10th June 2022

MADARA Cosmetics AS

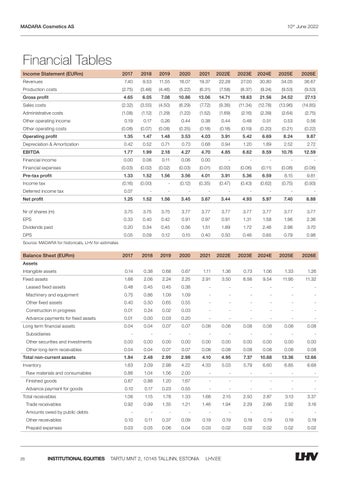

Financial Tables Income Statement (EURm) Revenues Production costs

2017

2018

2019

2020

2021

2022E

2023E

2024E

2025E

2026E

7.40

9.53

11.55

16.07

19.37

22.28

27.00

30.80

34.05

36.67

(2.75)

(3.48)

(4.46)

(5.22)

(6.31)

(7.58)

(8.37)

(9.24)

(9.53)

(9.53)

Gross profit

4.65

6.05

7.08

10.86

13.06

14.71

18.63

21.56

24.52

27.13

Sales costs

(2.32)

(3.55)

(4.50)

(6.29)

(7.72)

(9.36)

(11.34)

(12.78)

(13.96)

(14.85)

Administrative costs

(1.08)

(1.12)

(1.29)

(1.22)

(1.52)

(1.69)

(2.16)

(2.39)

(2.64)

(2.75)

0.19

0.17

0.26

0.44

0.38

0.44

0.48

0.51

0.53

0.56

Other operating income

(0.08)

(0.07)

(0.08)

(0.25)

(0.18)

(0.18)

(0.19)

(0.20)

(0.21)

(0.22)

Operating profit

Other operating costs

1.35

1.47

1.48

3.53

4.03

3.91

5.42

6.69

8.24

9.87

Depreciation & Amortization

0.42

0.52

0.71

0.73

0.68

0.94

1.20

1.89

2.52

2.72

EBITDA

1.77

1.99

2.18

4.27

4.70

4.85

6.62

8.59

10.76

12.59

Financial income

0.00

0.06

0.11

0.06

0.00

-

-

-

-

-

(0.03)

(0.02)

(0.02)

(0.03)

(0.01)

(0.00)

(0.06)

(0.11)

(0.08)

(0.06)

1.33

1.52

1.56

3.56

4.01

3.91

5.36

6.59

8.15

9.81

Financial expenses Pre-tax profit Income tax

(0.16)

(0.00)

-

(0.12)

(0.35)

(0.47)

(0.43)

(0.62)

(0.75)

(0.93)

Deferred income tax

0.07

-

-

-

-

-

-

-

-

-

Net profit

1.25

1.52

1.56

3.45

3.67

3.44

4.93

5.97

7.40

8.88

Nr of shares (m)

3.75

3.75

3.75

3.77

3.77

3.77

3.77

3.77

3.77

3.77

EPS

0.33

0.40

0.42

0.91

0.97

0.91

1.31

1.58

1.96

2.36

Dividends paid

0.20

0.34

0.45

0.56

1.51

1.89

1.72

2.46

2.98

3.70

DPS

0.05

0.09

0.12

0.15

0.40

0.50

0.46

0.65

0.79

0.98

2017

2018

2019

2020

2021

2022E

2023E

2024E

2025E

2026E

0.14

0.38

0.68

0.67

1.11

1.36

0.73

1.06

1.33

1.26

Source: MADARA for historicals, LHV for estimates

Balance Sheet (EURm) Assets Intangible assets Fixed assets

1.66

2.06

2.24

2.25

2.91

3.50

6.56

9.54

11.95

11.32

0.48

0.45

0.45

0.38

-

-

-

-

-

-

Machinery and equipment

0.75

0.86

1.09

1.09

-

-

-

-

-

-

Other fixed assets

0.40

0.50

0.65

0.55

-

-

-

-

-

-

Construction in progress

0.01

0.24

0.02

0.03

-

-

-

-

-

-

0.01

0.00

0.03

0.20

-

-

-

-

-

-

0.04

0.04

0.07

0.07

0.08

0.08

0.08

0.08

0.08

0.08

Leased fixed assets

Advance payments for fixed assets Long term financial assets Subsidiaries Other securities and investments Other long-term receivables

-

-

-

-

-

-

-

-

-

-

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.04

0.04

0.07

0.07

0.08

0.08

0.08

0.08

0.08

0.08

Total non-current assets

1.84

2.48

2.99

2.98

4.10

4.95

7.37

10.68

13.36

12.66

Inventory

1.63

2.09

2.98

4.22

4.33

5.03

5.79

6.60

6.85

6.68

Raw materials and consumables

0.86

1.04

1.56

2.00

-

-

-

-

-

-

Finished goods

0.67

0.88

1.20

1.67

-

-

-

-

-

-

Advance payment for goods

0.10

0.17

0.23

0.55

-

-

-

-

-

-

1.06

1.15

1.78

1.33

1.68

2.15

2.50

2.87

3.13

3.37

0.92

0.99

1.35

1.21

1.46

1.94

2.29

2.66

2.92

3.16

-

-

-

-

-

-

-

-

-

-

Other receivables

0.10

0.11

0.37

0.09

0.19

0.19

0.19

0.19

0.19

0.19

Prepaid expenses

0.03

0.05

0.06

0.04

0.03

0.02

0.02

0.02

0.02

0.02

Total receivables Trade receivables Amounts owed by public debts

28

INSTITUTIONAL EQUITIES

TARTU MNT 2, 10145 TALLINN, ESTONIA

LHV.EE