88

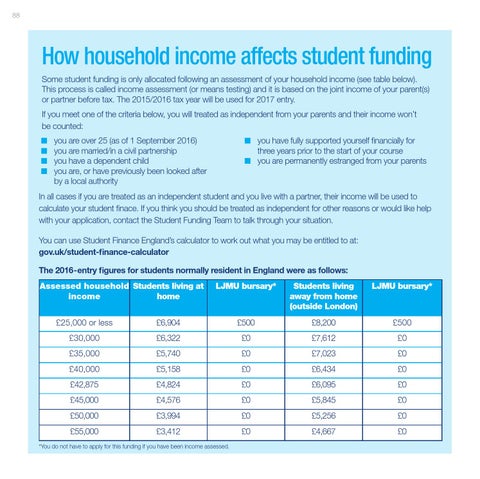

How household income affects student funding Some student funding is only allocated following an assessment of your household income (see table below). This process is called income assessment (or means testing) and it is based on the joint income of your parent(s) or partner before tax. The 2015/2016 tax year will be used for 2017 entry. If you meet one of the criteria below, you will treated as independent from your parents and their income won’t be counted: n n n n

you are over 25 (as of 1 September 2016) you are married/in a civil partnership you have a dependent child you are, or have previously been looked after by a local authority

n you have fully supported yourself financially for

three years prior to the start of your course

n you are permanently estranged from your parents

In all cases if you are treated as an independent student and you live with a partner, their income will be used to calculate your student finace. If you think you should be treated as independent for other reasons or would like help with your application, contact the Student Funding Team to talk through your situation. You can use Student Finance England’s calculator to work out what you may be entitled to at: gov.uk/student-finance-calculator The 2016-entry figures for students normally resident in England were as follows: Assessed household Students living at income home

LJMU bursary*

Students living away from home (outside London)

LJMU bursary*

£25,000 or less

£6,904

£500

£8,200

£500

£30,000

£6,322

£0

£7,612

£0

£35,000

£5,740

£0

£7,023

£0

£40,000

£5,158

£0

£6,434

£0

£42,875

£4,824

£0

£6,095

£0

£45,000

£4,576

£0

£5,845

£0

£50,000

£3,994

£0

£5,256

£0

£55,000

£3,412

£0

£4,667

£0

*You do not have to apply for this funding if you have been income assessed.

front end 17.indd 88

11/04/2016 15:29