6 minute read

Is the LED Market Saturated?

What the Data Says, and How You Can Win the Next Wave

By Parker Allen

Editor’s note: The analysis and examples in this article are adapted from Jeff Seifert’s Spring Seminar Learning Lab and recent webinar; the U.S. DOE’s 2024 U.S. Lighting Market Characterization (2020 baseline); and DNV’s 2024 LightingPLUS Market Characterization

It’s a question that’s starting to echo more frequently in industry circles. After more than a decade of widespread adoption, billions in investment, and near-universal awareness, some contractors and suppliers are beginning to wonder whether the retrofit boom is winding down.

The commercial market is two-thirds of the way through the first great retrofit cycle, but a sizeable tail of legacy stock remains, and an even larger second act, LED-to-LED replacements with controls, is now coming into view.

A DECADE OF TRANSFORMATION

The U.S. Department of Energy’s Lighting Market Characterization (LMC) shows how quickly LEDs took hold. They went from a rounding-error “other” category in 2010, to 10% commercial penetration in 2015, and 47% by 2020 (average across building types).

By 2025, that figure will likely climb to two-thirds (Figure 1), though we won’t know how accurate this projection is until data from this year is gathered.

Independent utility-sector research reaches a similar conclusion. DNV’s LightingPLUS Market Characterization (2) places legacy replacement saturation on a trajectory that flattens in the mid-80% range, implying meaningful runway still ahead.

And within the vast retrofit landscape lies another important distinction: not all LED installs are created equal. The earliest systems are now aging, with components like drivers beginning to fail. Controls, if they were included at all, often lack the intelligence or integration potential that today’s building owners demand.

The result? A market that isn’t saturated so much as it is shifting.

A NEW WAVE OF OPPORTUNITY

Once driven largely by the promise of simple energy savings, the market has since matured. We’re now seeing a new wave, one that’s focused on refreshing early LEDs and layering in advanced controls.

This new wave is taking shape just as market forces align to support it. Electricity rates are on the rise, and national grid demand is growing quickly, fueled by electrification and data center expansion.

Utility rebate programs remain strong, with the majority of U.S. regions still offering incentives for both LED and control installations (Figure 2). And at the same time, mandates, such as legacy bans and ESG reporting requirements, are nudging building owners to revisit lighting as a lever for compliance and cost control.

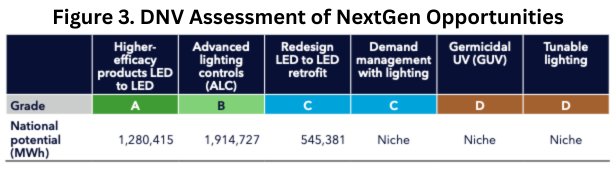

DNV’s assessmentii highlights the “next-gen” opportunity (Figure 3):

A. higher-efficacy LED replacements of early LEDs

B. adding advanced lighting controls, with LLLC commonly offering a more favorable payback profile than traditional networked controls.

C. design-level re-retrofits when ceilings, distribution, or visual goals change.

In practice, much of the currently installed base reaches end-of-useful life in staggered cohorts over the next decade, creating rolling windows for re-retrofit campaigns. As Seifert explained, the roughly 8.9 billion sq ft completed prior to 2015 “started running out of gas” around 2017 and will continue doing so through the 2030s; wave-two square footage follows on its heels starting in the early-to-mid 2020s (Figure 4).

Technically, while LED chips often claim 100,000+ hours, drivers and lumen output degradation typically limit real-world system life (~50–60k hours), bringing many two-shift facilities to refresh within 5–8 years, even before outright failures occur.

LESSONS FOR LM&M PROFESSIONALS

This evolving landscape calls for a pivot in approach, not a retreat. The biggest opportunities may lie not in cold leads, but in warm ones—past customers whose systems are approaching the end of their useful life.

Understanding real-world component lifespans is key.

While LED chips often boast long runtimes, drivers are frequently the first point of failure, particularly in high-use environments like warehouses or manufacturing. That’s where preventive service contracts, maintenance audits, and warranty tracking can evolve into a smart prospecting strategy.

At the same time, controls offer an opening to deepen value and differentiate services. Utility programs increasingly reward advanced control installations with higher rebates, and building owners are eager for functionality that aligns with modern needs. Think task tuning, integration with building automation systems, and data capture for ESG reporting.

This new phase also demands a broader value story. Energy savings alone may not be enough to close a deal, but combine them with maintenance reduction, tax advantages like §179D, improved occupant experience, and alignment with sustainability goals—and the case becomes compelling.

THE WORK ISN’T DONE

It’s tempting to look at a market that’s already halfway through its LED transformation and assume the work is behind us. But, as Seifert pointed out, we’re really just in the middle of the journey. The buildings that embraced LED early are now ready for their next evolution. The sectors that lagged are ripe for a first pass. And a new set of forces—economic, regulatory, and technological—is priming the market for continued investment.

The LED boom may have changed form, but it hasn’t run out of steam. For LM&M professionals willing to adapt, a robust, and perhaps more strategic, future awaits.

Sources

1 “2020 U.S. Lighting Market Characterization” (April 2024). U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy. https://www.energy.gov/ sites/default/files/2024-08/ssl-lmc2020_apr24.pdf

2 “LightingPLUS Market Characterization” (13 February 2025). DNV. https://www.dnv.com/publications/lightingplus-market-characterization/

3 “RebatePro for Lighting” (accessed August 2025). Briteswitch. https://briteswitch.com/rebatepro-for-lighting.php