4 minute read

Residential News

Habitat for Humanity International to Address Black Homeownership Gap

Habitat for Humanity International is launching an initiative to address the racial homeownership gap. Habitat’s Advancing Black Homeownership initiative “deepens our commitment to increase homeownership opportunities for Black individuals and families — and address the racial and systemic bias that has stymied access to homeownership for generations — through programs that will help end the social and economic disparity many Black people and communities of color continue to face,” the organization said in the announcement.

Leveraging funds provided in part by philanthropist MacKenzie Scott’s $436 million donation, Habitat is initially investing more than $25 million over the next three to five years — with a goal of raising $100 million or more — to develop and launch a slate of new programs, including an equitable commercial lending strategy and property acquisition fund through Habitat Mortgage Solutions.

Realogy Completes Rebrand to “Anywhere”

Say goodbye to Realogy and hello to Anywhere, as the residential real estate services company has completed its corporate rebrand. Shares of Anywhere’s common stock now trade on the New York Stock Exchange (NYSE) under the ticker symbol HOUS. The company’s CUSIP number remains unchanged.

The Anywhere rebrand reflects a broader strategic shift for the company, which is home for real estate brands including Better Homes and Gardens Real Estate, Century 21, Coldwell Banker, Corcoran, ERA and Sotheby’s International Realty as well as national title, settlement, and relocation companies and scaled mortgage origination and underwriting joint ventures. The company has placed a strong emphasis on building a more simplified, digitized and integrated home buying and selling experience, it said.

The new logo features an icon inspired by an eight-stroke asterisk that has been modified as a sun rising above a home’s roofline.

Jungreis and Rosewood Realty Broker Strulovitch’s 13-Building Portfolio at Bankruptcy Auction

Rosewood Realty Group’s Aaron Jungreis, Greg Corbin and Chaya Milworn brokered the $19.6 million auction sale of a 13-building portfolio in Brooklyn. Marvin Azrak, Joel Wertzberger, and Josef Mikkelson were the winners of the auction.

The 13 properties were part of Chaskiel Strulovitch’s 31-building portfolio. The bankruptcy sale included: 1125-1133 Greene Ave., 1213 Jefferson Ave., 568 Willoughby Ave., 618 Lafayette Ave., 834 Metropolitan Ave., 92 South 4th St., 325 Franklin Ave., 53 Stanhope St. and 263 18th St. The auction stretched over two days and consisted of 142 rounds of bidding.

According to Corbin, there were 11 registered bidders who signed 27 contracts for the portfolio in bulk and for individual properties. A bundle of five propertles are contiguous. “The properties appealed to a vast range of investors,” said Milworn. “We worked with buyers who viewed it as a value-add multifamily or as condo conversions.”

Photo courtesy of NYSE

Photo courtesy of Rosewood Realty

Concord Summit Capital Closes $269M Construction Loan on Florida Condos

Concord Summit Capital LLC has arranged a $269 million construction loan for Nautilus 220, a 330-unit luxury condominium project that is the first of its kind in Palm Beach County’s Town of Lake Park. The borrower, Forest Development, is developing 24-story twin condo towers on the water with a restaurant from chef David Burke (his first in Florida) and many amenities in the town just across the Intracoastal Waterway from Singer Island. Fortress Investment Group provided the loan to the Peter Baytarian-led Forest, which recently brought on Daniel Kodsi of Royal Palm Companies as a co-general partner in Nautilus 220.

Construction is underway, with an estimated completion in the second quarter of 2024. The project’s floating sales center is located on a barge in the Lake Park marina. Concord Summit Director Justin Morrow and Managing Director Kevin O’Grady, both of Concord Summit’s Miami office, sourced the financing on behalf of the borrowers.

New York Area Residential Sales Increase by 15.8% in June 2022

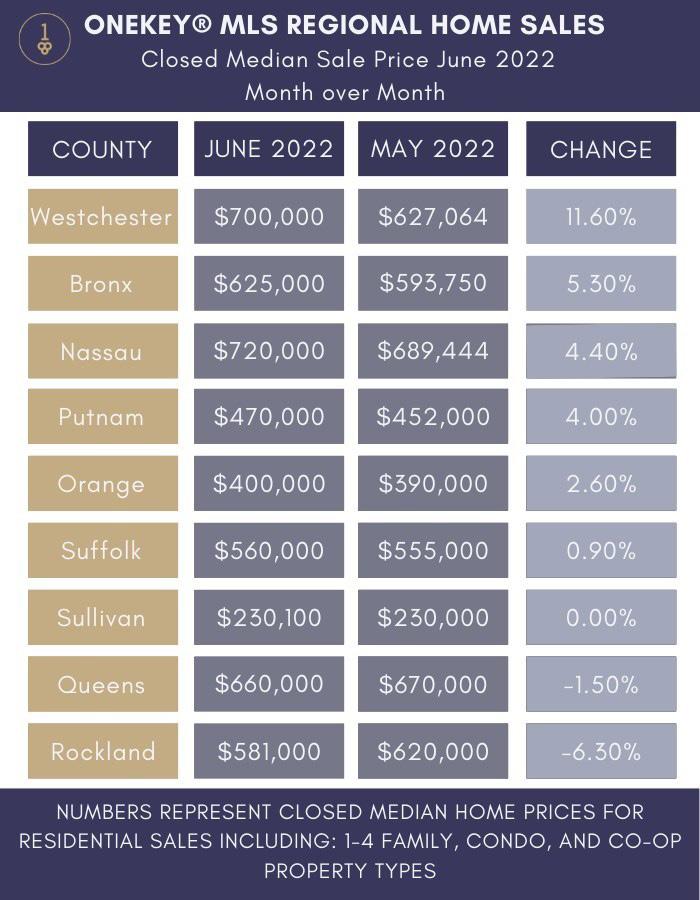

Despite rising mortgage rates, housing demand remains high for New York real estate and supply remains low. The result is that the number of New York regional residential sales transactions between June 2022 rose 15.8% over the previous month’s figures, reported OneKey MLS.

The closed median sale price was $615,000, representing a 1.7% increase over the reported $605,000 in May 2022.

Six of nine counties reported an increased closed median sale price while two of nine counties reported a decrease and one reported no change. Westchester (11.6%), Bronx (5.3%), Nassau (4.4%), Putnam (4%), Orange (2.6%), and Suffolk (0.9%) had month-over-month increases in closed median sale price.

373 Palmetto Launches Sales in Bushwick

Sales for 373 Palmetto, Bushwick’s newest ground-up condominium, have officially commenced, announced The InHouse Group.

The five-story, design-driven boutique building’s light-filled residences have been meticulously crafted to create a modern, yet warm, aesthetic anchored by soaring ceilings and a serene color palette. This increased focus on design, as well as strategic decision to incorporate communal, outdoor spaces, landscaped and outfitted with seating areas, addresses both the increased demand for luxury housing in the area, as well as the amenities and design details that today’s buyers crave.

Envisioned by Abell Design, the condominium’s façade is composed of contemporary Roman brick, creating a point of resonance with the surrounding buildings as well as the classic pre-war architecture for which New York is known.

Nautilus 220

Photos courtesy of Concord Summit

Photo via PRNewswire

373 Palmetto