24 minute read

8

GLOBAL OUTLOOK EUROZONE

by ROYCE LOWE

IHS Markit’s Eurozone Manufacturing Composite Purchasing Managers’ Index (PMI) rose to 39.4 in May from 33.4 in April, as the continued sharp contraction in Eurozone manufacturing continued. There were sharp drops in new orders and production, but at noticeably slower rates than in April. There is a pessimistic outlook on the employment front, with France, Spain and Germany particularly hard hit, but with severe reductions in all Business confidence showed a slight improvement, and was up to a three-month high. Car sales in Western Europe were down 80 percent in April, with French sales down 88.8%; German down 61.1%; Spanish down 96.5%; Italian down 97.6% ; and UK down 97.3%. Forecasts are putting the reduction in sales for the year at 20-25 percent. Crude steel production in Germany in April was at 3,000 MT, down 10.7 percent year-over-year; in Italy 1,350 MT, down 30.7 percent year-over-year; in France 800 MT, down 37.9 percent year-over-year and in Spain 670 MT, down 48.0 percent year-overyear. Russia’s crude steel production for April was at 4,700 MT, down 19.4 percent year-over-year; Ukraine’s was 1,339 MT, down 30.9 percent yearover-year.

IHS Markit’s PMI for the UK saw an easing in the pace of contraction since April, rising from 32.6 in April to 40.7 in May. Production, new orders, and employment were all down, but less so than in April. There were some pockets of growth, mostly linked to healthcare-related or PPE products. There is a general feeling of uncertainty in UK manufacturing. The UK produced 560 MT of crude steel in April, down 11.2 percent year-over-year.

The Manufacturing & Business Podcast Network

MFGTALKRADIO.COM

OUR PODCASTS:

LISTEN TO OUR PODCASTS AT: www.jacketmediaco.com

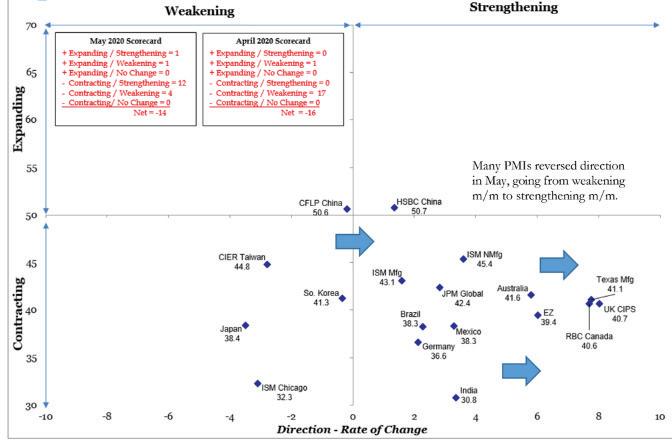

GLOBAL PMI OUTLOOK

by NORBERT ORE, DIRECTOR, HEAD OF INDUSTRIAL SURVEYS, STRATEGAS RESEARCH PARTNERS

Global manufacturing took a first step on the road to recovery in May. Two of the 18 PMIs we follow reported above the 50-mark while 12 others reversed direction. Global supply chains are still in chaos, but it appears that they have begun the necessary reset. China is the contrarian as both PMI surveys printed slightly above the mid-point. China is the first country to recover as it quickly rebounded from the precipitous drop in February when both surveys set record lows. Eurozone countries registered a combined 39.4 in May with Germany (36.6, +2.1) slightly improved, but still lagging. The region has not grown for 16 consecutive months.

The ISM PMI® - In May, the U.S. Manufacturing ISM PMI® (43.1, +1.6) proved resilient as the rate of decline slowed in the sector. The sector is recovering, following

a deep dive precipitated by April’s record low index levels of new orders, production, and employment. The past relationship between the PMI® and the overall economy indicates that the PMI® for May (43.1) corresponds to a 0.1-percent increase in Real GDP on an annualized basis, according to the ISM press release. However, this is based on the historical relationship between the ISM Manufacturing PMI® and U.S. GDP. It does not include provisions for the impact of the Covid-19 Global Pandemic which has chaotically impacted global supply and demand. Drivers: The PMI® month-over-month improvement in May was led by Production (33.2, +5.7), Employment (32.1, +4.6), and New Orders (31.8, +4.7). Supplier Deliveries (68.0, -8.0) was the only component above the mid-point. A Supplier Deliveries reading above 50 is typically associated with improving demand. However, the strong Supplier Deliveries reading in this instance may be misleading as delivery times slower due to plant closures, limited hours, supply shortages, and product mix. Given the state of the other components, we believe slowing delivery times are an indication of weakness at this time.

New Orders Minus Inventories: This key measure shows New Orders (31.8) are contracting faster than Inventories (50.8). Compared to the average gap (+4.4 pp beginning in 2011), a significant inventory correction needs to take place.

CREDIT MANAGERS’ OUTLOOK

by DR. CHRISTOPHER KUEHL MANAGING DIRECTOR OF ARMADA CORPORATE INTELLIGENCE THIS REPORT REPRINTED COURTESY OF THE NATIONAL ASSOCIATION OF CREDIT MANAGERS (NACM.ORG) WHERE MORE IN-DEPTH INFORMATION CAN BE FOUND.

Combined Sectors

There is a temptation to look at the May Credit Managers’ Index (CMI) data and start cheering wildly, but it would probably be a good idea to show some restraint—at least for the time being. NACM Economist Chris Kuehl, Ph.D., reports that after a catastrophic month in April, there are signs of a recovery showing up in May. As usual, there are plenty of caveats, but it is important to remember the CMI is very often a harbinger of things to come due to the nature of credit management. The focus of a credit manager is always on the future—trying to gauge the likelihood of getting paid 30, 60, 90, 120 days from now. The data this month would suggest that many are seeing a better future ahead. It may be possible to assert that April will be the bottom of this crisis and conditions should improve from this point. Over the last few months, the majority of the damage has been seen in the favorable factors as the lockdown recession took its toll. It was impossible for the majority of the business community to function at any level under these conditions, but now there appears to be a slow and halting movement to allow the recovery of the economy. This appears to be resonating with the data in this month’s CMI.

The combined score for the CMI is still thoroughly mired in contraction territory (below 50) with a reading of 44.1. In April, it sat at 40.6. The index of favorable factors at 32, had plunged to levels not seen since the recession of 2008. The favorable factors data this month shows a gain to 39.5. That is still very, very low and no reason to celebrate, but it is heading in the right direction. The index of unfavorable factors gained a little as well—moving from 46.3 to 47.2. Kuehl notes that obviously, this remains in contraction, but it is significant that the negatives have not worsened and may, in fact, be improving.

Last month, the subcategories told a very bleak story. These numbers were as low as they have been in the history of the CMI. The improvement this month still leaves the data below 50, but there was considerable concern these numbers would get even worse before starting to rebound. The sales numbers fell like a rock the last couple of months— from 64 in February to 39.5 in March and a crushing 20 in April. This month’s gain is significant but still leaves the index near historical lows with a reading of 28.6. The new credit applications number rose to 43.3 from 31.1. “It is a very good sign and shows that companies are starting to prepare for the rebound that was promised this summer,” said Kuehl. The dollar collections data also left the 30s behind with a reading of 43.2 as opposed to the 35.5 notched the month prior. The amount of credit extended stayed roughly the same as it had in April

as it moved from 41.6 to 42.8. It is not a huge move, but it is a move in the preferred direction.

The unfavorable factors have not been as miserable as the favorables as there has not been enough time for these issues to start kicking in. Kuehl said that this was the month when there was an expectation of more angst in these numbers, but so far, the data is holding more or less steady. The rejections of credit applications fell just slightly from a reading of 52.7 to 51.9, but the important consideration is that it remains out of contraction territory. There was an improvement in accounts placed for collection from 47.4 to 49.1. This has been one of the crucial markers as far as the index is concerned. “Collections will start as creditors are unable to meet their obligations,” he said, “but thus far, there has not been time for these issues to develop given that the crisis is roughly two months old.” The disputes category improved a little as it climbed from 50.8 to 51.5. There has also been a slight rebound in the dollar amount beyond terms reading. “As business was locked down, the majority became very guarded as far as cash flow,” he said. This led to a huge surge in slow pays and a reading of 27.6. The latest number is still deep in contraction territory at 32.4, but it is an improvement, nonetheless. The dollar amount of customer deductions climbed out of contraction territory (49.4 to 50.9). The filings for bankruptcies numbers started to fall, however, and that is a concern. The number in April was 50.2 and now it is sitting at 47.3. This is the first time the bankruptcy numbers have been below 50 in several years. He added, “this is a sign that already weak companies are succumbing to the lockdown recession.”

Manufacturing Sector

According to Kuehl, the numbers this month are certainly not great but they are better than they were in April. The wholesale collapse in the favorable factors seems to have slowed, although the readings are still very firmly in contraction territory. There was not a great deal of change as far as the unfavorable categories are concerned.

NACM CMI — 2 — May 2020 The overall manufacturing readings showed that the decline has started to slow and reverse—if only by a very narrow margin. The index was at 42 last month and is now up to 44.1. Not the most inspiring level, but hopefully the beginning of a trend that would extend over the next few months.

“Last month, the damage in the favorable categories was considerable. It dragged the entire index down to levels not seen in several years,” Kuehl said. “The data this month still shows the damage, but there has been some slightly more encouraging news as the numbers went from 34.3 to 38.6. Whatever optimism this generates is tempered by the knowledge these readings were at 62 in February and had not been below 56 in over a year.” The shift in the unfavorable factors was far less dramatic as it went from 47.2 to 47.8, but at least it is hovering close to the expansion zone. The details within the categories tell the story.

The sales data stayed in the 20s although there has been a slight improvement from 21.4 to 27.5. That remains a very long way from the readings as recently as February when it hit 65.7. Kuehl noted, “there has been a complete crash in the sales of manufactured goods.” The biggest gain came with the category of new credit applications as this went from 35.7 to 43.2. This is still a very low reading, but far better than had been seen earlier. The dollar collections data also jumped back into the 40s with a reading of 40.5 as compared 35 in April.

The amount of credit extended data slipped a bit from 45.1 to 43—not such a good development. “It suggests that those who are seeking and getting credit have been slowing down.” The data from the unfavorable categories has not changed as much. The rejections of credit applications improved a little and stayed in positive territory (53.3 from 52.8). “This would suggest that most of those applying for credit are having some success.”

There has been stability as far as accounts placed for collection as the reading this month was 50.4 and last month it was at 50. “There has not been enough time for many companies to get to the point that collection is an option, but that could well develop in the next few months if there is a slow economic rebound.” The disputes category saw an improvement from 50.6 to 51.6. There was even some recovery as far dollar amount beyond terms. The reading is still bad but has climbed out of the 20s by notching a 31.9 compared to the previous month at 28.6. The dollar amount of customer deductions remained very similar to what it had been—going from 50.1 to 50.5. The filings for bankruptcies slipped a bit from 51.1 to 49.3; this is a concern. He noted that there had not been time for the bankruptcy issue to develop in previous readings, but it is now clear that companies that were already weak are starting to get in some real trouble. This is a category that will require a lot of attention in the weeks and months to come.

JUNE 2020 METALS OUTLOOK

by ROYCE LOWE

Not surprisingly, the world steel industry is taking a beating in the midst of the coronavirus pandemic. The month of April saw the U.S. mill price for hot-rolled coil drop from just under $530 per ton to just under $470 per ton, that of coldrolled coil from around $690 per ton to around $640 per ton. This represents drops in hot-rolled from $590 to $470 since early March and from $750 to $640 for cold-rolled in the same time frame. A similar pattern was observed for hot-dip galvanized material.

Under these conditions, with the U.S. steel sector being an “essential industry” during the epidemic, and demand dropping over the past few weeks, steel buyers are obtaining significant discounts from domestic suppliers, who are out looking for orders. Delivery lead times are short, and tonnages at service centers and endusers are down, particularly from automakers and associated parts manufacturers. This falling demand naturally leads to production cutbacks at mills, with capacity utilization rates dropping below 60 percent, or the lowest levels recorded since September of 2008.

Recovery in steel demand, and hence prices, will depend upon the scheduling of the lifting of restrictions, which is presently an unknown. In the wake of all this bad news, Nucor Corp and Arcelor Mittal recently announced increases in hot-rolled, cold-rolled and hot-dip galvanized flat products of a minimum of $50 per ton.

The U.S. construction industry is slowing, but still remains one of the better-performing enduser sectors. Domestic long-product prices are expected to fall in the near term, following an April reduction in mill scrap costs.

Stainless steel production for the year 2020 is forecast to fall by 10 percent to 46.8 million tons. A similar pattern is being observed in Europe, where

flat-rolled prices were largely unchanged in late March/early April, but reductions in auto output resulted in the inevitable lack of demand. Mills cut back production in the hopes of stabilizing prices, but the orders just aren’t there. Even though the Chinese steel industry and Chinese manufacturing are improving, these factors alone cannot bring things back to normal.

The global steel industry is in for a fairly long recovery process, and normal may not be normal, if ever, for a good long time. In the midst of this, steel trading has been suspended in both India and South Africa, where virus conditions are virtually shutting down these countries. Brazil and Mexico are suffering similar, but not as drastic, conditions.

Cleveland Cliffs, which recently completed the acquisition of AK Steel, has announced it is idling production at iron ore mines in Minnesota and Michigan. Meanwhile, “sources” say that AK Steel’s Dearborn Hot Strip Mill is to be idled. These same sources say it will not be coming back, and that slab rolling will be moved to Middletown, Ohio. STEEL PRODUCTION WAS DOWN BY 6.0 PERCENT YEAR-OVER-YEAR IN THE MONTH OF MARCH for the 64 reporting countries – which represent 99 percent of world crude steel production – to 147,054 MT.

Primary Global Aluminum Production in March was reported at 5.447 million tons, with production in China, at 3.100 million tons, representing 57 percent of world total. Production was 507,000 tons in GCC; 348,000 tons in the rest of Asia; 287,000 tons in Western Europe; 342,000 tons in North America and 354,000 tons in Eastern and Central Europe.

In the U.S., non-ferrous metal data show aluminum steady through April at $0.66 per lb; copper ranging from $2.18 per lb to $2.35 per lb through the month; nickel from $5.05 to $5.50 and zinc from $0.84 to $0.87.

Canada produced 1.060 MT of crude steel in March, down 15.3 percent year-over-year.

JUNE 2020 AEROSPACE OUTLOOK

by ROYCE LOWE

On May 30, Space X’s rocket took off from the Johnson Space Center in Florida, en route for the International Space Station. It was the first time a private enterprise had launched humans into orbit. Some nineteen hours later it docked at the ISS and the first part of the mission was deemed an unqualified success. The length of time the two astronauts who made the journey will stay “up there” has yet to be determined.

Since the termination of the Space Shuttle program in 2011, NASA astronauts had been hitching rides to the ISS aboard Russian rockets launched from Kazakhstan. The Commercial

NASA ASTRONAUTS BOB BEHNKEN, LEFT, AND DOUG HURLEY CREDIT: SPACEX

Crew Program at NASA was founded with the aim of developing spacecraft by private companies ‘with the goal of achieving safe, reliable and costeffective access to and from the ISS and low-earth orbit.’

This latest flight, a Falcon 9 rocket and a Crew Dragon capsule, is a cruise to certify that the spacecraft meets NASA’s needs and standards of safety to start routine trips taking astronauts to and from the ISS.

Success of the mission will entail the return to earth of the two astronauts Bob Behnken and

SPACEX CREW DRAGON CAPSULE CREDIT: SPACEX

Doug Hurley in the Crew Dragon, which they have named Endeavor, the same as the retired space shuttle they both flew on, and the British sailing ship in which Commander James Cook explored the Pacific.

Boeing, the other company on the original list for this mission, experienced difficulties during test flights, but is also on the list for future manned launches, the first of which is expected for early next year.

The Associated Press says that NASA’s project to return to the moon in the near-term, and a voyage to Mars in the 2030s, will look to Space X and Boeing, both companies having received large contracts for services and support.

ELON MUSK CREDIT: NASA/AUBREY GEMIGNANI

Meanwhile, the commercial aircraft and engine manufacturers find themselves in COVID-19 disarray, with Airbus, Boeing, Rolls Royce and G.E.Aviation all looking to let go some 10 to 15 percent of their workforce.

Airbus has completed construction of its A220 final assembly line in Mobile, Alabama, a 270,000 sq.ft. complex to assemble both the A220-100 and A220-300 versions of the twin-engine, single-aisle aircraft. This is the second assembly plant for the A220, the primary plant being in Mirabel, Québec.

The A220 originated as the Bombardier C series, in which Airbus purchased a majority stake in 2017, forming a partnership with Bombardier Aerospace and Investissement Québec, a provincial development agency. The C series was relabeled as the A220 series in 2018. Airbus increased its holdings to 75 percent earlier this year as Bombardier exited the partnership, and Investissement Québec taking a 25 percent share. To date there are 642 orders for the C series/ A220 aircraft and 113 have been delivered.

Boeing has started low-volume production of the 737 MAX , but the aircraft has not yet been approved to resume service with its redesigned flight-control program.

JUNE2020 ENERGY OUTLOOK

by ROYCE LOWE

The electric vehicle, commonly known as the EV, is, as we all really know, here to stay. It has been touted as the vehicle that will save the planet, but it’s not selling at all to beat the band, and perhaps the big reason for this is its price and the lack of a vroom vroom that is so popular with certain members of the population. It may also have something to do with the range.

A decade ago, when a new generation of electric vehicles started to appear on the roads, researchers at The Georgia Institute of Technology spent a year tracking the habits of almost 500 American motorists to see how suitable such vehicles would be for them. They found that almost a third could have completed most of their journeys using an EV with a range of only 100 miles. On the few occasions that people needed to travel farther, they could have charged up en route, or hired a gas-powered car.

An electric car means a battery, and a battery means the type that was first commercialized by Sony in 1991. At that time, the batteries were used to power such appliances as phones and laptops, but it was this same battery, the LI-ion battery, that made EVs possible.

The Li-ion battery is special. It has a high energystorage capacity, and a modern battery can pack 200 watt-hours of electrical potential into a single kilogram (2.2 pounds) of kit, for an energy density of 200wh/kg. This represents a fivefold improvement on the old lead-acid battery, and researchers are, of course, constantly trying to do better.

Li-ion cells get their name from the movement within them of lithium ions, that have a positive charge. When the cell discharges, the ions are created at one electrode, the anode. They then pass via a separator through a liquid electrolyte to a second electrode, the cathode. Electrodes that leave the anode, meanwhile, travel towards the cathode via an external electrical circuit, creating a current that can be used to power an electric motor.

For such a weight-sensitive application, it’s good that lithium is the lightest metal in the periodic table, but it is also reactive. Construction must be such that there be no short circuits, hence a fire risk. Anodes usually consist of a carbonrich material, and the lithium in the cathode is typically an oxide, lithium cobalt oxide. Cobalt is the costliest material in the battery, hence producers are trying to reduce its use. Plus most of the world’s cobalt comes from the Democratic Republic of Congo, not the easiest part of the world to negotiate. So cobalt’s use is reduced by replacing some of it with nickel and manganese, to produce what are called NMC cells.

Last year, China’s biggest manufacturer of electric-car batteries, Contemporary Amperex Technology Limited (no kidding) or CATL, began mass production of NMC batteries with an energy density of 240wh/kg. Other firms, Tesla included, hope to get rid of cobalt completely. Reduced materials cost and economies of scale are bringing down the price of batteries. BloombergNEF says that in 2010 the price averaged $1,160 per kwh and by 2024 it may drop below $100. Such a number would make EVs more competitive with ICEs. Further work on lithium-ion batteries includes variations in the materials used for anodes, plus attempts to replace the liquid electrolyte by a solid electrolyte.

Li-ion batteries will continue to be the subject of much research and development, both for car batteries and for batteries to store solargenerated energy. Work will continue at a steady pace, coincident with the auto and energy-related industries.

JUNE 2020 AUTOMOTIVE OUTLOOK

by ROYCE LOWE

We can’t talk about automobiles these days without talking about energy, be it oil or be it electricity. Either way, the pandemic that hit our globe recently will have an effect on the way we look at cars, and certainly upon the way we choose what we think is best for us.

Recent events in the oil industry, where we saw a negative value for a barrel of oil, brought home how vulnerable this business can be to world events. Just a few months after Aramco’s IPO, when it was hoping to break all records, the first quarter of 2020 was impacted by declining global crude oil demand resulting from COVID-19 and its impact on worldwide economic activity. This led to lower crude oil prices and continued pressure on refining and chemicals margins, according to a statement from Saudi Arabia’s oil giant. Chevron is laying off due to low oil demand and prices. Layoffs are happening in the self-driving sector of the auto business, a sector that doesn’t even seem to fit in there these days. With April auto sales in the U.S. at just over 700,000 units, around half what they were a year ago, it’s survival mode in the industry. May’s figure was forecast at just over a million units, or a 32.1 percent year-overyear decrease. April auto sales in Europe were down some 80 percent, year-over-year, reflecting the degree of lockdown there. But it could be a temporary downturn if it creates pent-up demand when people return to work and paychecks. Research and development into electric vehicles is ongoing, and billions of dollars have been committed by the major automobile companies to ensure that one stays ahead of the others. The penetration of electric vehicles has been low, unless you live in Scandinavia. An independent forecast says that automobile sales in North America will fall by 26 percent in 2020, and will come back by 12.6 percent in 2021, but that the 2021 figure will be only 85 percent of the 2019 total.

All this to say that anyone looking to buy a new car these days will think long and hard before opting for an EV, due partly to the price of gas and also to the relative cost of the new vehicles. The pandemic and the accompanying loss of jobs leave no doubt that there will be fewer buyers chasing the cars available.

In what can only be described as a humanitarian gesture, Ford and GM have agreed to pay, on delivery, small suppliers with cash-flow problems. In the meantime, automobile production has resumed.

JUNE 2020 ISSUES OUTLOOK

by ROYCE LOWE

A recent survey by the National Association of Manufacturers (NAM), the Manufacturers’ Outlook Survey, when reviewing the second quarter of 2020, found that despite a fall in optimism due to the ongoing pandemic to nearly 34 percent, the vast majority of manufacturers have carried on in business or only temporarily halted operations. The survey further found that manufacturers are looking for solutions to keep businesses running while protecting workers and communities. Some 22 percent are retooling to produce PPE; 67 percent are reengineering processes to reflect COVID-19 safety protocols; 12 percent are looking at a complete reevaluation of their firm’s mission.

To counter the difficult conditions being experienced by the nation, NAM’s CEO, Jay Timmons, urges a focus on a renewal agenda laid out in the American Renewal Action Plan, which stresses the safety and appropriate protection of employees, and further, significant investment in America’s infrastructure. Mr. Timmons continues: We have been encouraged by actions taken thus far, but there is still greater need for targeted liability reform, tax provisions to ensure investment in manufacturing, and measures to reaffirm the U.S. supply chain to protect those businesses that continue to work on the front lines of the COVID-19 response to ensure as swift a recovery as possible. The reference to America’s infrastructure, long a bone of contention, is surely timely. With so many out of work, and a great number not sure of a job at the end of the crisis, now would be a good time to grab this issue, which seems too big to tackle, before it really runs out of reach. America needs to fix this problem.

America’s infrastructure, for the large part, is a mix of outdated roads, bridges, waterways, ports, runways, and drinking water systems, many of which are over fifty years old. But this is hardly news; the American Society of Civil Engineers gave the nation’s infrastructure a rating of D+ in a 2017 survey. The U.S. Department of Transportation says that 65 percent of major U.S. roads are in “less than good condition.”

Connecticut, for example, has the richest one per cent of any state, but according to several studies of crumbling infrastructures, its roads are among the worst in the country. As are its bridges, its traffic congestion, and its traffic fatality rates. In fact, its roads come in at number 46 in the nation. Perhaps all the funds put aside for tax breaks for the rich might be put to good use on America’s infrastructure. Connecticut would be a good place to start.

THE

MANUFACTURING TALK RADIO: VOICE OF MANUFACTURING

Manufacturing Talk Radio is a manufacturing news podcast with new episodes every Tuesday. Hosts Lew Weiss and Tim Grady engage guests from manufacturers, industry associations, think tanks and government agencies in conversations about modern manufacturing, industry forecasts, and the latest news stories covering robotics, 3D printing, the Internet of Things, Big Data, Industry 4.0 and other milestone changes happening now. New Episodes Every Tuesday at MFGTALKRADIO.COM

SPECIALIZING IN LARGE & HEAVY WEIGHT FORGINGS