IN-STORE PERFORMANCE Prepared food is the new sales leader

REGIONAL BREAKDOWNS

Advancing Convenience & Fuel Retailing JUNE 2023

Diving into State of the Industry data reveals many paths to greater profitability.

Unfair tobacco regulations could hurt your business. Stand up for your store. Click the button to join store owners across the country who are fighting for fair tobacco policies. TO GET INVOLVED CLICK HERE

36

The Elephant in the Room

Inside sales held on in 2022 despite facing high inflation and record gasoline prices.

44 Inside Sales Exceed Expectations

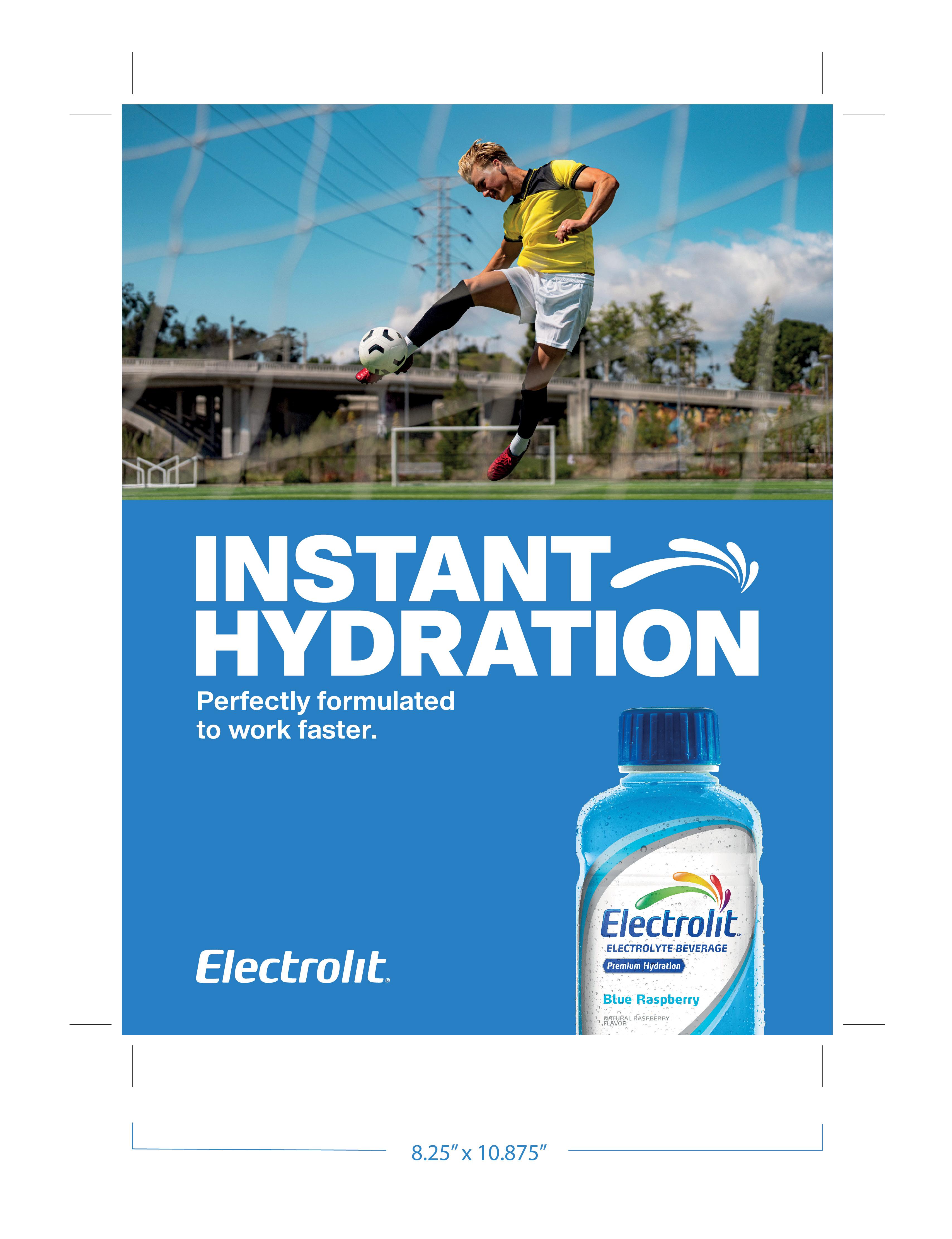

Convenience stores are the destination for food, snacks and beverages.

56 Uncertainty Remains

The economic outlook is ‘really, really difficult to read’—but retailers can prepare for whatever scenario unfolds.

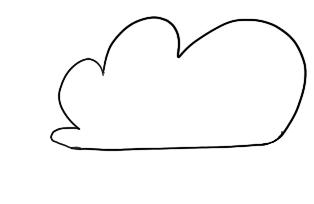

60 How Each Region Stacks Up

Regional performance metrics reveal insights for fuel, merchandise and store expenses in 2022.

70

4 Key Points From the SOI Summit

Amid thousands of data points and a treasure trove of insights, here are some important big-picture takeaways.

75

The Ultimate C-Store Road Trip

What happens when two sisters and a cat drive 3,189 miles across 13 states in seven days?

82

A Fresh Look at Managing Retail Fuels

Branded or proprietary? How many grades or blends?

88 Fuels Outlook 2023 Up, down, or sideways?

92

‘The Headlines Don’t Tell the Whole Story’ EVs will play an important role in the future. The question is when … and where.

104 Competing With Your Battleships or Destroyers

How one convenience retailer’s optimization process determines the best use for each site it operates.

108

‘Billions of Touchpoints’ Casey’s marketing approach aims to create a unified experience wherever customers engage.

96

NACS JUNE 2023 1 Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs On the cover and this page: Siberian Art/Shutterstock Growing Your Basket Size in 2023 The NACS Convenience Voices program reveals four shopper trends that are shaping 2023 and beyond.

FEATURES

ONTENTS NACS / JUNE 2023

IT’S A FACT

$18,063

ONTENTS NACS / JUNE 2023

DEPARTMENTS

06 From the Editor

08 The Big Question

10 NACS News

20 Convenience Cares

24 Inside Washington NACS advocates for retailers to have the ability to sell E15 year-round.

32 Ideas 2 Go EddieWorld caters to those coming and going between Los Angeles and Las Vegas.

112 Cool New Products

116 Gas Station Gourmet At Geaux Fresh Convenience Market, community and festival-worthy food come together.

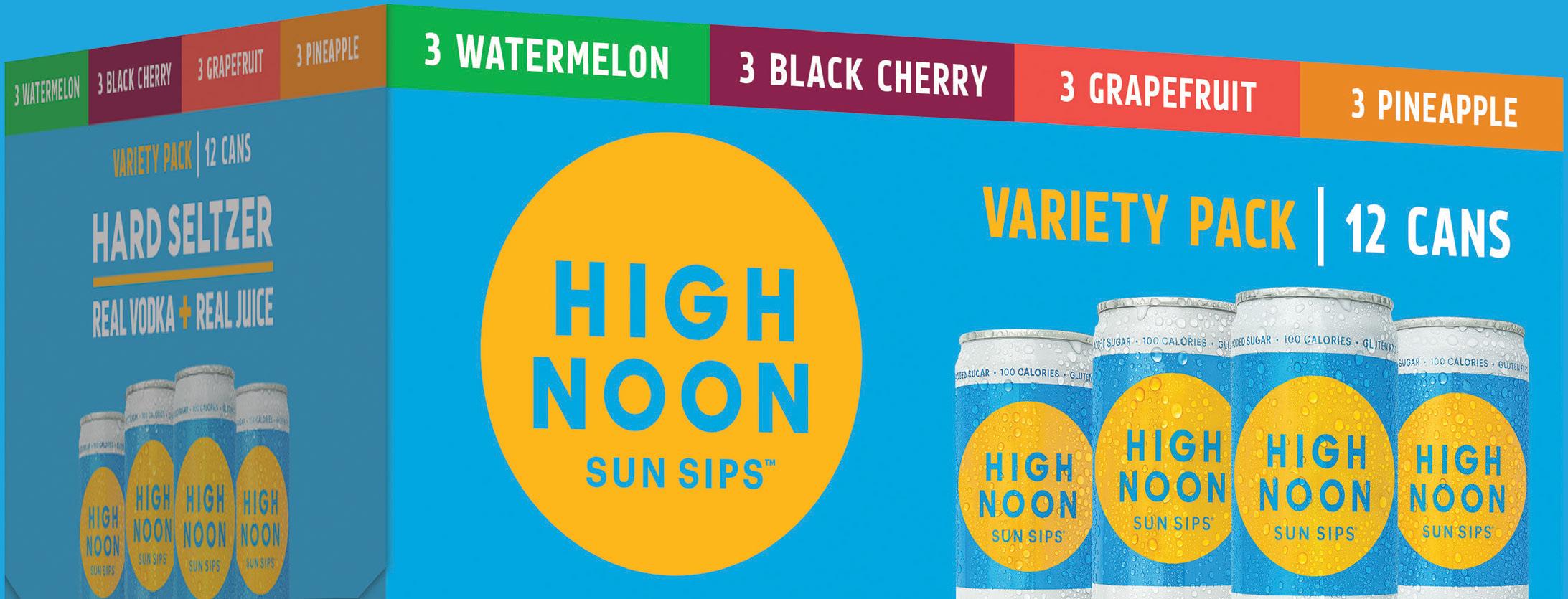

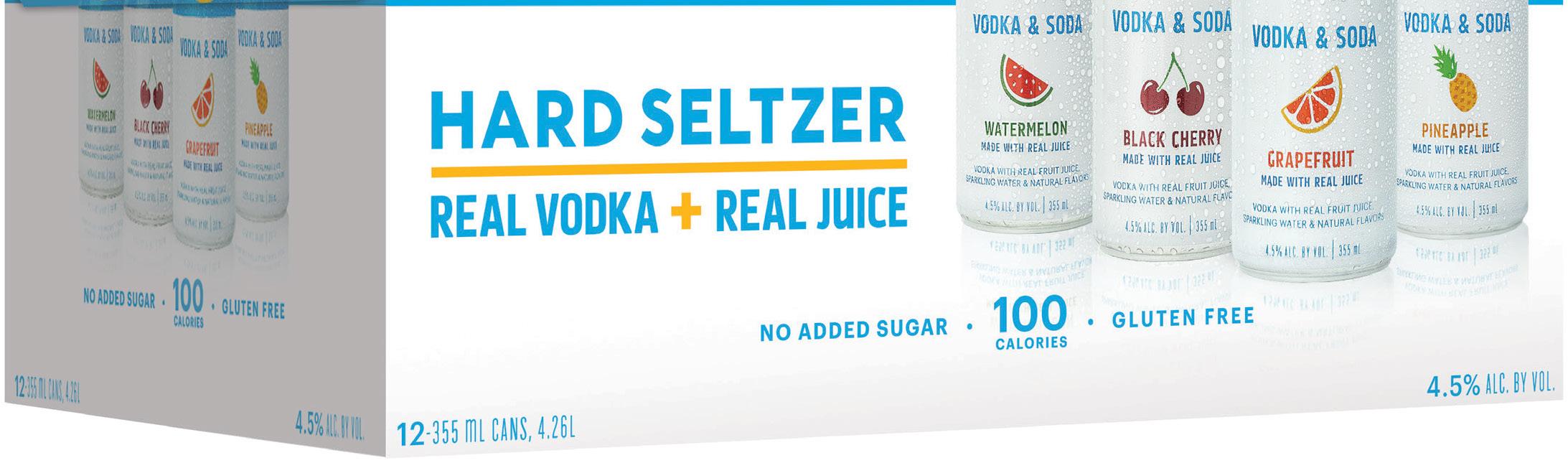

120 Category Close-Up Beer continues to attract customers into c-stores as sales hover near their pandemic peak, while innovation and variety keep the cold dispensed beverage category fresh.

136 By the Numbers

Average monthly sales per store for beer in 2022.

CATEGORY CLOSE-UP PAGE 120

The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE

2 JUNE 2023 convenience.org

Be the destination for smart snacking.

Today’s convenience store consumers want healthier options when they’re grabbing something on the go.

of shoppers identify as being health conscious.

KeHE raises the standard for convenience foods.

We’re a nationwide distributor with the broadest selection of natural & organic, specialty, and fresh products anywhere.

See how KeHE can make you the destination.

Join

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allen, Sarah Hamaker, Al Herbert, Pat Pape

DESIGN Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

NACS SUPPLIER BOARD

CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles Sr., Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Tropicana Brands Group; Alicia Cleary, Video Mining LLC; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley; Danielle Holloway,Altria Group Distribution Company;

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles Sr., Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

Jim Hughes, Krispy Krunchy Foods LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes, NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

TOGETHER. DO MORE.

us at conveniencecares.org

COME

/ JUNE 2023

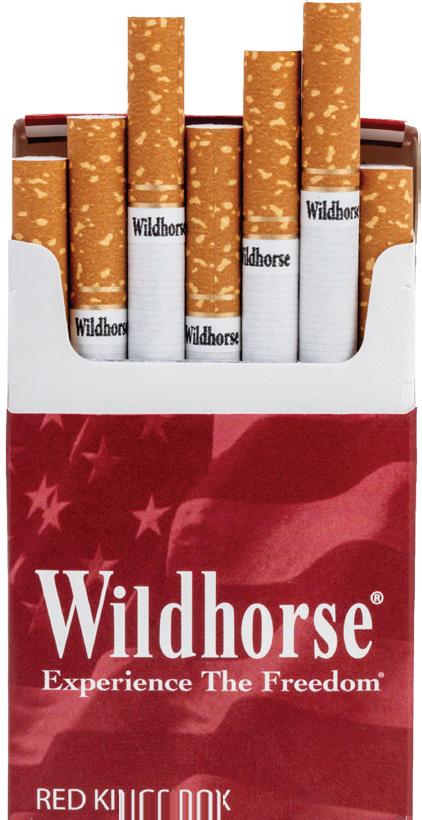

Premier Manufacturing:

Bran s Built on Integrity

Owned by a cooperative of proud American farmers using the best U.S.-grown tobacco blends among their competitors, Premier provides high-quality, value-priced cigarette brands for the adult consumer. C-stores across the country are buying in.

Commitment to Quality

Premier Manufacturing, Inc. is the consumer products division of U.S. Tobacco Cooperative Inc. (USTC), an American grower-owne marketing cooperative base in Raleigh, NC.

500+ member farmers throughout the Southeast

Members maintain GAP Connections Certification Standards Ensures sustainable, ethical agricultural practices

Robust Partnerships

Premier’s support staff pri es itself on meeting customer goals with seamless execution in achieving the highest regulatory standards.

• Provides sales/service support across the U.S.

• Develops POS materials for high visibility

• Creates custom sales & merchandising programs

• Maintains strong relationships with top distributors

Trackable process includes all aspects of manufacturing under one roof Tobacco processing & stemmery Primary blending / Cigarette finishing

A Cut Above the Rest

All products made in USA & 100% guaranteed

Premier pro ucts use only top-en tobacco blen s.

The finest flue-cure tobacco in the worl

• All U.S. grown

• Environmentally sustainable

• Compliant with every regulation

The best blen among competitors

• Highest concentration of flue-cured tobacco

• Partners with top national and regional retail chains

• Vibrant color

• Blends provide exceptional aroma and flavor experience

Manufacture on in ustry-lea ing equipment

• Laser perforation

• Inked code dating

• Latest high-tech advancements

Your Truste Premier Brands Choose the brand that suits your loyal consumers. Each brand features a variety of styles to satisfy every taste. Contact Premier Manufacturing to ay! www.gopremier.com/contact

Summiting Another SOI

Sales. Operating expenses. Inflation. Those were the dominant themes at the 2023 State of the Industry Summit and are naturally the central themes within this issue, which provides exhaustive coverage of the SOI Summit. Sales, operating expenses and inflation can also create the acronym SOI. Well, what do you know …

Industry sales set a record in 2022, but sales are only part of the equation. Expenses related to operations, especially labor and a staggering increase in swipe fees, plus the cost of goods and inflationary pressures, are the other half. Overall, the industry was profitable in 2022, but on a store level, profits were most dependent upon what you sold. “Mix matters,” stressed NACS Vice President of Research & Education Lori Buss Stillman—and foodservice is a huge part of that mix.

This issue presents the most comprehensive overview of the industry’s performance in 2022 and serves as a playbook for your business in 2023 and beyond. But, to reuse another phrase, it’s only part of the equation. The NACS State of the Industry Report of 2022 Data dives even deeper into the numbers—and analysis. If your company submitted numbers, you’ll be getting the report in mid-June. If not, you can order it at convenience.org/research.

A lot has changed since our first NACS State of the Industry Summit in 2002, one that I remember very well.

It was in Washington, D.C., so it was easy for my wife and infant daughter to join me to check it out. I was new to parenting and didn’t know that bringing an infant to a conference is never a good idea, no matter how briefly, especially one who is teething. Our daughter Rachel promptly grabbed a table card for featured speaker George Will and ate it. It was paper, so she survived. Mr. Will still found his table. But paper products still are classified as nonedible according to the NACS Category Definitions.

This was my 22nd NACS SOI Summit (including the virtual versions in 2020 and 2021). For several of our newer NACS colleagues, this was not just their first SOI Summit, but their first NACS event, and they were blown away by the scope of the event and by the camaraderie of our industry. In interviews with new applicants, we always stress how unique our industry is—and how willing people in the industry are to share ideas. It’s hard to believe it until you see it. They are believers now.

Among the first-timers was Ben Nussbaum, our new editor-in-chief. For this issue, his first, he led the effort to pull together 50 pages of coverage of the event and deliver it for layout within five business days of the SOI Summit. Navigating tight deadlines and delivering compelling copy is something Ben is accustomed to. When he was at USA Today, he led the magazine division that ultimately grew to 50 titles a year.

While the company had talked about creating magazines, it wasn’t until news broke that Michael Jackson died that they put ideas to motion, and they had a complete publication to the printer within 24 hours.

That nimbleness and ability to pivot will serve Ben well in his new role covering a very nimble industry that continues to amaze me even after 22 SOI Summits. Let him know what you think of this SOI issue of NACS Magazine or the magazine in general. What do you appreciate most? What would you change? Drop him a line at bnussbaum@convenience.org.

vice president, strategic industry initiatives,

6 JUNE 2023 convenience.org

FROM THE

UP FRONT

EDITOR

Jeff Lenard,

NACS

NACS Vice President of Research & Education Lori Buss Stillman shared insights about the industry.

n Increased facings from 70 to 90, a 29% increase*. n Automatically billboards and faces product. n Reduces losses from bag hook tearout. n Cuts over 1 hour/day labor for restocking. n Allows rear restocking and proper date rotation. n Dramatically increases sales in the same space. n Adjusts to accommodate various package widths. * Based upon average 8’ run by 5’ high peg candy gondola installations. Your results may vary. ©2020 Trion Industries, Inc. Sell More Peg Candy Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 Gain Facings and Cut Labor with WONDERBAR® Tray Merchandising MODERNIZE YOUR MERCHANDISING SELL MORE IN THE SAME SPACETM Ga S S VS AFTER WONDERBAR® 90 FACINGS BEFORE WONDERBAR® 70 FACINGS WonderBar® Tray Merchandising

UP FRONT THE BIG QUESTION

How do the SOI Summit numbers inform your business decisions?

What’s unique about the NACS State of the Industry Summit is it provides great statistics on how the industry is performing, where the opportunities and struggles are and how we can best prepare Maverik to continually exceed our customers’ expectations. There is no other event quite like it.

We have a broad distribution of stores across the Intermountain West, the part of the country that enjoys significant exposure to outdoor recreation and adventure activities, including mountain climbing, offroading, canoeing, biking, skiing, camping and much more. In some cases, we feel our customers are unique, with more of a focus on “work hard, play hard,” but there are also so many commonalities around convenience that ring true across the country—and the world. We’re continually analyzing the industry and surveying our customers to ensure we’re innovating to meet the ever-changing needs of our adventure-enthusiast customers.

Our customers share many commonalities, but there is no typical customer. And there’s no typical store format. We’ve evolved from small country stores in rural communities to much larger store

formats that feature our “Adventure’s First Stop” branding that captures our mission and spirit best.

The industry is evolving rapidly, and it is important to stay nimble and innovative in how we run our businesses. We realize customer demands and preferences are shifting, and retailers need to be ready to adapt to those changing needs. Technology also brings tremendous opportunity for innovation as well as new risks of disruption.

Any information that can be used to benchmark Maverik’s performance to that of our peers is incredibly valuable, which is the most exciting part of reviewing the data sets. We treat the State of the Industry Report as a scorecard that we update every year to measure our progress relative to our peers in the market. Regarding key performance metrics, for fuel, we rely heavily on fuel margin and volume. For in-store performance, we look at unit volume and margin. For store operations,

we look at direct store operating expenses (especially labor) as well as break-even cents per gallon.

The pandemic and continued supply chain shortages have taught us a lot about how culture, teamwork and communication among our nearly 7,000 team members can yield amazing resilience, ingenuity and innovation to help us rise above uncertain times. Key areas of focus include in-store operational efficiency and using technology to provide flexibility for store operations, such as assisted checkout and back-office efficiency in areas like reporting and bookkeeping. Buying smartly and the ability to manage inventory so that customers can get what they expect will continue to offset supply chain disruptions. The ability to reinvest in our stores by remodeling, upgrading and building new stores will continue to help us serve our customers the best way possible.

8 JUNE 2023 convenience.org

Chuck Maggelet, President and Chief Adventure Guide, Maverik – Adventure’s First Stop

Get to Know Your Customers Through Better Marketing

Convenience retail is a fast-paced industry with new challenges and opportunities each day—and sometimes by the minute. To keep up, retailers have

realized that their marketing strategies are more than product promotions— they’re about delivering exceptional customer experiences.

Become a Master of Convenience

The NACS Marketing Leadership Program is the only marketing executive education course tailored to the convenience retail industry. Over a fiveday program, participants can expect to learn valuable insights from their peers and program facilitators about:

• Segmentation/targeting and positioning

• The power of non-customers

• Building successful customer loyalty programs

• Digital strategies that make clicks count

• Creating remarkable customer experiences

• The ADPLAN framework

• Building a powerful brand portfolio Participants network with industry peers from around the world and collaborate on a group project that they present on the final day of the program. Sharpen your marketing expertise at the NACS Marketing Leadership Program. The next session takes place July 23-28, 2023, at the Kellogg School of Management, Northwestern University in Evanston, Illinois.

Registration is now open at convenience.org/MLP

This program is endowed by Jack Link’s, Keurig Dr Pepper and NIQ.

The NACS Master of Convenience designation acknowledges the hard work and investment NACS members have made in their personal leadership development. It is awarded to convenience retailers who have attended three or more of the five NACS Executive Education programs. For questions, contact Brandi Mauro, NACS Education Program Manager: bmauro@convenience.org or (703) 518-4223.

10 JUNE 2023 convenience.org UP FRONT NACS NEWS Master1305/Shutterstock

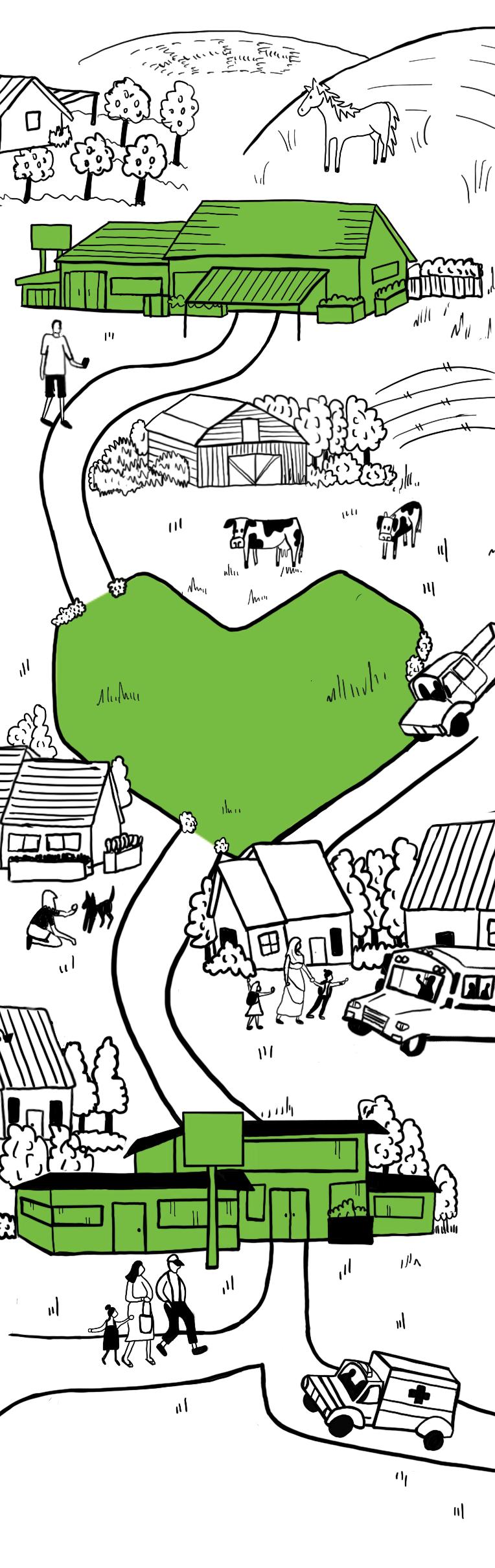

Making Sustainability Convenient: The NACS Sustainability Playbook

Convenience retailers have increasingly developed and incorporated business goals and KPIs into their strategic plans that focus on sustainability. At its core, the concept of sustainability is to meet current needs without compromising the ability of future generations to meet their own needs. For businesses, embracing sustainability presents opportunities to grow sales and increase efficiencies.

The NACS Sustainability Playbook was published just as the world was facing the effects of an economic downturn brought on by the coronavirus pandemic. While this resource provides timeless guidance, it also can help businesses sustain themselves by:

• Reducing costs

• Growing a customer base

• Creating efficiencies

• Fostering a community spirit

Content throughout this resource highlights where retailers can take credit for initiatives they are doing well and identifies opportunities to do more. Every business is on a different point in their sustainability journey, and NACS encourages retailers to use this playbook as a guide for advancing the areas most relevant to their business today and considering how other areas could transform their business in the future. Access this free NACS resource at www.convenience.org/Topics/Sustainability/ NACS-Sustainability-Playbook.

NACS JUNE 2023 11

Ivan

For businesses, embracing sustainability presents opportunities to grow sales and increase efficiencies.”

Bajic/Getty Images

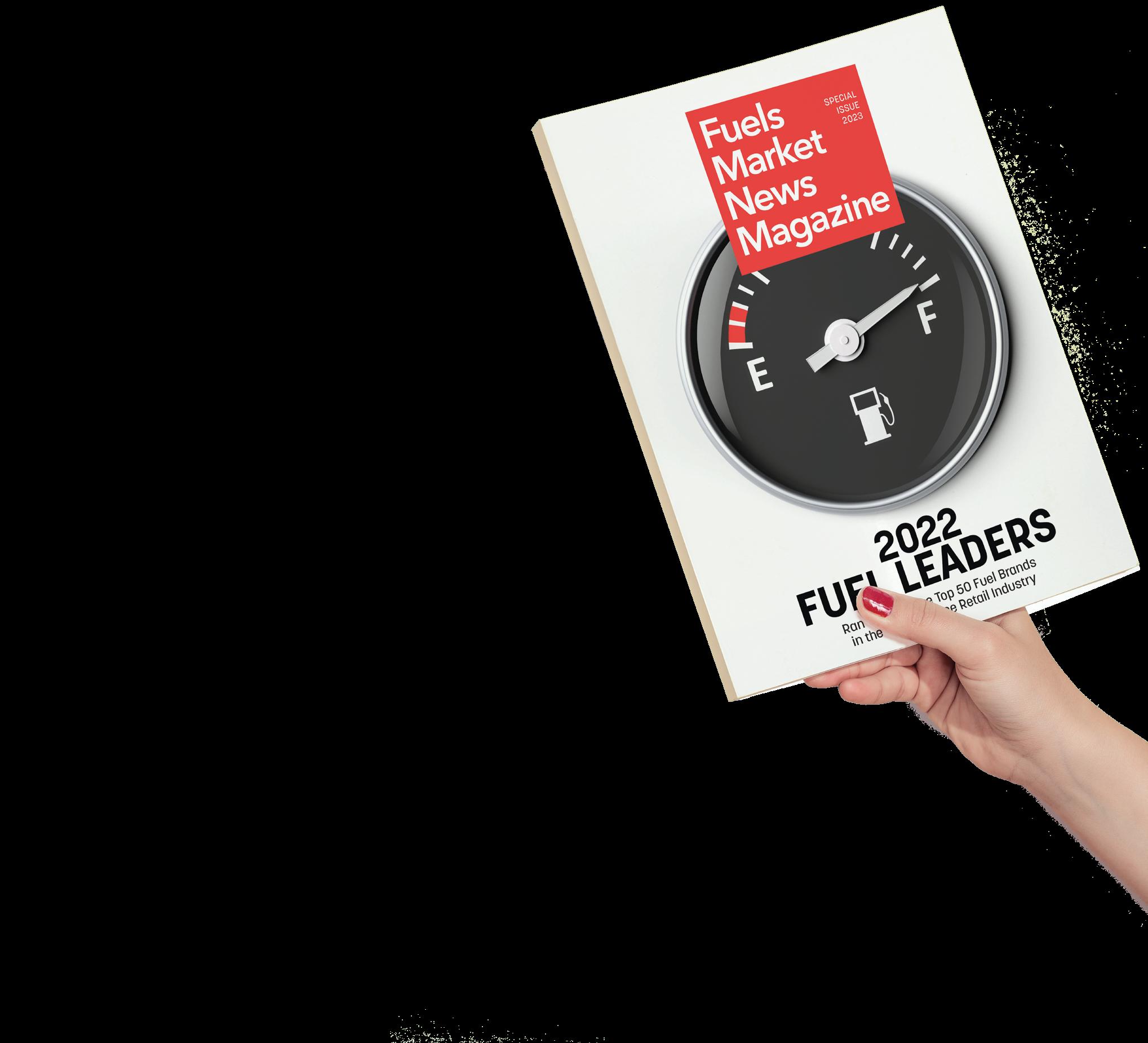

Fuels Market News: 2022 Fuels Leaders Special Issue

Released in June 2023, the 2022 Fuel Leaders supplement published by Fuels Market News and NACS is based on data collected by the Oil Price Information Service (OPIS) and drawn from hundreds of retail operations of all sizes throughout the fuel retailing industry. OPIS, a Dow Jones Company, tracks the performance of over 250 fuel retailers and ranks them in an annual report.

Fuels Market News Magazine 2022 Fuel Leaders provides an analysis of which companies have the greatest efficiency with their consumer and commercial fueling programs.

Benchmark your operations against top performers who, in many cases, can be regional or local competitors. The top 50 leaders featured are a split between companies with more than 100 sites and those with fewer. It’s also notable that the top five tend to be mid-sized operations ranging from 400 sites to almost 1,000. No matter the scale of your business; entrepreneurship, flexibility and a knowledge of local markets—as well as being able to execute efficiently and effectively—is vital.

Calendar of Events

2023

MAY

NACS Convenience Summit Europe

May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

JULY NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

OCTOBER NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

NOVEMBER NACS Innovation Leadership Program at MIT November 05-10 | MIT Sloan School of Management | Cambridge, MA

NACS Women’s Leadership Program at Yale November 12-17, 2023 | Yale School of Management | New Haven, CT

For a full listing of events and information, visit www.convenience.org/events.

12 JUNE 2023 convenience.org UP FRONT NACS NEWS EKIN KIZILKAYA/Getty Images

*Bottle only, 330mL and 500mL sizes **Projected total bottle volume per 2023 sales forecast © 2023 FIJI Water Company LLC. All Rights Reserved. FIJI, EARTH’S FINEST, EARTH’S FINEST WATER, the Trade Dress, and accompanying logos are trademarks of FIJI Water Company LLC or its affiliates. FW230418-12 FIJI Water is committed to sustainability and is proud to have launched its 330mL and 500mL bottles made from 100% recycled plastic* in 2022. This change replaces nearly 70% of FIJI Water’s plastic bottles.** FIJI Water is available direct. Contact your FIJI Water representative at 888.426.3454 or at FIJIWater.com . Earth’s Finest Water is also Earth-Friendly

Member News

RETAILERS

Adam Wright was announced as chief executive officer of Pilot Company. Wright will lead the company’s long-term growth and vision plans. Wright has over two decades of experience as a leader in the energy sector and brings expertise in strategic planning and operational excellence. He joined Berkshire Hathaway in 1996.

Joe Lillo now serves as chief financial officer at Pilot Company. Lillo has been an integral part of the Berkshire Hathaway Energy family of businesses for more than 25 years. He has significant expertise in enhancing financial controls, managing risk and driving responsible value creation.

Nick Hand now serves as loyalty and brand manager at Parker’s, designing and executing marketing campaigns that drive brand engagement, increase loyalty program enrollment and create personalized customer journeys. Hand is the former digital marketing manager for Tijuana Flats Restaurants LLC, where he managed all digital aspects for more than 125 locations across four states.

Vanessa Lehnen joined Parker’s as leader of talent acquisition. In this role, Lehnen is responsible for Parker’s recruiting strategies and oversees the recruiting team. Lehnen serves as liaison and advisor to the company’s leadership team and implements talent acquisition, diversity and inclusion initiatives as well as culture and engagement strategies.

SUPPLIERS

Prairie Farms

Dairy announced Chris Hackman as its chief operating officer. Hackman previously served as SVP of operations. Hackman currently serves on the Missouri State Milk Board Advisory Committee. In 2017, he was inducted into the Missouri Dairy Hall of Honors and received the Missouri Dairy Hall of Honors Leadership Award for his outstanding service to the Missouri dairy industry.

Amy’s Kitchen, an organic and natural food company, has named Goretti Hamlin chief people officer. Hamlin will be responsible for overseeing the company’s human resources strategy, driving employee engagement and growth and the development of its teams. Throughout her 20

years with Amy’s, Hamlin has held HR roles.

Len Baccaro now serves as vice president of business development and sales with Navitas Credit Corp., a subsidiary wholly owned by United Community Banks Inc. Baccaro brings nearly 40 years of industry experience to Navitas and will develop relationships with manufacturers and vendors in multiple retail verticals.

KUDOS

Alimentation Couche-Tard Inc. won the 2023 Gallup Exceptional Workplace Award, which honors the world’s most engaged workplace cultures. It is the second consecutive year the corporation has received the award.

MAPCO, the Tennessee-based convenience store chain, has been named a 2023 Top Workplace USA for the second consecutive year by employee survey and research firm Energage. The list, published annually, is determined entirely by employee feedback. MAPCO has more than 3,000 dedicated team members.

14 JUNE 2023 convenience.org UP FRONT NACS NEWS

Adam Wright

Vanessa Lehnen

Chris Hackman

Goretti Hamlin

Len Baccaro

Joe Lillo

Nick Hand

July 16-21, 2023

The Wharton School

University of Pennsylvania

Endowed by:

July 23-28, 2023

Kellogg School of Management

Northwestern University

Endowed by:

July 30-August 3, 2023

The Dyson School

Cornell University

Endowed by:

November 5-10, 2023

MIT Sloan School of Management

Massachusetts Institute of Technology

Supported by:

November 12-17, 2023

Yale School of Management

Yale University

Endowed by:

NACS JUNE 2023 15

Questions? Contact: Brandi Mauro | NACS Education | Program Manager (703) 518-4223 | bmauro@convenience.org The only convenience industry MBA. Turn your potential into reality. convenience.org/NACSExecEd Join the Masters. Earn the exclusive Master of Convenience designation by completing 3 of our 5 programs. convenience.org/NACSMaster

New Members

NACS welcomes the following companies that joined the association in April 2023. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW RETAIL MEMBERS

Big D Oil Co. Rapid City, SD www.bigdoil.com

Katahdin General Store Millinocket, ME www.katahdingeneral.com

NS Investments Inc. Highland, CA

The Convenience Group LLC Vancouver, WA

Wally’s Houston, TX www.wallys.com

NEW HUNTER CLUB SILVER MEMBERS

Black Buffalo Inc. Chicago, IL www.blackbuffalo.com

Celsius Inc. Boca Raton, FL www.celsius.com

KickBack LLC

dba KickBack Rewards Systems Twin Falls, ID www.kickbacksystems.com

Mashgin Inc. Palo Alto, CA www.mashgin.com

NIQ Chicago, IL www.nielseniq.com

Sweetwood Smokehouse Steamboat Springs, CO www.sweetwood.com

NEW HUNTER CLUB BRONZE MEMBERS

Circana

Chicago, IL www.circana.com

NRC Realty & Capital Advisors LLC Chicago, IL www.nrc.com

Standard AI San Francisco, CA www.standard.ai

Stuzo LLC Philadelphia, PA www.stuzo.com

The Vita Coco Company New York, NY www.vitacoco.com

NEW SUPPLIER MEMBERS

104 Sales Group Pinecrest, FL www.104salesgroup.com

6666 Grit & Glory Marietta, GA www.6666gritandglory.com

AAA Beverage Company Manhattan Beach, CA www.drinkintelligent.com

Accenture Houston, TX www.accenture.com

Acuity Brands Lighting Conyers, GA www.acuitybrands.com

Adventure Furniture dba Fan Creations Cumming, GA www.fan-creations.com

Alamance Foods Burlington, NC www.alamancefoods.com

Baja Vida Snacks Solana Beach, CA www.bajavida.com

BigBrother BV Ede, Netherlands www.bigbrother.nl

Boost Oxygen LLC Milford, CT www.boostoxygen.com

Built Brands LLC American Fork, UT www.built.com

Calbee North America Fairfield, CA www.harvestsnaps.com

CandyASAP Santa Monica, CA www.candyasap.com

Carly’s Natural El Segundo, CA www.carlysnatural.com

Carolina Foods Inc. Charlotte, NC www.carolinafoodsinc.com

Cell Phone Seat Franklin ,TN www.cellphoneseat.com

Celtic Bank Salt Lake City, UT www.celticbank.com

CFS Brands Oklahoma City, OK www.sanjamar.com

Cheers Houston, TX www.cheershealth.com

CigarBros USA Inc. El Cajon, CA www.cigarbros.com

CKE Restaurants Holdings Inc. Franklin, TN www.ckefranchise.com

Cloud Cover Music El Segundo, CA www.cloudcovermusic.com

Corporate Chaplains of America Wake Forest, NC www.chaplain.org

Creative Concepts dba Pucker Powder Irondale, AL www.puckerpowder.com

DDS/Cisaplast USA Elkton, KY www.ddsglassdoors.com

Diageo Beer Company USA Norwalk, CT www.diageo.com

Dualite Sales & Service Inc. Williamsburg, OH www.dualite.com

Duro-Last Saginaw, MI www.duro-last.com

Easy Refrigeration Co. Macon, GA www.easyrefrigeration.com

Elo Touch Solutions Knoxville, TN www.elotouch.com

Empire Imports LLC Ontario, Canada www.eivape.com

EN-R-G Foods LLC (Honey Stinger) Steamboat Springs, CO www.honeystinger.com

ENTOUCH Richardson, TX www.entouchcontrols.com

Essentialware Kirtland, OH www.essentialware.com

Ethel’s Baking Company Saint Clair Shores, MI www.ethels.com

EverGreen USA LLC Union City, NJ www.evergreenusa.co

16 JUNE 2023 convenience.org

NACS NEWS

UP FRONT

UP FRONT NACS NEWS

Evolution Fresh Rancho Cucamonga, CA www.evolutionfresh.com

EVunited Dublin, OH www.evunited.com

Fabian Couture Group Lyndhurst, NJ www.fabiancouturegroup.com

Fifth Generation Inc. Austin, TX www.titosvodka.com

Fine Tune Expense Management Chicago, IL www.finetuneus.com

Fire Brands Chicago, IL www.drinkwarheads.com

FIS Jacksonville, FL www.worldpay.com

FPPF Chemical Company Inc. Buffalo, NY www.fppf.com

Fronto King LLC Brockton, MA www.frontoking.com

Glo Pop Draper, UT www.glopop.com

Global Marketing Concepts LLC Snellville, GA www.gmconceptsllc.com

Golden Dough Foods Winter Park, FL www.goldendoughfoods.com

Golden West Food Group Vernon, CA www.gwfg.com

Gourmet Innovations Pompano Beach, FL www.gicream.com

Grandma Emily Inc. Montreal, QC, Canada www.grandmaemily.com

Great Lakes Cheese Hiram, OH www.greatlakescheese.com

Great Northern Baking Company Minneapolis, MN www.greatnorthernbaking.com

Grinds LLC Westfield, IN www.getgrinds.com

GTI Designs Ronkonkoma, NY www.gtidesigns.com

Harry & David Medford, OR www.harryanddavid.com

Hawaii Volcanic Beverages Princeville, HI www.hawaiivolcanic.com

Hemper Las Vegas, NV www.hemper.co

Hint Inc. San Francisco, CA www.drinkhint.com

HYLA US Holdco Limited Houston, TX www.hyladistribution.com

Jack In The Box Restaurants San Diego, CA www.jackinthebox.com

Jones Dairy Farm Fort Atkinson, WI www.jonesdairyfarm.com

Kayco Inc. Bayonne, NJ www.kayco.com

Land O’ Sun LLC Live Oak, FL www.thundercoffeemilk.com

Lillie’s Q Sauces and Rubs Chicago, IL www.lilliesq.com

Madix Inc. Terrell, TX www.madixinc.com

Marmon Foodservice Technologies Glendale Heights, IL www.cornelius.com

Medterra CBD Irvine, CA www.medterracbd.com

Mile High Cure Temple City, CA www.milehighcure.com

Morris National Inc. Azusa, CA www.morrisnational.com

Moskinto Farmers Branch, TX www.moskintousa.com

NGS Printing Elgin, IL www.ngsprint.com

NTL Brands Ltd. Dallas, TX www.capitolcups.com

Ojeda USA Inc. Spartanburg, SC www.ojedausa.com

Pastel Cartel Pflugerville, TX

Pervine Foods Pittsburgh, PA www.fitcrunchbars.com

Plasticade Des Plaines, IL www.plasticade.com

PriceEasy Houston, TX www.priceeasy.ai

ProAmpac Cincinnati, OH www.proampac.com

PSM LLC dba Mila Wholesale Las Vegas, NV www.milawholesale.com

Red E Charging Detroit, MI www.redecharge.com

Renau Corporation Chatsworth, CA www.renau.com

Resnick Distributors New Brunswick, NJ www.resnickdistributors.com

Rotella’s Italian Bakery Lavista, NE www.rotellasbakery.com

Sahlen Packing Co. Buffalo, NY b2b.sahlen.com

Salsa God New York, NY www.salsagod.com

Sandland Sleep Marina Del Rey, CA www.sandlandsleep.com

Sanzonate Global Inc. Omaha, NE www.sanzonate.com

SMOOD LLC. New York, NY www.mysmood.com

Smoodi Inc. Boston, MA www.getsmoodi.com

Splash Beverage Group Ft. Lauderdale, FL www.splashbeveragegroup.com

Stone Gate Foods Shakopee, MN www.stonegate-foods.com

Structural Concepts Corporation Norton Shores, MI www.structuralconcepts.com

Suzhou Ownace Commercial Equipment Co. LTD Suzhou, Jiangsu, China www.china-rack.com

T Lines Design, Supply & Build Milford, CT

Texas Pete dba Garner Food Co. Winston Salem, NC www.texaspete.com

The Imagine Group Shakopee, MN www.theimaginegroup.com

The PoP Shoppe Stoney Creek, ON, Canada www.thepopshoppe.com

Trefethen Advisors LLC Scottsdale, AZ www.trefethenadvisors.com

Turkey Creek Trading Baltimore, MD www.eturkeycreekco.com

Two Way Radio Gear Inc. Fort Pierce, FL www.twrg.com

United Gaming Atlanta, GA www.unitedgamingllc.com

Ventura Foods Brea, CA www.venturafoods.com

VPR Collection City of Industry, CA www.vprcollection.com

18 JUNE 2023 convenience.org

Parker’s Community Fund Donates Landmark $5 Million Gift

Francis Healthcare and are inspired by the healthcare system’s vision for the future. Parker’s and Roper St. Francis Healthcare share a commitment to the Lowcountry community and to improving lives,” said Greg Parker, founder and CEO of Parker’s and Parker’s Kitchen.

Parker established the Parker’s Community Fund in 2020. Over the years, Parker’s has donated more than $30 million to support charitable causes across coastal Georgia and South Carolina.

“We are deeply grateful to Greg and the Parker’s Community Fund for helping to fuel programs that support our community and caregivers,” said Dr. Jeffrey DiLisi, president and CEO of Roper St. Francis Healthcare. “This transformational gift will help us expand upon the work we are already doing to increase access to care in the Lowcountry.”

The Parker’s Community Fund will establish the Roper St. Francis Foundation Parker’s Community Impact Fund with a $5 million gift. This will support community health initiatives and the caregivers of Roper St. Francis Healthcare across the Charleston, S.C. area.

This Parker’s Community Fund investment—the largest gift in the history of the Roper St. Francis Foundation— was announced at the 17th annual Roper Xavier Society Gala.

“We are truly honored to support the patients and caregivers at Roper St.

The Parker’s Community Impact Fund will support programs at the core of Roper St. Francis Healthcare’s mission. This gift will enhance numerous existing priorities, including: the Greer Transitions Clinic, assistance for uninsured and underinsured patients, debt-free degree programs and career development services for Roper St. Francis Healthcare teammates, youth apprenticeships, on-the-job training for historically marginalized communities and emerging initiatives to help Roper St. Francis Healthcare meet its 2030 vision.

“Ensuring teammate success and serving our patients and community are central to Roper St. Francis Healthcare’s mission of ‘healing all people with compassion, faith and excellence,’” said Stacy L. Waters, president of the Roper St. Francis Foundation. “We are extremely thankful for this incredibly generous gift from the Parker’s Community Fund. This historic and visionary gift will have an extraordinary impact for generations to come.”

20 JUNE 2023 convenience.org

CONVENIENCE CARES

Parker’s founder and CEO Greg Parker with Roper St. Francis Healthcare staff. The center will support patients and caregivers across the South Carolina Lowcountry.

RED, WHITE AND IN THE BLACK.

Create a sales stampede with the new limited edition blend from last year’s fastest-growing moist snuff brand.

2X rewards points on every can. Online rewards points promotion drives even more sales.

Contact your sales rep today!

Only Available June 5th - August 28th

A FO ADE U O E ON Y

CONVENIENCE CARES

In The Community

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories.

Learn more at www.conveniencecares.org

STEWART’S SHOPS SUPPORTS 4-H

1 Stewart’s Shops donated $100,000 to the Saratoga County 4-H for its 4-H Lead the Legacy Campaign to raise funds for a new educational facility at the Saratoga County 4-H Training Center in Ballston Spa, N.Y. The center is used by 4-H youth clubs and for community events and attracts over 12,000 youth each year.

The expansion will include 3,780 square feet of additional classroom space, a dedicated space for STEM, space to host robotics teams, additional restrooms and a community event space.

Stewart’s gives $9 million annually to over 6,000 nonprofit organizations.

RUTTER’S BOOSTS YOUTH SPORTS

2 Rutter’s Children’s Charities brought back its $50,000 Youth Sports Giveaway for 2023. Local youth sports leagues applied online and 100 teams were chosen to receive a $500 donation for use towards uniforms, equipment, travel expenses and other team needs.

“We’re excited to continue our support of local kids and young adults to get involved in sports,” said Chris Hartman, president of Rutter’s Children’s Charities.

“After seeing the impact of the giveaway in 2022, we can’t wait to see the results in 2023!”

HY-VEE AIMS TO DONATE

100 MILLION MEALS

3 Hy-Vee announced an initiative to help fight hunger across its eight-state region. Now through the end of the year, Hy-Vee aims to provide 100 million meals to the Feeding America network of partner food banks across the Midwest. This collaborative campaign brings together Feeding America partner food banks, manufacturers and suppliers, as well as Hy-Vee customers, to help support people across the Midwest who are experiencing food insecurity.

The 100 Million Meals Challenge began March 1 with a register round-up across all Hy-Vee, Dollar Fresh Market and Hy-Vee Fast & Fresh locations.

ENMARKET RAISES

$250,000

4 Savannah, Ga.-based Enmarket raised $250,000 at its fourth-annual Enmarket Charity Classic golf tournament. The funds are to be split evenly between the 200 Club of the Coastal Empire, which serves the families of fallen first responders, and Make-A-Wish Georgia. More than 280 golfers participated in the charity tournament this year.

“This event benefits two remarkable nonprofit organiza-

tions, and Enmarket couldn’t be prouder of our role in helping both the 200 Club and Make-AWish Georgia,” said Matt Clements, Enmarket’s president.

CROSBY’S DONATES TO CHILDREN’S HOSPITAL

5 Crosby’s and Reid Petroleum Corp. supported the Patricia Allen Fund benefiting John R. Oishei Children’s Hospital with a donation of $86,805.13. Throughout the NFL football season, Crosby’s offered multiple ways for customers to assist in supporting pediatric critical care through the following donation opportunities: 17 cents for every slice purchased of Crosby’s fresh-baked The Mafia Pizza, a penny for every gallon of fuel dispensed at designated dispensers for “Gallons for Patricia Allen,” $2 donations directly from customers in pin-up donations and 8% from every custom-designed t-shirt purchased for “Circle the Wagons.” Crosby’s has 87 locations throughout New York and Pennsylvania.

22 JUNE 2023 convenience.org

2 3 4 5 1

Summer Fuels and E15

BY PAIGE ANDERSON

Key Figures 31

The number of states in which E15 is available.

1.02 billion

E15 sales in gallons in 2022, according to Renewable Fuels Association

It’s summertime at last! While most of us are thinking about barbecues, beaches and baseball, you might not know that our motor fuels system undergoes a complex transition between winter and summer. Not only are fuel retailers selling a different blend of gasoline, but fuel retailers are also unable to offer E15 to their customers.

In this month’s Inside Washington, we look at how this supply transition came about and key issues surrounding the ability—or in this case, inability—to sell certain fuels during the summer.

SUMMER BLENDS VERSUS WINTER BLENDS

By June 1, fuel retailers must sell gasoline with a lower volatility than gasoline sold in the winter. This fuel switch is a result of amendments to the Clean Air Act in 1990 enacted by Congress and implemented by EPA.

Summer-grade gasoline has a lower volatility than winter-grade gasoline to limit evaporative emissions that normally increase with warm weather and cause unhealthy ground-level ozone. Volatility is a measure of how easily a liquid will change into a vapor. For

gasoline, it is measured by Reid vapor pressure (RVP). The higher the RVP, the more volatile the gasoline. Some areas of the country require cleaner reformulated gasoline (RFG), which must meet stricter limits on volatility.

In the summertime, gasoline has a greater chance of evaporating from a vehicle’s fuel system, which can produce smog and increase emissions. Thus, refiners produce gasoline blends that have a lower RVP. Winter-blend gasoline has a higher RVP, which means it evaporates more and allows gasoline to ignite more easily to start vehicles during cold temperatures.

For logistical reasons, the transition from winter blends of gasoline to sum-

24 JUNE 2023 convenience.org INSIDE WASHINGTON chutarat sae-khow/Getty Images

NACS advocates for retailers to have the ability to sell E15 year-round.

mer blends of gasoline happens over the course of several months in the spring as temperatures rise. Refiners and terminals must transition to summer blends of fuels by May 1, and fuel retailers have to begin selling these fuels by June 1. This requirement lasts until September 15.

As one can imagine, facilitating lowering the RVP in fuels and handling the logistics of reducing winter-blend gasoline inventories can bring challenges. Hence, EPA does have waiver authority to provide flexibility in times of emergencies to allow winter blends to be extended past June 1 or brought into the fuels market before September 15, such as during hurricanes and other natural disasters. A waiver was also

granted during COVID-19 in 2020 when the economy essentially shut down as the industry was transitioning to summer blends. NACS has worked with EPA and industry groups in advocating for these emergency waivers.

E15

E15, gasoline blended with 10.5% to 15% ethanol, was approved by EPA in 2011 for use in light-duty conventional vehicles of model year 2001 and newer. This came about through a Clean Air Act waver request.

Vehicles prohibited from using E15 include motorcycles, vehicles with heavy-duty engines (e.g., school buses and delivery trucks), off-road vehicles,

NACS JUNE 2023 25

Refiners and terminals must transition to summer blends of fuels by May 1.

engines in off-road equipment (e.g., lawn mowers and chain saws) and cars older than model year 2001.

There is no mandate or requirement to sell E15, but many fuel retailers are selling E15 due to consumer demand and the ability to reduce costs of fuel for their customers. E15 is available in 31 states and at over 2,500 stations. As expected, the Midwestern states of Minnesota, Wisconsin and Iowa lead the way in selling the most E15. However, Texas, Florida, Pennsylvania and North Carolina fall right behind in the top ten states selling E15.

One challenge for fuel retailers who sell E15 or are considering selling E15 is that retailers are unable to sell E15 in the summer unless a one-pound RVP waiver is granted. While EPA originally approved year-round sales of E15 in 2019, a number of legal and regulatory battles have prevented this from happening. Currently, EPA must issue emergency fuel waivers each summer on an ad hoc basis, which it did last summer. NACS, working with other stakeholders, sent a letter in April to EPA, asking for such a waiver to allow for the sale of E15 this summer. The waiver was authorized later that month.

Unsustainable Swipe Fee Increases

BY ANNA READY BLOM

There was a seismic shift towards payment card usage during the COVID-19 pandemic. Yet, while more and more people are using plastic, nothing has changed in how those cards are processed.

Our industry has seen a dramatic increase in swipe fees. The convenience store industry’s swipe fees are up more than 81 percent since 2020. Last year alone, they were up 44 percent from 2021. How do you explain these types of increases? Since credit card swipe fees are a percentage of the total transaction cost, they multiply with every cent of inflation. On top of that, Visa and Mastercard raised fees in April 2022, even after a bipartisan group of lawmakers asked them not to move forward with the increases.

The reality is that these fees never come down because they aren’t subject to normal market pressures.

Visa and Mastercard operate as a duopoly, controlling 83 percent of the credit card market. They set the swipe fees that their issuing banks charge retailers. This would be like NACS setting fuel prices for our retail members. The difference is that if we did it, the leaders at NACS would be wearing orange jumpsuits, while Visa and Mastercard have been getting away with operating as a cartel. This pricing scheme is very lucrative for them. Last year, Visa’s net profit margin was more than 60 percent and Mastercard’s was more than 50 percent. In

fact, Visa’s leadership acknowledged on two separate earnings calls last year that they benefit from the current inflationary environment.

It’s time for Visa and Mastercard to have to compete, which is why NACS has been advocating for Congress to pass the Credit Card Competition Act (CCCA). This legislation would require there be a second network routing option on credit cards, similar to what happens on debit cards today. It could no longer be just Visa or just Mastercard as the only network option. The biggest credit card issuers would have to offer retailers a second, more competitive network. Retailers would then get to choose which network to route the transaction over. NACS estimates this legislation would save the convenience store industry more than $1 billion annually—about $7,000 per store per year.

Convenience retailers compete every day. It’s time for the credit card industry to do the same. Take action today by visiting www.convenience. org/takeaction.

Anna Ready Blom is NACS director of government relations. She can be reached at ablom@ convenience.org.

26 JUNE 2023 convenience.org INSIDE WASHINGTON Talaj/Getty Images

Minnesota, Wisconsin and Iowa lead the way in selling the most E15.

Be the destination for elevated snacking.

of shoppers identify as being health conscious.

Today’s convenience store consumers want healthier options when they’re grabbing something on the go. See how

KeHE raises the standard for convenience foods.

We’re a nationwide distributor with the broadest selection of natural & organic, specialty, and fresh products anywhere.

KeHE can make you the destination.

Lack of long-term certainty and the inability to sell E15 year-round continues to be an obstacle for fuel retailers. Legislation was introduced last year and reintroduced in March of this year to help resolve these issues.

The Consumer and Fuel Retailer Choice Act of 2023 was introduced in the Senate (S. 785) by Senators Deb Fischer (R-NE) and Amy Klobuchar (D-MN) and in the House (H.R. 1608) by Representatives Adrian Smith (R-NE) and Angie Craig (D-MN). The bill would enable year-round, nationwide sale of ethanol blends higher than 10% and permanently extend the RVP volatility waiver to ethanol blends above 10%. It also ensures uniformity and prevents a patchwork of regulations from disrupting the national fuel supply chain by nullifying pending governors’ petitions to remove the one-pound RVP waiver. NACS supports this legislation and is working with the bill sponsors and other industry groups to move this legislation forward.

ONE VOICE

This month, NACS talks to Sharif Jamal, Director of Brand Development Chestnut Market

What role in the community do you think convenience stores should play?

Convenience stores play an active role in communities by providing a safe and welcoming environment with easy access to essential goods and services, particularly for people who may not have easy access to larger supermarkets or specialty stores. Convenience stores also provide local employment opportunities, and most stores work with local charities and schools to give back.

What does NACS political engagement mean to you and what benefits have you experienced from being politically engaged?

Through NACS political engagement, members have had the opportunity to meet and educate policymakers on Capitol Hill on the issues and concerns the c-store industry faces. It has been a great experience to help advocate for my team and develop relationships with people in our industry who are working towards the same goals at both state and federal levels.

What federal legislative or regulatory issues keep you up at night?

The issue on my mind lately is the Credit Card Competition Act that NACS has been trying to get reintroduced and passed into law. Since credit card swipe fees are our second largest expense (after labor), and they continue to increase year after year, it is an issue that all retailers should care about.

What c-store product could you not live without?

A fresh cup of Lotta Java Coffee at Chestnut Market.

28 JUNE 2023 convenience.org INSIDE WASHINGTON

Paige Anderson is NACS director of government relations. She can be reached at panderson@ convenience.org.

NACS supports this legislation and is working with the bill sponsors.

INSIDE WASHINGTON

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac. NACSPAC donors who made contributions in April 2023 are:

George Abdoo Imperial Trading Company

Toby Awalt Mashgin Inc.

Wesley Ayers

Tropicana Brands Group

Dave Baker Standard AI

Chad Beck Core-Mark International

John Benson AlixPartners LLP

Suzanne Bowers Clear Demand Inc.

Gary Braaten CHS Inc.

Brett Brobston

Altria Group Distribution Company

Lucas Brown Altria Group Distribution Company

Bill Bustin Rovertown

Kathleen Byrd Home Market Foods Inc.

Satish Chander K&G Petroleum LLC

David Charles, Jr. Cash Depot

Tom Christoffel

iSEE Store Innovations LLC

Sean Colman

The Boston Beer Company

Jamie Cousart

The Coca-Cola Company

Sheryl Coyne-Batson

Techniche

Matt Domingo Reynolds

Duane Duppong

The Hub Convenience Stores Inc.

Fouad El-Nemr

Nouria Energy Corp.

Tony El-Nemr

Nouria Energy Corp.

Jodi Gehrts

Tropicana Brands Group

Ramona Giderof Anheuser-Busch InBev

Grace Gilbert Shiftsmart

Paul Goldean Pace-O-Matic

Robert B. Griffith Golden Pantry Food Stores Inc.

Lisa Ham Yesway

Krister Hampton Altria Group Distribution Company

Jeffry Harrison Rovertown

Mike Headly AlixPartners LLP

Bradley Heetland Advantage Solutions

John Hill Utah Petroleum Marketers Association

Benjamin Hoffmeyer TXB Stores

Brandon Hofmann The Parker Companies

Jack Hogan Mashgin Inc.

Cas Holloway Shiftsmart

Kurt Holtschlag Stuzo LLC

Kendall Huckabee

The Coca-Cola Company

James Hughes Krispy Krunchy Foods LLC

Tommy Hughes CORD Financial Services

Jennie Jones Schaerer

Gaurav Kikani Shiftsmart

Scott Klein Cash Depot

Craig Koehler Anheuser-Busch InBev

Monica Lewis Altria Group Distribution Company

Jerry Marfut Pace-O-Matic

Kevin Martello Keurig Dr Pepper

Brandon Mayer The Hershey Company

Kyle McKeen TruAge

Lonnie McQuirter 36 Lyn Refuel Station

Sahil Mehta Shiftsmart

Drew Mize PDI Technologies

Trevor Moyle Moyle Petroleum Company

Pawan Nanda K&G Petroleum LLC

Kelly Naudain Altria Group Distribution Company

Jason Noll Capital One Bank

Erik Ogren Patron Points

Emily Paege Stuzo LLC

Corey Paluch Moyle Petroleum Company

Matt Pascal Pace-O-Matic

Jigar Patel SAASOA

Giulio Petraccaro Schaerer

Alex Plant Standard AI

Ashley Pridon Ecolab

Gabriel Purvis

The Convenience Group LLC

Michael Quinn Capital One Bank

Ryan Razowsky Rmarts LLC

Gina Reinhardt Pace-O-Matic

Robert Rivera

The Coca-Cola Company

Justin Robinson Hutchinson Oil Co. Inc.

Lisa Rountree TruAge

Joseph Sheetz Sheetz Inc.

Scott Smith

The Parker Companies

Megan Sprenger

Anheuser-Busch InBev

Saurabh Swarup Liquid Barcodes Inc.

Ali Van Dalen Kwik Trip Inc.

Dustin Viktorin Crow Holdings

Marvin Vines

The Coca-Cola Company

Scott Walters Rovertown

Julie Whittington Hunt Brothers Pizza

Casey Williams

Tropicana Brands Group

Elijah Wilson

VIBEZ Sunglasses Inc.

Marie Wise

Imperial Trading Company

Kristen Wuerth

Altria Group Distribution Company

Jeffrey Ziegler

Midwest Petroleum Company

30 JUNE 2023 convenience.org

Name of company: EddieWorld

Year founded: 2018

stores:

The Road Well-Traveled

EddieWorld caters to those coming and going between Los Angeles and Las Vegas.

BY SARAH HAMAKER

Alex Ringle picked a busy road for EddieWorld, which he said is the largest gas station in California. “It’s along Highway 15 near Yermo, California, nearly dead halfway between Los Angeles and Las Vegas,” he said. “No one gave us any confidence we’d make it, but obviously it’s worked out.”

EddieWorld’s reputation as the place to stop on the way to Vegas or Los Angeles continues to grow. “It’s very strategically placed to be a natural stopping point whether you’re coming or going,” he said.

32 JUNE 2023 convenience.org IDEAS 2 GO

# of

1 Website: eddieworld.com

REFRESHMENT RUNS IN THE FAMILY ©2023 The Coca-Cola Company We are Coca-Cola and so much more, o ering the preferred categories and leading brands to drive your sales and profit growth. Contact your Coca-Cola representative, call +1-800-241-COKE, or visit www.coca-colacompany.com

GROWING THE WORLD

The idea for EddieWorld grew out of the Death Valley Nut and Candy Company, which Ringle’s father opened in 2001 in Beatty, Nevada, along Highway 95, about five miles from Death Valley. “I managed it for two years, learning all about the business,” Ringle said. “I really loved the concept and how he made it so unique for a gas station. I figured if his concept did so well along a less-traveled highway, then we stood to do even better along a much busier interstate.”

From the beginning, Ringle had his eye on the future. “I knew in my lifetime, the internal combustion engine vehicle would be overtaken by the electric vehicle, so we wanted to make it convenient to stop and charge your EV,” he said. “The normal gas station doesn’t work for the EV charging crowd—you need a lot more things and amenities to appeal to EV drivers because charging takes longer than filling a gas tank.”

To that end, he developed a facility with snacks, coffee, restaurant-quality food and plenty of private-label products to entice customers to stay for a few minutes or half an hour. “This works for passenger cars and EVs—we wanted to straddle both worlds with plenty of reasons to stop,” Ringle said. He even installed solar panels over the entire fueling station canopy to reduce the store’s carbon footprint.

Inside the store, three EddieWorldbranded restaurant concepts tempt customers to fill up their bellies. One offers sandwiches on fresh-baked bread and salads; another has grilled food, such as burgers, hot dogs, hand-battered chicken tenders, french fries and tacos; and a third serves custom pizzas in an oven which bakes the pies in 90 seconds.

“We also make our own ice cream on-site and our own gourmet popcorn,” he said. “We wanted everything to be as fresh as possible and all is branded EddieWorld.”

The private label extends to the store’s wide selection of snacks and treats. “The packaged goods are our bread and butter—we bag everything on-site in one-pound bags and it’s a huge portion of our retail operation,” Ringle said. Candy, nuts, chocolate, dried fruit and sugar-free candy are popular with customers. For the kids, EddieWorld has a wide selection of plush animals, as well as travel games, activity books and art kits.

In addition to the private-label goods, the store stocks 30 different kinds of Jedidiah’s Jerky. “There’s a huge demand for our jerky because it’s a popular travel snack,” he said. There’s even an extensive hot sauce collection, a Mexican candy section and items for dogs. “We’re trying to cover all the bases now,” he said.

CUSTOMER SATISFACTION

For Ringle, the best part of operating EddieWorld is seeing the expression on a customer’s face. “You can always tell when someone walks in for the first time—the look on their faces as they see how different this is from your traditional gas station is amazing,” he said. “It’s almost as if they don’t know where to look because it’s so bright and colorful. We have a lot going on here.”

Part of EddieWorld’s charm is its employees. “I lean on senior staff members to train the new employees—it’s a huge operation and the only way to understand it is time,” he said. “It’s important that

BRIGHT IDEAS

To Alex Ringle, owner of EddieWorld, the best advertisement is clean restrooms. “We have a high emphasis on our bathrooms,” from the design to the cleanliness, he said. The store has two sets of men’s and women’s restrooms, each with floor-to-ceiling enclosed stalls.

Having two men’s and two women’s bathrooms allows the staff to close one of each during slower traffic times for thorough cleanings.

our new workers are trained by people who’ve been around the longest because they get it, they understand the unique things about our operation,” Ringle said. “It takes time to learn and adapt and execute that model because we’re a total departure from the traditional.”

Ultimately, EddieWorld was created outside of the box. “We figured out something no one was doing and decided to provide that experience,” Ringle said. “People like these experiences, and in the long run, you’ll go far if you can deliver that to your customers.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

34 JUNE 2023 convenience.org IDEAS 2 GO

For trade purposes only. ©2023 Swedish Match North Europe AB TOBACCO PRODUCTORDER RECEIVED A MODIFIEDRISK or contact your Swedish Match Rep to learn more. Call 800-367-3677 IF YOU STOCK IT, IF YOU STOCK THEY WILL COME THIS IS THE PREMIUM PRODUCT THAT CREATES LOYAL TH I S I S TH E P R E M I U M P RO D U CT TH AT C R E ATE S LOYA L CUSTOMERS. LOYAL CUSTOMERS WHO DRIVE PROFITS. #1 in penny profit in snus The World’s #1 Selling Snus First to Receive a Modified Risk t to R ive odified Tobacco Product Order

The Elephant in the Room

Inside sales held on in 2022 despite facing a high inflationary environment and record gasoline prices.

NACS Vice President of Research & Education Lori Buss Stillman stressed during her presentation at the NACS State of the Industry Summit in Dallas that all the information and insights at the event serve a bottom-line purpose: “We’re here to learn from the past to plan for the future.”

“This is not about rehashing what has already happened—it’s about recognizing the conditions that impacted our businesses and learning how to take advantages of the opportunities those conditions created,” said Stillman, noting that the basic building block of our industry is the transaction.

“Whether it’s inside your stores or at the forecourt, everything you do should be about growing transaction counts and growing basket value,” she said, adding, “Leave no stone unturned when looking for incremental transactions.”

INFLATION’S BROAD IMPACT

Inflation peaked in June 2022 at 9.1% according to the Consumer Price Index (CPI) and ended the year at an average of 8%. Inflation sits at 5.0% for the 12 months ending in March 2023, which is good news, but don’t look for the 2% interest rates from the last decade to return anytime soon.

“Although inflation has been moderating in recent months, the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy,” Jerome Powell, chairman of the Federal Reserve, told the Senate Banking Committee in March.

36 JUNE 2023 convenience.org

60% saying they are cutting back or plan to cut back on discretionary spending due to rising financial pressures, according to AlixPartners. Those reduced purchases will come from retail, restaurants, travel, grocery spending and leisure activities.

The rise in interest rates has created new headwinds for businesses. A Bloomberg survey found that 48% of executives said that their company has been severely or very impacted by interest rates and the inflationary environment. No doubt this one-ton elephant is still sitting in the room—or your store—and putting spending pressure on your business and

But convenience retailers have demonstrated throughout history that ours is a resilient industry. At the NACS State of the Industry Summit, more than 650 stakeholders heard how industry sales—even when adjusted for inflation—proved that tough economic times are opportunities to deliver what customers want, when they want it and where they are.

INFLATION’S IMPACT ON CONVENIENCE RETAIL

When inflation was beginning to increase in 2021, NACS created a model to calculate a Convenience Consumer Price Index that contains the categories that make up more than 85% of merchandise sales. The curve began to accelerate in August 2021 and grew steeper, reaching a 9.1% inflation rate by December 2022.

Unadjusted merchandise sales saw outstanding sales growth from January 2021 through the end of 2022—some months saw merchandise sales improve more than 10% year over year. However, when adjusted for inflation, merchandise sales tell another story. Merchandise sales had a negative performance in 11 months over the past two years after pricing adjustments. This gap grew considerably wider during Q4 of 2022, capping off the year with 9+ point gap in both Q3 and Q4.

NACS JUNE 2023 37

AnaitSmi and Siberian Art/Shutterstock

Growth for Different Retail

Source: U.S. Department of Commerce, 12 Months Ending December 2022

for Different

In 2021, the convenience CPI model estimated that the average annual inflation was 3.3%, and this number increased to 7.9% in 2022. “This [7.9%] number is your benchmark for merchandise—if your company was over 7.9% growth in merchandise that’s solid growth that’s likely marginal unit or mix growth,” she said.

“The reality is that after adjusting for inflation, merchandise sales were flat to down for most months throughout 2022,” said Stillman.

Inflation also had a significant impact on foodservice.

The gaps between unadjusted and adjusted foodservice sales were larger than what the industry experienced with merchandise. Inflation also moved faster for foodservice and reached +10.3% in Q4 of 2022.

In 2021, the average annual foodservice convenience CPI saw an increase of 5.5%, and with a full year of inflation under the industry’s belt, the average foodservice CPI increase for 2022 was 9.7%. “If your company’s foodservice sales growth was 9.7% or better, there was likely some unit or mix growth,” said Stillman.

Other retail channels also grew sales quickly due to the inflationary environment. The exception was drug stores, which registered a modest 2.7% sales growth, well below

inflation. The channel has closed 1,000 sites for a 2.5% decrease in total store count over two years.

FUEL PRICES UP, VOLUMES FLAT

The story of retail fueling in 2022 came down to pricing. “Essentially all sales increases in terms of dollars were price driven,” said Stillman, adding that volatility in crude oil sent gasoline prices soaring.

Estimated industry fuel sales increased 41.2% reaching $603.2 billion, largely as a result of higher gasoline prices, which increased 33.1% to an average of $4.06 in 2022—up from an average of $3.05 in 2021.

TRANSACTIONS HOLD THEIR GROUND

The good news around transaction counts is that they’re on the right path. Total industry transactions had declined every year from 2016 until 2021, a year that experienced a COVID-19 rebound.

In 2022, inside transaction count growth resumed after a general trend of decline since 2016. “Thinking back to last year’s SOI Summit, the goal was to get back to 2019 levels on inside transactions,” said Stillman, adding that total transactions in 2022 were outpacing 2020 and 2021 during most months, which is great news for the industry.

38 JUNE 2023 convenience.org

Channels +9.0% Convenience Inside 8.3% Grocery 16.7% Restaurants 2.7% Drug 19.3% Liquor 9.8% Dollar

Sales

Growth

Channels +1.5% Convenience (9.0)% Restaurants (1.0)% Drug (0.7)% Grocery +4.4% Dollar (9.4)%* Gas Kiosks +2.8%* Liquor +5.7%* Smoke Shop *504 Kiosk Locations Reclassified to Traditional Convenience Source: NIQ YE2022 Retail Channel Census

Store

Retail

If your company’s foodservice sales growth was 9.7% or better, there was likely some unit or mix growth.”

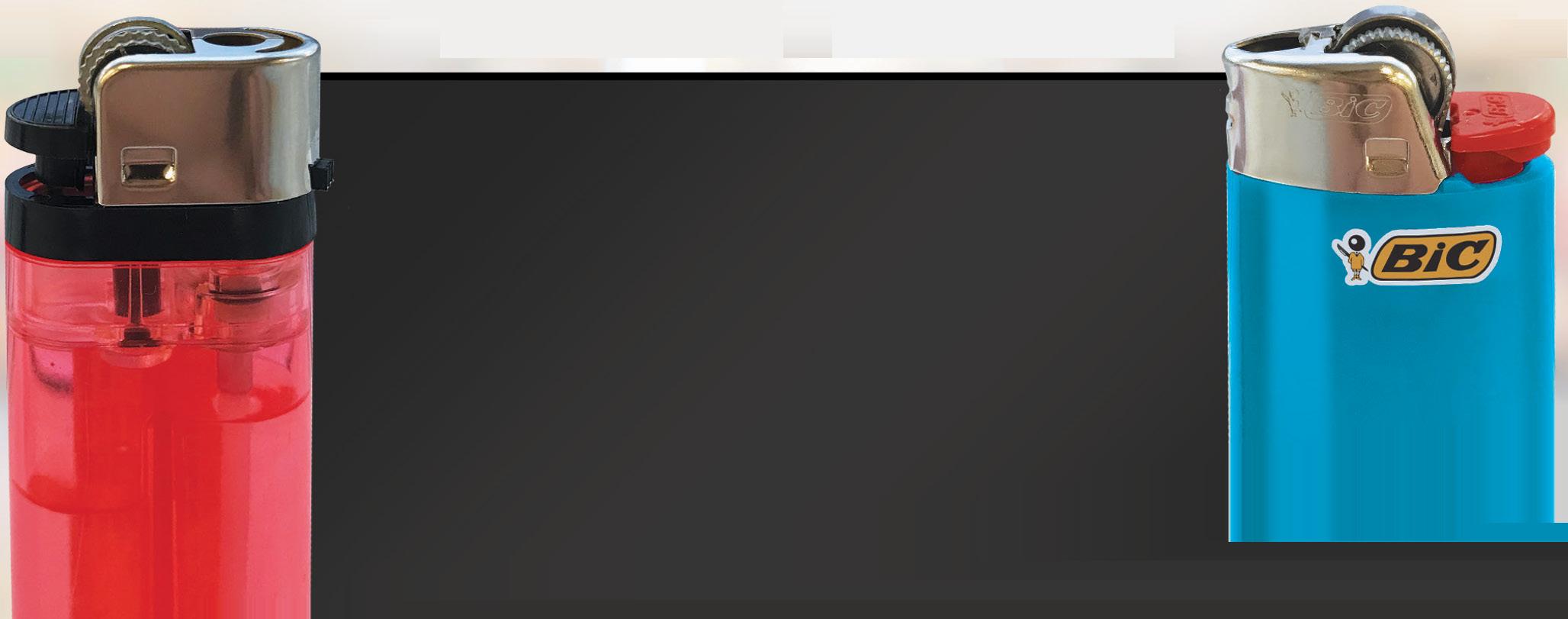

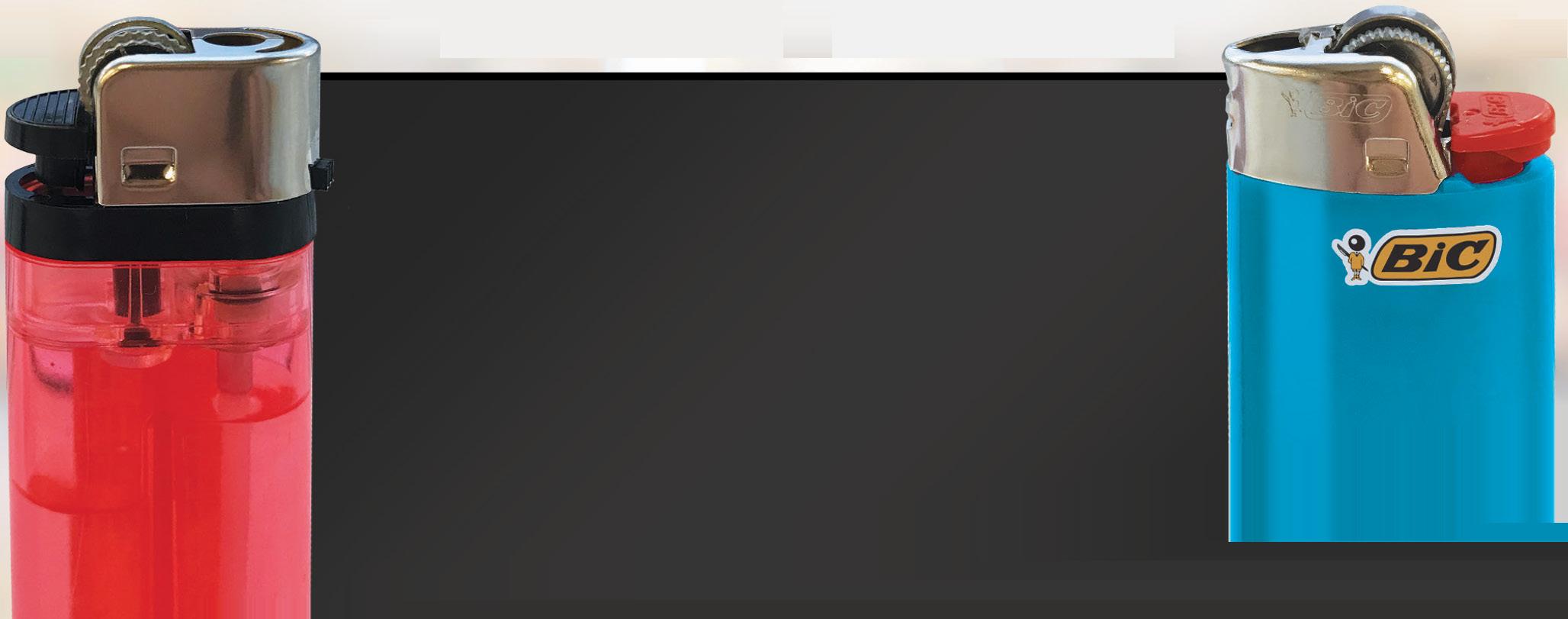

Consistent flame height Resistance to elevated temperature Drop-resistant from a height of 5 feet Flame extinguishes within 2 seconds Safe volumetric displacement * ARE YOU PLAYING WITH FIRE? SELLING GENERIC LIGHTERS COULD PUT YOU AT RISK. Not a BIC® Lighter e Longest-Lasting Lighter merica’s Safest and © 2023 BIC USA Inc., Shelton, CT 06484 *vs. fixed-flame, non-refillable lighters of comparable size BIC.® SAFETY YOU CAN COUNT ON. TO ORDER, VISIT NEWREQUEST.BIC.COM Did you know when it comes to lighters, most safety standards are voluntary? At BI At BIC, we never compromise on quality. In fact, every lighter we sell undergoes more than 50 quality checks. That’s why BIC® Maxi Classic® is known as America’s safest and longest-lasting lighter.*

“We should all go back and celebrate with our frontline employees. This is a big win for everyone in this room,” Stillman said. Basket value, a combination of inside merchandise and foodservice, held steady in 2021 but started to show signs of inflationary pressure by the end of the year. In 2022, however, it was off to the races as prices increased and basket value followed, even as transaction counts increased.

YoY Change Basket Value

Source: NACS CSX Convenience Benchmarking Database

Inside store operating profit (excluding gross profits, expenses and card fees related to the fuel component of a site) declined, as direct store operating expenses (DSOE) grew at a faster rate than inside gross profit dollars.

In 2022, average inside operating profit declined by 50% to $111 per store, per month. This also means that the $7.52 average basket value experienced a 34-cent loss of inside store operating profit.

“This metric can be unforgiving,” said Stillman, adding that operating expenses are the main difference between 2021 and 2022. “If operating expenses had held flat, basket value in 2022 would have broken even.”

HIGHER WAGES DON’T IMPROVE TURNOVER

Finding a way to control labor costs is a top concern for convenience retailers, and 2022 proved to be another challenging year. Unemployment remained at historic lows (3.3% in December 2022) and thousands of jobs were unfilled.

Although non-manager turnover shrunk by a little less than a point, manager turnover trended the opposite way, increasing by 2.5 points to 34.9%. “They’re being actively recruited because other operators know that if you can be a good convenience store manager, there’s not a job that they’re not going to do well,” Stillman said. “Really pay attention to your managers.”

Compared to other retail channels, convenience retailers consistently outspend to attract and retain employees, with total compensation (wages and benefits) increasing at a much higher rate.

Amid this trend of outspending to attract and retain employees, NACS data shows that almost 8 of 10 separations were voluntary, which reflects culture in a company’s offices and its stores.

NACS CSX Convenience Benchmarking Database

40 JUNE 2023 convenience.org Transaction YoY

Per Store Month 2021 2022 %Chg Inside Transactions 28,497 29,306 2.8% Pump Transactions 9,749 10.616 8.9% Total Transactions 38,246 39,922 3.6% Source:

Convenience Benchmarking

Performance

NACS CSX

Database

Per Store Month 2021 2022 %Chg Inside Sales $204,399 $220,491 7.9% Inside Transactions 28,497 29,306 2.8% Basket Value Avg. $7.17 $7.52 4.9%

Metric (per store, per month) 2021 2022 %Chg Basket Value $7.17 $220,491 7.9% Net Cost Of Good Sold $4.64 29,306 2.8% Inside GP$ + Other Income per Transaction $2.80 $3.02 7.9% Net DSOE + Facility Expense per Transaction $3.02 $3.36 11.3% Inside Operating Profit/Transaction (22) cents (34) cents (12) cents

Source:

Lori Buss Stillman

Help responsibly connect & engage with your ATCs 21+ in the digital environment

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

Inside Operating Profit by Decile

Bottom Second Third Fourth Fifth Sixth Seventh Eigth Ninth Top

Source: NACS CSX Convenience Benchmarking Database

“Convenience retailers that have a reputation for being great places to work also have an edge when it comes to workplace culture. These companies are able to keep their turnover rates well below 100%, even in this environment,” said Stillman.

TOP PERFORMERS ENJOY THE APEX

Looking at data from top industry performers is a great way for other retailers to see how the best in the business are faring. NACS generates this by ranking all the companies that submit SOI survey data by their calculated store operating profit (minus cost of goods, facility expenses and DSOE; including fuel gross profit dollars and expenses from selling fuel).

When fuel gross profits are stripped from the store operating profit equation, only the best operators profit.

“If you really want to compare to the best of the best, this is it. Not only is there a $56,000 monthly swing of inside store operating profit between the top and bottom deciles, the top decile has a 3.2 times multiple for inside store operating profit versus the next best decile,” said Stillman.

The rubber really hits the road for top performers on store profitability when it comes to foodservice. These companies sold 5.5 times the bottom on foodservice and conducted 1.4 times the total transactions. Top performers also generated 6.9 times foodservice gross profit dollars versus the bottom.

“Of course, more complex operations have more services, and more food prep will result in higher wages,” said Stillman.

The top performers enjoyed much lower turnover, but wages and benefits were a considerably larger drain on gross profit dollars—these retailers pay almost $6 per hour more in total compensation than companies at the bottom, which are about 30% higher.

42 JUNE 2023 convenience.org

-32,337 -18,762 -11,874 -8,951 -6,249 -3,022 -1.022 2,433 7,561 24,024 3.2X

Metric Top Decile Bottom Decile Multiple Employee Turnover 84.0% 135.9% (51.9) pts Manager Turnover 22.4% 37.7% (15.3) pts Wages Benefits % of GP$ 31.1% 23.7% 7.4 pts Inside Transactions 48,383 31,944 1.5X In-Store Sales per Labor Hour $119.89 $84.75 1.4X In-Store GPS per Labor Hour $48.61 $27.46 1.8X Labor Cost Per Hour 38,246 $19.68 1.3X

Source: NACS CSX Convenience Benchmarking Database

Inside Sales Exceed Expectations

Convenience stores are the destination for food, snacks and beverages.

BY CHRISSY BLASINSKY

Amid pricing and inflationary pressures, U.S. convenience stores had record in-store sales of $302.9 billion in 2022, according to NACS State of the Industry data.

“No surprise but we continue to be a destination for food and drinks, ,” said Annie Gauthier, CFO/co-CEO of St. Romain Oil Company and Y-Not Stop, based in Mansura, Louisiana.

Gauthier shared newly released State of the Industry data that focused on the top six merchandise categories—cigarettes, packaged beverages, beer, OTP, salty snacks, candy—and the five foodservice categories of prepared food, commissary and hot, cold and frozen dispensed beverages, that make up nearly 90% of inside sales and gross margin.

44 JUNE 2023 convenience.org

Metric Per Store, Per Month National Total All Sales $781,143 Fuel Sales $593,599 Fuel Gallons 144,728 Avg. Selling Price $4.02 Inside Sales $220,491 Foodservice Sales $56,491 Merchandise Sales $164,234 Merchandise Less Cigarettes $121,039 Cigarettes $43,195 Transactions 39,922 3.6% Source: NACS CSX Convenience Benchmarking Database

Unit price for top six merchandise categories ranked by year-over-year change

Inside Sales and Gross Margin

2022

NACS JUNE 2023 45

Average U.S. Convenience Price 2021 Average U.S. Convenience Price 2022 YoY Change Candy $1.84 $2.09 13.9% Salty snacks $2.14 $2.41 12.5% Packaged beverages $2.20 $2.41 9.2% OTP $4.16 $4.37 5.1% Cigarettes $8.08 $8.45 4.6% Beer $6.07 $6.32 4.1%

86.7% 5.0% 5.2% 3.9% 6.2% 21.0% 9.3% 36.1% Inside Gross Margin Contribution 13.4% Inside Sales Contribution 11.8% 3.5% 4.6% 7.0% 7.5% 17.2% 22.8% 25.6%

Source: NACS CSX Convenience Benchmarking Database

All Other Categories Candy Salty Snacks Beer Other Tobacco Products Packaged Beverages Cigarettes Foodservice Categories

Contribution,

Ron Dale/Shutterstock

The Top 10 Merchandise Categories Delivered Impressive Sales Growth, Impacted by Pricing

*Indicates sales growth outpacing inflation

Source: NACS CSX Convenience Benchmarking Database

Gross Profit Growth Outpaced Sales Growth in Nearly Every Merchandise Category

Checkmark indicates that GP$ growth is outpacing that of sales.

Source: NACS CSX Convenience Benchmarking Database

Looking at the per store, per month sales for the top 10 merchandise categories, all but cigarettes and general merchandise had increased sales year over year, said Gauthier. Packaged beverages, OTP, salty snacks, candy and packaged sweet snacks all had double-digit sales growth year over year.

Two categories saw sales drop. Cigarettes, which had experienced two years of sales growth, retracted in 2022. For general

merchandise, the sales decrease could be caused by lower consumer demand for items like gloves, hand sanitizer and masks—items that were in high demand over the peak pandemic years.

When looking at the top 10 through the lens of gross profit contribution, cigarettes and packaged beverages trade the No. 1 and No. 2 spots since packaged beverages is a higher margin category.

46 JUNE 2023 convenience.org