1 minute read

Housing Affordability

Supply Challenges Key Conerns in 2021

BY ROBERT DIETZ

Economic data improvement slowed at the start of 2021, as virus cases remain elevated and some local economies have enacted tightened activity restrictions. For example, December saw the first net job loss nationwide since April, with payroll employment down 140,000 and the unemployment rate flat at 6.7%.

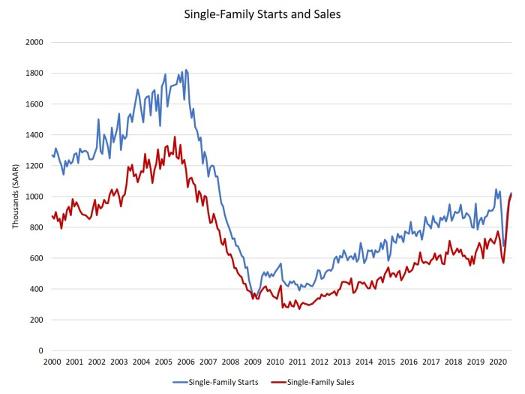

Choppy macroeconomic conditions will persist at least through the first half of 2021, as the rollout of the vaccine continues. However, housing data remain robust, though somewhat reduced compared to the fall of 2020. Mortgage purchasing activity slowed in recent weeks but remains 10% higher year over year. And home building and remodeling employment increased 22,700 in December. The sector has now offset all of its job losses from the spring of 2020.

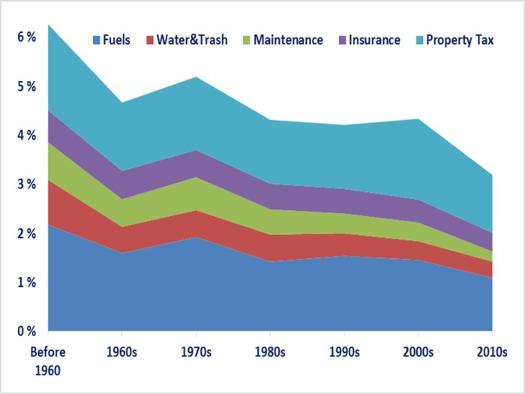

Housing affordability will be the key challenge of 2021. Interest rates are expected to increase somewhat. And new home prices will rise even higher largely because of ongoing gains in construction costs — led by a resurgence in lumber prices. In fact, softwood lumber prices recently climbed back to near their midSeptember highs.

Combined with delays and cost increases for other building materials and low lot supplies in some regional markets, builders will need to balance higher costs with the ability to expand home building volume. These factors have led to two consecutive months of declining builder confidence. Though sentiment remains relatively strong, according to January’s NAHB/Wells Fargo Housing Market Index reading of 83, these declines reflect growing supply-side market challenges. Moreover, they add to the growing uncertainty regarding potential tax and regulatory policy changes that could slow the overall recovery.