LNG & ALTERNATIVE FUELS

GROWING ASIAN DEMAND FUELS RED HOT LNG MARKET Sharp recoveries in demand for energy in Asia and Europe, supply disruption and unseasonal weather have contributed to a sharp run up in seaborne LNG prices, but the long-term rise in LNG demand seems certain to continue, Kari Reinikainen hears

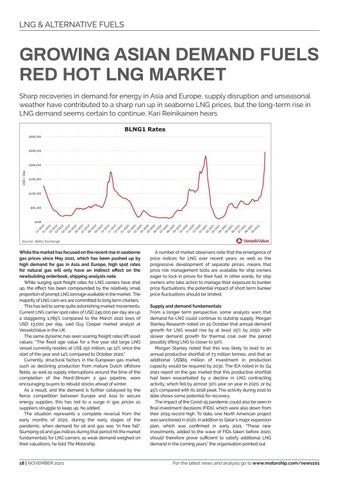

While the market has focused on the recent rise in seaborne gas prices since May 2021, which has been pushed up by high demand for gas in Asia and Europe, high spot rates for natural gas will only have an indirect effect on the newbuilding orderbook, shipping analysts note. While surging spot freight rates for LNG carriers have shot up, the effect has been compounded by the relatively small proportion of prompt LNG tonnage available in the market. The majority of LNG carri-ers are committed to long term charters. This has led to some quite astonishing market movements. Current LNG carrier spot rates of USD 245,000 per day are up a staggering 1,785% compared to the March 2021 lows of USD 13,000 per day, said Guy Cooper market analyst at VesselsValue in the UK. The same dynamic has seen soaring freight rates lift asset values: “The fixed age value for a five year old large LNG vessel currently resides at US$ 150 million, up 12% since the start of the year and 14% compared to October 2020.” Currently, structural factors in the European gas market, such as declining production from mature Dutch offshore fields, as well as supply interruptions around the time of the completion of the Nord-Stream 2 gas pipeline, were encouraging buyers to rebuild stocks ahead of winter. As a result, and the demand is further catalysed by the fierce competition between Europe and Asia to secure energy supplies, this has led to a surge in gas prices as suppliers struggle to keep up, he added. The situation represents a complete reversal from the early months of 2020, during the early stages of the pandemic, when demand for oil and gas was “in free fall”. Slumping oil and gas indices during that period hit the market fundamentals for LNG carriers, as weak demand weighed on their valuations, he told The Motorship.

18 | NOVEMBER 2021

A number of market observers note that the emergence of price indices for LNG over recent years, as well as the progressive development of separate prices, means that price risk management tools are available for ship owners eager to lock in prices for their fuel. In other words, for ship owners who take action to manage their exposure to bunker price fluctuations, the potential impact of short term bunker price fluctuations should be limited. Supply and demand fundamentals From a longer term perspective, some analysts warn that demand for LNG could continue to outstrip supply. Morgan Stanley Research noted on 25 October that annual demand growth for LNG would rise by at least 25% by 2050, with slower demand growth for thermal coal over the period possibly lifting LNG to closer to 50%. Morgan Stanley noted that this was likely to lead to an annual productive shortfall of 73 million tonnes, and that an additional US$65 million of investment in production capacity would be required by 2030. The IEA noted in its Q4 2021 report on the gas market that this productive shortfall had been exacerbated by a decline in LNG contracting activity, which fell by almost 30% year on year in 2020, or by 45% compared with its 2018 peak. The activity during 2021 to date shows some potential for recovery. The impact of the Covid-19 pandemic could also be seen in final investment decisions (FIDs), which were also down from their 2019 record high. To date, one North American project was sanctioned in 2020, in addition to Qatar’s major expansion plan, which was confirmed in early 2021. “These new investments, added to the wave of FIDs taken before 2020, should therefore prove sufficient to satisfy additional LNG demand in the coming years,” the organisation pointed out.

For the latest news and analysis go to www.motorship.com/news101