3 minute read

Lighting Contractors Beware: The Highs and Lows of the EV Charging Market

In previous issues, we have written extensively about growing EV charging opportunities and how lighting maintenance contractors can capitalize on those opportunities. Here, we offer a word of caution.

The Administration’s recent announcement of a $46.5 million investment into the EV charging infrastructure presents a complex picture for contractors in the business of installing these chargers. On one hand, there’s a clear commitment by the government to expand America’s electric vehicle (EV) charging network, with an ambitious goal to construct 500,000 public EV charging ports by 2030 and move towards net-zero emissions by 2050. This funding is directed towards enhancing charging performance, resilience, and reliability, while also fostering job growth in the clean energy sector.

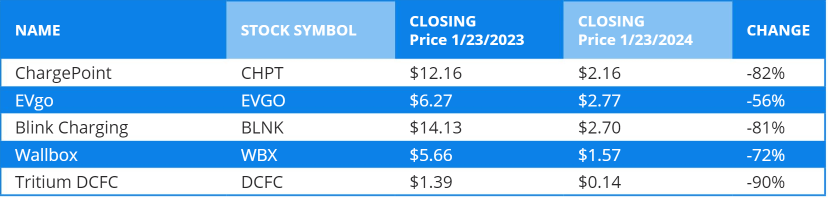

However, the current financial health of companies within the EV charging industry tells a different story. Despite the increase in EVs on the road and the government’s investment in charging infrastructure, companies like ChargePoint Holdings, Blink Charging, and EVgo have seen their share prices plummet, with significant losses and missed revenue projections. These companies don’t anticipate profitability for about another year, and the pressure is mounting with the possibility of Tesla opening its charging network to other EVs.

For lighting contractors, this represents a cautionary tale. While the demand for charging stations is growing, the profitability of installing them isn’t guaranteed—or even getting paid for your labor. The industry faces challenges that include customer uncertainty, economic downturns, higher costs, delayed EV deliveries, and the need for a critical mass of EV drivers to make the business model viable.

McKinsey estimates suggest that 1.5 million public chargers are needed by 2030 to keep pace with EV sales, yet the U.S. currently has only about 159,000 public charging ports.

Tesla’s aggressive expansion of its charging network adds another layer of competition, as they continue to add thousands of fast chargers. Other big players, such as BP, Shell, Walmart, and various automakers, are also entering the charging network space, either by partnering with existing providers or starting their own networks.

However, what happens if the demand for EV chargers plummets?

Tesla’s stock price has come crashing back down to earth. It began the year at about $250. As of this writing, the stock was at $182. There is other bad news. Hertz ordered 100,000

Teslas in 2021 and has sold-off about 30% of them, taking a $245 million charge against its earnings. Its pledge to buy 175,000 EVs from GM seems unlikely to happen.

A Wall Street Journal article says truck maker Rivian lost $33,000 on every electric vehicle it built in the second quarter of 2023.

Perhaps Toyota has the winning strategy—hybrids. And many hybrid drivers (myself included) don’t use public charging stations. We simply charge at home.

For electrical contractors, this means navigating an evolving landscape with cautious optimism. While there is growth and the promise of an electric future, the market is still finding its footing. The expansion is not without its risks, and contractors need to be prepared for the long game, where market consolidation and partnerships with financially solid companies might prove to be the most sustainable path forward.

Perhaps lighting maintenance contractors are the big winners, after all. If EV makers are losing money and EV charging companies are losing money, the lighting maintenance contractors can laugh all the way to the bank— if they get paid. ■