C-STORE COUNT

Where the industry stands in 2025

FOODSERVICE FINDINGS

Survey reveals consumer cravings

C-STORE COUNT

Where the industry stands in 2025

FOODSERVICE FINDINGS

Survey reveals consumer cravings

share how to turn up the

C-STORE COUNT

Where the industry stands in 2025

FOODSERVICE FINDINGS

Survey reveals consumer cravings

Top industry advocates share how to turn up the volume on your story.

The State of Eating in America NACS surveyed how and why Americans are eating on the go— and what it means for the convenience industry.

FEATURES

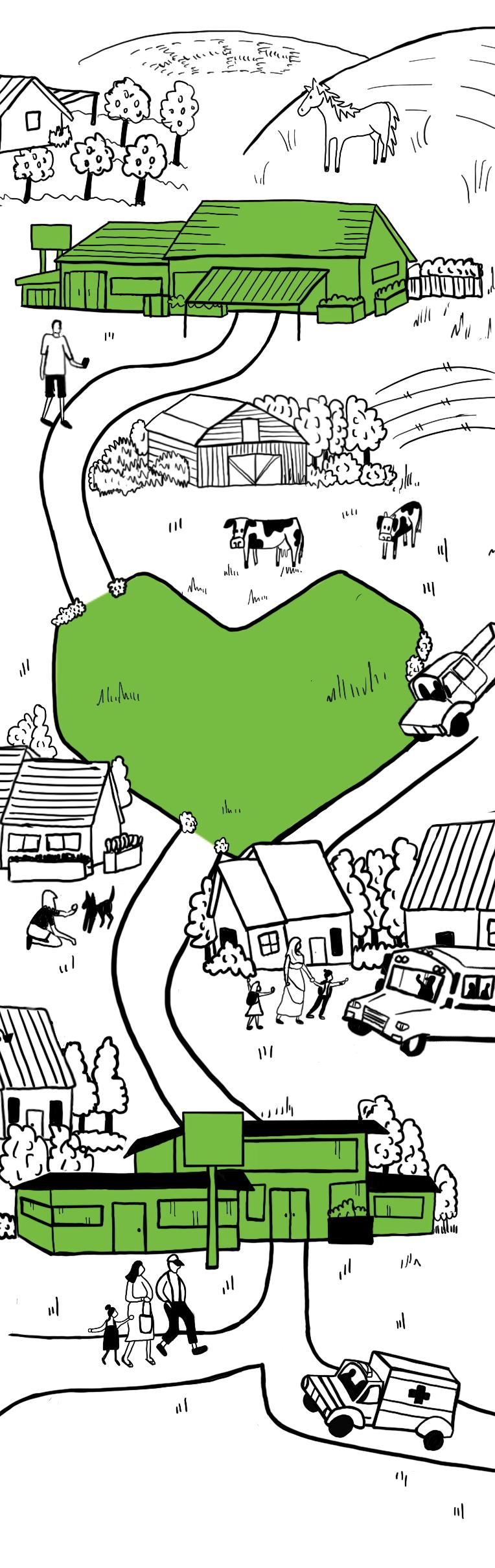

30 U.S. Convenience Store Count Stands at 152,255 Stores

This was the first decline in two years.

36 Advocacy in Action Industry champions share their advice for using your voice to drive positive change.

STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs

46 Telling the C-Store Story

Advocacy is about a lot more than lobbying your elected leaders—it means talking to your chiropractor, too.

52 From A to V and In Between

State and regional associations face unique challenges but share a common goal— advancing the industry.

Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703) 518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Leah Ash Editor/Writer lash@convenience.org

Noelle Riddle Editor/Writer nriddle@conveneince.org

Lauren Shanesy Editor/Writer lshanesy@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Sarah Hamaker, Al Hebert, Emma Tainter, Adam Rosenblatt DESIGN MX www.themxgroup.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

CHAIR: Brian Hannasch, Alimentation Couche-Tard Inc.

TREASURER: Annie Gauthier, CFO/Co-CEO, St. Romain Oil Co. LLC

OFFICERS: Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charles McIlvaine, Coen Markets Inc.; Tony Miller, Retail Delek US; Chris Bambury, Bambury Inc.; Missy Matthews, Childers Oil Co.

GENERAL COUNSEL: Doug Kantor, NACS

MEMBERS: Lisa Blalock BP North America Inc.; Tom Brennan, Casey’s; Andrew Clyde, Murphy USA; Terry Gallagher, Gasamat Oil Corp/ Smoker Friendly; Raymond Huff, HJB Convenience Corp. dba Russell’s

NACS SUPPLIER BOARD

SUPPLIER BOARD CHAIR: Vito Maurici, McLane Co. Inc.

CHAIR-ELECT: Bryan Morrow, Chobani & La Colombe

VICE CHAIRS: Kevin LeMoyne, The Coca-Cola Company; Mike Gilroy, Mars Wrigley; Jim Hughes, GALLO

MEMBERS: Tony Battaglia, Tropicana Brands; David Charles, Cash Depot; Brent Cotten, The Hershey Company; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falcone, Greenridge Naturals; Kevin Farley, Impact 21; Danielle Holloway, Altria Group Distribution Co.; Kevin Kraft, Tropicana Brands; Sarah Vilim,

Convenience; Mark Jordan, Refuel Operating Co.; Brian McCarthy, Blarney Castle Oil Co.; Natalie Morhous, RaceTrac Inc.; JP Patel, FASTIME; Robert Razowsky, Rmarts LLC; Stanley Reynolds, 7-Eleven Inc.; Kristin Seabrook, Pilot Travel Centers LLC; Travis Sheetz, Sheetz Inc.; Babir Sultan, Fav Trip; Doug Yawberry, Weigel’s Stores Inc., Scott Zietlow, Kwik Trip Inc.

PAST CHAIRS: Victor Paterno, president and CEO of Philippine Seven Corp.; Don Rhoads, president and CEO of The Convenience Group LLC.

SUPPLIER BOARD REPRESENTATIVES: Vito Maurici, McLane; Brian Morrow, Chobani & La Colombe

Keurig Dr Pepper; Jay Nelson, Excel Tire Gauge; Nick Paich, GSTV; Ramona Giderof, Diageo Beer; Ryan Calong, Pabst; Jordan Nicgor

GENERAL COUNSEL: Doug Kantor, NACS

STAFF LIAISON: Bob Hughes, NACS

RETAIL BOARD REPRESENTATIVES: Tom Brennan, Casey’s; Scott Hartman, Rutter’s; Kevin Smartt, TXB

PAST CHAIRS: David Charles, Cash Depot; Brent Cotton, The Hershey Company; Kevin Farley, Impact 21

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

n Increased facings from 99 to 121, a 22% increase*.

n Automatically billboards and faces product.

n Reduces losses from bag hook tearout.

n Cuts over 1 hour/day labor for restocking.

n Allows rear restocking and proper date rotation.

n Dramatically increases sales in the same space.

n Adjusts to accommodate various package widths.

*

FRONT FROM THE EDITOR

NACS as we know it today stands on three pillars: Knowledge, connections and advocacy. However, it didn’t start out that way. When the founders of NACS first got together at the Hotel Muehlebach in Kansas City, Missouri, in August of 1961, it was all about connections. Entrepreneurs in this fledgling industry wanted to meet their peers and share their thoughts about what they were doing. They also wanted to have an opportunity to meet some of their suppliers (and … hopefully … have them pick up the bar tab).

From that humble beginning, NACS evolved into a functioning association and began providing the resources that a growing industry required. Specifically, knowledge. In the 1970s, the NACS education department began producing training videos, workshops and seminars on a wide range of topics including crime, foodservice, management, fuel sales and “train the trainer.” Later, the NACS research department began collecting industry data and producing the State of the Industry Report® and hosting an annual SOI Summit.

Advocacy didn’t really make an appearance until the early 1980s, when Teri Richman was hired as NACS’ first government relations employee. At that time, there was a nationwide concern over drunk driving. Legislative bodies of all sizes proposed some very sensible ideas to address the very real problem. Unfortunately, some of the ideas were not so sensible, including the proposal to ban alcohol sales at businesses that also sold motor fuel. These “beer/gas bans” were started in California and quickly spread to state capitals around the country. In 1984, Teri hired me (NACS’ second government relations employee). My job was to build a coalition of convenience store operators to fight

these proposed bans. I spent most of the year in California creating Food and Fuel Retailers for Economic Equality (FFREE), bringing NACS members from across the state to lobby in Sacramento. We ultimately defeated the initiative in California, and the other states quickly shelved theirs.

The success of FFREE was an eye-opener. As an industry, we realized the power we have when we work collectively for a mutual goal. There are convenience stores on street corners of every Congressional district in America. What potential! NACS began investing more resources into our government relations department, where today we focus on national issues in Washington, D.C. (We also work closely with the many state and regional associations that represent the convenience and fuel retailing industry around the country, assisting them with industry data and holding a monthly call during which we all share legislative updates and ideas.)

The NACS government relations team represents the industry within the halls of Congress and federal agencies, as well as works to facilitate engagement between our members and their elected representatives. Through events such as our NACS Day on the Hill, NACS In Store, and our legislative calls to action, as well as our political action committee NACSPAC, we continue to concentrate the power of our industry to proactively push the NACS legislative agenda.

But advocacy doesn’t just mean government relations (for more on that, see Jeff Lenard’s article “Telling the C-Store Story” on page 46). Advocacy is standing up for something you are passionate about. That’s what we at NACS do every day, in every department and in so many different ways. And it is a lot of fun … especially when YOU win!!

Lyle Beckwith senior vice president, government relations

The NACS government relations team represents the industry within the halls of Congress and federal agencies, as well as works to facilitate engagement between our members and their elected representatives.

Inspiring, determined, empathetic and supportive are all words that her Hop Shops coworkers use to describe store manager Anne Domaschko.

“Anne has a unique ability to lead with empathy while keeping everyone focused on our goals,” said one of her team members. “She’s the type of manager who not only inspires us to do our best but also makes us feel valued every day.”

Anne started working at her local Dairy Queen when she was 15, which at the time was owned by Harper Oil and later acquired by Valor Oil, the parent company of Hop Shops. She quickly became an assistant manager. After several years of work and about one year off after having her daughter, the now 23-year-old Anne returned to Hop Shops in March 2023 with a goal in mind—to become a store manager.

She spoke with NACS about:

WHY SHE LOVES WORKING IN CONVENIENCE

I love it—I love the people I work with. Everybody is like family. I also love my customers. We have a lot of regulars at my store, some of whom come in twice a day. You can really meet some incredible customers at this job who are almost like family, too.

I’m also a single mother, so this position and its flexibility really help me and my daughter a lot.

WHAT SHE FINDS FULFILLING ABOUT HER JOB

I really appreciate my customers and the people that I work with at Hop Shops. They treat you just like family and they would be there for you, whether you’re at work or outside of work.

After having a child, Anne Domaschko returned to work at Hop Shops with goals of growth in mind— now she’s a store manager.

Celebrating the people who make our industry great.

“I'm a go, go, go person and this job keeps me going.”

WHY SHE WOULD ENCOURAGE OTHERS TO PURSUE A CAREER IN CONVENIENCE

It’s a really good place to start a career if you want to move up in management roles. You can move up in the industry and you can meet a lot of really great people while working here, including out-of-state people traveling.

HER FAVORITE THING ABOUT HER JOB

The biggest thing that stands out to me is that I have a phenomenal team. I hardly have to ask them to do anything because they are just really on top of their roles. They know what my expectations for the store are.

I do a lot as a manager to keep the store running, but I also get on the floor and am a regular employee, too. I like to be both an employee and a manager—to do it all and be there for everybody. I’m a go, go, go person and this job keeps me going.

NACS’ annual Day on the Hill is one of the best opportunities for you to get in front of lawmakers, share your story and advocate for the convenience industry. This year’s event will take place March 11-12, 2025, in Washington, D.C.

By voicing your perspectives and sharing your challenges, you enhance lawmakers’ understanding of the issues that they cast their votes on. NACS schedules your Congressional meetings and pairs you with other convenience retailers and experienced advocates.

The team will also prepare you to meet with legislators during the twoday event, providing you with the necessary training and resources, including videos, webinars and briefing materials, before visiting Capitol Hill. The informational general session that takes place the day before meetings helps you understand the issues and gives you the opportunity to network with industry peers from around the nation.

Day on the Hill is an invaluable chance to interact not just with your representatives but with fellow retailers who face similar challenges and share similar concerns. Together, you can exchange experiences, insights and best practices, strengthening the collective resilience of our industry. For more information, go to convenience.org/events/day-on-thehill or contact Katie Bohny at kbohny@ convenience.org.

The NACS Food Safety Forum will take place April 8, 2025, in Dallas. The event will be co-located with the NACS State of the Industry Summit.

With more labor intensive and sophisticated foodservice programs being developed and executed within our industry, food safety is essential. The Food Safety Forum is developed and administered by convenience industry food safety, foodservice, quality assurance and risk management leaders. This is the only retail-focused event of its kind for the global convenience community. Participants will become more engaged and empowered to recognize how certain behaviors can enhance and protect their teams, customers and brand.

The 2025 event will focus on:

• Preparing for the FDA’s traceability rule that will take effect in 2026.

• How to use tech and data to improve efficiency, with a case study on how Circle K stores have invested in tech-driven tools like sensors and digital temperature monitoring to streamline food safety protocols, as well as optimize labor, reduce waste, and deliver ROI that extends beyond food safety measures.

• Building consumer trust in food safety and your foodservice program.

• Insights from CEOs on shaping food culture during a conversation with two industry leaders about the importance of food safety, their brands and empowering their teams to do the right thing. This high-level discussion will offer valuable perspectives on leadership, innovation, and the future of food and food safety in convenience retail.

For more information and to register, visit convenience.org/fsf

Throughout the year, NACS hosts Industry Update Luncheons across the country. At these events, NACS leadership shares insights, performance trends and metrics, and discusses issues

and opportunities that are relevant to the convenience and fuel industry. By attending, you’ll gain insight and knowledge on:

• The NACS State of the Industry Report® and CSX data relevant to your region and state

• Important legislative and regulatory issues currently facing the industry and how NACS is advocating on your behalf

• Timely and relevant topics from within and outside our industry that will have an effect on your business today and in the future

The NACS State of the Industry Report® of 2024 Data (SOI) Survey is open, and your data is critical. Ahead of this year’s report and the SOI Summit in April, participate in the survey and submit your numbers for key financial and operational benchmarks. Only with continued support from convenience retailers can the NACS SOI Report provide the vital benchmarks retailers use to assist in their strategic decision-making process.

The SOI Report contains over 200 pages of tables, charts and analysis of the previous year’s operational data for convenience sites across every region of the United States. The SOI Report drills down to the NACS regional level, providing industry stakeholders an opportunity to undertake a more granular analysis of the data. Shopper insights from NACS Convenience Voices shopper survey program rounds out the financial analysis with an in-depth look at what is driving shopper behavior in the convenience channel.

Look out for a luncheon coming to your region this year. Events are currently scheduled in:

• Atlanta: March 24, 2025

• Pleasanton, California: March 27, 2025

• Houston: April 2, 2025

• Des Moines, Iowa: May 1, 2025

• Providence, Rhode Island: May 6, 2025

• Salt Lake City: May 13, 2025

• Richmond, Virginia: May 20, 2025

For more information, visit convenience.org/events/ industry-update-luncheons.

Survey participants will receive:

• Two digital access licenses to the NACS State of the Industry Report of 2024 Data

• One complimentary registration to the 2025 NACS State of the Industry Summit on April 8-10, Hyatt Regency DFW International Airport

• A custom report of your company’s data in comparison to the SOI aggregate data to assist in your internal analysis of your company’s performance

Submit your data by March 16, 2025. For more information, visit convenience.org/soisurvey or contact Chris Rapanick at crapanick@convenience.org.

Rakesh Srinivasan now serves as senior vice president, chief data and artificial intelligence officer for Pilot. Srinivasan brings more than 15 years of experience developing best practices for leveraging and driving revenue growth through innovative analytics and AI solutions. He has held leadership roles for various market leaders including Walmart, Jet. com and Moda Operandi. Most recently he served as senior vice president, chief data and analytics officer and head of consumer technology for Petco.

EG America named Lisa N’Chonon as the company’s chief financial officer and treasurer. She leads all aspects of the company’s finance organization, including accounting, FP&A, tax and treasury and risk management. Since joining the company in 2017, N’Chonon has previously served as chief accounting officer and VP of accounting operations.

Elizabeth Pierce recently joined EG America (EGA) as the company’s chief operating officer, where she now leads retail operations. Most recently, she was president/CEO of Applegreen’s U.S. operations. She brings

extensive experience to EGA in designing and executing complex business strategies, acquisitional growth and organic expansion, and developing multifunctional teams.

Laura Sherman was recently named EG America’s general counsel. Since joining the company in 2013, Sherman has held a series of progressively senior leadership positions within the legal department, most recently assistant general counsel and interim general counsel. As general counsel she leads all aspects of the legal department, including litigation, contracts, records management, retail licensing and compliance and regulatory matters.

EG America hired Whitney Johnson as vice president of loyalty and digital commerce, where she spearheads and drives the company’s future growth through loyalty marketing and digital commerce. She previously led grocery merchandising and category management for GoBrands Inc. and held several senior roles in merchandising strategy, loyalty, and category management at Murphy Oil USA Inc. and Sunoco LP.

Michael Pengue, previously CEO of Zoa Energy has been named CEO of Hint Inc. Pengue brings more than three decades of experience in the beverage industry, including senior executive roles at Keurig Dr Pepper, BAI Brands, where he helped facilitate the company’s sale to Dr Pepper Snapple and Nestlé Waters. Most recently, he served as CEO of Zoa Energy, the brand created by Dwayne “The Rock” Johnson, which just saw Molson Coors take a majority stake in the business.

Kevin Benmoussa has joined Hint Inc. as CFO, bringing two decades of experience spanning Fortune 500 and private equitybacked startup companies in the food and beverage space. Benmoussa most recently served as the executive vice president and CFO of food tech start-up Aleph Farms.

Krispy Krunchy Chicken appointed Matt Testa as COO. In this role, Testa will focus on strengthening the sales and operations teams for the brand, which licenses over 3,000 locations. Prior to Krispy Krunchy, Testa spent more than twenty years with the Pilot Flying J network.

From low to lowest price, Xcaliber International offers unparall options for rug consumers. purposes only.

NACS welcomes the following companies that joined the Association in November 2024. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting convenience.org/ create-login. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership

RETAILERS

Quickie Mart Inc. Goldendale, WA

Sandhu Truckline Inc. Fresno, CA

Sunoco LP Dallas, TX

Yakamart at Phato Crossing Toppenish, WA

SUPPLIERS

A&R Distribution LLC Antioch, TN

Affinity Jeffersonville, IN www.affinityhub.com

Arizona Lottery Phoenix, AZ azlottery.gov

Bonded Filter Co. dba BFC Solutions Nashville, TN www.bondedfilter.com

Bones Coffee Co. Cape Coral, FL

Clinton Electronics Loves Park, IL www.clintonelectronics.com

Cognitec Systems www.cognitec.com

DBZ Enterprises Chandler, AZ www.k-chill.com

Diecast Masters America Sunrise, FL

Duvel USA/Boulevard Brewing Co./Ommegang Kansas City, MO

Ezaki Glico USA Corporation Irvine, CA www.glico.co.jp/en

Foozy Fun Sockz

Group Nine Risk Consulting Mableton, GA groupnine.us

2025

MARCH

NACS Day on the Hill

March 11-12 | Westin Washington D.C. Downtown Washington, D.C.

NACS Human Resources Forum March 24-26 | Hutton Hotel Nashville, Tennessee

APRIL

NACS State of the Industry Summit

April 08-10 | Hyatt Regency DFW International Airport Dallas, Texas

NACS Food Safety Forum April 8 | Hyatt Regency DFW International Airport Dallas, Texas

MAY

NACS Leadership for Success May 12-16 | Hershey Lodge Hershey, Pennsylvania

NACS Convenience Summit Europe May 27-29 | Copenhagen

Kayco Inc. Bayonne, NJ www.kayco.com

Low and Slow Snacks Farmers Branch, TX www.lowandslow.com

OpenEye Liberty Lake, WA openeye.net

Takeoff Brands Inc. Rancho Cucamonga, CA

TDK Doors Inc. Surrey, British Columbia, Canada tdkdoors.com

X Mood Drinks Pleasant Grove, UT www.xmooddrinks.com

Xenia Miami, FL www.xenia.team

JULY

NACS Financial Leadership Program at Wharton July 13-18 | The Wharton School, University of Pennsylvania Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg July 20-25 | Kellogg School of Management, Northwestern University Evanston, Illinois

For a full listing of events and information, visit www.convenience.org/events.

The retailer held a round up campaign and donated bottled water to impacted communities.

Nittany MinitMart, a retailer with 28 locations in Pennsylvania, raised over $24,000 for Hurricane Helene relief during the month of October. The retailer said it was motivated to give back after Hurricane Helene’s devastation left communities grappling with loss and destruction. The retailer worked with suppliers to purchase and deliver 38,304 bottles of water. The water was picked up in Ebensburg, Pennsylvania, and shipped to Candler, North Carolina, where it was distributed by a local church.

“We were heartbroken by the devastation left in the wake of Hurricane Helene,” said John Martin, president of Nittany MinitMart. “Seeing people without power and water drove us to find a way to make a difference.”

Nittany MinitMart stores also raised funds through a round-up campaign held throughout October. Customers “contributed by rounding up their purchases, with every cent going toward supporting those in need. All $24,165 raised was donated to Samaritan’s Purse, an international relief organization providing much-needed aid and resources to those affected, helping families and communities on their path to recovery,” Nittany MinitMart said.

Nicole Masullo, division manager of operations at Nittany MinitMart, expressed gratitude for the outpouring of support from customers: “We run round-up programs several times a year, and this was one of our most successful ones yet. We’re incredibly proud of the compassion our customers have shown through their generosity. We know our contributions will go a long way in helping these communities rebuild.”

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories. Learn more at www.conveniencecares.org

1 Weigel’s donated to Joy of Music School, a Knoxville-based nonprofit dedicated to providing free music education to children. The funds donated will help supply essential instruments and resources to the students, specifically going toward violins and MacBooks.

Weigel’s said the new violins will open up possibilities for budding string players, while the MacBooks will support both virtual and in-person learning, helping students expand their skills and access a broader world of musical resources.

REFUEL OPERATING

COMPANY RAISES $535,000 FOR CHARITY

2 Refuel Operating Company held its second-annual golf tournament in support of the Leukemia and Lymphoma Society (LLS). Refuel said it “was an overwhelming success,” with the event raising $535,000. “Thanks to the generosity of our sponsors and industry partners, this event helped us surpass a major milestone—raising over $1 million for LLS.”

“This year, we had the privilege of spotlighting our honored hero, Zach, a courageous survivor of T-Cell Leukemia. Diagnosed just four years ago at the age of 10, Zach’s unwavering strength and resilience continue to inspire and motivate us all,” Refuel said.

ONCUE DONATES

$275,000 TO ST. JUDE

3 OnCue raised $275,000 for St. Jude Children’s Research Hospital through its fall fundraiser, bringing the partnership total to more than $3.8 million raised over 17 years. “OnCue’s gift will help ensure families being treated by St. Jude never receive a bill from the hospital and give patients the chance to focus on what’s most important.”

During the month of October, OnCue “connected its customers

to the cause through pinup sales, rounding change at the register and specialty fountain cups. Throughout pinup sales, OnCue team members had additional opportunities to show off their St. Jude support through ‘Dress as a Superhero Day.’”

4 Cubby’s announced that through the first three quarters of 2024, its Raise Some Dough program raised $37,072 for local schools. The program raised over $12,000 in both Q2 and Q3.

Twenty-one Cubby’s locations in Nebraska, Iowa and South Dakota participate in the Raise Some Dough program and donate $1 for every large Godfather’s Pizza Express or breakfast pizzas sold.

5 Williams Companies, owner of Dandy Convenience Stores in northern Pennsylvania and southern New York, donated $20,000 to Arnot Ogden Medical Center. The donation “will immediately impact specialized services in the Arnot Neonatal Intensive Care Unit (NICU),” Williams Companies said. Wil-

liams Companies said this contribution will aid Arnot in continuing its critical work to provide life-saving healthcare services and support to families in need.

6 In honor of Thanksgiving, Parker’s Kitchen employees prepared hot holiday meals for Savannah’s homeless community by volunteering with Union Mission. “This is our most loved Thanksgiving tradition,” Parker’s Kitchen said. “Helping others is one of our key values as a company, and we’re so proud to see our Parker’s team giving their time to make Thanksgiving a little better for those in need.”

7 Onvo held its annual October fundraiser in honor of Breast Cancer Awareness Month. “This year we raised a record amount of $75,000 for the PA Breast Cancer Coalition through our fundraising efforts, which included the sale of pink ribbons, raffles and corporate donations. We are thankful to everyone who donated and to everyone who worked hard to make this year’s fundraiser a success,” Onvo said.

Here’s how 2025’s changes in political leadership could impact the industry.

BY JON TAETS

At the time of this writing in early December, most of the dust has settled on the 2024 elections. The NACS Government Relations team is now sorting through the results to gauge what the outcome may mean for our industry’s priority issues in the coming months. There are several things we know, and a few that are still up in the air.

Republicans have secured a trifecta in Washington. They control the majorities in both chambers of Congress and have the White House, meaning the ball is entirely in their court for 2025 and 2026.

In the last weeks of 2024, it is unclear when the Republican majority will be at full strength given that there will be special elections to fill the seats of those Members of Congress who are leaving to join the Trump administration. House Republicans have won 220 seats to the Democrats’ 215. However,

due to former Rep. Matt Gaetz’s (R-FL) resignation, they will start the 119th Congress down one seat already, giving them a 219-215 split.

President Trump has nominated three current House Republicans to his administration, which will necessitate special elections for those seats and will leave the House majority short of those votes for some time. As of this writing, two special elections have already been scheduled: one to replace former Rep. Matt Gaetz (R-FL), who was nominated for U.S. Attorney General and then withdrew from consideration, and one to replace Rep. Michael Waltz (R-FL), who has been nominated to be Trump’s National Security Advisor. Both special elections will take place on April 1. Additionally, Rep. Elise Stefanik (R-NY) was

nominated to be U.S. Ambassador to the United Nations, meaning her seat will become vacant when she is confirmed by the Senate. These vacancies will make a razor-thin majority even more precarious for GOP leadership to manage. Since Gaetz resigned, his seat will remain empty until the special election in April. Waltz’s resignation will become effective January 20, and Stefanik’s will likely come once she is confirmed by the Senate. This means that the GOP could have as few as 217 votes from mid-January until early April.

The biggest change on Capitol Hill is not just the Republican majority in the Senate—it’s the change of who is at the helm of the caucus. After 18 years

as Republican Leader, Senator Mitch McConnell (R-KY) stepped down from his post at the end of the 118th Congress and passed the torch to Senator John Thune (R-SD), who won the caucus-wide election to succeed him. Thune now assumes the role of Majority Leader and the control of the Senate that comes with it. With Thune’s ascension, Senator John Barrasso (R-WY) was elected to the No. 2 position in leadership as Majority Whip.

The House majority: Unlike in the Senate, the leadership of the Republican Majority in the House remains the same. Representatives Steve Scalise (R-LA) and Tom Emmer (R-MN) were reelected to their posts with ease as Majority Leader and Whip, respectively, following the November elections. As of this writing, Speaker Mike Johnson (R-LA) is also

Your voice matters, and with a new Congress in session, the stakes are higher than ever for our industry. Attending NACS Day on the Hill (DOH) gives you the opportunity to connect with your federal lawmakers, especially the newly elected ones, and make sure they understand the convenience and fuel retailing industry’s priorities.

DOH, taking place March 11-12, 2025, is more than just a chance to visit Washington, D.C.—it’s an opportunity to advocate for the issues that matter most. And it’s not too late to register to attend. Retailers, if you’re ready to join us and share your perspectives on how our federal officials’ decisions impact your stores and communities, reach out to NACS Political Engagement Director Katie Bohny at kbohny@ convenience.org. Suppliers, you can also connect with Bohny to learn more about how to attend and the critical role you play in keeping our industry running smoothly.

We’re looking forward to seeing you in our nation’s capital this March!

expected to reclaim his post as Speaker of the House. He will likely have had to make some concessions to the right wing of the party to secure the necessary votes, but with Trump’s endorsement, he should be able to secure a full term as Speaker. (It’s worth noting that all three GOP leaders have participated in the NACS In Store Program in the past.)

With Republicans in full control of Washington, we can speculate on what that may mean for some of our industry’s priority issues over the next few years.

Tax policy: With many significant pieces of the Tax Cuts & Jobs Act expiring at the end of this year, tax reform will be a major focus in the halls of the Capitol. Full Republican control means legislators can use the budget reconciliation process to bypass the need for Democrat votes in the Senate to pass new tax reform legislation—and we expect them to do just that.

Republican majorities are likely to look fondly on many of the provisions that are most important to our industry, including bonus depreciation, the 199A business income deduction and preserving the 21% corporate tax rate. The biggest challenge is likely to be the focus among some Republicans on offsetting the cost of tax extensions to limit—to some extent at least—adding to the national debt in the process. This may end up requiring tradeoffs within the tax code or limiting the time frame these provisions are extended for again. Swipe fee reform and payments policy: There has been growing momentum in Congress to pass legislation to give businesses and consumers relief from the enormous credit card swipe fees they bear. While the banks spent close to $100 million fighting the bill last Congress, the Credit Card Competition Act (CCCA) garnered support

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac. NACSPAC donors who made contributions in November and December 2024 are:

Annie Alabaugh

Casey’s General Stores Inc.

Chris Bambury Bambury Inc. dba BONNEAU

Blake Benefiel Altria Group Distribution Company

John Bertucci III RowLogic LLC

Damon Borden Alsaker Corp dba Broadway

Ned Bowman Florida Petroleum Marketers Association

Robert Buhler

Open Pantry Food Marts of Wisconsin Inc.

Chet Cadieux QuikTrip Corporation

Brad Call J&T Management

Spencer Cavalier Matrix Capital Markets Group Inc.

David Charles Sr. Cash Depot

Andrew Clyde Murphy USA

Chris Cope Pilot Travel Centers LLC

Timothy Cuneo iSee Store Innovations

Rick DeRose TSN-A Bunzl Company

Bhagdeep Dhaliwal Dhaliwal & Associates Inc.

Henry Dodge Dodge’s Stores

Justin Erickson Harbor Wholesale Foods

Barry Eveland Rocket Oil Company

Cedric Fortemps

Matrix Capital Markets Group Inc.

Jimmy Frangis PDI Technologies

Chad Frazell

Casey’s General Stores Inc.

Peter Garrett Volta Oil Company Inc.

Derek Gaskins Yesway

Annie Gauthier St. Romain Oil Company LLC

Christopher Gheysens Wawa Inc.

Erin Graziosi

Robinson Oil Corporation

D. Brian Griffith

Golden Pantry Food Stores Inc.

Ieva Grimm J.M. Davis Industries Inc.

Joseph Hamza

Nouria Energy Corp.

Brian Hannasch Alimentation Couche-Tard Inc.

Shultz Hartgrove Tres Picosos LLC

Jane Hartgrove Tres Picosos LLC

Tom Healey Nouria Energy Corp.

Tom Heinz

Coffee Cup Fuel Stops and Convenience Stores Inc.

Chris Hobson Core-Mark International

Sonja Hubbard Yates Group Inc.

Brian Johnson

Casey’s General Stores Inc.

Jeff Kahler Ready Training Online—RTO

Eli Kai FLOW

Bill Kent

The Kent Companies dba Kent Kwik Convenience Stores

Jeff Lenard NACS

Michael Lipton Lipton Inc. dba LiptonMart

Bill McCloskey Rmarts LLC

Charlie McIlvaine Coen Markets Inc.

Josh Milazzo Lard Oil Company Inc

Johnny Milazzo Lard Oil Company Inc.

Tony Miller Delek US

Andrew Mitchell Toot’n Totum Food Stores LLC

Thomas Palombo The InStore Group

Ken Parent

Duane Phillips Dandy Mini Marts Inc.

Robby Posener RaceTrac Inc.

Daniel Razowsky Rmarts LLC

Mark Reese RaceTrac Inc.

Merlix Reynolds RaceTrac Inc.

Donald Rhoads The Convenience Group LLC

Tom Robinson Robinson Oil Corporation

Chuck Ryan Ambest Inc.

Travis Sheetz Sheetz Inc.

Steve Spinks The Spinx Company Inc.

Nick St. Romain St. Romain Oil Company LLC

Darlene Stanley Johnson Junction Inc.

Bill Stein Core-Mark International

Marc Strauch Cameron Park Petroleum

Paul Suarez Casey’s General Stores Inc.

Melissa Sungela Yesway

Nan Thomae Casey’s General Stores Inc.

Jill Van Pelt RaceTrac Inc.

Lynn Wallis Wallis Companies

De Lone Wilson Cubby’s Inc.

Brian Wright Executive Leadership Solutions Inc.

from members on both sides of the aisle, including Vice President JD Vance, who was a co-sponsor. At a Senate Judiciary Committee hearing in November, Republican Senators acknowledged the fees are too high and that Congress would need to act if the fees don’t come down. As this industry knows all too well, with monopolists like Visa and Mastercard, the fees never come down but instead rise year after year. The CCCA’s champions will continue to fight for a vote.

Another payments issue to watch is the expansion of digital currencies. The chairs of the Senate Banking Committee and the House Financial Services Committee have said it is a top priority to pass a crypto regulatory framework. The Senate will need 60 votes to pass that kind of measure, but a number of Democrats have signaled they would be supportive.

Food policy: Congress failed to pass a new Farm Bill in 2024, which means we will see another Farm Bill fight play out in the 119th Congress. With the nomination of Robert F. Kennedy Jr. to lead the Department of Health and Human Services, which plays a big role

in shaping the country’s nutrition policy, it’s anticipated that the Trump administration’s “Make America Healthy Again” initiative will impact the new Farm Bill legislation. It’s possible that language could be included that would restrict customers’ SNAP purchases to only healthy or “nutrient dense” foods. Regardless of the administration’s priorities, the bill will still likely require extensive bipartisan negotiations between House and Senate Agriculture Committee leadership in order to pass.

Energy policy: President Trump made energy policy one of the pillars of his election effort. He criticized Biden administration policies on shifting to electric vehicles and pushed for more oil drilling and refining in the United States. The expectation is that the Environmental Protection Agency (EPA) will work to implement those changes—principally by undoing some of the policies put in place by the Biden administration. The process of changing regulations can be difficult, however, and the Trump EPA will have to make those changes in a way that will withstand the inevitable litigation challenges.

Tobacco and nicotine policy:

The Biden administration pursued an aggressive anti-tobacco agenda with proposals to ban menthol cigarettes and flavored cigars, as well as its plans to limit the amount of nicotine in cigarettes. It is unlikely that the FDA under President Trump will pursue these actions. While he regulated flavored vapor products during his first term, he posted on Truth Social last fall, “I’ll save vaping again.” It is unclear what that will look like, but it could mean more decisions in the lengthy PMTA process, which would mean more clarity for retailers. With Republican control in Congress, there may be more opportunities to hold FDA accountable through legislation, such as requiring the agency to provide lists of which products can and cannot be marketed.

Labor policy: Congress will continue to be hamstrung by stark differences of opinion on labor policy between the parties. With most legislation still requiring 60 votes in the Senate to bypass the filibuster, it’s unlikely we will see much from Congress on the policy front in this space. The administration is a different story. Some business groups have expressed reservations about President Trump’s pick for the Secretary of Labor, former Rep. Lori Chavez-DeRemer (R-OR) because of her generally pro-organized labor track record during her one term in the House. Despite her support for union-backed legislation, it is still likely we will see a much more business-friendly DOL than we have for the past four years. We will likely see new action on the overtime, independent contractor and joint employer rules for example, but even with DeRemer at the helm they are likely be much more reasonable proposals.

Jon Taets is NACS director of government relations. He can be reached at jtaets@ convenience.org

Welch’s Stop N Shop has been a beloved staple of its community for more than four decades.

BY SARAH HAMAKER

Name of company: Welch’s Stop N Shop

Year founded: 1981

# of stores: 1

Since 1981, Welch’s Stop N Shop in Oakdale, Louisiana, has been dispensing fuel, food and love to its customers. “My mother-in-law, Elsie Welch, started the store and my husband, Andy, grew up in the store,” said Melissa Welch, who owns the store with Andy. “Local folks still fondly call the store Miss Elsie’s because she was so loved by the community.”

Andy worked in the store as a teenager, stocking and mopping floors, and Melissa occasionally did the payroll and other tasks after they married. That sense of family ownership prompted the couple to purchase the store from Andy’s mother in 2000 when she retired.

While the Welches kept much of what made Stop N Shop popular with locals, they also put their own stamp on the store. “With Andy’s background in trucking, we were able to expand the offerings and change some things to make the store more modern and accommodating,” Melissa said.

The Welches continued Elsie’s tradition of investing in the local community.

“We do a lot for the community because we love our community,” Melissa said. For example, the store recognizes “elementary school students of the month,” and gives them a coupon for a “hunk” (a fourth) of a pizza to celebrate their special moment. The Stop N Shop logo adorns banners and t-shirts around town, supporting schools, sports teams and local events.

Melissa stocks inexpensive and trendy candy and toys, like slime lickers, to give to kids who come in with a good report card or other scholastic success. During the holidays, Santa will drop by on the Coca-Cola truck with prizes for the kids, and around Easter time, the store’s “little bunnies” can hop to the counter for a prize. “We try to keep the kids happy with these little items, and we expanded our children’s section to accommodate more of these products,” Melissa said.

In addition, the store raises funds for the local animal shelter. “There are a lot of stray dogs in our area and our daughter is passionate about helping these animals,” she said.

Truckers are a core customer for Stop N Shop. The store’s 10 gas pumps and separate fast fuel diesel/DEF area, as well as a pump with off-road fuel, caters to professional drivers, loggers and farmers. Andy expanded the truckers’ section with more automative items, plus added a shower. He bought an adjacent piece of land to offer more parking

for larger vehicles, which allowed his and Elsie’s design for a separate, heavy duty fueling area to come to life. “We recognized the need for a well-lit parking lot that could accommodate trucks,” he said.

Stop N Shop was already drawing in customers with its Hunt Brother’s Pizza and Krispy Krunchy Chicken foodservice franchises, but Melissa added additional healthy food options, like salads and grilled items, to the selection. “We have new lunch specials and some evening specials, like the ‘after church special’ of a combo pizza/tender meal for families,” she said. Chicken and dumplings and lasagna are two well-received lunch specials.

One popular foodservice item is the chicken bombs—a chicken tender wrapped in bacon with a jalapeno slice in the middle. “These are our own creation and we always sell out when we offer them,” Melissa said. But the biggest draw is the homemade hamburgers and beef stew. “We also have homemade cinnamon rolls, banana pudding bread pudding bars and bundt cakes that fly off the shelves,” she said.

The Welches said the best advice they have for creating a unique experience for customers is to think outside the box. “Try to think about the customer in everything you do,” Melissa recommended. To find new ideas, she visits the NACS Show and other food shows. “Some of our most popular items are [ones] that I found at one of those shows,” she said. For example, children’s cups that light up with sparkles, large tumblers and candles to eliminate pet or smoke odors have been popular additions to Stop N Shop’s inventory.

At the end of a visit, she wants customers “to feel like they left a family member’s house, like they have been well taken care of, appreciated and they

Welch’s Stop N Shop in Oakdale, Louisiana, has a unique incentive program for its 26 employees. “Our workers can earn Stop N Shop Bucks, which they call Andy Bucks after my husband,” said co-owner Melissa Welch. “These bucks can be redeemed in our store and are earned by being on time, completing checklists, etc. Additional bucks are also awarded for taking an extra shift or going above and beyond for our customers. They value these because they love the perk, but above all, they love knowing they are doing a good job.”

Overall, Melissa and her husband, Andy, try to set the tone in the store for their employees. “We’re in the store every day and lead by example,” she said. “We solicit and value the employees’ opinions on how to make Stop N Shop the best that it can be. We have some long-term, committed employees and we rely on their expertise. We have a lot of one-on-one and group meetings with our employees to check in with them, and I also send out group messages to our employees via our app, such as shout-outs for jobs well done.”

recognized we value them,” she said. “This is really a small town, and we’re the local, welcoming store that everyone’s been coming to for years—some all their lives.”

Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow. To see videos of the c-stores we profiled in 2024 and earlier, go to www.convenience.org/Ideas2Go

The number of convenience stores in the United States stands at

West (region 6) 23,080 stores

South Central (region 4) 24,539 stores a decline of 0.1%.

The industry lost

141 total stores.

Central (region 5)

13,287 stores

Locations that sell fuel are up by

1,791, bringing the total to 121,852 convenience store locations that sell fuel.

Midwest (region 3)

23,991 stores

Locations that do not sell fuel fell by

1,932, to a total of 30,403 sites without fuel.

Northeast (region 1)

30,784 stores, down from 31,497 last year

Southeast, (region 2)

36,574 stores up from 36,288 last year

played a role in the shift toward more E-size locations and fewer D-size locations, including Alimentation CoucheTard’s purchase of GetGo and Casey’s purchase of CEFCO.

With the U.S. population at an estimated 340 million, according to the U.S. Census Bureau, there is one convenience store for every 2,233 people.

Source: 2025 NACS/NIQ TDLinx Convenience Industry Store Count

Mostbreadscanbecategorizedaspanbreadsorhearthbreads. However,somebreadsmaybedifficulttoclassifybecausethey exhibitcharacteristicsofmorethanonecategory.Forexample, ryebreadscanbepanbreadsorhearthbreads.Theexamplesin thisdocumentareintendedtobegeneralguidelinesonly.

By way of introduction, we are the association that supermarkets, C-stores, foodservice, manufacturers, and restaurants can tap for the industry resources that drive success.

Connect with industry professionals from across the world by attending IDDBA 2025 in beautiful New Orleans!

their advice

BY LAUREN SHANESY

There’s an oft spoken mantra at NACS when it comes to advocacy: “If you’re not at the dinner table, then you’re on the menu.”

“If you’re not engaged, understand that there are other groups that are advocating for something that will negatively impact your business,” said Tom Brennan, chief merchandising officer at Casey’s General Stores. “I would encourage retailers to get engaged so you can give your point of view, your business’s point of view and the industry’s point of view and counter the other narratives that are out there. Political engagement needs to be ingrained in how we operate because of the impact legislation can have on your business.”

Whether you’re a CEO, a store manager, a supplier partner, or anyone else in the c-store ecosystem, advocacy comes down to one thing: Tell your story.

“Convenience retailers are quite literally where the rubber meets the road. We represent folks that our elected representatives want to hear from,” said Alex Olympidis, president of operations at Indiana retailer Family Express. “And your elected representatives need you just as much as you need them. They are real people and in most cases are thrilled to talk to their real constituents.”

That holds true whether the government official is at the federal, state or local level, and whether they are elected or appointed.

When I graduated college my dad told me, ‘If you don’t like something, get involved and find a way to change it.’ And I’ve walked by those words.”

—Dan Alsaker, Principle at Alsaker Corp. dba Broadway

Raymond Huff, president of HJB Convenience, testified earlier this year in front of the House Small Business Committee about making provisions of the 2017 Tax Cuts and Jobs Act permanent (they are set to expire after 2025). Prior to the hearing, he prepped his testimony with NACS’ government relations team and met with representatives on the opposing side of the issue.

“It was an honor to represent the industry, even if it was a little bit scary. But a few of the committee members changed their position after hearing my story, because it makes a lot of sense,” said Huff, who owns around 10 stores in the Denver area. He described how the deductions allowed him to reinvest in his business, buy coolers, fixtures and point of sales systems, expand to open new stores and hire more employees.

“Additionally, I made some new contacts” while in D.C., added the Colorado-based retailer. “I talked to representatives from all over the United States on both sides of the issue. It was a great experience, and I think it was effective.”

Two years ago, Dan Alsaker, principle at Alsaker Corp. dba Broadway in Spokane,

Key to your story being effective and resonating with lawmakers is developing relationships with your state and local representatives.

After that, make sure to continue to cultivate the relationship over time, said Alex Olympidis, president of operations at Family Express. “After we did an In Store program with our Congressman Rudy Yakym, he now texts me when he’s at other convenience stores. He learned a lot about what it means to be a retailer and what it means to be a frontline worker that day, but that relationship continues. Every time he visits a convenience store, he thinks of us— and not just of Family Express, but of our industry as a whole.”

Laying the groundwork for those connections will also go a long way in the future—you don’t want to wait until you have a problem arise to meet your elected officials.

“It takes years to develop these kinds of relationships, but now when something new comes up, it’s common for me to walk into a congressional office, speak to someone and maybe see or hear somebody talking about that very same issue,” said Dan Alsaker, Principle at Alsaker Corp. dba Broadway.

Retailers also said it’s important to connect with legislators’ staffers on the Hill. “They direct most of the traffic on a day-to-day basis, so that’s an important relationship to develop,” said Alsaker.

We all assume Members of Congress understand the issues facing us. Before coming to Congress, some of them ran their own companies, and one or two have even been in the convenience store business. (Welcome newly elected congressman and former convenience store owner Tony Wied!) However, the vast majority need to have even simple issues affecting you explained to them. If you don’t ... they won’t know!

Lyle Beckwith guest editor

Advocacy starts in your store. From being a friendly face for your customers and getting involved in your local community all the way to testifying on Capitol Hill, everyone from the business owner or CEO to the cashier can be an advocate. Here are some ways to get started.

Educate yourself … One of the first steps is to familiarize yourself with the most important issues to the convenience retailing business. “Get educated on the issues and understand the impact that they could have on your business,” said Tom Brennan, chief merchandising officer at Casey’s General Stores.

… And your government officials … Oftentimes, said Raymond Huff, president of HJB Convenience, officials get voted in and might try to enact legislation that doesn’t make the most sense for businesses. “The only way you can fight that is to have a seat at the table and educate your legislator about why that’s not beneficial, as they might not realize it’s even detrimental. When you do that, you can usually win,” Huff said.

… And your customers. Customer issues are constituent issues. If your local area is facing a new rule or regulation (tobacco bans are a great example of this), let your customers know about it. Talk to them about how it might impact them, and educate them at checkout with signage or ways they might be able to make their voice heard as well. Officials want to hear from them, too.

Washington, was invited by Energy & Commerce Chair Cathy McMorris Rogers to participate in a roundtable on energy costs and their impact on the convenience and fuel industry.

“I had a story to tell,” he said. He described to the group how the high cost of energy was impacting his workforce and keeping him from staffing the right number of employees. “I had members come up to me afterwards and say, ‘I had no idea this was going on in a real world context.’ That really helped.”

Its critical for lawmakers to hear directly from retailers who experience the day-in, day-out nature of top issues and are personally impacted by proposed legislation.

“When you’re an elected representative, especially in the United States Congress, you’re asked to be an expert on a lot of things that maybe you didn’t anticipate you would need to be an expert on. So you have to rely on the experts in their field in order to make informed decisions,” said Olympidis. “As a business and community leader, I need the representative to move the needle in the way I want it to be moved, but the truth of the matter is that the elected representative needs us in a much more profound way. They rely on those who are willing to help them inform the decisions that they make.”

Steve McKinley is the founder of Urban Value Corner Store, a 10-store chain in the Dallas area. “It doesn’t matter what size business you are—your voice is as powerful as [any large company]. Anybody who is trying to get involved in advocacy needs to understand that your voice is important.”

The power of speaking up as a small business owner also resonates with Alsaker, who said that his involvement with advocacy started with the simple need to survive. “I felt that, as a little guy, if I didn’t have the width and breadth of a major company, then I had to go out and fight for every little thing that we could, even just to see an adjustment. If it wasn’t going to be us, then who was it going to be? It had to be me. I jumped in hook, line and sinker,” he said.

Represent your state March 11-12, 2025 in our

Embrace local issues. Brennan stressed the importance of attending local hearings and board meetings to advocate in your local area. “Sometimes there might be resistance to opening a new store for example, so talking about the jobs it would create, services offered, and your company’s approach to creating a great guest experience can help people view it differently.”

Just show up. Get involved in whatever ways you can, said Huff. “Volunteer to be on a legislative committee or a local board. Volunteer to write letters. Just show up. There are a lot of things that you can do to advocate for the industry,” he said.

Volunteer on local boards. You can start getting engaged in advocacy at the community level by volunteering for local organizations or boards. Huff said that was how he first got involved in advocacy and it allowed him to make connections in his area. “It’s usually an hour or two per month of your time, and then from there you can find other ways you can be helpful in your community,” he said. And you don’t necessarily have to volunteer with convenience-specific organizations. Alex Olympidis, president of operations at Family Express, is a proud member of his town’s park foundation because he believes well-maintained parks are a sign of a thriving community—just like healthy convenience stores.

Host legislators in your store. NACS’ In Store program is a great way to arrange this, but inviting officials to your store helps them experience the convenience business—and its pain points—firsthand.

Go to Day on the Hill. NACS’ annual Day on the Hill occurs in March and is an opportunity to visit Capitol Hill to meet your representatives, get in front of lawmakers, build connections and share your story.

Know your stats. There are a lot of facts about the convenience industry that are worth boasting about, from how great the foodservice is to how many people the industry employs to the impact c-stores have on their local communities. Know the stats and how to talk to people about them, whether you’re talking to a legislator, a customer, your family member or your doctor.

Network with industry leaders. Go to networking events and meet other leaders, even if they’re in different

If you’re not speaking up to tell your story and share your experience, then the opposing side will control the narrative. Take swipe fees for example, said Brennan.

“Members of Congress are hearing a very different message from the banks. That’s why it’s so important for them to hear from retailers and businesses of all sizes. If you have a particular point of view, you need to ensure that you’re at least giving someone the opportunity to see something in a different light, ask questions and get a greater depth of understanding on the issue,” he said. “We have to make sure that our story is told right, and that we tell it in a way that has very real examples. Silence is not an option—that is how you will get an outcome you don’t want.”

“Advocacy is a long game,” added Brennan. It can be quick to get a win at the local level, but when it comes to federal issues, many bills benefiting the convenience business can take years or even decades to push through. “But it’s not about getting discouraged. It’s about continuing to be engaged and continuing to have those conversations that hopefully lead to eventual payoff.”

For Kenny Shim, president of the Ontario Convenience Stores Association and a retailer with 34 years in the business, getting approval for convenience stores to sell beer, wine and ready-to-drink cocktails in Ontario, Canada, was 20 years in the making. “When you work with the government, you have to be very, very patient—which I have become,” he said. “You have to be persistent and learn who the right people to talk to are. If you go through the wrong person, it could take an extra three or four months. That has been a learning process for me over the years.”

Shim collected half a million signatures from the industry in support of allowing c-stores to sell alcohol, and with the help of a recently elected premier, he helped get the legislation passed in September 2024.

Alsaker once worked diligently on a bill to combat fuel tax evasion for almost four years before it got passed. “I think I took a record

Business owners and retailers need to be active to protect regulations and keep them reasonable instead of unreasonable. Your voice can do that.”

—Raymond Huff, president of HJB Convenience

channels, said Steve McKinley, founder of Urban Value Corner Store. “I have made so many contacts in the last few years with those from large companies like Walmart to other small business owners. It’s important to not only learn what they’re going through, but some of the best practices they’re doing.”

Find peers. Get to know other industry advocates at fellow convenience businesses. “As a small business owner, I also want to know who is speaking for [the large convenience companies]. They in turn rely on me as a small business owner to share my point of view,” said Dan Alsaker, Principle at Alsaker Corp. dba Broadway. He also noted that networking with industry advocates in other countries can help you navigate legislation they may have tackled before and can provide insight on.

Brag about the industry. Social media is full of great things convenience businesses are doing, from hosting local community events to donating to causes in their areas. Share these stories and highlight how crucial convenience businesses are to the local fabric. Another great thing to brag about: food! Everyone loves a good food recommendation, and in many areas, a local convenience store might have the best meal in town.

Silence is not an option— that is how you will get an outcome you don’t want.”

—Tom Brennan, chief merchandising officer at Casey’s General Stores

Lyle Beckwith guest editor

This is especially true with our fight against the credit card industry. They have unlimited money ... and spend it to break us. They are counting on a war of attrition that will wear us down and crush our resolve. They have severely miscalculated.

17 trips in one year to Washington, D.C. But I led a team that was persistent. From there we also helped make changes to state-level regulations about fuel tax evasion, which was a big deal.”

“The hope of the opposition is that we won’t stay persistent, that we will go away,” continued Alsaker. But with perseverance and the industry keeping its feet to the ground, the narrative—and outcomes—on pivotal issues can change.

In the five years that he’s been participating in Day on the Hill, Brennan said 2024’s event had the “most receptive and positive conversations” he’s been a part of. “Not that anyone is committing to voting a certain way yet, but they seem more open and the nature of the questions they ask are more supportive versus pointed,” he said.

“Advocacy isn’t something that necessarily always translates into, ‘look at what we accomplished this year,’” Brennan continued. “It’s about staying in it for the long run and continuing to engage. It’s not always quick wins—it’s about ensuring that you’re helping shape the narrative and making your point of view heard, so that when we do get to a decision point, you know you’ve done everything you can to put the perspective of the industry out there and hopefully get the best outcome.”

Lauren Shanesy is a writer and editor at NACS and has worked in business journalism for a decade. She can be reached at lshanesy@ convenience.org.

Advocacy is about a lot more than lobbying your elected leaders—it means talking to your chiropractor, too.

BY JEFF LENARD

’ve shared the industry’s story for more than 25 years. In that time, I’ve seen how the importance of storytelling has grown and the impact that it can have. But storytelling has always been around to bond communities—whether ancient civilizations creating narratives around clusters of stars in the universe or modern filmmakers creating origin stories about a universe of superheroes.

Storytelling also is advocacy, and it’s a type of advocacy that everyone can do—a frontline worker, a store manager or a CEO.

Advocacy is talking about what you care about—and then making your audience care about it, too. Advocacy doesn’t have to be a conversation with a politician that leads to getting their vote on a bill. It just has to make whoever you are talking to become more interested in the industry.

A few years ago, I was invited to speak to a group of teens about nutrition. My presentation was scheduled for 8:30 a.m. on a Saturday morning in Durham, North Carolina. It was the worst possible group to deliver a standard presentation to. So, instead I opened by talking about something everyone likes: Eating delicious food.

“Before I start, I want to talk about my dinner last night,” I said. “Stuffed pork chops, with garlic mashed potatoes and sauteed veggies— from a gas station just up the road. It was one of the best meals I’ve had in months.” I shared that my amazing meal was from Saxapahaw General Store, a convenience store nearby.

The mood of the room brightened. The kids treated me as if I was a food expert they wanted to hear, not the speaker they were quite possibly forced to hear. And that allowed me to seamlessly weave in some messaging.

Don’t expect that your audience will immediately understand what you know and want to say. Find entry points than anyone can relate to and pull them in.

Lyle Beckwith guest editor

This holds true for lobbying as well. Members of Congress are familiar with their own convenience stores and NACS lobbyists need to know their point of reference. You don’t talk about Wawa hoagies with Members from California or Casey’s pizza with Members from Vermont!

My job at NACS is to tell the industry’s story. In each of the thousands of interviews I’ve done with reporters, I want to tell stories that amplify a point. It could be about gas prices, sales trends or any other issue our industry faces. These stories connect the message I want to convey with industry insights. But insights can sometimes fail if your audience can’t understand them.

That happened to a friend who was disappointed by a newspaper story in which he was quoted. His immediate reaction was, “I can’t believe the reporter got it all wrong!”

My friend had been in the business for 40-plus years and had a 20-minute conversation that he expected was sufficient to explain a complex issue to a news reporter who covers a different topic every day. The time spent on the interview was probably sufficient, but the context was wrong. He was likely too high-level and that’s a lot to digest for someone new to the subject—and on a tight deadline. He should have started the interview with a few minutes of background information, which could have provided valuable context for his later comments to resonate.

Not every one of my interviews with reporters has gone well either. My first one at NACS was terrible. It was with an industry trade publication, so there is no reason that it

shouldn’t have gone well. I was asked about a complex government relations issue and simply repeated what someone told me about the issue. I didn’t provide any context and my comments that were printed didn’t present NACS in the best light. Instead of making that my last interview opportunity, my boss made it a learning opportunity. She used a great restaurant analogy: “Don’t just be the server and deliver the meal. Be the chef and prepare it.”

I heard that lesson worded differently by 2001 NACS Show speaker John Major, the former Prime Minister of the United Kingdom. After he concluded his presentation, he said he had time for questions. “You can ask any questions you want, and I will answer them any way I want,” he said.

He gave the audience insight into one of the most important lessons in media training: Answer the question you want to answer—and that may not be the question asked.

Ultimately, you’re in control of your story. Make sure you provide necessary context for what you want your audience to remember, and that may mean modifying the topic beyond simply responding to questions.

Your opportunities to advocate are limitless, and they also can be opportunities to test things out.

Every now and then I’ll go to the chiropractor to get an adjustment. At some point, he’ll ask me about my family and my job. It took me a while to figure out that maybe he doesn’t actually care what my answers are. Instead, they are incredibly easy conversation starters for him to keep the session lively, even if it’s not always easy for me to answer when I’m face down on the table. But I digress.

When he asks about my job, I don’t talk about how many e-mails I sent, meetings I had or even where the office is located. I talk about things that I think might make him like convenience stores more. Just like the way a comedian might workshop jokes in a small club before going out on tour, I’ll try some material out on him about cool stores, like a gas station that had a swimming pool (Fuel City), a brewery connected with a convenience store (93 Octane) or fantastic birria tacos and quesadillas in a Shell station (Birria Boys). It’s pretty easy to quickly sense what works and what doesn’t, and that is great practice for what I might later say in a speech or to a reporter.

My chiropractor isn’t an elected official, but he has a say in the future of our industry—as a voter and as a consumer. So why not plant a few seeds and see if they take root? You never know how it could play out—he could tell two friends, they could tell two friends and … that was the logic behind that classic Faberge Organics shampoo word-of-mouth advertising campaign from the 1980s.

I do the same thing at meetings outside our industry. I serve on the boards of a few community-focused groups, and there’s always some sort of industry fact or nugget I will add when we go around the room giving introductions. At some meetings, people are actually disappointed if I don’t bring a new one.

The takeaway:

As an industry advocate, you’re never really off duty. You can hone your skills wherever you are and with whomever you’re talking with.

One of the most important tools for me in communications is the extensive research we’ve conducted on consumer perceptions. Understanding what consumers think about our industry allows us to amplify positive attributes and address others that may be perceived as less positive. And those insights allow us to have valuable context around what people think. For instance, 24-hour operations are often perceived as a negative and assumptions are that nothing good happens after a certain time of the day. We have a different take on that, as you’ll see below.

In addition, we’ve also tested messages to see how effective they are, much like how a political campaign is run: Find out what people consider most important and then focus on how you best address those issues of importance. And just like with political campaigns, we’ve seen that messages bringing issues down to a local level are highly effective.

Below are three broad messages that have related context and facts that have been very effective in telling our industry’s story. Most of the statistics are U.S.-focused, but the messages can easily resonate across the globe with different metrics to support them.

Convenience stores are one of the few 24/7 businesses that provide much-needed food, fuel and refreshment for millions of Americans, especially first responders, police officers, firemen, factory workers, hospital workers and restaurant employees.

Increasingly, Americans working later shifts depend upon convenience stores, which are often the only stores open to serve them. More than one in seven workers (15% of all full-time wage-earners) are defined as “second or third shift workers” (those who work between 6:00 pm and 7:00 am).

For some professions, shift work is much more common. Over half (51%) of all protective service workers (police, fire, EMT, etc.) work either second or third shifts—and 28% of health-care support workers (hospital, home care, etc.) work second or third shifts. Workers supporting other critical services are also more likely to work later shifts. Twenty-nine percent of transportation workers (truckers, delivery, etc.) work second or third shifts, as do 40% of those involved with food preparation and related occupations.

As 24/7 operations, convenience stores are in a unique position to address important societal issues, like human trafficking. More than 30,000 stores work with the organization Convenience Stores Against Trafficking, posting “Freedom Stickers” in restroom stalls, while others work with the U.S. government’s “Blue Campaign.” Other con-

venience stores assist at-risk youth through the National Safe Place Network or the National Center for Missing & Exploited Children (NCMEC).

Convenience stores are part of the fabric of the communities they serve, and demonstrate that through their charitable giving programs and in their continual enhancements to stores. The convenience store industry cumulatively collects and contributes more than $1 billion per year to charities. Two in three c-stores (66%) support five or more charitable causes. Local causes are particularly important to c-stores, whether church groups, shelters, food banks or youth groups.

Convenience stores also are there for communities when disaster strikes. They are often the last to close and the first to open during natural disasters, whether that’s forest fires, hurricanes or floods. Countless c-store parking lots have become command centers for first responders to gather.

Lyle Beckwith guest editor

And don’t forget the vital role we played during the Covid shutdown. As essential businesses, we were a lifeline of normalcy to the communities we serve.

In addition to serving communities, convenience store operators invest in them. The average cost to build a new store is more than $5 million. In addition, stores are regularly remodeled; the average cost of a remodel is nearly $800,000. With this large investment, store owners have a valuable stake in the community’s success.

Convenience stores also invest in the people in a community. The industry overall adds 2.74 million jobs to the U.S. economy. Every convenience store that opens provides 18.1 jobs at the store level—plus 1.2 jobs for headquarters personnel. These convenience store jobs present great opportunities to establish business skills, whether as good first jobs for those looking to enter the workforce or for those who will work their way up to become managers or even run their own stores. Convenience store jobs are also flexible and offer students, parents, caretakers and others a way to earn a paycheck on nights and weekends.

Convenience stores are closer to their customers than any other channel: 93% of Americans say they are within 10 minutes of a convenience store, including 86% of rural Americans.

The 152,396 convenience stores in the United States—one for every 2,200 people—are intensely local businesses that are tailored to the needs of customers who are often located within a mile or two of the store. Collectively, they conduct approximately 160 million transactions per day, which equates to nearly half the U.S. population.

C-stores also cater to the needs of commuters and travelers. They sell an estimated 80% of the fuel purchased in the United States, which equates to about 32 million fill-ups every day.

In addition to having convenient locations, convenience stores offer speed of service—the average time spent inside a convenience store is under 4 minutes, which is significantly faster than any other channel.

Convenience store sales in 2023 were $860 billion, which was 3.1% of the $27.4 trillion U.S. economy; that means that one of every $32 spent in the country on goods and services was spent at a convenience store. And if total industry sales were compared to the GDP of countries, the industry would rank at #20, behind Switzerland and ahead of Poland.

As part of these sales, the convenience industry paid or collected $19.7 billion in state and federal taxes. That’s about $350 per store, per day filling up government coffers and helping to pay for essential services.

Okay, so let’s put everything together. Opportunities to advocate are limitless, especially when you properly frame your conversation with stories that are both of interest to your audience and advance a message important to you. The final element is adding facts. But not just any facts. You want fun facts. And fun facts are facts that someone else wants to hear. (Fun fact: Most of the time when someone starts a sentence with “fun fact,” odds are what they next say is not fun.)

Over the years, we have developed some key messages that we have seen work. They are statements that position the industry in a positive light. They provide context so you don’t get lost in numbers that are difficult to follow. And they make someone understand our industry a little bit better.