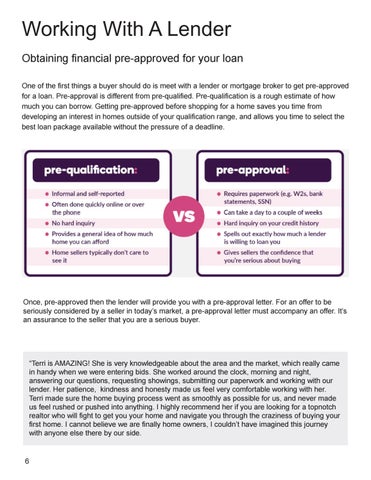

Working With A Lender Obtaining financial pre-approved for your loan One of the first things a buyer should do is meet with a lender or mortgage broker to get pre-approved for a loan. Pre-approval is different from pre-qualified. Pre-qualification is a rough estimate of how much you can borrow. Getting pre-approved before shopping for a home saves you time from developing an interest in homes outside of your qualification range, and allows you time to select the best loan package available without the pressure of a deadline.

Once, pre-approved then the lender will provide you with a pre-approval letter. For an offer to be seriously considered by a seller in today’s market, a pre-approval letter must accompany an offer. It’s an assurance to the seller that you are a serious buyer.

“Terri is AMAZING! She is very knowledgeable about the area and the market, which really came in handy when we were entering bids. She worked around the clock, morning and night, answering our questions, requesting showings, submitting our paperwork and working with our lender. Her patience, kindness and honesty made us feel very comfortable working with her. Terri made sure the home buying process went as smoothly as possible for us, and never made us feel rushed or pushed into anything. I highly recommend her if you are looking for a topnotch realtor who will fight to get you your home and navigate you through the craziness of buying your first home. I cannot believe we are finally home owners, I couldn’t have imagined this journey with anyone else there by our side.

6