6 minute read

Housing Watch

MAY HOUSING WATCH

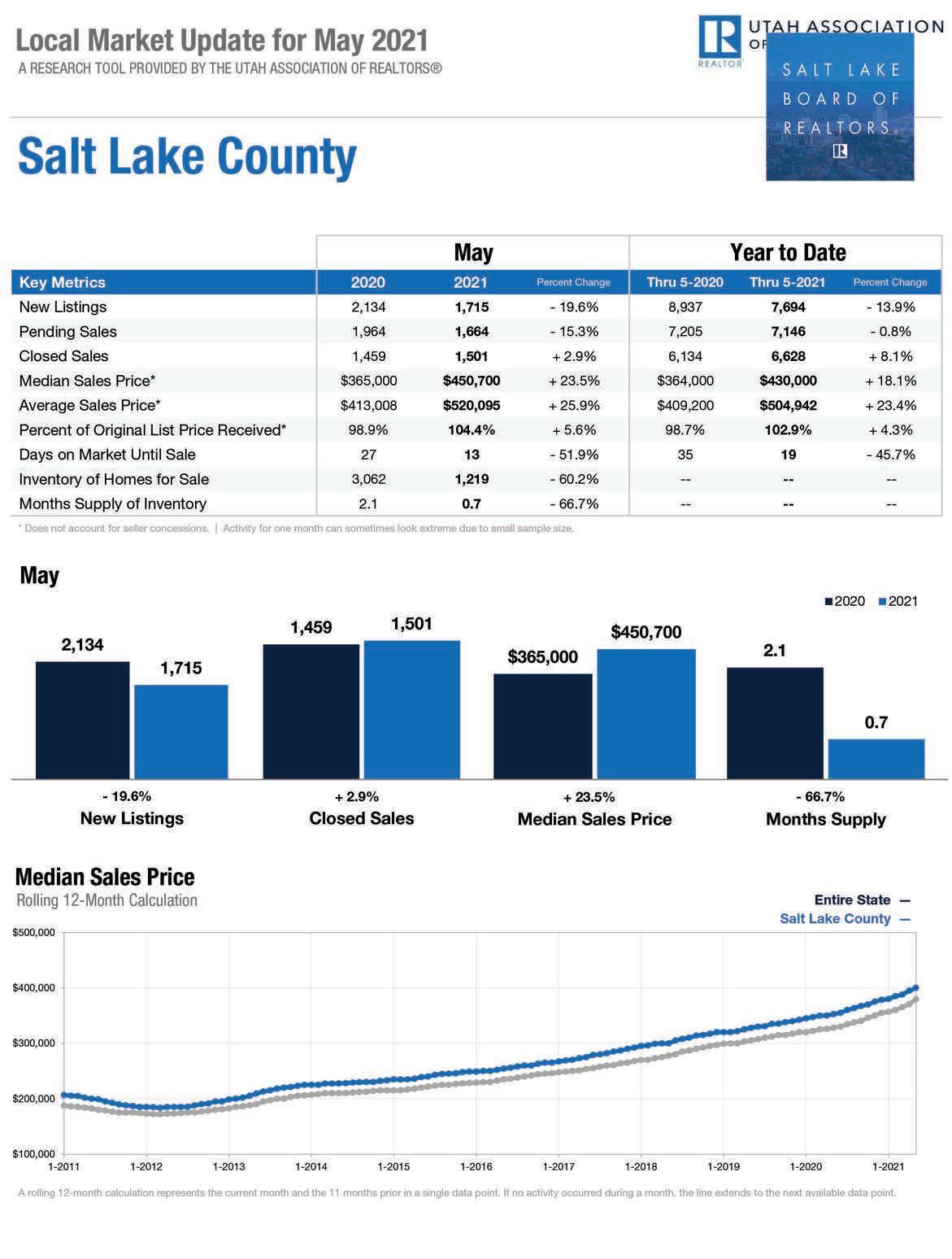

May Home Sales Down 15% Compared to Five-Year Average

Home sales in Salt Lake County increased 3% in May

“Supply is expected to compared to the same month a year earlier but were down 15% compared to the five-year sales average (2015-2019) for improve, which will give the month of May. buyers more options and help Typically, May is a strong month for home sales, with an average of nearly 1,800 sales. However, the continued lack tamp down record-high asking of new listings and existing inventory of homes for sale has prices for existing homes.” dragged sales down. In May, there were 1,501 homes sold (all housing types) in Salt Lake County. said Lawrence Yun, NAR’s New listings in Salt Lake County fell nearly 20% in May. chief economist. Pending sales also slowed to 1,664, down 15% compared to May 2020, a month when home buyers pulled back from purchasing because of Covid-19 fears. The limited supply of housing for sale has caused home prices to climb sharply. The median price of all housing types sold in May soared to $450,700, up 24% compared to a median price of $365,000 in May 2020. The median price of a single-family home in Salt Lake County increased to $535,000 in May, up 31% from a year earlier. Nationally, home sales in total climbed year-over-year, up 44.6% from a year ago (4.01 million in May 2020). “Lack of inventory continues to be the overwhelming factor holding back home sales, but falling affordability is simply squeezing some first-time buyers out of the market,” said Lawrence Yun, NAR’s chief economist. “The market’s outlook, however, is encouraging,” Yun continued. “Supply is expected to improve, which will give buyers more options and help tamp down record-high asking prices for existing homes.” In the U.S., the median existing-home price for all housing types in May was $350,300, up 23.6% from May 2020 ($283,500), as every region registered price increases. This is a record high and marks 111 straight months of year-overyear gains since March 2012. First-time buyers were responsible for 31% of sales in May, also even with April but down from 34% in May 2020. NAR’s 2020 Profile of Home Buyers and Sellers – released in late 20204 – revealed that the annual share of first-time buyers was 31%. Individual investors or second-home buyers, who account for many cash sales, purchased 17% of homes in May, even with April and up from 14% in May 2020. All-cash sales accounted for 23% of transactions in May, down from 25% in April and up from 17% in May 2020. A new study released by NAR last week – the 2021 Vacation Home Counties Report – found that from January to April 2021, the share of vacation home sales to total existing-home sales rose to 6.7%. Vacation home sales jumped 57.2% yearover-year compared to the 20% year-over-year growth in total existing-home sales.

Building More Housing (continued from page 34) real estate sectors, which could otherwise require an extended period of time to recover from pandemic-related shutdowns. Expand capacity for residential construction by applying federal resources to help address construction capacity challenges such as rising construction costs and labor and materials shortages. • In addition to the regulatory environment, which adds significantly to the time and money required to produce new housing, labor and materials availability and costs represent major hurdles that delay projects, limit the financial viability of new housing construction and, ultimately, will continue to set a ceiling on the pace of housing production without major steps to address these issues. • There are numerous factors contributing to the sharp rise in material costs (especially lumber), and the challenges of limited labor and materials availability, including supplyside pressure resulting from the recent acceleration in construction (although, as previously mentioned, even at the current ‘increased’ pace of construction it would still take 20 years to fill the underbuilding gap), as well as COVIDrelated national and international supplychain disruptions that have added to material shortages and costs. • While particularly challenging, potential steps to alleviate these strains could include minimizing trade/tariff restrictions on construction materials, while also leveraging federal resources to expanding domestic infrastructure for manufacturing, production and distribution of essential construction materials. • Tax incentives for construction training and apprenticeships programs could also help expand the construction labor force. This would not only increase national capacity to build housing and address the affordability crisis, but could help get people back to work in an economy with outsized levels of unemployment and underemployment by training workers in valuable skills for an essential industry. • As highlighted previously, additional construction labor income would generate a positive multiplier effect throughout the economy, increasing national economic activity and federal income tax revenue. Perhaps most importantly, addressing the national underbuilding gap will require a coordinated approach to planning, funding and development of all forms of infrastructure to not only build more housing, but also build better housing that will be more inclusive and well-integrated into local communities. Solving one of the nation’s most pressing issues of the 21st century will require an interconnected web of national solutions, including coordinated efforts across agencies to maximize funding and plan thoughtfully and holistically for transportation, energy, housing and community development. Without access to affordable housing, investments in transportation and other forms of infrastructure will fall short of creating vibrant communities. Instead, building on lessons of the past, a coordinated and intentional national focus could help to bridge communities and promote inclusivity, community revitalization and housing opportunities for households of all backgrounds. In particular, mechanisms to achieve these goals include strengthening and expanding the existing Affirmatively Furthering Fair Housing (AFFH) obligation (established by the Fair Housing Act of 1968) by reinstating the 2015 AFFH framework, while making the process more efficient and less burdensome for communities, and seeking to ensure that the obligation to proactively consider housing and equity implications of new development is an integral part of all types of infrastructure planning in order to overcome existing patterns of segregation and foster inclusive communities. In addition, substantive progress will likely require a comprehensive recognition of the need for genuine community engagement in all types of infrastructure development (including the importance of understanding the existing and historical community landscape and identifying the challenges, trade-offs and equity impact involved in new development) though community task forces and advisory committees, as well as systematic adoption of planning tools such as fair housing and equity impact analyses. Collectively, these policy pathways, and likely many other promising ideas to address the chronic national shortage of supply, are critically important, and combined with thoughtful and integrated planning, certainly have great potential to ease the national housing affordability crisis. However, while supply solutions represent longterm infrastructure solutions vital to the future of the nation, these approaches will necessarily take time to implement, and will undoubtedly need to be combined with a range of demand-side efforts and structural changes to expand access, level the playing field and address the ongoing challenges of racial and socioeconomic equity in our housing and communities.

Our business is growing yours.

SINCE 1976.

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Our best-in-class marketing and technology platforms give you the advantage that no other competitor can hope to match. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career.

Join our team bhhsutah.com/join-us

SALT LAKE CITY (801) 990-0400 | PARK CITY | ST. GEORGE | MOAB | CACHE VALLEY