CUSTOMER-OWNED BANKS ROUNDTABLE

How broker connections have lifted growth for mutuals RISING STARS

Australia’s top young brokers revealed SPECIALIST LENDING Flexible solutions for greater range of borrowers

How broker connections have lifted growth for mutuals RISING STARS

Australia’s top young brokers revealed SPECIALIST LENDING Flexible solutions for greater range of borrowers

Responding to brokers’ needs produces third win for Macquarie Bank

Got a story or suggestion, or just want to find out some more information?

twitter.com/MPAMagazineAU

facebook.com/Mortgage ProfessionalAU

02 Editorial

Building success on genuine, trusted relationships

04 Statistics

The highs and lows in real estate

FEATURES

06 Opinion

The unique value proposition of customer-owned banks

MPA’s annual survey report highlights the impressive results of banks that prioritise collaborating with brokers to achieve success for their customers

Adapting to changing customer needs and forging strong broker partnerships has paid o for the mutual banks

26 Macquarie Bank takes top spot

Listening to brokers has resulted in the bank’s third consecutive victory in the Brokers on Banks survey

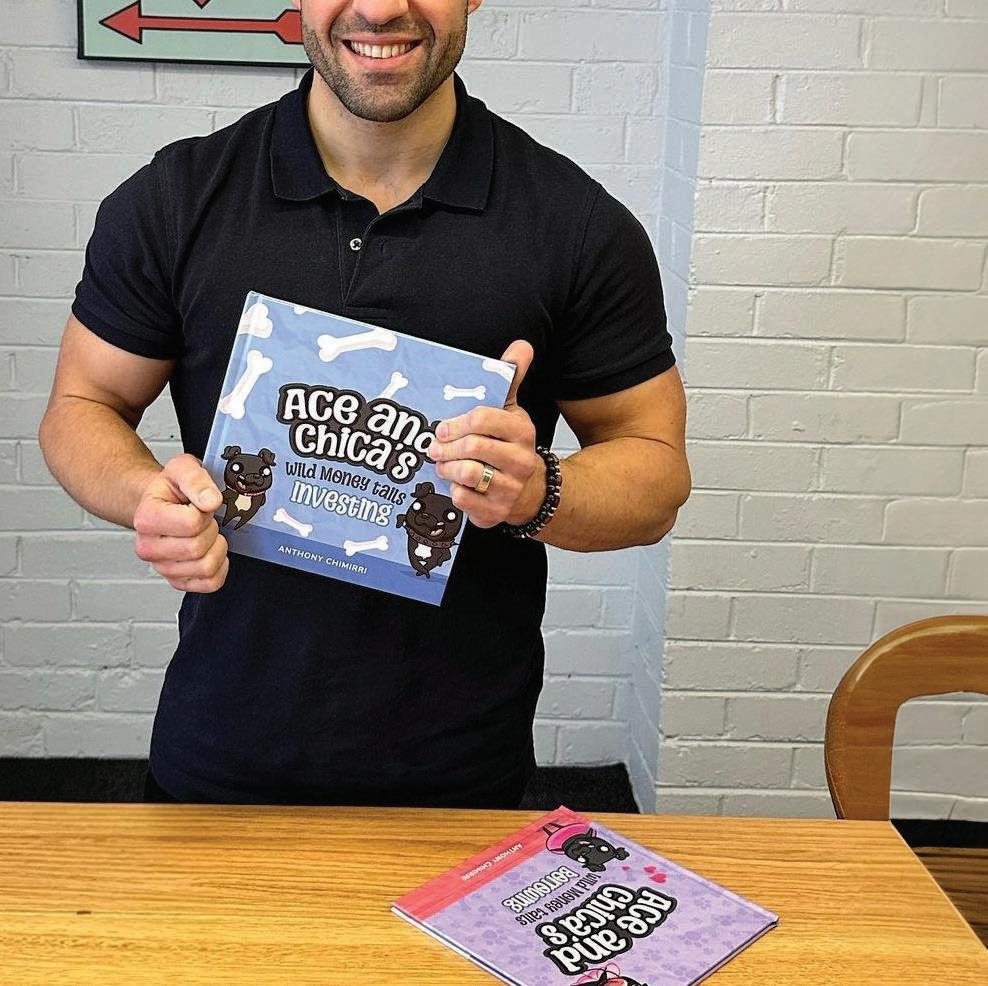

Kode Finance’s Anthony Chimirri makes finance fun for kids 12

SFG’s managing director looks back on a strong year for the aggregator, and to a future of innovations and growth

08

50 Committed to backing brokers

Retaining second spot in Brokers on Banks, Bankwest says it’s “going all in” for brokers as it strives to be the best

68 Communicating change

The agile, inclusive solutions o ered by non-banks to borrowers who don’t fit the traditional lending profile

Four steps to building employees’ trust with a focus on transparency

70 Brokerage insight

A diversity of products and services helps Infinity Finance Solutions meet clients’ needs

72 Other life

61

This year’s standout new-to-industry brokers are already making waves with their energy, passion and ambition to succeed

NOW ONLINE:

Our daily newsletter. Keep on top of property market trends, business strategy, and what industry leaders have to say.

Human beings have an innate need for connection with one another. It’s hardwired into us, and it’s why many people struggled during the COVID-19 pandemic, when for long periods we had to cope with the social isolation of lockdowns. This lack of human contact with anyone outside our immediate families – or, for those who lived alone, often no contact at all – had a major impact on the mental health of many people that is still being felt post-pandemic.

The need to talk and connect with other people is also highly important in the world of mortgage brokers. It’s no secret that the most successful brokers are the ones who work hard at building genuine and trusted relationships with their customers and don’t just pay lip service to ‘customer service’.

To maintain a strong and steadfast client base might mean checking in frequently with customers to have a chat about their current loan and rate or what’s happening with the Reserve Bank cash rate; and about their property and finance goals or other finance needs they might have. It can also involve providing regular updates on the property and lending markets via social media or EDMs.

In a broking sector with more than 70% of all new residential loans written by

The most successful brokers work hard at building genuine and trusted relationships with their customers

brokers, there’s more competition between brokers than ever. It’s probably accurate to say that brokers are now competing more with each other than with the lenders.

This means brokers need to stand out from their competitors, and one way they can do this is by staying in close contact with customers, learning their life stories and anticipating and facilitating their financial needs and goals.

Brokers also need to cultivate and maintain close working relationships with lenders, to keep up to date with their products, policies and processes and be able to find the loan deal that’s in the best interests of their customers.

In this first edition of MPA for 2024, we examine how customer-owned banks have built strong partnerships with brokers, who they rely on heavily to source home loans. Third party leaders at customer-owned banks recently joined broker representatives at MPA’s annual roundtable to discuss these relationships and other industry issues.

We also look at how non-bank lenders provide specialist solutions to assist brokers whose clients have been rejected for loans by traditional banks.

Finally, we reveal the winners of MPA’s 2024 Brokers on Banks survey, as well as the top emerging young brokers in Rising Stars 2024.

Enjoy the March issue, and let’s hope that 2024 is a great year for everyone.

continues his journey with SFG for another 5 years!

Fabio De Castro

Fabio De Castro

Fabio De Castro

Fabio De Castro

$10.3trn

Total value of residential real estate at end December

The real estate market was subdued in December, with more than a 50% drop in new listings on realestate.com.au compared to November – a decline that aligns with the typical year-end slowdown. Despite this, new listings activity showed a 0.4% increase year-onyear, PropTrack figures revealed.

488,898

Year's total number of housing sales nationally

Median time it took to sell a capital city home in Dec quarter

The property market rebounded strongly in 2023, with national home values jumping 5.52%, hitting a new peak, PropTrack reports. Both capital cities and regional areas experienced year-on-year growth. Perth, Adelaide and Brisbane excelled, avoiding downturns and consistently reaching new price highs. However, Hobart, Darwin, regional Victoria and the NT witnessed slight year-on-year declines.

ANNUAL GROWTH IN HOME VALUES, YEAR TO DEC 2023, ALL DWELLINGS

8.3%

National annual increase in rent values

Source: CoreLogic Monthly Housing Chart Pack, January 2024

Source: PropTrack

In 2023, AFCA recorded 100,000 complaints, jumping 23% from 2022. Chief Ombudsman David Locke noted an unsustainable rise, highlighting spikes of 95% in scam-related complaints and 29% in financial hardship complaints.

Number of complaints

CoreLogic’s Home Value Index reported a increase of 8.1% in 2023, bouncing back from a drop of 4.9% in 2022 but falling short of 2021’s surge. December saw a modest 0.4% increase, reflecting a typically softer year-end.

In the year to November 2023, new owner-occupier loan values for dwellings soared by 10.1%, with commitments up by 7.3%, the ABS reports. Mish Tan, ABS head of finance statistics, noted a monthly uptick of 0.1% and 1% in values and commitments, respectively.

Customer-owned banks o er more than just great rates to brokers and their clients, says COBA CEO Michael Lawrence

THIS YEAR and beyond presents an interesting landscape for both consumers and financial institutions. While inflation shows signs of abating, Australians continue to grapple with the higher cost of living, which demands greater security, transparency and authenticity from banks. We know banking customers will be looking closely at their banks for support and an alignment with their values.

It’s against this backdrop that customerowned banks emerge with a unique proposition for brokers and their clients, with a mission to always put people before profit. Because of the mutual ownership model, profits are not distributed to external shareholders. Instead, they are reinvested into extremely competitive products, better services and vital community initiatives.

This is great news for brokers with clients who want not just a great rate but to also feel satisfied about where they are banking and the values of the organisation. As expected, our research shows this is most customers, with 84% of people wanting a higher purpose out of their bank.

Additionally, customer-owned banks have a market-leading satisfaction rate of 91.6% according to Roy Morgan. And when looking at the sector, customer-owned banks collectively record a Net Trust Score higher than that of any individual bank in Australia.

What is central to all customer-owned banks is their commitment to putting their customers’ interests first, and this is an important fact to consider in light of the recent trend of mergers across the sector.

Mergers are a feature of the financial services landscape and aren’t just exclusive to

mutuals. But in our sector they are driven by the ability to better meet the shared values and objectives of both institutions while expanding an institution’s product range or geographic reach.

Any merger between customer-owned banks is carefully considered with a customerfirst lens, in the context of the broader market

the same high standards as every bank by the government and regulators, including APRA and ASIC; are backed by the Australian government’s $250,000 guarantee on deposits; and continue to digitally innovate and transform to provide even greater service to customers and industry suppliers.

Protecting customers from scams is an absolute priority for the Customer Owned Banking Association and our members this year. COBA has already joined forces with the Australian Banking Association to launch a new Scam-Safe Accord that includes a comprehensive set of anti-scam measures across the entire industry.

At the heart of the accord is a $100 million investment by the industry in a new confirmation-of-payee system to be rolled out across all banks. This will help reduce scams by ensuring people can confirm they are transferring money to the person they intend to.

Customer-owned banks collectively record a Net Trust Score higher than that of any individual bank in Australia

and in the interests of their members, who ultimately need to vote on whether a merger proceeds or not. It’s yet another example of how our sector ensures it delivers positive outcomes for its customers.

Brokers account for nearly 70% of the mortgage market* and have a powerful role to play in helping their clients find a bank that does more than just meet their financial needs. Whether a client cares about the environment, their local community or a special charitable organisation, brokers can find the perfect customer-owned bank for everyone.

Many customer-owned banks also serve specific professions, including police, teachers, nurses, and defence and military professionals. Each of these banks provides a unique understanding of the intricacies and challenges faced in these professions and o ers a tailored and personalised service to its customers that won’t be found elsewhere.

Our sector can be recommended with confidence too. Customer-owned banks are held to

With 15.4 billion transactions totalling $2.5 trillion in value occurring every year across the banking sector, the design and build of an industrywide confirmation-ofpayee system is a major undertaking. Design of the new system has already started and will be rolled out over 2024 and 2025.

Technology is evolving, and the banking landscape continues to change. But one thing remains constant: when a customer chooses a customer-owned bank, they will be treated as more than just a number. With competitive rates, best-in-market customer service and a genuine commitment to putting people first, you can be confident your clients will be in good hands with a customer-owned bank.

*MFAA/Comparator

Despite rising rates and inflation, Specialist Finance Group enjoyed strong growth in 2023. MPA talks to MD William Lockett about the year’s highlights and challenges – and SFG’s big goals for 2024

IN A 2023 mortgage market heavily a ected by cash rate increases and a cost of living crisis, leading aggregator SFG adapted and continued to grow.

SFG managing director William Lockett has more than three decades of experience dealing with the highs and lows of the industry’s constantly evolving and complex financial landscape. He talks to MPA about how SFG achieved growth in 2023, the challenges the industry faces, and what’s on the

“A

ever holiday away from work – a six-week European holiday with my beautiful family.

It was great to detach from running SFG and spend quality time away with the family, enjoying travelling through four countries and sharing some wonderful experiences.

It also showed me that I can take extended breaks away from the SFG business as we are fortunate to have an amazing SFG team covering my absence.

From a business perspective, we enjoyed

key highlight was SFG now having 1,300 finance brokers Australiawide,

which is a significant achievement for our group and one that we are very proud of”

horizon in terms of further innovations and development in 2024 for the aggregator’s broker members.

MPA: What were the main highlights for SFG, and you personally, in 2023? William Lockett: There were a number of business and personal highlights during 2023, and from a personal point of view the highlight was enjoying my longest-

another year of business growth, which resulted in our membership base growing by 22%, as well as maintaining our great brokerfocused relationships with all of our existing SFG members.

A key highlight was SFG now having 1,300 finance brokers Australiawide, which is a significant achievement for our group and one that we are very proud of.

We also rolled out our new commissions

platform SFGassist. This business achievement was probably one of the biggest tasks that we have ever undertaken, given we had to migrate 33 years of data into a new commissions platform.

We also had to ensure that all of our commission payment obligations were met and there was no disruption for any of our SFG members.

Another key milestone was having our very first SFG National Conference & Awards outside of our home city of Perth. We hosted our marquee event in the beautiful location of Port Douglas, Queensland.

Not only were we blessed to have an amazing location for our national conference and awards, but we also enjoyed stunning weather and had 350 SFG members and business partners in attendance.

MPA: What is the biggest challenge facing the mortgage industry?

WL: Certainly a major issue that our industry is facing is the current payroll tax matter that is being initiated by the O ce of State Revenue in New South Wales.

We acknowledge that this issue is also being dealt with by the courts. However, it’s disappointing that our industry has had to deal with this payroll tax matter given that it is our view, and the third party industry’s

Name: William Lockett

Title: Managing director

Company: Specialist Finance Group

Years in the industry: 33

Highlights of 2023:

• Achieving 1,300 SFG members

• Rollout of new commission platform SFGassist

• SFG National Conference in Port Douglas

• Family trip to Europe

view, that finance brokers are essentially independent business owners exercising their own business rights in running their individual business models.

It’s a major disappointment for our industry considering that finance broking has been going for some 34 years in Australia and during this time it has operated in all states and territories under both sides of political persuasion.

tion services for our SFG members and the commitments that we also have to our SFG business partners.

We again rea rmed our business mantra, which is: SFG is a private and family-owned business that is solely focused on being the best possible aggregating business partner.

We have a relationship-based approach to doing business. Trust and communication are at the forefront of all of our dealings with both

“We again rea rmed our business mantra, which is: SFG is a private and family-owned business that is solely focused on being the best possible aggregating business partner”

During this time, our industry has also worked with and engaged with not only state and federal governments but also other government departments such as ASIC and Treasury to make our industry better and stronger and deliver better outcomes for consumers wishing to not only utilise the services of a finance broker but also get the best possible finance option for their consideration.

To have this significant hurdle facing our industry after 34 years in operation is both unfair and, we say, has no relevance or substance in the way our industry and finance brokers operate.

WL: We’re excited this year to be opening our very first SFG Queensland office, which will provide greater support for our Queensland SFG team and our Queensland SFG members. We have managed to secure a wonderful location in Woolloongabba, and we look forward to opening this SFG Queensland o ce in March 2024.

One of our key goals for this year – which was part of our SFG strategy meeting in Sydney in January – was to concentrate on our core focus, which is our aggrega-

our members and business partners. We are empowered and agile, and we make decisions e ciently, with all issues being resolved both quickly and fairly.

Deploying the next upgrade of SFGconnect 2.0 will bring even greater e ciencies and synergies to our SFG members.

We get a lot of compliments – from both our existing members and opposition brokers from other aggregators – that our software programs are among the best in the industry. The upgrade in SFGconnect 2.0 will be like going from driving a Ferrari to driving Formula One.

MPA: With the RBA likely to cut interest rates some time in 2024, how will this affect broker activity?

WL: Any reduction of interest rates makes it easier and more a ordable for people to borrow funds; therefore it’s our belief that this will only increase broker activity. Lower interest rates make borrowing funds cheaper and more attractive, which will lead to increased demand for broker services.

This increased broker activity would also be across residential, commercial and personal finances both for owner-occupancy use and for investment.

Growing membership to 1,500

Implementing 5 weeks’ annual leave for SFG sta

Establishment of support and compliance team

As a 100% customer-owned bank, we always put the needs of our customers first. So, you can recommend Beyond Bank with confidence.

We take the same approach to maintaining mutually rewarding relationships with our broker partners.

• Our customer satisfaction score is 95% with our broker network.

• We offer genuine support, with open access to our Australian-based broker support team.

• Continuity of service is assured with our team owning each file from lodgement to settlement.

• Canstar Customer-Owned Bank Digital Bank of the year in 2023.

• Ranked in the top three in Australia for Forbes World’s Best Bank in 2023.

Beyond Bank is a certified B Corp bank, we use our business as a force for good to drive positive outcomes for our people, customers, communities and planet. We commit to balancing purpose with profit by meeting the highest verified standards of social and environmental performance, accountability and transparency.

Our broker support team will work for you and with you to help your customers with their lending needs. Chat the team on 1800 029 990 or email brokerloans@beyondbank.com.au

Expectations are shifting within the dynamic lending landscape, bringing the broker–bank relationship into heightened focus as the economic future remains uncertain

AUSTRALIA’S MORTGAGE brokers are going to bat for their clients, powered by a deep concern over the challenging interest rate environment that is expected to continue through at least the first half of the year.

MPA’s Brokers on Banks 2024 survey garnered marks from hundreds of brokers evaluating the performance of lenders across 10 metrics in the last 12 months, with those prioritising collaborative broker channel partnerships emerging victorious.

The best banks for brokers have established trust by forming strong alliances with their third party partners to ensure optimal outcomes for their mutual clients.

Brokers’ feedback reveals what they value most, underscoring how the leading banks are earning the business of these mortgage professionals, who wrote 71.5%

of new residential home loans between July and September 2023:

• “Competitive interest rates and BDMs who pick up the phone”

• “Good, simple products and no channel conflict”

• “No gimmicks, good service and broker loyalty”

• “Ability to workshop tricky deals”

• “Excellent turnaround times”

• “Providing good rate and service to the customers

• “Great credit policy, good pricing”

This year’s Brokers on Banks survey results indicate a dramatic change in what brokers expect from banks, illustrating a shift towards lenders that back up their competitive loan products with support

and credit policies that instil trust.

“Between the rate rises and spike in mortgage holders coming o the COVID fixed rates, there was a lot of consumer anxiety in 2023,” says Tanya Sale, CEO and co-founder of aggregator outsource Financial.

“Lenders really stepped up and supported the third party channel to provide education and strategies to help alleviate consumer panic.”

Mortgage Choice CEO Anthony Waldron adds, “There is always a healthy tension in the bank–broker relationship, but positive changes throughout the year helped this relationship, including a general improvement in bank service levels due to process simplification, investment in credit assessors, and other operational roles that increase capacity.”

TYPICAL RESPONDENT

Aged between 46 and 55

Years as a broker

Writes $20m–$40m worth of mortgages each year

Has been in the industry for > 15 years

Is most likely to live in Vic

What do brokers want from banks?

As the a ordability chasm continued to widen, brokers chose bank interest rates as their number one priority, while 2023’s primary concern about diversification opportunities sank to eighth place

WITH THEIR fingers on the pulse of rising inflation and consumer demand for savings, brokers’ search for the best rate to help clients achieve their financing goals has eclipsed all criteria for them.

Interest rates soared to number one on brokers’ priority list from 10th place in 2023. This is unsurprising given the rapid rise in the RBA o cial cash rate and that a majority of brokers saw no change in products and pricing over the past year and more felt the banks had

worsened rather than improved. “Notably, this change in rank isn’t solely broker-driven,” says outsource Financial CEO Tanya Sale. “It reflects a broader trend influenced by consumers having to navigate a record number of interest hikes. That rate surge has prompted borrowers to actively seek opportunities to save in a bid to mitigate financial impact.”

A second-place tie for product range and brand trust suggests brokers are prone to recommending banks with a track record of

o ering competitive and relevant products aligned with current market conditions.

There was a noticeable decline in the importance of diversification opportunities, which, while still high at 3.931 out of 5, slipped to eighth place from top spot last year. But diversification remains important given brokers’ concerns about high interest rates:

• “It’s harder to bring in new clients due to servicing. This will mean a loss of business”

• “It is di cult for many borrowers, and it has dampened some enquiry levels”

Macquarie Bank clinched a hat-trick of victories, achieving first-place wins overall for the third straight year. It continued to lead in turnaround times and ranked first for its interest rates and communications as well as training and development. It placed in the top three in every survey category.

Comments on Macquarie Bank included:

• “A bank that really supports the broker”

• “They have better deals”

• “Consistent turnaround times, credit policy, and decisions”

Bankwest, which placed second overall, recorded first-place wins for its credit policy, diversification opportunities and product range. Brokers praised Bankwest’s products and policies:

• “Self-employed policy is the best in the market, as well as improvements made over the last year for investors”

• “Credit policy, specifically alternative assessment. Good processes, and the BDM support is excellent”

• “Most clients I have placed in the last 12 months have fit really nicely with Bankwest’s complete variable product”

Credit policy remains vital to brokers, who elevated CommBank to second in the category

this year, citing its multiple o set accounts, internet banking platform and flexibility as di erentiators. The bank also placed third in interest rates and diversification. It’s the only big four bank that cracked these categories.

Suncorp earned third place in the overall ranking, including third for product range, with brokers praising its variable products and “common-sense policy application, good value and competitive rates”.

Brokers elevate brand trust as their top priority regarding the support banks provide

BRAND TRUST has long been highly valued by brokers, as evidenced by its consistent rating of at least four out of five on the importance scale.

However, the significant rise of brand trust to the number two spot from ninth place last year has trumped the other indicators that constitute broker support – commissions and communications – which fell to ninth and 10th place, respectively, from fourth and sixth last year.

This place shift reflects a consumer-driven change in priorities within the market, says outsource Financial’s Tanya Sale, where the natural inclination is to turn to well-known brands for a sense of safety when facing economic uncertainty.

But such unfamiliar times can put a strain on partnerships.

“The broker–bank relationship delicately balances on the line between being symbiotic and competitive, and a noticeable impact I saw

unbalance last year was the cashback fiasco, which I believe did not do anything good,” Sale adds.

“All it did was start a cashback war leading to a trend of consumer lender-hopping. This, in turn, triggered broker clawbacks, creating a churning e ect. Brokers expressed a lot of frustration over the added volatility, and it created this ripple e ect of discord felt by consumers, brokers, banks and the industry.”

Bankwest is on an impressive upward

“It’s more that there has been a run on certain types of deals, leading us to position them towards a particular lender. First home buyers have been steered towards Westpac and NAB due to pricing, making their product so much more attractive than other participants in the scheme”

“Bankwest and Macquarie have had low rates, quick turnaround times and great BDMs to deal with”

“We have given Adelaide Bank more business in the past 12 months. The ability to discuss the proposed loan and, where and when possible, the BDM will endeavour to ensure the client’s needs are met. This is down to the skill of the BDM and the trust they have in us for proposing good, clean deals to them”

“UBank, Bankwest and Suncorp, all due to better proposition for clients at the time, including overall product, interest rates, flexibility, multiple o sets, and cashbacks”

“ANZ has taken most of our lending when considering the banks only. It comes down to policy and price combination being the best fit” YES NO

“I do not favour lenders; it’s about the client’s circumstances and providing them the lender options available. Usually, clients will choose the most competitive interest rate from their available lenders. When reviewing the past 12 months, I’ve written the majority of loans to Bank Australia and CBA”

“It’s a spread based on clients’ needs”

“Initially, the majority of my business went through ANZ as I was just starting and was familiar with its policies and products. Now, I am branching out to di erent banks”

“Not really, although Macquarie has received slightly more due to good rates and excellent turnaround times”

“Nope, I have shared the love around”

trajectory in the brand trust category, achieving gold this year after moving up from second last year and third the year before.

ING also moved up one place, attaining a silver win this year, while Macquarie Bank took bronze.

Brokers noted that consistency across a bank’s business model helped build trusted relationships, and they gave accolades to these top three lending champs, noting:

• Bankwest is “competitive and responsive”, o ering “good discounts and more financial facilities”

• ING “is doing well with keeping rates lower than the big four and really looking after their clients”

• Macquarie Bank is “easy to deal with and provides fast and e cient service”

Bankwest won gold for commission structure for the third year, while ANZ took silver and Macquarie Bank retained the bronze.

After dipping to third place last year, Macquarie Bank rebounded to the top spot for communications, training and development in 2024. Bankwest remained in second place, and CommBank grabbed the bronze.

A broker commented that Bankwest and ANZ had won a large portion of their brokerage’s business due to their willingness to provide additional training to its sta .

A perceived lack of backing from some banks has been the source of much criticism from brokers this year. Several said lacklustre service and little help navigating the loan process had caused them to rethink recommending certain banks to clients.

“I have reduced my use of all the big four as I find the smaller lenders more agile and willing to find a way to make deals work,” one broker said.

Brokers appreciate digital banking services and wish for more, yet the ability to speak to a BDM remains a deal clincher

AN EXCEPTIONAL BDM’s skills cannot be overstated. Brokers have elevated BDM support to their fourth priority, reflecting a consistent three-year upward trend emphasising their crucial role in enhancing positive client and broker experiences.

It was clear from brokers’ responses that a personalised approach makes or breaks a deal:

• “Quite often, there are multiple lenders where the deal can be placed. So, I take it to the one where I can get a hold of the BDM to run the scenario past them”

• “Bankwest has a BDM that is willing to work with you”

• “We have excellent BDM support (critical) from Macquarie”

• “Suncorp is just doing everything right, including BDM support”

For the second year, Bankwest took the gold in BDM support, Macquarie Bank retained its silver place, and Suncorp emerged a winner for the first time with bronze.

While turnaround times plummeted to sixth place from its all-important second

place last year, there is no denying a bank’s ability to quickly process a loan to settlement is an essential component of the broker-bank relationship.

It is one of the factors that is consistently mentioned by brokers as a reason to consider severing ties with a lender, particularly HSBC.

• “I stopped using them because, at 33 days turnaround for the past several months, I cannot with all good conscience put my clients’ applications with them”

For the banks on top of turnaround times, brokers were e usive in their appreciation:

• “Macquarie Bank has very quick turnarounds with purchases where time is of the essence. I would not hesitate to include them in my recommendations”

• “Suncorp o ers rapid turnaround times”

A smaller margin of brokers reported that turnaround times had improved or improved significantly, at 66% compared to 75% in 2023. Double the number of respondents this year said times had worsened over the year prior, at 12.58%.

Mortgage Choice CEO Waldron points out that the heightened cashback o ers at the start of 2023 adversely a ected turnaround times for many lenders, resulting in some SLAs being extended to more than 40 days.

“Brokers will set expectations with customers during the submission process, but delays outside of their control can cause uncertainty and worry for customers,” Waldron adds.

Macquarie Bank reigned at the top of this category again, with Bankwest moving up this year to clinch second, and ING and Suncorp taking bronze in a tie.

Digital bank ING achieved first place in the online platform and services category, with Macquarie Bank and Adelaide Bank taking second and third.

Some brokers praised Bankwest’s portal

for submitting supporting documents as “fast and easy”, while Macquarie Bank’s internet banking functionality impressed them. Others commented that updated broker platforms enhanced application submissions, automated valuation reports improved e ciency, and digital document

signing improved turnaround times. Still, more work needs to be done.

“More lenders are now o ering digital document signing for mortgage o er documents,” said a broker. “This is a big improvement. As soon as all lenders allow everything to be digitally signed the better.”

“Your Loans on CommBroker has been a godsend”

“DocuSign or other digital signing options on all onboarding forms; lenders not o ering this are falling behind”

“Enhanced application tracking in broker portals saves time on the telephone for status updates”

“I am using Quickli, which has improved my turnaround times. While this doesn’t necessarily assist lender turnaround times, it certainly benefits my clients as I can work smarter and not harder”

“Tech introduced into this industry is not done to improve turnaround times”

“Not really. Manual pre-credit review still required for approval in principle (AIP) assessment”

HAVE TURNAROUND TIMES IMPROVED OR WORSENED OVER THE LAST YEAR?

2023 tested brokers’ resilience and adaptability as they grappled with an a ordability crisis and consumer anxiety. Here’s what brokers had to say about rates, green loans, channel conflict and lenders’ assessment of living expenses

THE RESERVE BANK in February 2024 left the cash rate target unchanged at 4.35%. While it noted inflation continued to ease, it remains high, and despite encouraging signs, the economic outlook is uncertain.

Many respondents were concerned about how the rate environment would a ect their business and their clients’ ability to service loans. Over the past 18 months it has made finding solutions for clients di cult as their borrowing capacity diminished and loan approvals became more challenging to secure. Some worried about a potential slowdown in the housing market within the next 12 months and the potential for a recession.

Despite these concerns, some brokers view the current situation as an opportunity, asserting that their services will continue to be valued by their clients.

The performance of banks in assessing a potential borrower’s basic living expenses varies considerably, depending on the broker’s experience. Many respondents took aim at the household expenditure measure.

• “Banks and lenders are requiring more explanation or mitigation regarding HEM figures which di er from baseline”

• “Living expenses are by their nature a moving target”

Just under half of brokers surveyed (44.65%) reported channel conflict as a minor problem, and a third said it was a major problem.

The highly competitive home loan market of 2023 led to increased channel conflict for brokers, with reports of banks’ retention teams offering better rates to existing customers despite informing the broker that they couldn’t offer the customer an improved deal, says Mortgage Choice’s Anthony Waldron.

“I’d like to see lenders have clearer rules of engagement for broker-introduced customers to avoid channel conflict.”

How worried are you about the present rate environment, and what impact do you expect it to have on your business?

Prize-winning comments

Johnnie Walker whiskey: “I’m slightly concerned/worried. We’ve been through these cycles before, but with household debt levels at all-time highs, I expect that some mortgage holders will be forced to sell their properties in the coming year or two. I expect enquiry levels to remain strong, but being able to place business will be harder, mainly due to servicing issues”

$100 VISA gift card: “I think that servicing will be a massive issue unless the banks can find solutions to allow customers to consolidate, and not just dollar-for-dollar refinances but also include general debt consolidation and the ability to easily revert to interest-only terms for a period”

$100 VISA gift card: “I’m worried for clients who are struggling, but don’t believe it will impact my business”

“As rates move, we become more important to our clients, and communication with our clients during these times is very important”

“Clients will always need advice. Whether upgrading, downsizing or managing their existing facilities, brokers support clients with strategy, and these brokers will continue to do well. Anyone who sold on rates or cashback, unfortunately, will be struggling very hard right now”

“Still hit and miss with lenders, but many are improving, requiring less need for account confirmation and scrutiny”

“Increased significantly, mostly in line with the actual cost of living increases”

“Quite acceptable. However, private health and private school fees should not be additional to HEM when, in fact, they are voluntary and can be ceased at any stage. Why these are considered an added liability is beyond the broker network”

“Some banks have applied common sense, others have done quite the opposite and, rather than apply common sense or ask questions, they annualise all expenses, even if they were one-o and you supplied commentary as to why they are one-o ”

“It’s painful, and there’s no consistency between lenders”

“Same as previous 12 months, although I do understand they will be increasing HEM to align with current overinflation”

“Haven’t had a single query raised by a lender on living expenses in the last 12 months. HEM values have increased dramatically, justifiably, I suppose”

“Much better than the previous few years. They are taking a more realistic view of discretionary spending than they have in the past”

“Unnecessarily di cult. This is the biggest frustration in our industry”

“No paper and wet signatures at all”

“We have zero client interest in these options”

“O er a discounted rate or fees package for specific property types or features”

“Green loan options are so restrictive and complicated that you could rarely put such products to the client as an o er”

“First, by being more transparent. Secondly, by refusing to transact with non-environmentally friendly businesses and employees of those businesses”

“Make the eligibility criteria easier and more accessible, and more user-friendly”

“Reduce home loan rates specifically for borrowers who install green systems, not just solar but worm farms, tanks, batteries, etc.”

“Haven’t deliberately stopped using any specific bank, but haven’t used much of Adelaide Bank or AMP, simply for credit policy or rate reasons”

“No, we haven’t purposely stopped using any bank. Each has a product or facility we measure against the client’s needs and requirements”

“We haven’t stopped dead, but CBA is way down as other banks have caught up with policy, and CBA has not been pricing as keenly”

“Suncorp, Macquarie and Bankwest, because of rates”

“HSBC, Bank of China due to turnaround times blown out”

“BankSA. Everything from application stage to settlement is very stressful ... The deal I did this month went eight days over the finance clause and not even the state manager could get a result”

“Not really but try to avoid St George. While they have best pricing, the credit process is terrible”

MPA presents the overall winners of the 2024 Brokers on Banks survey, showcasing the areas in which these banks soared and why brokers favoured them above their challengers

Position in 2023: 1st

Position in 2022: 1st

Macquarie Bank has again earned the trust and loyalty of brokers, who catapulted the leading lender into the top spot for the third straight year. It’s an extraordinary feat in a competitive market driven by the top bank’s reliable and consistently superior performance.

Across the 10 categories rated by brokers, Macquarie Bank took home an impressive medal haul of three golds, three silvers and four bronzes.

The bank reigned supreme in turnaround times for the fourth year, handily besting its nearest competitor. It also excelled in interest rates, brokers’ top priority this year, and communications, training and development, two areas in which it rebounded from fourth and third place, respectively.

The lender maintained its strong second place in BDM support but slipped to second from last year’s top spot in online platform and services. It came back fighting in the product range category, jumping into a tight second place from its third-place finish the year prior.

Macquarie Bank’s O set Home Loan Package snagged brokers’ top product pick this year, up from second place the year prior. It was also brokers’ top preferred bank for property investors by a sizeable margin.

In the past four years, the bank’s steadfast approach to continuous improvement and service excellence has left a lasting positive impression on brokers. It has firmly entrenched itself as an award-winning lender that values and nurtures the broker channel.

Macquarie Bank reigned supreme in the ever-important turnaround times category and excelled in communications, training and development as well as interest rates, brokers’ top priority

To generate the overall survey results, MPA took an average of the results across each category. Each category had an equal weighting in the final result.

We serve education, emergency services and health workers nationally in all states and territories.

We’re one of a small number of banks participating in the Home Guarantee Scheme to help essential workers own their home sooner.

We understand essential workers like no other bank. Essential workers in education, emergency services, and healthcare who take up our Your Way Plus package will receive a reduced variable interest rate and if they’re a first home buyer the loan’s annual fees will be waived for the life of the loan.

Unlock nationwide access to hundreds of thousands of essential workers in niche industry sectors.

Become an accredited Teachers Mutual Bank Limited broker today to access four customer-owned industry banking divisions.

To find out more or to become accredited contact broker@tmbl.com.au or 1300 86 22 65

Position in 2023: 2nd Position in 2022: 2nd

A tiny margin of 0.01% separated Bankwest from the overall firstplace winner, Macquarie Bank. Bankwest took home more gold than any other competing bank in 2024, with the highest rating in six out of 10 categories. It maintained its top-notch reputation in commission structure, regarded as a core strength for the past five years.

Its gold triumph in BDM support was hard fought again, with a slim margin between Bankwest and Macquarie Bank. Bankwest also returned to a gold win for its product range, having slipped to second place last year. Brand trust, credit policy and diversification opportunities rounded out its first-place medals.

Three solid silver finishes capped Bankwest’s haul this year in communications, training and development, turnaround times and interest rates, a top broker priority in which it narrowly missed gold.

The Perth bank’s complete variable home loan package received the nod for brokers’ product pick again this year, and it retained its second place as the preferred bank for property investors, while slipping to third for first home buyers.

Position in 2023: 5th Position in 2022: 10th

Suncorp Bank continues its remarkable ascent to the top three of the best banks rated for performance by brokers in 2024. It cracked the top five last year, signifying an upward trajectory from 10th place in 2022.

The determined contender picked up three bronze medals in BDM support, product range and the all-important turnaround times for the first time, demonstrating its ability to compete with larger lenders.

It retained fourth place in online platform and services, and its adoption of AI drew accolades from many brokers, citing more streamlined services and ease of doing business.

Brokers lauded the bank for its competitive loan deals and the excellent value it provides to customers. It placed third in brokers’ preferred banks for commercial clients.

CommBank finished fourth overall this year. While its medal haul is lighter than last year, brokers rea rmed Australia’s biggest bank as their top choice for first home buyers and foreign non-residents.

The bank delivered a solid performance in diversification opportunities and credit policy, earning two silver medals. But it was nudged out of the gold by rival Bankwest in these two areas.

CommBank also picked up two bronzes for its communications, training and development, and interest rates.

The bank’s overall score was negatively impacted by its ongoing underperformance in online platform and services. Despite this, brokers noted that it is leading the way in leveraging AI to streamline processes. They also expressed appreciation for CommBank’s updated broker and valuation portals.

This year, digital bank ING advanced one spot, moving from sixth place to fifth. It was separated from fourth by a razor-thin margin.

Its online platform and services earned the highest rating among brokers, garnering it gold in the category.

The lender also achieved silver and bronze for brand trust and turnaround times, respectively, two key metrics that brokers consider crucial.

ING is building a reputation for o ering the best loan deals to customers, with many brokers citing it among the top banks for competitive rates and customer satisfaction.

By harnessing technology to provide a seamless experience for brokers and their customers, ING is well positioned to ignite competition among Australia’s legacy lenders and banks of all sizes.

As well as ranking the banks in 10 categories, brokers were asked to name their favourite mortgage products of the last 12 months. Here are the top three

Macquarie Bank and its enduring O set Home Loan Package are back in the top spot in 2024 after falling to third place last year from first in 2022.

Brokers emphasised the bank’s low rates and annual fees, credit policy and great BDM support. They also praised the bank for its commitment to excellent client service.

Other respondents appreciated the fast turnaround times and “no channel conflict”. Brokers highlighted the product and process as “simple, e cient and well-priced”.

“Good all-around option, good rates, good lender with good policy,” one broker said. Another respondent added, “Multiple o sets, great digital platform, a reputable lender.” Several respondents cited the package as among the most flexible loan structures, noting that clients can open up to 10 o set accounts.

Bankwest’s Complete Variable Home Loan Package and Macquarie Bank have traded places for the two top spots since 2021. This year, Macquarie Bank took the top spot, pushing Bankwest to second.

The product continues to be highly regarded for its features and policy, with brokers reporting that it had been a good fit for many of their clients in the last 12 months. With its multiple o sets, pricing and low-cost o set options, brokers don’t hesitate to recommend it.

Brokers cited an a nity for the bank’s BDMs and mentioned several by name, a testament to their outstanding customer service and broker support.

“Bankwest has a great mix of policies, making them a lender of choice for many scenarios,” a broker remarked.

Another commented, “Excellent policy. This product suits first home buyers, new home buyers, investors and all refinancers.”

ANZ’s Standard Variable Home Loan Package has emerged in third place, garnering a spot among brokers’ top picks for the first time.

Brokers appreciate its cost-saving features, reliable policy and exceptional support.

According to one broker, the product o ers “the best policy” among Australia’s big four banks, while another highlights the trustiness of the bank’s service level agreement. Additionally, the product’s competitive price with no annual fee; negotiated rates; and availability of o sets make it an attractive option for many clients. The bank’s responsive BDMs add to the overall positive experience.

ANZ finished in sixth place overall in the 2024 Brokers on Banks survey and picked up silver in the commission structure category.

Macquarie Bank’s efforts to work closely with brokers have been rewarded with the bank claiming the No. 1 spot in the Brokers on Banks survey for the third year in a row. MPA talks to head of broker sales Wendy Brown

AN UNWAVERING commitment to developing strong and enduring relationships with broker partners continues to pay dividends for Macquarie Bank.

The major bank has been named winner of MPA’s Brokers on Banks for 2024, the third consecutive year it has won the coveted title.

To gain an understanding of the findings of the Brokers on Banks report, the areas Macquarie Bank excelled in, how the bank responds to the needs of brokers, and its ongoing investment in technology, MPA caught up with Macquarie Bank head of broker sales Wendy Brown.

“Brokers are at the heart of our home loans business, so we’re incredibly proud to be named the winner of the Brokers on Banks award for the third year running,” says Brown.

“As a committed partner to the broker industry, this award is wonderful recognition of all our teams that work hard to deliver a best-in-class service and experience to brokers and their clients.”

Brown says Macquarie Bank’s teams spend a lot of time listening to feedback and getting to the heart of what brokers tell them they need, including where they can enhance their offering.

“To receive this award for the third year in a row is a great testament to those teams, and

we’re delighted that our offering continues to resonate with the broker community across Australia.”

More than 90% of Macquarie Bank’s home loans were sourced via brokers over the last 12 months.

“This channel is extremely important to our business,” says Brown. “We take a relationship-focused approach, meaning our market-facing teams are committed to building deep and lasting connections with

through direct conversations with Macquarie’s BDM teams.”

The feedback is captured and shared internally and is essential to prioritising what the bank works on next, ensuring that “we’re acting on what brokers tell us matters most to them and their clients”.

As an example, Brown says brokers have told Macquarie that giving support staff access to the Broker Portal would significantly improve the running of their busi-

“Brokers are at the heart of our home loans business, so we’re incredibly proud to be named the winner of the Brokers on Banks award for the third year running”

brokers, understanding what matters most to their businesses.”

Broker feedback is fundamental to how Macquarie Bank reviews and evolves its offering, says Brown. “We take an ‘alwayson’ approach to the feedback that brokers have about their engagement and experience with Macquarie. We do this in a number of ways, such as via surveys and

nesses. “So we’ve evolved our portal to include access for support teams, which is driving meaningful efficiencies for broker businesses across Australia.

“In addition, we’ve also combined our broker channels across home, commercial and car loans as one team, which allows us to diversify our offerings to meet more client needs and drive efficiencies.”

Name: Wendy Brown

Title: Head of broker sales Company: Macquarie Bank

Years in the industry: 24

What’s the best part about winning Brokers on Banks 2024? “The award recognition is especially important to us as it’s voted for by brokers we work with every day and further solidi es our position as a committed partner and tier-one lender.”

Brown says Macquarie Bank BDMs are also highly experienced and knowledgeable, providing brokers with confidence and guidance every step of the way.

In this year’s Brokers on Banks survey, the bank ranked first in three categories: communications, training and development; interest rates; and turnaround times.

Macquarie Bank’s strong feedback mechanism for brokers has been instrumental to “how we do business and to our ability to innovate”, Brown says.

“We also use a range of data insights to gain a deeper understanding of our clients and brokers, delving into their needs and wants.

“We communicate regularly with brokers and their support staff in a variety of ways to provide them with regular updates, news, and give them the confidence that they have everything they need to support their clients.”

To further support broker partners, Macquarie Bank offers:

• direct access to specialised support teams (BDMs, Broker Support, credit team, etc)

• BDMs who are credit specialists who can help brokers through any scenario to find the fit for their clients

• a clear and transparent rates and credit policy

• weekly SLAs – consistent and transparent messaging across the business

• proactive communication on product, service and business changes

Brown says Macquarie Bank recognises that control, transparency and confidence are fundamental throughout the home loan application journey for both brokers and their clients.

“We know this from the conversations we’ve with brokers day in and day out, and we apply this understanding to all of our touchpoints across our home loan offering.”

Brokers are given information on a weekly basis, including current turnaround times, updates to credit policy and interest rates, and details on new features and functionality.

Communications, training and development

Macquarie Bank communicates with brokers and their support teams regularly, sharing important information in a timely and effective way

Effective and regular communication builds trust and deeper, more transparent relationships

The bank runs regular training and development sessions with its broker partners

BDM teams have a deep understanding of products, platforms and processes

Significant investment in technology means that Macquarie Bank consistently delivers market-leading turnaround times, providing greater confidence and clarity throughout the application process

Brown says effective and regular communication with broker partners and their support teams builds trust and deeper, more transparent relationships.

Macquarie Bank runs regular training and development sessions with brokers.

Its BDM teams have a deep understanding of the products, platforms and processes the bank offers, as well as broader marketplace trends.

“They are supported by the wider Macquarie home loan ecosystem, which includes our operational and support functions which we’ve continued to invest in and grow,” says Brown.

Credit teams also work closely with BDMs to share updates and changes on credit policies to ensure brokers have easy access to the information they need.

Brown says turnaround times are one of the most important factors for brokers and their clients. “Because of the significant

investments we’ve made over several years in our technology platforms, we consistently deliver market-leading turnaround times. This provides greater confidence and clarity throughout the application process.”

Brokers also voted Macquarie Bank the No. 1 preferred bank for property investors. Browns says its lending products and banking solutions have been engineered to support investors.

Within a single Macquarie Bank loan facility, she says customers can set up multiple loan accounts, and each of those accounts can have different repayment types and interest types.

“For example, within a single facility you may decide to have one loan account that’s got a fixed rate principal and interest repayment, and another loan account that has a variable rate interest-only repayment.”

Technology and innovation are a key focus at Macquarie Bank. Brown says empowering brokers and clients with faster, simpler and more secure technology gives them the tools to carry out their work.

“Often, we find it’s the everyday improvements that our brokers respond best to. For example, our portal allows brokers to see their clients’ loan details, interest rates, fixed rate loan expiration and much more, all at their fingertips.”

Brown says this helps brokers navigate discussions and questions from their clients quickly and easily and support clients through crucial moments.

“These enhancements were brought to light through broker feedback.”

In 2024, Macquarie Bank has a range of new and exciting initiatives underway to improve efficiency, productivity and, “most of all, improve brokers’ experience with us”, Brown says.

“We are working on some enhanced security features, real-time platform support, in addition to continuing to improve the functionality within Broker Portal even more, and we look forward to communicating these enhancements with our brokers throughout the year.”

Up to $3,000 cash rebate*

For First Home Buyers with Lender’s Mortgage Insurance

heritage.com.au

*First Home Buyers who purchase or build a home or investment property and purchase Lenders Mortgage Insurance can receive up to $3,000 cashback. Available for applications submitted between 1 February 2024 and 30 April 2024 and funded by 31 July 2024. Excludes Bridging loans and Business loans and refinances of existing Heritage Bank loans or any existing People’s Choice loans. Terms and conditions, fees, charges and lending criteria apply. Full terms and conditions available at heritage.com.au/terms-conditions. Target Market Determinations available at heritage.com.au/TMD. Offer may be varied or withdrawn at any time. Heritage Bank, a trading name of Heritage and People’s Choice

AFSL and Australian Credit Licence 244310.

We can do:

Alt Doc up to 90% LVR.

ATO debt consolidation.

Cashout for business purposes and working capital.

Credit impairments and missed repayments.

Self-employed from 6 months.

During a tougher economic period in 2023, customer-owned banks held their own, working closely with brokers to retain home loan clients. Now they are looking forward to interest rate cuts, improving their loan processing technology and highlighting their environmental and ethical frameworks

IT’S BEEN another challenging year for the mutual banking sector, but once again the banks’ ability to adapt to changing customer needs and build on strong partnerships with brokers has paid off.

Despite aggressive competition from the major banks, which pursued new customers through cashbacks, customer-owned banks outperformed their bigger rivals.

The KPMG Mutuals Industry Review 2023 report revealed loan portfolio growth of 6.1% for the sector, compared to 4.8% for the major banks and 4.2% for all banks.

Customer-owned banks worked hard, in conjunction with their broker partners, to assist customers struggling with higher interest rates and inflation, offering the best rates possible to those rolling off fixed rates onto variable loans.

Staying close to their customers and broker partners and being responsive and upfront about their value proposition assisted with customer retention and maintaining market

share. Other factors, such as green lending, ethical investment and ESG, also attracted new business.

While processing and turnaround times continue to be a challenge, customer-owned banks are determined to lift their game in this area, investing in new technology.

In 2023, Greater Bank and Newcastle Permanent merged to create Newcastle Greater Mutual Group, while Heritage Bank and the People’s Choice Credit Union also merged, with the brands to be unified under the name People First Bank.

To discuss these and other issues, third party leaders from top customer-owned banks Bank Australia, BankVic, Beyond Bank, Gateway Bank, Heritage Bank, Newcastle Permanent, P&N Bank and BCU Bank and Teachers Mutual Bank Limited attended MPA’ s annual industry roundtable, held at Woodcut Restaurant in Sydney. Also taking part in the discussion were mortgage brokers Jennifer Lemme

In a year of rising interest rates, higher inflation and reduced borrowing capacity, how have customer-owned banks and their broker partners risen to these and other challenges?

Zeb Drummond, chief operating officer at Gateway Bank, said brokers and lenders in partnership had done a really good job of bringing customers through this challenging experience, “something that they likely haven’t faced before”.

“You list off all the pressures, and brokers at the coalface are trying to manage expectations of customers and trying to, in some instances, get them into market in an environment where historically it’s been running away from people,” Drummond said.

In a higher interest rate environment with loan buffers, “it runs away even faster”.

Drummond said for customers this meant loan approvals ‘in principle’ that were expiring; reassessments; and potentially reduced borrowing capacity.

“That person’s dream right in front of your eyes slips away. For us, it’s been about acknowledging that and trying to support brokers managing those customers’ expectations and trying to meet them.”

This involved listening to what customers and brokers were saying and honouring, wherever possible, “what we said we were good for”, Drummond said.

“Let’s find a way to continue to honour

to be able to educate their borrowers about a BankVic home loan.

“The key for us has been working with our brokers to make sure they are comfortable with our product mix, how we work and the assessment criteria we require. We want to make sure that they are comfortable with our end-to-end process and who BankVic is – so it’s not just about the rate.”

Farrell said BankVic had just come out of testing with one aggregator and now had a national broker offering.

“It’s been a slow burn for us because we want to make sure we get it right”

“As a customer-owned bank, one of our core values is putting people before profits. Instead of dividends for third party shareholders, profits are reinvested to benefit our customers through competitive interest rates for the life of the loan”

Kaine Adamson, P&N Bank and BCU Bank

that approval in principle so that we’re not snatching that dream away from people.”

Drummond said this approach was well received by brokers.

“It’s what I would like to have happen if I was a consumer. Just appreciate that it’s me trying to buy a house for my family, not just a number on a piece of paper. See that I’m good for it; help me do it.”

BankVic head of distribution channels

Jay Farrell said the bank was new to the broker channel, “so navigating the differences between working directly with members and via brokers has been a great learning experience”.

Echoing Drummond’s comments, Farrell said BankVic was focusing on building its relationships with brokers in order for them

Mark Middleton, head of third party distribution at Teachers Mutual Bank Limited, said it had been a “really interesting year of two halves for both banks and brokers”.

He said at the beginning of 2023 a lot of loans went to banks offering cashbacks, particularly the majors.

“That would be hard for those brokers, as well as the banks, when you’ve got someone sitting in front of you – where do you direct the right solution for those customers?

“We’ve found that as cashbacks came off during the year, [loan] flows went up substantially during that period, and then it’s trying to manage those flows from an SLA perspective.”

Middleton said it had been difficult for TMBL to manage the expectations of brokers

as the focus went more towards refinances, and turnaround times rose.

“We had to be honest and tell brokers, if you’ve got a purchase it’s going to make it really hard – we don’t have that queueing system of purchase versus refinances, and our flows went up 300%,” Middleton said.

TMBL also had to cope with high customer demand for the Home Guarantee Scheme.

“We’ve changed our focus away from fixed rate products to variable rate products. This has rebalanced our portfolio for the future and produced better margins.”

Middleton said all customer-owned banks appreciated working with brokers – a core part of their businesses.

Newcastle Permanent head of digital product development Simon Burt agreed with Middleton about 2023 being a year of contrasts and banks needing to understand how they should position themselves in the market.

“Last year in this forum we were talking about the fixed rate cli ,” Burt said. “Part of that was the shift away from the majority of new business as fixed into a much more variable mix.

“We all have this challenge of trying to find

that balance between the right level of pricing to drive our first party business, and broker.”

Burt said the broker sector had performed strongly for Newcastle Permanent over the year. “We’ve also had a lot of success in that retention space. We wrote a lot of those

have the best options presented to them at roll time for their situation.”

Burt said that in terms of broker partnerships, one of the challenges for customers had been borrowing capacity as rates rose and capacity reduced.

“The broker sector has performed strongly for Newcastle Permanent. We also worked hard to retain customers when their fixed rates rolled o , ensuring they have the best options presented to them at roll time”

Simon Burt, Newcastle Permanent

customers on fixed rate loans to brokers, and new customers to the bank.”

Burt said the bank had worked hard to retain customers when their fixed rates rolled o onto variable rates.

“We’ve done really well in that space, looking after our customers, ensuring they

“We continue to get feedback from our broker partners. Staying close to them through our BDMs is really critical, and making adjustments to policies, process and products to continually evolve.”

Darren McLeod, head of third party at Beyond Bank, said the bank had enjoyed a

There’s a different way. We’re a customer-owned bank with more than 120 years’ experience you can count on.

newcastlepermanent.com.au

record year of third party lending, with 50% of total volume.

“We only started dealing with brokers seven years ago, and that volume is not bad in that short space of time,” McLeod said. Brokers enjoyed more than 70% share of the residential home loan market.

“We had a record year, so our focus has been on making sure we’ve got competitive prices, products and features,” McLeod said. “The results speak for themselves. As a smaller lender, you’ve just got to make sure you take your opportunities when they come.

“We had some good pricing and products for the last 12 months. Our first half of the year was a lot of first home buyers through the NHFIC scheme.”

McLeod said that in the second half, when Beyond Bank wrote most of its volume, cashbacks dissipated, “so our refinances really increased”.

“We’re also quite aggressive on investment, because our book was a bit skewed towards owner-occupied, so in the last six months we’ve written lot of investment [loans] as well.”

Beyond Bank’s biggest challenge had been keeping up with service and turnaround times, McLeod said.

“2024 is the year of improvement for us. We’re investing heavily in technology, structure, processing, etc, so we can still have these competitive products and pricing and turn them around as brokers expect.”

Heritage Bank head of broker and business banking Stewart Saunders said that from a customer perspective, “it’s been an incredibly challenging year with increasing costs across the board”.

“Homeownership is the largest component in most households’ cost base, and that’s increased significantly over the year,” he said. “Low fixed rates coming o has been really challenging for many households with significant increases in repayments.”

Saunders said customer-owned banks had remained competitive on pricing and by supporting customers coming o fixed rates.

“Brokers are so instrumental to how mutual banks really do work to support those

“For brokers facing clawback, our team call them and say, ‘Do you realise that your customers are refinancing? If it’s going to another broker or it’s going to another lender, we need you to know’ ”

Zeb Drummond, Gateway Bank

customers. You see it coming to the fore now. It’s coming through in the growth numbers for all of the mutual banks.”

Saunders said banks were working with brokers to help first home buyers, refinancers and investors, and existing customers facing servicing issues.

“Working with brokers and customers to get better rates and options has really helped all of us and means that fewer people are facing hardships. This is where mutual banks and brokers are so fundamentally aligned, because we’ve all got the customer’s best interests at the heart of what we do.

“As a mutual bank, our members are our

owners. That’s why we always have our customer’s best interests as our top priority, just as brokers do under best interests duty.”

Saunders said customer-owned banks didn’t have the challenge of trying to maximise profits for investors. “This is not about the best price for one customer; it’s about the best price for all of our members.”

Broker support was shifting to the mutuals, and brokers were o ering them as a competitive option for their borrowers.

“We’ve now passed five million mutual bank customers across the sector,” said Saunders. “One in five households are now banking with a mutual, which is great to see.”

Saunders said customer-owned banks had more than 720 branches across the country, which was 18% of the total branch footprint. Of all the banks represented at the roundtable, 52% of staff from mutual banks worked in non-metro areas.

“It’s the overall service offering that mutuals provide which has really been recognised by customers,” he said.

Bank Australia had also grown considerably over the last year, said national manager broker Matthew Wood.

“Our annualised growth rate is currently at about 22%; and 70%, from a settlement perspective has been attributed to brokers,” said Wood.

“Brokers have really stood up in the last year. Their communication and their strategies – talking well in advance to those clients coming off fixed rates, to me was quite impressive.”

Wood said Bank Australia had worked extensively with brokers throughout the year, and “we’re getting the benefit of it”.

More time and resources had gone into ensuring that customers’ financial wellbeing “was being looked after, between us and the broker”.

“I think in the 2023 financial year, we only had 0.3% in financial hardship within our portfolio. The brokers are looking after their clients, and we’re emulating that as well.”

pressure, consumers wanted to turn to banks they could trust for support.

“I believe that as part of the customerowned sector, putting people before profits is a fundamental value shared by everyone

“The key for us has been working with our brokers to make sure they are comfortable with our product mix, how we work and the assessment criteria we require”

Jay Farrell, BankVic

Kaine Adamson, general manager broker at P&N Bank and BCU Bank, said that in a challenging economic environment with household budgets already under increased

at this table,” Adamson said. “As a customerowned bank we’re not focused on delivering dividends for shareholders, instead passing our profits back to our customers through competitive interest rates for the life of the loan.”

Adamson said that with a number of customers coming off fixed rate mortgages, it was natural to see increased concern about repayment shock.

“Our brokers were telling us they were spending a lot of time repricing their existing customers, diverting their focus from generating new business. We asked ourselves –what’s a way that we can solve that?”

So P&N Bank launched a new revert product for all new and existing customers to roll onto once their fixed rate matured, with a rate that matched its competitively priced advertised rates.

Adamson said that across the industry, fixed-rate customers typically transitioned to a standard variable rate product, which often carried an interest rate between 1% and 3% higher than advertised rates for new borrowers.

“Not only was this a way to reward the loyalty of our existing customers, but it has also alleviated some of the strain borrowers have been experiencing and has saved our brokers countless hours of having to negotiate

to be partnering with SFG BankVic have joined the Specialist Finance Group lender panel.

BankVic is the bank for police, emergency and health workers. Our products and services are designed with these sectors in mind, to make banking easier and more accessible for those who protect and serve our community.

To find out how to get accredited with BankVic contact the BankVic broker team today brokerloans@bankvic.com.au bankvic.com.au/broker

better rates on behalf of their clients. It’s good for our customers, it’s supported retention, and we believe it’s a win-win for everyone involved.”

Servicing was also getting tighter, and brokers were struggling to find out where a deal would fit, Adamson said. In response, P&N Bank partnered with Quickli, getting the bank’s servicing calculator onto the platform, saving brokers more than 30 minutes per deal.

Broker Mandy Hill said customer-owned banks really looked after customers, and she used them on a regular basis.

“You’ve really come to the market with your retention rates, offering great interest rates right off the bat,” she said. “With other lenders I have to really fight for that, which takes up a lot of our time. It just creates a better customer experience because they feel like you’re showing loyalty to them.”

Hill also praised the retention rates, some of which were better than what was advertised. “I’ve definitely felt very supported by the customer-owned banks in that space over the last 12 months,” she said.

Mortgage adviser Jennifer Lemme said she was a big believer in supporting local small

businesses. She was referring more clients to customer-owned banks, and they were easier to get in touch with.

“You can reach out to assessors; you can have a discussion. It’s just not a decline; you can talk things through,” said Lemme. “Especially with servicing calculators and

more supportive of brokers than other lenders, and the customer service was more personalised.

“I think the after-loan customer care is great. If there’s an issue, they can ring up. A lot of clients with the majors, they get someone overseas or they never get back to them.”

“We’ve got a new loan origination platform, with the aim of quick turnaround times. We also want to be auto-approving more loans, doing more electronic valuations and using tools like eSign”

Darren McLeod, Beyond Bank

borrowing capacity – anything they could possibly do just to get a deal over the line.

“They’re just nice. They get back to you straight away. You don’t tend to have that touchy-feely experience with the majors.”

Lemme said customer-owned banks were

Hill said customer-owned banks were a long-term solution for clients because of their retention policies.

“When I’m offering that long-term solution, it’s a win-win situation for everyone. It’s a win for Heritage Bank, for example, because you retain the business. It’s a win for Mortgage Managed because I’ll retain the business. It’s a win for my client because they’re still getting a really attractive offer.”

Middleton said the difference for brokers compared to dealing with a big bank was that “we know who you are”.

“You get to know from looking at the flows coming through which brokers are supporting you.”

Due to the mortgage cliff, all customerowned banks had made a concerted effort on retention, Middleton said.

“How do we protect our portfolio?

The difference probably to an ANZ or a CommBank is they’ll go right through the process, [say] here’s your best price, and at the last minute they change their mind and give you a better price.”

Unlike the big banks, Middleton said TMBL was upfront about the retention rates

it could offer brokers, which were below the published rate. “We really do want to look after the customers you’ve got, [rather] than trying to bring on a new one.”

Hill said this was a massive point of difference for brokers and a time-saver.

Burt said all the mutuals had a similar approach, which had built a lot of trust with brokers.

McLeod said Beyond Bank had always been transparent and upfront about its rate sheet, with no “trickery” involved.

Hill said she just wanted banks to tell her their best price. Giving an example of a rate pricing from a major bank, she said she went through the pricing tool and “then they gave me the best choice, I escalated it, and they still didn’t come back with a very competitive offer. I went to my relationship manager, and I said, ‘Surely you can do better here; either that or I’ve got to take them elsewhere, because it’s not the right thing by the client’.”

Hill was told to ring the retention team “as if they [the customer] is leaving”.

“So, I’ve done a pricing request, I’ve done an escalation, I’ve contacted my relationship