50 Top

The most influential women in Canada’s mortgage industry whose significant impact is shaping a more equitable future

BROKERS ON LENDERS

This year’s top-performing lenders in the eyes of their broker partners

SPEAKING THEIR MINDS

Leading women in mortgages advocate for female empowerment

JOURNEY TO THE TOP

FCT president on her remarkable path to mortgage success

MPAMAG.COM/CA ISSUE 18.02 | $12.95

Discover how Karen Fogel, Vice President, Marketing, embodies Blue Culture. Visit MCAPblue.com/Karen More than just business, it’s personal. MCAP Service Corporation | Ontario Mortgage Brokerage #10515 | Ontario Mortgage Administrator #11692

CONTENTS

FEATURES WOMEN IN MORTGAGES

Female industry leaders on how they are promoting women’s growth in the

CONNECT WITH

US

Got a story or suggestion, or just want to find out some more information?

twitter.com/CMPmagazine

facebook.com/MortgageProfessionalCA

UPFRONT

02 Editorial

The value of nurturing relationships

04 Statistics

The ups and downs of a volatile market

09 Opinion

Brokers’ success lies in embracing their individuality

FEATURES

10 Integration journey

CENTUM’s new mortgage calculator is a key step forward in its integration with its sister companies

24 Genius broker tool

SPECIAL REPORT

TOP 50 WOMEN OF INFLUENCE 2023

CMP presents this year’s most influential women in Canada’s mortgage industry who are lighting the way forward for emerging leaders

PEOPLE INDUSTRY ICON

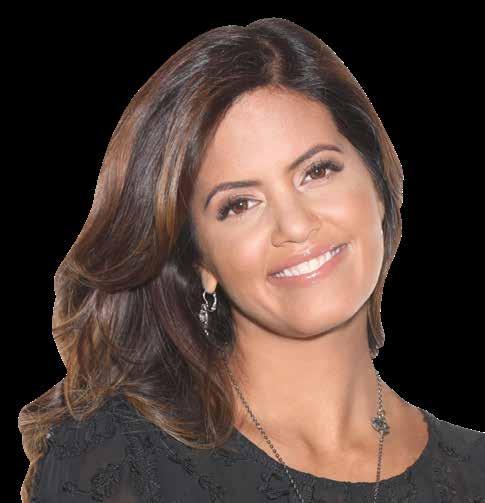

Daniela DeTommaso’s journey through law to mortgage success: from a lucky break at FCT in its days as an “exhilarating” startup to her rise to president of the title insurance giant

Canada’s best mainstream and alternative mortgage lenders as rated by their broker partners

SPECIAL SECTION LENDING GUIDE

Borrowers facing challenges are finding new paths to funding at alternative and private lenders

Axiom Innovations’ new deal placement tool, Scarlett Genius, can give brokers more control over the mortgage process

26 Benefits of outsourcing

Intellifi explains how business process outsourcing can save costs and free up lenders’ time for scaling their operations

38 Lenders respond

Top-performing companies in this year’s Brokers on Lenders survey talk about how they achieved their best-in-class marks

PEOPLE

44 Broker insight

Mortgage Savvy CEO Rakhee Dhingra discusses the company’s growth as a wealth-building movement

46 Other life

Vine Group’s Kim Nguyen on how

MPAMAG.COM/CA

CHECK IT OUT ONLINE

www.mpamag.com/ca 1 06

ISSUE 18.02

17

12 27

Relationships build value proposition

Throughout the housing market boom of recent years, the ability of mortgage brokers to step up to the plate and help clients secure their dream homes was in ample evidence – but the changing markets of 2022 and 2023 have shone an even stronger light on the value of brokers.

Surging mortgage costs and higher qualifying criteria have presented their fair share of challenges for homeowners and buyers alike in the year to date. Still, while brokers excelled from a transactional perspective when rates were low and activity was high, their knack for developing relationships with clients has come to the fore in 2023, highlighting a quality of service that simply can’t be matched elsewhere.

It’s been a common theme of CMP’s discussions with brokers this year: that they make themselves available to clients day and night, on workdays and weekends, to field their queries and concerns about the range of issues that have emerged in 2023.

When it comes to customers who already own a home, those conversations often involve advice on whether to lock into a shorter-term fixed mortgage rate or ride out the variable. Extended amortizations and refinancing options are just some of the other topics discussed.

New homebuyers have seen prices rebound while interest rates continue to climb, meaning brokers’ being able to present a variety of different borrowing options, rather than the yes/no answer often offered by the big banks, continues to make them a huge asset in the eyes of prospective new entrants to the market.

The ability to flourish through a relationship-driven approach is a value proposition that shouldn’t be underestimated. With a recent Real Estate and Mortgage Institute of Canada survey indicating that many Canadians have regrets over taking out a mortgage, agents and brokers are the financial professionals best equipped to steer those homeowners through the current market challenges and get them safely to the other side.

After all, homeownership remains a leading aspiration across the country –71% of non-homeowners still aspire to buy their own place, according to a June CIBC poll – and by building relationships and demonstrating genuine care for the financial well-being of their clients, agents and brokers are leading the way in showing that help is at hand when needed.

TheteamatCanadianMortgageProfessional

www.mpamag.com/ca

ISSUE 18.02

EDITORIAL

Global Managing Editor

Paul Lucas

Editor

Fergal McAlinden

Writers

Desmond Devoy, Kim Champion, Ephraim Vecina

Lead Production Editor

Roslyn Meredith

Copy Editor

Allison Ingusan

CONTRIBUTOR

Jason Singh

ART & PRODUCTION

Designers

Joenel Salvador, Juan Ramos

VP - Production

Monica Lalisan

Production Coordinators

Kat Guzman, Loiza Razon

Client Success Coordinators

Cole Dizon, Jenelle Guarin

SALES & MARKETING

VP - NAUK Mortgage

Chris Anderson

Account Executives

Shane Lakhani, Erik Nielsen

Head of Marketing

Oliver McCourt

Awards Director

Jessica Duce

CORPORATE

President & CEO

Tim Duce

HR Business Partner

Alisha Lomas-Oliver

Director – People and Culture

Julia Bookallil

Chief Information Officer

Colin Chan

Chief Revenue Officer

Dane Taylor

Global CEO

Mike Shipley

Global COO

George Walmsley

EDITORIAL INQUIRIES fergal.mcalinden@keymedia.com

SUBSCRIPTION INQUIRIES

tel: 416 644 8740 • fax: 416 203 8940 subscriptions@kmimedia.ca

ADVERTISING INQUIRIES chris.anderson@keymedia.com

KM Business Information Canada Ltd 317 Adelaide Street West, Suite 910 Toronto, ON M5V 1P9

tel: +1 416 644 8740 www.keymedia.com

Canada • USA • UK • Australia • NZ • Philippines

CanadianMortgageProfessionalis part of an international family of B2B publications, websites, and events for the real estate and mortgage industries

MORTGAGE PROFESSIONAL AUSTRALIA claire.tan@keymedia.com

T +61 2 8437 4772

AUSTRALIAN BROKER simon.kerslake@keymedia.com

T +61 2 8437 4786

NZ ADVISER alex.knowles@keymedia.com

T +61 2 8437 4708

MORTGAGE PROFESSIONAL AMERICA katie.wolpa@keymedia.com

T +1 720 316 7423

MORTGAGE INTRODUCER (UK) matt.bond@keymedia.com

T +44 7525 456869

UPFRONT EDITORIAL 2 www.mpamag.com/ca

Copyright is reserved throughout. No part of this publication can be reproduced in whole or part without the express permission of the editor. Contributions are invited, but copies of work should be kept, as the magazine can accept no responsibility for loss

The ability of brokers and agents to flourish through a relationship-driven approach is a value proposition that shouldn’t be underestimated

STAY CONNECTED - ANYTIME, ANYWHERE!

Introducing our innovative connect platform that empowers our members to tap into our comprehensive suite of resources and utilities, regardless of their global location. Forge connections with esteemed peers throughout the CENTUM Network, all without the distractions and chaos often found on popular social media platforms and forums.

• View all our events, manuals, documents, and communications anywhere you go.

• Share your triumphs with fellow CENTUM Members.

• Engage in private group discussions, cultivating meaningful dialogues.

• Tackle challenges head-on, with the support of our platform.

• Comment on other members’ posts and follow your new connections.

®/™ trademarks owned by Centum Financial Group Inc. (C) 2022 Centum Financial Group Inc. The intent of this communication is for informational purposes only, and is not intended to be a solicitation to anyone under contract with another mortgage brokerage operation. jeff_sampson@centum.ca

joincentum.ca

|

DEBT NOW AN OVERRIDING CONCERN

RATE HIKES REVERBERATE THROUGH HOUSING MARKET

The Bank of Canada’s rate-hiking campaign that saw the policy rate spike tenfold between March 2022 and July 2023 has had a significant cooling effect on home prices. This was most apparent during the central bank’s conditional pause over the first half of 2023. “Bank of Canada signalling appears to be playing a major role in shaping housing market dynamics,” TD Economics said in a June 2023 report.

VOLATILE MARKET SLOWS HOME SALES

Home sales momentum across Canada ground to a crawl with the Bank of Canada’s 2022/23 rate hikes. Aside from the BoC policy rate reaching a 22-year high this June, other major factors that contributed to the slowdown were ongoing economic volatility and steadily rising construction costs.

CHANGE

UPFRONT STATISTICS 4 www.mpamag.com/ca Jul 2022 Jan 2023 Oct 2022 Apr 2023 Sep 2022 Mar 2023 Dec 2022 Jun 2023 Jul 2023

Source:StatisticsCanada;CAIRP;TransUnionCanada Note: Some months have no data as the BoC did not conduct policy meetings during those months Source: Canadian Real Estate Association

IN VOLUME

NATIONAL HOME SALES 5% 4% 3% 2% 1% 0% 20% 10% 0% -10% -20% -30% -40%

OF

$11.2 billion Canadian mortgage debt in first three months of 2023 alone 14.9% Household debt service ratio as of Q1 2023

Annual increase in Canadian consumer insolvencies in Q2 2023

Share of Canadians who believe a recession is already in progress, further jeopardizing their financial outlook Dec 2022 Nov 2022 May 2023 Oct 2022 Apr 2023 Sep 2022 Mar 2023 Aug 2022 Feb 2023 Jul 2022 Jan 2023 Bank of Canada policy rate Monthly Annually Jun 2023 Jul 2023 2.5% 3.25% 3.75% 4.25% 4.5% 4.5% 4.5% 4.75% 5%

23.5%

36%

Month-over-month change in aggregate composite home price index

PRESSURE OF FALLING INVENTORY

The irregular trend in housing starts in the first half of 2023 led to a steady decline in the number of homes available for purchase, although supply appeared to stabilize as the middle of the year approached.

NUMBER OF MONTHS OF HOUSING INVENTORY

PACE OF HOUSING STARTS STEADIES MID-YEAR

With residential building costs spiking significantly over the past year or so, the pace of home construction in Canada has been inconsistent in 2023. However, the trend seemed to normalize mid-year, with the pace of starts increasing for the second straight month in July.

SEASONALLY ADJUSTED ANNUAL RATE OF HOUSING STARTS – MONTHLY CHANGE

Sources:BankofCanada;CanadianRealEstateAssociation

Source: Canadian Real Estate Association

INFLATION STILL FAR OFF BOC TARGET

The Bank of Canada’s unprecedented series of rate hikes in 2022 and 2023 had the goal of bringing down headline inflation to more manageable levels, but the strategy hasn’t yet reined in the consumer price index to the BoC’s target range of 2%.

CONSUMER PRICE INDEX

Source:CanadaMortgageandHousingCorporation

www.mpamag.com/ca 5

3% 2% 1% 0% -1% -2% -3%

Source: Statistics Canada

May 2023 Apr 2023 Mar 2023 Feb 2023 Jan 2023 0% 1% 4% 2% 5% 3% 6% 7% Jun 2023 Jul 2023 30% 20% 10% 0% -10% -20% 2022 average Jan 2023 Feb 2023 Mar 2023 Apr 2023 May 2023 Jun 2023 Jul 2023 300,000 200,000 100,000 0 -10% -20% JAN 2023 4.3 APR 2023 3.3 FEB 2023 4.1 MAY 2023 3.1 MAR 2023 3.9 JUN 2023 3.1 JUL 2023 3.2

Jul 2022 -1.7% Nov 2022 Mar 2023 +0.2% Sep 2022 -1.4% -1.4% Jan 2023 -1.9% May 2023 +2.1% Aug 2022 -1.6% -1.6% Dec 2022 Apr 2023 +1.6% Oct 2022 -1.2% Feb 2023 -1.1% Jun 2023 +2% Jul 2023 +1.1% Monthly Annually

FINDING OPPORTUNITY THROUGH CHALLENGES

DANIELA DETOMMASO had returned to where it all started – and where it all matters.

The president of title insurance giant FCT was vacationing under sunny 45-degree skies in the very south of mainland Italy, Calabria, when she spoke with CMP in July. A place not far from where she was born, she has returned there almost every summer since she left at the age of three to live in Toronto’s North York.

The youngest of three girls, DeTommaso told the story of her Italian immigrant parents

also manufactured kitchens. When his wife lost her sight, he sold his business so that he could drive her around for business. He became a licensed agent himself.

When DeTommaso was a teenager, her mother won a recognition trip from her company for being a top agent. “She was a rock star. She was amazing,” DeTommaso recalled.

“Now I have the privilege of attending a lot of these trips … and I always tell people that win these trips, ‘Do not discount what a big

wanting to be a lawyer,” she says, in part because “I was a big talker.”

She had originally wanted to go into family law, but a rotation at a firm that handled family law cases made her realize that it probably didn’t best suit her personality.

DeTommaso went on to study law at York University’s Osgoode Hall Law School. After graduation in the mid-1990s, she worked in downtown Toronto at what was then Canada’s oldest law firm. Out of 18 articling students, she was one of three selected for a job.

It was 1996 and life was progressing: she was working on real estate law files – and due to get married. Then the firm declared bankruptcy. “I was devastated,” DeTommaso said.

and the good example they set for her to follow – it’s a family story worthy of a Steven Spielberg movie.

Her maternal grandmother died when her mother was only a year old. Later, her mother was diagnosed with retinitis pigmentosa in her thirties, which left her blind. Yet she became one of the top agents at insurance firm Sun Life, despite not having gone to school.

DeTommaso’s father was a carpenter who

deal this is for families,’ because I remember when my mother won. I was proud of her. She’s inspired me in more ways than I can ever articulate.”

Her parents let her know that nothing was impossible for her.

From law to the meadows of mortgages

One of the dreams DeTommaso had for herself was to go into law. “I always remember

Fate intervened in the shape of a former co-worker, a senior lawyer, who made a connection for her to be interviewed for a job at the fledgling FCT title insurance firm in Toronto’s western suburbs. Through the February snows she trudged, only to be told that the job required five years’ experience, which she didn’t have.

But they took a chance on her anyway, letting her work at FCT while she looked for another job.

As time went by, DeTommaso carried on in the role and grew to love it. Fellow lawyers would call to tell her that their new firm was hiring, but she said “there was absolutely no

INDUSTRY ICON 6 www.mpamag.com/ca

How one of Canada’s largest law firm bankruptcies led an Italian immigrant’s daughter to divert from law to mortgage success

PEOPLE

“We have the people with the skills, we have the competencies ... And we’re always looking for the next thing to add value. Our core is adding value for our customer”

PROFILE

Name: Daniela DeTommaso

Title: President

Company: FCT

Years in the Industry: 27

Big supporter of: The Meagan Bebenek Foundation, which supports research into pediatric brain tumours, as well as the families impacted

INDUSTRY ICON

way that I was interested in going back to a law firm.”

She called her new start-up firm “exhilarating” – she was doing everything from product pricing to underwriting to customer service. “It was just the most exciting job I could never have imagined.”

DeTommaso counts herself lucky that things worked out as they did, even if it was a baptism by fire. She has since worked in every division of the company.

Fast-forward from 1996 to 2021 and the word came out that DeTommaso had been made company president.

“I was overwhelmed with gratitude and humility and appreciation,” she said. When she put down the phone, her first call was not to her family but to those at FCT who

Canadians by doing behind-the-scenes work on a small business loan program administered by the federal government.

“We listened, we mobilized, we delivered,” DeTommaso said.

Innovation is the word for success

FCT has grown from putting its main focus on title insurance and mortgage document processing services to honing in on the value of technology, business process outsourcing, and the like.

“Innovation has always been one of our values,” DeTommaso said, emphasizing the importance the company places on “thinking differently.”

FCT began to look at the value of the information it was collecting; its ability to

FCT AT A GLANCE

Company name

FCT stands for…

First Canadian Title

Founded 1991 Headquarters Oakville, Ontario

Parent company

First American Financial Corporation

Number of employees

More than 1,000 across Canada Services

Residential and commercial title insurance services; residential mortgage processing and valuation solutions for lenders; default and recovery solutions

had given her her start years earlier.

Her husband was so supportive, she said, and her experience showed her three daughters that anything was possible for them.

There were, of course, challenges along the way, perhaps the biggest being the sudden shift to remote work that occurred during the early days of the pandemic. Tough times were expected for the industry in 2020, and FCT made the promise that no one would be let go because of COVID-19.

“It was important to us that we gave our employees that security and peace of mind, knowing that they would be fine,” DeTommaso said. “And then we ended up having the best years in our history.”

They were also able to help their fellow

leverage data to make better decisions internally; and how those skills could be used to help customers, identify their pain points, and offer solutions.

“We have the people with the skills, we have the competencies, and so it was very organic,” DeTommaso said. “And we’re always looking for the next thing to add value. Our core is adding value for our customer.”

She returned to her parents’ example: the immigrant work ethic.

“Keep your head down. Work hard. You’re not entitled – you have to earn everything,” she said. “That has served me so well. I always set goals, but I was always willing to put in the effort to achieve those goals and work hard. I never expected anything to happen.”

Has worked with 450 lenders, 43,000 legal professionals, and 5,000 recovery professionals

Awards

Named one of the Best Workplaces in Canada for the ninth consecutive year in 2023 by the Great Place to Work Institute

“[During the pandemic] it was important to us that we gave our employees security and peace of mind, knowing that they would be fine. And we ended up having the best years in our history”

PEOPLE 8 www.mpamag.com/ca

Embrace your personal brand

Irrespective of where they hang their hats, brokers need to realize the power behind their own brands, says this mortgage pro

IN THE WORLD of mortgage brokering, there is a prevailing belief that success hinges on aligning oneself with a well-known brokerage or network brand. However, I feel this notion couldn’t be further from the truth. Clients choose to work with mortgage brokers because of the individual brokers’ qualities and expertise, rather than the mortgage flag they fly. It’s time to challenge the misconception that your brand is determined by the company you represent and recognize that, as a broker, you are your own brand.

When meeting a new broker or agent, the all-too-common question arises, “Who are you with?” This inquiry is akin to asking about one’s affiliation with a street gang or political party, and it reflects a misguided perspective within our industry. Brokers are often judged based on their response to this question, but this practice is flawed. As a community of brokers, we need to shift our focus and acknowledge the intrinsic value of the individual broker or agent as the true brand, as it’s you whom clients choose to work with.

Clients seek out mortgage brokers for their expertise, guidance, and personalized service. The relationship between a broker and a client is built on trust and a genuine connection. Clients are not solely interested in the brand of the brokerage; they want to work with someone they trust, someone who understands their unique needs and goals. It’s the broker’s individual qualities, skills, and ability to foster relationships that truly matter. By focusing on building your personal brand, you can cultivate a loyal client base that values you for who you are.

Differentiation and competitive edge

Embracing your individual brand allows you to stand out in a crowded marketplace. In an industry saturated with brokers affiliated with various companies, establishing your unique identity becomes crucial. By highlighting your expertise, industry knowledge, and exceptional service, you can differentiate yourself from the competition. Clients are more likely to choose a broker who demon-

Focusing beyond the network

When selecting a mortgage brokerage or team leader, it’s vital to look beyond the surface and examine their capacity to give you the following: attention and guidance, underwriting knowledge, and relationships with service providers. Instead of being swayed by the marketing strategies or brand image, focus on the values and principles that the team upholds and the ability to close deals. Your choice of a work family within the mortgage brokerage industry not only impacts your financial success but also plays a crucial role in maintaining your mental well-being. Prioritizing these factors will ensure that you find a mortgage brokerage that fosters a positive and fulfilling work experience and enables you to give your clients the best product for their specific needs.

The ability to close deals efficiently is another vital aspect to consider. A brokerage with a track record of successful deal closures demonstrates its commitment to excellence and a strong understanding of the industry.

strates a deep understanding of their needs and offers personalized solutions. Your brand as an individual broker is what sets you apart and gives you a competitive edge.

Taking ownership of your brand

It’s time to empower ourselves as mortgage brokers and take ownership of our personal brands. By shifting the focus from the brokerage to the individual, we can reshape the industry’s perception and client expectations. Rather than relying solely on the reputation of a company, brokers should strive to develop their own reputations based on integrity, professionalism, and client-centricity. Building your personal brand requires continuous learning, networking, and honing your skills to deliver exceptional service consistently.

Mortgage brokers should recognize that their success lies in embracing their individuality and establishing their personal brand. Clients choose to work with brokers because of their expertise, trustworthiness, and ability to connect on a personal level. It’s time to challenge the misguided belief that the brokerage or network brand determines one’s value. By cultivating your personal brand, you can differentiate yourself from the competition, build lasting client relationships, and ultimately achieve success in the mortgage industry. Remember, “you are your brand,” and your clients choose you because of you.

UPFRONT OPINION GOT AN OPINION THAT COUNTS? Email mortgagebrokernews@kmimedia.ca www.mortgagebrokernews.ca 9

As a community of brokers, we need to shift our focus and acknowledge the intrinsic value of the individual broker or agent as the true brand

Jason Singh is a mortgage broker at Real Mortgage Associates based in Markham, Ontario.

CENTUM takes first steps in integration journey

CENTUM’s new mortgage calculator on Century 21 Canada’s website is an important step forward in its integration with sister companies

CENTUM FINANCIAL GROUP INC. is taking its first steps toward more closely integrating with its sister companies, with everyone hoping to benefit.

“If these tough times prove anything, it’s that you really, really need to consider additional revenue streams in your mortgage business. Full stop,” said CENTUM Financial Group Inc. president Chris Turcotte, who spoke with CMP recently from his Vancouver-area home office.

That’s why, using integration, CENTUM is part of the solution to ensuring property owners get the most out of their properties,

so that each brand can benefit from crossselling synergies,” he said. The dream was always that, one day, technology would allow for integration opportunities.

CENTUM adds new calculator to roster

On July 28, CENTUM launched a mortgage calculator on the Century 21 Canada website.

“It’s really like nothing the industry’s ever seen before on a real estate site,” Turcotte said. “Our calculator is just on another level.”

CENTUM ’s closing-cost calculator is another addition; its approach sees the online

“They see great value to consumers on the tools,” Turcotte said. The calculators are also sponsored by CENTUM , and “of course, there’s a click-through to our brand. That is our very first live and real integration stuff.”

Century 21 Canada gets more than 500,000 unique visitors every month, according to Turcotte’s latest look at Google Analytics. And that’s in a down market. So that’s hundreds of thousands who will see the calculators brought to them by CENTUM And while a potential client is clicking around, they can also select a mortgage advisor to help them on their journey.

“It’s a gateway to the brand,” Turcotte said. But how else will real estate professionals benefit from this integration?

“Century 21 agents are not paying for all these tools and resources,” Turcotte said. “The CENTUM side is not paying for the exposure. That’s true integration.”

making life easier for them at the same time.

CENTUM is part of Charlwood Pacific Group (CPG), also based in Vancouver, which includes companies like CPG Real Estate Group, Century 21 Canada, and Real Property Management.

Having all this talent under one roof creates a whole real estate ecosystem. When it comes to property, especially investment properties, “we can help buy and sell them, finance them, and then we can manage them,” Turcotte said.

Technology has finally evolved to the point where CENTUM can “create an environment

journey through the eyes of a real estate buyer.

“You’re just trying to figure out how does this whole buying a house thing work,” Turcotte said. “We came at it from that angle.”

The site also boasts a purchasing calculator and a maximum-mortgage calculator.

“Oftentimes, people will look for the house they like, and then they’ll go see if they qualify,” Turcotte said. But the tools also let buyers see the maximum price they can buy for, giving their search more realistic budgetary boundaries.

While it’s early days yet, Century 21 franchisees have been effusive in their praise.

Marketing has its place, but these calculators connect people who have at least a passive interest in a new home to people who can manage their properties, get them a mortgage, etc.

Next steps in the integration journey

In the coming months there will be AB testing, and assessment of consumer traffic behaviour to monitor how well the calculators are doing.

“The whole point of doing that is to make sure that we can raise our penetration rate to ultimately generate mortgage leads for agents,” Turcotte said. “It’s about providing tools and resources for consumers looking to understand the real estate transaction, but with that same spirit of being a helping hand.”

MORTGAGE SERVICES SPECIAL PROMOTIONAL FEATURE 10 www.mpamag.com/ca

“If these tough times prove anything, it’s that you really, really need to consider additional revenue streams in your mortgage business. Full stop”

Chris Turcotte, Centum Financial Group Inc.

There will be more integration news this fall, but Turcotte stressed that CENTUM was taking its time to get it right. One upcoming innovation will be to expand the integration of local Century 21 locations with local CENTUM agents and teams.

“We feel like we’ve really come up with a model that encourages both sides to integrate,” Turcotte said.

The first two Century 21 offices to integrate with a CENTUM franchise are already working together. “And a really high level of CENTUM integration is ultimately what we envision,” he said.

“I’m really excited because I couldn’t have picked two better franchisees that

understand the broader vision, what integration means.”

Integration solution for property investors

“With Real Property Management [RPM] integrated with a CENTUM location, things get really interesting,” Turcotte explained.

He put forward this scenario for CENTUM’s integration with RPM, which has 300 doors under management. Each one of those doors will require a mortgage, as well as property management. Both of those needs can be handled through the planned integration – everything from collection of rent to cutting the grass, to recommending

repairs to increase the property value.

Then there’s CENTUM ’s mortgage company. As part of the package, “we’re always going to make sure you pay the lowest amount on renewal,” Turcotte said. “We’re going to keep an eye on this via our auto-evaluation API, and if there’s an opportunity where you have enough equity to refinance and potentially buy another revenue property, you’re not using any of your own money.”

Back to the 300-doors example. Imagine knowing when all their renewal dates are coming up and being able to farm out those mortgage renewals in-house?

“You don’t mind being competitive on a renewal rate, because you had zero cost of acquisition,” Turcotte said. “You should be able to get almost every single renewal.”

With the property management company, the client knows that the properties have been maintained to a professional standard and have increased their equity. That equity can then be used as a downpayment on the next revenue property, meaning not having to pay anything out of pocket. Which then means that the property management company will get another door to add to its rosters and the mortgage company another mortgage (purchase and refinance), with the knock-on effects from there. That’s not to mention the fully qualified buying referral that’s generated for a real estate agent.

“By identifying one potential refinance lead, we’ve set off five transactions,” Turcotte said.

There is plenty of talk in business, according to Turcotte. Which makes CENTUM the strong, silent type.

“We’re not going to talk; we’re going to execute, and you’re going to see that over the coming months more and more,” he promised. “It’s important to see who is talking and who is executing. Talk can be powerful, but it’s really cheap.”

It can be easy to “look like a hero” during the good times, but during hard times it’s wise to look to companies like CENTUM that are continuing to push the envelope. Turcotte encourages interested parties to “reach out, and we’re happy to tell the story and how you can be involved in it. So leave the execution to us.”

www.mpamag.com/ca 11

“We’re not going to talk. We’re going to execute”

Chris Turcotte, Centum Financial Group Inc.

SPEAKING THEIR MINDS: MEET THE MORTGAGE INDUSTRY’S WOMEN OF INFLUENCE

Whether in boardrooms or back offices, on in-person calls or at our Women in Mortgage event, CMP has taken the pulse of Canada’s top female leaders in the industry on how women are being encouraged in their roles, and what more can be done to create opportunities

What are some of the steps you’re taking to encourage more women to reach the top of the mortgage industry?

Ameera Ameerullah, Canada Mortgage and Financial Group: “To encourage more women to excel in the mortgage industry, I’ve taken steps by serving as a role model, advocating for their representation in leadership positions, and offering mentorship. I actively participate in initiatives that amplify women’s voices and talents.”

Zeynep Babir, 8Twelve Mortgage:

“We’re focused on creating a diverse and equal workplace in the mortgage industry. Our commitment to equal opportunities means we provide a level playing field for everyone. We support women’s growth

through mentoring, training, and networking. By doing so, we’re breaking barriers and promoting women’s leadership, making the mortgage industry more inclusive and balanced.”

Michelle Campbell, Mortgage District: “My focus is to promote visibility and recognition, ensuring that women’s achievements and contributions are recognized and celebrated, not only within my organization but the entire mortgage industry. I believe that increased visibility can inspire other women and create a more inclusive environment.”

Natalie Dixon, Haventree Bank: “I urge my team to step forward and voice their thoughts confidently by encouraging active participation. Collaboration is a priority,

both within our team and with industry partners. I emphasize the importance of cultivating strong relationships and fostering a supportive network that contributes to women’s professional growth.”

Vivianne Gauci, HomeEquity Bank:

“To support the progress of women in the mortgage industry, I’ve been actively working on building real connections. I believe in the power of networking, and I’m all about reaching out to my fellow women professionals, not just at formal events but also in relaxed settings like grabbing coffee or sharing lunches. My advice to ambitious women is to take the initiative and connect with the role models they look up to, whether it’s someone who’s just a step or two ahead of you in the industry or someone at the top of their game after a long career.”

FEATURES 12 www.mpamag.com/ca WOMEN IN MORTGAGES

Meaghan Hastings, The Mortgage Coach: “As a dedicated female leader and broker-owner, my mission is to empower women to build a fulfilling career in the mortgage industry. For some, that means stepping into leadership roles, while another’s vision may be to be the sole income earner in their household and have the systems in place that allow them to also travel extensively. My strategy is centred around fostering an environment of growth and empowerment.”

Kim Mercer, MCAN Financial Group: “MCAN Home was a sponsor and panel participant at the inaugural Women in Mortgage Summit. We feel it’s important to actively support events that celebrate the diversity of our community and amplify women’s voices by sponsoring and hosting

events where their stories, achievements, and challenges are brought to the forefront. That’s where great ideas and innovation are cultivated. Closer to home, we have female representation at all levels of leadership and make space for divergent thinking to create an inclusive and prosperous future for everyone.”

Rejean Roberge, CWB Optimum Mortgage: “We understand the challenges women can face while juggling responsibilities, which is why we offer flexible work arrangements. As a mother myself, I’ve experienced the importance of such arrangements first-hand and strive to ensure all women have the same opportunities. If you can see her, you can be her. I personally engage in speaking on panels that are geared towards empowering women in the

mortgage industry. By sharing my journey and the challenges I’ve overcome, I aim to show that it’s not only possible to succeed as a woman in the mortgage industry, but that it’s also possible to thrive in all areas of life and especially as a mother.”

Sherri Vanderleeuw, Magenta Capital Corporation: “At Magenta, everyone’s tomorrow matters. As our chief operating officer Greg Sinclair puts it, ‘Quite simply, Magenta would not be what it is today without the strong women that have contributed and continue to contribute to the Magenta story.’ We believe in supporting opportunities for knowledge sharing as seen at the Women in Mortgages Summit, which featured contributions from myself and other members of our team. In our day-to-day, we support staff

www.mpamag.com/ca 13

WOMEN IN MORTGAGES

with accommodating schedules and hybrid opportunities. We also launched our own campaign, #hertomorrowmatters, both internally and externally.”

Elizabeth Wood, CMI: “Empowering women to take roles of leadership. We make sure we’re removing barriers and obstacles that may inhibit them – [offering] everything from work flexibility to jobshadow opportunities. Encouraging women leaders to be role models and mentors to other women. It sets an aspirational example, which is badly needed since leadership qualities have traditionally been associated with stereotypically male qualities.”

What more could the mortgage industry at large do to create opportunities for women?

Ameera Ameerullah, CMFG: “To create further opportunities for women in the industry, fostering a supportive and inclusive work environment, providing mentorship programs, and raising awareness of gender bias can be crucial steps.”

Zeynep Babir, 8Twelve Mortgage: “The mortgage industry can further enhance opportunities for women by actively promoting flexible work arrangements, implementing unbiased hiring and promotion processes, and providing comprehensive training and mentorship programs. At 8Twelve Mortgage, we’re committed to these principles. We’ve established mentoring programs, offer flexible work options, and ensure fair and transparent advancement processes.”

Michelle Campbell, Mortgage District: “Support work-life balance. Recognize the importance of work-life balance and offer flexible work arrangements, such as remote work options or flexible hours. This can help women balance their professional and personal responsibilities, making it easier for them to pursue career advancement opportunities. Address unconscious bias by raising awareness of its impact on

career progression. Implement policies and practices that mitigate bias in recruitment, promotion, and compensation decisions.”

Natalie Dixon, Haventree: “While great strides have been made to recognize women’s contributions in the mortgage industry, a stronger push is needed for women to take on executive leadership roles. The presence of women in these positions serves as a powerful inspiration, offering concrete proof that such career growth is attainable. Seeing women leaders first-hand creates momentum for other women to achieve similar roles confidently.”

Vivianne Gauci, HomeEquity: “The mortgage industry can further enhance opportunities for women by creating mentorship and sponsorship programs that pair women with industry leaders. Also, enhancing flexible work arrangements, such as remote options and supporting work-life balance, can accommodate the diverse responsibilities women often manage. Additionally, fostering a supportive and inclusive culture that values diversity and offers equal pay for equal work can attract and retain talented women.”

Meaghan Hastings, The Mortgage Coach: “Addressing the question of how the mortgage industry can further create opportunities for women is truly multifaceted. The establishment of formal mentorship programs would be a great start. Navigating the gauntlet of advancement within the industry can be overwhelming. These initiatives would pair seasoned professionals with aspiring women, facilitating the exchange of insights, guidance, and experience. Mentorship relationships hold the potential to provide both direction and increased confidence for women looking to advance.”

Kim Mercer, MCAN: “There’s an opportunity to invest in developing brandagnostic mentoring programs for women in our industry. We’re all interested in seeing our future leaders – those who will guide our industry forward – learn and grow within all areas of what we do: lender, broker, advocate, and policymaker. We are all responsible for ensuring the voices that speak on our behalf and influence power are truly representative and inclusive of the people who make up our industry and the Canadians we serve.”

FEATURES

14 www.mpamag.com/ca

Rejean Roberge, CWB: “It’s important that women not only have a seat at the table but have an equal voice in the conversation. I think our industry could do a better job of establishing accessible networking platforms that connect women with mentors and role models. Being a woman juggling both a career and familial obligations can make it challenging to attend these types of events. Make networking events more accessible to women so that they can have the opportunity to be a part of the conversation.”

Sherri Vanderleeuw, Magenta Capital: “Mentorship programs, where successful women in the industry have the chance to show their new or less-established peers the ropes, would be a great first step.

Another step forward is inclusive networking events with activities that cater to a wide spectrum of interests and respect personal commitments, and that also open the floor to all genders being speakers and facilitators. Providing incentives to women-run brokerages and other businesses by raising financial support through grants. Finally, implementing equity and inclusion through training sessions, seminars and speakers at industry events could encourage increased awareness and understanding of the issues facing women in the mortgage industry today and assist with advancement.”

Elizabeth Wood, CMI: “The biggest opportunity – and responsibility – for the industry is to address the barriers faced

by aspiring female leaders:

• Raising awareness of and addressing unconscious bias

• Organizing more inclusive industry events – and ensuring women get the invite to those that are often viewed as solely for men, like golf tournaments and sporting events. That also means planning more events during the workday, and not the evening when there are likely to be family commitments

• Providing unique training opportunities –like workshops for aspiring female leaders.

• Flexible work arrangements will enable not just women but all employees to better balance career and family commitments

• More formal mentoring opportunities for women in the industry.”

www.mpamag.com/ca 15

WOMEN IN MORTGAGES

LEADING WOMEN OF INFLUENCE: PROFILES

Ameera Ameerullah

CEO-broker-lender, Canada Mortgage and Financial Group

With over 22 years of hands-on experience in the mortgage industry, Ameerullah stands as a distinguished figure at the helm of one of Canada’s leading independent brokerages, Canada Mortgage and Financial Group (CMFG). Her journey is defined by her commitment to innovation, empowerment, and philanthropy.

Zeynep Babir

Director of business development, 8Twelve Mortgage Babir leads the sales team at 8Twelve Mortgage and ensures exceptional service for clients and partners. With over a decade of experience in the mortgage industry, her efforts resulted in $351 million in mortgage volume in 2022 and earned her CMP’s Women of Influence award for her exceptional leadership and drive. Babir is passionate about mentoring teams, as she believes in empowering others to reach their full potential and achieve success.

Michelle Campbell

Principal broker, Mortgage District

Passionate about the mortgage industry, Campbell is dedicated to promoting diversity and inclusion. She is committed to creating opportunities for underrepresented groups, particularly women. Campbell is a lifelong learner, constantly seeking new knowledge and skills to stay ahead, and is dedicated to making a positive impact.

Natalie Dixon

Assistant vice president of mortgage originations, Haventree Bank

Dixon oversees the lending experience at Haventree Bank and manages a

team of talented underwriters who are dedicated to helping its broker partners find homeownership solutions for their clients. With over 20 years of experience, Dixon has extensive knowledge in a variety of disciplines, from loan officer to underwriting. She has spent her career developing and implementing new strategies and programs to benefit mortgage brokers and help Canadians with homeownership.

Vivianne Gauci

Senior vice president, customer experience and chief marketing officer, HomeEquity Bank

Gauci leads HomeEquity Bank’s marketing and customer experience design and delivery teams. She is responsible for driving originations growth by leading awardwinning brand and performance marketing that has increased awareness and demand. Gauci joined HomeEquity in 2015 and has more than 20 years of experience in marketing, product development, and strategy in financial services, including over 10 years at companies such as American Express and Aviva.

Meaghan Hastings

Founder, CEO, leader, The Mortgage Coach Hastings entered the mortgage industry in 2000 as a mortgage specialist at one of the “Big 5” after a successful career in the automotive industry. She completed mortgage agent licensing in 2008 and joined the broker channel as an agent. Hastings purchased an established book of business and trademark licences in early 2010 and continued to build a successful career as a mortgage agent over the following eight years. She completed mortgage broker licensing in 2018 and opened The Mortgage Coach in January 2019.

Kim Mercer

Director, corporate brand and marketing, MCAN Financial Group

Mercer recently led the enterprise rebranding initiative and launch of MCAN Home. She has previously been recognized as a Woman of Influence and continues to advocate for diversity in leadership in the mortgage and tech industries. Mercer has extensive experience building brands, strategic narratives, and channel strategies for early- and growth-stage tech and financial companies. She honed her storytelling skills as a national magazine editor and continues to seek and share stories that resonate personally and professionally.

Rejean Roberge

Vice president, CWB Optimum Mortgage

Roberge is the driving force behind CWB Optimum Mortgage’s success and growth. Not only has she solidified her position as a prominent leader in the mortgage industry, but her strategic vision and exceptional execution have resulted in record-breaking year-over-year new mortgage originations, setting the standard for excellence in the mortgage industry.

Sherri Vanderleeuw

Vice president of marketing, Magenta Capital Corporation

Vanderleeuw has a vast amount of experience in the CPG industry and holds a Bachelor of Commerce (Honours) degree from Queen’s University and a Certificate in Social Media from the University of British Columbia. She is currently pursuing her MBA at Heriot-Watt University.

Elizabeth Wood

Executive vice president, CMI

Wood joined CMI in 2015, transitioning to the executive leadership team as executive vice president in early 2018. Recognized among Canada’s top 50 leaders in the Globe and Mail’s Report on Business Best Executive Awards 2023, Wood is a solutions-oriented leader focused on developing and implementing sustainable and scalable policies and operational workflows. For her trailblazing contributions, she was named a CMP Woman of Influence in 2019 and 2022, and the Canadian Mortgage Awards Woman of Distinction in 2021.

FEATURES 16 www.mpamag.com/ca

www.mpamag.com/ca 17 SPECIAL REPORT CONTENTS PAGE Feature article 18 Methodology 19 Top 50 Women of Influence 2023 21 50 Top

Canada’s most influential women in the mortgage industry are shaping a more equitable future

TOP 50 WOMEN OF INFLUENCE 2023

LEADING BY EXAMPLE

CANADIAN MORTGAGE PROFESSIONAL’S Top 50 Women of Influence for 2023 have had an extraordinary impact on the industry, significantly shaping the future of a dynamic market and lighting the path ahead for others. Selecting this year’s cohort proved daunting for the esteemed judging panel, which remarked that there was no shortage of accomplished women driving change and progress.

“I love hearing and witnessing how the women of the mortgage industry support their clients, communities, and each other,” says panel member Veronica Love, chair at Mortgage Professionals Canada, SVP of corporate development at TMG The Mortgage Group, and also a 2023 Woman of Influence. “Most understand that we are stronger when we work together and ensure all are supported.”

Fellow judge Kuljit Singh echoes those sentiments, adding that the achievements that most impressed him include:

• nurturing emerging leaders and contributing to talent growth

• contributing to industry associations’ growth and initiatives

• conducting impactful community outreach, philanthropy, and initiatives that benefit underserved populations

Josie Milanetti: private lending trailblazer

Due to her extensive experience in private lending, Josie Milanetti’s unparalleled underwriting expertise and client service are respected industrywide. Her nominators offer high praise: “Josie consistently

TOP 50 WOMEN OF INFLUENCE BY YEARS IN THE INDUSTRY

goes above and beyond, never losing sight that behind every deal is a borrower, often a vulnerable or disadvantaged one.”

The now-three-time Woman of Influence counts among her noteworthy achievements:

• growing her team by nearly 50% and skillfully managing rigorous due diligence to meet surging demand for private financing while simultaneously ensuring the quality of mortgage originations in 2022

“We must be champions for other women, especially the younger generation, bring them up to our level, and be the examples to help them become the next leaders in this industry”

18 www.mpamag.com/ca BUSINESS STRATEGYSPECIAL REPORT

Josie Milanetti, Canadian Mortgages Inc.

2–5 years 11–20 years 6–10 years 21–30 years More than 31 years 3 27 12 4 4

• underwriting 866 deals in 2022, a 41% annual increase with a 17% yearover-year increase in deals closed, all while leading Canadian Mortgages Inc. (CMI’s) large and growing underwriting team

The six-time finalist for Lender Underwriter of the Year at the Canadian Mortgage Awards is a highly regarded subject matter expert.

“I think I’ve helped CMI meet the huge demand for private financing that has grown over the last couple of years,” says Milanetti. “But we have to remember that if we’re not taking care of ourselves, we’re not empowering the people around us to feel that they could do the same thing.”

Tina Trama-Mayol: philanthropist paying it forward

As a finance and mortgage industry veteran, Tina Trama-Mayol of Mortgage Alliance has led her teams with empathy and positively impacted the lives of colleagues. Describing the motivation for putting her forward as a worthy nominee, a peer says, “Tina continuously mentors and coaches new agents, not only in financial matters but in life.”

who aren’t as fortunate as me,” she says. Within the mortgage industry and society, Trama-Mayol’s significant contributions include:

• being the 2023 recipient of Mortgage Alliance’s 5-Diamond award

• fundraising and participating in events in support of the Canadian Cancer Society

• dedicating 40 years to volunteerism

Instilling the importance of caring, giving, and striving for professional excellence is a legacy that makes Trama-Mayol proud.

“When you reach a point in your career when you’ve established an amazing team and are watching them flourish, that is when I can say I’ve arrived,” she says.

Kate Wybrow: collaborative leader Colleagues describe Kate Wybrow as “a thoughtful and intelligent leader who continuously contributes to FCT Canada’s overall profitability by developing meaningful relationships.” She, in turn, attributes her noteworthy collaborative approach and partnerships to the phenomenal women who have inspired her.

“If you look at our senior executive table

METHODOLOGY

To compile the 2023 Top 50 Women of Influence list, CMP encouraged mortgage professionals to nominate outstanding female leaders from across the industry. Nominators were asked to provide details of their nominees’ achievements and initiatives over the past 12 months, including specific examples of their professional accomplishments and contributions to the industry as a whole.

The final list was selected by a judging panel made up of industry leaders and previous Women of Influence, including:

• Caroline Rapson, Mortgage Brokers Institute of British Columbia

• Kuljit Singh, Mortgage Professionals Canada

• Marina Bournas, RFA Mortgage

• Pam Pikkert, Alberta Mortgage Brokers Association

• Petra Keller, Pineapple

• Susan Thomas, M3 Financial Group

• Veronica Love, Mortgage Professionals Canada

To avoid any potential conflicts of interest, the CMP team voided selfvoting and votes for a judge’s own organization.

Among her notable achievements are:

• building and growing a successful business in partnership with a team of people she sees as close allies and friends

• being an innovative thinker who consistently provides solutions to complex problems

Trama-Mayol has received several prestigious awards as a top sales performer who models the highest industry ideals of integrity, trust, and sincerity. Out in the community, she shares the success she has built.

“I feel it is my responsibility to pass it forward because there are a lot of people

at FCT, it’s primarily female, so, for me, it goes without saying that we are breaking the norm,” she says.

Over Wybrow’s nearly two-decade career, she has grown within the company and modelled the importance of balance, creating the space to celebrate wins as they come to other aspiring female leaders.

“When we have challenging times, it’s the perfect opportunity to take a step back and think differently about our business,” Wybrow says. “I firmly believe that challenge creates opportunity and space for people to think differently and move forward, perhaps in a different direction.”

www.mpamag.com/ca 19

“Having success and being influential is not a secret; start treating people like you would want to be treated and pass that forward” Tina Trama-Mayol, Mortgage Alliance

TOP 50 WOMEN OF INFLUENCE 2023

can use their skills to propel growth and prosperity in the mortgage industry.

As Woman of Influence Veronica Love says, “I hope all of the women who were recognized this year reach out to at least one woman they see talent in and share that they are willing to do all they can to sponsor, mentor, or cheer them on.”

The path to the top has differed for each of this year’s Women of Influence, but each offers their own insight on what has helped them get to where they are now.

A career change steered Conroy toward the mortgage market, but gaining confidence was a years-long process; however, it’s since defined her ability to impact the industry.

“When I realized that I had confidence and could be successful, that was a defining moment for me,” Conroy says.

And Milanetti adds, “I got out of the mortgage business for a year, regrouped, and came back with a fresh perspective and an actual game plan.”

Wybrow’s career progression was built on hard work, building relationships, and adding value to her organization and clients.

“I’ve enjoyed each phase, and I’ve learned so much about the business along the way,” she says.

Being able to solve problems and help people realize their goals has enabled TramaMayol to shine.

Leanne Conroy: enterprising advocate

An in-demand speaker on market trend analysis, training, and education, MCAN’s Leanne Conroy has a style that forges positive connections with industry peers. She passionately advocates for supporting women to succeed in the mortgage industry, and for embracing a balanced approach to work, life, and well-being. She has twice been named a Woman of Influence.

Her remarkable career highlights include:

• achieving the highest producing sales volume in Canada for two years

• being a regular spokesperson for MCAN

at industry events across Canada

• being a co-chairperson of the Northern Ontario Lenders Association

“You have to be your own advocate and use your voice, whether or not you’re told it’s too bold, too strong, or too outspoken,” Conroy says. “I encourage people to be autonomous, to set their own goals, and to create their own success.”

Inspirational role models

Conroy and the other influential women of 2023 encourage aspiring female leaders to step up into positions where they

“It’s not a job for me, and as I progressed in my career, it felt like I had the chance to do a little bit more each time to help someone,” she says.

These female leaders in mortgage have garnered a reputation for their inspiring achievements, track record of impactful ideas, mentorship, and demonstrated passion.

“Leading by example and illuminating a path for younger females entering the industry hold immense significance for the Top 50 Women of Influence,” judge Singh says. “I’m convinced that by following in the footsteps of these influential women, the younger generation can emerge as future leaders within the industry.”

20 www.mpamag.com/ca BUSINESS STRATEGYSPECIAL REPORT

“I’ve learned my leadership skills through osmosis, by having great leaders throughout my career here at FCT, and, hopefully, I’ve imparted some of that” Kate Wybrow, FCT Canada

50 WOMEN OF INFLUENCE

LOCATION Manitoba 1 British Columbia Alberta Quebec Ontario Newfoundland and Labrador Nova Scotia 10 7 2 26 2 2

TOP

BY

TOP 50 WOMEN OF INFLUENCE 2023

Josie Milanetti

Vice President, Underwriting Canadian Mortgages Inc. (CMI)

Phone: 1 888 465 1432

Email: josie.milanetti@thecmigroup.ca

Website: canadianlending.ca/brokers

Kate Wybrow

Vice President, National Sales, Residential Lending Solutions FCT Canada

Phone: 416 305 4763

Email: kwybrow@fct.ca

Website: fct.ca

Meaghan Hastings Chief Executive Officer and Principal Broker The Mortgage Coach

Phone: 416 371 7922

Email: meaghan@themortgagecoach.ca

Website: themortgagecoach.ca

Tina Trama-Mayol Mortgage Broker and Team Leader Mortgage Alliance

Phone: 647 290 4676

Email: ttramamayol@mortgagealliance.com

Website: mortgagealliance.com

Alison Lopes Broker

Dominion Lending Centres

Phone: 519 897 1608

Email: alopes@dominionlending.ca

Website: alisonlopes.ca

Ameera Ameerullah

Chief Executive Officer

Canada Mortgage and Financial Group

Angela Calla President, The Angela Calla Mortgage Team

Ann Marie Drohan Mortgage Broker

East Coast Mortgage Brokers

Barbara Cook

Vice President, National Sales Mortgage Centre Canada

Christa Mitchell Chief Strategy Officer Pineapple

Cheryl Buhs

Vice President, National Sales RFA Mortgage

Phone: 403 612 4717

Email: cheryl.buhs@rfamortgages.ca

Website: rfa.ca

Elena Robinson

Vice President, Residential Sales

First National Financial

Phone: 416 320 3138

Email: elena.robinson@firstnational.ca

Website: firstnational.ca

Fiona Campbell

National Director, Mortgage Brokers Manulife Bank

Phone: 289 439 6474

Email: fiona_campbell@manulife.ca

Leanne Conroy Director of Sales, GTA and GVR MCAN Home

Phone: 437 350 6085

Email: lconroy@mcanfinancial.com

Website: mcanfinancial.com

Christine Buemann Co-Owner

The Collective Mortgage Group

Christine Xu President and Principal Broker Moneybroker Canada

Crystal Mamchur Broker Owner

Flare Mortgage Group

Dalia Barsoum

Founder Streetwise Mortgages

Deanne Whelan

Owner and Mortgage Broker East Coast Mortgage Brokers

Denise Laframboise Mortgage Broker

Laframboise Mortgage

Elaine Taylor President Mortgage Alliance

www.mpamag.com/ca 21

TOP 50 WOMEN OF INFLUENCE 2023

TOP 50 WOMEN OF INFLUENCE 2023

Frances Hinojosa

Chief Executive Officer

Tribe Financial

Hali Noble

Founding Member, Director and Senior Vice President

Fisgard Asset Management

Isabelle Barbeau

Vice President

Mortgage Intelligence

Isabelle Tremblay

Executive Vice President of Human Capital

M3 Financial Group

Jen Woodley Broker

Dominion Lending Centres

Jill Moellering

Mortgage Broker

Mortgage Architects

Jill Paish

Vice President, National Sales

MERIX Financial

Kate Brady President

Dominion Media

Kim McKenney

President and Owner

Dominion Lending Centres – The Mortgage Source

Krista Valadao

Business Development Manager

Home Trust

Kristy-Lynn Maxwell

Regional Vice President, Western Canada Business Relations

VERICO Canada

Luisa Hough

Mortgage Professional

Xeva Mortgage

Marci Deane

Mortgage Broker

Mortgage Architects

Mary Swaffield

Chief Executive Officer

Alberta Mortgage Brokers Association

Michelle Crane

Account Manager, Nova Scotia

Sagen

Michelle Drover

Vice President, Atlantic Premiere Mortgage Centre

Natasha Bridgmohan

President and Chief Visionary Officer

The Bridg Group of Companies

Pam Pikkert

Licensed Mortgage Broker

The Place To Mortgage

Petra Keller

Director, Partnerships and Events

Pineapple

Rachelle Gregory

Senior Vice President, Originations

MERIX Financial

Rosa Bovino

Mortgage Specialist Invis

Sabeena Bubber

Mortgage Broker

Xeva Mortgage

Sarah Strauss

Business Owner and Mortgage Broker

The Place To Mortgage

Susan Thomas Executive Vice President, Network Development M3 Financial Group

Tiffany Pedersen Director, Western Canada Sales Strive Capital

Tina Francis Regional Business Manager EQ Bank

Tracy Valko

Brokerage Owner, Founder and Chief Visionary Officer Valko Financial

Ut Yue

National Sales Leader, AVEO CMLS Financial

Veronica Love

Senior Vice President, Corporate Development TMG The Mortgage Group

22 www.mpamag.com/ca BUSINESS STRATEGYSPECIAL REPORT

It takes a Genius…

Scarlett Genius saves valuable time for brokers in identifying lenders and inputting data – and eases headaches with lender rate sheets

THE DRIVING FORCE of the Scarlett platform has always been that it allows mortgage professionals to run their businesses rather than having their businesses run them – and with the launch of a new deal placement tool, Scarlett Genius, brokers are set to gain even more control over the mortgage process.

Every broker knows the valuable time that can be expended working out which lender is the best fit for a deal, and what rates apply to different products. Where Genius can help, according to Sarah Potter – director, sales operations at Axiom Innovations – is by conducting analysis on a file and suggesting possible solutions without the broker having to do their own search.

mation from a file and input it manually into another system.

“Having it within the deal makes it immediately accessible,” she says. “You don’t have to do extra work to get the information that you’re looking for. We can also include other data points in the file to make it even more exact and helpful for brokers.

“The whole idea is that data is power, so the more information you can pull from your file natively, the better you’re going to be positioned within the industry to figure out the best product. To have it actually within the module and be able to pull from the hundreds of data points we have in there is unique to Scarlett for sure.”

gage information in my file, the system is automatically analyzing,” Schultz says. “It just produces recommendations right there on screen while you’re working.”

Potter’s background is in underwriting and brokering, a factor that Schultz says was a significant advantage for Axiom when devising and developing the Genius product. “Her understanding of the industry has allowed us to bring a product to market by taking a critical approach before releasing it to the brokers,” he explains.

That was essential to developing the feature’s ability to assist brokers with two major challenges in their day-to-day work: placing the deal, and reading the rate sheet.

“Lender rate sheets can be incredibly complex and confusing,” Potter says. “You can spend hours trying to understand, and it can be embarrassing for the broker if you think you have it right – and then you make a misstep, or misquote, or forget that there’s a premium for this or that service. So, any tool that can help you get that much closer to exact quotes all the time is always beneficial.”

The availability of this new tool means that Scarlett Mortgage not only offers origination with full connectivity to all lenders across the industry, lead conversion for deals, and full automation and communication platforms; it also now has a state-of-the-art deal assistant tool allowing the broker to identify what products, services, and features are best for their clients.

The big differentiator between Scarlett Genius and competitive products is the fact that it operates internally to the deal, saving valuable time and energy for brokers, Potter says, meaning they don’t have to take infor-

A unique value proposition

The ability to analyze business based on any data point in a file – totalling a few hundred – is a huge advantage for Scarlett over other platforms, according to Andrew Schultz, Axiom’s vice president of sales. This offers brokers the ability to get “incredibly pinpointed” insights into deals, he says.

The core of that architecture has been applied to Scarlett Genius.

“Instead of preparing my file, having to take those data points and then plug them into a product, I’m filling out my applicant’s information, and as I’m filling out the mort-

Ultimately, Schultz says, the develop ment marked the latest stage in Scarlett’s mission to revolutionize and streamline the mortgage process for brokers.

“With Axiom Innovations and the Scarlett suite of products, the focus is constant innovation – always providing more resources and more tools under one roof to make the broker and agent more efficient and provide better value to their client,” Schultz says. “This is just an extension of that.

“This is really one of those key building blocks that’s going to make this what we believe to be the most robust program in the industry.”

BROKER TOOLS SPECIAL PROMOTIONAL FEATURE 24 www.mpamag.com/ca

“To have [the information] actually within the module and be able to pull from the hundreds of data points we have in there is unique to Scarlett for sure”

Sarah Potter, Axiom Innovations

Join Scarlett Network today to connect to over 300+ lenders! scarlettnetwork.com DON'T LET YOUR BUSINESS RUN YOU...RUN YOUR BUSINESS

BUSINESS PROCESS OUTSOURCING

The benefits of outsourcing

ATTRACTING NEW business and maintaining relationships with current clients can be like changing the wheels on a bus while it’s still in motion. There is so much else on your plate. But what if there was a way to delegate duties like underwriting and even administration to a trusted third party?

That’s where business process outsourcing (BPO) can come in.

BPO “involves contracting specific business processes or functions to a third-party service provider,” says Tara Somerset, vice president and managing director of residential services at Intellifi. This can involve outsourcing functions like underwriting, funding, call centre servicing, administration, and investment management for mortgage lenders.

Somerset has worked at Intellifi, which is headquartered in Calgary, since January 2022, and in the mortgage industry since 2004.

“We take responsibility for performing the functions on behalf of the mortgage lender, following agreed-upon processes and service level agreements,” she says. “We follow their servicing and compliance standards.”

Multiple benefits for lenders

There are different reasons why a mortgage lender would seek such BPO services.

“They allow the lender to scale their operations more efficiently,” Somerset says.

There are cost savings such as reduced overhead expenses related to managing day-to-day operations or hiring staff and training them on new technology. Or a company may need more staff at some times of the year than others due to seasonal volume fluctuations. “We specialize in all of these functions,” Somerset says.

Beyond cost savings, there is another benefit. “[Outsourcing] allows the lender to focus on core competencies,” she says. Through outsourcing, “the lender can then redirect their internal resources and expertise towards strategic initiatives, like business development and customer relationships.”

Outsourcing can also mean faster turnaround times for loan approvals, since a client can have access to dedicated resources that streamline the process. “We’re able to process transactions quicker,” Somerset says. “We can make decisions with established quality control

onboarded by Intellifi in as little as six weeks.

“Not quite as simple as plug-and-play, but we do pride ourselves on simplifying the process for the lender to make the experience as seamless as possible,” Somerset says. “Intellifi also offers back-up servicing and back-up underwriting as part of our suite of services.”

Intellifi stays on top of the latest regulations and compliance requirements, thereby reducing the burden on the lender. It also provides specialized risk management expertise, thus minimizing lender risks associated with underwriting and servicing functions.

measures in place, as well as compliance and regulatory adherence.”

So, how does a client pick what service they need from Intellifi?

“Lenders can choose Intellifi for their end-to-end needs or choose services à la carte,” Somerset says. “We have a dedicated project delivery team as well as our subject matter experts who spend time with the lender, learning and understanding their business model so that we can replicate the customer experience to the lender’s specifications.”

Responding to complex needs

Depending on the complexity of a new client’s needs and the mortgage products, they can be

The company currently supports close to a dozen lenders, as well as the Canada government’s Greener Homes Loan Program. It has offices in Vancouver, Calgary, and Toronto, as well as remote workers across the nation. There are about 160 BPO employees and 320 employees overall, all working in Canada (all data and information is stored in Canada too).

“Our track record, industry experience and expertise, technology capabilities, quality assurance practices, and the ability to customize solutions to meet specific lender needs really speak for themselves,” Somerset says. “This is what we do. Your success as a lender directly impacts our success as a service provider. So we treat this as a partnership.”

SPECIAL PROMOTIONAL FEATURE 26 www.mpamag.com/ca

So much to do, only so many hours in a day. Delegating to a trusted third party may allow you time to concentrate on core competencies

“Your success as a lender directly impacts our success as a service provider. So we treat this as a partnership”

Tara Somerset, Intellifi

Canada’s best mortgage lenders, as judged by their broker partners, are modernizing the lending process and prioritizing seamless operations

www.mpamag.com/ca 27 CONTENTS Feature article .............................................. Methodology ................................................ Brokers on Lenders 2023 ........................... PAGE 28 29 32

SPECIAL REPORT

BROKERS ON LENDERS 2023

GOING STRONG AND STRIVING HIGHER

BROKERS COME to the forefront in volatile markets, and the best mortgage lenders in Canada are in lockstep with them. The nationwide broking community plays a crucial role in shaping the industry as the bridge between borrowers and lenders. Their evaluation of mainstream and alternative lenders pushed the top 13 performers into the winner’s circle in Canadian Mortgage Professional’s 17th

annual Brokers on Lenders survey.

As the challenges in the housing market showed no signs of abating, lenders worked collaboratively with their broker partners, communicating proactively and emphasizing flexibility to stand out in an increasingly competitive field.

Brokers rated lenders across 10 segments, highlighting and critiquing a lender’s service over the last 12 months, identifying areas for

POLL: HOW MANY LENDERS HAVE YOU SUBMITTED DEALS TO IN THE LAST 12 MONTHS?

improvement, and identifying where they performed at their peak.

Broker analysis

This year, lenders logged a slight to moderate decline in their scores across most categories compared to 2022.

While turnaround time, BDM support, and product range scores fell the furthest, brokers still rated them well, suggesting that lenders are performing above average,

28 www.mpamag.com/ca SPECIAL REPORT BROKERS

ON LENDERS 2023

“Our team’s expertise delivers results for brokers, and that’s part of the reason they’ve chosen us as winners in some of these categories”

Todd Poberznick, Canadian Mortgages Inc. (CMI)

1 5% 2 5% 3 8% 4 9% 5 or more 73%

but there’s room for improvement.

One broker emphasized that their lender “made great exceptions on files for people who need help.” Another commented that their lender referred business to them.

“I always want to work with a lender who genuinely cares for your success; in turn, I place business with lenders who look after me and want to see me succeed,” a broker said.

Lenders have also gone above and beyond to assist brokers in running their businesses effectively, as evidenced by the following feedback:

• “Guided me to their resources to stay informed on their latest developments and offerings”

• “Called us with a problem and a solution”

• “Owned a mistake and covered the per diem and extra legal costs for a client when a deal didn’t close on time because of their error”

with competitive offerings and packages.

All 13 top winners scored a medal in at least one category, with three runaway performers earning medals across all 10 categories. Another three lenders dominated six or more areas, a testament to the exceptional service and value they provide to brokers.

Alternative lender aims for excellence

In the alternative lending space, Canadian Mortgages Inc. (CMI) won a silver medal overall and nods in nine categories, including underwriter support, turnaround time, and product range. Brokers rated the private mortgage lender above this year’s average scores across all metrics. The former brokerage draws on its profound understanding of brokers’ and borrowers’ needs to structure unique solutions.

“One of the keys to our success is that we encourage brokers to reach out to us even

METHODOLOGY

To uncover the best lenders in the eyes of Canada’s broker community, CMP reached out to brokers across the country, asking them to rate the lenders they work with across 10 key areas, including turnaround time, interest rates, product range, broker support, overall service levels, and more.

As in previous years, CMP also asked brokers to weigh in on important aspects of the broker-lender relationship, such as how commissions and bonuses might change and why they choose to send deals to banks rather than monoline lenders.

For each category, lenders were ranked in order of merit according to an average score calculated from the ratings they received from brokers. The top three lenders and alternative lenders in each category received a gold, silver, or bronze medal. Lenders’ combined average score from all categories determined the overall gold, silver, and bronze medallists.

58% of respondents said past clients were their strongest referral partners

• “BDM stepped in and rescued a deal I had been working on for a month”

• “Making an effort to help us learn and care about our clients”

The most significant brokers’ score increases were in interest rates, and a yearover-year uptick in commission structure suggests lenders are at the leading edge

before submitting a deal so we can work proactively with them to ensure it runs smoothly,” says vice president of national sales Todd Poberznick.

CMI’s strengths lie in its:

• broker partnerships

• innovative processes to make onboarding and borrowing more streamlined

41% of respondents have been brokers for over 11 years

93% of respondents said their own business was the type of deal they had with the lender

www.mpamag.com/ca 29

“We’ve got a heavy human touch here, and we’re known for the expertise of our people; we’re excited about the future, and we’ve got a lot of faith in our broker partners and the market”

Dave Fromow, Bridgewater Bank

BROKERS ON LENDERS 2023

• diverse and dedicated team of experts who understand and know their products

“We continue to lean into the collaborative approach with our brokers and partners, and we understand that things change,” Poberznick says. “We need to be on top of what’s happening in the marketplace to get the maximum for their clients and our future clients.”

Feedback fuels top lender’s innovative products