TOUCH Electronic Measuring System

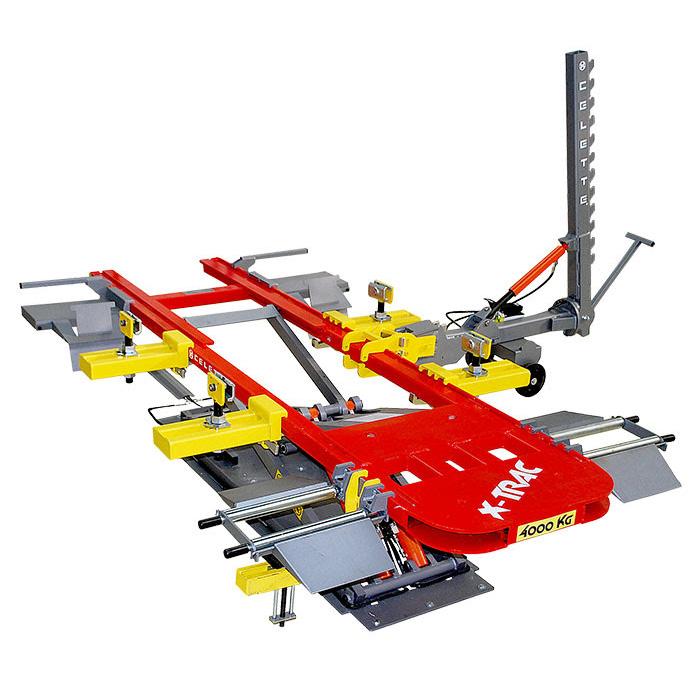

The Spanesi® Touch Electronic Measuring System and Multibench Structural Repair Workstation are designed to work together seamlessly.

The Multibench allows technicians to drive most vehicles directly onto its low-profile ramps. After the vehicle is disassembled to evaluate the damage, the Touch rolls right up, letting the technicians gather measurement data in no time.

With its 10-ton pulling column, the Multibench also serves as a single-bay repair solution. Finally, technicians use Touch to check structural repairs and ensure proper OEM specifications are achieved.

MULTIBENCH

Structural Repair Workstation

Touch Electronic Measuring System: Comparative Measurements

Complete Documentation

Mechanical Parts Measurements

Suspension Parts Measurements

User Added Points with Photos

Vehicle Frame and Structural Items

Wheel and Tire Alignment Checks Multibench Structural Repair Workstation:

COVER STORY

BY CHASIDY RAE SISK

VEHICLE VALUATION EXPERTS APPRAISE TOTAL LOSS CONCERNS

Total loss doesn’t always mean “end of life.”

LOCAL NEWS

10 DON’T MISS THE BOAT: RATE INSURANCE COMPANIES IN WMABA SURVEY

Don’t miss out on rating insurance companies.

12 “WHO PAYS FOR WHAT?” SURVEYS: HOW THIS POWERFUL TOOL IS HELPING REPAIRERS SUCCEED BY ALANA QUARTUCCIO BONILLO

CRASH Network and Collision Advice track trends.

CIC STRESSES SAFE REPAIRS REQUIRE RESEARCH

Shops eager to do the right thing for consumers.

INDUSTRY ADVICE: ASK MIKE WHAT SHOULD BE CONSIDERED IN A REALISTIC LABOR RATE CALCULATION?

Identify your cost of doing business.

My entire body quivered as perspiration dripped down my nose. After years of fantasizing about this day, the imminent reality of what was about to happen – and my anticipations about how it would change me forever – filled me with equal parts fear and excitement.

I’d thought I was prepared, but my trembling legs indicated otherwise, and I couldn’t seem to control my shaky breath as I wondered: “What if I’m bad at this?” Adjusting my shoulder strap and gathering courage, my foot penetrated the threshold of a room filled with men I’d never met. My “press” badge carried the weight of a Scarlet A, warning those around to avoid me.

On March 18, 2011, I attended my first collision repair industry event: the NORTHEAST® Automotive Services Show. Admittedly, I remember little of what I learned, but I vividly recall feeling completely overwhelmed and out of place. I knew no one, and as an introvert, I wasn’t sure I wanted to get to know them in the first place.

Well, if that young woman could visit her future (my present), she wouldn’t know what to think!

Not to say that I don’t experience a little mild trepidation before every event…but earlier this year, at the most recent Collision Industry Conference (CIC), I found myself in a room filled with friends, acquaintances and some folks I’ve yet to encounter but look forward to meeting. My brand-spanking-new Gold Pin announced my employment with Thomas Greco Publishing, and I wore it with pride.

In 2011, I quickly sat in a chair near the back of the room and took a couple of poor-quality photos, refusing to turn my flash on for fear of disturbing attendees. I struggled to scribble every word uttered by a presenter, walking out with 50-plus pages in notes. As far as networking, I spoke only when spoken to, barely concealing my mortification when people greeted me, forcing me to raise my ducked head. I exchanged business cards with less than a dozen brave souls

PRESIDENT Steve Krieps steve@gregclineauto.com 304-755-1146

VICE PRESIDENT Rodney Bolton boltonconsulting61@gmail.com 443-386-0086

TREASURER Kris Burton kris@rosslynautobody.com 703-820-1800

SECRETARY Phil Rice phil@ricewoods.com 540-846-6617

IMMEDIATE PAST PRESIDENT Torchy Chandler Torchy Chandler torchy.chandler@gmail.com 410-309-2242

BOARD OF DIRECTORS

Don Beaver (donbeaver3551@gmail.com) 443-235-6668

Barry Dorn (bdorn@dornsbodyandpaint.com) 804-746-3928

EXECUTIVE DIRECTOR

Jordan Hendler (jordanhendler@wmaba.com) 804-789-9649

WMABA CORPORATE OFFICE

P.O. Box 3157 • Mechanicsville, VA 23116

Bill Hawkins (hawkinswilliamjr@gmail.com) 510-915-2283

John Shoemaker (john.a.shoemaker@basf.com) 248-763-4375

who attempted to break through my self-imposed isolation.

Fast forward to 2022: From my position in the front row, I snapped as many photos as necessary to get a decent shot (sorry to y’all who got half-blinded by the flash) and calmly typed a dozen pages worth of notes (Check out the recap of CIC’s educational program on pages 14 & 20) and captured hours’ worth of audio recordings.

When I spoke to people, I didn’t duck my head this time; I met their eyes. I chatted with old friends and handed out business cards to new ones. Dinner with my favorite Collisionista, learning to fold a dollar bill into a heart (Mrs. Terlep did it beautifully) and an afterreception Uber ride to grab burgers with a friend were just a few of the things that would have made my younger self’s jaw drop.

But what Chasidy of 2011 truly wouldn’t believe? I enjoyed the hell out of myself! Despite it being a whirlwind of a working trip, despite taking a five-hour flight each way to spend a mere 52 hours in Phoenix, I had an absolute blast learning more about this industry, catching up with folks I admire and simply feeling like this is where I’m supposed to be. It seems like that comfort level grows with each event I attend, and I’m eagerly looking forward to the day that those pre-event butterflies don’t visit.

The next BIG event on my calendar will take me back to the beginning, back to the Meadowlands Exposition Center in Secaucus, NJ for NORTHEAST 2022 on March 18-20. This will be my TENTH in-person NORTHEAST event, yet it almost feels like my first time. Don’t we all get butterflies when we encounter our “first” again?

Hopefully NORTHEAST is on your calendar too, so be sure to say hi (just find the gal with blue hair, my personal debut for this awesome weekend)! But if it isn’t, what are you waiting for? Register at aaspnjnortheast.com H&D

PUBLISHER Thomas Greco thomas@grecopublishing.com

SALES DIRECTOR Alicia Figurelli alicia@grecopublishing.com

EDITORIAL/CREATIVE Alana Quartuccio Bonillo COORDINATOR alana@grecopublishing.com

MANAGING EDITOR Chasidy Rae Sisk chasidy@grecopublishing.com

OFFICE MANAGER Donna Greco donna@grecopublishing.com

PRODUCTION Joe Greco COORDINATOR joe@grecopublishing.com

WMABA is planning an in-person membership meeting March 24 at the old stomping grounds of PJ Skidoo’s in Fairfax, VA, and with special guests Mark Allen and Shawn Hart from Audi of America giving us all insight into “Structural Diagnosis: Is it Bent? And how do you know?

It’s not been often we’ve been able to get together since the beginning of the pandemic, and well, it’s about time! This much-anticipated dinner - which is welcome to members and non-members alike! will be an opportunity to come out, have community time and get educational information relevant to the hurdles being faced today.

In between bites, Mark and Shawn will give us their unique perspective – from a major manufacturer- on the strategies and processes a repairer can align to when it comes to ascertaining structural damage. Their combined decades of training in our industry, combined with their candid personalities, will make for a great evening.

Along with the special presentation, we will present our current WMABA Board of Directors and enjoy reception-style time to mingle and connect.

Go, right now, and get your reservation at www.wmaba.com!

If you’re not currently a member, make sure you come

With all the current issues in the industry, we know one thing we can have and be in control of: Getting together as collision repairers. Shipping delays, employee shortages, inflation, technology advancements, vehicle procedure changes and so on. It’s harder and harder to stay up on training and vehicle changes, and this community needs to stick together, and learn from each other, now more than ever.

Meeting in person gives us the rubbing of elbows we need right now. It’s important to know your community, and to have colleagues you don’t see as competitors, but rather as teammates. We’re all in this industry together, and WMABA is the place where it’s all about furthering the professionalism of our trade. You get beat up on enough; this is a great way to have a refreshing night among friends.

with plans to join up! It’s never been more important to support your association doing the work in the industry, helping to give insightful information, educational opportunities and a “hotline” for resources. You’d be surprised at all the connections we have when a shop has an issue!

Jordan Hendler (804) 789-9649 jordanhendler@wmaba.com

Rely on what Mazda drivers already know-Genuine Mazda parts extend a

Designed specifically for Mazda vehicles

Get the right part the first time

We're an accurate, trusted resource as close as your phone Give us the opportunity to serve you

Contact these Mazda dealers for all your parts needs:

Brown’s Fairfax Mazda

10570 Lee Hwy

Fairfax, VA 22030

Toll Free: 800-234-8642

Phone: 703-385-3994

Fax: 703-591-5348

Fitzgerald Mazda

114 Baughmans Lane

Frederick, MD 21702

Toll Free: 800-545-4745

Fax 877-696-1841

E-mail parts@fitzmall com

www fitzparts com

Nu Car Mazda

172 North Dupont Hwy

New Castle, DE 19720

Toll Free: 800-346-5283

Fax: 302-322-7135

Fitzgerald Mazda of Annapolis

1930 West Street

Annapolis, MD 21401

Toll Free: 866-280-8022

Phone: 410-224-4636

Fax: 410-224-4264

www fitzmall com

Ourisman Mazda of Rockville 801 Rockville Pike

Rockville, MD 20852

Parts Direct: 301-340-7668

Phone: 855-417-4511

Fax: 240-499-2488

e-mail: rockvilleparts@ourismanautomotive com

www ourismanmazdaofrockville com

If you spend an hour in a room full of collision repair professionals, you’re bound to hear a few stories about the industry’s challenging interactions with insurance carriers, but all insurers are not created equal.

Borne from a desire to know how claims are handled in the Mid-Atlantic region, WMABA has opened its second biennial “Shops Rate Insurers” survey as part of its ongoing efforts to create and provide consumer-driven resources, tools and information to help the collision repair industry at-large.

Conducted online, the survey allows repairers to anonymously rate insurance company behaviors in several categories, including shop relations/claims handling, customer experience, insurer knowledge base, overall fairness, insurer payment for proper procedures and transparency. Collision shops will rate each insurer on a scale of 1 to 5, with 1 being the lowest score and 5 being the highest.

Survey respondents also have the opportunity to share specific feedback regarding the largest insurers by market share to help identify trends and issues as they emerge and develop resources and solutions to support WMABA members and their customers.

WMABA launched its first Insurance Survey in December 2018, attracting high participation. Results from the previous survey supported many expected perspectives – both positive and negative – about certain carriers, but it also yielded some unexpected findings. Additional comments from survey respondents indicated beliefs that insurers are only concerned about profits and that they are tragically prone to disregarding OEM. Not surprisingly, many repairers expressed frustrations with adjusters’ continuous insistence on the “We don’t pay for that” narrative.

The pandemic provided many new challenges for collision

repairers, including insurer delays related to photo estimating and refusal to pay for disinfectant application, and WMABA expects some of those challenges to be reflected in the responses collected this time around.

The information compiled provides a good resource for consumers seeking more knowledge about these carriers and their practices, and survey results are an effective tool for starting conversations with customers who can also use the information to help them in the policy-buying process. WMABA anticipates that the information collected on approximately two dozen carriers will also be beneficial when approaching consumer protection agencies regarding inappropriate insurer behaviors in the future. By identifying the specific market tactics individual insurers use in their market, WMABA plans to use the information to demonstrate the repair industry’s perceptions about those practices to carriers and hopes to engage in meaningful dialogues that will hopefully improve shops’ relationships with local carriers.

Results of the 2022 survey will be published in a future edition of Hammer & Dolly, just as the results of the 2018-19 survey were published in the May 2019 issue (available at bit.ly/ins1819).

There’s no movement in still waters, so it’s time for collision repairers to rock the boat. Positive change will never occur unless repairers use their collective voices to stand up for their customers, their shops and the industry at-large. WMABA’s Insurance Survey offers a quick and easy way to share your thoughts and be part of positive progress.

Although the 2022 “Shops Rate Insurers” survey is a local undertaking, WMABA encourages participation from industry professionals outside the region as well. Share your opinions by taking the survey at bit.ly/rateinsurers H&D

How does your shop compare?

BY ALANA QUARTUCCIO BONILLO

There’s no question that collision repairers need all the help they can get their hands on to remain successful in this everchanging and – all too often – challenging industry.

So, perhaps the question is: Why wouldn’t repairers want to take advantage of the resources available to them?

Presented by CRASH Network and Collision Advice, the quarterly “Who Pays for What?” survey is one of the best tools around. And it’s FREE!

By taking the survey, shops lend their voices to the industry by reporting about operations, and the results help educate them – and the whole industry – about “not included” operations, while also tracking trends and reporting issues. The data compiled can be used in negotiations and even as a training tool. Repairers can sign up to take the surveys at crashnetwork.com/ collisionadvice/. Everyone who completes the survey receives a report once the results are compiled.

As reputable consultant Mike Anderson (Collision Advice) and one of the creators of “Who Pays for What?” stated in a recent survey report: “It has been said there are people in life who WATCH stuff happen, and there are people in life who MAKE stuff happen. A huge thanks to the many shops who take our surveys. They are the people who MAKE stuff happen!”

Anderson garnered inspiration for these surveys from a publication he used to depend on back in his body shop days.

“When I had my shops, there was a publication called Collision Insight, produced by this guy named Charlie Baker. It was this little newsletter with industry trends in it. He always had a survey about 20 things relating to the top eight insurers which asked, ‘How often did you get paid for those?’ This was back in the days of fax machines. So, you would fill it out and fax it to him. Then he’d compile the results and put them in a future issue.

“I used to love that, when I had my shops,” he continued. “Once I became a consultant, I wanted to do something along the same lines but on a grander scale. So, I called John Yoswick at CRASH Network and suggested putting out a survey collaboratively. We put together a list of questions and got it out, and people saw value in it.”

The survey got off the ground in 2015. Repairers took to it quickly, Yoswick and Anderson report; one of the first surveys brought in more than 1,000 responses, according to Yoswick.

Anderson decided to break it into four surveys, which are distributed in January, April, July and October and conducted annually.

“We decided to group them into themes,” says Yoswick. “There have been some changes over the years, but we always do one on refinishing operations, one on body labor operations, one on frame and mechanical and one on scanning and calibration and/or shop materials, which would ask questions such as ‘Are you charging for seam sealer?’”

Some interesting things have been uncovered over the years as a result of the surveys. For the past six years, repairers have been asked if they charge for administrative fees on total losses. Back in 2015 when the survey debuted, only 46 percent reported asking for reimbursement “regularly, always or most of the time.” Yoswick indicates their most recent results show that figure has driven up to 72 percent.

Anderson cited the four main reasons why repairers should take the 15 to 20 minutes to complete the quarterly survey:

“The number one reason is to create awareness about things repairers may not be charging for. Number two is to show repairers that they aren’t ‘the only one’ and to give them confidence they aren’t alone. Third, it’s also a great training tool; repairers can take the results and share it with their staff during training.

“The fourth benefit is a credit to the Database Enhancement Gateway (DEG). We’ve upgraded over the years to include links to the DEG inquiries that show ‘not-included’ operations after every question.”

Anyone can download the results for free via the website.

Although the survey does generate results from hundreds of shops each quarter, Anderson still wishes more would complete it and therefore encourages every repairer to invest the time.

It doesn’t cost anything more than a few minutes and using the results brings a high-level of value into one’s business.

“It’s just good for the industry,” says Anderson. H&D

Mitsubishi now offers Genuine OEM parts through our new “Opt-OE” parts program at discounted prices. See Mitsubishi’s Ultra-Conquest parts and prices in the Optional OEM Suppliers category of popular collision estimating systems.

Ultra-Conquest Collision Parts Program Highlights:

• Discounted prices on quality new and unblemished OEM parts

• Automated price and part selection in collision estimating systems

• High parts availability

• Delivery to most major U.S. cities within 24 hours

To find out more about Ultra-Conquest pricing contact your local Mitsubishi dealer. For Genuine Mitsubishi parts, contact these authorized Mitsubishi Dealers.

Fitzgerald Mitsubishi

1930 West Street

Annapolis, MD 21401

Direct: 410-224-4636

Fax: 410-224-4264

E-mail: adamsf@fitzmall.com

Younger Mitsubishi

1945 Dual Highway Hagerstown, MD 21740

Direct: 800-296-1190

Fax: 301-733-5465 www.youngermitsubishi.com

Buy Genuine Mitsubishi Parts and get the perfect fit at the perfect price.

10% off on all parts orders when you mention this ad.

• Available through all participating Northeastern area Mitsubishi dealers

• Includes the majority of key collision components for select popular models

• We can meet or beat aftermarket prices!

Jerry’s Mitsubishi

1906 E. Joppa Road Baltimore, MD 21234

Toll Free: 844-817-9406

Local: 443-219-2728

Fax: 443-403-1419 mitsubishiparts@jerrymitsubishi.com www.jerrysmitsubishi.com

“Through increased awareness and new ideas, we improve our mutual industry, seeking a higher level of performance and ultimately excellence. We as an industry establish our stature and seek to raise it,” CIC Chair Darrell Amberson set the tone for the day’s purpose at the recent Collision Industry Conference (CIC) in Phoenix, AZ. “Let’s also remember that ‘the moment of truth’ ultimately occurs on the shop floor where the safe and quality repair is finalized.”

Future Disruptions Committee Co-Chairs Frank Terlep (Auto Techcelerators) and Jake Rodenroth (Lucid Motors) were joined by Michael LoPrete (Critica Consulting) as the trio explored how virtual reality (VR) and augmented reality (AR) are being used in the collision, automotive and insurance industries presently as well as the dramatic impact these technologies will have in the future.

Utilizing AR/VR provides an optimal training environment for students through 3D interactive models that reduces consumption (and subsequently the cost) of materials and minimizes potential risks while simultaneously providing hands-on experience with all the essentials of automotive and collision education to better prepare students for the workforce.

“We know that we face hiring challenges in our industry, and when you’re recruiting and training the late generation millennials or the Gen Z staff, they don’t want to sit in a classroom,” LoPrete pointed out. “This is how they want to learn; they want experiential, high-tech learning.”

AR/VR also benefits the repair process in myriad other ways, such as by reducing costs and mistakes associated with repair procedures, improving process management, allowing visual damage inspections from a remote location and providing a new forum for remote diagnostics and calibration support.

“A major challenge we see in calibration is the environmental failures where a shop identifies an area to do a calibration as a good place to do it,” Rodenroth noted. “Having this capability allows another technician’s eyes on it to point out, ‘There’s a lot of sunlight or a checkerboard floor,’ so it helps you overcome some of those environmental failures as well.”

“This is the next big thing,” Terlep predicted. “There are tons of benefits not just for the industry in general, but for the businesses that invest in this, for the people who use and experience it. We as an industry don’t have a choice; we need to start implementing this technology as quickly as we can.”

The Estimating Committee urged collision professionals to “Stop Guessing and Start Researching for Safe Repair Outcomes” during a panel discussion moderated by Committee Chair Danny Gredinberg (Database Enhancement Gateway) which included Jerry Gastineau (Mitchell), Rich O’Leary (Fix Auto) and WMABA President Steve Krieps (Collision Safety Consultants of West Virginia)

“We can’t assume what we did yesterday or on the last car we repaired is going to apply today, and if you just assume, you could potentially repair the car completely wrong,” Gredinberg stressed. “Something as simple as a weld primer could completely make or break that repair. We find the correct process by looking at the OEM repair procedures to find that critical bit of information. You don’t know what you don’t know, but now that you know the information is available, a safe repair outcome can be achieved. We have to The

focus on that ‘empty chair’ [representing the consumer] and perform a proper repair – based on repair procedures – for the customer’s safety.”

“What you’re reading today could be different tomorrow,” O’Leary added. “That’s why it’s important to review procedures on every vehicle.”

“The OEMs are providing a wealth of information which just continues to multiply,” Gastineau acknowledged. “There are specs that are useful to know which weren’t there before, and some fasteners are not reusable; there’s information in there that the repairers need to access, and you find that out by looking at the repair procedure to build all that knowledge together.”

Krieps emphasized the value of creating a role specifically dedicated to researching repair procedures: “If someone is multitasking and wearing too many hats, he may do okay, but okay doesn’t get the job done. If you’re not doing everything great, you’re doing something awful.”

Diving into “Supply Channel Pressures in Collision Repair,” Parts & Materials Committee Past Co-Chair Ken Weiss began by observing that while only 44 percent of attendees at a January 2021 CIC meeting identified supply chain disruptions as a problem, that number had increased to 90 percent at the November meeting.

Alluding to the many articles written about parts delay woes – in both industry and consumer publications – he pointed out, “We’re in an industry that has to fix cars, and because we have to fix cars, we have to find solutions to these headlines and keep on running.”

Weiss turned the microphone over to Greg Horn (PartsTrader) who provided an overview of one of the biggest bottlenecks in the industry: the Ports of Los Angeles and Long Beach. Although the ports approved the decision to impose a $100 daily fine on containers that aren’t removed from the docks, it has not yet been implemented. The lack of qualified CDL drivers poses another problem, and the Biden administration has proposed utilizing the National Guard to assist with the driver shortage; that hasn’t happened yet either.

“What do we do in this situation?” Horn asked. “Well, the Port of Los Angeles implemented a pretty interesting rule. They said, ‘We’re going to ease traffic and make it easier to negotiate, so we want you to anchor your ships more than 100 miles off the Port of Los Angeles.’ Well, that makes great visuals when you suddenly don’t see the backup, yet the boats are still out there and still unable to be unloaded. But it’s a wonderful visual to say, ‘We’re actually making progress.’ I don’t believe we are.”

Exploring the median delivery days for all parts, for aftermarket parts and for recycled parts, Horn observed, “When we look at

Protect your business, your team and your customers. BY

comparing OEM to aftermarket parts, it’s a completely different level of delays, but [aftermarket parts] still show increasing delays. So, yes, aftermarket parts are less subject to delays, but it’s a much different population. OEMs produce everything, so for a road wheel or hood, you may be able to find an alternate part, but if it’s a specific part where there’s no competition, that’s causing those delays.

CHASIDY RAE SISK

“Looking at recycled parts, we see a different picture with more widespread delays,” Horn continued. “We’re totalling more vehicles than in regular times, so that should be fantastic for parts harvesting, but because they’re being totaled out at something below the traditional threshold, that car becomes a great rebuild. Instead of being used for parts harvesting, those cars are being acquired by retailers which puts a further strain on the supply.”

“We can’t snap our fingers and make parts appear wherever we want them,” Weiss added. “We have to be resourceful, to wake up every morning and figure out creative ideas to solve these problems. We can all learn from one another, so let’s do it.”

I-CAR’s Bud Center, Dirk Fuchs and Niel Speetjens delivered “A ‘techy’ demonstration of electric vehicle tooling and safety

CONTINUED ON PG. 30

“We want to educate the industry, but it’s not all just the training. It’s that constant knowledge that’s being shared in all these different formats, and if your technicians aren’t seeing it, reading it and taking time, there’s going to be a lot of things that they’re missing. If we don’t put in the effort, who’s going to die?”

The cost of parts and labor continue to rise, exceeding the rates of inflation which elevate fairly consistently, while used car prices also skyrocket to unprecedented levels. Although claim count is down, severity is up, creating a market overflowing with total losses – or is it?

During the most recent Collision Industry Conference (CIC), the Industry Relations Committee delved into this topic with four individual presenters from various industry segments collectively providing a holistic view of the issues related to total loss plaguing the industry. In a further exploration of these concerns, Hammer & Dolly asked three vehicle valuations experts to weigh in, and WMABA President Steve Krieps (Collision Safety Consultants of West Virginia), Robert McDorman (Auto Claim Specialists) and John Walczuk (ZB Negotiations) graciously agreed to share their insights.

CIC Industry Relations Committee Co-Chair Jim Keller (1Collision) kicked off the conversation about total loss by examining these situations from the consumer’s perspective. Displaying an image of all industry segments, as he stressed, “The consumer is right in the center and should be our biggest concern, no matter what segment you represent. Everything we do revolves around the consumer, and the more trust between all those segments, the better off we’re all going to be and the better we’ll be able to focus on the consumer’s standpoint.”

When Keller polled attendees to determine their perception on total loss frequency, 87 percent of respondents agreed that it is increasing, and 73 percent believe the factors driving the increase include a combination of salvage values, virtual appraisals and parts availability.

Hammer & Dolly: What role does “trust” play in total losses, and how can the collision repair industry improve consumer trust, especially in instances where the shop and insurer are at odds about the total loss designation?

Steve Krieps: That question is not as straightforward as it seems. It really depends on the state and their respective laws. For example, West Virginia has a 75 percent ACV (actual cash value) total loss threshold to determine total loss; however, under the terms of most policies, you would need to reference the specific policy since an insurer may have the right to repair, replace or pay for the loss in money.

From a shop’s perspective, they really don’t have a dog in that fight. All they can do is write an accurate repair plan and present that to the consumer. I know we all feel we are the ones that have to take care of this consumer and while I agree that’s true within the realm of your profession, policy and legal disputes are not a world the shop needs to play in. Now, if a consumer goes to bat and you want to back them up on an insurance commission complaint or through a legal process, go for it. As far as trust, I believe the shop needs to be honest, and they also need to be educated on their state’s respective rules. Let a consumer know

where they can get help and assure them that you will be there with them. Otherwise, you are writing checks you can’t cash.

Robert McDorman: As long as the insurance carriers are allowed to participate in valuing the loss and manipulating the unsupported data provided by the Market Valuation/Data Provider firms, there will continue to be trust issues related to the total loss designation. The unsupported data is being used in manipulated form as a weapon against the insured and claimant to undervalue the loss.

Also, the opening question limiting the cause for total loss frequency only to salvage values, virtual appraisals and parts availability was not complete. The insurance carriers play an instrumental role in the total loss process and the wrongful deeming of repairable vehicles as economic total losses.

John Walczuk: Trust in your body shop is important as the client is looking for professional guidance; however, the problems are twofold: Is the shop independent or a DRP contracted shop? Are they following contract requirements, or is the shop fixing a vehicle that should be a total based on proper repair guidelines? Being at odds with the carrier in current times is likely a commonplace issue. The real question is what constitutes a total. Is it repair costs, is it salvage value, is it anticipated loss of use claim costs, or is it parts availability? The phrase “constructive total” is commonplace when the percentage threshold criteria is not reached but other factors of undefined cost are anticipated.

Dan Risley (CCC Intelligent Solutions) provided statistics to demonstrate that total loss frequency has been rising annually since 2013, yet 2021 served as an anomaly due to the elevation of used car prices. At the same time, supply chain constraints limit the availability of new cars, causing people to keep their cars longer, driving up the average age of vehicles on the road, including rental car fleets. A number of factors adversely affect severity. Claims data continues to suggest that more higher speed crashes are still occurring, and the cost of parts and labor has shot up faster than inflation rates which hover in the six to seven percent range according to the Consumer Price Index.

“Used car prices are going up and outpacing – or at least equalling – the cost of repairing the vehicle,” Risley summarized. “Yet, we’re not seeing a proportionate increase in total losses, so it makes me wonder how much of that can be attributed to the fact that claim count is down. If we’re not seeing such a huge jump in total loss percentages, can that be directly attributed to claim count?”

H&D: Is total loss frequency increasing in the current market, and why?

SK: The short answer is ‘yes.’ Some vehicles are being declared totals simply because parts are not available and the cars cannot be repaired in a reasonable amount of time. In addition to this, the valuation methods (or lack thereof) from the carrier utilizing CCC, Mitchell and Audatex valuation software always seems to undervalue a vehicle, leading to potentially incorrect total loss determinations.

RM: Yes, and the carriers play an integral part in the total loss frequency. CCC, Audatex and Mitchell data is strong and helpful but not complete. Their valuing tools include many input levers for the carriers to use to obtain a desired result. With salvage values high, the desired result is more often to total these vehicles.

JW: Currently, I am seeing 2022 vehicles that could be fixed, but the parts shortage is resulting in a total loss determination.

Where Do Total Loss Vehicles Go?

“Total loss is affecting all of us – it’s not just affecting the collision repairers; it’s also affecting the salvage industry,” Automotive Recyclers Association Executive Director Sandy Blalock began as she addressed CIC attendees. “Total loss does not necessarily mean end of life for every vehicle, and many vehicles leave the professional market and are bought by rebuilders because a lot of them can be rebuilt safely. But some of them cannot.”

No restrictions exist related to who can purchase salvage vehicles, including nonrepairables. As a result, they are purchased daily by licensed auto recyclers and dealers; however, at least 30 percent are sold to unlicensed and unregulated buyers. Often, these non-repairable cars are then rebuilt – “certainly not using any OEM repair procedures” – and often resold via curbstoning, an illegal scheme by which a “hustler” flips dozens of cars each year with no consideration for the safety of the consumer who unknowingly climbs behind the wheel.

“Title washing is an epidemic in the US, and

one out of every 325 vehicles on the roads today may be operating on a fraudulent title,” Blalock claimed. “These unlicensed curbstoners have no ethics and no concern for the consumers they’re defrauding. Let’s challenge each other to make a difference. Our purpose should be to contribute to making things better, not only for the professional businesses we each represent, but most importantly for the consumer.”

H&D: Since being deemed a total loss doesn’t necessarily mean “end of life” for a vehicle, what concerns exist with the number of salvage vehicles being “curbstoned” or resold with “blue titles” as a result of increasing total loss frequency? What effect could this have on the driving public?

SK: Curbstoning and vehicles being sold with blue titles are huge issues and deceptive practices which cause major harm to consumers. More and more people are being lied to, and as a result, they purchase potentially dangerous vehicles. Sadly, I see this same thing happening in my area through the work I do with law firms to rectify these exact situations. It is real, it is happening, and it is a problem that costs consumers money and potentially their safety.

RM: Ms. Blalock provided a good overview of the safety issue of vehicles deemed a total loss, subsequently sold to various sources, repaired and resold; however, she offered no cure to stop this process.

Until each state requires a vehicle to be titled as a salvage vehicle once the insurance carrier deems the vehicle a total loss, the insurance carriers will continue to manipulate the titling system to sell as many vehicles as possible at the salvage sale as vehicles with a good title history (blue title). Insurers play an important part in the titling of total loss vehicles with good titles, and this affects consumers because less-than-desirable rebuilders purchase these total loss vehicles with good titles only to perform substandard, unsafe repairs and then sell them to the public with limited or no disclosure of the vehicle’s history.

CONTINUED FROM PG. 24

JW: Being deemed a total does not mean end of life. The vehicle will likely go to auction with several possible outcomes: It will either be purchased, properly repaired, inspected and then sold for public use, or it will be purchased and cannibalized for parts to repair another vehicle, or it could be purchased and sold for an overseas final sale where safety features are not a concern. Purchasing any used vehicle requires due diligence, and any buyer should be aware of any prior incidents to a vehicle. Even vehicles with a prior repair history, but without a branded title, should be reviewed in detail.

“We only represent the consumer,” McDorman warned before analyzing a random sample of 200 total loss claims worked by his company to demonstrate that one-third of those vehicles deemed a total loss were either sold with a blue title or still remain in the client’s name with a blue title.

Using a 2017 Chevrolet Traverse claim as an example, McDorman explained that State Farm valued it at $18,889 and sold it at auction for $4,800 with a clean title and no indication of damage history – despite showing an estimated repair cost of $14,345 and being reported to CarFax as a total loss. Furthermore, the actual repair value used to deem the vehicle a total loss came in at $18,970.01, which would have prevented the car from being sold with a clean title if that value had been provided at auction. The current driver has no idea how badly damaged his vehicle had been.

“These are driving weapons that could fall into somebody’s hands,” McDorman cautioned. “When the insurance company deems the vehicle a total loss, they should be required to issue a salvage affidavit and transfer the title as a salvage title. Insurers should be required to transfer the title on all total losses to a salvage title within 30 days which would prevent a lot of curbstoning and detour rebuilders from buying these cars to rebuild and remarket as clean title vehicles.

“The problem is twofold: The data provided by the market valuation/data provider firms is unsupported, incomplete, and the carrier plays an instrumental role in evaluating the loss. It’s multifaceted. It is a virus and a problem. It’s a safety problem, and we need relief. We all need to get together to talk about how we can address these problems so we can fix them and take care of our consumer.”

By invoking Right to Appraisal (RTA), McDorman helps consumers settle total losses for higher values, and his data demonstrated that final estimates regularly exceed carriers’ original estimates by an average of 77 percent up to 102 percent, depending on the insurer.

H&D: In your experience, how does invoking the Right to Appraisal impact total loss determinations, including its effects on consumers and shops?

SK: I strongly agree with the unethical and disturbing trends in total loss evaluations presented by Robert McDorman at CIC as I see these same issues in my state through activities I conduct. Invoking RTA – given it is the correct and best option – typically yields a positive result for the consumer. I would imagine the shop benefits as well, but honestly (with no disrespect meant to my fellow collision repairers), their happiness following or during an RTA is irrelevant. On total losses, I’m seeing an increase in ACV settlements of $2,500-$3,500 on average; some have exceeded $6,000!

Although RTA is discussed less often as an option for loss disputes (not total losses), it may be the best choice in some cases when the policyholder and the insurer cannot reach an agreement on a repairable vehicle . I’ve seen increases in loss amounts of $3,000$7,000, up to $10,000, in loss disputes where the carrier wrote only $1,500-$2,000 based on photos while the shop wrote $8,000 after a physical inspection and repair planning.

RM: In most (if not all) insurance policies we have in our library, the limit of liability is based on the ACV. The market valuation indicated through data provider firms use a complex algorithm to arrive at an adjusted value (AV) that is biased and always favors the insurance carrier. This adjusted value is not the ACV. Once the ACV has been defined, this becomes the fence post to determine loss. The carrier always wants to use the total loss formula (TLF) to determine the repair or replace loss type. The TLF, commonly known as an economic total loss, always benefits the carrier at the insured’s expense; “economic total loss” essentially means it’s in the carrier’s best economic interest to total the insured’s safely repairable vehicle.

In eight out of 10 claims, we see a significant enough error to invoke RTA in contest of the loss. Once the ACV is defined, the increase between the AV and the defined ACV through appraisal is $3,672 on average, and this delta between these two figures is the under-indemnification of the loss. Once the ACV is properly defined, a significant number of these types of claims are eligible to be safely repaired under the policy limit of liability.

JW: We invoke the appraisal clause on 99 percent of all client vehicles. We specialize in obtaining fair valuations for the vehicle owner when we have been hired to obtain correct ACV. Shops recommend us after they have already determined the vehicle is a total or have been told by the carrier that it is a total as a way of assisting their client by directing them to a resource who will fight for the client’s rights. H&D

Por sche technology.

Por sche G enuine S er vice & Par t s .

Porsche Bethesda 11990 Rockville Pike

Nor th Bethesda, MD

855-683-3144

Fax 301-945-4341

bethesda porschedealer com

Porsche Silver Spring 3141 Automobile Boulevard

Silver Spring, MD

844-413-6929

Fax 301-890-3748

silverspring porschedealer com

Euroclassics Porsche 11900 Midlothian Turnpike Midlothian, VA

804-794-3399

Fax 804-794-9771

euroclassics porschedealer com

procedures,” during which they shared some tips for safely repairing EVs. Fuchs recommended beginning the process with a pre-scan to confirm that the battery pack was not damaged in the accident by testing each cell’s temperatures; when damage occurs in multiple cells, the subsequent friction can create heat, potentially causing a fire.

After the pre-scan, the next step is to safely disconnect the

battery, and Speetjens explained, “When we touch the vehicle, there is a lot of potential for voltage that could hurt us, the shop and our environment, so we want to safely disconnect and verify the situation to ensure it’s safe to touch the vehicle’s components.”

Speetjens and Fuchs also stressed that a clean environment is imperative when working on EVs since dust and other particulates can get into the connector and increase resistance to dangerous levels.

“We all have to step up our game because we all have to learn a lot,” Fuchs emphasized. “We always talk about the technician’s safety, but it’s not only the technician. It also affects consumer safety. There’s no room for mistakes. If you make a mistake with this technology, you are dead.”

Emerging Technologies Committee Co-Chairs Chuck Olsen (AirPro Diagnostics) and Bob Augustine (Opus IVS) kicked off the conversation on “Tool and Equipment Updates for Scanning, Diagnostics, Programming and ADAS Calibrations” by reviewing secure gateway modules and the different methods of accessing them.

“Connected cars are potential targets for remote attacks,” Olsen noted. “Without proper protection, they can be compromised, resulting in loss of control, driver injury and costly litigation. Automotive secure gateways serve a critical role in vehicle security, performing data routing functions and supporting new, vehicle-wide applications.”

During “Vehicle Construction Advancements Relevant to ADAS,” Emerging Technologies Vice Chair Jason Bartanen (Collision Hub) was joined by I-CAR’s Scott VanHulle as they covered the ongoing changes in vehicle structures, ADAS updates and the need for effective repair planning.

“If you don’t do the proper planning and have the proper procedures in place, there’s no way you’re going to do it correctly,” VanHulle insisted. “We want to educate the industry, but it’s not all just the training. It’s that constant knowledge that’s being shared in all these different formats, and if your technicians aren’t seeing it, reading it and taking time, there’s going to be a lot of things that they’re missing. If we don’t put in the effort, who’s going to die?”

“The information is readily available; it’s just a matter of finding it. I would take anyone to task that if you’re not leveraging the OEM information and procedures, it simply is not possible to repair a collision damaged vehicle,” Bartanen added. “If you don’t have the proper tools and equipment, I hope you have the courage to turn it away and know you shouldn’t be repairing that vehicle.” H&D

Stepping up the game on education methodology to keep up with changing technologies is really cool, and I encourage all to check out the presentations from CIC at ciclink.com/meetingpresentations - especially the one from the Future Disruptions committee. We’re watching the landscape change right in front of us, and knowing what the industry is going to face in the near future is the sure way to shore up your business to deal with the waves. Make sure you’re watching further out than your day-to-day! -Jordan Hendler

PRESIDENT: Steven Krieps srkrieps@live.com 304-755-1146

VICE PRESIDENT: Rodney Bolton rbolton@aacps.org 443-386-0066

TREASURER: Kris Burton kris@Rosslynautobody.com 703-820-1800

SECRETARY: Phil Rice phil@ricewoods.com 540-846-6617

PAST PRESIDENT: Torchy Chandler torchy.chandler@gmail.com 410-309-2242

Don Beaver don.beaver3551@gmail.com 443-235-6668

Bill Hawkins hawkinswilliamjr@gmail.com 510-915-2283

Barry Dorn bdorn@dornsbodyandpaint.com 804-746-3928

John Shoemaker’ john.a.shoemaker@basf.com 248-763-4375

Just like equipment and training, WMABA membership is not only a commitment to excellence, but also a valuable investment.

WMABA is recognized both regionally and nationally as the key forum for the exchange of ideas concerning the D.C., MD, VA and WV collision repair industry. It is the venue to discuss, learn about and impact evolving standards and policies in the technical, administrative and legislative fronts of our industry. Shops and industry supporters can best develop themselves and their employees by actively engaging in the association and its activities.

Automotive collision repair facilities in Maryland, Virginia, West Virginia and Washington, D.C. who are willing to adopt WMABA’s Standards of Membership and offer a guarantee to their consumers are encouraged to engage their business as an active member of the association. For over 40 years, the WMABA membership of professional collision repair businesses and affiliates have committed to operating at a higher standard on behalf of their industry and their consumers. Over the years, WMABA has proudly represented the collision repair industry at hearings on Capitol Hill, in Annapolis, MD, and Richmond, VA as well as almost every national collision repair event. While WMABA has a rich history of dedicated men and women serving the local collision repair community, WMABA also boasts numerous past and current accomplished Board members who represent our membership at the national level.

WMABA offers current and dynamic discussion forums on topics facing collision repairers, technical information and educational seminars, opportunities to network and discuss pressing topics with leaders of the collision repair industry, an arbitration program that works with consumers to help resolve issues they might have, apprenticeship programs, legislative representation and the ability to receive and contribute to one of the nation’s leading collision repair magazines, Hammer & Dolly

EXECUTIVE DIRECTOR:

Jordan Hendler

jordanhendler@wmaba.com

804-789-9649

This month, we “ASK MIKE” to share his thoughts on some of the critical things shops should consider when calculating their Labor Rates. We at Hammer & Dolly hope you find the following exchange useful, and we encourage you to reach out to us if you have a question for Mike on this or any industry-related matter that he can answer in a future issue.

Hammer & Dolly: We could easily come up with a list of things that are negatively impacting shops’ profitability these days, but not all shops know how to adjust their Labor Rates to reflect these issues and charge a reasonable amount of money to stay in business. What are some of the most critical things a shop needs to keep in mind when determining a realistic Labor Rate?

Mike Anderson: First of all, employee recruitment is one of the major things our industry has been talking about recently. Obviously, part of recruiting new employees is being able to pay them a competitive wage. There are three ways to accomplish that. Number one: Shops could charge more for not-included operations, which is really the easiest path. Number two: They could increase their rates. Number three would be a combination of the first two.

When I ran my own shops, I was never a proponent of just randomly raising my Labor Rate by a dollar or two. That never made sense to me. Every business is going to be different. For example, where my shops were in Alexandria, the property tax rate was very high. Ten miles down the road, that property tax was much less. Additionally, my shops were located close to areas where there were a lot of government employees and contractors. The Federal Government paid people certain salaries and offered retirements and great benefits, so I had to compete with that.

Another consideration would be the wages you need to pay in your town. The cost of living in your shop’s area could be much different from where you actually live.

On top of an employee’s salary, you have their health insurance costs – which could have doubled over the last couple of years. Then, add in vacation time – one week could be two percent of an employee’s income – and workers’ compensation, 401(k)s and FUTA [Federal Unemployment Tax Act] and SUTA [State Unemployment Tax Act] contributions. It’s not just about what you pay an employee – it’s also about all the other things you have to pay. Those expenses, in addition to their wages, could average thousands of dollars a month. You need to figure out how many hours your employees need to produce to cover that, and then include that information in your considerations when determining your Labor Rate.

Also, if you’re going to invest $200,000 in equipment, you need to figure out what you have to do to offset that. Is that equipment going to be paid through the increased efficiency it’s bringing to your shop, or do you need to take that into consideration in your Labor Rate? You also need to think about profit. How much money do you want to make? What is it going to take to get to that? Don’t forget that when fuel prices go up, it costs us more to paint a vehicle.

When it comes to raising Labor Rates, you have to understand your cost of doing business and understand what your rates need to be based on what you’ve invested in training and equipment, the benefits you offer and the property taxes in your area. All of that needs to be considered.

Your Labor Rate should never be just a fictitious number pulled out of the air. Shops need to determine their rates through business analyses. What are their training budgets for the year? That is going to be different for a shop that’s Porsche-certified versus someone who is Honda-certified versus someone who has no certifications. Also, what do competitive industries in your area pay? If you’re located near Amazon or the Federal Government,

then you need to be competitive with them.

HD: Based on your experience, how many shops are doing a thorough examination of their numbers to determine a realistic Labor Rate instead of just fabricating a number?

MA: The majority of shops still pick some number out of the sky with no rhyme or reason behind it. I don’t mean to hurt anybody’s feelings; I just don’t think a lot of shops have ever been led through an exercise on analyzing what their Labor Rate should be. The majority of shops don’t know how to determine what that effective rate needs to be.

H&D: Are there any COVID-19-specific factors that you’ve seen impact Labor Rate calculations in ways that shops didn’t need to consider two years ago?

MA: I don’t know that COVID-19 has impacted Labor Rates or people’s business decisions. But with supply chain issues, shops are having to float a lot more WIP [work in progress]. They have to make more money because they have to float more money. I talked with a shop this morning that told me they had $100,000 in WIP for one OEM sitting in their lot that couldn’t be delivered because they were waiting on parts. That shop owner has already paid for the parts for other areas of repair; he’s already paid his people to fix those cars. The paint and materials have already been paid for. He has $100,000 of his money tied up because he can’t get a couple of parts. You need to have cash flow in order to support those types of things. We’ve also seen vendors increase their prices recently. So, that means shops need to look at their paint and material rates in addition to their Labor Rates.

H&D: Let’s say a shop follows your suggestions and comes up with a revised Labor Rate, but that rate is high enough to raise a payer’s eyebrows. What are some ways that shops may be successful

in communicating these necessary charges to that other party?

MA: One way is to just start raising the rate on your estimates, and then a staff appraiser finds out about it and runs it up their chain of command. The second option is to send a letter out to all the insurance companies notifying them that you’re increasing your rates as of a certain date. The third option, which I always thought was better, is to meet with the insurance company’s decisionmaker in that area. When I had my shops,

Stop guessing and start getting paid.

I’d sit down with them and say, ‘Here’s why I’m doing this.’ I didn’t just review what my Labor Rates were going to be; I reviewed what I called a ‘pricing menu.’ I’d say to them, ‘When you see me charge for feather, prime and block, this is my premise for how I’m charging for this, and this is why I’m charging for it.’ This provides the reasoning behind the charges based on factual data. We’d have discussions as to what we could agree on so that the insurer’s field staff and my estimators wouldn’t be put in a frictional position. H&D

Mike Anderson is an Accredited Automotive Manager (AAM) and the former owner of Wagonwork Collision Centers, two highly acclaimed shops located in Alexandria, VA. He has served as a member of many industry organizations throughout his career, including the WMABA Board of Directors, the Mitchell Advisory Board, the MOTOR Advisory Board, the ASE Test Review Committee, the National Auto Body Council, the Collision Industry Conference and the Society of Collision Repair Specialists. Additionally, he is a past Virginia SkillsUSA chairman, serves as a facilitator for Axalta Coating Systems’ highly recognized Business Council 20 Groups in both the US and Canada and facilitates numerous courses for Axalta Coating Systems’ Educational Series. He currently offers expert industry consulting via his latest venture, Collision Advice (collisionadvice.com).

Valspar Refinish combines best performance with best value, from primer to clear. With this solvent system, you will achieve color consistency, great coverage and hiding, and an overall quality finish—every time.