Prepared for:

Linda Degnan & Tim Young

Property(s)

16276 Hiram Ave

Oregon City, OR 97045

This Packet Includes:

• Trio (s)

• Topo Map

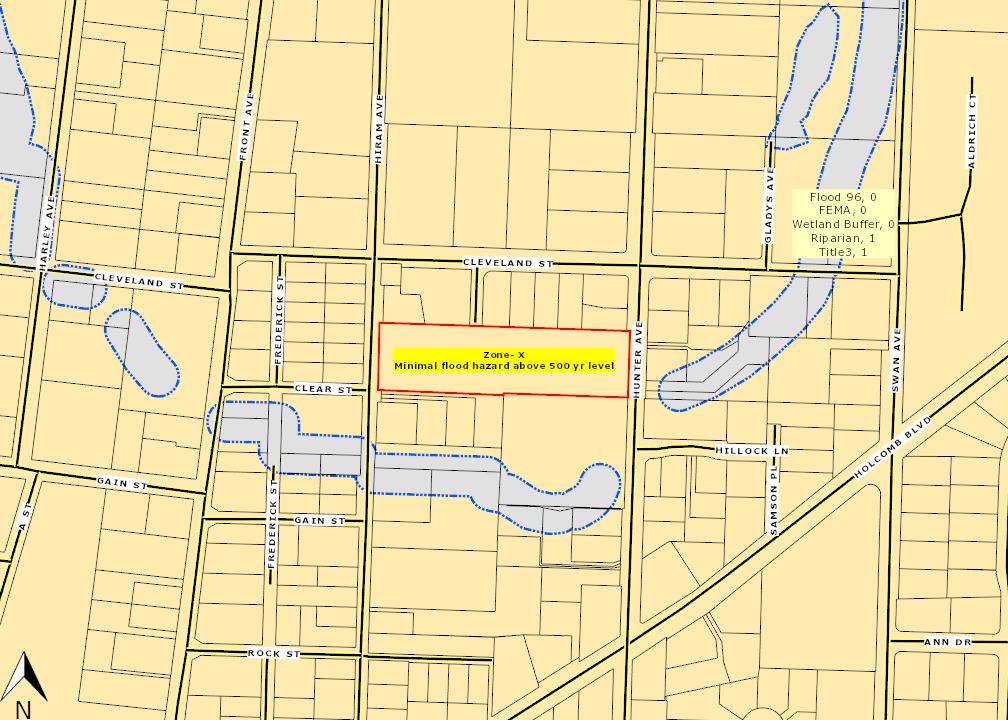

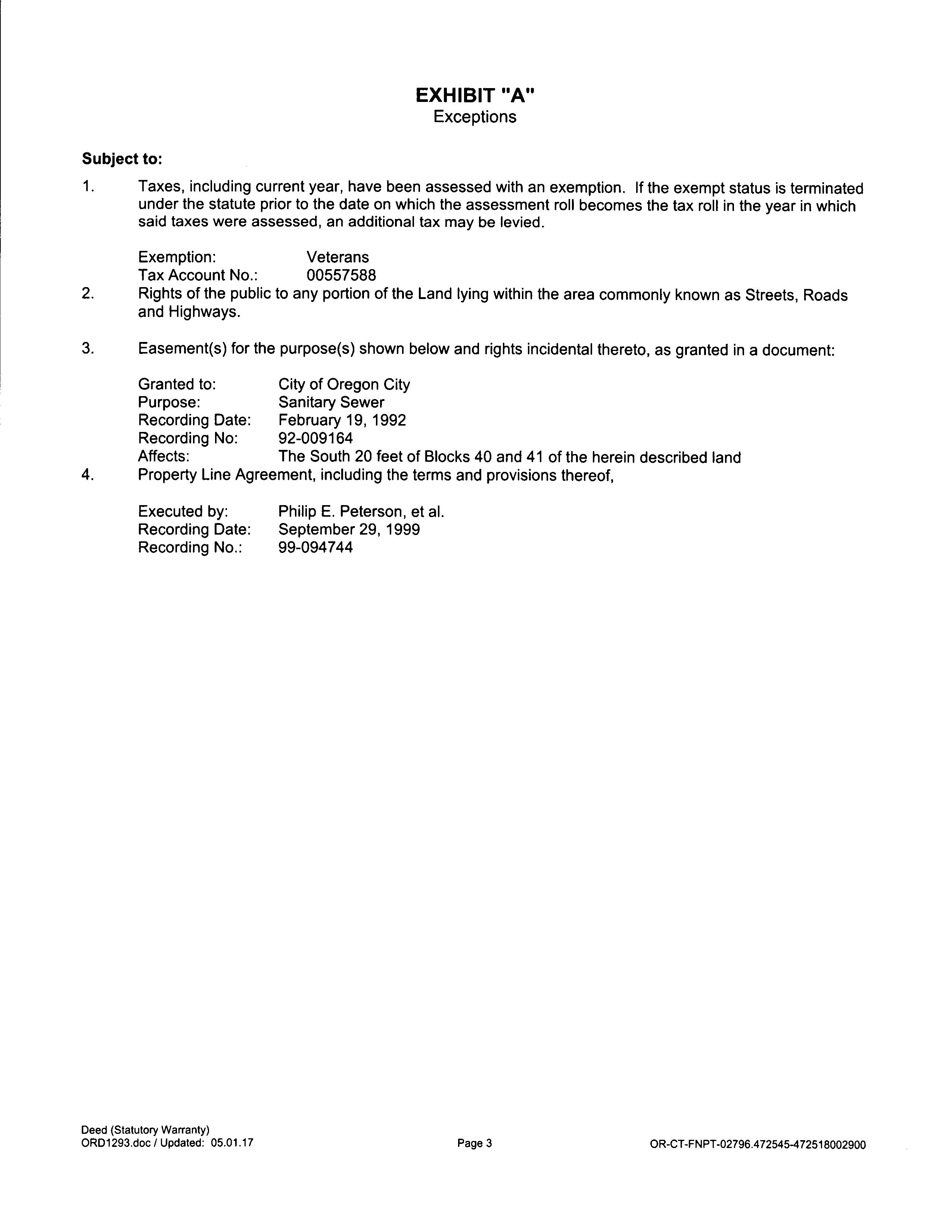

• Flood Map

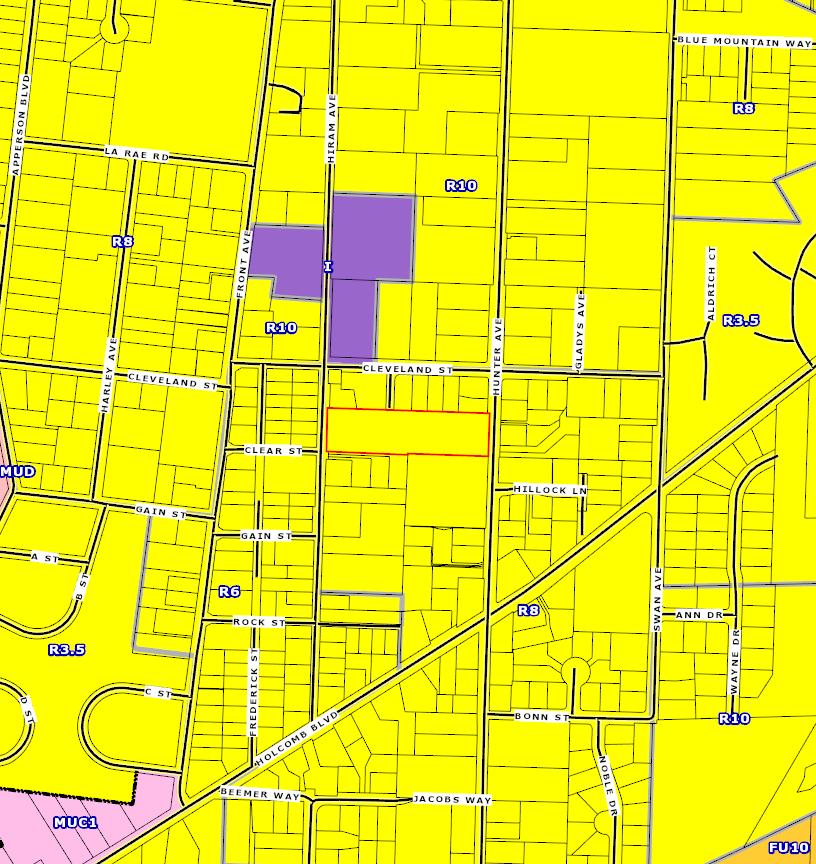

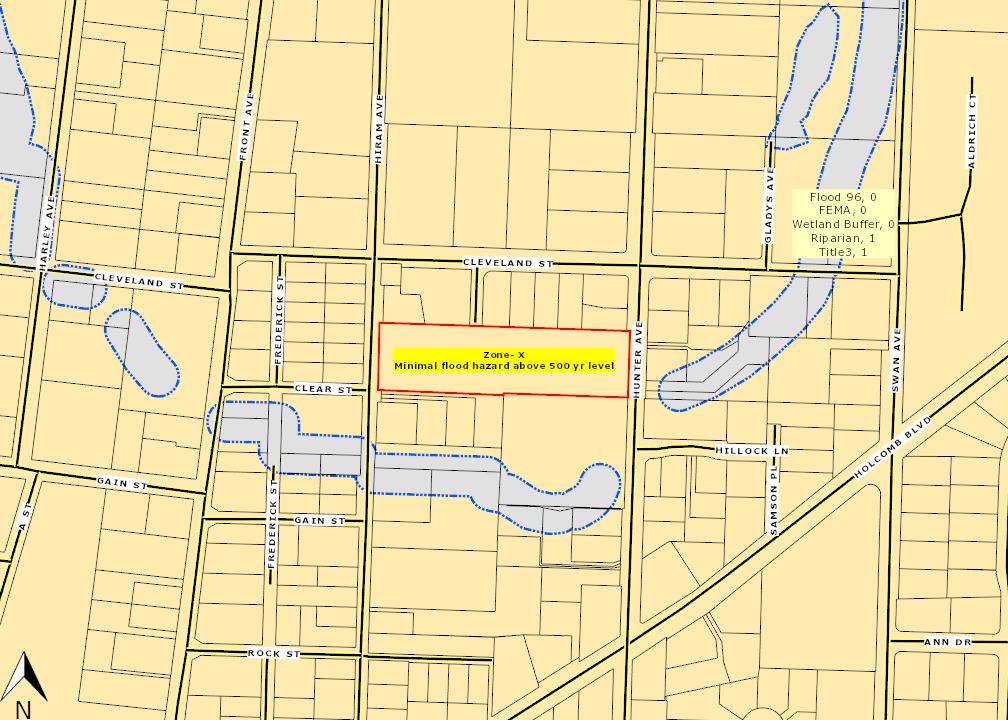

• Zoning Map

• Zoning Code - R8

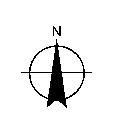

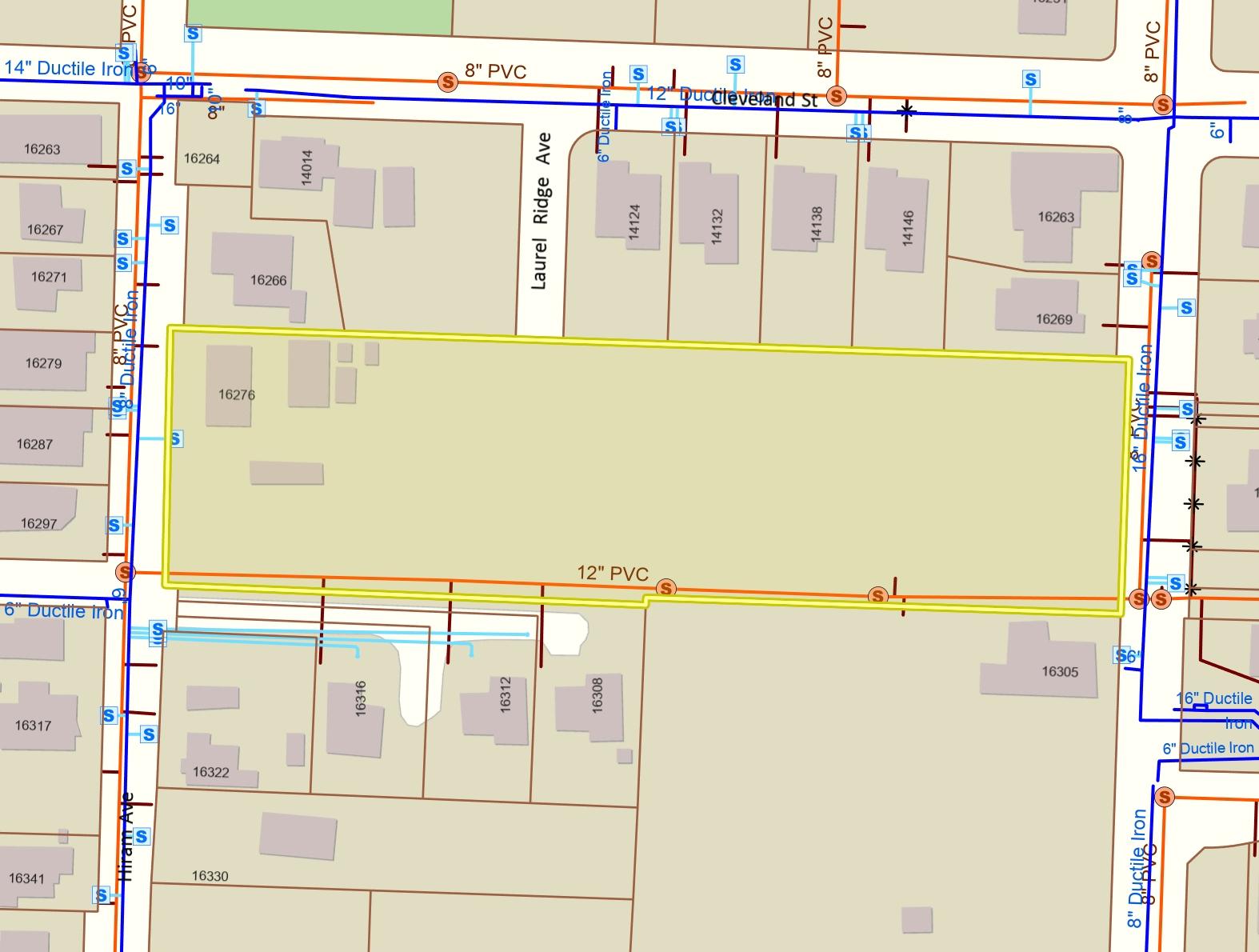

• Water & Sewer Map

ClackamasCountyParcelInformation

ParcelInformation

Parcel#:00557588

TaxLot:22E28BC00300

SiteAddress:16276HiramAve

OregonCityOR97045-1250

Owner:Edwards,CharleyGene

Owner2:

OwnerAddress:16580HunterAve

OregonCityOR97045-1227

Twn/Range/Section:02S/02E/28/NW

ParcelSize:239Acres(104,304SqFt)

Plat/Subdivision:ClackamasHeights

Lot:37

Block:

MapPage/Grid:687-F6

CensusTract/Block:022301/3003

Waterfront:

BuildingUse:RS0-SingleFamily

Land

CntyLandUse:101-Residentiallandimproved

Zoning:OregonCity-R8-SingleFamilyDwellingDistrict

Watershed:LowerClackamasRiver

PrimarySchool:HOLCOMBELEMENTARYSCHOOL

HighSchool:OREGONCITYSENIORHIGHSCHOOL

Improvement

YearBuilt:1926

Bedrooms:2

ExteriorWallType:Wood

Stories:1

Bathrooms:1

TaxInformation

LevyCodeArea:062-002

LevyRate:182713

TaxYear:2022

AnnualTax:$4,40148

ExemptDescription:

AssessmentInformation

MarketValueLand: $495,83200

MarketValueImpr: $259,07000

MarketValueTotal: $754,90200

AssessedValue: $240,89600

LandUseStd:RSFR-SingleFamilyResidence

Neighborhood:ParkPlace

SchoolDistrict:62-OregonCity

MiddleSchool:OGDENMIDDLESCHOOL

Fin SqFt:1,488

Garage:

BasementFin SqFt: Fireplace:

Heat:ForcedAirOil RoofType-Cover:Composition

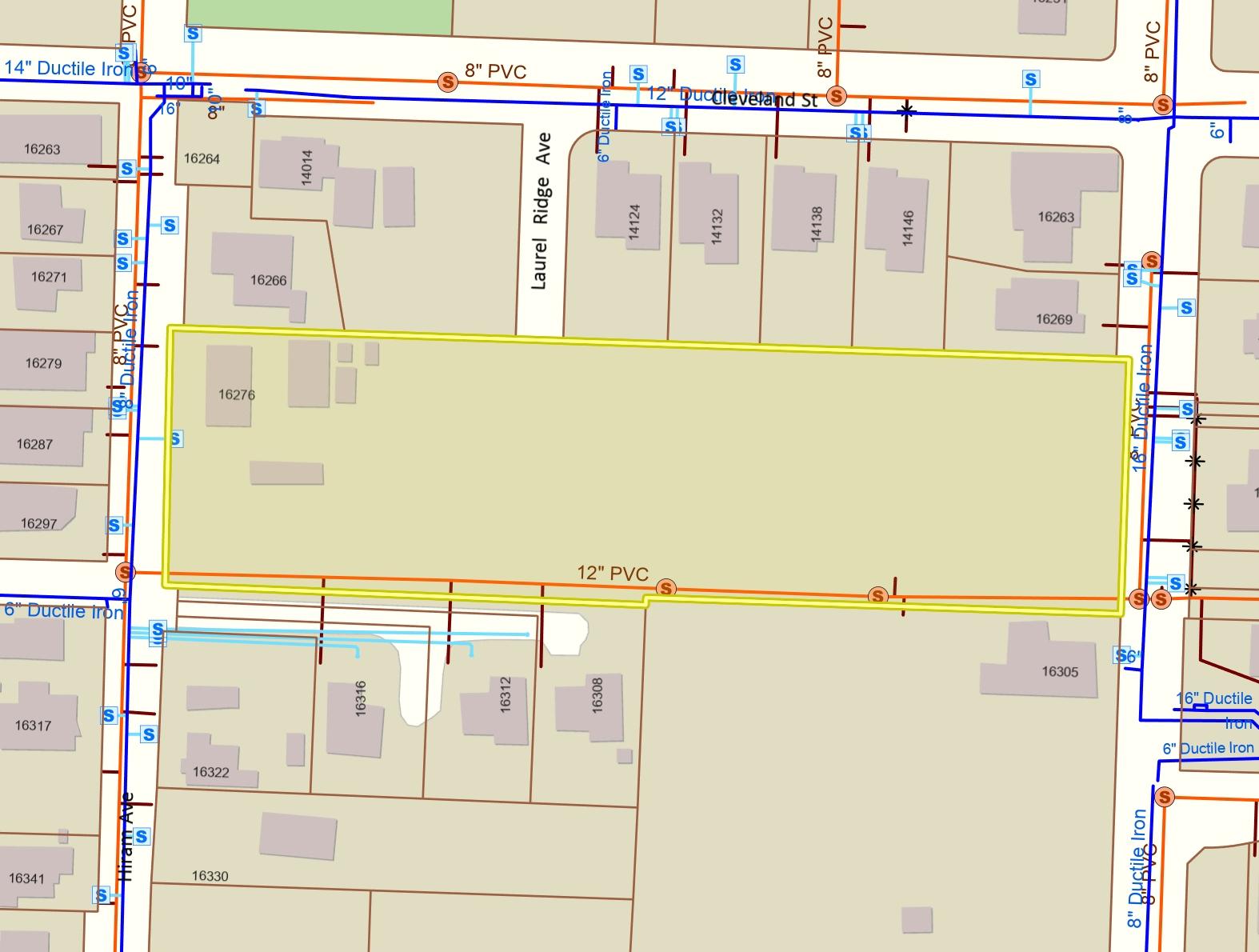

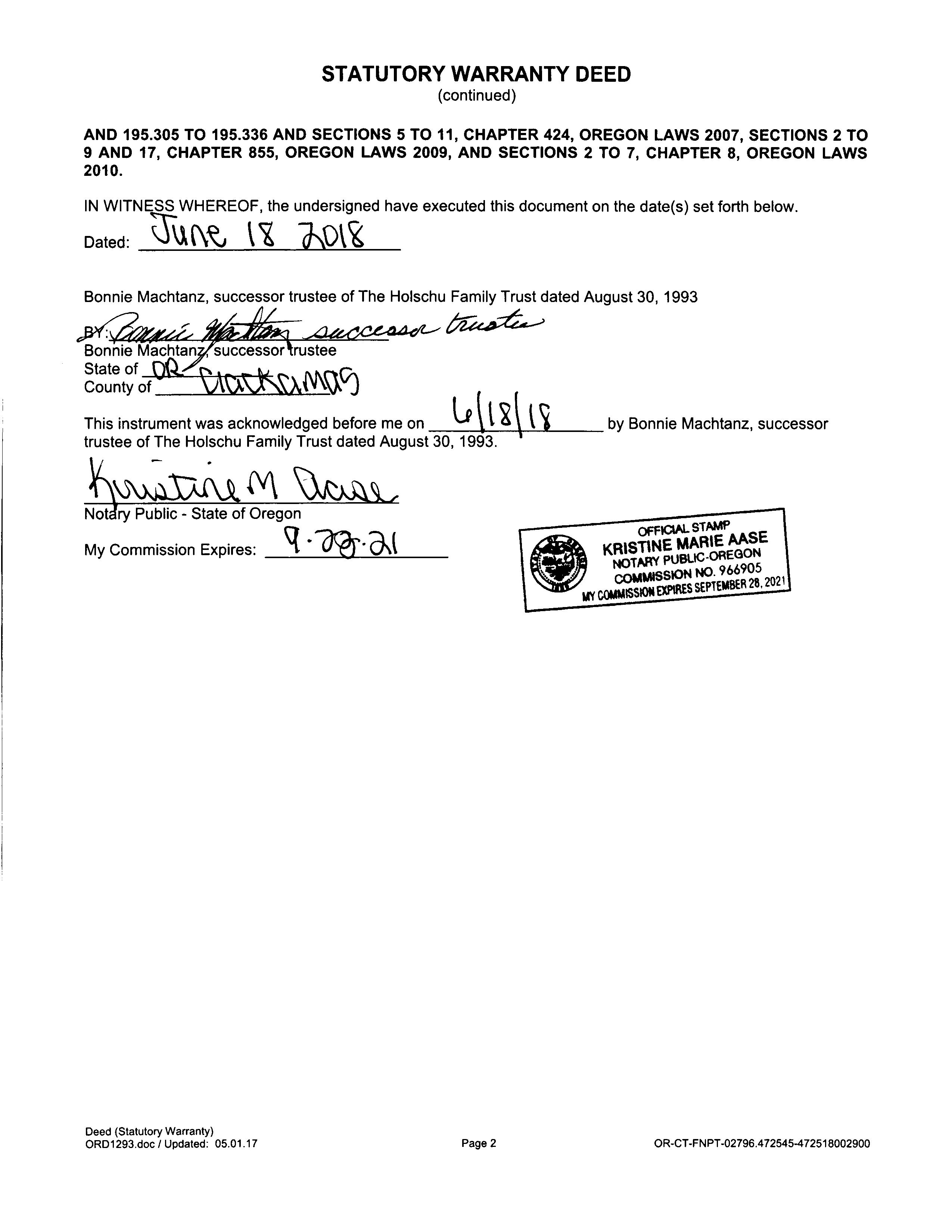

TransferInformation

Rec Date:06/18/2018

Owner:GrantEEdwards

SalePrice:$675,00000

DocNum:2018-037160

DocType:Deed

Grantor:HOLSCHUFAMILYTRUST

Orig LoanAmt: TitleCo:CHICAGOTITLECO

FinanceType: LoanType: Lender:

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressorimplied,astotheaccuracyor completenessofinformationcontainedinthisreport

30CLACKAMASHEIGHTSPTLTS3740&41|Y|184,366

Legal

Property Account Summary

GeneralInformation AlternateProperty# 22E28BC00300 PropertyDescription 30CLACKAMASHEIGHTSPTLTS3740&41 LastSalePrice $675,00000 LastSaleDate 06/27/2018 LastSaleExciseNumber 336563 PropertyCategory Land&/orBuildings Status Active,LocallyAssessed TaxCodeArea 062-002 Remarks TaxRate Description Rate Total Rate 18.2713 PropertyCharacteristics Neighborhood 13031: Holcomb area 100, 101 Land Class Category 101: Residential land improved Building Class Category 13: Single family res, class 3 Year Built 1926 Change property ratio 1XX Parties Role Percent Name Address Taxpayer 100 EDWARDS CHARLEY GENE 16580 HUNTER AVE, OREGON CITY, OR 97045 Owner 100 EDWARDS GRANT E NO MAILING ADDRESS, AVAILABLE, Owner 100 JOHNSTON KELLI A NO MAILING ADDRESS, AVAILABLE, PropertyValues ValueType TaxYear 2022 TaxYear 2021 TaxYear 2020 TaxYear 2019 TaxYear 2018 AVR Total $240,896 $233,880 $227,068 $220,455 $214,034 Exempt TVR Total $240,896 $233,880 $227,068 $220,455 $214,034 Real Mkt Land $495,832 $434,388 $391,521 $387,234 $322,934 Real Mkt Bldg $259,070 $227,130 $207,910 $205,990 $170,550 Real Mkt Total $754,902 $661,518 $599,431 $593,224 $493,484 M5 Mkt Land $495,832 $434,388 $391,521 $387,234 $322,934 M5 Mkt Bldg $259,070 $227,130 $207,910 $205,990 $170,550 M5 SAV SAVL (MAV Use Portion) MAV (Market Portion) $240,896 $233,880 $227,068 $220,455 $214,034 Mkt Exception AV Exception Parents ParcelNo. Seg/MergeNo. Status FromDate ToDate Continued DocumentNumber No Parents Found AccountNumber 00557588 PropertyAddress 16276 HIRAM AVE , OREGON CITY, OR 97045

NoChargesarecurrentlydue.Ifyoubelievethisisincorrect,pleasecontacttheAssessor'sO�ice.

Children ParcelNo. Seg/MergeNo. Status FromDate ToDate DocumentNumber No Children Found ActiveExemptions No Exemptions Found Events Effective Date EntryDateTime Type Remarks 06/18/2018 06/27/2018 08:43:00 Recording Processed Property Transfer Filing No.: 336563, Warranty Deed, Recording No.: 2018-037160 06/18/2018 by SUNDQUISTR 06/18/2018 06/27/2018 08:43:00 Taxpayer Changed Property Transfer Filing No.: 336563 06/18/2018 by SUNDQUISTR 04/03/2008 04/03/2008 16:24:00 Annexation Completed For Property Annex to Clackamas Fire 1, Ord 2008-36 pt 1-annexed by 062-002 for 2008-Revise TCA Membership by JENMAYO 07/01/1999 07/01/1999 12:00:00 Ownership at Conversion Bargain and Sale: 93-63392, 8/1/93, $ 10 TaxBalance TotalDueonlyincludesthecurrent2022taxes PleaseselectViewDetailedStatementforafullpayo� InstallmentsPayable/PaidforTaxYear(Enter4-digitYear,thenClick-Here): 2022 Receipts Date ReceiptNo. AmountAppliedto Parcel TotalAmount Due Receipt Total Change 11/16/2022 00:00:00 5317878 (ReceiptDetail.aspx? receiptnumber=5317878) $4,401.48 $4,401.48 $4,269.44 $0.00 11/15/2021 00:00:00 5128892 (ReceiptDetail.aspx? receiptnumber=5128892) $4,224.46 $4,224.46 $4,097.73 $0.00 11/18/2020 15:28:00 4956421 (ReceiptDetail.aspx? receiptnumber=4956421) $4,103.76 $4,103.76 $3,980.65 $0.00 11/19/2019 08:08:00 4753634 (ReceiptDetail.aspx? receiptnumber=4753634) $4,016.80 $4,016.80 $3,896.30 $0.00 11/16/2018 13:15:00 4563327 (ReceiptDetail.aspx? receiptnumber=4563327) $3,817.10 $3,817.10 $3,702.59 $0.00 SalesHistory SaleDate EntryDate Recording Date Recording Number Sale Amount Excise Number Deed Type Transfer Type Grantor(Seller) Grantee(Buyer) Other Parcels 06/18/2018 06/27/2018 06/18/2018 2018-037160 $675,000.00 336563 S HOLSCHU DORTHA M TRUSTEE EDWARDS GRANT E No Property

LivingAreaSqFt ManfStructSize YearBuilt ImprovementGrade Stories Bedrooms FullBaths HalfBaths 1488 0 X 0 1926 35 1.0 2 1 0

Details

Detailed Statement

AsOfDate: 4/27/2023

TaxYear Category TCA/District Charged Minimum BalanceDue DueDate 1993 PropertyTaxPrincipal 062-065 $2,144.14 $0.00 $0.00 11/15/1993 1994 PropertyTaxPrincipal 062-002 $2,048.66 $0.00 $0.00 11/15/1994 1995 PropertyTaxPrincipal 062-002 $1,941.91 $0.00 $0.00 11/15/1995 1996 PropertyTaxPrincipal 062-002 $2,210.84 $0.00 $0.00 11/15/1996 1997 PropertyTaxPrincipal 062-002 $1,943.60 $0.00 $0.00 11/15/1997 1998 PropertyTaxPrincipal 062-002 $2,039.14 $0.00 $0.00 11/15/1998 1999 PropertyTaxPrincipal 062-002 $2,087.34 $0.00 $0.00 11/15/1999 2000 PropertyTaxPrincipal 062-002 $2,251.12 $0.00 $0.00 11/15/2000 2001 PropertyTaxPrincipal 062-002 $2,240.69 $0.00 $0.00 11/15/2001 2002 PropertyTaxPrincipal 062-002 $2,236.27 $0.00 $0.00 11/15/2002 2003 PropertyTaxPrincipal 062-002 $2,303.18 $0.00 $0.00 11/15/2003 2004 PropertyTaxPrincipal 062-002 $2,338.98 $0.00 $0.00 11/15/2004 2005 PropertyTaxPrincipal 062-002 $2,394.26 $0.00 $0.00 11/15/2005 2006 PropertyTaxPrincipal 062-002 $2,443.44 $0.00 $0.00 11/15/2006 2007 PropertyTaxPrincipal 062-002 $2,596.17 $0.00 $0.00 11/15/2007 2008 PropertyTaxPrincipal 062-002 $2,821.62 $0.00 $0.00 11/15/2008 2009 PropertyTaxPrincipal 062-002 $2,983.60 $0.00 $0.00 11/15/2009 2010 PropertyTaxPrincipal 062-002 $3,052.96 $0.00 $0.00 11/15/2010 2011 PropertyTaxPrincipal 062-002 $3,116.56 $0.00 $0.00 11/15/2011 2012 PropertyTaxPrincipal 062-002 $2,905.70 $0.00 $0.00 11/15/2012 2013 PropertyTaxPrincipal 062-002 $3,020.79 $0.00 $0.00 11/15/2013 2014 PropertyTaxPrincipal 062-002 $3,111.79 $0.00 $0.00 11/15/2014 2015 PropertyTaxPrincipal 062-002 $3,202.91 $0.00 $0.00 11/15/2015 2016 PropertyTaxPrincipal 062-002 $3,286.04 $0.00 $0.00 11/15/2016 2017 PropertyTaxPrincipal 062-002 $3,346.83 $0.00 $0.00 11/15/2017 2018 PropertyTaxPrincipal 062-002 $3,817.10 $0.00 $0.00 11/15/2018 2019 PropertyTaxPrincipal 062-002 $4,016.80 $0.00 $0.00 11/15/2019 2020 PropertyTaxPrincipal 062-002 $4,103.76 $0.00 $0.00 11/15/2020 2021 PropertyTaxPrincipal 062-002 $4,224.46 $0.00 $0.00 11/15/2021 2022 PropertyTaxPrincipal 062-002 $4,401.48 $0.00 $0.00 11/15/2022 TOTAL Due as of 04/27/2023 $0.00 ParcelNumber 00557588 PropertyAddress 16276 HIRAM AVE , OREGON CITY, OR 97045

MAP 2 2E 28BB

CITY BY B.O. 92-1103

P.P. 1997-146

/ / / / / / / / / / / / / / / / / / / / / / / / / / / / / / " " 100.00' 100.00' 100.00' 100 00' 100.00' 100.00' 100.00' 100.00' 200.00' 49.75' 148.59' 49.75' 200.00' 100.00' 49.75 49.75' 49. 75' 49. 75' 174.95 49.25 49.75' 49.75 74.42' 49.75' 1 4 0 .0 0' 100.00' N 00 º 0 0 00" E 49. 75' 49. 75' 49. 75' 313.50' 381.00' N 89º 58' 37" W 576.95' N 11 º 10' 37" W 105.12 93.5 0' 111.22 41 50' 6 7 .0 0' 313.50 100.00 10 2. 0 0' 27 7. 38 ' 1 6 5.0 0' 626.83 7' 50.00' 55.00' 102.00' 11 2 .00 12 2 .00' 91.50' 10' 10' 10' S 00º 02' 4 1" E 313.50' 66 0 0' 66 0 0 ' 102.0 0' 17 2.00' S 0 0 º 0 2 4 7" E 20.50 ' S 89º 58' 37" E 5 5 0 0' 50.00 70.00 70.00 73.35 304.85' 234.85' 164.85' 132 .00' N 89º 58' 37" W 313.50' 1 3 8 9 10 1 9 10 11 30' 4 5 6 7 2 3 4 12 C B 12 11 2 PARCEL 2 PARCEL 1 PARCEL 3 STREET T)

40 41 36 37 PARCEL 2 PARCEL 1 MENTAL

(CHA RMAN STREET) TRACT "B 10' 5' AVENUE CLEVELAND SEE

TO

49.53' AVENUE Tr. A P.P. 2002 33' -62 1 2 3 1 72.0 0' 4 LAUREL RIDGE 4595 48.05 60' 60' 60' 102.44' N 81°19'50" W 53.07' N 00 °01'23 " E N 00°01'23 " E 138' S 0 0°00'0 0" W 1 1 7.99 1 38' RD. NO. 2638 43' 5 6 LAUREL RIDGE AVEN UE 31' 2' 68' 60' 60' 60' 112 49' N 90° W 60' 72 5 3' 5 5.4 7' 3142 15.70 74 .57 ' 63 43' 138 0.23 Ac. 2.43 Ac. 0.06 Ac. 0.23 Ac. 0.27 Ac. 2.43 Ac. 0.21 Ac. 1.87 Ac. 0.47 Ac. 0.42 Ac. 601 4701 4600 4602 700 4400 602 4001 102 800 4802 4700 500 600 4401 4500 4702 300 4000 200 4801 4800 4300 101 4803 6600 6700 6800 69007000 7100 16250 16271 16308 16298 16316 16268 16341 16272 16276 14053 16322 16317 16279 16263 16297 16266 16305 16348 16267 14050 14014 16330 16287 16312 16263 HUNTER 14124 14132 14138 14146 16269 I R10

STREET

OREGON

ParcelID:00557588

SentryDynamics,Inc anditscustomersmakenorepresentations, warrantiesorconditions,expressorimplied,astotheaccuracyor completenessofinformationcontainedinthisreport

AerialMap

ParcelID:00557588

SentryDynamics,Inc anditscustomersmakenorepresentations, warrantiesorconditions,expressorimplied,astotheaccuracyor completenessofinformationcontainedinthisreport

ContourMap

ParcelID:00557588

SentryDynamics,Inc anditscustomersmakenorepresentations, warrantiesorconditions,expressorimplied,astotheaccuracyor completenessofinformationcontainedinthisreport

ZoningMap

Oregon City Municipal Code

Chapter 17.10 - R-8 Single-Family Dwelling District

17.10.010 Designated.

This residential district is designed for single-family homes on lot sizes of approximately eight thousand square feet.

17.10.020 Permitted Uses.

Permitted uses in the R-8 district are:

A. Single-family detached residential units;

B. Parks, playgrounds, playfields and community or neighborhood centers;

C. Home occupations;

D. Farms, commercial or truck gardening and horticultural nurseries on a lot not less than twenty thousand square feet in area (retail sales of materials grown on site is permitted);

E. Temporary real estate offices in model homes located and limited to sales of real estate on a single piece of platted property upon which new residential buildings are being constructed;

F. Accessory uses, buildings and dwellings;

G. Family day care provider, subject to the provisions of Section 17.54.050.

H. Residential home per ORS 443.400

I. Cottage housing

J. Transportation Facilities

17.10.030 Conditional Uses.

The following conditional uses are permitted in this district when authorized by and in accordance with the standards contained in Chapter 17.56:

A. Golf courses, except miniature golf courses, driving ranges or similar commercial enterprises;

B. Bed and breakfast inns / boarding houses;

C. Cemeteries, crematories, mausoleums and columbariums;

D. Child care centers and nursery schools;

E Emergency service facilities (police and fire), excluding correctional facilities;

F. Residential care facility;

G. Private and/or public educational or training facilities;

H. Public utilities, including sub-stations (such as buildings, plants and other structures);

I. Religious institutions.

J. Assisted living facilities; nursing homes and group homes for over 15 patients

17.10.040 Dimensional Standards.

Dimensional standards in the R-8 district are:

A. Minimum lot area, eight thousand square feet;

B. Minimum lot width, sixty feet;

C. Minimum lot depth, seventy-five feet;

D. Maximum building height, two and one-half stories, not to exceed thirty-five feet;

E. Minimum required setbacks:

1. Front yard fifteen feet minimum setback,

Oregon City Municipal Code – Effective August 16, 2013 1

2. Front porch, ten feet minimum setback,

2. Attached and detached garage, twenty feet minimum setback from the public right-ofway where access is taken, except for alleys. Detached garages on an alley shall be setback a minimum of five feet in residential areas.

3. Interior side yard, nine feet minimum setback for at least one side yard, seven feet minimum setback for the other side yard,

4. Corner side yard, fifteen feet minimum setback,

5. Rear yard, twenty feet minimum setback,

6. Rear porch, fifteen feet minimum setback.

F. Garage Standards: See Section 17.20 – Residential Design Standards.

G. Maximum Lot Coverage: The footprint of all structures 200 square feet or greater shall cover a maximum of 40 percent of the lot area.

Oregon City Municipal Code – Effective August 16, 2013 2

The City of Oregon City makes no representations, express or implied, as to the accuracy, completeness and timeliness of the information displayed. This map is not suitable for legal, engineering, surveying or navigation purposes. Notification of any errors is appreciated.

Water & Sewer Map

Notes Legend 4/27/2023 Map created

625 Center St 1,200 200 1: Feet (503) 657-0891 Oregon City OR 97045 www.orcity.org 0 PO Box 3040 City of Oregon City Overview Map 100 Street Names Taxlots Unimproved ROW Water Service Meters (City Owned) Water Pipes (City Owned) Water Service Lines Sewer Structures (City Owned) Sewer Pipes (City Owned) Force Main Gravity Line Outfall Overflow Sewer - Laterals Inactive or Abandoned Active City Limits UGB Basemap