THE

Podcast

May 2025

REGULATORY 15/15

Podcast

May 2025

REGULATORY 15/15

+1 345 814 5666

chris.capewell@maples.com

+1 345 814 5155 anthony.mourginos@maples.com

345 814 6144

• Private Funds – Fund Annual Returns

• Corporate Governance Compliance

• Anti-Money Laundering Compliance

• Virtual Asset Service Providers Regime Update

• Beneficial Ownership Reminder

• Common Reporting Standard Update

• A 15-minute summary of the latest developments in the regulatory laws of the Cayman Islands released on the 15th day of every month

• A copy of the previous 15/15 released on 15 March can be accessed on our website: Maples 15/15

• Comments and suggestions to format of the 15/15 are always welcome –please email speakers directly

• Fund Annual Return ("FAR"): is an annual filing required by the Cayman Islands Monetary Authority ("CIMA") for all regulated investment funds (mutual and private funds)

• Deadline: six months after the financial year-end of the fund. Funds with a 31 December 2024 year-end must file by 30 June 2025

• Documents required to be filed on CIMA's Portal - REEFS:

• CIMA FAR form

• Audited financial statements

• Operator declaration (private funds only)

• The FAR form is a Microsoft Excel-based tool used to capture general, operating, investor and financial information for each fund

• Local Cayman Islands auditor or other designated party must file the FAR on behalf of the fund

• The fund operator (directors, trustee or general partner depending on how the fund is structured) are ultimately is responsible for completing the FAR

• Following filing, a CIMA filing fee is required to be paid

• Exemptions for newly registered funds

• Funds that have not accepted capital or commenced investment activity may be eligible for an audit waiver for their first financial year. A signed declaration must be submitted to CIMA, confirming that the fund was inactive during the period and is seeking an audit waiver

• Newly registered funds may benefit from an extended first audit period of up to 18 months from the date of registration instead of the standard 12 months, allowing more time before their first audit and FAR filing is due

• Operator meetings

• To comply with CIMA's regulatory framework, at least one operator meeting must be held during the fund's reporting period or before the FAR is filed

• Private and mutual fund FARs

• Mutual and private fund FAR requirements are different in terms of the FAR form used and who can file it

• October 2023 – CIMA Rule on Corporate Governance for Regulated Entities

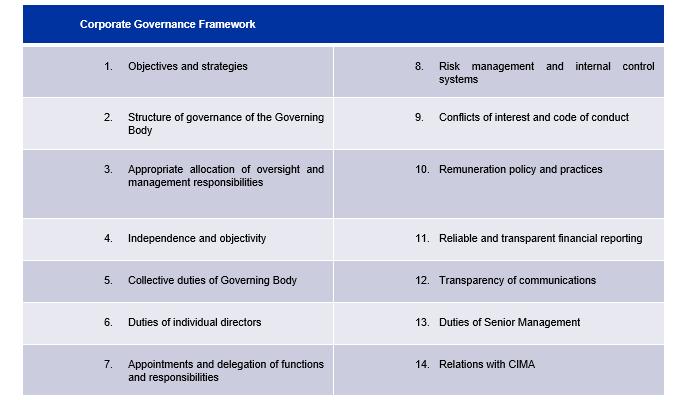

• Regulated entities (including regulated funds) required to establish, implement, and maintain a corporate governance framework that provides sound and prudent management oversight of the regulated entity's business and protects the legitimate interests of relevant stakeholders

• Regulated entities must undertake an annual review and evaluation of several prescribed aspects of their corporate governance framework

• Once a year, the governing body should:

• Review strategic objectives and policies and revise as appropriate / evaluate progress towards achieving strategic objectives

• Review composition of the governing body

• Undertake self-assessments of the governing body as a whole and individual members, documenting and remedying any deficiencies

• Review the implementation of risk assessment and risk management systems

• Review the implementation of internal controls

• Where applicable, review the remuneration policy for senior management

• Cayman Islands entities conducting "relevant financial business" as defined under the Proceeds of Crime Act (As Revised) are subject to the Cayman Islands AML Regime, including the requirement to maintain and implement appropriateAML policies and procedures

• There has been an enhanced emphasis on AML enforcement and prosecution in the Cayman Islands and other jurisdictions

• Interesting to note Public Prosecutor v Zheng Jia [2025] SGHC 76

• Singapore decision regarding the directors of a corporate services provider that offered locally resident director services and assisted with the opening of bank accounts

• Directors failed to conduct adequate due diligence and to monitor client transactions initially leading to the imposition of fines and ban on acting as a director or partaking in company management

• Prosecution appealed the trial decision seeking the imposition of custodial sentence and succeeded leading to directors' incarceration

• 1 April 2025 – Phase 2 of the Virtual Asset Service Providers ("VASP") legislative framework commenced

• All VASPs providing virtual asset custody and virtual asset trading platform services in or from the Cayman Islands required to obtain a licence

• Within 90 days, a currently registered person engaged in the provision of either of these activities required to apply for a licence under new regime

• Additionally, certain new operational requirements apply to all VASPs

• Have at least three directors (one independent)

• Seek CIMA's prior approval of business plan changes

• Notify CIMA of litigation within 30 days

• Where holding fiat currency on behalf of clients, hold that fiat currency in an account in a regulated bank

• Misrepresentations about virtual asset activities now an offence

• 30 March 2025 - CIMA published the Supervisory Circular – practical information for VASPs. Key points:

• Application process for registrations remains the same

• Existing registrants that must now license will be contacted by CIMA directly

• New licensees must apply through CIMA's REEFS online platform

• Consult CIMA's VASP Licensing and Waiver Application Checklist

• New applicants are encouraged to schedule a meeting with CIMA and review CIMA's Rule, Statement of Guidance and Regulatory Policy for VASPs

• Entities engaged in virtual asset services that are not registered / licenced / granted a waiver will be subject to penalties and cease and desist orders

• 14 March 2025 – CIMA released a new Private Sector Consultation Paper on proposed Rule and Regulatory Procedure – Cancellation of Licences or Registrations for VASPs

• Currently no established procedures for the cancellation of a VASP's licence or registration – these new measures address that gap

• Provides procedure for VASPs that are ceasing to operate, never initiated business, relocating or otherwise voluntarily surrendering.

• General conditions:

• Good standing (fees, filed all audits / accounts, no unresolved reg obligations with CIMA – specifically mentions CIMA will check for any outstanding AML Survey / Travel Rule Reports, onsite inspection reports, pending requests for change of ownership / officers)

• AML compliance (specific confirmation from AMLCO that all AML procedures complied with and finalised including no suspicious transactions remaining under review)

• Stakeholder communications (clients informed and confirmation that all relevant agreements / relationships cancelled and no ongoing obligations or liabilities)

• The multi-pronged approach – BOTA regime is premised on the understanding that all parties to the regime (CSP, Legal Person, BOs and Competent Authority) are all effectively working together to present the required information

• BOTA provides for different notice obligations on different parties:

• CSPs – required to issue notices in circumstances where breaches have occurred (or are deemed to have occurred). In certain circumstances, CSPs are then under further obligations to issue Restriction Notices against particular interests

• Legal Persons – required to issue notices to BOs (or potential BOs) to obtain or confirm required particulars, if they haven't been confirmed already. Important

– this notice operates to protect Legal Persons in some circumstances against penalty where they can demonstrate that any delay has been effectively caused by the BO in failing to provide the information requested

• BOs – equivalent obligations to notify of changes and respond to notices to confirm required particulars (or confirm not a BO).

• 31 March 2025 - TIA published the updated lists of CRS Participating Jurisdictions and CRS Reportable Jurisdictions in the CI Gazette

• Armenia, Georgia, Kazakhstan, Moldova, and Ukraine added to the list of Participating Jurisdictions

• Saint Kitts and Nevis added to the list of Reportable Jurisdictions for reports due in 2025 and onwards

• Cameroon and Mongolia added to the list of Reportable Jurisdictions for reports due in 2026 onwards

• Tunisia is now included under reports due in 2026 onwards instead of 2025 onwards

• Reminder on enforcement

This presentation was presented on, and is only accurate to, [ ] May 2025. The information within this presentation is provided for general guidance only, is not intended to be comprehensive and does not constitute legal advice or give rise to an attorney / client relationship.

Specialist legal advice should be taken in relation to specific circumstances. If you require legal advice, please reach out to your usual Maples and Calder contact.

Published by Maples and Calder (Cayman) LLP.