C-STORE COFFEE SHOP

Luring customers with barista-made beverages

C-STORE COFFEE SHOP

Luring customers with barista-made beverages

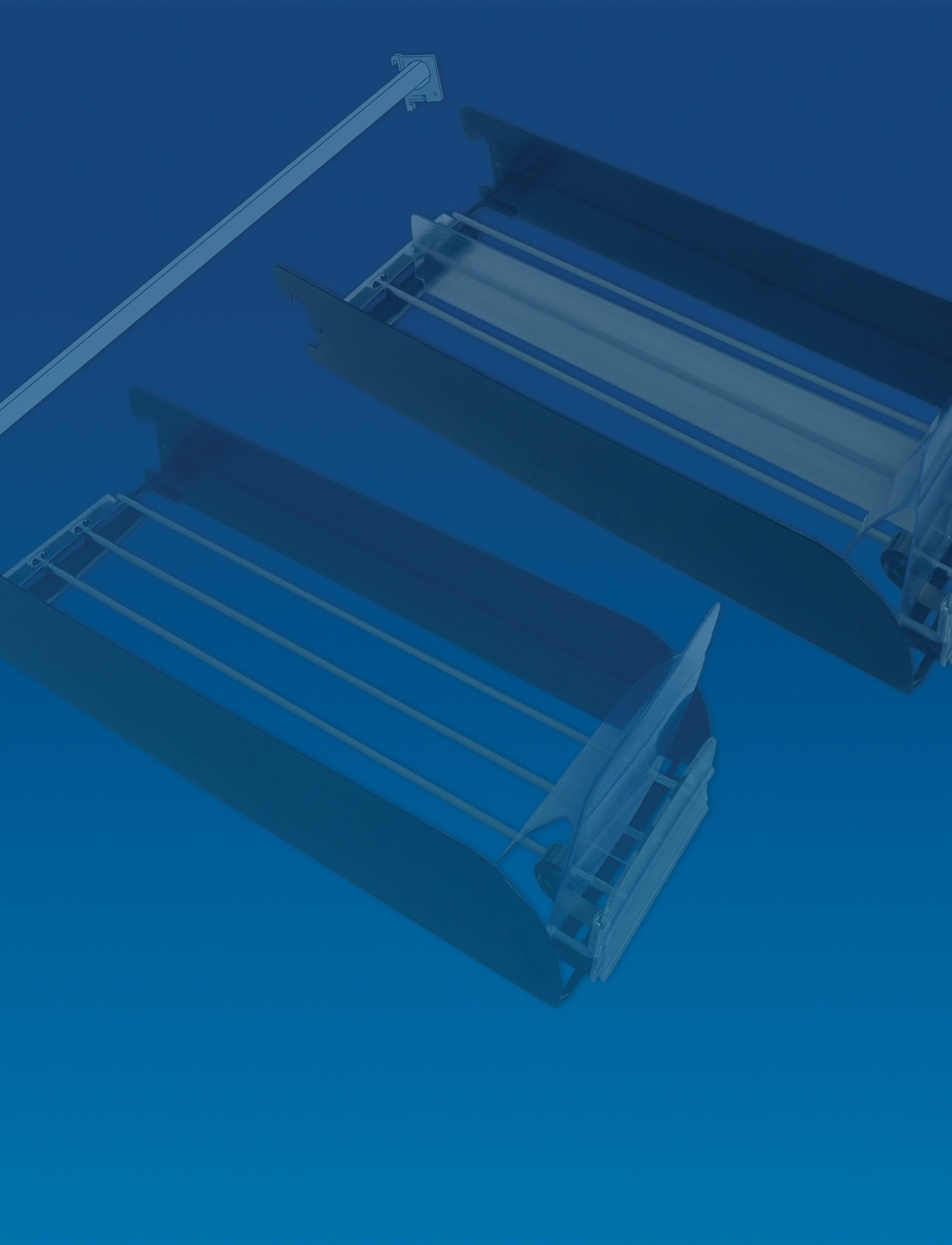

WELL-EQUIPPED Labor-saving foodservice equipment A First Look at NACS SOI Data

IT’S A FACT

$32,081 The average monthly sales per store for prepared food in 2021.

CATEGORY CLOSE-UP PAGE 76

06 From the Editor

08 The Big Question

10 NACS News

16 Convenience Cares

18 Inside Washington

After a long hiatus, convenience industry advocates returned to Capitol Hill to make their voices heard.

24 Ideas 2 Go

Breez-In has made its foodservice program the key to customer satisfaction.

70 Cool New Products

74 Gas Station Gourmet

What was left of a c-store became a lifeline for a stormravaged community.

76 Category Close-Up

Foodservice leaders share plans, goals and tips for foods made on-site.

84 By the Numbers

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Senior Editor (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Amanda Baltazar, Sarah Hamaker, Al Hebert, Pat Pape, Riddhima Sharma, Amanda Silver

DESIGN Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

NACS SUPPLIER BOARD

CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles, Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Rick Brindle, Mondelez International; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Juul Labs; Alicia Cleary, AnheauserBush/In Bev; Jerry Cutler InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley;

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Douglas S. Haugh, Parkland USA; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles, Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors Beverage Company; David Jeffco, Dirty Dough LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

We had a big family dinner planned: a hamburger at a gas station.

Okay, that’s dramatically oversimplifying and downgrading the experience for literary effect. We recently went to Dash In’s newest store, in Chantilly, Virginia, for the debut of the new Spike Burger, created by celebrity chef and restauranteur Spike Mendelsohn. It is an awesome menu addition by a company that already has an impressive foodservice offer.

We were looking forward to the experience—and we’re not alone, according to NACS State of the Industry data. Foodservice accounts for more than one in four dollars spent inside convenience stores and more than one in three profit dollars. And by all accounts these numbers are expected to increase over the next decade.

There are some very passionate advocates for the quality of our industry’s food. In early March, we brought together two of them for a road trip around Lafayette, Louisiana. One of them you already know: Al Hebert, otherwise known as the “Gas Station Gourmet,”

celebrates great food at a gas station/convenience store every month in this magazine. The other, Stafford Shurden, started a video series called Gas Station Tailgate Review. He visits stores and samples their fare, using his truck’s flatbed as his on-camera dining room table. He’s clearly tapped into something with these videos, some of which have been viewed around 800,000 times.

The passion of Al and Stafford was contagious. We didn’t just eat food and film it, we talked about it and asked questions. How is it prepared? Where do you get your ingredients? How do you develop your menus? And who comes in for the food—and from how far? For the record, the answer to that last question, in some cases, is an hour away. Most of all, we celebrated what these stores mean to the communities they serve through their food.

The big idea isn’t that you should start selling boudin or cracklins or plate lunches to replicate the amazing food at the stores we visited. The idea is to create your own restaurant-quality food offer that thrills customers, who will probably buy a lot more than just a meal. The ideas in this annual foodservice issue of NACS Magazine will help you define how to create an upscale offer, or to just “kick it up a notch,” as Louisiana native Emeril Lagasse often says.

Of course, not everyone is aware of the great food at gas stations across the country. The Buffalo Bills created what they thought was a fun TikTok video asking players what they would eat at the gas station if it’s 2:00 a.m. and they are starving. A few players suggested some packaged snacks and drinks, then defensive tackle Ed Oliver jumped in and passionately said he would get a threepiece fish-and-fries meal from Y-Not Stop. To which teammate Kingsley Jonathan asks, “From a gas station?” Y-Not Stop was one of the places we visited on our road trip. The food was great. Sounds like we need to invite Kingsley on our next trip there. Ready, Al and Stafford?

My background is in food manufacturing. When I was approached about the job, I questioned why a convenience store company needed a food safety professional.

And then I started realizing, oh wait, there’s coffee. There’s pastries, they’re cooking stuff, they’re doing all this. I saw that there’s definitely the need for a food safety professional, especially one with a manufacturing background.

Convenience retail is spilling into the QSR restaurant space right now There’s going to be a lot of changes in the industry—there already are—in terms of food.

Quite honestly, “The Simpsons” and the portrayal of the food at the Kwik-E-Mart convenience store made me want to help lead change in the industry. I’m a big “Simpsons” fan and the only thing I could imagine was walking into one of our stores and seeing—like on the show—the roller grill items that are held together by tape and glue because they’re so old that they’re falling apart. Obviously, that’s not the case, though that was the perception even just a few years ago.

Last year we held the inaugural NACS Food Safety Conference in conjunction with the NACS Show and we’ll do it again this year. Attendees said that they liked having the range of experts who discussed everything from the basics to the latest emerging food trends.

This year we want many voices of c-store food safety professionals involved so that we can share practices that help not only the food safety folks but also foodservice managers, who really can be seen as category managers . Last year c-suite folks attended, and it gave them a really good overview of what the industry is and how it’s growing. This year we’re inviting more people from other companies, all different sizes, so we can learn from their experiences. Hopefully they can give some really good advice and share some of the failures so that others can learn what works and what may not.

If a QSR or c-store is not really doing what its supposed to do in practicing food safety, you often can tell right away. How dirty is it? How unkempt is the outside? Is the landscaping a mess? If they’re not attending to the things you can see, imagine how they are attending to the things that you can’t see—like food safety

Food safety culture is the idea that everybody practices, believes and wholeheartedly understands what makes food safe and how to keep food safe. It’s also a philosophy. It’s saying that I am going to do things that are

not necessarily more efficient, and not necessarily more cost effective. However, they do contribute to food safety, and that’s critical to our business.

A culture of food safety is not just the health and safety team understanding where the risks are; we want the store employees and the frontline employees to understand what the risks are and to create a dialogue and reach back out so that they’re practicing food safety. We hope to create a space where everybody is going to give feedback and they all have food safety top of mind when they’re performing their everyday tasks.

NACS Convenience Summit Asia-Pacific brought together leaders of the global convenience and fuel retailing industry to exchange ideas and learn new perspectives in Bangkok on February 28 to March 2.

Attendees from across the globe met in the epicenter of retail disruption and innovation—Asia—for an immersive look into the future of convenience retailing. The event featured the CSA Ideas 2 Go store tours, where participants experienced interactive store tours of some of Asia’s most iconic brands. General ses-

sions highlighting global strategic issues in Asia and the impact of eMobility on the retail fuel industry, as well as case studies from 7-Eleven and Cafe Amazon, were some of the topics covered.

The NACS Convenience Retail Awards Asia-Pacific gala awarded the 2023 NACS Convenience Retail Awards Asia-Pacific.

• The 2023 NACS Convenience Industry Leader Asia-Pacific award, sponsored by PepsiCo, was awarded to Mr. Lei Zhu, general manager of PetroChina uSmile Co. Ltd.

• The 2023 NACS Convenience Retailer of the Year Asia-Pacific award, sponsored by The Hershey Co., was awarded to Jiangxi Ledoujia for its Fun Bean Convenience Store concept.

• The 2023 NACS Convenience Retail Sustainability Asia-Pacific award, sponsored by The Coca-Cola Company, was awarded to Central Food Retail Company for its “Renew” strategy for sustainable retail.

• The 2023 NACS Convenience Retail Technology Asia-Pacific award, sponsored by Gilbarco Veeder-Root, was awarded to FamilyMart Co. Ltd. for its new unmanned convenience store concept.

For more than a decade, NACS Convenience Summit Asia has hosted the NACS Convenience Retail Awards Asia-Pacific event. This prestigious competition recognizes outstanding achievements in the Asian retail communities. The awards—judged by the pillars of the convenience industry—provide one of the greatest benchmarks of global convenience retailing excellence.

NACS Convenience Summit Asia is where global convenience retailers can see what future disruptions are taking place today. Join NACS in Seoul, Korea, March 5-7, 2024. To learn more, visit www.convenience.org/events/GlobalEvents/Convenience-Summit-Asia

The NACS State of the Industry Compensation Report of 2022 Data is available for purchase! This invaluable report is the only industry-specificconveniencebench- marking snapshot that provides the most up- to-date employee com- pensation and incentive programs, benefits, turnover and recruitment data.

With new 2022 proprietary aggregate data, HR professionals in convenience and fuel retailing can stay one step ahead with data and analysis that makes it easier to attract and retain top talent. Get an insider’s look at aggregate human resource metrics as reported by 90 retail companies representing more than 21,000 stores of all sizes and over 302,000 employees.

Upon purchase of a digital license (list price: $399.00, NACS member price: $289), you will receive access to the report through a DRM-secured PDF through your www.convenience.org login profile. Today’s dynamic labor market positions convenience store retailers against virtually every channel of trade in the race to attract, hire and retain the best talent. To gain a compet- itive edge, get your copy of the industry’s premier compensation benchmarking report. Order today at www.convenience.org/

Solutions/Store/Products/NACS-SOI-Report-Compensation-2022-Data

Melissa Paul joined NACS as a meetings and events manager. Most recently, she served at the Institute of International Finance, where she managed operations and logistics for all of its events related to its Future Leaders Group. Prior to that, Paul planned events for George Washington University’s Institute for Communitarian Policy Studies. Paul earned an M.S. in tourism administration, event and meeting management from George

Washington University and a B.A. in international relations from Wellesley College.

David Espinal joined NACS as accounts payable coordinator. In this role, he will manage all vendor-related invoicing and records and month-end close procedures, among other duties. Espinal earned a B.S. in finance from Liberty College.

Tom Love, founder and executive chair of Love’s Travel Stops, passed away at the age of 85. Love guided the family-owned and operated business from one store in 1964 to a network of more than 600 locations across America. A respected community and business leader, Love was admired for his genuine humility, good-natured disposition, generosity and helpfulness toward others.

Brookwood Financial Partners LLC announced Thomas W. Brown as the chief real estate officer of Yesway. Brown will be responsible for directing all real-estate related activities for the firm, including identifying potential site and convenience store acquisitions and overseeing remodel, raze and rebuild and new-to-market construction initiatives.

Lynn Kilbourne was appointed to the board of directors at Harbor Foods. Kilbourne also serves on the boards of LLBean and the Joshua Green Corporation. She previously served on the boards of PMI Worldwide, Saax Underwear and Z Gallerie. She was the president of Zumiez, Inc. from 2008-2014 after serving as the executive vice president, general merchandise manager from 2004-2008.

Jack Cuniff has been appointed to the board of directors at Harbor Foods. Cuniff became chairman of the board for Les Schwab on January 1, 2023, after five years as CEO. Prior to Les Schwab, Cuniff served as CEO of Adidas North America for 10 years, including one year as interim CEO and five years as CFO.

Tony Jacobs, president of Bazooka Candy Brands, is now chair of the National Confectioners Association board of trustees for a two-year term. Prior to leading Bazooka Candy Brands, Jacobs worked for more than a decade in marketing roles at Nabisco, Unilever and Dr Pepper Snapple Group.

Jeremy Kleinberg joined Electrolux Professional Group in Americas as product line manager, cooking. Kleinberg, who has deep experience with product management, will be an essential part of strategic growth with the cooking equipment portfolio of Electrolux Professional. Kleinberg has more than 18 years of experience in product portfolio management in the flooring and consumer electronics industries.

Golbon has named Kevin Wilson as the company’s president. With over 20 years of

foodservice distribution experience, Wilson brings a progressive background in leadership, finance, accounting, IT and field operations. His background includes roles at Food Services of America, Shamrock Foods and US Foods.

Eric Hildenbrand now serves as chief strategy officer at McLane Company. Hildenbrand will leverage his extensive business and legal experience to help shape the future of McLane. Hildenbrand will advance the corporate vision and enterprise strategy, oversee strategic initiatives and lead McLane’s transformation.

McLane Company announced Vito Maurici as customer experience officer. Maurici will develop and implement key strategies to scale current business, build new relationships and add value enhancements to McLane’s extensive portfolio of products and services.

The Wills Group was awarded Great Place to Work certification for the second year in a row. The Wills Group family of businesses includes Dash In, Splash In ECO Car Wash and SMO Motor Fuels. According to a Great Place to Work assessment, 84% of Wills Group employees say it’s a great place to work, compared to 57% for a typical U.S. company.

NACS welcomes the following companies that joined the association in March 2023. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/Create-Login. All members receive access to the NACS Online Membership directory, latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW RETAILER MEMBERS

Hardcastle Enterprises Inc DBA Mother Hibbard’s Country Store Blackfoot, ID www.motherhibbardscountrystore.com

Heas Energy Lynchburg, VA

Indian Pueblos Marketing Inc. Albuquerque, NM www.indianpueblo.com

Jayen/Fastop Victoria, TX

www.newdistributing.com

Meyer Oil Co. dba Mach 1 Food Shop Teutopolis, IL www.mach1stores.net

Roche Oil Inc. Tulare, CA www.rocheoil.com

Secc Ltd. dba The Corner Store Loreauville, LA

Target Hospitality Spring, TX www.targethospitality.com

YATCO Energy Northborough, MA

F.M.C. Santa Cruz Servicenter N.V. Oranjestad, Aruba

Repsol Comercial de Productos Petrolíferos S.A. Madrid, Spain

Thomas Lex GmbH Bramsche, Niedersachsen Germany www.tankstelle-bramsche.de

YSATI SRL Santa Cruz de La Sierra Bolivia www.tiendaskiosco.com

NEW HUNTER CLUB BRONZE MEMBERS

Black Rifle Coffee Company San Antonio, TX www.blackriflecoffee.com

Eagle Family Foods LLC Cleveland OH www.eaglefoods.com

NEW SUPPLIER MEMBERS

Acuative Fairfield, NJ www.acuative.com

Bloc Enterprises Norwalk, CT www.nicoblocusa.com

2023

APRIL

NACS State of the Industry Summit

April 18-20 | Hyatt Regency DFW International Airport | Dallas, Texas

NACS Leadership for Success

April 30-May 05 | Virginia Crossings Hotel & Conference Center |

Glen Allen (Richmond), Virginia

MAY

NACS Convenience Summit Europe

May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

JULY

NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

Britcan Inc. dba Rich Ltd. Oceanside, CA www.richltd.com

C Store Depot/ZEO Tampa, FL www.cstoredepot.com

Clear Cut Phocus Louisville, KY CMA Dishmachines Garden Grove, CA www.cmadishmachines.com

C-StoreAi Gallatin Gatewaym, MT www.c-store.ai

Dataplor

Manhattan Beach, CA www.dataplor.com

Disruptive Technologies Atlanta, GA www.disruptive-technologies.com

Earth Water Beverage LLC Hazlehurst, GA www.earthwaterbeverage.com

ECOPAX

Englewood, NJ www.ECOPAXINC.com

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

OCTOBER

NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

For a full listing of events and information, visit www.convenience.org/events.

EHP Holdings Marlboro, NJ

www.ehplabs.com

Exponent Energy Inc. London, Ontario Canada www.drinkexponent.com

Fredericksburg Distribution Fredericksburg, TX www.fbgfarms.com

Fresh Smoke of MN LLC Saint Paul, MN www.freshsmoke.com

FridgeWize Shawnee, KS www.fridgewize.com

Funny Water Inc. Chicago, IL www.funnywater.com

GET Group North America Waltham, MA

Golden Grail Beverages Weston, FL www.goldengrailbeverages.com

Good Foods Pleasant Prairie, WI www.goodfoods.com

Grade A Quality Wilmington, DE

Graphic Packaging International LLC

Atlanta, GA www.graphicpkg.com

Greenridge Farm Elk Grove Village, IL www.greenridgefarm.com

Haynes and Boone www.haynesboone.com

Headrick Signs & Graphics Inc. Laurel, MS www.headricks.com

Healthy Earth Snack

www.healthyearthsnack.com

HF Sinclair Dallas, TX

www.hfsinclair.com

HS Wholesale Addison, IL

www.hswsupply.com

Icebox Mfg Griffin, GA

Imex Vision LLC

Lake Forest, CA www.imexvision.com

Innovative Technology Americas Inc. Suwanee, GA

www.innovative-technology.com

IntelliQA

Hatfield, Hertfordshire United Kingdom

International Food Solutions/Comida Vida Oviedo, FL www.asianfoodsolutions.com/ www.comidavida.com

JC World Bell Wholesale Co. Inc. Hackensack, NJ www.jcworldbell.com

Jocko Fuel Jay, ME www.store.jockofuel.com

Keysight Technologies Santa Rosa, CA www.keysight.com

Loyalty Methods Irving, TX www.loyaltymethods.com

Mandel Distributors Lakewood, NJ www.mandeldistributors.com

Mary Ann’s Baking Company Sacramento, CA www.maryannsbaking.com

Mississippi Lottery Corporation Flowood, MS www.mslotteryhome.com

Molly Bz Eagle River, AK www.mollybz.com

Mr. Vapor Wholesale www.mrvapordisposables.com

NuStrips San Diego, CA www.nustrips.com

Pat Brown System LLC Bakersfield, CA www.Jumpstartenergyshot.com

Plantasia Foods

Dallas, TX

www.plantasiafoods.com

R&J Almonds Inc. dba Jonny Almond Nut Company Flint, MI www.jonnyalmond.com

RapStar Energy LLC Fayetteville, GA www.rapstarenergy.store

Ready Credit Corporation Eden Prairie, MN www.readycreditcorp.com

REDCON1 Boca Raton, FL www.redcon1.com

Savage Snacks Inc. Phoenix, AZ www.savagesnacks.co

SHENZHEN FIRSTUNION TECHNOLOGY CO. LTD. Shenzhen, Guangdong China www.becovape.com

SK Investment Inc. Memphis, TN www.sknoveltywholesale.com

Soldier Boy Beef Jerky Irwin, PA www.sbjerky.com

Soulless Ginger Ale Sackets Harbor, NY www.drinksoulless.com

SouthEastern Canopies Inc. Shelby, AL www.secanopies.com

Sow Good Inc. Irving, TX www.thisissowgood.com

Starmaker Distribution Windsor, NS Canada www.starmakerdistribution.com

TEXAWATT Inc. dba TEXAS TEA FUELS & LUBES Tahoe City, CA www.TexasTeaLubes.com

Torch Enterprise Irvine, CA www.torchenterprise.com

Virtue Products LLC South Plainfield, NJ www.Virtuevapes.com

W. Two Plus LLC Kennedale, TX

WCC Tank Technology Inc. Montgomery, NY www.wcctank.com

Wild Planet Foods McKinleyville, CA www.wildplanetfoods.com

Zipline Logistics Columbus, OH www.ziplinelogistics.com

ZKONG Networks Co. Ltd

Shanghai China www.zkong.cn

Share your company’s giving-back news on social media and use our industry hashtag #ConvenienceCares

Loop Neighborhood Market is all about community. Part of its mission as a positive influence is to give back to customers through savings and deals, but also to give back to the communities where it does business.

Loop Neighborhood Market and Think Together, a California nonprofit serving K-12 schools, announced a philanthropic partnership, one kicked off by a $50,000 donation for afterschool and expanded learning programs in traditionally under-resourced communities throughout California.

The donation will help Think Together continue its mission of providing students with access to high-quality educational resources and experiences outside of the traditional school day. With the support of partners like Loop Neighborhood Market, Think Together is able to make a lasting impact on the lives of nearly 200,000 students throughout the state annually.

Other organizations that benefit from Loop Neighborhood Market’s fundraising efforts include San Francisco Pride, the California Fire Foundation, Bay Area Deputy Sheriff’s Association and its annual Christmas shopping event, Bay Area food banks and RotaCare Bay Area. During the past three years, over $400,000 went back to organizations making a positive impact in Bay Area communities.

“At Loop Neighborhood Market, we believe in giving back to the communities we serve,” said Varish Goyal, president and CEO of Loop Neighborhood Market.

The contribution comes after the conclusion of Loop, Au Energy and Shell USA’s three-month initiative The Giving Pump that used proceeds from a colorful, specially designated pump at over 100 gas stations in the Bay Area. Loop and Au Energy are a joint venture between Vintners Distributors and Shell USA.

We believe in giving back to the communities we serve.”

—Varish Goyal, president and CEO, Loop Neighborhood Market

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories.

Learn more at www.conveniencecares.org

1 Yesway announced that over the past two years it has raised more than $1 million during its annual Golf & Clays Classic charitable fundraising tournaments. The beneficiaries of the 2022 event included the Christian Outdoor Alliance and Operation Homefront, a national 501(c)(3) nonprofit whose mission is to help build strong.

2 Casey’s and Monster Energy partnered in March to raise funds to provide 10 million meals to families and children across 16 states in the heartland. The funds raised by Casey’s customers by rounding up at the register, along with 250,000 meals from Monster Energy, will benefit 53 Feeding America network food banks. One in eight children and 5.2 million seniors age 60 and

above faced hunger in 2021, according to Feeding America. The partnership between Casey’s and Feeding America began in 2020 as part of Casey’s “Here for Good” mission to create stronger communities.

3 Hershey brought together young women from around the world for the Future CEO program, in partnership with nonprofit partners Girl Up and Girls on the Run. Held during Women’s History Month, the goal of the mentorship program is to equip young women with a better understanding of their leadership skills and strengths. The young women participated in group discussions and activities across an array of topics, including setting actionable goals, navigating imposter syndrome and trusting one’s intuition. Hershey executives also dedicated time to learning from these young women to better understand what the next generation of the workforce needs to succeed.

4 Kum & Go, along with its store associates and customers, raised more than $450,000 through its “Let’s Build a Home Together” project in collaboration with Habitat for Humanity. Kum & Go became a proud national partner of Habitat for Humanity in March.

The company made a $100,000 corporate donation and committed to sponsor a Habitat home in the region that collected the most money in donations as a percentage of customer traffic through its stores. Kum & Go associates enthusiastically embraced this challenge, developing creative ways to encourage customers to give to the cause. Customers responded swiftly by donating $100,000—the goal for the entire month—in just nine days. By March 31, customer contributions soared to more than $262,000.

5 Sheetz and Ripken Baseball, a leader in youth sports events, partnered to bring 12 free baseball clinics to children ages 7 to 14 in Maryland, Virginia, West Virginia, Ohio, North Carolina and Pennsylvania. Starting in April and continuing through June, the Sheetz Community Clinics presented by Ripken Baseball will teach the fundamentals of baseball to players of all levels. The clinic schedule includes the following cities and dates:

• May 4: Morgantown, WV.

• May 31: Greensboro, N.C.

• May 31: Columbus, OH

• June 1: Raleigh, N.C.

• June 1: Pittsburgh, PA

• June 2: Cleveland, OH

• June 15: Charleston, WV

You might recall that NACS’ last in-person Day on the Hill was on March 11, 2020. Yes, that 2020. Our attendees were one of the very last groups on Capitol Hill meeting with lawmakers. By March 13, Congressional offices closed their doors to any outside visitors. Shortly thereafter, the entire world shut down. Back then, we had no idea the impact the pandemic would have on the way we live our lives. We never could have imagined that it would force us to make our Day on the Hill event virtual in both 2021 and 2022.

Needless to say, now that Capitol Hill is back to business as usual, the NACS Government Relations team was delighted to finally welcome back convenience advocates to Washington, D.C., for Day on the Hill 2023 in early March.

After a long hiatus, convenience industry advocates returned to Capitol Hill to make their voices heard.Lisa Dell’Alba (Square One Markets) delivers opening remarks at the General Session. Brandon Duckett (RaceTrac) and Senator Tim Scott (R-SC).

Over the course of a day and a half, Day on the Hill gives convenience retailers and suppliers the opportunity to advocate on behalf of the convenience and fuel retailing industry on Capitol Hill. This year, 161 attendees traveled to Washington, representing over 11,000 stores in 44 states. Of those individuals, 41 were first-time attendees who had either never participated in Day on the Hill or only had done Virtual Day on the Hill.

Ahead of Congressional meetings, NACS spends time preparing attendees to hit the Hill the following day. To kick off our General Session, Legislative Committee Chair Lisa Dell’Alba, president and CEO of Square One Markets, discussed the importance of building meaningful relationships with legislators and returning to Day on the Hill each year. The convenience industry is in every state, city, town and neighborhood across the country, serving 165 million Americans every day, 24/7. Our industry plays a crucial role in the American economy and our story is one that lawmakers need to hear, whether they are a freshman representative or a senator entering their sixth term. That way, when they’re about to draft a bill or vote on a piece of legislation, they think of the convenience industry and the impact their choice would have on our businesses and customers.

The world has drastically changed since the last time our industry advocates met in Washington, but there’s one issue that unfortunately has remained the same: exorbitant credit card swipe fees. These fees continue to be the industry’s second-highest operating cost due to Visa and

Mastercard’s domination of the marketplace. In fact, total card fees ballooned to $160.7 billion in 2022—a 16.7% increase and $23 billion more than in 2021. Merchants paid $126.35 billion in 2022 in credit card fees alone—a staggering 20.2% increase from 2021.

Why do these fees continue to skyrocket year after year? Because the market is broken. Visa and Mastercard centrally set the swipe fee rates that banks charge retailers to accept card payments. Because of Visa and Mastercard’s control over the market, retailers have no choice but to accept whichever network is on a card.

Because of this, NACS did something for this year’s Day on the Hill that we’ve never done before. We brought only one issue to the Hill—the Credit Card Competition Act.

In 2022, the bipartisan and bicameral Credit Card Competition Act was introduced by Senators Roger Marshall (R-KS) and Dick Durbin (D-IL) in the Senate and Representatives Lance Gooden (R-TX) and Peter Welch (D-VT) in the House of Representatives. This legislation provides a market-based solution by requiring there be two network routing options on a credit card—which already happens on debit today. This would give

retailers the choice of which network to route each transaction over, bringing some competitive pressure to how the networks set their prices. NACS Day on the Hill teams asked Congress to bring much needed relief to their businesses and their customers by supporting the Credit Card Competition Act upon its reintroduction for this Congress.

For this year’s Day on the Hill, 38 teams of convenience retailers, suppliers, state association executives and NACS staff participated in over 200 Congressional meetings, including meeting with 91 senators. Attendees were thrilled to finally be back in person on Capitol Hill, even if it meant standing in the cold to get into House and Senate

This month, NACS talks to Tom

Brennan,senior vice president and chief merchandising officer, Casey’s General Stores Inc.

What role in the community do you think convenience stores should play?

Convenience stores play a central role in their communities given the frequency of visits to stores, which creates a special relationship between the store team and their guests. It is that connection that makes community engagement efforts all the more impactful.

What does NACS political engagement mean to you and what benefits have you experienced from being politically engaged?

Staying on top of the legislative issues that could materially impact the industry, both good and bad, and ensuring that the convenience retailer voice is heard on those issues is why political engagement is not only necessary but a healthy practice. The benefits of being engaged are many, including getting to build relationships with members of Congress and their staff, doing the same with colleagues across convenience retail and continuing to learn about the dynamic landscape in which we operate.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)?

The convenience industry has demonstrated its resilience, specifically the last three years. Where I see opportunity is continuing to limit legislative activity that doesn’t allow the industry to serve our guests and meet the needs of the local communities we operate in. It also continues to be important to maintain, and advance, a pro-business environment that supports retailers’ ability to operate while enabling growth.

What c-store product could you not live without?

Casey’s Bacon Breakfast Pizza, of course!

office buildings. As they heard from lawmakers that day, nothing beats showing up in person to tell your story.

This won’t be our only fly-in of the year. In 2022, we brought small groups of convenience retailers to Capitol Hill an extra five times to meet with legislators and their staffs to advocate for the Credit Card Competition Act. Have your swipe fees skyrocketed over the past few years? Are you looking for more ways to join the fight? We need to keep up our drumbeat, so if you would like to join us in D.C. for one of our fly-ins this year or if you would like to get involved back at home, you can reach out to Margaret Hardin, NACS Grassroots Manager, at mhardin@convenience.org And swipe fees aren’t our only focus—there are a number of other issues (from SNAP to electric vehicles to labor and more) that we are lobbying on each day. If you would like to get engaged with any other issues, reach out to Margaret for tips on how to get involved.

Margaret Hardin is the NACS grassroots manager. She can be reached at mhardin@ convenience.org.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www. convenience.org/nacspac . NACSPAC donors who made contributions in March 2023 are:

Dennis Dirkse

Alta Convenience

Mike A. Jones

S&S Petroleum Inc.

Aaron Littlefield

Littlefield Oil Company

James McNutt

Midwest Petroleum Company

Stanton Sheetz Sheetz Inc.

Stephen G. Sheetz Sheetz Inc.

Barrett Sims

Pak-A-Sak Inc.

Richard Spresser

Alta Convenience

Melissa Vonder Haar

iSee Store Innovations LLC

Name of company: Breez-In Year founded:

BY SARAH HAMAKERThe foundation of Breez-In, a six-unit chain headquartered in Prince George, Virginia, is its chicken. The company put a lot of effort into developing its proprietary recipes and branding its foodservice with chicken—fried and baked—at the center.

“Our foodservice is an integral part of our stores,” said David M. Bogese, COO for parent company Breez-In Associates. “The basis for that program is chicken. We want to be known for having the best fried chicken within the convenience store industry.”

The hand-battered, always fresh chicken is the star of the deli, which has expanded to include potato wedges and mac and cheese, along with other items. “We wanted the

Breez-In has made its foodservice program the key to customer satisfaction.

flexibility to be creative with our chicken, rather than conform to a franchise recipe,” he said. “That’s the main reason we developed our own foodservice brand.”

Bogese’s father started the company in 1984, growing it to 15 Virginia locations and five Houston stores by 1996. The senior Bogese added a deli with a focus on chicken from the beginning, with fried chicken and chicken gizzards and livers, as well as baked spaghetti, barbecue pork and goulash specials. Over the years, he sold parts of the business, retaining only a handful of locations. By the time the junior Bogese graduated from college in 2015, Breez-In had only two locations.

“He asked me if I wanted to get into the c-store business, and I saw an opportunity to restart our brand and grow the company,” the younger Bogese said. Since then, four more locations have been acquired, with the company actively looking for additional opportunities. “As we’ve ramped up our business, we’ve found older customers saying they remember Breez-In from my father’s time, while we’re still building the brand with our younger customers.”

First on Bogese’s agenda was completely gutting the stores to update the kitchen equipment and to include a larger foodservice area. “The original space we allotted for foodservice we’ve already outgrown, with increasing sales and demand,” he said. The company will soon renovate kitchens and foodservice areas to accommodate more staff and product.

In addition to living up to its slogan as offering “Virginia’s Finest Fried

Chicken,” Breez-In stores have walk-in beer caves with a large selection of craft beers, including local Virginia brews and other domestic beers, as well as an expanded selection of wines. The chain also partners with local businesses such as Richland’s, which provides ice cream and milk products, and Appomattox River Peanut Company, which offers shelled peanuts, peanuts in the shell and peanut butter.

Assisting Bogese with merchandising and foodservice initiatives is John Coonley, director of operations. “He’s done a lot to help us stock what our customers want and implement new ideas,” Bogese said.

For Bogese, one of the main reasons for the chain’s success is its employees. “We’re a family-owned business and we treat all employees like family,” he said. “We take care of our employees, which is the reason many stick around.”

For example, Breez-In offers competitive pay to all levels. After a year of employment, full-time employees are eligible to participate in a 401(k) with a 4% match by the company, as well as short-term and disability plans, plus term life insurance, all paid 100% by the company. After two years, full-time workers can enroll in the company healthcare plan, with Breez-In picking up 100% of the premiums.

To connect with customers onsite, Breez-In hired Mood Media to provide in-store music mixed with commercials that play about every 10 minutes. “They hear about our chicken, beer cave or another special,” Bogese said.

Digital menus rotate to showcase menu items such as their made-to-order sandwiches, chicken or burgers. “We’re also developing a commercial to air in our local news channels and on Comcast cable to entice people to stop by to see what Breez-In has to offer,” he

Trial and error—that’s the best advice David M. Bogese, COO of Breez-In Associates, which operates six Breez-In convenience stores, can give a retailer looking to provide customers with a unique experience. “You have to try new things and take some risks to see what’s going to work,” he said. “If it doesn’t work, explore other avenues.”

He also stressed having a friendly and courteous attitude toward customers. “If you can grab them during their first visit to your store, 90% of the time they will become a regular customer,” Bogese said. “But that only works if you have your store centered around the customer.”

said. The company has a robust Facebook presence as well, giving it another opportunity to interact with current and potential customers.

“At the end of the day, we hope customers appreciate our good, clean locations and a friendly and customer-service-oriented atmosphere, along with the aroma of our delicious fried chicken,” Bogese said.

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

BY EMMA TAINTER

BY EMMA TAINTER

The convenience store industry is vast and diverse, but there is one thing many convenience retailers have in common: They believe that foodservice is their future because it’s already a huge part of their present operations. Foodservice accounts for more than one in four sales dollars and one in three profit dollars inside the store.

Foodservice, done right, can be a cure-all for the fierce competition that convenience stores face at the pump and inside the store. It can provide high margins and generate excitement through new offers unique to your market.

But that doesn’t mean there aren’t challenges.

Just as convenience retailers turned the corner from COVID-19 restrictions, they found themselves facing strong headwinds

in 2022: a remarkably volatile supply chain, four-decade-high inflation rates and a tough labor market.

Despite this turbulence, convenience retailers saw a 14.3% year-over-year increase in total foodservice sales, based on preliminary data from the 2022 NACS State of the Industry survey. Foodservice, which consists of the categories of prepared food; commissary; and hot, cold and frozen dispensed beverages, was responsible for revenue of $677,897 per store, or 25.6% of total in-store sales. All categories saw a year-over-year increase in sales.

Retailers reaped the benefits from solid foodservice sales. For La Crosse, Wisconsin-based Kwik Trip, 2022 marked the “best year ever,” according to Paul Servais, director of foodservice. “From a hot food standpoint, our fresh fried chicken program really took off,” he said. Servais added that Kwik Trip “had a lot of growth in our bakery program [too] … those two food categories had an explosive year.”

Within foodservice, prepared food was the highest-grossing category at $538,531.

Issues in the supply chain put pressure on retailers who were trying to keep their foodservice offers strong, but Pennsylvania-based Rutter’s embraced the challenge and worked with its manufacturers.

“We certainly had some [supply chain] struggles … but we really tried to work with [our suppliers] with what they had available and push innovation that way,” said Chad White, food service category manager at Rutter’s.

Record gasoline prices—which peaked at $5.02 per gallon in June 2022—had a major impact on disposable income. Some retailers found creative ways to attract gas-only customers inside the store.

And some of those sales strategies worked. A record 59% of customers refueling said they also went inside the store, according to the latest NACS Consumer Fuels Survey. (See the April 2023 cover story, “Selling Fuel to People in a Bad Mood.”) One program that retailers found successful before and after gasoline prices soared, especially those with dedicated mobile apps, was to offer a discount on fuel with an in-store purchase. “Fuel prices are always a hot topic, and anytime you can discount, it gets people really excited,” said Kwik Trip’s Paul Servais.

Retailers also had to make the tough decision to either accept rising inflation and absorb losses or raise their prices to keep margins level. This created a conundrum for retailers, as foodservice sales historically provide higher gross margins than most merchandise categories.

Retailers that operate a foodservice program have felt the sting of rising food costs and have had to push the boundaries of price inelasticity, making tough decisions on pricing. Servais described keeping up with rising costs as a race against time, recalling that he’s never adjusted pricing strategies as much as he has in his 24 years with Kwik Trip.

FLAVORS:

- Bacon Cheddar & Chive - Crab Feast

- Bacon Jalapeno - The Reuben

- Buffalo Chicken - Chorizo Burrito

- Breakfast Skillet - Cheese Bomb

Request Samples Today!

taterkegs.com

THE BEST PARTS OF A BAKED POTATO IN THE PERFECT HANDHELD PACKAGE.

Because of higher costs in 2022, gross profit dollars for foodservice did not increase at the same pace as sales, rising a more modest 8.8% to $354,550 per store in 2022 and accounting for 36.1% of in-store gross profits. Foodservice gross profit margins dropped 2.7 points to 51.73% in 2022. The margin loss was led by frozen dispensed beverages, which dropped 3.3 points to 63.5%, and prepared food, which dropped 2.4 points to 55.4%. Cold and hot dispensed beverages were the only categories spared from decreased margins, instead increasing by 4.0 points and 1.1 points, respectively.

The increase in the consumer price index (CPI) of food items used in foodservice had retailers across the U.S. taking second (or third) looks at their financial statements. In most cases, higher sales numbers compensated for tighter margins.

Servais noted that Kwik Trip’s percent margins decreased, but sales were high enough to make up for that in the categories.

“Margins decreased quite simply due to the fact you couldn’t raise prices fast enough to keep up with the price changes,” he said.

Another challenge was product spoilage, which shot up 33.2% because of the wild swings in demand coming out of the pandemic. Retailers dealt with increased spoilage in different ways.

Servais saw the trend in increased food waste at Kwik Trips stores, but the retailer does a number of things to control that waste. “The biggest thing we do is donate everything we can to food banks, like Feeding America,” he said. “We try to mitigate the amount of [food waste] going into the landfills.”

Rutter’s, meanwhile, leaned into menu rationalization, a process that had begun before the pandemic. Rutter’s was able to cut down on food spoilage by honing its menu, ensuring that foodservice offers were not only attractive to customers but versatile in terms of ingredients across dayparts.

For commissary—i.e., ready-to-eat meals; sandwiches and wraps; thaw, heat and eat meals; and sides and salads—the industry saw sales increase by 5.5% to $76,217 and gross profit dollars increase 1.8%.

Commissary found its footing during the pandemic as customers didn’t want to purchase ‘handled’ food.

70 years ago, we pioneered c-store fried chicken.

Ongoing menu innovation leading to multiple Best New Product Awards for our dipping sauces and mac & cheese.

Ranked for 15 consecutive years in Entrepreneur’s Franchise 500.

However, commissary was not spared the wrath of cost increases and experienced a 1.30 point decline in margins.

Ready-to-eat-meals were the star for commissary, with sales increasing 15.3% and gross profit dollars increasing 14.4%. While ready-to-eat meals also saw a decline in terms of margin, the drop was less dramatic than other foodservice categories.

Margins for ready-to-eat meals declined 0.3 points, while sides and salads (-4.51 points), sandwiches and wraps (-5.4 points), and thaw, heat and eat (-8.2 points) saw more dramatic declines.

Three out of the four commissary subcategories’ gross profit dollars also shrunk. Thaw, heat and eat, the smallest contributor, saw the highest decrease in gross profit dollars—almost triple the loss of sandwiches and wraps.

Commissary’s 5.5% sales increase and 1.8% increase in profit dollars shows that it remains a popular part of a broader foodservice program, and one that can be executed without the same labor costs as prepared foods.

Dispensed beverages accounts for more than one in five foodservice dollars (22.5%) and consists of hot dispensed (9.0% of total foodservice sales), cold dispensed (7.8%) and frozen dispensed beverages (5.8%).

Hot dispensed beverages (coffee, hot tea, hot chocolate, cappuccino and specialty coffee, refills, coffee club mugs) saw a 0.4% decline in year-over-year sales, bringing in $73,758 in in-store sales; gross profit dollars increased a more modest 1.2%.

Retailers have welcomed customers back to the morning daypart, and are beginning to see morning commute sales return. Coffee sales in 2022 were increased by 3.7% compared to 2021. Gross margins for coffee experienced a decline of 2.3 points.

While retailers were experiencing shrinking margins, they were still able to find a bright spot in the hot dispensed category: cappuccinos and specialty drinks saw strong 22.1% sales growth. The subcategory brought

in a healthy 74.8% margin, which was down 2.2 points compared to 2021.

The industry’s continued focus on quality food and beverages helped propel these sales. Customers increasingly expect something akin to the lattes, cappuccinos and cold coffee concoctions they can get at the cafe down the street.

White said that these drinks were key to Rutter’s success overall with hot beverages. “We were able to make up [lost hot dispensed sales] margins … with our hand-crafted beverage program. We had a lot higher margin items in frappes and lattes, specialty coffees,” he said.

Hot tea saw sales increase 8.5%, and hot chocolate, which improved sales considerably in 2021, experienced a sharp 21.3% decline in sales. Both subcategories saw a decline in margin.

Cold dispensed beverages (carbonated, non-carbonated, refills, sports drinks, club mugs, other non-carbonated) saw the strongest year-over-year sales growth at 17.3% and saw an increase of 24.7% in gross profit dollars. Also, it was the only one among the three dispensed beverage categories to increase its gross margin, increasing by 4.0 points.

Sales of frozen dispensed beverages (frozen - non-carbonated, frozen – carbonated, other) which are iconic to the industry, are often

Margins decreased quite simply due to the fact you couldn’t raise prices fast enough to keep up with the price changes.”

strongest during the warmer months and deliver a hard-to-beat margin. In 2022, frozen dispensed beverage sales increased 11.3% to reach $47,724 and saw the smallest decrease in margin, falling 3.4 points to 63.5%.

According to the NACS Foodservice Growth Drivers Survey, the top three challenges impacting 2022 foodservice programs were staff turnover, supply constraints and inflation. About 58.2% of retailers indicated that staff turnover was impacting foodservice implementation.

Because foodservice requires more labor than the sales of packaged items, high turnover remains a troubling trend. Turnover numbers from the NACS State of the Industry Compensation Report of 2022 Data for fulland part-time associates came in at 141.2%. This high rate of turnover comes despite wages rising 68.4% over the past decade. As foodservice offers have become more sophisticated, the complexity of foodservice jobs has also increased.

Convenience retailers have sought to ease the workload on employees by integrating worker-friendly aspects when redesigning spaces for increased foodservice. Retailers such as Rutter’s kept retention high by maintaining COVID-era wages and benefits, as well as having supportive upper management.

Loyal customers expect their local convenience store to stock the basics, but they also like to be surprised with new offers. More retailers are tapping into consumer

preferences to deliver something new and exciting at their stores.

More than half of retailers (64%) participating in the NACS Foodservice Growth Drivers Survey reported they are constantly implementing new or evolving current foodservice offerings to match the latest consumer trends. Oftentimes these strategies can lead to menu innovation that differentiate a c-store from a QSR.

Many convenience stores offer a signature foodservice item or a fan favorite. For Kwik Trip, it’s fried chicken. Kwik Trip also recognized the importance of limited time offers (LTOs) in driving traffic to its stores. Constantly rotating LTOs and keeping customers engaged is key: “You’ve got to have pizza, you’ve got to have a bakery item, you’ve got to have coffee. You have to be doing it all.” Kwik Trip “rolled through 105 LTOs,” according to Servais.

LTOs not only keep customers excited and wanting to come back for more, but they are also trial runs to gauge customer preferences. Rutter’s recently released its Inspired Food Menu, a confident leap into the LTO deep end. “[LTOs] allow innovation through a test trial, almost, to see what the customers are looking for. It will allow us to do some unique items that customers aren’t normally seeing out in c-stores and see what kind of traction we get,” said White.

For many retailers, 2023 is going to be a big year full of big flavors, and hopefully big sales. For Rutter’s, this means keeping its eye on the foodservice prize: “Our goal is to keep innovating going forward and keep giving the customer what they want and allow them to be able to build whatever they’re looking for. We’re excited about the future here,” said White.

Beyond our endlessly-innovative portfolio for c-stores, Rich’s is in your corner with insight-driven partnership and 75+ years of culinary expertise. Subscribe to Rich’s C-Store Newsletter for valuable data, tips, trends, inspiration and more –delivered straight to your inbox.

SUBSCRIBE TO RICH’S C-STORE NEWSLETTER TODAY!

he term ‘ghost kitchen’ traditionally refers to a foodservice facility that houses a delivery-only restaurant,” says Alex Canter, CEO of Nextbite, a Denver-based virtual restaurant organization.

A ghost kitchen can go by other names, such as dark kitchen, cloud kitchen or virtual kitchen, and there are a variety of strategies for operating this type of business. Multiple restaurants can rent and share the same food preparation facility—or not. They can operate out of a brick-and-mortar restaurant—or not. What they all have in common is that the food prepared in the kitchen is delivered directly to the people who order it and is consumed off premises.

During the pandemic, the Nextbite team concluded that there were about 800,000 foodservice facilities across the United States with underutilized kitchens and that Nextbite could profit while helping those businesses generate more sales.

“Every restaurant has slow parts of the day or the week,” Canter said. “And Nextbite has created a portfolio of new restaurant brands that we can offer any foodservice kitchen, restaurant, gas station, c-store or any facility with kitchen equipment. They can sign up with Nextbite, and we’ll pay them to make food for the brands we offer.”

Nextbite has 25 different menus. “Our clients carry specified ingredients and make the food to our specifications,” Canter explained. “Then, they put this [brand] sticker on the bag and sell the new brand on delivery apps like DoorDash and Uber Eats from the kitchen

Canter knows something about restaurants. He is a fourth-generation owner of Canter’s Deli, one of the last traditional Jewish delis in Los Angeles. It was founded by his great-grandfather in 1931 and is still operated by family members. He also knows technology. In 2017, he developed Ordermark, software that helps restaurants manage several different delivery apps on a single device.

“Ordermark is used in a lot of kitchens today,” Canter said. “If you’re going to be taking orders from multiple sources, it’s important to have an underlying technology to manage all the complexities that come with that.”

Ordermark morphed into Nextbite, which today partners with thousands of eateries, including the 1,200-plus IHOP restaurants nationwide. The pancake chain uses its kitchens to prepare three Nextbite virtual brands: one featuring grilled cheese sandwiches, another offering quesadillas and a third presenting plant-based chicken meals.

“Basically, we are paying IHOP to make food and deliver it to the customer in a different bag,” Canter said.

This is not unusual in a large urban area with plenty of restaurants and a large custom-

According to the DoorDash Online Ordering Trends report for 2022, the top five menu items ordered via DoorDash in the first quarter were:

• French fries

• Burrito bowls and burritos

• Chicken nuggets and sandwiches

• Hash browns

• Cheeseburgers

The top five cuisines that DoorDash customers requested in the first quarter were:

• American

• Mexican

• Japanese

• Italian

• Chinese

er base. A recent news report by a Chicago television station found that some local restaurants serve as the ghost kitchen for as many as 20 virtual brands.

Currently, Nextbite is expanding its reach to nontraditional foodservice operators. “We started with restaurants and then realized there are a lot of idle kitchens that could benefit from more orders,” Canter said. “Churches, hotels, nightclubs, hospitals, bowling alleys and convenience stores have kitchens and the ability to cook food. Any food facility that has a TurboChef oven or the capability to do pizzas, wings or hotdogs is a potential client.” What about smaller facilities that don’t have a grill or fryer? “They can do dessert brands,” he said. “Like ice cream and cookies and light concepts that we have in our portfolio.”

Busy people crave good food they don’t have to cook themselves, but that doesn’t mean they want to sit down in a restaurant.

Take-out and pickup food orders, including drive-through, have increased between 10% and 15% from pre-pandemic norms for full- and limited-service restaurants, respectively, according to Rich Shank, senior principal and vice president of innovation for Technomic. That should mean good things for ghost kitchens. According to predictions from CBRE Group, a commercial real estate services and investment firm, by 2025 ghost kitchens will account for 21% of the total U.S. restaurant market.

“Amazon and all these businesses have created a new expectation—that you can have anything you want delivered,” Canter said. “There is an explosive trend where people who are at home can open an app or a smartphone and have food brought to them. And it’s not just young people using these apps. People of all ages use them.”

He’s convinced that in the next 10 years, the generation growing up with smartphones will have a new relationship with restaurants. “Instead of getting in their cars and going to restaurants, they’ll have the option to have whatever food they like brought to them at their house,” he said. “Not only fast food, but high-end food, fast casual.”

Currently, Nextbite has no convenience store partners, although c-stores have shown an interest in the ghost kitchen idea. In 2022, Couche-Tard/Circle K invested in Kitchen United, a California-based ghost kitchen company that concentrates on major urban markets.

“We see many commercial opportunities in partnering with Kitchen United,” said Kevin Lewis, chief marketing officer of Alimentation Couche-Tard, when the announcement was made. “We believe this business stands apart from other industry players with its centralized locations, multiformat offerings, experienced management team and mature technology stack—all of which align with Circle K’s mission to make our customers’ lives a little easier every day as we work together to shape the future of convenience.”

Other c-store retailers with their own successful foodservice programs think the concept is compelling.

The generation growing up with smartphones will have a different relationship with restaurants.”

“I think ghost kitchens are the new food truck,” said Elise Babey, senior manager of product development and supply chain for Neon Marketplace, a Massachusetts retailer that opened during the pandemic. “But as a new business, we want to focus on our brand before growing another brand under a ghost kitchen name.”

“We’ve discussed it, but we have never pursued it,” said Jimmy Crowder, director of food innovation at TXB, based in Texas. “We’re focused on basic operations and efficiency— being fast, friendly, clean. Could we go down that road in the future? Potentially.”

Not everyone is sold on the idea that ghost kitchens will continue to proliferate. Shank sees a role for ghost kitchens in the foodservice industry, “But they will not have the runway early adopters assumed.”

He said that the ratio of on-premise dining to off-premise dining seems to have settled. “Delivery will be primarily a traffic stealer between competitors versus a general traffic builder for the market. Wendy’s backed off a pretty aggressive ghost kitchen plan, and moves like that are indicative that the market had over-corrected on the ghost kitchen front. I expect them to settle into a niche in the market that helps foodservice operators with adequate resources fill service gaps.” Examples include filling holes in delivery zones or outsourcing delivery instead of remodeling a store.

According to proponents, one big benefit of ghost kitchens is that they’re a less expensive startup than a bricks-and-mortar restaurant. But critics say that those real estate costs are simply being replaced by the price of technology, which is mandatory for order tracking, customer-facing applications and other management tasks. Those costs and the importance of a smooth-operating virtual kitchen make the right technology solution one of the first things to investigate when considering a ghost kitchen partnership, said Andrea G. Mulligan, chief customer officer for Paytronix, a technology provider for restaurants and retailers.

“You can find someone with a kitchen infrastructure who can support you. You can

find people you can train to produce your product in a high-quality way. But with a ghost kitchen, you have no storefront where a customer can walk in and complain to a manager,” said Mulligan.

“A ghost kitchen needs that end-to-end program where guests can provide feedback and reviews you can respond to,” Mulligan explained. “You can use artificial intelligence to get to know them and bring them back in based on their buying preferences. You can link their loyalty to their online ordering and ensure that you’re providing products that are relevant to them.” At the end of the day, the purpose of technology infrastructure is to bring customers back. Shank thinks convenience retailers are in a unique position to consider beneficial uses for ghost kitchens, but he cautions that consumers are more likely to respond to an established brand than a virtual brand that is relatively unknown.

When a c-store is exploring a new model or stepping up its offerings to compete with other foodservice providers, “Ghost kitchens can be a source of experimentation to determine if that’s worth doing,” he said. “Maybe a c-store can sell elevated food under its flagship brand for off-premise consumption or potentially use [ghost kitchens] in the same way they leverage a commissary to prepare on-site purchases off-site.”

In Shank’s view, ghost kitchens are less a long-term growth opportunity and more a low-risk way to experiment with new models and new foods. “As I understand it,” he added, “c-stores of the future are heavily focused on developing culinary capabilities in-store and they may not need this type of experiment. For those with less confidence, ghost kitchens may be a way of dipping their toes into the fresh-prepared foods market as they seek ways to compete with QSRs.”

Pat Pape worked in the convenience store industry for more than 20 years before becoming a full-time writer. See more of her articles at patpape.wordpress.com.

I think ghost kitchens are the new food truck.”

s convenience stores increasingly operate as restaurants, foodservice operators must provide high-quality food and a varied menu to satisfy the different tastes of the customers who come through their doors daily. That challenge is magnified by the tight labor market.

“There’s a push for fresh, a push for quality, and what we really see is variety,” said Ben Leingang, CEC, associate director of national accounts with Alto-Shaam, based in Menomonee Falls, Wisconsin. “Some of our customers are building incredibly robust food programs that are as varied as those at any restaurant or grocery store.”

Customers are demanding variety, Leingang said, but with a shrinking labor market and continuing challenges with employee turnover, it can be difficult for operators to offer quality foodservice. To help, retailers are increasingly relying on easy-to-operate equipment that allows for flexible staff hours and ensures consistent results each time, reducing human error.

equipment might be the answer to your foodservice labor crunch.

Food packaging has many important roles to play in a convenience store’s foodservice program. It needs to present food at its most enticing; it needs to keep food hot (or cold); it needs to maintain the integrity of the food; and it needs to be practical—able to be stacked in display cabinets and stable enough for customers to eat from while driving.

“Packaging needs to help sell and remove the obstacles to selling—the food needs to be visible and the presentation must be good,” said Kurt Richars, director of market development and sustainability, Anchor Packaging, St. Louis, Missouri. “And it has to help operationally, which includes packaging that can hold food at that fresh-made quality for longer.”

“While cost is always important, our top priority is, ‘Is it the right product for our food?’” said Chad White, food service category manager, Rutter’s, based in York, Pennsylvania. “We produce high-quality products, and the wrong packaging can downgrade that quality.”

Typically, Rutter’s stores use clear plastic, paperboard and paper products for packaging, but the company is considering other materials. Ideally, it opts for packaging that can be cross-utilized for different applications to reduce SKUs and provide efficiencies.

White also looks at ease of use, such as paper cups designed to resist sticking together in the sleeve or folded packaging that’s easily opened. “These are small efficiencies, but small efficiencies help create a smooth-running restaurant,” he said.

Ovens are arguably the No. 1 piece of equipment for a convenience store foodservice program. Without them, there’s no freshly cooked food. Today’s ovens, from combi ovens to multicook and high-speed ovens, require almost no training. Once the equipment has been programmed, all employees need to do is push a button, which often is a simple-to-read icon.

High-speed ovens are key to operating a successful foodservice program for Kwik Trip, which has 848 stores, primarily in Wisconsin, Minnesota and Iowa.

They are simple to operate and cook food fast, said Paul Servais, retail foodservice director for the La Crosse, Wisconsin-based company. They allow for a lot of food to be cooked and held before peak hours, he said, as well as for food to be made during the busy lunch and dinner periods. This enables the company to be more flexible when it comes to scheduling foodservice staff.

Combi ovens are one of the top pieces of equipment recommended by Rob Moak, vice president of strategic accounts, TriMark Gill, a foodservice supply company in Phoenix, Arizona. They are “so versatile,” he said. “You can cook something in a combi, put it in a chiller, then retherm it.” These are completely programmable, so employees hit an icon to cook or reheat food, then walk away to complete another task.

Placon has a full line of packaging and understands the importance of food presentation. The Madison, Wisconsin-based company has added anti-fog technology to its containers. “You want something quick when you’re in a c-store, but you still want it to look good,” said product manager Kali Kinziger.

Placon also has a tamper-evident line in multiple sizes. It “does really well in convenience because there are so many people passing through that you want to ensure nothing has been opened,” she said. The tamper-evident line also has been designed with custom inserts to give food the greatest visual appeal and to hold it better. Salads might have the lettuce and other vegetables in the base, with croutons and toppings on the insert tray to keep them crispy, for example.

“You can see how fresh it looks; as soon as you mix in the toppings, they’re going to get soggy,” Kinziger pointed out.

Convenience store customers love fried food, but holding temperature can be a challenge since these foods need to stay hot to retain their essential crunch.

Anchor’s Crisp Food Technologies line is specifically designed for fried foods. With vents both on the top and on the side, the packaging ensures air circulation so that steam doesn’t make the food moist. Food also sits on raised channels in the base of the container, which means warm air can pass around it from all directions.

Anchor’s products can be used for hot food or cold food. Once hot food has been held at temperature for the maximum safe time, that container can be moved into the cold case for customers to take home. Having this dual functionality, said Richars, means less packaging waste and less food waste, since hot food can simply transition to become cold food. This saves employees time since workers don’t need to repackage and redisplay food items if they need shifting.

A key consideration with convenience store packaging is durability. “If packaging doesn’t hold up, it could create a mess in [customers’] vehicles or downgrade our food,” pointed out White. “This is why quality [of packaging] is important; choosing lower quality to save cost could impact the end user and create a bad customer experience.”

How the food holds up is a key consideration for Kwik Trip, too. “Most important is food quality,” explains Paul Servais, retail foodservice director. “I’ll pay a little more for a package if it holds our food longer and better.” And, he adds, if packaging can’t hold its own in a car, he won’t use it.

Using the right packaging can also help convenience store operators save on labor. With packaging and equipment that can hold hot foods at temperature, employees can prepare the food before peak times, and then those same employees can transition to dealing with other orders or ringing up sales during the lunch or dinner rush.

“You’re taking stress off your team, and you can do more with less so you don’t have to invest in more labor,” Richars said.

Multi-cook ovens are among Alto-Shaam’s equipment that is most popular with convenience store operators. The Vector and Converge ovens can be operated with almost no training. The latter is a combi oven with multiple chambers, each of which can be a different temperature.

Convenience stores typically opt for one or both of these ovens, Leingang said. Both have a small footprint (24 inches for Converge and 21 inches for Vector), and they can be stacked with each other.

But a lot of convenience operators, he said, start off with cook-and-hold equipment to get their food program off the ground. Then they might build onto that by adding a multicook oven and then using the cook-and-hold as a holding cabinet for cooked or rethermed foods.

These ovens are simple to use, said Leingang, and “the ability to press a button and walk away trumps all.” Another plus is that since these ovens rely on employees pressing icons to cook foods, there are no language difficulties for people who don’t read English very well. “It makes it plug and play,” he added.

Easy-to-use equipment brings great advantages when it comes to maximizing labor. Employees can have a dual role, cooking food but also working as a cashier, Leingang said. “Employees can multitask, and [this equipment] really frees them up. The biggest thing we can offer is flexibility.”

The Vector and Converge ovens can be operated with almost no training.Simple push-to-cook buttons cut through any potential language barriers.

Kwik Trip relies on fryers to prepare key menu items like chicken tenders and waffle fries. But fryers can mean a lot of work for foodservice staff when it comes to cleaning, oil filtering and oil changing.

That’s why Servais likes to use auto-filtering fryers in Kwik Trip stores. Every four or five food drops—or whatever the setting—the

fryer automatically filters the oil. “Without this, you are relying on the co-worker to flip levers and switches to filter, and they may not do it after the recommended drop,” he said. In this case, “The oil quality diminishes, which leads to poor-quality fried foods.”

The stores also have a Restaurant Technologies Inc. (RTI) oil system. RTI is a company that delivers fresh oil and picks up waste oil. Kwik Trip stores have two tanks in the backroom so that employees do not have to handle oil. “This saves time and reduces injury risk,” Servais points out.

Rutter’s, based in York, Pennsylvania, uses an RTI system “designed to polish the oil and pull out impurities to ensure longer oil life,” said Chad White, foodservice category manager. “With these added benefits, it also helps reduce the cleaning time on fryers versus our previous unit, which was handcranked pumps.”

For frying, Rutter’s has recently begun using a double basket fryer, which “helps improve efficiency in our fryer program by taking the same footprint of our Perfect Fry units but with two loading stations,” White explained. This allows one employee to produce double the food.

“We are essentially getting two fryers out of the same footprint,” White said. “While capacity is reduced, it works perfectly for our made-for-you program as we are cooking products to order.”

They might not be very well understood, but cook-chill systems can be a boon to convenience store operators, said Moak. Put simply, food that’s cook-chilled is fully cooked then rapidly chilled in a blast-chiller and refrigerated until it needs to be reheated.

By using cook-chill systems, convenience store operators can schedule staff to work during off-peak hours or make shifts longer, two tactics that can help them hold onto the employees they have.

Cook-chill allows foodservice managers to allocate labor and to create a food stash while also producing great quality food, Moak points out. “You have a very consistent product with these,” he said, “just as good as if I’d just pulled it right out of the oven.”

These systems, he said, are ideal for home

meals that customers buy cold then take home to heat. These could be all-in-one meals like pasta and meatballs, or dinners with two or three components. For the latter, Moak said, “I would cook each individual item separately, marry them in a container, then put it together and chill that, seal it and then offer that in the case.”

Saving labor is a key consideration for all equipment, said White, and on top of that, “Every piece of equipment is selected to be easy to use and clean. It must work quickly and make the operator’s job more efficient.”

Amanda Baltazar has been writing about foodservice and retail for trade magazines for more than 20 years. Read more of her work at www. chaterink.com