Core

THE FUTURE STARTS HERE

MARCH/APRIL

Vol. 105 Issue 1223

Vol. 105 Issue 1226

MAN Engines: New workboat enigne

Thrusters: A novel combination

Future

14

GTT Q1 LNG orders

GTT has announced multiple LNG orders in the first quarter of 2025, reinforcing the fuel’s position as a key player in the maritime industry.

37 GNV leverages machine learning for vessel optimisation

Its newest vessel GNV Polaris (see page 32 for more on this vessel) is testing RINA’s SERTICA Performance system to enhance vessel optimisation.

37 WinGD X-DF-A test

WinGD has confirmed the key performance parameters of its X-DF-A ammonia-fuelled engine design after full-load testing.

11

Leader Briefing

Cavotec, a provider of electrification and automation solutions, has appointed three new members to its Group Management team.

32

Ship Description

The GNV Polaris, the latest delivery to European principals is distinguished by its predominantly Chinese origination.

34

Design for Performance

On a par in size and capacity with a European-built vessel, the 324-metre Adora Magic City is China’s cruise ship contender.

38

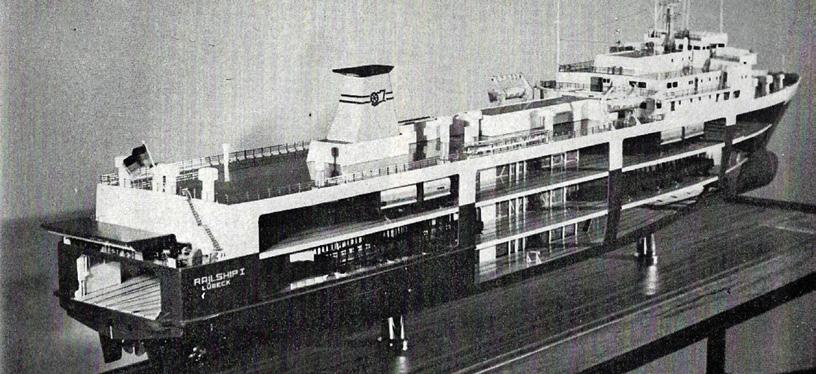

50 Years Ago

The March 1975 issue of The Motor Ship covered shortages in oil supply leading to speculation about the future of the large oil tanker.

16

China advances ammonia shipping

China leads the world in ship owning and shipbuilding and ammonia is high on its agenda for the future.

20

CORE POWER’s vision for energy

Led by CEO Mikal Bøe, CORE POWER is spearheading a transformative initiative in the shipping industry through its Liberty program, which focuses on floating nuclear reactors.

22 LNG: From pipe-dream to mainstream

When the first Motorship Gas Fuelled Ships conference was held in Hamburg, LNG-fuelled propulsion was seen as a promising novelty, albeit with a limited market.

24

Thrusters and DP critical to WTIV operation

Kongsberg Maritime is supplying power, DP control and thruster technology for a string of wind turbine installation vessels, most recently for the U.S.-built Charybdis.

VIEWPOINT

DAVID STEVENSON | Editor dstevenson@motorship.com

China calling GTT’s Q1 LNG orders

With Trump’s inauguration at the end of January, many expected a repeat of the “China baiting” which was a hallmark of his last administration. They weren’t disappointed, and what has become known as the “Trump trade” was seized upon by investors looking to make hay from his pro-business policies.

One policy which was conceived during Biden’s time in office but accelerated with Trump’s arrival is targeting Chinese-made ships. Fines of up to $1.5 million per vessel have been proposed in a bid to boost the US’ domestic shipbuilding industry with, it seems, little regard for what such a punitive measure will mean for consumers of goods arriving on containerships (of which China has an 81% share of the global market). This move has already sparked significant concern from international shipping companies, many of which fear increased costs and potential retaliatory tariffs from China. If enacted, this policy could disrupt global supply chains and force companies to rethink their logistics strategies to mitigate financial impact.

In this issue, we see China’s influence over the shipping industry may be increasing and not limited to the container and bulk carrier segments (which the country has a 75% share of the market according to Veson Nautical). The trend is also evident in ship financing, where Chinese banks have been extending their reach, offering competitive loans to global operators looking to replace aging fleets. On page 34, David Tinsley reports how China is eyeing “Europe’s jewel in the crown,” this is to say the cruise market, arguably the last stronghold for European shipbuilding ambitions. I spoke to one of the famous shipyards mentioned in the article this week and when enquiring about China’s progress in this sector, I was given a polite but decidedly firm “no comment.” Make of that what you will.

Away from forays into previously uncharted waters for the Chinese, on page 32, David Tinsley gives us what should be a familiar account of China’s dominance of the large Ro-Pax market. But GNV’s new vessel Polaris breaks from the standard as hitherto ships in this segment were usually designed in Europe and just put together in China. This ship contains a number of examples of Chinese intellectual property, varying from its interior design to its heat recovery system developed by China Shipbuilding Corporation’s No711 Institute of Shanghai. The engines, despite being produced under license by China’s Shaanxi Diesel Heavy Industry, are reminders of Europe’s shipbuilding prowess, being MAN products. Industry insiders believe this shift towards Chinese design influence is an inevitable outcome of the nation’s investment in research and development, something European yards may struggle to match in the long run.

In the race for a net zero propulsion system, China is also most certainly in the mix. On page 16, Wendy Laursen gives us an update on China’s progress with ammonia, which has seen participation from COSCO Shipping under the guidance of China Classification Society (CCS). We learn that far from being late to the party, China has been studying and researching ammonia for a number of years, as seen with CCS issuing Guidelines for Ships Using Ammonia Fuel in 2022. Additionally, China’s push into alternative fuels extends beyond ammonia, with hydrogen and methanol-powered ship designs also gaining traction. China’s hegemony over global shipping may well extend to future fuels going forward.

GTT has announced multiple LNG orders in the first quarter of 2025, reinforcing the fuel’s position as a key player in the maritime industry.

The orders involved collaborations with major shipyards across Asia and Europe, highlighting the increasing demand for advanced LNG containment systems.

An Asian shipyard has placed an order for the tank design of two new Liquefied Natural Gas Carriers (LNGCs) on behalf of an Asian ship-owner. Each vessel will have a total capacity of 174,000 m³ and will be equipped with a membrane containment system from the NO96 series, developed by GTT. The deliveries of these vessels are planned for the second and third quarters of 2027.

GTT has also secured an order from its Korean partner, HD Hyundai Heavy Industries, to design cryogenic fuel tanks for 12 new LNG-fuelled container vessels for a European shipowner. Each vessel will be fitted with LNG tanks offering a capacity of 12,750 m³, incorporating the Mark III Flex membrane containment system. These tanks will feature the “1 barg” design, allowing an effective operating pressure of up to 1 barg instead of the conventional 0.7 barg. This design will support compliance with future port regulations requiring vessels to be electrically connected to the quayside. Deliveries are scheduled between the second quarter of 2027 and the fourth quarter of 2028.

Additionally, Samsung Heavy Industries has commissioned GTT for the tank design of a new LNG carrier. This vessel will have a total

capacity of 180,000 m³ and will be equipped with GTT’s Mark III Flex membrane containment system. Another significant order comes from the Chinese shipyard Hudong-Zhonghua, which has contracted GTT to design tanks for six very large LNG carriers. These vessels will each have a total capacity of 271,000 m³ and will be fitted with GTT’s NO96 Super+ membrane containment system. Deliveries are scheduled across multiple years, including the second quarter of 2028, the second and third quarters of 2029, and the first and third quarters of 2031.

These orders underscore the ongoing trust between GTT and its shipbuilding partners, driven by a shared commitment to LNG as a strategic lever in maritime decarbonisation. The use of LNG as a fuel supports compliance with stringent emissions regulations, significantly reducing nitrogen oxides, sulphur oxides, CO₂, and fine particulates.

Philippe Berterottière, chairman and CEO of GTT, commented: “GTT is proud to place its innovation at the service of its customers and to support them in the energy transition of maritime transport. The Mark III Flex containment system and the ‘1 barg’ concept, which is being applied here for the second time, offer concrete solutions for optimising LNG propulsion and anticipating regulatory changes. These new orders demonstrate our partners’ confidence in our expertise and their commitment to more sustainable shipping.”

ZURICH, MAY 19 – 23, 2025

31st CIMAC WORLD CONGRESS

The Global event on large engines, power, drives and propulsion

The 31st CIMAC World Congress, taking place from May 19-23, 2025, in Zurich, Switzerland is a unique opportunity for stakeholders to keep up to date with the latest developments in the industry and to discuss technological challenges and solutions with other specialists and fellow colleagues.

220 presentations, approx. 20 Pecha Kuchas, some 60 posters, and ca. 50 exhibitors, along with keynote speakers such as Prof. Lynn Loo, CEO of the Global Centre for Maritime Decarbonisation (GCMD), and more await you.

Book now under cimaccongress.com and secure your place!

GNV leverages machine learning for vessel optimisation

GNV has adopted RINA’s SERTICA Performance system to enhance vessel optimisation and energy efficiency, using machine learning and predictive modelling to improve vessel performance and reduce fuel consumption.

The newest ship in its fleet, the GNV Polaris (see page 32 for more on this vessel), is currently testing the advanced vessel monitoring system during its maiden voyage from China to Italy.

“GNV is making significant strides in sustainable shipping with their latest initiatives,” said Ivana Melillo, energy efficiency director at GNV.

“The GNV Polaris boasts high environmental standards and can achieve over 30% fuel savings, significantly reducing CO₂ emissions compared to the current fleet.”

Real-time data

RINA’s SERTICA Performance

DNV AiP for carrier

system collects real-time data to optimise fuel use, ensuring peak vessel performance. It enables GNV to define two optimal operating scenarios, minimising Specific Fuel Consumption (SFC) and serving as a benchmark for future operations.

The vessel monitoring system gathers data through onboard sensors, tracking fuel consumption, generator power and engine efficiency.

During its trial run, multiple operational scenarios are being tested, including alternating diesel and shaft generators, to determine the most fuel-efficient setup.

This approach helps to ensure the accuracy of machine learning for predictive modelling, allowing GNV to optimise energy use on its Genoa-Palermo route.

The system has so far demonstrated exceptional accuracy, serving as a valuable tool to track vessel performance, identify efficiency losses and

Wärtsilä supply ADM

■ The newest ship in GNV’s fleet, the GNV Polaris, is currently testing the advanced vessel monitoring system during its maiden voyage from China to Italy

simulate operational scenarios.

These data-driven insights can guide retrofit decisions, such as hull cleaning or engine maintenance, to sustain long-term efficiency of the vessel.

“The added value of SERTICA Performance lies in its ability to provide unparalleled data monitoring and analysis,” said Lars Riisberg, marine digital solutions executive director at RINA.

“With real-time dashboards and alerts, it enables advanced analytics, ensuring optimal vessel efficiency and fuel management.”

With SERTICA Performance now installed on over 800 ships, GNV said it continues to invest in digital solutions to modernise its fleet, with the aim of cutting emissions and acheiving a greener business model.

Nakilat 8 LNG carriers

WinGD X-DF-A test

WinGD has confirmed the key performance parameters of its X-DF-A ammonia-fuelled engine design after full-load testing.

The results provide crucial assurance as the first users prepare their vessels and auxiliary systems for ammonia fuel.

“Our well-structured development approach has paid off,” said WinGD vice president R&D, Sebastian Hensel.

“After intensive efforts to understand the principles of ammonia injection and combustion, we are the first two-stroke engine designer to demonstrate 100% ammonia operation with 5% pilot fuel consumption and such low emissions.”

Tests at WinGD’s Engine Research and Innovation Centre in Winterthur, Switzerland, confirmed the engine’s thermal efficiency on ammonia matches diesel. Pilot oil also in line with expectations; consumption was just 5% at full load.

Emissions data was promising: ammonia below 10ppm, N₂O under 3ppm, and NOx well below diesel levels. Notably, these low emissions were achieved without an ammonia slip catalyst, proving the engine can run on ammonia without additional after-treatment.

The first engines will be delivered from mid-2025 for ammonia carriers owned by Exmar LPG and bulk carriers operated by CMB.Tech. Nearly 30 orders have already been secured.

BRIEFS

MAN 175D for OSV

DNV has awarded AiP to Shell and Brevik Engineering for a 74,000 cbm LCO₂ carrier, designed for cost-effective CO₂ transport in Asia Pacific CCS projects. The vessel features 15 low-pressure tanks and future onboard CO₂ capture. At 290m long with a 12m draft, it supports growing regional demand for large-scale carbon transport solutions. It features 15 cylindrical tanks to store LCO2 at -50°C and 6-8 barg, with possible future OCCS.

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion

Wärtsilä will supply replacement engines for ADM Naviera Chaco’s tug pusher vessels, Decatur Lady and Tendota, operating in Paraguay. Each will be fitted with three fuel-flexible Wärtsilä 20 engines, reducing emissions and improving efficiency. The project supports ADM’s goal to cut emissions by 25% by 2035 while enhancing operational reliability and sustainability. The orders for the engines were booked in Q2 and Q4 of 2024.

Nakilat has begun construction on eight new 174,000 cbm LNG carriers at Hanwha Ocean Shipyard, supporting Qatar’s LNG fleet expansion. Fully owned by Nakilat and chartered to QatarEnergy affiliates, the vessels feature advanced technology for efficiency and sustainability. This milestone strengthens Nakilat’s position as a global leader in LNG shipping and maritime services. Last year the company signed a deal for 25 LNG carriers with QatarEnergy.

Poland’s Crist Shipyard has ordered six MAN 12V175D variable speed gensets for the Sea Dragon, an offshore support vessel for DOF. Set for delivery in early 2027, the 110m, ice-classed vessel will operate off Newfoundland. Featuring DP3 and capacity for 164 personnel, it will support drilling, crew changes, field safety, emergency towing, and ice management. It is cleared for operation on biofuels such as FAME and HVO.

SINGAPORE REGIONAL FOCUS

We asked Ansuman Ghosh, director of risk assessment for Singapore and Akshat Arora, senior risk assessor at UK P&I questions about the South-East Asian city state

How are regional decarbonisation efforts, such as Singapore’s push for green shipping corridors, influencing insurance and risk assessment for shipping companies?

Singapore is not only a dynamic market in its own right, but it is playing an active role in contributing to the maritime industry’s wider efforts to achieve its 2050 net-zero targets.

As well as proving to be an innovation hub for clean technology and alternative fuels, it has taken decisive steps in recent years to ensure the development of net-zero pathways. For example, Singapore has established multiple bilateral Green and Digital Shipping Corridors (GDSC) with the ports of Rotterdam, Los Angeles, Long Beach, Tianjin, Japan, Australia, and Shandong. These corridors aim to establish standards and best practices that will support the decarbonisation, digitalisation and growth of the maritime industry. This includes the development of alternative marine fuels such as ammonia, methanol, and hydrogen value chains to safely offer a range of alternative fuel technologies to the maritime industry within the region.

Singapore continues to lead in the development of alternative fuel technology and was an early adopter of LNG as a fuel, with the Maritime and Port Authority of Singapore (MPA) awarding its’ first LNG bunkering licence in 2016. In its efforts to support its Members in their decarbonisation journey, The UK P&I Club has collaborated with the Methane Abatement in Maritime Innovation Initiative (MAMII), part of the Lloyds Register’s SafetyTech Accelerator program. This partnership unites industry leaders, technology innovators, and maritime stakeholders to advance technologies that monitor, measure and mitigate methane emissions in the maritime sector.

With regards to broader alternative fuel initiatives, in 2024, the MPA – in collaboration with Fortescue – conducted the world’s first ammonia-diesel marine trial to support the development of ammonia bunkering within the region. The first simultaneous methanol bunkering and cargo operations (SIMOPS) were conducted at Tuas Port. Singapore also plans to release a Technical Reference for methanol bunkering in 2025 to address safety, competencies, and regulatory frameworks.

Of course, from a safety and risk management perspective, the introduction of alternative fuels into maritime operations – although vital – also poses unique challenges in terms of their evolving risk profiles. Emerging fuel technologies such as methanol and ammonia are distinctly toxic substances, which will require a new approach to crew training to ensure that seafarers are equipped with the knowledge and understanding that will promote the safe handling of new fuels onboard.

There currently exists a significant lack of operational experience for crews in handling alternative fuels, with no formal training programmes in place and a distinct lack of formalised regulatory frameworks that govern the safe handling and use of such alternative fuels. This means that there is a requirement for more operational training and guidelines to be developed to support the safe integration

and operational handling of newly introduced fuel technology. The MPA has proactively addressed this competency gap by establishing Singapore’s Maritime Energy Training Facility (METF). This industry-supported facility will provide dedicated training to international seafarers on the safe handling, bunkering and management of incidents involving the use of alternative fuels.

The UK Club is also exploring potential collaborations to provide bespoke training that equips seafarers with knowledge and understanding of the risks associated with using ammonia as a fuel. Additionally, we are considering partnerships to create a learning portal for Club Members focused on alternative fuels, including ammonia. Alongside these initiatives, we are working on a structured 'Risk Focus' to produce guidelines highlighting the additional safety risks associated with using ammonia as a fuel. The objective is to improve the understanding of the risks associated with bunkering, carrying, and using ammonia, with a special focus on crew safety.

With Asia Pacific being home to some of the busiest ports in the world (like Singapore), how do you assess risks related to port congestion and infrastructure adequacy?

Singapore’s port terminal operators – PSAC and JPPL –are acutely aware of the challenges that they face as one of the busiest ports in the world. As a result, they have worked to deploy smart systems and solutions to enhance port operational efficiency to reduce idle or waiting time by vessels and vehicles at the port terminals. The most notable example is the implementation of a “Just-in-Time” (JIT) planning and coordination platform, which matches available berths upon arrival in Singapore to expedite any linked services such as bunkering, or husbandry. The implementation of JIT arrival protocols in Singapore helps to optimise vessel schedules and reduce the likelihood of congestion. Reducing idling time at anchorage also has environmental benefits. Quicker turnaround times means vessel are burning less fuel and therefore reducing emissions.

Singapore’s foresight in developing a smart port like Tuas Mega port highlights its commitment to addressing future capacity demands. However, unforeseen events such as extreme weather, cyber attacks, a global pandemic, or wider geopolitical events represent ongoing challenges and risk for our Members.

As a result, we are taking a proactive approach to assessing the risks associated with a port’s infrastructure adequacy and preparedness in handling these disruptions. For instance, with regards to cyber attacks, the Club is currently working with maritime cyber experts, CyberOwl, to develop an updated version of the “Risk Focus: Cyber” publication, to assist Members in identifying, managing, and mitigating evolving cyber risks.

Vigilance around navigational safety is a key concern for our Members operating in the Singapore Straits, due to the high traffic density. This requires a combination of technical and operational skills as well as behavioural competencies. We are seeing more digital navigation tools come into the market which are making this easier once they are fully integrated but there is still a need for holistic training which includes the human factors. To help support this, we collaborate with leading civil aviation trainers CAE to offer our Members human behaviour and decision-support training.

Expanding the behavioural theme, we also partner with award-winning psychologist, Dr Marcin Nazaruk. His innovative “Learning from Normal Work” methodology challenges traditional approaches to safety and risk management by focusing exclusively on identifying potential hazards, or improving through accident investigation, which helps companies to identify the sources of operational inefficiencies and the causes of accidents, before they happen.

A further risk that our Members face, is the potential for the detention of ships operating or anchoring in undesignated areas, particularly within Singapore’s Outer Port Limits (OPLs). Vessels operating in these areas risk detention by Malaysian or Indonesian authorities if the ship’s location is within their territorial waters. However, through our extensive network of local correspondents, The UK P&I Club is able to provide its Members with up-to-date information on designated anchorages and compliance requirements to avoid costly detentions and operational disruptions.

An additional safety and risk consideration is with regards to armed robbery, which remains prevalent in the Singapore and Malacca Straits. Shipping companies are advised to adopt heightened vigilance and follow Best Management Practises (BMP) protocols to mitigate such risks and the UK P&I Club remains closely engaged with maritime organisations like Singapore Shipping Associations (SSA), the

Singapore’s foresight in developing a smart port like Tuas Mega port highlights its commitment to addressing future capacity demands. However, unforeseen events such as extreme weather, cyber attacks, a global pandemic, or wider geopolitical events represent ongoing challenges and risk for our Members

Information Fusion Centre (IFC) and the Regional Cooperation Agreement on Combating Piracy and Armed Robbery against Ships in Asia (ReCAAP), to ensure we are able to offer the best assistance to Members within the region.

This myriad of challenges is an understandable reflection of Singapore’s position as the world’s largest transhipment hub, which is emphasised by its record high annual throughput of more than 40m TEUs in 2024. Against this backdrop, Singapore is an important hive of innovation in areas such as decarbonisation and digitalisation and is continuously setting new standards in port innovation. The UK P&I Club is excited to be part of these developments as we continue to collaborate with progressive companies that are operating in the region. By doing so, we can equip Members with the right support to improve operational safety and manage risk as market dynamics evolve.

Propulsion & Future Fuels is the longest-running technical conference in the ships & marine engineering sector providing senior executives with a meeting place to learn, discuss, and share knowledge of the latest developments in efficient propulsion technology and low flashpoint, low carbon fuels.

Sponsors:

Media supporters:

Visit: motorship.com/propulsion-and-future-fuels-conference

Contact: +44 1329 825335

Email: conferences@propulsionconference.com

CAVOTEC CHANGES MANAGEMENT TEAM

Cavotec, a provider of electrification and automation solutions, has recently appointed three new members to its Group Management team, reinforcing its commitment to operational excellence, customer focus, and sustained growth

Jonathan Eriksson has been named senior vice president and head of the industry division, while Nicklas Vedin assumes the role of senior vice president and head of the ports & maritime division. Additionally, Patrick Mares, who has been a member of Group Management since 2019, has been appointed senior vice president, product management and Chief Technology Officer.

These appointments are part of Cavotec’s strategy to further strengthen its management structure and drive its ambitious goals of building long-term value and expanding its market presence. According to David Pagels, CEO and President of Cavotec, the new Group Management team brings a wealth of experience, energy, and industry knowledge to the company, helping it to create the right conditions for future growth. “We now have a Group Management team with a strong focus on customers and sales as well as operational excellence. We have a clear goal to build value and this requires high energy levels, experience, and good judgment. With our new Group Management, we have created good conditions to continue growing and creating value,” Pagels said.

Jonathan Eriksson and Nicklas Vedin, both internal promotions, have a deep understanding of Cavotec’s operations and the markets in which the company operates. Their expertise and leadership experience within Cavotec will be key to driving forward the company’s strategic priorities in both the industrial and maritime sectors.

Jonathan Eriksson brings significant experience to his new role as head of the industry division. Having joined Cavotec in 2020, he has held senior positions within the company, including vice president of the industry division, vice president and head of business development, and project director for global operations. One of his notable achievements was establishing Cavotec’s Indian operations, which officially launched in 2024. Prior to joining Cavotec, Eriksson worked as a management consultant at Roland Berger and as a project leader at Atlas Copco Industrial Technique. Born in 1992, he holds a Master of Science (M.Sc.) in Industrial Management and Engineering from the Royal Institute of Technology in Sweden.

Nicklas Vedin has been appointed Head of the Ports & Maritime Division, a role he is well-suited for due to his extensive experience in this sector. Vedin joined Cavotec in 2018 and has held key leadership positions, including vice president of sales in the ports & maritime division and vice president of product management for MoorMaster, Cavotec’s automated mooring system. One of his key accomplishments at Cavotec was expanding the MoorMaster technology to Asia and Latin America, positioning the company as a leader in the growing automated mooring market. Before joining Cavotec, Vedin worked as a management consultant at Ericsson in Sweden and the US. Born in 1991, he holds a Master of Science (M.Sc.) in Industrial Engineering and Management from Linköping University in Sweden.

Patrick Mares, who has been part of Cavotec’s Group Management team since 2019, will continue in his new role as senior vice president, product management and Chief Technology Officer. Before joining Cavotec, Mares served in senior positions at several large companies, including as Vice President EMEA at Harsco Rail, vice president of sales & business development at GKN Land Systems, President EMEIA at Ingersoll Rand Security Technologies, and in various leadership roles at General Electric. Born in 1962, Mares holds a Master of Science (M.Sc.) in Engineering from the University of Leuven in Belgium.

Alongside these leadership changes, Cavotec has also appointed Gabriella Sereni as head of marketing and communications. Gabriella, who joined Cavotec in 2022 as group sales enablement manager, brings a wealth of experience in marketing communications and product marketing, having previously worked at Atlas Copco. In her new role, she will play a key part in shaping Cavotec’s brand and communicating its strategic vision to the wider market.

The remainder of the Group Management team remains unchanged. Patrick Baudin continues to lead Cavotec’s service operations, while Jörgen Ohlsson remains head of global operations. Vanessa Tisci continues as Chief Legal & Human Resources Officer, and Joakim Wahlquist remains Chief Financial Officer.

Cavotec is a leading cleantech company that develops connection and electrification solutions, enabling the decarbonisation of ports and industrial applications. Its innovative technologies are critical in supporting the global transition towards a more sustainable future. The company’s new Group Management team is well-positioned to drive forward Cavotec’s strategic objectives, leveraging their extensive expertise to deliver value to customers and stakeholders alike.

Book your place today

Conference speakers include:

Director General, Spanish Shipowners’ Association (ANAVE) & President, Spanish Shortsea Promotion Center

Supporters:

Topics include: Renaissance of Short Sea Shipping OPS Expansion: Increasing the pace to meet demand

Infrastructure development at ports to support short sea shipping

Expansion of green and digital corridors ETS Carbon Levy What do Shippers Want?

Coastlink is a neutral pan-European network dedicated to the promotion of short sea shipping and intermodal transport networks. Learn from and network with international attendees representing shipping lines, ports, logistics companies, terminal operators, cargo handlers, and freight organisations.

For more information on attending, sponsoring or speaking contact the events team: visit: coastlink.co.uk contact: +44 1329 825335 or email: info@coastlink.co.uk

OCEANSCORE’S REGULATORY ANSWERS

The maritime sector is facing increasingly stringent regulations aimed at reducing emissions, with the EU’s FuelEU Maritime and the EU Emissions Trading System (EU ETS) taking centre stage

These regulations are intended to guide shipping companies in transitioning towards greener fuel sources, but they also bring significant challenges for operators who must navigate compliance, fuel choices, and costs. OceanScore, a company providing compliance solutions, is offering innovative ways to help shipping companies meet these challenges and optimise their compliance strategies.

Albrecht Grell, managing director of OceanScore, explains that the company’s approach is distinct in its ability to blend strategic planning with day-to-day operational management. While many companies in the market focus on providing compliance services, OceanScore’s unique proposition lies in its combination of a strategic planner and operational compliance tools.

OceanScore’s most recent offering is the Compliance Manager, a tool designed to handle the intricacies of both FuelEU Maritime and EU ETS in one package. It allows shipping companies to strategically plan their fuel choices, from biofuels to synthetic options, and optimise their operations accordingly. The Compliance Manager goes further by incorporating elements of financial management, ensuring that shipping companies can effectively manage risks, invoicing, and payments related to carbon allowances and fuel-related costs.

Part of this strategy, according to Grell, lies in OceanScore’s FuelEU Planner. This tool helps companies model various scenarios, including the use of biofuels, the costs of carbon credits, and the availability of different fuel types. “It’s a strategy optimiser,” says Grell, “helping companies draft the best approach to comply with FuelEU Maritime regulations and plan for future fuel use in a commercially viable way.” This tool sets OceanScore apart from competitors, as it’s specifically designed to integrate various operational and financial factors into a single planning solution, something other companies offering compliance services may not provide.

Different approach

While companies like Ahti Pool and BetterSea focus on offering fuel pooling services, OceanScore takes a more nuanced approach to pooling, offering it as a free service for clients rather than commercialising the process. Grell is firm in his belief that the pooling business model may not be as prominent as many expect, especially since many shipping companies already engage in pooling arrangements based on long-standing relationships. “Most pools will be internal,” he explains, “and I don’t think it’s necessary to commercialise that service.”

OceanScore's comprehensive approach ensures that clients can manage the complexities of both FuelEU Maritime and EU ETS regulations under one roof, streamlining compliance and reducing the administrative burden. The platform seamlessly integrates data from verifiers, commercial systems, and financial processes, giving operators complete transparency into their compliance status and financial positions.

A crucial aspect of compliance under EU ETS is managing

the price risk associated with carbon emissions allowances. Grell highlights the importance of hedging as a way for shipping companies to protect themselves against the volatility in the carbon credit market. By using forward trading and incremental purchases, companies can lock in prices for EUAs (EU Allowances) at an agreed-upon rate, mitigating the risk of price fluctuations as they fulfil their contractual obligations with customers. This kind of risk management is essential when operating in a market where the cost of carbon allowances can fluctuate significantly, impacting both profitability and compliance.

Moreover, Grell emphasises the interdependencies between FuelEU Maritime and EU ETS. While FuelEU focuses on fuel-related decisions, such as the use of biofuels, EU ETS is more concerned with the process of carbon credit trading. The two regulations are intertwined, and shipping companies must consider the impact of one on the other. For instance, switching to biofuels under FuelEU can reduce the EU ETS costs, but it also affects the overall fuel costs due to the calorific value differences of biofuels. As such, OceanScore’s Compliance Manager is designed to optimise both operational and strategic decisions in light of these interdependencies.

The introduction of new fuel types, such as biofuels, into the debate has been contentious. Given the recent protest to the IMO regarding the use of biofuels, many advocate for the reduction of these in maritime operations, especially nonwaste-based biofuels, Grell suggests that the conversation is somewhat academic. He acknowledges the need for sustainability but argues that biofuels, particularly waste-based types, remain a viable short-term solution. “The debate on waste-based versus non-waste-based biofuels is somewhat irrelevant now,” he notes, pointing out that the production process for biofuels has evolved and that waste-based biofuels can be made from previously non-waste sources.

ACCELLERON’S CEO ON CLIMATE

Coming from Switzerland, the International Year of Glacier Preservation and World Water Day’s glacier theme strike a chord with me. I have witnessed the alarming retreat of Swiss glaciers firsthand – a 65% ice loss since 1850, with 10% gone in just 2022-2023

Maritime has a front-row seat to glacial and polar melting, with rising sea levels, surging storms, and threats to coastal infrastructure. If the climate crisis escalates, supply chains and industries worldwide will face disruption.

The point is, this is a climate red flag. And it’s a call to unite like never before. Maritime’s strength has always been partnership, and in the past five years, together we have deployed efficiency technologies, dual fuel engines, and digitalization to curb emissions.

Yet, even with these efforts, progress is too slow, and two more red flags appeared last year. Global emissions should have peaked before 2025; instead, they hit an all-time high in 2024. It was also the first full year of 1.5°C warming.

One year of 1.5° is not a point of no return, but it raises the stakes ahead of 2030 emissions targets. Missing those could make future goals unattainable. On the other hand, meeting shipping’s 20-30% reduction target would prove that we can pull our weight.

A 2023 IMO study confirms we can, if we accelerate two key developments.

First, we have to go viral with fuel efficiency

The technology for maximum efficiency already exists—from speed optimization to hull cleaning, digital tools, and wind propulsion. Just derating engines with optimized turbochargers can save a conservative 3% in fuel and emissions. We have a customer that combined that with a propeller upgrade to save 25%. But in a global fleet averaging 13.1 years (weighted), only 37% of ships have energy saving technology (EST) retrofits.

We need to finish the efficiency job, and it only makes sense. Investing now will future-proof ships, cut fuel costs, and ensure compliance with new carbon regulations, avoiding wasted money on penalties.

Second, and not as easy, we need to solve the carbon-neutral fuel challenge

To meet the 2030 target, the IMO estimates 5-10% of the global fleet must also switch to carbon-neutral fuels. Consensus is growing around green methanol and ammonia, with new ships already designed for them. Theoretically, we could just scale up infrastructure for green hydrogen production and non-fossil carbon capture as feedstock, boosting green methanol and ammonia production and driving deep decarbonization toward net zero. Unfortunately, theory and reality are far apart, and the way forward is blocked by infrastructure and investment challenges.

Green shipping corridors help, by concentrating carbonneutral fuel availability, and in 2024, they grew 40% to 62 initiatives worldwide. Still, the actual fuel is in short supply.

As a result, LNG dual fuel technology now leads in new ship orders, Of course, we have to manage methane slips, but mitigation technologies exist. With no perfect path, a 25% emissions drop from conventional fuel is still progress, and onboard carbon capture (OCC) is gradually emerging which could further reduce CO2 emissions from LNG.

But it will not get us to net zero.

Navigating the fuel challenge requires a cross-industry compass

We are not alone in our infrastructure needs. Shipping accounts for 3% of global emissions, but combined with other hard-to-abate sectors—aviation, steel, cement, and chemicals—the total jumps to 25%. Adding power generation (34% of global emissions) and agriculture (12%) brings the total to over 70%, all reliant on green hydrogen and carbon capture. Some sectors, especially shipping, also depend on increased production of green methanol and ammonia.

Right now, infrastructure is critically lagging, and continuing with a fragmented, sector-specific approach will see green hydrogen demand outstrip supply by at least 900% in 2030, with carbon capture facing a similar gap. As major energy players are now scaling back renewable investments, that gap could well grow.

We must join forces to build critical mass Why not unite to shift the balance in our favor? A crossindustry initiative could consolidate demand and provide

Green shipping corridors help, by concentrating carbon-neutral fuel availability, and in 2024, they grew 40% to 62 initiatives worldwide. Still, the actual fuel is in short supply

market certainty, unlocking the requisite investment: $9 trillion for green hydrogen, $3.5 trillion for carbon capture, five times current methanol production, and a tripling of ammonia production by 2050.

Of course, demand alone will not suffice. With prohibitive costs and long payback periods, making green hydrogen and carbon capture cost-competitive also requires bold national leadership and large-scale incentives—like the ones that drove solar growth in Germany, and made it viable against fossil fuels.

Shipping, a natural starting point for a united fuel front

As stewards of 80-90% of global trade, shipping has a responsibility – and a unique position – to unite sectors,

aggregate demand, and amplify our collective voice with policymakers. When it comes to the climate challenge, we are all in the same ship, sailing the same ocean. Acting together now can turn the carbon-neutral fuel challenge into our greatest opportunity for net zero.

■ Daniel Bischofberger is CEO of Accelleron. With a 100-year heritage of innovation, Accelleron helps the world move further, more efficiently and sustainably through its turbocharging, fuel injection, and digital solutions for heavy-duty applications. The company serves marine and energy customers in more than 100 locations across 50 countries, continuously innovating to drive the energy transition forward and accelerate the decarbonization journey.

Leading the Future of Marine HVAC Systems

Sail Green, Breathe Clean

– Eco-Friendly HVAC Solutions for a Sustainable Voyage.

Please contact sales@hiairkorea.co.kr

CHINA ADVANCES AMMONIA FUELLED SHIPPING

China leads the world in ship owning and ship building, and ammonia is high on its agenda for the future

Ammonia was bunkered for the first time in China late last year when Liaoning Suppliers refuelled the tugboat Yuantuo 1. It was one of very few ammonia bunker transfers to date globally, and the operation was conducted at the COSCO SHIPPING Heavy Industry terminal in Dalian thanks in part to guidance from China Classification Society (CCS).

The 5,500HP tugboat was the first ammonia-fuelled ship built in China, and CCS played a major role in the vessel design, including designing the ammonia fuel containment and supply system. The society also conducted research into the catalyst technology used in the vessel’s SCR, among other technical developments.

CCS released its Guidelines for Ships Using Ammonia Fuel in 2022 and continues to research safety and new vessel designs. It’s part of a national push. Also in 2022, China’s National Energy Administration released a "Medium and Long-term Plan for the Development of Hydrogen Energy Industry (2021-2035)" which actively promoted the advance of ammonia-fuelled vessels.

CCS has been involved in the development of a range of ship designs including a 16,000 TEU container ship designed by MARIC, a 3,500 TEU container ship designed by CSSC Huangpu Wenchong Shipbuilding, bunkering vessels by MARIC and DSDC, oil tankers by MARIC and DIMC ORIC and a bulk carrier by SDARI.

In November 2024, CCS granted AiP to China's first medium-speed high-power ammonia fuelled engine developed by CRRC Dalian Company. CCS was first to grant AiP for Wärtsilä’s W25DF ammonia engine. It has also granted AiP for WinGD and Dalian University of Technology engines,

for ammonia fuel valves to PK Valve & Engineering in South Korea, and for an ammonia fuel supply system by COSCO SHIPPING Heavy Industry Technology (Weihai).

In December last year, MSC 109 adopted amendments to the IGC Code to enable the use of ammonia cargo as fuel, and this has paved the way for vessel designs such as the 50,000 cubic meter ammonia carrier jointly developed by COSCO SHIPPING Energy and COSCO SHIPPING Heavy Industry. Primarily designed for ammonia cargo, it also has the capability to carry LPG simultaneously. The ammonia dual-fuel engine system is expected to achieve net-zero carbon emissions.

Price is key

Getting beyond the design stage for ammonia fuelled cargo vessels will require favourable economics, another area of research for CCS. The International Renewable Energy Agency (IRENA) has calculated the current cost of producing green ammonia at $700 to $1,300 per ton. That is expected to decrease to $450-$900 by 2030, a range confirmed by CCS’s own calculations. “After 2035, the economy of ships using green ammonia will begin to be equivalent to that of ships using fuel oil. After 2045, ships using green ammonia will generally be more economical than ships using fuel oil,” says Jin Ding, CCS Wuhan Rules & Research Institute.

Safety risks will need to be mitigated. Lei Wei, CCS Wuhan Rules & Research Institute, says toxicity is the primary risk to be controlled when using ammonia as fuel. This means controlling ammonia leakage and accumulation, preventing ammonia contact, and life-saving measures. Mitigation measures include the use double-walled pipes, avoidance of

threaded joints as much as possible, mechanical ventilation, water spraying, the division of toxic areas and restricted access to high-risk leakage areas.

Ammonia’s corrosive properties rule out the use of materials such as copper, zinc, nickel and their alloys, and plastics, so steel is commonly used as the metal in ammonia storage tanks, pipelines and fittings. For seals, nitrile rubber can be used instead of conventional rubber.

Ammonia has a relatively low risk of explosion as it is not easy to ignite and has a high lower limit of flammable concentration (15%). However, it can exacerbate the consequences of an explosion caused by other fuels or flammable materials, and it reacts with oxidants such as chlorine and bleach to produce explosive compounds.

Ammonia-fuelled vessels should be equipped with at least three sets of safety protection equipment, and each should be able to provide sufficient protection to allow entry into gas-filled areas. This means at least one self-contained positive pressure air respirator (including the entire mask) with a capacity of at least 1,200 litres of free air (without using stored oxygen), airtight protective clothing, boots, gloves, steel core rescue rope with belt and an explosion-proof lamp. Ammonia-fuelled vessels should also have safe shelters that can accommodate all personnel onboard in case of severe ammonia fuel leakage.

There is a certain foundation for the development of the regulations, rules, and standards related to ammonia-fuelled vessels worldwide, and the corresponding rules and standards have taken shape

The ammonia fuel tank and ammonia fuel preparation room should be located in areas where the hull structure is stable and not easily affected by external factors such as collision or grounding. They should be arranged outside of Class A machinery areas. When the ammonia fuel tank is located on deck, a coaming, water spray system, and independent ammonia water release system should be installed to avoid direct discharge of aqueous solutions containing liquid ammonia or dissolved ammonia overboard.

An instantly available water curtain should be installed at the entry to the ammonia fuel preparation room, and it should be able to be activated from outside the room. Gaseous ammonia has good solubility in water, so this measure can be effective in containing a leak.

An ammonia release management system is required to collect any ammonia releases during normal or reasonably foreseeable abnormal situations. This includes ventilation of double shut-off vent valves in ammonia fuel pipelines, release of safety valves in the ammonia fuel system and release of ammonia during pipeline purges.

Due to the toxicity of ammonia fuel, it may be better to adopt enclosed or semi-enclosed design for the ammonia fuel bunkering station, says Niu Song CCS Shanghai Rules & Research Institute. This contrasts with LNG and methanol bunkering stations that are preferably arranged in wellventilated areas such as open decks.

The IMO guidelines stipulate that regardless of whether the bunkering station is in an open area, semi-enclosed area, or enclosed area, a risk assessment must be conducted which considers factors such as the isolation of the bunkering

station from other areas of the ship, the division of hazardous and toxic areas, ventilation requirements, leak detection and safe measures. These can include direct monitoring or closed-circuit television monitoring of the bunkering station.

“As a preliminary application of a new system and technology, ammonia-fuelled vessels still lack the experience of onboard application despite their high technological maturity. It is necessary to adopt acceptable and recognized risk analysis techniques to assess the potential risks involved in the design of ammonia-fuelled vessels, in order to eliminate or mitigate their adverse effects on onboard personnel, environment, structural strength, or ship integrity,” says Nui.

On-going service

CCS has established a scientific research and service centre for the establishment of rules and standards, approval of ships and systems, risk analysis and carbon intensity assessments. Despite the advances made, the society sees some challenges ahead. For example, cost, safety, infrastructure, regulatory framework, technological maturity, and market acceptance. These challenges will need to be addressed through global cooperation, technological innovation, policy support, and investment.

“There is a certain foundation for the development of the regulations, rules, and standards related to ammonia-fuelled vessels worldwide, and the corresponding rules and standards have taken shape,” says Ma Dan CCS Wuhan Rules & Research Institute. “However, there are still deficiencies and improvement. In the future, in-depth research needs to be made in the following five aspects: the standards for specifications of marine ammonia fuel; the standards for ammonia fuel bunkering; the standards for testing ammonia fuel power plants (engines, boilers); the standards for design and testing of ammonia fuel supply system; the standards for design and testing of ammonia emission reduction system.”

For bunkering, CCS launched a research project titled "Research on Technical Standards for Ammonia Fuel Bunkering Ships and Operation" in 2024. The aim is to conduct research on technical standards for ammonia bunkering operations and ammonia bunkering ships. The work undertaken has already included development of technical standards for the arrangement of bunkering vessels, bunkering systems, cargo containment systems, related monitoring and safety systems, personnel protection, evacuation, and fire protection systems. "Guidelines for Ships Using Ammonia Fuel" and "Guidelines for Marine Ammonia Fuel Bunkering Operation" are expected to be released around the end of 2025.

Meanwhile, Chinese yards are already attracting orders globally for ammonia-fuelled vessels. Last year, CMB.TECH and Yara Clean Ammonia announced the order of the world’s first ammonia-powered container ship to be built at Qingdao Yangfan Shipbuilding. More recently, on February 19, Norway’s Skarv Shipping announced it had contracted an ammonia-fuelled general cargo vessel from Huanghai Shipbuilding for delivery in 2027.

A SAFE ROUTE TO THE AMMONIA ALTERNATIVE

As orders for ‘ammonia-ready’ ships accumulate, ClassNK’s work to overcome its crew safety challenge will be key role in realizing the fuel’s potential as a contributor to maritime decarbonization

Latest published figures from Clarksons Research indicate that 25 ammonia-fueled ships were ordered during 2024.

Given that 50% of all 2024 ships ordered will burn alternatives to conventional fuels, ammonia’s contribution to a low CO2 emission future, therefore, appears modest, compared to 390 fueled by LNG, 119 by methanol, 72 by LPG (and 12 by hydrogen), and 206 with battery/hybrid propulsion.

However, the figure compares to just four ammonia-fueled ship orders in 2023, according to the same source, while a broader view counts 130 of the ships ordered in 2024 as ammonia ‘ready’. These add to 322 ammonia-ready ships on order at the start of 2024, according to Clarksons.

Numbers such as these suggest a market that is prepared to consider a greater commitment to ammonia as a fuel type at a later date.

Advocates for ammonia point to the fact that it does not emit CO2 when burned. Using renewable energy sources and electrolysis to create ‘green’ ammonia would result in a fuel that would cut GHG emissions through its lifecycle by up to 90% - meeting International Maritime Organization zero-carbon expectations even if translated to a ‘well-to-wake’ assessment.

Advances in ammonia

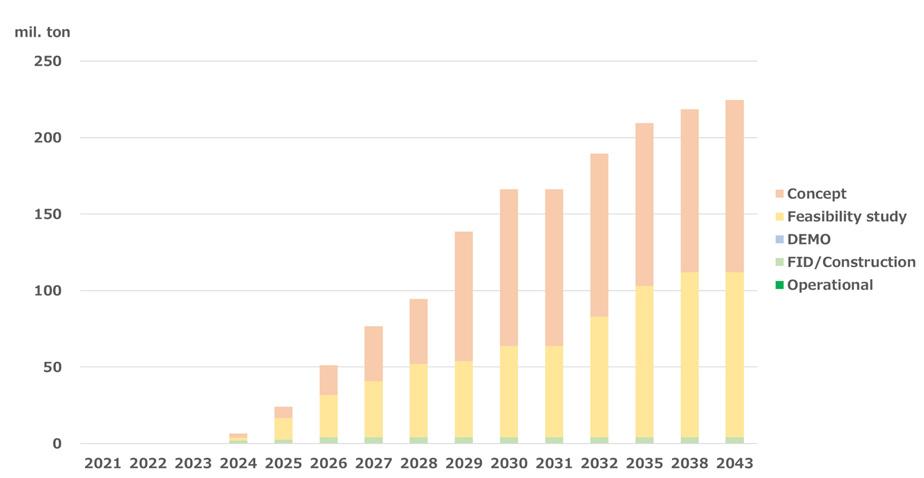

Research recently published by ClassNK shows that production capacity for green ammonia will reach around 220 million tons by 2043, taking account of all publicly announced projects – including those where the start-up has been most delayed.

If the number appears high (where the IMO estimates global ships of above 5,000GT consume around 215 million tons of fuel oil a year, though ammonia’s energy density

differs from oil), it reflects expectations that ammonia will provide an alternative fuel for coal-fired thermal power plants and will be used as a hydrogen carrier. Furthermore, since most projects are still in the conceptual or feasibility stages, it is unlikely that all will go ahead.

But toxicity, rather than availability, represents the first obstacle to ammonia’s acceptability as a marine fuel. Even in low concentrations. Ammonia has an adverse effect on human health in cases of repeated exposure.

And its uptake will depend on not only advances in design, technology and training that protect seafarers and the environment from ammonia’s risks in theory, but also the changes to maritime law that ensure that any usage upholds necessary and agreed standards in practice.

In December 2024, the IMO’s Maritime Safety Committee moved forward with interim guidelines covering the use of ammonia, and towards an international standard for ships using ammonia as fuel. The new guidelines are an important milestone in developing rules on ship design including the arrangement of fuel tanks, machinery space, piping, and containment, bunkering and fuel supply, as well as control, monitoring, and safety systems.

Work will continue on these guidelines, and on extending the IGF Code covering low-flashpoint fuels to include ammonia in 2025. Meanwhile, changes to the IGC Code will enter into force on 1 July 2026 that allows it as a fuel pathway.

Guidance on risk

Where technical support and the development of formalized ship and equipment design requirements are concerned, ClassNK has been in the vanguard of several projects

contributing to cumulative knowledge on the use of ammonia as a marine fuel.

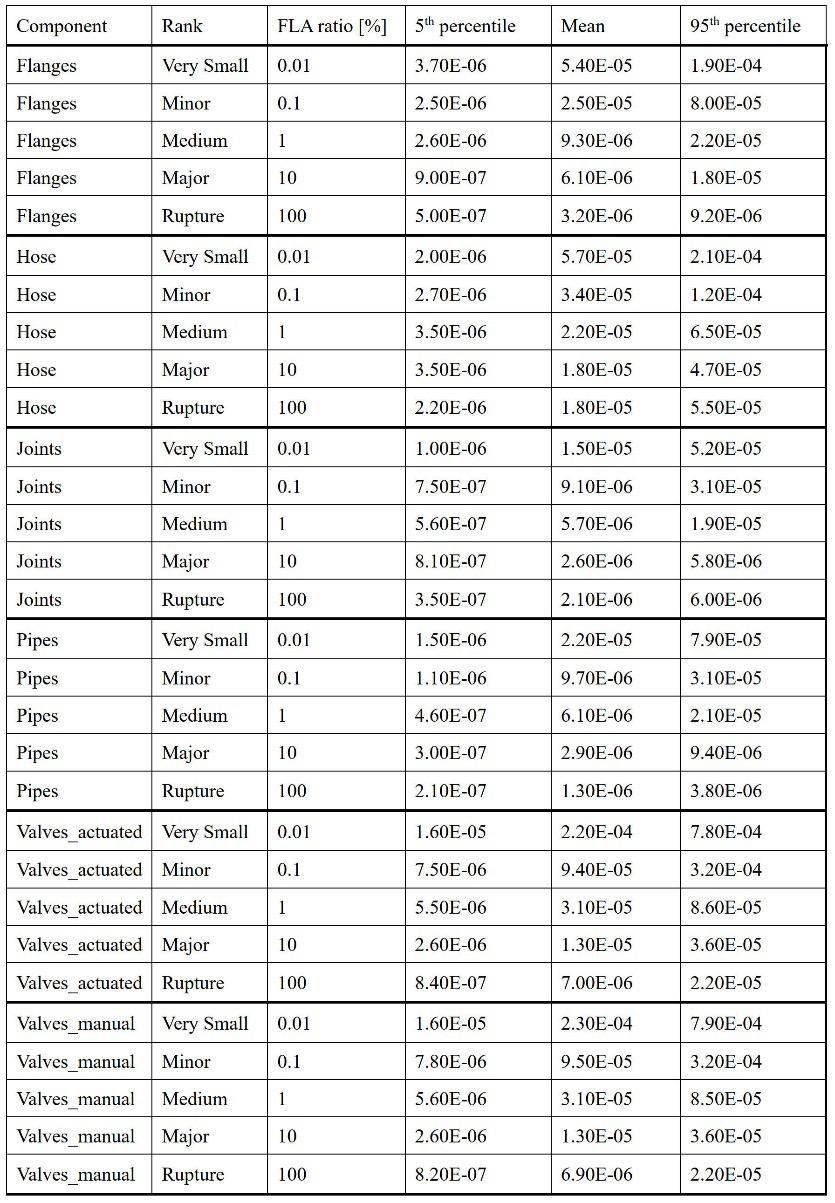

For the maritime industry to move forward with the practical application of ammonia-fueled ships, it will be essential to incorporate comprehensive risk assessments in ship design. A recently published study offers a further reminder of ClassNK’s energetic work to advance the viability of ammonia as a future mainstream marine fuel. A key component of these assessments involves estimating the probability of ammonia leaks from various onboard components.

Conducted in a collaboration with the Society and Research Institute of Science for Safety and Sustainability (RISS), National Institute of Advanced Industrial Science and Technology (AIST), the study estimates the probabilities of leakages in ship fuel systems using ammonia.

Leakage frequency from piping, storage tanks, and associated equipment will vary depending on the type of gas in the fuel system. Deriving estimates for ammonia leakage is therefore an essential part of the design risk assessment process. The purpose of the study has been to develop a more robust and reliable basis for future risk assessment work on the prevention of leakages, with results also helpful for developing measures to protect crew safety and the surrounding environment.

Given the lack of existing ammonia-fueled ship systems, however, authors faced a practical challenge in estimation work. To overcome it they used the Bayesian method to estimate probabilities of leakage for each component by combining onshore ammonia leakage frequency data from the High Pressure Gas Safety Institute of Japan with leakage frequency data applied to risk assessments for LNG-fueled ships.

The result is the world’s first ammonia leak frequency estimates for onboard components for ammonia-fueled ships (valves, hoses, pipes, flanges, joints, etc. - see Table 1).

The study feeds into the knowledge bank at the disposal of the ClassNK Transition Support Services to support customers on their journey towards zero-emission emissions. In addition, leak frequencies associated with specific components have been included by ClassNK as an appendix to Part C of Guidelines for Ships Using Alternative Fuels (Edition 3.0).

Drawing on real projects to update its Guidelines for Ships Using Ammonia as Fuel, ClassNK is also amassing further food for thought for regulators working on how ammonia can be safely brought into use and take its place in The IGF Code and The IGC Code.

ClassNK’s updated Guidelines independently establish provisions for minimizing risks to ships, seafarers, and the environment, as well as standards for the equipment (including control and monitoring systems).

CORE POWER’S VISION FOR ENERGY

CORE POWER, led by CEO Mikal Bøe, is spearheading a transformative initiative in the shipping industry through its Liberty program, which focuses on floating nuclear reactors. These reactors, designed to be modular and cost-effective, are positioned as a viable solution to the pressing need for decarbonisation in maritime

The urgency for change is clear. Thousands of vessels will need replacing by 2040, by which time international shipping will have to be 70% of its way to net zero, the final deadline for which is 2050. With the average ship lifespan being around 25 years, new builds will need to meet stringent emissions regulations, making conventional fuelpowered vessels obsolete.

According to Bøe, alternative fuels such as ammonia and methanol present significant energy inefficiencies and prohibitive costs. Instead, CORE POWER’s floating nuclear technology offers a high-energy-density solution that can ensure long-term sustainability and efficiency for global shipping and beyond.

At the heart of CORE POWER’s innovation is the molten chloride fast reactor (MCFR). Unlike conventional solid-fuel reactors, MCFRs utilise a fuel comprising a liquid solution of uranium and chloride salts. This design eliminates meltdown risks and ensures safer operations compared to traditional nuclear power. The reactors, on Floating Nuclear Power Plants measuring 160 metres in length and weighing 25,000 tons, will generate between 170-250 GWh of electricity annually –ar surpassing the efficiency of existing hydrocarbon-based fuels.

The case for nuclear in shipping

Bøe is a vocal advocate for nuclear power, challenging public perception and regulatory hurdles that have historically

hindered its adoption. There are many misconceptions about nuclear power that have their roots in groups that wanted nuclear weapons to be disarmed.

The current drive for nuclear power is because of the global imperative to decarbonise shipping and this technology is the ‘silver bullet’ that can help deliver that goal

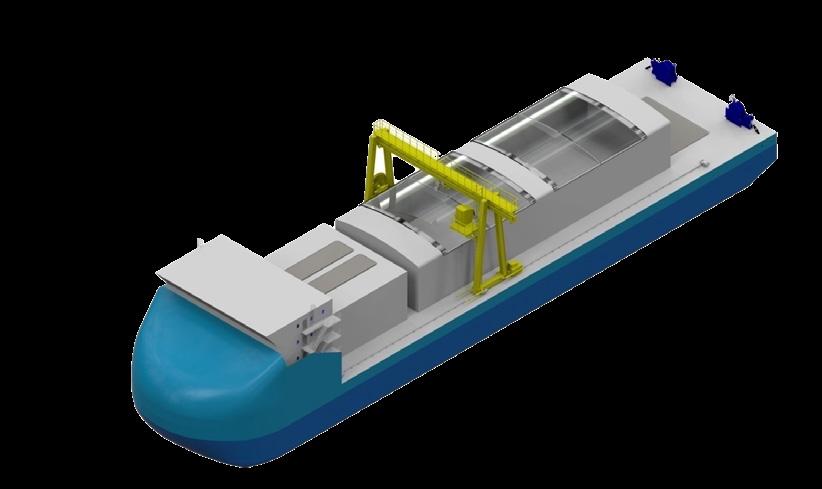

“CORE POWER’s Liberty program envisages a two-stage approach to maritime decarbonisation. The first stage will focus on building floating nuclear power plants (FNPPs) in shipyards. FNPPs will operate in a similar way to existing power barges, being centrally manufactured then towed to wherever they are needed. Initial smaller-capacity designs will be able to be moored in ports, while later larger-capacity FNPPs will be anchored further offshore.

“Rolling out FNPPs will create the regulatory environment and operational expertise necessary for the second stage of the Liberty program - nuclear propulsion for civil ships.”

The fundamental driver behind nuclear adoption, Bøe contends, is its unparalleled energy efficiency. “Every single substantial change in human development, in human prosperity, is directly linked to how effectively we use energy,” he explains. “The way that we live today is entirely because of our immense ability to harness energy from fossil fuels in an efficient way.” The challenge, then, is to transition from fossil fuels to an energy source that is equally, if not more, effective—hence the shift towards nuclear.

While nuclear energy has come with high initial costs in the

past, the advanced technology CORE POWER will be deploying will mean that these costs are far lower than for conventional nuclear technology. Also, nuclear energy’s economic model is the inverse of traditional bunkering models: while fossilfuelled ships may have a relatively low capex but substantial operational costs over time, the high capex costs of nuclear are significantly offset by its minimal operational costs. A ship using an advanced nuclear reactor will not need refuelling for its entire 25-year design life, Bøe says.

Compared to alternative fuels, nuclear energy density is staggering. “Ammonia and methanol have an energy density of between 17 and 19 megajoules per kilo, while bunker fuels range from 42 to 44 megajoules per kilo,” Bøe explains. “You would have to use between two and two and a half times as much fuel in order to get the same amount of power.” Given shipping’s main purpose is the transport of people or goods, larger tanks would mean less cargo space therefore future fuel adoption has a fundamental problem.

Overcoming industry challenges

The Liberty program is addressing the key barriers to nuclear adoption, including public opinion, regulatory concerns, and insurance. “Liberty is developing a new nuclear technology, which is the one that solves the liability, that solves the port access, which solves the public opinion piece,” says Bøe. Encouragingly, the International Maritime Organization (IMO) is revising its nuclear safety codes, and the International Atomic Energy Agency (IAEA) is setting up specific initiatives to facilitate floating nuclear power.

Market potential for floating nuclear stations is vast, with an estimated addressable value of $2.6 trillion by 2060.

CORE POWER’s model is built on a modular approach, ensuring reliable and timely delivery. Large technology companies, such as Google and Meta, are also eyeing floating nuclear power to support their energy-intensive data centres, which cannot afford the delays and costs associated with traditional nuclear plants.

When it comes to safety, CORE POWER’s long fuel cycle model eliminates the need for refuelling, thereby removing risks associated with spent nuclear fuel. “We’re not trying to impose a technology that doesn’t fit shipping,” Bøe states. His confidence in the technology’s viability is unwavering: “We

Rolling out FNPPs will create the regulatory environment and operational expertise necessary for the second stage of the Liberty program - nuclear propulsion for civil ships ‘‘

see the industry standing up and realising that this is not a question of if, it’s a question of how we do it.”

As the UK government considers legislative changes to support nuclear-powered shipping, CORE Power stands at the forefront of an energy revolution. Bøe remains sceptical about competing alternatives, particularly green ammonia. “The fact of the matter is physics and chemistry matter; you can't break the rules of nature. The laws of nature apply whatever you do,” he asserts.

Ultimately, CORE POWER’s floating nuclear solution offers an opportunity to redefine maritime energy, ensuring longterm sustainability and cost-effectiveness. With the support of leading shipyards in Japan and South Korea, as well as growing regulatory acceptance, the Liberty program is wellpositioned to drive the next generation of zero-emission

LNG – FROM PIPE-DREAM TO MAINSTREAM

Nearly 15 years ago, when the first Motorship Gas Fuelled Ships conference was held in Hamburg, liquefied natural gas-fuelled propulsion was seen as a promising novelty, albeit with a limited market

Fast forward to 2025, and the number of dual-fuel, LNG capable vessels afloat and on order has reached a number that would have seemed staggering in 2010. Then, LNG as fuel was solely the preserve of gas tankers, which could use cargo boil-off as fuel, as well as short-distance coastal ferries, such as those crossing the Norwegian fjords, where suitable and safe refuelling stations could be provided.

Although technology had proved burning gas as well as liquid fuels in the same engine was feasible, LNG was being considered for only a very few mainstream ship types. It was the infrastructure that was regarded as the main hurdle. Add to this the fact that, for ships travelling long distances between bunkering ports, LNG tank volumes would need to be far greater than for conventional fuels.

Maritime LNG industry collective Sea-LNG has recently published its analysis of the LNG-fuelled fleet. From a mere handful of ships 10 years ago, there are now 638 LNG-fuelled ships afloat. This may still be a small minority of the total world fleet – some 6-7% - but the figure is expected to almost double to 1200 by 2028.

Most marine engines are capable of being retrofitted for dual-fuel LNG use, but such activity has been very limited. This is no doubt due to the complexity of incorporating LNG fuel storage and handling systems on existing ships. So the growth in the gas-fuelled fleet is down to the number of newbuilding orders that are capable of dual fuel (LNG and oil fuel) operation. Sea-LNG notes that about 70% of alternativefuelled tonnage ordered in 2024 is capable of running on LNG. Those figures are even more noteworthy as they specifically exclude gas carrier ships.

Such expansion has only been possible because of the rapid growth in the LNG fuelling infrastructure. In the early years of gas fuelled ships, longer voyages – initially just the maiden delivery voyage from Far Eastern shipyards to European operators – had to be meticulously planned, with road tankers ready at various ports en route, as insufficient locations were able to supply LNG in bulk. Sea-LNG’s analysis shows that by the end of 2024, LNG bunkers were available in nearly 200 ports worldwide, with plans in progress for full LNG bunkering facilities in an additional 78 location. There has been a considerable increase in LNG bunker ships - over 60 are currently operating today, marking a 22% increase from 2023’s figures. More still are being planned and delivered.

Many in the industry have moved from seeing LNG fuel as a novelty, appropriate in a few specialised markets, to an interim fuel, offering a bridge between fossil fuels and zeroemission alternatives, which still have a way to go before they too enter the mainstream. This is a view that is accepted by Sea-LNG, but the industry coalition sees a longer-term future, with synthetically (e-methane) or biologically produced (bio-methane) gas offering a net zero-emission virtual drop-in for LNG.

Sea-LNG chairman Peter Keller said: “Our latest [January 2025] ‘View from the Bridge’ report reaffirms the importance of the LNG pathway as a practical and realistic route to shipping’s decarbonisation now. We continue to believe that the shipping industry is heading towards a successful multifuel future where LNG will always play a critical role. To deliver net zero by 2050 across the global shipping fleet, a basket of fuels is required and the LNG pathway will continue to lead the way. This is not a case of my fuel versus your fuel but rather which fuel best allows the industry to reach its stated goals. The LNG pathway provides the path to net zero.”

According to Keller, bio-methane and e-methane are an important step along that pathway, allowing dual-fuel ships ordered today to burn, with little or no modification to engines or fuel systems, gaseous fuels complying with netzero well to wake specifications.

Methane slip

Sea-LNG’s analysis suggests that the FuelEU Maritime regulations, that started to take effect from the beginning of 2025, create a favourable climate for the LNG/bio-methane pathway. Running on LNG fuel, the latest dual-fuel vessels can immediately reduce GHG emissions by up to 23%, making them compliant until around 2039. Then, switching to liquefied bio-methane and e-methane can extend compliance beyond the IMO net-zero deadline of 2050. When such vessels are part of a Fuel EU Maritime pooling arrangement, the economics of running on gas can look highly attractive.

Although use of LNG fuel offers a significant reduction in carbon dioxide emissions, the main component of LNG –methane (CH4) – is a far more potent greenhouse gas than CO2, and there is a real danger that unburnt methane can be released into the atmosphere from LNG-fuelled engine exhausts. Methane slip, i.e. unburnt methane, has therefore tended to detract from the environmental contribution of gas fuelled ships.

The first dual-fuel engines were four-stroke units, operating on the lean-burn Otto cycle in gas mode and Diesel cycle in oil mode. Relatively high levels of methane slip were observed from such engines in gas mode. It should be noted that for gas-only, spark-ignited engines, methane slip is somewhat more tightly controlled, but such units, being limited to one fuel type, are less attractive for most maritime applications. For both types, methane slip increases significantly at low load – in the case of Otto cycle engines running at 25% load, methane slip has been found to increase by around a factor of four, according to a paper presented at the last CIMAC congress.

As dual-fuel marine engines developed, methane slip has been addressed in a number of ways. Safetytech Accelerator, which was established in 2018 by Lloyd’s Register and became an autonomous company in 2021, has taken a leading role through its Methane Abatement in Maritime Innovation Initiative (MAMII). In this initiative, four companies - Daphne Technology, CDTi Advanced Materials, Rotoboost, and Plenesys - were selected to take part in trials of a number of systems, in conjunction with shipping companies MSC, Seapeak and Capital Gas. Daphne Technologies’ SlipPure system is installed in the ship exhaust, and converts methane into water and CO2; CDTi offers a catalyst solution that oxidises the methane gas; Rotoboost’s system enables onsite pre-combustion low-carbon hydrogen production through thermo-catalytic decomposition, and Plenesys employs plasma torches to crack methane molecules.

In the trials, all have been found effective in cutting methane slip, by up to about 80%, while the Plenesys and Rotoboost methods reduced CO2 emissions as well. All were

considered cost-effective ways of meeting the IMO emission goals.

MSC Group EVP Bud Darr said: “Information about how methane combustion performs under different conditions will be critical to solving the challenge of methane slip. Research insights from studies such as this one get the industry a step closer to understanding not only combustion performance but also what combination of onboard technologies can deliver significant methane emissions reduction. Improving the methane footprint of the global maritime fleet will be crucial to unlocking the net zero potential of bio and synthetic LNG. MSC is proud to support MAMII’s research focused on improving methane performance, which will ultimately support our efforts to achieving net zero decarbonisation by 2050.”

‘‘

To deliver net zero by 2050 across the global shipping fleet, a basket of fuels is required and the LNG pathway will continue to lead the way

Kaisa Nikulainen, CEO Rotoboost said: “The collaboration has been exceptional, bringing together charterers, ship owners, LR, and industry partners such engine/equipment makers, to expedite the decarbonisation process and reduce the carbon footprint of the assets”.

The story is somewhat different for dual-fuel two-stroke engines. MAN B&W’s first-to-the-market ME-GI operates on the Diesel cycle in both modes, with minimal methane slip in gas mode, thanks to a high-pressure fuel system. However, the cost and complexity of the system prompted the industry to look for simpler alternatives. Wärtsilä (now WinGD) offered its X-DF low-speed dual fuel engine with a much simpler lowpressure Otto cycle system, but that was affected in a similar way to the Otto-cycle four strokes. MAN B&W introduced the low-pressure ME-GA in competition, but this was short-lived and was withdrawn in 2024. However, with the engine designers’ own improvements to the combustion process as well as the separate developments highlighted in programmes such as MAMII, the methane slip problem is well on track to be significantly reduced, if not eliminated altogether.

Sea-LNG’s Keller concluded: “As LNG continues to gain widespread recognition as the current practical and realistic alternative fuel pathway, it is reassuring to see growing evidence that the challenge of methane slip will be eliminated within this decade.”

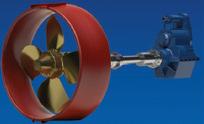

THRUSTERS AND DP CRITICAL TO WTIV OPERATION

Kongsberg Maritime is supplying power, DP control and thruster technology for a string of wind turbine installation vessels, most recently for the U.S.-built Charybdis

The first-ever Jones Act compliant offshore wind turbine installation vessel (WTIV), the Charybdis, is nearing completion at Seatrium AmFELS in Brownsville, Texas. Upon delivery, it will be owned and operated by Blue Ocean Energy Marine, a subsidiary of Dominion Energy, and will start operation on the Coastal Virginia Offshore Wind project, the largest offshore wind project in the United States.

The self-propelled, self-elevating GUSTO NG-16000XL design vessel is 144 x 56 metres and has a draught of 11.5 metres. It is equipped with a crane capable of lifting up to 2,200 tonnes and has an accommodation capacity of up to 119 people.

WTIVs have distinct operating modes (loading, sailing, DP, jacking and installation). They need to lift the complete weight of the vessel during installation operations, so power systems need to support this as well as ensuring DP, sailing and manoeuvring capabilities are maintained to the highest standard.

Kongsberg Maritime has supplied an extensive and fully integrated equipment package to Charybdis including engines, thrusters, deck machinery, electrical systems, DP, marine automation, safety, navigation, and telecommunication systems. “The integration of these systems ensures seamless operation and enhanced reliability, leveraging proven technology specifically designed for this type of vessel,” said

at Kongsberg Maritime.

The propulsion system features six Bergen Engines (B33:45L8A) and a combination of Kongsberg Maritime Z-drive and combi thrusters, providing robust and efficient manoeuvrability. The thruster models are 4 x US 305 FP Z-drive /3,200kW/3.2m propeller, 2 x ULE 355 FP Combi/3,700kW/ 3.5m propeller and 1 x UL 355 FP/3,700kW/3.5m propeller.

The electrical system includes generators, medium and low voltage switchboards, propulsion drives, transformers, shore connection, and UPS, all designed to ensure a stable and reliable power supply.

“The dynamic positioning (DP2) and thruster control systems, along with marine automation and safety systems, offer precise control and enhanced safety. Additionally, the navigation and K-Bridge systems, along with a comprehensive telecommunication suite, ensure effective communication and operational efficiency. This integrated approach highlights Kongsberg Maritime's commitment to delivering advanced and reliable solutions for the offshore wind industry.”

ABS

standard

The project was enrolled into the U.S. Coast Guard’s NVIC 10-82 and 10-92 programs which delegated the majority of statutory inspections and plan approval to ABS. Rob Langford,

ABS Vice President, Global Offshore Renewables, said the DP system is built to ABS DP2 classification requirements and is a highly redundant system that can maintain the vessel’s position even if faced with a single component failure. “With our extensive knowledge of U.S. regulations and with our longstanding offshore industry leadership, ABS is the ideal partner for the Charybdis.”

As the first Jones Act WTIV, Charybdis would be available for projects in U.S. waters, eliminating the need for foreignflagged WTIVs to have local vessels deliver turbines to them to meet Jones Act requirements. The global WTIV fleet continues to grow in size and number as offshore wind projects get underway further from shore.

In August last year, Kongsberg Maritime secured a contract from COSCO Shipping Heavy Industry to supply a package of mission-critical technology for the latest WTIV which is currently under construction for Cadeler. This is the fifth Cadeler WTIV to be built at COSCO’s Qidong yard, all equipped with Kongsberg Maritime systems.

The new GUSTO NG-20000X design vessel will have a complete electrical, automation and propulsion system from Kongsberg Maritime which features nine thrusters, all with fixed-pitch propellers. The package comprises four UUC355FP main propulsion thrusters, two ULE355FP retractable azimuth thrusters, and two TT3300DPNFP tunnel thrusters to provide additional lateral manoeuvrability.

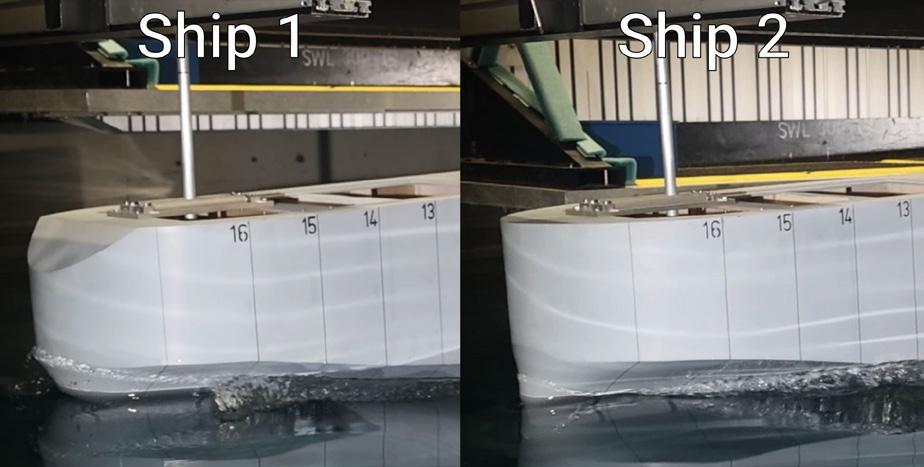

Kongsberg Maritime introduced the UUC355FP, a new member of its underwater mountable azimuth thruster range in July 2024. The thruster has a 3.7-metre propeller and 4.2MW power output. It features an integrated permanent magnet motor that delivers 81 tonnes of bollard pull while requiring less space in machine rooms than comparable systems. Other features of the new thruster included low noise operation, less lubricating oil volume, and no oil-to-sea interfaces.