Northern Gritstone was founded with the philosophy of Profit with Purpose, which means we believe that profitable organisations can and should have a wider purpose.

That purpose for us is to support aspiration and ambition in the North of England, and in doing so create positive societal and economic impact. Profit means delivering attractive returns to our shareholders, who have the patient capital to invest into an untapped innovation seam in the North of England and benefit from the returns of the world-class companies of tomorrow.

How do we do that? By creating change.

We invest in and support the commercialisation of science and technology-enabled IP-rich businesses based in the North of England — predominantly originating from the Northern Arc universities of Leeds, Liverpool, Manchester and Sheffield. We work incredibly closely with these universities, with whom we have in place long-term agreements. We also invest in early-stage companies based in the North of England outside of these universities. Since our inception, Northern Gritstone and co-investors

have invested £366 million into science and technology-enabled early-stage businesses based in the North of England.

These investments are in some of the UK’s most exciting emerging sectors such as pioneering life-science, advanced materials, health technology, clean technology, cognitive computation and artificial intelligence.

In doing so, we are helping to create a leading ecosystem of funding and support. Over time this creates a virtuous circle. And that is our belief and our mission — to create a virtuous circle of investee companies, who bring people to the region including other investors and community members, who lean in and help others on their journey. This in turn generates high-skilled jobs in the North of England. That local impact has a regional and ultimately global impact through the creation of world-class innovative businesses.

High-paid job creation

Skilled workers & companies relocate to the region

Investee companies launch

A new Silicon Valley

Region recognised as an innovation leader

Northern Gritstone invests and supports

New funders enter the region

& Committed Co-investment into the North of England

It gives me great pleasure to report on another successful year for Northern Gritstone.

We have seen strong momentum and progress within our portfolio, which now stands at 32 companies, whose ambitious leaders are meeting key milestones including attracting highcalibre talent into the region. Notably, this year two entities in our existing portfolio (Phlux and Silveray) have attracted follow on-funding at a premium to our existing investment, providing strong validation of our strategy.

Northern Gritstone has continued to deploy its Profit with Purpose strategy, supporting innovation and growth within the Northern ecosystem. I am very pleased that we have strengthened our relationships within the Liverpool City region, including with the University of Liverpool, with whom we signed a partnership agreement in May 2025. I look forward to reporting on the additional spinout investments which are the aim of this partnership. The addition of the University of Liverpool to Northern Gritstone’s

existing university partners of Leeds, Manchester and Sheffield means that Northern Gritstone is now working with a group of universities which collectively produce more spinouts annually and have higher research income than any other Higher Education institute in the UK — a superb opportunity for growth.

Northern Gritstone has established a strong reputation, and as a result, during the year we attracted numerous investment offers. Consequently, in March 25, we successfully secured an additional £50 million in capital, bringing the total capital commitments to £362 million. We were pleased once again to receive support from regional local authority pension funds as well as institutional investors and high-net-worth individuals.

It is my pleasure to welcome Paddy Dowdall, who joined the Board of Directors as a Non-Executive Director on 1 April 2025. Paddy is Assistant

Executive Director of the Greater Manchester Pension Fund, and his extensive investment experience will be a valuable addition to the Northern Gritstone team.

Northern Gritstone continues to find numerous opportunities to allocate capital. During the year, Northern Gritstone invested in 8 new companies, including 6 spinouts from the Founding Universities of Leeds, Manchester, and Sheffield.

" WE WERE PLEASED ONCE AGAIN TO RECEIVE SUPPORT FROM REGIONAL LOCAL AUTHORITY PENSION FUNDS AS WELL AS INSTITUTIONAL INVESTORS AND HIGH-NET-WORTH

during the year, providing the ‘+++’ to support our portfolio companies to grow quickly and sustainably. NG Innovation Services continues to expand and already includes established talent and business support services functions, as we report on page 26.

Last year, I reported on the launch of NG Studios powered by Deeptech Labs, aimed at accelerating deep-tech early-stage spinouts from the Founding Universities. During this financial year, two cohorts completed the program, benefiting from 1-2-1 mentoring and networking with industry experts. The goal is to help founders turn their ideas into investible opportunities, and I am pleased to report that Northern Gritstone has further invested in 5 participants in the program to date.

The third NG Studios cohort program is currently in progress and is scheduled for completion in July, with presentations from the cohort members to be featured at our Annual General Meeting and Innovation Showcase. We are pleased to announce that this cohort, as well as future cohorts, will incorporate earlystage spinouts from the University of Liverpool.

In the Purpose and Impact report on pages 38 to 51, we detail how our portfolio companies contribute to job creation in the region and align their activities with the UN-backed Sustainable Development Goals (SDGs), indicating their potential global impact. NG Innovation Services launched

On a final note, we are all acutely aware that profound economic and trade shifts are happening. Northern Gritstone is nothing if not resilient and determined to weather any storm. I would like to extend my gratitude to the Board of Directors and the entire Northern Gritstone team, who show true grit. They should take great pride in all that has been accomplished this year.

Lord Jim O’Neill CHAIRPERSON

The last twelve months has seen our business start to season as our initial portfolio begins to mature and our first follow-on investment decisions have been made. Our investment team has established itself as a core component of the Northern Arc tech ecosystem and with the power of NG Innovation Services completing our ‘Capital+++ model’, we now have the ability to help our founders reach their goals quicker and in better shape.

We have a number of emerging stars in our portfolio which have raised sensible follow-on rounds in the year which highlights both how good a business needs to be to raise capital in the current market but also the depth of opportunity we enjoy in the North of England. Phlux, which designs and manufactures ultralow-noise infrared sensors, raised a £9 million Series A round from both new and existing shareholders at a sensible uplift which will see the business scale

its Sheffield based operations. Silveray, which has developed a novel X-ray material, raised a £4 million Seed-plus round, again at an attractive uplift in value from the previous round, allowing it to continue to develop its technology in conjunction with its initial customers.

On the back of Northern Gritstone’s successful development to date, we were delighted to close out an additional fundraise for our own

balance sheet in the year. We welcomed two new shareholders: Fulcrum Asset Management; and Aviva PLC; as well as three existing shareholders increasing their current shareholdings: Greater Manchester Pension Fund; Merseyside Pension Fund; and West Yorkshire Pension Fund. Northern Gritstone now enjoys c.£362 million of committed capital.

Our team has continued to build over the course of the year with new resource in our investment team matching the build in NG Innovation Services alongside our middle and back office teams which are so invaluable in providing the foundations on which we operate our business. Mid-way through the year, our wholly owned subsidiary, Northern Gritstone Investment Manager Limited, became regulated giving us the optionality to raise more traditional GP / LP funds alongside our permanent capital when market conditions permit.

this market will not impact our portfolio. From insulating our portfolio we can quickly turn to what opportunities the current dislocation can present to Northern Gritstone and our investees and this is where we are now focused.

"WE HAVE A NUMBER OF EMERGING STARS IN OUR PORTFOLIO"

Market conditions have not been as favourable as we had anticipated a year ago. There has been a large impact from the administration change in the US, not just in the early-stage venture world, but one felt much more widely. A private markets’ world which was steadily moving towards ‘risk-on’ up until January 2025 has now gone quickly into reverse as significant uncertainty has entered the world financial system. By focusing on quality and ensuring that our investee companies are built on solid foundations, we hope that the worst of

We are blessed to have a diverse and skilled team at Northern Gritstone along with an engaged Board of Directors. I would like to thank everyone for their efforts this year and in making our business such an enjoyable place to work.

Duncan Johnson CHIEF EXECUTIVE OFFICER

13 June 2025

The Company made 8 new investments and 7 follow-on investments in the period, deploying a total of:

£21.9m

The fair value of the portfolio at 31 March 2025 was:

£56.7m

During the period there was a change in the fair value of investments of:

£(6.5) m

This change is largely the result of investment fair value movements of two investments, where the reduction in carrying value reflects the short funding horizons of these businesses. It is the nature of our valuation process that we adopt a prudent approach when making these judgements as required by our Valuation policy, but we remain excited by the potential for these businesses. In addition, C-Capture ceased trading in the period, having failed to attract the funds necessary to continue operations. Consequently, the fair value of Northern Gritstone’s investment in the company was nil at 31 March 2025, with a £(1.3)m negative fair value movement recognised in the year.

All other investments are making progress executing their respective strategies as set out at the time of investment. We remain pleased with the companies in which we have invested and their potential to deliver both profit and purpose.

In the past year we expanded our portfolio of IP-rich knowledge-intensive companies, including graduates from our accelerator program NG Studios, and supported existing portfolio companies with their growth ambitions. Highlights from this activity include (shown opposite):

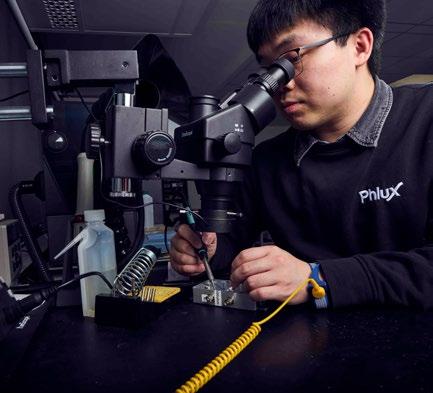

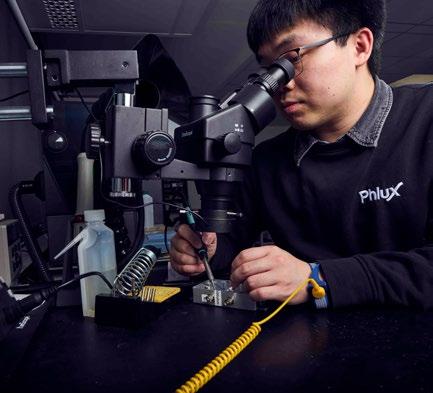

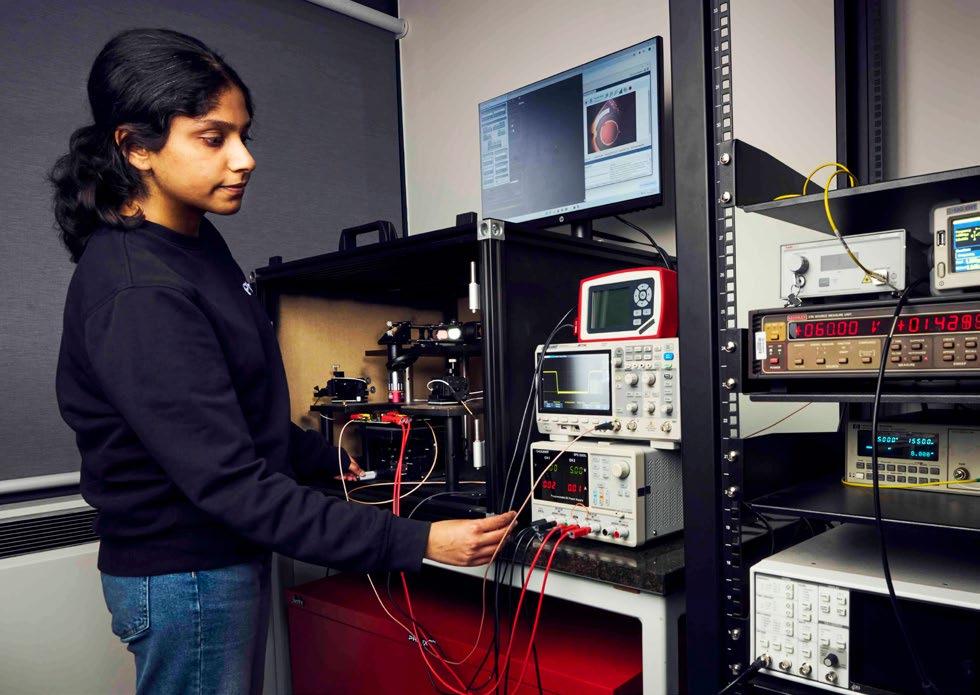

Phlux is a spinout from the University of Sheffield. The company designs and manufactures ultra-low-noise infrared sensors with best-in-class performance. Since Northern Gritstone’s original investment in November 2022 the company has launched its first product — Aura — a drop-in replacement for Lidar systems, secured its first design win and delivered its first revenues. In March 2025, it raised £9 million in a Series A round in which Northern Gritstone invested alongside existing funders and a new investor, BGF. The Series A was priced at a significant premium to the Seed round in which Northern Gritstone had originally invested. We are delighted to support the continued success of a business which is delivering on its ambition to be a leader in its field.

In November 2024, we reinvested at an uplifted valuation into existing portfolio company Silveray’s Seed+ round, along with new investors Empirical Ventures and Hamamatsu. Silveray — based in Manchester — is transforming radiography through digitisation and its ‘bendy’ X-ray material that can wrap around pipes and be fed into tight, awkward spaces. Applications range from industrial inspections — checking for corrosion or damage — to the health sector where mammograms could be made much more comfortable.

In December 2024, we invested in BOW, a Sheffield spinout that simplifies robotics programming through its universal software platform and Software Development Kit (SDK). BOW’s mission is to make robotics more accessible by allowing developers to program various types of robots using

their preferred programming languages and operating systems. By lowering the barriers to robotics programming, BOW aims to unlock new possibilities in industries such as manufacturing, healthcare, and education.

In November 2024, we led Exciting Instruments’ Seed round. The company, which is a spinout from the University of Sheffield, has developed a practical and efficient single-molecule detection platform, opening up adoption to an unconstrained user base spanning pharma, healthcare and other industrial applications. The technology allows users to visualise and analyse individual molecules and their interactions, whilst also providing high throughput processing and automation of analytics — advancements that are critical for improved efficiency and productivity.

In October 2024, we led a Seed round in Leeds spinout MicroLub. The company has developed food ingredients technology using waterbased ‘scaffolds’ coated with polysaccharides to replicate the creamy texture of fats and oils. This technology allows for a significant reduction in fat content and calories without compromising sensory qualities such as taste and texture. It has applications across various food categories, including reduced-fat dairy products, baked goods, and plant-based meats.

In June 2024, we participated in Cavero Quantum’s Seed round. A Leeds spinout, Cavero has created a quantum-safe cryptography and encryption technology for secure mutual key generation and authentication. The technology replaces multi-factor authentication and one-time passwords. With cyber attacks estimated to cost the global economy £5.5 billion per year, demand for Cavero Quantum’s technology is expected to increase as existing cryptographic methods become more vulnerable to quantum computers.

In March 2025, we invested into Apini, a University of Manchester spinout developing small molecule compounds to target chronic inflammatory diseases such as Crohn’s and Ulcerative Colitis. Apini is based on the groundbreaking work of its founder Dr Sam Butterworth, the inventor of Tagrisso, a life-saving drug for epidermal growth factor receptor mutant lung cancer.

In November 2024, we invested in the Series A round of Partful — a Manchesterbased manufacturing aftersales technology solution provider. Partful has developed a 3D SaaS platform of interactive models that ‘explode’ to reveal a product’s individual components. This makes it easier for the customers and dealers of original equipment manufacturers (OEMs) to identify and order the components they need and access the work instructions needed to fit them.

In December 2024, we invested in our first Newcastle spinout Literal Labs, which is pioneering logic-based AI models that are orders of magnitude faster and more energy efficient than existing neural networks. Its approach is inspired by the work of Mikhail Tsetlin; a mathematician and contemporary of John Macarthy who pioneered neural networks. Like neural networks, the Tsetlin machine can perform complex machine learning training. However, unlike neural networks, it is based on propositional logic which makes it more efficient in terms of computation and energy usage, whilst speeding up inferencing.

Investments were also made in five participants in the second NG Studios cohort.

Profiles of Northern Gritstone’s top 10 holdings by carrying value appear on pages 15 to 24.

• Pragmatic was founded in 2010, and at inception, acquired IP from Manchester University.

• The company has developed a process for making thin-film semiconductors on flexible substrates. This enables the production of ultra low-cost integrated circuits that are faster to produce than silicon chips with a significantly lower carbon footprint.

• The initial target application is chips for radio frequency labels to enable products to be identified and tracked around the globe.

• Pragmatic is using investment to build a semiconductor manufacturing plant in North-East England.

Marketing & scaling opportunity

• Pragmatic is initially disrupting the radio frequency identification (‘RFID’) market — its low-cost chips are predicted to expand the market 5x to $50bn per annum.

IP & barriers to entry

• Pragmatic has over 200 patents and extensive know-how and trade secrets around the manufacturing process of thin film transistors.

Productisation & pipeline

• The company is currently selling its first product (an RFID barcode) and plans to launch soon 2 additional smart-RFID products.

• The company also supplies foundry services to customers outside the RFID market.

Management team

• David Moore, CEO, 20+ experience in the semiconductor industry, ex-Micron, ex-Intel.

• Board Includes Non-Executive Directors from Cambridge Innovation Capital, M&G, ARM, Avery Dennison, Nordic Semiconductor & UKIB. pragmaticsemi.com

INVESTMENT DETAILS

Northern Gritstone equity held

Return to date:

PURPOSE AND IMPACT

£7.5 m n/a 2%

Current valuation

1.0 x

Multiple of money invested

Internal rate of return

Key co-investors include: M&G, UK Infrastructure Bank, Aramco and Cambridge Innovation Capital.

Industry, Innovation & Infrastructure RFID tags can digitise the supply chain, improve quality control and authentication of products.

Responsible Consumption & Production

The company has dramatically reduced the amount of energy and water needed to manufacture semiconductor chips.

Job Creation

A high number of new skilled jobs based in the North of England to be generated through this investment.

KEY INFORMATION

• Optalysys has developed a hardware solution that enables processing of encrypted data to be performed at speeds equivalent to that of unencrypted data (c.1 million times faster), allowing companies to maintain data security whilst sharing and collaborating with confidential data. This process is known as Fully Homomorphic Encryption (FHE).

• The market-creating technology is based on Optical Fourier Transforms in which founder Dr Nick New has >20 years commercial experience.

• The business model is to develop a server mounted unit that can be sold to cloud providers to enable secure cloud base analysis of data using FHE.

Marketing & scaling opportunity

• FHE is potentially a multi-billion-dollar market and has longevity through being quantum-secure.

• Optalysys is working with software developers to fully enable the market.

IP & barriers to entry

• Optalysys’ optical solution is the only method that delivers performance and low-power consumption.

• 10 relevant patent families registered, with the 4 core patent areas at late patent approval stage.

Productisation & pipeline

• Revenue model will be a blend of infrastructure-asa-service, hardware sales and license models.

Management team

• Dr Nick New (CEO) — PhD from Cambridge University in Optical Pattern Recognition.

• Robert Todd (CTO) — 30 years experience in the optical industry. Previous company supplied precision optical systems to CERN.

• Dipesh Patel (Chair) — former CTO of Arm.

optalysys.com

Good Health & Wellbeing Potential in the healthcare industry to improve diagnostics and treatment.

Peace, Justice & Institutions

Protecting sensitive intelligence data preserves peace. Technology can be used to prevent financial fraud and identity theft.

Job Creation

A high number of new skilled jobs based in the North of England to be generated through this investment.

• Founded in 2020, Phlux has developed a patented, highly sensitive semiconductor material with best-in-class performance for sensing and communication systems.

• Phlux is a spinout company from the University of Sheffield and is based in Sheffield.

• Since the seed investment, the company has launched its first product — Aura — a drop-in replacement for Lidar systems, secured its first design win and delivered its first revenues.

• The company recently raised a £9m Series A round, which it will use to launch a new range of products, transfer fabrication to Taiwan and establish sales and distribution channels in the US.

Marketing & scaling opportunity

• Phlux’s novel semiconductor material has many end markets such as LIDAR and Optical Communications, combined offer a TAM of $8.1bn.

IP & barriers to entry

• The core of Phlux’s IP lies in the formulation and application of its novel material, protected by multiple patent families.

Productisation & pipeline

• The company have secured its first design win and has a strong sales pipeline. It also has Letters of Intent regarding its optical comms product from two large multi-nationals.

Management team

• CEO Dr Ben White, technical founder with 3 patents filed on Phlux’s technology.

• Chair, David Crisp, an experienced chair who has raised VC funding.

• VP BD, Christian Rookes, 25 years' experience & set up product lines with >1bn capacity.

phluxtechnology.com

AND IMPACT

Climate Action

Phlux’s products can reduce processing power from 0.8 Watts to 0.3 Watts. Other climate applications include measuring methane gas.

Industry, Innovation and Infrastructure

Improving value proposition of high-value sensing devices and high-speed communications.

Job Creation

Bringing high-skilled jobs to the North of England, both retaining talent within region and attracting talent to the region from elsewhere.

KEY INFORMATION

• Phagenesis spun out of the University of Manchester in 2007, following 18 years of research carried out by Shaheen Hamdy (CSO) during his time there.

• The company has developed a medical technology — Phagenyx — to treat dysphagia (difficulty swallowing). Phagenyx is a temporary therapy (i.e. no implant or surgery) which permanently restores swallowing across 3x 10-minute treatments, improving patient outcomes and reducing hospital length of stay by as much as 13 days, saving hospitals $6k/day in ICU bedspace costs.

• The device is CE-marked and FDAapproved. 15 clinical studies on 800+ patients have been completed, as well as the treatment of 300+ patients.

phagenesis.com

Northern Gritstone equity held

Return to date:

1.0 x

Multiple of money invested

Marketing & scaling opportunity

• Phagenyx is approved for use in the treatment of post-stroke dysphagia. In itself, this is a large market with significant unmet need. Beyond this, the same product can be used in additional large markets such as post-ventilation dysphagia therapy.

IP & barriers to entry

• Phagenesis has a substantial portfolio of patents which sit alongside know-how, clinical evidence, and regulatory approvals which act as a ‘moat’ of protection around the market opportunity.

Productisation & pipeline

• Strong sales in Europe are demonstrative of market pull and adoption. The data and clinical confidence generated in Europe will be used to support global growth efforts, with US market growth building.

Management team

• Phagenesis is Chaired by veteran medtech entrepreneur Oern Stuge, who has overseen multiple, large exits as Chair.

• CEO Chad Hoskins is an experienced medtech startup CEO with expertise in scaling companies and US sales and marketing.

Current valuation

Internal rate of return

Key co-investors include: EQT, Sectoral, BPC, Aphelion Capital, Nestle.

Good Health & Wellbeing

Patient outcomes are improved as the technology enables faster recovery and treats the cause of dysphagia — not just the symptoms.

Climate Action

Phagenyx eliminates the need for assisted feeding, and by association the use of single-use plastics.

Job Creation

New skilled jobs based in the North of England will be generated through this investment.

• Exciting Instruments is a University of Sheffield spinout from the lab of Professor Tim Craggs.

• The Company’s technology — the EI-FLEX — is a bench-top scientific instrument which enables high resolution study of single molecules.

• To date, the company has generated revenues via sales of a version 1 device into academic institutes. Beyond this, the same core technology has utility in pharmaceutical markets.

• Two Big Pharma customers are currently using the company’s technology to understand the conformation and binding mechanisms of ‘blockbuster’ drugs in their drug discovery development pipelines. This is information currently unavailable to pharma via incumbent tools.

excitinginstruments.com

Marketing & scaling opportunity

• Exciting Instruments’ solution has multiple end market applications including academic research, pharmaceutical drug discovery and diagnostics –an expected $40bn TAM by 2031.

IP & barriers to entry

• The Company’s technology is pioneering.

• One patent filed and a further four patent submissions in the pipeline.

Productisation & pipeline

• Exciting Instruments has a diverse set of potential revenue streams across multiple markets, encompassing; unit sales, SaaS licenses, consumables.

Management team

• Tim Craggs is a highly respected academic in this space. Strong commercial team in place being augmented by board level appointments of individuals ex-Abcam and ex-ThermoFisher.

Good Health & Wellbeing

The product will be used with the ultimate goal of improving good health and wellbeing via the development of new drugs.

Decent Work & Economic Growth

Multiple of money

Return to date: Key co-investors include:

Bringing high-skilled jobs to the North of England, both retaining talent within region and attracting talent to the region from elsewhere.

Industry, Innovation & Infrastructure

The democratization of single molecule analysis facilitates innovation across multiple industries.

KEY INFORMATION

• A spinout of the University of Sheffield, Crucible is developing advanced therapies to treat central nervous system conditions with high unmet needs, beginning with Amyotrophic lateral sclerosis (ALS) and Frontotemporal dementia (FTD).

• Crucible has developed CGT-01, a gene therapy administered in a single injection to the cerebrospinal fluid, which uses an adeno-associated virus (AVV) to silence the SRSF1 gene, thought to be an underlying cause of some forms of ALS / FTD.

• CGT-01 aims to prevent neurotoxicity and motor neuron death and early pre-clinical data in mice and human derived neuronal cells shows the technology working — the first of its kind targeting the SRSF1 gene.

crucible-tx.com

Return to date:

x

Multiple of money invested

Key co-investors include: ArgoBio.

%

m

KEY INVESTMENT HIGHLIGHTS

Marketing & scaling opportunity

• Large unmet need in ALS / FTD with 2,500 cases annually and a market of £2.5bn.

IP & barriers to entry

• Technology is patented and European based clinical trials are being discussed with the UK regulator with plans to host the trials at Sheffield University, where a new gene therapy manufacturing centre has been built.

Productisation & pipeline

• Tranched investment with proof of concept, regulatory approvals and clinical trial design the end goals.

Management team

• Prof. Dame Pamela Shaw — world leading clinician in ALS and Dr Mimoun Azzouz — world renowned for AAV gene therapy work.

• Prof. Guillaume Hautbergue (CTO) — expert in translational RNA biology.

• ArgoBio — therapeutics focussed investment entity — providing the Chair (Neil Mackenzie) and COO (Jonathan Foley).

PURPOSE AND IMPACT

Good Health & Wellbeing

Crucible aims to save lives or significantly improve the quality and duration of lives in those that would otherwise die from conditions for which no efficacious treatments exist.

Job Creation

A high number of new skilled jobs based in the North of England to be generated through this investment.

• adsilico is a University of Leeds spinout, built on 15+ years of research and £10m+ of non-dilutive funding.

• The company is building an end-to-end solution for medtech companies to run insilico trials (‘ISTs’). ISTs use computational models and simulations to assess safety, efficacy and performance of medical devices ahead of real world human clinical trials. They also reduce the need for animal experimentation.

• The solution will comprise 3 core services; virtual populations, IST execution (virtual experiments simulating a medical intervention), and digital evidence (simulation results to inform device design).

Marketing & scaling opportunity

• Regulatory bodies have recently accepted in-silico data in place of animal testing. In-silico businesses have seen successful uptake in the pharma industry, demonstrating utility, enterprise value build, and large exit multiples.

IP & barriers to entry

• adsilico has a filed patent and others are in the pipeline. The reputation of Prof. Frangi is an additional barrier to competition.

Productisation & pipeline

• The medical devices industry is demanding solutions to reduce the cost of trials and device re-calls. adsilico is well positioned to deliver this at scale and is already engaged with a big player in the industry in a commercial partnership.

Management team

• Founder, Prof. Alex Frangi, is a high-profile opinion leader on computational medicine and ISTs with Chair and Director positions in leading academic and professional institutes.

• CEO and Co-founder Sheena Macpherson.

adsilico.uk

INVESTMENT DETAILS

• Chris Richardson (Chair) — a veteran in implantable medical device start-ups.

PURPOSE AND IMPACT

Good Health & Wellbeing

The platform will enable more cost efficient and safer development of medical devices.

Job Creation

Multiple of money invested

£2.7m 30% 30% 1.3x Current valuation Internal rate of return Northern Gritstone equity held

Return to date: Key co-investors include: Parkwalk Advisors.

New skilled jobs based in the North of England will be generated through this Investment.

• BOW is a spinout from the University of Sheffield. The company is developing a toolkit to democratise robotics software development. Its cross-platform, crossrobot solution opens robotics programming to all software developers by making it possible to code in any programming language and to deploy that code on any robot, making the development of robotic applications quicker, easier and more cost effective.

• Robotics software enables robots to function and operate and to integrate within an environment. The global robotics software market is forecast to grow to $50bn by 2032.

Marketing & scaling opportunity

• Versatile robotics for dynamic environments are expected to outperform traditional fixed-task systems, opening up a multi-billion dollar market.

• BOW is well-positioned to seize this opportunity, providing developers with easy-to-use tools for creating adaptable robotic solutions.

IP & barriers to entry

• BOW’s approach to decoupling robotic hardware and software based on years of research in cognitive behaviour and natural intelligence is hard to replicate and differentiates them in the market.

• Trade secrets held over the fundamental techniques that make this possible.

Productisation & pipeline

• BOW provides the tools that open robotic development to a wider pool of software developers, leading to applications across the entire robotics ecosystem.

• Focus is on building a developer community whilst embedding the software with key OEM partners.

usebow.com

INVESTMENT DETAILS

22 %

Northern Gritstone equity held

1.0 x

Multiple of money invested Return to date:

Management team

• CEO Nick Thompson has previously built a software company to £22m revenue before a PE exit.

• Chair Liz Upton is one of the founders of Raspberry Pi where she focused on community and ecosystem development, key areas of importance for BOW.

Current valuation

£2.6 m 4 %

Internal rate of return

AND IMPACT

Decent Work & Economic Growth

New jobs based in the North of England to be created through this investment.

Industry, Innovation & Infrastructure

By reducing the complexity and cost of robotic development, BOW supports increased innovation and the development of scalable infrastructures within the robotics sector.

• Partful is a 7-year-old Manchester based company that develops software products to enable Original Equipment Manufacturers (‘OEMs’) to rapidly generate 3D interactive parts catalogues and work instructions from diverse data sets, for their engineers, dealerships and customers.

• The software allows Partful’s customers to access and participate in the aftermarket sales market, worth >$1Tn. Aftermarket revenues can last for decades and be more profitable than selling the original product, yet most OEMs do not have the sophisticated processes to access this market; two-thirds of aftermarket sales are lost to 3rd parties.

• Partful’s products also benefit customers by training their workforces, enabling efficiency savings in their manufacturing processes and in service centres.

partful.io

INVESTMENT DETAILS

Northern Gritstone equity held

Return to date:

£2.5 m n/a 10 %

Marketing & scaling opportunity

• Very large opportunity to provide a broad range of enterprise and SME customers with the capability to provide aftermarket parts and work instructions to customers, dealerships and distributors — boosting stretched margins.

• SaaS model gives potential for hyper scaling.

IP & barriers to entry

• Significant copyright and know-how in software and architecture.

• Underpinned by 5 years of work with customers and the team’s first-hand domain experience of the sector’s problems.

Productisation & pipeline

• The company is generating recurring revenue through its existing product set, with further product releases set to unlock significant additional demand.

Management team

• CEO and founder Sam Burgess; ex special forces with vision, commitment and team ethos. Supported by experienced Chair Mark Robinson.

Responsible Consumption & Production

Enable easier repair of products, reducing waste, increasing accessibility to vital parts and components.

Industry, Innovation and Infrastructure

Increasing efficiency, reliability and up-time of products that depend on the industrial supply chain.

Decent Work & Economic Growth

Multiple of money invested

1.0 x Current valuation Internal rate of return

Key co-investors include: Par Equity and Blumberg.

Increase productivity by automating low-level tasks and improving training. Manchester HQ with additional new high-skilled jobs in the North of England planned.

KEY INFORMATION

• Founded in 2018 Silveray has developed a newly patented, direct X-ray detector material which improves X-ray sensitivity up to 1,000x compared to existing technologies, at a lower cost.

• Benefits for existing applications include higher-resolution images for an equivalent dose in industrial X-ray inspection, lower dose medical X-ray and larger possibilities for automated X-ray inspection.

• Due to the sensitivity of the conversion material (a semiconductor ink doped with nanoparticles) Silveray also facilitates new applications such as curved X-ray detectors, as only a thin product layer is necessary.

• Silveray relocated to Stockport to access X-ray specialists and resources, becoming a ‘spin-in’ to the wider University of Manchester deep-tech ecosystem.

silveray.co.uk

INVESTMENT DETAILS

19 %

Northern Gritstone equity held

Return to date:

1.0 x

Multiple of money invested

Marketing & scaling opportunity

• Silveray’s solution has multiple end market applications including industrial, security, medical and veterinary — a TAM of $6.3bn.

IP & barriers to entry

• The core of Silveray’s IP lies in the formulation and application of its novel material, protected by multiple patent families.

Productisation & pipeline

• Prototypes of the Digital X-ray Film product have been positively received and Letters of Intent have been secured from large multi-nationals.

Management team

• Silveray is led by CEO Dan Cathie who has built and exited businesses in the space previously.

• CTO Stephen Whitelegg has significant experience including going through 2x IPOs.

• CPO Norman Stapelberg has built and delivered products in the X-ray industry.

• Perry Duffill (Chair) — extensive experience as a senior executive in multinational electronics manufacturers.

PURPOSE AND IMPACT

Innovation & Infrastructure

Current valuation

£2.4 m 6 %

Internal rate of return

Key co-investors include: UKI2S, R42 Group, Angel CoFund, UK Future Tech Invest.

The technology changes the value proposition of digital X-ray detection, disrupting the way industrial and medical industries utilise X-ray technologies.

Job Creation

A high number of new skilled jobs based in the North of England to be generated through this investment.

Reduced Inequalities

Decrease in cost supports wider use of X-ray technology, particularly in lower-income regions and markets.

Northern Gritstone invests in world-class science and technology. How we support our portfolio companies to become world-leading is just as important.

Deploying our Capital+++ platform, we back our ambitious founders by enhancing capability and bringing in the talent and the infrastructure that can help grow a world-class scalable business.

NG Innovation Services is the ‘early-stage toolkit’ for founders that ‘leans in’ very early to create highperforming teams that transform a science- or technologyled business into a customer-led business with solid operational foundations. The support offered by the different functions of NG Innovation Services form a jigsaw, each part of which plays a critical role in building success.

NG Co-Investment

Builds high-calibre and complementary syndicates connecting founders with domestic and international investors from pre-Seed and Seed onwards.

A venture building program delivered with exceptional partners. In 2024 NG Studios ran two technology cohort programs with Deeptech Labs, supporting eleven earlystage companies. The first cohort raised over £15 million of Seed funding. KQ Labs will deliver our life sciences program with the first cohort launching in June 2025.

NG Growth

Offers hands-on support to enhance commercial capability, accelerating the essential transition from businesses which are technology and product-led to become customer-centric and revenue-generating faster.

Business Services Provides easy access to fundamental business ‘building blocks’ through best-in-breed, cost-effective, provider panels in HR, Finance, Insurance, IT and Branding.

NG Talent

Builds first-rate leadership teams, mentors leaders and connects them with expertise — industry entrepreneurs who have successfully ‘been there and done it’.

Together and individually, the four Northern Arc universities have an impressive research footprint, history, and funding record. Their research quality is ranked equivalent to Oxford and Cambridge universities.* On a combined basis:

#1 #1 1 in 10 70 + 62,000

UK spinout volume UK research income ranking of every UK university patent academic institutes talent pool

They produce the highest annual volume of spinouts with Higher Education ownership in the UK2.

They have more research income than any Higher Education institute in the UK1

They produce 1 in 10 of every patent filed by a Higher Education institute in the UK2

Leading research institutes at the Founding and Partner Universities include:

They comprise over 70 leading academic institutes. A talent pool of over 16,000 research & academic staff 2 and almost 46,000 postgraduate students 2 .

This is summarised in the table below:

*Average of 92% of research rated as ‘world leading/internationally excellent’ by the Research Excellence Framework, which compares against 91% for Oxford University and 93% for Cambridge University.

Sources: 1 — Universities 2 — HESA 3 — Research Excellence Framework. All data from 2023/24 except 3 which relates to 2021 and is the latest data available.

The Northern Gritstone team of ‘Gritstoners’ turn the wheel of Profit with Purpose by supporting ambitious companies in the North of England and by being active members of the North’s innovation hub.

We care deeply about regional growth through the creation of world-class companies. We know that building these businesses is hard work for our portfolio company founders, which is why we bring our support and empathy.

Our combined ‘Gritstoner’ skills are how we best support amazing founders and their teams. In the past year, our team has grown in our investment management business and in NG Innovation Services (the Capital+++).

Some of the Gritstoners turning the wheel of profit with purpose are shown opposite.

Jess McCreadie INVESTMENT DIRECTOR

Jess is an Investment Director specialising in Health Tech. She joined Northern Gritstone from Octopus Ventures where she worked as Principal specialising in Health Tech and B2B SaaS. Prior to Octopus, she was Investment Director at L&G, investing in Health Tech, Clean Tech and Infrastructure scale Clean Energy. Jess has a first-class honours degree in International Business from the University of Strathclyde. She manages the relationship with the University of Manchester for Northern Gritstone.

James Gibbons INVESTMENT MANAGER

James is an Investment Manager specialising in Life Sciences, including Biotech and Therapeutics. James leads the NG Studios Therapeutics accelerator program working with our delivery partner KQ Labs. He previously worked in commercialisation at the University of Leeds leading a team responsible for IP licensing. James has a Masters degree in Pharmacology from the University of Bristol.

Joanne Hosker HEAD OF NG INNOVATION SERVICES

Joanne is our Head of NG Innovation Services (‘NGIS’) and brings over 10 years' experience in talent selection and connecting C-Suite individuals with entrepreneurs and industry specialists, one of the bedrocks of the NGIS function. Joanne joined from BGF’s Talent Network Team where she supported the creation of effective boards introducing BGF portfolio businesses to a network of non-executive board directors and chairs.

Andy Naylor INVESTMENT DIRECTOR

Andy is an Investment Director with more than 20 years’ experience growing technology businesses. He was previously CEO of Nottingham Technology Ventures, a company that manages the University of Nottingham’s spinout portfolio and associated investment funds. Andy has been an investor, advisor, CEO and Non-Executive Director of technology companies. He holds a first-class honours degree and PhD in Physics from the University of Nottingham. Andy manages the relationship with the University of Leeds for Northern Gritstone.

Khadija Ashfaq INVESTMENT MANAGER

Khadija is an Investment Manager specialising in physical technology including Cybersecurity, Semiconductors and novel AI. Prior to joining Northern Gritstone, Khadija worked in venture capital for Northstar Ventures where she covered AI. She holds a BSc in Economics from the University of York and the CFA Investment Management Certificate.

Alan Pong PORTFOLIO ANALYTICS MANAGER

Following his graduation from the University of Edinburgh with a MA(Hons) in Accounting and Finance, Alan trained as a chartered accountant through ICAS in the audit and data assurance practices of PwC, specialising in asset and wealth management businesses. Alan also has experience in corporate accounting with Amazon UK prior to joining Northern Gritstone.

Effective management of risk is necessary for Northern Gritstone to achieve its strategic objectives and is part of good management and effective governance.

The Group has a holistic approach to risk management embedded into its structures and processes through governance and risk appetite frameworks, and an underlying policy and control environment that integrates risk management into planning and decision-making.

The Group operates a systematic process of risk identification which is both bottomup and top-down, as well as aligned to its strategic aims. The approach is deliberately multi-faceted, to maximise the chances of successfully identifying risks and to ensure so far as possible that risks feature at the front of management thinking at all levels within the Group.

Overall responsibility for risk management rests with the Board, but Northern Gritstone recognises that it is important for all stakeholders across the Group to engage actively in risk management in order to ensure

that a positive risk management culture is developed and maintained.

Northern Gritstone’s Risk Management Methodology and Framework and its implementation is led by the Chief Financial Officer, with oversight from the Investment Committee, Audit and Risk Committee and Board.

The Investment Committee oversees risks associated with the investment strategy and that the investee portfolio is managed appropriately.

The Audit and Risk Committee oversees and reviews the annual risk management cycle. It reviews the Group’s risk appetite, reviews the principal risks affecting the business, and on-going mitigating actions. The Audit and Risk Committee also liaises with the external auditor regarding their assessment of the risks facing the business. The Audit and Risk Committee reports its findings to the Board.

Northern Gritstone operates an on-going risk management cycle in accordance with its Risk Management Methodology and Framework. This includes: identifying and evaluating the material risks affecting the business; reviewing the Group’s risk appetite; gathering input from the Group’s auditors; determining mitigating actions then monitoring their implementation.

Northern Gritstone’s risk appetite is reviewed annually as part of the Group’s governance cycle, with oversight and input from both the Audit and Risk Committee and the Board.

Northern Gritstone has a high appetite for investment risk, which is inherent to investing at an early stage in innovative technology and life-science businesses. It intends to mitigate this risk by ensuring that the portfolio is diverse and that exposure is spread across

a large number of investments. This risk is further mitigated by active engagement with investee Boards, investee access to Northern Gritstone support and a focus on future funding options.

Northern Gritstone has a low appetite for risks relating to its: reputation; compliance; legal and regulatory; ethics; and financial integrity. The Group operates governance and control systems to ensure that risks across these areas are appropriately managed.

The Group’s Risk Register is formally reviewed and updated annually by the Audit and Risk Committee and approved by the Board. Highlighted overleaf are risks that are deemed key to the effective delivery of Northern Gritstone’s strategy, and the Group’s responses to them.

Early-stage companies typically face a range of risks. A significant number of investee companies could perform poorly, leading to material losses for the Group.

The inability of Northern Gritstone’s investee companies to access sufficient capital at the right time could lead otherwise successful companies to fail.

The Group has a high level of dependence upon the Chief Executive Officer and Chief Investment Officer, particularly at this early stage of the Group’s development.

Insufficient volume or quality of spinout companies emerging from the Founding and Partner Universities may limit Northern Gritstone’s long-term growth prospects.

• Northern Gritstone’s employees have significant experience in sourcing, developing, and growing early-stage companies to significant value.

• Support is offered to all investee companies and members of Northern Gritstone’s investment team engage with investee company Boards to help identify and remedy critical issues promptly.

• Capital is deployed gradually across a large range of companies, at different stages of growth and across different sectors.

• Northern Gritstone seeks to employ a capital efficient process deploying low levels of initial capital to enable identification and mitigation of potential failures at the earliest possible stage.

• Northern Gritstone’s investee portfolio is young and will not have a significant cash need in the short-term. The Group regularly forecasts the cash requirements of investee companies along with identifying additional potential funding sources for future fundraising rounds.

• A strategy of working with co-investors is being pursued to reduce forward funding risk.

• Short-term succession plans have been developed for the roles of Chief Executive Officer and Chief Investment Officer.

• The Group offers a balanced incentive package which is designed to reward loyalty and retain the Chief Executive Officer and Chief Investment Officer.

• The strong reputation and long history of the Founding and Partner Universities supports a healthy research funding environment.

• Current government policies are supportive of innovation and the Levelling-Up agenda should drive innovation funding to the region in which Northern Gritstone operates.

• The Group engages with government and policy makers to support the funding environment for universities and early-stage innovation.

• Northern Gritstone has developed a good working relationship across the Founding and Partner Universities with departments from which spinouts are likely to emerge, in addition to running a range of accelerator programmes.

Failure to attract or retain suitable staff (who are largely highly skilled and specialist) would have a significant impact on the ability to execute Northern Gritstone’s strategy.

The Group is at an early stage of development and the culture adopted will have a significant impact on future performance.

The Group may be subjected to phishing and ransomware attacks, data leakage and hacking.

The Group has committed to be an example for other businesses to follow. Failure to do so could cause significant reputational damage.

• The Group carries out regular market comparisons for staff and executive remuneration and seeks to offer a balanced incentive package comprising a mix of salary, benefits, short-term and longterm incentives which are designed to reward loyalty and attract and retain key talent.

• The Group operates a rigorous hiring process and encourages employee development and inclusion through training and carries out annual objective setting and appraisals.

• The Group retains specialist recruitment firms to help fill open roles.

• The Group aims to create an open and inclusive culture which embraces challenge and value-add feedback.

• Diversity of thought and experience is actively encouraged and the Group has made available publicly its commitment to Equality, Diversity and Inclusion.

• The Group places strong emphasis on developing the right culture and operates a zero-tolerance approach to inappropriate behaviours.

• Northern Gritstone has in place a cyber & IT security policy and reviews its data and cyber-security processes with its external outsourced IT provider.

• The Group has a regular IT management reporting framework in place.

• There is an ongoing focus on IT security and staff training, including simulated cyber attacks and maintenance of a business continuity plan.

• The Group’s governance is of a high standard and the strong ethical values the Group embraces guide how we do business in every aspect.

Continued...

The Group must comply with a broad range of regulatory and legal requirements. Failure to adhere to these rules could result in a fine, legal proceedings against Directors or the failure of the Group to continue to operate.

Northern Gritstone is reliant on the Founding Universities for a large volume of its potential investments. Were the Framework Agreement to be terminated it would have a significant impact on the strategy of the Group.

Failure of key third-party suppliers or service level agreement failure affecting Northern Gritstone’s ability to maintain operational viability. In addition, failure in internal controls and procedures could have the same impact.

One-off climate events may disrupt operations.

• The Group maintains a continual review of its compliance in key areas, including commissioning third-party reviews where required. No material issues have been identified to date.

• The Group maintains D&O and professional indemnity insurance policies.

• The Founding Universities are shareholders in Northern Gritstone, which creates a mutually beneficial partnership. In addition, each Founding University appoints a Non-Executive Director to the Group’s Board and is an active member of at least one subcommittee of the Board.

• Northern Gritstone is collaborating well with the Founding Universities and the relationships with the Technology Transfer Offices are strong. Should an issue arise, the Framework Agreement contains mechanisms for managing these.

• The Group has the ability to invest beyond spinouts from the Founding Universities.

• The Group is in regular contact with third-party suppliers and monitors for any impending issues.

• All third-party suppliers provide functions which could be switched to another supplier if required.

• The Group has established internal controls and procedures appropriate for its stage of development.

• The Group’s employees have the ability to work in multiple offices or from home if there is a climate event in their location.

• A prolonged climate event across the region is possible, but is likely to be temporary in nature.

During the period reported Northern Gritstone has continued to develop its Purpose & Impact (‘P&I’) strategy. The results of the annual P&I focused survey of our investee companies are incorporated into this report.

During the period Northern Gritstone invested in an additional 8 companies. In total, the Group has now backed 32 science and innovation-based businesses in the North of England, all enjoying strong intellectual property underpinned by world-class science and an ability if successful to become world-leading businesses.

Since inception, an additional £301m of co-investment has been invested or committed by a series of local, European and other international investors into the North of England alongside the Group’s £65m of committed and invested capital. This represents c.4x

the value that Northern Gritstone has invested. Total funding to date made by Northern Gritstone and co-investors now stands at £366m.

The 32 investments Northern Gritstone has made to date funded 245 additional jobs, with significantly more to follow as the monies invested are fully deployed by the investee companies. At 31 March 2025 Northern Gritstone’s investee companies employed 744 people in total. 100% of investee companies pay all employees and contractors at least the Real Living Wage. This is consistent with the high-skill, high-wage jobs which Northern Gritstone intends to generate.

Note: Numbers refer to the UN classification of the Sustainable Development Goals.

EXAMPLES OF INVESTEE COMPANIES WITH HIGH IMPACT TOWARDS SPECIFIC UN SDGS INCLUDE:

Climate Action

Currently data centres emit c.1 billion tonnes of CO2e emissions each year globally (3% of total global CO2e emissions). Iceotope’s precision liquid cooling products can reduce energy usage in data centres by up to 40% and water usage by up to 96%. Their technology has already helped their customers avoid c.1,450 tonnes of CO2e emissions.

Good Health and Wellbeing

Crucible significantly improve the quality and duration of lives in those that would otherwise die from conditions for which no efficacious treatments exist. The company is initially focused on developing treatments for Amyotrophic Lateral Sclerosis and Frontotemporal Dementia, of which there are a combined 2,500 cases diagnosed annually but with no effective treatments available.

Industry, Innovation and Infrastructure

BOW is developing a toolkit to democratise robotics software development. Its cross-platform, cross-robot solution opens robotics programming to all software developers by making it possible to code in any programming language and to deploy that code on any robot, making the development of robotic applications quicker, easier and more cost effective. By reducing the complexity and cost of robotic development, BOW supports increased innovation and the development of scalable infrastructures within the robotics sector with the potential for positive impact on a global scale.

40

The total level of carbon emissions increased in the period driven by scope 3 emissions as a result of an increase in both the average number of employees, which rose to 27 during the period ended 31 March 2025 (2024:19), and the Group’s average invested capital, which rose to £48.9m during the period ended 31 March 2025 (2024: £26.2m).

The Group’s two key measures of annualised tCO2e per average invested capital and per average employee both increased in the period due to:

(a) a proportional shift to investment in later stage companies with manufacturing capabilities and thereby generally higher emissions-intensity; and (b) greater international travel in the period, necessitating the use of air travel.

The Group aims to minimise its carbon footprint in the first instance and then to offset any excess carbon emissions. The Group fully offset carbon emissions from its own operations for the period ended 31 March 2025 and for the period ended 31 March 2024. The carbon offset for both periods was performed through Carbon Footprint Limited, which runs a unique tree buddying scheme. As part of this scheme, Northern Gritstone funded the planting of trees in schools in the North of England and also supported projects reducing deforestation in the Amazon and Africa. These projects have been validated and verified against the Verified Carbon Standard.

During the period the Group re-affirmed its commitment to the Net Zero Asset Manager’s initiative. In the prior period the Group defined interim targets to achieve net zero across the Group and all of our investments by 2050 or sooner. The interim targets set, under the Paris Aligned Asset Owners Net Zero Investment Framework, are:

• 50% of invested capital actively engaged in carbon reduction conversations at Board level by 2030, increasing to 100% by 2040. At 31 March 2025, 22% of invested capital is actively engaged in carbon reduction conversations at Board level (2024: 14%).

• 30% of invested capital aligning or aligned with a net zero goal by 2030, increasing to 80% by 2040 and 100% by 2050. At 31 March 2025, 15% of invested capital is aligning or aligned with a net zero goal (2024: 12%).

• 100% of invested capital to have achieved net zero by 2050, with interim absolute carbon emission reduction targets to be set once Northern Gritstone’s portfolio has been fully established (expected by 2027). At 31 March 2025, no invested capital has achieved net zero (2024: nil).

THE GENDER AND DIVERSITY MEASURES REPORTED BY THE GROUP ARE:

In the long-term, the Group aims to reflect the communities in which it operates across all levels of the business and will continue to focus on developing a diverse and inclusive team as it builds out its operations. We are committed to removing barriers that may hold people back because we know that when people come together with different views, approaches and insights it can lead to a richer, more creative and innovative environment for creating the world-leading businesses of tomorrow. The Group ultimately aims, across all levels of the business, for a 50:50 gender balance and for at least 14% of people to come from an ethnic minority background. These percentages are consistent with the demographics of Leeds, Greater Manchester, Merseyside and Sheffield.

Northern Gritstone’s focus on Purpose & Impact and doing business in the right way underpins the business’ culture. Good businesses are diverse businesses by thought, experience, background and outlook as well as by gender, race, sexuality and other characteristics. The Group recognises that true diversity is 3D and incorporates a broad range of measures including socio-economic background, neurodiversity and education. Creating a diverse and inclusive working environment is central to our culture at Northern Gritstone and the Group has adopted and published on the Group’s website a statement on its commitment to equality, diversity and inclusion.

The portfolio P&I survey provides an insight into the backgrounds of those leading and employed by our investee companies. 18% of all people employed by Northern Gritstone portfolio companies come from an ethnic minority background, which is above the average of 14% of the populations of Leeds, Greater Manchester, Merseyside and Sheffield. However, only 24% of people employed by portfolio companies identified as female. This level is consistent with UKwide surveys of people employed in STEM (‘Science, Technology, Engineering and Maths’) industries, but is an area on which the Group will continue to engage with investee companies as they build out their operations. More positively, over 70% of investees have a mixed-gender Board, which compares against 28% across the UK venture-capital market 2 .

The Group is a signatory to the Investing in Women Code, with a commitment to improve the potential for female entrepreneurs to access successfully the tools, resources, investment and finance they need to build and grow their businesses. This reflects the Group’s commitment to gender equality across both Northern Gritstone itself and its existing and future investee companies. During the period reported, the Group has taken the following specific actions to promote female entrepreneurship:

• Established an investment committee that is 50:50 male / female;

• Established an investment team which is 50:50

male / female;

• Attended and presented at events focused on promoting female entrepreneurs;

• Held an Equality, Diversity and Inclusion Day, which celebrated the diversity of our workforce;

• Engaged positively on diversity matters with investee companies (including through talent support services provided by NG Innovation Services);

• Backed female led companies (e.g. Pencil Biosciences, Floreon and adsilico) and companies with leading female academic founders (e.g. Auxetec, MicroLub and Crucible); and

• Analysed diversity and inclusion data for the Group and the portfolio at Executive and Board level.

NO GOVERNANCE OR LEGAL ISSUES AROSE DURING THE PERIOD. THE BOARD AND GOVERNANCE COMMITTEES MET PER THE TABLE BELOW:

Jim O’Neill

Duncan Johnson

James Hadley

Andrew Graham

Alex Macpherson

Jane Madeley

Luke Georghiou

Sue Hartley

Niranjan Sirdeshpande

Marion Bernard

Keith Breslauer

Tim Lewis

The Group focuses on working closely with its investee companies and their Boards, both through direct engagement by Northern Gritstone’s investment team and through sharing best practice. As part of the latter, we were pleased to hold our first P&I focused webinar with investees in the period. NG Innovation services now also offers a

toolkit which early-stage investees can use to set their businesses on course for success. Through this involvement, the Group takes an active role in developing, assisting, supporting and monitoring the strategic development of our investee companies. It is Northern Gritstone’s belief that if investee companies adopt a strong approach to governance,

which is appropriate for their stage of development, they are more likely to progress well in other areas of P&I and as a business more generally. Given this focus it was pleasing that, of the topics covered in

The Group is focused on ensuring that it works closely with other businesses in the North of England along with supporting the local communities in which we operate. This is alongside being a strong advocate for the Northern innovation economy and supporting this with commercial initiatives wherever possible.

A vibrant Angel community is vital to support early-stage investment. In order to support the development of Angel networking across the region, the Group continued to engage actively with Manchester Angels, of which Northern Gritstone is a founding investment partner.

We were delighted to collaborate with Cambridge Innovation Capital and Oxford Science Enterprises to host an event at the Mansion House promoting the benefits of investing in UK university spinouts attended by over 300 institutional investors. Northern Gritstone also supported the Manchester based Royce Tata Materials MedTech Catalyst, the Sheffield-based National Centre for Children’s Health Technology and sponsored the Northern Triangle Therapeutics Accelerator Programme, which supports the commercialisation of therapeutics discoveries emerging from the Founding Universities.

The Group actively seeks to partner with suppliers which have a presence in the North of England. At 31 March 2025 over 50% of the Group’s suppliers were either headquartered in the North of England or service the Group from a team based in the North of England.

During the period the Group continued to develop is outreach programme, connecting with students attending local schools as well as students of the Founding Universities. Northern Gritstone has now connected with over 100 students in total through

the portfolio P&I survey undertaken in the period, investee companies scored highest in those related to governance.

its outreach programme. The Group engaged with Young Enterprise, with members of Northern Gritstone’s investment team volunteering to sit on panels judging student enterprises. Northern Gritstone employees also provided business mentoring to teachers who received grants from educational charity SHINE and volunteered to assist South Yorkshire Community Foundation with its grant allocation process, with the aim of maximising local impact.

Northern Gritstone is a signatory to the United Nations Principles for Responsible Investment.

The Group utilises the Sustainability Accounting Standards Board (‘SASB’) materiality guidelines when assessing the Purpose & Impact factors most likely to impact materially the financial condition or operating performance of both the Group and its investee companies.

As part of the investment appraisal process for potential investee companies, Northern Gritstone maps each company’s impact against the UN’s Sustainable Development Goals and utilises the Impact Management Project framework for

measuring and assessing impacts. The Group tracks and reports on progress against the impacts identified.

The Group has in place an investment exclusion list, detailing businesses or activities in which it does not and will not invest. This covers a broad range of activities which are harmful to people or the planet. A full copy of Northern Gritstone’s investment exclusion list is available to download from the Group’s website.

We recognise the importance of combating climate change and are committed to assessing and integrating the impact of climate change into our business strategy, operations and risk management processes. Northern Gritstone is not required to report against the recommendations of the Task Force on Climate-related Financial Disclosures (‘TCFD’), but has chosen to do so on a voluntary basis as part of its commitment to the Net Zero Asset Manager’s initiative.

We are in the early stages of aligning with the recommendations of the TCFD and our focus in the period reported was on assessing, qualitatively, the associated impact and management of climaterelated risks and opportunities on Northern Gritstone and our portfolio. Our approach has been guided by the ‘TCFD Implementation Considerations for Private Equity’ report published by TCFD, which recommends an approach to implementing TCFD recommendations that is appropriate to an

organisation’s size, the geographic coverage of its investments and its exposure to high-risk climate sectors. Northern Gritstone is a small business by asset management standards, invests in businesses based in the North of England and has no exposure to high-risk climate sectors. Consequently, our approach to reporting under TCFD has been informed by these considerations. Going forward, we will continue to evolve and enhance our climate governance and reporting as appropriate.

Disclose the organisation’s governance around climate-related risks and opportunities.

a. Describe the Board’s oversight of climaterelated risks and opportunities.

b. Describe management’s role in assessing and managing climaterelated risks and opportunities.

The Board actively identifies and evaluates the risks inherent in the business, formally reviews these on at least an annual basis, and ensures that appropriate controls and procedures are in place to monitor and, where possible, mitigate these risks (see Risk Management on pages 32 to 36 of this Annual Report for further information).

This process includes climate-related risks and opportunities, which are discussed and approved by the Board, having been considered by the Purpose & Impact committee. Climate change targets have been set by the Board, with metrics updated and tracked at least annually (see Metrics and Targets within this TCFD section for further information).

The Chief Financial Officer is responsible for leading on Purpose & Impact matters throughout the Group and is a member of the Purpose & Impact committee, Executive committee and the Board (see Governance on pages 52 to 60 of this Annual Report for further information on the Governance structure of the Group).

The investment team engage with portfolio companies on climate risks and opportunities. Processes are in place so that management and the Board are appropriately informed of climate-related issues and that they are escalated where applicable (see Risk Management within this TCFD section for further information).

Purpose & Impact goals form part of the annual performance objectives of all employees of the Group and the Board are informed by climate-related issues when reviewing and guiding the Group’s strategy.

Disclose the actual and potential impacts of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning where such information is material.

a. Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term.

b. Describe the impact of climate-related risks and opportunities on the organisation’s business, strategy and financial planning.

c. Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

The information on the following pages highlight the actual and potential climate-related risks and opportunities that Northern Gritstone is exposed to and describe, qualitatively, the impact these may have on the organisation, and how we aim to mitigate climate risks and harness climate opportunities. Our financial planning informs our business and strategy, and is reactive to the environment in an iterative manner. We will continue to assess these climate-related risks and opportunities as part of our risk management process and aim to advance our analysis in the coming years.

We have considered Northern Gritstone Limited and its subsidiaries, as well as Northern Gritstone’s portfolio in aggregate. We recognise that the associated impact resulting from each risk and opportunity will vary across different portfolio companies. Moreover, while the identified risks and opportunities are those that we deem to be most material across Northern Gritstone and the portfolio as a whole, there are risks and opportunities not included below which may be more relevant for specific portfolio companies.

We have qualitatively assessed these risks over the short-term (0-5 years), medium-term (6-15 years), and long-term (16-30 years), considering transition risks, physical risks (both acute and chronic) and opportunities. The analysis was performed

using two scenarios developed by the Network for Greening the Financial System. These are:

Net Zero 2050 — Assumes that ambitious climate policies are introduced immediately. CO₂ removal is used to accelerate decarbonisation but kept to the minimum possible and broadly in line with sustainable levels of bioenergy production. Net CO₂ emissions reach zero around 2050, giving at least a 50% chance of limiting global warming to below 1.5°C by the end of the century. Physical risks are relatively low but transition risks are high.

Current Policies — Assumes that only currently implemented policies are preserved, leading to high physical risks. Emissions grow until 2080 leading

to about 3°C of warming and severe physical risks. This includes irreversible changes, such as higher sea levels, and results in a hot house world.

Based on this initial assessment, we believe Northern Gritstone’s strategy is resilient to the identified climate risks, as we continue to evolve and put resources towards climate risk assessment, mitigation, and reporting. Given Northern Gritstone invests in multiple companies providing climate solutions, at a high level the opportunities out-weigh the risks in the Net Zero 2050 scenario, whilst the opposite is true in the Current Policies scenario.

Increased energy and raw material costs

Enhanced reporting obligations

Increased pricing of energy and raw materials, including increased pricing of greenhouse gas emissions, is primarily a risk for later-stage energy-intensive companies. Given most of Northern Gritstone’s portfolio are early-stage, we believe this risk will have a low level of impact in the shortterm. However, this risk may increase in the medium- to long-term as companies scale. We aim to reduce exposure to this risk by engaging with new investments and portfolio companies on energy intensity, emissions measurement and emissions reduction.

Enhanced reporting obligations will require both Northern Gritstone and our portfolio companies to commit time and resources to comply with emissions- and climate-related reporting requirements. This is more of a risk to Northern Gritstone itself in the short-term, given the early-stage nature of our portfolio, though we expect this to have a higher level of impact on portfolio companies, given the time and resource constraints start-ups experience in times of expansion. This year, the Purpose & Impact committee began an annual review of the emissions- and climaterelated reporting requirements impacting Northern Gritstone and its portfolio. We also collect Purpose & Impact, including climate, data from our portfolio companies, and aim to highlight Purpose & Impact and climate reporting requirements to our new investments.

Supply chain instability

Risk of supply chain disruption which limits the availability of component parts required for manufacturing for certain companies. We support portfolio companies to review supplier sourcing strategies; encourage companies to develop contingency plans for when one supplier is affected; and encourage companies to avoid overconcentration of risk with key suppliers.

Political instability

Extreme weather events

Risk of political instability resulting from widespread climate crises globally. The impact could lead to social breakdown and increased conflict, with the effects being difficult to predict and potentially fast-moving. We support portfolio companies to develop business models and strategies that are flexible; encourage companies to avoid over-concentration of risk with key customers; and review the political landscape when considering future suppliers, customers and investors.

Business interruption because of extreme weather events taking electricity offline, flooding lab space and disrupting supply chains. As the physical effects of climate change worsen over time, we expect the level of impact to also increase. We aim to identify whether new investments are exposed to physical risks resulting from climate change, including exposure to supply chain risks, and engage with the company to develop back-up and resilience plans.

Climate and Cleantech investment opportunities

Shift in consumer preferences