMC/NMC/GDC regulatory body hearings, leading to gross misconduct outcomes and striking off orders.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Megan Quilter, BDO LLP

Megan Quilter is an ACA qualified Economic Crime Specialist with 10 years of experience in professional services providing advisory services to a wide range of clients regarding fraud risk and other elements of economic crime.

Jamie Lankey, RGI Solutions

Jamie has been with RGI since 2008 and has brought with him considerable multi lines technical investigative management experience. Having worked in an operational fraud management role for a large UK general insurer, Jamie has a detailed understanding of how RGI can assist our clients by accurately contributing to the measurement processes relating to investigation management and savings. Jamie has operational management responsibility for our investigation teams ensuring that the quality and performance of both our in house and field investigators always meets and excels our client’s level of expectation.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest