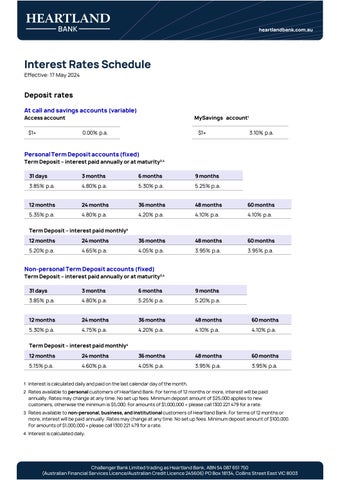

Interest Rates Schedule

Effective: 17 May 2024

Deposit rates

call and savings accounts (variable)

Personal Term Deposit accounts (fixed)

Non-personal Term Deposit accounts (fixed)

1 Interest is calculated daily and paid on the last calendar day of the month.

2 Rates available to personal customers of Heartland Bank. For terms of 12 months or more, interest will be paid annually. Rates may change at any time. No set up fees. Minimum deposit amount of $25,000 applies to new customers, otherwise the minimum is $5,000. For amounts of $1,000,000 + please call 1300 221 479 for a rate.

3 Rates available to non-personal, business, and institutional customers of Heartland Bank For terms of 12 months or more, interest will be paid annually. Rates may change at any time. No set up fees. Minimum deposit amount of $100,000. For amounts of $1,000,000 + please call 1300 221 479 for a rate.

4 Interest is calculated daily