BREAKFAST

Win back the morning daypart

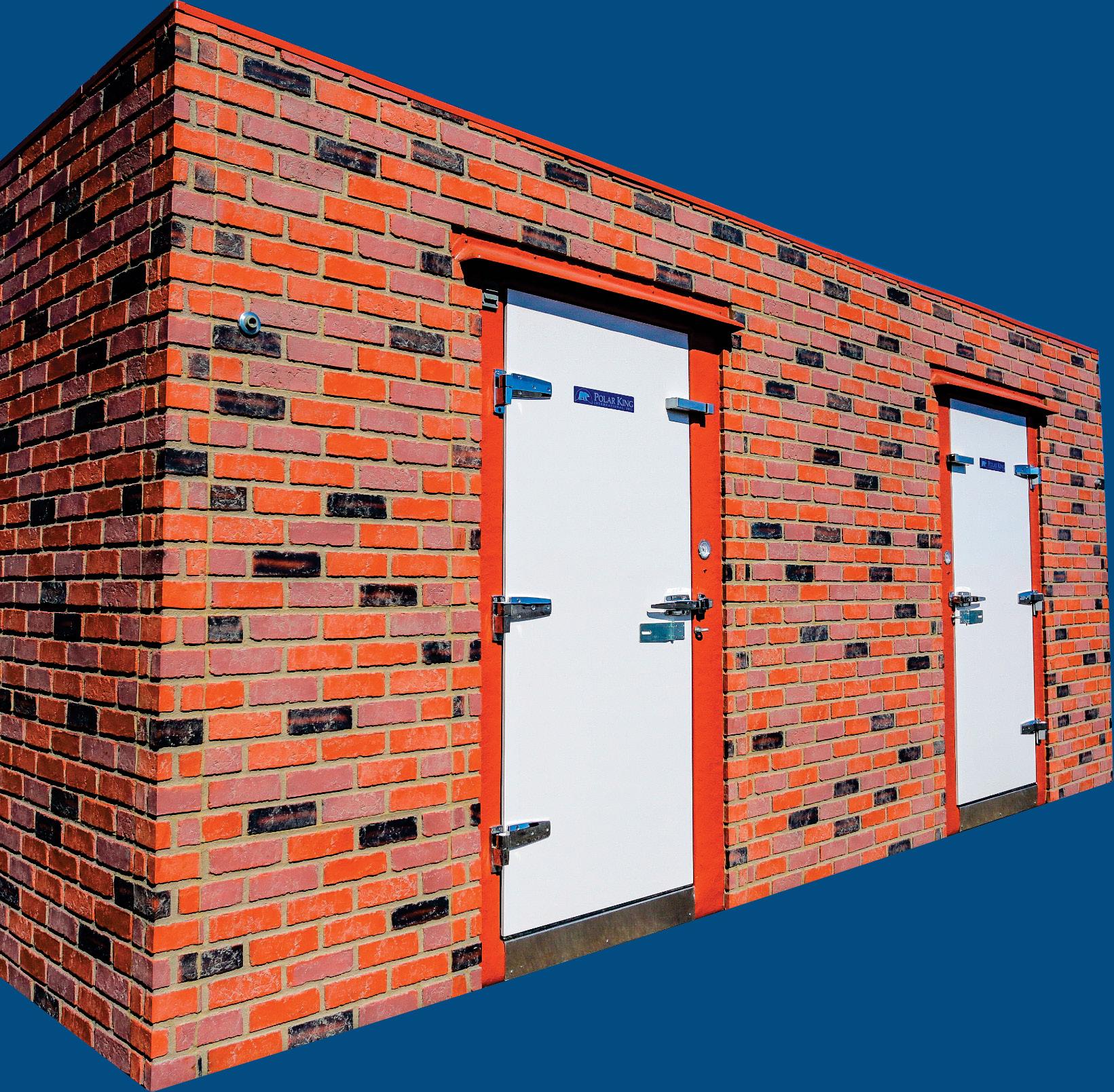

CONSTRUCTION

Avoid common permitting pitfalls

about convenience and fuel retailing

convenience.org Advancing Convenience & Fuel Retailing APRIL 2023

n

What Consumers

TM

are your greatest representative. TO GET INVOLVED Join store owners across the country who are fighting for fair tobacco policies. CLICK HERE

You

Power

NACS APRIL 2023 1 Subscribe to NACS Daily—an indispensable “quick read” of industry headlines and legislative and regulatory news, along with knowledge and resources from NACS, delivered to your inbox every weekday. Subscribe at www.convenience.org/NACSdaily STAY CONNECTED WITH NACS @nacsonline facebook.com/nacsonline instragram.com/nacs_online linkedin.com/company/nacs On the cover: Melnikov Sergey/Shutterstock ONTENTS FEATURES 30 Finding the Right Brand Partner A Q&A with Sunoco. 32 Selling Fuel to People in a Bad Mood Consumer sentiment is down, but there are opportunities to set yourself apart. 42 Freshening Up Your Brand Rebranding can revitalize your business— if it’s done right. 50 Permitting Pitfalls How to avoid (or learn to accept) the common hiccups that occur with local development and building approvals. 66 Thriving in an Online World THRIVR, created by NACS and powered by SOCi, helps retailers connect with consumers before they walk in the door. 70

to Lead in the Age of Disruption The 2023 NACS Leadership Forum explored transformation, inspiration and innovation. 58

How

meal of the day.

Breakfast Capitalize on the most important

IT’S A FACT $1,917

The average monthly sales per store for ice cream in 2021.

CATEGORY CLOSE-UP PAGE 84

ONTENTS NACS / APRIL 2023

DEPARTMENTS

06 From the Editor

08 The Big Question

10 NACS News

16 Convenience Cares

20 Inside Washington Meet the eight new senators of the 118th Congress.

28 Ideas 2 Go

While Kenly 95 Petro caters to professional drivers, the complex has plenty to lure tourists and locals alike.

78 Cool New Products

82 Gas Station Gourmet Rocket Market is a neighborhood hub that offers its customers a uniquely local experience.

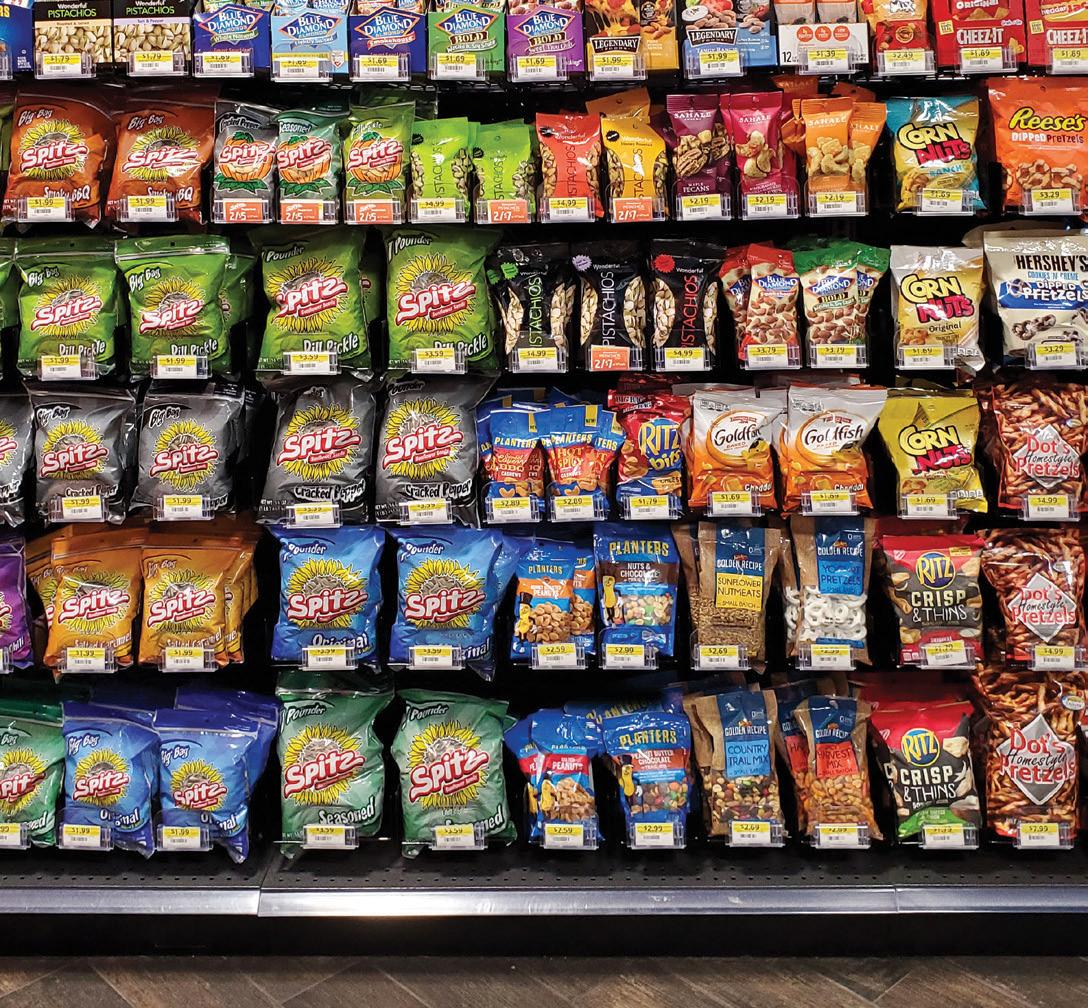

84 Category Close-Up Packaged ice cream continues to bring in significant sales, especially as the weather warms; also, alternative snacks were making a comeback, but that momentum was cut short by inflation. What’s next for the category?

96 By the Numbers

2 APRIL 2023 convenience.org The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view. PLEASE RECYCLE THIS MAGAZINE viennetta/Shutterstock

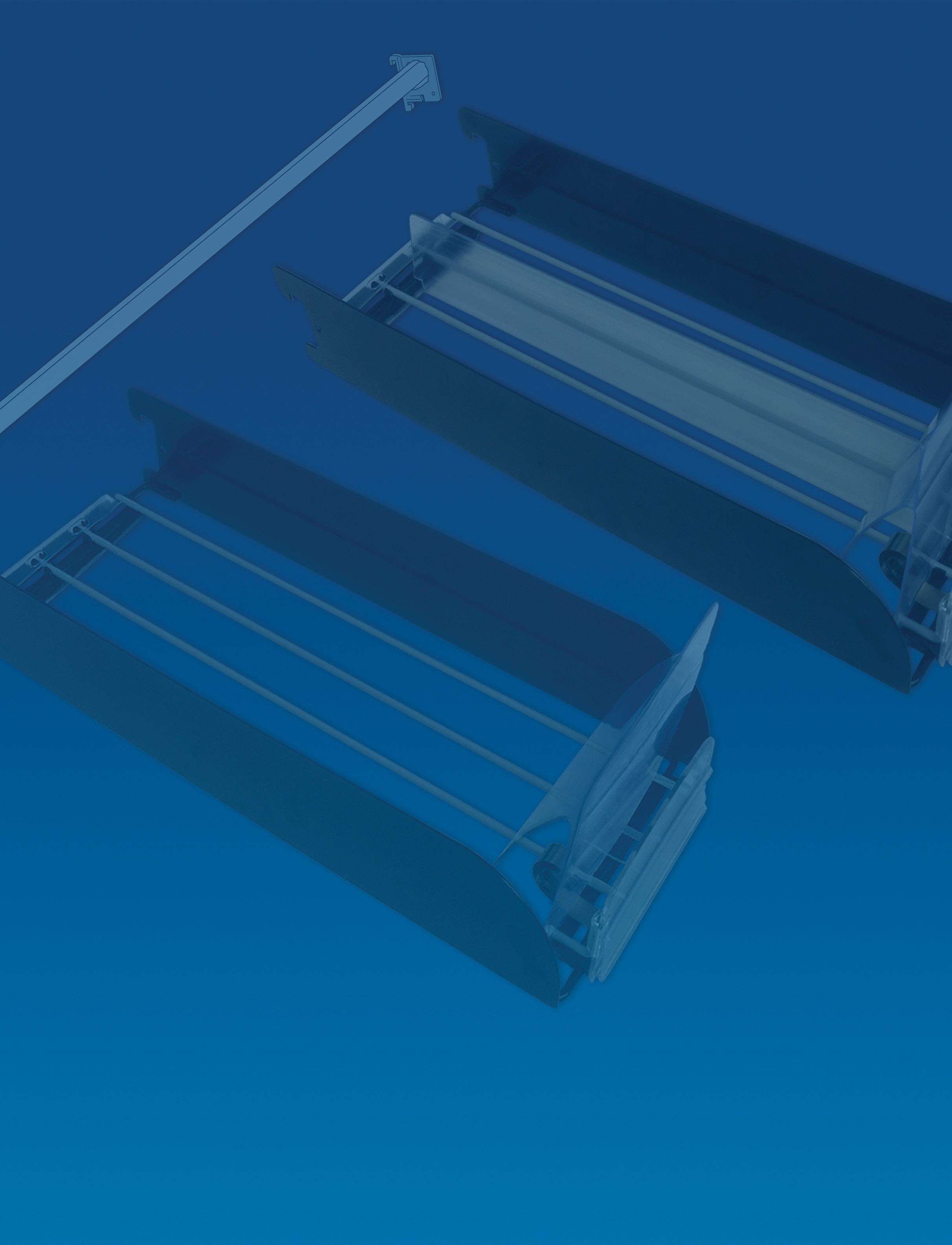

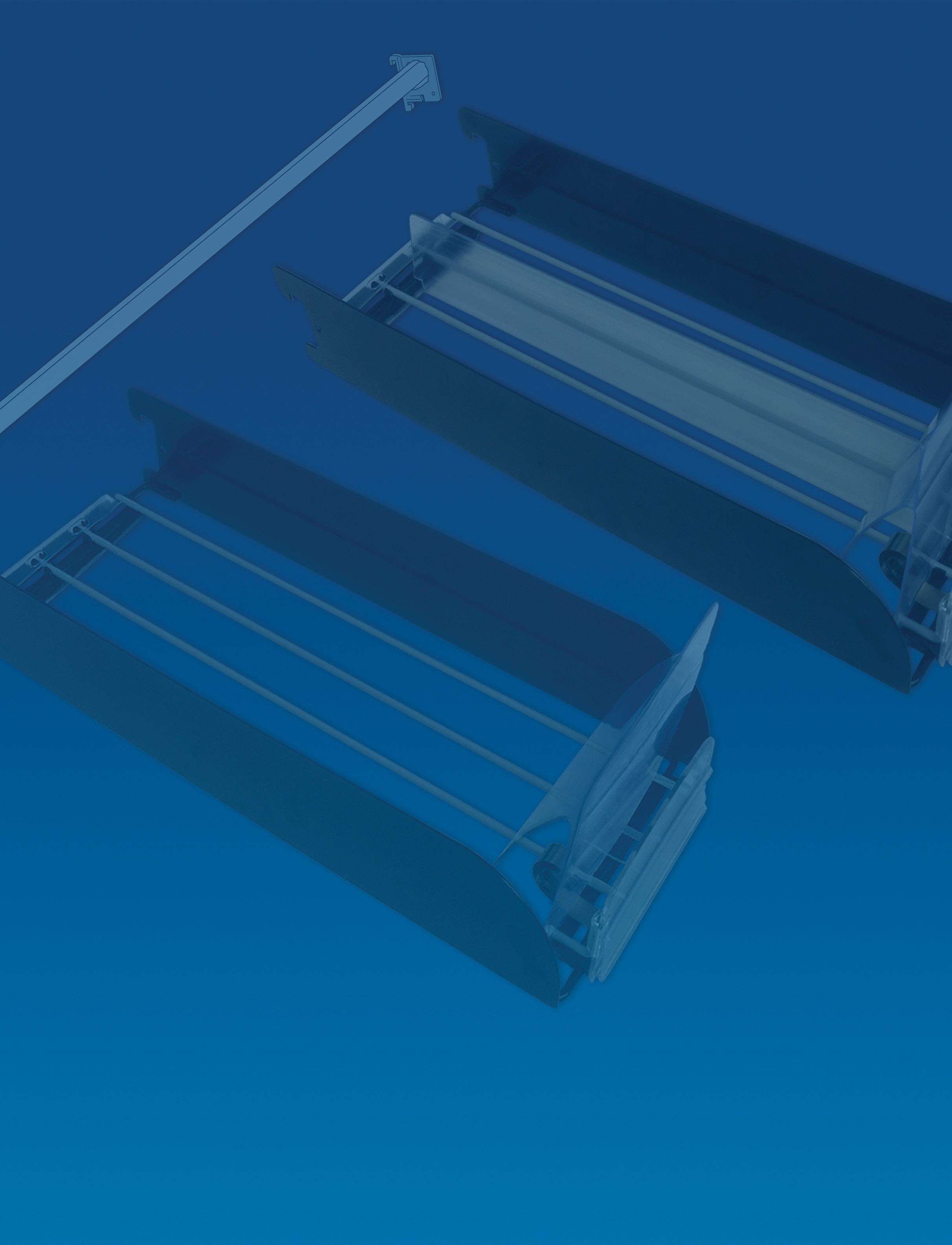

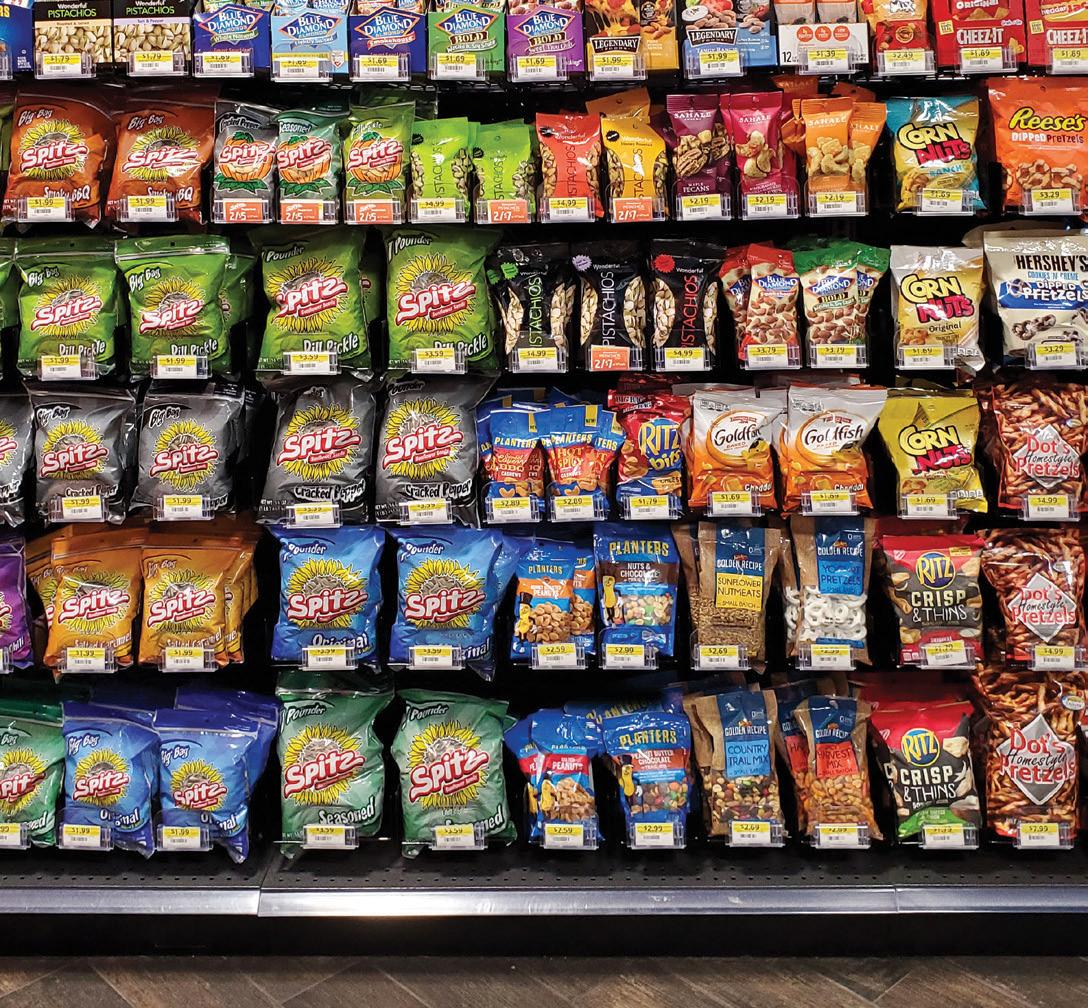

Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 Gain Facings and Cut Labor with WONDERBAR® Tray Merchandising n Increased facings from 99 to 121, a 22% increase*. n Automatically billboards and faces product. n Reduces losses from bag hook tearout. n Cuts over 1 hour/day labor for restocking. n Allows rear restocking and proper date rotation. n Dramatically increases sales in the same space. n Adjusts to accommodate various package widths. * Based upon average 8’ run by 5’ high salty snack gondola installations. Your results may vary. ©2020 Trion Industries, Inc. MODERNIZE YOUR MERCHANDISING Sell More Salty Snacks WonderBar® Tray Merchandising VS BEFORE WONDERBAR® 99 FACINGS AFTER WONDERBAR® 121 FACINGS SELL MORE IN THE SAME SPACETM Ga S

EDITORIAL

Kim Stewart Editor-in-Chief (703) 518-4279 kstewart@convenience.org

Ben Nussbaum Senior Editor (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281 lking@convenience.org

Sara Counihan Contributing Editor (703) 518-4278 scounihan@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Sarah Hamaker, Al Hebert, Renee Pas

DESIGN Imagination www.imaginepub.com

ADVERTISING Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich National Advertising Manager/Northeast (703) 518-4276 jleidich@convenience.org

Ted Asprooth National Sales Manager/ Midwest, West (703) 518-4277 tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Vice President, Marketing (703) 518-4231 ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

NACS BOARD OF DIRECTORS

CHAIR: Don Rhoads, The Convenience Group LLC

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Varish Goyal, Loop Neighborhood Markets; Brian Hannasch, Alimentation Couche-Tard Inc.; Chuck Maggelet, Maverik Inc.; Ken Parent, Pilot Flying J LLC; Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

PAST CHAIRS: Jared Scheeler, The Hub Convenience Stores Inc.; Kevin Smartt, TXB Stores

MEMBERS: Chris Bambury, Bambury Inc.; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC

NACS SUPPLIER BOARD

CHAIR: Kevin Farley, GSP

CHAIR-ELECT: David Charles, Cash Depot

VICE CHAIRS: Josh Halpern, JRS Hospitality; Vito Maurici, McLane Company; Bryan Morrow, PepsiCo Inc.

PAST CHAIRS: Brent Cotten, The Hershey Company; Rick Brindle, Mondelez International; Drew Mize, PDI Technologies

MEMBERS: Tony Battaglia, Juul Labs; Alicia Cleary, AnheauserBush/In Bev; Jerry Cutler InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi, Oberto Snacks Inc.; Mike Gilroy, Mars Wrigley;

Terry Gallagher, Gasamat Oil/ Smoker Friendly; Douglas S. Haugh, Parkland USA; Raymond M. Huff, HJB Convenience Corp. dba Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews, Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Charles McIlvaine, Coen Markets Inc.; Lonnie McQuirter, 36 Lyn Refuel Station; Tony Miller, Delek US; Jigar Patel, FASTIME; Elizabeth Pierce, Applegreen LTD; Robert Razowsky, Rmarts LLC; Richard Wood III, Wawa Inc.

SUPPLIER BOARD

REPRESENTATIVES: David Charles, Cash Depot; Kevin Farley, GSP

STAFF LIAISON: Henry Armour, NACS

GENERAL COUNSEL: Doug Kantor, NACS

Danielle Holloway,Altria Group Distribution Company; Jim Hughes, Molson Coors Beverage Company; David Jeffco, Dirty Dough LLC; Kevin Kraft, Q Mixers; Kevin M. LeMoyne, Coca-Cola Company; Lesley D. Saitta, Impact 21; Sarah Vilim, Keurig

Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Steve Loehr, Kwik Trip Inc.; Chuck Maggelet, Maverik Inc.

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig

Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices. 1600 Duke Street, Alexandria, VA 22314-2792

/ APRIL 2023 COME TOGETHER. DO MORE. Join us at conveniencecares.org

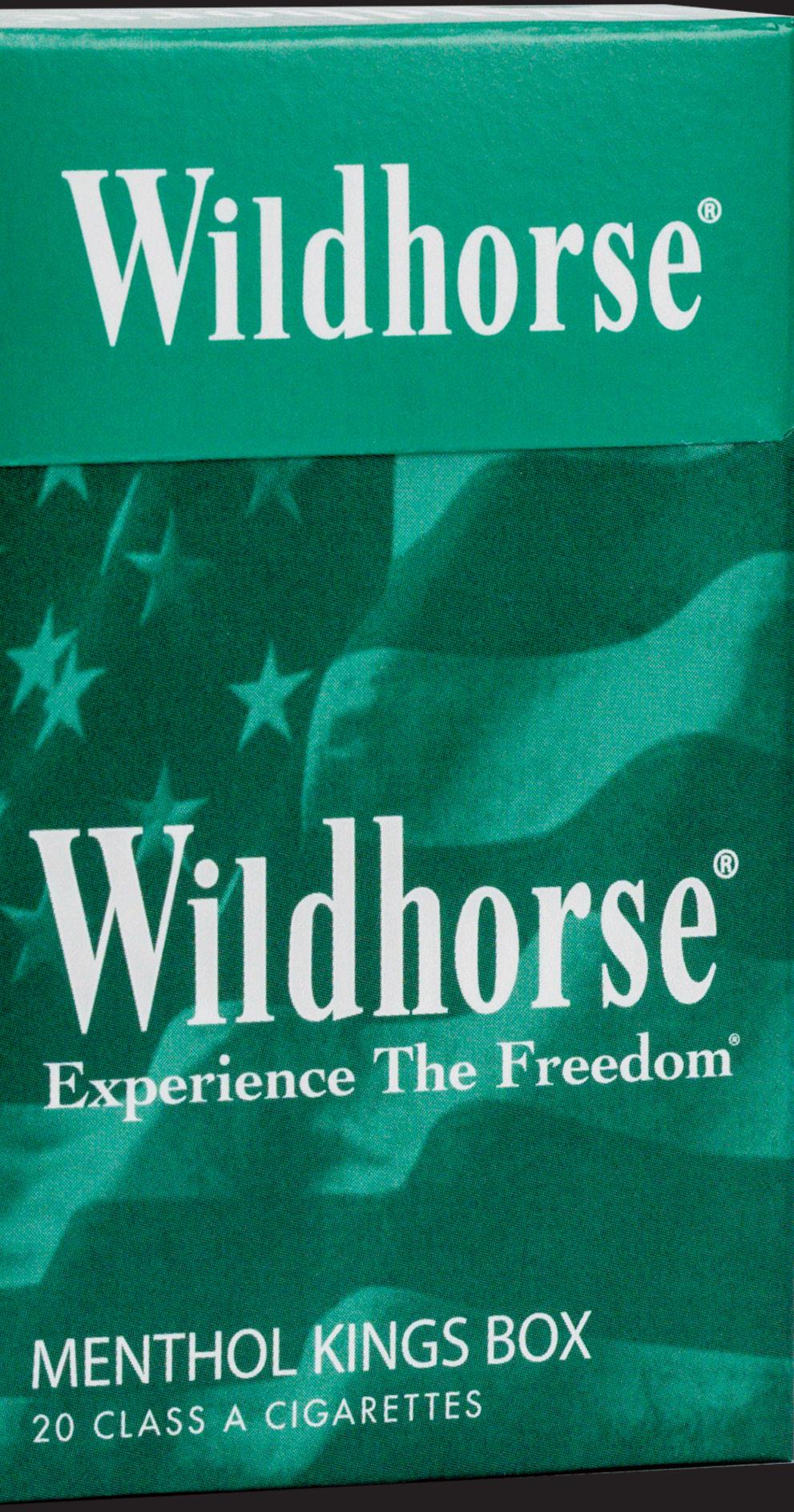

THE BOLD CHOICE

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

GOPREMIER.COM

UP FRONT FROM THE EDITOR

Fueled Up

Does anyone get excited about buying gas? Some version of that question is one I’ve heard many times during my four years at the helm of NACS Magazine. I have to say, I don’t mind gassing up my car (except for those times working at a weekly newspaper after college when I could only afford a few dollars at a time). Hang around long enough with folks in this industry, especially on the petroleum side, and you can’t help but smile when you see gleaming new EMV-compliant fuel dispensers in the wild—double points for ones with touchscreens and advertising.

For most consumers, buying gas isn’t the highlight of their day. In fact, consumers are grumpy about buying anything these days, mainly because of inflation. The findings of the 2023 NACS Consumer Fuels Survey indicate widespread pessimism about the U.S. economy, with 90% of drivers surveyed saying that gasoline prices have a “great impact” or “some impact” on how they perceive the economy. When it comes to convenience, there are some bright spots. The survey found that 85% of consumers rated their last experience at a c-store as excellent or good, and consumers say c-stores outrank other retail channels for customer experience. Read more in our cover story, “Selling Fuel to People in a Bad Mood.”

Ask anyone who’s ever dealt with construction and they’ll be quick to share how even the most straightforward project can go awry. In “Permit-

ting Pitfalls,” we tap into the wisdom of two convenience retailers with newly opened stores: Babir Sultan, president of FavTrip, and Kevin Smartt, CEO of TXB Stores, who share practical advice for dealing with setbacks.

Last year we looked at THRIVR, an exciting new initiative from NACS and SOCi that provides an affordable way for convenience retailers big and small to manage their digital presence. This month we provide an update in “Thriving in an Online World.”

Elsewhere, we share ways to build back the breakfast daypart, how to refresh your store’s brand and leadership lessons from the 2023 NACS Leadership Forum.

Here’s to spring and new beginnings. See you on the road, my friends.

Geeking out over the gleaming fuel dispensers at TXB in Georgetown, Texas, and Kenly 95 Petro in Kenly, North Carolina.

6 APRIL 2023 convenience.org

Kim Stewart , Editor-In-Chief

For most consumers, buying gas isn’t the highlight of their day.”

Photo credit: Kim Stewart

Stock up today Contact your distributor to order or visit 5-hourENERGY.com Visit 5hourEnergyRetailer.com to join the FREE program designed just for independent retailers. ©2023 Living Essentials Marketing, LLC. All rights reserved. Hot Sales On Deck Carry the flavors your customers want this summer

UP FRONT THE BIG QUESTION

Innovation is a cultural imperative for the Wills Group and Dash In. It’s one of our pillars. Innovation is not just the responsibility of the senior leadership team or a specific functional area. It’s an objective for the entire organization, and we ask all of our employees to think about innovation as part of their day-to-day jobs.

Oftentimes people think innovation is looking for the next million- or billion-dollar idea. I’ve told our team, don’t get caught up in that, just focus on continuous improvement. What can you do daily that can be innovative, that can help propel the company forward?

Wills Group has seven core values, and one of our values is courage. We define courage as saying we trust that our employees are going to take intelligent risks, rewarding them for positive results and not penalizing them for negative outcomes. We recognize not everything is going to work out, but if we’re not pushing ourselves to do something different and to take some risks, then we’re never going to move forward.

We built a new store in Richmond, Virginia, in 2018, and it was one of our first neighborhood store concepts. Richmond is a big craft beer market, and so, we said, ‘Why don’t we sell craft beer and partner with local breweries?’ We developed a growler and crowler

What does innovation mean for Dash In and the Wills Group?

and architecture and the environment of the store, along with the food and beverage program.

We’re making a big step forward with this concept. We’re going to be bringing in raw proteins and making craft burgers in-house. We’re going to have plant-based options, which is pushing the envelope for the convenience channel. We’ve got an Impossible Burger and a plant-based sausage product for breakfast sandwiches.

This new store concept is going to be the North Star for the Dash In brand. It’s also the launch of our new visual identity for Dash In and Splash In—new logos, new design aesthetic. It looks completely different from what we’ve done up until now.

program. Fast forward five years later, and we’ve kept it, but we haven’t taken it further. This test showed us there’s not enough consumer demand to take this across all of our Virginia stores. I’m the first to raise my hand and say, ‘Hey, that was my idea, it didn’t work out as planned, and we move on.’

I think that helps from an authenticity perspective, just to let the rest of the organization know that if we don’t push ourselves, we’re not really pursuing innovation, and along the way, we’re going to make some mistakes. But as long as we mitigate the impact of those mistakes, then things are good.

Next on the horizon for us is our new Dash In concept in Chantilly, Virginia. It is very much an elevated offering, elevated in terms of the design

Our team is really excited about this Chantilly store and the 16 ones coming behind it. Over time, we’ll rebrand all of our locations and bring in the new menu. We want to test and learn some things first in these new concepts.

Innovation is a cultural imperative, and among the things we’re doing internally is to invest in examining our diversity, equity and inclusion commitment. We’ve done a lot of internal surveys and interviews with employees to think about, ‘What are the things that we need to do to move the organization forward?’

Innovation has to be a part of everything we do, and not just from a technology perspective or from a product development perspective. It’s really an integral part of the culture here at the Wills Group.

8 APRIL 2023 convenience.org

Julian B. (Blackie) Wills III, President and COO of the Wills Group

Today, more than 20 million U.S. adult smokers are seeking potentially less harmful alternatives to cigarettes. We are committed to preserving the harm reduction opportunities that smoke-free tobacco products hold for adult smokers. And to making sure that, even as the tobacco category changes, your retail success continues.

©2023

Connect With Exec Ed Alumni

NACS has launched the NACS Executive Education Alumni Network to expand the educational and professional networking opportunities for the hundreds of people who have attended one or more of the five NACS Executive Programs.

“The NACS Executive Education series is the only comprehensive, multi-discipline industry curricula that offers customized, Ivy League training exclusively for senior convenience management. The Alumni Network extends this value by providing long-term connections and professional development

for the leaders who are shaping the future of our industry and of retail overall,” said NACS Vice President of Research and Education Lori Stillman.

The Alumni Network provides curated executive-level content via newsletters, in-person networking events, live webinars with university professors, discounts to open-enrollment courses and an invitation to join the official NACS Alumni LinkedIn group for year-round interaction with like-minded peers.

“The NACS Executive Education program already offers an unparalleled, prized education experience. The

NACS Welcomes Logan Dion

Alumni Network provides participants with long-term connectedness and additional professional development opportunities to extend their learning journey,” said Stillman.

The five NACS Executive Education programs include: NACS Financial Leadership Program at Wharton, NACS Marketing Leadership Program at Kellogg, NACS Executive Leadership Program at Cornell, NACS Innovation Leadership Program at MIT and NACS Women’s Leadership Program at Yale.

Starting in March, participants of any of the five NACS Executive Education programs since 2017 began receiving invites to join the Alumni Network. Anyone who attended a NACS Executive Education program in 2016 or prior also is eligible to join.

Contact Brandi Mauro at bmauro@ convenience.org to request an invitation. The first scheduled networking event will take place in April at the NACS State of the Industry Summit.

Logan Dion has joined NACS as digital media and ad trafficker. In this role, Dion will help with the endto-end execution of supplier-paid advertising campaigns for all official NACS Media and Fuels Market News properties—both print and digital—including subscription boxes, convenience.org, webinars, paid product placement and branded-content activation. Dion spent nearly seven years at Boston Scientific, where she started as an intern. Upon joining full time, she was promoted to increasingly responsible positions that included marketing operations specialist and marketing communications specialist. Dion earned a B.A. in marketing-communication from the University of Massachusetts Amherst.

10 APRIL 2023 convenience.org UP FRONT NACS NEWS

Logan Dion

New Members

NACS welcomes the following companies that joined the association in January 2023. NACS membership is company-wide, so we encourage employees of member companies to create a username by visiting www.convenience.org/Create-Login. All members receive access to the NACS Online Membership directory, latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

NEW HUNTER CLUB MEMBERS

Juice Head Pouches

Huntington Beach, Calif. www.streamlinegroupinc.com

VIBEZ Sunglasses Inc. Hooksett, N.H. www.vibezsunglasses.com

NEW RETAIL MEMBERS

7-11 Store 33637 Newark, Calif.

Atco Inc. Sarasota, Fla.

Good2Go Stores LLC

Idaho Falls, Idaho

www.good2gostores.com

Granite Peak Smelting Company LLC

dba Miner’s Grab N Go McCall, Idaho

Petroleum Marketing Group Falls Church, Va. www.petromg.com

RUBiS Energy Bermuda St. George’s, Bermuda

Short Trip Management Inc. Summerton, S.C. www.shorttrip.com

Shout and Sack Vinita, Okla. www.shoutandsack.com

NEW SUPPLIER MEMBERS

37th Street Bakery LLC Chicago, Ill. www.37thstreetbakery.com

Airosol Company Inc. Neodesha, Kan. www.airosol.com

Altaine Auckland, New Zealand www.altaine.com

Atomic Brands Fort Wayne, Ind. www.drinkmonaco.com

Big Rig Tees Tulsa, Okla. www.bigrigtees.com

Calumet Carton South Holland, Ill.

CigTrus Pomona, N.Y. www.cigtrus.com

Cima Cash Handling America Inc. Houston, Texas www.cima-america.com

Calendar of Events

2023 APRIL NACS State of the Industry Summit

April 18-20 | Hyatt Regency DFW International Airport | Dallas, Texas

NACS Leadership for Success

April 30-May 05 | Virginia Crossings Hotel & Conference Center | Glen Allen (Richmond), Virginia

MAY

NACS Convenience Summit Europe

May 30-June 01 | Intercontinental Dublin | Dublin, Ireland

EMCO spol. s r. o. Prague, Czech Republic www.emco-us.com

Fit Tea Miami, Fla.

Helios Brands LLC Spicewood, Texas www.chinookseedery.com

InStore.ai Los Altos, Calif. www.instore.ai

Kressner Strategy Group Bayside, N.Y. www.kressnerstrategygroup.com

Lawrence Foods Elk Grove Village, Ill. www.lawrencefoods.com

Montavue Missoula, Mt. www.Montavue.com

Performance Inspired Nutrition Warrendale, Pa. www.pi-nutrition.com

Port Jersey Logistics Cranbury, N.J. www.portjersey.com

JULY

NACS Financial Leadership Program at Wharton

July 16-21 | The Wharton School University of Pennsylvania | Philadelphia, Pennsylvania

NACS Marketing Leadership Program at Kellogg

July 23-28 | Kellogg School of Management | Northwestern University | Evanston, Illinois

Proper Wild New York, N.Y. www.properwild.com

Puka Creations Gardena, Calif.

Spectas

Chattanooga, Tenn. www.spectas.global

STM Display Sales Inc. Mississauga, Ontario www.stmdisplays.com

The Whole Coffee Company Miami Gardens, Fla. www.tncruz.com

Toufayan Bakeries Inc. Ridgefield, N.J. www.toufayan.com

White Coffee Corporation Long Island City, N.Y. www.whitecoffee.com

Wind River Environmental Marlborough, Mass.

Wm. Bolthouse Farms dba Bolthouse Farms Bakersfield, Calif. www.bolthouse.com

NACS Executive Leadership Program at Cornell

July 30-August 03 | Dyson School, Cornell University | Ithaca, New York

OCTOBER

NACS SHOW

October 03-06 | Georgia World Congress Center | Atlanta, Georgia

For a full listing of events and information, visit www.convenience.org/events.

12 APRIL 2023 convenience.org

UP FRONT NACS NEWS

Member News

RETAILERS

Sheetz announced that Joe Sheetz has been appointed chairman of the Sheetz board of directors.

Sheetz will oversee the board’s activities as they relate to corporate governance and risk, executive appointments and compensation in addition to longterm planning.

Ryan Speakes has been named vice president of fuel center and convenience stores at SpartanNash. Speakes will be responsible for providing leadership, strategic direction and operations plans for SpartanNash’s 37 fuel centers, most of which include a convenience store and are co-located with a company-owned grocery store.

SUPPLIERS

ADD Systems announced the passing of Bruce A. Bott, the founder of ADD Systems.

Bott built ADD Systems from a one-person operation to a corporation that employs 150+ people across the U.S. and Canada. Bott partnered with Bill Dixon of Dixon Oil to create ADD Systems, developing fuel management software that automated the process of predicting fuel deliveries. In 1997, Bott spearheaded the first of three acquisitions, each of which added additional industry expertise, clients, and software.

CITGO named Chris Kiesling as assistant vice president light oils operations and marketing. Kiesling will oversee all activities related to terminals and pipelines, brand development, light oils sales, light oils pricing and business analysis.

Impact 21 has named Scott Knox as principal consultant, program manager. Knox has served in the convenience retailing industry for the past 16 years, including prior work with national and proprietary brands.

S. Abraham & Sons, a subsidiary of Imperial Trading Company, has promoted George Bennett to president of S. Abraham & Sons. Bennett began his career with SAS in 2010 as vice president of sales and was promoted to vice president of sales & marketing in 2014 and chief marketing officer in 2019.

Jim Leonard has retired as chief operating officer from S. Abraham & Sons. He began his career with SAS in 1988 working with the Abraham Seniors in all facets of the company to

include vice president, administration and chief financial officer. In 2019 Leonard was promoted to COO leading SAS to continued growth and expansion.

David Price has joined FeedbackNow by Forrester as account executive for its convenience retail clients. Price will focus on helping clients with real-time responses to customer-impacting operations.

Mark Tentis was named vendor director on the 2023-24 board of directors of the International Carwash Association. Tentis also serves as senior vice president for global sales and service at OPW Vehicle Wash Solutions. Tentis, who has 22 years of experience as a professional in the vehicle wash market, was nominated for the position by his fellow colleagues in the industry. He will serve a two-year term.

KUDOS

Congratulations to ADD Systems on the company’s 50th anniversary. ADD Systems was founded in 1973 with the goal of improving the way energy distributors operate. Today, ADD Systems is happy to carry on that same goal to the energy distribution, HVAC and c-store industries.

14 APRIL 2023 convenience.org UP FRONT NACS NEWS

Joe Sheetz

Ryan Speakes

Bruce A. Bott

Chris Kiesling

Scott Knox

George Bennett

Jim Leonard

Mark Tentis

David Price

NACS APRIL 2023 NOW AVAILABLE IN 2 FOR $1.49, SAVE ON 2 AND 5 FOR $2.99 RESEALABLE POUCHES CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM GAMECIGARS.COM ©2022 SMCI Holding, Inc. LIMITED EDITION GAME LEAF CRÈME COMING 2023 A CR é ME COME TRUE

Wawa Warms Up Polar Plungers

Wawa and The Wawa Foundation brought back the Wawa Community Care Vehicle for another year with visits to more than 20 events this winter and spring. The vehicle supports local partners with food and hot beverage donations.

The vehicle’s year began with stops at annual polar plunges that support Special Olympics, and Wawa served more than 10,000 hot beverages at events in Delaware, Florida, Maryland, New Jersey, Pennsylvania and Virginia.

“At Wawa, we believe in being a positive force for good in every community where we live and work—not just with donations, but with heartfelt actions and interactions that help bring out the best in everyone,” said Liz Simeone, senior manager of Wawa Community Care and

The Wawa Foundation. “Our Community Care Vehicle is one way we connect with and amplify the efforts of those serving others in our communities. We wish all the polar plungers luck and hope our hot beverages help warm you up as you take a dip in those frigid waters to support the amazing athletes of Special Olympics.”

Wawa’s Community Care Vehicle serves an estimated 50,000 hot beverages at events throughout the year. National charity partners of The Wawa Foundation include JDRF, Special Olympics, the Leukemia and Lymphoma Society, the USO and the American Red Cross. Meanwhile, Wawa teamed up with QuikTrip before the Super Bowl for some friendly competition by showing support for their hometown teams

while making a positive impact in the community.

QuikTrip, which has a large store presence in the Kansas City area, backed the Chiefs, while Pennsylvania-based Wawa rooted for the Eagles. Following the game, Wawa donated $10,000 to Synergy Services, one of the only shelters for runaway and homeless youth in western Missouri.

“Our thanks to Wawa for partnering with us to turn our good-natured rivalry into a win-win for our very deserving local charity partners,” said Aisha Jefferson-Smith, QuikTrip corporate communications manager. “Our partnership with Synergy Services and our national Safe Place locations provide our community’s most vulnerable youth with a safe environment when they need it most.”

16 APRIL 2023 convenience.org

CONVENIENCE CARES

CONVENIENCE CARES In The Community

Every year, the convenience and fuel retailing industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America, and to share these powerful stories. Learn more at www.conveniencecares.org

SHARE THE LOVE

1 Love’s Travel Stops celebrated the 10th year of its annual Share the Love event by donating $110,000 to nonprofit organizations across the U.S. on behalf of its more than 39,000 employees. Additionally, 300 Love’s employees in Oklahoma City, and 40 Trillium Energy and Musket employees in Houston, spent Valentine’s Day volunteering at organizations where their corporate offices are located. Team members at Love’s Travel Stop locations also had the chance to participate in the event by voting on an organization in their division to receive $10,000.

SOCIAL SHARES

NACS encourages retailers to share their giving-back news on social media using #ConvenienceCares

SUICIDE PREVENTION

2 The GATE Foundation, the philanthropic arm of Jacksonville, Florida-based GATE Petroleum Company, and GATE customers raised $50,000 for the American Foundation for Suicide Prevention (AFSP). Funds were collected July 1 through December 31, 2022, in coin boxes at the registers of all GATE locations in Florida, Georgia, North Carolina and South Carolina. Funding will be allocated to AFSP chapters in the state where collected.

ALTA SUPPORTS MAKE-A-WISH

3 Alta Convenience stores and sister company Petro Marts have raised over $300,000 for Make-A-Wish. CF Altitude LLC, the parent company of both brands, has locations in Colorado, Illinois, Kansas, Missouri, Nebraska, New Mexico and Wyoming, and the funds raised in each state will go directly to that state’s Make-A-Wish chapter.

PILOT CO. SPOTLIGHTS HEART HEALTH

4 Pilot Company launched its annual round-up drive to support the American Heart Association’s Life is Why cause

campaign to encourage heart health. Customers donated at participating Pilot, Flying J or One9 Fuel Network travel centers during February. Pilot also promoted heart health and safety among its 30,000 employees by providing virtual, hands-only CPR training, resources to find nearby CPR classes, virtual cooking classes and other health and wellness tips.

EG AMERICA SUPPORTS

AMERICAN RED CROSS

5 To help the American Red Cross in its efforts to assist those in need and to commemorate Red Cross Month in March and its generous volunteers, EG America held a fundraiser with a goal of raising $150,000. During March, guests had the opportunity to donate $1, $5 or an amount of their choosing to the Red Cross during checkout. All proceeds will go toward supporting the urgent needs of the Red Cross’s humanitarian mission to alleviate human suffering in the face of emergencies. This U.S. fundraiser was part of EG Group’s global participation to support the Red Cross.

18 APRIL 2023 convenience.org

2 3 5 4 1

IS F ECI E.

We’ve got the ingredients you need to operate a turnkey branded pizza program with profi t margins 50% and higher.

CCESS LE N M E

Y S Scan the code, or visit HuntBrothersPizza.com/nacs to download your Branded Pizza Guide.

CCES F E.

Meet the New Senators of the 118th Congress

BY PAIGE ANDERSON

Now that the 118th Congress is convened, committee assignments filled and hearings and policy agendas underway, let’s turn our attention to the eight newest members of the U.S. Senate. Democrats hold a slim majority of 51-49 in this chamber, which means each senator could play a critical role in moving any bill through the legislative process. All of these freshmen, or first-term senators, sit on committees important to the convenience and fuel retailing industry, handling such issues as swipe fees, electric vehicles, fuels, SNAP, privacy and labor, among many others.

Several of the new senators served in the U.S. House of Representatives, and NACS has already had an opportunity to build a strong relationship with them working on issues together. With the senators who have not previously served in federal office, the NACS government relations team has been working to educate their legislative staff about our industry and create new relationships. A critical part of that effort is bringing together these new offices with NACS members from these states.

SEN. KATIE BRITT (R-ALA.)

Katie Britt was elected to the Senate in 2022 having never served in public of-

fice before. While she is newly elected, she is not unfamiliar with Congress. Following her graduation from the University of Alabama, she worked for her predecessor, Sen. Richard Shelby, eventually serving as his chief of staff. She is a practicing attorney by trade and was CEO of the Business Council of Alabama from 2019-21. In the Senate, Britt serves on three committees: Banking, Appropriations and Rules. Her committee assignments on banking and appropriations will be important to the convenience and fuel retailing industry, especially with payments issues and swipe fees.

SEN. TED BUDD (R-N.C.)

Ted Budd served three terms in the U.S. House of Representatives representing North Carolina’s 13th Congressional Dis-

20 APRIL 2023 convenience.org INSIDE WASHINGTON

8 The number of new U.S. senators serving in the 118th Congress 51 The number of senators who are Democrats or caucus with them in the 118th Congress

Key Figures

Among the eight freshmen, there are six Republicans and two Democrats.

Sen. Katie Britt (R-Ala.)

Sen. Pete Ricketts (R-Neb.)

trict before his election to the Senate in 2022. Prior to running for Congress in 2016, Budd had never held elected office. He was a business owner, operating a successful gun store and range. During his time in the House, Budd defined himself as a conservative and member of the House Freedom Caucus. He also served on the House Financial Services Committee. He was a vocal supporter of a proposal in 2017 that would have repealed the Durbin Amendment, the debit swipe-fee reforms that were championed by NACS and the convenience store industry. In the Senate, Budd is serving on four committees: Small Business; Health, Education, Labor and Pension; Commerce, Science, and Transportation; and Armed Services. Issues such as labor, health care, transportation, infrastructure, privacy,

data security, gasoline prices and others are in the jurisdiction of his committee assignments and important to the convenience industry.

SEN. JOHN FETTERMAN (D-PA.)

Prior to his election to the Senate in 2022, John Fetterman served four years as Lieutenant Governor of Pennsylvania and 13 years as mayor of Braddock, Pennsylvania. He also worked in the insurance industry and for AmeriCorps. Fetterman positioned himself as a progressive during his years in Pennsylvania, focusing on youth programs and redevelopment of low-income areas. He has battled health issues, including suffering a stroke during the 2022 campaign. In the Senate, Fetterman serves on five committees: Agriculture, Banking, Environment and Public

NACS APRIL 2023 21 U.S. Senate

Several of the new senators served in the U.S. House of Representatives, and NACS has already had an opportunity to build a strong relationship with them.”

Sen. Ted Budd (R-N.C.)

Sen. John Fetterman (D-Pa.)

Sen. Markwayne Mullin (R-Okla.)

Sen. Eric Schmitt (R-Mo.)

Sen. J.D. Vance (R-Ohio)

Sen. Peter Welch (D-Vt.)

Works, the Joint Economic Committee, and the Special Committee on Aging. NACS will be working with him on issues such as the farm bill, SNAP, swipe fees and fuels.

SEN. MARKWAYNE MULLIN (R-OKLA.)

Markwayne Mullin served five terms in the U.S. House of Representatives representing Oklahoma’s 2nd Congressional District before succeeding retiring Sen. Jim Inhofe (R-Okla.) in 2022. He is the first tribal citizen of the Cherokee nation to serve in the U.S. Senate and the second Native American to serve in the Senate. Prior to running for Congress, Mullin was a businessman and rancher. While in the U.S. House of Representatives, Mullin served on the House Energy and Commerce Committee, where NACS worked closely with him and his staff on fuels, climate, privacy, menu labeling and numerous other issues. Mullin also participated in a NACS In Store event. In the Senate, Mullin serves on four committees: Armed Services; Environment and Public Works; Health, Education, Labor and Pensions; and Indian Affairs. Both the Environment and Public Works Committee and the Health, Labor and Pensions Committee have jurisdiction over important issues affecting the convenience industry, including fuels, infrastructure, labor and health care.

SEN. PETE RICKETTS (R-NEB.)

Pete Ricketts served as the 40th governor of Nebraska before his appointment to the U.S. Senate in January. As governor, he created a business-friendly climate and focused much of his administration on economic development and eliminating state taxes on Social Security and veterans’ benefits. Before running for governor, Ricketts worked for TD Ameritrade and is a former board member of the Chicago Cubs baseball franchise. In the Senate, Ricketts serves

ONE VOICE

This month, NACS talks to Jay Nelson, CEO, Excel Tire Gauge LLC

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

I’m a frequent NACS Day on the Hill attendee. Anyone who hasn’t been before should seriously consider going. It’s a great opportunity to see firsthand how policies directly impact your business and our industry, and you’re able to share with our federal representatives directly on the issues that matter most. Every year I’m impressed by how engaging and interactive these meetings are. The c-store and fuel retailing industry is vast, and Congress needs to hear from us.

What federal legislative or regulatory issues keep you up at night?

Electric vehicles and credit card swipe fees keep me up at night. With respect to electric vehicles, policymakers continue to push for increased incentives for electric vehicles and charging stations. Convenience stores have a lot of resources and are currently the fueling destination for the traveling public. C-stores should not be left out of the electric vehicle equation and should be given the option to sell any legal source of transportation energy in a competitive marketplace.

As for credit card swipe fees, there needs to be more competition in the credit card market. Visa and Mastercard control about 80% of the credit card market. Main Street businesses—including convenience stores— thrive on competition, and the card networks should, too.

What c-store product could you not live without?

Water and Vitaminwater are my go-to in the store. Every time I fill up my tank, I go inside and grab a bottle or two!

22 APRIL 2023 convenience.org INSIDE WASHINGTON

on three committees: Environment and Public Works, Foreign Relations and the Special Committee on Aging. With fuels-related issues a top priority for NACS, Rickets’ assignment to the Environment and Public Works Committee will be important to the industry.

SEN. ERIC SCHMITT (R-MO.)

Eric Schmitt served as Attorney General of Missouri before being elected to the U.S. Senate to replace retiring Sen. Roy Blunt (R-MO). In addition, he held numerous state and local offices, such as state senator and treasurer of Missouri. In the Senate, Schmitt serves on three committees: Armed Services; Commerce, Science, and Transportation; and the Joint Economic Committee. His committee jurisdiction over commerce and transportation will also make him a key figure as the infrastructure legislation passed by the last Congress is implemented, along with privacy, data security and gasoline price issues.

SEN. J.D. VANCE (R-OHIO)

J.D. Vance served in the Marine Corps, was a combat correspondent in Iraq and worked in finance after his military service and before becoming a U.S. Senator. He serves on four Senate committees: Banking; Commerce, Science, and

Transportation Committee; the Joint Economic Committee; and the Special Committee on Aging. His position on the banking committee may make him an important figure in our industries’ efforts to pass the Credit Card Competition Act. In addition, privacy, data security, transportation and infrastructure issues all fall in the Commerce Committee jurisdiction.

SEN. PETER WELCH (D-VT.)

Prior to his election to the Senate in 2022, Peter Welch represented Vermont in the U.S. House of Representatives for 14 years. Welch previously served two stints in the Vermont Senate from 1981 to 1989 and 2001 to 2007. During his time in the House of Representatives, Welch often worked across party lines on legislation. In fact, during his 2008 reelection campaign, Welch had the rare distinction of being the nominee of both the Democratic and Republican parties for Vermont’s lone House seat. Welch has long been a champion of the convenience retailing industry and has led the fight for reform of credit- and debit-card swipe fees, including sponsoring legislation to reform these fees and pressing regulators to act against abuses of the credit card industry. In addition, he was helpful on menu labeling, privacy and data security issues. Welch was also one of the first members of Congress to participate in a NACS In Store event and participated in the 100th In Store event with two other members of Congress at a convenience store in Washington, D.C. In the Senate, Welch serves on four committees: Agriculture; Commerce, Science, and Transportation; Judiciary; and Rules.

24 APRIL 2023 convenience.org PeopleImages/Getty Images

Paige Anderson is NACS director of government relations. She can be reached at panderson@ convenience.org.

Welch was also one of the first members of Congress to participate in a NACS In Store event.”

INSIDE WASHINGTON

If you are interested in meeting with your senator, please reach out to Margaret Hardin, NACS Grassroots manager, at mhardin@convenience.org.

Millions of visits to BlackBuffalo.com 50% of surveyed prefer to buy in store Thousands of retailers across America ZERO reasons not to carry Black Buffalo CHARGE AHEAD For trade purposes only. Black Buffalo products are strictly intended for 21+ current consumers of nicotine, tobacco, or comparable alternatives. wholesale@blackbuffalo.com

INSIDE WASHINGTON

NACSPAC DONORS

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac

NACSPAC donors who made contributions February 1-28, 2023, are:

Brad Anderson Weigel’s Stores Inc.

Ted Asprooth

NACS

Lisa Biggs

Impact 21

Sajid Chaudhry NSR Petro Services LLC

Lucia Romanello Crater

Impact 21

Gary Dake Stewart’s Shops

Karim Dhukani Easy Lane Stores

Jack Dickinson Dover Corporation

Jim Forsyth FKG Oil Company

Wilson Friend Altria Group Distribution Company

Joe Hamza Nouria Energy Corp.

Scott Hill Jack Link’s Protein Snacks

Lindsey Hjemstad Standard AI

Sonja Yates Hubbard Yates Group Inc.

Akhtar Hussain CHS Inc.

Jen Johnson NACS

Abbey Karel Bounteous

Mike Lindberg CHS Inc.

Bryan Morrow PepsiCo Inc.

Jerry Niblett Perfetti Van Melle USA

Steven O’Toole Stuzo LLC

Nick Paich GSTV Alex Plant Standard AI

Carl Rick Kwik Trip Inc.

Kent Rollins Nashville Wire Products

Ron Rutherford Apter Industries Inc.

Ray Ryan Sheetz Inc.

Brian Sedra Phusion Projects LLC

Stan Storti The Spinx Company Inc.

Linda J. Toth Conexxus

George Ubing E&J Gallo Winery

Elizabeth Waring Johnson & Johnson Inc.

Paula Weeks Coca-Cola Company

Alicia West Altria Group Distribution Company

Angie Westbrock Standard AI

Geoff Wigner Nashville Wire Products

Kathy Williams Coca-Cola Company

Mike Wilson Cubby’s Inc.

Michael Winton Pace-O-Matic

26 APRIL 2023 convenience.org

Contact your GOYA® representative or email salesinfo@goya.com | trade.goya.com Authentic. Refreshing. Delicious. ©2023 Goya Foods, Inc. Learn More! Variety meets the tropics. Offer your shoppers a taste of the tropics on the go. GOYA® Beverages come in exotic, thirst-quenching flavors they’re sure to love!

Name of company: Kenly 95 Petro

Year founded: May 1980 (purchased by Iowa

80 Group in 2004)

# of truckstops: 3

Website: www.kenly95.com

More Than a Truckers’ Paradise

BY SARAH HAMAKER

Kenly 95 Petro in Kenly, North Carolina, has the appearance of a small city, with its sprawling complex of buildings and fuel locations designated for truckers and regular cars. When it first opened in May 1980 as Truckland Truckstop, the location included a small store, sit-down restaurant and diesel fuel islands. But that was only the beginning of expansions and name changes before it became the Kenly 95 Petro of today.

“Through the years, we’ve kept growing physically and sales-wise,” said Ernie Brame, general manager with Corbitt Partners LLC, which operates as Kenly 95 Petro.

28 APRIL 2023 convenience.org IDEAS 2 GO

While Kenly 95 Petro caters to professional drivers, the complex has plenty to lure tourists and locals alike.

A GROWING BUSINESS

Within two years of its existence, the company became a franchisee of TravelCenters of America and within a decade, the owners began the first of many expansions and remodels, from adding a convenience store and mechanics shop to revamping the restrooms and shower facilities. Today, the complex is the largest truck stop on the East Coast and has five fast-food restaurants in its food court, plus the full-service Iron Skillet restaurant.

“In the older days, we used to market ourselves as being midway between the apple (New York City) and the orange (Florida),” Brame said. Kenly 95 “tries to give a North Carolina flavor for the car traveler and tourist in our retail operation, along with our extensive gear and accessories for truckers,” he said. For example, the store stocks truck parts and chrome accessories and clothing for truckers and motorcyclists. For tourists, Kenly 95 has North Carolina souvenirs and traveler essentials.

Brame said they are constantly turning over inventory and trying new items. “Sometimes, we have what we think will be a sure fit and it fizzles,” he said. “Then we get some items, like these toy rifles that shoot salt at flies to kill them called Bug-A-Salt, and those sold like hot cakes.”

Another surprising hit was to-go deviled eggs. “I’d noticed deviled eggs were

the first to go at covered-dish church suppers, so thought we should try making them,” Brame said. “We put six half deviled eggs in a grab-and-go container and sold 20 to 30 in a day. Now even Iowa 80 has put the item in their store.”

A NORTH CAROLINA CONNECTION

Kenly 95 plays up its North Carolina pride with its décor. For example, a scaled 65-foot replica of the Cape Hatteras lighthouse (the original is 215 miles to the east) welcomes truckers and tourists, drawing attention to the location. “We have quite a few people each day who stop to snap their photo beside our lighthouse,” Brame said. “It’s helped make Kenly 95 Petro a destination of its own.”

Inside the store, a mural of Interstate 95 from Maine to Florida adorns the trailer of a full-sized semi and highlights Kenly 95’s importance to interstate travelers and truckers. Along I-95, billboards also draw attention to the stop. A recent billboard campaign incorporates the lighthouse replica into the design, with the lighthouse tower going all the way down to the ground and rising above the billboard’s message center. “Adding the lighthouse to our billboards really made them pop, and it’s been a great marketing campaign for us,” he said.

Kenly 95 Petro also has strong ties to the Kenly community. “We are one of the largest businesses in town, and we try to give back as much as we can to the community,” he said. For example, the company hosts the town’s Independence Day fireworks and holds the East Coast Trucker’s Jamboree, a three-day festival celebrating trucking, over Mother’s Day weekend each year.

The company also supports local charities, especially area schools.

“We’re one of the biggest supporters of the high school booster clubs,” Brame said. “It was a natural fit given how many times team members come into our store.”

BRIGHT IDEAS

Ernie Brame, general manager of Kenly 95 Petro in Kenly, North Carolina, said a focus on cleanliness and loyal employees is the secret to success. “I tell our employees: ‘The lighthouse might point the way here, but you’re going to point the way back.’”

The complex employs roughly 250 people, with new employees paired with seasoned workers who know how to tell the stories of Kenly 95. While Kenly does have employee turnover, the management team has longevity on its side, with most managers having clocked 10 to 20 years, and one who has been with Kenly’s since opening day in 1980. Brame himself has been with the company 40 years.

“We also emphasize to our employees to use the tools they were taught growing up—say please, thank you, come see us again—and smile,” he said. “That goes a long way to welcoming people back.”

“We like to consider ourselves a destination stop,” said Brame. “We want people to plan their stop around our location.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

Ideas 2 Go showcases how retailers today are operating the convenience store of tomorrow.

To see videos of the c-stores we profiled in 2022 and earlier, go to www.convenience.org/Ideas2Go

NACS APRIL 2023 29

FINDING THE RIGHT BRAND PARTNER

Choose what fuel to carry wisely because it’s an ongoing partnership.

IF AN OPERATOR IS LOOKING TO SWITCH FUEL PARTNERS OR IS CONSIDERING GOING FROM UNBRANDED FUELS TO BRANDED FUELS, WHAT ARE SOME OF THE MOST IMPORTANT THINGS TO CONSIDER?

The power of a brand plays a large role in your consumer’s willingness to consider you. Trust, perceived higher-quality fuel and the drive for higher-margin premium fuel sales are all key considerations for operators. Brands can bring with them established programs such as loyalty, private-label credit cards and other gallon-driving partnerships, such as grocery loyalty or other exclusive relationships. Marketing support from the brand, inclusive of national partnerships and sponsorships, is also a differentiator for a station owner’s customers. Value-added programs such as Sunoco’s industry-leading dispenser equipment discount program provide significant savings to station owners and imaging programs also offer business benefits: Sunoco’s centennial program drives more than 10% gallon growth when a site rebrands.

FLEXIBILITY IS A KEY PART OF THE VALUE PROPOSITION ANY PARTNER PROVIDES, BUT WHAT DOES THAT MEAN IN PRACTICE?

Flexibility means finding ways to meet your customers where they’re at today and to give them what they need to continue to be successful in the future. Sunoco recognizes every business is unique and has its own criteria for success. Our flexible financing options are unique in our industry: We’re able to provide capital up front if that is what a customer needs and update term options and pricing when those situations arise. Having a flexible approach means more than offering a range of financing options; it speaks to a brand’s commitment to its partners in communication and customer support, too. One of Sunoco’s biggest differentiators is accessibility. Sunoco’s customers can pick up the phone and call anyone within their account team organization, including our leadership.

Flexibility isn’t just about the deal, but about how you manage the relationship moving forward and meeting station owners where their needs are.

AFTER A PARTNERSHIP AGREEMENT IS SIGNED, WHAT ARE SOME ONGOING WAYS A PARTNER CAN HELP AN OPERATOR?

One of the first things our new station customers read in their onboarding kits is: “Your success drives ours,” because Sunoco is successful when our stations are successful.

This involves supporting operators with programs and partnerships driving business to their station(s), including generating demand through digital avenues (e.g.: location-based Google ads), regional/national advertising and more. Our

Sunoco Go Rewards app helps station owners generate demand by offering discounts on fuel. As a company, we invest in consumer research to fuel innovative solutions and programs. The Sunoco mystery shop program helps operators gauge how their stations appeal to consumers and details what can be done to create the safest, most approachable station possible. And the brand provides ongoing quarterly point-of-purchase (POP) promotions to continue to promote the brand and a station owner’s business.

WHAT IS SUNOCO’S VALUE PROPOSITION WITHIN THE REALM OF FUELS?

Sunoco’s value proposition is first and foremost about the fuel quality itself. High-quality fuel is a top consideration driver for consumers—behind only price and convenience. Sunoco Ultratech is a top-tier certified fuel proven to make your engine run cleaner and last longer. This is evidenced by Sunoco’s 20 years as the exclusive fuel provider of NASCAR, where we’ve done 20 million miles across three different fuel blends, and we’ve never had a defect. It’s a testament to the quality of our fuel and the excellence of our operations team. We fuel every race, every driver, flawlessly every time. Sunoco puts the same focus and care into the fuel at its stations as it does for the fuel that powers the fastest racing machines around the world. And as the largest fuel distributors in the country, Sunoco’s reliability as a fuel supplier is something our operators appreciate.

SUNOCO REVAMPED ITS FUEL BRAND IMAGE. WHAT WAS THE MOTIVATION FOR THAT, AND WHAT ARE THE RESULTS?

In our consumer research, consumers’ perception of station safety showed to be a significant determining factor when they selected where to refuel. When updating our fuel brand image, we focused on making safety a priority by adding additional lighting, as well as making LED mandatory at every station. The result is a modern, clean and simpler design for the next generation of Sunoco consumers. We leveraged our heritage to bring back the iconic Sunoco diamond to the canopy and our dispenser valences. We place an emphasis on our product quality with Sunoco Ultratech as well as being the official fuel of NASCAR. We introduced a new POP element dedicated to communicating the benefits and quality of Sunoco Ultratech fuel. These culminate in a big impact for our operators: We see more than 10% gallon growth at the stations that receive the new image.

NACS APRIL 2023 31

This article is brought to you by Sunoco LP, a NACS member.

Fred McConnell, Director of Brand and Fuels Marketing at Sunoco LP www.sunocolp.com

Selling

Bad

Mood Fuel to People in a

There are opportunities to set yourself apart and create a connection with your customers—even if they’re grumpy.

BY JEFF LENARD

BY JEFF LENARD

There is a lot of angst out there. And there is a lot of pessimism. You’ve probably seen it in your community, in your stores and even with your family. And let’s not even get started on how that manifests itself on social media.

We have the numbers that back up what you are seeing—or feeling.

Seven in 10 gas customers (70%) say the country is heading down the wrong track, a big jump from the 63% who said so a year ago. Two thirds of consumers (66%) are pessimistic about the economy. Even more worrisome, half of all Americans (50%) now think that things in their own area are headed down the wrong track, a three-point uptick from a year ago. In

The

United States

2023 2022 In

other words, the problems aren’t just happening to “those folks” in a different state or region. What’s causing this crisis in confidence?

32 APRIL 2023 convenience.org

the right direction

For one, the aftereffects of the pandemic remain top of mind. Most consumers say that life hasn’t returned to normal—and 1 in 5 say their life will never return to the way it was prior to COVID-19. the wrong track 70% 63%

is headed …

30% 37% Down

NACS APRIL 2023 33

About the 2023 Survey

NACS has conducted national consumer sentiment surveys since 2007, with a specific focus on fueling issues. (In 2021, questions were specific to COVID-19 and so are not included when looking at multiyear trends.) The 2023 NACS Consumer Fuels Survey was conducted by national public opinion research firm Bold Decision (bold-decision.com). A total of N=1,200 U.S. consumers, including N=1,048 who say they drive and fill up at least monthly, were surveyed from February 17-26, 2023. The margin for error for the study is +/2.83 at the 95% confidence level. When referring to survey respondents, we interchange “drivers,” “consumers,” “Americans,” etc.— they all refer to people who buy fuel at least once a month, unless otherwise indicated.

Would you say your day-to-day life has “gone back to normal,” in other words, the way it was before the pandemic?

46% Yes

54% No or don’t know (combined)

20% No, and it never will

31% No, but I think it will eventually

3% Don’t know

Crime also is a big concern. Overall, nearly half of all drivers (46%) say crime has increased, compared to only 1 in 8 (13%) who say crime has decreased.

Crime in my community has …

17% Increased a lot

29% Increased some

41% Stayed about the same

8% Decreased some

5% Decreased a lot

Another point of concern: The gas prices at your stores. Consumer sentiment on the economy is heavily influenced by the price of gas, and 90% of drivers say that gas prices have a “great impact” or “some impact” on their feelings about the economy. What’s more, 83% of all drivers are very or somewhat concerned that gas prices in their area will top $5 a gallon again this year.

Summing things up, consumers are already in a bad mood, and they expect that things will get worse because of the price of a product central to your business.

Don’t be thoroughly depressed though, because there also is good news. There are plenty of opportunities for you to help turn your customers’ frowns upside down—if you appeal to how they are thinking and what they want.

34 APRIL 2023 convenience.org

THEY LIKE CONVENIENCE

People like what you sell: convenience. The 1.5% increase in the convenience store count for 2023 was impressive given all the economic headwinds of the past year. And the 150,174 convenience stores in the country is a staggering number. Let’s put that into context. It’s about the same as adding all the country’s grocery stores (45,380), drugstores (40,008) and dollar stores (37,067 stores), and then throwing in all of the country’s Starbucks (about 16,000 stores) and McDonald’s (about 13,000 stores).

They also like how you sell convenience. Their last experience at a convenience store was excellent or good, say 85% of consumers. Just 2% of the people surveyed rated their most recent experience as poor.

This is especially astonishing considering how many customers shop in convenience stores every day. Convenience stores conduct an estimated 160 million customer transactions a day, meaning that convenience stores serve about half the U.S. population on any given day. Let’s put that another way. It’s very likely that more people went to a convenience store on Super Bowl Sunday than watched the “Big Game,” which had 113 million viewers.

How would you rate your last experience at a convenience store?

More impressive, customers say they like their customer experience in convenience stores more than in other retail channels: 33% say it’s a better customer experience, compared with 10% who say it’s worse.

How would you rate your convenience store experience compared to other retail locations (like grocery stores)?

It’s not easy to serve millions of people every day—especially in a labor crunch. But customers do value the customer experience our stores provide—and the personal connection. The majority still prefer to check out the “traditional” way—interacting with your teams at the register—although there are some variations by age. Customers under age 35 are almost twice as likely to want to use self-checkout machines (44% vs. 25%).

If both options were available, which do you prefer?

NACS APRIL 2023 35

Total Under age 35 Age 65+ Interact with a live cashier 50% 48% 52% Use self-checkout 36% 44% 25% No preference 14% 8% 23% Poor 2% 13% Fair 57% Good 28% Excellent 54% About the same 33% Better customer experience 10% Worse customer experience 3% Not sure

It’s critical to get drivers to the forecourt because a record percentage of drivers (59%) say that they go inside the store after they fill up.

The last time you purchased gas, did you go inside the store?

(drivers answering “yes”)

GETTING THEM TO SHOP WITH YOU

Here’s where things get trickier. People love convenience, but they aren’t necessarily in the best mood as they determine where to shop. How do you tell them why they should shop with you?

First, fueling is not inherently fun for most drivers. By a 3:1 margin, most view it is as a chore rather than something they enjoy. So how do you make it something they enjoy? Make them enjoy their in-store experience.

Which is closer to your view?

Before we get to what drivers do when they come inside the store, let’s look at what they are looking for—and at. It’s clear the basics are more important than ever—safety and cleanliness, especially among women. Those under age 35 overindex most on wanting a speedy experience and knowing how you serve the community.

How important are the following when it comes to choosing to shop at a specific c-store?

(multiple selections permitted; top seven responses listed.)

% who said “very important” Overall Women Ages 18-34

The price of fuel remains the top reason they pick a specific location to fill up—and the importance of price as the leading factor has greatly increased over the past several years.

Interestingly, “cares about the community” (29%) scored twice as high as “donates to/supports charitable causes (14%),” indicating that consumers want to hear not just what you do for the community, they want to hear why. And that’s a huge opportunity to tell your story.

36 APRIL 2023 convenience.org

Safety 65% 73% 61% Cleanliness 63% 69% 57% In and out quickly 51% 50% 54% Availability of the products 47% 47% 48% Friendly employees 45% 46% 44% Quality of food/meals 32% 36% 34% Cares about the community 29% 29% 33%

2023 2022 2021 2020 59% 72% 19% 9% 58% 52% 44% Fueling my vehicle is a chore I enjoy fueling my vehicle Not sure

when buying gas? 2023 2022 2020 2019 Price 68% 69% 58% 59% Location 21% 22% 19% 23% Brand 12% 10% 11% 10%

Which of these factors is most important

The Rich, The Bold Flavo Bold FlavoR o oF Our premium quality cigarettes, pipe tobacco, cigarette tubes, and roll-your-own tobacco products are all made from the finest U.S. tobacco. ContaCt us today! www.gopremier.com/contact a customer favorite — now available — in enticing NeW PacKaGiNG

Another opportunity is the return of the commuter. While most people say life hasn’t returned to what it was like before the pandemic, some things are moving closer to what life was like in early 2020. Fully three-quarters of all full- or part-time workers (77%) now commute at least a few times a week. And more than half (57%) say they commute every day.

Work/commute habits

57% Commute every day

20% Commute a few days a week

16% Commute less than once a week

17% Exclusively work at home

And with commuting returning, so is rush hour and the rush-hour customer. After sliding during the pandemic, morning fill-ups have returned, up 3 points from just a year ago and tied for the highest percentage since we tracked this metric.

With the morning fill-up returning and customers wanting to kick-start their day, that’s a perfect opportunity to grow coffee or energy drink sales. And the numbers show that drinks are the most common item purchased.

What did you do the last time you went in the store? (multiple responses permitted; top 10 responses listed)

46% Paid for gas at the register (+1% over 2022)

43% Bought a drink (fountain or packaged)

32% Bought a snack (-3%)

28% Bought cigarettes/ vaping product

When

22% Used the bathroom (-2%)

21% Bought lottery tickets

16% Used the ATM (-1%)

14% Bought beer/wine

13% Bought a sandwich/meal (+1%)

38 APRIL 2023 convenience.org

10% Bought gum/mints do you buy gas? 24% Morning (6-10 a.m.) 36% Midday (10 a.m.-3 p.m.) 32% Afternoon (3-7 p.m.) 7% Night (7 p.m.-12 a.m.) 2% Overnight (12-7 a.m.)

NACS has online fuels-related resources that communicate the industry’s voice to consumers and to the media.

Convenience Corner (convenience.org/media/conveniencecorner)

Our blog attracts hundreds of thousands of readers. Some popular, recent fuel-related articles include:

• Does the President Control Gas Prices?

• Who’s Responsible for Debit Holds?

• Is Gas Tax Relief a Good Idea?

• Do Oil Companies Make Money on High Gas Prices?

• Do Gas Prices Come Down Slower Than They Rise?

Got a question that you want us to answer? Send a note to Jeff Lenard at jlenard@convenience.org

Fuels Resource Center (www.convenience.org/fuels)

The online Fuels Resource Center shares consumer-friendly content related to gas prices, retail operations and consumer behavior, as well as fun pieces on 9/10 cent pricing and the evolution of self-serve fueling.

Fuels Market News (www.fuelsmarketnews.com)

Published by NACS, FMN is the downstream petroleum industry’s trusted source for fuels-related news and information, covering the fuels of today and tomorrow.

SO WHAT … AND WHAT’S NEXT?

While the national average gas price dropped below $3.50 per gallon in mid-February 2023, the shock of record prices in June 2022 is still on drivers’ minds.

Nearly half (46%) of drivers say they are “very concerned” about gas prices hitting $5 a gallon in their area this summer, though only a quarter (25%) think that $5 gas seems “very likely” in their area. But here is the bigger question: What price does gas have to reach before they say they will drive less?

The answer: $4.51.

Will gas prices reach $4.51 and would it affect demand? Behavioral economists can debate the second part of that question all

I would be sad or disappointed if the convenience store closest to my home were to permanently close or go out of business.

78% agree

80% agree

day. The bigger question is why people drive and how much they could cut back. After all, most people don’t hit the road because they like driving; it’s because they have an obligation (work, errands, etc.) that requires them to drive.

How do you get more drivers to your store to purchase gas and in-store items? The survey responses indicate that consumers crave a sense of normalcy. They want things to feel like they remember them—even if their memory paints an overly positive picture of the past. They also want the basics associated with Maslow’s hierarchy: Safety, security, cleanliness and full shelves are paramount. And they also want to hear your story. They want to know what matters to you because they do believe that convenience stores matter—and that convenience stores are an integral part of their communities and daily existence.

Jeff Lenard is NACS vice president, strategic industry initiatives. You can reach him at jlenard@convenience.org.

40 APRIL 2023 convenience.org

The convenience store closest to my home is an important part of my community.

42 APRIL 2023 convenience.org Rebranding can revitalize your business

Images

Klaus Vedfelt/Getty

BY SARAH HAMAKER

In2020,

Kwik Chek began its transformation to TXB, or Texas Born. “I didn’t think our old brand was current—it didn’t feel authentic to who I was,” said Kevin Smartt, CEO of TXB, in a 2022 interview with NACS. “I wanted to have a name and concept that I thought really resonated with our customers, with our employees and with myself.” The new brand reflected TXB’s new emphasis on serving fresh food and connected more with the customers of today.

NACS APRIL 2023 43

—if it’s done right.

The decision to rebrand is one that retailers should not take lightly, but for those whose offerings have evolved in recent years, a rebrand can be a way to let customers know what to expect now and in the future.

REBRAND REQUIRED?

Not all brands need to refresh right now, but brand evolution is mandatory. “A brand is not stagnant,” said Keith Broviak, chief marketing officer for Coen Markets Inc., during the “Build a Better Brand” educational session at the 2022 NACS Show. “It’s always growing … and you need to make sure your brand and your logo are [evolving, too].”

At Coen Markets, the impetus to rebrand came about because of customer confusion. “We had a collage of stores—four convenience store brands and four fuel brands,” said Broviak. “Our goal was to figure out how to take all these fuel and convenience store brands and make them into one brand.”

How to Rebranding Missteps

How can retailers go wrong when launching a new or revised brand? By ignoring the importance of incorporating a strong foodservice offering. “For c-stores, growth of their on-site foodservice revenue and profit continues to be a focus area,” said Paul Stippich, director of marketing for Otis Spunkmeyer. “One-stop shopping drives consumers when choosing c-store foodservice over restaurants,” so having foodservice be a large part of the rebrand is essential to success. Here are three other ways retailers could mess up a rebrand:

• By ignoring customer feedback, which is crucial in determining what changes a brand needs to make.

• By overcomplicating the brand because a complex brand can be difficult for customers to understand. This can result in a lack of brand recognition.

• By losing the brand’s core identity, which can confuse customers and lead to a decrease in brand loyalty.

Coen Markets had these three things in mind when rebranding itself. “We wanted to come out with one brand and one voice … in a cohesive manner,” said Keith Broviak, chief marketing officer for Coen Markets, during the “Build a Better Brand” educational session at the 2022 NACS Show. “We have 57 stores and wanted all remodels to look the same with branding elements tying them together.”

44 APRIL 2023 convenience.org

How do we create the brand and the representation and the feeling we want our customers to have when they come onto the parking lot?”

Klaus Vedfelt/Getty Images

Convenience Retailer of the Year

Asia-Pacific

Presented to Jiangxi Ledoujia

Sponsored by

Convenience Industry Leader of the Year

Asia-Pacific

Presented to Lei Zhu PETRO CHINA USMILE CO., LTD.

Sponsored by

Convenience Retail Technology Award

Asia-Pacific

Presented to FamilyMart Co., Ltd.

Sponsored by

Convenience Retail Sustainability Award

Asia-Pacific

Presented to Central Food Retail Company Limited

Sponsored by

Congratulations

2023 winners! convenience.org/csa

to the

The NACS Convenience Retail Awards Asia-Pacific are made possible by the generous support of our sponsors.

Here are four other factors that might motivate a convenience retailer to kick off a rebrand.

Declining sales or customer engagement

If your store isn’t seeing the same numbers in terms of sales and/or traffic, it might be because customers don’t consider your store relevant to them.

Outdated brand image. What worked 10, 20 or even 30 years ago as your logo and brand messaging might not speak to today’s consumer. For example, MAPCO has begun working to bring its brand into the future, starting in 2021 with a rebuilt flagship location in Nashville, Tennessee. The Store of the Future concept is how the more than 300-unit chain is reimaging convenience to bring in younger consumers while keeping its current clientele engaged.

Lack of differentiation . One of the keys to success in a crowded marketplace is to highlight how a store is different from the competition. With the saturation of the convenience store market, it’s crucial for retailers to differentiate themselves from the competition. A rebrand can help achieve this.

For TXB, the rebranding effort started with thinking about where the industry was and where the company needed to go. That launched conversations about how to highlight to customers what made TXB different. Smartt decided to focus on one word: authenticity. “For us, being authentic to our customers, to ourselves. It’s operating with integrity and it’s greeting everybody with hospitality,” Smartt said.

The company asked questions about the future of its stores, such as:

• How do we continue to evolve our food menu?

• How do we add more convenience items for the customer?

• How do we add more value for our customers?

Then they used the answers to craft TXB.

A new shopping experience. C-stores are evolving, offering more fresh food and a new customer experience. A rebrand can both create more evolution and alert customers that changes have already occurred. For MAPCO, a major part of the brand renovation was to add touchscreen fountain machines, new food displays, hot and cold grab-and-go options, gondolas with popular snacks and a beer cave to

46 APRIL 2023 convenience.org Klaus Vedfelt/Getty Images

The competitive nature of the industry means retailers must ensure each customer engagement maximizes both experience and profit opportunity.”

AVAILABLE IN 2 FOR $1.19 AND SAVE ON 2 FOR MORE INFORMATION CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM WHITEOWLCIGAR.COM © 2023 SMCI Holding, Inc.

create a better customer experience. “Many convenience brands are completely revamping their shopper experience to offer the best of both convenience and QSR worlds,” said Paul Stippich, director of marketing for Otis Spunkmeyer.

SUCCESSFUL REBRANDING

Revamping your brand involves more than picking a new logo or colors. The retailer should have a clear purpose for the rebrand. This will help customers understand why changes are being made and can increase customer engagement.

Retailers should also ensure the brand is aligned with customer needs. To do that, the branding should be done with the customer experience in mind. “We want TXB to be a lifestyle brand,” Smartt said. “We want it to be a consumer experience. … When you walk in the door, just from the look, the products, the music, the screens, the whole ambiance—I think people feel good.”

Maintaining brand consistency is also key to a successful rebranding. This extends across all brand touchpoints—signage, packaging, website, forecourt, pumps and store. MAPCO’s Store of the Future design includes an updated interior with modern, large-scale tiles and custom tile backsplashes, and bright, welcoming messaging throughout the store.

“Our new slate of modernized stores are just the latest examples of how we go above and beyond to deliver the best customer experience,” said Frederic Chaveyriat, CEO of MAPCO, in a 2022 press release.

The cornerstone of any brand is its logo. Coen Markets created a logo with clean lines and visual interest that would work in large or small formats and in black and white and full color, too. “Your logo is the foundation of your visual identity,” said Dave Bray, agency designer and art director for the Three Sixty Group, which designed the Coen Markets rebranding materials. “The main logo must also

work on the sub-brands, such as rewards and loyalty, food, coffee and payment programs.”

The TXB brand begins outside the store and flows inside. “How do we create the brand and the representation and the feeling we want our customers to have when they come onto the parking lot?” asked Smartt. That same question applies to the store itself. “The first thing you see [when you walk in] is our brand wall [with] our high-quality TXB items. ... You get that instant connection” to the TXB brand, he said.

“We aspire to be a lifestyle brand that just happens to sell convenience store items, as well as food and apparel and some of the things you might not think of in a traditional convenience store,” said Benjamin Hoffmeyer, TXB vice president of marketing and merchandising, in a 2022 NACS interview. “Convenience is evolving quickly, and it means different things to [different] folks.”

A REFRESHED FUTURE

Rebranding can be a powerful tool for convenience stores looking to remain relevant and appealing to consumers. Retailers who keep in mind the signs that indicate a rebrand is necessary, avoid the potential pitfalls of relaunching a rebrand and pay attention to the top things to consider when rebranding can successfully launch their rebrand and remain at the forefront of the industry.

Done right, a rebrand can give retailers a new way to reconnect with current customers while also bringing in new ones. “The competitive nature of the industry means retailers must ensure each customer engagement maximizes both experience and profit opportunity,” said Stippich. “Convenience retail leaders are successfully combining core shopping needs with QSR-quality food into a single stop and under a cohesive and easily recognizable brand.”

48 APRIL 2023 convenience.org Klaus Vedfelt/Getty Images Sarah Hamaker is a freelance writer, NACS Magazine contributor, and romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

PERMITTING

50 APRIL 2023 convenience.org yewkeo/Getty Images. T.Dallas/Shutterstock

PITFALLS

trying to drop in multiple stores in a certain time frame.” Smartt’s preference, whenever possible, is to request approval for both the building site and the building plan simultaneously. “If we can get those both approved at the same time, it goes a lot quicker and tends to be smoother.” That said, surprises do arise.

NACS APRIL 2023 51