SWEET SCOOPS

Hand-dipped cones draw customers

JOBS, CRIME, PRICES

NACS surveys

c-store consumers

SWEET SCOOPS

Hand-dipped cones draw customers

JOBS, CRIME, PRICES

NACS surveys

c-store consumers

30 Boosting

This article is brought to you by Pace-O-Matic. Pace-O-Matic skill games draw customers into stores and keep them there.

34

Summer road trips are on the horizon, and convenience stores are gearing up to be the ultimate one stop shop.

42 What

The

60

50

66

72

IT’S A FACT

$18,063

The average sales per store, per month of beer in 2022.

CATEGORY CLOSE-UP PAGE 94

06 From the Editor

08 The Big Question

10 NACS News

16 Convenience Cares

20 Inside Washington NACS has worked to ensure retailers have a level playing field when it comes to EV charging.

28 Ideas 2 Go Corner Post delivers fast, personalized convenience to its customers.

90 Cool New Products

92 Gas Station Gourmet The Henry family makes customers feel like they’re a part of the family.

94 Category Close-Up C-stores buck the trend of soft beer sales as the category drives trips for retailers.

104 By the Numbers

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor lking@convenience.org

Leah Ash Assistant Editor lash@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Amanda Baltazar, Shannon Carroll, Sara Counihan, Sarah Hamaker, Al Hebert, Maura Keller, Pat Pape, Emma Tainter

DESIGN

Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

CHAIR: Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Chuck Maggelet, Maverik Inc.; Don Rhoads, The Convenience Group LLC; Brian Hannasch, Alimentation Couche-Tard Inc.; Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charlie McIlvaine, Coen Markets Inc.

PAST CHAIRS: Don Rhoads, The Convenience Group LLC; Jared Scheeler, The Hub Convenience Stores Inc.

MEMBERS: Chris Bambury, Bambury Inc.; Tom Brennan, Casey’s; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC Terry Gallagher, Gasamat Oil/Smoker Friendly;

NACS SUPPLIER BOARD

CHAIR: David Charles, Cash Depot

CHAIR-ELECT: Vito Maurici, McLane Company Inc.

VICE CHAIRS: Josh Halpern, JRS Hospitality/BCIP dba Big Chicken; Bryan Morrow, PepsiCo Inc.; Kevin LeMoyne, Coca-Cola Company

PAST CHAIRS: Kevin Farley, Impact 21; Brent Cotten, The Hershey Company; Drew Mize, PDI

Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Tony Miller, Delek US; Natalie Morhous, RaceTrac Inc.; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Kristin Seabrook, Pilot Travel Centers LLC; Babir Sultan, FavTrip; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES:

David Charles Sr., Cash Depot; Kevin Farley, Impact 21

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

MEMBERS: Tony Battaglia, Tropicana Brands Group; Patricia Coe, Advantage Solutions; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Ramona Giderof; Mike Gilroy, Mars Wrigley; Danielle Holloway, Altria Group Distribution Company; Jim Hughes, Krispy Krunchy Foods LLC; Kevin Kraft, Q Mixers; Jay Nelson, Excel Tire Gauge; Nick Paich, GSTV; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Chuck Maggelet, Maverik Inc.; Tom Brennan, Casey’s

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices.

1600 Duke Street, Alexandria, VA 22314-2792

Why don’t more people want to work in the convenience industry?

The NACS/Coca-Cola Retailing Research Council recently released a new report titled “Convenience Industry Action Plan for Becoming an Employer of Choice.” The report highlights how, for convenience stores, a small pool of candidates is a big problem.

In another sign (if you needed one) of how massive our industry is, a full 8% of respondents said they currently work in a c-store or have in the past, while 9% would be interested in working in a c-store. That means 83% of respondents would take a pass on working at a c-store.

The report highlights opportunities to change negative perceptions. For example, concerns about team member safety are keeping some people out of the c-store labor pool. These can be addressed. Look for detailed insights about this report in the May issue of NACS Magazine. You can download the report at www.convenience.org/NCCRRC .

Separately, a recent NACS survey dove into various perceptions consumers have toward c-stores, including jobs in convenience retail. You can read some of the findings in the article “What Consumers Say About Prices, Crime and C-Store Jobs.”

To whet your appetite, here are a few results:

• 82% of respondents agree that convenience stores provide good first jobs for those looking to enter the workforce.

• 64% of the people surveyed agree that customers are generally kind and appreciative toward people who work in c-stores.

• 53% feel that working in a c-store is a relatively easy job.

64% of the people surveyed agree that customers are generally kind and appreciative toward people who work in c-stores.”

Jeff Lenard, NACS vice president of strategic industry initiatives, walks readers through the findings, starting on page 42. The results of the NACS survey show that there are opportunities to tell a better story about c-store jobs.

Be sure to check out our other highlights in this issue, too, with several focusing on getting ready for summer drive season. My favorite is our feature on ice cream, which starts on page 80.

I hope you’re looking forward to a great summer, packed with travelers and opportunity.

Ben Nussbaum Editor-in-Chief

Ben Nussbaum Editor-in-Chief

But for most people who are Gen Z—people born between 1996 and 2010— they’ve had to grow up so fast. I was talking to someone the other day, she said “I was nine years old when the recession hit and that completely transformed my life. I remember how that affected my parents. I remember the serious conversations in our household.” Gen Z is just so much more practical, I feel like, than generations before. They’ve had to be.

You see people talking about this generation, and how they’re asking for higher wages, or they’re pushing back on the finances, and it’s kind of like, of course they are! They grew up during two recessions and then they lived through the pandemic and saw the kind of financial impact that had.

Gen Z tends to have Gen X parents, who are so different than Baby Boomer parents. Boomer parents tended to be more like, “I want to empower you to shoot for the stars and craft your own way.” And Gen X parents tend more towards, “Do you know how difficult the world is out there?”

With Gen Z, what we’re seeing is, because they are so practical, if you’re a leader for any kind of company, say to them, “I care about you as a person. I’m going to give you some resources to train you. So even if you leave here, you can take the skills you learned at

Hannah Ubl, Good Company Consulting. Ubl spoke at NACS Leadership Forum and NACS Human Resources Forum.

this company and they are transferable somewhere else.” I think Gen Z is drawn to places that invest in them.

Another thing: Gen Z is looking for a psychologically safe environment, and looking for leaders who take time to listen to them and then take action based on what they’re hearing.

One thing that’s important about this group is they want extremely clear, explicit instructions. We worked with a theme park for a couple of years. And people who are making funnel cakes, for example, might say, “You need to tell me exactly steps 1 through 10 of how to make these, but then I need to know all of the extra steps, like when do I change my gloves?” It’s about having truly explicit instructions. Whereas for Millennials, there’s less of a desire for some of that because it takes away the opportunity for them to try it their own way.

Anecdotally, I hear from people that this generation is great in the workplace. We should listen to them. We all do better when we listen to young voices.

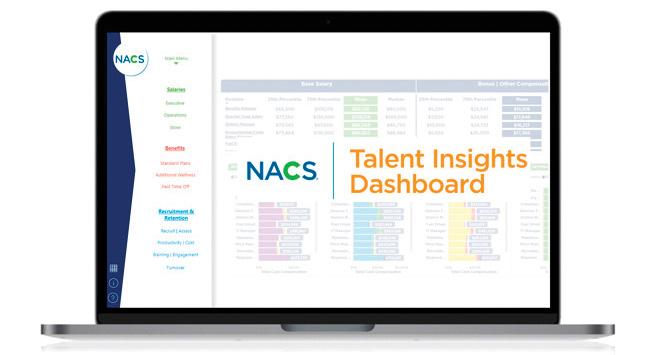

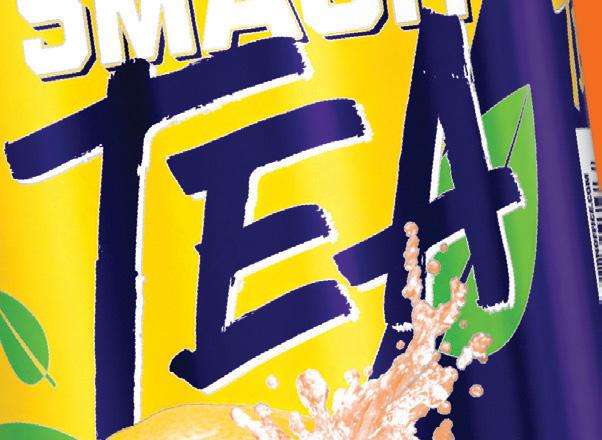

The Dashboard, which replaces the Compensation Report, allows enterprise access to all of the benchmarking data retailers need.

NACS’ annual compensation study aggregates convenience industry-specific compensation, total rewards and retention data to help retailers build a competitive compensation strategy. To ensure you can use NACS compensation data to its fullest potential, NACS has created an interactive dashboard that aids data visualization and helps retailers hire strategically and benchmark against peers in the industry.

The NACS State of the Industry Talent Insights Dashboard® provides the most current year’s human resource benchmarking data, highlighting

the key categories of compensation, turnover, benefits and recruitment. It’s all the same data and insights human resources professionals were used to seeing in the former Compensation Report, and is wholly collected from convenience retailers.

“This is a game-changer—no more scrolling through pages and pages of a static PDF. You’ll be able to easily and quickly find and access the benchmarking data you need,” said Jayme Gough, NACS research manager. Purchase access to the Dashboard at convenience. org/store

NACS has added new staff, including two new members of its engagement team.

April VanApeldorn is the NACS director of retail engagement, west and Chris Postlewaite is the NACS director of retail engagement, east.

VanApeldorn most recently served as vice president of operations for Mass Equities, which operates roam’n stop stores. Prior to that, she served as director of dealer wholesale operations for MAPCO Express Inc. She also served in leadership roles with Delek and RaceTrac.

Postlewaite was most recently at Campell Oil Co./Minuteman Food Mart, where he was senior director of retail. He also held leadership positions at Holmes Oil/Cruizers, CEFCO Convenience Stores, GPM Investments, Valor Oil/ Jumpin’ Jack’s and Postlewaite’s Gas & Deli. He also served three years in the United States Navy.

In these newly created roles, VanApeldorn and Postlewaite are responsible for engaging new and existing member companies and their employees.

“Bringing in these industry veterans is part of our commitment to making sure our retailer members have great partners at NACS who help them get the most out of NACS membership, including our educational resources, events and fantastic advocacy team,” said Jeff Burrell, NACS vice president of retail engagement. “April and Chris will be at many industry events and are also traveling to visit select retailers when they are able."

Scott Bolden joined NACS as a marketing manager. Bolden has extensive experience in strategic plan development, managing website and social media content development, exhibits and events marketing and project management. Most recently, Bolden was marketing manager for the Executive Leadership Council.

Romeo Clemente joined NACS as an accounts payable coordinator. Clemente earned a B.S. in finance from Virginia Commonwealth University earlier this year. While in school, he served as a financial advisor intern for First Financial Group and as an accounting intern for Energy Recovery Inc.

The Transportation Energy Institute will hold its annual conference at the Loews Minneapolis Hotel in Minneapolis, Minnesota, May 13-15.

This year’s theme is Innovation for Sustainable Transportation. The event offers attendees a chance to explore the latest issues facing the market and network with their peers.

The conference is an opportunity to learn from speakers and, more importantly, from other attendees who are deeply involved in the energy industry. It is the one place to connect with experts from all facets of the transportation sector.

A list of session topics can be found online at transportationenergy.org. Some of the 2024 program topics include:

• A Data-Centric Perspective on the Light-Duty Vehicle Transition

• Transitioning Fleets to Zero Carbon

• Building a Viable EV Charging Network

• Electricity Reliability in an Increasingly Electrified World

• Biofuels—The Near-Term Solution?

• Future of Low Carbon Fuel Standards

Parkland Corporation announced the appointment of James Neate, an investment banking executive, to its board of directors.

Neate has an over 30-year career in the Canadian banking industry at Scotiabank. Neate most recently served as president and group head of corporate and investment banking, with global management responsibility for investment banking, global business payments and corporate banking.

Emily Sheetz now serves as executive vice president of strategy and IT for Sheetz Inc.

Emily is responsible for providing leadership and direction for 250 employees from Sheetz’s strategy, IT and innovation teams. Emily will also focus on formalizing the company’s strategic planning processes and forging new working relationships and synergies across the organization.

Ryan Sheetz is now executive vice president of marketing and supply chain at Sheetz Inc. Ryan oversees the company’s marketing, as well as Sheetz Distribution Services and Sheetz Brothers Kitchen. Ryan will develop the company’s annual marketing strategies and drive implementation of go-to-market plans.

Sheetz Inc. appointed Trevor Walter as executive vice president of petroleum supply management. Walter will lead and direct all aspects of the organization’s supply chain policies, objectives and initiatives. Walter also will lead external logistics and control processes and oversee domestic sourcing of material and services and transportation.

Mondelēz International Inc. appointed Brian McNamara to the company’s board of directors.

McNamara has served as chief executive officer of Haleon plc, formerly GSK Consumer Healthcare, since May 2022.

Steve Wright is now manager, strategic dealers at Hoshizaki. Wright has 26 years in the foodservice industry. Wright brings a wealth of industry knowledge as a certified foodservice professional (CFSP) and certified professional manufacturer’s representative (CPMR).

John Blizzard joins Hoshizaki as manager of strategic sales. Blizzard will drive new business initiatives within national chains,

consultants and the medical channel. Blizzard has over 20 years of industry experience.

Kevin Geyer joins Hoshizaki as the newest area sales manager supporting the Michigan territory. Geyer has 18 years industry experience and previously was part of Parks Maintenance, where he cultivated longterm industry relationships while selling foodservice equipment.

Tyler Cameron joined the Rovertown company as head of strategy and analytics. Cameron will spearhead the development of next-generation digital engagement analytics and reporting. Cameron most recently served as MAPCO’s director of loyalty. Cameron also launched the MAPCO mobile app.

Kathy Puckett is now vice president of sales and business development at Reichel Foods. Puckett joined the Reichel Foods team in February 2023 as national sales manager. Puckett will continue to assist retailers in all industry channels including convenience, distributors, vending, airline and private brands.

NACS welcomes the following companies that joined the Association in January 2024. NACS membership is companywide, so we encourage employees of member companies to create a username by visiting www.convenience.org/createlogin. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership

Bronze AMCON Distributing Company Omaha, NE www.amcon.com

J & M Distributors Inc. Little Rock, AR www.jmdistributorsinc.com

OLIPOP Oakland, CA www.drinkolipop.com

Philips 66 Company Houston, TX

REDCON1

Boca Raton, FL www.recon1.com

Silver Chobani Norwich, NY www.chobani.com

Lucky Beverage Co. Austin, TX

Trinchero Family Estates dba Sutter Home Winery Saint Helena, CA www.tfewines.com

RETAILERS

Brenton Investment Corp. dba Hit-n-Run Food Stores Youngsville, LA

Broadway Express Svcs Ltd. Arima, Trinidad and Tobago

Bowlin Travel Centers Inc. Albuquerque, NM www.bowlintc.com

Phillips 66 Company Houston, TX

Posto de Gasolina Lord Barra Sul Ltda Rio de Janeiro, Brazil www.autolord.com

RMC Brea, CA www.rahimiancorp.com

SUPPLIERS 1st Phorm Fenton, MO www.1stphorm.com

AdToScreen Pleasant Grove, UT

Advanced Refrigeration Technology (China) Co. Ltd Yantai, Shandong, China

Aqua Case Scottsdale, AZ www.aquacase.net

Arla Foods Inc. Basking Ridge, NJ www.arlausa.com

Azure Standard Dufur, OR www.azurestandard.com

Best Name Badges Plantation, FL www.bestnamebadges.com

BlackArch Partners Charlotte, NC

Bolthouse Fresh Foods Bakersfield, CA www.bolthouse.com

C. Cretors & Company Wood Dale, IL www.cretors.com

CAMO Energy Pittsburgh, PA www.camoenergyshots.com

Central Beer Miami, FL

Chenming Industry and Commerce Shougang Co. Ltd Shouguang, Shandong, China www.chenhongwood.com

Chuckanut Bay Foods Blaine, WA www.chuckanutbay.com

Club 13/Deltiva Hastings, FL

Confetti Snacks Inc. San Fransico, CA

Convenience Store News dba EnsembleIQ Chicago, IL www.csnews.com

Cosun Technology (Shenzhen) Co. Ltd. Pudong New District, Shanghai, China

CT Bakery Etobicoke, ON, Canada www.ctbakery.com

Dauphinias Sherbrooke, QC, Canada www.dauphinias.co

Dieffenbach’s Potato Chips Inc. Womelsdorf, PA www.dieffenbachs.com

Dongguan Display Leader Co. Ltd. Dongguan, China www.tonghuihardware.en.alibaba.com

E S Foods Woodbury, NY www.esfoods.com

Emmi Roth Stoughton, WI www.emmiroth.com

Fanale Drinks Hayward, CA

Ford Gum & Machine Co. Inc. Buffalo Grove, IL www.fordgum.com

Fox Marketing Products Murrieta, CA

Fresh Innovations LLC Rhome, TX www.freshinnovationsllc.com

Go Energy Foods Inc. Bluffdale, UT www.e3energycubes.com

Gorilla Mind Boise, ID www.gorillamind.com

Gaungzhou Trond Display Co. LTD Guangzhou, Guangdong, China www.gspmed.com

Hara Brands Las Vegas, NV www.harabrands.com

Hawaiian Host Group South Lebanon, OH www.hawaiianhostgroup.com

Imperial Brown Portland, OR Imprint Plus Richmond, BC, Canada www.imprintplus.com

Jail Breaker Brands London, KY www.jailbreakerbrands.com

Jans Enterprises Corp. El Monte, CA www.jansfood.com

Kagome Foods Inc. Los Banos, CA

KC Belle Baton Rouge, LA

KC Store Fixtures Kansas City, MO

King B Distribution LLC Sandy, UT www.gotkushkubes.com

Kırdağ LTD/Perfect Delights USA

Kudo Snacks Sandy, UT Loomis Houston, TX www.loomis.us

Lust Vapes Inc. Edison, NJ

M&Q Packaging LLC dba PanSaver Limerick, PA www.pansaver.com

Mama’s Creations East Rutherford, NJ

Mini Melts Ice Cream Trevose, PA www.minimeltsusa.com

Mitra9 Brands Fort Myers, FL

NAELCO INC. Columbia, TN www.bigdotlighting.com

Neon Phoenix, AZ

Northeast DSD Group Inc. Mount Vernon, NY

Nutrifreeze Cypress, TX www.nutrifreezellc.com

Palermo’s Villa Inc. dba Palermo’s Pizza Milwaukee, WI www.palermospizza.com

Platinum Goods Corp. Miami, FL

Pure Green Juice Co. Sunrise, FL www.puregreen.com

Revolution Consumer Solutions Vernon, CA

2024

APRIL

Conexxus Annual Conference

April 28-May 02 | Live! By Loews Arlington, Texas

JUNE

NACS Convenience Summit Europe

June 04-06 | Intercontinental Barcelona Barcelona, Spain

JULY

NACS Financial Leadership Program at Wharton

July 14-19 | The Wharton School University of Pennsylvania Philadelphia, Pennsylvania

Sauer Brands Richmond, VA www.cfsauer.com

Sawang Leangtong Company Bangkae, Thailand

Schafer Retail Solutions + Adair, IA

Simply Gum Brooklyn, NY

Southern Champion Tray Murfreesboro, TN

Spylt Lehi, UT

Star Charge Americas Corp Santa Ana, CA

Suzhou HongYuan Business Equipment Manufacturing Co. Ltd Suzhou, China

SwiftScale Retail Solutions Rolling Meadows, IL www.swiftscaleretail.com

NACS Executive Leadership Program at Cornell

July 28-August 01 | Dyson School, Cornell University Ithaca, New York

OCTOBER

NACS Show

October 07-10 | Las Vegas Convention Center Las Vegas, Nevada

NOVEMBER

NACS Innovation Leadership Program at MIT

November 03-08 | MIT Sloan School of Management Cambridge, Massachusetts

Synergy Flavors Wauconda, IL www.synergytaste.com

Tillamook Country Smoker Inc. Bay City, OR www.tcsjerky.com

Top Notch Jerky LLC Sugar City, ID www.topnotchjerky.com

Trimark Food Brands Inc. Toronto, ON, CA www.tropicaldelight.com

Tugboat Creative Works New Haven, CT

U.S. Cooler Quincy, IL www.uscooler.com

VoCoVo Aurora, IL www.vocovo.com

Zyng Technologies Chandler, AZ www.zyngtechnologies.com

NACS Women's Leadership Program at Yale

November 17-22 | Yale School of Management New Haven, Connecticut

2025

JANUARY

Conexxus Annual Conference January 26-30 | Loews Ventana Canyon Tucson, Arizona

visit www.convenience.org/events.

More than 11,000 children directly benefitted from the contributions.

Sheetz For the Kidz, an employeedriven charity supporting underprivileged children, raised more than $1.7 million in 2023, including a record-breaking $807,328 in December.

During the months of July and December, Sheetz customers made donations at checkout through donation boxes or by adding donations to their purchase at point of sale. Each of Sheetz’s more than 700 stores supported 16 children from their local communities, totaling over 11,500 children helped this past holiday season. In the last two years, Sheetz For the Kidz has raised over $3 million for local families in need during its annual months of instore fundraising.

“Each and every year, we are blown away by our customers, who always exceed our expectations. Our customers continue to bring hope and joy to thousands of children across our footprint during the holiday season,” said Brittany Funcheon, Sheetz For the Kidz executive director.

In partnership with Make-A-Wish, funds raised during the campaign also sponsored wishes of children with

life-threatening medical conditions. The charity sponsors one child per Sheetz operating district, totaling 71 children this past year.

In addition, Sheetz For the Kidz partners with Feeding America to provide food to children in need. In 2023, its $716,000 commitment served over 1.5 million meals through backpack programs, kids cafés, school and mobile pantries and summer programs.

In 1992, two district managers created Sheetz For the Kidz as a way to give children in need the opportunity to celebrate the holidays with new toys, clothes and other basic needs. That first year, the managers raised $12,000 and took 126 children shopping. The charity partners with the Salvation Army, which selects families within each store’s community to participate in the program.

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities.

The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories.

Learn more at www.conveniencecares.org.

1 United Way Canada (Greater Montreal Area) was the recipient of more than $318,000 from Alimentation CoucheTard. The funds were raised through a variety of initiatives, including events such as a company auction, a special pastries day event, the generous donations of employees and a series of fundraising activities across various points of sale.

2 Guests at EG America’s Certified Oil, Cumberland Farms, Fastrac, Kwik Shop, Loaf N’ Jug, Minit Mart, Quik Stop, Sprint Food Stores, Tom Thumb and Turkey Hill stores donated $1, $5 or an amount of their choosing during EG America’s

fifth annual fundraiser for Disabled American Veterans (DAV). In total, EG America raised $750,000. DAV programs include transportation to and from medical appointments at no cost. Members of EG America’s leadership team presented a check to DAV Executive Director and CFO Cody VanBoxel in January.

3 The GATE Foundation, the philanthropic arm of Jacksonville-based GATE Petroleum Company, and GATE customers raised $50,000 for the American Lung Association. Funds were collected in coin boxes located at the registers of all GATE locations in Florida, Georgia, North Carolina and South Carolina, beginning in July and running through December 2023.

4 GPM Investments LLC, a subsidiary of ARKO Corp., raised more than $193,000 in customer donations during its 13th annual holiday pinup campaign in 2023, and cumulatively has raised over $2 million for the mission of the Muscular Dystrophy Association since 2011.

5 Parker’s Kitchen celebrated the new Gregory M. Parker Emergency Department at Roper St. Francis Healthcare in Charleston, South Carolina, on January 29. The ribbon-cutting ceremony recognized Parker’s $5 million donation—the largest in the system’s history—which established the Roper St. Francis Foundation Parker’s Community Impact Fund to support uninsured and underinsured residents throughout the greater Charleston area.

6 Sinclair Oil raised more than $635,000 in its campaign Fueling Folds of Honor for educational scholarships to support the children and spouses of fallen or disabled veterans and first responders. The funds were raised during the company’s fall 2023 giving campaign. A portion of funds from fuel purchased at participating retail locations and $3 for every new DINOPAY app account went to Folds of Honor. About 127 educational scholarships of $5,000 each will go to families of fallen veterans and first responders in the areas served by Sinclair stations.

• Establishes a digital foundation to optimize the ATC 21+ journey

• Enables an integrated marketing approach focused on the ATC 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect and engage with your ATC 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes and enables new channels for ATC 21+ experiences

Meet the evolving ATCs 21+ expectations to improve consumer experiences by enhancing retail digital capabilities and building a foundation of responsibility

©2024 Altria Group Distribution Company For Trade Purposes Only

NACS has worked to ensure retailers have a level playing field.BY PAIGE ANDERSON

500,000

the number of EV charging stations that the Biden administration aims to install $2.5 billion the money allocated to a grant program to help fund EV charging projects along designated alternative fuel corridors.

At the beginning of his term, President Joe Biden stated that his administration had a goal of installing at least 500,000 EV chargers in the transportation refueling system across the United States to lower the carbon footprint of the transportation system.

To meet that goal, the Biden administration has been pursuing an aggressive regulatory agenda to reduce carbon emissions in the transportation sector. The administration has also been pursuing an expedited transition to a net-zero vehicle profile through incentives included in the Infrastructure Investment and Jobs Act (IIJA) (also known as the Bipartisan Infrastructure Law) and the Inflation Reduction Act for EVs and EV charging infrastructure, along with regulatory proposals, such as EPA’s tailpipe emissions rulemakings on light-duty vehicles and mediumand heavy-duty vehicles. While the regulatory rulemakings have not been finalized, funding has begun to be released from the incentive programs, including the National Electric Vehicle Infrastructure (NEVI) program.

The NEVI program was created and included in the $1.2 trillion bipartisan infrastructure bill, which was passed by Congress and signed into law by President Biden in November 2021.

The NEVI program will allocate $7.5 billion for EV charging projects and to establish an interconnected network to facilitate data collection, access and reliability of the EV charging network. There are two groups of funding: The

Funding has begun to be released from the incentive programs.

In January, the U.S. Department of Labor (DOL) released its new rule governing independent contractor status and, at publication time, is tentatively scheduled to release its final rule governing overtime exemptions sometime in February. These are just two of the myriad regulations we are likely to see released by the Biden administration before July. The DOL has almost three dozen rules listed in the “proposed rule stage,” according to the latest Unified Agenda of Regulatory and Deregulatory Actions. Other agencies—such as the Department of Interior and the EPA—have dozens more pending. Many of those won’t directly affect the convenience retailing industry, but some will.

This kind of rush to finalize new rules in, potentially, the final year of an administration is nothing new. Every four years, we tend to see an increase in the pace of significant rulemakings out of Washington in the first half of the year or so. The reason has to do with the Congressional Review Act (CRA). The CRA allows Congress to vote to nullify regulations if such a resolution of disapproval is acted on within a 60-consecutive-legislative-day window after the rule is released. The law was created in 1996 but was only successfully used once prior to 2016. In the last eight years, Congress has successfully nullified 19 more regulations. The majority of those happened following President’s Trump inauguration in 2017.

The 60-consecutive-legislation-day window is the real driver of the timing. If that clock has not expired before the end of a Congress, the next Congress gets an additional window of time within which to file such a resolution. Because both chambers are scheduled to be out of session for the entire months of August and October, rules must be finalized before some time likely in May or June to avoid running out the clock during the 118th Congress.

With the possibility of changes in the White House and in Congressional majorities on the table, the Biden administration wants to avoid having that clock running out.

These state plans … took many approaches to expand EV charging station networks.

first is the NEVI formula program for the states, and the second is a $2.5 billion grant program to help fund EV charging projects along designated alternative fuel corridors. The goal of these two programs is to create a nationwide, interconnected network of DC fast-charging stations along federally designated alternative fuel corridors.

During the IIJA legislative process, NACS supported the statute and worked to make sure language was included that ensures that convenience and fuel retailers would have access to these incentives. Ensuring this program encouraged private sector investment and a competitive market and level playing

field for EV charging were top priorities for NACS.

As part of the NEVI program implementation, states had to submit their plans for approval on how they would spend and distribute these funds, and they will have to submit updated plans annually. All state plans were approved for the initial round in 2023.

These state plans varied and took many approaches to expand EV charging station networks. Some states took a traditional, competitive RFP approach with a large number of recipients. Other states had a single application approved for funding. Some states focused on larger businesses,

with broader sites receiving funds, and other states had a mix of large and small business operators based on their sites win funding. As part of the criteria to determine who would receive funding, businesses that had amenities such as bathrooms and food service or that were open 24/7 were rated positively. And in some states, limits on profits are being considered if a business receives NEVI funding.

Also included in the IIJA was language to encourage states to look at their electricity rates for transportation and to address potential obstacles for private sector investment, such as

unfair rates and extra fees, including demand charges. Again, state actions were varied. Some state public utility commissions are looking at alternative rate structures for electricity being used to charge EVs, with some states specifically looking at ways to address demand charges. Meanwhile, other states took a cursory approach with little change.

Throughout the implementation process, whether it has been the state implementation plan process, public utility commission proceedings or state legislative proposals for modernizing the electricity market and the role of investor-owned utilities in expanding the EV charging network, NACS has been closely monitoring this effort. NACS has also been looking at whether or not the legislative intent and guardrails to ensure private sector investment and competition are being met.

NACS, as a founding member, has been working through the Charge Ahead Partnership on much of this work, and where appropriate, has sent joint industry letters. NACS will continue to keep a close eye on this program and work to ensure the convenience and fuel retailing industry has the opportunity to compete and offer EV charging to its customers.

If you are interested in learning more about what’s happening with the NEVI program in your state, you can go to the Federal Highway Administration’s website at www.fhwa.dot.gov and go to the Bipartisan Infrastructure Law section. In addition, the Charge Ahead Partnership is another valuable resource to learn about what is going on with creating a competitive EV charging market. Information can be found at www. chargeaheadpartnership.com

This month, NACS talks to Bill Weigel, chief executive officer, Weigel’s

What role in the community do you think convenience stores should play?

Convenience stores, by their very nature, are central to the daily lives of their customers and the communities they serve. They are not just stops for fuel or last-minute groceries—they are neighborhood hubs where people can connect, find essential items at any hour and access services that might not be available elsewhere. We aim to be more than just a place to shop. We also strive to be a supportive neighbor—providing jobs, sourcing local products such as our own packaged milk and participating in community and charitable events. Our convenience stores are places where customers feel recognized and valued and where they can rely on us for more than just products—namely community engagement and support.

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

NACS political engagement, to me, means having a voice in the shaping of policies that directly affect our industry and our ability to serve our communities effectively. It’s about advocacy, education and partnership—ensuring the unique challenges and opportunities facing the convenience store industry are recognized and addressed by policymakers. Being politically engaged has allowed us to contribute to discussions that affect our operations—from credit/ debit card fee issues to regulations on fuel standards and tobacco sales to labor laws. The benefits are tangible. We’ve been able to influence positive changes, mitigate challenges before they become hurdles and ensure our industry’s needs are considered in legislative and regulatory processes. Being engaged has empowered us to better navigate the complex regulatory landscape and anticipate changes that could affect both our business and our customers.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)?

Several federal legislative and regulatory issues are of concern, particularly those related to labor laws, fuel regulations and credit/debit card fee issues. The ongoing discussions around minimum wage increases and overtime rules could significantly affect our operational costs and staffing flexibility. Fuel regulations, including those related to renewable fuel standards and emissions, are also critical issues. Finally, the financial pressure our industry continues to face with credit card fees is at the forefront and is a key to providing value to our customers.

What c-store product could you not live without?

Paige Anderson is NACS director of government relations. She can be reached at panderson@ convenience.org.

On a lighter note, the one c-store product I couldn’t live without has to be Weigel’s own locally produced milk. It’s a staple in my daily routine, a direct link to our roots as a dairy and a reminder of the importance of supporting local products and businesses. It also represents the quality and care we put into all our offerings—symbolizing our commitment to only providing the best to our community. Plus, it’s just incredibly fresh and delicious!

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac . NACSPAC donors who made contributions in February 2024 are:

Blaine Applebee Global Partners LP

Alexander Baloga Pennsylvania Food Merchants Association

Michael Barley Pace-O-Matic

Tumay Basaranlar Atlantis Management Group

Lisa Biggs Impact 21

Gary Braaten CHS Inc. (Cenex)

Patricia Coe Advantage Solutions

Lucia Crater Impact 21

Matt Durand EG America LLC

Ryan McElroy Weigel’s Stores Inc.

James Fiene Clark Oil Company Inc.

David Freese Titan Cloud Software

Terry Gallagher Gasamat Oil Corp./ Smoker Friendly

Paul Goldean Pace-O-Matic

Jeffry Harrison Rovertown

Jessica Hendrickson Altria Group Distribution Company

Ryan Herrin Kellanova Away From Home

Scott Hill Jack Link’s Protein Snacks

Brandon Hofmann The Parker Companies

Kendall Huckabee The Coca-Cola Company

Jen Johnson NACS

Sam Johnson J & M Distributors Inc.

Abbey Karel Bounteous

Andy McIlvaine Coen Markets Inc.

Laura Miller NACS

Bryan Morrow PepsiCo Inc.

Paul Neuhoff GSP

James Norberg Krispy Krunchy Foods

Gus Olympidis Family Express Corporation

Steven O’Toole Stuzo LLC

Nick Paich GSTV

Jigar (JP) Patel FASTIME

David Poulnot Upside

Nicolas Poxson Krispy Krunchy Foods

Allen Preslar InComm Payments

Trish Riddle Keurig Dr Pepper

John Rodriguez Upside

John Rudolfs The Parker Companies

Darrin Samaha Yesway

Jonathan Shaer Altria Client Services LLC

Dan Shapiro Krispy Krunchy Foods

Adam Sheetz Sheetz Inc.

Keith Slater Family Express Corporation

Gray Taylor Conexxus

Ron Tobb Minor Decliner

Tom Trkla Yesway

Daniel Trotzer GSTV

David Tucker NCR Corporation

Jason Wakely Pilot Travel Centers LLC

Scott Walters Rovertown

Paula Weeks The Coca-Cola Company

Alicia West Altria Group Distribution Company

Geoffrey Wigner Nashville Wire Products

Kathy Williams The Coca-Cola Company

Michael Winton Republic Amusements

Scott Worthington Juice Head Pouches

Name of company: Corner Post

Year founded: 2018

# of stores:

1

Website: cornerpostnd.com

In Watford City, North Dakota, locals and tourists can find quick, customized service at Corner Post Convenience Store. “We offer the community a convenient location that serves quality food and offers fuel,” said manager Starla Davis. “As we like to say, we’re a place that doesn’t sacrifice quality for convenience.”

In 2018, Brady Lund, a local businessman, opened the store with the idea “to strive to make our customers’ day a little more awesome,” according to the store’s mission statement. Lund had worked for his parents’ gas station and store for years before branching out on his own with Corner Post. “He took his experience in running a gas station property and put that into Corner Post,” Davis said.

The Corner Post has a thriving car wash as well, with salt from the roads in the winter, mud from the banks of Lake Sakakawea in the summer and plenty of unpaved roads around the area.

The cornerstone of Corner Post is its fresh foodservice program. “Our kitchen puts out our own customized food products,” Davis said. Homemade fried chicken, pizza, meatloaf, tacos and other comfort foods dominate the menu. The store has a rotation of daily specials: Meatloaf Mondays, Taco Tuesdays, Chinese Wednesdays, Pasta Thursdays and Barbecue Fridays. “Everything we serve is prepared fresh each day in our kitchen,” Davis said.

The kitchen also stocks the store’s grab-and-go section with pizzas, breakfast sandwiches and burritos, salads, fruit cups, wraps and sandwiches. In addition, all of the meals can be packaged to go. “We also have four two-tops and three tables that could seat four to six people if our customers want to eat their meal on the premises,” she said.

The foodservice has proven to be a big draw for customers. “While Watford City has lots of restaurants, we offer restaurant-quality food faster, which our customers appreciate,” Davis said. The store has fresh coffee, tea, iced coffee, slushies and fountain drinks too.

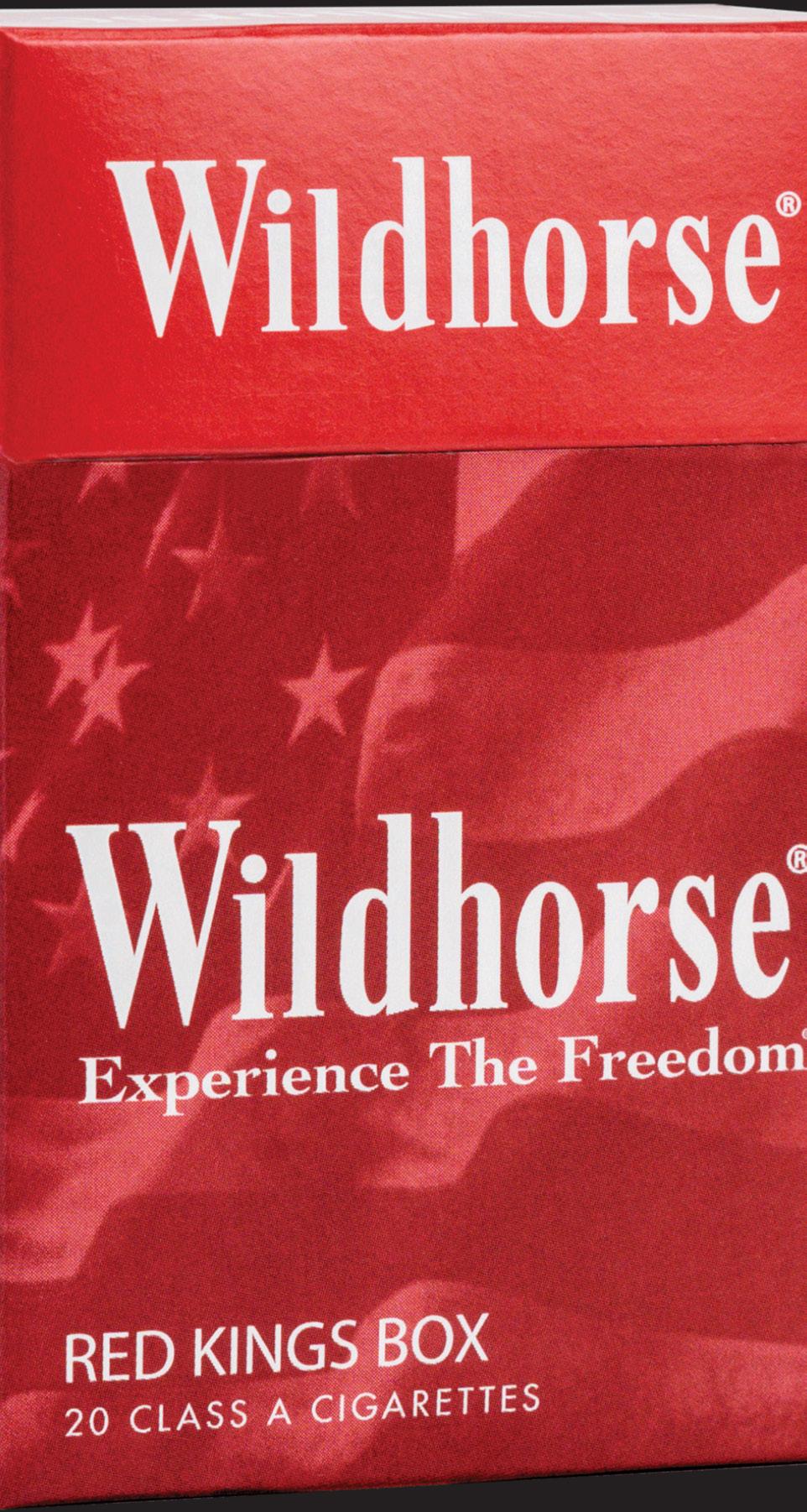

The store doesn’t stock wine or beer because of a North Dakota law requiring alcohol sales to be conducted in a separate location from other products. “We do have tobacco products and the usual snacks, along with a large number of protein bars, and also packaged drinks, including a huge selection of energy drinks,” she said.

Soon, the Corner Post will offer barista coffee under its own store brand. “This will be another way we can offer a more personalized experience to our customers,” Davis said.

In addition to food and beverages, the store has an extensive bait and tackle

department with top-of-the-line equipment. “We’re situated near a good area for water and ice fishing, and the owner is an avid outdoorsman, so we do a brisk business in bait and tackle all year long,” she said.

The store also stocks gear for cold or warm weather depending on the season, novelty items and automotive products. “We do hats and hoodies all year long, and warm jackets and gloves in the winter and sunscreen, sunglasses and UV-protected clothing items in the summer,” Davis said.

Treating employees like family has many of them sticking around for years. “We offer a very close, calm and welcoming atmosphere to staff and customers alike,” David said. “With competitive pay as well, we don’t have an issue keeping people working at our store.”

The Corner Post has become a staple in the community, providing sponsorships for many children’s and teen sports teams and schools, as well as giving donations to various charities and events. “We also participate in community cleanups, and had a cookies with Santa event this past December,” Davis said.

Each year on the anniversary of the store’s opening, it throws a bash for the community with free hot dogs and games in the parking lot. “We’re very passionate about giving back to the community,” she said.

Overall, it’s the family-oriented environment that turns one-time visitors into regulars. “A lot of our local customers have become friends,” she said. “I like to say we’re ‘Cheers’ without the beer.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Part of the way Corner Post in Watford, North Dakota, gives back to the community is through an on-the-job training program run by the local high school. “We get kids from this class who work in the store to learn the ropes,” said manager Starla Davis.

The high schoolers learn what it takes to run all aspects of a gas station and convenience store during their class. Over the years, several of them have graduated and returned to work at the Corner Post as fullfledged employees. “Our employees love working with these kids, who might be young but they’ve all made a good impression. It’s been fun to watch them blossom and grow into responsible young adults,” she said.

Pace-O-Matic skill games draw customers into stores and keep them there.BY AMANDA BALTAZAR

When potential customers ask Pace-O-Matic about their skill games and if they’d be a good fit for their stores, the company is more than happy to answer their questions.

But quite often, the most valuable response can come from existing customers. The customers who, years ago, made the decision to go with Pace-O-Matic and have stuck with them.

“We operate with a lot of transparency,” said Paul Goldean, the CEO of Pace-O-Matic. “We always say, don’t take our word for it, ask the companies who have been with us for years.”

What do they say?

Bill Douglass, chairman of Douglass Distributing, who owned Lone Star Food Stores, a chain of 23 establishments, for decades, says Pace-O-Matic’s skill games are “the best single investment any retailer can make.”

Douglass says retailers are looking for new sources of revenue to offset an increase in operating costs and a decrease in gallons sold.

To get there, he said, you must have a product that draws consumers in. And keeps drawing them in.

“We have sold more fuel and inside sales since going with the games,” he said, adding that games remove the chore for consumers of stopping at a convenience store for gas.

“Every month our sales increase, and the reason the sales increase is because the games are creating a marketing awareness that we’ve got a fun activity. Fun sells. Fun works.”

Goldean says he hears the same thing from Pilot, 7-Eleven and Love’s, along with hundreds of mom-and-pop convenience stores.

“We’re all about metrics,” Goldean said. “Our research shows that once customers come in to play the games, they’ll stay in the store for around 30 minutes.”

That equates to a boost in overall revenue.

That extra revenue can accomplish many things, he said. From buying a new roof, to paying competitive wages, to expanding healthcare access for employees or paying critical expenses.

“One retailer was able to get specialized oncology care for his wife thanks to the revenue Pace-O-Matic games brought in,” he said.

Goldean says Pace-O-Matic takes a lot of pride in helping operators of all sizes, but it’s “particularly meaningful” when the games make a big impact in the lives of smaller operators.

“When you make it possible for a momand-pop store, which was on its last legs, to stay open in Rock Springs, Wyoming, that’s exciting.”

When a convenience store signs up with PaceO-Matic, the two parties sign a contract.

The agreement states that a store cannot have more than five machines and that the machines cannot bring in more than half of the store’s revenue.

“That way we’re always a supplement to the main business of a c-store,” Goldean said.

The successful partnership of Pace-O-Matic and Republic Amusements, a multistate operational company based in Colorado, works together to deliver supplemental income to small businesses.

Like Goldean, Matt Pascal, the owner of Republic Amusements, gets most excited when helping small businesses turn around.

“This gives people an entry point to the American dream,” Pascal said.

“They see their margins slip and see the cost of business continually going up, not to mention the clampdowns in their industry,” he said.

“But we can come in and give them an opportunity to earn equal or more revenue per square foot than anything else they can earn in the store,” he said. “That is exhilarating.”

Pascal has been working with Pace-OMatic for seven years and his company is responsible, in some states, for installing the machines, servicing them, handling the money and dealing with any service issues.

Pascal mentioned one improvement that has made things much easier for operators is the use of ticket redemption terminals (TRTs).

When players win, they can cash out that ticket at the TRT so that the store staff doesn’t have to worry about paying out winnings and the safety of carrying that cash.

“Pace-O-Matic is always making improvements,” Pascal said. “And the best part about it is we all have a voice. We can tell Pace-OMatic any challenges we’re having and they’ll work on it. The TRT is a great example.”

… STAY IN THE STORE FOR AROUND 30 MINUTES.—Paul Goldean Pace-O-Matic CEO

Crucial to Pace-O-Matic’s success are the regulations it adheres to.

“Everyone knows the rules. It’s a limited field and you have referees,” Goldean said. “You have to have that type of regulatory structure in place. Operators have to agree to that.”

Frank Fina, Pace-O-Matic’s chief administrative officer, is in charge of compliance. He’s got a strong network of compliance officers in every state, largely made up of former law enforcement officials.

“We want to be regulated and we want to be good corporate citizens,” Fina said, pointing out that Pace-O-Matic’s business model ensures most of the income of the games goes into the states—to the c-stores, the local operators, as well as to taxing agencies.

Because Pace-O-Matic is so confident in the legality of its games, it indemnifies any convenience store it works with against damages.

The mastermind behind Pace-O-Matic, Michael Pace, pioneered a new era of entertainment for small businesses. With a rich history in gaming innovation, Pace’s journey began in 1980 with the invention of the first bar-top video game. A decade later, he introduced the world to the electronic pull tab, “Pot of Gold.”

However, Pace’s vision extended beyond mere entertainment; he sought to empower small businesses with revenue-generating opportunities. In his quest to merge skill-based gaming with local establishments, Pace-O-Matic was born.

In 2000, Pace realized his dream by launching Pace-O-Matic. His dedication to legal compliance and ethical practices attracted the attention of Paul Goldean, who joined the company in 2019, recognizing the potential for small businesses to thrive amidst economic challenges.

“There’s nothing I’ve come across that is as economically powerful for a small business. People can sustain themselves through the ups and downs.” Goldean said, emphasizing PaceO-Matic’s commitment to small business and partnerships.

Michael Pace Founder and Chairman Pace-O-Matic

Michael Pace Founder and Chairman Pace-O-Matic

“Pace-O-Matic has become a beacon of hope for both large and small convenience store operations,” he said.

Pace-O-Matic’s journey isn’t just about entertainment; it’s about empowerment, innovation, and integrity. By providing a lifeline for mom-and-pop stores and fostering economic resilience, Michael Pace’s legacy extends far beyond gaming—it’s about transforming lives.

“If anyone challenges the legality of the game, we show up with an army of experts and lawyers, show them the facts and the data and have always prevailed,” Fina said.

Pace-O-Matic takes this so seriously that it turned off all 7,000 of its terminals in the state of Virginia in July 2021 when the state passed a bill making them illegal.

“And we didn’t turn them back on until we won an injunction against the state against that ban,” said Goldean.

Although there is no evidence that skill games impact casino revenues, large casino conglomerates have opposed regulating the games, Fina said. “They’ve launched campaigns against us—sometimes attempting to regulate us out of existence—but when you have the facts and court rulings on your side it’s easy to come out on top,” he said.

The legality of the games, he said, is on a state-by-state basis, and Pace-O-Matic conducts an intense analysis of every state before it even begins to think about entering that market.

Because of this, Pace-O-Matic only operates in certain states—10 currently, though that may expand.

In some states, such as New York and Texas, it only operates in certain counties.

“We’re very deliberate, and we don’t want to rush into states until we feel we’re going to be secure there and have the human capital to expand and do it the right way,” Fina said.

The Pace-O-Matic compliance team conducts store visits to ensure adherence to contracts, proper operation of Pace-O-Matic machines and compliance with local regulations by operators. “We provide full operational support and ensure everyone follows the rules,” said Goldean.

The software in all Pace-O-Matic’s machines is checked and certified, too, by an outside party, and each machine features a sticker showing that it’s been certified and showing that it is legal.

Convenience stores are an ideal location for Pace-O-Matic’s games because they work best in locations where a business is accustomed to identifying the age of its shoppers.

“Convenience stores are used to selling beer, cigarettes and lottery tickets and have a system that can check the age of the player,” Goldean said. “We don’t want them in places that don’t have that built-in expertise.”

The mid-20th century saw the construction of the Interstate Highway System, which led to the birth of the Great American Road Trip. Now, summer road trips are deeply embedded in the nation’s culture.

According to Stephanie Stuckey, the CEO of Stuckey’s, the road trip is making a comeback. And she would know—her grandfather’s company, which is now hers, was founded on supplying travelers fuel, food and a few smiles.

“I think people are rediscovering literally their backyards and that you can take a road trip and not have to get in a woody station wagon and drive for a week,” she said.

According to Circana’s 2023 Snacking Survey, close to half of consumers eat three or more snacks during the day.

“One trend we’ve seen and expect to see through the summer is all-day snacking,” said Casey Creegan, manager of private brands at Love’s Travel Stops. Creegan says that peach rings, beef jerky and doughnuts are popular snacks at Love’s during the summer.

According to Stuckey, travelers want a mix of tried-and-true comfort food and something new. She sees her customers pairing the company’s classic pecan log rolls with Stuckey’s new habanero cumin trail mix, for example. Travelers also want international flavors and unique taste profiles.

We want to make sure that as the times change, we change with them.”

“[Road trips] are a time when you’re open to exploring, so you’re also open not only to exploring different places but exploring different palettes because that’s part of the experience,” she said.

According to the Frito Lay Snacking Index, 80% of respondents agree that combining multiple food products to create the perfect bite is an art form, while 65% say they have their own favorite “eccentric” snack combos. Consumers are also looking for nutritional value, with protein being the most important nutritional attribute (55%).

Some snacks are never far from customers’ minds when they’re in a convenience store. According to the most recent NACS State of the Industry Report ®, salty snacks was the only category that had unit increases among the top six in-store merchandise categories in 2022. Salty snacks accounted for 4.57% of inside sales, up 0.42 points from 2021, and was the sixth largest sales contributor and fifth largest margin contributor inside the store.

People want to be indulgent on a road trip.”

Although salty snacks still have consumers’ hearts and wallets, candy is not far behind, representing 3.55% of inside sales in 2022. Alex Ringle, owner of EddieWorld in Yermo, California, is making sure that his store is fully supplied with gummy candy for the summer, and he’s also stocking up on another buzzing sweet treat—freeze-dried candy.

“[Freeze-dried candy] is the massive new trend,” he said. “It’s selling ridiculously.”

According to Stuckey, customers use their road trip as a time to be indulgent in their snacking.

“More people are looking for combos, asking ‘What am I going to buy with this and make it fun?’” she said. “So putting those two together and telling your customers, ‘You’re road-tripping this summer? Be sure to grab something sweet and […] pair it with our really good Colombian coffee,’ recognizing that when people are on road trips, it is a moment to treat themselves.”

Speaking of coffee, nearly two-thirds of Americans have a cup of Joe every day, says the American Coffee Association, and cold coffee is quickly taking center stage, growing in popularity by 45% since January 2023 and a staggering 300% since January 2016.

“As the weather warms up, travelers are looking for a refreshing caffeine kick to keep them fueled,” said Jamie King, vice president, food and deli operations at Pilot Travel Centers, which offers iced coffee and cold brew with a rotation of limited-time flavors.

And customers aren’t just reaching for coffee to get that spark of energy. They are also opting for energy drinks to give them a jolt for the road. According to a Statista survey, 33% of respondents aged 18 to 29 years old state that they drink energy drinks regularly.

“Any convenience store shelf [should] be well-stocked, not just with coffee, but also with energy drinks,” Stuckey said. “A lot of the younger consumers especially are grabbing an energy drink instead of a coffee.”

According to the 2022 NACS Convenience Voices survey, 16% of all shoppers describe their reason for visiting a c-store as “I want to use the restroom.”

“Clean restrooms are so important to a traveler, and of course, they don’t know what the restroom’s going to be like from the outside, so they’re analyzing the outer appearance of the store, and if it’s well-maintained, that’s likely a reflection of what the inside will be,” said Stafford Shurden, a frequent road tripper and restaurant owner.

Ringle takes clean restrooms so seriously that he hires staff members whose sole responsibility is to clean and maintain the restrooms, and during the busy summer travel season, he hires extra staff members for this role.

“[Clean restrooms] is the name of our game. That’s what we built our reputation on,” he said. “We built two sets of bathrooms to ensure that they’re always clean, and we rotate between the two.”

Maintaining a clean and efficient store is another key to attracting and keeping discerning consumers. According to the Con-

Here are tips and tricks from savvy retailers on catering to summer road trippers.

Casey Creegan, Love’s Travel Centers Retailers should expand their offerings to summer road trippers beyond just food and beverages. “[Our] customers are also really enjoying cooling gel neck pillows.”

Jamie King, Pilot Travel Centers

Convenience is key on the road, so make sure there are enough quick food options for customers. “We have plenty of grab-and-go hot and cold items, including freshly cut fruit, sweet and salty snacks, and all the coffee and cold beverages a road tripper needs.”

Al Hebert, Gas Station Gourmet Bibs should be available at convenience stores for customers eating on the move, and it’s a thoughtful touch much appreciated by parents.

Alex Ringle, EddieWorld

Discover the newest food and merchandise trends by exploring TikTok. “I feel like TikTok is definitely becoming a leading indicator of what’s coming and what is relevant.”

Stafford Shurden, Gas Station Tailgate Review and restaurant owner

Don’t be afraid to stretch the limits of your foodservice offer. “Any gas station that serves hot food has the same kitchen I have [in my restaurant]. I do wish that some owners wouldn’t mentally limit themselves. You can literally do anything.”

[Freeze-dried candy] is the massive new trend.”

venience Voices data, c-store shoppers who noted dirty or broken equipment and didn’t make a purchase increased from 5.4% in 2021 to 7.8% in 2022.

Prior to the busy summer season, Ringle also invests in maintenance in and around the property. He paints the exterior, resurfaces sidewalks and relandscapes, among other tasks.

“I want people to feel like we’re reinvesting and keeping our property up to standard,” he said. “I think it is important to either maintain or enhance the facility, which shows the customers you’re committed to reinvesting in the business to give them a better experience.”

Along with maintenance, Ringle also makes sure his store is stocked well before road-tripping season begins. “I’m placing a lot of my orders [in the winter], and I’m actually ordering extra of my most popular items, because I know that those are the things I can’t take the chance of running out of,” he said.

How retailers stock the store is vital to setting the stage for increased summer sales, according to Stuckey, who emphasized the importance of catering to road trippers’ indulgent desires.

If you can sell someone a candy bar at your register, it makes more sense to sell them a freshly baked cookie from your kitchen instead.”

“People want to be indulgent on a road trip. It’s when you’re exploring, it’s when you’re taking time to discover new products and new flavors. So be cognizant of that and build your store displays around it. ‘Are you discovering America? Well, discover our snack aisles while you’re at it,’” she said.

As the self-proclaimed Gas Station Gourmet, Al Hebert has visited hundreds of convenience stores in search of the best food. He says fresh food is the best, but that fresh food also needs to be convenient, which is why he recommends “food on a stick.”

“If you put your chicken tender on a stick, you’re going to sell more,” he said. “I’ve seen all kinds of c-store foods on a stick. It makes life easier for the traveler.”

Like Hebert, Shurden is also in pursuit of the best gas-station cuisine and has filmed dozens of YouTube videos under the moniker Gas Station Tailgate Review. He also says that fresh, portable snacks are key.

“If you can sell someone a candy bar at your register, it makes more sense to sell them a freshly baked cookie from your kitchen instead,” he said. “Your customers can get a candy bar anywhere, so offer them something fresh and unique to your store.”

Convenience stores are no longer just pit stops; they are evolving into one-stop shops that cater to the needs and desires of modern road trippers, and the industry has a unique opportunity to play in this space.

“Convenience stores [should be] the onestop shop,” Stuckey said. “We don’t want our consumers having to go down the street to another store to get what they want. We want them to be able to pull over, fuel up, get their snacks and drinks and anything else they might need.”

By understanding what road trippers want and expect—whether it’s a diverse selection of snacks, energizing beverages, or quick and efficient service—retailers can position themselves as indispensable allies in the quest for the perfect summer adventure.

Sara Counihan is a frequent contributor to NACS Magazine and previously was managing editor of the publication.

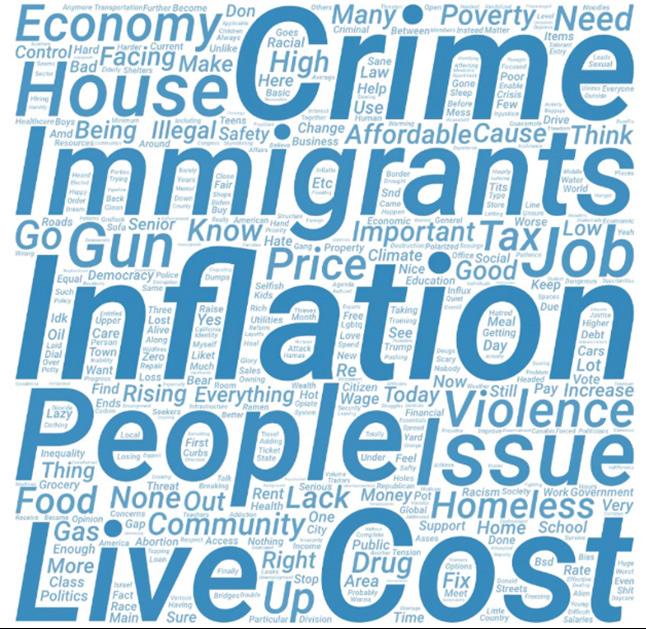

The good news is that consumers are in a way better mood than last year—but that doesn’t mean they don’t have concerns.BY JEFF LENARD

What a difference a year makes. Consumers are in a much better mood than they were this time last year, and consumer sentiment has largely returned to the levels of 2022.

The bad news is that consumers weren’t overly optimistic two years ago.

Nearly two in three Americans (64%) still say the country is heading down the wrong track, but that’s a significant improvement over the 70% who felt that way last year. When asked specifically about their area, consumers were considerably more optimistic, with 50% saying that things are heading in the right direction, the same percentage as last year.

Rural consumers are particularly pessimistic; 81% say that the country is headed down the wrong track and 61% say their area also is, the highest rate of any demographic measured.

People are in a better mood, but they’re not in a great mood. What’s behind current consumer sentiment? Certainly gas prices play a role. An overwhelming 83% of Americans say that gas prices affect their feelings about the economy. The good news is that gas prices were in decline at the start of 2024; in January, when the survey was fielded, gas prices were $3.10 per gallon, 24 cents lower than when the survey was fielded last year.

One particularly distressing number did emerge. While 51% say that life has gone “back to normal,” meaning as it was before the pandemic, 22% of Americans say that things will never get back to normal, an increase of two points over last year. Females and Midwesterners were particularly pessimistic, with 27% of each group saying things will never get back to normal.

With around one in five Americans saying things will never get back to normal, that means it’s more important than ever to understand what consumers are thinking—and what you can do about it. Three areas in particular popped: Concerns about fuel prices, mixed feelings on c-store jobs and crime.

How much do gas prices affect your feelings on the economy?

34% Great impact

49% Some impact

11% Little impact

6% No impact

While consumers are feeling better than last year, and lower gas prices may play a role, they are definitely concerned about prices overall. Inflation has cooled considerably from 9.1% in June 2022 to 3.4% in December 2023, but the cumulative effect from the past few years is taking its toll. Fully three in four Americans (75%) say that higher prices have forced their family to adjust their spending habits. Given that approximately 80% of items purchased in a convenience store are impulse items consumed within the hour, that’s a worrisome statistic.

Another worrisome number: 36% of Americans (and 42% of rural Americans) say we are currently in a recession and another 35% say we will be in a recession this year; only 30% say that we will likely avoid a recession.

This consumer angst may be affecting c-store trips. Only one in three Americans (31%) say they shop convenience stores at least multiple times per week, a 9-point decline from last year.

However, there are ways to entice pricestrapped consumers, and customer service can play a role. Consumers generally give our industry positive marks for customer service, with three in four (75%) rating their experience as at least good.

NACS has conducted national consumer sentiment surveys since 2007, with a specific focus on fueling issues. The 2024 NACS Consumer Survey was conducted by national public opinion research firm Bold Decision (bolddecision.com). A total of 600 U.S. consumers were surveyed from January 2128, 2024. The margin for error for the study is +/- 4.0 at the 95% confidence level.

In another good sign, customers say they like their customer experience in convenience stores more than in other retail channels: 23% say our industry provides a better customer experience than other channels, compared with 14% who say the customer experience is worse at c-stores.

Customers give the industry solid scores for customer service, but great service requires a continuous pipeline of new employees. However, consumer perceptions are very mixed in terms of what they think about convenience store jobs, especially when it comes to wages. Let’s start out with the good news: By a nearly 4:1 ratio, consumers have a positive perception of convenience store jobs compared to a negative perception.

Consumers have a more favorable view of companies that take a leadership role in addressing societal issues.

72% say they are more favorable to retailers that partner with nonprofits dedicated to raising awareness of human trafficking and identifying victims (only 5% say they are less favorable).

What do you think c-store wages are in your area?

50% Minimum wage

35% Above minimum wage

15% Don’t know

Americans living in the Midwest are most likely to say that jobs pay above minimum wage (41%), while those in the West are least likely to say jobs pay above minimum wage (23%).

To dive deeper, we prodded consumers to guess the average wage of convenience store jobs. The median answer was $13 per hour, but it varied by region and location.

There may be an opportunity to tell your story on wages if you pay considerably higher than perceptions.

64% say they are more favorable to stores that have Narcan available in the event someone has an opioid overdose (only 7% say they are less favorable).

What is your perception of convenience store jobs?

36% Positive

49% Neutral

10% Negative

5% Don’t know

However, Americans clearly don’t think that convenience store pay well. Fully half of all consumers say that convenience stores pay minimum wage.

What is the average c-store wage?

$13 Overall average

$15 Northeast

$12 Midwest

$12 South

$15 West

Estimated c-store salaries in the West were the highest, but consumers in the West also say that salaries were most likely only at minimum wage. This dynamic may be related to the higher state minimum wages in many Western states, with California and Washington both having minimum wages over $15 per hour.

Regardless of your region, there may be an opportunity to tell your story on wages if you pay considerably higher than perceptions—or the competition.

There are other messages that may work in telling your jobs story. The survey tested 11 messages related to c-store jobs (six positive ones, five negative ones). The two positive messages testing best related to first jobs and the ability to move up the ladder. However, anything stating that c-store jobs can be good careers or provide a middle-class living did less well.

Percent who agree with these jobs-related messages:

82% Convenience stores provide good first jobs for those looking to enter the workforce.

78% Working in a c-store is a good temporary job for making money but it’s not a real career.

77% Working in a c-store is more difficult today than it was five years ago.

76% The challenges of working in a c-store make it a high burnout job.

75% C-stores have a lot of difficulty finding good job applicants.

74% Entry-level c-store employees often work their way up to become managers or even run their own stores.

67% C-stores jobs are enjoyable where employees get to interact with different people in their community.

64% Customers are generally rude and disrespectful toward people who work in c-stores.

64% Customers are generally kind and appreciative toward people who work in c-stores.

53% Working in a c-store is a relatively easy job.

42% A person working in a c-store can earn a middle-class living.

NACS has online resources that dive deeper into the issues covered.

Topics pages at convenience.org: Under “topics” in the main navigation bar you can find information on these issues and many more:

• Security and safety

• Human resources

• Community

• Human trafficking

• PR strategies

Convenience Corner (convenience.org/media/conveniencecorner): Our blog attracts hundreds of thousands of readers. Some popular, recent fuel-related articles include:

• How to Get Social With Your Food

• Does the President Control Gas Prices?

• Three Fueling Predictions for 2024

• What Convenience Stores Do Best

Convenience Matters podcast (conveniencematters.com) With 400 episodes and counting, the weekly Convenience Matters podcast has covered every topic discussed in this article. The 20- to 30-minute episodes are perfect for on-the-go education and entertainment, whether you’re at the gym, walking the dog or spending some windshield time traveling between stores.

Do you have a question you want answered in any or all of these forums? Send a note to Jeff Lenard at jlenard@convenience.org

One in three customers (32%) say that they have changed shopping habits because they felt unsafe at a particular store or location.

A big issue on consumers’ mind is crime. Nearly half of all Americans say that crime has increased (45%), almost four times the number who say that crime has decreased (12%).

Americans also see that stores take preventative measures to address crime; 72% say that they have been to stores where products are locked behind security cases. And nearly half (49%) have been to stores that had security guards. Both practices are most common in the West; 83% of these survey respondents have seen locked cases and 73% have seen security guards.

Most worrisome is that customers are also taking preventative measures. One in three customers (32%) say that they have changed shopping habits because they felt unsafe at a particular store or location.

Consumers also weighed in on how to address crime. They were split 50-50 when asked whether local law enforcement or retailers should have greater responsibility for preventing crime and shoplifting in stores.

They also felt that addressing the social issues that can cause crime should have a higher priority than law enforcement and deterring crime.

If you were forced to choose, which comes closer to your view?

71% Problems and crime might occur at c-stores and gas stations, but the stores are not the cause.

21% C-stores and gas stations attract problems and crime in communities.

9% Don’t know.

SO WHAT? … AND WHAT’S NEXT?

There’s a lot on consumers’ minds now, and it’s possible that consumer sentiment will backtrack during a contentious election cycle in which both sides will use pocketbook issues—especially gas prices—as a central talking point.

So how do you keep customers coming to your stores with all the noise that they are facing?

First, be an oasis of normalcy. It was clear from the survey results that consumers want things to be better and care about their communities. Play to your strengths in both of these areas.

If you were forced to choose, which statement do you more support?

56% More money and effort should go towards addressing social and economic problems that lead to crime.

44% More money and effort should go towards law enforcement and deterring crime.

If there is any good news about crime, it’s that convenience stores aren’t blamed as the reason for it.

Find ways to give your customers at least a few minutes of refuge from negative things in the world. Play to their concerns over inflation by communicating your value offer, whether price cuts or 2-for-1 and combo deals. Make your stores as fun as they can be. And show that you care about the community and issues important to them.

And most of all tell them—over and over again—about what you stand for. They want to hear it.

Jeff Lenard is NACS vice president, strategic industry initiatives. You can reach him at jlenard@convenience.org.

’s y oods is pr v sandw o w om or v

18th Street Fresh

h pr

With travelers hitting the road, summer is a chance to fine-tune your vehicle care offers.

BY MAURA KELLERAs c-stores continue to evolve, the vehicle maintenance area is evolving, too. This includes car washes, air and vacuum machines and in-store vehicle maintenance products.

According to Rob Deal, vice president of key accounts at OPW Vehicle Wash Solutions, c-store operators are increasingly offering the kinds of enhanced vehicle care options that would normally be found at standalone service locations.

Deal said, “Consumers are now expecting much more than the old, standard car wash. They are expecting more wash options, better quality washes, faster service and a monthly wash club that can be used at more than one location and be managed in a mobile app. The air and vacuum machines should be free with the purchase of a car wash club program.”

Shannon Jandt, car wash manager at Kwik Trip, said today’s c-store customers want to ensure they are protecting their vehicle

investments—after all, the average price of a new car is almost $50,000, while used cars top $25,000 on average.