Your Medicare Advisor

What You Can Expect to Pay for Medicare Services in 2016

By Diana Wisniewski

E

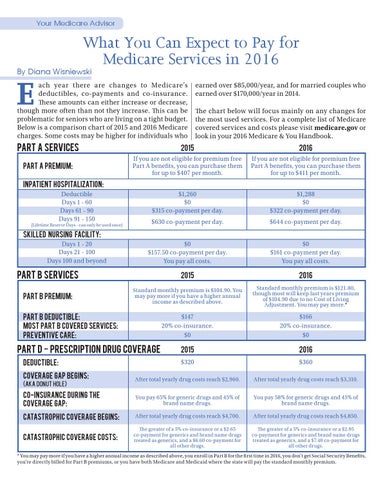

ach year there are changes to Medicare’s deductibles, co-payments and co-insurance. These amounts can either increase or decrease, though more often than not they increase. This can be problematic for seniors who are living on a tight budget. Below is a comparison chart of 2015 and 2016 Medicare charges. Some costs may be higher for individuals who

earned over $85,000/year, and for married couples who earned over $170,000/year in 2014. The chart below will focus mainly on any changes for the most used services. For a complete list of Medicare covered services and costs please visit medicare.gov or look in your 2016 Medicare & You Handbook.

Part A Services

2015

2016

Part A Premium:

If you are not eligible for premium free Part A benefits, you can purchase them for up to $407 per month.

If you are not eligible for premium free Part A benefits, you can purchase them for up to $411 per month.

$1,260 $0 $315 co-payment per day.

$1,288 $0 $322 co-payment per day.

$630 co-payment per day.

$644 co-payment per day.

$0 $157.50 co-payment per day. You pay all costs.

$0 $161 co-payment per day. You pay all costs.

Part B Services

2015

2016

Part b Premium:

Standard monthly premium is $104.90. You may pay more if you have a higher annual income as described above.

Standard monthly premium is $121.80, though most will keep last years premium of $104.90 due to no Cost of Living Adjustment. You may pay more.*

$147 20% co-insurance.

$166 20% co-insurance.

$0

$0

2015

2016

$320

$360

Coverage Gap Begins:

After total yearly drug costs reach $2,960.

After total yearly drug costs reach $3,310.

Co-Insurance during the Coverage Gap:

You pay 65% for generic drugs and 45% of brand name drugs.

You pay 58% for generic drugs and 45% of brand name drugs.

Catastrophic Coverage Begins:

After total yearly drug costs reach $4,700.

After total yearly drug costs reach $4,850.

Catastrophic Coverage Costs:

The greater of a 5% co-insurance or a $2.65 co-payment for generics and brand name drugs treated as generics, and a $6.60 co-payment for all other drugs.

The greater of a 5% co-insurance or a $2.95 co-payment for generics and brand name drugs treated as generics, and a $7.40 co-payment for all other drugs.

Inpatient Hospitalization: Deductible Days 1 - 60 Days 61 - 90 Days 91 - 150

(Lifetime Reserve Days - can only be used once)

Skilled Nursing Facility: Days 1 - 20 Days 21 - 100 Days 100 and beyond

Part B Deductible: Most Part B Covered Services: Preventive Care:

Part D - Prescription drug coverage Deductible: (aka Donut Hole)

* You may pay more if you have a higher annual income as described above, you enroll in Part B for the first time in 2016, you don’t get Social Security Benefits, you’re directly billed for Part B premiums, or you have both Medicare and Medicaid where the state will pay the standard monthly premium.