How smart store design can help solve for labor

FLEXIBLE SCHEDULES

Honor employees’ time

THE TOP 100

These are the largest U.S. c-store chains

convenience.org Advancing Convenience & Fuel Retailing MARCH 2023

Steps Saving

• • • ©2023 Altria Group Distribution Company | For Trade Purposes Only

26

Store Design With Labor (or Lack of It) in Mind

As labor shortages increase, every detail is being scrutinized when building new stores to eke out ways to add greater efficiency.

42

Lifting Up a Community

Sioux Valley Coop offers a modern destination that meets a community’s growing needs.

46

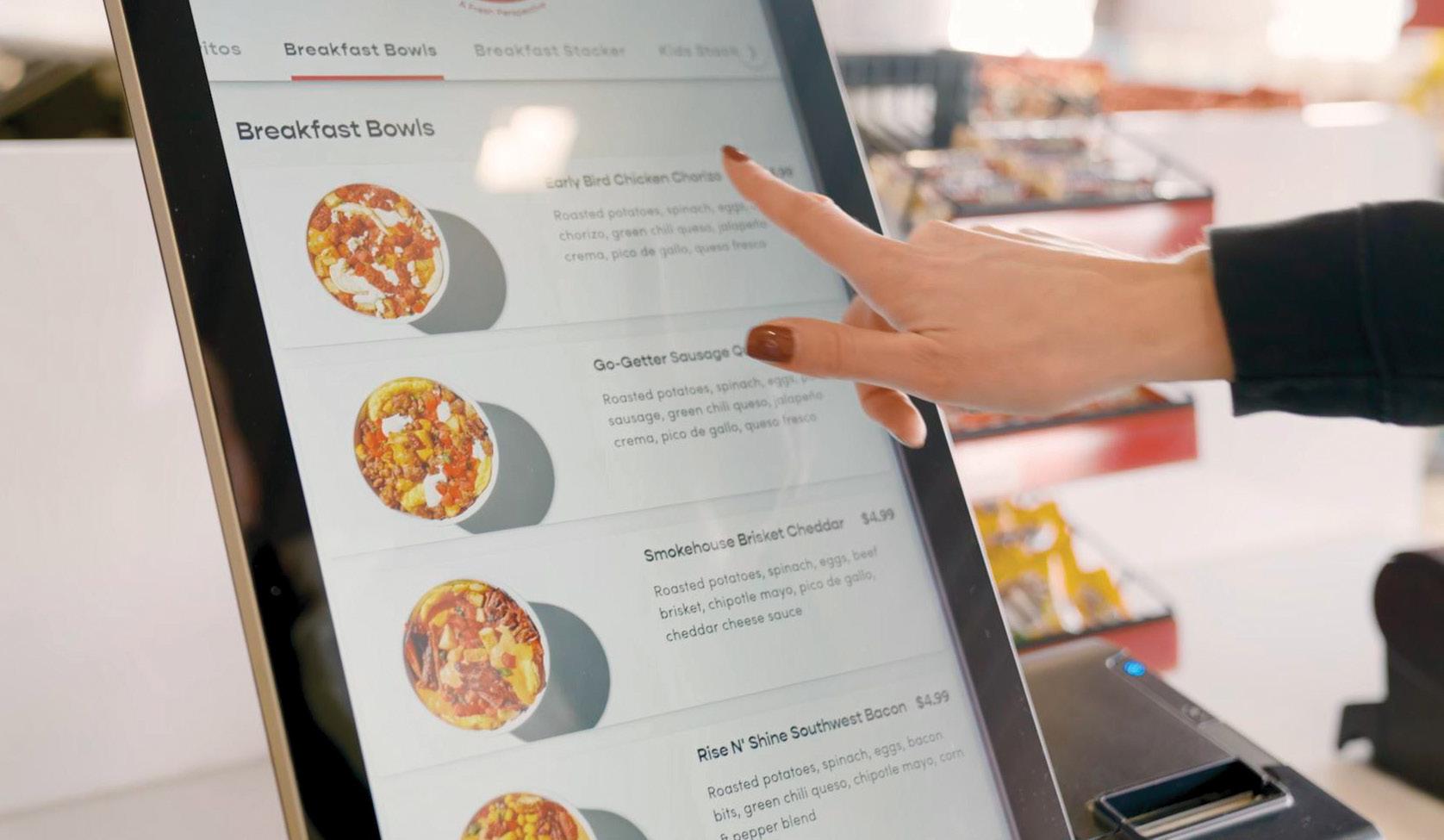

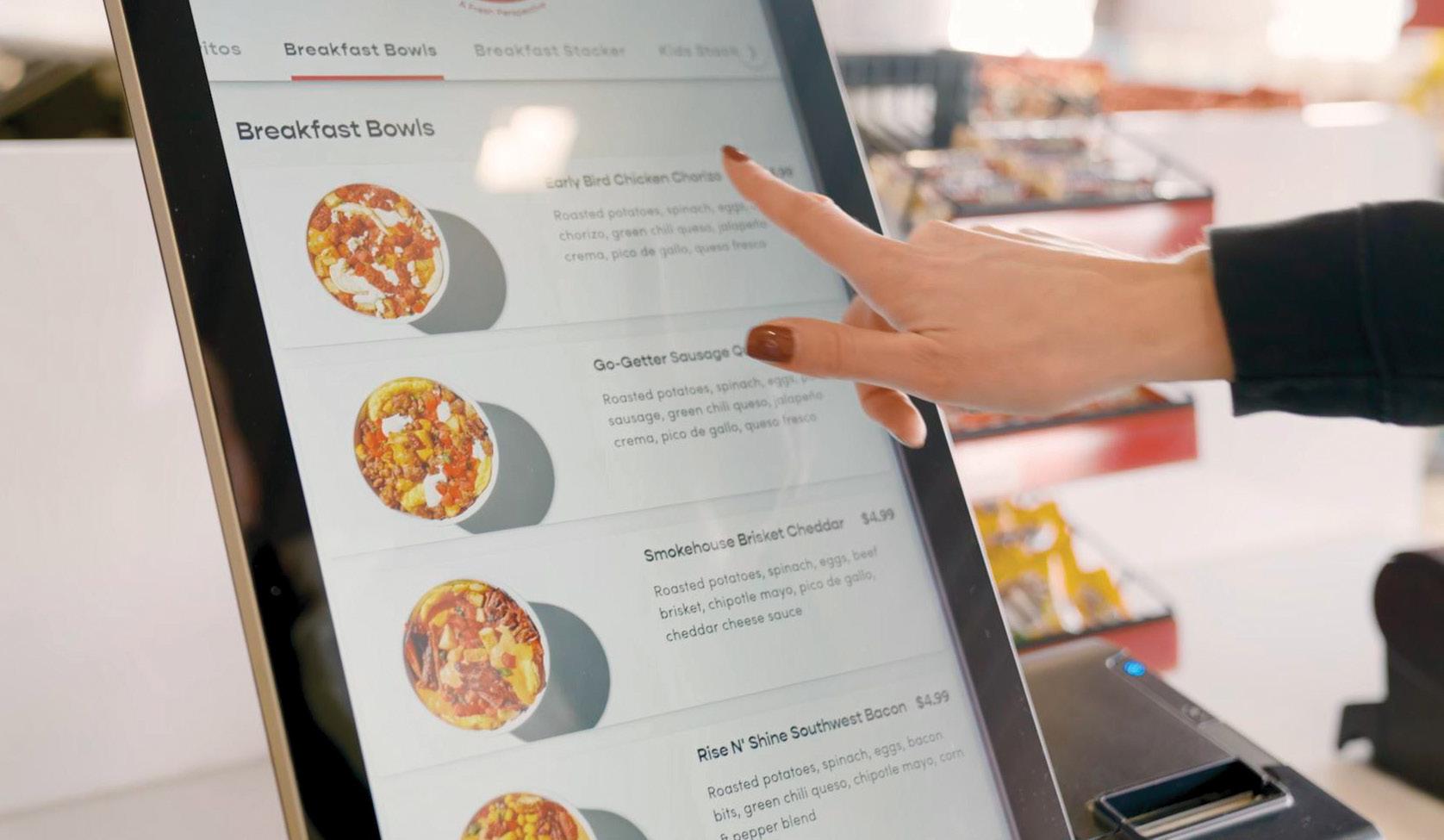

The Digital Advantage

More retailers are embracing in-store kiosk and mobile ordering for menu items— and seeing a corresponding lift in sales.

52

Shifting to Flexibility

Today’s workers want something money can’t buy: their time.

NACS MARCH 2023 1 Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs On the cover: Mega Pixel/Shutterstock The Top 100 These are the leading convenience retail chains in the U.S., ranked by number of locations.

FEATURES

ONTENTS NACS / MARCH 2023 35

ONTENTS NACS /

MARCH 2023

DEPARTMENTS

06 From the Editor

08 The Big Question

10 NACS News

16 Convenience Cares

20 Inside Washington NACS Grassroots efforts helped move the needle on industry priorities.

24 Ideas 2 Go

Curby’s Express Market combines drive-thru, foodservice and convenience into a next-generation retail experience.

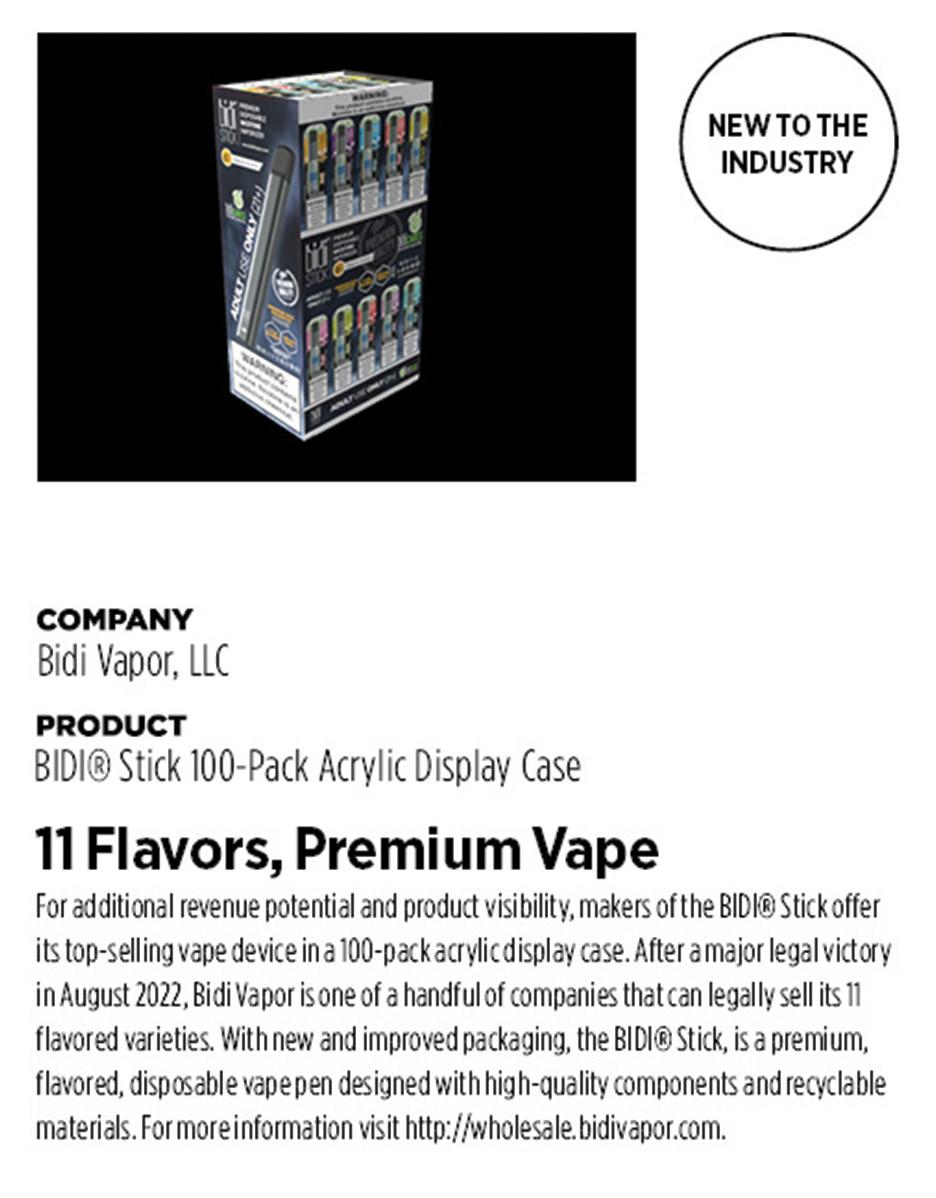

58 Cool New Products

62 Gas Station Gourmet

A restaurant in a c-store in Little Rock, Arkansas, offers unexpected cuisine.

64 Category Close-Up

Enhanced hot beverage programs offer variety, customization and convenience; the liquor category offers high margins and entices addon purchases.

76 By the Numbers

CATEGORY CLOSE-UP PAGE 64

2 MARCH 2023 convenience.org

presence of an article in our magazine

constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE BrianAJackson/Getty Images

A FACT

average monthly sales per store for hot dispensed beverages in 2021.

The

should not be permitted to

IT’S

$5,025 The

EDITORIAL

Kim Stewart Editor-in-Chief (703) 518-4279 kstewart@convenience.org

Ben Nussbaum Senior Editor (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Sarah Hamaker, Al Hebert, Pat Pape, Renee Pas DESIGN Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Douglas S. Haugh, Parkland USA; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles, Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

NACS SUPPLIER BOARD

CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles, Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Rick Brindle, Mondelez International; Drew Mize, PDI Technologies

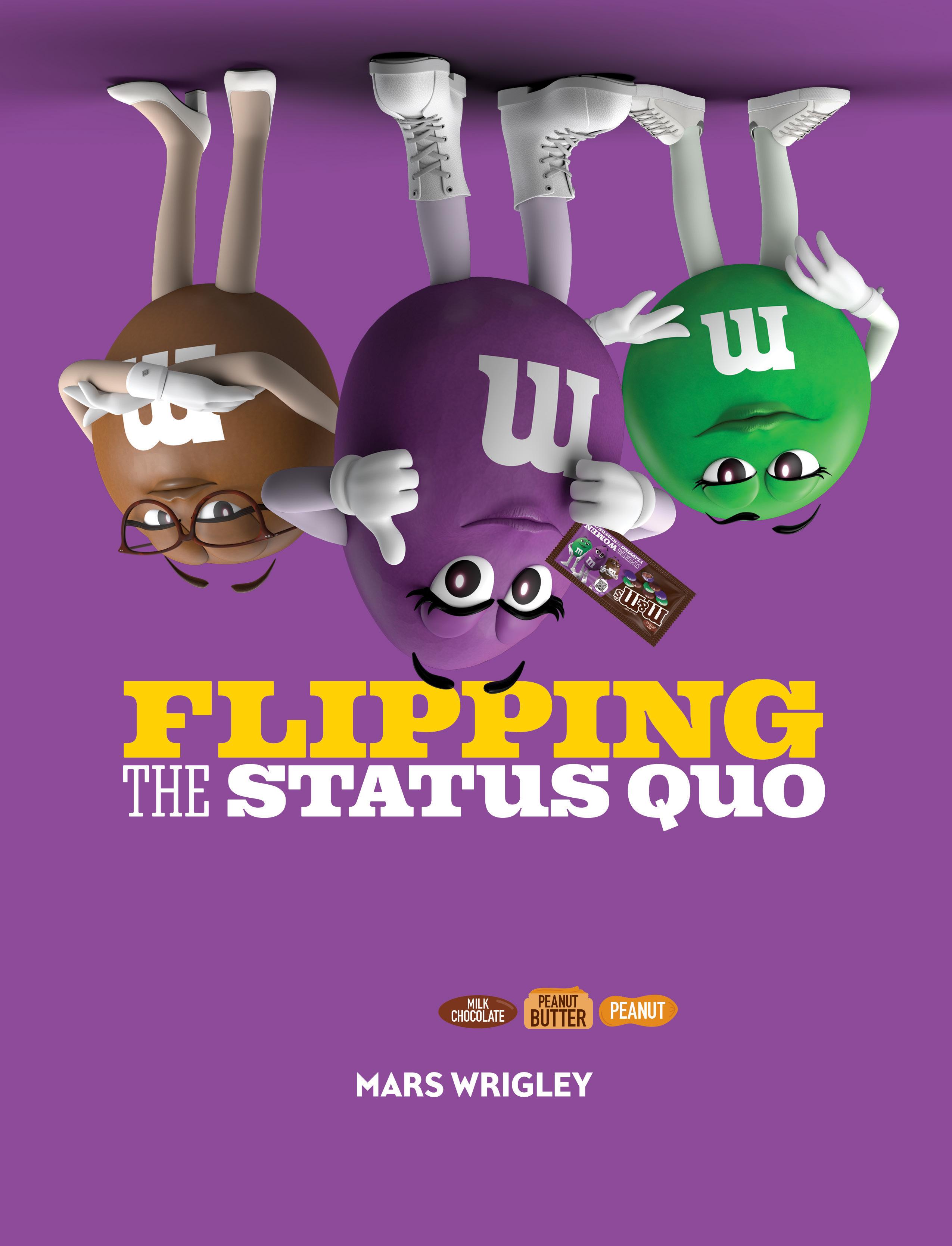

MEMBERS: Tony Battaglia, Juul Labs; Alicia Cleary, AnheauserBush/In Bev; Jerry Cutler InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley;

Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors Beverage Company; David Jeffco, Dirty Dough LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2022 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

COME TOGETHER. DO MORE. Join us at conveniencecares.org /

MARCH 2023

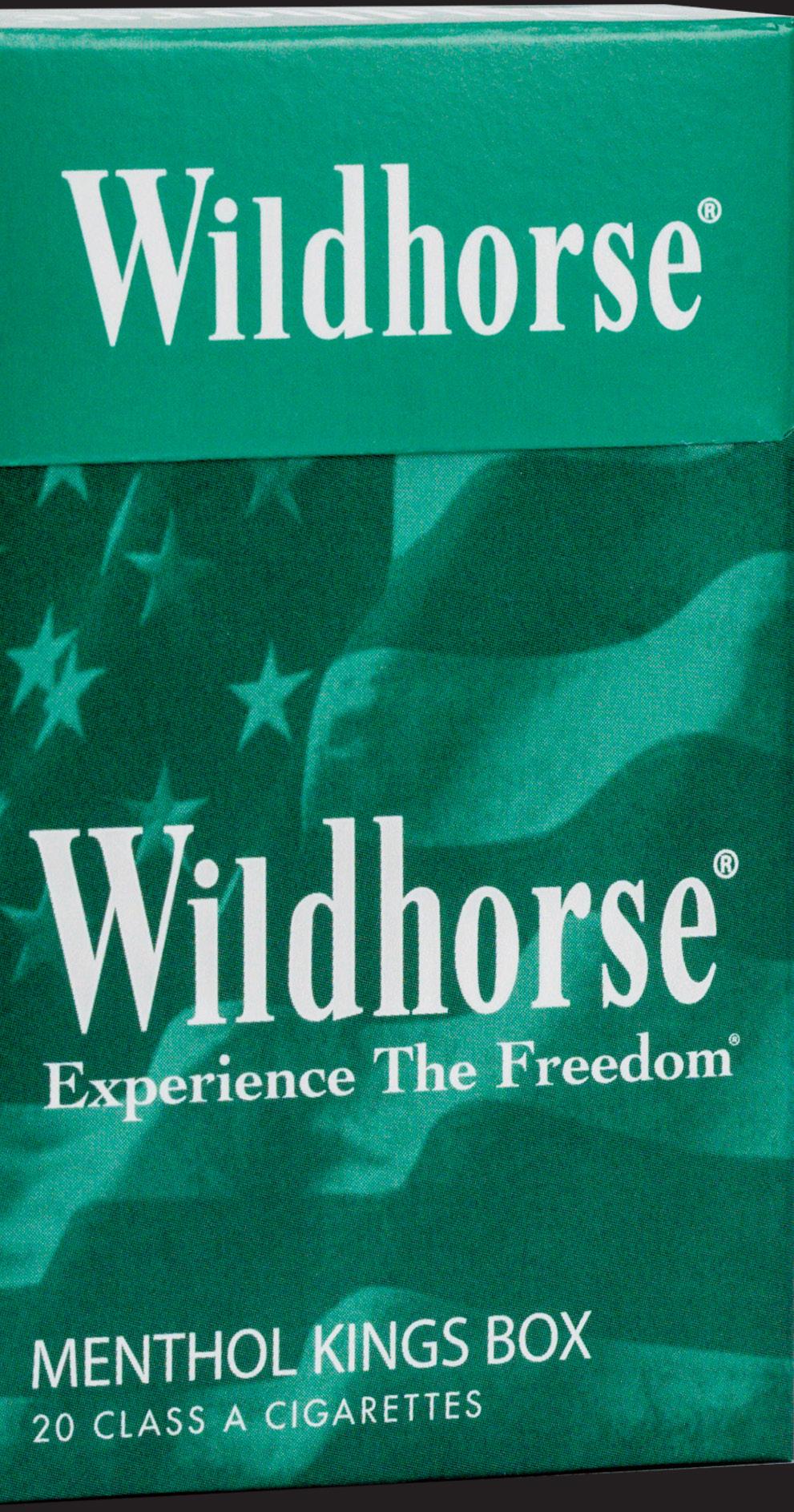

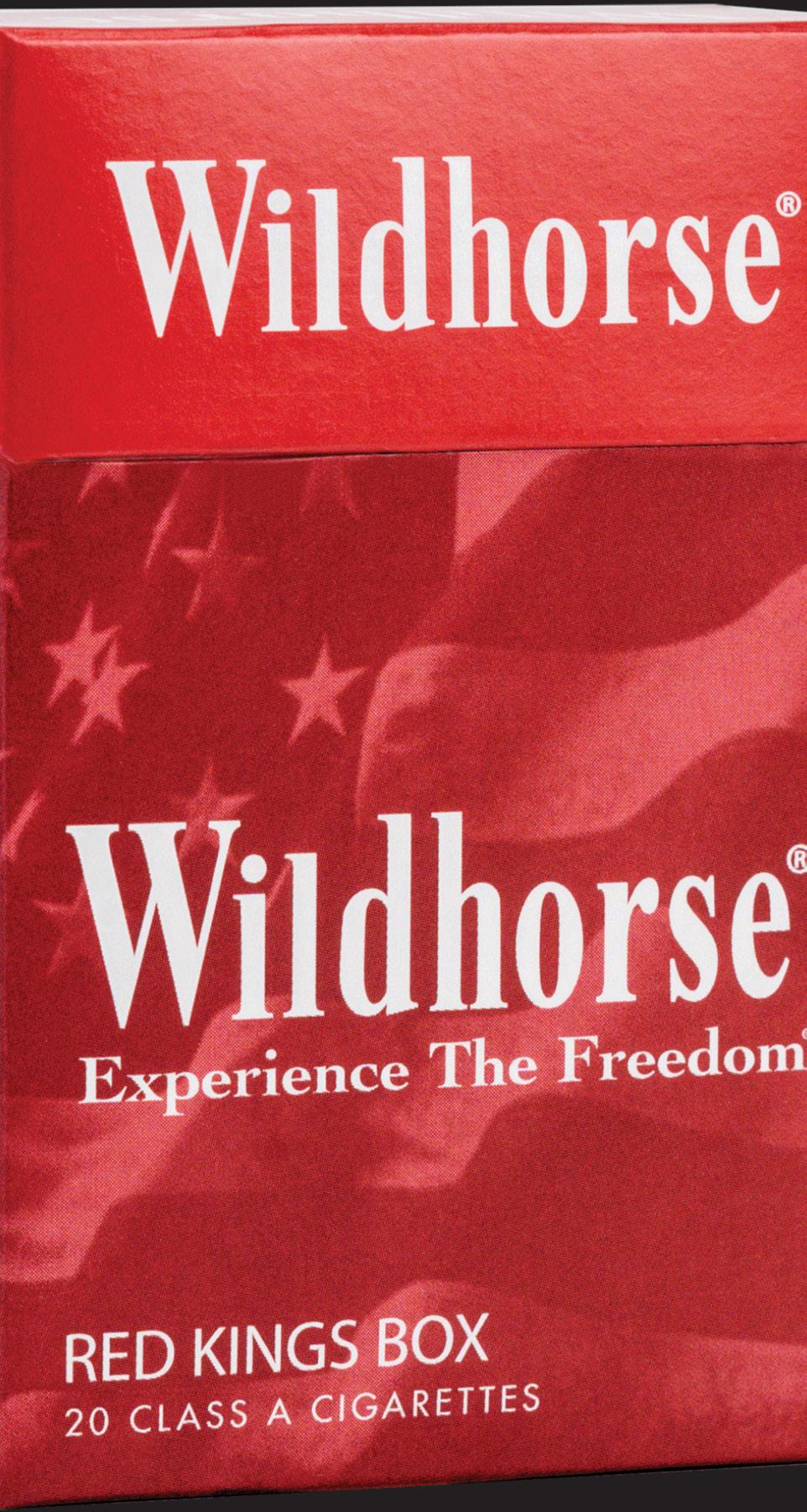

THE BOLD CHOICE

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

GOPREMIER.COM

UP FRONT FROM THE EDITOR

How Efficient

Sitting in a Marriott hotel lounge during a February out-of-town trip, I looked up with amusement to see a robot shuttling a tray of food to the bartender from the hotel’s kitchen. Naturally I snapped a photo. It was the first time I’d seen a robot server in a foodservice setting. Judging by how far the kitchen was located from the hotel’s lounge, its use surely saves many human steps each shift. Likewise, I encountered a more humanistic model at a Virginia hospital, where its role consisted of shuttling supplies from one part of the building to another.

Our cover story this month is all about ways convenience retailers like TXB Stores and Yesway are designing new builds and retrofitting legacy c-stores to make efficient use of labor. Although neither retailer is putting robots to work inside their stores just yet, they are focused on driving efficiencies that save employees’ time while encouraging customer wayfinding.

“It’s about making the employee’s life a little easier,” Kevin Smartt, TXB CEO, says.

How managers set scheduling for their employees is another way to maximize labor efficiencies while also honoring their employees’ lives away from the job. Jared Scheeler, CEO of The Hub Convenience Stores, shares how his stores use flexible scheduling and nontraditional labor pools in “Shifting to Flexibility” to attract and retain team members.

Digital ordering is another way to streamline operations by freeing up both staff and customers’ time when it comes to foodservice orders, as we explore in “Digital Advantage.” Says Andrew Robbins, CEO of Paytronix,

“Digital ordering is clearly a must-have for anyone doing food ordering, and it’s emerging quickly for center-store items.”

What would March be without our now-annual ranking of the top 100 U.S. convenience retail chains based on store count? 7-Eleven remains the leader by sheer size at more than 12,800 stores. Other chains are fast-growing. See who’s in the running by NACS region in “The Top 100.”

Spring is nearly here, my friends!

Kim Stewart , Editor-In-Chief

6 MARCH 2023 convenience.org

It’s about making the employee’s life a little easier.”

Robots log the steps at hospitals and hotels.

Photography by Kim Stewart

Your Partner in Foodservice Innovation

With low minimum order quantities and an unwavering focus on collaboration, Bluegrass Ingredients offers turnkey culinary applications and scalable ingredient solutions to ensure foodservice offerings that keep customers coming into the store again and again.

The Bluegrass Ingredients team of food scientists, culinary specialists, and R&D experts partners with food manufacturers to develop and refine leading ingredients and finished applications. We’re partners in creating the sandwich spreads, soups, sides, and seasonings that consumers crave.

not just an ingredients manufacturer. We’re a trusted partner in inventing and improving the future of convenience food. Dairy Powders and Concentrates Dairy Seasonings Citrus Powders Plant-based Powders Trend and Market Analysis

Product Prototyping

We’re

Innovation-driven

info@bluegrassingredients.com +1-270-297-7850 BluegrassIngredients.com

UP FRONT THE BIG QUESTION

Why start with inclusion?

People are at the center of everything we do at Sheetz. Our company’s values—our Sheetz DNA—compel our actions to be people-centric. Demonstrating respect, a core component of our values, means honoring and recognizing diverse experiences, individual identities and unique perspectives.

In the wake of the #MeToo movement and the murder of George Floyd, we acknowledged we were way behind in our diversity and inclusion efforts . We pride ourselves in having an employee-centric culture. But we were missing intentionality. An authentically inclusive workplace and having diverse representation at all levels doesn’t just happen. It requires intentionality and effort.

This realization meant we quickly needed to learn, listen, be vulnerable and humbly approach this cultureshifting work.

Getting this right is critical to the future of our company. The business reasons for embracing inclusion and diversity are well documented. Changes in demographics and a shrinking labor pool are trends we can’t ignore. And just as important, getting this right matters to our people and culture.

We named this work our IDEA (Inclusion, Diversity, Equity and Accessibility) Initiative, an integral part of our corporate strategy. Placing the “I” at the beginning was intentional.

Why start with inclusion? We learned that a culture with strong underpinnings of inclusion is foundational to embracing diverse perspectives. A company made up of diverse individuals isn’t automatically inclusive.

Education is paramount . Our executive team committed to reading books, listening to podcasts and hiring outside experts. If we are going to get this right, we must learn about our biases and humbly acknowledge when we have been wrong, where our words and actions could have been better. Then change. Education

has been shared with all employees. Our goal is to raise awareness and change behavior, resulting in a great workplace for all.

We launched employee resource groups, providing underrepresented employees an amplified voice and network of support . ERGs are safe, inclusive spaces for those who may otherwise feel excluded. ELEVATE, a group dedicated to supporting Black employees, launched first, with other groups forming to support women, LGBTQIA+ and Latinx employees.

This is a journey. Opening our hearts and minds not only creates a better work environment, but it’s a chance to embrace humanity, making a better world. Personally and professionally, individually and together. Our collective future will be brighter if we get this right.

8 MARCH 2023 convenience.org

Stephanie Doliveira is Executive Vice President, People & Culture, Sheetz Inc.

CELEBRATING ONE BILLION IN RETAIL REVENUE Stock your shelves with proven moneymakers. ZYN is the first and only nicotine pouch to break one billion in retail sales. Increase your bottom line with America’s #1 nicotine pouch. FOR TRADE PURPOSES ONLY. | Source: IRI Total US Multi-Outlet, YTD Ending 11-06-22. | ©2023 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more.

Meet the 2023 NACS Masters of Convenience

NACS congratulates the eight 2023 NACS Master of Convenience award recipients who were honored at the invitation-only NACS Leadership Forum in February, where they received a certificate and pin.

“The NACS Executive Education programs I participated in not only enhanced my professional skills but also had a huge impact on my personal development,” said awardee Staci Donahue, director, capital project controls, 7-Eleven Inc. “The coursework and networking opportunities helped

me gain valuable experience, skills and resources that are moving my career and organization forward in meaningful ways.”

The NACS Master of Convenience designation acknowledges the leaders from around the globe who have invested in their personal leadership development and attended three or more NACS Executive Education programs. These leaders have also invested in the growth of their organizations—and the industry as a whole—by harnessing and infusing their strengths with a world-class curriculum and a network of like-minded leaders.

“I gained insights and confidence that enable me to lead my teams more effectively as we tackle complex challenges,” said Donahue.

Here are the latest elite leaders who are shaping the future, proactively and powerfully:

• Rodolfo Castillo, AMPM Centro America

• Edwin de Graaff, Shell International Petroleum Company Ltd.

• Staci Donahue, 7-Eleven Inc.

• Nichole Evans, Par Mar Oil Co.

• Sharan Kalva, C-Store Master

• Teoman Ozben, Shell International Petroleum Company Limited

• Donald R. Rhoads, The Convenience Group LLC, 2022-23 NACS chairman

• Rashid Samiev, Mega Saver

Learn more about the NACS Executive Education programs at www.convenience.org/ Education/NACS-Executive-Education , and contact Brandi Mauro, NACS education program manager, with questions at bmauro@ convenience.org or (703) 518-4223.

Fuels Institute Report Spotlights Medium- and Heavy-Duty Vehicles

In the quest to reduce emissions from the transportation sector, policymakers are beginning to explore options that will directly affect medium- and heavy-duty commercial vehicles, which account for

about 10% of vehicle miles traveled in the United States, distribute nearly three-quarters of the nation’s freight and contribute 24% of the nation’s transportation-related greenhouse gas emissions.

10 MARCH 2023 convenience.org UP FRONT NACS NEWS

L to R: Rashid Samiev, Teoman Ozben, Henry Armour, Nichole Evans, Edwin de Graaff, Rodolfo Castillo and Don Rhoads. Not pictured: Staci Donahue and Sharan Kalva.

NACS Welcomes New Staff

NACS started 2023 with six new team members working in departments across our organization.

Kaitlin Bivens joins NACS as education production manager. She will oversee education components for the NACS State of the Industry Summit, Convenience Summit Europe, webinars and be part of the team that develops content for the NACS Show. Bivens has spent the past four years planning and implementing events and conferences, most recently serving in event production at AFCEA International, a nonprofit committed to bringing together government, academic, military and corporate members to further defense, security and intelligence disciplines.

Jennifer Johnson joins NACS as director of business development. In this role, she leads business development for the new NACS localized marketing platform THRIVR. Prior to joining NACS, Johnson had a 20-plus year career at NCR Corporation, with roles across telecom and technology, hospitality and global sales and operations. Most recently, she was channel account manager responsible for growing the convenience and fuels channel.

CeCe Lee is the new NACS email and marketing manager and will oversee all aspects of email and SMS marketing campaigns for NACS. Prior to joining NACS, Lee was the digital product manager at the American Cancer Society. Previously, CeCe was an online account manager for the full-service agency Mal Warwick Donordigital, focused on strategy, fundraising and campaign management for nonprofits. She also served as a social media strategist at Chapman, Cubine & Hussey.

Ethan Medrano has joined NACS as data services coordinator. Medrano most recently held information technology positions with Razor Talent and Armedia. He earned a B.S. in information systems and operations management from George Mason University. During college, he was lead enrichment instructor for STEM Excel, teaching robotics to elementary school-age students in Fairfax County, Virginia.

Ben Nussbaum will oversee operations, strategy and content creation for NACS Magazine, NACS Daily and Fuels Market News, among others, as our new senior editor. Nussbaum comes to NACS with more than 20 years in the publishing industry. His most recent endeavor was as editor-in-chief and publisher of Spirituality & Health magazine, a bimonthly wellness magazine, and spiritualityhealth.com. He also launched and grew USA Today’s magazine program in the mid-2000s, created single-topic newsstand magazines at I-5 Publishing and served as an editor for a children’s book company.

Emma Tainter has joined NACS as a research analyst/ writer and will support the research department’s activities, with a focus on writing and editing.

Tainter most recently was a community reporter and editor for the Central Virginian, based in Richmond, Virginia. She has experience in organizing events and managing social media accounts for former employers that include the Louisa County Historical Society, Environmental Defense Fund and World Science Foundation.

To help policymakers and affected stakeholders better understand the specific effects such initiatives might have on the MHDV market, the Fuels Institute in a new report has outlined

considerations that are critical to address when crafting and implementing such policies.

“As policymakers throughout the nation consider policies to address MHDV emissions, it is critical to understand the unique characteristics of the vehicles in

operation and the important role they play in moving the economy of the country forward,” the Fuels Institute states.

Download “Policy Considerations: Emissions Reduction Proposals Affecting Medium- and Heavy-Duty Vehicles” at www.fuelsinstitute.org

NACS MARCH 2023 11

Kaitlin Bivens

Jennifer Johnson

CeCe Lee

Ben Nussbaum

Emma Tainter

Ethan Medrano

Member News

RETAILERS

ARKO Corp. announced that Chief Financial Officer Don Bassell intends to retire by the end of 2023 after 42 years in the industry. Bassell is expected to remain as chief financial officer until April 2024.

Sheetz announced the promotion of Stephanie Doliveira to executive vice president of people and culture. Doliveira, who has been with Sheetz for nearly 22 years, was previously Sheetz vice president of human resources. Doliveira will lead strategic planning and execution of all employee-related initiatives for over 24,000 employees at Sheetz.

Alimentation Couche-Tard Inc. appointed Alex Miller to the newly created position of chief operating officer. He will oversee North America, Europe and Asia operations, including its food program, merchandise procurement and supply chain activities.

SUPPLIERS

Hunt Brothers Pizza announced the passing of the last living co-founders, brothers Charlie Hunt, 78, on December 22, and Don Hunt, 88, on December 27. They are preceded in death by their two brothers and co-founders, Lonnie Hunt and Jim Hunt. The four brothers formed a cohesive team that led to an extended family of more than 9,000 store partnerships, over 550 team members and countless communities and charities supported over the years. Since 2009, the company has been led by the second generation of leaders from the Hunt family.

GSP in January announced the passing of Craig Neuhoff, vice president of new business development, who died as a result of a surfing accident while on vacation in Costa Rica. Neuhoff, who moderated a 2022 NACS Show education session, was passionate about store design—and surfing with his family.

Brett Padgett has joined Blanc Display Group as sales manager. Padgett comes to Blanc with over 35 years in the supermarket and retail industry.

For the past 21 years Padgett has worked on the wholesale side of the business.

Impact 21 welcomed Greg Tornberg as a principal consultant. Tornberg has expertise in driving multimilliondollar growth in foodservice sales, acquisition transitioning and integration, as well as developing and executing new foodservice offerings.

Charles Conti has joined Impact 21 as a senior principal consultant. Conti has over 24 years experience in the convenience industry. He most recently served as director of hardware product management at PDI.

Impact 21 announced that Paula Conti has joined the company as a senior principal consultant. With more than 28 years of experience in the convenience store, wholesale fuel and logistics industry, Conti has a passion for helping companies succeed.

12 MARCH 2023 convenience.org DNY59/Getty Images UP FRONT NACS NEWS

Don Bassell

Charlie Hunt and Don Hunt

Brett Padgett

Craig Neuhoff

Charles Conti

Paula Conti

Alex Miller

Greg Tornberg

Stephanie Doliveira

Willis Smith now serves as director of educational sales at LTI, manufacturer and designer of modular and custom food serving counters, fabrication and serving technologies. Smith joined LTI in 2007 as a VisionDesign project manager.

KUDOS

TXB (Texas Born), which has nearly 50 locations in Texas and Oklahoma, was awarded Store Brands’ 2022 Impact Award for Philanthropic/Corporate Giving. For more than 12 years, TXB has been a supporter of CASA (Court

Appointed Special Advocate), which supports and promotes volunteer advocacy for children in the foster-care system who have experienced abuse or neglect. TXB has raised more than $682,000 for CASA.

TravelCenters of America was named to Forbes’ list of America’s Best Small Companies 2023. Rankings are based on earnings growth, sales growth, return on equity and total stock return for the latest 12 months available and over the past five years. TA ranks No. 86 on the list.

Casey’s has been certified as a Great Place To Work US, highlighting its investment in 43,000 team

members who take great care of guests and the communities Casey’s serves every day.

Alimentation Couche-Tard Inc. has been awarded the Bronze-level Parity Certification™ by Women in Governance for its progress toward gender parity in the workplace. Women in Governance’s Parity Certification helps organizations increase the representation of women in sectors where they have historically been underrepresented and in senior management positions.

Kwik Trip, MAPCO and Delta Sonic Car Wash all made the 2023 Top Workplaces USA list. The retailers ranked No. 24, No. 90 and No. 98, respectively.

Experience that fuels the Future

SYSTEMS

MOVING FORWARD Your driver Jim B will be delivering fuel today to 12 East 2nd St. Anywhere, NC ADD ENERGY Co. Thank you to our clients for consistently collaborating with us to bring innovative software solutions to the industry.

ALWAYS

SOFTWARE FOR THE PETROLEUM & CONVENIENCE STORE INDUSTRIES Learn more at addsys.com 800-922-0972

Willis Smith

New Members

NACS welcomes the following companies that joined the association in December 2022. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/Create-Login. All members receive access to the NACS Online Membership directory, latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW RETAIL MEMBERS

Kelley Williamson Company Rockford, IL www.kelleysmarket.com

Lucky’s Market Vancouver, WA

STORELIFT Paris, France www.getboxy.co

NEW SUPPLIER MEMBERS

ADC Enterprises Inc. Northbrook, IL www.adc-enterprises.com

Beverage USA LLC Freehold, NJ www.Nerdfocus.com

BIXOLON America Inc. Torrance, CA www.bixolonusa.com

CCA and B LLC Atlanta, GA

Crown Bakeries LLC Brentwood, TN www.crownbakeries.com

Culinevo Kitchen San Diego, CA www.culinevo.com

Calendar of Events

2023

MARCH

NACS Day on the Hill

March 07–08 | Washington, D.C.

NACS Human Resources Forum

March 20-22 | The DeSoto | Savannah, Georgia

APRIL

NACS State of the Industry Summit

April 18-20 | Hyatt Regency DFW International Airport | Dallas, Texas

NACS Leadership for Success

April 30-May 05 | Virginia Crossings

Hotel & Conference Center | Glen Allen (Richmond), Virginia

MAY

NACS Convenience Summit Europe

May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

JULY

NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

Nationwide Processing Saint Louis, MO www.atmcreditcard.com

Premium Swedish Boca Raton, FL www.premiumswedish.com

Refrigeration Technologies LLC Pottstown, PA www.RefrigerationTechnologiesLLC.com

Sunmed Palmetto, FL www.getsunmed.com

Telaid Peachtree Corners, GA www.telaid.com

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

OCTOBER

NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NOVEMBER

NACS Innovation Leadership Program at MIT

November 05-10 | MIT Sloan School of Management | Cambridge, Massachusetts

For a full listing of events and information, visit www.convenience.org/events.

14 MARCH 2023 convenience.org UP FRONT NACS NEWS

Convenience Cares for Kids’ Health

The convenience retailing industry collects or contributes $1 billion to charities and community groups each year, NACS research indicates. For more than 35 years, convenience stores have been engaging employees and customers in campaigns to support local children’s hospitals throughout the U.S. and Canada.

Convenience retailer OnCue, based in Stillwater, Oklahoma, donated $1 million to the neonatal intensive care unit (NICU) at Stillwater Medical Center in Stillwater, Oklahoma, the largest single gift ever received at Stillwater Medical. Stillwater Medical Foundation has been raising funds to bring a Level II NICU to the hospital, where the new 10-bed unit will serve all central and north central Oklahoma.

The OnCue Neonatal ICU is scheduled to open in spring 2024.

“We knew our gift would make the NICU a reality, and our commitment would have an impact on children and families in Oklahoma for decades to come,” said OnCue President Laura Aufleger. “Our stores have been serving the Stillwater area for 55 years, and I am beyond grateful that we can make this investment to save lives in our community.”

Often, premature babies must be sent out of state because there are not enough NICU beds to keep Oklahoma families together. OnCue’s donation will help families with premature babies who have to face unimaginable decisions such as being separated from their baby minutes after delivery or

16 MARCH 2023 convenience.org CONVENIENCE CARES

We knew our gift would make the NICU a reality.”

having to choose whether to stay with their postpartum spouse or travel with their newborn. The creation of a Level II NICU in Stillwater allows families to stay closer to home.

“The Foundation is grateful for OnCue’s vision and generous investment in Stillwater and all of north central Oklahoma, and we are excited to celebrate the naming of the OnCue Neonatal Intensive Care Unit,” said Michal Shaw, Stillwater Medical Foundation executive director.

Supply chain services leader McLane Company has helped raise more than $101 million for Children’s Miracle Network Hospitals since 1987 through local fundraising efforts, hospital donations, underwriting of CMN Hospitals operations and supplier campaign support.

“Our longstanding partnership with Children’s Miracle Network Hospitals allows us and our supplier and customer partners to join forces in making a difference in the lives of children with critical needs across the country,” said Tony Frankenberger, CEO of McLane. “We’re proud to have reached this milestone and will continue our steadfast support for years to come.”

A large part of McLane’s support for CMN Hospitals comes from grassroots fundraising at more than 75 distribution centers across the country. Distribution centers engage their local communities in supporting local hospitals through a variety of events.

McLane Phoenix, for example, recently supported the 21st Annual Duel in the Desert Golf Tournament raising more than $30,000 to benefit Phoenix Children’s Hospital. Charles Pray, McLane Phoenix division general manager, serves as a Phoenix Children’s Hospital Foundation corporate executive board member.

In The Community

Every year, the convenience and fuel retailing industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories. Learn more at www.conveniencecares.org

partners for their continued support over the last 50 years,” said Stewart Spinks, founder and chairman of The Spinx Company. “Without these organizations, the Upstate would not be the place it is today. We celebrated a big anniversary this past year, and it just made sense to share the celebration with our neighbors and partners.”

MURPHY USA DONATES $25 MILLION

SPINX COMPANY PROVIDES FREE MEALS

1 The Spinx Company commemorated its 50 th anniversary by donating over 2,000 meals to multiple nonprofits in the Upstate region of South Carolina. Spinx celebrated 50 years in business on December 1, 2022, and harnessed the power of The Cluk Truk—an initiative launched in 2020 to serve Spinx’s popular fried chicken in surrounding communities. As part of its yearlong celebration, Spinx selected one organization per month to receive free meals from the Cluk Truk. “We are sincerely grateful to our community

2 Murphy USA donated $25 million to the Murphy USA Charitable Foundation, which will continue to support positive changes in local communities. The foundation funds the company’s matching gifts, including the annual United Way campaign and other charities. “Murphy USA and its board of directors are firmly committed to the communities where we live and work, especially in South Arkansas and our headquarters town of El Dorado. By making this donation to our foundation, we will continue to look for ways to make a positive impact with all of our key stakeholders,” said Murphy USA President and CEO Andrew Clyde.

NACS MARCH 2023 17

1 2

In The Community

TIGER FUEL GIFTS $25,000 TO UVA STRONG FUND

3 Tiger Fuel Company, based in Charlottesville, Virginia, made a $25,000 holiday donation to the UVA Strong Fund, an effort administered by the University of Virginia Alumni Association to honor the victims and support the survivors, families and broader student community in the wake of the events of November 13, 2022. The Tiger Fuel Company charitable giving program includes a meaningful donation every holiday season in honor of employees and customers. “We all unanimously agreed that we wanted to do something to honor the victims and support the survivors, families and broader UVA student community in the wake

of the events of November 13,” said Gordon Sutton, president of Tiger Fuel Company. “Tiger Fuel’s generosity will help us provide support to those most affected by the tragedy and honor the lives of our three slain fellow Wahoos, Devin Chandler, Lavel Davis Jr. and D’Sean Perry,” said Lily West, president and CEO of the UVA Alumni Association, which administers the fund.

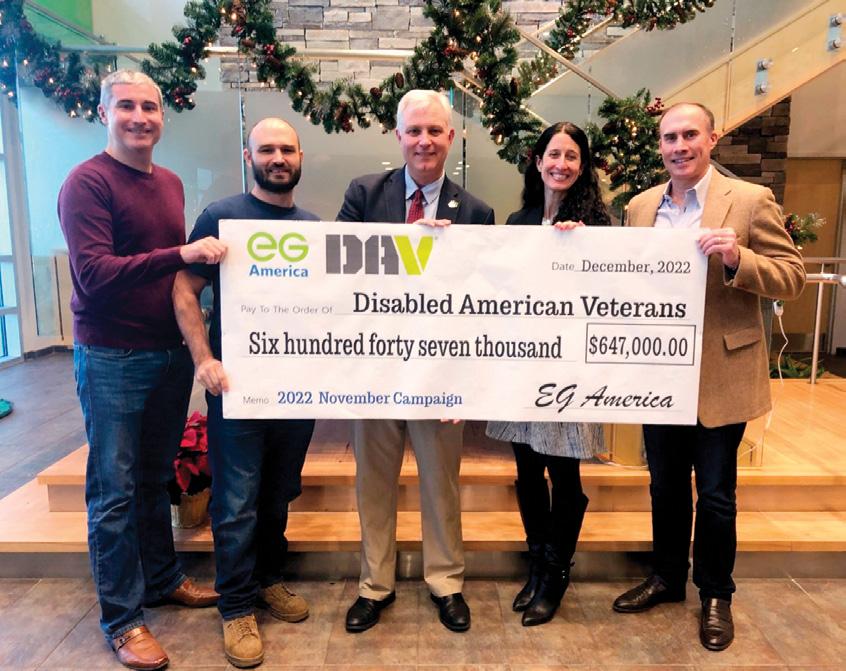

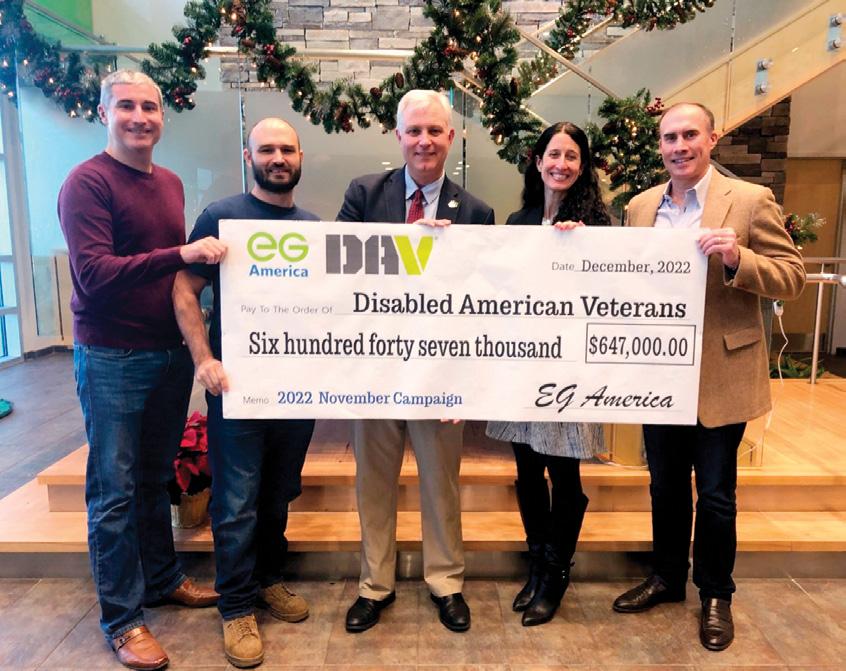

EG GROUP RAISES $647,000 FOR DAV

4 EG Group raised $647,000 in its 2022 campaign to support Disabled American Veterans (DAV), surpassing previous years’ totals. Customers were encouraged to donate when they visited any of EG Group’s 1,700+ convenience stores, including Cumberland Farms, Certified Oil, Fastrac, Kwik Shop, Loaf N’ Jug, Minit Mart, Quik Shop, Sprint Food Stores, Tom Thumb and Turkey Hill. In December, EG America leadership presented a check to Third Junior Vice Commander and Marine Veteran Coleman Yee of

DAV, the national nonprofit dedicated to empowering veterans to lead high-quality lives with respect and dignity.

MAVERIK DONATES OVER $470,000 TO FEEDING AMERICA

5 Maverik—Adventure’s First Stop donated $471,397 to Feeding America, thanks to funds raised by customers and employees who rounded up their cash and credit transactions to the nearest dollar or more at Maverik stores across 12 states. Maverik also made a direct donation of $50,000 to kick off the campaign. Maverik’s donation will be distributed to Feeding America member food banks across 12 western states where Maverik operates. The remaining donation will support national strategies to help Feeding America address hunger in America. “We are overwhelmed by the kindness of our customers and team members this year!” said Chuck Maggelet, president and chief adventure guide of Maverik.

“With record-high food prices and many turning to food banks this season, it’s an amazing feeling to help make an impact through this contribution and donations through our food waste reduction program.”

Maverik’s food waste reduction program has so far donated over 492,000 pounds of surplus food, helping to provide over 410,000 meals. The program is running in more than 90 stores in five states, and Maverik plans to expand it throughout its operating states.

CONVENIENCE CARES

3 4 5

Conexxus 2023 Annual Conference

Loews Coronado Bay | Coronado, CA April 30 - May 4, 2023

RETAILERS & VENDORS TOGETHER: COLLABORATING ON INNOVATION & CHANGE

LEADERSHIP

2023 Diamond Sponsors

>> The Next Great Transformation | Anat Baron, Futurist

>> Keynote with Vish Ganapathy, Customer Engineer Retail, Google

>> How AI is Shaping the Future of Convenience Retailing | Frodi Hammer, A2i Systems

>> Computer Vision Technology | Sridhar Sudarson, Spark Cognition

| Susan Sly, RadiusAI | Jordan Fisher, Standard AI

... and much more! see conexxus.org/ac2023 for full agenda

1. Register

2. Discuss & Learn how innovating technology fits into your organization and impacts your strategy.

conexxus.org/ac2023

3. Network with industry experts, peers, and partner organizations during the highly collaborative week.

Sponsorship Packages available, contact: azecca@conexxus.org

Register Today: conexxus.org/ac2023

2022: A Year for Wins

BY JON TAETS

Key Figures

6,200 NACS Grassroots messages sent to Capitol Hill in 2022

243 Meetings held with members of Congress during 2022’s NACS Day on the Hill

The year 2022 was another busy and eventful one for the NACS government relations team. The convenience and fuel retailing industry saw some important wins in the payments and electric vehicle spaces, helped prevent onerous regulations and was invited to testify in front of various congressional committees.

Helping drive the policy wins were highly successful NACS Grassroots efforts throughout the year. In addition to policy successes, NACSPAC had a strong year in fundraising and in seeing candidates supported by the PAC win their elections. Here is a look at some of our legislative activities for 2022.

SWIPE FEES

Our advocacy efforts seeking competition and fairness on swipe fees gained significant traction in 2022. Bipartisan legislation was introduced in both the House and the Senate that would inject competition into the credit card market by requiring that a second competitive network be enabled on credit cards, prohibiting Visa and Mastercard from dominating those payments. The introduction of the Credit Card Competition

Act by Senators Dick Durbin (D-IL) and Roger Marshall (R-KS), as well as Representatives Peter Welch (D-VT) and Lance Gooden (R-TX), marked the first bipartisan effort in over a decade to reform the swipe fee marketplace. While the bill did not pass last year, NACS is already building upon the momentum and pushing for its passage in 2023.

In addition to the introduction of that legislation, our industry was integral in getting a bipartisan group of members of Congress to send a letter to Visa and Mastercard urging those companies not to move forward with planned fee increases. Unfortunately, the credit card firms raised fees.

20 MARCH 2023 convenience.org Party people studio/Shutterstock INSIDE WASHINGTON

NACS Grassroots efforts helped move the needle on industry priorities.

From a regulatory standpoint, our industry saw wins in the payment space. We were successful in getting a favorable rulemaking from the Federal Reserve clarifying that two network routing options must be enabled on all card-not-present, mobile and in-app debit transactions. Additionally, NACS successfully urged the Federal Trade Commission to bring enforcement action against Mastercard for blocking debit-routing competitors.

FUELS/ELECTRIC VEHICLES

The industry saw some significant wins in the fuels arena. While the effort continues, NACS helped successfully

halt the expedited process and proposal which would have created onerous fire code requirements for EV chargers at gas stations. That fight is not over, but efforts to fast track the regulations were stopped. We were successful in achieving a short-term Reid Vapor Pressure (RVP) one-pound waiver to allow for the sale of E15 in the summer months of 2022 and worked with a broad group of stakeholders from ethanol and oil and gas producers and retailers to get legislation introduced to allow for yearround sales of E15 fuels.

NACS also saw success in amending a price-gouging bill in the House which would have marked the first time that

replacement cost increases would be considered when evaluating price-gouging claims. While the overall legislation passed the House, it was not taken up by the Senate. NACS also helped keep parts of the supply chain moving by achieving multiple extensions of the hours-of-service waivers for truck drivers hauling goods to c-stores and ensured that the waivers applied to fuel truck drivers as well.

OMNIBUS APPROPRIATIONS BILL

As Congress moved closer to the holidays and the end of the year to pass a massive omnibus appropriations package to fund the government for 2023, NACS remained hard at work advocating for the industry’s interests. In the end, we were able to stop an effort to remove labeling requirements for renewable diesel, which would have prevented businesses in the industry from knowing when they were buying renewable diesel and would have prevented the tax advantages of the product from being part of the purchases. NACS also prevented multiple onerous privacy bills from being included and worked with a coalition to add language to advance implementation of the Safe Driver Apprenticeship Program and truck size and weight research to encourage raising the limits on gross vehicle weight.

NACS GRASSROOTS

Much of these policy wins can be credited to the strength of the NACS Grassroots program, which relies on our members and industry colleagues to engage directly with their members of Congress. In 2022, our signature advocacy event, NACS Day on the Hill, was held virtually, with 131 attendees

NACS MARCH 2023 21

completing 243 congressional meetings covering 45 states. Throughout the year, NACS also helped organize several fly-ins focused on the swipe fee issue, bringing nearly 200 retailers and merchants to Washington, D.C. Our grassroots Calls to Action generated over 6,200 messages to Capitol Hill, and NACS also hosted 11 NACS In Store Events with members of Congress in their home districts or states.

NACSPAC

NACSPAC had a successful year as well. The PAC raised $755,650 from 517 individual contributors in 2022, compared with $701,546 from 474 individuals in 2021. NACSPAC helped ensure that the voice of the convenience and fuel retailing industry was heard on Capitol Hill. NACSPAC contributed $788,000, supporting 163 candidates and 52 leadership PACs throughout the year. For the entire two-year election cycle, $1.46 million was raised and $1.44 million was contributed to members of Congress and candidates who support our industry.

Last year was a successful one in Washington for our industry, but much work remains. The government relations team has hit the ground running in 2023, getting to know the newly elected congressional members and ensuring that your priorities are top of mind in Congress. In order to get our policy objectives across the finish line, we need your continued help. Please keep an eye on your inboxes for “Calls to Action” from NACS, and be sure to add your own voice to those being heard by your elected representatives. You can reach out to our team to get involved and take action today!

Jon Taets is NACS director of government relations. He can be reached at jtaets@ convenience.org

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

Engagement is knowledge as opposed to getting the information secondhand. Knowledge is our greatest asset in life and has benefited me personally and professionally. Professionally, it gives me the opportunity to understand what our customers’ pain points are and solve their issues with my products and services accordingly. Personally, I feel I make a difference by engaging on Capitol Hill and locally to drive change.

What federal legislative or regulatory issues keep you up at night?

The biggest for me is minimum wage and the public’s understanding of how our currency system works. People need to understand that we can raise wages all day long, but then prices go up as well. The employee’s disposable income remains the same, as items just cost more.

When prices go up as we’ve seen with this inflationary environment, the only ones who benefit are the largest networks and banks because they make more in credit card swipe fees, since they are a percentage of the total transaction cost.

What c-store product could you not live without?

Gas is the obvious item I could not live without. But as far as a personal consumption item, it would be fresh brewed coffee any time of day. The new bean-to-cup is my favorite, as I drink coffee all day long!

22 MARCH 2023 convenience.org INSIDE WASHINGTON

ONE VOICE

This month, NACS talks to Tony Gaines, CEO, Stewart’s Enterprise Holdings Inc.

Our advocacy efforts seeking competition and fairness on swipe fees gained significant traction in 2022.

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac NACSPAC donors who made contributions January 1-31, 2023, are:

Paige Anderson NACS

Beaver Aplin Buc-ee’s Ltd.

Henry Armour NACS

Laura Beck NACS

Lyle Beckwith NACS

George Bennett Imperial Trading Company - S. Abraham & Sons Inc.

Chrissy Blasinsky NACS

Anna Ready Blom NACS

Katie Bohny NACS

Britt Brewer NACS

Jenna Collard NACS

Michael Davis NACS

Allison Dean NACS

Kirk Dickerson Dickerson Petroleum Inc.

Stacey Dodge NACS

John Eichberger Fuels Institute

Robert Gallo Impact 21

Linnea Geiss PDI Technologies

Suzanne George NACS

Jayme Gough NACS

Margaret Hardin NACS

Keith Harlow NACS Scott Hartman Rutter’s

Jeff Hassman PDI Technologies

Jessica Hayman NACS

Jessica Hendrickson Altria Group Distribution Company

Danielle Holloway Altria Group Distribution Company

Bob Hughes NACS

Sam Johnson J&M Distributors Inc.

Doug Kantor NACS

Leroy Kelsey NACS

Brian Kimmel NACS

Alicia Landrum NACS

Jennifer Nichols

Leidich NACS

Greg Levitan NACS

Brandi Mauro NACS

Jeff McQuilkin NACS

Jay Nelson Excel Tire Gauge LLC

Nancy Pappas NACS

Chris Rapanick NACS

Jay Ricker Ricker Holdings

Ron Rutherford Apter Industries Inc.

Taha Saleh

T. A. Saleh Enterprises Inc.

Jared Scheeler The Hub Convenience Stores Inc.

Anna Serfass NACS

Dan Shapiro

Krispy Krunchy Foods LLC

Stephanie Sikorski NACS

Doug Spencer NACS

Nick Stanley Johnson Junction Inc.

Lori Buss Stillman NACS

Jon Taets NACS

Tom Taunton Gurley’s Foods

David Tucker NCR Corporation

TJ Velasco NACS

Nicole Walbe NACS

Leigh Walls NACS

Elizabeth Waring Johnson & Johnson Inc.

Don Wasek Buc-ee’s Ltd.

William Weigel Weigel’s Stores Inc.

David Woodley Sheetz Inc.

NACS MARCH 2023 23

Name of company:

Curby’s Express Market

Year founded: 2022

# of stores: 1

Website: www.curbys.com

Food Forward

BY SARAH HAMAKER

Customers sometimes don’t know quite what to call Curby’s Express Market. Is it a quick-service restaurant? A mini-mart? Or a convenience store without gas pumps? “All of the above,” says Tony Sparks, head of customer wow! for the budding chain in Lubbock, Texas. “We call it a next-generation convenience store because we’re focusing on our own made-to-order food on one side and traditional consumer packaged goods on the other side, plus a double-lane drive-thru.”

Sparks led a team of consultants and experts to devise the new concept, which took a few years to come to fruition. “The owners tasked me with crafting this new kind of convenience store along the lines of Green Zebra, Amazon Go, Choice Market and Foxtrot,” he said. “None of those have fuel, and all are food-forward stores.”

24 MARCH 2023 convenience.org IDEAS 2 GO

Curby’s Express Market combines drive-thru, foodservice and convenience in a new retail experience.

FOOD FIRST

For Sparks, the concept started with fresh food, which occupies the left side of the 4,000-square-foot store. “We knew we wanted our own made-to-order food and beverages,” he said. “We figured anything Panera or Dutch Bros. could do, we could do better.”

Research figured heavily into all decisions, especially what to put on the menu. “Our research showed what the area could support in terms of demographics and competition, so we settled on flatbread pizzas and melts,” Sparks said. He also added a local favorite—kolaches, a sausage wrapped in a croissant. Sausages also take prominence on the menu, with Chicago-style, all-American and prosciutto-cheese-and-bacon versions.

“We wanted to do something a little bit different but still provide that quick and fast service with our foodservice program,” he said. He tapped a foodservice consulting group to start with, then also hired a former Starbucks employee to bring the hand-crafted beverages to life and a food-forward designer to create the menu.

On the beverage side, Curby’s “is crushing it” when it comes to its line of made-to-order energy drinks and fresh iced teas. “We have seven different SKUs of our proprietary energy blend, Zoomies, which has the most stimulant per ounce you can buy anywhere in the area, and a separate line of five SKUS of made-to-order Red Bull energy drinks,” he said.

Along with a 20-head fountain, Curby’s serves 40 Crathco bubblers of iced tea with all flavors having sweet and unsweet variations. “We buy tea leaves in bulk, and we’re brewing all day

long,” he said. “We have 20 linear feet of stainless steel, self-serve dispensers of fresh-brewed iced teas.” Last summer, Curby’s sold on average 600 cups of iced tea per day.

On the store’s right side are the packaged goods, such as candy, snacks, bottled drinks, beer, wine and other c-store staples. Curby’s utilizes four-sided pod merchandisers instead of linear gondola shelving to keep the area open and inviting. “This allows for the layout to have a different look and lets us configure the floor differently,” he said. “I also plan to bring in more regional and local products and have a pod dedicated to those items as well.”

At the back of the store is the horseshoe-shaped sales counter, with tobacco products facing the convenience side. Curby’s also has two self-checkout stations, in addition to two manned checkouts. “We’re going to add more self-checkout stations in the future because right now, 65% of our checkout is already done through self-checkout stations, and we want to bring more of our Pack Members out from behind the counter and onto the floor,” Sparks said.

BRINGING THEM IN

While Curby’s has embraced technology in the form of self-checkout, the retailer also sees value in the drive-thru. “We based our drive-thru on Chick-fil-A, with a double lane for cars and line busters out taking orders, rather than ordering through an order box,” Sparks said.

For Curby’s, the biggest challenge is getting customers through the door or drive-thru. “Because we don’t have fuel, people aren’t sure what Curby’s is,” he explained. “We do a lot of promotion on social media to help spread the word, but customer awareness, trial and repeat business is an ongoing challenge.”

While working on increasing awareness, the company has plans to open 10 stores within 36 months. “For us, it

BRIGHT IDEAS

For Tony Sparks, head of customer wow! for Curby’s Express Market in Lubbock, Texas, creating the right customer experience starts with the company culture. “We’re a faith-based company with a God-focused mission statement, and the people development part is so important to the founders of the company,” he said. To that end, each employee has a one-on-one each month with a supervisor that has nothing to do with store performance and everything to do with the worker as a person. “We want to know what’s going on in their life, what are they doing and how can we help them achieve those plans,” Sparks said. “From the store associates to the shift leaders to the kitchen manager and assistant store director—we want to hear from all of them on a monthly basis so we can support them as both Curby’s employees and as people.”

starts with the customer experience,” Sparks said. “What we’re trying to do is provide an underserved market with a different and better shopping experience than what is traditionally out there. We hope they see us as a progressive store with great food and service.”

NACS MARCH 2023 25

writer,

in

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go Sarah Hamaker is a freelance

NACS Magazine contributor, and romantic suspense author based

Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Mega Pixel/Shutterstock; Delmaine Donson/Getty Images; design56/Getty Images

Mega Pixel/Shutterstock; Delmaine Donson/Getty Images; design56/Getty Images

Store Design With Labor (or Lack of It) in Mind

BY RENEE PAS

BY RENEE PAS

Consistent labor concerns play a role in how convenience store retailers approach many areas of their businesses, from operational considerations to recruitment and retention and more. In the “more” category, new store builds offer the chance to rethink, reflow and restructure ways to drive labor efficiencies. The labor consideration can apply to nearly every area of a store, from the checkout counter to flooring materials.

When building new TXB stores, CEO Kevin Smartt noted, “We always start first with the customer experience. Once we understand that journey, it’s almost like reengineering how we can gain efficiencies; we try not to let efficiencies cloud the customer experience.”

When it comes to new builds at Yesway, Derek Gaskins, chief marketing officer, said the chain works to trickle down any rethink that happens with a new build to benefit existing stores. “All brands have an affinity for new stores,” he said. “There’s a constant tug of ‘What’s different; What’s better?’ There is a natural balance to that to avoid a lot of one-offs.”

With more than 40 new stores opening last year from the ground up, Yesway took a hard look at how to minimize the footsteps an employee must take, said Gaskins. “We are always working to drive efficiency in store layout and design.”

NACS MARCH 2023 27

As labor shortages increase, every detail is being scrutinized when building new stores to eke out ways to add greater efficiency.

360-degree circular area in the center of the store—is a very deliberate approach to labor efficiency, enabling employees to be within arm’s reach of everything. Staff can reach for tobacco items and cook food all from one space. In new builds, the cashier’s space is actually double the size of what exists at Yesway’s legacy stores.

The philosophy builds around the idea of everyone being a team player. The integrated components at Yesway’s checkout support the principal of shared responsibilities for all categories. “There is no segmentation or separation of tasks,” Gaskins said. “We have designed operations to maximize labor efficiencies and do not have silos.”

Gaskins understands the foodservicenext-to-everything component reverses common c-store design trends, where the typical approach separates foodservice, with its dedicated labor and square footage, away from the main checkout. “Other chains certainly have a more complex model and likely higher labor costs. We are geared for speed,” he said. “Every brand has its own tenets.”

NEW-BUILD CONSIDERATIONS

With each new store comes a fresh opportunity to contemplate improvements. “The operations team is always learning, and we are building stores fast, so we do modify in real time. We absolutely evolve and adapt,” said Gaskins.

28 MARCH 2023 convenience.org

When we look at how we lay out new stores, we always look to make it even more efficient.”

In addition to expanding the checkout area, Gaskins said adaptions have included everything from changes to specific offerings to determining the best location for the ice machine. Considering the best flooring, for example, when working on a new build, offered the chance to find a product that will endure while being easier for staff to clean. The goal, Gaskins noted, is to avoid any special mops or equipment necessary for the floor to look its part—again placing the emphasis on efficiency improvements.

In bathrooms, new-build considerations include air machines to dry hands and anything that can make it easier and faster for employees to clean that space, Gaskins said.

On the beverage program side, Yesway moved coffee brewers closer to the main cashier area. That eases the requirements of maintaining an all-day brewed coffee program, Gaskins said, allowing employees to better keep up with demand during peak periods. The chain relies on its bean-to-cup machines as its primary coffee offering during nonpeak periods.

Efficiency drivers can be small things, but they add up. That is often the case with the tweaks that happen at TXB’s new-build stores. “It’s about making the employee’s life a little easier,” Smartt said.

One example is TXB’s cold vault: Longer, deeper shelves in higher volume areas mean

PRACTICAL CONSIDERATIONS

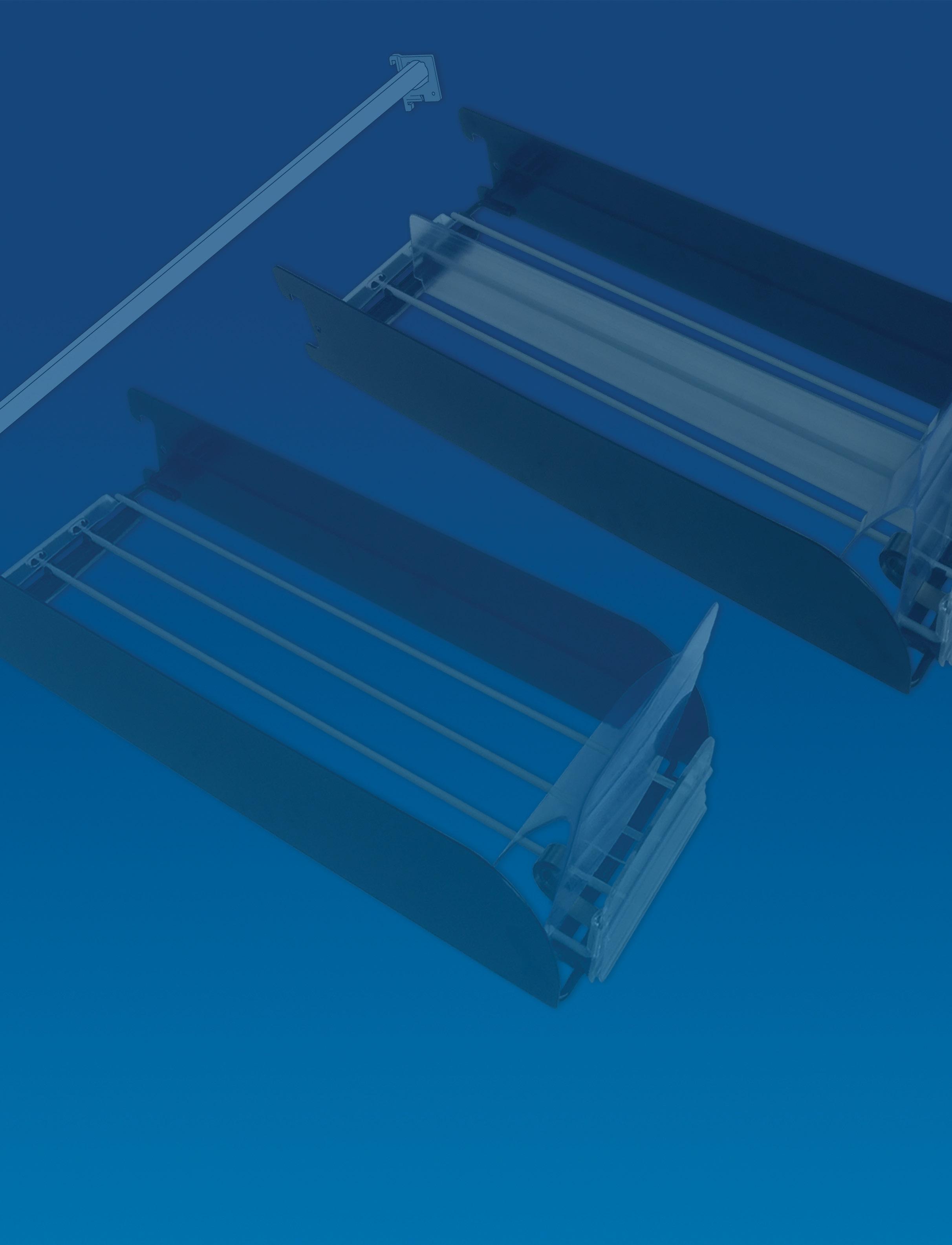

Four c-store suppliers share insights on ways labor efficiencies have become part of the purchasing consideration for fixtures, equipment, signage and more.

• Craig Neuhoff, vice president of business development at GSP Retail, believes people will continue to think smarter—and with labor in mind—when building new stores. It’s about the precision of systems and task management.

“How can we make it as easy as possible to do so many tasks?” he said. Smart approaches he has seen include adding drains in the floor near the fountain area and even in counters themselves for easy spill cleanup. He advises retailers to think about everything from self-cleaning ovens to durability/ease of cleaning when considering floor surfaces. (Editor’s note: Neuhoff passed away shortly after this interview with NACS Magazine. We extend our deepest condolences to his family and many friends.)

• Kent Rollins , division manager for retail display manufacturer Nashville Display, suggests retailers consider functionality first when making purchasing decisions on fixtures. “When the planogram changes, will the fixture need to be modified? Minimal or no hardware changes minimizes labor,” he said.

Common mistakes he sees retailers making include not considering the life cycle of the fixture (instead basing the buying decision on looks and cost); forgetting to consider maintenance issues (how easy is it to get a replacement part?); not thinking about shipping and installation particulars (who will assemble it? Will it ship via distribution center?); and not considering cleaning factors (is the fixture easy to keep clean and clean around?).

• Rick Sales , president and founder of digital engagement company Abierto Networks, said that all of the company’s major clients either built new stores or redid stores in a major way last year and have plans for growth this year. “Labor is a big part of the conversation across the board,” he said, adding that it is not the biggest reason c-store operators invest in digital signage programs.

The part of the solution he focuses on is driving value through customer engagement. “We work to improve the quality of the stream of communication being fed to customers,” he said. “It’s more value and less work; the information can change frequently.” Instead of putting up traditional window signs, which tend to refresh weekly at best, digital signage programs enable the message to change daily or even multiple times throughout the day (by daypart, for example).

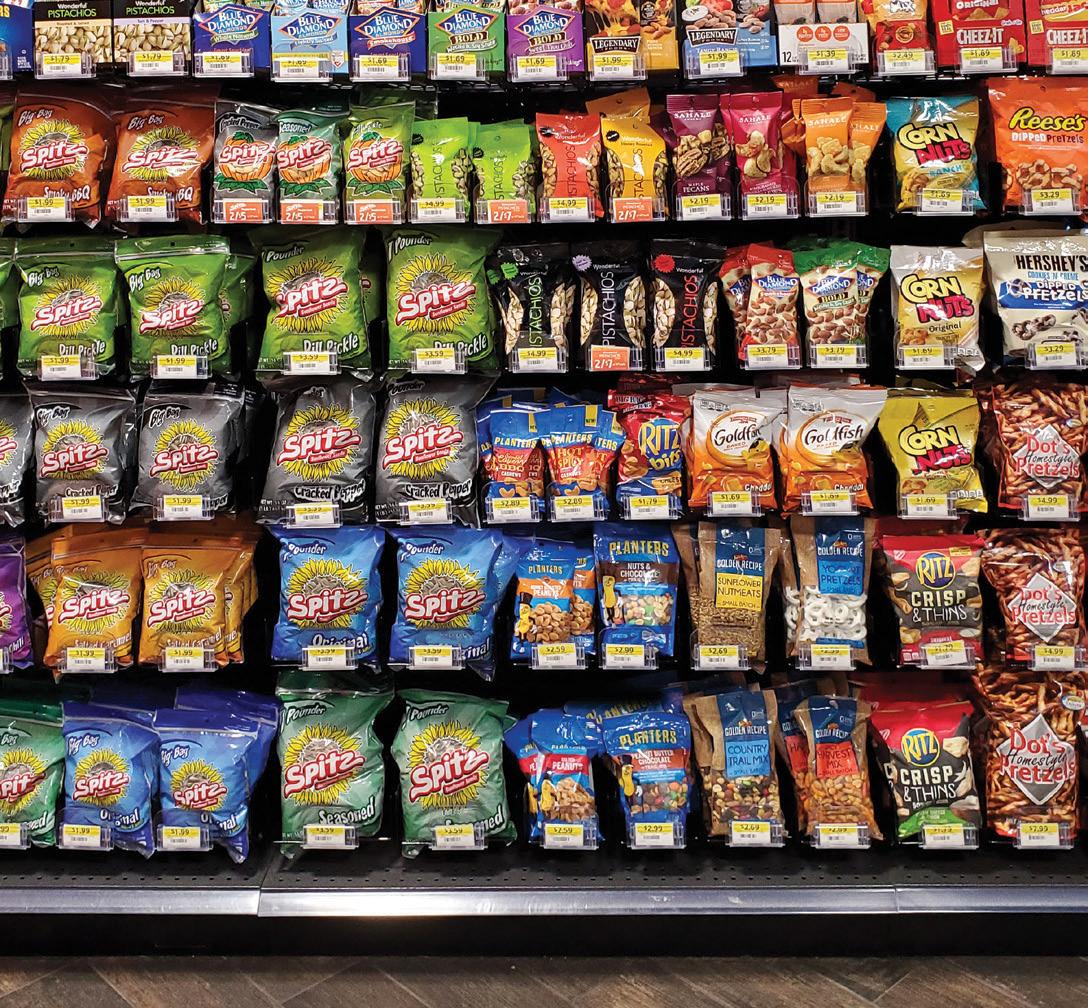

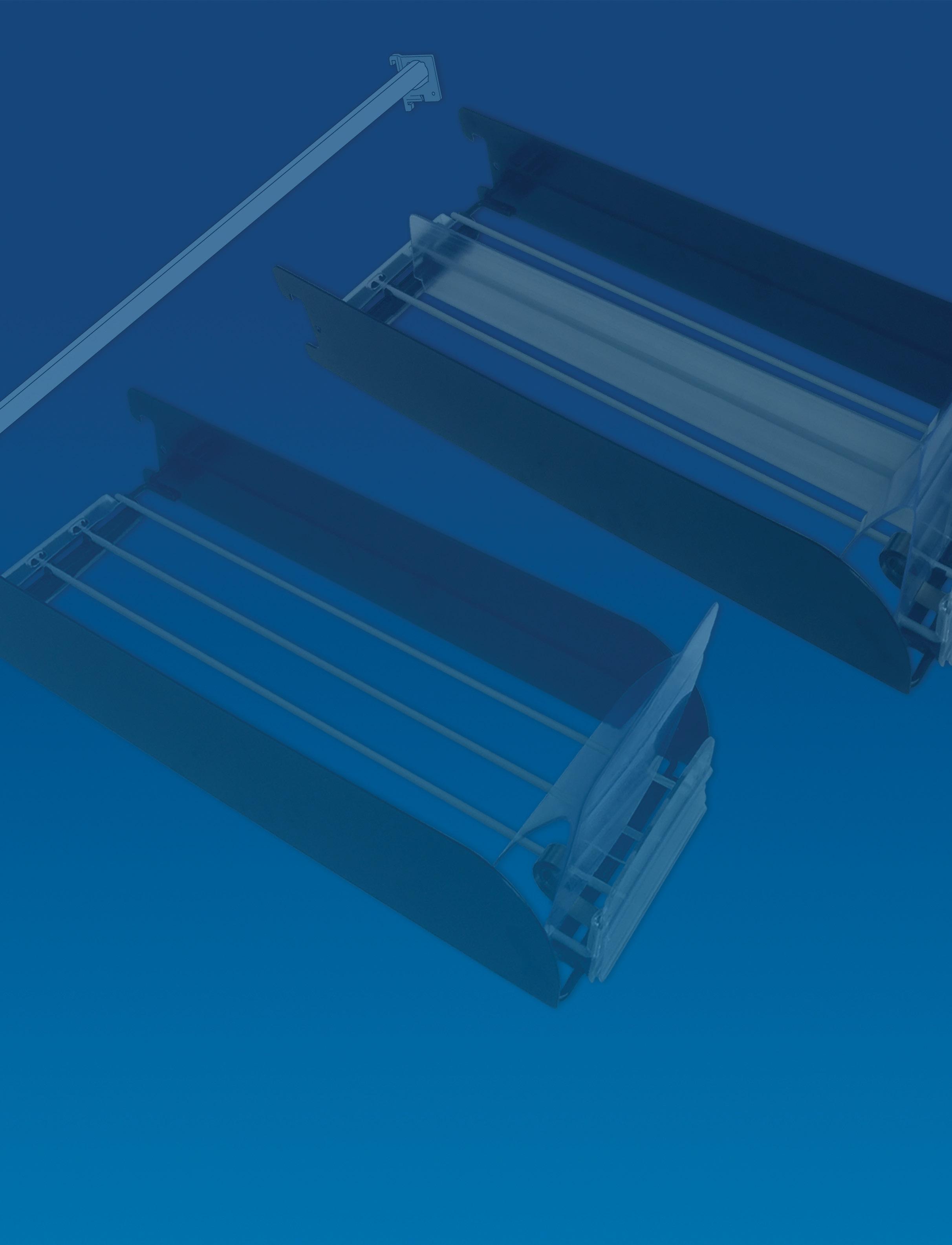

• Craig Weiskerger, director of sales and marketing for Trion Industries Inc., which provides merchandising solutions, said that current limitations on staffing reduce the amount of time available for store personnel to stock and organize shelves. “Store managers need systems that help keep merchandise displays looking fuller and consistently more presentable,” he said, which enables store personnel to spend more time interacting with customers.

“It’s an issue every business is facing,” he added. “You don’t want to have your limited staff using labor hours to restock the traditional way when there is a more efficient way to do it.” Increasing the number of facings translates to less restocking, he noted, adding that a system that pushes product forward maximizes presentation and keeps everything looking fully stocked and attractive.

NACS MARCH 2023 29

We have designed operations to maximize labor efficiencies and do not have silos.”

employees don’t have to restock as often, Smartt noted. Additionally, gravity-fed shelving with microbeads in place keep product front-facing and pushed forward. “Product often got stuck with the old glides we used,” he said. “Keeping shelf facings front now is not an issue.”

That also means the cold vault maintains its desired appearance with minimal employee requirements. Another merchandising/presentation-oriented change at newer stores, which saves time on restocking tasks, is to have more sleeves of cups throughout stores. Cups for both cold and

hot beverages are now “everywhere,” said Smartt. “It’s technically more than we need, but it works because customers always have a cup available, and employees don’t have to worry about restocking during a rush.”

The chain also tweaked the equipment used in its bean-to-cup coffee program ever so slightly. The brewed-on-demand system produces a coffee “puck” after customers brew an individual cup, which falls into a container that employees take out and empty after a certain number of cups are brewed. To eliminate the need for employees to empty the tray as often, the coffee pucks now drop through a tube that runs from the machine, under the counter and into a trash can. “We can produce coffee all through the rush now without having to empty the puck tray,” Smartt said.

30 MARCH 2023 convenience.org

A change at newer TXB stores is to have more sleeves of cups available throughout stores.

Iuliia Pilipeichenko/Getty Images; akiyoko/Getty Images

Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 Gain Facings and Cut Labor with WONDERBAR® Tray Merchandising n Increased facings from 99 to 121, a 22% increase*. n Automatically billboards and faces product. n Reduces losses from bag hook tearout. n Cuts over 1 hour/day labor for restocking. n Allows rear restocking and proper date rotation. n Dramatically increases sales in the same space. n Adjusts to accommodate various package widths. * Based upon average 8’ run by 5’ high salty snack gondola installations. Your results may vary. ©2020 Trion Industries, Inc. MODERNIZE YOUR MERCHANDISING

WonderBar® Tray Merchandising VS BEFORE WONDERBAR® 99 FACINGS AFTER WONDERBAR® 121 FACINGS SELL MORE IN THE SAME SPACETM

Sell More Salty Snacks

Optimizing floor stock offers yet another way to drive efficiencies. “One key from a labor perspective is getting the right fixture configuration to optimize the set without overstocking,” said Geoff Wigner, director of sales for retail display manufacturer Nashville Display. The fixture design should marry in with the case pack, he explained, so it holds the correct amount of product for the sales cycle.

“It’s about space utilization in relation to sales,” Wigner said. Whatever the cycle from delivery to delivery is, that should factor into the fixture, he said.

AI LABOR CUES

Smartt believes AI will continue to expand within convenience retailing. TXB uses AI in several stores now and plans to add it to new stores going forward, he said, in addition to adding it to high-volume stores when remodeling. The AI system uses TXB’s existing security camera setup and analyzes specific use cases, which enables a store manager to react in real time.

It is less about data and more about action items, something Smartt said store managers report is more valuable to them. “The feedback we get from managers is, ‘We don’t need more data.’ What they told us they prefer is actionable information,” he said. “That’s what we are constantly working toward now.”

The older approach meant looking at data and telling team members to clean the restrooms twice an hour. Now, Smartt said, with this more advanced approach, the system can count how many people are going in and out of the restrooms every hour and adjust the cleaning needs when fewer people are using the restrooms.

Messages are sent to store managers in the form of “action reports,” which come through on a manager’s smartphone. The approach works in many scenarios, Smartt said, citing the cash register area as another example. Customers are counted when they first enter the store, he explained, and “the system knows to cue the store manager in advance when extra employees will be needed to check customers out because we know that’s going to happen about three minutes after they enter the store.” TXB continues to tweak the system. Smartt already sees the advantage it can bring in labor efficiencies and delivering real-time data to managers.

Renee Pas ’ writing draws from both her c-store background and her more than 20 years writing about various retail channels. She can be reached at reneepas4@gmail.com

32 MARCH 2023 convenience.org

Efficiency drivers can be small things, but they add up.

Last year’s fastest growing

*

IS JUST GETTING STARTED.

LONGHORN REWARDS

We designed our new rewards program to strengthen customer loyalty, encourage new trials and grow your bottom line. Which means selling Longhorn—just got a lot more rewarding.

Contact your sales rep today.

+ + * * Introducing

moist snuff brand

of 2022 Data

The

Trusted by HR professionals for more than 40 years, the NACS State of the Industry Compensation Report® gives you an inside look at HR metrics and trends in critical areas including salaries, benefits, recruitment & retention, and turnover rates.

Develop a more data-driven strategy to recruit, retain and reward employees compared to the competition.

inside look at c-store labor and compensation data to benchmark for success.

2022 DATA

DIGITAL

convenience.org/CompReport

ORDER YOUR

COPY TODAY!

These are the leading convenience retail chains in the U.S., ranked by number of locations.

NACS MARCH 2023 35

NortheastTotalStores Southeast MidwestSouthCentral Central West

It’s no surprise that 7-Eleven Inc. remains the largest convenience retail chain with 12,821 stores as of December 31, 2022, according to the 2023 NACS/ NielsenIQ list of the Top 100 Convenience Retailers. That’s nearly 100 stores more than 7-Eleven had in the 2022 ranking.

The Irving, Texas, convenience retailer has locations across the U.S., with the largest presence in the Northeast, where it has 3,542 stores, and the smallest footprint in the Central region, where it has 693 stores.

Alimentation Couche-Tard Inc., which owns the Circle K and Couche-Tard brands, is the second-largest chain by store count, with 5,702 stores in the U.S. The parent company is based in Laval, Quebec, with U.S. headquarters in Arizona. Couche-Tard operates convenience stores in 26 countries and territories, with more than 14,200 stores, of which roughly 10,800 offer road transportation fuel. Circle K’s largest U.S. footprint is in the Southeast, where it has 2,003 locations, up from 1,911 stores at the end of 2021.

36 MARCH 2023 convenience.org

Independent 90,950 19,193 24,033 13,239 15,139 5623 13,723 7 Eleven Inc. 12,821 3,542 1,759 2,060 1,670 693 3,097 Alimentation Couche-Tard/U.S. HQ 5,702 240 2,003 928 1,027 580 924 Casey’s General Stores Inc. 2,470 0 50 740 187 1493 0 EG America 1,696 836 205 195 2 359 99 GPM Investments LLC 1,391 274 337 421 307 28 24 Murphy USA Inc. 1,089 179 422 68 345 66 9 Wawa Inc. 991 741 250 0 0 0 0 QuikTrip Corp. 972 0 265 5 324 244 134 Kwik Trip Inc. 823 0 0 498 0 325 0 Sheetz Inc. 674 491 114 69 0 0 0 Pilot Company 655 61 151 148 117 80 98 Love’s Country Stores Inc. 607 30 114 105 199 100 59 RaceTrac Petroleum Inc. 567 0 395 2 170 0 0 Military 532 90 135 30 77 41 159 Yesway 429 0 0 0 364 65 0 Maverik Inc. 399 0 0 0 13 67 319 Kum & Go LLC 394 0 0 0 94 300 0 Global Partners/ Alliance Energy 359 356 1 0 1 0 1 Stewart’s Shops Corp. 358 358 0 0 0 0 0 United Pacific 330 0 0 0 0 51 279 Copec Inc. 305 0 301 3 1 0 0 Jacksons Food Stores Inc. 303 0 1 0 0 0 302 ExtraMile Convenience Stores LLC 303 0 0 0 0 0 303 Two Farms Inc. 268 268 0 0 0 0 0 CAPL Retail LLC 258 185 47 26 0 0 0 Delek US Holdings Inc. 256 0 2 0 254 0 0 TravelCenters of America Inc. 252 35 49 51 47 31 39 Anabi Oil Co. 233 14 67 36 0 0 116 United Refining Company of Pennsylvania 229 220 0 9 0 0 0 Giant Eagle Inc. 228 87 0 141 0 0 0 Cals Convenience Inc. 211 2 0 0 209 0 0 Refuel Co. 207 0 164 0 43 0 0 Croton Holding Co. 202 149 0 53 0 0 0 Meijer Inc. 186 0 0 186 0 0 0 Shell Oil/Motiva Enterprises LLC 175 0 2 1 170 0 2 Fikes Wholesale Inc. 175 0 33 0 142 0 0 United Dairy Farmers 175 0 0 175 0 0 0 G & M Oil Company Inc. 174 0 0 0 0 0 174 Terrible Herbst Inc. 174 0 0 0 0 0 174 True North Energy LLC 167 0 0 167 0 0 0 Hy-Vee Food Stores Inc. 165 0 0 18 0 147 0 Bolla Management Corp. 164 164 0 0 0 0 0 Tri Star Energy LLC 160 0 155 5 0 0 0 CF Altitude LLC 153 0 0 1 5 147 0 H & S Energy Products LLC 153 0 0 0 0 0 153 Nouria Energy 145 145 0 0 0 0 0 Blarney Castle Oil Co. 143 0 0 143 0 0 0 Flash Oil Co. 142 0 81 0 59 2 0 Break Time Corner Market LLC 140 0 6 0 91 43 0 Parkland USA 135 0 20 0 0 68 47 Majors Management Inc. 125 17 56 4 48 0 0

NACS REGIONS

Casey’s, EG America and GPM Investments LLC round out the top five by size, with 2,470, 1,696 and 1,391 stores, respectively. Casey’s, based in Ankeny, Iowa, dominates the Central region, where it has 1,493 stores. Casey’s has a presence in 16 Midwestern states, and about half of its c-stores are located in areas with populations of 5,000 or less. In fiscal 2023, Casey’s plans to add about 80 stores.

The NACS State of the Industry enterprise breaks down the size of convenience retail chains as A (1-10 stores), B (11-50), C (51-200), D (201-500) and E (500+). In the 2023 Top 100 Convenience Retailers list, there are 14 E-size firms atop the list, followed by 19 D-size firms and 67 C-size chains. (Note: The top 100 includes several ties in the rankings when chains had the same number of stores.)

Industrywide, 150,174 convenience stores operate in the United States—a 1.5% increase in the number of stores from a year earlier, according to the 2023 NACS/NielsenIQ Convenience Industry Store Count. Of these, 118,678 convenience stores sell motor fuels (79.0% of all convenience stores). Store count increases were recorded in 39 states and Washington, D.C.

38 MARCH 2023 convenience.org NortheastTotalStores Southeast MidwestSouthCentral Central West Martin & Bayley Inc. 125 0 6 107 0 12 0 Go Mart Inc. 123 112 0 11 0 0 0 Englefield Oil Co. 119 1 0 118 0 0 0 Enmarket Inc. 118 0 118 0 0 0 0 Gas Express HQ 113 0 77 0 36 0 0 Mountain Express Oil Inc. 111 0 37 0 73 1 0 Little General Stores Inc. 110 109 0 1 0 0 0 Mirabito Energy Products 109 109 0 0 0 0 0 Sampson Bladen Oil Company Inc. 109 0 109 0 0 0 0 Plaid Pantries Inc. 107 0 0 0 0 0 107 Petrogas Group SC LLC 106 12 69 17 0 8 0 Victory Marketing LLC 106 0 104 0 2 0 0 Town Pump Inc. 106 0 0 0 0 106 0 M M Fowler Inc. 103 3 100 0 0 0 0 Stinker Station 102 0 0 0 0 39 63 Panjwani Energy LLC 99 0 0 0 99 0 0 Vintners Distributors/ AU Energy 98 0 0 0 0 0 98 Carroll Independent Fuel LLC 94 94 0 0 0 0 0 Toot’n Totum Food Stores Inc. 88 0 0 0 85 3 0 Newcomb Oil Co. 88 1 1 86 0 0 0 Reid Stores Inc. 86 86 0 0 0 0 0 The Spinx Company Inc. 85 0 85 0 0 0 0 CHR Corp. 84 84 0 0 0 0 0 Family Express Corp. 81 0 0 81 0 0 0 FKG Oil Company 81 0 0 63 0 18 0 Johnson Oil Co. 79 0 0 61 0 18 0 Sunoco Inc. 77 19 6 0 0 0 52 Southwest Georgia Oil Co. 77 0 77 0 0 0 0 Krist Oil Co. 77 0 0 76 0 1 0 Quick Track Inc. 76 0 0 0 76 0 0 CN Brown Co. 75 75 0 0 0 0 0 Campbell Oil Company 75 0 0 75 0 0 0 Midjit Market Inc. 75 0 0 0 0 0 75 The Kent Companies 74 0 17 0 57 0 0 MFA Petroleum 74 0 0 0 0 74 0 CPD Energy Corp. 74 74 0 0 0 0 0 Fuel Maxx Inc. 74 0 0 0 74 0 0 First Coast Energy LLP 73 0 73 0 0 0 0 Good 2 Go Stores LLC 73 0 0 0 16 25 32 Petroleum Marketing Group Inc. 73 53 19 1 0 0 0 Sam’s Food Stores 72 72 0 0 0 0 0 Atlantis Management Group 72 70 1 0 1 0 0 Convenient Food Mart Inc. 72 46 0 23 0 3 0 GATE Petroleum Co. 72 0 72 0 0 0 0 Weigel’s Stores Inc. 72 0 72 0 0 0 0 The Parker Companies 72 0 72 0 0 0 0 Stop & Go 71 0 0 71 0 0 0 Holiday Oil Co. 71 0 0 0 0 0 71 BFS Foods Inc. 70 68 0 2 0 0 0

NACS REGIONS

of employees say they're more likely to stay with a company that offers continuous training.

HR managers who say that training is benef icial for employee attraction and retention.

1/3 of organizations LACK ACCESS TO THE RIGHT TRAINING CONTENT.

Train to Retain.

Develop employees with industry-specific training content and a path to success. Deliver training using trainingGrid ® - our easy-to-use Learning Management System (LMS).

Document results with robust reports and dashboards. www.readytrainingonline.com

• ® Ready Training Online Trusted Name in Training

TOP 5 CONVENIENCE RETAILERS BY REGION

“The value of convenience continues to grow, and that’s a driving factor why every retailer, regardless of channel, seeks to provide it. And it’s also clear that the convenience offer at convenience stores resonates with consumers, given the record in-store sales at convenience stores and increase in store count,” said NACS Managing Director of Research Chris Rapanick.

The main trend line in the 2023 NACS/ NielsenIQ store-count data is growth in the number of single-store operators after several years of shrinking numbers amid industry consolidation and a tough business climate. There are 90,423 single-store operators in the U.S., accounting for 60.2% of all convenience stores.

Consolidation continues in the convenience retail industry. ARKO Corp.’s GPM Investments, for example, acquired more than 200 retail stores in 2022, including Pride Convenience Holdings, Transit Energy Group

and Uncle’s Convenience Stores, among others. “With our liquidity and deal-making ability, we believe we have a long runway to continue our long-term growth strategy, making disciplined, accretive acquisitions at attractive multiples to continue growing our convenience store footprint,” Arie Kotler, ARKO’s chairman, president and CEO, said in announcing the Pride Convenience Holdings deal in October. ARKO, based in Richmond, Virginia, has grown its c-store holdings from about 200 stores in seven states in 2013 to more than 1,390 c-stores in 33 states and Washington, D.C., via 22 acquisitions.

It’s not just the E-size firms that are growing. Among the smaller chains, Lawrenceville, Georgia-based Majors Management, which ranks 56 on this year’s list, recently announced deals to acquire 21 convenience stores from Davis Oil Co. and 13 Maritime Farms c-stores from Maritime Energy.

40 MARCH 2023 convenience.org

Region 1: Northeast Company Store Count 7 Eleven Inc. 3,542 EG America HQ 836 Wawa Inc. 741 Sheetz Inc. 491 Stewart’s Shops Corp. 358 Region 2: Southeast Company Store Count Alimentation Couche-Tard/US HQ 2,003 7 Eleven Inc. 1,759 Murphy USA Inc. 422 RaceTrac Petroleum HQ 395 GPM Investments LLC 337 Region 3: Midwest Company Store Count 7 Eleven Inc. 2,060 Alimentation Couche-Tard/US HQ 928 Casey’s General Stores Inc. 740 Kwik Trip Inc. 498 GPM Investments LLC 421 Region 5: Central Company Store Count Casey’s General Stores Inc. 1,493 7 Eleven Inc. 693 Alimentation Couche-Tard/US HQ 580 EG America HQ 359 Kwik Trip Inc. 325 Region 6: West Company Store Count 7 Eleven Inc. 3,097 Alimentation Couche-Tard/US HQ 924 Maverik Inc. 319 ExtraMile Convenience Stores LLC 303 Jacksons Food Stores Inc. 302 Region 4: South Central Company Store Count 7 Eleven Inc. 1,670 Alimentation Couche-Tard/US HQ 1,027 Yesway 364 Murphy USA Inc. 345 QuikTrip Corp. 324

NACS REGIONS

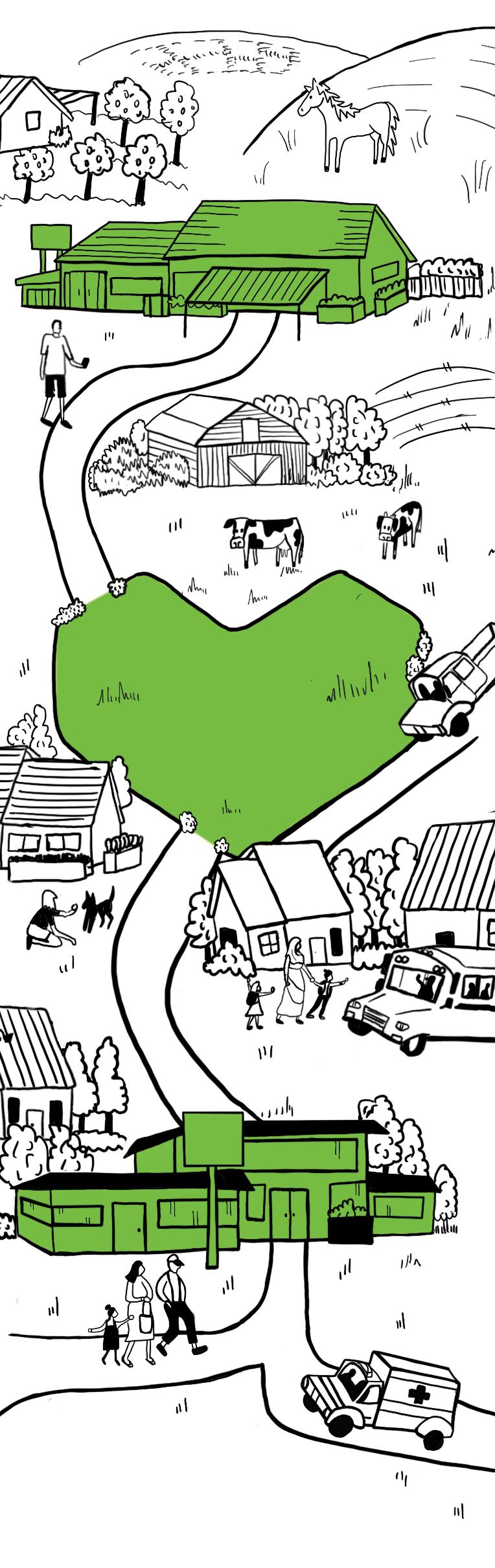

LIFTING UP A COMMUNITY

Sioux Valley Coop offers a modern destination that meets a community’s growing needs.

BY SARA COUNIHAN

BY SARA COUNIHAN

Harrisburg, South Dakota, is a picturesque small town that is quickly expanding. Located just outside of Sioux Falls, it’s a magnet for young families and those who want to be close to a bigger city but still experience that small town feel.

But sometimes a growing small town can lack certain amenities. That’s where Sioux Valley Coop comes in.

“We learned through research that Harrisburg was growing rapidly. It was full of young families that were building in a smaller town, but they didn’t really have a lot of options,” said Renae Greenfield, director of retail and operations for Sioux Valley Coop. “We thought that it would be a great place for us to grow and build and become part of the community.”

42 MARCH 2023 convenience.org

All Cenex locations will receive the Halo image upgrades that include a lighted canopy with a 360-degree LED light band and a three-dimensional Cenex logo and backlit blue arch.

A NO-BRAINER

Sioux Valley Cooperative has five convenience store locations in South Dakota, including its newest one in Harrisburg. All locations are Cenex branded. When the company was considering the Harrisburg location, building the store in partnership with Cenex was a no-brainer.

“Cenex is premium-quality fuel and premium-quality products,” said Greenfield.

Partnering with Cenex, the energy brand of CHS, allowed Sioux Valley Coop to take advantage of Cenex’s LIFT Initiative, which provided Sioux Valley Coop with lighting, image and facility amenities, as well as a low-interest loan financing option.

“We think by partnering with our local stores and offering them this capital, that we are not only solidifying our commitment to the community, we’re developing trust on that business level with our business partners, understanding that we want to be successful with them into the future,” said Akhtar Hussain, director of refined fuels marketing for CHS, on a recent episode of the NACS Convenience Matters podcast.

Greenfield said that when the store was being designed, the company wanted a more modern, upscale design to compete with the other new builds in town.