EMPLOYERS OF CHOICE A plan to grow the labor pool

LEADERSHIP INSIGHTS How culture drives success

convenience.org

foodservice

The latest NACS SOI numbers show that

sales continue to grow

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals.

EASY TO EXECUTE

It’s simpler for associates to execute rather than manually entering in date of birth.

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Scan

Tobacco

Prompt

POS System Validates Transaction Continues

Product Scanned

to Scan for Age Validation Verify and

I.D.

R 5 6

26 Foodservice Sales Stack Up

Convenience foodservice categories add another win as all foodservice categories increase in sales and gross profit dollars.

32

A Celebrity Chef’s Creative Ways to Elevate Foodservice Chef Andrew Zimmern talks simple upgrades to food offerings that will impress customers.

36

Caught Red-Handed C-stores use a mix of old-fashioned techniques and new technology to limit internal theft.

44

A Parting of the Clouds Drivers continue to feel better about the economy, and they are looking for retailers who best understand their needs.

54

NACS Leadership Forum: How to Build and Grow Your Culture

Every company has a culture—but is it the one you want?

68

Cultivating C-Store Jobs into Careers of Choice

The NCCRRC offers an action plan for how convenience retailers can attract prospective employees.

76

Creating C-Store Leaders of the Future

This article is brought to you by Ready Training Online. Ready Training Online helps customize your c-store training program to set your managers on the path to success.

STAY CONNECTED WITH NACS

@nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

NACS MAY 2024 1

On the Cover: nyvltart/Getty Images. This Page: Arthimedes/Shutterstock A C-Store’s Heartbeat Managers are the heart of the store, and retailers are finding the best ways to attract and retain them. 62

ONTENTS NACS / MAY 2024

NACS / MAY 2024

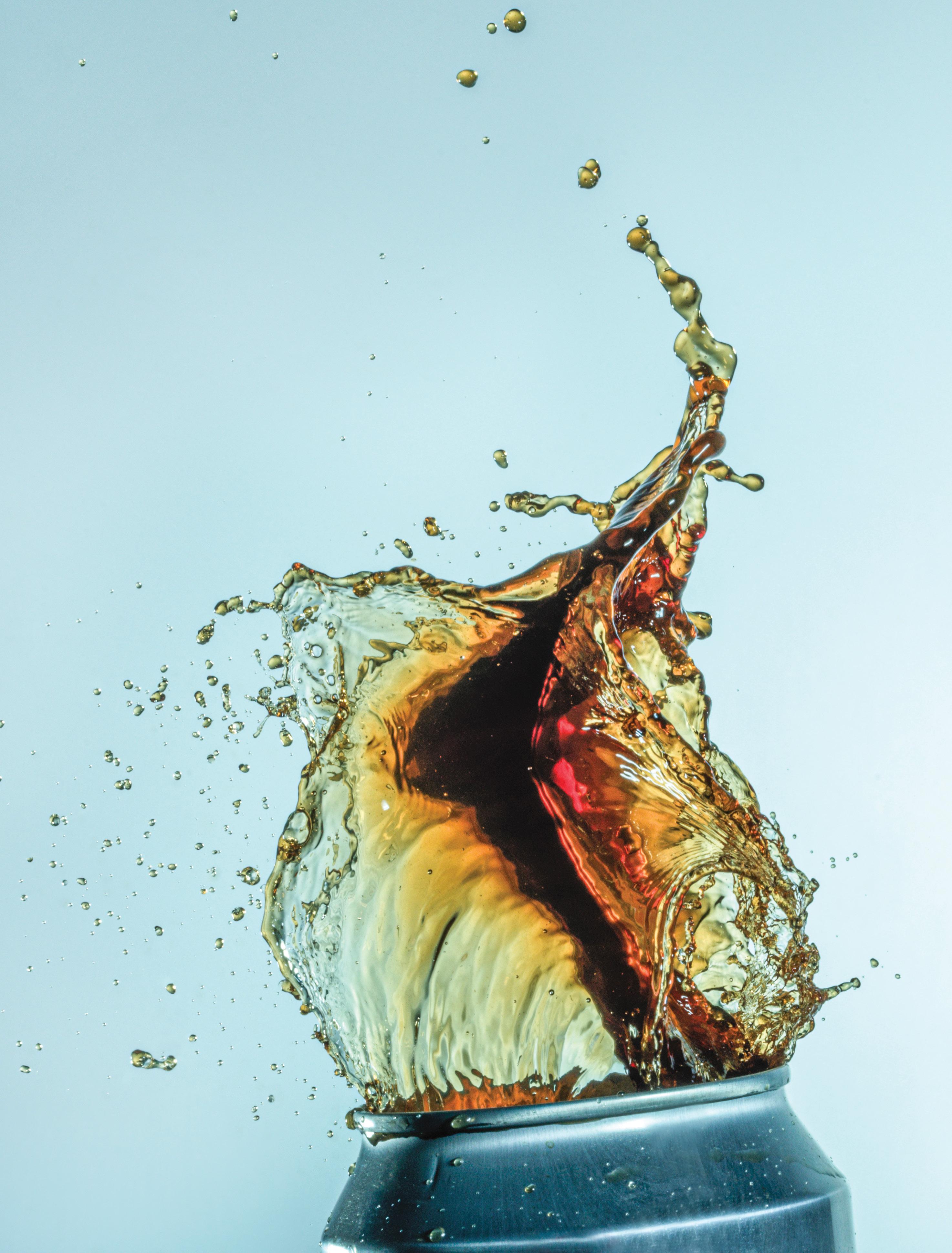

IT’S A FACT $37,496

The average sales per store, per month of packaged beverages in 2022.

CATEGORY CLOSE-UP PAGE 86

DEPARTMENTS

06 From the Editor

08 The Big Question

10 NACS News

18 Convenience Cares

20 Inside Washington

The NACS government relations team and state associations work together for the good of the industry.

24 Ideas 2 Go

Compass Travel Center offers European food delights and a focus on trucker amenities.

80 Cool New Products

84 Gas Station Gourmet At Blake’s Deli, seafood specials and southern cooking attract customers.

86 Category Close-Up

Packaged beverages remain key for c-stores as innovation beckons consumers.

96 By the Numbers

2 MAY 2024 convenience.org

ONTENTS

The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE Jonathan Knowles/Getty Images

ZIP UP BEVERAGE PROFITS

ZIP ® is a modern merchandising system that forwards and faces its product offerings at all times. Quickly add new facings with this cost-effective easy to install and adjust system.

With The Most Versatile System for Grab-and-Go Beverage Sales.

Trion Industries, Inc. TrionOnline.com/ZipTrack info@triononline.com Z I P Perfect for all beverages including alcohol Use in multiple storewide categories SELL IT 3 ZIP IT 1 FILL IT 2 Use actual product to set lane width. Slide product front-to-back to ‘ZIP’ tracks together in final position. Fill it with product. ZIP Track® maintains its width accurately for the entire length of facing without the need for a rear anchoring system. Deploy ZIP Track® for many different size and shape beverages. CUSTOM DEPTH ADJUSTABLE SPRING TENSION ADJUSTABLE WIDTH 2.00”- 3.75” 7 tensions match any shelf depth ©2022 Trion Industries, Inc. 800-444-4665 Adaptable, multi-use Zip Track ® system handles different size and shape packages with ease.

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor lking@convenience.org

Leah Ash Editor/Writer lash@convenience.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Chrissy Blasinsky, Shannon Carroll, Sarah Hamaker, Al Hebert, Adam Rosenblatt, Emma Tainter

DESIGN MX www.themxgroup.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

/ MAY 2024

NACS BOARD OF DIRECTORS

CHAIR: Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Chuck Maggelet, Maverik Inc.; Don Rhoads, The Convenience Group LLC; Brian Hannasch, Alimentation Couche-Tard Inc.; Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charlie McIlvaine, Coen Markets Inc.

PAST CHAIRS: Don Rhoads, The Convenience Group LLC; Jared Scheeler, The Hub Convenience Stores Inc.

MEMBERS: Chris Bambury, Bambury Inc.; Tom Brennan, Casey’s; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC Terry Gallagher, Gasamat Oil/Smoker Friendly;

NACS SUPPLIER BOARD

CHAIR: David Charles, Cash Depot

CHAIR-ELECT: Vito Maurici, McLane Company Inc.

VICE CHAIRS: Josh Halpern, JRS Hospitality/BCIP dba Big Chicken; Bryan Morrow, PepsiCo Inc.; Kevin LeMoyne, Coca-Cola Company

PAST CHAIRS: Kevin Farley, W. Capra; Brent Cotten, The Hershey Company; Drew Mize, PDI

MEMBERS: Tony Battaglia, Tropicana Brands Group; Patricia Coe, Advantage Solutions; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi,

Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Tony Miller, Delek US; Natalie Morhous, RaceTrac Inc.; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Kristin Seabrook, Pilot Travel Centers LLC; Babir Sultan, FavTrip; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES:

David Charles Sr., Cash Depot; Vito Maurici, McLane Company Inc.

STAFF LIAISON:

Henry Armour, NACS

GENERAL COUNSEL:

Doug Kantor, NACS

Greenridge Natural; Ramona Giderof, Diageo Beer; Mike Gilroy, Mars Wrigley; Danielle Holloway, Altria Group Distribution Company; Jim Hughes, Krispy Krunchy Foods LLC; Kevin Kraft, Q Mixers; Jay Nelson, Excel Tire Gauge; Nick Paich, GSTV; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Kevin Smartt, TXB; Tom Brennan, Casey’s

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA. Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria. Subscription requests: nacsmagazine@convenience.org POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA. Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

COME TOGETHER. DO MORE. Join us at conveniencecares.org

Winning With Foodservice

I’ve probably walked through the doors of my local c-store more than 1,000 times.

In my first few visits—15 years ago—I was impressed how it always seemed to have those crucial little items that got lost in my move to the neighborhood, items like a lightbulb, an extension cord, duct tape.

The store quickly became part of my morning commute. Its chocolate-frosted cake donuts were ridiculously tasty.

When I started working from home, I discovered that the c-store was a fun option when I needed to throw together a quick school lunch for one of my kids—the go-to was a croissant, a pack of crackers and a fresh fruit cup.

I’ve walked or driven there for dozens of reasons over the years. Beer … milk … butter … a sugar craving.

But, honestly, I haven’t been going there as much. No particular reason. It just hasn’t spoken to me. I haven’t had any problems it solves.

But … plot twist. Breakfast tacos, two for $4, according to a big sign out front. I had to check it out.

Inside, I discovered a new hot case and an expanded grab-and-go section, plus an assortment of cookies by the register. I’m all in on this pivot toward foodservice. The tacos lured me in, but the sausage breakfast sandwich keeps me coming back. It’s tasty, filling and

With food prices spiking, a breakfast sandwich remains an affordable indulgence.

My neighborhood c-store embodies the industry’s move towards bigger and better foodservice.

only sets me back $2. Hey, that’s practically free.

My visits to the store had dwindled to once a month, at most, but now they’re back to about once a week.

The moral: Foodservice is powerful. This isn’t new news, of course. Across all its categories, foodservice contributed $60,578 in sales per store, per month. Emma Tainter dives deep into all the latest foodservice data in “Foodservice Sales Stack Up,” revealing the latest foodservice data from the NACS State of the Industry Report ® of 2023 Data.

If my local c-store is any indicator, I can see how this industry’s food-forward future is looking pretty bright.

You can learn more about our industry’s foodservice trends, as well as its 2023 financial and operational performance, by purchasing a copy of the soon-to-be-released SOI Report at convenience.org/store

Ben Nussbaum Editor-in-Chief

Ben Nussbaum Editor-in-Chief

6 MAY 2024 convenience.org AnnapolisStudios/Getty Images

UP FRONT FROM THE EDITOR

ARTIFICIALLY FLAVORED ©Mondelēz International group

UP FRONT THE BIG QUESTION

Investing more in your people can feel expensive, but the reality is that not investing is far more expensive and far less competitive than many retail leaders realize. Low investment in people leads to high turnover. In an operationally intensive service industry like convenience, the cost of turnover is high, sometimes existential.

C-stores can fairly easily calculate the direct cost of turnover—hiring, training and getting teams to base productivity. We’ve seen this come in at 2-10% of revenue or 10-25% of payroll for some retailers and restaurants—and this is the smallest cost of turnover. Turnover will never be zero, but reducing turnover means you can invest those payroll dollars in keeping people (more training, higher pay) rather than losing them.

You need strong operational execution to deliver convenience: to be always in stock, process customers fast, offer quality food options, have relentlessly clean stores 24 hours a day and more. That level of execution is very hard to deliver with high turnover. We’ve heard from c-store leaders that the cost of poor execution is high —from higher shrink to lower inventory accuracy to maintenance issues to dirty stores to staff burnout.

All of these issues can increase costs and reduce sales today and tomorrow by reducing customer loyalty and goodwill. You can start to quantify this by looking at your

“What’s the business case for investing in your people?”

key operational and customer satisfaction metrics and identifying the gap between where you are today and where you could be with stronger teams. We’ve found this gap is often substantial—20-50% untapped potential you could harness with better jobs. And this is still not the largest cost of low people investment.

Your customers have lots of choices about where to fuel up. For c-stores to stay competitive in a rapidly changing world—especially those carving out a niche in foodservice—you need to have strong, stable teams that drive operational execution, build customer relationships and help you adapt to new technology, regulations and market changes.

Even when looking at these costs, it can feel like a big leap to make higher investments in pay, especially

after many companies have made significant investments over the past few years. That is where the Good Jobs Strategy comes in. C-stores that make strategic investments in people can leverage and derisk that investment with better operations and job design to drive stronger productivity, execution, and service. And we can help, though our partnership with NACS.

Your customers have lots of choices: if stable, engaged teams spend every day creating operational excellence and friendly service, that will position your business, and this industry, to be the channel of choice.

Discover more at www.convenience. org/Topics/Employee-Engagement/ The-Good-Jobs-Strategy/

8 MAY 2024 convenience.org

Sarah Kalloch, Executive Director, Good Jobs Institute

WHEN ZYN ROLLS IN, ZYN ROLLS OUT…FAST 16 of the 20 fastest selling nicotine pouch SKUs are ZYN 5-can Rolls (based on can velocity). STOCK MORE ROLLS, SELL MORE ROLLS. CALL 800-367-3677 OR CONTACT YOUR SWEDISH MATCH REP TO LEARN MORE. *Statistic source: IRI Total US Convenience, 26 Weeks Ending 1-14-24. For Trade Purposes Only. Not for Distribution to Consumers. ©2024 Swedish Match North America LLC WARNING: This product contains nicotine. Nicotine is an addictive chemical.

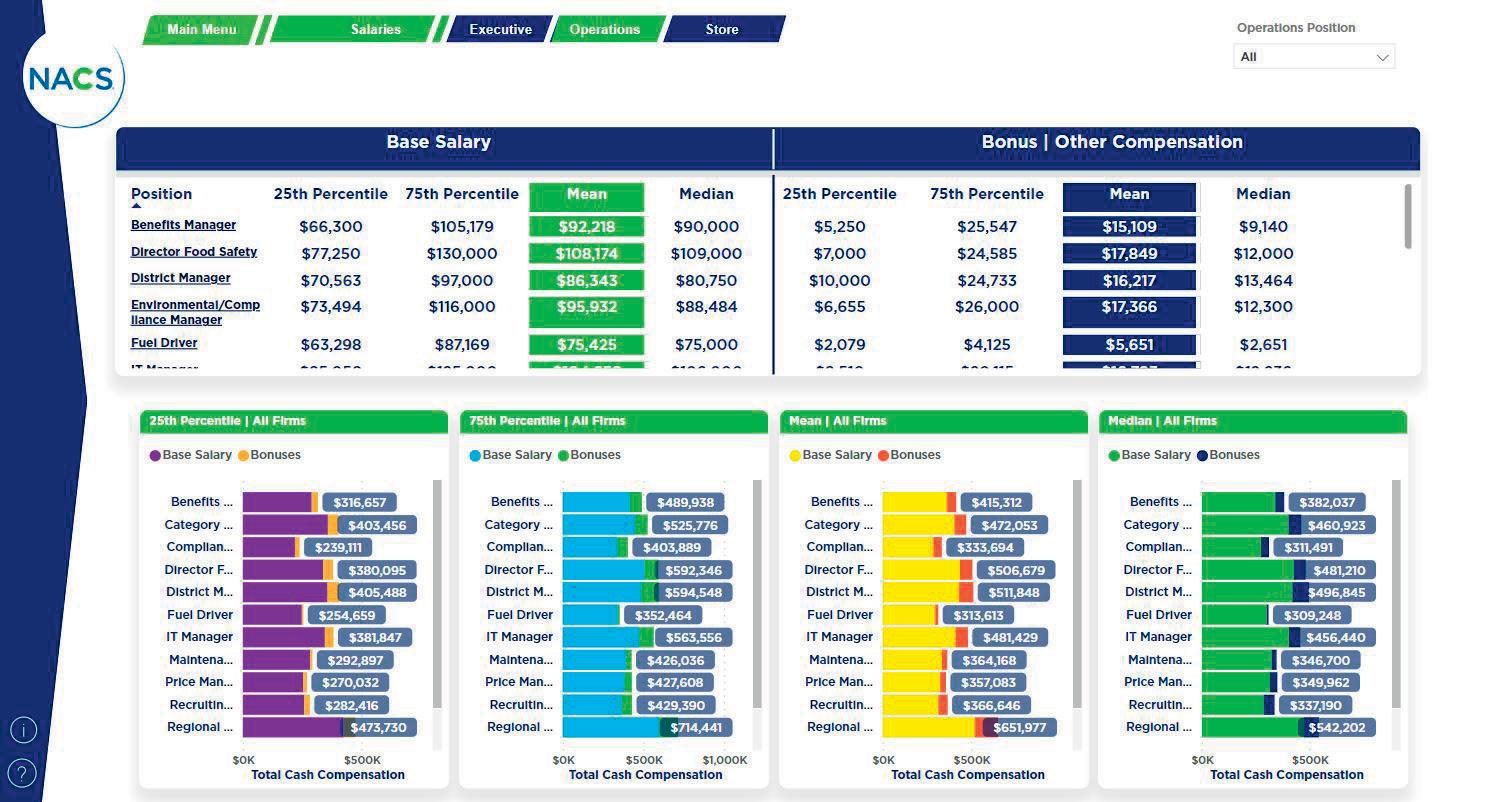

Go Deep With the State of the Industry Data Archive Subscription

NACS members can get access to up to 10 years of exclusive data from over 27,000 convenience stores.

The NACS State of the Industry Report® is the convenience and fuel retailing industry’s premier benchmarking tool and its most comprehensive collection of data and trends— and the report is now available through a single, searchable database.

The NACS State of the Industry Data Archive puts 10 years’ worth of convenience fuel and retailing industry data at your fingertips, and it’s the only place to access a decade of proprietary NACS data.

Retailers can quickly view historical data and gain immediate year-over-year

industry perspective, including quartile rankings by store, operating profit and chain size with weighted average based on the annual NACS NIQ/TDLinx Store Census. Other features of the archive include being able to view inside sales, gross profits and gross margin percentage across all years to the category level as well as fuel sales volume in gallons, price per gallon and margin in cents per gallon by fuel grade.

The State of the Industry Data Archive is available for purchase by NACS members only. Upon purchase of a digital license, you will receive access to the report through a DRM-secured PDF through your convenience.org login profile. The subscription is purchased for your company, so all employees included in your NACS account profile will be granted access.

Want to know more? Schedule a demonstration of the SOI Data Archive with Chris Rapanick, crapanick@ convenience.org

UP FRONT NACS NEWS adventtr/Getty Images

10 MAY 2024 convenience.org

Helping to Build Leaders

NACS Executive Education offers a range of classes at elite universities.

Informed, confident and nuanced leaders are the best asset an organization can have. The NACS Executive Education series has partnered with world-class institutions—boasting some of the best educators in the world—to provide exclusive training to shape the forward-thinking, determined leaders who will seize the opportunities of tomorrow.

lucrative. Designed for executives who seek to maximize their financial adeptness and in turn amp up their organizational value and their organization’s bottom line.

Endowed by:

The NACS Executive Education series is the only comprehensive, multidiscipline industry curricula that offers customized, Ivy League training exclusively for senior convenience management. When it comes to transformative learning for the top-most sector of the convenience channel, NACS brings 60 years of industry experience and the global network to deliver an unparalleled education experience.

Each immersive program is designed to actualize potential. Which will you and your team attend?

Financial Leadership Program

July 14-19, 2024

The Wharton School of the University of Pennsylvania

Balance sheets are black and white. The thinking around finances, the insights and the strategies are where financial awareness (and associated action) grows more informed, more confident, more

Marketing Leadership Program

July 21-26, 2024

Northwestern University

When you deeply understand and connect with your customer, you excel. When you don’t, you decline. Marketing is about showing customers that you understand them; you have what they need. And it’s about building the connections that create loyalty. Are you a senior-level executive looking refine your expertise when it comes to branding, consumer experience and analytics? This program is for you.

Endowed by:

Executive Leadership Program

July 28-August 1, 2024

Cornell University

Competition surrounds you. How will you lead? How will you excel? Senior-level retail management, this program is designed to enlighten, inform and level up your skills. Foster new ways of thinking and responding to the challenges you will face. Be equipped, and own your position as a visionary leader.

Endowed by:

Innovation Leadership Program

November 3-8, 2024

MIT Sloan School of Management

Innovation isn’t just a word—it’s a necessity. In convenience, we must bring it to our perspective, our skillset and our implementation. Because without innovation, stagnation sets in. And we all know this fast-paced world has no room

NACS MAY 2024 11 Worawut Prasuwan/Getty Images

for stagnation. Want to be an innovator? An innovative thinker? Want to network with other innovative leaders? This program is for you.

Supported by:

Women’s Leadership Program

November 17-22, 2024

Yale School of Management

Unapologetic. Powerful. Respected. Authentic. Women aren’t simply equipped to succeed because they are human—they have unique strengths. Often they can harness an innate emotional intelligence that allows a deeper breadth of understanding and clarity. This empowering course is designed for women who want to individually and collectively bolster their leadership abilities, reinvigorate their companies and expand their networks.

Endowed by:

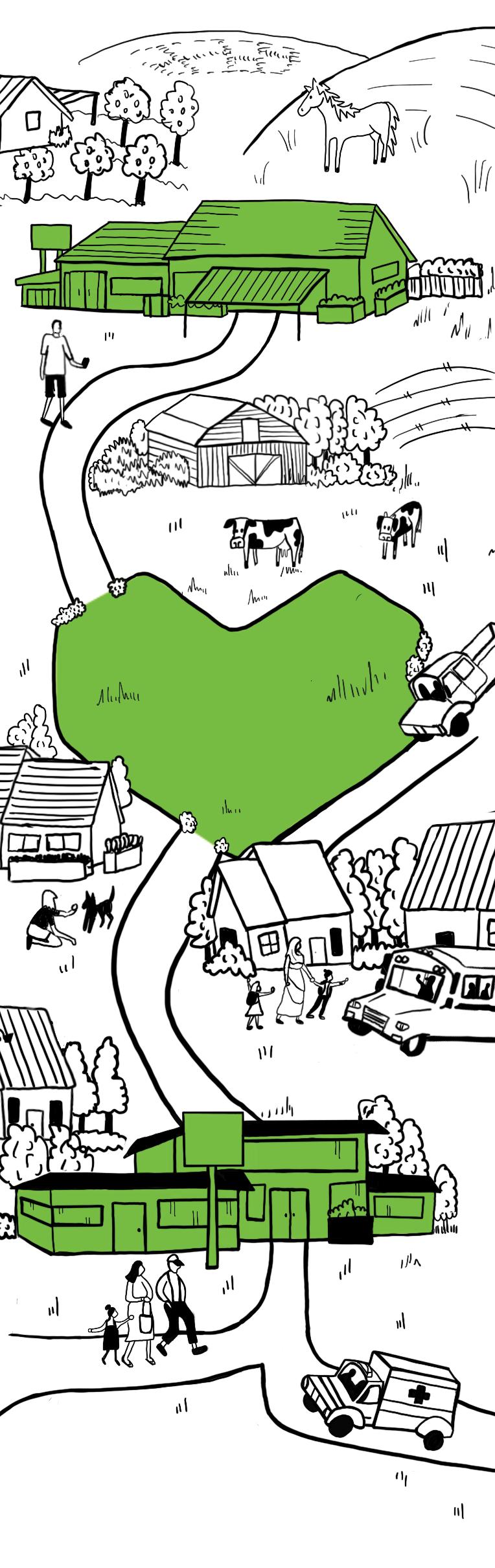

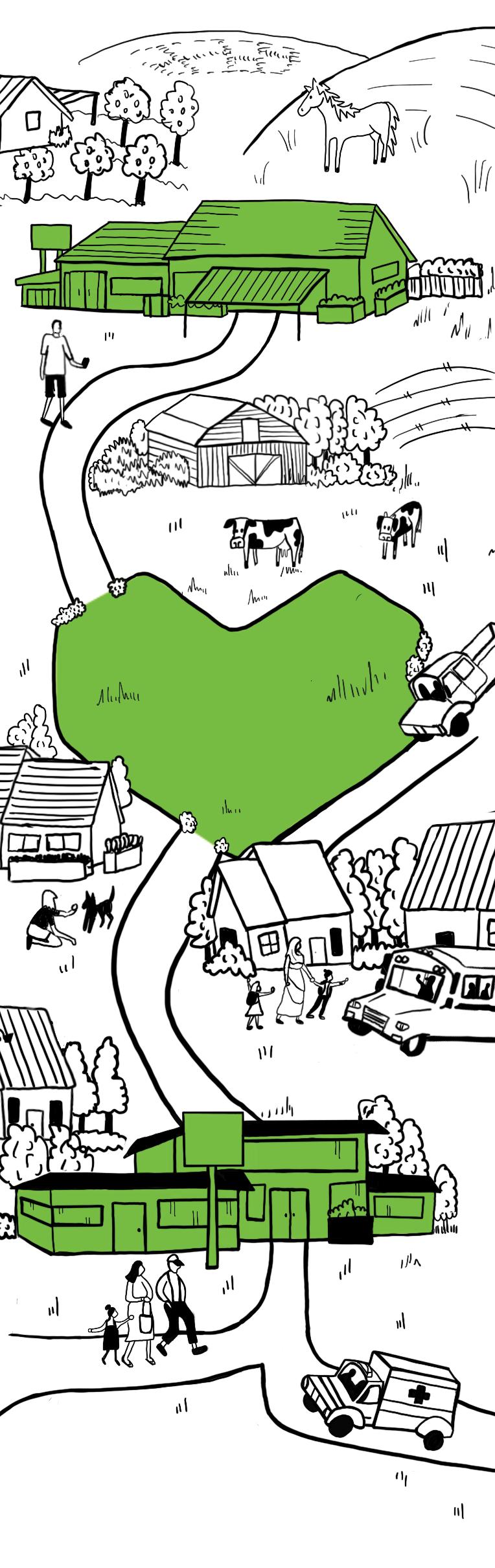

Coming Soon: NACS 24/7 Day

NACS is preparing for the sixth annual 24/7 Day. This event celebrates local heroes who work 24 hours a day, seven days a week helping others in the community. It spotlights how convenience retailers across the country are open around the clock, becoming a safe respite for firefighters, police officers, EMTs and others.

“Convenience retailers are often the first supporters to first responders. Thanks to their 24/7 operations, convenience stores are often the only place open to serve first responders and medical personnel working overnight hours. Convenience stores also help ensure fuel, water, food and other necessities are available for emergency workers and customers during the duration of disaster events,” said Stephanie Sikorski, executive director of the NACS Foundation.

Sikorski says that the power of 24/7 Day is that it’s not a onesize-fits-all celebration—retailers who participate can tailor their recognition of these individuals.

“It’s about showing up and doing it in a way that’s true to who you are as a brand, as a company, how your employees show up,” she said.

Learn how you can get involved in this important initiative at www.conveniencecares.org.

12 MAY 2024 convenience.org UP FRONT NACS NEWS

NACS MAY 2024 13 InStore.ai

Member News

RETAILERS

Mindy West now serves as executive vice president and chief operating officer at Murphy USA Inc. In the newly created position, West is responsible for both the Murphy USA and QuickChek brands, including store operations, merchandise, marketing and fuels. As COO, West will drive strategic initiatives and enhance the performance and profitability of the entire business.

Murphy USA Inc. hired Galagher Jeff as executive vice president and chief financial officer. Jeff joins the company from Dollar Tree, where he served as SVP finance and strategy, treasurer and chief transformation officer. Jeff also held senior roles at Advanced Auto Parts and spent 11 years at Walmart.

Chris Click was promoted to executive vice president of strategy, growth and innovation at Murphy USA Inc., where he is responsible for asset development and digital transformation.

Tri Star Energy named Steve Perry as its new chief operating officer. Perry joined the Tri Star Energy team in 2022, bringing over 20

years of operations leadership experience within the convenience store industry. Perry most recently served as the company’s vice president of wholesale operations.

M&G Realty Inc., part of Rutter’s Holdings Inc., named Chris Hartman as its president. Hartman succeeds Tim Rutter, who retired at the end of 2023. M&G plans to continue Rutter’s growth in Maryland, West Virginia, Delaware and Virginia. Hartman is the 11th generation to join the Rutter family business.

SUPPLIERS

Derek Brodt joins Electrolux Professional Group Americas as the director of customer care. Brodt will drive the long-term strategic vision and direction of Electrolux Professional Group’s branded service program, Essentia. His primary responsibility is creating a seamless after-sale customer experience.

Charles Jarrett joined ResultStack as executive vice president of the consulting practice. In his new role, Jarrett will oversee ResultStack’s consultants, assist with company growth and supervise project teams.

KUDOS

Melissa Trimmer, CEPC, corporate executive chef and director of Culinary and Innovation Studio, Dawn Foods, was honored with the American Culinary Federation (ACF) Pastry Chef of the Year Award 2022 by the Michigan Chefs de Cuisine chapter of ACF. This year marked the first Chef of the Year dinner by the ACF Michigan Chefs de Cuisine since Covid, and they honored both 2022 and 2023 recipients. The award recognized Trimmer’s passion for the craft, accomplished reputation in the pastry field and dedication to educating others by sharing skills and knowledge.

The Wills Group has received Great Place to Work certification, with an employee satisfaction rating of 87%, up from 82% in 2022 and 84% in 2023. The company, in part, credits that in recent years it has remodeled its benefits package to achieve equity across all offerings, ensuring both retail and corporate employees have equitable access to resources.

14 MAY 2024 convenience.org

UP FRONT NACS NEWS

KEEP NACS IN THE KNOW— send in your news to news@convenience.org

Mindy West

Galagher Jeff

Chris Click

Steve Perry

Chris Hartman

Derek Brodt

Charles Jarrett

Melissa Trimmer

New Members

NACS welcomes the following companies that joined the Association in February 2024. NACS membership is companywide, so we encourage employees of member companies to create a username by visiting www.convenience.org/createlogin. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership

NEW HUNTER CLUB MEMBER

Silver SPYLT American Fork, UT spylt.com

Bronze Zen Beverage LLC Irvine, CA zenwtr.com

Built Brands LLC American Fork, UT built.com

Crunch Pak Cashmere, WA crunchpak.com

nData Services LLC Centennial, CO ndataservices.com

RETAILERS

Berger Ridgeview LLC Olathe, KS

David Sahagun Enterprises, Inc. San Francisco, CA www.pacificheightschevron.com

Doman’s General Store Inc. Vassar, KS

Khushi Ali Inc Stockbridge, GA

Legacy Cooperative Bisbee, ND

Meyer Oil Co. dba Mach 1 Food Shop Teutopolis, IL mach1stores.com

Pardner’s Mini Markets Winthrop, WA

Prairie Band LLC Holton, KS prairiebandllc.com

S&D Quisberg LLC Baxter, MN holiday-bla.com

Simonson Station Stores Inc Grand Forks, ND

Speedsmart Mesa, AZ

Western Oil Omaha, NE

Muswick LLC Little Rock, AR

NACS GLOBAL SUPPLIER COUNCIL

Blue Yonder Scottsdale, AZ blueyonder.com

SUPPLIERS

A&C GLASS DOOR LLC Chino, CA www.shhag.com

Addcentia Inc dba Autoreimbursement.com Oconomowoc, WI autoreimbursement.com

Bauducco Foods Inc. Miami, FL bauducco.com

Big Mozz New York, NY bigmozz.com

Bite Brands LLC Atlanta, GA bitebrands.com Budderfly Shelton, CT budderfly.com

Cizmeci Gida San ve Tic AS Kocaeli, Turkey

Clean Control Corporation Warner Robins, GA odoban.com

Cornerstone Consulting Engineers & Architectural Inc Allentown, PA cornerstonenet.com

Deschutes Brewery Bend, OR deschutesbrewery.com

Empacados USA San Antonio, TX

Food Camp Corporation

Santa Fe Springs, CA sites.google.com/foodcampco.com/main/ home

Go Mouthwash Grand Rapids, MI gomouthwash.com

Grass Flip Flops Inc Westlake Village, CA grassflipflops.com

Green Planet Inc Riverside, CA thegreenplanetproducts.com

Harmless Harvest San Francisco, CA harmlessharvest.com

International American Supermarkets Corp. Piscataway, NJ iasusa.com

J Plus Specialty Foods LLC Lincolnwood, IL tastelli.com

Jiangxi ECO Technology Group Co., Ltd Nanchang, China jxecobox.com

LidWorks Plant City, FL lidworks.com

Master Creations Inc Atlanta, GA

16 MAY 2024 convenience.org UP FRONT NACS NEWS

Melinda’s Foods Irving, TX

Mira International Foods Inc East Brunswick, NJ enjoymira.com

Nexchapter LLC Clive, IA Noka Pacific Palisades, CA nokaorganics.com

NXTPoint Logistics Jacksonville, FL nxtpointlogistics.com

Pacific Blue Corp. Capitol Heights, MD pbnoodle.com

Padrino Foods Irving, TX padrinofoods.com

Pilgrim’s Pride Corporation Greeley, CO poultry.com

PLS Tempe, AZ plsusa.com

POSBANK

Seoul, Korea posbank.com

Qit Pouches Inc. West Palm Beach, FL qitpouches.com

Calendar of Events

2024 JUNE

NACS Convenience Summit Europe

June 04-06 | Intercontinental Barcelona Barcelona, Spain

JULY

NACS Financial Leadership Program at Wharton

July 14-19 | The Wharton School University of Pennsylvania Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 21-26 | Kellogg School of Management, Northwestern University Evanston, Illinois

RapidRMS Calhoun, GA rapidrms.com

Rosina Foods Buffalo, NY

Sarpes Beverages LLC dba Dream Products Miami, FL drinkdreamwater.com

Show Cigars Inc New Castle, PA showcigars.net

Slate Craft Goods Westwood, MA

Slate Group Lubbock, TX

NACS Executive Leadership Program at Cornell July 28-August 01 | Dyson School, Cornell University Ithaca, New York

OCTOBER

NACS Show October 07-10 | Las Vegas Convention Center Las Vegas, Nevada

NOVEMBER

NACS Innovation Leadership Program at MIT

November 03-08 | MIT Sloan School of Management Cambridge, Massachusetts

SLEEGERS Engineered Products Inc London, Ontario, Canada sleegers.ca

Spectrum Industrial Products dba Mopit Logan, UT mopit.com

Upshop Tampa, FL upshop.com

Wismettac Asian Foods Inc Santa Fe Springs, CA

Zero FG zerofgenergy.com

NACS Women's Leadership Program at Yale

November 17-22 | Yale School of Management New Haven, Connecticut 2025

JANUARY

Conexxus Annual Conference

January 26-30 | Loews Ventana Canyon Tucson, Arizona

FEBRUARY

NACS Leadership Forum

February 11-13 | The Ritz-Carlton Amelia Island, Florida

For a full listing of events and information, visit www.convenience.org/events.

NACS MAY 2024 17

Love’s Field Opened at University of Oklahoma

The $37 million softball stadium that Love’s helped build opened on March 1.

In 2021, Love’s announced that it provided the lead and naming gift for the University of Oklahoma’s new softball stadium. Three years later, Love’s Field is completed, and the first pitch was thrown on March 1.

At the field, the company’s name is displayed at the top of the scoreboard, as well as behind home plate. The facility will feature a 10,669-square-foot indoor training facility, more than double the size of the previous training space, and several team spaces, including a training room, locker room and classroom. It will

also have space for a recognition area to showcase national championships, All-Americans and other outstanding accomplishments.

“My family and I are so proud to play a part in making Love’s Field a reality,” Jenny Love Meyer, chief culture officer for the retailer, said. But she also pointed out that while the stadium might have the company name on it, this project took years and a village of dedicated people to complete.

“This 44,000-square-foot complex is a nod to Coach Gasso and all those who

have been instrumental to building the Oklahoma softball dynasty and hopefully an inspiration for the female student-athletes who compete in it. They are our leaders of the future,” Love Meyer said. “Love’s is humbled to stand alongside the more than 1,100 donors who graciously supported this project. The $37 million raised is the largest dollar amount privately fundraised for a female-specific facility project in college athletics history.”

The first pitch in Love’s Field coincided with the start of Women’s History Month.

18 MAY 2024 convenience.org CONVENIENCE CARES

In The Community

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories. Learn more at www.conveniencecares.org

CASEY’S LAUNCHES ANNUAL FEEDING AMERICA CAMPAIGN

1 Casey’s kicked off its annual campaign in the fight against hunger in March, partnering with Celsius and with Feeding America. Through April 2, Casey’s guests could round up at the register to participate in the campaign, supporting children and families impacted by food insecurity across the Midwest and South. Since the start of their partnership in 2020, Casey’s and Feeding America have donated over 30 million meals. This year, Casey’s is committed to helping provide 10 million meals.

WAWA BATTLES FOOD INSECURITY WITH FLY BEYOND PROGRAM

2 Wawa launched its “Buy a Kids’ Meal, Make an Impact,” initiative last March. For every Wawa kids’ meal purchased until July 28, Wawa will donate funds to local food bank partners to provide meals to the community. The initiative is an extension of the retailer’s Fly Beyond program, which aims to expand access to fresh and nutritious foods to underserved communities through local Feeding America Food Bank partners.

MIRABITO CONVENIENCE STORES SUPPORTS HONOR FLIGHT NETWORK

3 Mirabito Convenience Stores launched a round-up campaign across all its stores dedicated to supporting the Honor Flight Network. The Honor Flight Network is a nonprofit organization that offers veterans the opportunity to visit the memorials dedicated to their service and sacrifices free of charge to them. The round-up campaign took place throughout March. All funds collected during this campaign will be donated to local Honor Flight hubs in Upstate New York.

PARKER’S KITCHEN PARTNERS WITH THE WOUNDED WARRIOR PROJECT

4 Parker’s Kitchen announced a new partnership with Wounded Warrior Project (WWP) to support local veterans in Georgia and South Carolina. Parker’s Kitchen customers can round up their purchases to the nearest dollar to benefit WWP.

Proceeds from the Parker’s Kitchen round-up campaign, which will run through July 4, will be donated to support WWP. Parker’s Kitchen will match 25% of each customer donation.

EG AMERICA KICKS OFF ANNUAL FUNDRAISER FOR THE AMERICAN RED CROSS

5 EG America, based in Westborough, Massachusetts, announced it will support the American Red Cross during Red Cross Month by hosting a nationwide in-store fundraiser. During the month of March, guests who visited EG America’s Certified Oil, Cumberland Farms, Fastrac, Kwik Shop, Loaf N’ Jug, Minit Mart, Quik Stop, Sprint Food Stores, Tom Thumb and Turkey Hill stores had the opportunity to donate at checkout to the American Red Cross. The company’s goal for the fundraiser, which began March 1, is $250,000.

EG HOLDS HEARING AWARENESS CAMPAIGN

6 In honor of World Hearing Day, EG Group held a hearing awareness campaign for staff members in partnership with Clears Healthcare. Over 600 staff members were screened. A proactive step saw 546 employees opt for hearing tests, and 157 received ear wax removal services. The campaign was a hit, with 100% of participants expressing interest in making it an annual wellness event.

NACS MAY 2024 19

1 2 4 3 5 6

State-Level Advocacy Bolsters Industry Impact

The NACS government relations team and state associations work together for the good of the industry.

BY THE NACS GOVERNMENT RELATIONS TEAM

While the NACS government relations (GR) team is largely focused on the federal government, the team also keeps an eye on state capitals across the country as policy issues that affect our industry develop there.

Quite often, NACS’ work in Washington, D.C., can overlap with or complement work being done by our industry’s representatives in your home states. To that end, the NACS GR team works closely with our state association partners and occasionally takes direct actions at the state level in conjunction with those partners.

Most often, when engaging on a state-level issue, the NACS GR team provides support in the way of data, research or talking points, for example, to our state partners. Each month, the NACS team meets virtually with state executives from all over the country to share information about what’s happening at both the state and federal levels. The NACS team and state executives also meet in person annually, just ahead of the NACS Show, for the same purpose. This partnership has proven to be

fruitful on several occasions in the past and will continue to serve the industry in the future. Below are a few examples of times that NACS has engaged at the state level in partnership or cooperation with state partners when issues cross jurisdictional levels or rise to national significance.

ELECTRIC VEHICLES AND ELECTRIC VEHICLE CHARGING INFRASTRUCTURE

Issues related to electric vehicles (EVs) and EV charging infrastructure are a good example of how issues can overlap at the federal and state levels. The National Electric Vehicle Infrastructure (NEVI) formula grants program is a federal incentives program created by Congress and implemented by the U.S. Department of Transportation but distributed by state governments via their approved state plans. Some states are adopting policies counter to guidance to discourage the sort of private sector investment and competition that NACS advocated for and that is stipulated in the bipartisan infrastructure bill. For example, Minnesota and Iowa are

NACS has been working to create a competitive market for EV charging by modernizing outdated rules in the electricity market.

20 MAY 2024 convenience.org INSIDE WASHINGTON

attempting to limit the profitability of EV charging.

In addition, NACS has been working to create a competitive market for EV charging by modernizing outdated rules in the electricity market. That includes providing the ability for non-utilities to sell electricity for the purpose of charging EVs and not be regulated like a utility, removing unnecessary demand charges and creating a level playing field for all players in the EV charging space. NACS worked to include language in the Bipartisan Infrastructure Law to encourage states to address those issues and co-founded the Charge Ahead Partnership to advance these issues at the federal and state levels. Through the Charge Ahead Partnership, NACS has been able

to work closely with state associations and other stakeholders to pass legislation and weigh in with state public utility commissions working on developing the EV charging marketplace.

FUELS

Fuels policy—particularly issues relating to low-carbon fuel programs, bans on the sale of vehicles powered by an internal combustion engine (ICE) and zero-emission vehicle (ZEV) mandates—has been active at the federal and state levels and is a good example of how state action can spread to federal action. Many states, such as California, have aggressively pursued these policies, and many states have followed the lead of these most aggressive states. California, Oregon and

Washington all have low-carbon fuel standards, with Minnesota and New Jersey considering similar programs. Some in Congress would like to federalize a low-carbon fuel standard. NACS is working with a broad group of stakeholders to look at a technology-neutral, pro-marketbased solution to lower carbon emissions in the transportation sector.

The same is happening with ICE bans and ZEV mandates. Again, California is leading the pack by establishing a ban on the sale of ICE-powered vehicles, with over 17 states poised to follow. At the same time, the Environment Protection Agency (EPA) has proposed an “indirect” EV mandate with its proposed rule on tailpipe emissions for light-, mediumand heavy-duty vehicles. NACS submit-

NACS MAY 2024 21 Eoneren/Getty Images

ONE VOICE

This month, NACS talks to Tony Miller, executive vice president, Delek US

What role in the community do you think convenience stores should play?

Convenience stores have long been—and continue to be—part of the fabric of the community by providing customers with the products and services they need to make their days a little easier. It is our obligation to serve and to give back to our communities in a very responsible way, and most importantly, to provide our customers with a unique shopping experience—which is fast, friendly and fresh each and every day.

What does NACS political engagement mean to you and what benefits have you experienced from being politically engaged?

The NACS government relations team is among the best in Washington. That said, if we (the convenience retail industry) want to make a difference on the Hill, let’s focus on moving mountains with the collective voices of the millions of convenience store employees. Together we can make a difference and it will be very gratifying for everyone involved. When I am politically engaged, I am left with a feeling of making a difference. Traveling to D.C. to participate in Day on the Hill can be the most rewarding day of the year.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)?

The only legislative issues that keep me up at night are the decisions that are made by the ill-informed or the politically motivated. I worry about any government intervention that is not driven by the free market, which is always the best for the consumer. We have experienced many legislative issues over recent years that have driven up cost to unsustainable levels—costs have reached a tipping point beyond affordability.

ted comments critical of the proposed rule and is working with a wide range of groups and congressional leaders to halt or delay this rulemaking.

In addition to pursuing efforts on the legislative and regulatory side, NACS has been working to get good policy outcomes through the courts. NACS has worked with other groups to file three lawsuits challenging state technology mandates. These include challenging California’s light-duty and heavy-duty vehicle ZEV mandates, as well as Minnesota’s light-duty vehicle ZEV mandate that follows California’s rules. NACS hopes the courts will agree with its view that federal law prohibits states from implementing these technology mandates.

SWIPE FEES

NACS has been playing offense on federal swipe fees legislation, and our state association affiliates have been playing offense as well. For several years now,

22 MAY 2024 convenience.org INSIDE WASHINGTON Lilit Amirkhanian/Getty Images

states around the country have been pursuing legislation that would prohibit banks from charging swipe fees on the sales tax portion of a transaction. It’s especially egregious that banks profit off the portion of the transaction that retailers don’t even get to keep. This year, Colorado, Georgia, North Dakota and Pennsylvania are pursuing bills. To be expected, the state banking trades are fighting the legislation with all of their might, but the retail and business communities have formed coalitions supporting the bills. Our collective efforts, at both the state and federal levels, to reform the swipe fee system place enormous pressure on the credit card industry and bring needed attention to this broken marketplace.

VAPE ENFORCEMENT

The FDA has created mass confusion in its PMTA process by not providing a clear list to retailers of which vapes are

legal to sell. As a result, illicit vapes have flooded the market. In response, states around the country are considering directory bills to bring clarity to retailers and to call for enforcement against products not on the list.

Concurrently, NACS is working on federal legislation that would compel the FDA to provide a clear list to retailers of which vape products can be on the market to ensure retailers are complying with the law and not selling illicit products. Once a list is published, the FDA would be required to enforce the law and go after bad actors.

Additionally, NACS will engage with various state-level nongovernmental organizations as needs arise. Currently, NACS has a partnership with the National Governors Association, allowing the GR team access to policy experts at the association who can provide insight into governors’ priorities and a pipeline into governors’ offices nationwide to help pursue our industry’s goals. In the past, we have engaged with other groups, as well, including the National Conference of State Legislatures and the National Association of Attorneys General. NACS continually evaluates memberships in such organizations for the benefit of the convenience industry. The NGO memberships and our partnerships with state associations continue to help strengthen and protect our industry.

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www. convenience.org/nacspac . NACSPAC donors who made contributions in March 2024 are:

Matt Domingo Reynolds

Mike Gilroy Mars Wrigley

Josh Halpern JRS Hospitality/ BCIP dba Big Chicken

Julie Jackson Jackson Advisory & Consulting

Aaron Littlefield Littlefield Oil Company

James McNutt Midwest Petroleum Company

Nicolas Papadopoulos Verifone Inc.

Lisa Rountree TruAge

Stanton Sheetz Sheetz Inc.

Stephen Sheetz Sheetz Inc.

Rich Spresser Alta Convenience

Melissa Vonder Haar iSee Store Innovations

John Wilson iSee Store Innovations

NACS MAY 2024 23

Name of company:

Compass Travel Center

Year founded: 2022

# of stores:

1

Website: compasstravelcenter.com/

The Comforts of Home

Compass Travel Center offers European food delights and a focus on trucker amenities.

BY SARAH HAMAKER

Compass Travel Center is more than a stop—it’s a destination along I-65 in Demotte, Indiana.

Its owner, Roy Dobrasinovic, is a former professional truck driver from Montenegro, so when he bought the property in 2014, he wanted to build a home away from home for truckers. The travel center first opened its doors in 2022.

HOME COMFORTS

Dobrasinovic “makes sure Compass Travel Center has all the comforts of home for our truckers,” said Rick Farias, general manager. The center boasts eight showers, a driver’s laundry room and 85 semi-truck parking spots. “Plus, we have arcade games and massage chairs—it’s these little things that show we care about our customers,” he added.

24 MAY 2024 convenience.org IDEAS 2 GO

But what makes the center unique is its treats and snacks from Europe, including candies, meats by the pound, chocolates, sausages, smoked beef and ham, a variety of cheeses and many kinds of European packaged beverages. Bureks, similar to potpies, are one of the unusual and popular food items.

“Because of the owner’s European background, he wanted to bring in those foods and drinks popular overseas,” Farias said. “It’s been a huge hit with our customers, since they can get items here that aren’t available any place else.”

Because Dobrasinovic is a former trucker, he added special amenities for them, including a showroom with trucks for sale and Bob’s Chrome Shop. On the Trucker’s Path app, Compass is ranked third among independent truck stops and fourth overall in the United States. “These are things that truckers both need and enjoy exploring when stopping with us,” Farias said. “Of course, we have 10 high-speed clean diesel islands and 24 fueling positions, which offer gasoline, auto-diesel, E85 and E15, along with air for tires. In addition, we’ve recently added a pool table and darts for more entertainment options, and will offer live music on Thursdays. This summer, we will be opening a patio dining area.”

Compass has a double-drive thru Dunkin’, a Hunt Brothers Pizza and its full-service Roadhouse Grill concept serves breakfast, lunch and dinner and has a three-way license to offer wine, beer and liquor.

COMMUNITY CONNECTIONS

Two billboards welcome truckers and tourists to stop at Compass Travel Center. “We do a lot of our own promotions and advertisements on the 20 TVs throughout the complex and on our gas and diesel dispensers, letting our customers know about truck and trailer

leasing, factoring, smart board, restaurant specials, groceries or gifts we have available,” Farias said.

The store connects with the community through participation in local events via the chamber of commerce and other nonprofit opportunities, such as the annual Touch of Dutch Festival. “We gladly give away a lot but we’re fairly new in the community and we want to be part of the local area to get our name out there,” he said.

But the best advertisement comes from the employees. “Our management team has a ton of experience in the industry. For example, Phil Brauchla, director of operations, has 34 years of experience and I have 31 years in the industry, and that shows with how we manage our people,” Farias said. “We’ve always been more people-minded in trying to reduce turnover and create a positive work environment.”

Compass sets the tone with a warm welcome during the new employee orientation, which includes a facility tour, staff introductions and a talk about the company culture and expectations. “We want each member of our staff to know the expectations and to make sure they can achieve success while working here,” Farias said. “All of our managers have an open-door policy for suggestions or concerns, along with monthly manager and safety meetings.”

While he acknowledged on open-door policy might feel unstructured, “the relaxed atmosphere cultivates a very open communication style among employees and management staff.” The emphasis on communication has reduced annual turnover to 20% or under. “When we hire someone, we focus on the things we can’t train, such as having a positive attitude,” Farias said. “So once they’re here, they can grow and flourish with training and the opportunities for advancement we give them.”

BRIGHT IDEAS

For Rick Farias, general manager of Compass Travel Center in Demotte, Indiana, the best advice for convenience retailers is to take chances. “Don’t be afraid to try new things,” he said. “You should track and evaluate them, tweak them if necessary to make them work in your store, and say it doesn’t work if that’s the case.”

He credits a willingness to see how different ideas, products or services work for the Compass facility as how they’ve kept the concept fresh and exciting for their core customers and visitors alike. “You need to see what works for you in your situation, because everywhere is different.”

Overall, Compass Travel Center’s goal is to “make customers feel welcome and wanting to come back, to make this a destination, not just a stop,” he said. “I think we’re heading in the right direction.”

Sarah

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2023 and earlier, go to www.convenience.org/Ideas2Go

NACS MAY 2024 25

Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

razum/Shutterstock

FOODSERVICE SALES STACK UP

Convenience

foodservice categories add another win as all foodservice categories increase in sales and gross profit dollars.

BY EMMA TAINTER

Each May, NACS releases preliminary foodservice State of the Industry data. The data not only tells us how the industry performed but sets a tone for the coming year—especially in an important category such as foodservice.

Of course, the data is just that—preliminary. This data comes before the release of the NACS State of the Industry Report ® of 2023 Data, which will be hitting the (online) shelves in mid-June.

However, the NACS 2024 State of the Industry Summit has already come and

gone, and you may have heard the news: sales in prepared food once again beat sales of cigarettes, bringing its winning streak over the long-time c-store juggernaut to two years.

At this point, it is easy to drive home the point that foodservice has become one of the most important parts of the convenience business. Foodservice—which consists of prepared food, commissary, hot dispensed beverages, cold dispensed beverages and frozen dispensed beverages—grew to 26.9% of in-store sales.

Foodservice adds a much-needed opportunity for growth for convenience

NACS MAY 2024 27

retailers who face the ongoing challenge of encouraging customers at the pump to go inside the store and make additional purchases. Foodservice, across all its categories, contributed $60,578 in sales per store, per month, a year-over-year increase of 9.3%. In comparison, the other top two best-sellers of packaged beverages and cigarettes brought in $40,339 and $44,765, respectively.

And it’s profitable. Foodservice margins are consistently higher than those of other in-store items, with 2023 margins at 51.34%, a year-over-year increase of 0.65 points. Foodservice gross profit numbers rose to $31,103 per store, per month, a solid 10.7% increase from $28,106 in 2022.

When looking at total profits, which include in-store and at the pump, foodservice is responsible for 21.2% of total gross profit dollars, up from 19.8% the year prior.

Foodservice has become one of the most important parts of the convenience business.

2023 Inflation Gauge:

Did Your Company Grow or Keep Pace?

NACS Research calculated that if a company’s sales growth was 8.9% or better, their stores experienced true growth. Foodservice sales were up 9.3% in 2023, meaning that sales beat inflation, and foodservice saw true growth, not just increased numbers fueled by inflation-related price increases.

PREPARED FOOD

Prepared food accounts for 71.9% of total foodservice sales, by far the largest contributor to the category. It is also continuing to experience growth, increasing sales 12.2%, to $51,500 per store, per month in 2023.

Prepared food gross profit dollars increased 13.9% to $28,627 per store, per month. Margins increased 1.5 percentage points, rising to 55.59%.

Foodservice does more than drive great margins—it also drives frequency among c-store shoppers. According to NACS’ Convenience Voices program, which captures insights from thousands of c-store shoppers, nearly one in nine customers (10.9%) who purchased prepared food said that they shopped more than once a day. Because these customers tend to be store loyal, becoming a prepared food destination creates brand stickiness for core categories other than prepared food. For example, of customers who purchased prepared food at a certain c-store chain, 70.5% of them also purchased a cold dispensed beverage from that chain.

28 MAY 2024 convenience.org mphillips007/Getty

Images; Tim Macpherson/Getty Images

©2023 Johnsonville, LLC *Technomic Roller Grill Consumer Study, August 2020 **IRI 1/2/22 THE TOTAL ROLLER GRILL PACKAGE

Pay to Play:

Prepared Food and Wages

Prepared food is obviously the most labor-intensive foodservice category, and foodservice wages reflect this. According to the 2024 NACS State of the Industry Talent Insights Dashboard (previously known as the NACS Compensation Report), foodservice associates are responsible for a clean, safe and customer-friendly foodservice area, and that requires mastering multiple skills. They receive both register and food preparation training and work under the supervision of the foodservice manager. In 2023, the average foodservice employee wage was $14.76, just slightly more than the $14.73 earned by other full-time employees. This is almost a full dollar more per hour than part-time employees, reflecting the value of that regular, familiar face behind the counter. Foodservice employees also complete more training than part-time employees. Overall, 17.8% of foodservice employee training is focused on foodservice safety training, compared to 9.1% for non-foodservice employees. For cleaning protocols, 13.9% of foodservice employees’ training focuses on cleaning, compared to 11.0% for nonfoodservice employees.

Food safety is a critical part of operations for anyone providing foodservice. NACS holds an annual Food Safety Forum in conjunction with the NACS Show. To learn more about this year’s event, contact Chrissy Blasinsky, NACS’ digital and content strategist, at cblasinsky@convenience.org.

Foodservice, across all its categories, contributed $60,578 in sales per store, per month.

COMMISSARY

Commissary—which includes ready-to-eat meals; sandwiches and wraps; thaw, heat and eat meals; and sides and salads—was 6.0% of foodservice sales in 2023. Sales increased 6.0% to $4,260 per store, per month. Margins had solid growth, rising 1.77 percentage points to 31.62%. Gross profit dollars had even more impressive growth—up 12.3% to $1,347 per store, per month in 2023.

Commissary can be an unsung hero of the c-store foodservice operations—according to NACS’ Convenience Voices program, 27.7% of customers chose a certain site because of the availability of good pre-packaged foods.

DISPENSED BEVERAGES

Hot dispensed beverages—including coffee, tea, hot chocolate, cappuccino/specialty coffee, refills and coffee club mugs—were 8.8% of foodservice sales in 2023. In 2023, hot dispensed beverage sales were $6,324 per store, per month, a 5.1% increase from the year prior. Margins decreased by 0.38 percentage points, falling to 63.21%; however, gross profit dollars increased from $3,825 to $3,997.

While hot dispensed beverage margins declined, profits in this category increased because of increased sales—not an easy feat when the morning daypart is still struggling to recover from a decrease in morning commuter traffic related to the pandemic and the resultant work-from-home policies that many office workplaces have at least partially embraced. In 2023, only 27% of workers commuted, a still-significant drop from the 35% who commuted before the pandemic,

30 MAY 2024 convenience.org JulieAlexK/Getty Images

Nearly one of two (46%) shoppers describe their c-store visit as a meal or snack occasion.

although the number of commuters has increased over the past few years.

Cold dispensed beverages—carbonated, non-carbonated, refills, sports drinks, club mugs, other non-carbonated—were 7.3% of foodservice sales. This category increased sales by 9.4% to $5,233 per store, per month. Margins, however, decreased 3.53 percentage points to 50.97%, although strong sales helped grow gross profit dollars 2.3% to $2,667, per store, per month.

The smallest contributor to foodservice sales mix is frozen dispensed beverages— which includes the subcategories of frozen-non-carbonated, frozen-carbonated and other. While it was the smallest contributor at 5.8% of sales, it increased the most in sales dollars, surging 18.0% to $4,182. Frozen dispensed beverages historically have the highest margins among foodservice categories, and 2023 was no different. Frozen dispensed margins in 2023 were 64.12%, a year-overyear increase of 0.76 percentage points.

FOODSERVICE PRESENTS MORE OPPORTUNITIES IN 2024

According to the NACS Convenience Voices program, nearly one of two (46%) shoppers describe their c-store visit as a meal or snack occasion, and three out of the top five reasons why people stopped at convenience stores related to food. Additionally, 23.3% of people reported that they would shop more at convenience stores if they had higher quality food.

To continue to grow sales and customer loyalty, convenience retailers must continue to find ways to connect the needs and wants of the consumers to their offerings. The first step in growing foodservice sales could be to grab the attention of the consumer with the quality of the options.

NACS MAY 2024 31 Farknot_Architect/Getty Images

Emma Tainter is the NACS research analyst/writer. She can be reached at etainter@ convenience.org

A CELEBRITY CHEF’S Creative Ways TO ELEVATE

FOODSERVICE 32 MAY 2024 convenience.org

Chef Andrew Zimmern talks simple upgrades to food offerings that will impress customers.

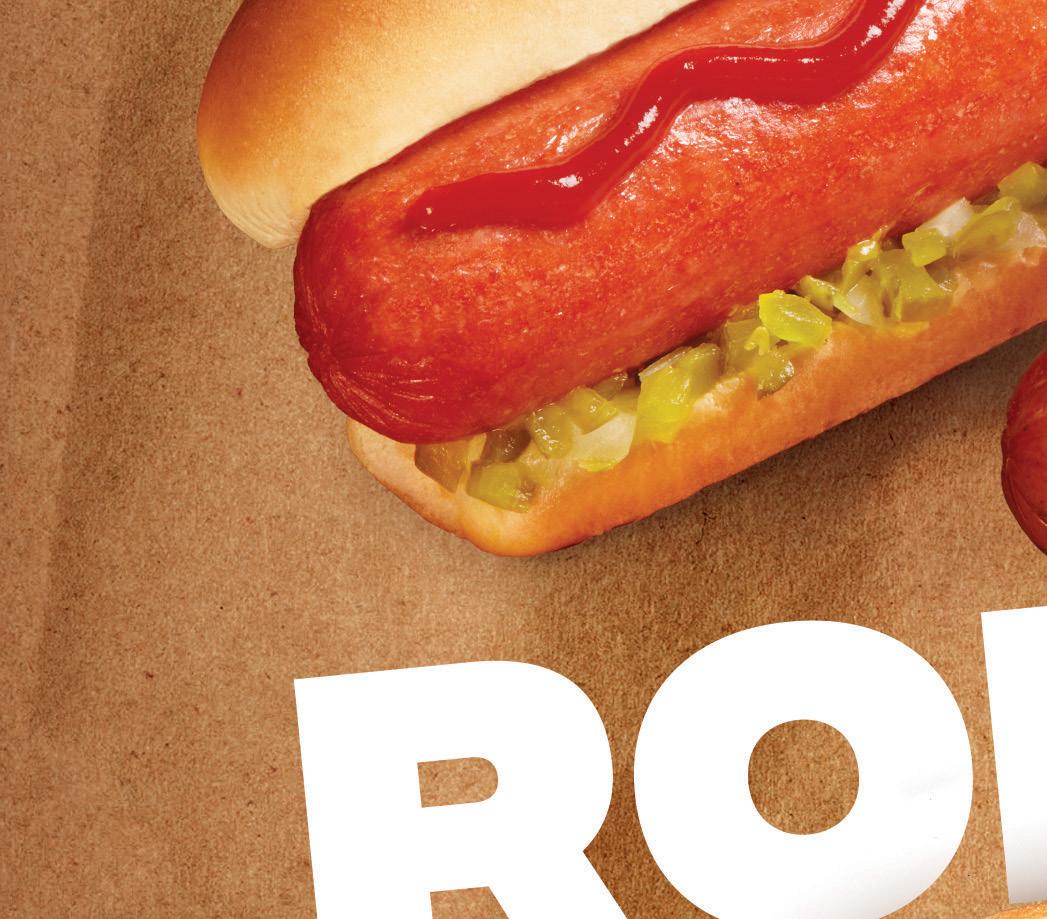

ommanding 26% of sales and 35% of profits in 2022, foodservice is the biggest category in the convenience industry.

To elevate its foodservice products, Team Modern, a wholesale and inventory distribution business for c-stores, partnered with award-winning TV host and chef Andrew Zimmern. On a recent episode of the NACS Convenience Matters podcast, Zimmern talked about how he’s inspiring convenience retailers to rethink their foodservice offerings.

NACS: When you heard about this opportunity, how did you look at doing foodservice in a different way than in a traditional kitchen?

Zimmern : I’m a traveler—I spend two weeks at a time driving around in a van shooting shows in the U.S. I love stopping at convenience stores because if you get off the main road, the regional foods that you’re able to taste in these convenience stores are equal to or better than anything that you’ll find anywhere else. Gas stations now offer so much more.

The trend has been to see how we can take the most popular items from our food culture that we know consumers love—burgers, fried chicken, burritos and pizza—and make them a value add to what we’re already doing. C-stores adding breakfast pizzas 15 years ago is a great example of this really smart idea. Or as a consumer, when I’m in the Southwest, I don’t want a plain hamburger. I want one with hatch chilies on it. So how does somebody who has two burners, a griddle and a different cook every day make simple changes to their menu that engage customers in a more personal way?

NACS MAY 2024 33

For these smaller companies, I am helping jumpstart that creative process for them. After doing three chicken tender sandwich demos, I don’t care if any of those vendors put those examples in their stores. What I care about is that they upgrade their chicken sandwich offerings for their customers. It’s very fulfilling for me as a culinarian to be able to put these simple ideas in front of people knowing that they can use them and it’s going to make a difference in their lives, and more importantly, in their business, which means in their communities. I’d love to see these stores be competitive and do so at a price that everyone can afford.

NACS: And when you’re a retailer, you have to do this all in a small space and do it fast. What has been the feedback on whether people can do this in a small kitchen?

Zimmern : As an example, recently at the Food Network South Beach Wine and Food Festival, we cooked our version of Choripán, an Argentinian street food, in our booth for thousands of people. It was a grilled sausage sandwich topped with peppers, cheese, herbs and relish. We had store-bought hot red relish and sweet red relish that we mixed together in gallon containers. We did not make it from scratch, I just combined existing elements and offered people something new, but something that was familiar at the same time. Who doesn’t love a grilled sausage sandwich? If you can differentiate yourself and build a reputation as the place with the Argentine

sausage sandwich that everyone talks about, for example, that’s where I’d like stores to get to. It’s a story and an experience for consumers, and that’s what drives everything.

NACS: Working in the food community and talking to people about how to elevate things, how do you nudge consumers to change behavior?

Zimmern : You’re not going to move someone a mile. But if someone’s doctor is telling them to mix in a salad every once in a while, but they love fried chicken … then give them a fried chicken salad. It allows people to mix in more fresh vegetables. Science and technology have allowed lettuce to stay fresher in bags longer, there’s less cutting and you can buy really good salad dressings from foodservice companies. There are so many ways people can be helped even with limited product, so if you’re only selling five or six a day, no problem. You will grow to sell more as people realize that it’s not only good for you but tastes really great as well.

You can do this with packaged snacks too— those little three packs of salami-wrapped cheese fly off the shelves. And the reason is someone’s spouse or doctor told them to slow down on the carbs, and this is a super easy pick-me-up snack that’s just protein and dairy. I buy them myself when I’m in a convenience store. These are the simple little changes we can make to help improve everything.

34 MAY 2024 convenience.org

This

been shortened and

for clarity. To hear the whole conversation, listen to Convenience Matters

433—How Celebrity

Changing C-Store Foodservice at conveniencematters.com.

interview has

edited

episode

Chef Andrew Zimmern is

CHOOSE

Red-Handed

C-stores use a mix of old-fashioned techniques and new technology to limit internal theft.

BY SHANNON CARROLL

36 MAY 2024 convenience.org

Fertnig/Getty Images

NACS MAY 2024 37

hile organized retail crime is getting plenty of buzz, convenience stores face an equally damaging threat to profits: internal theft.

Many of the suggested remedies boil down to good old-fashioned discipline and monitoring to recognize an issue before it spirals out of control.

Kelly Harrington, the director of asset protection at RaceTrac, said preventing internal theft starts early. “If you can create an impression of control out of the gate, people either go one of two paths,” he said. They take the risk of stealing despite knowing that they could be caught, or they decide to “take their business elsewhere and go down the road” and try to steal at some other business.

Harrington added that while people may like to point fingers at new employees, they’re not always the perpetrators. Sometimes, the thieves are long-tenured employees who have established trust and have figured out ways to keep their sticky fingers under the radar.

A big piece of curbing internal theft is publicizing it when it happens, Harrington said. It’s not about defaming someone; instead, share that someone was caught without

If someone is stealing, chances are they’re not keeping an orderly till.

explaining how. “That’s really good publicity for the store team,” he said, “because if there are other people stealing in your store, they’re going to stop.”

Important, too, is exception reporting.

At RaceTrac, Harrington is working to improve exception reports. Not too long ago, he was at a workshop where, in 30 minutes, attendees found several cases of internal theft just by looking at data and reporting.

Harrington said that clutter around the register and associates using their phones during work hours can be signs that the risk of internal theft is high.

“It doesn’t mean that every time you see chaos and disorder you have theft going on,” he said. “But if someone is stealing, chances are they’re not keeping an orderly till and things like that.”

“When our corporate asset protection team is monitoring exceptions, they can see, hey, something’s going on here and can work that down the chain,” he said. “That helps make everyone realize you’re on top of things every step of the way so that it’s harder for [employees] to get away with something.”

At a previous job, Harrington worked on a team that established and enhanced a tip line. “Some of the best internal cases I’ve worked came because someone came forward,” he said. “Associates make a choice: ‘I’m going to do it, too,’ or, ‘I’m going to tell someone about it.’ So tapping into that and offering a reward or incentive program is a good benefit.”

INNOVATIVE STRATEGIES FOR INTERNAL THEFT PREVENTION

Babir Sultan, the president and CEO of Kansas City-based Fav Trip and a NACS board member, has seen a number of scams. Those include cashiers pretending to scan an item but not actually ringing it up; an accomplice buying $40 worth of merchandise, giving the cashier a $20 bill and getting $60 from the cashier in return; employees stocking cigarettes throw a few packs in a trash can, only to collect their ill-gotten goods on their way out; and an employee who claimed they were exchanging five $20 bills for a $100 bill but instead put five $1 bills in the register.

Sultan talked to an absentee c-store owner who was letting employees fill up the ATM

38 MAY 2024 convenience.org Valerie Loiseleux/Getty Images

and who brought Sultan in to help him figure out why he was losing money. Sultan said, “By the time we came on board and figured out what [employees were] doing, they got them for almost $20,000-plus.” An employee was saying they were filling up the ATM, but the owner never checked to see if there were appropriate, corresponding transactions.

“We noticed [the employees tested] out the waters,” he said. “They start off small and think, ‘Did anybody tell me anything the next day? No? OK, great.’ Then they start going for the big dollar amounts.”

To figure out how to decrease issues with safe drops, Sultan turned to an interesting source: the casino industry. “We suggest everybody look into other industries because all of us business owners have common problems,” he said.

Casinos make employees show their hands (even if the only observer is a camera) whenever they handle cash or chips. Similarly, to ensure there’s no theft happening at Fav Trip, the retailer put in its training manual that management must clearly show what they’re doing with their hands during safe drops— with no fidgeting whatsoever. That way, no one can sneak any money out.

They start off small and think, ‘Did anybody tell me anything the next day?’

RETAILERS ARE TURNING TO ARTIFICIAL INTELLIGENCE

To curtail crime, Fav Trip amped up its internal camera monitoring, and then realized that other retailers would pay for similar video monitoring, too. Now, Sultan has a team of about a dozen people who monitor c-store video almost 24/7 for about ten retail companies.

He’s a little wary of AI—“We had an AI system in place where every time an employee picked up their phone or put their phone in their pocket, it gave 400-plus notifications”— but he’s aware there is plenty of technology that could make AI a game-changer in curtailing internal theft.

Standard AI, a San Francisco-based company at the forefront of the industry, uses AI in certain zones in stores—including the backbar. As a result, if there’s a sale that doesn’t line up with, say, a tobacco-related item, a store manager or front-office employee can check to make sure a transaction lines up with video.

Alex Plant, the company’s vice president of marketing said, “I think a lot of these problems seem kind of simple … but I think that’s how this whole AI thing is going to be. It can’t be so complicated or inaccessible or expensive or complex—you have to meet the market where the market is, and the market needs help to address shrink.”

Read Hayes, the director of the Loss Prevention Research Council (LPRC) and the co-director of the Loss Prevention Research Team at the University of Florida, said, “What AI is doing is finding things that we might not. It can help us because [on the video], there’s a lot of noise and a lot of boredom.”

Before, employees might have had to watch store tape for hours. Plant said Standard AI can tell an employee exactly when shrink might have occurred. “With AI and computer vision, we can add the actions and transactions concept. I think you can get a lot closer to the prevention of loss.”

Friendly Express implements Standard AI’s technology in one of its stores and is monitoring the experience. Amy Wood, director of enterprise IT at the Georgia-based retailer, said the company installed cameras on its backbar. If an item is removed from that area, Friendly Express should see a corresponding transaction.

40 MAY 2024 convenience.org stnazkul/Getty Images

CUSTOM BUILT

RELIABLE EFFICIENT

Polar King walk-in coolers and freezers offer stateof-the-art refrigeration solutions for the convenience store industry. Perfectly designed to meet the unique demands of retail environments, these units provide reliable, efficient storage for perishable goods. ach Polar King unit is constructed with a seamless fiberglass design that ensures outstanding insulation and durability, resulting in energy savings and reduced operational costs.

FLEXIBILITY AND VErSATILITY

Polar King offers customizable walk-in coolers and freezers, which allows store owners to design a layout that maximizes the use of space according to their specific needs. By efficiently organizing products, stores can improve customer flow and increase sales.

Polar King's innovative approach to walk-in coolers and freezers offers convenient stores a reliable, efficient, and custom-fit solution to their refrigeration needs. With these benefits and features, store owners can not only preserve their inventory but also enhance their daily operations and customer satisfaction.

866-576-7645

POLARKING.COM

Now, we just say, ‘I want to learn how they went about it.’

“If we don’t see that transaction occur, then it’s going to create an alert to send to the manager that there was an issue,” Wood said. “But the really cool part is [the technology has] captured images from that time frame for you to be able to determine what happens. Now, instead of looking at 24 hours of data, we can look at 15 minutes. … It’s a huge time-saving technology.”

If there’s an issue, then Friendly Express can match up the data with video before going to an employee. The retailer already has cameras in its stores and currently encourages managers to watch surveillance videos. So Wood doesn’t think the backbar cameras will be too much of a change for the company’s employees. Plus, Friendly Express tries to educate its employees that, with the more general rise in crime, “This is for your safety, as well,” she said.

“It’s not to be Big Brother and catch every little thing [employees] do,” Wood said, “but it is to ensure that, when there is an issue, we have something to back it up. We have visual proof, and it’s not just an assumption. Right now, we may not have a good view of the area. [Previously] it could have been that you were working with another person on a shift and [the theft] might have been a little bit of a gray area. So we feel like this is just one more tool that we will have to help confirm what issue we have so we can determine, ‘Who actually did this?’ so that there’s absolutely no confusion.”

She said retailers often don’t know an issue has happened until weeks later, and thieves will continue stealing because they realize no one at the company has picked up on what they’re doing.

“Then it’s a big issue all of a sudden,” she said. “We’re hoping to be more active instead of reactive. I feel like [AI is] going to help us address an issue or determine when there’s an issue so it’s not just, ‘We had this huge loss and there’s nothing we can do about it.’ If we had realized this issue was going on three weeks ago, we could have stopped it before it became a true big issue.”

ADDITIONAL WAYS TO DETER INTERNAL THEFT

Regardless of exactly how big of an issue internal theft is, there are a plethora of innovative ideas for limiting it.

The LPRC’s Hayes recommended working to help employees understand that “corporations and companies aren’t just faceless entities—they’re all people.” And they’re operating at very slim margins to serve and provide for the communities where these employees live.

To make sure Fav Trip is hiring trustworthy employees, Sultan makes sure the retailer is thoroughly checking references. The managerial team will call references to verify that a potential employee worked there—and that people who worked with that person have good things to say.

“It might be a little bit of a slower hiring process,” he said, “but it’s worthwhile.”

Still, he goes back to—and emphasizes— what Harrington originally said: Make it clear you’re aware of potential internal theft and can nip it in the bud.

“[For us, internal theft] always starts with the newcomers who think they can outsmart us, but it’s also a good thing for us,” Sultan said. “I look at it as a learning curve. Before, it used to be, ‘Oh, my God, how could you do this?’ … Now, we just say, ‘I want to learn how they went about it. How long did it take us to realize what was happening and fire them quickly?’ instead of dwelling on the why, which can help our monitoring staff get trained better.”

Essentially, Sultan wants to create an environment where potential thieves think: “I shouldn’t try my luck here.”

Shannon

Shannon

Carroll is a contract writer/editor for NACS.

42 MAY 2024 convenience.org JohnDWilliams/Getty Images

Copyright 2024 VeriFone Systems, Inc. All rights reserved. Verifone and the Verifone logo are either trademarks or registered trademarks of Verifone in the United States and/or other countries. All other trademarks or brand names are the properties of their respective holders. All features and specifications are subject to change without notice, and do not constitute a warranty of any kind, including, but not limited to, warranties of merchantability or fitness for a particular purpose. Product display image for representation purposes only. Actual product display may vary. Reproduction or posting of this document without prior Verifone approval is prohibited. The Verifone

+ Self-Checkout

Upgrade today! Scan and get in touch with a Verifone Payments Architect.

C18 POS

= One Powerful System

A PARTING

DRIVERS CONTINUE TO FEEL BETTER ABOUT THE ECONOMY, AND THEY

44 MAY 2024 convenience.org

Aleksandra BataevaShutterstock; Gelpi/Getty Images; Andrey Magda/Shutterstock

OF THE

ARE LOOKING FOR RETAILERS WHO BEST UNDERSTAND THEIR NEEDS.

BY JEFF LENARD AND ADAM ROSENBLATT

BY JEFF LENARD AND ADAM ROSENBLATT

The latest NACS Consumer Fuels Survey reveals that many Americans are feeling better—though that doesn’t yet mean things are good. On the whole, consumers today are sour on the state of the economy, with 56% of drivers saying they are pessimistic compared to 44% saying optimistic. But this is a noteworthy 10 percentage point improvement compared to one year ago, when 34% were optimistic while 66% were pessimistic.

As it relates to convenience retailing, the newest survey shows several signs that overall consumer behavior is creeping closer to what it was like before the pandemic. The morning commute continues to see more traffic as businesses are increasingly encouraging workers to return to their offices.

Though inflation remains a fact of life, consumers today appear a little less concerned about gas prices and, in turn, they are less likely to blame their local retailer for the price at the pump.